High Frequency Ventilators Market Report

RA08646

High Frequency Ventilators Market by Type (High-frequency Oscillatory Ventilator, High-frequency Jet Ventilator, and High-frequency Percussive Ventilator), Application (Neonate and Others), End-user (Hospitals and Others), and Regional Analysis (North America, Europe, Asia-Pacific, and LAMEA): Global Opportunity Analysis and Industry Forecast, 2022-2031

Global High Frequency Ventilators Market Analysis

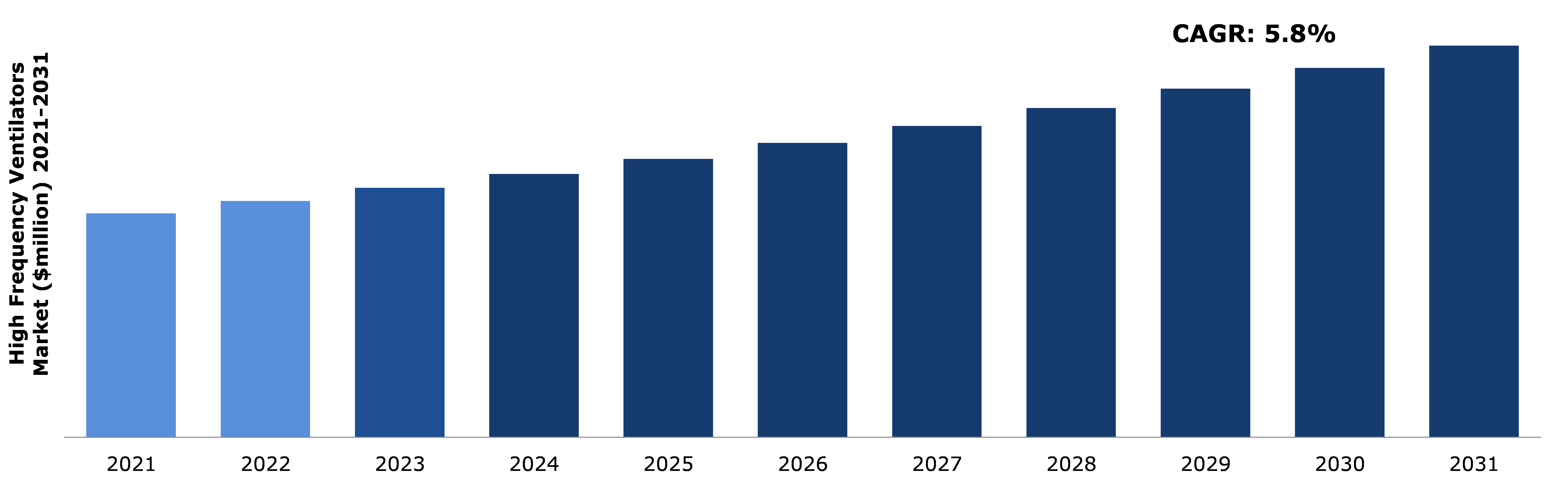

The Global High Frequency Ventilators Market Size was $92.7 million in 2021 and is predicted to grow with a CAGR of 5.8%, by generating a revenue of $162.1 million by 2031.

Global High Frequency Ventilators Market Synopsis

The growing incidences of preterm childbirth globally and breathing issues associated with early birth are expected to drive the high frequency ventilators market share growth during the forecast time. Newborn respiratory distress syndrome (NRDS) is a lung disease that affects premature babies and decreases the life expectancy of the child. Thus, to prevent the severity caused by the disease, the demand for potent treatment options has increased which is expected to boost the high frequency ventilators market during the forecast period.

The market growth is expected to be restricted owing to the non-availability of skilled professionals and researchers for operating high frequency ventilators during the forecast period. Also, the high cost of installing high frequency ventilators in small and medium hospitals and clinics in developing and underdeveloped countries is further expected to restrain market growth in the future.

Increase in government support through an increase in funding for improving healthcare standards and providing the highest quality of treatment to premature babies in order to improve life expectancy is expected to drive high frequency ventilators market expansion. Also, increased reimbursement policies to enable common people to benefit from newly developed respiratory disease management services are creating excellent opportunities for the key players operating in the high frequency ventilators market.

