Online/Virtual Fitness Market Report

RA08673

Online/Virtual Fitness Market by Streaming Type (Live and On-demand), Session Type (Group and Solo), Revenue Model (Subscription, Advertisement, and Hybrid), Device Type (Smart TV, Smartphone, Laptops Desktops and Tablets, and Others), End User (Professional Gyms, Sport Institutes, Defense Institutes, Educational Institution, Corporate Institution, Individuals, and Others), and Regional Analysis (North America, Europe, Asia-Pacific, and LAMEA): Global Opportunity Analysis and Industry Forecast, 2022-2031

Global Online/Virtual Fitness Market Analysis

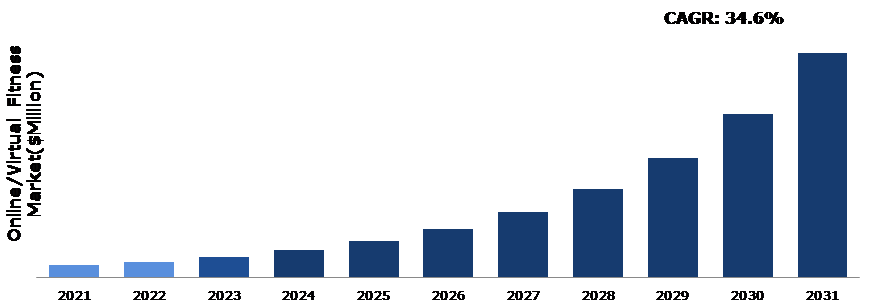

The Global Online/Virtual Fitness Market Size was $10,710.0 million in 2021 and is predicted to grow with a CAGR of 34.6%, by generating a revenue of $2,04,359.4 million by 2031.

Global Online/Virtual Fitness Market Synopsis

Increase in a new trend in the online fitness industry such as innovative on-demand and live fitness assessments is finding a place in people's daily routines. In addition, the market is benefiting from gym-goers' rising knowledge of the importance of learning about their progress, sleep quality, and body fat percentage. Many established and emerging companies are developing new goods, which are becoming more well-liked by consumers. For example, in July 2020, Twenty Billion Neurons GmbH, a cutting-edge artificial intelligence startup announced the launch of ‘Fitness Ally’ an integrated virtual training experience app powered by AI. The app's virtual fitness coach Allie can give users real-time instructions and offers a variety of other capabilities with the aid of the front-facing camera. In addition, one of the main driving factors is the increase in adoption of technology and digital solutions in the fitness industry. With the widespread availability of smartphones, wearables, and other digital devices, consumers are more connected than before and are looking for convenient, on-demand solutions that fit into their busy lifestyles. These factors are anticipated to boost the online/virtual fitness market growth in the upcoming years.

However, one of the key factors hindering the virtual fitness company is the high cost of the most advanced virtual fitness programs. In addition, the global fitness industry market is expected to be hampered during the forecast period due to a lack of knowledge regarding live and on-demand exercise classes in developing countries.

The increase in global popularity of exergaming technologies is providing ideal conditions for the virtual fitness industry. The online fitness platform uses interactive game solutions, which assists the user in developing self-confidence and strength. Therefore, technological pioneers such as Nintendo are introducing unique products. For example, in June 2020, Nintendo announced the 'Jump Rope Challenge'. Experts created the challenge to encourage those working from home to keep physically and psychologically active throughout the pandemic. Such technical advances are expected to create significant opportunities for the major players operating in the market.

According to regional analysis, the North America online/virtual fitness market accounted for a dominant market share in 2021. Online/virtual fitness is becoming more popular in North America due to a number of factors such as the significant rise in smartphone usage, the aging society, and an increase in the prevalence of chronic illnesses.

Online/Virtual Fitness Overview

The ultramodern fitness training is the online or virtual workout. Customers can approach a health instructor or trainer electronically rather than physically visiting the place. The virtual/online fitness platforms enable consumers to maintain a healthy lifestyle without leaving their homes. Individuals with busy schedules frequently choose this option owing to its convenience. Virtual fitness programs have seen an increase in demand in recent years due to the increase in popularity of such learning platforms.

COVID-19 Impact on Global Online/Virtual Fitness Market

The COVID-19 impact on online/virtual fitness market pandemic led to an increase in demand for virtual/online fitness as exercisers choose Internet courses and training sessions to maintain physical distance and prevent the transmission of the dangerous virus. The virtual/online fitness organizations have been encouraged to design live or pre-recorded workout sessions or courses due to the shutdown of fitness clubs as a result of lockdown limitations imposed by government authorities in various COVID-19 impacted countries. In addition, the COVID-19 pandemic had a significant impact on people's physical and mental health. Several people have turned to technology to help them stay healthy and connected. With lockdowns and social distancing measures in place, traditional gym and fitness options have been limited, and people have had to find new ways to stay active and healthy. Therefore, major and creative suppliers in the virtual fitness industry used various successful techniques, such as introducing insightful workout sessions, free subscriptions, and strategic alliances, in order to expand in the worldwide market. For instance, in March 2020, Peloton, an American fitness equipment and media firm, announced the expansion of the ‘Peloton Digital’ subscription free trial for 30 to 90 days in order to help and support society in maintaining their mental and physical well-being through cutting-edge health and exercise programs.

