Mass Transfer Equipment Market Report

RA00117

Mass Transfer Equipment Market by Type (Column Internals, Trays, Random Packing, Structured Packing, and Others), Application (Food & Beverages, Pharmaceuticals, Oil & Gas, Water & Waste Water Treatment, Chemical, Pulp & Paper, and Others), Regional Analysis (North America, Europe, Asia Pacific, and LAMEA): Global Opportunity Analysis and Industry Forecast, 2022-2031

Global Mass Transfer Equipment Market Analysis

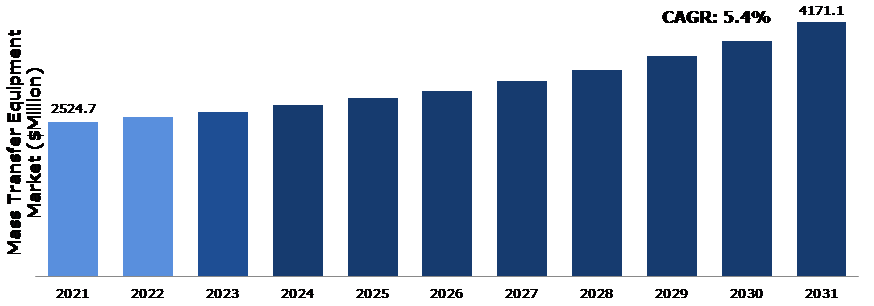

The Global Mass Transfer Equipment Market Size was $2,524.7 million in 2021and is predicted to grow with a CAGR of 5.4%, by generating revenue of $4,171.1 million by 2031.

Global Mass Transfer Equipment Market Synopsis

One of the major factors driving the significant expansion of the mass transfer equipment market is an increase in demand for sustainable and creative mass transfer equipment solutions for crucial operations in many sectors. Recent advancements, as well as significant investment in cost-effective and efficient mass transfer technologies, are expected to fuel demand for the global market. For instance, the extremely sophisticated Schoepentoeter Plus is best suited for liquid and vapor-containing feed. Furthermore, this mass transfer equipment design provides clean liquid disengagement, low pressure drops, and improved vapor dispersion.

However, the mass transfer equipment share sector is expected to be hampered by factors such as rising technology costs. Furthermore, there are some restrictions in the gas-to-liquid mass transfer process that might present an impediment to syngas fermentation for biofuel generation. These reasons are expected to reduce demand for mass transfer equipment market, thus inhibiting global market growth.

Future mass transfer technologies will have important uses in the food packaging industry. This technique might be used primarily to protect food quality and safety, as well as to reduce food waste and food germs and diseases while increasing food shelf life. Modified Atmosphere Packaging (MAP), for example, is based on the alteration of the interior atmosphere by the product itself, by gas flushing, or the use of gas emitters or scavengers; this can be achieved by mass transfer technology. Furthermore, packaging material mass transfer has a positive effect on maintaining an appropriate environment in packing. These market trends for mass transfer equipment are expected to provide profitable possibilities in the global industry.

According to regional analysis, the Asia-Pacific mass transfer equipment market accounted for $2524.7 million in 2021 and is predicted to grow with a CAGR of 5.7% in the projected timeframe. This is because in China, China is investing significantly in infrastructure and water efficiency technology to satisfy future demand and avert a shortage. Furthermore, highly advanced mass transfer technology has significant applications in oil & gas refineries.

Mass Transfer Equipment Overview

Mass transfer processes are utilized in different food processing industries for various physical separations of components from liquids or solids in order to recover valuable products or remove undesired food or nonfood components. In contrast to mechanical separations, which are based on differences in the macroscopic shape, size, and density of solid particles or pieces, they differ from mechanical separations in that the primary transport mechanism is mass transfer at the molecular level.

COVID-19 Impact on Global Mass Transfer Equipment Market

The unprecedented COVID-19 outbreak and its impact on mass transfer equipment have significantly impacted the expansion of the mass transfer equipment industry. The nationwide lockdowns, which were necessary to prevent the spread of the new virus, also resulted in the shutdown of companies. This has a negative impact on the global market for mass transfer equipment. As a result of the disturbed flow of manufacturing and distribution of the equipment in the market, demand for the equipment diminished. Furthermore, the expensive cost of the equipment, as well as the risk of occupational risks, stifles the growth of the mass transfer equipment market. The mass transfer equipment used in industry contributes significantly to environmental pollution. Flight limitations and cancellations have lowered total utilization of aviation turbine fuel, resulting in a decrease in market demand.

