Nutritional Food And Drink Market Report

RA09179

Nutritional Food and Drink Market by Type (Food (Sugar & Fat Replacers, Fiber-Enriched Products, Nutritional Supplements, and Others) and Drink (Energy Drinks, Flavored & Enhanced Waters, Juices, and Others)), Application (Healthcare, Sports & Fitness, and Others), and Region (North America, Europe, Asia-Pacific, and LAMEA): Global Opportunity Analysis and Industry Forecast, 2023-2032

Nutritional Food and Drink Overview

Nutritional food and drink, also known as ‘nutraceuticals’ or ‘functional foods and beverages,’ are products that offer health advantages in addition to basic nourishment. These products are created with a variety of bioactive chemicals, ingredients, or components with the goal of promoting well-being, improving health, and preventing or managing specific health disorders. Nutritional food and drink are intended to provide additional value by improving health, boosting immunity, supporting certain biological processes, or addressing dietary inadequacies. Food contains nutrients—substances essential for the growth, repair, and maintenance of body tissues and for the regulation of vital processes.

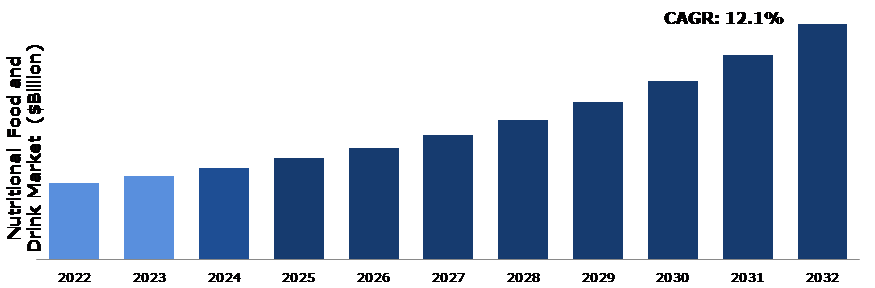

Global Nutritional Food and Drink Market Analysis

The global nutritional food and drink market size was $105.3 billion in 2022 and is predicted to grow with a CAGR of 12.1%, by generating a revenue of $ 320.7 billion by 2032.

Source: Research Dive Analysis

COVID-19 Impact on Global Nutritional Food and Drink Market

The pandemic led to an increase in public awareness about health & wellness. Consumers are increasingly interested in solutions that strengthen their immune systems and improve their overall health. This tendency has resulted in an increase in demand for nutritional meals and beverages including vitamins, minerals, and other health-promoting elements. During the pandemic, many consumers turned to e-commerce platforms for their healthy food and drink purchases. Therefore, enterprises in this industry were forced to adopt online sales channels and direct-to-consumer (DTC) methods.

The pandemic affected global supply networks, disrupting the production and delivery of nutritional food and beverages. Some businesses had difficulties obtaining raw materials and ingredients, which led to price rises and supply shortages. The pandemic affected consumer behavior and preferences as well. People wanted convenience as well as healthy eating options. This trend resulted in innovation in the nutritious food and drink business, with companies developing new products and reformulating existing ones to fulfill these demands.

Growing Demand for Sports Nutrition and Healthy Drinks to Drive the Market Growth

The shift in consumer focus toward health and fitness has resulted in an increase in sports nutrition. Professional athletes and fitness enthusiasts are using social media platforms and sponsorships to ask others to live a healthy lifestyle, which is raising the demand for nutritional meals around the world. People are turning to sports and consuming foods with nutrition as the global population becomes more afflicted with diseases such as diabetes, obesity, and cardiovascular disease. Therefore, this is one of the major factors expected to boost the nutritious food industry during the forecast period. Furthermore, the nutritional drink industry is experiencing considerable expansion owing to the rising demand for health supplements. Nutritional drinks are specially made beverages that contain vitamins, minerals, and other essential nutrients that the human body need. In addition, drink mixtures such as Ensure Original Nutritional Powder are used as breakfast substitutes. Similarly, other types of nutritional drinks include additional benefits and ingredients that are tailored to fulfill the needs of a certain target market.

Fluctuating Prices of Raw Materials to Restrain the Market Growth

Various raw materials are used in nutritional food to provide the body with needed vitamins, proteins, and minerals. The changing prices of these raw ingredients have a significant impact on the nutritional food market expansion. As the price of raw materials rises, so does the total cost of the product, reducing its demand. Therefore, the continual fluctuation in raw material prices is impeding market growth. Furthermore, in the nutritional food and drink sector, innovation is frequently dependent on the availability and prices of raw materials. Fluctuations in these prices can hamper innovation and development of new, more cost-effective, and healthier products. Manufacturers may also face uncertainties and compliance issues as a result of this.

