Solar Laser Drilling Market Report

RA09182

Solar Laser Drilling Market by Cell Type (Crystalline Silicon, Thin Film, and Others), Laser Type (Fiber Lasers, Solid State Lasers, and Others), and Region (North America, Europe, Asia-Pacific, and LAMEA): Global Opportunity Analysis and Industry Forecast, 2023-2032

Solar Laser Drilling Overview

Solar laser drilling uses solar energy to create high-intensity laser rays which are subsequently focused on a precise location to ablate, vaporize, or pierce materials. It combines two basic components: solar concentrators and laser systems. Solar concentrators capture and focus sunlight on a specified target area, often in the form of parabolic mirrors or lenses. This concentrated solar energy is then channeled into a laser system, where it is magnified and focused onto the substance to be drilled.

Solar laser drilling has a wide range of applications, including aerospace, electronics, automotive, and renewable energy. By drilling complicated patterns on materials such as carbon fiber composites, it helps in the development of lightweight yet durable components in aerospace. Solar laser drilling is used in electronics to make complicated circuit boards, and in the automobile sector for precise cutting & drilling of metal components. The demand for efficient photovoltaic cells is expected to rise as the variety of solar sections being manufactured is expanding. Lasers are widely used for a variety of activities, including solar cell drilling, trimming, welding, and engraving. In the future, the need for laser drilling in the manufacture of thin-film solar components for applications such as component separation recording and cell-associated is anticipated to increase.

Solar Laser Drilling Market Analysis

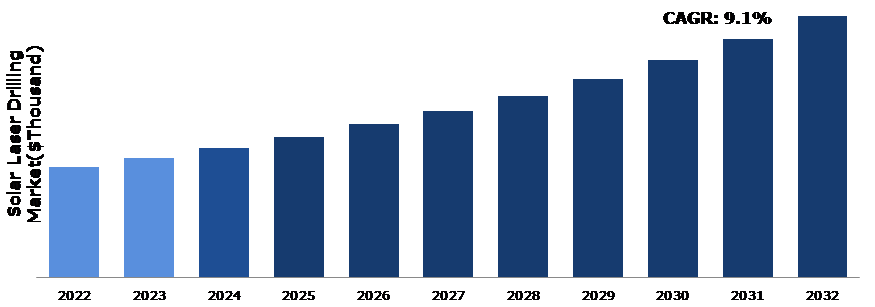

The solar laser drilling market size was $28,10,600.0 thousand in 2022 and is projected to grow with a CAGR of 9.1%, by generating a revenue of $66,59,155.7 thousand by 2032.

Source: Research Dive Analysis

COVID-19 Pandemic Impact on Solar Laser Drilling Market

The COVID-19 pandemic has had a significant impact on the solar laser drilling market. One of the immediate effects of the pandemic was disturbance in the global supply chain as the solar business depends on diverse components, materials, and equipment from all around the globe. Furthermore, travel restrictions, lockdowns, & quarantine procedures hampered the smooth flow of commodities, creating delays in project timetables and significant cost overruns. In addition, manufacturers of solar laser drilling equipment faced shortages of key components and material, causing disruptions in their manufacturing schedules.

Post COVID-19 pandemic, the solar laser drilling market is experiencing resurgence and is expected to augment in the future. As industries rebound, there is renewed focus on sustainable energy solutions. Solar laser drilling emerges as a pivotal player, offering efficient and eco-friendly solutions for harnessing solar power. With increasing global awareness of environmental concerns, the post-pandemic era presents a unique opportunity for the market to thrive and contribute to a green future.

The Growing Demand of Solar Photovoltaics Is Fueling Demand for Advanced Technologies to Drive the Market Growth

Rise in demand for solar photovoltaics is surging the need for cutting-edge technologies; therefore, propelling significant market growth. With boosting global commitment toward using renewable energy, solar photovoltaic systems are emerging as a primary player in transition to sustainable power sources. This shift is being underscored by surge in global awareness about environmental concerns and collective push for clean energy alternatives. Advanced technologies are becoming integral to the solar energy landscape, with spotlight on innovations such as solar laser drilling market growth. These technologies play a pivotal role in enhancing the efficiency and precision of solar photovoltaic manufacturing processes. Solar laser drilling addresses the need for precision and reliability in creating high-performance solar panels.

