Oxygen Cylinders And Concentrators Market Report

RA00030

Oxygen Cylinders and Concentrators Market by Type (Portable and Fixed), End-Use (Healthcare, Pharmaceutical & Biotechnology, Manufacturing, Aerospace & Automotive), and Regional Analysis (North America, Europe, Asia-Pacific, and LAMEA): Global Opportunity Analysis and Industry Forecast, 2022-2031

Global Oxygen Cylinders and Concentrators Market Analysis

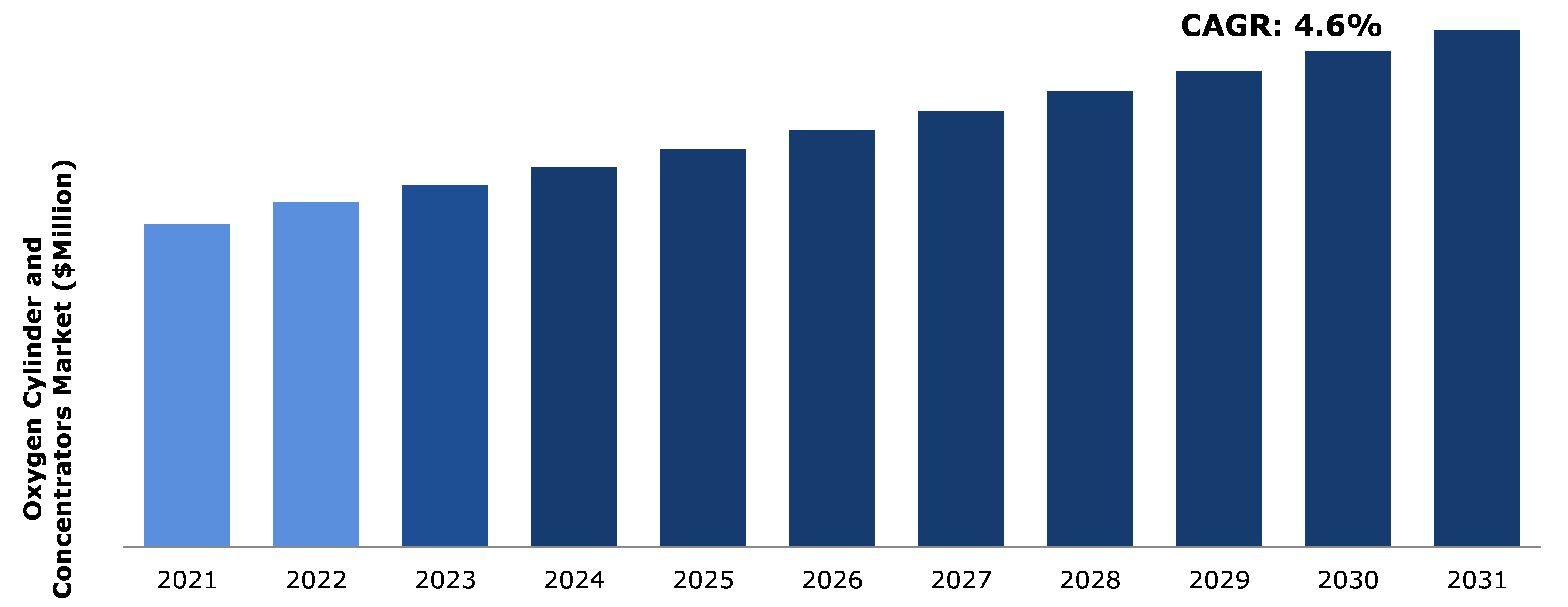

The Global Oxygen Cylinders and Concentrators Market Size was $4,151.6 million in 2021 and is predicted to grow with a CAGR of 4.6%, by generating a revenue of $6,658.5 million by 2031.

Global Oxygen Cylinders and Concentrators Market Synopsis

Due to the rapid growth in the healthcare, manufacturing, and other industries, oxygen cylinders and concentrators market demand in the coming years is anticipated to grow. Oxygen concentrators provide a wide range of advantages such as uninterrupted oxygen supply and are portable and convenient to carry with the patient. Oxygen concentrators are user friendly and help the patients in conditions such as breathlessness, shortness of breath, and others.

It is anticipated that significant technological advancements in respiratory equipment and medical oxygen devices will boost the demand for oxygen cylinders and concentrators worldwide. Companies are investing huge on R&D operations to build cutting-edge technology gadgets for better use by patients suffering from respiratory ailments as the need for sophisticated oxygen equipment is significantly increasing. For instance, Teijin, a Japanese pharmaceutical, chemical, and information technology (IT) business, declared that Hai Sanso 5S, a smart oxygen concentrator, would be unveiled in South Korea for the first time in June 2021. The voice guiding system included into this concentrator alerts the patient when the equipment requires inspection and offers solutions, notably in Korean.

According to regional analysis, the North America oxygen cylinders and concentrators market accounted for the highest market share in the year 2021. According to the report published by U.S. Centers for Disease Control and Prevention in 2021, the U.S. needs more than seven billion respirators per year, which can be provided to the medical equipment industry in order to prevent the worst-case spread of a severe respiratory outbreak like COVID-19. These factors are predicted to boost the North America oxygen cylinders and concentrators market.

