Global Commercial Fan And Air Purification Equipment Market Report

RA08737

Global Commercial Fan and Air Purification Equipment Market by Equipment Type (Air Purification Equipment, Attic and Exhaust Fan, and Others), Power Range Type (Less Than 200 Square Ft, 200 - 400 Square Ft, and More Than 400 Square Ft), and Region (North America, Europe, Asia-Pacific, and LAMEA): Opportunity Analysis and Industry Forecast, 2023-2032

Commercial Fan and Air Purification Equipment Overview

The commercial fan and air purification equipment include industrial attic fans, warm air furnace filters, electrostatic precipitation equipment, air washers, and other dust collection equipment. Commercial fan and air purification equipment is a category of devices developed primarily for commercial and industrial settings to improve indoor air quality and offer adequate ventilation. Commercial fans promote airflow and circulation, assisting in the maintenance of an easy and well-ventilated environment. In contrast, air purification technology uses modern filtration and purification technologies to eliminate pollutants, allergens, odors, and airborne contaminants from the surrounding air, resulting in a cleaner, healthier, and more breathable interior environment. These devices are used in a variety of commercial contexts, including offices, retail spaces, healthcare facilities, and industrial buildings, to improve occupant well-being, increase productivity, and create a more pleasant and conducive workplace.

Global Commercial Fan and Air Purification Equipment Market Analysis

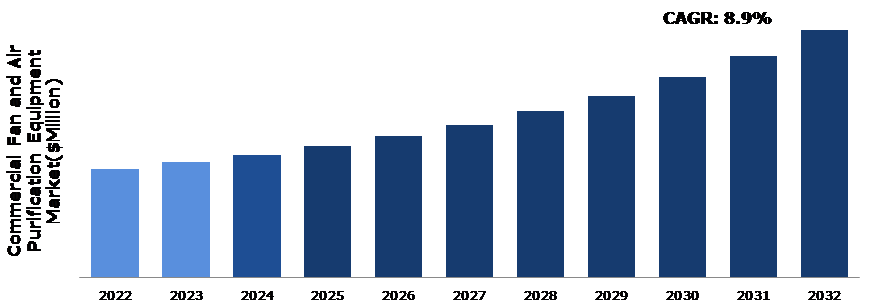

The global commercial fan and air purification equipment market size was $71,062.4 million in 2022 and is predicted to grow with a CAGR of 8.9%, by generating a revenue of $161,946.9 million by 2032.

Source: Research Dive Analysis

COVID-19 Impact on Global Commercial Fan and Air Purification Equipment Market

The global supply chains were severely disrupted during the pandemic, leading to challenges in sourcing raw materials, components, and finished products. Manufacturers faced difficulties in maintaining production levels, which resulted in delays in product availability. The pandemic created a rise in demand for certain types of commercial fan and air purification equipment, particularly those equipped with advanced filtration technologies. The sudden increase in demand placed additional load on supply chains that were already disrupted, leading to longer lead times and difficulties in meeting customer requirements.

The pandemic has dramatically increased public awareness of the importance of indoor air quality and the necessity for robust air filtration equipment. This greater awareness has raised the demand for commercial air filtration systems, resulting in significant commercial fan and air purification equipment market growth. The pandemic has accelerated the adoption of cutting-edge technologies in commercial fan and air purification equipment. HEPA filters, UV germicidal irradiation, and other advanced methods that can efficiently capture and remove airborne particles, including viruses, are gaining popularity in the post-pandemic period. Currently, manufacturers are investing in R&D to improve the efficiency and efficacy of their air filtration devices.

During the COVID-19 pandemic, there was a decrease in the number of people working in office spaces due to remote working model. Consequently, the demand for ventilation and air purification systems in commercial settings reduced. However, the pandemic led to an increase in awareness regarding maintaining a healthy and comfortable indoor environment. Therefore, there has been a rising emphasis on investing in air purification and ventilation systems to create safer and more inviting spaces. This increased focus on health and well-being is expected to drive commercial fan and air purification equipment market growth in the post-pandemic phase.