The global mass transfer equipment market is expected to be driven by the latest innovations in product development, as well as considerable expenditure by leading companies in R&D

Mass transfer techniques have improved and developed products for chemical and petrochemical industrial operations. Mass transfer equipment is critical in providing important answers to all mass transfer problems encountered in processes such as crystallization, absorption, distillation, evaporation, and liquid-liquid extraction. Furthermore, the concept of mass transfer is critical in maintaining high standards of purity and quality in chemicals. In chemical plants, mass transfer processes such as liquid-liquid extraction, structured packaging, and product purification are widely used.

To know more about global Mass Transfer Equipment market drivers, get in touch with our analysts here.

Global mass transfer equipment market factories pollution is expected to restrict the market growth

Pollution is caused by mass transfer equipment factories. For example, industries polluted the water and air during the Industrial Revolution by burning coal and manufacturing metals and chemicals. Furthermore, they discharged contaminants straight into rivers and streams. Today, industrial pollution is still a problem. According to UNESCO, nearly all industry operations produce pollutants as byproducts, and water pollution is on the rise worldwide. Every year, the car sector alone is responsible for the discharge or transfer of millions of pounds of lead in the U.S.

Rapid developments in mass transfer technology in the food business are expected to open up huge opportunities for the worldwide market

The next generation of mass transfer technologies will have a big influence on the food and beverage industries. This technique is frequently used to preserve food quality and safety, as well as to reduce food waste and foodborne viruses and diseases while increasing food shelf life. Modified Atmosphere Packaging (MAP), for example, is based on the alteration of the interior atmosphere by the product itself, by gas flushing, or by the use of gas emitters or scavengers; this can be accomplished by mass transfer technology. Furthermore, packaging material mass transfer technology aids in maintaining an appropriate environment in packing. These market trends for mass transfer equipment are expected to provide profitable possibilities in the global industry.

To know more about global Mass Transfer Equipment market opportunities, get in touch with our analysts here.

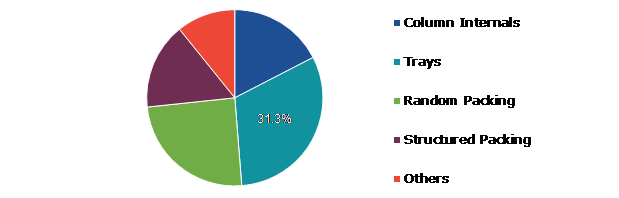

Global Mass Transfer Equipment Market, by Type

Based on type, the market has been divided into column internals, trays, random packing, structured packing, and others. Among these, the trays sub-segment accounted for the highest market share in 2021, whereas the structured packing sub-segment is estimated to show the fastest growth during the forecast period.

Global Mass Transfer Equipment Market Share, by Type, 2021

Source: Research Dive Analysis

The trays gas sub-type is anticipated to have a dominant market share and generate revenue of $1,264.6 million by 2031, growing from $790.8 million in 2021.T Due to active area upgrades and improved Downcomer Technology, the tray market for mass transfer equipment is expected to grow. Furthermore, these cutting-edge trays offer a variety of advantageous uses in mass transfer stages and mass transfer efficiency. As a result, these trays are predominantly employed as splitters in aromatic, petrochemical, and petrochemical applications. As a result, the global market is expected to expand.

The structured packing sub-type is anticipated to show the fastest growth and shall generate revenue of $715.7 million by 2031, increasing from $400.6 million in 2021. High-capacity structured packing is employed to enhance capacity and decrease drop in pressure in new construction as well as to replace standard sheet metal structured packing and trays. In addition, they are good for trickle bed reactors due to their superior compressive strengths. Their unique design allows uniform liquid distribution at both low and high liquid contents.

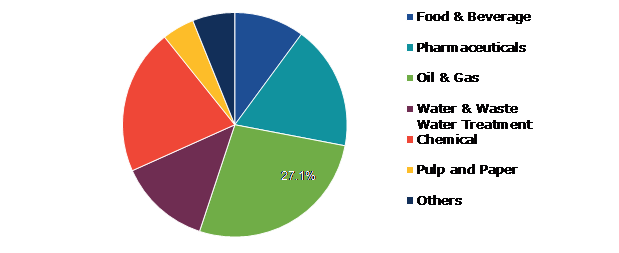

Global Mass Transfer Equipment Market, by Application

Based on application, the market has been divided into food & beverages, pharmaceuticals, oil & gas, water & waste water treatment, chemical, pulp& paper, and others. Among these, the oil & gas sub-segment accounted for highest revenue share in 2021.

