Zinc Ion Batteries Market Report

RA09219

Zinc Ion Batteries Market by Type (Aqueous Zinc Ion Batteries (AZIBs) and Flexible Zinc Ion Batteries (FZIBs)), Application (Energy Storage, Portable & Flexible Electronics, and Electric Vehicles), and Region (North America, Europe, Asia-Pacific, and LAMEA): Global Opportunity Analysis and Industry Forecast, 2023-2032

Zinc Ion Batteries Overview

A zinc ion battery is a type of rechargeable battery that uses zinc ions as charge carriers between its electrodes during the charging and discharging cycles. It works on the basis of electrochemical interactions between zinc and zinc ions, using zinc metal as the anode and a cathode material which may combine or mix with zinc ions. The electrolyte, which enables the passage of ions between the electrodes, is typically composed of a zinc salt dissolved in an appropriate solvent. Zinc-ion batteries have received a lot of attention as viable options for energy storage applications due to their high energy density, cheap cost, and relative safety when compared to other battery chemistries such as lithium-ion.

Zinc's availability and low cost make it a desirable alternative to lithium, which is more costly and less plentiful. Furthermore, zinc-ion batteries have higher stability and less dendrite development than lithium-ion batteries, possibly increasing their longevity and safety. Zinc-ion batteries have immense potential for a variety of applications, such as portable devices, electric cars, renewable energy integration, and grid-scale energy storage. Their adaptability, along with their cost-effectiveness and safety profile, make them a disruptive force in the worldwide energy storage business.

Global Zinc Ion Batteries Market Analysis

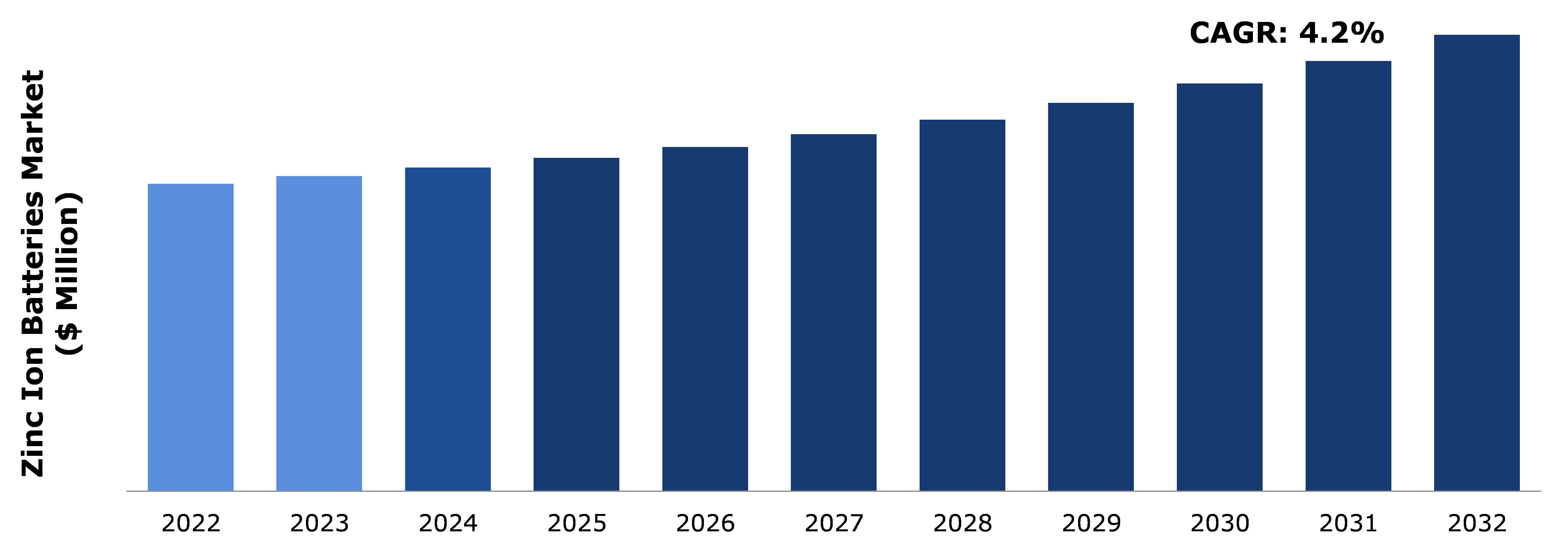

The global zinc ion batteries market size was $314.6 million in 2022 and is predicted to grow with a CAGR of 4.2%, by generating a revenue of $467.1 million by 2032.

