Global Voice Communication Equipment Market Report

RA08760

Global Voice Communication Equipment Market by Type (Tablets, Smartphones, IP Phones, Soft Phones, and Others), Network Equipment (Router, Private Branch Exchange, Switches, and Others), Enterprise Size (Large Enterprises and Small & Medium Enterprises), Industry Verticals (BFSI, Healthcare, Hospitality, Retail, Transportation & Logistics, IT & Telecom, and Others), Component (Solution and Services), and Region (North America, Europe, Asia-Pacific, and LAMEA): Opportunity Analysis and Industry Forecast, 2023-2032

Voice Communication Equipment Overview

Voice communication equipment refers to gadgets or systems that allow the transmission and reception of audio alerts for the purpose of human communication. These units are designed to facilitate the alternate of verbal records between people or businesses over quick or lengthy distances. Voice communication equipment can be observed in a range of contexts, which include telephony, broadcasting, public tackle systems, and navy communication.

The most frequent voice communication device used for private and commercial enterprise communication are IP phones, softphones, smartphones, and many different voice communication equipment. It allows users to transmit voice signals over long distances using wired or wireless networks. Portable devices enable voice communication between individuals or groups within a limited range. They are commonly used in public safety, security, construction, and event management industries.

Global Voice Communication Equipment Market Analysis

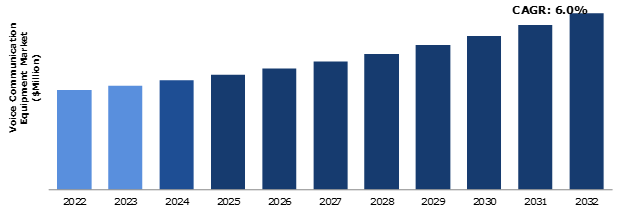

The global voice communication equipment market size was $7,415.70 million in 2022 and is predicted to grow with a CAGR of 6.0%, by generating a revenue of $13,118.50 million by 2032.

Source: Research Dive Analysis

COVID-19 Impact on Global Voice Communication Equipment Market

The COVID-19 pandemic has had a significant impact on various industries worldwide, including the voice communication equipment market. During the pandemic, many businesses faced operational challenges due to lockdowns, social distancing measures, and remote work policies. There was a significant shift towards remote communication and collaboration tools to ensure business continuity.

Before the pandemic, the voice communication equipment market was steadily growing driven by various factors such as increasing demand for efficient communication systems in businesses, rising adoption of Voice over Internet Protocol (VoIP) technology, and advancements in wireless communication technologies. The market witnessed a growing number of enterprises investing in voice communication solutions to enhance productivity and streamline their operations.

In the post-pandemic period, the voice communication equipment market is the present process of a massive transformation. It continues to evolve with the emergence of new technologies and altering work dynamics. The market is witnessing improved adoption of artificial intelligence (AI) and machine learning (ML) capabilities in voice communication systems, enabling aspects such as voice recognition, natural language processing, and digital assistants.

Growing Demand for Unified Communication and Collaboration (UC&C) Solutions to Drive the Market Growth

The growing need for seamless communication and collaboration in organizations boosts the demand for voice communication equipment. Organizations require efficient and seamless communication & collaboration among their teams, regardless of their physical locations. UC&C solutions provide a unified platform that integrates various communication channels, including voice, video, messaging, and others. Voice communication equipment plays a crucial role in facilitating real-time voice communication within these solutions, enabling smooth collaboration among team members. Moreover, UC&C solutions aim to consolidate and streamline communication channels within organizations. By integrating voice, video, messaging, and other channels into a single platform, these solutions simplify the user experience and improve productivity. Voice communication equipment, such as IP phones, headsets, conference call systems, and related hardware, are essential components in achieving this integration. Furthermore, as organizations recognize the benefits of UC&C solutions, their adoption rates are growing. These solutions offer features like instant messaging, presence information, video conferencing, and voice calling, all accessible from a unified interface. This trend drives the demand for compatible voice communication equipment to support the voice calling aspect of UC&C solutions. The growing need for seamless communication and collaboration, the integration of communication channels, increasing adoption of UC&C solutions, the rise of remote work, enhanced productivity, and technological advancements are all driving the demand for voice communication equipment.

To know more about global voice communication equipment market opportunities, get in touch with our analysts here.

