Milk Bottle Market Report

RA09213

Milk Bottle Market by Capacity (Below 200 ML, 200 ML to 500 ML, 500 ML to 2000 ML, and Above 2000 ML), Application (Baby Feeding Bottle and Milk Storage Bottle), Material (Plastics and Glass), Closure Type (Screw Caps, Snap-On Caps, and Others), and Region (North America, Europe, Asia-Pacific, and LAMEA): Global Opportunity Analysis and Industry Forecast, 2023-2032

Milk Bottle Overview

Milk bottle, an essential container in dairy industry, has undergone significant evolution since its inception. Traditionally made of glass, modern milk bottles now feature various materials such as plastic or recyclable materials, enhancing durability and eco-friendliness. These containers are designed to preserve the freshness and nutritional integrity of milk, preventing contamination and extending shelf life. With the advent of technology, some milk bottles incorporate smart sensors to monitor freshness and provide consumers with real-time information. The iconic design, often characterized by a narrow neck and a sturdy body, facilitates easy pouring and handling. In addition to functionality, milk bottles also serve as a platform for branding and marketing, with dairy companies using distinctive labels and packaging to differentiate their products in a competitive market.

Global Milk Bottle Market Analysis

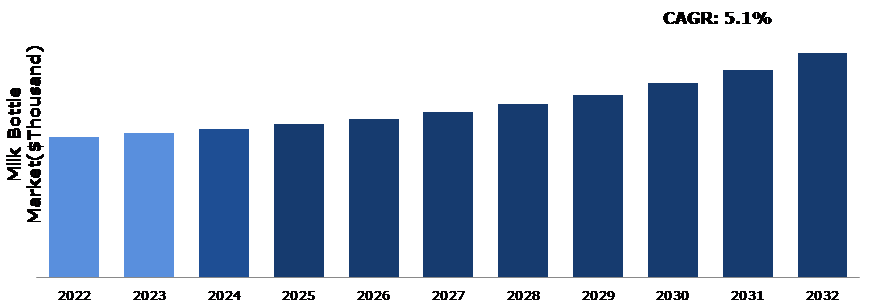

The global milk bottle market size was $3,580,115.0 thousand in 2022 and is predicted to grow with a CAGR of 5.1%, by generating a revenue of $5,718,650.5 thousand by 2032.

Source: Research Dive Analysis

Rising Use of Milk Bottles in the Dairy Industry to Drive the Market Growth

One significant driving force is the ever-growing global population, leading to higher dairy consumption patterns. As more people incorporate dairy products into their diets, there is a natural surge in the production of milk to meet this rising demand. Consequently, the need for reliable and efficient milk bottles increases, as they serve as the primary vessel for storing and transporting dairy products. In addition, changing dietary habits and lifestyle choices contribute to the expansion of the dairy sector. As consumers become more health-conscious, there is an increase in emphasis on the nutritional benefits of dairy, further boosting its popularity. This shift in consumer behavior not only leads to an increase in demand for dairy but also elevates the significance of proper packaging, with milk bottles playing a pivotal role in preserving the freshness and quality of these products. Furthermore, advancements in technology and packaging innovation are factors driving the market growth. The incorporation of smart packaging solutions and sustainable materials aligns with the changing preferences of environmentally conscious consumers.

Increasing Prices of Raw Materials to Restrain the Milk Bottle Market Growth

The price instability of raw materials, particularly plastic and glass, poses a significant challenge to the production cost of milk bottles. Manufacturers, dependent on these materials for bottle production, are susceptible to price fluctuations that can reverberate through the entire supply chain. Fluctuations in the cost of raw materials directly influence production expenses, thereby impacting manufacturers' profit margins. The unpredictability in pricing introduces a level of financial uncertainty for producers, compelling them to navigate a landscape where material costs are subject to sudden and sometimes drastic changes. This instability in production costs often leads to a problem for manufacturers, as they must take a delicate approach to maintaining product quality and managing expenses. When raw material prices increase, manufacturers may face a squeeze on their profit margins unless they opt to pass the increased costs onto consumers. Therefore, end-users may experience higher prices for milk bottles, reflecting the economic consequences of the manufacturing process. As the industry grapples with these fluctuations, strategic material sourcing, cost-effective production methods, and innovation in packaging technologies become imperative for manufacturers seeking to mitigate the impact of raw materials price volatility on both their bottom line and consumer affordability.