Rising Investment in the Sports and Fitness Industry to Drive Excellent Opportunities

The growth of the sports and fitness industry has created a profitable potential for the nutritional food and beverage business. The emphasis on nutrition has grown as a result of the sports and fitness industry's expansion. The increase in number of sporting events around the world has highlighted the importance of consuming fiber foods. Furthermore, as chronic diseases have become more prevalent, individuals around the world have become more concerned about their health and, as a result, are adopting a healthier lifestyle. Therefore, fitness enthusiasts and athletes are increasingly interested in plant and animal-based protein supplements, which aid in digestion. Furthermore, healthy eating has proven to offer athletes with additional energy. It also includes less fat and more fiber, which is important for people who indulge in strenuous activity. Therefore, high-end supplements require nutritional ingredients, further driving the nutritional drink and food market. Furthermore, health-conscious consumers are actively looking for natural-ingredient products. They consider these items to be healthier, free of artificial ingredients, and more natural. There are several growth opportunities for the manufacturers operating in the market by meeting this desire and attracting a rising consumer base by integrating natural components.

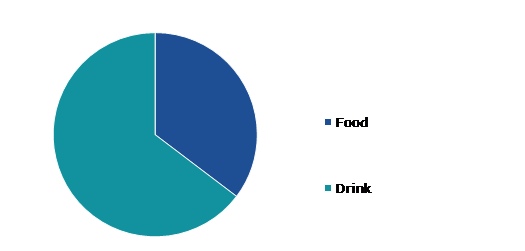

Global Nutritional Food and Drink Market Share, by Type, 2022

Source: Research Dive Analysis

The food sub-segment accounted for the highest market share in 2022. In recent years, many unhealthy eating trends have emerged, such as eating foods high in sugar, salt, and fat, that seem more nutritious but are harmful to health. This contributes to the growth of the nutrition food market because of the growing need for interventions targeting healthier diets. Growing awareness about healthy food alternatives and nutritionally enhanced food products in the market is leading to the growth of the nutrition food market. People with more disposable income can choose the best diet plan based on their preferences and health status. Rising disposable income is one of the factors leading to the growth of the food sub-segment in the nutrition food and drink market.

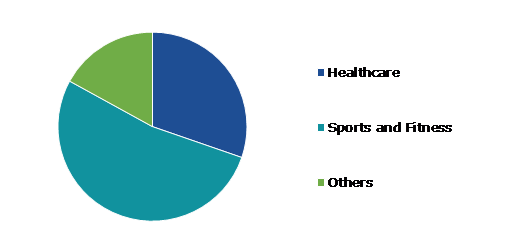

Global Nutritional Food and Drink Market Share, by Application, 2022

Source: Research Dive Analysis

The sports & fitness sub-segment accounted for the highest market share in 2022. Nutrition and diet are necessary for maximum performance in the sports sector. Sports nutrition solutions offer advantages such as appropriate weight gain, increased recuperation between training sessions and competitions, maintaining and achieving ideal weight, lowering the risk of injury, and performance stability. In addition, an increasing awareness regarding the importance of active lifestyles and a higher disposable income further boosts the market growth. Furthermore, convenience plays an important role in defining customer preferences leading to a growth in demand for easily consumable and on-the-go sports nutrition choices. The emphasis on personalization, diverse dietary options, and convenient consumption aligns with modern consumers' evolving lifestyles and preferences, driving demand for sports nutrition products that not only deliver performance benefits but also resonate with individual health & wellness priorities.

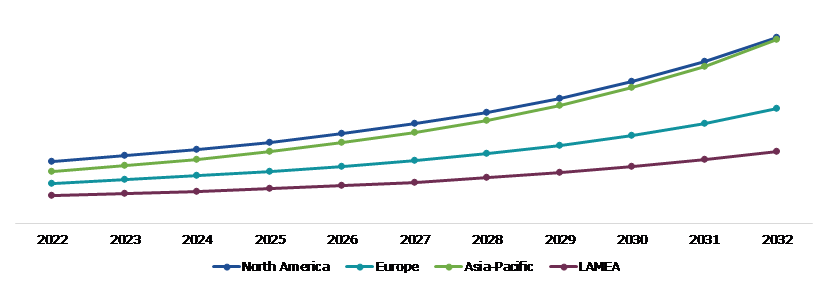

Global Nutritional Food and Drink Market Size & Forecast, by Region, 2022-2032 ($Million)