Oxygen Cylinders and Concentrators Overview

A patient with low blood oxygen levels and respiratory problems can receive oxygen through an oxygen concentrator. These concentrators and cylinders are well regarded for being safe, dependable, easy to operate, and less expensive. The oxygen from the ambient air is compressed and filtered by these concentrators.

COVID-19 Impact on Global Oxygen Cylinders and Concentrators Market

The coronavirus pandemic has largely boosted the healthcare sector and accelerated its growth curve. The second wave of the pandemic attacked the respiratory system of the people worldwide which made them suffer from many different and dangerous respiratory diseases. This led to millions of deaths worldwide. Amid such health challenges, the demand for oxygen cylinders and concentrators increased, which boosted the growth of the market. To counter the rising demand for oxygen, many companies stepped forward to support the healthcare system and manufacture oxygen concentrators in bulk quantities. For instance, according to a news published in BW Business World, on July 15, 2021, Bharat Heavy Electricals Limited (BHEL), using CSIR-IIP technology, set up the manufacturing plant for medical oxygen cylinders. Such developments are expected to drive the market of oxygen cylinders and concentrators in the coming years. Also, many countries have come forward to help the other severely affected countries in tackling the rising demand for oxygen supply. For instance, according to a news published on The Economic Times, on May 13, 2021, Indonesia donated 200 oxygen concentrators to India to cope up with the increasing demand for medical oxygen amid rising COVID-19 cases. Such factors are expected to contribute the growth of the market in the stipulated time period.

Growing Demand from Healthcare Sector to Drive the Oxygen Cylinders and Concentrators Market Growth

The market is driven largely by the healthcare and medical sector. These oxygen concentrators are primarily used for treating respiratory conditions, such as bronchitis, emphysema, asthma, and COPD, which are frequent disorders in the elderly. Due to the use of oxygen cylinders in numerous applications, including the oxidation process, reducing NOx emissions from glass and ceramics, and coal gasification, the manufacturing industry is experiencing an increase in the consumption of oxygen cylinders.

To know more about global oxygen cylinders and concentrators market drivers, get in touch with our analysts here.

Lack of Oxygen Concentrators Anticipated to Restrain the Market Growth

The market is restrained by lack of availability of oxygen concentrator devices, price of the device and lack of infrastructure for the production of devices. Improper storage and unsafe operation may lead to serious injuries. Oxygen concentrators need to be maintained in a good condition as they purely work with the help of electricity, and the major function of these devices is to supply uninterrupted oxygen supply to the patients. Additionally, the cost for setting up a manufacturing unit of oxygen cylinders and concentrators is much higher. These factors are anticipated to hamper the market growth.

Rapid Growth in Research and Development Activities are Anticipated to Create Growth Opportunities

Future market growth is anticipated to be driven by rising technological developments in oxygen cylinders and concentrators. Researchers and scientists have stepped up their research and development activities to create cutting-edge technology products for better use by patients suffering from respiratory ailments as the demand for oxygen cylinders and concentrators is rising at an alarming rate. For instance, researchers at the Jawaharlal Nehru Centre for Advanced Scientific Research (JNCASR), Bengaluru, India, have created a mobile oxygen concentrator called OxiJani that can be used in rural areas and can also be quickly deployed for emergencies in any location, according to news published in EET India in June 2021. On June 30, 2021, engineering students at Lords Institute of Engineering & Technology (LIE&T), Hyderabad, invented and created a dual-use oxygen concentrator from a water purifier for emergency use, according to another case published in The Hans India. These factors are anticipated to create better growth opportunities for the growth of oxygen cylinders and concentrators market.

To know more about global oxygen cylinders and concentrators market opportunities, get in touch with our analysts here.