Technological Advancements and Creative Design & Material Choices for Packaging of Milk Bottles to Drive Excellent Growth Opportunities

The growth of the milk bottle market is largely attributed to technological advancements and innovative design and material choices in packaging. As the industry continues to evolve, advancements in materials play a pivotal role. The development of robust yet lightweight materials has emerged as a game-changer. This not only enhances the durability of milk bottles, ensuring secure storage and transportation but also addresses environmental concerns by reducing the overall ecological footprint associated with production and disposal. Moreover, creative design choices contribute significantly to the market expansion. Packaging aesthetics and functionality are increasingly recognized as critical factors influencing consumer preferences. In the milk bottle industry, attractive and distinctive designs not only set products apart on store shelves but also bolster brand identity. Technological advancements extend beyond materials and design to encompass intelligent packaging techniques. The integration of smart sensors and tracking technologies ensures real-time monitoring of freshness and quality. This not only aligns with consumer demands for transparency but also enhances the overall consumer experience. Intelligent packaging not only extends shelf life but also minimizes waste by providing accurate information about the product's condition. All these factors are anticipated to create an excellent opportunity for the milk bottle market growth during the forecast years.

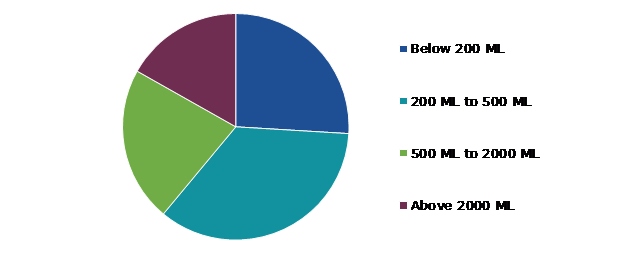

Global Milk Bottle Market Share, by Capacity, 2022

Source: Research Dive Analysis

The 200 ml to 500 ml sub-segment accounted for the highest market share in 2022. Consumers' shifting lifestyles and consumption patterns are an important factor leading to an increase in demand for 200 ml to 500 ml milk bottles. Modern customers, who frequently live fast-paced lifestyles, demand convenience in their everyday routines. Smaller milk bottles address this demand by providing a more controllable and portable solution. Individuals that priorities on-the-go drinking, such as workers and busy professionals, will find these smaller bottles more convenient and simpler to integrate into their daily routines. The 200 ml to 500 ml milk bottles are ideal for individuals who are cautious of portion management and want to better regulate their daily consumption. These sizes are ideal for single servings, allowing customers to have a controlled amount of milk without the risk of waste. This component appeals to health-conscious consumers who want to eat a balanced diet and keep track of their calorie consumption, which is consistent with current nutrition and wellness trends. The dairy business has expanded its product options to meet the different demands of consumers. This enables dairy farmers to provide a wider range of milk products, including flavored milk, lactose-free choices, and customized formulas in smaller volumes.