Increase in Demand for Progressive Fitness Assemblies to Acquire Physical Fitness to Drive the Market Growth

An increase in number of individuals across the world are choosing healthier lifestyles that include flexibility activities, good diets, and better healthcare. Availing online progressive training programs and virtual fitness programs help to achieve the goal. Several approaches are used by online/virtual service providers to meet the customer needs. The increase in demand for progressive fitness assemblies to acquire physical fitness is one of the key factors driving the growth of the virtual fitness market. As consumers become more health-conscious and prioritize fitness and wellness, there is a rising demand for innovative and convenient fitness solutions that can help them achieve their goals. In addition, virtual fitness platforms offer a range of progressive fitness assemblies, including high-intensity interval training (HIIT), yoga, Pilates, strength training, and others. These assemblies are designed to be accessible and effective, providing users with a convenient and affordable way to achieve their fitness goals.

To know more about global online/virtual fitness market drivers, get in touch with our analysts here.

High Cost Associated with the Advanced Virtual Fitness Programs is one of the Major Reasons Hampering the Virtual Fitness Industry

The high cost of advanced virtual fitness programs is one of the main challenges faced by the virtual fitness industry. While there are many affordable or free options available, some of the more advanced virtual fitness programs can be prohibitively expensive for many users in the developing countries. In addition to cost, there are also concerns around the quality and effectiveness of some virtual fitness programs, as well as the lack of personalized attention and guidance. To overcome these challenges, it is important for virtual fitness providers to offer a range of options at different price points, and to prioritize safety and effectiveness in their programming.

Introduction of Exergaming Platforms Among Individuals to Create Growth Opportunities for Key Players

Exergaming, the combination of exercising and gaming, has become one of the most well-known fitness trends in recent years. The interesting gaming platform assists people in developing self-confidence, health, and strength. Recently developed exergaming systems are the ideal way for gamers to enjoy their favorite games while being physically active. Therefore, market leaders such as Zwift Inc. are expanding into the global market to deliver interactive video game workout platforms. The company provides an innovative app that enhances indoor training activities for cyclists, runners, and triathletes. For example, in December 2019, Zwift collaborated with Absa Cape Epic, the most broadcast mountain bike race, to expand its indoor training portfolio for gravel riders and mountain bikes. Such strategic alliances and technological advances are also projected to open up massive market opportunities during the upcoming years.

To know more about global online/virtual fitness market opportunities, get in touch with our analysts here.

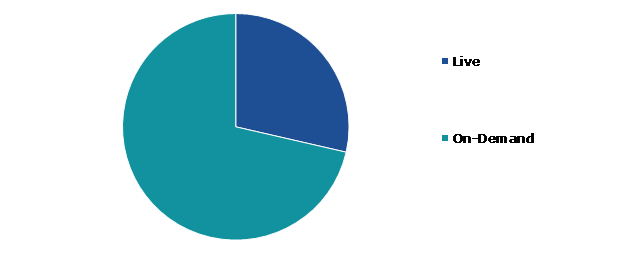

Global Online/Virtual Fitness Market, by Streaming Type

Based on streaming type, the market has been divided into live and on-demand. Among these, the on-demand sub-segment accounted for the highest market share in 2021, whereas the live sub-segment is estimated to show the fastest growth during the forecast period.

Global Online/Virtual Fitness Market Size, by Streaming Type, 2021

Source: Research Dive Analysis

The on-demand sub-segment accounted for a dominant market share in 2021. Customers are increasingly adopting on-demand virtual fitness owing to the ease of accessing a choice of training sessions. On-demand virtual fitness streaming providers are wisely developing their offers in order to reach a large number of exercisers of all fitness levels and to give a range of coaching techniques, difficulty levels, and music genres. These factors are anticipated to boost the growth of the on-demand sub-segment during the forecast timeframe.

The live sub-segment is projected to have the highest CAGR during the forecast period. Live streaming workout is the greatest way to make exercising at home entertaining and fresh. Live streaming workout platforms are designed to provide users with a convenient and effective way to stay active and maintain their daily workout routines. These platforms offer a range of features and benefits that can help users achieve their fitness goals, including access to live workouts, personalized guidance and support, and a sense of community and connection with other users. Furthermore, customers may complete live-streamed training programs in the comfort of their own home or a corporate fitness facility. In addition, professional advice and techniques, exceptional comfort for beginners, and unique wellness content are some of the primary aspects boosting the demand for live virtual fitness platforms among fitness-freaks and health-conscious individuals.

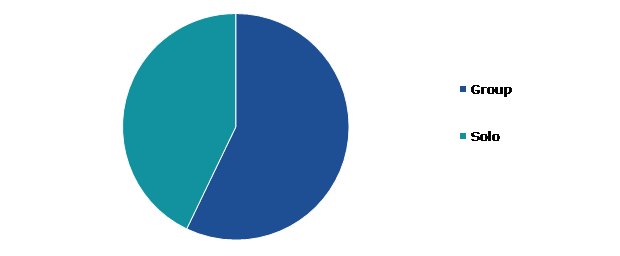

Global Online/Virtual Fitness Market, by Session Type

Based on session type, the market has been divided into group and solo. Among these, the group sub-segment accounted for the highest revenue share in 2021.

Global Online/Virtual Fitness Market Share, by Session Type, 2021

Source: Research Dive Analysis

The group sub-segment accounted for a dominant market share in 2021. Group activities that encourage connection and healthy competition among users have been demonstrated to benefit their overall health. Moreover, there is a variance in training timing due to people's busy schedules. In addition, the popularity of group workouts has increased dramatically as the class focuses primarily on developing postural alignment, which results in robust strength and balance, freedom of movement, and improved functional fitness. These factors are anticipated to boost the growth of the group sub-segment during the forecast period.

