India B2B Gold Jewellery Market Report

RA08653

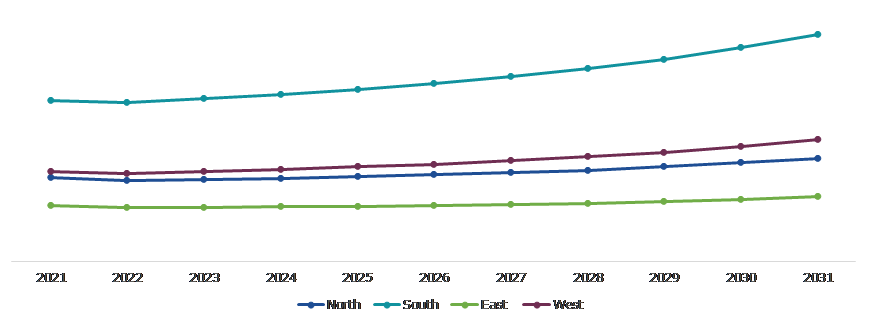

India B2B Gold Jewellery Market by Manufacturers (Organized Manufacturers and Unorganized Manufacturers), Wearings (Occasional Wear, Bridal Wear, and Daily Wear), Product Type (Neckwear/Necklace, Earrings, Rings, Bangles/Bracelets, Chains, and Others), and Regional Analysis (North, South, East, and West): Opportunity Analysis and Industry Forecast, 2022–2031

India B2B Jewellery Market Analysis

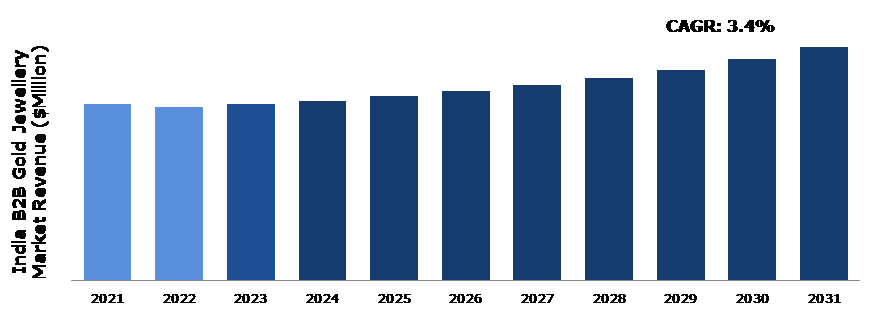

The India B2B Gold Jewellery Market Size was $22,239.0 million in 2021 and is predicted to grow with a CAGR of 3.4%, by generating a revenue of $29,415.2 million by 2031.

India B2B Gold Jewellery Market Synopsis

Indian customers believe in investing in gold for better returns in the future. It has been one of the most popular modes of financial investments. Investment philosophies have changed over the last few years. There are a variety of options to invest in gold due to the expanding culture of digital investment and easy Internet banking. In the past few years, the Indian Government has introduced several schemes to provide various gold purchase options to investors/customers. These schemes have served major benefits to the customers and have encouraged them to purchase gold. For instance, in November 2015, the Indian Government introduced Sovereign Gold Bond as a profitable alternative to physical gold and is backed up by the Reserve Bank of India. Every year, the scheme is revised by the government in their financial budget to offer more benefits to gold investors. The scheme has some attractive policies and features due to which most customers prefer to purchase gold bonds over physical gold jewellery.

However, small and medium gold jewellery retailers face many challenges to make their business profitable. Unorganized players also deal with several issues, including pressure on money-lending operations (a major contributor to profitability), the absence of gold-on-lease, limited capital availability, and restrictions on investments in company’s expansion. For unorganized sector players, declining interest in running the business by the next generation and growing family conflicts are also significant drawbacks. All such factors are anticipated to restrict the market growth during the forecast period.

On a digital platform, jewellers can engage with more individuals and expand their customer base. When jewellers choose digital channels, whether an app or a website, they can generate more revenue. Jewellers can enhance conversions with the aid of technologies such as augmented reality. According to Shopify Company analysis in 2022, utilizing augmented reality (AR) to market products can boost conversion rates by a remarkable 94% when compared to not using augmented reality. When jewellers add AR to their services, they can anticipate significant returns on investment and better consumer satisfaction owing to an enhanced user experience. All such factors are likely to create several growth opportunities for the major market players in the B2B gold jewellery businesses across India.