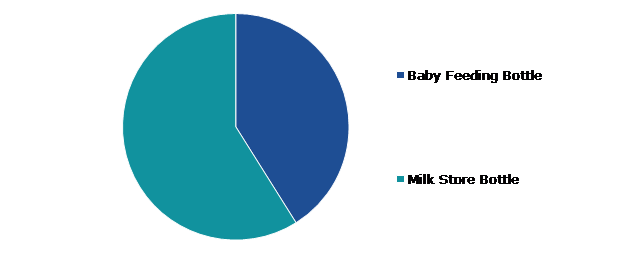

Global Milk Bottle Market Share, by Application, 2022

Source: Research Dive Analysis

The milk storage bottle sub-segment accounted for the highest market share in 2022. One of the key reasons for the rise of milk storage bottles is a rising awareness about environmental sustainability. Traditional single-use plastic containers cause enormous pollution and have a negative impact on ecosystems. Milk bottles, which are frequently constructed of glass or recyclable polymers, provide a more sustainable option, lowering the carbon footprint associated with packing and disposal. As customers grow more environmentally concerned, there is a greater demand for items that promote sustainable practices. Milk bottle businesses respond to this desire by offering a packaging option that eliminates waste and promotes environmentally friendly efforts. This shift in customer tastes has prompted the dairy sector to consider more sustainable packaging choices. Companies are recognizing the importance of adopting corporate responsibility to create a positive brand image. Adopting milk storage bottles not only demonstrates a commitment toward sustainability, but also enables businesses to present themselves as ecologically responsible. This, in turn, builds consumer trust and loyalty. Governments and regulatory agencies throughout the world have introduced stronger regulations to decrease plastic consumption and encourage sustainable activities. Several countries have imposed prohibitions or limitations on single-use plastics, prompting businesses to consider alternate packaging options such as milk bottles. Compliance with these requirements has become a driving force behind the dairy industry's adoption of sustainable packaging.

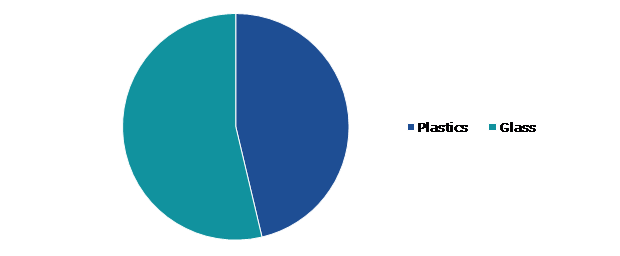

Global Milk Bottle Market Share, by Material, 2022

Source: Research Dive Analysis

The glass sub-segment accounted for the highest market share in 2022. Glass is a completely recyclable material, and recycling glass requires less energy than creating new glass. The closed-loop feature of glass recycling is consistent with current consumers' increased concerns about environmental impact and waste reduction. Glass milk bottles, unlike single-use plastics, may be reused several times, lowering the overall carbon footprint associated with packaging. Furthermore, glass is inert, which means it does not leak dangerous substances into the milk. This makes glass an excellent alternative for people who value both environmental sustainability and the safety of their food and beverages. The option to return empty glass bottles to be cleaned, sterilized, and refilled further increases the environmental profile. Consumer preferences strongly influence dairy producers' packaging options. In recent years, there has been an increase in the need for transparency in product packaging, both in terms of materials and production methods. Glass milk bottles, with their transparent and inert qualities, allow customers to view the contents clearly and are regarded as a reliable and pure packaging option.

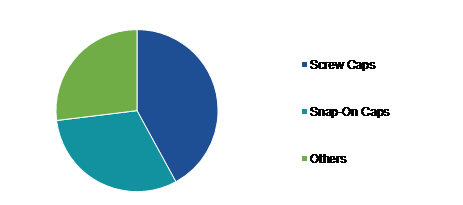

Global Milk Bottle Market Share, by Closure Type, 2022

Source: Research Dive Analysis

The screw caps sub-segment accounted for the highest market share in 2022. Screw caps are simple to open and reseal, allowing for quick pouring while preventing spills. This user-friendly design is in line with current customers' fast-paced lifestyles, which value ease in all aspects of their everyday lives. Screw caps create an airtight seal, reducing exposure to external factors like air and light. This hermetic seal helps to maintain the freshness of the milk and increases its shelf life. Screw caps provide a more robust barrier against contaminants than standard closures, ensuring that milk retains its nutritious content and flavor for a prolonged period of time. Screw caps' secure and tamper-evident characteristics reassure customers about the integrity of the milk in the bottle, fostering trust in the product and its source. To address the rising need for efficiency and cost-effectiveness, the dairy sector has shifted to automated packaging techniques. Screw caps are ideal for automated production lines, since they integrate seamlessly into high-speed manufacturing processes. The efficiency of these closures helps to reduce manufacturing costs and boost throughput.