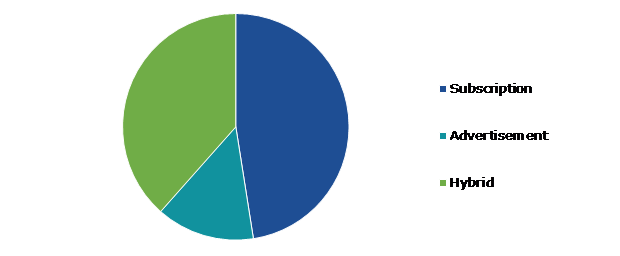

Global Online/Virtual Fitness Market, by Revenue Model

Based on revenue model, the market has been divided into subscription, advertisement, and hybrid. Among these, the subscription sub-segment accounted for the highest revenue share in 2021.

Global Online/Virtual Fitness Market Analysis, by Revenue Model, 2021

Source: Research Dive Analysis

The subscription sub-segment accounted for a dominant market share in 2021. Customers with exercise subscriptions have access to all types of workouts, including barre yoga, boxing, core, rowing, strength, HIIT, and riding. The platform is simple to use and offers customers on-demand access to a variety of exercise courses that can be watched on laptops, cellphones, or televisions. The subscription model offers its customers on-demand or live-streamed courses, and they can also choose a training schedule if they are beginners. These factors are anticipated to boost the growth of the subscription sub-segment in the upcoming years.

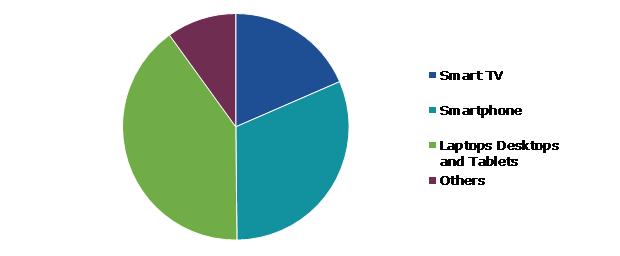

Global Online/Virtual Fitness Market, by Device Type

Based on device type, the market has been divided into smart tv, smartphone, laptops desktops and tablets, and others. Among these, the laptops desktops and tablets sub-segment accounted for highest revenue share in 2021.

Global Online/Virtual Fitness Market Growth, by Device Type, 2021

Source: Research Dive Analysis

The laptops desktops and tablets sub-segment accounted for a dominant market share in 2021. The use of laptops desktops and tablets has made it easier for consumers to access virtual fitness programs. Users can access these programs from the comfort of their own homes or while on the go, allowing them to include workouts into their busy schedules. This has made virtual fitness programs a popular choice for people with busy schedules or those who prefer to work out in the comfort of their own homes. Furthermore, these devices offers multiple important characteristics such as longer battery life, high-performance speed, simplicity of use, and miniaturization. These factors are anticipated to boost the demand for laptops desktops and tablets sub-segment in the online/virtual fitness market forecast period.

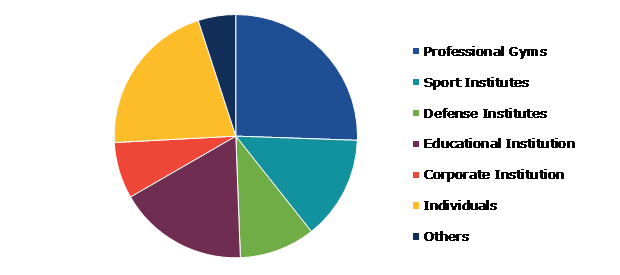

Global Online/Virtual Fitness Market, by End User

Based on end user, the market has been divided into professional gyms, sport institutes, defense institutes, educational institution, corporate institution, individuals, and others. Among these, the professional gyms sub-segment accounted for the highest revenue share in 2021.

Global Online/Virtual Fitness Market Trend, by End User, 2021

Source: Research Dive Analysis

The professional gyms sub-segment accounted for a dominant market share in 2021. Rapid increase in obesity rates, especially in urban areas, has led to an increase in consumers' awareness of health and wellbeing. The rise of online/virtual fitness programs had a significant impact on the professional gyms industry. While traditional gyms still have a strong presence, many have started to incorporate virtual fitness programs into their offerings to meet the changing demands of consumers. In addition, professional gyms have recognized the benefits of virtual fitness programs, which include the ability to reach a wider audience and offer a greater variety of workouts and trainers. Many gyms have started to offer virtual classes and personal training sessions, which can be accessed from anywhere at any time. This has allowed gyms to expand their customer base beyond their local area and provide more value to their existing members.

Global Online/Virtual Fitness Market, Regional Insights

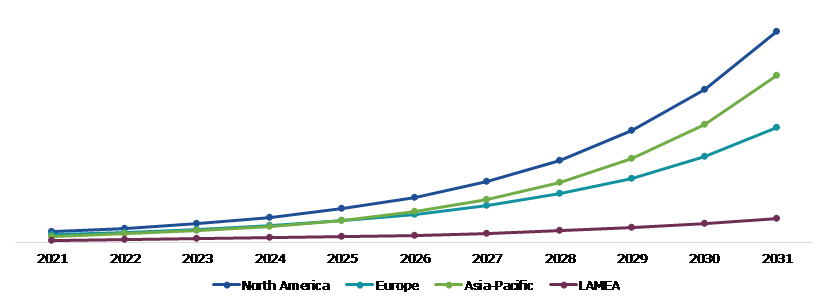

The online/virtual fitness market was investigated across North America, Europe, Asia-Pacific, and LAMEA.