According to regional analysis, the South India B2B gold jewellery market accounted for the highest market share in 2021. For instance, jewellery preferences are no longer regional and traditional due to better exposure to Indian and worldwide trends. Consumers in South India are now more open to trying on Jaipur jewellery or jewellery with diamond studs on gold. Similar to how temple jewellery was once exclusively purchased only in the South but is now accepted throughout the country.

India B2B Gold Jewellery Overview

India has a long history with gold and considers it to be significant. In addition to serving as a status symbol and a sign of wealth, it also serves as a financial tool for investing and saving. The practice of wearing jewellery is not only customary and traditional among Indians, but each jewellery piece also has significance and importance. With its easy conversion to cash, gold is an investment that grows over time. Gold is a source of comfort and security during unfavorable economic times due to its value and scarcity. An increase in festival gift exchanges and shifting consumer preferences towards celebration gifts for families and friends are also driving the expansion of the India B2B gold jewellery market. Surging demand for branded jewellery products, as well as the assurance of the authenticity and purity of the premium metals and stones used in jewellery, will also help the market to expand in the upcoming years.

COVID-19 Impact on India B2B Gold Jewellery Market

The India B2B jewellery market was significantly impacted by the COVID-19 pandemic. Governments of various countries across the globe implemented strict restrictions, nationwide lockdowns, and banned travel due to the rapid spread of COVID-19. The country's jewellery sector came to a halt, with virtually no footfalls in jewellery stores due to the fear of the virus spreading. Several jewellers had been forced to close their stores in malls and shopping centers. The impact of COVID-19 on the industry has been devastating, with lakhs of artisans who rely on orders are now out of work as a result of the shutdown. This sector is entirely labor-oriented, and lack of skilled labor during the pandemic had a negative impact on the market as well. Due to the fear of getting infected by the coronavirus, laborers returned to their villages which resulted in a lack of skilled labor when the restrictions were released to a certain extent.

Importance of Gold Jewellery in Indian Tradition to Drive the Market Growth

In India, wearing gold jewellery has great meaning, especially during religious events, births, and wedding ceremonies. It is one of the most expensive and precious metals and has long been a part of Indian tradition. Gold has always endured in some form or another despite shifting social norms, from improving beauty to denoting power, rank, and spirituality. Jewellery is not only an artistic and creative expression for some people, but also plays a significant role in their culture and traditions. To make the most of the social values and beliefs associated with gold, jewellers advertise their businesses or brands by offering a variety of jewellery styles and discounts to customers.

The styles and designs offered by the jewellers cover the majority portion of cultural beliefs in different religions. For instance, in Hindu culture, bridal gold jewellery is incomplete without various gold ornaments such as bangles, maang tika, mangalsutra, a neckpiece, nose rings, and other bridal jewellery. Major jewellery industry players not only stock contemporary jewellery but also offer modernized touches and designs to the above-mentioned bridal jewellery. They also offer the facilities to manufacture intricate design jewellery based on the customers’ requirements.

To know more about India B2B gold jewellery market drivers, get in touch with our analysts here.

Strict Regulations on the Import and Export of Gold Jewellery and the High Cost of Customization Hamper the Market Growth

Several countries have strict regulations and guidelines on the import and export of ornaments, which has led to an increase in product tariffs. The final cost of the product rises due to this tariff increase. Furthermore, an increase in political tension between the two countries may have an impact on import and export trade. Therefore, all of these factors are expected to impede the growth of the India B2B gold jewellery market during the forecast period. Gold may not be suitable for metal allergy sufferers due to the presence of nickel in the gold alloy. This factor also limits the India B2B gold jewellery market growth in coming years.

Real gold is a limited resource that entails some risks due to issues like theft, storage, and others. None of these dangers exists with mutual funds, digital gold, or gold ETFs. Furthermore, the high cost of gold jewellery manufacturing is expected to hinder the industry during the forecast period. The creation of custom-made gold jewellery requires highly specialized skills, meticulous attention to detail, and continued attempts. Furthermore, the tools and technologies needed for making jewellery or gold contribute to the manufacturing costs. The expensive cost of manufacturing jewellery and stones is expected to hinder market growth.