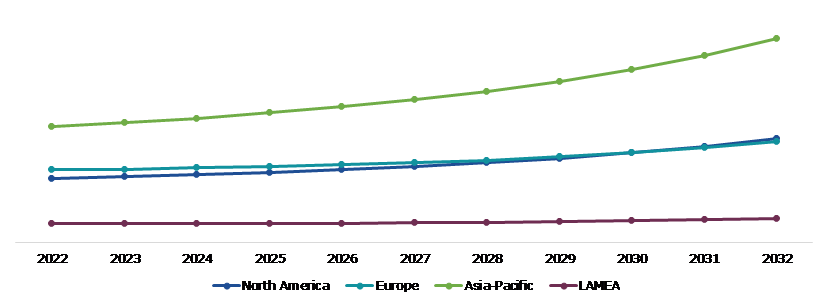

Global Milk Bottle Market Size & Forecast, by Region, 2022-2032 ($Thousand)

Source: Research Dive Analysis

The Asia-Pacific milk bottle market generated the highest revenue in 2022. One of the key reasons driving milk bottle manufacturing is the region's growing population. As one of the world's most populated regions, with countries like China and India driving the demographic charge, there is a sizable and rising customer base for dairy products. The growing population not only leads to an increase in demand for milk, but also for packaging options such as milk bottles. As the region's urbanization and disposable incomes grow, consumer tastes change towards packaged and convenient dairy goods, driving up demand for milk bottles. Rapid urbanization in many Asia-Pacific countries is closely related to economic development. As individuals move to cities in quest of greater opportunities, their lives and eating habits change. The fast-paced urban lifestyle typically necessitates accessible and portable food & beverage alternatives, contributing to an increase in the use of packaged dairy products, which are frequently packed in milk bottles. The convenience element connected with these bottles, such as ease of storage and transportation, complements the urban lifestyle, driving up demand for milk bottle manufacturing in the region.

Competitive Scenario in the Global Milk Bottle Market

Partnerships with retailers & distributors and global market expansion are common strategies followed by major market players. For instance, on March 7, 2023, Ember Technologies, Inc. (Ember), the global design-led temperature control brand and technology platform, announced the launch of the world's first self-warming baby feeding bottle system.

Source: Research Dive Analysis

Some of the leading milk bottle market analysis players are Longshen Industrial, Huhtamaki, Amcor, Gerresheimer, Tupperware Brands, Maharashtra Industries, MeadWestvaco, Bormioli, Rocco, WWP Direct, and Kadolta Packaging.

| Aspect | Particulars |

| Historical Market Estimations | 2020-2021 |

| Base Year for Market Estimation | 2022 |

| Forecast Timeline for Market Projection | 2023-2032 |

| Geographical Scope | North America, Europe, Asia-Pacific, and LAMEA |

| Segmentation by Capacity |

|

| Segmentation by Application |

|

| Segmentation by Material |

|

| Segmentation by Closure Type |

|

| Key Companies Profiled |

|

Q1. What is the size of the global milk bottle market?

A. The size of the global milk bottle market size was $3,580,115.0 thousand in 2022 and is projected to reach $5,718,650.5 thousand by 2032.

Q2. Which are the major companies in the milk bottle market?

A. Longshen Industrial, Huhtamaki, Amcor, Gerresheimer, Tupperware Brands, Maharashtra Industries, MeadWestvaco, Bormioli, Rocco, WWP Direct, and Kadolta Packaging are some of the key players in the global milk bottle market.

Q3. Which region, among others, possesses greater investment opportunities in the future?

A. North America possesses great investment opportunities for investors in the future.

Q4. What will be the growth rate of the Asia-Pacific milk bottle market?

A. The Asia-Pacific milk bottle market share is anticipated to grow at 6.1% CAGR during the forecast period.

Q5. What are the strategies opted by the leading players in this market?

A. Partnerships with retailers & distributors and global market expansion are the two key strategies opted by the operating companies in this market.

Q6. Which companies are investing more on R&D practices?