Global Mass Transfer Equipment Market Size, by Application, 2021

Source: Research Dive Analysis

The oil & gas sub-segment is anticipated to have a dominant market share and generate revenue of $11,028.7 million by 2030, growing from $8,025.9 million in 2021.The oil & gas sub-segment of the global mass transfer equipment market is expected to increase significantly due to the increasing use of mass transfer technology in maintaining high standards of purity and quality of chemicals. Mass transfer procedures such as structured packaging, product purification, and liquid-liquid extraction are widely undertaken in the chemical industries, accelerating the sub-rise segments by 2026.

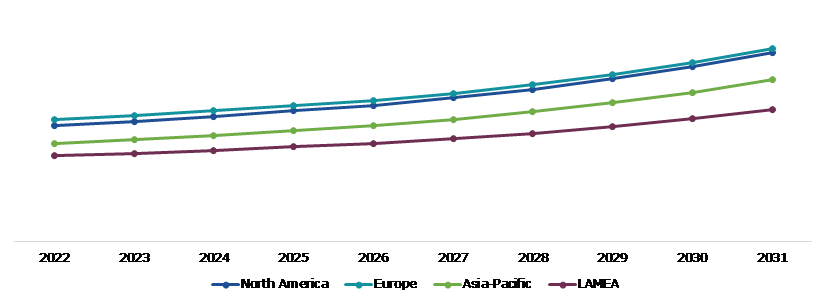

Global Mass Transfer Equipment Market, Regional Insights

The mass transfer equipment market was investigated across North America, Europe, Asia-Pacific, and LAMEA.

Global Mass Transfer Equipment Market Size & Forecast, by Region, 2021-2031 (USD Million)

Source: Research Dive Analysis

The Market for Mass Transfer Equipment in Europe to be the Most Dominant

The Europe mass transfer equipment market accounted for $731.2 million in 2021 and is projected to grow at a CAGR of 5.2%. The European chemical sector is essential to almost all value chains and the European economy. Its objective is to attain climate neutrality, and the industry is ideally located in the core of European industry to assist the continent in accomplishing this goal. T chemical manufacturing sector must preserve its ability to compete while making the transformation to an olive and digital matching transformation to become digital and circular, all while directing the Chemical compounds Strategy for Sustainable development, which will have a significant current effect across numerous supply chain that depend on chemicals and will have an economic impact on the sector for years and decades to come.

Competitive Scenario in the Global Mass Transfer Equipment Market

Investment and agreement are common strategies followed by major market players. For instance, in September 2021, Sulzer Ltd, Sulzer and Medmix shares will start trading separately. The shares of Sulzer Ltd. (“Sulzer”) will start trading exclusively with Medmix AG (“medmix”).

Source: Research Dive Analysis

Some of the leading Mass Transfer Equipment market players areSulzer Ltd, Koch-Glitsch., Beijing Zehua Chemical Engineering Co., Ltd., Finepac Structures Pvt. Ltd., DtEC, MTE Group., Munters Group, Baretti, Tianjin Univtech Co., Ltd., HAT International Ltd.

| Aspect | Particulars |

| Historical Market Estimations | 2019-2020 |

| Base Year for Market Estimation | 2021 |

| Forecast Timeline for Market Projection | 2022-2030 |

| Geographical Scope | North America, Europe, Asia-Pacific, and LAMEA |

| Segmentation by Type |

|

| Segmentation by Application |

|

| Key Companies Profiled |

|

Q1. What is the size of the global mass transfer equipment market?

A. The size of the global mass transfer equipment market was over $2524.7million in 2021 and is projected to reach $4171.1millionby 2031.

Q2. Which are the major companies in the mass transfer equipment market?

A. Sulzer Ltd., Beijing Zehua Chemical Engineering Co., Ltd., and Koch-Glitsch are some of the key players in the global mass transfer equipment market.

Q3. Which region, among others, possesses greater investment opportunities in the near future?

A. Asia-Pacific possesses great investment opportunities for investors to witness the most promising growth in the future.

Q4. What will be the growth rate of the Asia-Pacific mass transfer equipment market?