Compatibility Issues, Security, and Privacy Concerns to Restrain the Market Growth

Voice communication equipment can be vulnerable to hacking attempts and unauthorized access. Malicious actors may attempt to intercept or manipulate voice data, compromising the confidentiality and integrity of communications. This poses risks in sensitive sectors such as government, finance, and healthcare. Moreover, voice communication equipment often processes and stores large volumes of voice data. If not adequately protected, this data can be susceptible to breaches, leading to the exposure of sensitive information. Data breaches can have severe consequences, including financial losses, reputational damage, and regulatory penalties. Effective encryption of voice data is crucial to ensure privacy and security. Voice communication equipment needs to use robust encryption algorithms and protocols to protect data during transmission and storage. Voice communication equipment need to integrate smoothly with these external systems to provide a comprehensive solution. However, compatibility issues can arise when attempting to connect with various third-party applications, services, or hardware, limiting the flexibility and functionality of the equipment, which is anticipated to hamper the voice communication equipment market growth.

Growing Adoption of VoIP Technology to Drive Excellent Opportunities

There is a growing demand for devices that are compatible with Voice over Internet Protocol (VoIP) technology. These devices can offer advanced features, improved audio quality, and seamless integration with VoIP networks. Moreover, Private Branch Exchange (PBX) systems are essential for managing internal and external voice communications within organizations. The adoption of VoIP allows for the development of IP-based PBX systems, which can replace traditional analog or digital systems. Manufacturers can create feature-rich IP-PBX solutions that offer advanced call routing, voicemail, conferencing, and integration with other communication tools like email and instant messaging. Furthermore, VoIP technology is often integrated into unified communication platforms, which combine various communication channels like voice, video, messaging, and collaboration tools. Manufacturers can develop voice communication equipment that seamlessly integrates with unified communication (UC) platforms, enabling users to make and receive calls directly from their UC clients or applications. This integration enhances productivity and streamlines communication for businesses. The adoption of VoIP technology opens up several opportunities for manufacturers of voice communication equipment to develop innovative, cost-effective, and feature-rich solutions that meet the evolving needs of businesses and individuals in a connected world.

To know more about global voice communication equipment market opportunities, get in touch with our analysts here.

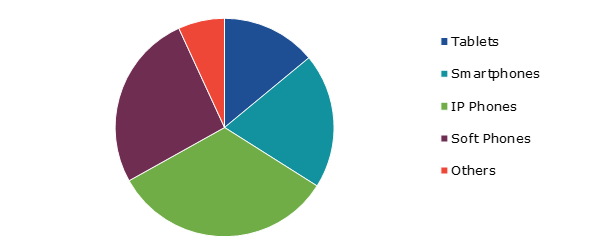

Global Voice Communication Equipment Market Share, by Type, 2022

Source: Research Dive Analysis

The IP phones sub-segment accounted for the highest market share in 2022. An IP phone is identical to a standard analog handset. It is a device that allows users to receive and make phone calls. The difference is that, instead of being connected to a traditional phone line, IP phones are linked to an Internet Protocol (IP) network and make calls over Voice over Internet Protocol (VoIP). They usually have power adapters and Ethernet connectors. The user has easy access to an unlimited number of phone calls with an IP phone. Any company trying to optimize its phone network can profit from an IP phone. Businesses that handle a high volume of calls, such as VoIP call centers or organizations with huge customer support networks.

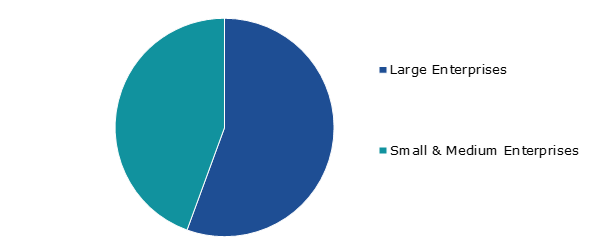

Global Voice Communication Equipment Market Share, by Enterprise Size, 2022

Source: Research Dive Analysis

The large enterprises sub-segment accounted for the highest market share in 2022. Large organizations, because of their size, complexity, and global nature, have a greater need for effective collaboration. Voice communication technology, such as IP phones, is critical for enabling seamless collaboration, information exchange, and collaborative efforts toward common goals. Large organizations can streamline communication channels and increase efficiency by using modern voice communication technology. These technologies enable faster decision-making, better productivity, and lower operational expenses by lowering the time and effort necessary for communication. In addition, when handling significant amounts of sensitive information, major organizations require Voice Communication Equipment and equipment that provides both convenience and robust security safeguards to assure data security.