Changing Dynamics for Indian Jewellery to Promote B2B Gold Jewellery Business in India

The dynamics of gold jewellery have changed due to factors including the abolition of the Gold Control Act, growing liberalization, and other factors that have affected both the retail and trade sectors. As a result of the long-term improvements in consumer earnings over the last three decades, India generated a significant income from gold jewellery. With changing lifestyles and rising earnings of the population, jewellery preferences and tastes have evolved. For instance, jewellery preferences are no longer regional and traditional due to better exposure to Indian and worldwide trends. Consumer in South India is now more open to trying on Jaipur jewellery or jewellery with diamond studs on gold. Similar to how temple jewellery, which was once exclusively purchased in the South now is accepted throughout the country and has gained significant popularity. The popularity of modern and daily wear jewellery is also rising as young shoppers are looking for jewellery which will go along with their western attire.

To know more about India B2B gold jewellery market opportunities, get in touch with our analysts here.

India B2B Gold Jewellery Market, by Manufacturers

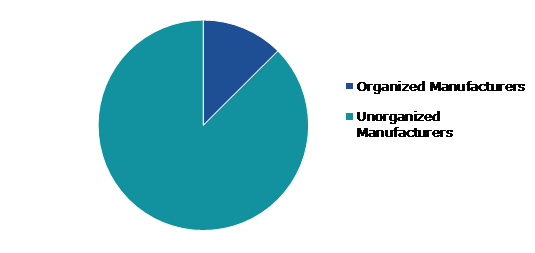

Based on manufacturers, the market has been divided into organized manufacturers and unorganized manufacturers. Among these, the unorganized manufacturers sub-segment accounted for the highest market share in 2021, whereas the organized manufacturers sub-segment is estimated to show the fastest growth during the forecast period.

India B2B Gold Jewellery Market Size, by Manufacturers, 2021

Source: Research Dive Analysis

The unorganized manufacturers sub-segment accounted for the highest market share in 2021. The manufacturing industry in India is still fragmented and unorganized. Almost 55% of manufactured jewellery is handmade by karigars (artisans) who create intricate pieces, preserving the distinct selling point for which Indian gold jewellery. However, the unorganized sector remains a dominant force in rural centers, where many jewellers also act as moneylenders within their community.

The organized manufacturers sub-segment is anticipated to show the fastest growth by 2031. Demonetization and GST have aided the expansion of organized businesses, even though the increase in import duties initially benefited unorganized commerce. Chain retailers are increasing their market share in India, according to numerous research organizations. This tendency is partly a result of shifting customer behavior and rising quality and pricing transparency awareness. All these factors are likely to promote the growth of the India B2B gold jewellery market during the forecast years.

India B2B Gold Jewellery Market, by Wearings

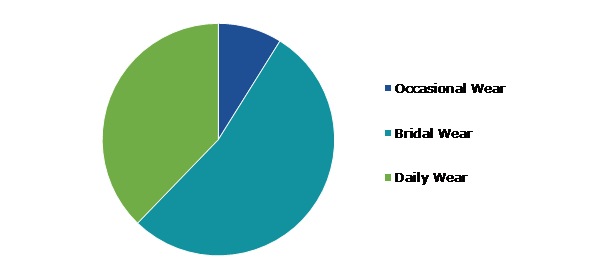

Based on wearings, the market has been divided into occasional wear, bridal wear, and daily wear. Among these, the bridal wear sub-segment accounted for the highest revenue share in 2021.

India B2B gold jewellery Market Share, by Wearings, 2021

Source: Research Dive Analysis

The bridal wear sub-segment accounted for the highest market share in 2021. Some of the factors driving the growth of the bridal wear market include an increase in urbanization and fashion upgrades, an increase in disposable income, technological advancements, the entry of local players, and an increase in luxury weddings. People are interested in the latest trends in designer brands worn by celebrities, and companies such as Manyawar are investing heavily in developing the same fashion fabrics at a low cost, which is driving the market demand for bridal wear.