A. Huhtamaki and Amcor are the companies investing more on R&D activities for developing new products and technologies.

1. Research Methodology

1.1. Desk Research

1.2. Real time insights and validation

1.3. Forecast model

1.4. Assumptions and forecast parameters

1.5. Market size estimation

1.5.1. Top-down approach

1.5.2. Bottom-up approach

2. Report Scope

2.1. Market definition

2.2. Key objectives of the study

2.3. Report overview

2.4. Market segmentation

2.5. Overview of the impact of COVID-19 on global milk bottle market

3. Executive Summary

4. Market Overview

4.1. Introduction

4.2. Growth impact forces

4.2.1. Drivers

4.2.2. Restraints

4.2.3. Opportunities

4.3. Market value chain analysis

4.3.1. List of raw material suppliers

4.3.2. List of manufacturers

4.3.3. List of distributors

4.4. Innovation & sustainability matrices

4.4.1. Technology matrix

4.4.2. Regulatory matrix

4.5. Porter’s five forces analysis

4.5.1. Bargaining power of suppliers

4.5.2. Bargaining power of consumers

4.5.3. Threat of substitutes

4.5.4. Threat of new entrants

4.5.5. Competitive Rivalry Intensity

4.6. PESTLE analysis

4.6.1. Political

4.6.2. Economical

4.6.3. Social

4.6.4. Technological

4.6.5. Legal

4.6.6. Environmental

4.7. Impact of COVID-19 on milk bottle market

4.7.1. Pre-covid market scenario

4.7.2. Post-covid market scenario

5. Milk Bottle Market Analysis, By Capacity

5.1. Overview

5.2. Below 200 ML

5.2.1. Definition, key trends, growth factors, and opportunities

5.2.2. Market size analysis, by region, 2022-2032

5.2.3. Market share analysis, by country, 2022-2032

5.3. 200 ML to 500 ML

5.3.1. Definition, key trends, growth factors, and opportunities

5.3.2. Market size analysis, by region, 2022-2032

5.3.3. Market share analysis, by country, 2022-2032

5.4. 500 ML to 2000 ML

5.4.1. Definition, key trends, growth factors, and opportunities

5.4.2. Market size analysis, by region, 2022-2032

5.4.3. Market share analysis, by country, 2022-2032

5.5. Above 2000 ML

5.5.1. Definition, key trends, growth factors, and opportunities

5.5.2. Market size analysis, by region, 2022-2032

5.5.3. Market share analysis, by country, 2022-2032

5.6. Research Dive Exclusive Insights

5.6.1. Market attractiveness

5.6.2. Competition heatmap

6. Milk Bottle Market Analysis, by Application

6.1. Overview

6.2. Baby Feeding Bottle

6.2.1. Definition, key trends, growth factors, and opportunities

6.2.2. Market size analysis, by region, 2022-2032

6.2.3. Market share analysis, by country, 2022-2032

6.3. Milk Storage Bottle

6.3.1. Definition, key trends, growth factors, and opportunities

6.3.2. Market size analysis, by region, 2022-2032

6.3.3. Market share analysis, by country, 2022-2032

6.4. Research Dive Exclusive Insights

6.4.1. Market attractiveness

6.4.2. Competition heatmap

7. Milk Bottle Market Analysis, by Material

7.1. Overview

7.2. Plastics

7.2.1. Definition, key trends, growth factors, and opportunities

7.2.2. Market size analysis, by region, 2022-2032

7.2.3. Market share analysis, by country, 2022-2032

7.3. Glass

7.3.1. Definition, key trends, growth factors, and opportunities

7.3.2. Market size analysis, by region, 2022-2032

7.3.3. Market share analysis, by country, 2022-2032

7.4. Research Dive Exclusive Insights

7.4.1. Market attractiveness

7.4.2. Competition heatmap

8. Milk Bottle Market Analysis, by Closure Type

8.1. Overview

8.2. Screw Caps

8.2.1. Definition, key trends, growth factors, and opportunities

8.2.2. Market size analysis, by region, 2022-2032

8.2.3. Market share analysis, by country, 2022-2032

8.3. Snap-On Caps

8.3.1. Definition, key trends, growth factors, and opportunities

8.3.2. Market size analysis, by region, 2022-2032

8.3.3. Market share analysis, by country, 2022-2032

8.4. Others