Increasing Demand for Healthier Indoor Environments to Drive the Market Growth

The growing focus on providing healthier interior environments is one of the main forces behind the increasing demand for commercial air filtration systems. There has been a major increase in understanding and awareness of the influence of indoor air quality on human health and well-being in recent years. In addition to health concerns, regulatory requirements and recommendations are encouraging the use of commercial fan and air purification equipment. Government organizations and business groups have developed guidelines and rules to assure sufficient indoor air quality in a variety of situations, including schools, healthcare institutions, and workplaces. Compliance with these requirements involves the installation of air filtration equipment, resulting in significant market demand. Furthermore, the need to provide cool and productive environments increases demand for commercial air filtration equipment. Poor air quality can cause allergies, respiratory difficulties, stress, and reduced cognitive performance. Many businesses and companies increase employee well-being and productivity by investing in air purification systems, which is expected to have a beneficial influence on overall market performance and success.

To know more about global commercial fan and air purification equipment market drivers, get in touch with our analysts here.

High Initial and Maintenance Costs to Restrain the Market Growth

Commercial fan and air purification equipment often come with higher costs compared to conventional alternatives. The advanced technologies, filtration systems, and features incorporated into these products contribute to their higher price tags. The high costs of commercial fan and air purification is due to a variety of factors, such as the original purchase price, installation fees, and continuing maintenance and operational costs. The requirement for larger systems to service commercial premises raises the total economic load. Furthermore, modern features such as HEPA filters, UV germicidal irradiation, and smart control systems add to the higher price range. The primary investment required for businesses to install these systems can be a significant barrier, particularly for small and medium-sized enterprises with limited budgets. Apart from the high costs, ongoing operational and maintenance expenses can be a restraint for businesses. Air purification equipment often requires regular filter replacements, servicing, and cleaning to ensure optimal performance and longevity. These recurring costs can be a burden, especially for businesses operating on tight budgets or lacking dedicated maintenance staff.

Integration of IoT Technologies to Drive Excellent Opportunities in the Market

The integration of Internet of Things (IoT )technologies in commercial fan and air purification equipment offers excellent opportunities by enhancing functionality and efficiency. Real-time monitoring, predictive maintenance, remote diagnostics, and advanced sensors optimize performance, improve energy efficiency, and provide a seamless user experience, driving the demand for these advanced solutions. Commercial fan and air purification equipment systems are remotely monitored and controlled using IoT. Some of the features of IoT-connected commercial fan and air purification equipment include real-time monitoring, predictive maintenance, remote diagnostics, system adaption, continuous comfort, enhanced efficiency, and a focus on user experience. Advancements in technology have led to the development of innovative features in commercial fan and air purification equipment. Smart controls, Internet of Things (IoT) integration, remote monitoring, and advanced sensors enhance the functionality, efficiency, and user experience of these products. Technological advancements attract businesses looking for cutting-edge solutions to optimize their indoor environments.

To know more about global commercial fan and air purification equipment market opportunities, get in touch with our analysts here.

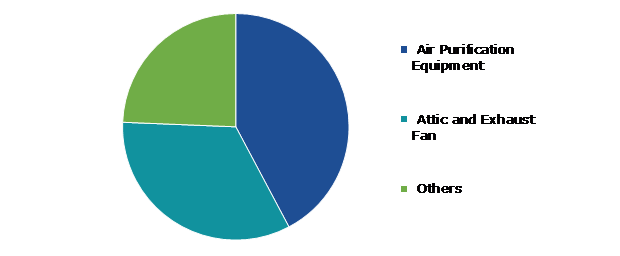

Global Commercial Fan and Air Purification Equipment Market Share, by Equipment Type, 2022