India B2B Gold Jewellery Market, by Product Type

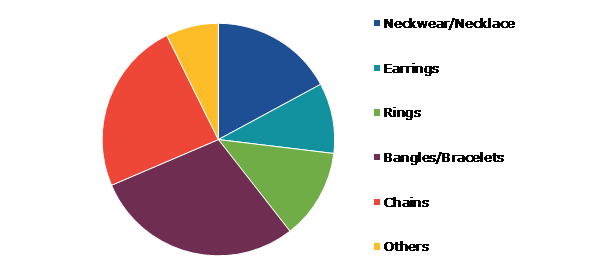

Based on product type, the market has been divided into neckwear/necklace, earrings, rings, bangles/bracelets, chains, and others. Among these, the bangles/bracelets sub-segment accounted for the highest revenue share in 2021.

India B2B Gold Jewellery Market Forecast, by Product Type, 2021

Source: Research Dive Analysis

The bangles/bracelets sub-segment accounted for the highest market share in 2021. This is because bangles are symbols of Indian literature that mark feminine grace. Indian women largely prefer gold bangles of 22 carats that are available in various designs and types. It is a tradition to wear gold bangles in India, especially after marriage that symbolized luck and prosperity. Some of the widely preferred bangles in India include kada, cuffs, filigree, kundan, and enamel. Kada is the most preferred bangle with a thick style that is made from 22-carat gold. Also, the cuff bangles are available in different varieties in minimal and versatile styles.

Kerala is well-known for traditional gold bangles that are available in different varieties and designs known as Nagapadam vala which is the traditional gold bangle popular in Kerala. Some other popular bangle designs in Kerala include Navratna vala, Palakka manga Vala, Lakshmi Vala, Ashta Lakshmi Bangles, and others. In bangles/bracelets, various fusion designs blend with traditional designs with a modern choice of metals, stones, and finishing.

India B2B Gold Jewellery Market, Regional Insights

The India B2B gold jewellery market was investigated across North, South, East, and West.

India B2B Gold Jewellery Market Size & Forecast, by Region, 2021-2031 ($ Million)

Source: Research Dive Analysis

The Market for India B2B Gold Jewellery in South to be the Most Dominant

The South India B2B gold jewellery market accounted for the highest market share in 2021. South India is a significant region in the Indian business-to-business gold jewellery market. The region is well-known for its traditional jewellery styles, and gold jewellery is highly bought due to its cultural significance. South Indian states such as Tamil Nadu, Karnataka, Kerala, and Andhra Pradesh are major players in the gold jewellery industry. One of the primary factors driving the growth of the B2B gold jewellery market in South India is the presence of a significant number of talented artists and craftsmen.

