Paving Stone Market Report

RA08645

Paving Stone Market by Paving Material (Concrete Pavers, Natural Stone Pavers, and Clay Brick Pavers), Natural Stone Pavers (Granite, Marble, Limestone, Slate, Sandstone, and Others), Application (Driveway, Walkway, Patio, Pool Decks, Garden, and Others), End-Use (Residential Construction and Commercial Construction), and Regional Analysis (North America, Europe, Asia-Pacific, and LAMEA): Global Opportunity Analysis and Industry Forecast, 2022-2031

Global Paving Stone Market Analysis

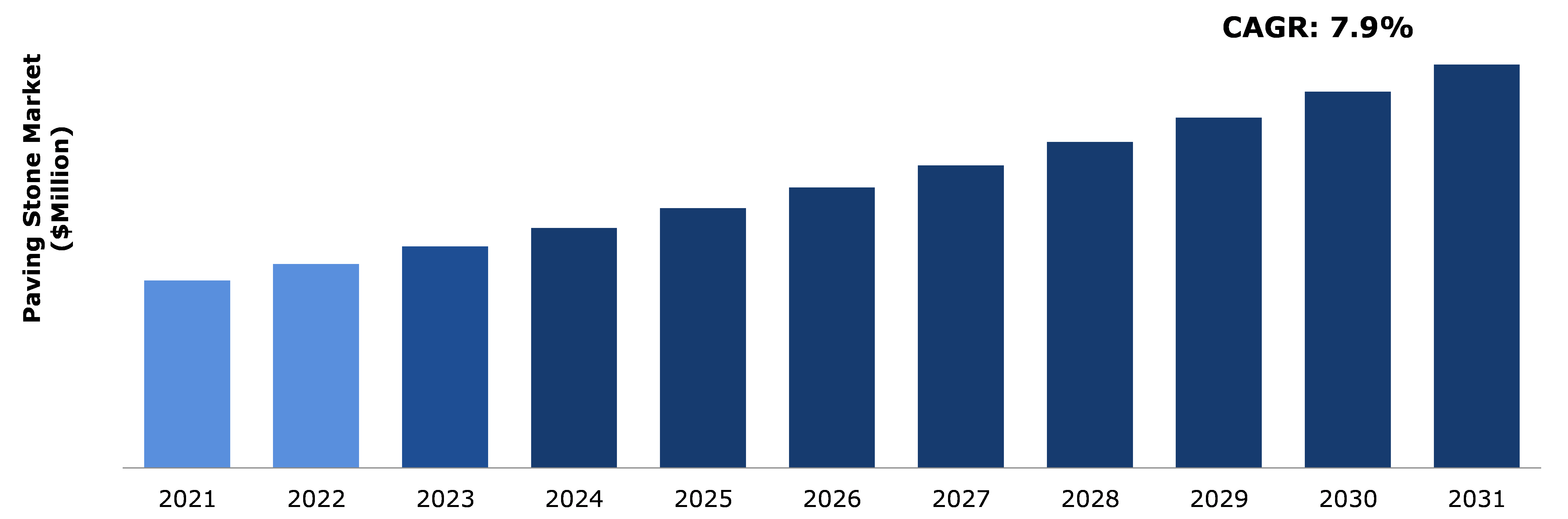

The Global Paving Stone Market Size was $ 40,289.30 million in 2021 and is predicted to grow with a CAGR of 7.9%, by generating a revenue of $ 86,730.90 million by 2031.

Global Paving Stone Market Synopsis

Natural stones are utilized to build drivable and pedestrian walkways outside using stone pavers. Road surfaces, walkways, patios, and courtyards are examples of these components. They can also be utilized to breathe life into outdoor fires, gardens, and swimming pools. All stones have some degree of durability, but none are as durable as natural stones. These are resistant to every wear and tear and therefore a great option for getting a durable pavement that will last for many years. Additionally, they can tolerate many weather variations. The pavements will remain the same in appearance and texture in spite of rain, wind, or hurricane.

Natural stone has the drawback of absorbing moisture much more quickly than concrete or brick. During the winter, moisture within the stones may freeze and cause the pavers to crack. This causes a visible fracture to form on the stone's surface, which can make the patio look less appealing overall.