The synergy between boost in demand for solar photovoltaics and technological advancements in solar laser drilling creates a mutually reinforcing cycle. With expansion of the solar industry; advancements in technology become pivotal to drive continuous improvements in efficiency, production scalability, and overall performance. This symbiotic relationship positions the market at the forefront of sustainable energy solutions; promising a future where solar photovoltaics, powered by cutting-edge technologies, play a central role in meeting the global increase in requirement for clean and renewable energy. All these factors are projected to drive the market growth during the forecast period.

High Initial Cost to Restrain the Market Growth

One of the primary disadvantages of deploying solar laser drilling is the high initial cost of establishing the necessary infrastructure. Solar panels with the efficiency levels necessary for industrial laser drilling applications are costly to purchase and install. Furthermore, the laser drilling equipment itself, having great precision and quality, is expensive. These initial investments act as a considerable obstacle for various firms, particularly the small ones having low financial resources. The price covers the solar panels and laser drilling equipment, as well as the costs of site preparation, installation, and maintenance. In addition to the initial setup expenditures, recurring maintenance and repairs significantly increase the financial burden. Solar panels require cleaning and maintenance on a regular basis to ensure maximum performance, which results in additional expenditures. Furthermore, any damage to the panels caused by weather or accidents needs expensive repairs or replacements. While solar energy is usually regarded as a long-term, cost-effective, and sustainable energy source; the high initial costs discourage various potential adopters of solar laser drilling market growth. In conclusion, the high initial cost of deploying solar laser drilling acts as a substantial restraint, preventing some businesses from embracing this technology.

Advancements in Laser Technology and Integration of Automation to Drive Excellent Opportunities

The solar energy landscape is witnessing a transformative wave propelled by continuous advancements in laser technology and seamless integration of automation. This dynamic synergy is creating fertile ground for excellent opportunities within the industry. Laser technology, with its precision and versatility, is becoming essential in various solar applications, ranging from solar cell manufacturing to intricate processes such as solar laser drilling. The evolution of lasers is leading to rise in efficiency, reduction in manufacturing costs, and improvement in overall performance of solar energy systems. Furthermore, deployment of automation into solar processes is revolutionizing the operational landscape of industry. Automated systems enhance accuracy, speed up production cycles, and ensure consistent quality; thereby addressing key challenges in the solar manufacturing sector. This integration streamlines processes as well as significantly reduces the margin of error, thus fostering a more reliable and cost-effective solar energy production ecosystem.

As technology continues to advance, the synergistic impact of laser technology & automation is unlocking new dimensions of innovation and market growth. The prospect of highly efficient, automated solar manufacturing processes not only accelerates the adoption of solar energy but also positions the industry as a key player in the global transition to sustainable practices. Continuous evolution of laser technology and integration of automation represent a transformative force; driving the solar energy sector toward a future of increased reliability, scalability, & economic viability.