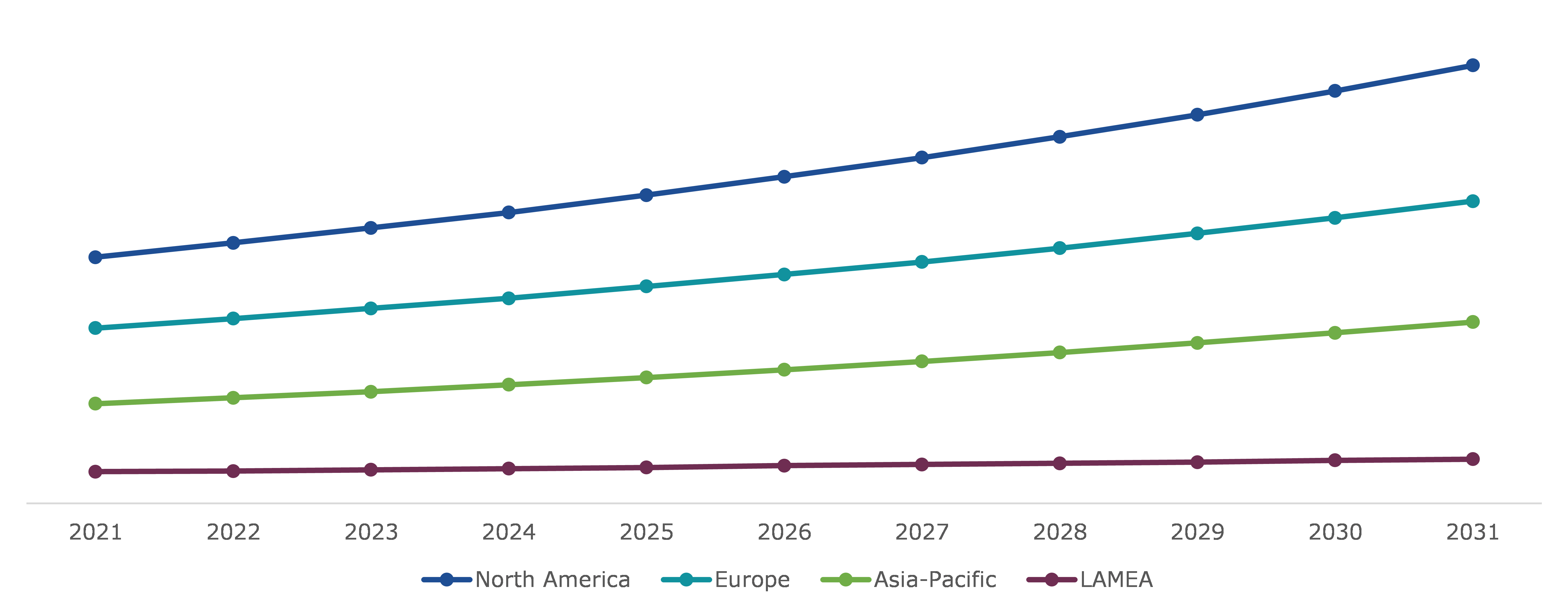

According to regional analysis, the North America high frequency ventilators market accounted for a dominating market share in 2021. The regional growth is majorly attributed to extensive research ongoing in the field of cancer research and treatment options like high frequency ventilators and chemotherapy by researchers.

High Frequency Ventilators Market Overview

High-frequency ventilators are designed to deliver the lowest tidal volume feasible by breathing at substantially higher frequencies than ordinary ventilators. High-frequency ventilators are certified for hundreds of cycles per minute operation. When conventional ventilation fails, high-frequency ventilation (HFV) is used to replace it. It is a technique in which the set respiratory rate is significantly higher than the typical breathing rate. The tidal volume provided in this rescue approach is much less and may be less than dead space ventilation. A high frequency ventilator is a bedside machine used in HFV. The ventilator delivers oxygen and eliminates carbon dioxide through a breathing tube put in the child's windpipe. Depending on the child's condition, healthcare experts can alter the equipment as needed.

COVID-19 Impact on Global High Frequency Ventilators Market

The COVID-19 pandemic has had a moderate impact on the high frequency ventilators market industry. In 2020, the high frequency ventilator market witnessed a significant increase in demand whereas the product supply was severely affected, globally. A significant gap in ventilator supplies resulted in panic buying around the world to meet the increase in the number of patients requiring breathing support. The development of new vendors was noticed, with large transactions signed by firms that had never been seen before. Existing vendors who were able to increase output were also leading the market in terms of market share. Numerous inadequate ventilators were purchased which was not very useful for some healthcare professionals due to limited supplies at several places. Thus, this factor further increased the demand and supply gap in the market during the pandemic.

As the COVID-19 pandemic worsened, the prevalence of preterm childbirth increased which resulted in the high demand for high frequency ventilators. Premature babies have a weak respiratory system owing to which they require oxygen from outside sources like ventilators. This factor has increased the market growth during the pandemic period.

Growing Prevalence of Severe Breathing Diseases among People to Drive Market Growth

The need for effective disease treatment has increased due to the increase in the frequency of respiratory diseases like Acute Respiratory Distress Syndrome (ARDS) cases worldwide, especially among the geriatric population, and this is expected to drive the growth of high frequency ventilators market during the forecast period. ARDS is a rapid, widespread, inflammatory form of injury that can be fatal in seriously ill individuals. It is characterized by poor oxygenation, pulmonary infiltration, and an abrupt start. As per the report published in December 2022, ‘Acute respiratory distress syndrome: Epidemiology, pathophysiology, pathology, and etiology in adults’, every year approximately 10% to 15% of total patients admitted to ICU owing to their respiratory diseases suffer ARDS and approximately 23% of patients treated with mechanical ventilator suffer from ARDS and require high frequency ventilators. Apart from this, the growing cases of preterm childbirth and breathing issues associated with early childbirth are likely to drive the market growth even further.

To know more about global high frequency ventilators market drivers, get in touch with our analysts here.

High Cost of High Frequency Ventilations to Restrain Market Growth

The high frequency ventilators are very expensive as these are expensive technologies and require the latest technological precision for manufacturing. Thus, most small-scale hospitals, especially situated in small towns and rural areas of developing and underdeveloped countries are unable to afford and maintain the technology. This factor is expected to hinder the market growth during the forecast time. Also, not many healthcare technicians and professionals are aware of the functionality of such ventilators and hence are unable to operate the machines. This is also one of the major factors likely to impede the high frequency ventilators market growth during the forecast time frame.

Scientific Advancements in the R&D Field in Medical Devices to Create Market Opportunities

Various technological breakthroughs, such as the development of sophisticated portable ventilators and improvements in sensor technologies utilized in ventilators, are expected to provide attractive market prospects. Furthermore, advances in non-invasive and microprocessor-controlled portable ventilators will provide several potential prospects for the industry. Furthermore, an increase in government funding for establishing fully equipped healthcare facilities in rural areas of developing and underdeveloped countries is likely to create several growth opportunities for the key players operating in the high frequency ventilators market in the future.