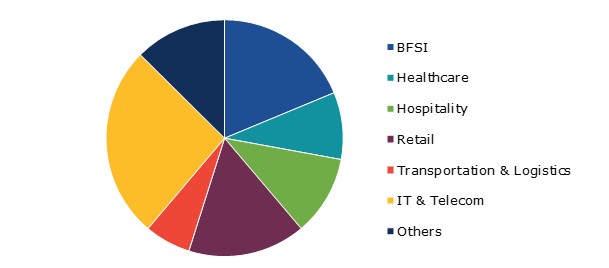

Global Voice Communication Equipment Market Share, by Industry Vertical, 2022

Source: Research Dive Analysis

The IT & telecom sub-segment accounted for the highest market share in 2022. IT & telecom operators are significant players in the voice communication equipment market, as they provide end users with voice communication services. These service providers offer a variety of alternatives, including landline connections, broadband Internet, and wireless connectivity for mobile devices. In addition to these services, telecom operators provide voice communication equipment and services that allow individuals and businesses to call anywhere across the world. Traditional landline phones, cell phones, and the increasingly ubiquitous IP phones that use Voice over Internet Protocol (VoIP) technology to carry voice calls over the Internet are all examples of voice communication equipment.

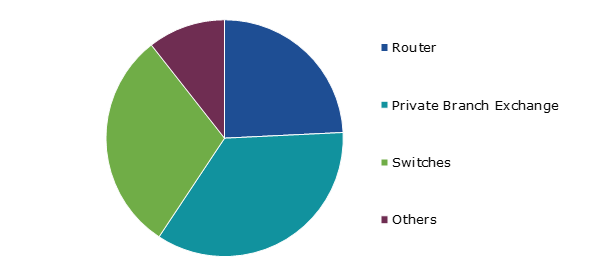

Global Voice Communication Equipment Market Share, by Network Equipment, 2022

Source: Research Dive Analysis

The private branch exchange sub-segment accounted for the highest market share in 2022. Private branch exchange or PBX is a private telephone network that allows users to communicate with one another. Different hardware components collaborate to enable telephone network connectivity. A PBX manages an organization's internal telephone network. It is also responsible for relaying calls to the outside world, as well as routing and advanced calling features for both inbound and outgoing calls. The PBX devices help manage and complete calls according to a predetermined schedule. The operator can direct the branching out and create an operating procedure in the PBX network tree. To prevent expensive charges, operators might restrict or allow international dialing as needed.

Global Voice Communication Equipment Market Share, by Component, 2022

Source: Research Dive Analysis

The solution sub-segment accounted for the highest market share in 2022. These solutions include call management systems, unified communications platforms, speech recognition software, contact center solutions, and others. Furthermore, businesses and organizations are increasingly seeking comprehensive communication solutions that go beyond simple voice calls. Voicemail, call routing, conferencing, and collaboration capabilities are all included in integrated systems, allowing for increased productivity and streamlined communication workflows.

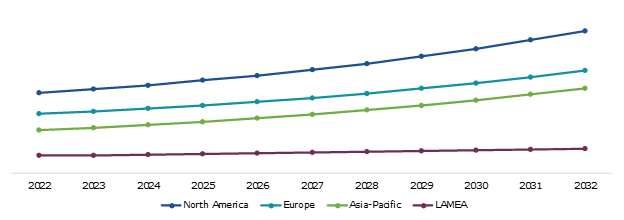

Global Voice Communication Equipment Market Size & Forecast, by Region, 2022-2032 ($Million)

Source: Research Dive Analysis

The North America voice communication equipment market generated the highest revenue in 2022. North America is known for its highly advanced technology and infrastructure. This has led to a high demand for voice communication equipment that can facilitate easy communication and collaboration among businesses and individuals. The shift towards cloud-based solutions has been significant in North America. This has led to a high demand for voice communication equipment that can be used on devices such as IP phones, soft phones, and others, allowing for easy and convenient communication on the go.