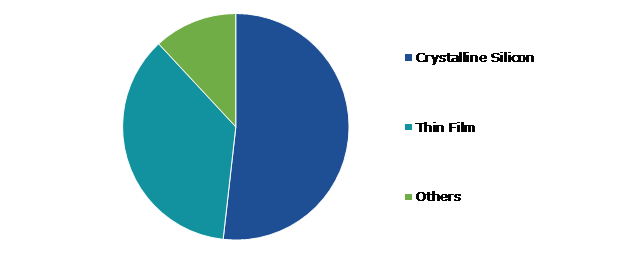

Solar Laser Drilling Market Share, by Cell Type, 2022

Source: Research Dive Analysis

By cell type, the market is divided into crystalline silicon, thin film, and others. The crystalline silicon segment accounted for the highest market share in 2022. The solar laser drilling market is being driven notably, with the crystalline silicon segment emerging as a prominent driving factor. Crystalline silicon, a widely used material in solar cell production, demands precise and efficient drilling processes to enhance its performance. Solar laser drilling proves instrumental in this regard, ensuring meticulous perforations for improved conductivity and energy conversion. Upsurge in preference for crystalline silicon solar panels is attributed to their high efficiency and reliability, which intensifies the demand for advanced drilling technologies. As the solar industry considerably drifts toward crystalline silicon technology, the solar laser drilling market trend is projected to witness significant growth.

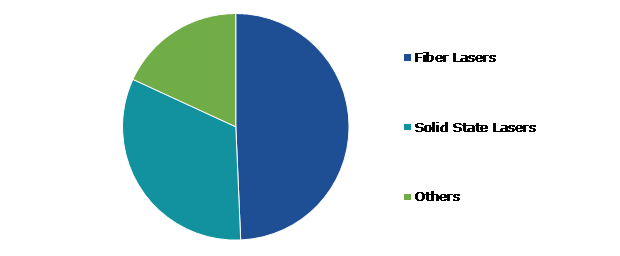

Solar Laser Drilling Market Share, by Laser Type, 2022

Source: Research Dive Analysis

By laser type, the market is classified into fiber lasers, solid state lasers, and others. The fiber lasers segment accounted for the highest market share in 2022. Characterized by superior precision, efficiency, and versatility; fiber lasers have emerged as the preferred choice for solar industry applications. Their ability to deliver high-power output with minimal maintenance requirements makes them essential in the precise drilling processes required for solar panel manufacturing. Boost in emphasis on improving production efficiency and reducing costs in the solar energy sector has fueled the demand for fiber lasers. As technology continues to advance, the fiber lasers segment is anticipated to play a central role in shaping the future of solar laser drilling market, thereby contributing to increased productivity and enhanced sustainability goals of the market. All these factors are projected to drive the segment during the forecast period.

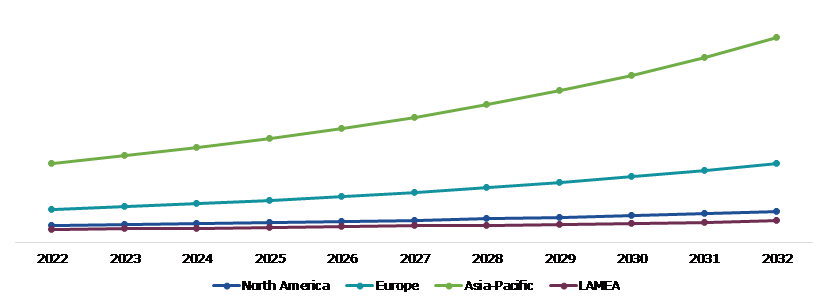

Solar Laser Drilling Market Size & Forecast, by Region, 2022-2032 ($Thousand)

Source: Research Dive Analysis

On the basis of region, the solar laser drilling market share is analyzed across North America, Europe, Asia-Pacific, and LAMEA. The Asia-Pacific solar laser drilling market generated the highest revenue in 2022. The region's robust commitment to renewable energy, coupled with increasing emphasis on technological innovation, positions it at the forefront of solar laser drilling advancements. Government initiatives promoting clean energy and surge in sustainable practices fuel the demand for precise, efficient solar panel manufacturing technologies. As Asia-Pacific continues to prioritize reduction of carbon footprints, the solar laser drilling market in the region is poised for substantial growth. This dynamic landscape not only reflects a commitment toward environmental stewardship but also signifies the region's strategic role in steering the global solar energy industry toward a more sustainable & technologically advanced future.