To know more about global high frequency ventilators market opportunities, get in touch with our analysts here.

Global High Frequency Ventilators Market, by Type

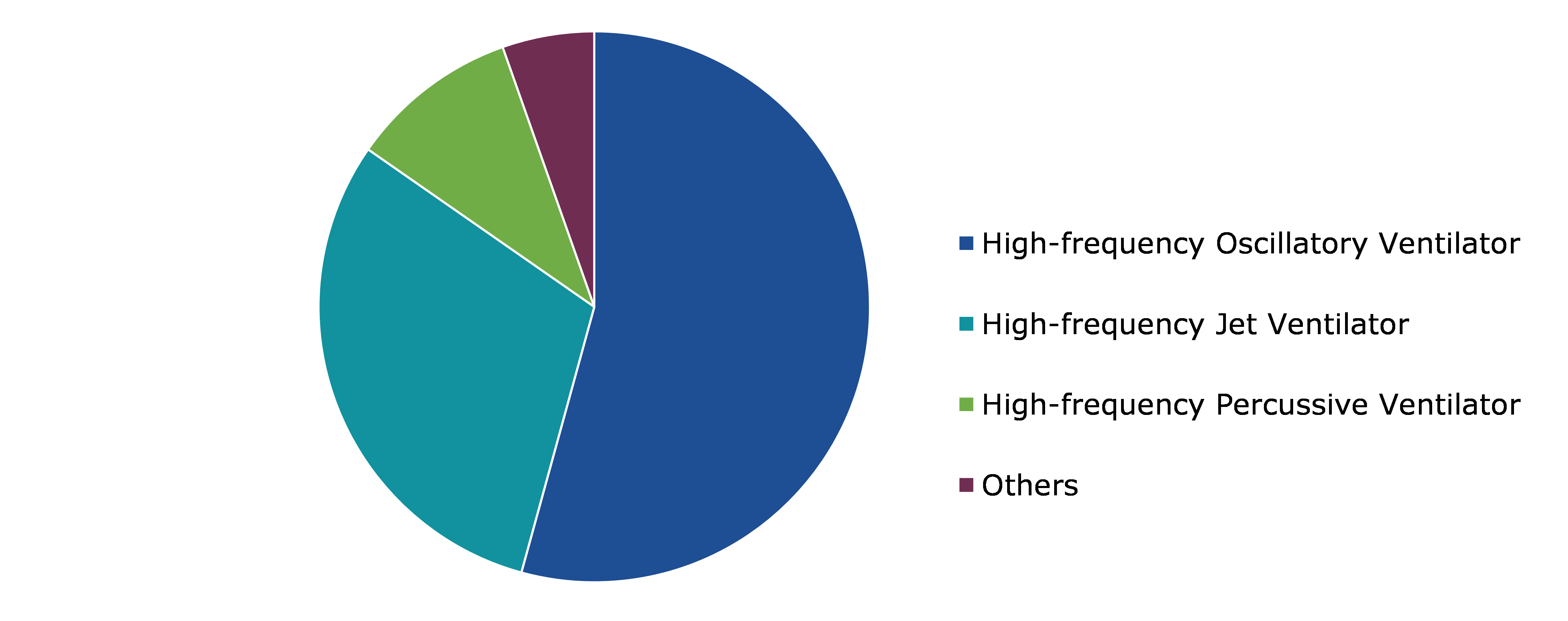

By type, the market has been divided into high-frequency oscillatory ventilator, high-frequency jet ventilator, high-frequency percussive ventilator, and others. Among these, the high-frequency oscillatory ventilator segment accounted for a dominant market share in 2021 and the high-frequency jet ventilator segment is anticipated to witness the fastest growth during the forecast period.

Global High Frequency Ventilators Market Share, by Type, 2021

Source: Research Dive Analysis

The high-frequency oscillatory ventilator segment accounted for a dominant market share in 2021. High frequency oscillatory ventilation (HFOV) is an alternate technique of mechanical ventilation that can aid a patient in certain circumstances and can be used as a 'lung protective approach' in the therapy of some severe lung disorders. The most popular high-frequency ventilator for adults is HFOV. The ventilatory and oxygenation needs of newborns, full-term infants, and kids who might be failing despite conventional ventilation can be supported by HFOVs. The primary mechanical distinction between the jet ventilator and conventional ventilators is the employment of a diaphragmatically sealed, electromagnetically driven piston.

