Bridal Jewelry Market Report

RA09194

Bridal Jewelry Market by Material (Gold, Diamond, Silver, and Others), Product Type (Earrings, Necklaces, Rings, Bracelets, Chains, and Others), Distribution Channel (Online and Offline), and Region (North America, Europe, Asia-Pacific, and LAMEA): Global Opportunity Analysis and Industry Forecast, 2023-2032

Bridal Jewelry Overview

The bridal jewelry industry encompasses a diverse range of special jewelry pieces exclusively designed for brides to wear on their wedding day. These meticulously crafted accessories are chosen to complement the bridal attire, emphasizing the overall bridal look. Bridal jewelry includes a wide range of products such as necklaces, earrings, bracelets, and rings, each meticulously selected to align with the bride's personal style and harmonize with the wedding gown and other accessories. For instance, necklaces are focal point of bridal jewelry, and it ranges from delicate chains to elaborate designs featuring gemstones, pearls, and intricate pendants. The choice of necklace contributes to framing the bride's neckline, adding a touch of grace and sophistication to her overall appearance. Bridal jewelry holds a huge significance during traditions and ceremonies surrounding weddings globally.

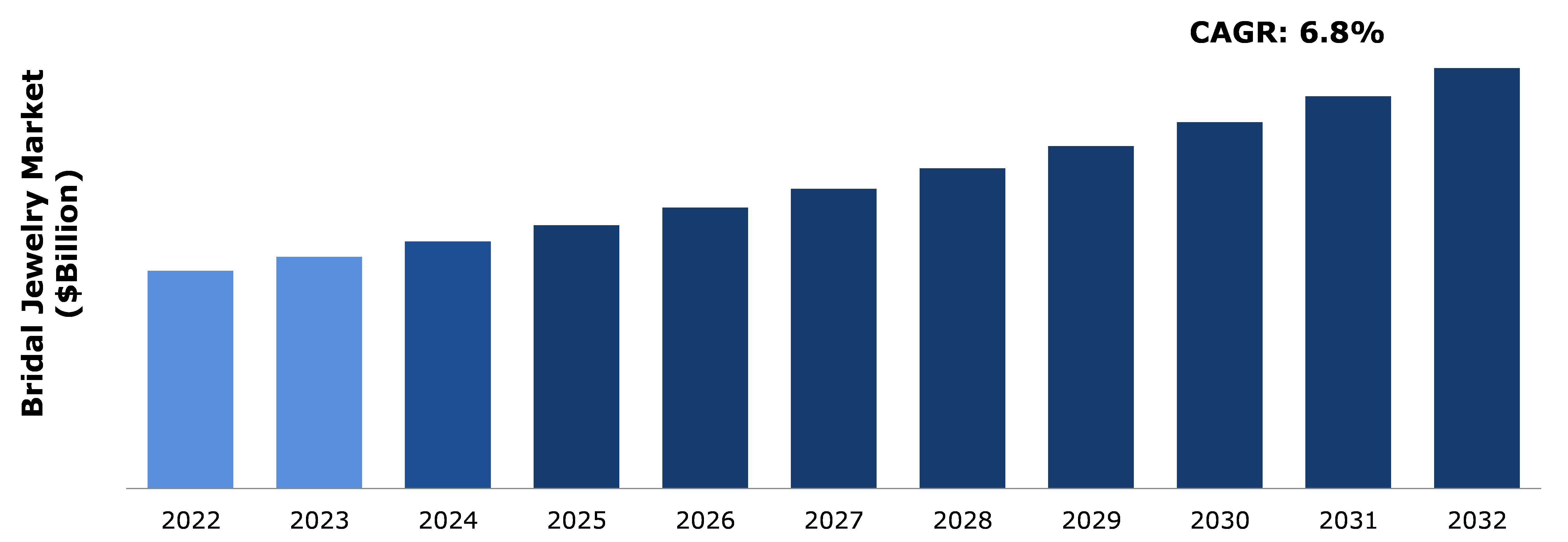

Global Bridal Jewelry Market Analysis

The global bridal jewelry market size was $112.1 billion in 2022 and is predicted to grow with a CAGR of 6.8%, by generating a revenue of $216.4 billion by 2032.

Source: Research Dive Analysis

COVID-19 Impact on the Global Bridal Jewelry Market

The global bridal jewelry industry faced significant challenges and disruptions as a result of the COVID-19 pandemic. The far-reaching impacts of the virus, including economic slowdowns, nationwide shutdowns, and disruptions to daily life, profoundly affected various sectors, and the gems and jewelry industry is no exception. The pandemic-induced economic downturn led to a sharp decline in domestic demand for bridal jewelry. With economic uncertainties, consumers have been cautious about discretionary spending, impacting the sales of luxury items like bridal jewelry.

