Global Green Mining Market Report

RA08756

Global Green Mining Market by Mining Type (Surface Mining, Underground Mining, Placer Mining, and In-situ Mining), Mineral or Metal Extracted (Mineral Fuels, Iron & Ferro-alloys, Non-ferrous Metals, Precious Metals, and Industrial Minerals), Technology (Mine Filling, Water Preservation, Simultaneous Extraction of Coal & Gas, Oxidizing Utilization of Ventilation Air Methane (VAM), Gangue Discharge Reduction, Mining From Tailings, Dust Suppression Techniques, Liquid Membrane Emulsion Technology, and Others), and Region (North America, Europe, Asia-Pacific, and LAMEA): Opportunity Analysis and Industry Forecast, 2023-2032

Green Mining Overview

Green mining refers to the practice of extracting minerals, metals, or other valuable resources from the Earth while minimizing the environmental impact and promoting sustainability. It involves implementing technologies, processes, and practices that aim to reduce carbon emissions, water consumption, and waste generation associated with mining activities. Moreover, the concept of green mining emerged as a response to the environmental challenges and concerns associated with traditional mining methods. Traditional mining practices often involve significant land disturbance, water pollution, deforestation, and the release of greenhouse gases, leading to ecological degradation and harm to surrounding communities.

Green mining focuses on utilizing environmentally friendly approaches throughout the entire mining lifecycle, from exploration and extraction to processing and reclamation. It is done by implementing energy-efficient processes and equipment to reduce the carbon footprint of mining operations. This may involve using renewable energy sources, optimizing energy consumption, and adopting advanced technologies. Water usage is minimized through recycling, treating, and reusing water within mining operations. In addition, strategies like rainwater harvesting and implementing responsible water discharge practices help reduce the impact on local water systems. Methods are utilized to reduce waste generation and promote recycling and proper disposal of mining by-products. This includes initiatives such as tailings reprocessing, converting waste materials into useful products, and implementing responsible waste management practices.

Global Green Mining Market Analysis

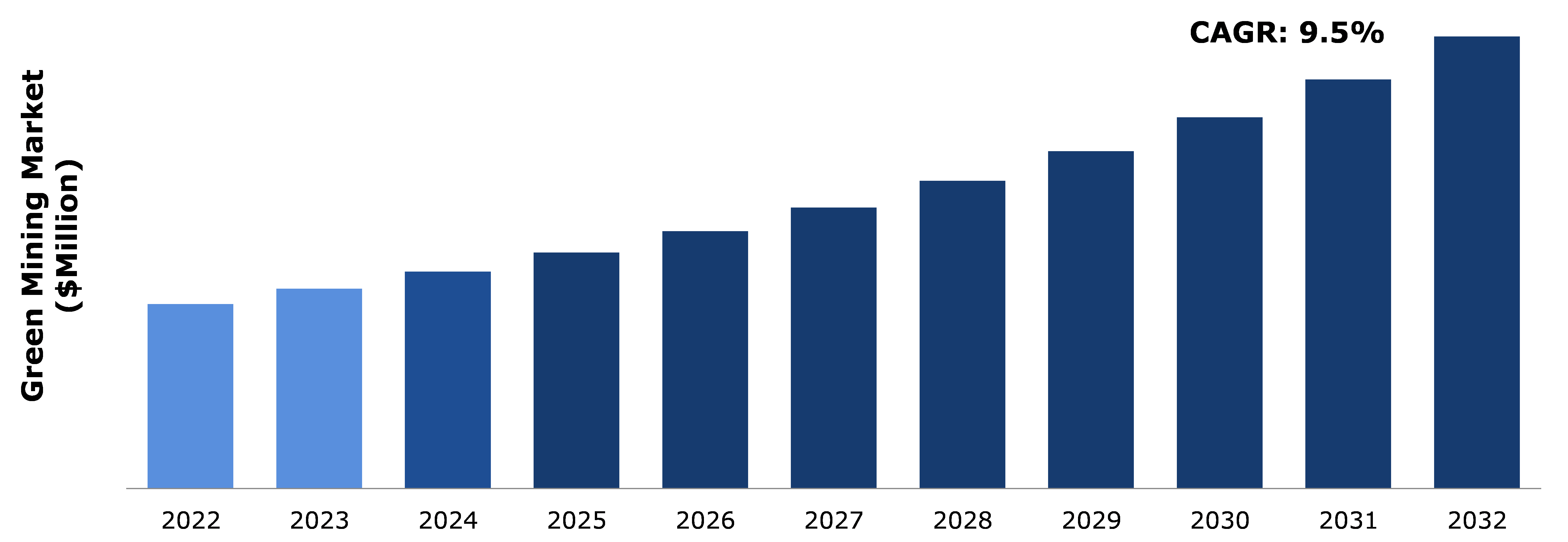

The global green mining market size was $11,399.4 million in 2022 and is predicted to grow with a CAGR of 9.5%, by generating a revenue of $27,911.3 million by 2032.

Source: Research Dive Analysis

COVID-19 Impact on Global Green Mining Market

The COVID-19 pandemic had both positive and negative impacts on various industries, including the green mining industry. The pandemic caused disruptions in global supply chains, affecting the availability of raw materials, equipment, and components necessary for green mining operations. This slowed down the development and expansion of green mining projects. Moreover, the pandemic led to an increase in awareness about the importance of sustainability and environmental conservation. Therefore, there is an increase in focus on green initiatives, including green mining practices. Governments and companies may prioritize environmentally friendly mining methods and invest in sustainable technologies. Furthermore, the pandemic resulted in an economic slowdown in many countries, impacting the mining industry as a whole. Reduced demand for minerals and metals, fluctuating commodity prices, and financial constraints affected investments in green mining projects. Companies have prioritized cost-cutting measures and delayed sustainability initiatives due to financial uncertainties.