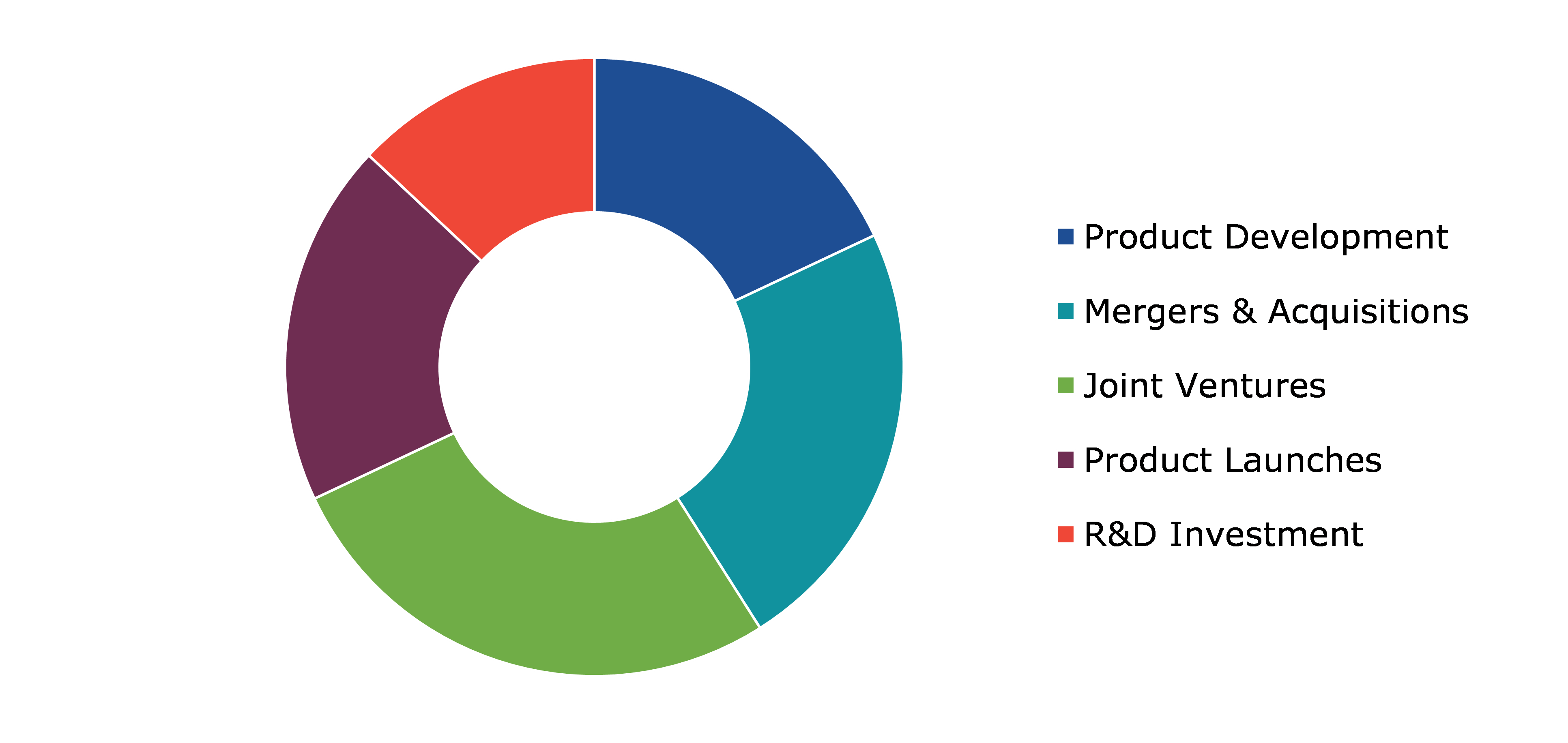

Competitive Scenario in the India B2B Gold Jewellery Market

Investment and agreement are common strategies followed by major market players. For instance, on January 20, 2022, The Gem & Jewellery Export Promotion Council and Maharashtra Industrial Development Corporation signed a draft agreement granting possession of a plot for setting up the park. The Gem & Jewellery Export Promotion Council (GJEPC), a body under the Indian government, and the Maharashtra Industrial Development Corporation (MIDC) signed a draft agreement granting possession of land for 95 years for setting up an ‘India Jewellery Park’, in Mumbai.

Source: Research Dive Analysis

Some of the leading India B2B gold jewellery market players are Derewala Industries Ltd, Alankeetcreations Llp India, Gurukrupa Gems, Essentials Jewelry, Vivah Creation, Dws Jewellery Pvt. Ltd., Dwarka Jewelry, Pinkcity Jewel House P.Ltd, Kapil Jewels & Art, and Nsb Jewels.

| Aspect | Particulars |

| Historical Market Estimations | 2020 |

| Base Year for Market Estimation | 2021 |

| Forecast Timeline for Market Projection | 2022-2031 |

| Geographical Scope | North, South, East, and West |

| Segmentation by Manufacturers |

|

| Segmentation by Wearings |

|

| Segmentation by Product Type |

|

| Key Companies Profiled |

|

Q1. What is the size of the India B2B gold jewellery market?

A. The size of the India B2B gold jewellery market was over $22,239.0 million in 2021 and is projected to reach $29,415.2 million by 2031.

Q2. Which are the major companies in the India B2B gold jewellery market?

A. Derewala Industries Ltd, Dws Jewellery Pvt. Ltd., Pinkcity Jewel House P.Ltd, and Gurukrupa Gems are some of the key players in the India B2B gold jewellery market.

Q3. Which region, among others, possesses greater investment opportunities in the future?