Nationwide shutdowns and economic slowdowns have disrupted supply chains and affected the export market for bridal jewelry. The sudden lockdown, implemented in 2020, disrupted normal business operations for the bridal jewelry industry. The closure of retail stores, along with decreased footfall due to fear among public regarding the spread of coronavirus, resulted in a significant drop in sales. In addition, the bridal jewelry industry, primarily driven by weddings and events, faced a standstill as many events got canceled due to the outbreak. The cancellation of weddings and other celebratory occasions resulted in a low demand for bridal jewelry, impacting the industry's overall business.

High Cultural Significance of Gold in Bridal Jewelry to Drive the Market Growth

Gold holds a deep and enduring significance in Indian culture, where traditions play a pivotal role in shaping societal values. The cultural significance of gold has been passed down through generations, making it an integral part of various ceremonies, including weddings. The cultural connection to gold influences purchasing decisions, and adherence to tradition becomes a driving force for buying gold bridal jewelry. For instance, in India, weddings are major occasions when gold is purchased. The significance of weddings goes beyond mere celebrations; it extends to the cultural and emotional value attached to the exchange of gold during these occasions.

Gold bridal jewelry, characterized by its weight and intricacy, becomes a symbol of tradition, prosperity, and cultural continuity. Bridal jewelry accounted for a substantial share of more than 50-55% in the overall jewelry industry in 2022. The immense significance and grandeur associated with weddings contribute to a higher demand for heavy gold jewelry pieces such as necklaces, bangles, and chains, establishing bridal jewelry as a major driver of the overall gold jewelry landscape. These factors are anticipated to boost the bridal jewelry market growth in the upcoming years.

Presence of Substitutes Such as Imitation or Artificial Jewelry to Restrain the Market Growth

The bridal jewelry market faces a significant restraint in the form of substitutes, particularly imitation jewelry. Also known as fashion or costume jewelry, imitation jewelry is crafted from non-precious materials to mimic the appearance of genuine precious metals and stones. The availability of such substitutes at more affordable prices poses a direct challenge to the market growth of traditional bridal jewelry. In addition, bridal jewelry faces a challenge in keeping up with the ever-changing world of fashion.

Imitation jewelry provides a solution for consumers to align with the latest fashion trends without the need for significant investment. Also, imitation jewelry often replicates the appearance of high-end products. It duplicates patterns, settings, and, in some cases, the stones themselves. This similarity in aesthetic appeal can divert consumer preferences towards imitation jewelry, reducing the demand for traditional bridal jewelry. Thus, the rapid evolution of fashion preferences is anticipated to hamper the bridal jewelry demand during the forecast period.

Revival of Traditional Designs in Bridal Segment to Drive Excellent Opportunities

The growing popularity of traditional designs, such as temple jewelry and Kundan sets, presents an opportunity for the bridal jewelry market. For instance, the rising popularity of layering and stacking jewelry creates opportunities for the bridal market players to offer versatile and customizable pieces. In addition, the dominance of Polki diamonds in the 2023 jewelry landscape presents an opportunity for the bridal jewelry market to capitalize on the appeal of raw and uncut finishes.

Designers can craft regal sets featuring Polki diamonds in earrings, necklaces, and maang tikkas, offering brides a distinctive and elegant option for their wedding day. The evolving designs of Kundan jewelry, which uses glass instead of diamonds, provide an opportunity for the bridal jewelry market to offer budget-friendly alternatives with a unique and classy vibe. Adapting Kundan designs to contemporary trends and incorporating semi-precious stones offers excellent opportunities for the bridal jewelry manufacturers. Furthermore, the trend of mixing metals, such as combining yellow gold with white or rose gold, offers a fresh perspective on traditional Indian wedding jewelry. Bridal jewelry designers have the opportunity to create unique, modern pieces that cater to brides looking for a contemporary aesthetic while maintaining cultural significance.