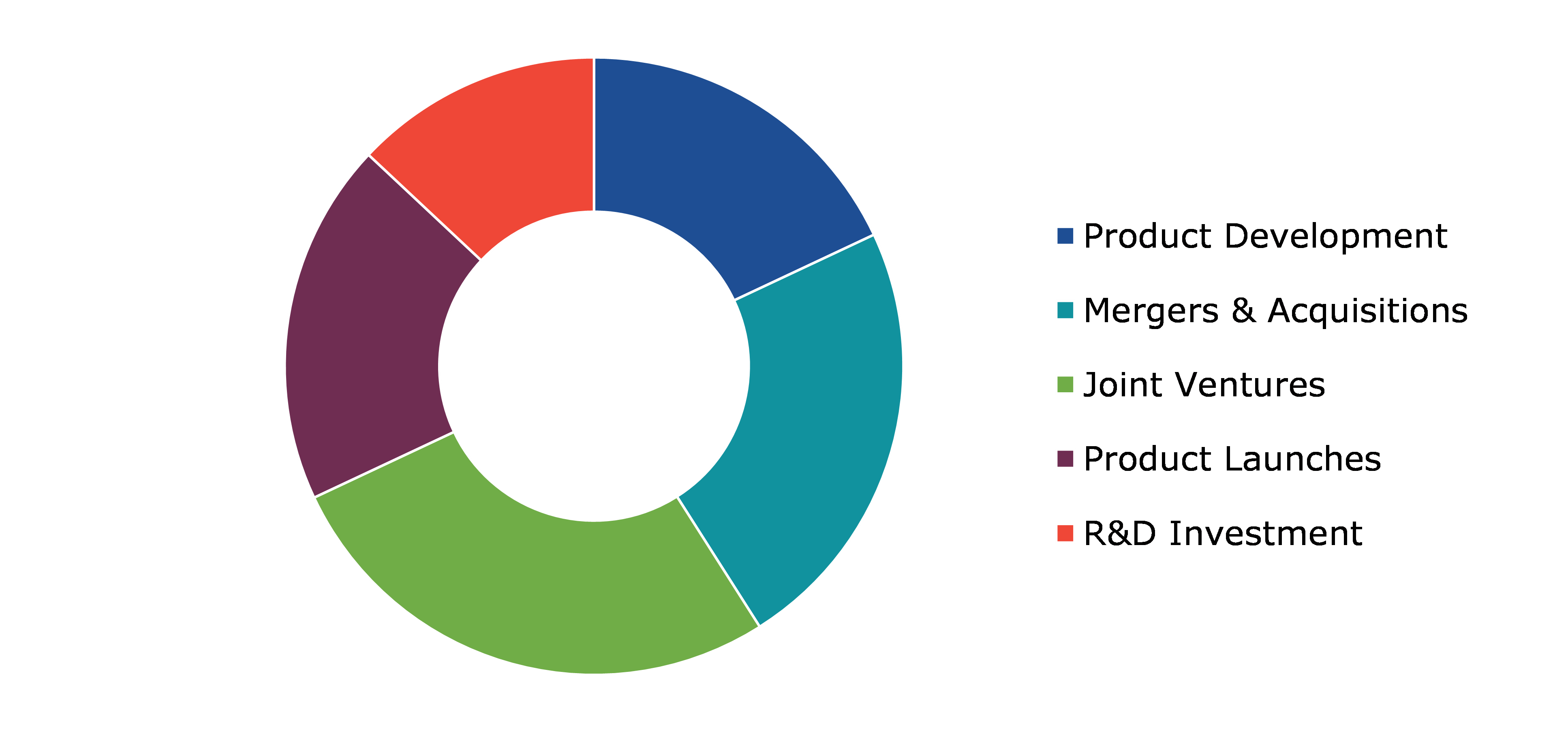

Competitive Scenario in the Global Voice Communication Equipment Market

Investment and agreement are common strategies followed by major market players. For instance, in October 2022, Flyingvoice, a leading supplier of communication terminal devices and VoIP one-stop solutions, launched the FIP15G Plus Elite Touch Screen IP Phone. The FIP15G Plus Elite featured a sleek touch screen interface, providing users with an intuitive and user-friendly experience. With its advanced VoIP technology, the IP phone offers high-definition voice quality and seamless communication capabilities.

Source: Research Dive Analysis

Some of the leading voice communication equipment market players are , ADTRAN, Inc., MDS Gateways, Samsung Electronics Co Ltd, Speedflow Communications, Apple, Inc., Microsoft Corporation, 8x8, Inc., Siemens Enterprise Communication, PanTerra Networks, and IBM Corporation.

| Aspect | Particulars |

| Historical Market Estimations | 2020-2022 |

| Base Year for Market Estimation | 2022 |

| Forecast Timeline for Market Projection | 2023-2032 |

| Geographical Scope | North America, Europe, Asia-Pacific, and LAMEA |

| Segmentation by Type |

|

| Segmentation by Network Equipment |

|

| Segmentation by Enterprise Size |

|

| Segmentation by Industry Verticals |

|

| Segmentation by Component |

|

| Key Companies Profiled |

|

Q1. What is the size of the global voice communication equipment market?

A. The size of the global voice communication equipment market was over $7,415.70 million in 2022 and is projected to reach $13,118.50 million by 2032.