Global High Frequency Ventilators Market, by Application

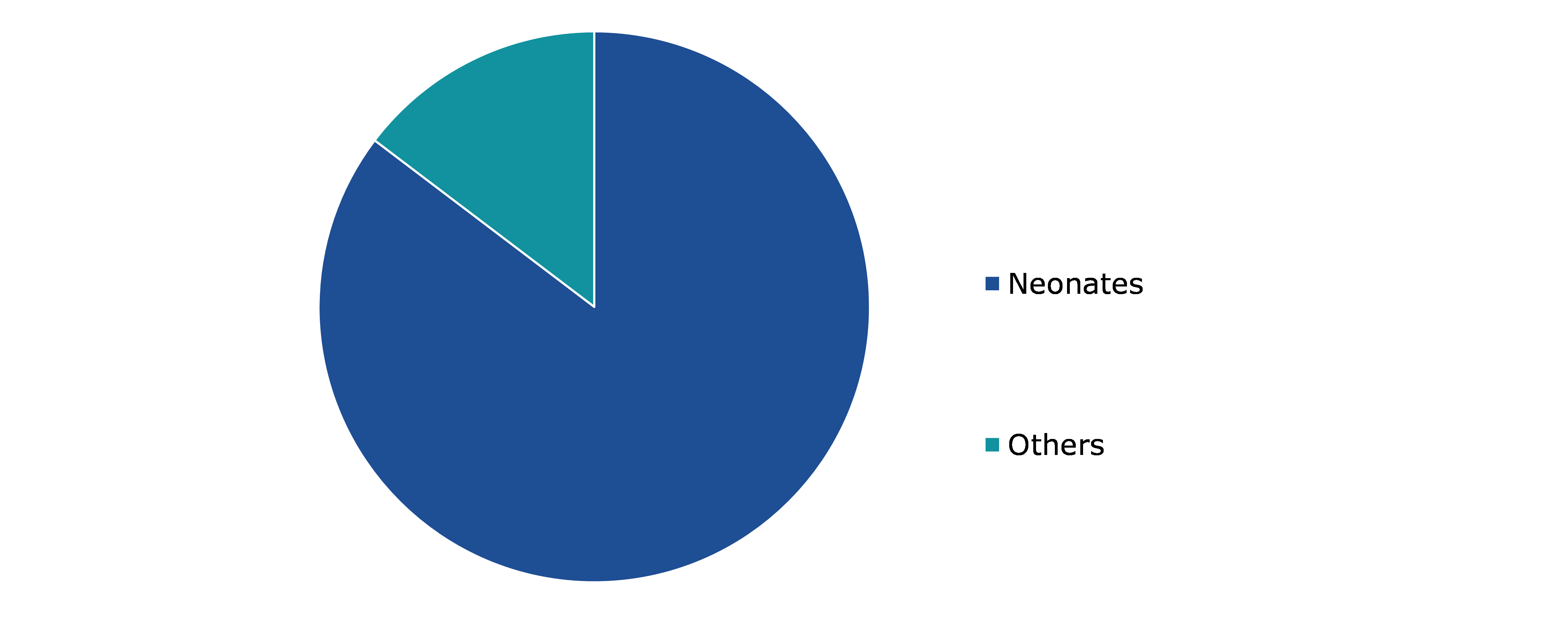

By application, the market has been divided into neonates and others. Among these, the neonates segment accounted for a dominant market share in 2021 and is anticipated to show the fastest growth during the forecast period.

Global High Frequency Ventilators Market Size, by Application, 2021

Source: Research Dive Analysis

The neonates segment accounted for a dominant market share in 2021. Growing cases of blood cancer cases among people, globally, have increased the demand for cancer monoclonal antibody treatment. Preterm birth rates are increasing due to a number of factors. The lungs of premature newborns are undeveloped and they require assistance with breathing as they are unable to breathe on their own. These factors are projected to boost the global high frequency ventilators market growth during the forecast period.