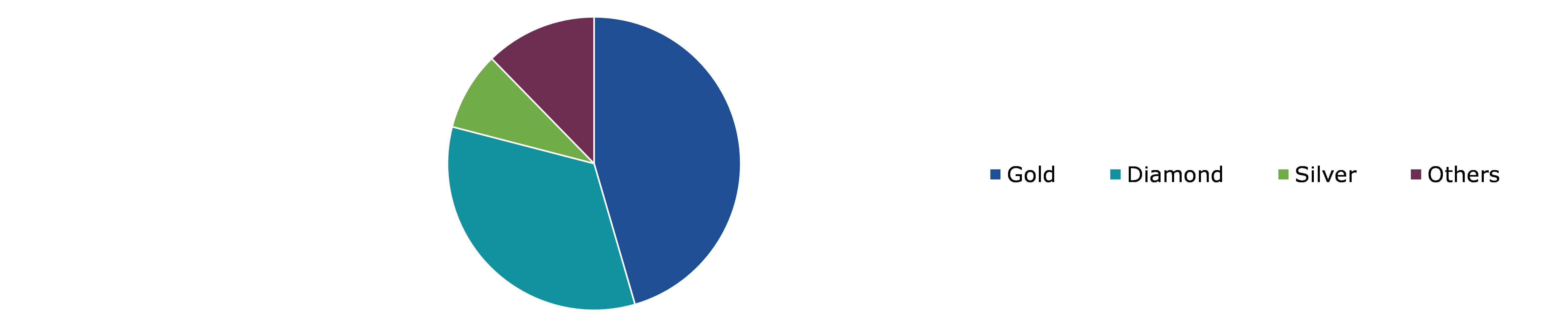

Global Bridal Jewelry Market Share, by Material, 2022

Source: Research Dive Analysis

The gold sub-segment accounted for the highest market share in 2022. The growing popularity of gold in bridal jewelry is majorly attributed to its cultural significance and auspiciousness. Gold holds immense cultural significance, especially in traditional Indian jewelry. It is considered auspicious for major life events, particularly weddings. In addition, gold is renowned for its durability and resistance to tarnishing, even with everyday use. This durability ensures that gold bridal jewelry remains in pristine condition over time, making it a practical and enduring choice for brides.

The longevity of gold jewelry enhances its appeal for special occasions like weddings. It is also considered as a symbol of power, wealth, good health, prosperity, and femininity, aligning with cultural and spiritual beliefs that enhance its demand. Furthermore, the high demand for gold in bridal jewelry is attributed to its inherent beauty. Gold possesses a luster and sheen that is enhanced through curving, polishing, and shaping processes. The visual appeal of gold adds to the allure of bridal jewelry, making it a preferred metal for crafting intricate and exquisite designs.

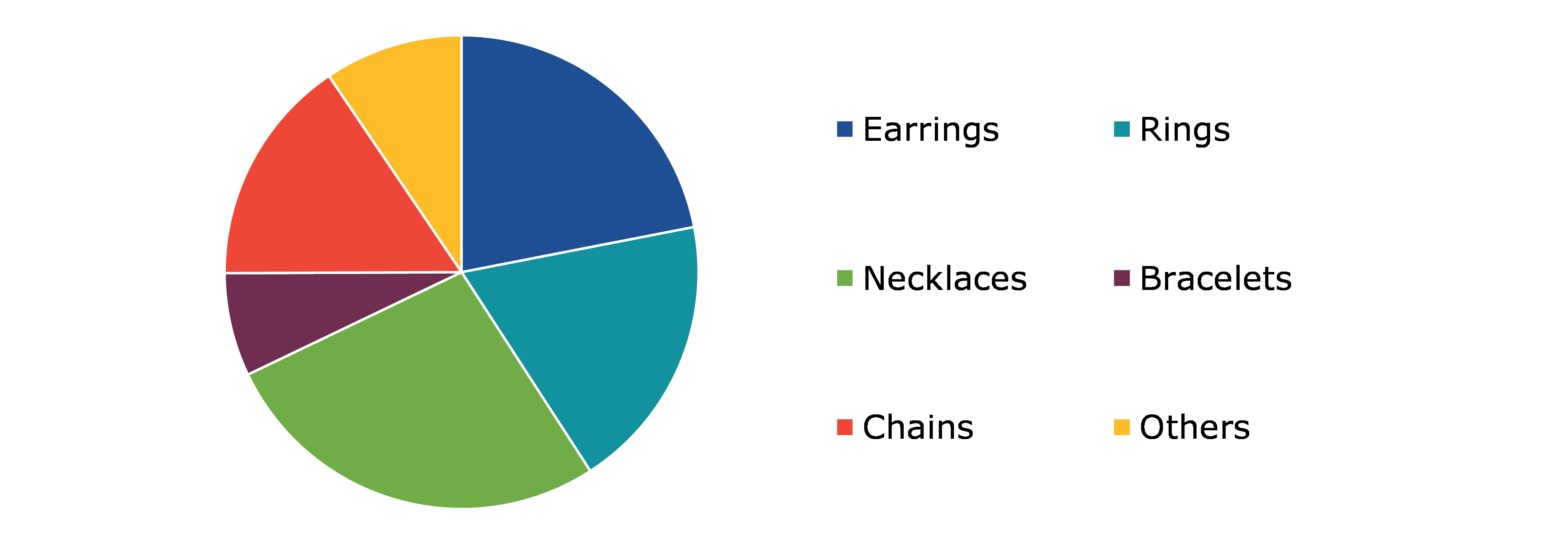

Global Bridal Jewelry Market Share, by Product Type, 2022

Source: Research Dive Analysis

The necklaces sub-segment accounted for the highest market share in 2022. Necklaces play a significant role in enhancing the overall look of a bride on her wedding day. Particularly for brides wearing simple or minimalist gowns or those with low or plunging necklines, a well-chosen necklace can add a touch of elegance. The availability of various necklace styles provides brides with a wide range of options to suit their preferences and wedding dress styles.