Source: Research Dive Analysis

The air purification equipment sub-segment accounted for the highest market share in 2022. The increased concern about indoor air quality and its influence on human health is one of the factors driving the increase in demand for air purification equipment. People and organizations are becoming increasingly aware of the need to create healthier indoor settings owing to the increase in pollution levels and growing awareness of the harmful effects of airborne pollutants. Air pollution has been linked to a variety of health concerns, including respiratory disorders, allergies, asthma, and even cardiovascular disease. As people spend much time indoors, particularly in homes and offices, ensuring clean and fresh air has become a key responsibility. This has increased the use of air purification equipment as a preventative strategy to reduce the harmful effects of pollutants. The rising number of health issues caused by air pollution is expected to drive demand for air purification equipment. Devices used for air purification to remove dangerous pollutants from the air are in greater demand due to an increase in air pollution-related illnesses and mortality.

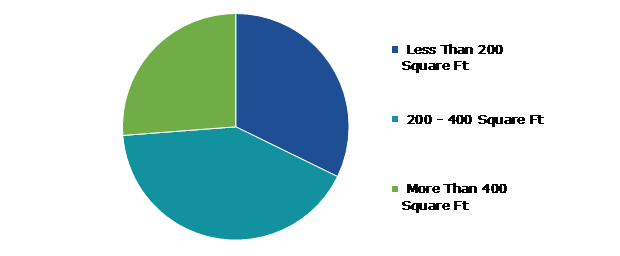

Global Commercial Fan and Air Purification Equipment Market Size, by Power Range Type, 2022

Source: Research Dive Analysis

The 200 - 400 Square Ft sub-segment accounted for the highest market share in 2022. The rising popularity of small, adaptable business spaces is one of the driving factors for the 200-400 square ft power range segment growth. Businesses and entrepreneurs are increasingly using smaller premises for a variety of uses, such as pop-up stores, boutiques, cafes, coworking spaces, and small offices. Proper air circulation is critical in company settings for ensuring a comfortable and productive atmosphere. Insufficient air can result in stagnant air, which can cause unpleasant odors, moisture buildup, and an increase in airborne contaminants. The air may be properly circulated using commercial fans, ensuring a consistent supply of fresh air and reducing the risk of discomfort or health issues for staff and consumers. All these factors drive the 200 - 400 square ft segment growth during the forecast period.

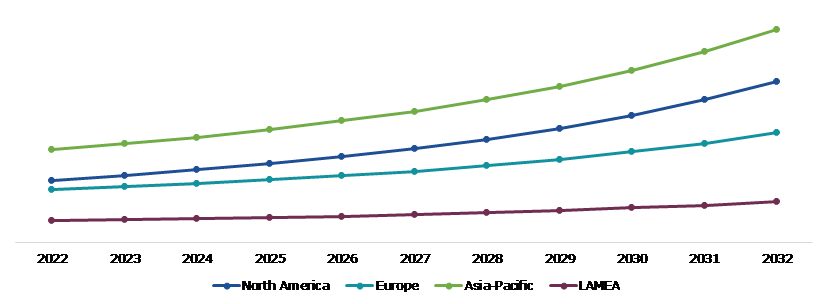

Global Commercial Fan and Air Purification Equipment Market Size & Forecast, by Region, 2022-2032 ($Million)

Source: Research Dive Analysis

The Asia-Pacific commercial fan and air purification equipment market share generated the highest revenue in 2022. Asia-Pacific has seen a substantial increase in the demand for commercial fan and air purification equipment in recent years. Several factors contribute to this rising demand, making it a significant market for commercial fan and air purification equipment. One of the significant driving factors is the increasing urbanization and industrialization that has taken place across several countries across Asia-Pacific. As countries develop and industrial activities increase, there is a greater need for effective air circulation and purification in commercial spaces. Commercial fans are essential for maintaining proper airflow, reducing stuffiness, and improving ventilation, especially in densely populated urban areas. Furthermore, air pollution is a significant concern in many Asian countries due to factors such as industrial emissions, vehicle congestion, and geographical location. This has led to an increase in demand for air purification equipment in commercial spaces. Air purifiers with advanced filtration technologies are increasingly required to remove pollutants, allergens, and harmful particles from the indoor air, promoting healthier environments for employees and customers.