A. Asia-Pacific mass transfer equipment market is anticipated to grow at5.7%CAGR during the forecast period.

Q5. What are the strategies opted by the leading players in this market?

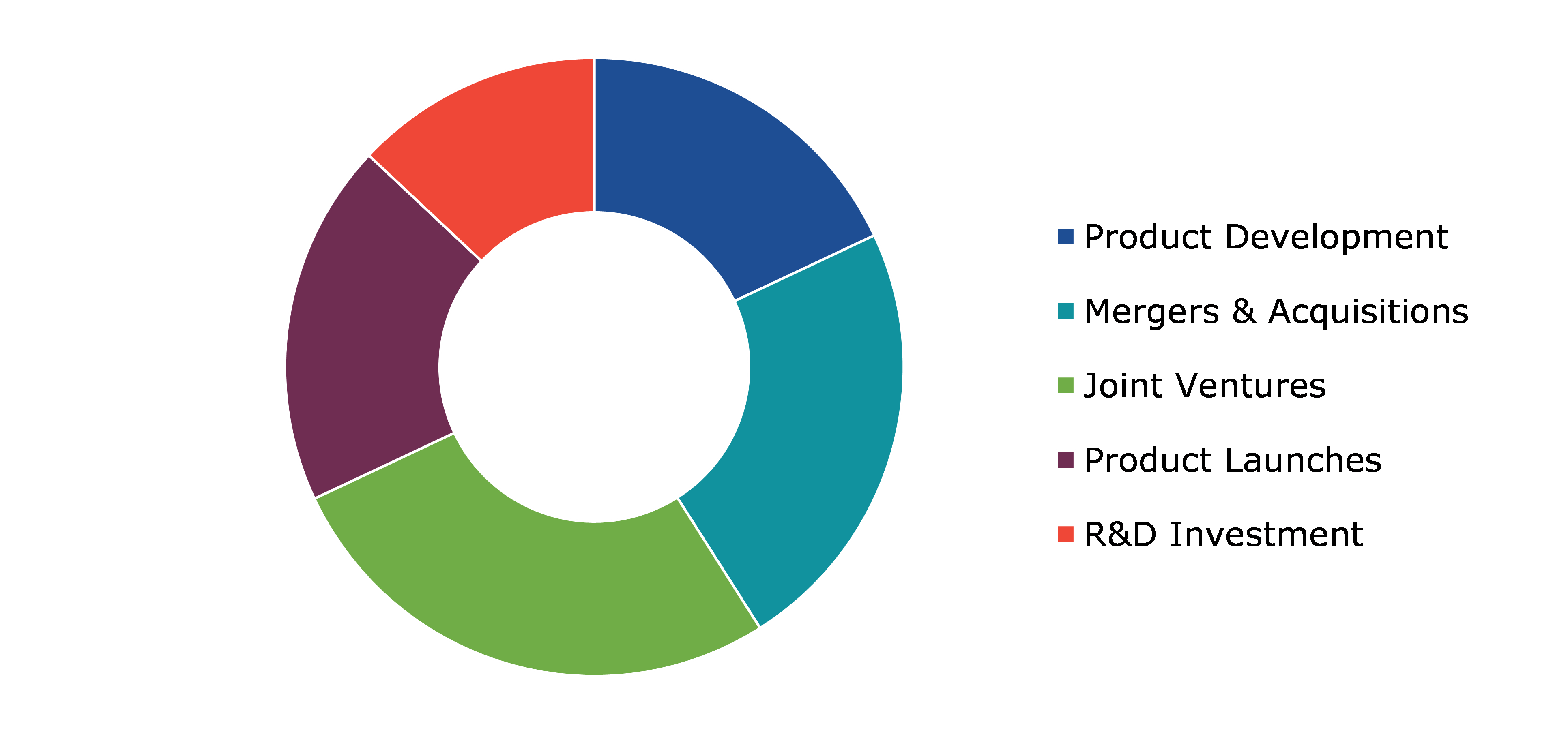

A. Technological advancements, product development, along with joint ventures are the key strategies opted by the operating companies in this market.

Q6. Which companies are investing more on R&D practices?

A. Munters Group and Baretti companies are the companies investing more on R&D activities for developing new products and technologies.