Global Oxygen Cylinders and Concentrators Market, by Type

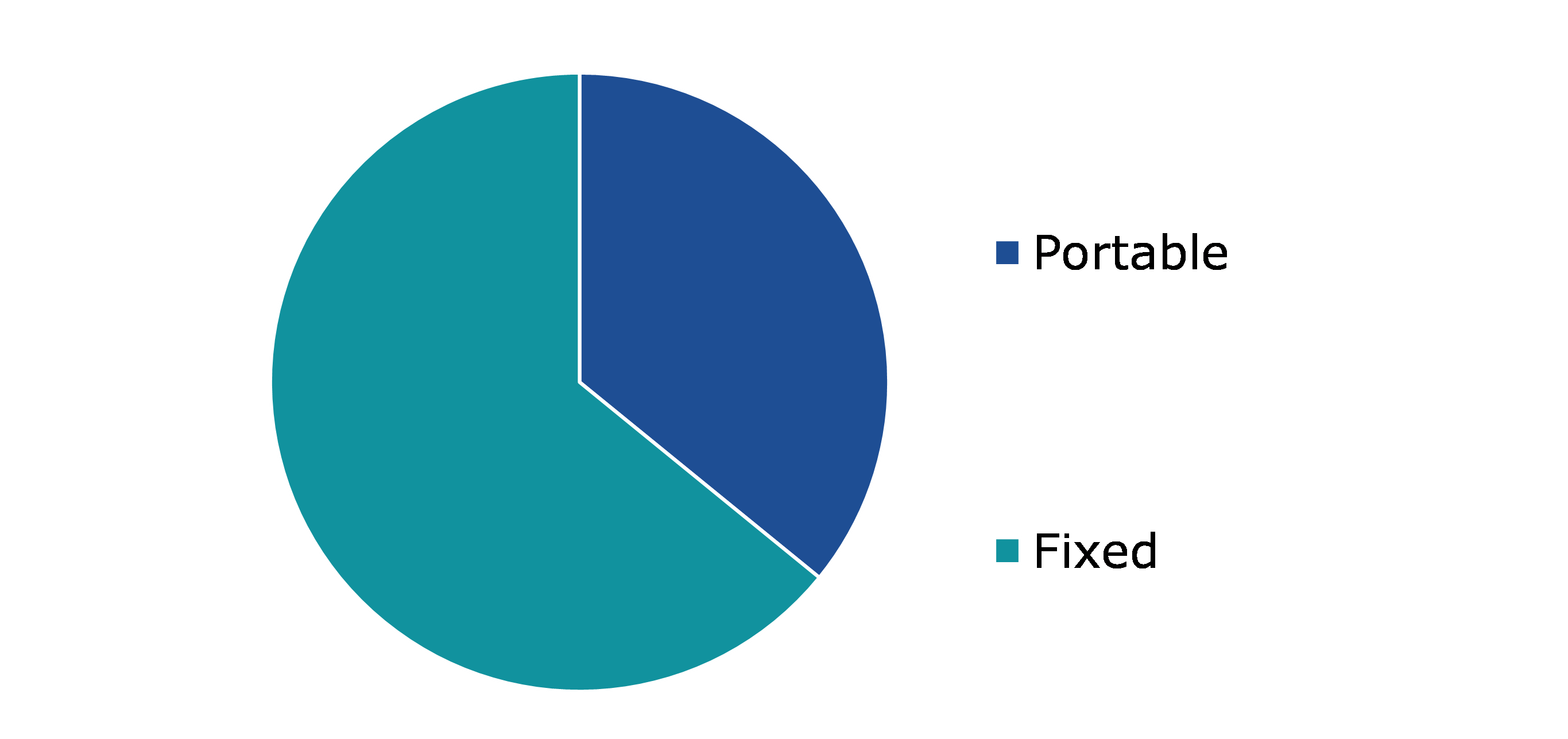

Based on type, the market has been divided into portable and fixed. Among these, the fixed sub-segment accounted for the highest market share in 2021.

Global Oxygen Cylinders and Concentrators Market Size, by Type, 2021

Source: Research Dive Analysis

The fixed type sub-segment accounted for a dominant market share in 2021. When compared to portable oxygen concentrators and cylinders, fixed oxygen concentrators and cylinders are typically heavy and immobile. Also, compared to small portable concentrators, fixed type oxygen concentrators and cylinders produce more oxygen. Furthermore, patients who need a constant flow of oxygen during both inhalation and exhalation are advised to use fixed-type oxygen concentrators and cylinders. Also, the cost of a fixed type oxygen concentrator and oxygen cylinders is three to six times less than that of a portable kind. Additionally, a number of major market players offer a range of stationary oxygen concentrators, including CAIRE Inc., which also sells home oxygen delivery devices like the AirSep VisionAire 5 and the CAIRE Companion 5. These devices deliver oxygen to patients in accordance with their individual oxygen needs. These factors are boosting the demand for portable segment.