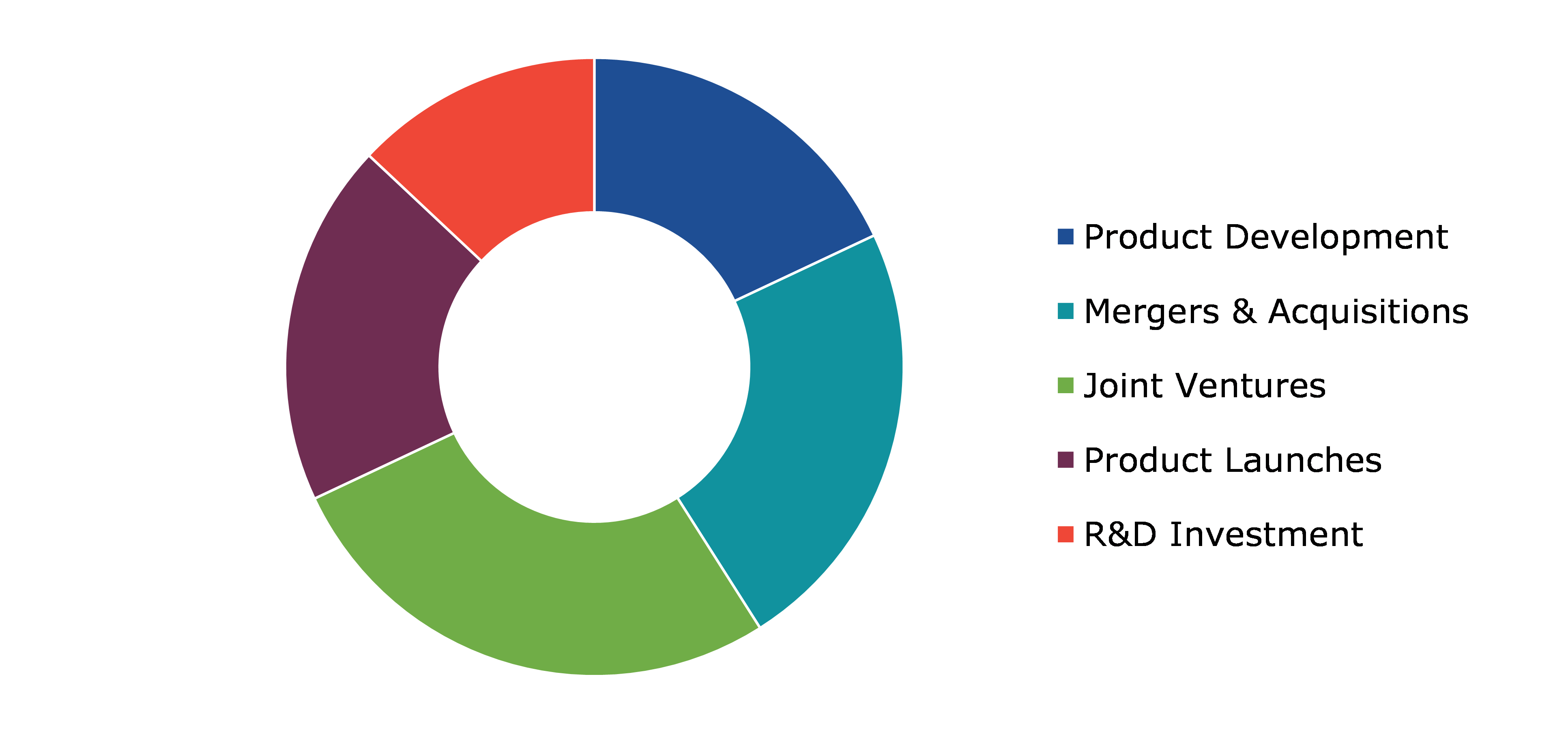

Competitive Scenario in the Global Commercial Fan and Air Purification Equipment Market

Investment and agreement are common strategies followed by major market players. for instance, in November 2022, Samsung India Electronics Ltd. (SIEL), a subsidiary of Korea-based technology corporation Samsung Electronics Corporation Ltd (SECL), introduced two air purifier models, AX46 and AX32. These purifiers can eliminate nanoparticles, ultrafine dust, germs, and allergies.