Many governments implemented stimulus packages to revive their economies during the pandemic. These packages often included provisions for infrastructure development and renewable energy projects, which could indirectly benefit the green mining market. Increased investments in renewable energy and electric vehicle infrastructure is expected to drive the demand for minerals and metals used in these sectors, potentially benefiting green mining initiatives.

Rising Focus on Eco-Friendly & Sustainable Practices and Implementation of Environmental Regulations to Drive the Market Growth

Increasing awareness of the environmental impact of mining activities has led to a rising demand for greener and more sustainable mining practices. Concerns about deforestation, habitat destruction, water pollution, and carbon emissions have encouraged the mining industry to adopt eco-friendly solutions. Moreover, green mining practices can lead to cost savings and operational efficiency. For example, energy-efficient technologies, such as renewable energy sources and energy management systems, can reduce energy consumption and lower operational costs. Similarly, recycling and waste management initiatives can optimize resource utilization and minimize waste disposal costs. Consumers and businesses are increasingly seeking products that are produced with minimal environmental impact. Mining companies that adopt green practices and can demonstrate their commitment to sustainability are likely to attract environmentally conscious customers and investors.

Furthermore, many mining companies recognize the importance of corporate social responsibility and the need to address environmental concerns. By adopting green mining practices, companies can enhance their public image, attract and retain talent, and maintain good relationships with local communities and stakeholders. Moreover, governments and regulatory bodies worldwide have implemented stricter environmental regulations for the mining industry. These regulations aim to mitigate the negative impacts of mining operations on the environment, including air and water pollution, land degradation, and greenhouse gas emissions. Compliance with these regulations often requires the adoption of green mining practices. These factors are shaping the mining industry's transition towards eco-friendly, sustainable practices to address environmental concerns and promote a more responsible approach to mining operations.

To know more about global green mining market drivers, get in touch with our analysts here.

High Initial Costs to Restrain the Market Growth

The high initial costs associated with implementing green mining technologies and practices can be a significant restraint for the market growth. Transitioning to greener mining practices often involves replacing or retrofitting existing equipment with more energy-efficient and environmentally friendly alternatives. This can include upgrading vehicles, machinery, and processing plants to reduce emissions, minimize waste generation, and improve energy efficiency. The cost of purchasing and installing such equipment can be substantial, posing a barrier for companies with limited financial resources. Moreover, green mining practices often rely on advanced technologies such as automation, remote sensing, data analytics, and real-time monitoring systems. These technologies enable companies to optimize resource utilization, minimize environmental impact, and improve safety. However, implementing these technologies may require substantial investment in R&D, procurement, and training of personnel, which can be challenging for smaller mining companies operating on tight budgets.

Furthermore, implementing comprehensive environmental management systems is a crucial aspect of green mining. This includes conducting environmental impact assessments, monitoring air & water quality, managing waste & tailings, and implementing land rehabilitation strategies. Developing and maintaining these systems requires dedicated personnel, specialized expertise, and investment in monitoring equipment and infrastructure, all of which can contribute to the high initial costs, which is anticipated to hamper the green mining market growth.

Renewable Energy Integration to Drive Excellent Opportunities

Green mining operations can integrate renewable energy sources, such as solar, wind, and hydro power, to reduce dependence on fossil fuels. By using clean energy sources, mining companies can significantly reduce their operational costs. By utilizing renewable energy sources like solar, wind, and hydro power, mining companies can significantly reduce their greenhouse gas emissions and overall carbon footprint. This transition to cleaner energy aligns with global efforts to mitigate climate change and can enhance the sustainability credentials of mining operations. Moreover, by incorporating renewable energy into their operations, mining companies can enhance their energy security and independence. Unlike fossil fuels, renewable energy sources are infinite and locally available in many regions. This reduces the dependence on external energy sources, enhances supply stability, and mitigates risks associated with fuel price volatility.

Adopting renewable energy integration demonstrates a commitment to sustainability and responsible environmental practices. Mining companies that prioritize green mining operations can gain a competitive advantage by attracting environmentally conscious stakeholders, investors, and customers who increasingly value sustainability in their decision-making processes. The integration of renewable energy in mining operations requires the development and deployment of new technologies and innovative solutions. This urge for technological advancement can lead to R&D opportunities, fostering collaboration between the mining and renewable energy sectors. It can also drive job creation and economic growth in related industries. The green mining market is poised for growth as mining companies recognize the long-term benefits of sustainable practices and renewable energy integration.

To know more about global green mining market opportunities, get in touch with our analysts here.