8.4.1. Definition, key trends, growth factors, and opportunities

8.4.2. Market size analysis, by region, 2022-2032

8.4.3. Market share analysis, by country, 2022-2032

8.5. Research Dive Exclusive Insights

8.5.1. Market attractiveness

8.5.2. Competition heatmap

9. Milk Bottle Market, by Region

9.1. North America

9.1.1. U.S.

9.1.1.1. Market size analysis, by Capacity, 2022-2032

9.1.1.2. Market size analysis, by Application, 2022-2032

9.1.1.3. Market size analysis, by Material, 2022-2032

9.1.1.4. Market size analysis, by Closure Type, 2022-2032

9.1.2. Canada

9.1.2.1. Market size analysis, by Capacity, 2022-2032

9.1.2.2. Market size analysis, by Application, 2022-2032

9.1.2.3. Market size analysis, by Material, 2022-2032

9.1.2.4. Market size analysis, by Closure Type, 2022-2032

9.1.3. Mexico

9.1.3.1. Market size analysis, by Capacity, 2022-2032

9.1.3.2. Market size analysis, by Application, 2022-2032

9.1.3.3. Market size analysis, by Material, 2022-2032

9.1.3.4. Market size analysis, by Closure Type, 2022-2032

9.1.4. Research Dive Exclusive Insights

9.1.4.1. Market attractiveness

9.1.4.2. Competition heatmap

9.2. Europe

9.2.1. Germany

9.2.1.1. Market size analysis, by Capacity, 2022-2032

9.2.1.2. Market size analysis, by Application, 2022-2032

9.2.1.3. Market size analysis, by Material, 2022-2032

9.2.1.4. Market size analysis, by Closure Type, 2022-2032

9.2.2. UK

9.2.2.1. Market size analysis, by Capacity, 2022-2032

9.2.2.2. Market size analysis, by Application, 2022-2032

9.2.2.3. Market size analysis, by Material, 2022-2032

9.2.2.4. Market size analysis, by Closure Type, 2022-2032

9.2.3. France

9.2.3.1. Market size analysis, by Capacity, 2022-2032

9.2.3.2. Market size analysis, by Application, 2022-2032

9.2.3.3. Market size analysis, by Material, 2022-2032

9.2.3.4. Market size analysis, by Closure Type, 2022-2032

9.2.4. Spain

9.2.4.1. Market size analysis, by Capacity, 2022-2032

9.2.4.2. Market size analysis, by Application, 2022-2032

9.2.4.3. Market size analysis, by Material, 2022-2032

9.2.4.4. Market size analysis, by Closure Type, 2022-2032

9.2.5. Italy

9.2.5.1. Market size analysis, by Capacity, 2022-2032

9.2.5.2. Market size analysis, by Application, 2022-2032

9.2.5.3. Market size analysis, by Material, 2022-2032

9.2.5.4. Market size analysis, by Closure Type, 2022-2032

9.2.6. Rest of Europe

9.2.6.1. Market size analysis, by Capacity, 2022-2032

9.2.6.2. Market size analysis, by Application, 2022-2032

9.2.6.3. Market size analysis, by Material, 2022-2032

9.2.6.4. Market size analysis, by Closure Type, 2022-2032

9.2.7. Research Dive Exclusive Insights

9.2.7.1. Market attractiveness

9.2.7.2. Competition heatmap

9.3. Asia-Pacific

9.3.1. China

9.3.1.1. Market size analysis, by Capacity, 2022-2032

9.3.1.2. Market size analysis, by Application, 2022-2032

9.3.1.3. Market size analysis, by Material, 2022-2032

9.3.1.4. Market size analysis, by Closure Type, 2022-2032

9.3.2. Japan

9.3.2.1. Market size analysis, by Capacity, 2022-2032

9.3.2.2. Market size analysis, by Application, 2022-2032

9.3.2.3. Market size analysis, by Material, 2022-2032

9.3.2.4. Market size analysis, by Closure Type, 2022-2032

9.3.3. India

9.3.3.1. Market size analysis, by Capacity, 2022-2032

9.3.3.2. Market size analysis, by Application, 2022-2032

9.3.3.3. Market size analysis, by Material, 2022-2032

9.3.3.4. Market size analysis, by Closure Type, 2022-2032

9.3.4. Australia

9.3.4.1. Market size analysis, by Capacity, 2022-2032

9.3.4.2. Market size analysis, by Application, 2022-2032

9.3.4.3. Market size analysis, by Material, 2022-2032

9.3.4.4. Market size analysis, by Closure Type, 2022-2032

9.3.5. Indonesia

9.3.5.1. Market size analysis, by Capacity, 2022-2032

9.3.5.2. Market size analysis, by Application, 2022-2032