Global Oxygen Cylinders and Concentrators Market, by End-use Industry

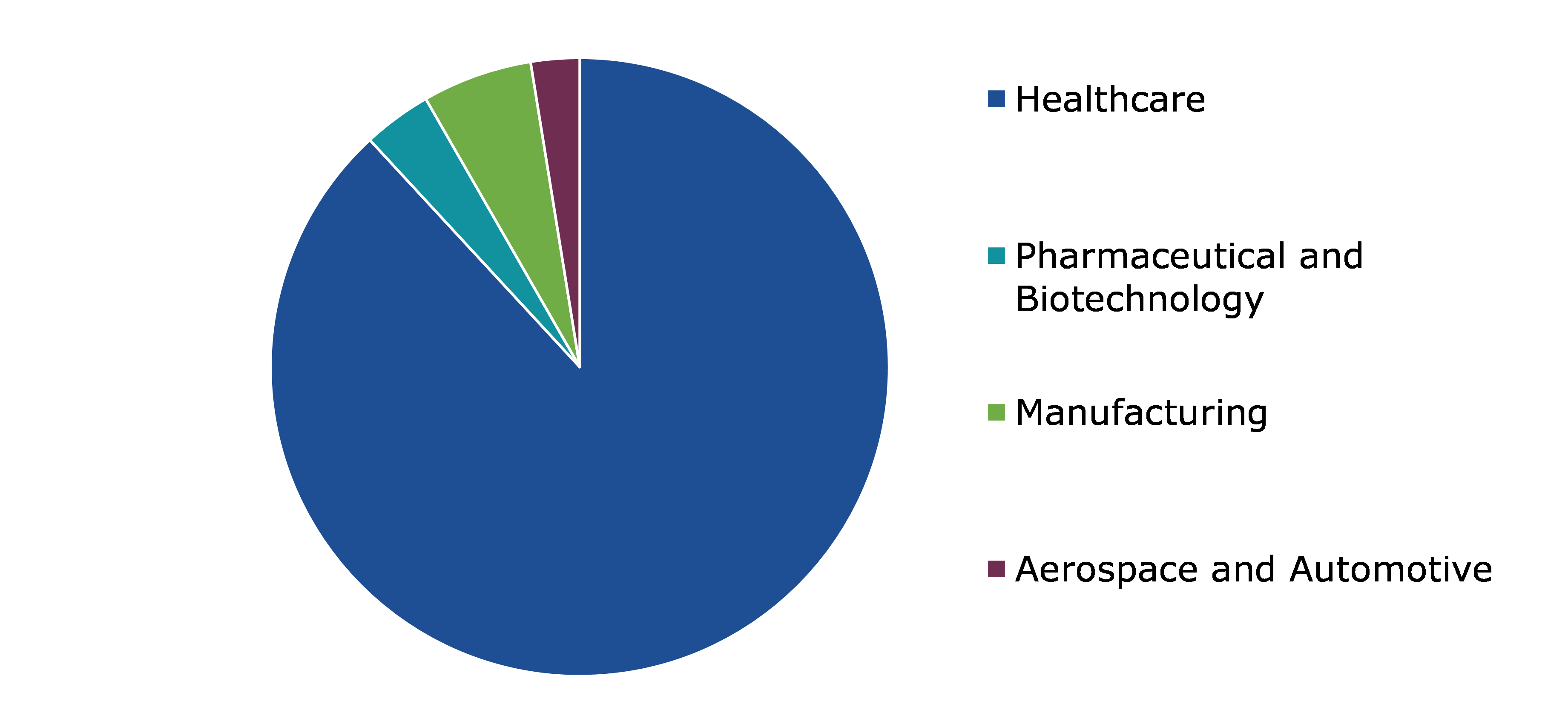

Based on end-use industry, the market has been divided into healthcare, pharmaceutical & biotechnology, manufacturing, and aerospace & automotive. Among these, the healthcare sub-segment accounted for the highest revenue share in 2021.

Global Oxygen Cylinders and Concentrators Market Forecast, by End-use Industry, 2021

Source: Research Dive Analysis

The healthcare sub-segment is accounted for a dominant market share in 2021. Oxygen cylinders and concentrators assist in providing more oxygen to patients with persistent hypoxemia, pulmonary edema, and COPD. Additionally, oxygen is necessary for patients receiving intense care during situations like surgery, pregnancy, and other medical emergencies. All of these factors will increase the demand in the oxygen cylinders and concentrators market.

The market demand for oxygen cylinders and concentrators will be further growing due to increase in the frequency of accidents and the need for rapid hospitalization and surgery. According to the US government, more than 16 million Americans have COPD and around 9 million have chronic bronchitis, with the majority of these instances being emergency situations. Moreover, a majority of COPD patients have survived by utilizing an oxygen concentrator and cylinder.

Global Oxygen Cylinders and Concentrators Market, Regional Insights

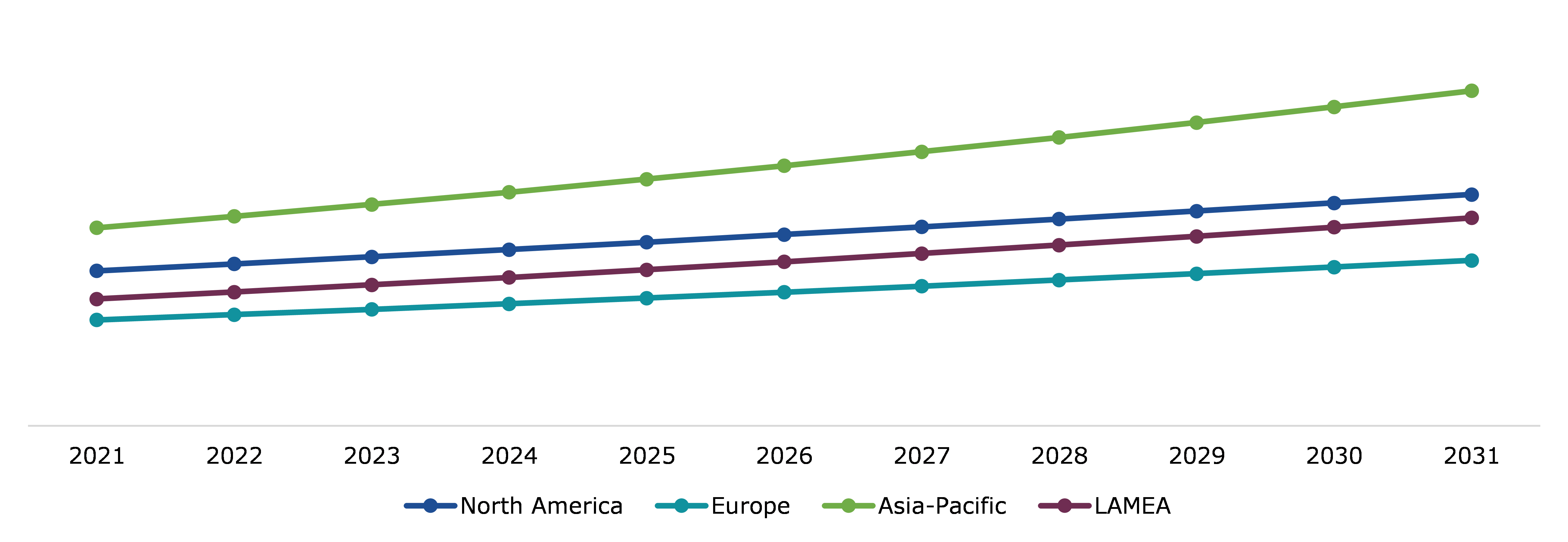

The oxygen cylinders and concentrators market was investigated across North America, Europe, Asia-Pacific, and LAMEA.

