Ayurvedic Herbal Extract Market Report

RA09184

Ayurvedic Herbal Extract Market by Type (Ashwagandha, Ajwain, Bramhi, Ginseng, Cardamom, Cumin, Basil, Neem, Licorice Root, Turmeric, Rosemary, and Others), Application (Food & Beverages, Personal Care & Cosmetics, Pharmaceutical & Nutraceutical, and Animal Feed), and Region (North America, Europe, Asia-Pacific, and LAMEA): Global Opportunity Analysis and Industry Forecast, 2023-2032

Ayurvedic Herbal Extract Overview

Ayurvedic herbal extracts are concentrated solutions derived from medicinal plants, representing a key component of traditional ayurvedic medicine. Herbal extracts play a pivotal role in ayurvedic remedies, utilizing the therapeutic properties of diverse plant species. These extracts are typically obtained through meticulous processes such as steam distillation, cold pressing, or solvent extraction, ensuring the preservation of the plant's active compounds. Ayurvedic herbal extracts encompass a wide array of botanicals, each selected for its unique healing properties and compatibility with individual compositions.

The herbal extract industry focuses on the extraction, processing, and commercialization of bioactive substances derived from plants for a variety of purposes. Herbal extracts are concentrated versions of plant materials rich in medicinal substances such as phytochemicals, alkaloids, flavonoids, and essential oils. Solvent extraction, distillation, cold pressing, and supercritical fluid extraction are all techniques used to obtain these extracts. Herbal extracts have applications in diverse industries, including pharmaceuticals, cosmetics, food & beverages, dietary supplements, and aromatherapy. They are used for their potential health benefits, flavoring properties, fragrance, and therapeutic applications. The herbal extract industry encompasses manufacturers, suppliers, distributors, and end-users who are involved in the manufacturing and utilization of these extracts.

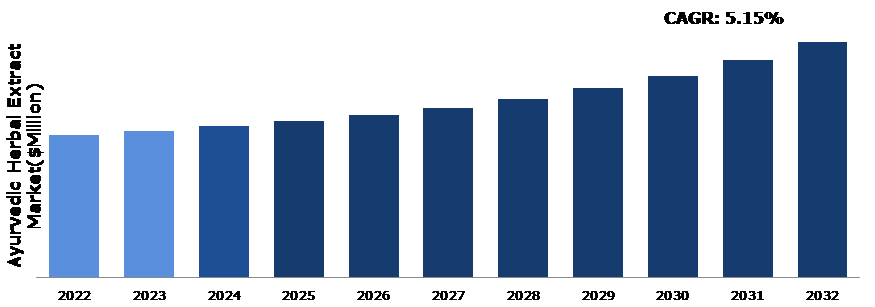

Global Ayurvedic Herbal Extract Market Analysis

The global ayurvedic herbal extract market size was $41,501.3 million in 2022 and is predicted to grow with a CAGR of 5.15%, by generating a revenue of $68,564.3 million by 2032.

Source: Research Dive Analysis

COVID-19 Impact on the Global Ayurvedic Herbal Extract Market

The COVID-19 pandemic had a significant impact on the ayurvedic herbal extract market. The ayurvedic herbal extract market faced challenges due to the pandemic, resulting disruptions in supply chains and production. Despite initial setbacks, the market adapted by emphasizing online sales and wellness products, experiencing a surge in demand for immunity-boosting extracts. The pandemic highlighted the importance of complete health, driving demand for ayurvedic offerings.

The ayurvedic herbal extract market has witnessed an increase in consumer interest in natural health solutions in the post-COVID-19 period. The demand for ayurvedic products surged as people prioritized immunity and overall well-being. The market growth is attributed to a rising awareness regarding traditional remedies and a shift towards preventive healthcare. Manufacturers are adapting to this trend by offering a diverse range of ayurvedic herbal extracts to meet the growing demand for natural and sustainable health solutions.