Global Online/Virtual Fitness Market Size & Forecast, by Region, 2021-2031 (USD Million)

Source: Research Dive Analysis

The Market for Online/Virtual Fitness in North America was the Most Dominant

The North America online/virtual fitness market share accounted for a dominant market share in 2021. The market in this region is anticipated to develop as chronic disorders including asthma, diabetes, obesity, arthritis, and others are diagnosed more frequently. The rising popularity of inventive fitness solutions with health awareness campaigns in this region is anticipated to drive up the expansion of the virtual fitness market during the forecast period. In addition, there is an increase in need for novel fitness platforms in the region due to the rise in incidence of chronic diseases including diabetes, obesity, CVDs, and others, which is largely responsible for the online/virtual fitness market growth. For instance, Type 2 diabetes, which is caused by a sedentary lifestyle and obesity in around 90% of cases, is estimated by the CDC to be the most prevalent disease in the U.S.

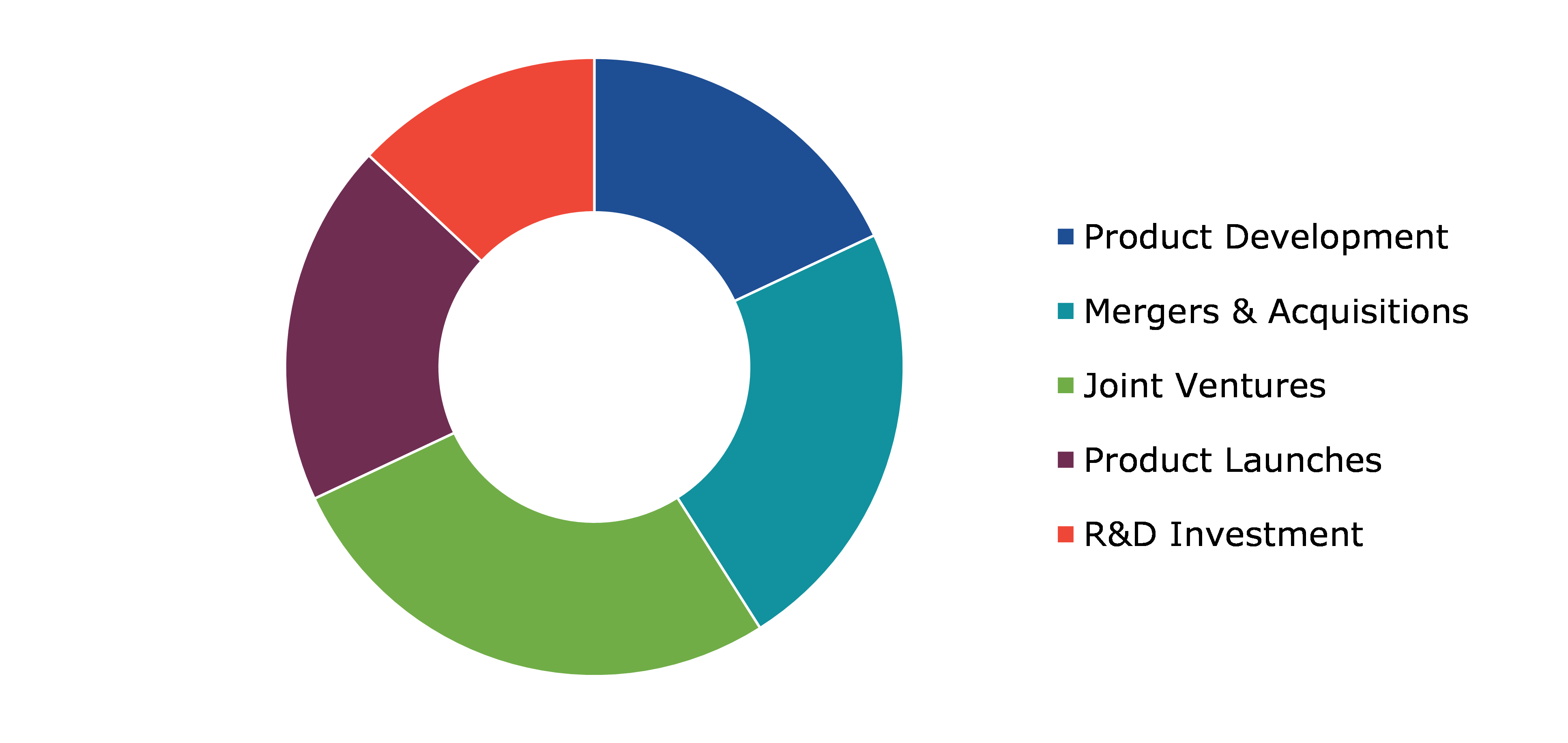

Competitive Scenario in the Global Online/Virtual Fitness Market

Investment and agreement are common strategies followed by major market players. For instance, in October 2021, Mindbody, a platform for scheduling and managing fitness classes and other wellness services, acquired ClassPass Inc., an innovative online fitness membership firm, in an all-stock deal to strengthen its position in the worldwide virtual fitness industry.