Global Oxygen Cylinders and Concentrators Market Size & Forecast, by Region, 2021-2031 (USD Million)

Source: Research Dive Analysis

The Market for Oxygen Cylinders and Concentrators in Asia-Pacific was the Most Dominant

In the upcoming years, it is projected that the Asia Pacific oxygen cylinders and concentrators market will generate strong growth prospects to seize significant revenue-producing opportunities. Due to the increase of conventional (Petroleum) cars, population growth, and deteriorating air quality caused by industrial effluents, the China market is predicted to grow significantly over the forecast period. The degraded air can be treated with oxygen concentrators, which will aid in maintaining the atmospheric oxygen content. The above-mentioned factors are anticipated to boost the Asia-Pacific oxygen cylinders and concentrators market over the forecast period.

Competitive Scenario in the Global Oxygen Cylinders and Concentrators Market

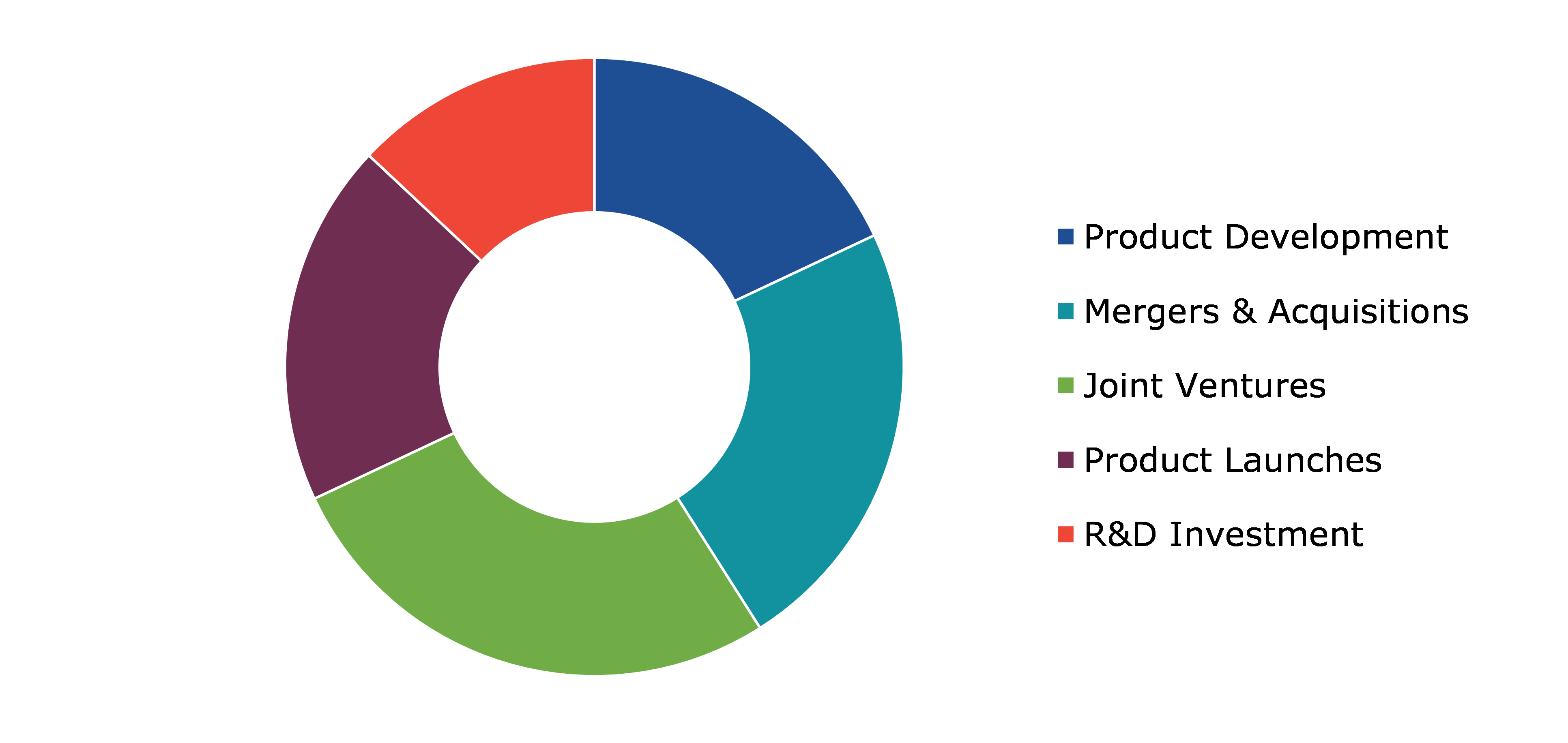

Investment and agreement are common strategies followed by major market players. These manufacturers are employing latest strategies to raise the caliber and effectiveness of their products. For instance, DeVilbiss Healthcare recently introduced the "DeVilbiss iFill personal oxygen station" in an effort to get a larger market share in the industry for oxygen cylinders and concentrators.