Source: Research Dive Analysis

The North America nutritional food and drink market generated the highest revenue in 2022. This can be attributed to an increasing focus on beverages with minimal fat content and a high concentration of vitamins and minerals. As these items are convenient and easily accessible and offer health advantages and nutrition to users, numerous dieticians recommend using them as a health supplement. Furthermore, the increasing number of new product launches in the sports supplement category as well as the local presence of significant industry players, are some of the important drivers projected to boost the regional growth. Another key element increasing the use of nutrition food & drink products in this region is a rise in the number of government initiatives supporting sports-related activities.

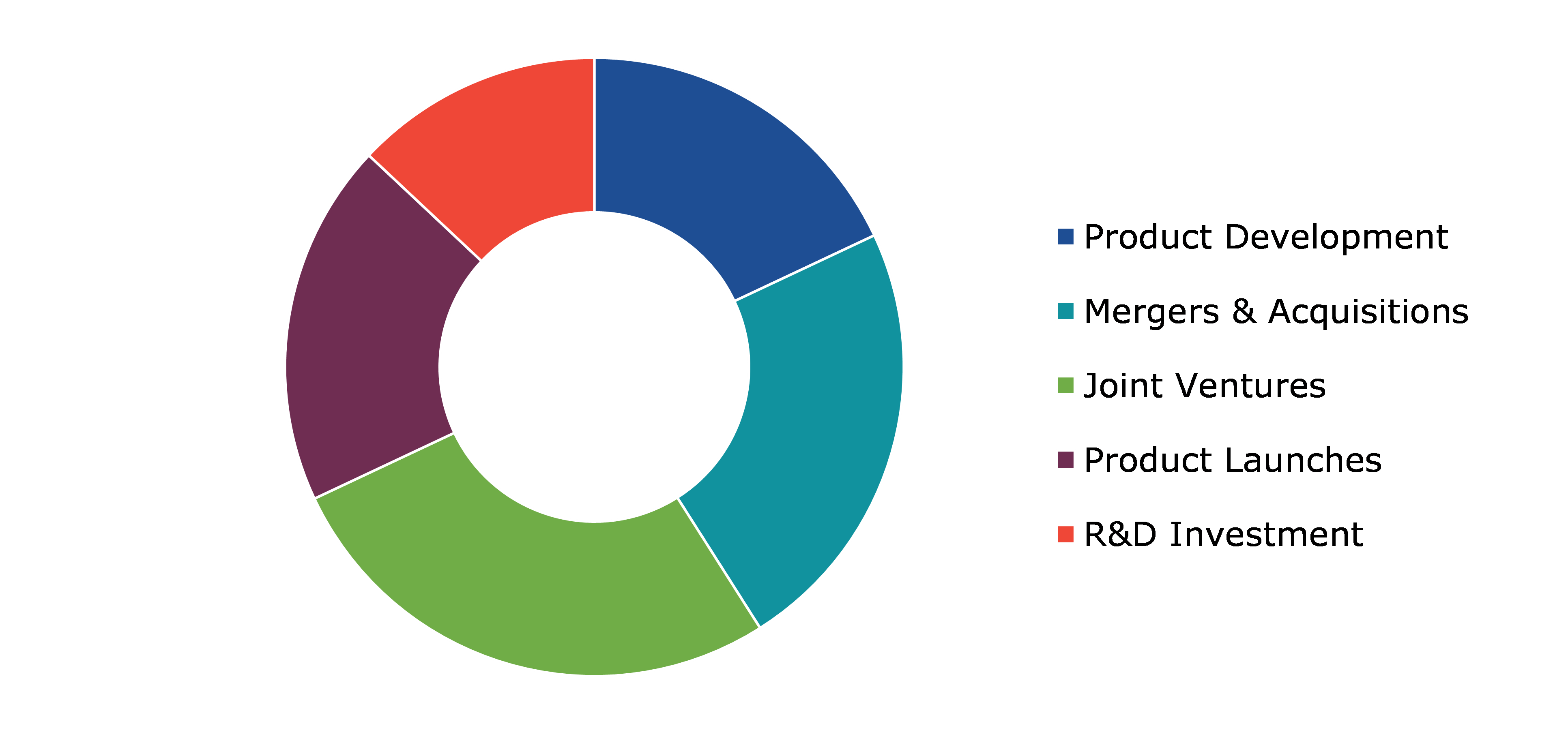

Competitive Scenario in the Global Nutritional Food and Drink Market

Investment and agreement are common strategies followed by major market players. In March 2023, Life Health Foods (India) Pvt. Ltd., a pioneer in the plant-based beverage industry, introduced their new vegan beverage, So Good Oat Unsweetened beverage, a plant-based milk that is free of dairy. The brand's new delectable So Good Oat beverage fulfills its promise to provide a nutritious and adaptable beverage manufactured right here in India that gives coffee, tea, baking, and smoothies an outstanding taste and creaminess.

Source: Research Dive Analysis

Some of the leading nutritional food and drink market players are Nestle, Abbott, Bayer AG, DUPONT, Amway, Health Food Manufacturers’ Association, Glanbia Plc, Bionova, GSK plc, and Herbalife International of America, Inc.

| Aspect | Particulars |

| Historical Market Estimations | 2020-2021 |

| Base Year for Market Estimation | 2022 |

| Forecast Timeline for Market Projection | 2023-2032 |

| Geographical Scope | North America, Europe, Asia-Pacific, and LAMEA |

| Segmentation by Type |

|

| Segmentation by Application |

|

| Key Companies Profiled |

|

Q1. What is the size of the global nutritional food and drink market?

A. The size of the global nutritional food and drink market was over $105.3 billion in 2022 and is projected to reach $320.7 billion by 2032.

Q2. Which are the major companies in the nutritional food and drink market?

A. Abbott and Unilever are some of the key players in the global nutritional food and drink market.

Q3. Which region, among others, possesses greater investment opportunities in the future?

A. Asia-Pacific possesses great investment opportunities for investors in the future.

Q4. What will be the growth rate of the Asia-Pacific nutritional food and drink market?

A. The Asia-Pacific nutritional food and drink market is anticipated to grow at 13.7% CAGR during the forecast period.

Q5. What are the strategies opted by the leading players in this market?

A. Agreement and investment are the two key strategies opted by the operating companies in this market.

Q6. Which companies are investing more on R&D practices?

A. Abbott, Unilever, Nestle S.A, and Pepsi co are the companies investing more on R&D activities for developing new products and technologies.