1.Research Methodology

1.1.Desk Research

1.2.Real time insights and validation

1.3.Forecast model

1.4.Assumptions and forecast parameters

1.5.Market size estimation

1.5.1.Top-down approach

1.5.2.Bottom-up approach

2.Report Scope

2.1.Market definition

2.2.Key objectives of the study

2.3.Report overview

2.4.Market segmentation

2.5.Overview of the impact of COVID-19 on Global Mass Transfer Equipment market

3.Executive Summary

4.Market Overview

4.1.Introduction

4.2.Growth impact forces

4.2.1.Drivers

4.2.2.Restraints

4.2.3.Opportunities

4.3.Market value chain analysis

4.3.1.List of raw material suppliers

4.3.2.List of manufacturers

4.3.3.List of distributors

4.4.Innovation & sustainability matrices

4.4.1.Technology matrix

4.4.2.Regulatory matrix

4.5.Porter’s five forces analysis

4.5.1.Bargaining power of suppliers

4.5.2.Bargaining power of consumers

4.5.3.Threat of substitutes

4.5.4.Threat of new entrants

4.5.5.Competitive rivalry intensity

4.6.PESTLE analysis

4.6.1.Political

4.6.2.Economical

4.6.3.Social

4.6.4.Technological

4.6.5.Environmental

4.7.Impact of COVID-19 on Mass Transfer Equipment market

4.7.1.Pre-covid market scenario

4.7.2.Post-covid market scenario

5.Mass Transfer Equipment Market, by Type

5.1.Overview

5.1.1.Market size and forecast, by Type

5.2.Column Internals

5.2.1.Key market trends, growth factors, and opportunities

5.2.2.Market size and forecast, by region, 2022-2031

5.2.3.Market share analysis, by country 2022 & 2031

5.3.Trays

5.3.1.Key market trends, growth factors, and opportunities

5.3.2.Market size and forecast, by region, 2022-2031

5.3.3.Market share analysis, by country 2022 & 2031

5.4.Random Packing

5.4.1.Key market trends, growth factors, and opportunities

5.4.2.Market size and forecast, by region, 2022-2031

5.4.3.Market share analysis, by country 2022 & 2031

5.5.Structured Packing

5.5.1.Key market trends, growth factors, and opportunities

5.5.2.Market size and forecast, by region, 2022-2031

5.5.3.Market share analysis, by country 2022 & 2031

5.6.Other

5.6.1.Key market trends, growth factors, and opportunities

5.6.2.Market size and forecast, by region, 2022-2031

5.6.3.Market share analysis, by country 2022 & 2031

5.7.Research Dive Exclusive Insights

5.7.1.Market attractiveness

5.7.2.Competition heatmap

6.Mass Transfer Equipment Market, by Applications

6.1.Overview

6.1.1.Market size and forecast, by Application

6.2.Food & Beverages

6.2.1.Key market trends, growth factors, and opportunities

6.2.2.Market size and forecast, by region, 2022-2031

6.2.3.Market share analysis, by country 2022 & 2031

6.3.Pharmaceuticals

6.3.1.Key market trends, growth factors, and opportunities

6.3.2.Market size and forecast, by region, 2022-2031

6.3.3.Market share analysis, by country 2022 & 2031

6.4.Oil & Gas

6.4.1.Key market trends, growth factors, and opportunities

6.4.2.Market size and forecast, by region, 2022-2031

6.4.3.Market share analysis, by country 2022 & 2031

6.5.Water & Waste Water Treatment

6.5.1.Key market trends, growth factors, and opportunities

6.5.2.Market size and forecast, by region, 2022-2031

6.5.3.Market share analysis, by country 2022 & 2031

6.6.Chemical

6.6.1.Key market trends, growth factors, and opportunities

6.6.2.Market size and forecast, by region, 2022-2031

6.6.3.Market share analysis, by country 2022 & 2031

6.7.Pulp and Paper

6.7.1.Key market trends, growth factors, and opportunities

6.7.2.Market size and forecast, by region, 2022-2031

6.7.3.Market share analysis, by country 2022 & 2031

6.8.Others

6.8.1.Key market trends, growth factors, and opportunities

6.8.2.Market size and forecast, by region, 2022-2031

6.8.3.Market share analysis, by country 2022 & 2031

6.9.Research Dive Exclusive Insights

6.9.1.Market attractiveness

6.9.2.Competition heatmap

7.Modified Starch Market, by Region

7.1.North America

7.1.1.U.S.