Source: Research Dive Analysis

High Energy Density and Performance of Zinc Ion Batteries to Drive the Market Growth

The development of improved electrode materials is a key factor for increasing energy density and performance in ZIBs (zinc-ion batteries). Zinc metal anodes have large theoretical capacities however they suffer from dendritic growth and low cycle stability. To address this issue, researchers have studied nanostructured zinc materials, alloying procedures, and surface modification approaches to reduce dendrite formation and increase cycle stability. Furthermore, the choice of appropriate cathode materials is critical for obtaining high energy density and specific capacity in ZIB.

Transition metal oxides, such as manganese dioxide (MnO2) and vanadium pentoxide (V2O5), have shown interesting electrochemical characteristics through reversible zinc intercalation/deintercalation processes, resulting in increased energy storage capacity. Technological improvements significantly improve the energy density and performance of ZIBs. The development of novel synthesis techniques, such as sol-gel processes, hydrothermal methods, and atomic layer deposition, allows for precise control over the morphology, composition, and nanostructure of electrode materials, tailoring their electrochemical properties to meet the demands of high-performance ZIBs.

Limited Life Cycle of Zinc Ion Batteries to Restrain the Market Growth

Electrode deterioration is one of the main causes of zinc-ion batteries' shorter cycle life. During charge-discharge cycles, the electrodes undergo structural and chemical alterations, resulting in the loss of active material and the production of irreversible side products. In zinc-ion batteries, the cathode is often degraded by processes such as active material dissolution, phase transitions, and electrolyte breakdown. Manganese dissolution and migration, for example, lead to capacity degradation and impedance increase during cycling in zinc-manganese dioxide (Zn-MnO2) batteries.

Similarly, in zinc-vanadium oxide (Zn-V2O5) batteries, reversible intercalation of zinc ions causes permanent structural changes in the vanadium oxide host lattice, resulting in capacity deterioration and voltage fading. Another important issue impacting the life cycle of zinc-ion batteries is electrolyte instability. The electrolyte acts as a medium for ion movement between the electrodes, therefore promoting the electrochemical processes required for battery functioning. However, the chemical reactivity of zinc ions with traditional electrolyte components poses a risk to long-term stability. Zinc ions, for example, can react with the electrolyte's water and oxygen, forming insoluble zinc oxide/hydroxide precipitates and releasing gases.

Technological Advancements and Ongoing R&D Initiatives to Drive Excellent Opportunities

The availability of zinc minerals is one of the key driving forces behind zinc-ion battery R&D. Unlike other battery elements like lithium, which are rare and geographically concentrated, zinc is generally available across the world. This abundance not only assures a secure and sustainable supply chain, but also helps to reduce costs, making zinc-ion batteries economically viable for broad use. The scalability and manufacture of zinc-ion battery technologies are crucial for boosting R&D projects.

Unlike certain unusual battery chemistries, which have scaling issues or rely on rare elements, zinc ion batteries use conventional electrochemical principles and abundant, low-cost ingredients, allowing for large-scale manufacture and commercialization. Furthermore, the compatibility of zinc-ion battery components with current manufacturing infrastructure makes the transfer from lab-scale prototypes to mass production more efficient, boosting innovation and market penetration. This inherent scalability and manufacturing practicality attract industry stakeholders and investors looking for viable alternatives to traditional battery technologies, creating a favorable environment for future R&D initiatives.

Global Zinc Ion Batteries Market Share, by Type, 2022

Source: Research Dive Analysis

The aqueous zinc ion batteries (AZIBs) sub-segment accounted for the highest market share in 2022. Aqueous zinc-ion batteries (AZIBs) have gained popularity due to their promising features and potential applications. These batteries utilize zinc ions as the charge carriers in an aqueous electrolyte, typically water-based which makes them safer and more environmentally friendly compared to traditional lithium-ion batteries.

The use of zinc as an electrode material is advantageous owing to its abundance, low cost, and high theoretical capacity. In addition, AZIBs exhibit excellent cycling stability and a relatively long lifespan which makes them suitable for various applications such as grid energy storage. Furthermore, the ability of zinc ion batteries to store and release large amounts of energy efficiently makes them well-suited for balancing the intermittent nature of renewable energy sources such as solar and wind. AZIBs could play a crucial role in improving the reliability and stability of electrical grids by storing excess energy during periods of low demand and delivering it when demand is high in the upcoming years.