Global High Frequency Ventilators Market, by End-user

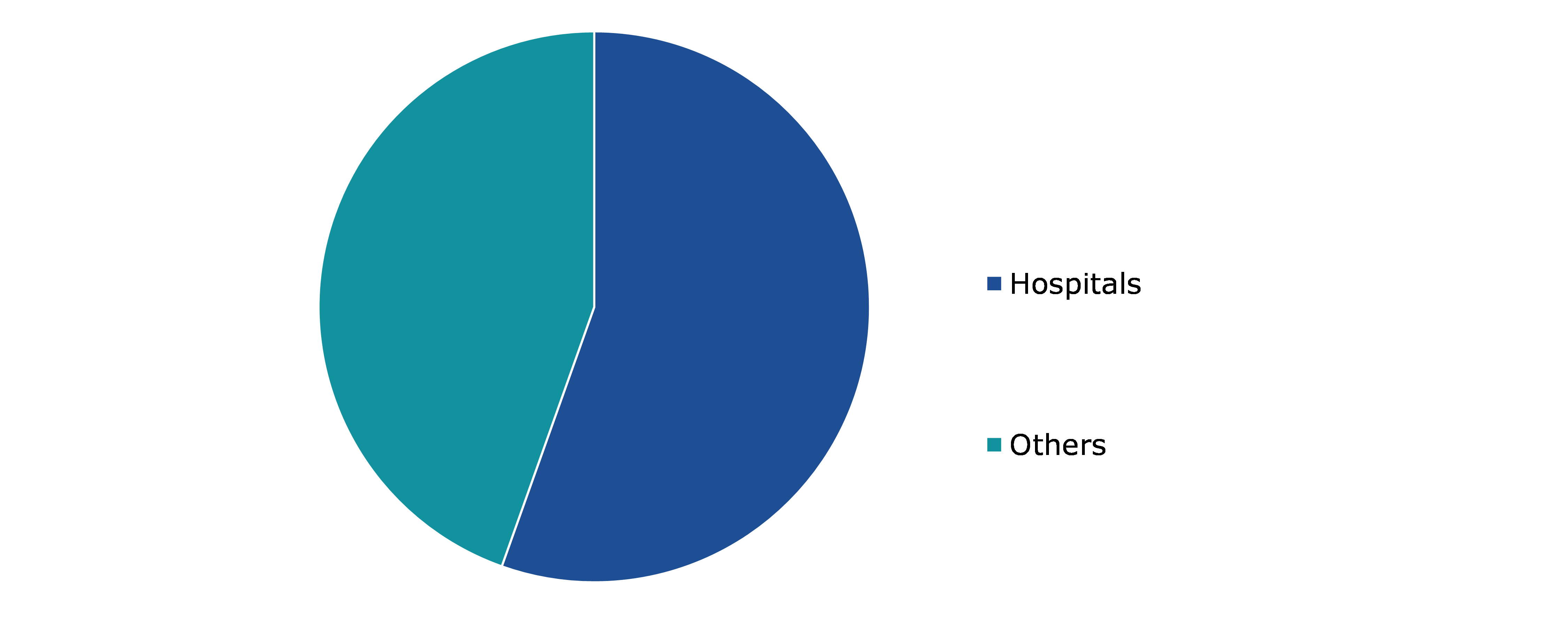

By end-user, the market has been divided into hospitals and others. Among these, the hospitals segment accounted for a dominant market share in 2021 and is anticipated to witness the fastest growth during the forecast period.

Global High Frequency Ventilators Market Forecast, by End-user, 2021

Source: Research Dive Analysis

The hospitals segment accounted for a dominant market share in 2021. Increase in government expenditures on the development of healthcare infrastructure has increased hospital spending, owing to which more technologically advanced ventilators are being installed in ICUs. In addition, the availability of competent health care providers to operate these ventilators, an increase in emphasis on better health outcomes, and an increase in hospital productivity all contribute to the segment growth. Furthermore, patients' preference for modern healthcare facilities is projected to expand owing to the constant monitoring offered by hospital employees.

Global High Frequency Ventilators Market, Regional Insights

The high frequency ventilators market was analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Global High Frequency Ventilators Market Size & Forecast, by Region, 2021-2031 ($ Million)

Source: Research Dive Analysis

The High Frequency Ventilators Market in North America to be the Most Dominant

The North America high frequency ventilators market size accounted for a dominating market share in 2021. The region offers tremendous growth opportunities for key players operating in the high frequency ventilators market. The market for high frequency ventilators market is expected to grow in North America owing to the region's growing prevalence of preterm childbirth and the high risk of respiratory concerns associated with it. Also, the increase in demand for a treatment option, and the rise in R&D on the development of advanced care units for premature babies has further driven the regional market growth. Technologically advanced established R&D centers and the availability of top industry players like Philips in the region are further anticipated to drive the market growth.