Source: Research Dive Analysis

Some of the leading oxygen cylinders and concentrators market players are Teijin Limited Company, Inova Labs Inc. (ResMed), NIDEK Medical Products, Philips N.V (Philips Healthcare), Worthington Industries, Inc., Inogen Inc., Chart Industries (AirSep), Invacare Corporation, Koninklijke O2 Concepts and De Vilbiss Healthcare (Drive DeVilbiss Healthcare).

| Aspect | Particulars |

| Historical Market Estimations | 2020 |

| Base Year for Market Estimation | 2021 |

| Forecast Timeline for Market Projection | 2022-2031 |

| Geographical Scope | North America, Europe, Asia-Pacific, LAMEA |

| Segmentation by Type |

|

| Segmentation by End-use |

|

| Key Companies Profiled |

|

Q1. What is the size of the global oxygen cylinders and concentrators market?

A. The size of the global oxygen cylinders and concentrators market was over $4,151.6 million in 2021 and is projected to reach $6,658.5 million by 2031.

Q2. Which are the major companies in the oxygen cylinders and concentrators market?

A. Chart Industries (AirSep), O2 Concepts and NIDEK Medical Products, Inc. are some of the key players in the global oxygen cylinders and concentrators market.

Q3. Which region, among others, possesses greater investment opportunities in the near future?

A. The Asia-Pacific region possesses great investment opportunities for investors to witness the most promising growth in the future.

Q4. What will be the growth rate of the Asia-Pacific oxygen cylinders and concentrators market?

A. Asia-Pacific oxygen cylinders and concentrators market is anticipated to grow at 5.7% CAGR during the forecast period.

Q5. What are the strategies opted by the leading players in this market?

A. Agreement and investment are the two key strategies opted by the operating companies in this market.

Q6. Which companies are investing more on R&D practices?

A. Inogen Inc., Invacare Corporation and Worthington Industries are the companies investing more on R&D activities for developing new products and technologies.

1.Research Methodology

1.1.Desk Research

1.2.Real time insights and validation

1.3.Forecast model

1.4.Assumptions and forecast parameters

1.5.Market size estimation

1.5.1.Top-down approach

1.5.2.Bottom-up approach

2.Report Scope

2.1.Market definition

2.2.Key objectives of the study

2.3.Report overview

2.4.Market segmentation

2.5.Overview of the impact of COVID-19 on Global oxygen cylinders and concentrators market

3.Executive Summary

4.Market Overview

4.1.Introduction

4.2.Growth impact forces

4.2.1.Drivers

4.2.2.Restraints

4.2.3.Opportunities

4.3.Market value chain analysis

4.3.1.List of raw material suppliers

4.3.2.List of manufacturers

4.3.3.List of distributors

4.4.Innovation & sustainability matrices

4.4.1.Technology matrix

4.4.2.Regulatory matrix

4.5.Porter’s five forces analysis

4.5.1.Bargaining power of suppliers

4.5.2.Bargaining power of consumers

4.5.3.Threat of substitutes

4.5.4.Threat of new entrants

4.5.5.Competitive rivalry intensity

4.6.PESTLE analysis

4.6.1.Political

4.6.2.Economical

4.6.3.Social

4.6.4.Technological

4.6.5.Environmental

4.7.Impact of COVID-19 on oxygen cylinders and concentrators market

4.7.1.Pre-covid market scenario

4.7.2.Post-covid market scenario

5.Oxygen Cylinders and Concentrators Market, by Type

5.1.Overview

5.1.1.Market size and forecast, by Type

5.2.Portable

5.2.1.Key market trends, growth factors, and opportunities

5.2.2.Market size and forecast, by region, 2021-2031

5.2.3.Market share analysis, by country 2021 & 2031

5.3.Fixed

5.3.1.Key market trends, growth factors, and opportunities

5.3.2.Market size and forecast, by region, 2021-2031

5.3.3.Market share analysis, by country 2021 & 2031

5.4.Research Dive Exclusive Insights

5.4.1.Market attractiveness

5.4.2.Competition heatmap

6.Oxygen Cylinders and Concentrators Market, by End-use

6.1.Overview

6.1.1.Market size and forecast, by End-use

6.2.Healthcare

6.2.1.Key market trends, growth factors, and opportunities

6.2.2.Market size and forecast, by region, 2021-2031

6.2.3.Market share analysis, by country 2021 & 2031

6.3.Pharmaceutical & Biotechnology

6.3.1.Key market trends, growth factors, and opportunities

6.3.2.Market size and forecast, by region, 2021-2031

6.3.3.Market share analysis, by country 2021 & 2031

6.4.Manufacturing

6.4.1.Key market trends, growth factors, and opportunities

6.4.2.Market size and forecast, by region, 2021-2031

6.4.3.Market share analysis, by country 2021 & 2031

6.5.Aerospace and Automotive

6.5.1.Key market trends, growth factors, and opportunities

6.5.2.Market size and forecast, by region, 2021-2031

6.5.3.Market share analysis, by country 2021 & 2031

6.6.Others

6.6.1.Key market trends, growth factors, and opportunities

6.6.2.Market size and forecast, by region, 2021-2031

6.6.3.Market share analysis, by country 2021 & 2031

6.7.Research Dive Exclusive Insights

6.7.1.Market attractiveness

6.7.2.Competition heatmap

7.Oxygen Cylinders and Concentrators Market, by Region

7.1.North America

7.1.1.U.S.