Also, a necklace is a key element in completing the overall bride’s look as it serves as a focal point in enhancing the bridal look. Furthermore, in various cultures, wearing a necklace is deeply rooted in tradition. For example, in Indian weddings, brides often wear elaborate necklaces as a symbol of prosperity and cultural heritage. The cultural significance linked to necklaces makes them a popular choice in bridal jewelry. These factors are anticipated to have a positive impact on the necklace sub-segment of the bridal jewelry market.

Global Bridal Jewelry Market Share, by Distribution Channel, 2022

Source: Research Dive Analysis

The offline sub-segment accounted for the highest market share in 2022. One of the primary drivers for the popularity of buying wedding jewelry offline is the strong preference for its touch and appealing look. As wedding jewelry holds immense sentimental value, the majority of the buyers prefer the in-store experience that offers the feature of trying and buying. Also, by trying different bridal jewelry, customers can experience the look and feel of the jewelry, contributing to the popularity of offline purchases. In addition, purchasing bridal jewelry offline allows customers to select pieces that can match their style which leads to personalized buying experience.

As precious jewelry, particularly wedding jewelry, often comes with intricate designs and details, the customers can closely examine the design details of jewelry including craftsmanship, and quality of materials used. In addition, the offline or in-store experience provides a level of scrutiny that is challenging to achieve online, leading customers to prefer offline purchases for bridal jewelry with design intricacies.

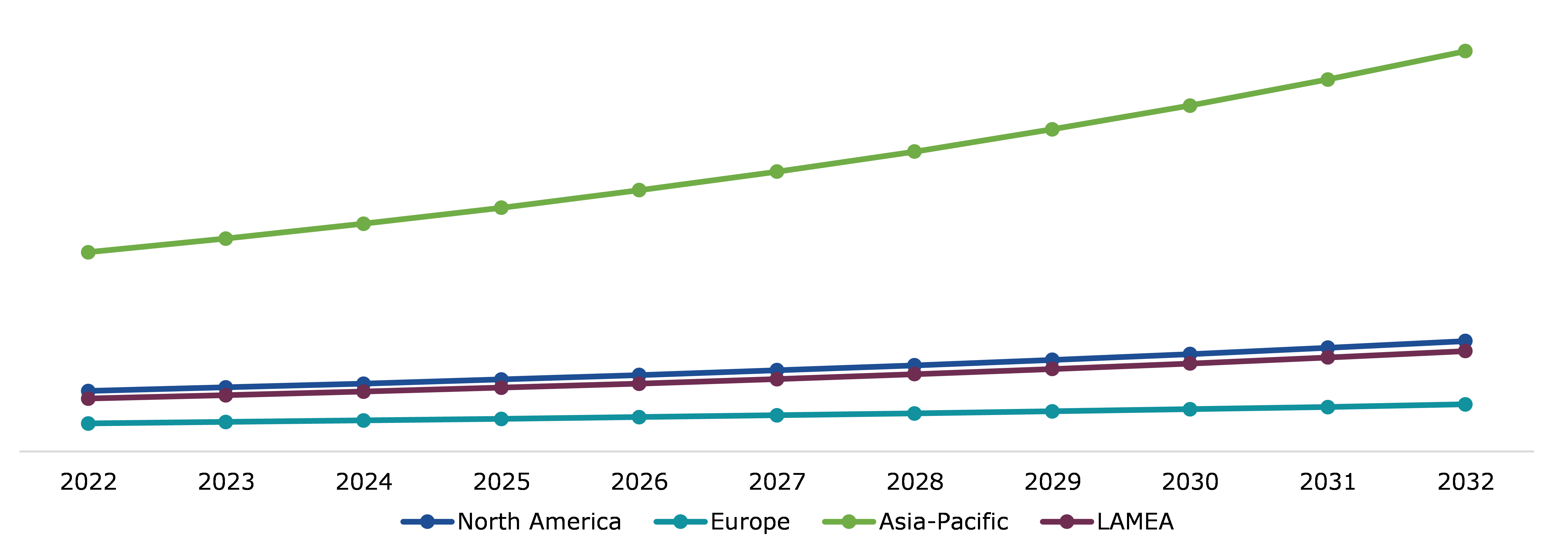

Global Bridal Jewelry Market Size & Forecast, by Region, 2022-2032 ($Billion)

Source: Research Dive Analysis

The Asia-Pacific bridal jewelry market generated the highest revenue in 2022. Bridal jewelry is quite popular in Asia-Pacific countries such as India, China, Indonesia, Singapore, and others. Gold jewelry, in particular, is deeply embedded in Indian culture and the preference for 22-carat jewelry and the dominance of bridal jewelry highlights the cultural and religious links associated with gold. Also, the gold market in India is experiencing changes in consumer preferences driven by economic growth, globalization, and changing design patterns in the bridal jewelry segment. For instance, in recent years, there has been a growing demand for lightweight and studded jewelry, indicating a shift in preferences towards more modern and versatile designs.