Rising Consumer Awareness Regarding Health & Nutrition to Drive the Market Growth

The global ayurvedic herbal extract market is projected to experience robust expansion, driven by the continuous growth of the food & beverage sector. This surge is driven by various factors such as the expanding world population, increasing food consumption, and rising standard of living. Climate change, demanding work schedules, and a busier lifestyle are prompting a global shift toward health-conscious choices. In response to these trends, consumers are increasingly opting for natural and organic food products to safeguard their well-being, leading to an increase in the global demand for herbal extracts and their end products. The rising focus on health & fitness, along with a growing middle-class population and higher disposable incomes, has empowered consumers to allocate more spending toward natural, organic, and healthy food & beverage options. This consumer behavior is a significant factor driving the global ayurvedic herbal extract market growth.

Slower Results in the Medicinal Process to Restrain the Market Growth

The ayurvedic herbal extract market faces a potential restraint in its growth due to the slower results observed in the medicinal process. While ayurvedic remedies are valued for their all-inclusive method to health, the comparatively gradual pace at which these herbal extracts exhibit results is expected to impede market expansion. Consumers, often adapted to faster-acting pharmaceuticals, may express hesitancy in embracing ayurvedic alternatives. This slowdown in the medicinal process could lead to a perception of reduced efficacy for some users. In addition, the intricate nature of clinical trials and the need for comprehensive safety assessments further extend the production timelines. These impediments collectively slow down the pace at which innovative medicinal solutions reach patients, posing a significant restraint to the overall growth of the market.

Increase in Popularity of Natural Products to Drive Excellent Opportunities

The ayurvedic herbal extract market is experiencing a significant expansion due to the increasing popularity of natural products. In recent years, there has been a notable shift in consumer preferences towards products that are derived from nature, and ayurvedic herbal extracts perfectly align with this trend. As people become more health-conscious and mindful of the substances they consume, the demand for ayurvedic herbal extracts has witnessed a remarkable surge. The rise in popularity of natural products can be attributed to a growing awareness regarding the potential benefits of traditional and herbal remedies. Consumers are increasingly seeking alternatives to synthetic ingredients, and ayurvedic herbal extracts, with their roots in ancient holistic practices, are gaining recognition for their potential health-promoting properties. This trend is creating excellent opportunities in the ayurvedic herbal extract market, as manufacturers and suppliers respond to the increasing demand for these natural solutions. Companies are investing in R&D to enhance the efficacy and variety of ayurvedic herbal extracts, providing consumers with a diverse range of options to address various health & wellness needs.

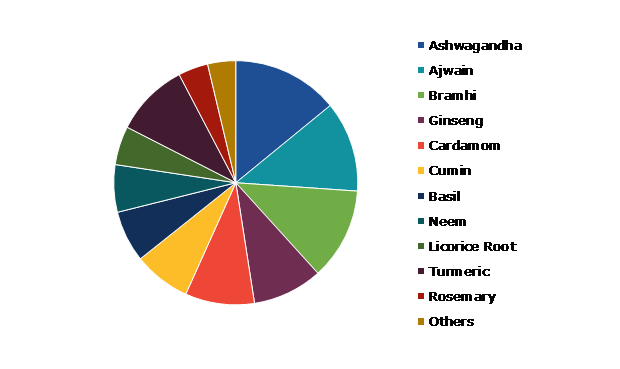

Global Ayurvedic Herbal Extract Market Share, by Type, 2022

Source: Research Dive Analysis

The ashwagandha sub-segment accounted for the highest market share in 2022. Ashwagandha is also known as Indian ginseng or Indian winter cherry. The rasayana (tonic) benefit of ashwagandha is widely known. Rasayana is an herbal or metallic combination that promotes happiness and physical and mental youth. Increase in demand for natural functional foods & beverages, as well as increased inclination toward healthy lifestyles and expenditure on healthy and fortified foods, are factors expected to drive the ashwagandha extract demand during the forecast period. Ashwagandha has a number of health benefits, including lowering cholesterol, increasing male fertility, reducing anxiety and stress, fighting diabetes, controlling hair loss, slowing the progression of osteoporosis and rheumatoid arthritis, treating cancer, stimulating the thyroid gland, reducing eye diseases, and having anti-tumor, anti-inflammatory, and antibacterial properties. Therefore, all of these factors are projected to boost the growth of the ashwagandha extract market size during the forecast years.