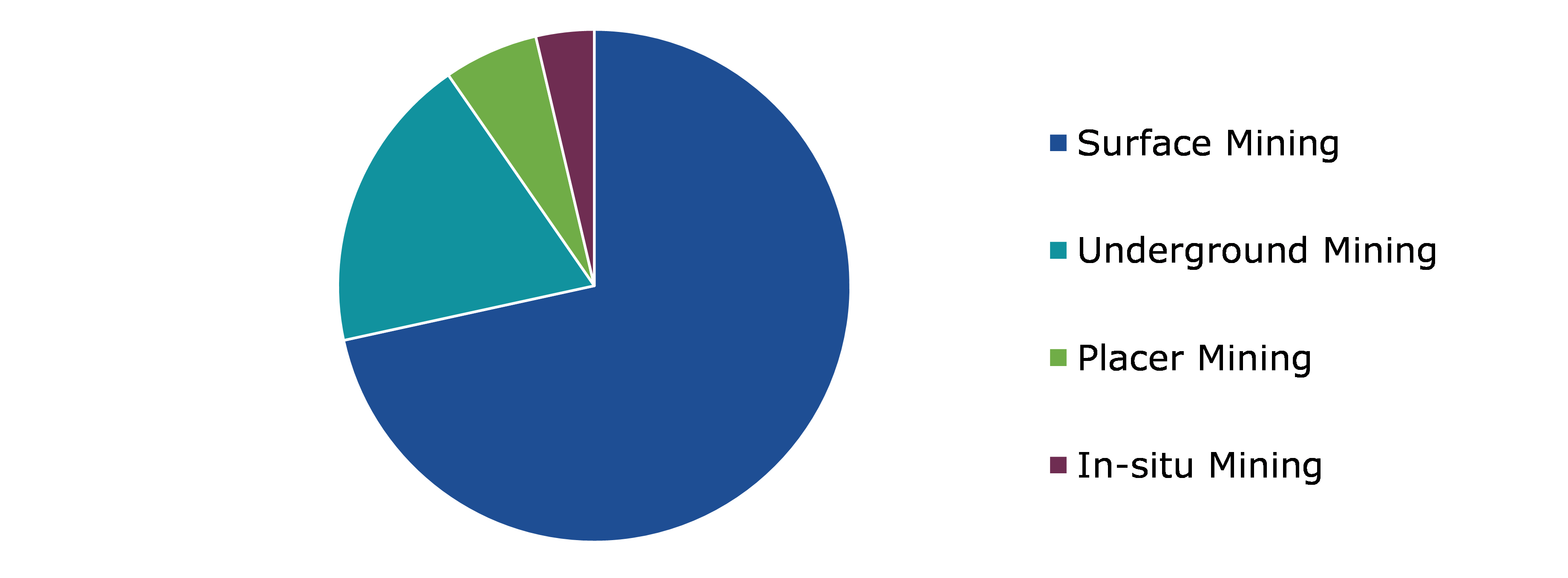

Global Green Mining Market Share, by Mining Type, 2022

Source: Research Dive Analysis

The surface mining sub-segment accounted for the highest market share in 2022. Increasing environmental concerns and stringent regulations regarding carbon emissions and ecological impact have compelled mining companies to adopt greener practices. Furthermore, surface mining often requires less water compared to underground mining operations. As water scarcity becomes a global concern, minimizing water usage in mining processes has gained significant importance. Surface mining methods, such as dry mining or using advanced water recycling systems, can contribute to reduced water consumption and better water management practices. In addition, surface mining offers opportunities for effective land rehabilitation and reclamation. After the extraction of minerals, the land can be restored, reshaped, and revegetated to support ecological diversity and create sustainable post-mining land use. This focus on reclamation aligns with the principles of green mining and contributes to the overall sustainability of the mining operation. The surface mining industry has seen significant technological advancements in recent years. Automation, advanced monitoring systems, and data analytics enable more precise and efficient extraction processes, leading to reduced waste and environmental impact. These technological innovations facilitate greener mining practices within the surface mining segment.

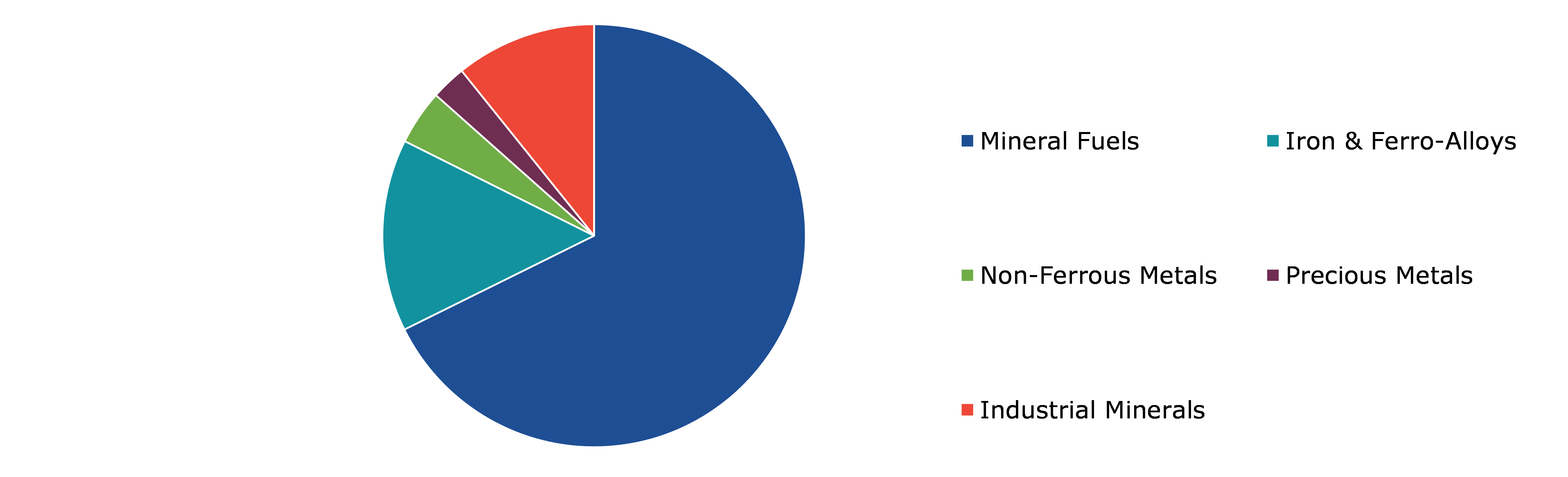

Global Green Mining Market Size, by Mineral or Metal Extracted, 2022

Source: Research Dive Analysis

The mineral fuels sub-segment accounted for the highest market share in 2022. The mineral fuels segment in the green mining market also focuses on adopting sustainable mining practices. This includes reducing water and energy consumption, minimizing waste generation, and improving the efficiency of resource extraction. By implementing environmentally friendly practices mining companies can reduce their overall environmental impact and contribute to the green mining movement. Increasingly stringent environmental regulations imposed by governments worldwide drive the need for cleaner and more sustainable mining practices. These regulations aim to reduce carbon emissions, promote energy efficiency, and minimize the environmental impact of mining activities. Moreover, the rising global demand for renewable energy sources is a significant driver for the mineral fuels segment growth.