Furthermore, India has a significant and vibrant silver jewelry market, further diversifying the options for bridal jewelry. India is one of the leading fabricators of silver jewelry in the world owing to which brides have various options to choose from in silver jewelry as well. The availability of diverse materials and styles, including silver, contributes to the overall growth of the bridal jewelry market by providing consumers with a variety of options. These factors are anticipated to boost the Asia-Pacific bridal jewelry market share in the upcoming years.

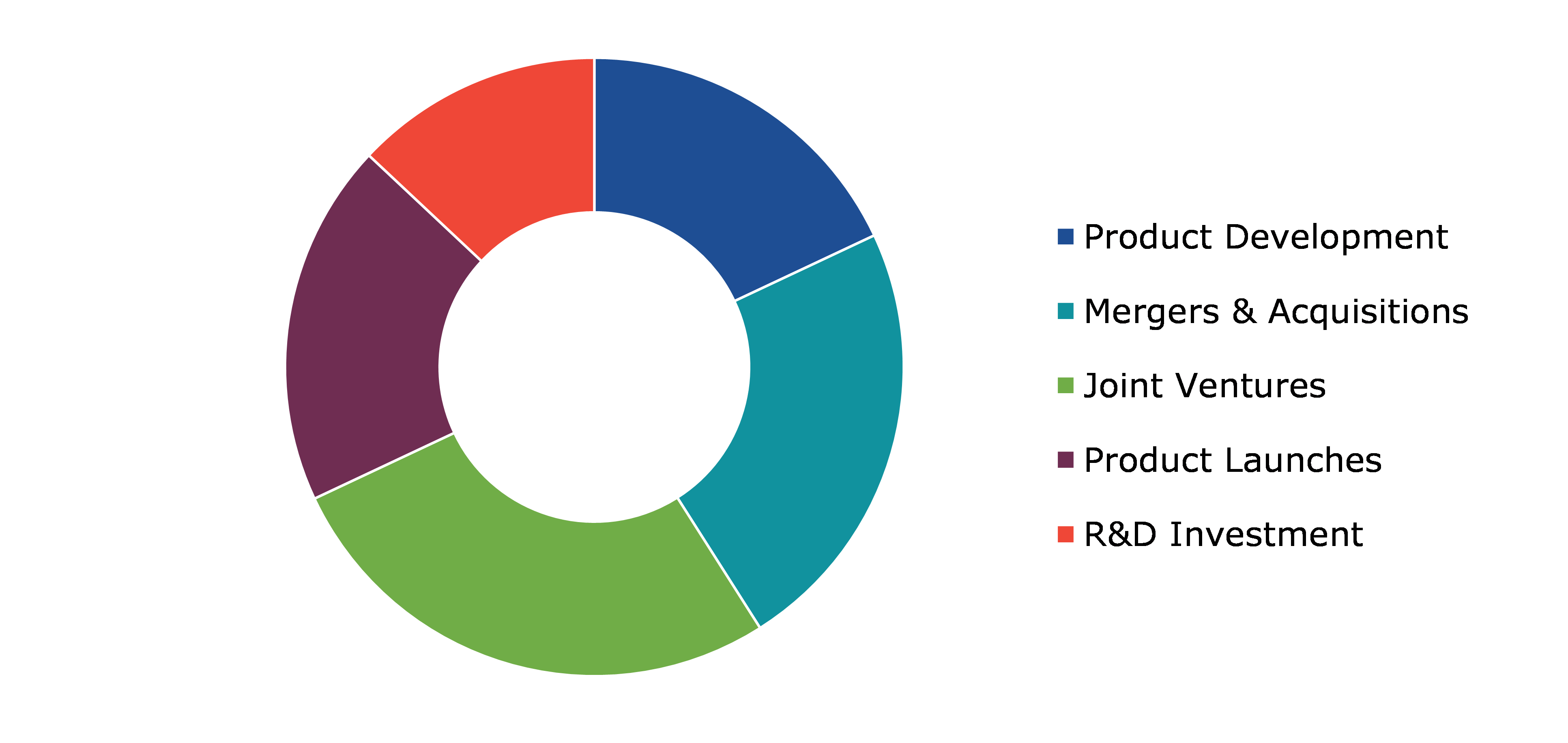

Competitive Scenario in the Global Bridal Jewelry Market

Product launch, partnership, and business expansion are common strategies followed by major market players. For instance, in December 2023, Fiona Diamonds, the leading jewelry brand in India, introduced lab-grown diamond jewelry in the Indian market. Fiona Diamonds has 3 outlets and 6 stores in ShoppersStop across India. The lab-grown diamonds introduced by the company uses high-quality stones created from raw diamonds and graphite or carbon under high pressure and temperatures. Also, the diamonds obtained as a result of this synthesis are identical to natural ones in their chemical and optical properties. In addition, these lab-grown diamonds offer the same aesthetics and quality as their mined counterparts, at much more affordable pricing.