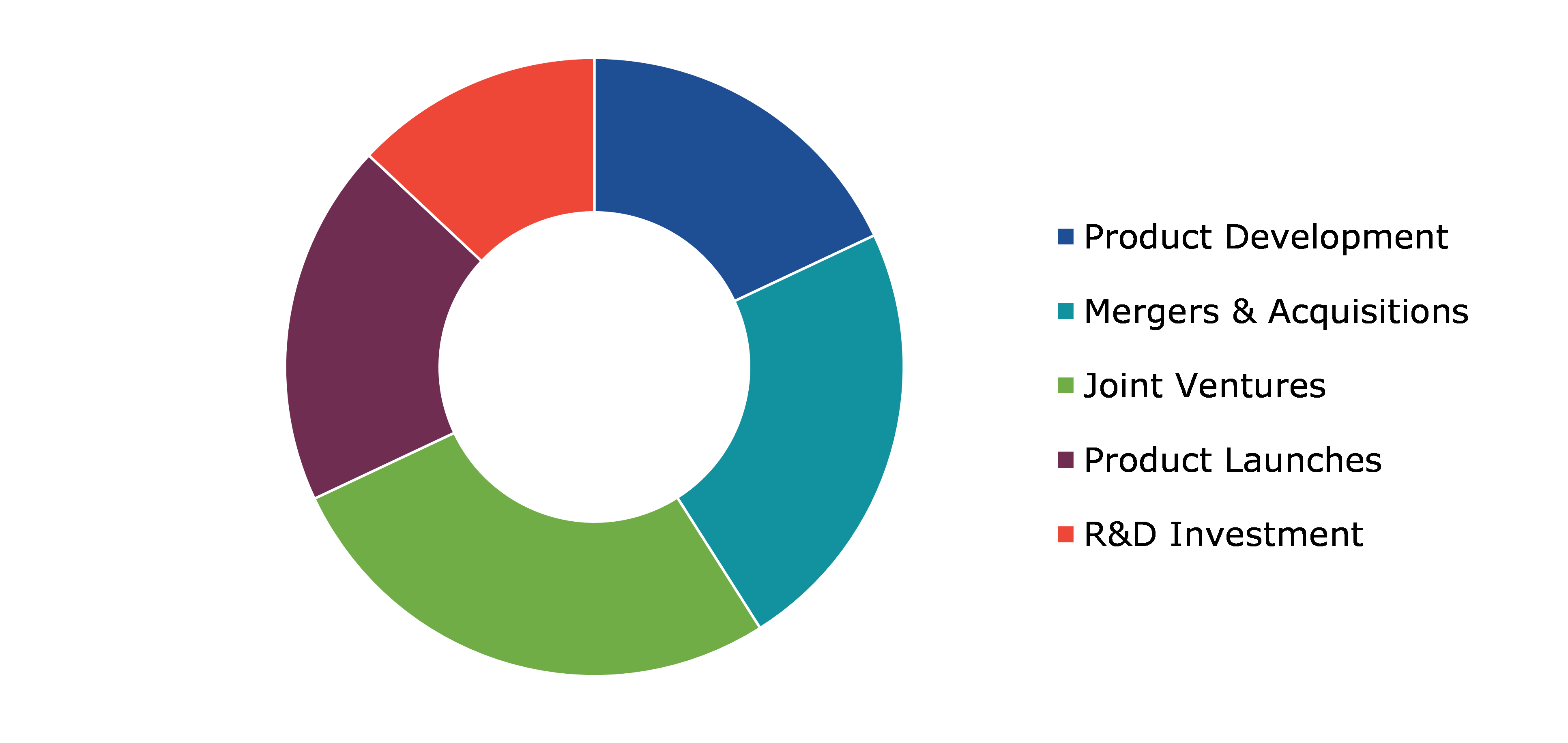

Competitive Scenario in the Solar Laser Drilling Market

Investment and agreement are common strategies adopted by major market players. In October 2022, SOLARCYCLE collaborated with solar providers such as Sunrun, striving to reclaim 95% of solar panel value. Through efficient recovery processes, the company reintegrated panels into the supply chain, either to manufacture new solar panels or to repurpose them into alternative materials. This sustainable approach underscored SOLARCYCLE's commitment to circular economy principles and minimized environmental impact in the solar industry.