Source: Research Dive Analysis

Some of the leading online/virtual fitness market analysis players ClassPass Inc., Fitbit, Inc., FitnessOnDemand, Les Mills International Ltd., Navigate Wellbeing Solutions, Peloton, REH-FIT, Sworkit, Viva Leisure, and Wellbeats, Inc.

| Aspect | Particulars |

| Historical Market Estimations | 2020 |

| Base Year for Market Estimation | 2021 |

| Forecast Timeline for Market Projection | 2022-2031 |

| Geographical Scope | North America, Europe, Asia-Pacific, and LAMEA |

| Segmentation by Streaming Type |

|

| Segmentation by Session Type |

|

| Segmentation by Revenue Model |

|

| Segmentation by Device Type |

|

| Segmentation by End User |

|

| Key Companies Profiled |

|

Q1. What is the size of the global online/virtual fitness market?

A. The size of the global online/virtual fitness market size was over $10,710.0 million in 2021 and is projected to reach $2,04,359.4 million by 2031.

Q2. Which are the major companies in the online/virtual fitness market?

A. ClassPass Inc., Fitbit, Inc., FitnessOnDemand, and Les Mills International Ltd. are some of the key players in the global online/virtual fitness market.

Q3. Which region, among others, possesses greater investment opportunities in the future?

A. Asia-Pacific possesses great investment opportunities for investors to witness the most promising growth in the future.

Q4. What will be the growth rate of the Asia-Pacific online/virtual fitness market?

A. Asia-Pacific online/virtual fitness market share is anticipated to grow at 39.3% CAGR during the forecast period.

Q5. What are the strategies opted by the leading players in this market?

A. Agreement and investment are the two key strategies opted by the operating companies in this market.

Q6. Which companies are investing more on R&D practices?

A. ClassPass Inc., Fitbit, Inc., FitnessOnDemand, and Les Mills International Ltd. are the companies investing more on R&D activities for developing new products and technologies.