7.1.1.1.Market size analysis, by Type,2022-2031

7.1.1.2.Market size analysis, by End-use,2022-2031

7.1.2.Canada

7.1.2.1.Market size analysis, by Type,2022-2031

7.1.2.2.Market size analysis, by End-use,2022-2031

7.1.3.Mexico

7.1.3.1.Market size analysis, by Type,2022-2031

7.1.3.2.Market size analysis, by End-use,2022-2031

7.1.4.Research Dive Exclusive Insights

7.1.4.1.Market attractiveness

7.1.4.2.Competition heatmap

7.2.Europe

7.2.1.Germany

7.2.1.1.Market size analysis, by Type,2022-2031

7.2.1.2.Market size analysis, by End-use,2022-2031

7.2.2.UK

7.2.2.1.Market size analysis, by Type,2022-2031

7.2.2.2.Market size analysis, by End-use,2022-2031

7.2.3.France

7.2.3.1.Market size analysis, by Type,2022-2031

7.2.3.2.Market size analysis, by End-use,2022-2031

7.2.4.Spain

7.2.4.1.Market size analysis, by Type,2022-2031

7.2.4.2.Market size analysis, by End-use,2022-2031

7.2.5.Italy

7.2.5.1.Market size analysis, by Type,2022-2031

7.2.5.2.Market size analysis, by End-use,2022-2031

7.2.6.Rest of Europe

7.2.6.1.Market size analysis, by Type,2022-2031

7.2.6.2.Market size analysis, by End-use,2022-2031

7.2.7.Research Dive Exclusive Insights

7.2.7.1.Market attractiveness

7.2.7.2.Competition heatmap

7.3.Asia-Pacific

7.3.1.China

7.3.1.1.Market size analysis, by Type,2022-2031

7.3.1.2.Market size analysis, by End-use,2022-2031

7.3.2.Japan

7.3.2.1.Market size analysis, by Type,2022-2031

7.3.2.2.Market size analysis, by End-use,2022-2031

7.3.3.India

7.3.3.1.Market size analysis, by Type,2022-2031

7.3.3.2.Market size analysis, by End-use,2022-2031

7.3.4.Australia

7.3.4.1.Market size analysis, by Type,2022-2031

7.3.4.2.Market size analysis, by End-use,2022-2031

7.3.5.South Korea

7.3.5.1.Market size analysis, by Type,2022-2031

7.3.5.2.Market size analysis, by End-use,2022-2031

7.3.6.Rest of Asia-Pacific

7.3.6.1.Market size analysis, by Type,2022-2031

7.3.6.2.Market size analysis, by End-use,2022-2031

7.3.7.Research Dive Exclusive Insights

7.3.7.1.Market attractiveness

7.3.7.2.Competition heatmap

7.4.LAMEA

7.4.1.Brazil

7.4.1.1.Market size analysis, by Type,2022-2031

7.4.1.2.Market size analysis, by End-use,2022-2031

7.4.2.Saudi Arabia

7.4.2.1.Market size analysis, by Type,2022-2031

7.4.2.2.Market size analysis, by End-use,2022-2031

7.4.3.UAE

7.4.3.1.Market size analysis, by Type,2022-2031

7.4.3.2.Market size analysis, by End-use,2022-2031

7.4.4.South Africa

7.4.4.1.Market size analysis, by Type,2022-2031

7.4.4.2.Market size analysis, by End-use,2022-2031

7.4.5.Rest of LAMEA

7.4.5.1.Market size analysis, by Type,2022-2031

7.4.5.2.Market size analysis, by End-use,2022-2031

7.4.6.Research Dive Exclusive Insights

7.4.6.1.Market attractiveness

7.4.6.2.Competition heatmap

8.Competitive Landscape

8.1.Top winning strategies, 2021

8.1.1.By strategy

8.1.2.By year

8.2.Strategic overview

8.3.Market share analysis, 2021

9.Company Profiles

9.1.Chart Industries, Inc.

9.1.1.Overview

9.1.2.Business segments

9.1.3.Type portfolio

9.1.4.Financial performance

9.1.5.Recent developments

9.1.6.SWOT analysis

9.2.O2 Concepts, LLC

9.2.1.Overview

9.2.2.Business segments

9.2.3.Type portfolio

9.2.4.Financial performance

9.2.5.Recent developments

9.2.6.SWOT analysis

9.3.Nidek Medical India.