A. The South region possesses great investment opportunities for investors in the future.

Q4. What will be the growth rate of the South India B2B gold jewellery market?

A. The South India B2B gold jewellery market is anticipated to grow at 4.0% CAGR during the forecast period.

Q5. What are the strategies opted by the leading players in this market?

A. Agreement and investment are the two key strategies opted by the operating companies in this market.

Q6. Which companies are investing more on R&D practices?

A. Derewala Industries Ltd, Dws Jewellery Pvt. Ltd., Pinkcity Jewel House P.Ltd, and Gurukrupa Gems are the companies investing more on R&D activities for developing new products and technologies.

1.Research Methodology

1.1.Desk Research

1.2.Real time insights and validation

1.3.Forecast model

1.4.Assumptions and forecast parameters

1.5.Market size estimation

1.5.1.Top-down approach

1.5.2.Bottom-up approach

2.Report Scope

2.1.Market definition

2.2.Key objectives of the study

2.3.Report overview

2.4.Market segmentation

2.5.Overview of the impact of COVID-19 on India B2B Gold Jewellery market

3.Executive Summary

4.Market Overview

4.1.Introduction

4.2.Growth impact forces

4.2.1.Drivers

4.2.2.Restraints

4.2.3.Opportunities

4.3.Market value chain analysis

4.3.1.List of manufacturers

4.3.2.List of distributors

4.4.Innovation & sustainability matrices

4.4.1.Technology matrix

4.4.2.Regulatory matrix

4.5.Porter’s five forces analysis

4.5.1.Bargaining power of suppliers

4.5.2.Bargaining power of consumers

4.5.3.Threat of substitutes

4.5.4.Threat of new entrants

4.5.5.Competitive rivalry intensity

4.6.PESTLE analysis

4.6.1.Political

4.6.2.Economical

4.6.3.Social

4.6.4.Technological

4.6.5.Environmental

4.7.Impact of COVID-19 on India B2B Gold Jewellery market

4.7.1.Pre-covid market scenario

4.7.2.Post-covid market scenario

5.India B2B Gold Jewellery Market Analysis, by Manufacturers

5.1.Overview

5.2.Organized Manufacturers

5.2.1.Definition, key trends, growth factors, and opportunities

5.2.2.Market size analysis, by region, 2021-2031

5.3.Unorganized Manufacturers

5.3.1.Definition, key trends, growth factors, and opportunities

5.3.2.Market size analysis, by region, 2021-2031

5.4.Research Dive Exclusive Insights

5.4.1.Market attractiveness

5.4.2.Competition heatmap

6.India B2B Gold Jewellery Market Analysis, by Wearings

6.1.Occasional Wear

6.1.1.Definition, key trends, growth factors, and opportunities

6.1.2.Market size analysis, by region, 2021-2031

6.2.Bridal Wear

6.2.1.Definition, key trends, growth factors, and opportunities

6.2.2.Market size analysis, by region, 2021-2031

6.3.Daily Wear

6.3.1.Definition, key trends, growth factors, and opportunities

6.3.2.Market size analysis, by region, 2021-2031

6.4.Research Dive Exclusive Insights

6.4.1.Market attractiveness

6.4.2.Competition heatmap

7.India B2B Gold Jewellery Market Analysis, by Product Type

7.1.Neckwear/Necklace

7.1.1.Definition, key trends, growth factors, and opportunities

7.1.2.Market size analysis, by region, 2021-2031

7.2.Earrings

7.2.1.Definition, key trends, growth factors, and opportunities

7.2.2.Market size analysis, by region, 2021-2031

7.3.Rings

7.3.1.Definition, key trends, growth factors, and opportunities

7.3.2.Market size analysis, by region, 2021-2031

7.4.Bangles/Bracelets

7.4.1.Definition, key trends, growth factors, and opportunities

7.4.2.Market size analysis, by region, 2021-2031

7.5.Chains

7.5.1.Definition, key trends, growth factors, and opportunities

7.5.2.Market size analysis, by region, 2021-2031