1.Research Methodology

1.1.Desk Research

1.2.Real time insights and validation

1.3.Forecast model

1.4.Assumptions and forecast parameters

1.5.Market size estimation

1.5.1.Top-down approach

1.5.2.Bottom-up approach

2.Report Scope

2.1.Market definition

2.2.Key objectives of the study

2.3.Report overview

2.4.Market segmentation

2.5.Overview of the impact of COVID-19 on Global Online/Virtual Fitness market

3.Executive Summary

4.Market Overview

4.1.Introduction

4.2.Growth impact forces

4.2.1.Drivers

4.2.2.Restraints

4.2.3.Opportunities

4.3.Market value chain analysis

4.3.1.List of raw material suppliers

4.3.2.List of manufacturers

4.3.3.List of distributors

4.4.Innovation & sustainability matrices

4.4.1.Technology matrix

4.4.2.Regulatory matrix

4.5.Porter’s five forces analysis

4.5.1.Bargaining power of suppliers

4.5.2.Bargaining power of consumers

4.5.3.Threat of substitutes

4.5.4.Threat of new entrants

4.5.5.Competitive rivalry intensity

4.6.PESTLE analysis

4.6.1.Political

4.6.2.Economical

4.6.3.Social

4.6.4.Technological

4.6.5.Environmental

4.7.Impact of COVID-19 on global Online/Virtual Fitness market

4.7.1.Pre-covid market scenario

4.7.2.Post-covid market scenario

5.Online/Virtual Fitness Market Analysis, by Streaming Type

5.1.Overview

5.2.Live

5.2.1.Definition, key trends, growth factors, and opportunities

5.2.2.Market size analysis, by region,2022-2031

5.2.3.Market share analysis, by country,2022-2031

5.3.On-demand

5.3.1.Definition, key trends, growth factors, and opportunities

5.3.2.Market size analysis, by region,2022-2031

5.3.3.Market share analysis, by country,2022-2031

5.4.Research Dive Exclusive Insights

5.4.1.Market attractiveness

5.4.2.Competition heatmap

6.Online/Virtual Fitness Market, by Session Type

6.1.Overview

6.2.Group

6.2.1.Definition, key trends, growth factors, and opportunities

6.2.2.Market size analysis, by region,2022-2031

6.2.3.Market share analysis, by country,2022-2031

6.3.Solo

6.3.1.Definition, key trends, growth factors, and opportunities

6.3.2.Market size analysis, by region,2022-2031

6.3.3.Market share analysis, by country,2022-2031

6.4.Research Dive Exclusive Insights

6.4.1.Market attractiveness

6.4.2.Competition heatmap

7.Online/Virtual Fitness Market, by Revenue Model

7.1.Overview

7.2.Subscription

7.2.1.Definition, key trends, growth factors, and opportunities

7.2.2.Market size analysis, by region,2022-2031

7.2.3.Market share analysis, by country,2022-2031

7.3.Advertisement

7.3.1.Definition, key trends, growth factors, and opportunities

7.3.2.Market size analysis, by region,2022-2031

7.3.3.Market share analysis, by country,2022-2031

7.4.Hybrid

7.4.1.Definition, key trends, growth factors, and opportunities

7.4.2.Market size analysis, by region,2022-2031

7.4.3.Market share analysis, by country,2022-2031

7.5.Research Dive Exclusive Insights

7.5.1.Market attractiveness

7.5.2.Competition heatmap

8.Online/Virtual Fitness Market, by Device Type

8.1.Overview

8.2.Smart TV

8.2.1.Definition, key trends, growth factors, and opportunities

8.2.2.Market size analysis, by region,2022-2031

8.2.3.Market share analysis, by country,2022-2031

8.3.Smartphone

8.3.1.Definition, key trends, growth factors, and opportunities

8.3.2.Market size analysis, by region,2022-2031

8.3.3.Market share analysis, by country,2022-2031

8.4.Laptops Desktops and Tablets

8.4.1.Definition, key trends, growth factors, and opportunities

8.4.2.Market size analysis, by region,2022-2031

8.4.3.Market share analysis, by country,2022-2031

8.5.Others8.5.1.Definition, key trends, growth factors, and opportunities

8.5.2.Market size analysis, by region,2022-2031

8.5.3.Market share analysis, by country,2022-2031

8.6.Research Dive Exclusive Insights

8.6.1.Market attractiveness

8.6.2.Competition heatmap

9.Online/Virtual Fitness Market, by End User

9.1.Overview

9.2.Professional Gyms

9.2.1.Definition, key trends, growth factors, and opportunities

9.2.2.Market size analysis, by region,2022-2031

9.2.3.Market share analysis, by country,2022-2031

9.3.Sport Institutes

9.3.1.Definition, key trends, growth factors, and opportunities

9.3.2.Market size analysis, by region,2022-2031

9.3.3.Market share analysis, by country,2022-2031

9.4.Defense Institutes

9.4.1.Definition, key trends, growth factors, and opportunities

9.4.2.Market size analysis, by region,2022-2031

9.4.3.Market share analysis, by country,2022-2031

9.5.Educational Institution

9.5.1.Definition, key trends, growth factors, and opportunities

9.5.2.Market size analysis, by region,2022-2031

9.5.3.Market share analysis, by country,2022-2031

9.6.Corporate Institution

9.6.1.Definition, key trends, growth factors, and opportunities

9.6.2.Market size analysis, by region,2022-2031

9.6.3.Market share analysis, by country,2022-2031

9.7.Individuals

9.7.1.Definition, key trends, growth factors, and opportunities

9.7.2.Market size analysis, by region,2022-2031

9.7.3.Market share analysis, by country,2022-2031

9.8.Others

9.8.1.Definition, key trends, growth factors, and opportunities

9.8.2.Market size analysis, by region,2022-2031

9.8.3.Market share analysis, by country,2022-2031

9.9.Research Dive Exclusive Insights

9.9.1.Market attractiveness

9.9.2.Competition heatmap

10.Online/Virtual Fitness Market, by Region

10.1.North America

10.1.1.U.S.

10.1.1.1.Market size analysis, by Streaming Type, 2022-2031

10.1.1.2.Market size analysis, by Session Type, 2022-2031

10.1.1.3.Market size analysis, by Revenue Model, 2022-2031

10.1.1.4.Market size analysis, by Device Type, 2022-2031

10.1.1.5.Market size analysis, by End User, 2022-2031

10.1.2.Canada

10.1.2.1.Market size analysis, by Streaming Type, 2022-2031

10.1.2.2.Market size analysis, by Session Type, 2022-2031

10.1.2.3.Market size analysis, by Revenue Model, 2022-2031

10.1.2.4.Market size analysis, by Device Type, 2022-2031

10.1.2.5.Market size analysis, by End User, 2022-2031

10.1.3.Mexico

10.1.3.1.Market size analysis, by Streaming Type, 2022-2031

10.1.3.2.Market size analysis, by Session Type, 2022-2031

10.1.3.3.Market size analysis, by Revenue Model, 2022-2031

10.1.3.4.Market size analysis, by Device Type, 2022-2031

10.1.3.5.Market size analysis, by End User, 2022-2031

10.1.4.Research Dive Exclusive Insights

10.1.4.1.Market attractiveness

10.1.4.2.Competition heatmap

10.2.Europe

10.2.1.Germany

10.2.1.1.Market size analysis, by Streaming Type, 2022-2031

10.2.1.2.Market size analysis, by Session Type, 2022-2031

10.2.1.3.Market size analysis, by Revenue Model, 2022-2031

10.2.1.4.Market size analysis, by Device Type, 2022-2031

10.2.1.5.Market size analysis, by End User, 2022-2031

10.2.2.U.K.