Source: Research Dive Analysis

Some of the leading bridal jewelry market players are Pandora, Chow Tai Fook, Tiffany & Co., Louis Vuitton SE, Richemont, Signet Jewelers Limited, H. Stern, Malabar Gold & Diamonds, Swarovski AG, and Cartier.

| Aspect | Particulars |

| Historical Market Estimations | 2020-2021 |

| Base Year for Market Estimation | 2022 |

| Forecast Timeline for Market Projection | 2023-2032 |

| Geographical Scope | North America, Europe, Asia-Pacific, and LAMEA |

| Segmentation by Material |

|

| Segmentation by Product Type |

|

| Segmentation by Distribution Channel |

|

| Key Companies Profiled |

|

Q1. What is the size of the global bridal jewelry market?

A. The size of the global bridal jewelry market was $112.1 billion in 2022 and is projected to reach $216.4 billion by 2032.

Q2. Which are the major companies in the bridal jewelry market?

A. Pandora, Chow Tai Fook, Tiffany & Co., and Louis Vuitton SE are some of the key players in the global bridal jewelry market.

Q3. Which region, among others, possesses greater investment opportunities in the future?

A. Asia-Pacific possesses great investment opportunities for investors in the future.

Q4. What will be the growth rate of the Asia-Pacific bridal jewelry market?

A. The Asia-Pacific bridal jewelry market is anticipated to grow at 7.3% CAGR during the forecast period.

Q5. What are the strategies opted by the leading players in this market?

A. Partnership, product launch, and business expansion are the key strategies opted by the operating companies in this market.

Q6. Which companies are investing more on R&D practices?

A. Richemont, Signet Jewelers Limited, H. Stern, and Malabar Gold & Diamonds are the companies investing more in R&D activities for developing new products and technologies.