As the world shifts towards a low-carbon economy, there is an increasing need for minerals such as lithium, cobalt, and rare earth metals that are used in the production of batteries for electric vehicles (EVs) and energy storage systems. This demand boosts the extraction and production of mineral fuels required for clean energy technologies. Furthermore, advancements in technology have played a vital role in driving the adoption of green mining practices within the mineral fuels segment. Innovative technologies and processes, such as advanced exploration techniques, remote sensing, and automation, enable more efficient and sustainable extraction of mineral fuels. In addition, advancements in carbon capture and storage (CCS) technologies help reduce greenhouse gas emissions associated with the use of fossil fuels.

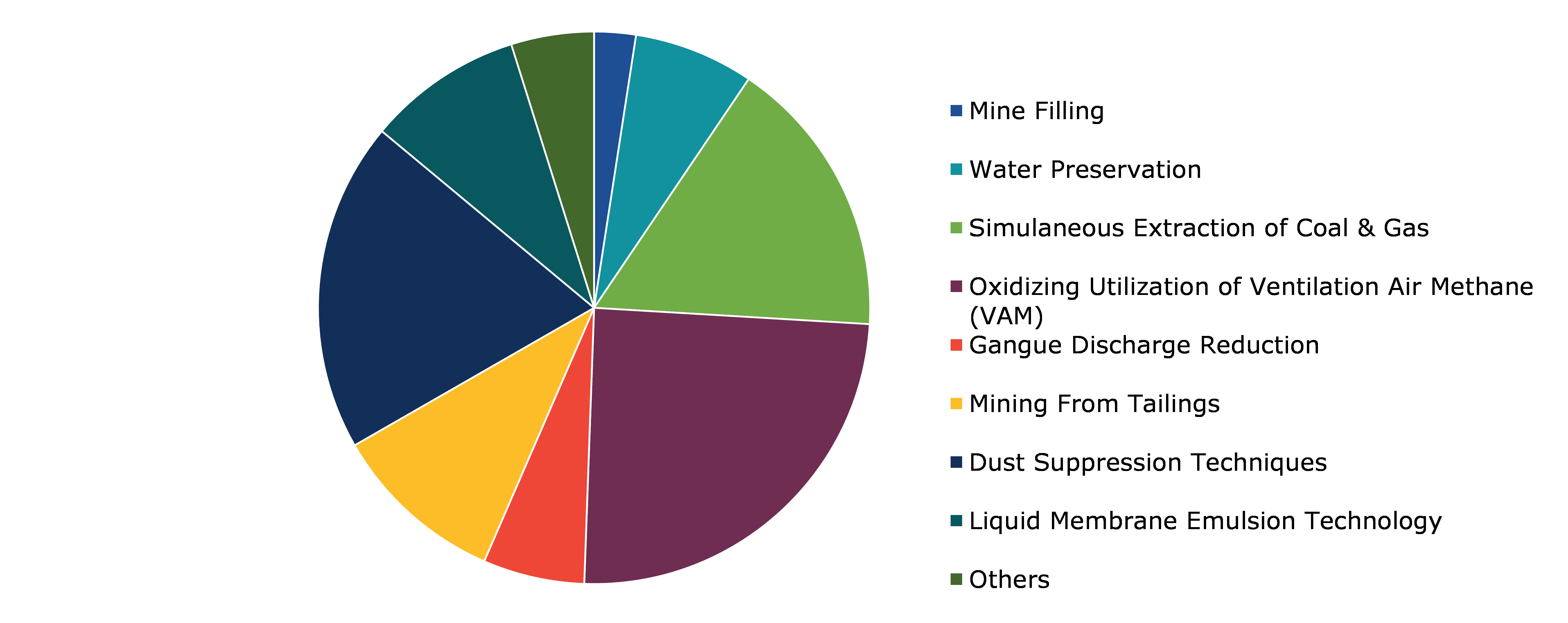

Global Green Mining Market Growth, by Technology, 2022

Source: Research Dive Analysis

The oxidizing utilization of ventilation air methane (VAM) sub-segment accounted for the highest market share in 2022. Increasingly stringent environmental regulations aimed at reducing greenhouse gas emissions and mitigating climate change have driven the mining industry to adopt greener practices. VAM which is a potent greenhouse gas released during underground coal mining, can be effectively mitigated through oxidizing utilization, thereby reducing its environmental impact. Moreover, the implementation of carbon pricing mechanisms and carbon trading schemes has created economic incentives for mining companies to reduce their carbon footprint. By capturing and utilizing VAM, mining operations can generate carbon credits or offset their emissions, providing a financial incentive for adopting oxidizing utilization technologies.

VAM, if left unutilized, represents a lost opportunity for energy generation. By capturing and utilizing VAM, mining companies can generate additional revenue through the production of electricity or heat, reducing their reliance on external energy sources and potentially lowering operational costs. Moreover, adopting oxidizing utilization of VAM can enhance energy security for mining operations. By utilizing VAM as an energy source, mines can reduce their dependence on external energy providers and ensure a stable and reliable energy supply, especially in remote locations. Mining companies are increasingly aware of the importance of corporate social responsibility (CSR) and sustainable practices. Adopting oxidizing utilization of VAM aligns with CSR goals by demonstrating a commitment to reducing greenhouse gas emissions, protecting the environment, and addressing climate change concerns.