Global Zinc Ion Batteries Market Share, by Application, 2022

Source: Research Dive Analysis

The energy storage sub-segment accounted for the highest market share in 2022. The popularity of zinc ion batteries (ZIBs) in energy storage has been growing steadily driven by several factors that make them attractive for various applications. One significant advantage is the abundance and low cost of zinc which makes these batteries cost-effective and scalable for large-scale energy storage projects. In addition, ZIBs offer improved safety compared to traditional lithium-ion batteries as they use aqueous electrolytes that minimize the risk of thermal runaway and fire incidents. In addition, the demand for energy storage solutions has been rising globally with increase in the integration of renewable energy sources.

ZIBs with their high energy density and cycling stability are well-suited to address the intermittent nature of renewable energy generation. They can store excess energy during periods of high production and release it when demand peaks, which contributes to grid stability and reliability. Governments and industries worldwide are increasingly investing in energy storage technologies to support the transition to cleaner and more sustainable energy systems. ZIBs, with their cost-effectiveness, safety, and environmental benefits, are likely to play a crucial role in meeting these demands. These factors are anticipated to boost the zinc ion batteries demand across energy storage applications.

Global Zinc Ion Batteries Market Size & Forecast, by Region, 2022-2032 ($Million)

Source: Research Dive Analysis

The Asia-Pacific zinc ion batteries market generated the highest revenue in 2022. Asia-Pacific, particularly countries like China, South Korea, and Japan has a well-established industrial capacity and infrastructure for battery manufacturing. These countries are investing heavily in the development of advanced energy storage technologies such as zinc ion batteries owing to its significant potential across energy storage applications. Robust R&D initiatives contribute to technological advancements which make these countries leaders in developing and commercializing innovative battery technologies like zinc ion batteries.

In addition, the region has experienced significant growth in renewable energy installations, such as solar and wind power. As the share of renewable energy increases, the demand for energy storage solutions, including zinc-ion batteries, also rises to address the rising energy demand. For instance, in November 2023, the India-Japan Conclave, was held in New Delhi during which the Union Minister for Power and New & Renewable Energy, R.K. Singh, highlighted India's achievements in renewable energy. He emphasized India's leadership in renewables, boasting a total non-fossil power generation capacity of 186 gigawatts, with an additional 99 gigawatts under construction. Singh stated India's early achievement of its National Determined Contributions, reaching the 40% non-fossil fuel target by 2021. He highlighted India's status as the fastest-growing renewable energy capacity outside China, attracting global investments through competitive open bids. The conclave highlighted the robust India-Japan clean energy partnership and India's position as a preferred destination for renewable investments. Such growing investments in the renewable energy sector are anticipated to drive the Asia-Pacific zinc ion batteries market size in the upcoming years.

Competitive Scenario in the Global Zinc Ion Batteries Market

R&D investments, brand building, and customer engagement are common strategies followed by major market players. For instance, on December 14, 2023, Enerpoly, a Swedish startup that produces zinc-ion battery storage systems with durations of two to 10 hours, planned to scale production up to 100 MWh per year by 2026.

Source: Research Dive Analysis

Some of the leading zinc ion batteries market players are Enerpoly AB, Æsir Technologies, Inc., Salient Energy, ZincFive, FDK CORPORATION, Eastman Kodak Company, ZeniPower (Zhuhai Zhi Li) Battery Co., Ltd., Primus Power, Shenzhen BetterPower Battery Co., Ltd., and GPIndustrial.

| Aspect | Particulars |

| Historical Market Estimations | 2020-2021 |

| Base Year for Market Estimation | 2022 |

| Forecast Timeline for Market Projection | 2023-2032 |

| Geographical Scope | North America, Europe, Asia-Pacific, and LAMEA |

| Segmentation by Type |

|

| Segmentation by Application |

|

| Key Companies Profiled |

|

Q1. What is the size of the global zinc ion batteries market?

A. The size of the global zinc ion batteries market was $314.6 million in 2022 and is projected to reach $467.1 million by 2032.

Q2. Which are the major companies in the zinc ion batteries market?

A. Enerpoly AB, Æsir Technologies, Inc., Salient Energy, and ZincFive are some of the key players in the global zinc ion batteries market.

Q3. Which region, among others, possesses greater investment opportunities in the future?

A. Asia-Pacific possesses great investment opportunities for investors in the future.

Q4. What will be the growth rate of the Asia-Pacific zinc ion batteries market?

A. The Asia-Pacific zinc ion batteries market is anticipated to grow at 4.8% CAGR during the forecast period.

Q5. What are the strategies opted by the leading players in this market?

A. R&D investments, brand building, and customer engagement are the key strategies opted by the operating companies in this market.

Q6. Which companies are investing more on R&D practices?

A. FDK CORPORATION, Eastman Kodak Company, ZeniPower (Zhuhai Zhi Li) Battery Co., Ltd., and Primus Power are the companies investing more on R&D activities for developing new products and technologies.