9.3.5.3. Market size analysis, by Material, 2022-2032

9.3.5.4. Market size analysis, by Closure Type, 2022-2032

9.3.6. Rest of Asia-Pacific

9.3.6.1. Market size analysis, by Capacity, 2022-2032

9.3.6.2. Market size analysis, by Application, 2022-2032

9.3.6.3. Market size analysis, by Material, 2022-2032

9.3.6.4. Market size analysis, by Closure Type, 2022-2032

9.3.7. Research Dive Exclusive Insights

9.3.7.1. Market attractiveness

9.3.7.2. Competition heatmap

9.4. LAMEA

9.4.1. Brazil

9.4.1.1. Market size analysis, by Capacity, 2022-2032

9.4.1.2. Market size analysis, by Application, 2022-2032

9.4.1.3. Market size analysis, by Material, 2022-2032

9.4.1.4. Market size analysis, by Closure Type, 2022-2032

9.4.2. UAE

9.4.2.1. Market size analysis, by Capacity, 2022-2032

9.4.2.2. Market size analysis, by Application, 2022-2032

9.4.2.3. Market size analysis, by Material, 2022-2032

9.4.2.4. Market size analysis, by Closure Type, 2022-2032

9.4.3. South Africa

9.4.3.1. Market size analysis, by Capacity, 2022-2032

9.4.3.2. Market size analysis, by Application, 2022-2032

9.4.3.3. Market size analysis, by Material, 2022-2032

9.4.3.4. Market size analysis, by Closure Type, 2022-2032

9.4.4. Argentina

9.4.4.1. Market size analysis, by Capacity, 2022-2032

9.4.4.2. Market size analysis, by Application, 2022-2032

9.4.4.3. Market size analysis, by Material, 2022-2032

9.4.4.4. Market size analysis, by Closure Type, 2022-2032

9.4.5. Rest of LAMEA

9.4.5.1. Market size analysis, by Capacity, 2022-2032

9.4.5.2. Market size analysis, by Application, 2022-2032

9.4.5.3. Market size analysis, by Material, 2022-2032

9.4.5.4. Market size analysis, by Closure Type, 2022-2032

9.4.6. Research Dive Exclusive Insights

9.4.6.1. Market attractiveness

9.4.6.2. Competition heatmap

10. Competitive Landscape

10.1. Top winning strategies, 2022

10.1.1. By strategy

10.1.2. By year

10.2. Strategic overview

10.3. Market share analysis, 2022

11. Company Profiles

11.1. Longshen Industrial

11.1.1. Overview

11.1.2. Business segments

11.1.3. Product portfolio

11.1.4. Financial performance

11.1.5. Recent developments

11.1.6. SWOT analysis

11.2. Huhtamaki

11.2.1. Overview

11.2.2. Business segments

11.2.3. Product portfolio

11.2.4. Financial performance

11.2.5. Recent developments

11.2.6. SWOT analysis

11.3. Amcor

11.3.1. Overview

11.3.2. Business segments

11.3.3. Product portfolio

11.3.4. Financial performance

11.3.5. Recent developments

11.3.6. SWOT analysis

11.4. Gerresheimer

11.4.1. Overview

11.4.2. Business segments

11.4.3. Product portfolio

11.4.4. Financial performance

11.4.5. Recent developments

11.4.6. SWOT analysis

11.5. Tupperware Brands

11.5.1. Overview

11.5.2. Business segments

11.5.3. Product portfolio

11.5.4. Financial performance

11.5.5. Recent developments

11.5.6. SWOT analysis

11.6. Maharashtra Industries

11.6.1. Overview

11.6.2. Business segments

11.6.3. Product portfolio

11.6.4. Financial performance

11.6.5. Recent developments

11.6.6. SWOT analysis

11.7. MeadWestvaco

11.7.1. Overview

11.7.2. Business segments

11.7.3. Product portfolio

11.7.4. Financial performance

11.7.5. Recent developments

11.7.6. SWOT analysis

11.8. Bormioli

11.8.1. Overview

11.8.2. Business segments

11.8.3. Product portfolio

11.8.4. Financial performance

11.8.5. Recent developments

11.8.6. SWOT analysis

11.9. WWP Direct

11.9.1. Overview

11.9.2. Business segments

11.9.3. Product portfolio

11.9.4. Financial performance

11.9.5. Recent developments

11.9.6. SWOT analysis

11.10. Kadolta Packaging

11.10.1. Overview

11.10.2. Business segments

11.10.3. Product portfolio

11.10.4. Financial performance

11.10.5. Recent developments

11.10.6. SWOT analysis

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com