7.1.1.1.Market size analysis, by Type

7.1.1.2.Market size analysis, by Applications

7.1.2.Canada

7.1.2.1.Market size analysis, by Type

7.1.2.2.Market size analysis, by Applications

7.1.3.Mexico

7.1.3.1.Market size analysis, by Type

7.1.3.2.Market size analysis, by Applications

7.1.4.Research Dive Exclusive Insights

7.1.4.1.Market attractiveness

7.1.4.2.Competition heatmap

7.2.Europe

7.2.1.Germany

7.2.1.1.Market size analysis, by Type

7.2.1.2.Market size analysis, by Applications

7.2.2.U.K.

7.2.2.1.Market size analysis, by Type

7.2.2.2.Market size analysis, by Applications

7.2.3.France

7.2.3.1.Market size analysis, by Type

7.2.3.2.Market size analysis, by Applications

7.2.4.Spain

7.2.4.1.Market size analysis, by Type

7.2.4.2.Market size analysis, by Applications

7.2.5.Italy

7.2.5.1.Market size analysis, by Type

7.2.5.2.Market size analysis, by Applications

7.2.6.Rest of Europe

7.2.6.1.Market size analysis, by Type

7.2.6.2.Market size analysis, by Applications

7.2.7.Research Dive Exclusive Insights

7.2.7.1.Market attractiveness

7.2.7.2.Competition heatmap

7.3.Asia-Pacific

7.3.1.China

7.3.1.1.Market size analysis, by Type

7.3.1.2.Market size analysis, by Applications

7.3.2.Japan

7.3.2.1.Market size analysis, by Type

7.3.2.2.Market size analysis, by Applications

7.3.3.India

7.3.3.1.Market size analysis, by Type

7.3.3.2.Market size analysis, by Applications

7.3.4.Australia

7.3.4.1.Market size analysis, by Type

7.3.4.2.Market size analysis, by Applications

7.3.5.South Korea

7.3.5.1.Market size analysis, by Type

7.3.5.2.Market size analysis, by Applications

7.3.6.Rest of Asia-Pacific

7.3.6.1.Market size analysis, by Type

7.3.6.2.Market size analysis, by Applications

7.3.7.Research Dive Exclusive Insights

7.3.7.1.Market attractiveness

7.3.7.2.Competition heatmap

7.4.LAMEA

7.4.1.Brazil

7.4.1.1.Market size analysis, by Type

7.4.1.2.Market size analysis, by Applications

7.4.2.Saudi Arabia

7.4.2.1.Market size analysis, by Type

7.4.2.2.Market size analysis, by Applications

7.4.3.UAE

7.4.3.1.Market size analysis, by Type

7.4.3.2.Market size analysis, by Applications

7.4.4.South Africa

7.4.4.1.Market size analysis, by Type

7.4.4.2.Market size analysis, by Applications

7.4.5.Rest of LAMEA

7.4.5.1.Market size analysis, by Type

7.4.5.2.Market size analysis, by Applications

7.4.6.Research Dive Exclusive Insights

7.4.6.1.Market attractiveness

7.4.6.2.Competition heatmap

8.Competitive Landscape

8.1.Top winning strategies, 2021

8.1.1.By strategy

8.1.2.By year

8.2.Strategic overview

8.3.Market share analysis, 2021

9.Company Profiles

9.1.Sulzer Ltd

9.1.1.Overview

9.1.2.Business segments

9.1.3.Product portfolio

9.1.4.Financial performance

9.1.5.Recent developments

9.1.6.SWOT analysis

9.2.Koch-Glitsch.

9.2.1.Overview

9.2.2.Business segments

9.2.3.Product portfolio

9.2.4.Financial performance

9.2.5.Recent developments

9.2.6.SWOT analysis

9.3.Beijing Zehua Chemical Engineering Co., Ltd.

9.3.1.Overview

9.3.2.Business segments

9.3.3.Product portfolio

9.3.4.Financial performance

9.3.5.Recent developments

9.3.6.SWOT analysis

9.4.Finepac Structures Pvt. Ltd.

9.4.1.Overview

9.4.2.Business segments

9.4.3.Product portfolio

9.4.4.Financial performance

9.4.5.Recent developments

9.4.6.SWOT analysis

9.5.DtEC

9.5.1.Overview

9.5.2.Business segments

9.5.3.Product portfolio

9.5.4.Financial performance

9.5.5.Recent developments

9.5.6.SWOT analysis

9.6.MTE Group.