1. Research Methodology

1.1. Desk Research

1.2. Real time insights and validation

1.3. Forecast model

1.4. Assumptions and forecast parameters

1.5. Market size estimation

1.5.1. Top-down approach

1.5.2. Bottom-up approach

2. Report Scope

2.1. Market definition

2.2. Key objectives of the study

2.3. Market segmentation

3. Executive Summary

4. Market Overview

4.1. Introduction

4.2. Growth impact forces

4.2.1. Drivers

4.2.2. Restraints

4.2.3. Opportunities

4.3. Market value chain analysis

4.3.1. List of raw material suppliers

4.3.2. List of manufacturers

4.3.3. List of distributors

4.4. Innovation & sustainability matrices

4.4.1. Technology matrix

4.4.2. Regulatory matrix

4.5. Porter’s five forces analysis

4.5.1. Bargaining power of suppliers

4.5.2. Bargaining power of consumers

4.5.3. Threat of substitutes

4.5.4. Threat of new entrants

4.5.5. Competitive Rivalry Intensity

4.6. PESTLE analysis

4.6.1. Political

4.6.2. Economical

4.6.3. Social

4.6.4. Technological

4.6.5. Legal

4.6.6. Environmental

4.7. Impact of COVID-19 on zinc ion batteries market

4.7.1. Pre-covid market scenario

4.7.2. Post-covid market scenario

5. Zinc Ion Batteries Market Analysis, By Type

5.1. Overview

5.2. Aqueous Zinc Ion Batteries (AZIBs)

5.2.1. Definition, key trends, growth factors, and opportunities

5.2.2. Market size analysis, by region, 2022-2032

5.2.3. Market share analysis, by country, 2022-2032

5.3. Flexible Zinc Ion Batteries (FZIBs)

5.3.1. Definition, key trends, growth factors, and opportunities

5.3.2. Market size analysis, by region, 2022-2032

5.3.3. Market share analysis, by country, 2022-2032

5.4. Research Dive Exclusive Insights

5.4.1. Market attractiveness

5.4.2. Competition heatmap

6. Zinc Ion Batteries Market Analysis, by Application

6.1. Overview

6.2. Energy Storage

6.2.1. Definition, key trends, growth factors, and opportunities

6.2.2. Market size analysis, by region, 2022-2032

6.2.3. Market share analysis, by country, 2022-2032

6.3. Portable & Flexible Electronics

6.3.1. Definition, key trends, growth factors, and opportunities

6.3.2. Market size analysis, by region, 2022-2032

6.3.3. Market share analysis, by country, 2022-2032

6.4. Electric Vehicles

6.4.1. Definition, key trends, growth factors, and opportunities

6.4.2. Market size analysis, by region, 2022-2032

6.4.3. Market share analysis, by country, 2022-2032

6.5. Research Dive Exclusive Insights

6.5.1. Market attractiveness

6.5.2. Competition heatmap

7. Zinc Ion Batteries Market, by Region

7.1. North America

7.1.1. U.S.

7.1.1.1. Market size analysis, by Type, 2022-2032

7.1.1.2. Market size analysis, by Application, 2022-2032

7.1.2. Canada

7.1.2.1. Market size analysis, by Type, 2022-2032

7.1.2.2. Market size analysis, by Application, 2022-2032

7.1.3. Mexico

7.1.3.1. Market size analysis, by Type, 2022-2032

7.1.3.2. Market size analysis, by Application, 2022-2032

7.1.4. Research Dive Exclusive Insights

7.1.4.1. Market attractiveness

7.1.4.2. Competition heatmap

7.2. Europe

7.2.1. Germany

7.2.1.1. Market size analysis, by Type, 2022-2032

7.2.1.2. Market size analysis, by Application, 2022-2032

7.2.2. UK

7.2.2.1. Market size analysis, by Type, 2022-2032

7.2.2.2. Market size analysis, by Application, 2022-2032

7.2.3. France

7.2.3.1. Market size analysis, by Type, 2022-2032

7.2.3.2. Market size analysis, by Application, 2022-2032

7.2.4. Spain

7.2.4.1. Market size analysis, by Type, 2022-2032

7.2.4.2. Market size analysis, by Application, 2022-2032

7.2.5. Italy

7.2.5.1. Market size analysis, by Type, 2022-2032

7.2.5.2. Market size analysis, by Application, 2022-2032

7.2.6. Rest of Europe

7.2.6.1. Market size analysis, by Type, 2022-2032