Source: Research Dive Analysis

Some of the companies operating in the solar laser drilling market are Coherent–Rofin, MITSUBOSHI DIAMOND INDUSTRIAL CO., LTD., SPI Lasers Limited, IPG Photonics Corporation, Sahajanand Laser Technology Limited, Ooitech, Perfect Laser, DMG MORI, Control Micro Systems, and Microlution.

| Aspect | Particulars |

| Historical Market Estimations | 2020-2021 |

| Base Year for Market Estimation | 2022 |

| Forecast Timeline for Market Projection | 2023-2032 |

| Geographical Scope | North America, Europe, Asia-Pacific, and LAMEA |

| Segmentation by Cell Type |

|

| Segmentation by Laser Type |

|

| Key Companies Profiled |

|

Q1. What is the size of the solar laser drilling market?

A. The size of the solar laser drilling market size was over $28,10,600.0 thousand in 2022 and is projected to reach $66,59,155.7 thousand by 2032.

Q2. Which are the major companies in the solar laser drilling market?

A. Coherent –Rofin, MITSUBOSHI DIAMOND INDUSTRIAL CO., LTD., and SPI Laser Limited are some of the key players in the solar laser drilling market.

Q3. Which region, among others, possesses great investment opportunities in the near future?

A. Asia-Pacific possesses great investment opportunities for investors in the future.

Q4. What is the expected growth rate of the Asia-Pacific solar laser drilling market?

A. The Asia-Pacific solar laser drilling market share is anticipated to grow at 10.1% CAGR during the forecast period.

Q5. What are the strategies opted by leading players in this market?

A. Agreement and investment are the two key strategies opted by the leading companies of this market.

Q6. Which companies are investing more in R&D practices?

A. Coherent–Rofin, MITSUBOSHI DIAMOND INDUSTRIAL CO., LTD., and SPI Lasers Limited are the companies investing more in R&D activities for developing new products & technologies.