7.6.Others

7.6.1.Definition, key trends, growth factors, and opportunities

7.6.2.Market size analysis, by region, 2021-2031

7.7.Research Dive Exclusive Insights

7.7.1.Market attractiveness

7.7.2.Competition heatmap

8.Competitive Landscape

8.1.Top winning strategies, 2021

8.1.1.By strategy

8.1.2.By year

8.2.India B2B gold jewellery market, by Company

8.3.Market share analysis, 2021

9.India B2B Gold Jewellery Market, by Region

9.1.North

9.1.1.1.Market size analysis, by Manufacturers, 2021-2031

9.1.1.2.Market size analysis, by Wearings,2021-2031

9.1.1.3.Market size analysis, by Product Type,2021-2031

9.1.2.Research Dive Exclusive Insights

9.1.2.1.Market attractiveness

9.1.2.2.Competition heatmap

9.2.South

9.2.1.1.Market size analysis, by Manufacturers, 2021-2031

9.2.1.2.Market size analysis, by Wearings,2021-2031

9.2.1.3.Market size analysis, by Product Type,2021-2031

9.2.2.Research Dive Exclusive Insights

9.2.2.1.Market attractiveness

9.2.2.2.Competition heatmap

9.3.East

9.3.1.1.Market size analysis, by Manufacturers, 2021-2031

9.3.1.2.Market size analysis, by Wearings,2021-2031

9.3.1.3.Market size analysis, by Product Type,2021-2031

9.3.2.Research Dive Exclusive Insights

9.3.2.1.Market attractiveness

9.3.2.2.Competition heatmap

9.4.West

9.4.1.1.Market size analysis, by Manufacturers, 2021-2031

9.4.1.2.Market size analysis, by Wearings,2021-2031

9.4.1.3.Market size analysis, by Product Type,2021-2031

9.4.2.Research Dive Exclusive Insights

9.4.2.1.Market attractiveness

9.4.2.2.Competition heatmap

10.Company Profiles

10.1.Derewala Industries Ltd

10.1.1.Overview

10.1.2.Business segments

10.1.3.Product portfolio

10.1.4.Financial performance

10.1.5.Recent developments

10.1.6.SWOT analysis

10.2.Alankeetcreations Llp India

10.2.1.Overview

10.2.2.Business segments

10.2.3.Product portfolio

10.2.4.Financial performance

10.2.5.Recent developments

10.2.6.SWOT analysis

10.3.Gurukrupa Gems

10.3.1.Overview

10.3.2.Business segments

10.3.3.Product portfolio

10.3.4.Financial performance

10.3.5.Recent developments

10.3.6.SWOT analysis

10.4.Essentials Jewelry

10.4.1.Overview

10.4.2.Business segments

10.4.3.Product portfolio

10.4.4.Financial performance

10.4.5.Recent developments

10.4.6.SWOT analysis

10.5.Vivah Creation

10.5.1.Overview

10.5.2.Business segments

10.5.3.Product portfolio

10.5.4.Financial performance

10.5.5.Recent developments

10.5.6.SWOT analysis

10.6.Dws Jewellery Pvt. Ltd.

10.6.1.Overview

10.6.2.Business segments

10.6.3.Product portfolio

10.6.4.Financial performance

10.6.5.Recent developments

10.6.6.SWOT analysis

10.7.Dwarka Jewelry

10.7.1.Overview

10.7.2.Business segments

10.7.3.Product portfolio

10.7.4.Financial performance

10.7.5.Recent developments

10.7.6.SWOT analysis

10.8.Pinkcity Jewel House P.Ltd

10.8.1.Overview

10.8.2.Business segments

10.8.3.Product portfolio

10.8.4.Financial performance

10.8.5.Recent developments

10.8.6.SWOT analysis

10.9.Kapil Jewels & Art

10.9.1.Overview

10.9.2.Business segments

10.9.3.Product portfolio

10.9.4.Financial performance

10.9.5.Recent developments

10.9.6.SWOT analysis

10.10.Nsb Jewels

10.10.1.Overview

10.10.2.Business segments

10.10.3.Product portfolio

10.10.4.Financial performance

10.10.5.Recent developments

10.10.6.SWOT analysis

In Indian culture, gold is very significant and is viewed as a sign of success, prosperity, and wealth. Gold is also seen as a safe investment option in India, as its value rises with time. As a result, there are numerous B2B gold jewellery businesses in the country.