Q2. Which are the major companies in the voice communication equipment market?

A. ADTRAN, Inc., MDS Gateways, and Samsung are some of the key players in the global voice communication equipment market.

Q3. Which region, among others, possesses greater investment opportunities in the future?

A. Asia-Pacific possesses great investment opportunities for investors in the future.

Q4. What will be the growth rate of the Asia-Pacific voice communication equipment market?

A. The Asia-Pacific voice communication equipment market is anticipated to grow at 7.1% CAGR during the forecast period.

Q5. What are the strategies opted by the leading players in this market?

A. Agreement and investment are the two key strategies opted by the operating companies in this market.

Q6. Which companies are investing more on R&D practices?

A. Siemens Enterprise Communication, PanTerra Networks, and IBM Corporation are the companies investing more on R&D activities for developing new products and technologies.

1.Research Methodology

1.1.Desk Research

1.2.Real time insights and validation

1.3.Forecast model

1.4.Assumptions and forecast parameters

1.5.Market size estimation

1.5.1.Top-down approach

1.5.2.Bottom-up approach

2.Report Scope

2.1.Market definition

2.2.Key objectives of the study

2.3.Report overview

2.4.Market segmentation

2.5.Overview of the impact of COVID-19 on Global voice communication equipment market

3.Executive Summary

4.Market Overview

4.1.Introduction

4.2.Growth impact forces

4.2.1.Drivers

4.2.2.Restraints

4.2.3.Opportunities

4.3.Market value chain analysis

4.3.1.List of raw material suppliers

4.3.2.List of manufacturers

4.3.3.List of distributors

4.4.Innovation & sustainability matrices

4.4.1.Technology matrix

4.4.2.Regulatory matrix

4.5.Porter’s five forces analysis

4.5.1.Bargaining power of suppliers

4.5.2.Bargaining power of consumers

4.5.3.Threat of substitutes

4.5.4.Threat of new entrants

4.5.5.Competitive rivalry intensity

4.6.PESTLE analysis

4.6.1.Political

4.6.2.Economical

4.6.3.Social

4.6.4.Technological

4.6.5.Environmental

4.7.Impact of COVID-19 on voice communication equipment market

4.7.1.Pre-covid market scenario

4.7.2.Post-covid market scenario

5.Voice Communication Equipment Market Analysis, by Type

5.1.Overview

5.2.Tablets

5.2.1.Definition, key trends, growth factors, and opportunities

5.2.2.Market size analysis, by region, 2022-2032

5.2.3.Market share analysis, by country, 2022-2032

5.3.Smartphones

5.3.1.Definition, key trends, growth factors, and opportunities

5.3.2.Market size analysis, by region, 2022-2032

5.3.3.Market share analysis, by country, 2022-2032

5.4.IP Phones

5.4.1.Definition, key trends, growth factors, and opportunities

5.4.2.Market size analysis, by region, 2022-2032

5.4.3.Market share analysis, by country, 2022-2032

5.5.Soft Phones

5.5.1.Definition, key trends, growth factors, and opportunities

5.5.2.Market size analysis, by region, 2022-2032

5.5.3.Market share analysis, by country, 2022-2032

5.6.Others

5.6.1.Definition, key trends, growth factors, and opportunities

5.6.2.Market size analysis, by region, 2022-2032

5.6.3.Market share analysis, by country, 2022-2032

5.7.Research Dive Exclusive Insights

5.7.1.Market attractiveness

5.7.2.Competition heatmap

6.Voice Communication Equipment Market Analysis, by Network Equipment

6.1.Router