1. Research Methodology

1.1. Desk Research

1.2. Real time insights and validation

1.3. Forecast model

1.4. Assumptions and forecast parameters

1.5. Market size estimation

1.5.1. Top-down approach

1.5.2. Bottom-up approach

2. Report Scope

2.1. Market definition

2.2. Key objectives of the study

2.3. Report overview

2.4. Market segmentation

2.5. Overview of the impact of COVID-19 on global solar laser drilling market

3. Executive Summary

4. Market Overview

4.1. Introduction

4.2. Growth impact forces

4.2.1. Drivers

4.2.2. Restraints

4.2.3. Opportunities

4.3. Market value chain analysis

4.3.1. List of raw material suppliers

4.3.2. List of manufacturers

4.3.3. List of distributors

4.4. Innovation & sustainability matrices

4.4.1. Technology matrix

4.4.2. Regulatory matrix

4.5. Porter’s five forces analysis

4.5.1. Bargaining power of suppliers

4.5.2. Bargaining power of consumers

4.5.3. Threat of substitutes

4.5.4. Threat of new entrants

4.5.5. Competitive rivalry intensity

4.6. PESTLE analysis

4.6.1. Political

4.6.2. Economical

4.6.3. Social

4.6.4. Technological

4.6.5. Environmental

4.7. Impact of COVID-19 on solar laser drilling market

4.7.1. Pre-covid market scenario

4.7.2. Post-covid market scenario

5. Solar Laser Drilling Market Analysis, by Cell Type

5.1. Overview

5.2. Crystalline Silicon

5.2.1. Definition, key trends, growth factors, and opportunities

5.2.2. Market size analysis, by region, 2022-2032

5.2.3. Market share analysis, by country, 2022-2032

5.3. Thin Film

5.3.1. Definition, key trends, growth factors, and opportunities

5.3.2. Market size analysis, by region, 2022-2032

5.3.3. Market share analysis, by country, 2022-2032

5.4. Others

5.4.1. Definition, key trends, growth factors, and opportunities

5.4.2. Market size analysis, by region, 2022-2032

5.4.3. Market share analysis, by country, 2022-2032

5.5. Research Dive Exclusive Insights

5.5.1. Market attractiveness

5.5.2. Competition heatmap

6. Solar Laser Drilling Market Analysis, by Laser Type

6.1. Fiber Lasers

6.1.1. Definition, key trends, growth factors, and opportunities

6.1.2. Market size analysis, by region, 2022-2032

6.1.3. Market share analysis, by country, 2022-2032

6.2. Solid State Lasers

6.2.1. Definition, key trends, growth factors, and opportunities

6.2.2. Market size analysis, by region, 2022-2032

6.2.3. Market share analysis, by country, 2022-2032

6.3. Others

6.3.1. Definition, key trends, growth factors, and opportunities

6.3.2. Market size analysis, by region, 2022-2032

6.3.3. Market share analysis, by country, 2022-2032

6.4. Research Dive Exclusive Insights

6.4.1. Market attractiveness

6.4.2. Competition heatmap

7. Solar Laser Drilling Market, by Region

7.1. North America

7.1.1. U.S.

7.1.1.1. Market size analysis, by Cell Type, 2022-2032

7.1.1.2. Market size analysis, by Laser Type, 2022-2032

7.1.2. Canada

7.1.2.1. Market size analysis, by Cell Type, 2022-2032

7.1.2.2. Market size analysis, by Laser Type, 2022-2032

7.1.3. Mexico

7.1.3.1. Market size analysis, by Cell Type, 2022-2032

7.1.3.2. Market size analysis, by Laser Type, 2022-2032

7.1.4. Research Dive Exclusive Insights

7.1.4.1. Market attractiveness

7.1.4.2. Competition heatmap

7.2. Europe

7.2.1. Germany

7.2.1.1. Market size analysis, by Cell Type, 2022-2032

7.2.1.2. Market size analysis, by Laser Type, 2022-2032

7.2.2. UK

7.2.2.1. Market size analysis, by Cell Type, 2022-2032

7.2.2.2. Market size analysis, by Laser Type, 2022-2032

7.2.3. France

7.2.3.1. Market size analysis, by Cell Type, 2022-2032

7.2.3.2. Market size analysis, by Laser Type, 2022-2032

7.2.4. Spain

7.2.4.1. Market size analysis, by Cell Type, 2022-2032

7.2.4.2. Market size analysis, by Laser Type, 2022-2032

7.2.5. Italy

7.2.5.1. Market size analysis, by Cell Type, 2022-2032

7.2.5.2. Market size analysis, by Laser Type, 2022-2032