The India B2B gold jewellery market contributes significantly to the country's economy. India has a long history with gold and regards it as precious. Apart from being a status symbol and a display of wealth, it also functions as a financial tool for investing and saving. Wearing jewellery is not only traditional and customary among Indians, but each piece has its own meaning and significance. Gold is an investment that increases with time because it can be quickly converted to cash. It can provide comfort and stability during difficult economic times because of its value and scarcity.

Recent Trends in the India B2B Gold Jewellery Market

Many B2B gold jewellery enterprises have started to create an online presence as e-commerce has grown in India. As a result, they can connect with a larger audience and increase the accessibility of their products. Thus, digital marketing tactics are being used by many businesses to promote their products and boost sales. Moreover, businesses that sell gold jewellery online are expanding the customizing possibilities available to their clients. This enables them to design unique jewellery products that are customized according to the individual requirements of their clients. This design is especially common in the wedding jewellery market, where couples choose unique and personalized pieces.

Newest Insights in the India B2B Gold Jewellery Market

As per a report by Research Dive, the India B2B gold jewellery market is expected to grow at a CAGR of 3.4% and generate revenue of $29,415.2 million by 2031. The primary factors driving the growth of the market are the significant role of gold jewellery in Indian tradition and the rising acceptance of modern and everyday jewellery. However, the high expense of producing gold jewellery and the stringent laws governing the import and export of gold jewellery are expected to hinder the market growth.

The India B2B gold jewellery market in the South is expected to remain dominant in the coming years. The region's high revenue in 2021 was driven by the presence of a large number of skilled craftsmen and artists. As a result, there is now a greater demand for trained technicians and artisans who can make complex patterns and fine gold jewellery.

How are Market Players Responding to the Rising Demand for Gold Jewellery?

Key players of the India B2B jewellery market are responding to the rising demand for B2B gold jewellery by investing in research and development to create new and innovative designs that appeal to the changing interests and preferences of consumers. Additionally, they are utilizing technology to improve the quality of their products and streamline their manufacturing process.

In addition, market players are increasingly focusing on strategic partnerships and collaborations with other players in the industry to leverage their strengths and expand their reach. Some of the foremost players in the India B2B gold jewellery market are Gurukrupa Gems, Alankeetcreations Llp India, Derewala Industries Ltd, Essentials Jewelry, Vivah Creation, Dwarka Jewelry, Pinkcity Jewel House P.Ltd, Dws Jewellery Pvt. Ltd., Kapil Jewels & Art, Nsb Jewels, and others. These players are focused on implementing strategies such as mergers and acquisitions, novel developments, collaborations, and partnerships to reach a leading position in the market.

For instance:

- In February 2021, Informa Markets, a leading B2B exhibition organizer in India that also organizes jewellery exhibits, announced its new project, 'Jewellery Connect,' India's first multicity gathering for the purchaser and seller communities in the gems and jewellery business.

- In October 2022, Malabar Gold & Diamonds, one of the nation's major networks of jewellery stores for gold and diamonds, launched the Malabar Gems & Jewellery Manufacturing Unit in Telangana, which was handed over with a foundation stone laying ceremony.

- In March 2023, Kisna from Hari Krishna Group, a leading manufacturer of diamond jewellery, launched its first franchise location in the Chhattisgarh state capital, Raipur. The new showroom offers designs and collections for every age group that have been carefully chosen to reflect local tastes.

COVID-19 Impact on the India B2B Gold Jewellery Market

The COVID-19 pandemic had an adverse impact on the India B2B gold jewellery market. Governments in various parts of India imposed stringent restrictions, nationwide lockdowns, and prohibited travel owing to the rapid spread of COVID-19. Moreover, due to the concern that the virus would spread, the country's jewels industry came to a complete halt, with hardly any customers entering jewellery stores. Several jewellers were forced to close their storefronts in malls and shopping centres. The impact of COVID-19 on the sector was severe, with thousands of artisans who relied on orders being out of jobs because of the lockdown. Furthermore, the market was negatively impacted by the shortage of trained labour during the pandemic because the gold jewellery is fully labor-oriented. However, the India B2B gold jewellery market is expected to recover soon during the post-pandemic period.

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com