1. Research Methodology

1.1. Desk Research

1.2. Real time insights and validation

1.3. Forecast model

1.4. Assumptions and forecast parameters

1.5. Market size estimation

1.5.1. Top-down approach

1.5.2. Bottom-up approach

2. Report Scope

2.1. Market definition

2.2. Key objectives of the study

2.3. Report overview

2.4. Market segmentation

2.5. Overview of the impact of COVID-19 on global Nutritional Food and Drink Market

3. Executive Summary

4. Market Overview

4.1. Introduction

4.2. Growth impact forces

4.2.1. Drivers

4.2.2. Restraints

4.2.3. Opportunities

4.3. Market value chain analysis

4.3.1. List of raw material suppliers

4.3.2. List of manufacturers

4.3.3. List of distributors

4.4. Innovation & sustainability matrices

4.4.1. Technology matrix

4.4.2. Regulatory matrix

4.5. Porter’s five forces analysis

4.5.1. Bargaining power of suppliers

4.5.2. Bargaining power of consumers

4.5.3. Threat of substitutes

4.5.4. Threat of new entrants

4.5.5. Competitive rivalry intensity

4.6. PESTLE analysis

4.6.1. Political

4.6.2. Economical

4.6.3. Social

4.6.4. Technological

4.6.5. Legal

4.6.6. Environmental

4.7. Impact of COVID-19 on Nutritional Food and Drink Market

4.7.1. Pre-covid market scenario

4.7.2. Post-covid market scenario

5. Nutritional Food and Drink Market Analysis, by Type

5.1. Overview

5.2. Food

5.2.1. Definition, key trends, growth factors, and opportunities

5.2.2. Market size analysis, by region, 2022-2032

5.2.3. Market share analysis, by country, 2022-2032

5.2.3.1. Sugar & Fat Replacers

5.2.3.1.1. Definition, key trends, growth factors, and opportunities

5.2.3.1.2. Market size analysis, by region, 2022-2032

5.2.3.1.3. Market share analysis, by country, 2022-2032

5.2.3.2. Fiber-Enriched Products

5.2.3.2.1. Definition, key trends, growth factors, and opportunities

5.2.3.2.2. Market size analysis, by region, 2022-2032

5.2.3.2.3. Market share analysis, by country, 2022-2032

5.2.3.3. Nutritional Supplements

5.2.3.3.1. Definition, key trends, growth factors, and opportunities

5.2.3.3.2. Market size analysis, by region, 2022-2032

5.2.3.3.3. Market share analysis, by country, 2022-2032

5.2.3.4. Others

5.2.3.4.1. Definition, key trends, growth factors, and opportunities

5.2.3.4.2. Market size analysis, by region, 2022-2032

5.2.3.4.3. Market share analysis, by country, 2022-2032

5.3. Drink

5.3.1. Definition, key trends, growth factors, and opportunities

5.3.2. Market size analysis, by region, 2022-2032

5.3.3. Market share analysis, by country, 2022-2032

5.3.3.1. Energy Drinks

5.3.3.1.1. Definition, key trends, growth factors, and opportunities

5.3.3.1.2. Market size analysis, by region, 2022-2032

5.3.3.1.3. Market share analysis, by country, 2022-2032

5.3.3.2. Flavored & Enhanced Waters

5.3.3.2.1. Definition, key trends, growth factors, and opportunities

5.3.3.2.2. Market size analysis, by region, 2022-2032

5.3.3.2.3. Market share analysis, by country, 2022-2032

5.3.3.3. Juices

5.3.3.3.1. Definition, key trends, growth factors, and opportunities