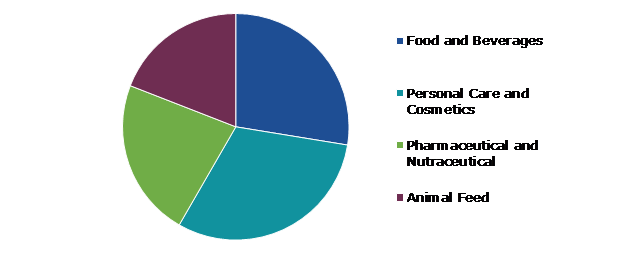

Global Ayurvedic Herbal Extract Market Share, by Application, 2022

Source: Research Dive Analysis

The personal care & cosmetics sub-segment accounted for the highest market share in 2022. There is an increasing use of herbal extracts in haircare, cosmetics, and skincare, due to the increase in consumer demand for natural and sustainable ingredients. Herbal extracts are becoming more popular in the personal care industry due to the rising demand of organic and clean cosmetic products. Customers' tastes are predicted to move from synthetic chemical products to herbal products, which is expected to boost the segment growth. Products containing herbal extracts do not damage the skin or cause any other problems with personal hygiene. These factors are anticipated to boost the market expansion in the upcoming years. The surge in consumer preference for natural ingredients in skincare and beauty products has led to an increase in demand for ayurvedic herbal extracts, known for their holistic and skin-friendly properties, further driving the ayurvedic herbal extract market growth.

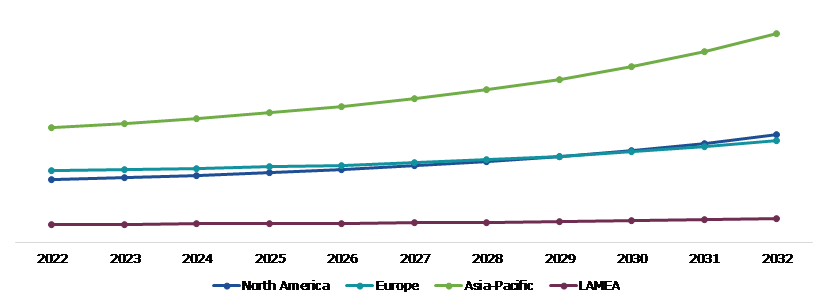

Global Ayurvedic Herbal Extract Market Size & Forecast, by Region, 2022-2032 ($Million)

Source: Research Dive Analysis

The Asia-Pacific ayurvedic herbal extract market share generated the highest revenue in 2022. One of the largest markets for herbal extracts used to make products like medications and personal care products is Asia-Pacific. Several countries, including China, Japan, and India, produce different herbal products. Furthermore, since several years, consumers have been using plant extracts for various purposes. Therefore, manufacturers are working hard to produce new kinds of products with herbal extracts to meet the growing need of the market. The demand for herbal extract in the region is anticipated to be affected by a number of factors, including the availability of a wide range of herbal plants, the long-standing custom of people using natural herbs, the therapeutic benefits of herbal products, the adoption of a healthy lifestyle following the pandemic, awareness regarding the adverse impacts of synthetic ingredients, the use of herbal cosmetics products, government policies, and business sustainability initiatives. China and India are expected to dominate the herbal extracts market in Asia Pacific, as they are the world's top exporters of some of the most valuable extracts, including kale, ashwagandha, and curcumin. In the past, two of the biggest markets for nutraceuticals in the region have been China and Japan. The market is growing healthy as pharmaceuticals and nutraceutical supplements are used more frequently in China, Japan, and other countries. China is the largest food & beverage consumer market in the world, which attracts a lot of foreign companies and players in the sector.