9.3.1.Overview

9.3.2.Business segments

9.3.3.Type portfolio

9.3.4.Financial performance

9.3.5.Recent developments

9.3.6.SWOT analysis

9.4.Devilbiss Healthcare LLC

9.4.1.Overview

9.4.2.Business segments

9.4.3.Type portfolio

9.4.4.Financial performance

9.4.5.Recent developments

9.4.6.SWOT analysis

9.5.Inogen, Inc.

9.5.1.Overview

9.5.2.Business segments

9.5.3.Type portfolio

9.5.4.Financial performance

9.5.5.Recent developments

9.5.6.SWOT analysis

9.6.Invacare Corporation

9.6.1.Overview

9.6.2.Business segments

9.6.3.Type portfolio

9.6.4.Financial performance

9.6.5.Recent developments

9.6.6.SWOT analysis

9.7.Worthington Industries

9.7.1.Overview

9.7.2.Business segments

9.7.3.Type portfolio

9.7.4.Financial performance

9.7.5.Recent developments

9.7.6.SWOT analysis

9.8.Resmed

9.8.1.Overview

9.8.2.Business segments

9.8.3.Type portfolio

9.8.4.Financial performance

9.8.5.Recent developments

9.8.6.SWOT analysis

9.9.Koninklijke Philips N.V.

9.9.1.Overview

9.9.2.Business segments

9.9.3.Type portfolio

9.9.4.Financial performance

9.9.5.Recent developments

9.9.6.SWOT analysis

9.10.TEIJIN LIMITED.

9.10.1.Overview

9.10.2.Business segments

9.10.3.Type portfolio

9.10.4.Financial performance

9.10.5.Recent developments

9.10.6.SWOT analysis

Oxygen cylinders and concentrators are medical devices which are specifically used in such cases where the patient is suffering from breathlessness or is facing problems retaining the oxygen that is being inhaled. In such cases, oxygen concentrators help in providing a consistent, steady, and purified form of oxygen to the patient, thus aiding the patient’s ability to inhale oxygen. For this, oxygen concentrators filter out oxygen from the surrounding atmosphere, thereby leaving out nitrogen and other gases, and through a pipe offers it to the patient.

Forecast Analysis of the Oxygen Cylinders and Concentrators Market

In recent years, there has been an increase in the expanse of global healthcare sector which has increased the demand for oxygen cylinders and concentrators. This surge in demand is predicted to be the primary growth driver of the global oxygen cylinders and concentrators market in the forecast period. Additionally, growing research and development activities in the field of oxygen concentrators manufacturing is anticipated to push the market forward. Along with this, advantages offered by oxygen cylinders such as portability have increased their demand in the medical industry which is projected to offer numerous growth and investment opportunities to the market in the analysis timeframe. However, lack of infrastructure to manufacture these devices is estimated to create hurdles in the full-fledged growth of the oxygen cylinders and concentrators market in the coming period.

Regionally, the oxygen cylinders and concentrators market in the Asia-Pacific region is expected to be highly dominant by 2031. Growing demand for oxygen concentrators due to overall deteriorating air quality of this region caused by industrial effluents is expected to be the leading factor behind the growth of the market.

According to the report published by Research Dive, the global oxygen cylinders and concentrators market is expected to gather a revenue of $6,658.5 million by 2031 and grow at 4.6% CAGR in the 2022–2031 timeframe. Some prominent market players include Teijin Limited Company, Worthington Industries, Inc., Invacare Corporation, Inova Labs Inc. (ResMed), Inogen Inc., Koninklijke O2 Concepts, NIDEK Medical Products, Chart Industries (AirSep), De Vilbiss Healthcare (Drive DeVilbiss Healthcare), Philips N.V (Philips Healthcare), and many others.

Covid-19 Impact on the Oxygen Cylinders and Concentrators Market

The outbreak of the Covid-19 pandemic has had a massive negative effect on almost all industries and businesses across the world. The oxygen cylinders and concentrators market, however, faced a positive impact of the pandemic due to obvious reasons. Since the SARS-CoV-2 virus primarily infects the lungs of the patient and reduces the ability to inhale oxygen, external support in the form of oxygen cylinders and concentrators becomes necessary. As a result, during the pandemic, the demand for oxygen cylinders and concentrators grew rapidly which helped the market grow.

Significant Market Developments

The significant companies operating in the industry are adopting numerous growth strategies & business tactics such as partnerships, collaborations, mergers & acquisitions, and launches to maintain a robust position in the overall market, thus helping the oxygen cylinders and concentrators market to flourish. For instance:

- In June 2021, Servotech Power Systems, a technological solutions provider, announced that it would be launching medical oxygen cylinders in a bid to meet the exponentially rising demand for oxygen cylinders and concentrators during the pandemic. This establishment of a new facility and the subsequent launch is expected to help the company to increase its presence in the market in the near future.

- In January 2022, NOVAIR, a leading on-site gas production systems manufacturer, announced the acquisition of Oxygen Generating Systems Intl., a leading manufacturer of oxygen generators and concentrators. This acquisition is predicted to offer huge growth and expansion opportunities to NOVAIR in the next few years.

- In March 2022, GRS India, a medical devices startup, announced the launch of a portable and easy-to-handle smartphone-based oxygen kit that can supply consistent oxygen supply to the patients. The launch of this innovation medical device is expected to help GRS India to increase its footprint in the market in the coming period.

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com