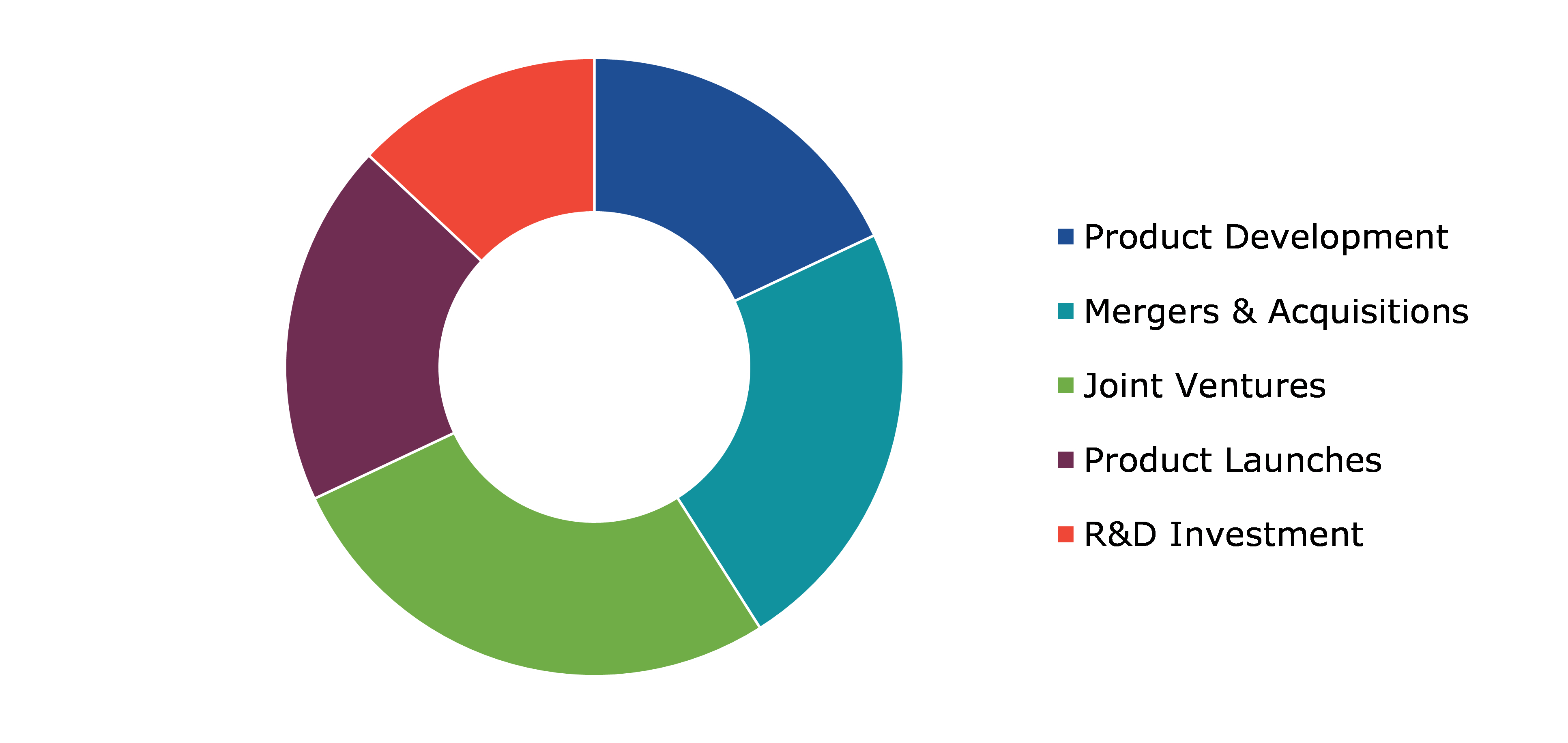

Competitive Scenario in Global High Frequency Ventilators Market

Investment and agreement are common strategies followed by major market players. For instance, in October 2021, Movair, a respiratory treatment firm, debuted Luisa, a sophisticated ventilator designed for use in homes, institutions, hospitals, or portable applications for both invasive and non-invasive ventilation.

Source: Research Dive Analysis

Some of the leading high frequency ventilators market players are Percussion Aire Corp., Bunnell 436 Lawndale Drive, ACUTRONIC Medical Systems AG, An Inspiration Healthcare Group Company, VYAIRE MEDICAL, INC., Carl Reiner GmbH, BPL Medical Technologies, General Electric Company, and Getinge AB.

| Aspect | Particulars |

| Historical Market Estimations | 2020 |

| Base Year for Market Estimation | 2021 |

| Forecast Timeline for Market Projection | 2022-2031 |

| Geographical Scope | North America, Europe, Asia-Pacific, and LAMEA |

| Segmentation by Type |

|

| Segmentation by Application |

|

| Segmentation by End-user |

|

| Key Companies Profiled |

|

Q1. What is the size of the global high frequency ventilators market?

A. The global high frequency ventilators market size was $92.7 million in 2021 and is predicted to grow with a CAGR of 5.8%, by generating a revenue of $ 62.1 million by 2031.

Q2. Which are the major companies in the high frequency ventilators market?

A. Vyaire Medical, Inc. is the key player in the global high frequency ventilators market.

Q3. Which region, among others, possesses greater investment opportunities in the future?

A. Asia-Pacific possesses great investment opportunities for investors in the future.

Q4. What will be the growth rate of the North America high frequency ventilators market?

A. North America high frequency ventilators market is anticipated to grow at a CAGR of 6.0% during the forecast period.

Q5. What are the strategies opted by the leading players in the market?

A. Agreement and investment are the two key strategies opted by the operating companies in this market.

1.Research Methodology

1.1.Desk Research

1.2.Real time insights and validation

1.3.Forecast model

1.4.Assumptions and forecast parameters

1.5.Market size estimation

1.5.1.Top-down approach

1.5.2.Bottom-up approach

2.Report Scope

2.1.Market definition

2.2.Key objectives of the study

2.3.Report overview

2.4.Market segmentation

2.5.Overview of the impact of COVID-19 on Global High Frequency Ventilators market

3.Executive Summary

4.Market Overview

4.1.Introduction

4.2.Growth impact forces

4.2.1.Drivers

4.2.2.Restraints

4.2.3.Opportunities

4.3.Market value chain analysis

4.3.1.List of raw material suppliers

4.3.2.List of manufacturers

4.3.3.List of distributors

4.4.Innovation & sustainability matrices

4.4.1.Technology matrix

4.4.2.Regulatory matrix

4.5.Porter’s five forces analysis

4.5.1.Bargaining power of suppliers

4.5.2.Bargaining power of consumers

4.5.3.Threat of substitutes

4.5.4.Threat of new entrants

4.5.5.Competitive rivalry intensity

4.6.PESTLE analysis

4.6.1.Political

4.6.2.Economical

4.6.3.Social

4.6.4.Technological

4.6.5.Environmental

4.7.Impact of COVID-19 on High Frequency Ventilators market

4.7.1.Pre-covid market scenario

4.7.2.Post-covid market scenario

5.High Frequency Ventilators Market Analysis, by Type

5.1.Overview

5.2.High-frequency Oscillatory Ventilator

5.2.1.Definition, key trends, growth factors, and opportunities

5.2.2.Market size analysis, by region, 2021-2031

5.2.3.Market share analysis, by country, 2021-2031

5.3.High-frequency Jet Ventilator

5.3.1.Definition, key trends, growth factors, and opportunities

5.3.2.Market size analysis, by region, 2021-2031

5.3.3.Market share analysis, by country, 2021-2031

5.4.High-frequency Percussive Ventilator

5.4.1.Definition, key trends, growth factors, and opportunities

5.4.2.Market size analysis, by region, 2021-2031

5.4.3.Market share analysis, by country, 2021-2031

5.5.Others

5.5.1.Definition, key trends, growth factors, and opportunities

5.5.2.Market size analysis, by region, 2021-2031

5.5.3.Market share analysis, by country, 2021-2031

5.6.Research Dive Exclusive Insights

5.6.1.Market attractiveness

5.6.2.Competition heatmap

6.High Frequency Ventilators Market Analysis, by Application

6.1.Overview

6.2.Neonates

6.2.1.Definition, key trends, growth factors, and opportunities

6.2.2.Market size analysis, by region, 2021-2031

6.2.3.Market share analysis, by country, 2021-2031

6.3.Others

6.3.1.Definition, key trends, growth factors, and opportunities

6.3.2.Market size analysis, by region, 2021-2031

6.3.3.Market share analysis, by country, 2021-2031

6.4.Research Dive Exclusive Insights

6.4.1.Market attractiveness

6.4.2.Competition heatmap

7.High Frequency Ventilators Market Analysis, by End-user

7.1.Overview

7.2.Hospitals

7.2.1.Definition, key trends, growth factors, and opportunities

7.2.2.Market size analysis, by region, 2021-2031

7.2.3.Market share analysis, by country, 2021-2031

7.3.Others

7.3.1.Definition, key trends, growth factors, and opportunities

7.3.2.Market size analysis, by region, 2021-2031

7.3.3.Market share analysis, by country, 2021-2031

7.4.Research Dive Exclusive Insights

7.4.1.Market attractiveness

7.4.2.Competition heatmap

8.High Frequency Ventilators Market, by Region

8.1.North America

8.1.1.U.S.