9.6.1.Overview

9.6.2.Business segments

9.6.3.Product portfolio

9.6.4.Financial performance

9.6.5.Recent developments

9.6.6.SWOT analysis

9.7.Munters Group

9.7.1.Overview

9.7.2.Business segments

9.7.3.Product portfolio

9.7.4.Financial performance

9.7.5.Recent developments

9.7.6.SWOT analysis

9.8.Baretti

9.8.1.Overview

9.8.2.Business segments

9.8.3.Product portfolio

9.8.4.Financial performance

9.8.5.Recent developments

9.8.6.SWOT analysis

9.9.Tianjin Univtech Co., Ltd.

9.9.1.Overview

9.9.2.Business segments

9.9.3.Product portfolio

9.9.4.Financial performance

9.9.5.Recent developments

9.9.6.SWOT analysis

9.10.HAT International Ltd.

9.10.1.Overview

9.10.2.Business segments

9.10.3.Product portfolio

9.10.4.Financial performance

9.10.5.Recent developments

9.10.6.SWOT analysis

10.Appendix

10.1.Parent & peer market analysis

10.2.Premium insights from industry experts

10.3.Related reports

Mass transfer technology is an important technique used in a variety of industrial processes. It is used to physically separate various materials or substances from liquids or solids in order to produce valuable goods or remove unwanted food or non-food components. Mass transfer technology is important in many sectors, including food packaging and manufacturing, water treatment, chemicals, oil and gas, pharmaceuticals, and many others.

Among these, mass transfer is a significant phenomenon with wide applications in food industries. Very few foods are sold without packaging since food packaging is at the very core of the contemporary food industry. A rise in the need for efficient and sustainable mass transfer equipment solutions for critical operations in various sectors, along with recent advancements and investment in cost-effective and efficient mass transfer technologies are expected to boost the growth of the global mass transfer equipment market.

Newest Insights in the Mass Transfer Equipment Market

Many food processing companies use mass transfer techniques, in which substances are mechanically separated from liquids or solids in order to recover valuable products or remove unwanted food or non-food components. Therefore, mass transfer equipment will be crucial to the food packaging industry in the upcoming years. An increase in the adoption of mass transfer equipment in the food packaging industry is expected to boost the growth of the global mass transfer equipment market. As per a report by Research Dive, the global mass transfer equipment market is expected to grow with a CAGR of 5.4% and surpass a revenue of $5,416.8 million in the 2022-2031 timeframe. The Europe mass transfer equipment market is expected to perceive dominant growth with a CAGR of 5.2% in the years to come. The region has a gigantic demand for mass transfer equipment owing to their growing usage in various end use industries, which is creating growth opportunities for the mass transfer equipment market in the region.

How are Market Players Responding to the Rising Demand for Mass Transfer Equipment?

Many market players are greatly investing in pioneering research and inventions to cater for the rising demand for mass transfer equipment. Some of the leading players are DtEC, Baretti, Sulzer Ltd, Koch-Glitsch., MTE Group., Beijing Zehua Chemical Engineering Co., Ltd., Tianjin Univtech Co., Ltd., Munters Group, HAT International Ltd., Finepac Structures Pvt. Ltd., and others. These players are focused on planning and devising tactics such as mergers and acquisitions, collaborations, novel advances, and partnerships to reach a notable position in the global market. For instance:

- In May 2021, 3D-Micromac, one of the leading companies in laser micromachining, launched a new microLED LIFT mass transfer tool.

- In June 2022, Suzler, a Swiss industrial engineering company, announced the signing of a Memorandum of Understanding with BASF, a leading chemical manufacturer. This collaboration aims to develop renewable fuels by combining Sulzer Chemtech's capabilities and mass transfer equipment with BASF's high-performance catalysts. This partnership is expected to assist the companies in achieving their goals in a more comprehensive and systematic way.

COVID-19 Impact on the Global Mass Transfer Equipment Market

The COVID-19 pandemic outbreak had an adverse effect on the development of the global mass transfer equipment market due to the implementation of a global lockdown, which led to the temporary closing of manufacturing facilities. The demand for mass transfer equipment from various end-use industries reduced massively amidst the pandemic period. The pandemic hampered operations in the industrial sector due to supply chain disruptions caused by import and export restrictions. In addition, companies faced labor scarcity and a lack of raw materials. However, the mass transfer equipment market is projected to experience growth in the post-pandemic period due to growing need for mass transfer solutions in the food packaging industry.

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com