1. Research Methodology

1.1. Desk Research

1.2. Real time insights and validation

1.3. Forecast model

1.4. Assumptions and forecast parameters

1.5. Market size estimation

1.5.1. Top-down approach

1.5.2. Bottom-up approach

2. Report Scope

2.1. Market definition

2.2. Key objectives of the study

2.3. Market segmentation

3. Executive Summary

4. Market Overview

4.1. Introduction

4.2. Growth impact forces

4.2.1. Drivers

4.2.2. Restraints

4.2.3. Opportunities

4.3. Market value chain analysis

4.3.1. List of raw material suppliers

4.3.2. List of manufacturers

4.3.3. List of distributors

4.4. Innovation & sustainability matrices

4.4.1. Technology matrix

4.4.2. Regulatory matrix

4.5. Porter’s five forces analysis

4.5.1. Bargaining power of suppliers

4.5.2. Bargaining power of consumers

4.5.3. Threat of substitutes

4.5.4. Threat of new entrants

4.5.5. Competitive Rivalry Intensity

4.6. PESTLE analysis

4.6.1. Political

4.6.2. Economical

4.6.3. Social

4.6.4. Technological

4.6.5. Legal

4.6.6. Environmental

4.7. Impact of COVID-19 on bridal jewelry market

4.7.1. Pre-covid market scenario

4.7.2. Post-covid market scenario

5. Bridal Jewelry Market Analysis, by Material

5.1. Overview

5.2. Gold

5.2.1. Definition, key trends, growth factors, and opportunities

5.2.2. Market size analysis, by region, 2022-2032

5.2.3. Market share analysis, by country, 2022-2032

5.3. Diamond

5.3.1. Definition, key trends, growth factors, and opportunities

5.3.2. Market size analysis, by region, 2022-2032

5.3.3. Market share analysis, by country, 2022-2032

5.4. Silver

5.4.1. Definition, key trends, growth factors, and opportunities

5.4.2. Market size analysis, by region, 2022-2032

5.4.3. Market share analysis, by country, 2022-2032

5.5. Others

5.5.1. Definition, key trends, growth factors, and opportunities

5.5.2. Market size analysis, by region, 2022-2032

5.5.3. Market share analysis, by country, 2022-2032

5.6. Research Dive Exclusive Insights

5.6.1. Market attractiveness

5.6.2. Competition heatmap

6. Bridal Jewelry Market Analysis, by Product Type

6.1. Overview

6.2. Earrings

6.2.1. Definition, key trends, growth factors, and opportunities

6.2.2. Market size analysis, by region, 2022-2032

6.2.3. Market share analysis, by country, 2022-2032

6.3. Rings

6.3.1. Definition, key trends, growth factors, and opportunities

6.3.2. Market size analysis, by region, 2022-2032

6.3.3. Market share analysis, by country, 2022-2032

6.4. Necklaces

6.4.1. Definition, key trends, growth factors, and opportunities

6.4.2. Market size analysis, by region, 2022-2032

6.4.3. Market share analysis, by country, 2022-2032

6.5. Bracelets

6.5.1. Definition, key trends, growth factors, and opportunities

6.5.2. Market size analysis, by region, 2022-2032

6.5.3. Market share analysis, by country, 2022-2032

6.6. Chains

6.6.1. Definition, key trends, growth factors, and opportunities

6.6.2. Market size analysis, by region, 2022-2032

6.6.3. Market share analysis, by country, 2022-2032

6.7. Others

6.7.1. Definition, key trends, growth factors, and opportunities

6.7.2. Market size analysis, by region, 2022-2032

6.7.3. Market share analysis, by country, 2022-2032

6.8. Research Dive Exclusive Insights

6.8.1. Market attractiveness

6.8.2. Competition heatmap

7. Bridal Jewelry Market Analysis, by Distribution Channel

7.1. Overview

7.2. Online

7.2.1. Definition, key trends, growth factors, and opportunities

7.2.2. Market size analysis, by region, 2022-2032

7.2.3. Market share analysis, by country, 2022-2032

7.3. Offline

7.3.1. Definition, key trends, growth factors, and opportunities

7.3.2. Market size analysis, by region, 2022-2032

7.3.3. Market share analysis, by country, 2022-2032

7.4. Research Dive Exclusive Insights

7.4.1. Market attractiveness

7.4.2. Competition heatmap

8. Bridal Jewelry Market, by Region

8.1. North America

8.1.1. U.S.

8.1.1.1. Market size analysis, by Material, 2022-2032

8.1.1.2. Market size analysis, by Product Type, 2022-2032

8.1.1.3. Market size analysis, by Distribution Channel, 2022-2032

8.1.2. Canada

8.1.2.1. Market size analysis, by Material, 2022-2032

8.1.2.2. Market size analysis, by Product Type, 2022-2032

8.1.2.3. Market size analysis, by Distribution Channel, 2022-2032

8.1.3. Mexico

8.1.3.1. Market size analysis, by Material, 2022-2032

8.1.3.2. Market size analysis, by Product Type, 2022-2032

8.1.3.3. Market size analysis, by Distribution Channel, 2022-2032

8.1.4. Research Dive Exclusive Insights

8.1.4.1. Market attractiveness

8.1.4.2. Competition heatmap

8.2. Europe

8.2.1. Germany

8.2.1.1. Market size analysis, by Material, 2022-2032

8.2.1.2. Market size analysis, by Product Type, 2022-2032

8.2.1.3. Market size analysis, by Distribution Channel, 2022-2032

8.2.2. UK

8.2.2.1. Market size analysis, by Material, 2022-2032

8.2.2.2. Market size analysis, by Product Type, 2022-2032

8.2.2.3. Market size analysis, by Distribution Channel, 2022-2032

8.2.3. France

8.2.3.1. Market size analysis, by Material, 2022-2032

8.2.3.2. Market size analysis, by Product Type, 2022-2032