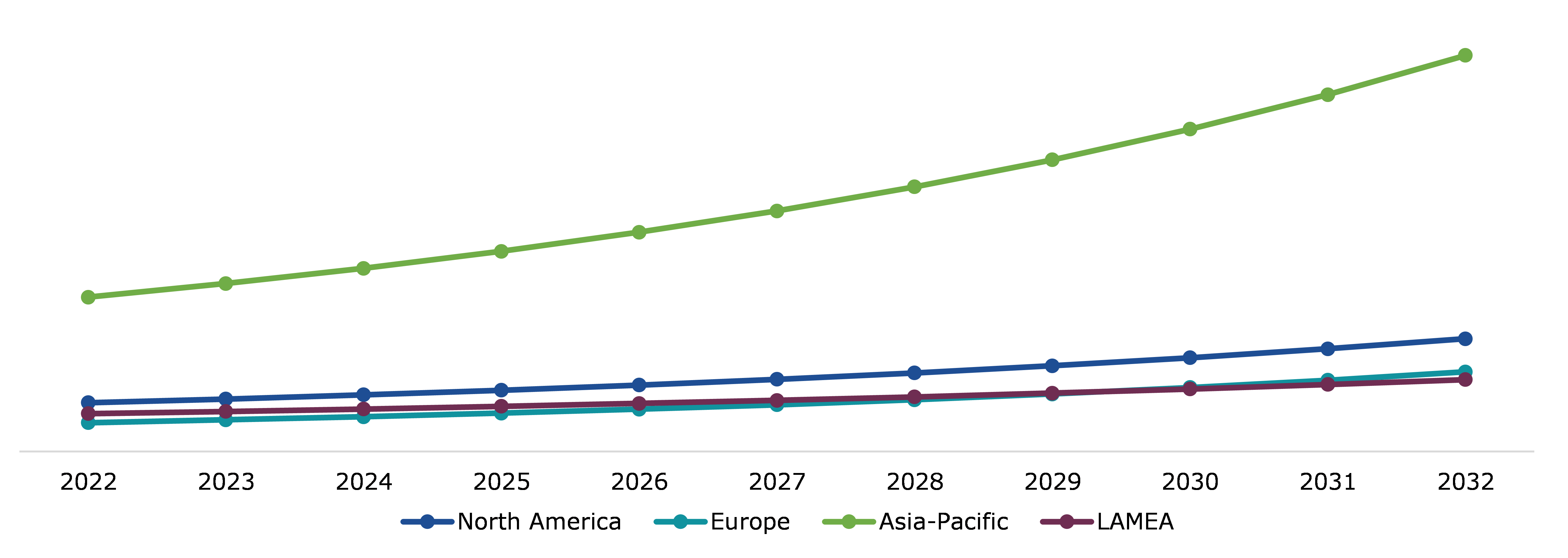

Global Green Mining Market Size & Forecast, by Region, 2022-2032 ($Million)

Source: Research Dive Analysis

The Asia-Pacific green mining market generated the highest revenue in 2022. Asia-Pacific has a rapidly growing economy and a rising population, leading to an increase in demand for minerals and metals. Green mining practices enable the extraction of these resources while minimizing environmental damage, making it an attractive option for meeting the region's resource needs sustainably. There is a rising awareness among stakeholders, including mining companies, investors, and consumers, about the importance of environmental sustainability.

Green mining practices help reduce carbon emissions, conserve water resources, and minimize ecological disruption, making them an appealing choice for companies looking to improve their environmental credentials. Asia-Pacific has been witnessing advancements in green mining technologies. These technologies include the use of automation, advanced analytics, and remote sensing to optimize mining processes and reduce environmental impact. The region has abundant renewable energy resources, such as solar, wind, and hydroelectric power. Mining companies are increasingly leveraging these renewable energy sources to power their operations, reducing their reliance on fossil fuels, and lowering their carbon footprint.