Source: Research Dive Analysis

Some of the leading commercial fan and air purification equipment market analysis players are Honeywell International Inc., Panasonic Corporation, Carrier Corporation, Hitachi Ltd., Sharp Corporation., 3M Company, Regal Beloit Corporation, DAIKIN INDUSTRIES LTD., Illinois Tool Works Inc., and SPX FLOW Inc.

| Aspect | Particulars |

| Historical Market Estimations | 2020-2021 |

| Base Year for Market Estimation | 2022 |

| Forecast Timeline for Market Projection | 2023-2032 |

| Geographical Scope | North America, Europe, Asia-Pacific, and LAMEA |

| Segmentation by Equipment Type |

|

| Segmentation by Power Range Type |

|

| Key Companies Profiled |

|

Q1. What is the size of the global commercial fan and air purification equipment market?

A. The size of the global commercial fan and air purification equipment market size was over $71,062.4 million in 2022 and is projected to reach $161,946.9 million by 2032.

Q2. Which are the major companies in the commercial fan and air purification equipment market?

A. Honeywell International Inc., Panasonic Corporation, and Carrier Corporation are some of the key players in the global commercial fan and air purification equipment market.

Q3. Which region, among others, possesses greater investment opportunities in the future?

A. North America possesses great investment opportunities for investors in the future.

Q4. What will be the growth rate of the North America commercial fan and air purification equipment market?

A. North America commercial fan and air purification equipment market share is anticipated to grow at 10.2% CAGR during the forecast period.

Q5. What are the strategies opted by the leading players in this market?

A. Agreement and investment are the two key strategies opted by the operating companies in this market.

Q6. Which companies are investing more on R&D practices?

A. Honeywell International Inc., Panasonic Corporation, and Carrier Corporation, are the companies investing more on R&D activities for developing new products and technologies.

1.Research Methodology

1.1.Desk Research

1.2.Real time insights and validation

1.3.Forecast model

1.4.Assumptions and forecast parameters

1.5.Market size estimation

1.5.1.Top-down approach

1.5.2.Bottom-up approach

2.Report Scope

2.1.Market definition

2.2.Key objectives of the study

2.3.Report overview

2.4.Market segmentation

2.5.Overview of the impact of COVID-19 on Global commercial fan and air purification equipment market

3.Executive Summary

4.Market Overview

4.1.Introduction

4.2.Growth impact forces

4.2.1.Drivers

4.2.2.Restraints

4.2.3.Opportunities

4.3.Market value chain analysis

4.3.1.List of raw material suppliers

4.3.2.List of manufacturers

4.3.3.List of distributors

4.4.Innovation & sustainability matrices

4.4.1.Technology matrix

4.4.2.Regulatory matrix

4.5.Porter’s five forces analysis

4.5.1.Bargaining power of suppliers

4.5.2.Bargaining power of consumers

4.5.3.Threat of substitutes

4.5.4.Threat of new entrants

4.5.5.Competitive rivalry intensity

4.6.PESTLE analysis

4.6.1.Political

4.6.2.Economical

4.6.3.Social

4.6.4.Technological

4.6.5.Environmental

4.7.Impact of COVID-19 on commercial fan and air purification equipment market

4.7.1.Pre-covid market scenario

4.7.2.Post-covid market scenario

5.Commercial Fan and Air Purification Equipment Market Analysis, by Equipment Type