5.3.3.3.2. Market size analysis, by region, 2022-2032

5.3.3.3.3. Market share analysis, by country, 2022-2032

5.3.3.4. Others

5.3.3.4.1. Definition, key trends, growth factors, and opportunities

5.3.3.4.2. Market size analysis, by region, 2022-2032

5.3.3.4.3. Market share analysis, by country, 2022-2032

5.4. Research Dive Exclusive Insights

5.4.1. Market attractiveness

5.4.2. Competition heatmap

6. Nutritional Food and Drink Market Analysis, by Application

6.1. Healthcare

6.1.1. Definition, key trends, growth factors, and opportunities

6.1.2. Market size analysis, by region, 2022-2032

6.1.3. Market share analysis, by country, 2022-2032

6.2. Sports & Fitness

6.2.1. Definition, key trends, growth factors, and opportunities

6.2.2. Market size analysis, by region, 2022-2032

6.2.3. Market share analysis, by country, 2022-2032

6.3. Others

6.3.1. Definition, key trends, growth factors, and opportunities

6.3.2. Market size analysis, by region, 2022-2032

6.3.3. Market share analysis, by country, 2022-2032

6.4. Research Dive Exclusive Insights

6.4.1. Market attractiveness

6.4.2. Competition heatmap

7. Nutritional Food and Drink Market, by Region

7.1. North America

7.1.1. U.S.

7.1.1.1. Market size analysis, by Type, 2022-2032

7.1.1.2. Market size analysis, by Application, 2022-2032

7.1.2. Canada

7.1.2.1. Market size analysis, by Type, 2022-2032

7.1.2.2. Market size analysis, by Application, 2022-2032

7.1.3. Mexico

7.1.3.1. Market size analysis, by Type, 2022-2032

7.1.3.2. Market size analysis, by Application, 2022-2032

7.1.4. Research Dive Exclusive Insights

7.1.4.1. Market attractiveness

7.1.4.2. Competition heatmap

7.2. Europe

7.2.1. Germany

7.2.1.1. Market size analysis, by Type, 2022-2032

7.2.1.2. Market size analysis, by Application, 2022-2032

7.2.2. UK

7.2.2.1. Market size analysis, by Type, 2022-2032

7.2.2.2. Market size analysis, by Application, 2022-2032

7.2.3. France

7.2.3.1. Market size analysis, by Type, 2022-2032

7.2.3.2. Market size analysis, by Application, 2022-2032

7.2.4. Spain

7.2.4.1. Market size analysis, by Type, 2022-2032

7.2.4.2. Market size analysis, by Application, 2022-2032

7.2.5. Italy

7.2.5.1. Market size analysis, by Type, 2022-2032

7.2.5.2. Market size analysis, by Application, 2022-2032

7.2.6. Rest of Europe

7.2.6.1. Market size analysis, by Type, 2022-2032

7.2.6.2. Market size analysis, by Application, 2022-2032

7.2.7. Research Dive Exclusive Insights

7.2.7.1. Market attractiveness

7.2.7.2. Competition heatmap

7.3. Asia-Pacific

7.3.1. China

7.3.1.1. Market size analysis, by Type, 2022-2032

7.3.1.2. Market size analysis, by Application, 2022-2032

7.3.2. Japan

7.3.2.1. Market size analysis, by Type, 2022-2032

7.3.2.2. Market size analysis, by Application, 2022-2032

7.3.3. India

7.3.3.1. Market size analysis, by Type, 2022-2032

7.3.3.2. Market size analysis, by Application, 2022-2032

7.3.4. Australia

7.3.4.1. Market size analysis, by Type, 2022-2032

7.3.4.2. Market size analysis, by Application, 2022-2032