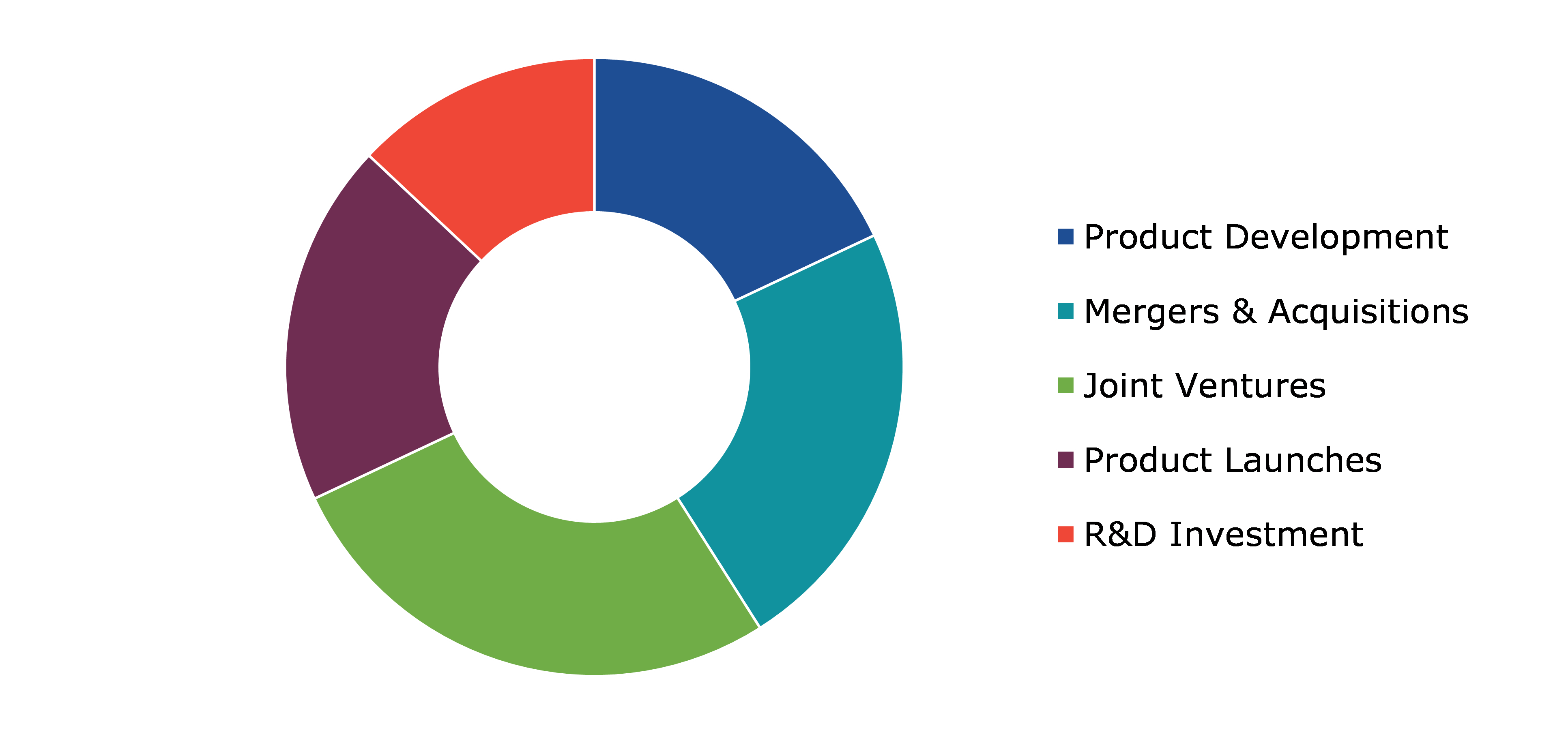

Competitive Scenario in the Global Green Mining Market

Investment and agreement are common strategies followed by major market players. For instance, on November 27, 2020, Tata Steel launched a new product, GalvaRoS-GP. Regular Spangle Product was designed to meet the needs of customers for galvanized steel sheets and coils that are eco-friendly, have superior corrosion resistance, are available in custom sizes, and provide a better return on investment. GalvaRoS is 100% RoHS compliant and offers product authenticity. This customized product gives the customers a better offer and ROI while strictly adhering to the BIS standards.

Source: Research Dive Analysis

Some of the leading green mining market players are BHP, Rio Tinto, Anglo American PLC, Glencore PLC, Liebherr, Tata Steel Mining Limited, Jiangxi Copper Corporation Limited, Exxaro, Dundee Precious Metals Inc., and Komatsu Ltd.

| Aspect | Particulars |

| Historical Market Estimations | 2021 |

| Base Year for Market Estimation | 2022 |

| Forecast Timeline for Market Projection | 2023-2032 |

| Geographical Scope | North America, Europe, Asia-Pacific, and LAMEA |

| Segmentation by Mining Type |

|

| Segmentation by Mineral or Metal Extracted |

|

|

Segmentation by Technology

|

|

| Key Companies Profiled |

|

Q1. What is the size of the global green mining market?

A. The size of the global green mining market was over $11,399.4 million in 2022 and is projected to reach $27,911.3 million by 2032.

Q2. Which are the major companies in the green mining market?

A. BHP, Rio Tinto, and Anglo American PLC are some of the key players in the global green mining market.

Q3. Which region, among others, possesses greater investment opportunities in the future?

A. Europe possesses great investment opportunities for investors in the future.

Q4. What will be the growth rate of the Europe green mining market?

A. The Europe green mining market is anticipated to grow at 10.8% CAGR during the forecast period.

Q5. What are the strategies opted by the leading players in this market?

A. Agreement and investment are the two key strategies opted by the operating companies in this market.

Q6. Which companies are investing more on R&D practices?

A. Glencore PLC, Liebherr, and Tata Steel Mining Limited are the companies investing more on R&D activities for developing new products and technologies.