7.2.6. Rest of Europe

7.2.6.1. Market size analysis, by Cell Type, 2022-2032

7.2.6.2. Market size analysis, by Laser Type, 2022-2032

7.2.7. Research Dive Exclusive Insights

7.2.7.1. Market attractiveness

7.2.7.2. Competition heatmap

7.3. Asia-Pacific

7.3.1. China

7.3.1.1. Market size analysis, by Cell Type, 2022-2032

7.3.1.2. Market size analysis, by Laser Type, 2022-2032

7.3.2. Japan

7.3.2.1. Market size analysis, by Cell Type, 2022-2032

7.3.2.2. Market size analysis, by Laser Type, 2022-2032

7.3.3. India

7.3.3.1. Market size analysis, by Cell Type, 2022-2032

7.3.3.2. Market size analysis, by Laser Type, 2022-2032

7.3.4. Australia

7.3.4.1. Market size analysis, by Cell Type, 2022-2032

7.3.4.2. Market size analysis, by Laser Type, 2022-2032

7.3.5. South Korea

7.3.5.1. Market size analysis, by Cell Type, 2022-2032

7.3.5.2. Market size analysis, by Laser Type, 2022-2032

7.3.6. Rest of Asia-Pacific

7.3.6.1. Market size analysis, by Cell Type, 2022-2032

7.3.6.2. Market size analysis, by Laser Type, 2022-2032

7.3.7. Research Dive Exclusive Insights

7.3.7.1. Market attractiveness

7.3.7.2. Competition heatmap

7.4. LAMEA

7.4.1. Brazil

7.4.1.1. Market size analysis, by Cell Type, 2022-2032

7.4.1.2. Market size analysis, by Laser Type, 2022-2032

7.4.2. Saudi Arabia

7.4.2.1. Market size analysis, by Cell Type, 2022-2032

7.4.2.2. Market size analysis, by Laser Type, 2022-2032

7.4.3. UAE

7.4.3.1. Market size analysis, by Cell Type, 2022-2032

7.4.3.2. Market size analysis, by Laser Type, 2022-2032

7.4.4. South Africa

7.4.4.1. Market size analysis, by Cell Type, 2022-2032

7.4.4.2. Market size analysis, by Laser Type, 2022-2032

7.4.5. Rest of LAMEA

7.4.5.1. Market size analysis, by Cell Type, 2022-2032

7.4.5.2. Market size analysis, by Laser Type, 2022-2032

7.4.6. Research Dive Exclusive Insights

7.4.6.1. Market attractiveness

7.4.6.2. Competition heatmap

8. Competitive Landscape

8.1. Top winning strategies, 2022

8.1.1. By strategy

8.1.2. By year

8.2. Strategic overview

8.3. Market share analysis, 2022

9. Company Profiles

9.1. Coherent–Rofin

9.1.1. Overview

9.1.2. Business segments

9.1.3. Product portfolio

9.1.4. Financial performance

9.1.5. Recent developments

9.1.6. SWOT analysis

9.2. MITSUBOSHI DIAMOND INDUSTRIAL CO., LTD.

9.2.1. Overview

9.2.2. Business segments

9.2.3. Product portfolio

9.2.4. Financial performance

9.2.5. Recent developments

9.2.6. SWOT analysis

9.3. SPI Laser Limited

9.3.1. Overview

9.3.2. Business segments

9.3.3. Product portfolio

9.3.4. Financial performance

9.3.5. Recent developments

9.3.6. SWOT analysis

9.4. IPG Photonics Corporation

9.4.1. Overview

9.4.2. Business segments

9.4.3. Product portfolio

9.4.4. Financial performance

9.4.5. Recent developments

9.4.6. SWOT analysis

9.5. Sahajanand Laser Technology Limited

9.5.1. Overview

9.5.2. Business segments

9.5.3. Product portfolio

9.5.4. Financial performance

9.5.5. Recent developments

9.5.6. SWOT analysis

9.6. Ooitech

9.6.1. Overview

9.6.2. Business segments

9.6.3. Product portfolio

9.6.4. Financial performance

9.6.5. Recent developments

9.6.6. SWOT analysis

9.7. Perfect Laser

9.7.1. Overview

9.7.2. Business segments

9.7.3. Product portfolio

9.7.4. Financial performance

9.7.5. Recent developments

9.7.6. SWOT analysis

9.8. DMG MORI

9.8.1. Overview

9.8.2. Business segments

9.8.3. Product portfolio

9.8.4. Financial performance

9.8.5. Recent developments

9.8.6. SWOT analysis

9.9. Control Micro Systems

9.9.1. Overview

9.9.2. Business segments

9.9.3. Product portfolio

9.9.4. Financial performance

9.9.5. Recent developments

9.9.6. SWOT analysis

9.10. Microlution

9.10.1. Overview

9.10.2. Business segments

9.10.3. Product portfolio

9.10.4. Financial performance

9.10.5. Recent developments

9.10.6. SWOT analysis

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com