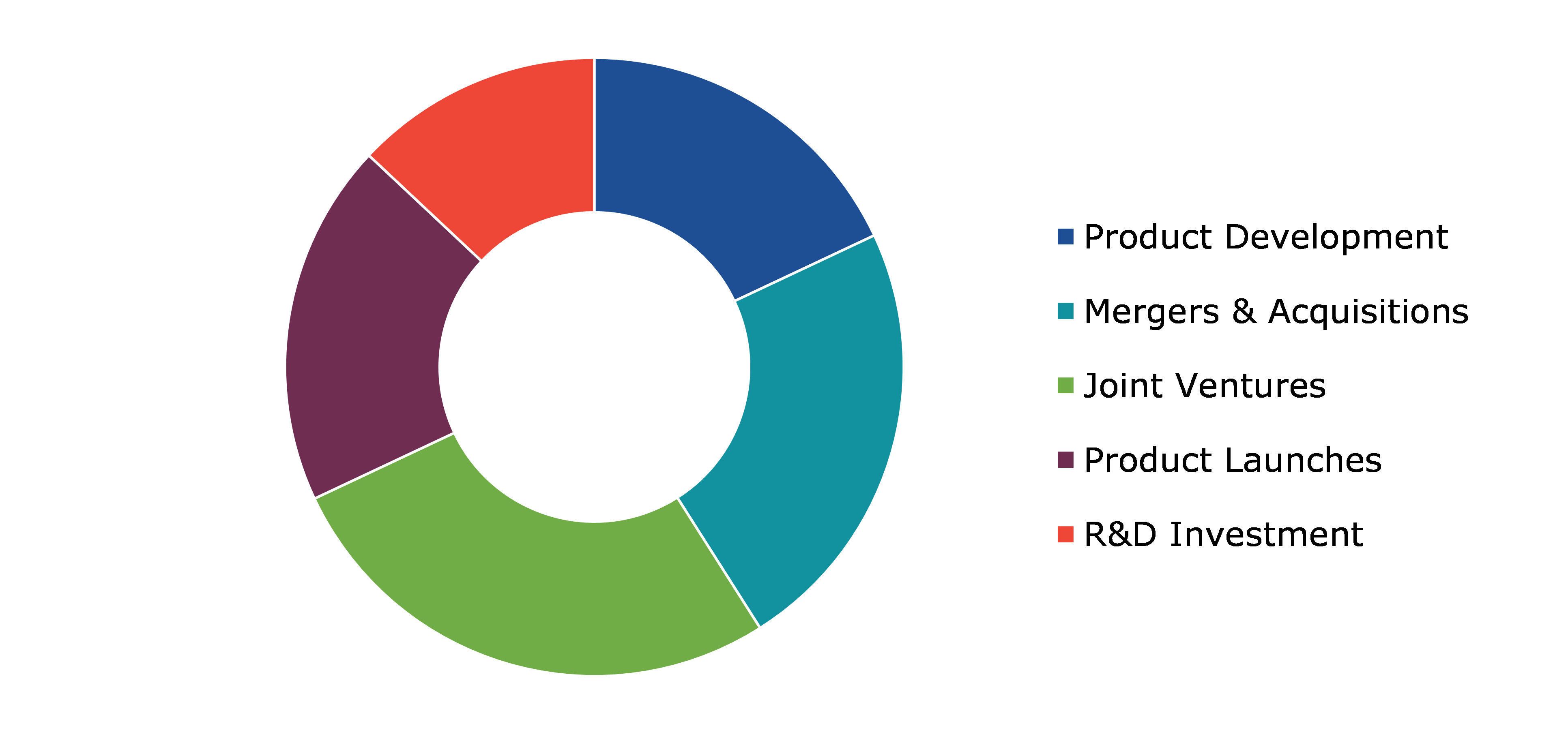

Competitive Scenario in the Global Ayurvedic Herbal Extract Market

Investment and agreement are common strategies followed by major market players. For instance, in May 2022, Leaven Essentials, an Indian startup, introduced a tailored, scientifically advanced solution for the food & beverage, cosmetics, and pharmaceutical industries. This innovation emphasizes the production of standardized herbal extracts, aligning with consumer preferences. By offering customized solutions, Leaven Essentials aims to elevate the quality and versatility of herbal extracts, meeting the specific needs of diverse industries and reflecting their commitment toward excellence in manufacturing.

Source: Research Dive Analysis

Some of the companies operating in the ayurvedic herbal extract market analysis are Nexira, Blue Sky Botanics, MartinBauer, Synergy, Döhler GmbH, The Biolandes Group, Kalsec Inc., Vidya Herbs Pvt. Ltd., International Flavors & Fragrances Inc., and Synthite Industries Ltd.

| Aspect | Particulars |

| Historical Market Estimations | 2020-2021 |

| Base Year for Market Estimation | 2022 |

| Forecast Timeline for Market Projection | 2023-2032 |

| Geographical Scope | North America, Europe, Asia-Pacific, and LAMEA |

| Segmentation by Type |

|

| Segmentation by Application |

|

| Key Companies Profiled |

|

Q1. What is the size of the global ayurvedic herbal extract market?