7.2.6.2. Market size analysis, by Application, 2022-2032

7.2.7. Research Dive Exclusive Insights

7.2.7.1. Market attractiveness

7.2.7.2. Competition heatmap

7.3. Asia-Pacific

7.3.1. China

7.3.1.1. Market size analysis, by Type, 2022-2032

7.3.1.2. Market size analysis, by Application, 2022-2032

7.3.2. Japan

7.3.2.1. Market size analysis, by Type, 2022-2032

7.3.2.2. Market size analysis, by Application, 2022-2032

7.3.3. India

7.3.3.1. Market size analysis, by Type, 2022-2032

7.3.3.2. Market size analysis, by Application, 2022-2032

7.3.4. South Korea

7.3.4.1. Market size analysis, by Type, 2022-2032

7.3.4.2. Market size analysis, by Application, 2022-2032

7.3.5. Australia

7.3.5.1. Market size analysis, by Type, 2022-2032

7.3.5.2. Market size analysis, by Application, 2022-2032

7.3.6. Rest of Asia-Pacific

7.3.6.1. Market size analysis, by Type, 2022-2032

7.3.6.2. Market size analysis, by Application, 2022-2032

7.3.7. Research Dive Exclusive Insights

7.3.7.1. Market attractiveness

7.3.7.2. Competition heatmap

7.4. LAMEA

7.4.1. Brazil

7.4.1.1. Market size analysis, by Type, 2022-2032

7.4.1.2. Market size analysis, by Application, 2022-2032

7.4.2. UAE

7.4.2.1. Market size analysis, by Type, 2022-2032

7.4.2.2. Market size analysis, by Application, 2022-2032

7.4.3. Saudi Arabia

7.4.3.1. Market size analysis, by Type, 2022-2032

7.4.3.2. Market size analysis, by Application, 2022-2032

7.4.4. South Africa

7.4.4.1. Market size analysis, by Type, 2022-2032

7.4.4.2. Market size analysis, by Application, 2022-2032

7.4.5. Rest of LAMEA

7.4.5.1. Market size analysis, by Type, 2022-2032

7.4.5.2. Market size analysis, by Application, 2022-2032

7.4.6. Research Dive Exclusive Insights

7.4.6.1. Market attractiveness

7.4.6.2. Competition heatmap

8. Competitive Landscape

8.1. Top winning strategies, 2022

8.1.1. By strategy

8.1.2. By year

8.2. Strategic overview

8.3. Market share analysis, 2022

9. Company Profiles

9.1. Enerpoly AB

9.1.1. Overview

9.1.2. Business segments

9.1.3. Product portfolio

9.1.4. Financial performance

9.1.5. Recent developments

9.1.6. SWOT analysis

9.2. Æsir Technologies, Inc.

9.2.1. Overview

9.2.2. Business segments

9.2.3. Product portfolio

9.2.4. Financial performance

9.2.5. Recent developments

9.2.6. SWOT analysis

9.3. Salient Energy

9.3.1. Overview

9.3.2. Business segments

9.3.3. Product portfolio

9.3.4. Financial performance

9.3.5. Recent developments

9.3.6. SWOT analysis

9.4. ZincFive

9.4.1. Overview

9.4.2. Business segments

9.4.3. Product portfolio

9.4.4. Financial performance

9.4.5. Recent developments

9.4.6. SWOT analysis

9.5. FDK CORPORATION

9.5.1. Overview

9.5.2. Business segments

9.5.3. Product portfolio

9.5.4. Financial performance

9.5.5. Recent developments

9.5.6. SWOT analysis

9.6. Eastman Kodak Company

9.6.1. Overview

9.6.2. Business segments

9.6.3. Product portfolio

9.6.4. Financial performance

9.6.5. Recent developments

9.6.6. SWOT analysis

9.7. ZeniPower (Zhuhai Zhi Li) Battery Co., Ltd.

9.7.1. Overview

9.7.2. Business segments

9.7.3. Product portfolio

9.7.4. Financial performance

9.7.5. Recent developments

9.7.6. SWOT analysis

9.8. Primus Power

9.8.1. Overview

9.8.2. Business segments

9.8.3. Product portfolio

9.8.4. Financial performance

9.8.5. Recent developments

9.8.6. SWOT analysis

9.9. Shenzhen BetterPower Battery Co., Ltd.

9.9.1. Overview

9.9.2. Business segments

9.9.3. Product portfolio

9.9.4. Financial performance

9.9.5. Recent developments

9.9.6. SWOT analysis

9.10. GPIndustrial

9.10.1. Overview

9.10.2. Business segments

9.10.3. Product portfolio

9.10.4. Financial performance

9.10.5. Recent developments

9.10.6. SWOT analysis

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com