5.1.Overview

5.2.Air Purification Equipment

5.2.1.Definition, key trends, growth factors, and opportunities

5.2.2.Market size analysis, by region, 2022-2032

5.2.3.Market share analysis, by country, 2022-2032

5.3.Attic and Exhaust Fan

5.3.1.Definition, key trends, growth factors, and opportunities

5.3.2.Market size analysis, by region, 2022-2032

5.3.3.Market share analysis, by country, 2022-2032

5.4.Others

5.4.1.Definition, key trends, growth factors, and opportunities

5.4.2.Market size analysis, by region, 2022-2032

5.4.3.Market share analysis, by country, 2022-2032

5.5.Research Dive Exclusive Insights

5.5.1.Market attractiveness

5.5.2.Competition heatmap

6.Commercial Fan and Air Purification Equipment Market Analysis, by Power Range Type

6.1.Less Than 200 Square Ft

6.1.1.Definition, key trends, growth factors, and opportunities

6.1.2.Market size analysis, by region, 2022-2032

6.1.3.Market share analysis, by country, 2022-2032

6.2.200 - 400 Square Ft

6.2.1.Definition, key trends, growth factors, and opportunities

6.2.2.Market size analysis, by region, 2022-2032

6.2.3.Market share analysis, by country, 2022-2032

6.3.More Than 400 Square Ft

6.3.1.Definition, key trends, growth factors, and opportunities

6.3.2.Market size analysis, by region, 2022-2032

6.3.3.Market share analysis, by country, 2022-2032

6.4.Research Dive Exclusive Insights

6.4.1.Market attractiveness

6.4.2.Competition heatmap

7.Commercial Fan and Air Purification Equipment Market, by Region

7.1.North America

7.1.1.U.S.