8.2.3.3. Market size analysis, by Distribution Channel, 2022-2032

8.2.4. Spain

8.2.4.1. Market size analysis, by Material, 2022-2032

8.2.4.2. Market size analysis, by Product Type, 2022-2032

8.2.4.3. Market size analysis, by Distribution Channel, 2022-2032

8.2.5. Italy

8.2.5.1. Market size analysis, by Material, 2022-2032

8.2.5.2. Market size analysis, by Product Type, 2022-2032

8.2.5.3. Market size analysis, by Distribution Channel, 2022-2032

8.2.6. Rest of Europe

8.2.6.1. Market size analysis, by Material, 2022-2032

8.2.6.2. Market size analysis, by Product Type, 2022-2032

8.2.6.3. Market size analysis, by Distribution Channel, 2022-2032

8.2.7. Research Dive Exclusive Insights

8.2.7.1. Market attractiveness

8.2.7.2. Competition heatmap

8.3. Asia-Pacific

8.3.1. China

8.3.1.1. Market size analysis, by Material, 2022-2032

8.3.1.2. Market size analysis, by Product Type, 2022-2032

8.3.1.3. Market size analysis, by Distribution Channel, 2022-2032

8.3.2. Japan

8.3.2.1. Market size analysis, by Material, 2022-2032

8.3.2.2. Market size analysis, by Product Type, 2022-2032

8.3.2.3. Market size analysis, by Distribution Channel, 2022-2032

8.3.3. India

8.3.3.1. Market size analysis, by Material, 2022-2032

8.3.3.2. Market size analysis, by Product Type, 2022-2032

8.3.3.3. Market size analysis, by Distribution Channel, 2022-2032

8.3.4. South Korea

8.3.4.1. Market size analysis, by Material, 2022-2032

8.3.4.2. Market size analysis, by Product Type, 2022-2032

8.3.4.3. Market size analysis, by Distribution Channel, 2022-2032

8.3.5. Australia

8.3.5.1. Market size analysis, by Material, 2022-2032

8.3.5.2. Market size analysis, by Product Type, 2022-2032

8.3.5.3. Market size analysis, by Distribution Channel, 2022-2032

8.3.6. Rest of Asia-Pacific

8.3.6.1. Market size analysis, by Material, 2022-2032

8.3.6.2. Market size analysis, by Product Type, 2022-2032

8.3.6.3. Market size analysis, by Distribution Channel, 2022-2032

8.3.7. Research Dive Exclusive Insights

8.3.7.1. Market attractiveness

8.3.7.2. Competition heatmap

8.4. LAMEA

8.4.1. Brazil

8.4.1.1. Market size analysis, by Material, 2022-2032

8.4.1.2. Market size analysis, by Product Type, 2022-2032

8.4.1.3. Market size analysis, by Distribution Channel, 2022-2032

8.4.2. UAE

8.4.2.1. Market size analysis, by Material, 2022-2032

8.4.2.2. Market size analysis, by Product Type, 2022-2032

8.4.2.3. Market size analysis, by Distribution Channel, 2022-2032

8.4.3. Saudi Arabia

8.4.3.1. Market size analysis, by Material, 2022-2032

8.4.3.2. Market size analysis, by Product Type, 2022-2032

8.4.3.3. Market size analysis, by Distribution Channel, 2022-2032

8.4.4. South Africa

8.4.4.1. Market size analysis, by Material, 2022-2032

8.4.4.2. Market size analysis, by Product Type, 2022-2032

8.4.4.3. Market size analysis, by Distribution Channel, 2022-2032

8.4.5. Rest of LAMEA

8.4.5.1. Market size analysis, by Material, 2022-2032

8.4.5.2. Market size analysis, by Product Type, 2022-2032

8.4.5.3. Market size analysis, by Distribution Channel, 2022-2032

8.4.6. Research Dive Exclusive Insights

8.4.6.1. Market attractiveness

8.4.6.2. Competition heatmap

9. Competitive Landscape

9.1. Top winning strategies, 2022

9.1.1. By strategy

9.1.2. By year

9.2. Strategic overview

9.3. Market share analysis, 2022

10. Company Profiles

10.1. Pandora

10.1.1. Overview

10.1.2. Business segments

10.1.3. Product portfolio

10.1.4. Financial performance

10.1.5. Recent developments

10.1.6. SWOT analysis

10.2. Chow Tai Fook

10.2.1. Overview

10.2.2. Business segments

10.2.3. Product portfolio

10.2.4. Financial performance

10.2.5. Recent developments

10.2.6. SWOT analysis

10.3. Tiffany & Co.

10.3.1. Overview

10.3.2. Business segments

10.3.3. Product portfolio

10.3.4. Financial performance

10.3.5. Recent developments

10.3.6. SWOT analysis

10.4. Louis Vuitton SE

10.4.1. Overview

10.4.2. Business segments

10.4.3. Product portfolio

10.4.4. Financial performance

10.4.5. Recent developments

10.4.6. SWOT analysis

10.5. Richemont

10.5.1. Overview

10.5.2. Business segments

10.5.3. Product portfolio

10.5.4. Financial performance

10.5.5. Recent developments

10.5.6. SWOT analysis

10.6. Signet Jewelers Limited

10.6.1. Overview

10.6.2. Business segments

10.6.3. Product portfolio

10.6.4. Financial performance

10.6.5. Recent developments

10.6.6. SWOT analysis

10.7. H. Stern

10.7.1. Overview

10.7.2. Business segments

10.7.3. Product portfolio

10.7.4. Financial performance

10.7.5. Recent developments

10.7.6. SWOT analysis

10.8. Malabar Gold & Diamonds

10.8.1. Overview

10.8.2. Business segments

10.8.3. Product portfolio

10.8.4. Financial performance

10.8.5. Recent developments

10.8.6. SWOT analysis

10.9. Swarovski AG

10.9.1. Overview

10.9.2. Business segments

10.9.3. Product portfolio

10.9.4. Financial performance

10.9.5. Recent developments

10.9.6. SWOT analysis

10.10. Cartier

10.10.1. Overview

10.10.2. Business segments

10.10.3. Product portfolio

10.10.4. Financial performance

10.10.5. Recent developments

10.10.6. SWOT analysis

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com