6.1.1.Definition, key trends, growth factors, and opportunities

6.1.2.Market size analysis, by region, 2022-2032

6.1.3.Market share analysis, by country, 2022-2032

6.2.Private Branch Exchange

6.2.1.Definition, key trends, growth factors, and opportunities

6.2.2.Market size analysis, by region, 2022-2032

6.2.3.Market share analysis, by country, 2022-2032

6.3.Switches

6.3.1.Definition, key trends, growth factors, and opportunities

6.3.2.Market size analysis, by region, 2022-2032

6.3.3.Market share analysis, by country, 2022-2032

6.4.Others

6.4.1.Definition, key trends, growth factors, and opportunities

6.4.2.Market size analysis, by region, 2022-2032

6.4.3.Market share analysis, by country, 2022-2032

6.5.Research Dive Exclusive Insights

6.5.1.Market attractiveness

6.5.2.Competition heatmap

7.Voice Communication Equipment Market Analysis, by Enterprise Size

7.1.Large Enterprises

7.1.1.Definition, key trends, growth factors, and opportunities

7.1.2.Market size analysis, by region, 2022-2032

7.1.3.Market share analysis, by country, 2022-2032

7.2.Small & Medium Enterprises

7.2.1.Definition, key trends, growth factors, and opportunities

7.2.2.Market size analysis, by region, 2022-2032

7.2.3.Market share analysis, by country, 2022-2032

7.3.Research Dive Exclusive Insights

7.3.1.Market attractiveness

7.3.2.Competition heatmap

8.Voice Communication Equipment Market Analysis, by Industry Verticals

8.1.BFSI

8.1.1.Definition, key trends, growth factors, and opportunities

8.1.2.Market size analysis, by region, 2022-2032

8.1.3.Market share analysis, by country, 2022-2032

8.2.Healthcare

8.2.1.Definition, key trends, growth factors, and opportunities

8.2.2.Market size analysis, by region, 2022-2032

8.2.3.Market share analysis, by country, 2022-2032

8.3.Hospitality

8.3.1.Definition, key trends, growth factors, and opportunities

8.3.2.Market size analysis, by region, 2022-2032

8.3.3.Market share analysis, by country, 2022-2032

8.4.Retail

8.4.1.Definition, key trends, growth factors, and opportunities

8.4.2.Market size analysis, by region, 2022-2032

8.4.3.Market share analysis, by country, 2022-2032

8.5.Transportation & Logistics

8.5.1.Definition, key trends, growth factors, and opportunities

8.5.2.Market size analysis, by region, 2022-2032

8.5.3.Market share analysis, by country, 2022-2032

8.6.IT & Telecom

8.6.1.Definition, key trends, growth factors, and opportunities

8.6.2.Market size analysis, by region, 2022-2032

8.6.3.Market share analysis, by country, 2022-2032

8.7.Others

8.7.1.Definition, key trends, growth factors, and opportunities

8.7.2.Market size analysis, by region, 2022-2032

8.7.3.Market share analysis, by country, 2022-2032

8.8.Research Dive Exclusive Insights

8.8.1.Market attractiveness

8.8.2.Competition heatmap

9.Voice Communication Equipment Market Analysis, by Component

9.1.Solution

9.1.1.Definition, key trends, growth factors, and opportunities

9.1.2.Market size analysis, by region, 2022-2032

9.1.3.Market share analysis, by country, 2022-2032

9.2.Services

9.2.1.Definition, key trends, growth factors, and opportunities

9.2.2.Market size analysis, by region, 2022-2032

9.2.3.Market share analysis, by country, 2022-2032

9.3.Research Dive Exclusive Insights

9.3.1.Market attractiveness

9.3.2.Competition heatmap

10.Voice Communication Equipment Market, by Region

10.1.North America

10.1.1.U.S.