7.3.5. South Korea

7.3.5.1. Market size analysis, by Type, 2022-2032

7.3.5.2. Market size analysis, by Application, 2022-2032

7.3.6. Rest of Asia-Pacific

7.3.6.1. Market size analysis, by Type, 2022-2032

7.3.6.2. Market size analysis, by Application, 2022-2032

7.3.7. Research Dive Exclusive Insights

7.3.7.1. Market attractiveness

7.3.7.2. Competition heatmap

7.4. LAMEA

7.4.1. Brazil

7.4.1.1. Market size analysis, by Type, 2022-2032

7.4.1.2. Market size analysis, by Application, 2022-2032

7.4.2. Saudi Arabia

7.4.2.1. Market size analysis, by Type, 2022-2032

7.4.2.2. Market size analysis, by Application, 2022-2032

7.4.3. UAE

7.4.3.1. Market size analysis, by Type, 2022-2032

7.4.3.2. Market size analysis, by Application, 2022-2032

7.4.4. South Africa

7.4.4.1. Market size analysis, by Type, 2022-2032

7.4.4.2. Market size analysis, by Application, 2022-2032

7.4.5. Rest of LAMEA

7.4.5.1. Market size analysis, by Type, 2022-2032

7.4.5.2. Market size analysis, by Application, 2022-2032

7.4.6. Research Dive Exclusive Insights

7.4.6.1. Market attractiveness

7.4.6.2. Competition heatmap

8. Competitive Landscape

8.1. Top winning strategies, 2022

8.1.1. By strategy

8.1.2. By year

8.2. Strategic overview

8.3. Market share analysis, 2022

9. Company Profiles

9.1. Nestle

9.1.1. Overview

9.1.2. Business segments

9.1.3. Product portfolio

9.1.4. Financial performance

9.1.5. Recent developments

9.1.6. SWOT analysis

9.2. Abbott

9.2.1. Overview

9.2.2. Business segments

9.2.3. Product portfolio

9.2.4. Financial performance

9.2.5. Recent developments

9.2.6. SWOT analysis

9.3. Bayer AG

9.3.1. Overview

9.3.2. Business segments

9.3.3. Product portfolio

9.3.4. Financial performance

9.3.5. Recent developments

9.3.6. SWOT analysis

9.4. DUPONT

9.4.1. Overview

9.4.2. Business segments

9.4.3. Product portfolio

9.4.4. Financial performance

9.4.5. Recent developments

9.4.6. SWOT analysis

9.5. Amway

9.5.1. Overview

9.5.2. Business segments

9.5.3. Product portfolio

9.5.4. Financial performance

9.5.5. Recent developments

9.5.6. SWOT analysis

9.6. Health Food Manufacturers’ Association

9.6.1. Overview

9.6.2. Business segments

9.6.3. Product portfolio

9.6.4. Financial performance

9.6.5. Recent developments

9.6.6. SWOT analysis

9.7. Glanbia Plc

9.7.1. Overview

9.7.2. Business segments

9.7.3. Product portfolio

9.7.4. Financial performance

9.7.5. Recent developments

9.7.6. SWOT analysis

9.8. Bionova

9.8.1. Overview

9.8.2. Business segments

9.8.3. Product portfolio

9.8.4. Financial performance

9.8.5. Recent developments

9.8.6. SWOT analysis

9.9. GSK plc

9.9.1. Overview

9.9.2. Business segments

9.9.3. Product portfolio

9.9.4. Financial performance

9.9.5. Recent developments

9.9.6. SWOT analysis

9.10. Herbalife International of America, Inc.

9.10.1. Overview

9.10.2. Business segments

9.10.3. Product portfolio

9.10.4. Financial performance

9.10.5. Recent developments

9.10.6. SWOT analysis

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com