A. The global ayurvedic herbal extract market size was over $41,501.3 million in 2022 and is projected to reach $68,564.3 million by 2032.

Q2. Which are the major companies in the ayurvedic herbal extract market?

A. Nexira, Blue Sky Botanics, MartinBauer, and Synergy are some of the key players in the global ayurvedic herbal extract market.

Q3. Which region, among others, possesses greater investment opportunities in the future?

A. Asia-Pacific possesses great investment opportunities for investors in the future.

Q4. What will be the growth rate of the Asia-Pacific communication software market?

A. The Asia-Pacific ayurvedic herbal extract market share is anticipated to grow at 6.18% CAGR during the forecast period.

Q5. What are the strategies opted by the leading players in this market?

A. Agreement and investment are the two key strategies opted by the operating companies in this market.

Q6. Which companies are investing more on R&D practices?

A. Nexira, Blue Sky Botanics, MartinBauer, and Synergy are the companies investing more on R&D activities for developing new products and technologies.

1. Research Methodology

1.1. Desk Research

1.2. Real time insights and validation

1.3. Forecast model

1.4. Assumptions and forecast parameters

1.5. Market size estimation

1.5.1. Top-down approach

1.5.2. Bottom-up approach

2. Report Scope

2.1. Market definition

2.2. Key objectives of the study

2.3. Report overview

2.4. Market segmentation

2.5. Overview of the impact of COVID-19 on global ayurvedic herbal extract market

3. Executive Summary

4. Market Overview

4.1. Introduction

4.2. Growth impact forces

4.2.1. Drivers

4.2.2. Restraints

4.2.3. Opportunities

4.3. Market value chain analysis

4.3.1. List of raw material suppliers

4.3.2. List of manufacturers

4.3.3. List of distributors

4.4. Innovation & sustainability matrices

4.4.1. Technology matrix

4.4.2. Regulatory matrix

4.5. Porter’s five forces analysis

4.5.1. Bargaining power of suppliers

4.5.2. Bargaining power of consumers

4.5.3. Threat of substitutes

4.5.4. Threat of new entrants

4.5.5. Competitive rivalry intensity

4.6. PESTLE analysis

4.6.1. Political

4.6.2. Economical

4.6.3. Social

4.6.4. Technological

4.6.5. Legal

4.6.6. Environmental

4.7. Impact of COVID-19 on ayurvedic herbal extract market

4.7.1. Pre-covid market scenario

4.7.2. Post-covid market scenario

5. Ayurvedic Herbal Extract Market Analysis, by Type

5.1. Overview

5.2. Ashwagandha

5.2.1. Definition, key trends, growth factors, and opportunities

5.2.2. Market size analysis, by region, 2022-2032

5.2.3. Market share analysis, by country, 2022-2032

5.3. Ajwain

5.3.1. Definition, key trends, growth factors, and opportunities

5.3.2. Market size analysis, by region, 2022-2032

5.3.3. Market share analysis, by country, 2022-2032

5.4. Bramhi

5.4.1. Definition, key trends, growth factors, and opportunities

5.4.2. Market size analysis, by region, 2022-2032

5.4.3. Market share analysis, by country, 2022-2032

5.5. Ginseng

5.5.1. Definition, key trends, growth factors, and opportunities

5.5.2. Market size analysis, by region, 2022-2032

5.5.3. Market share analysis, by country, 2022-2032

5.6. Cardamom

5.6.1. Definition, key trends, growth factors, and opportunities

5.6.2. Market size analysis, by region, 2022-2032

5.6.3. Market share analysis, by country, 2022-2032

5.7. Cumin

5.7.1. Definition, key trends, growth factors, and opportunities

5.7.2. Market size analysis, by region, 2022-2032

5.7.3. Market share analysis, by country, 2022-2032

5.8. Basil