1.Research Methodology

1.1.Desk Research

1.2.Real time insights and validation

1.3.Forecast model

1.4.Assumptions and forecast parameters

1.5.Market size estimation

1.5.1.Top-down approach

1.5.2.Bottom-up approach

2.Report Scope

2.1.Market definition

2.2.Key objectives of the study

2.3.Report overview

2.4.Market segmentation

2.5.Overview of the impact of COVID-19 on Global green mining market

3.Executive Summary

4.Market Overview

4.1.Introduction

4.2.Growth impact forces

4.2.1.Drivers

4.2.2.Restraints

4.2.3.Opportunities

4.3.Market value chain analysis

4.3.1.List of raw material suppliers

4.3.2.List of manufacturers

4.3.3.List of distributors

4.4.Innovation & sustainability matrices

4.4.1.Technology matrix

4.4.2.Regulatory matrix

4.5.Porter’s five forces analysis

4.5.1.Bargaining power of suppliers

4.5.2.Bargaining power of consumers

4.5.3.Threat of substitutes

4.5.4.Threat of new entrants

4.5.5.Competitive Rivalry Intensity

4.6.PESTLE analysis

4.6.1.Political

4.6.2.Economical

4.6.3.Social

4.6.4.Technological

4.6.5.Environmental

4.7.Impact of COVID-19 on green mining market

4.7.1.Pre-covid market scenario

4.7.2.Post-covid market scenario

5.Green Mining Market Analysis, by Mining Type

5.1.Overview

5.2.Surface Mining

5.2.1.Definition, key trends, growth factors, and opportunities

5.2.2.Market size analysis, by region, 2022-2032

5.2.3.Market share analysis, by country, 2022-2032

5.3.Underground Mining

5.3.1.Definition, key trends, growth factors, and opportunities

5.3.2.Market size analysis, by region, 2022-2032

5.3.3.Market share analysis, by country, 2022-2032

5.4.Placer Mining

5.4.1.Definition, key trends, growth factors, and opportunities

5.4.2.Market size analysis, by region, 2022-2032

5.4.3.Market share analysis, by country, 2022-2032

5.5.In-situ Mining

5.5.1.Definition, key trends, growth factors, and opportunities

5.5.2.Market size analysis, by region, 2022-2032

5.5.3.Market share analysis, by country, 2022-2032

5.6.Research Dive Exclusive Insights

5.6.1.Market attractiveness

5.6.2.Competition heatmap

6.Green Mining Market Analysis, by Mineral or Metal Extracted

6.1.Mineral Fuels

6.1.1.Definition, key trends, growth factors, and opportunities

6.1.2.Market size analysis, by region, 2022-2032

6.1.3.Market share analysis, by country, 2022-2032

6.2.Iron & Ferro-Alloys

6.2.1.Definition, key trends, growth factors, and opportunities

6.2.2.Market size analysis, by region, 2022-2032

6.2.3.Market share analysis, by country, 2022-2032

6.3.Non-Ferrous Metals

6.3.1.Definition, key trends, growth factors, and opportunities

6.3.2.Market size analysis, by region, 2022-2032

6.3.3.Market share analysis, by country, 2022-2032

6.4.Precious Metals

6.4.1.Definition, key trends, growth factors, and opportunities

6.4.2.Market size analysis, by region, 2022-2032

6.4.3.Market share analysis, by country, 2022-2032

6.5.Industrial Minerals

6.5.1.Definition, key trends, growth factors, and opportunities

6.5.2.Market size analysis, by region, 2022-2032

6.5.3.Market share analysis, by country, 2022-2032

6.6.Research Dive Exclusive Insights

6.6.1.Market attractiveness

6.6.2.Competition heatmap

7.Green Mining Market Analysis, by Technology

7.1.Mine Filling

7.1.1.Definition, key trends, growth factors, and opportunities

7.1.2.Market size analysis, by region, 2022-2032

7.1.3.Market share analysis, by country, 2022-2032

7.2.Water Preservation

7.2.1.Definition, key trends, growth factors, and opportunities

7.2.2.Market size analysis, by region, 2022-2032

7.2.3.Market share analysis, by country, 2022-2032

7.3.Simultaneous Extraction of Coal & Gas

7.3.1.Definition, key trends, growth factors, and opportunities

7.3.2.Market size analysis, by region, 2022-2032

7.3.3.Market share analysis, by country, 2022-2032

7.4.Oxidizing Utilization of Ventilation Air Methane (VAM)

7.4.1.Definition, key trends, growth factors, and opportunities

7.4.2.Market size analysis, by region, 2022-2032

7.4.3.Market share analysis, by country, 2022-2032

7.5.Gangue Discharge Reduction

7.5.1.Definition, key trends, growth factors, and opportunities

7.5.2.Market size analysis, by region, 2022-2032

7.5.3.Market share analysis, by country, 2022-2032

7.6.Mining From Tailings

7.6.1.Definition, key trends, growth factors, and opportunities

7.6.2.Market size analysis, by region, 2022-2032

7.6.3.Market share analysis, by country, 2022-2032

7.7.Dust Suppression Techniques

7.7.1.Definition, key trends, growth factors, and opportunities

7.7.2.Market size analysis, by region, 2022-2032

7.7.3.Market share analysis, by country, 2022-2032

7.8.Liquid Membrane Emulsion Technology

7.8.1.Definition, key trends, growth factors, and opportunities

7.8.2.Market size analysis, by region, 2022-2032

7.8.3.Market share analysis, by country, 2022-2032

7.9.Others

7.9.1.Definition, key trends, growth factors, and opportunities

7.9.2.Market size analysis, by region, 2022-2032

7.9.3.Market share analysis, by country, 2022-2032

7.10.Research Dive Exclusive Insights

7.10.1.Market attractiveness

7.10.2.Competition heatmap

8.Green Mining Market, by Region

8.1.North America

8.1.1.U.S.