10.2.2.1.Market size analysis, by Streaming Type, 2022-2031

10.2.2.2.Market size analysis, by Session Type, 2022-2031

10.2.2.3.Market size analysis, by Revenue Model, 2022-2031

10.2.2.4.Market size analysis, by Device Type, 2022-2031

10.2.2.5.Market size analysis, by End User, 2022-2031

10.2.3.France

10.2.3.1.Market size analysis, by Streaming Type, 2022-2031

10.2.3.2.Market size analysis, by Session Type, 2022-2031

10.2.3.3.Market size analysis, by Revenue Model, 2022-2031

10.2.3.4.Market size analysis, by Device Type, 2022-2031

10.2.3.5.Market size analysis, by End User, 2022-2031

10.2.4.Spain

10.2.4.1.Market size analysis, by Streaming Type, 2022-2031

10.2.4.2.Market size analysis, by Session Type, 2022-2031

10.2.4.3.Market size analysis, by Revenue Model, 2022-2031

10.2.4.4.Market size analysis, by Device Type, 2022-2031

10.2.4.5.Market size analysis, by End User, 2022-2031

10.2.5.Italy

10.2.5.1.Market size analysis, by Streaming Type, 2022-2031

10.2.5.2.Market size analysis, by Session Type, 2022-2031

10.2.5.3.Market size analysis, by Revenue Model, 2022-2031

10.2.5.4.Market size analysis, by Device Type, 2022-2031

10.2.5.5.Market size analysis, by End User, 2022-2031

10.2.6.Rest of Europe

10.2.6.1.Market size analysis, by Streaming Type, 2022-2031

10.2.6.2.Market size analysis, by Session Type, 2022-2031

10.2.6.3.Market size analysis, by Revenue Model, 2022-2031

10.2.6.4.Market size analysis, by Device Type, 2022-2031

10.2.6.5.Market size analysis, by End User, 2022-2031

10.2.7.Research Dive Exclusive Insights

10.2.7.1.Market attractiveness

10.2.7.2.Competition heatmap

10.3.Asia-Pacific

10.3.1.China

10.3.1.1.Market size analysis, by Streaming Type, 2022-2031

10.3.1.2.Market size analysis, by Session Type, 2022-2031

10.3.1.3.Market size analysis, by Revenue Model, 2022-2031

10.3.1.4.Market size analysis, by Device Type, 2022-2031

10.3.1.5.Market size analysis, by End User, 2022-2031

10.3.2.Japan

10.3.2.1.Market size analysis, by Streaming Type, 2022-2031

10.3.2.2.Market size analysis, by Session Type, 2022-2031

10.3.2.3.Market size analysis, by Revenue Model, 2022-2031

10.3.2.4.Market size analysis, by Device Type, 2022-2031

10.3.2.5.Market size analysis, by End User, 2022-2031

10.3.3.India

10.3.3.1.Market size analysis, by Streaming Type, 2022-2031

10.3.3.2.Market size analysis, by Session Type, 2022-2031

10.3.3.3.Market size analysis, by Revenue Model, 2022-2031

10.3.3.4.Market size analysis, by Device Type, 2022-2031

10.3.3.5.Market size analysis, by End User, 2022-2031

10.3.4.Australia

10.3.4.1.Market size analysis, by Streaming Type, 2022-2031

10.3.4.2.Market size analysis, by Session Type, 2022-2031

10.3.4.3.Market size analysis, by Revenue Model, 2022-2031

10.3.4.4.Market size analysis, by Streaming Type, 2022-2031

10.3.4.5.Market size analysis, by Session Type, 2022-2031

10.3.4.6.Market size analysis, by Revenue Model, 2022-2031

10.3.4.7.Market size analysis, by Device Type, 2022-2031

10.3.4.8.Market size analysis, by End User, 2022-2031

10.3.5.South Korea

10.3.5.1.Market size analysis, by Streaming Type, 2022-2031

10.3.5.2.Market size analysis, by Session Type, 2022-2031

10.3.5.3.Market size analysis, by Revenue Model, 2022-2031

10.3.5.4.Market size analysis, by Device Type, 2022-2031

10.3.5.5.Market size analysis, by End User, 2022-2031

10.3.6.Rest of Asia-Pacific

10.3.6.1.Market size analysis, by Streaming Type, 2022-2031

10.3.6.2.Market size analysis, by Session Type, 2022-2031

10.3.6.3.Market size analysis, by Revenue Model, 2022-2031

10.3.6.4.Market size analysis, by Device Type, 2022-2031

10.3.6.5.Market size analysis, by End User, 2022-2031

10.3.7.Research Dive Exclusive Insights

10.3.7.1.Market attractiveness

10.3.7.2.Competition heatmap

10.4.LAMEA

10.4.1.Brazil

10.4.1.1.Market size analysis, by Streaming Type, 2022-2031

10.4.1.2.Market size analysis, by Session Type, 2022-2031

10.4.1.3.Market size analysis, by Revenue Model, 2022-2031

10.4.1.4.Market size analysis, by Device Type, 2022-2031

10.4.1.5.Market size analysis, by End User, 2022-2031

10.4.2.Saudi Arabia

10.4.2.1.Market size analysis, by Streaming Type, 2022-2031

10.4.2.2.Market size analysis, by Session Type, 2022-2031

10.4.2.3.Market size analysis, by Revenue Model, 2022-2031

10.4.2.4.Market size analysis, by Device Type, 2022-2031

10.4.2.5.Market size analysis, by End User, 2022-2031

10.4.3.UAE

10.4.3.1.Market size analysis, by Streaming Type, 2022-2031

10.4.3.2.Market size analysis, by Session Type, 2022-2031

10.4.3.3.Market size analysis, by Revenue Model, 2022-2031

10.4.3.4.Market size analysis, by Device Type, 2022-2031

10.4.3.5.Market size analysis, by End User, 2022-2031

10.4.4.South Africa

10.4.4.1.Market size analysis, by Streaming Type, 2022-2031

10.4.4.2.Market size analysis, by Session Type, 2022-2031

10.4.4.3.Market size analysis, by Revenue Model, 2022-2031

10.4.4.4.Market size analysis, by Device Type, 2022-2031

10.4.4.5.Market size analysis, by End User, 2022-2031

10.4.5.Rest of LAMEA

10.4.5.1.Market size analysis, by Streaming Type, 2022-2031

10.4.5.2.Market size analysis, by Session Type, 2022-2031

10.4.5.3.Market size analysis, by Revenue Model, 2022-2031

10.4.5.4.Market size analysis, by Device Type, 2022-2031

10.4.5.5.Market size analysis, by End User, 2022-2031

10.4.6.Research Dive Exclusive Insights

10.4.6.1.Market attractiveness

10.4.6.2.Competition heatmap

11.Competitive Landscape

11.1.Top winning strategies, 2022

11.1.1.By strategy

11.1.2.By year

11.2.Strategic overview

11.3.Market share analysis, 2022

12.Company Profiles

12.1.ClassPass Inc.