10.1.1.1.Market size analysis, by Type, 2022-2032

10.1.1.2.Market size analysis, by Network Equipment, 2022-2032

10.1.1.3.Market size analysis, by Enterprise Size, 2022-2032

10.1.1.4.Market size analysis, by Industry Verticals, 2022-2032

10.1.2.Market size analysis, by Component, 2022-2032

10.1.3.Canada

10.1.3.1.Market size analysis, by Type, 2022-2032

10.1.3.2.Market size analysis, by Network Equipment, 2022-2032

10.1.3.3.Market size analysis, by Enterprise Size, 2022-2032

10.1.3.4.Market size analysis, by Industry Verticals, 2022-2032

10.1.3.5.Market size analysis, by Component, 2022-2032

10.1.4.Mexico

10.1.4.1.Market size analysis, by Type, 2022-2032

10.1.4.2.Market size analysis, by Network Equipment, 2022-2032

10.1.4.3.Market size analysis, by Enterprise Size, 2022-2032

10.1.4.4.Market size analysis, by Industry Verticals, 2022-2032

10.1.4.5.Market size analysis, by Component, 2022-2032

10.1.5.Research Dive Exclusive Insights

10.1.5.1.Market attractiveness

10.1.5.2.Competition heatmap

10.2.Europe

10.2.1.Germany

10.2.1.1.Market size analysis, by Type, 2022-2032

10.2.1.2.Market size analysis, by Network Equipment, 2022-2032

10.2.1.3.Market size analysis, by Enterprise Size, 2022-2032

10.2.1.4.Market size analysis, by Industry Verticals, 2022-2032

10.2.1.5.Market size analysis, by Component, 2022-2032

10.2.2.UK

10.2.2.1.Market size analysis, by Type, 2022-2032

10.2.2.2.Market size analysis, by Network Equipment, 2022-2032

10.2.2.3.Market size analysis, by Enterprise Size, 2022-2032

10.2.2.4.Market size analysis, by Industry Verticals, 2022-2032

10.2.2.5.Market size analysis, by Component, 2022-2032

10.2.3.France

10.2.3.1.Market size analysis, by Type, 2022-2032

10.2.3.2.Market size analysis, by Network Equipment, 2022-2032

10.2.3.3.Market size analysis, by Enterprise Size, 2022-2032

10.2.3.4.Market size analysis, by Industry Verticals, 2022-2032

10.2.3.5.Market size analysis, by Component, 2022-2032

10.2.4.Spain

10.2.4.1.Market size analysis, by Type, 2022-2032

10.2.4.2.Market size analysis, by Network Equipment, 2022-2032

10.2.4.3.Market size analysis, by Enterprise Size, 2022-2032

10.2.4.4.Market size analysis, by Industry Verticals, 2022-2032

10.2.4.5.Market size analysis, by Component, 2022-2032

10.2.5.Italy

10.2.5.1.Market size analysis, by Type, 2022-2032

10.2.5.2.Market size analysis, by Network Equipment, 2022-2032

10.2.5.3.Market size analysis, by Enterprise Size, 2022-2032

10.2.5.4.Market size analysis, by Industry Verticals, 2022-2032

10.2.5.5.Market size analysis, by Component, 2022-2032

10.2.6.Rest of Europe

10.2.6.1.Market size analysis, by Type, 2022-2032

10.2.6.2.Market size analysis, by Network Equipment, 2022-2032

10.2.6.3.Market size analysis, by Enterprise Size, 2022-2032

10.2.6.4.Market size analysis, by Industry Verticals, 2022-2032

10.2.6.5.Market size analysis, by Component, 2022-2032

10.2.7.Research Dive Exclusive Insights

10.2.7.1.Market attractiveness

10.2.7.2.Competition heatmap

10.3.Asia-Pacific

10.3.1.China

10.3.1.1.Market size analysis, by Type, 2022-2032

10.3.1.2.Market size analysis, by Network Equipment, 2022-2032

10.3.1.3.Market size analysis, by Enterprise Size, 2022-2032

10.3.1.4.Market size analysis, by Industry Verticals, 2022-2032

10.3.1.5.Market size analysis, by Component, 2022-2032

10.3.2.Japan

10.3.2.1.Market size analysis, by Type, 2022-2032

10.3.2.2.Market size analysis, by Network Equipment, 2022-2032

10.3.2.3.Market size analysis, by Enterprise Size, 2022-2032

10.3.2.4.Market size analysis, by Industry Verticals, 2022-2032

10.3.2.5.Market size analysis, by Component, 2022-2032

10.3.3.India

10.3.3.1.Market size analysis, by Type, 2022-2032

10.3.3.2.Market size analysis, by Network Equipment, 2022-2032

10.3.3.3.Market size analysis, by Enterprise Size, 2022-2032

10.3.3.4.Market size analysis, by Industry Verticals, 2022-2032

10.3.3.5.Market size analysis, by Component, 2022-2032

10.3.4.Australia

10.3.4.1.Market size analysis, by Type, 2022-2032

10.3.4.2.Market size analysis, by Network Equipment, 2022-2032

10.3.4.3.Market size analysis, by Enterprise Size, 2022-2032

10.3.4.4.Market size analysis, by Industry Verticals, 2022-2032

10.3.4.5.Market size analysis, by Component, 2022-2032

10.3.5.South Korea

10.3.5.1.Market size analysis, by Type, 2022-2032