8.1.1.1.Market size analysis, by Mining Type, 2022-2032

8.1.1.2.Market size analysis, by Mineral or Metal Extracted, 2022-2032

8.1.1.3.Market size analysis, by Technology, 2022-2032

8.1.2.Canada

8.1.2.1.Market size analysis, by Mining Type, 2022-2032

8.1.2.2.Market size analysis, by Mineral or Metal Extracted, 2022-2032

8.1.2.3.Market size analysis, by Technology, 2022-2032

8.1.3.Mexico

8.1.3.1.Market size analysis, by Mining Type, 2022-2032

8.1.3.2.Market size analysis, by Mineral or Metal Extracted, 2022-2032

8.1.3.3.Market size analysis, by Technology, 2022-2032

8.1.4.Research Dive Exclusive Insights

8.1.4.1.Market attractiveness

8.1.4.2.Competition heatmap

8.2.Europe

8.2.1.Germany

8.2.1.1.Market size analysis, by Mining Type, 2022-2032

8.2.1.2.Market size analysis, by Mineral or Metal Extracted, 2022-2032

8.2.1.3.Market size analysis, by Technology, 2022-2032

8.2.2.UK

8.2.2.1.Market size analysis, by Mining Type, 2022-2032

8.2.2.2.Market size analysis, by Mineral or Metal Extracted, 2022-2032

8.2.2.3.Market size analysis, by Technology, 2022-2032

8.2.3.France

8.2.3.1.Market size analysis, by Mining Type, 2022-2032

8.2.3.2.Market size analysis, by Mineral or Metal Extracted, 2022-2032

8.2.3.3.Market size analysis, by Technology, 2022-2032

8.2.4.Spain

8.2.4.1.Market size analysis, by Mining Type, 2022-2032

8.2.4.2.Market size analysis, by Mineral or Metal Extracted, 2022-2032

8.2.4.3.Market size analysis, by Technology, 2022-2032

8.2.5.Italy

8.2.5.1.Market size analysis, by Mining Type, 2022-2032

8.2.5.2.Market size analysis, by Mineral or Metal Extracted, 2022-2032

8.2.5.3.Market size analysis, by Technology, 2022-2032

8.2.6.Rest of Europe

8.2.6.1.Market size analysis, by Mining Type, 2022-2032

8.2.6.2.Market size analysis, by Mineral or Metal Extracted, 2022-2032

8.2.6.3.Market size analysis, by Technology, 2022-2032

8.2.7.Research Dive Exclusive Insights

8.2.7.1.Market attractiveness

8.2.7.2.Competition heatmap

8.3.Asia-Pacific

8.3.1.China

8.3.1.1.Market size analysis, by Mining Type, 2022-2032

8.3.1.2.Market size analysis, by Mineral or Metal Extracted, 2022-2032

8.3.1.3.Market size analysis, by Technology, 2022-2032

8.3.2.Japan

8.3.2.1.Market size analysis, by Mining Type, 2022-2032

8.3.2.2.Market size analysis, by Mineral or Metal Extracted, 2022-2032

8.3.2.3.Market size analysis, by Technology, 2022-2032

8.3.3.India

8.3.3.1.Market size analysis, by Mining Type, 2022-2032

8.3.3.2.Market size analysis, by Mineral or Metal Extracted, 2022-2032

8.3.3.3.Market size analysis, by Technology, 2022-2032

8.3.4.Australia

8.3.4.1.Market size analysis, by Mining Type, 2022-2032

8.3.4.2.Market size analysis, by Mineral or Metal Extracted, 2022-2032

8.3.4.3.Market size analysis, by Technology, 2022-2032

8.3.5.South Korea

8.3.5.1.Market size analysis, by Mining Type, 2022-2032

8.3.5.2.Market size analysis, by Mineral or Metal Extracted, 2022-2032

8.3.5.3.Market size analysis, by Technology, 2022-2032

8.3.6.Rest of Asia-Pacific

8.3.6.1.Market size analysis, by Mining Type, 2022-2032

8.3.6.2.Market size analysis, by Mineral or Metal Extracted, 2022-2032

8.3.6.3.Market size analysis, by Technology, 2022-2032

8.3.7.Research Dive Exclusive Insights

8.3.7.1.Market attractiveness

8.3.7.2.Competition heatmap

8.4.LAMEA

8.4.1.Brazil

8.4.1.1.Market size analysis, by Mining Type, 2022-2032

8.4.1.2.Market size analysis, by Mineral or Metal Extracted, 2022-2032

8.4.1.3.Market size analysis, by Technology, 2022-2032

8.4.2.Saudi Arabia

8.4.2.1.Market size analysis, by Mining Type, 2022-2032

8.4.2.2.Market size analysis, by Mineral or Metal Extracted, 2022-2032

8.4.2.3.Market size analysis, by Technology, 2022-2032

8.4.3.UAE

8.4.3.1.Market size analysis, by Mining Type, 2022-2032

8.4.3.2.Market size analysis, by Mineral or Metal Extracted, 2022-2032

8.4.3.3.Market size analysis, by Technology, 2022-2032

8.4.4.South Africa

8.4.4.1.Market size analysis, by Mining Type, 2022-2032

8.4.4.2.Market size analysis, by Mineral or Metal Extracted, 2022-2032

8.4.4.3.Market size analysis, by Technology, 2022-2032

8.4.5.Rest of LAMEA

8.4.5.1.Market size analysis, by Mining Type, 2022-2032

8.4.5.2.Market size analysis, by Mineral or Metal Extracted, 2022-2032

8.4.5.3.Market size analysis, by Technology, 2022-2032

8.4.6.Research Dive Exclusive Insights

8.4.6.1.Market attractiveness

8.4.6.2.Competition heatmap

9.Competitive Landscape

9.1.Top winning strategies, 2022

9.1.1.By strategy

9.1.2.By year

9.2.Strategic overview

9.3.Market share analysis, 2022

10.Company Profiles

10.1.BHP

10.1.1.Overview

10.1.2.Business segments

10.1.3.Product portfolio

10.1.4.Financial performance

10.1.5.Recent developments

10.1.6.SWOT analysis

10.2.Rio Tinto

10.2.1.Overview

10.2.2.Business segments

10.2.3.Product portfolio

10.2.4.Financial performance

10.2.5.Recent developments

10.2.6.SWOT analysis

10.3.Anglo American PLC

10.3.1.Overview

10.3.2.Business segments

10.3.3.Product portfolio

10.3.4.Financial performance

10.3.5.Recent developments

10.3.6.SWOT analysis

10.4.Glencore PLC

10.4.1.Overview

10.4.2.Business segments

10.4.3.Product portfolio

10.4.4.Financial performance

10.4.5.Recent developments

10.4.6.SWOT analysis

10.5.Liebherr

10.5.1.Overview

10.5.2.Business segments

10.5.3.Product portfolio

10.5.4.Financial performance

10.5.5.Recent developments

10.5.6.SWOT analysis

10.6.Tata Steel Mining Limited

10.6.1.Overview

10.6.2.Business segments

10.6.3.Product portfolio

10.6.4.Financial performance

10.6.5.Recent developments

10.6.6.SWOT analysis

10.7.Jiangxi Copper Corporation Limited

10.7.1.Overview

10.7.2.Business segments

10.7.3.Product portfolio

10.7.4.Financial performance

10.7.5.Recent developments

10.7.6.SWOT analysis

10.8.Exxaro

10.8.1.Overview

10.8.2.Business segments

10.8.3.Product portfolio

10.8.4.Financial performance

10.8.5.Recent developments

10.8.6.SWOT analysis

10.9.Dundee Precious Metals Inc.

10.9.1.Overview

10.9.2.Business segments

10.9.3.Product portfolio

10.9.4.Financial performance

10.9.5.Recent developments

10.9.6.SWOT analysis

10.10.Komatsu Ltd.

10.10.1.Overview

10.10.2.Business segments

10.10.3.Product portfolio

10.10.4.Financial performance

10.10.5.Recent developments

10.10.6.SWOT analysis

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com