12.1.1.Overview

12.1.2.Business segments

12.1.3.Product portfolio

12.1.4.Financial performance

12.1.5.Recent developments

12.1.6.SWOT analysis

12.2.Fitbit, Inc.

12.2.1.Overview

12.2.2.Business segments

12.2.3.Product portfolio

12.2.4.Financial performance

12.2.5.Recent developments

12.2.6.SWOT analysis

12.3.FitnessOnDemand

12.3.1.Overview

12.3.2.Business segments

12.3.3.Product portfolio

12.3.4.Financial performance

12.3.5.Recent developments

12.3.6.SWOT analysis

12.4.Les Mills International Ltd.

12.4.1.Overview

12.4.2.Business segments

12.4.3.Product portfolio

12.4.4.Financial performance

12.4.5.Recent developments

12.4.6.SWOT analysis

12.5.Navigate Wellbeing Solutions

12.5.1.Overview

12.5.2.Business segments

12.5.3.Product portfolio

12.5.4.Financial performance

12.5.5.Recent developments

12.5.6.SWOT analysis

12.6.Peloton

12.6.1.Overview

12.6.2.Business segments

12.6.3.Product portfolio

12.6.4.Financial performance

12.6.5.Recent developments

12.6.6.SWOT analysis

12.7.REH-FIT

12.7.1.Overview

12.7.2.Business segments

12.7.3.Product portfolio

12.7.4.Financial performance

12.7.5.Recent developments

12.7.6.SWOT analysis

12.8.Sworkit

12.8.1.Overview

12.8.2.Business segments

12.8.3.Product portfolio

12.8.4.Financial performance

12.8.5.Recent developments

12.8.6.SWOT analysis

12.9.Viva Leisure

12.9.1.Overview

12.9.2.Business segments

12.9.3.Product portfolio

12.9.4.Financial performance

12.9.5.Recent developments

12.9.6.SWOT analysis

12.10.Wellbeats, Inc.

12.10.1.Overview

12.10.2.Business segments

12.10.3.Product portfolio

12.10.4.Financial performance

12.10.5.Recent developments

12.10.6.SWOT analysis

Online or virtual fitness classes or regimes, as the name suggests, refer to such programs wherein one can enroll and attend workout and training sessions online without visiting an instruction in a gym. Thus, these programs allow the subscribers to take up workout sessions from their respective homes. Also, the subscribers of this program can opt for a flexible workout schedule and can choose the workout options as per their needs.

Forecast Analysis:

Introduction and increasing adoption of exergaming, the combination of exercising and gaming, among individuals across the world is expected to be the primary growth driver of the global online/virtual fitness market in the coming years. Along with this, an increase in demand for progressive fitness assemblies to acquire physical fitness is expected to push the market further. Also, new trends in the online fitness industry such as innovative on-demand and live fitness assessments are predicted to offer numerous investment and growth opportunities to the market in the analysis timeframe. However, the high cost associated with advanced virtual fitness programs may restrain the growth of the online/virtual fitness market in the forecast period.

Regionally, the online/virtual fitness market in the North America region is expected to be the most dominant by 2031. The growing prevalence of chronic disorders including asthma, diabetes, obesity, arthritis, etc., and rising popularity of innovative fitness solutions are anticipated to become the main growth driver of the market in this region.

According to the report published by Research Dive, the global online/virtual fitness market is expected to gather a revenue of $2,04,359.4 million by 2031 and grow at 34.6% CAGR in the 2022-2031 timeframe. Some prominent market players include ClassPass Inc., Navigate Wellbeing Solutions, Sworkit, Fitbit, Inc., Peloton, Viva Leisure, FitnessOnDemand, REH-FIT, Wellbeats, Inc., Les Mills International Ltd., and many others.

Covid-19 Impact on the Online/Virtual Fitness Market

The outbreak of the Covid-19 pandemic has had a massive negative effect on almost all industries and businesses across the world. The online/virtual fitness market, however, faced a positive impact of the pandemic. As a majority of the fitness centers and gyms were closed due to the lockdowns and social distancing norms, people started opting for online fitness programs, which increased the growth rate of the market substantially during the pandemic period.

Significant Market Developments

The significant companies operating in the industry are adopting numerous growth strategies & business tactics such as partnerships, collaborations, mergers & acquisitions, and launches to maintain a robust position in the overall market, thus helping the online/virtual fitness market to flourish. For instance:

- In October 2021, Mindbody, a fitness provider booking platform, announced the acquisition of ClassPass, a fitness subscription service. This acquisition is expected to boost the growth of the acquiring company, i.e., Mindbody in the coming period and help it to cater to the demands of the market in a holistic manner.

- In February 2022, Asics, a sporting goods company, announced that it was partnering with Zwift, an online in-game training platform. This partnership is aimed at providing runners with an immersive experience and help them achieve their fitness goals. The partnership is anticipated to garner a huge market share in the near future.

- In January 2023, Appointy, an online scheduling software developer, announced the acquisition of Zyoga, an AI-powered healthcare startup. This acquisition is predicted to help Appointy to consolidate its lead in the online fitness market in the next few years.

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com