10.3.5.2.Market size analysis, by Network Equipment, 2022-2032

10.3.5.3.Market size analysis, by Enterprise Size, 2022-2032

10.3.5.4.Market size analysis, by Industry Verticals, 2022-2032

10.3.5.5.Market size analysis, by Component, 2022-2032

10.3.6.Rest of Asia-Pacific

10.3.6.1.Market size analysis, by Type, 2022-2032

10.3.6.2.Market size analysis, by Network Equipment, 2022-2032

10.3.6.3.Market size analysis, by Enterprise Size, 2022-2032

10.3.6.4.Market size analysis, by Industry Verticals, 2022-2032

10.3.6.5.Market size analysis, by Component, 2022-2032

10.3.7.Research Dive Exclusive Insights

10.3.7.1.Market attractiveness

10.3.7.2.Competition heatmap

10.4.LAMEA

10.4.1.Brazil

10.4.1.1.Market size analysis, by Type, 2022-2032

10.4.1.2.Market size analysis, by Network Equipment, 2022-2032

10.4.1.3.Market size analysis, by Enterprise Size, 2022-2032

10.4.1.4.Market size analysis, by Industry Verticals, 2022-2032

10.4.1.5.Market size analysis, by Component, 2022-2032

10.4.2.Saudi Arabia

10.4.2.1.Market size analysis, by Type, 2022-2032

10.4.2.2.Market size analysis, by Network Equipment, 2022-2032

10.4.2.3.Market size analysis, by Enterprise Size, 2022-2032

10.4.2.4.Market size analysis, by Industry Verticals, 2022-2032

10.4.2.5.Market size analysis, by Component, 2022-2032

10.4.3.UAE

10.4.3.1.Market size analysis, by Type, 2022-2032

10.4.3.2.Market size analysis, by Network Equipment, 2022-2032

10.4.3.3.Market size analysis, by Enterprise Size, 2022-2032

10.4.3.4.Market size analysis, by Industry Verticals, 2022-2032

10.4.3.5.Market size analysis, by Component, 2022-2032

10.4.4.South Africa

10.4.4.1.Market size analysis, by Type, 2022-2032

10.4.4.2.Market size analysis, by Network Equipment, 2022-2032

10.4.4.3.Market size analysis, by Enterprise Size, 2022-2032

10.4.4.4.Market size analysis, by Industry Verticals, 2022-2032

10.4.4.5.Market size analysis, by Component, 2022-2032

10.4.5.Rest of LAMEA

10.4.5.1.Market size analysis, by Type, 2022-2032

10.4.5.2.Market size analysis, by Network Equipment, 2022-2032

10.4.5.3.Market size analysis, by Enterprise Size, 2022-2032

10.4.5.4.Market size analysis, by Industry Verticals, 2022-2032

10.4.5.5.Market size analysis, by Component, 2022-2032

10.4.6.Research Dive Exclusive Insights

10.4.6.1.Market attractiveness

10.4.6.2.Competition heatmap

11.Competitive Landscape

11.1.Top winning strategies, 2022

11.1.1.By strategy

11.1.2.By year

11.2.Strategic overview

11.3.Market share analysis, 2022

12.Company Profiles

12.1.ADTRAN, Inc.

12.1.1.Overview

12.1.2.Business segments

12.1.3.Product portfolio

12.1.4.Financial performance

12.1.5.Recent developments

12.1.6.SWOT analysis

12.2.MDS Gateways,

12.2.1.Overview

12.2.2.Business segments

12.2.3.Product portfolio

12.2.4.Financial performance

12.2.5.Recent developments

12.2.6.SWOT analysis

12.3.Samsung Electronics Co Ltd

12.3.1.Overview

12.3.2.Business segments

12.3.3.Product portfolio

12.3.4.Financial performance

12.3.5.Recent developments

12.3.6.SWOT analysis

12.4.Speedflow Communications

12.4.1.Overview

12.4.2.Business segments

12.4.3.Product portfolio

12.4.4.Financial performance

12.4.5.Recent developments

12.4.6.SWOT analysis

12.5.Apple, Inc.

12.5.1.Overview

12.5.2.Business segments

12.5.3.Product portfolio

12.5.4.Financial performance

12.5.5.Recent developments

12.5.6.SWOT analysis

12.6.Microsoft Corporation

12.6.1.Overview

12.6.2.Business segments

12.6.3.Product portfolio

12.6.4.Financial performance

12.6.5.Recent developments

12.6.6.SWOT analysis

12.7.8x8, Inc.

12.7.1.Overview

12.7.2.Business segments

12.7.3.Product portfolio

12.7.4.Financial performance

12.7.5.Recent developments

12.7.6.SWOT analysis

12.8.Siemens Enterprise Communication

12.8.1.Overview

12.8.2.Business segments

12.8.3.Product portfolio

12.8.4.Financial performance

12.8.5.Recent developments

12.8.6.SWOT analysis

12.9.PanTerra Networks

12.9.1.Overview

12.9.2.Business segments

12.9.3.Product portfolio

12.9.4.Financial performance

12.9.5.Recent developments

12.9.6.SWOT analysis

12.10.IBM Corporation

12.10.1.Overview

12.10.2.Business segments

12.10.3.Product portfolio

12.10.4.Financial performance

12.10.5.Recent developments

12.10.6.SWOT analysis

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com