5.8.1. Definition, key trends, growth factors, and opportunities

5.8.2. Market size analysis, by region, 2022-2032

5.8.3. Market share analysis, by country, 2022-2032

5.9. Neem

5.9.1. Definition, key trends, growth factors, and opportunities

5.9.2. Market size analysis, by region, 2022-2032

5.9.3. Market share analysis, by country, 2022-2032

5.10. Licorice Root

5.10.1. Definition, key trends, growth factors, and opportunities

5.10.2. Market size analysis, by region, 2022-2032

5.10.3. Market share analysis, by country, 2022-2032

5.11. Turmeric

5.11.1. Definition, key trends, growth factors, and opportunities

5.11.2. Market size analysis, by region, 2022-2032

5.11.3. Market share analysis, by country, 2022-2032

5.12. Rosemary

5.12.1. Definition, key trends, growth factors, and opportunities

5.12.2. Market size analysis, by region, 2022-2032

5.12.3. Market share analysis, by country, 2022-2032

5.13. Others

5.13.1. Definition, key trends, growth factors, and opportunities

5.13.2. Market size analysis, by region, 2022-2032

5.13.3. Market share analysis, by country, 2022-2032

5.14. Research Dive Exclusive Insights

5.14.1. Market attractiveness

5.14.2. Competition heatmap

6. Ayurvedic Herbal Extract Market Analysis, by Application

6.1. Food & Beverages

6.1.1. Definition, key trends, growth factors, and opportunities

6.1.2. Market size analysis, by region, 2022-2032

6.1.3. Market share analysis, by country, 2022-2032

6.2. Personal Care & Cosmetics

6.2.1. Definition, key trends, growth factors, and opportunities

6.2.2. Market size analysis, by region, 2022-2032

6.2.3. Market share analysis, by country, 2022-2032

6.3. Pharmaceutical & Nutraceutical

6.3.1. Definition, key trends, growth factors, and opportunities

6.3.2. Market size analysis, by region, 2022-2032

6.3.3. Market share analysis, by country, 2022-2032

6.4. Animal Feed

6.4.1. Definition, key trends, growth factors, and opportunities

6.4.2. Market size analysis, by region, 2022-2032

6.4.3. Market share analysis, by country, 2022-2032

6.5. Research Dive Exclusive Insights

6.5.1. Market attractiveness

6.5.2. Competition heatmap

7. Ayurvedic Herbal Extract Market, by Region

7.1. North America

7.1.1. U.S.

7.1.1.1. Market size analysis, by Type, 2022-2032

7.1.1.2. Market size analysis, by Application, 2022-2032

7.1.2. Canada

7.1.2.1. Market size analysis, by Type, 2022-2032

7.1.2.2. Market size analysis, by Application, 2022-2032

7.1.3. Mexico

7.1.3.1. Market size analysis, by Type, 2022-2032

7.1.3.2. Market size analysis, by Application, 2022-2032

7.1.4. Research Dive Exclusive Insights

7.1.4.1. Market attractiveness

7.1.4.2. Competition heatmap

7.2. Europe

7.2.1. Germany

7.2.1.1. Market size analysis, by Type, 2022-2032

7.2.1.2. Market size analysis, by Application, 2022-2032

7.2.2. UK

7.2.2.1. Market size analysis, by Type, 2022-2032

7.2.2.2. Market size analysis, by Application, 2022-2032

7.2.3. France

7.2.3.1. Market size analysis, by Type, 2022-2032

7.2.3.2. Market size analysis, by Application, 2022-2032

7.2.4. Spain

7.2.4.1. Market size analysis, by Type, 2022-2032

7.2.4.2. Market size analysis, by Application, 2022-2032

7.2.5. Italy

7.2.5.1. Market size analysis, by Type, 2022-2032

7.2.5.2. Market size analysis, by Application, 2022-2032

7.2.6. Rest of Europe

7.2.6.1. Market size analysis, by Type, 2022-2032

7.2.6.2. Market size analysis, by Application, 2022-2032

7.2.7. Research Dive Exclusive Insights

7.2.7.1. Market attractiveness

7.2.7.2. Competition heatmap

7.3. Asia-Pacific