8.1.1.1.Market size analysis, by Type

8.1.1.2.Market size analysis, by Application

8.1.1.3.Market size analysis, by End-user

8.1.2.Canada

8.1.2.1.Market size analysis, by Type

8.1.2.2.Market size analysis, by Application

8.1.2.3.Market size analysis, by End-user

8.1.3.Mexico

8.1.3.1.Market size analysis, by Type

8.1.3.2.Market size analysis, by Application

8.1.3.3.Market size analysis, by End-user

8.1.4.Research Dive Exclusive Insights

8.1.4.1.Market attractiveness

8.1.4.2.Competition heatmap

8.2.Europe

8.2.1.Germany

8.2.1.1.Market size analysis, by Type

8.2.1.2.Market size analysis, by Application

8.2.1.3.Market size analysis, by End-user

8.2.2.UK

8.2.2.1.Market size analysis, by Type

8.2.2.2.Market size analysis, by Application

8.2.2.3.Market size analysis, by End-user

8.2.3.France

8.2.3.1.Market size analysis, by Type

8.2.3.2.Market size analysis, by Application

8.2.3.3.Market size analysis, by End-user

8.2.4.Spain

8.2.4.1.Market size analysis, by Type

8.2.4.2.Market size analysis, by Application

8.2.4.3.Market size analysis, by End-user

8.2.5.Italy

8.2.5.1.Market size analysis, by Type

8.2.5.2.Market size analysis, by Application

8.2.5.3.Market size analysis, by End-user

8.2.6.Rest of Europe

8.2.6.1.Market size analysis, by Type

8.2.6.2.Market size analysis, by Application

8.2.6.3.Market size analysis, by End-user

8.2.7.Research Dive Exclusive Insights

8.2.7.1.Market attractiveness

8.2.7.2.Competition heatmap

8.3.Asia-Pacific

8.3.1.China

8.3.1.1.Market size analysis, by Type

8.3.1.2.Market size analysis, by Application

8.3.1.3.Market size analysis, by End-user

8.3.2.Japan

8.3.2.1.Market size analysis, by Type

8.3.2.2.Market size analysis, by Application

8.3.2.3.Market size analysis, by End-user

8.3.3.India

8.3.3.1.Market size analysis, by Type

8.3.3.2.Market size analysis, by Application

8.3.3.3.Market size analysis, by End-user

8.3.4.Australia

8.3.4.1.Market size analysis, by Type

8.3.4.2.Market size analysis, by Application

8.3.4.3.Market size analysis, by End-user

8.3.5.South Korea

8.3.5.1.Market size analysis, by Type

8.3.5.2.Market size analysis, by Application

8.3.5.3.Market size analysis, by End-user

8.3.6.Rest of Asia-Pacific

8.3.6.1.Market size analysis, by Type

8.3.6.2.Market size analysis, by Application

8.3.6.3.Market size analysis, by End-user

8.3.7.Research Dive Exclusive Insights

8.3.7.1.Market attractiveness

8.3.7.2.Competition heatmap

8.4.LAMEA

8.4.1.Brazil

8.4.1.1.Market size analysis, by Type

8.4.1.2.Market size analysis, by Application

8.4.1.3.Market size analysis, by End-user

8.4.2.Saudi Arabia

8.4.2.1.Market size analysis, by Type

8.4.2.2.Market size analysis, by Application

8.4.2.3.Market size analysis, by End-user

8.4.3.UAE

8.4.3.1.Market size analysis, by Type

8.4.3.2.Market size analysis, by Application

8.4.3.3.Market size analysis, by End-user

8.4.4.South Africa

8.4.4.1.Market size analysis, by Type

8.4.4.2.Market size analysis, by Application

8.4.4.3.Market size analysis, by End-user

8.4.5.Rest of LAMEA

8.4.5.1.Market size analysis, by Type

8.4.5.2.Market size analysis, by Application

8.4.5.3.Market size analysis, by End-user

8.4.6.Research Dive Exclusive Insights

8.4.6.1.Market attractiveness

8.4.6.2.Competition heatmap

9.Competitive Landscape

9.1.Top winning strategies, 2021

9.1.1.By strategy

9.1.2.By year

9.2.Strategic overview

9.3.Market share analysis, 2021

10.Company Profiles

10.1.Percussion Aire Corp.