7.1.1.1.Market size analysis, by Equipment Type, 2022-2032

7.1.1.2.Market size analysis, by Power Range Type, 2022-2032

7.1.2.Canada

7.1.2.1.Market size analysis, by Equipment Type, 2022-2032

7.1.2.2.Market size analysis, by Power Range Type, 2022-2032

7.1.3.Mexico

7.1.3.1.Market size analysis, by Equipment Type, 2022-2032

7.1.3.2.Market size analysis, by Power Range Type, 2022-2032

7.1.4.Research Dive Exclusive Insights

7.1.4.1.Market attractiveness

7.1.4.2.Competition heatmap

7.2.Europe

7.2.1.Germany

7.2.1.1.Market size analysis, by Equipment Type, 2022-2032

7.2.1.2.Market size analysis, by Power Range Type, 2022-2032

7.2.2.UK

7.2.2.1.Market size analysis, by Equipment Type, 2022-2032

7.2.2.2.Market size analysis, by Power Range Type, 2022-2032

7.2.3.France

7.2.3.1.Market size analysis, by Equipment Type, 2022-2032

7.2.3.2.Market size analysis, by Power Range Type, 2022-2032

7.2.4.Spain

7.2.4.1.Market size analysis, by Equipment Type, 2022-2032

7.2.4.2.Market size analysis, by Power Range Type, 2022-2032

7.2.5.Italy

7.2.5.1.Market size analysis, by Equipment Type, 2022-2032

7.2.5.2.Market size analysis, by Power Range Type, 2022-2032

7.2.6.Rest of Europe

7.2.6.1.Market size analysis, by Equipment Type, 2022-2032

7.2.6.2.Market size analysis, by Power Range Type, 2022-2032

7.2.7.Research Dive Exclusive Insights

7.2.7.1.Market attractiveness

7.2.7.2.Competition heatmap

7.3.Asia-Pacific

7.3.1.China

7.3.1.1.Market size analysis, by Equipment Type, 2022-2032

7.3.1.2.Market size analysis, by Power Range Type, 2022-2032

7.3.2.Japan

7.3.2.1.Market size analysis, by Equipment Type, 2022-2032

7.3.2.2.Market size analysis, by Power Range Type, 2022-2032

7.3.3.India

7.3.3.1.Market size analysis, by Equipment Type, 2022-2032

7.3.3.2.Market size analysis, by Power Range Type, 2022-2032

7.3.4.Australia

7.3.4.1.Market size analysis, by Equipment Type, 2022-2032

7.3.4.2.Market size analysis, by Power Range Type, 2022-2032

7.3.5.South Korea

7.3.5.1.Market size analysis, by Equipment Type, 2022-2032

7.3.5.2.Market size analysis, by Power Range Type, 2022-2032

7.3.6.Rest of Asia-Pacific

7.3.6.1.Market size analysis, by Equipment Type, 2022-2032

7.3.6.2.Market size analysis, by Power Range Type, 2022-2032

7.3.7.Research Dive Exclusive Insights

7.3.7.1.Market attractiveness

7.3.7.2.Competition heatmap

7.4.LAMEA

7.4.1.Brazil

7.4.1.1.Market size analysis, by Equipment Type, 2022-2032

7.4.1.2.Market size analysis, by Power Range Type, 2022-2032

7.4.2.Saudi Arabia

7.4.2.1.Market size analysis, by Equipment Type, 2022-2032

7.4.2.2.Market size analysis, by Power Range Type, 2022-2032

7.4.3.UAE

7.4.3.1.Market size analysis, by Equipment Type, 2022-2032

7.4.3.2.Market size analysis, by Power Range Type, 2022-2032

7.4.4.South Africa

7.4.4.1.Market size analysis, by Equipment Type, 2022-2032

7.4.4.2.Market size analysis, by Power Range Type, 2022-2032

7.4.5.Rest of LAMEA

7.4.5.1.Market size analysis, by Equipment Type, 2022-2032

7.4.5.2.Market size analysis, by Power Range Type, 2022-2032

7.4.6.Research Dive Exclusive Insights

7.4.6.1.Market attractiveness

7.4.6.2.Competition heatmap

8.Competitive Landscape

8.1.Top winning strategies, 2022

8.1.1.By strategy

8.1.2.By year

8.2.Strategic overview

8.3.Market share analysis, 2022

9.Company Profiles

9.1.Honeywell International Inc.

9.1.1.Overview

9.1.2.Business segments

9.1.3.Product portfolio

9.1.4.Financial performance

9.1.5.Recent developments

9.1.6.SWOT analysis

9.2.Panasonic Corporation

9.2.1.Overview

9.2.2.Business segments

9.2.3.Product portfolio

9.2.4.Financial performance

9.2.5.Recent developments

9.2.6.SWOT analysis

9.3.Carrier Corporation

9.3.1.Overview

9.3.2.Business segments

9.3.3.Product portfolio

9.3.4.Financial performance

9.3.5.Recent developments

9.3.6.SWOT analysis

9.4.Hitachi Ltd.

9.4.1.Overview

9.4.2.Business segments

9.4.3.Product portfolio

9.4.4.Financial performance

9.4.5.Recent developments

9.4.6.SWOT analysis

9.5.Sharp Corporation.

9.5.1.Overview

9.5.2.Business segments

9.5.3.Product portfolio

9.5.4.Financial performance

9.5.5.Recent developments

9.5.6.SWOT analysis

9.6.3M Company

9.6.1.Overview

9.6.2.Business segments

9.6.3.Product portfolio

9.6.4.Financial performance

9.6.5.Recent developments

9.6.6.SWOT analysis

9.7.Regal Beloit Corporation

9.7.1.Overview

9.7.2.Business segments

9.7.3.Product portfolio

9.7.4.Financial performance

9.7.5.Recent developments

9.7.6.SWOT analysis

9.8.DAIKIN INDUSTRIES LTD.

9.8.1.Overview

9.8.2.Business segments

9.8.3.Product portfolio

9.8.4.Financial performance

9.8.5.Recent developments

9.8.6.SWOT analysis

9.9.Illinois Tool Works Inc.

9.9.1.Overview

9.9.2.Business segments

9.9.3.Product portfolio

9.9.4.Financial performance

9.9.5.Recent developments

9.9.6.SWOT analysis

9.10.SPX FLOW Inc

9.10.1.Overview

9.10.2.Business segments

9.10.3.Product portfolio

9.10.4.Financial performance

9.10.5.Recent developments

9.10.6.SWOT analysis

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com