7.3.1. China

7.3.1.1. Market size analysis, by Type, 2022-2032

7.3.1.2. Market size analysis, by Application, 2022-2032

7.3.2. Japan

7.3.2.1. Market size analysis, by Type, 2022-2032

7.3.2.2. Market size analysis, by Application, 2022-2032

7.3.3. India

7.3.3.1. Market size analysis, by Type, 2022-2032

7.3.3.2. Market size analysis, by Application, 2022-2032

7.3.4. Australia

7.3.4.1. Market size analysis, by Type, 2022-2032

7.3.4.2. Market size analysis, by Application, 2022-2032

7.3.5. South Korea

7.3.5.1. Market size analysis, by Type, 2022-2032

7.3.5.2. Market size analysis, by Application, 2022-2032

7.3.6. Rest of Asia-Pacific

7.3.6.1. Market size analysis, by Type, 2022-2032

7.3.6.2. Market size analysis, by Application, 2022-2032

7.3.7. Research Dive Exclusive Insights

7.3.7.1. Market attractiveness

7.3.7.2. Competition heatmap

7.4. LAMEA

7.4.1. Brazil

7.4.1.1. Market size analysis, by Type, 2022-2032

7.4.1.2. Market size analysis, by Application, 2022-2032

7.4.2. Saudi Arabia

7.4.2.1. Market size analysis, by Type, 2022-2032

7.4.2.2. Market size analysis, by Application, 2022-2032

7.4.3. UAE

7.4.3.1. Market size analysis, by Type, 2022-2032

7.4.3.2. Market size analysis, by Application, 2022-2032

7.4.4. South Africa

7.4.4.1. Market size analysis, by Type, 2022-2032

7.4.4.2. Market size analysis, by Application, 2022-2032

7.4.5. Rest of LAMEA

7.4.5.1. Market size analysis, by Type, 2022-2032

7.4.5.2. Market size analysis, by Application, 2022-2032

7.4.6. Research Dive Exclusive Insights

7.4.6.1. Market attractiveness

7.4.6.2. Competition heatmap

8. Competitive Landscape

8.1. Top winning strategies, 2022

8.1.1. By strategy

8.1.2. By year

8.2. Strategic overview

8.3. Market share analysis, 2022

9. Company Profiles

9.1. Nexira

9.1.1. Overview

9.1.2. Business segments

9.1.3. Product portfolio

9.1.4. Financial performance

9.1.5. Recent developments

9.1.6. SWOT analysis

9.2. Blue Sky Botanics

9.2.1. Overview

9.2.2. Business segments

9.2.3. Product portfolio

9.2.4. Financial performance

9.2.5. Recent developments

9.2.6. SWOT analysis

9.3. MartinBauer

9.3.1. Overview

9.3.2. Business segments

9.3.3. Product portfolio

9.3.4. Financial performance

9.3.5. Recent developments

9.3.6. SWOT analysis

9.4. Synergy

9.4.1. Overview

9.4.2. Business segments

9.4.3. Product portfolio

9.4.4. Financial performance

9.4.5. Recent developments

9.4.6. SWOT analysis

9.5. Döhler GmbH

9.5.1. Overview

9.5.2. Business segments

9.5.3. Product portfolio

9.5.4. Financial performance

9.5.5. Recent developments

9.5.6. SWOT analysis

9.6. The Biolandes Group

9.6.1. Overview

9.6.2. Business segments

9.6.3. Product portfolio

9.6.4. Financial performance

9.6.5. Recent developments

9.6.6. SWOT analysis

9.7. Kalsec Inc.

9.7.1. Overview

9.7.2. Business segments

9.7.3. Product portfolio

9.7.4. Financial performance

9.7.5. Recent developments

9.7.6. SWOT analysis

9.8. Vidya Herbs Pvt. Ltd.

9.8.1. Overview

9.8.2. Business segments

9.8.3. Product portfolio

9.8.4. Financial performance

9.8.5. Recent developments

9.8.6. SWOT analysis

9.9. International Flavors & Fragrances Inc.

9.9.1. Overview

9.9.2. Business segments

9.9.3. Product portfolio

9.9.4. Financial performance

9.9.5. Recent developments

9.9.6. SWOT analysis

9.10. Synthite Industries Ltd.

9.10.1. Overview

9.10.2. Business segments

9.10.3. Product portfolio

9.10.4. Financial performance

9.10.5. Recent developments

9.10.6. SWOT analysis

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com