10.1.1.Overview

10.1.2.Business segments

10.1.3.Product portfolio

10.1.4.Financial performance

10.1.5.Recent developments

10.1.6.SWOT analysis

10.2.Bunnell 436 Lawndale Drive

10.2.1.Overview

10.2.2.Business segments

10.2.3.Product portfolio

10.2.4.Financial performance

10.2.5.Recent developments

10.2.6.SWOT analysis

10.3.ACUTRONIC Medical Systems AG

10.3.1.Overview

10.3.2.Business segments

10.3.3.Product portfolio

10.3.4.Financial performance

10.3.5.Recent developments

10.3.6.SWOT analysis

10.4.An Inspiration Healthcare Group Company

10.4.1.Overview

10.4.2.Business segments

10.4.3.Product portfolio

10.4.4.Financial performance

10.4.5.Recent developments

10.4.6.SWOT analysis

10.5.VYAIRE MEDICAL, INC

10.5.1.Overview

10.5.2.Business segments

10.5.3.Product portfolio

10.5.4.Financial performance

10.5.5.Recent developments

10.5.6.SWOT analysis

10.6.Carl Reiner GmbH

10.6.1.Overview

10.6.2.Business segments

10.6.3.Product portfolio

10.6.4.Financial performance

10.6.5.Recent developments

10.6.6.SWOT analysis

10.7.BPL Medical Technologies

10.7.1.Overview

10.7.2.Business segments

10.7.3.Product portfolio

10.7.4.Financial performance

10.7.5.Recent developments

10.7.6.SWOT analysis

10.8.General Electric Company

10.8.1.Overview

10.8.2.Business segments

10.8.3.Product portfolio

10.8.4.Financial performance

10.8.5.Recent developments

10.8.6.SWOT analysis

10.9.Getinge AB

10.9.1.Overview

10.9.2.Business segments

10.9.3.Product portfolio

10.9.4.Financial performance

10.9.5.Recent developments

10.9.6.SWOT analysis

11.Appendix

11.1.Parent & peer market analysis

11.2.Premium insights from industry experts

11.3.Related reports

High frequency ventilators are particularly useful for premature infants with underdeveloped lungs, who require respiratory support to survive. These ventilators provide gentle, continuous positive airway pressure (CPAP) to help the lungs inflate and deflate properly ensuring adequate oxygenation. High frequency ventilators deliver very small tidal volumes at high frequencies to assist in lung function and promote oxygen exchange. In adults, high frequency ventilation is used in cases where traditional ventilation methods have failed or are unlikely to succeed. High frequency ventilation has proven to be particularly useful in treating patients with acute respiratory distress syndrome (ADRS) and other conditions where the lungs have been severely compromised. These devices provide numerous health benefits such as reduced lung injury, improved oxygenation, better patient comfort, faster recovery, and many more.

Forecast Analysis of the Global High Frequency Ventilators Market

According to the report published by Research Dive, the global high frequency ventilators market is anticipated to garner a revenue of $162.1 million and grow at a CAGR of 5.8% over the estimated timeframe from 2022 to 2031.

The growing incidences of chronic respiratory diseases including acute respiratory distress syndrome (ARDS) among individuals, particularly among the geriatric population across the globe is expected to augment the growth of the high frequency ventilators market over the analysis period. Moreover, the growing advancements in non-invasive and microprocessor-controlled portable ventilators are expected to create wide growth opportunities for the market over the forecast timeframe. Furthermore, the increasing government funding for establishing fully equipped healthcare facilities in rural areas of developing and underdeveloped countries is expected to boost the market’s growth over the estimated timeframe. However, the high cost of high frequency ventilators may restrict the growth of the market throughout the forecast period.

The major players of the high frequency ventilators market include Getinge AB, Percussion Aire Corp., General Electric Company, Bunnell, BPL Medical Technologies, ACUTRONIC Medical Systems AG, Carl Reiner GmbH, An Inspiration Healthcare Group Company, VYAIRE MEDICAL, INC., and many more.

Key Market Developments

The key companies operating in the industry are adopting various growth strategies & business tactics such as partnerships, collaborations, mergers & acquisitions, and launches to maintain a robust position in the overall market, which is subsequently helping the global high frequency ventilators market to grow exponentially. For instance:

- In April 2021, Dräger, a leading manufacturer of medical equipment announced its acquisition of Stimit AG, an innovative medical technology company. With this acquisition, Dräger aimed to expand its portfolio by expertizing in the field of lung-protective ventilation and focusing on the development of non-invasive stimulation of respiratory muscles.

- In May 2021, CorVent Medical, a leading MedTech company that develops various lifesaving ventilators for critical care announced that it had received CE Mark approval to launch its new product namely, RESPOND-19™ Ventilator for commercial use in Europe. This novel product is designed to provide flexible and easy-to-use ventilation care solutions for patients suffering from acute respiratory distress syndrome.

- In January 2023, Getinge, a global medical technology company announced the launch of its new product, the Servo-c mechanical ventilator to provide lung-protective therapeutic tools for treating both pediatric and adult patients. Servo-c is specifically designed to make healthcare accessible and affordable for several hospitals across the globe.

Most Profitable Region

The North America region of the high frequency ventilators market generated the highest market share in 2021. The increasing demand for treatment options for various respiratory diseases and the rising R&D activities on the development of advanced care units for premature babies across the region are expected to fortify the regional growth of the market over the analysis timeframe. Moreover, the presence of leading market players in the region is another major factor expected to drive regional growth in the coming period.

Covid-19 Impact on the High Frequency Ventilators Market

Though the outbreak of the Covid-19 pandemic has devastated several industries, it has had a positive impact on the high frequency ventilators market. This is mainly due to the panic buying of ventilators by customers across the globe to meet their breathing requirements. Moreover, the purchasing of numerous inadequate ventilators by some healthcare professionals due to limited supplies at several places has further increased the demand for ventilators during the pandemic. Moreover, the increased prevalence of preterm childbirth during the pandemic has resulted in high demand for high frequency ventilators. Though there existed a gap between the demand and supply of ventilators, still the market has experienced a moderate impact with the rise of the pandemic.

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com