The expanding building industry in India, particularly in urban areas, is estimated to drive the paving stone market growth. Along with this, more and more house owners wish to enhance the beauty of their properties with lovely paved roads and walkways. In addition, it is anticipated that the demand for paver blocks will rise as a result of the government's emphasis on public-private partnerships (PPPs) for infrastructure development. However, a significant obstacle for the sector continues to be the lack of knowledge regarding the advantages of employing paver blocks.

According to regional analysis, the terms of volume, Asia-Pacific is expected to contribute for more than 70% of the worldwide paving materials market by 2021. Due to the region's rapid population expansion and the presence of some of the world's largest markets, such as China, Indonesia, and India, Asia-Pacific is seeing substantial investments in infrastructure and building and construction sectors. Furthermore, the Asia-Pacific building business is expanding rapidly.

Paving Stone Overview

Paving Stone, also known as the term "pavé," a common stone setting technique, is derived from the French word for paved or cobblestoned. Concrete, natural stone, clay brick, or even porcelain can be used to make pavers. They are typically little fragments of varying sizes. Homeowners can choose from a variety of hues, patterns, and textures. They are long lasting and durable. Pavers adjust to seasonal and climate changes, and are low maintenance.

COVID-19 Impact on the Global Paving Stone Market

The COVID-19 pandemic led to the suspension of manufacturing and transportation. The quarantine or "lockdown" period in the nation had a direct impact on the global market. Due to increased demand and new enquiries, the natural stone market almost ran out of supplies because these two things are its fundamental pillars. The requirement to maintain a minimum 2-meter social distance caused the building and architectural industries to cease operations completely, making it practically difficult for the sector to function normally. International sourcing of natural stones has been severely impacted as a direct result of the closure of the import-export market, including high-quality imported marble from nations like Spain, Italy, Turkey, etc. Export business was negatively impacted, causing a sharp decline in demand from both the domestic and international markets.

The completion of the consignment is impacted by the entire cessation of transport between inter district and interstate levels. Orders that needed to be delivered but had no way of doing so became stranded there. B2B demand has decreased because it is unclear when the project will resume or whether there will still be a need for commercial space given the rise of the work from home culture. Along with personal safety and adhering to social distance standards, safety and hygiene protocols have been a top priority. It has grown to be a challenging task, particularly in the quarries, with workers returning to their homes during the lockdown. It has been challenging to balance staff for the intended incoming work and projects. All these factors had a negative impact on the growth of paving stone market share growth in the pandemic time period.

Paving Stone in Industrial and Commercial Sector to Drive the Market Growth

Paving stone has immense growth across global products. For instance, pavers can yield a return on investment of up to 70% on one’s property. Pavers enhance outdoor areas. A patio with patterns or a pathway leading to the garden will provide visual interest and break up a monotonous lawn area. Pavers are also easier to maintain than wood decks and are more durable than cement slabs, so there is no need to bother about staining and sealing wood every few years or, unlike wood, replacing damaged deck boards. If one paver fractures, it can be replaced rather than having to redo the entire patio as would with a slab, and pavers won't shift or crack like a slab patio. If done correctly, paver patios and driveways can survive well over 50 years. Pavers are simple to maintain and inexpensive to fix. These factors are estimated to drive the paving stone market growth during forecast period.

To know more about global paving stone market drivers, get in touch with our analysts here.

Disadvantages of Paving Stone to Restrain the Market Growth

Due to the interlocking nature of block paving, weeds and moss can grow in the gaps and quickly spread across the entire area if the blocks are not properly positioned next to one another. During paver block installation, airborne seeds in the air drop in the sand and sprout between the paver blocks over time. Sand is washed out of block paving as a result of routine cleaning; as a result, gaps form and vegetation and moss grow between the pavers. When block paving is not cleaned for a lengthy period of time, circular areas emerge on the top surface of the paver, and these places welcome lichen (a simple slow-growing plant.) These factors are expected to restrain the paving stone market share growth.

Growing Uses of Paving Stone to Drive Excellent Opportunities

The demand for clay and concrete for construction projects is growing in the building sector which is one of the most important elements driving the increase of the block paving industry. One of the primary reasons for the block paving expansion is that as the economy improves, an increasing number of people are interested in implementing the cutting-edge construction concepts that have become available. The aggregate demand for concrete and clay construction bricks and paving stones is driving the paving stone market revenue growth.

To know more about global paving stone market opportunities, get in touch with our analysts here.

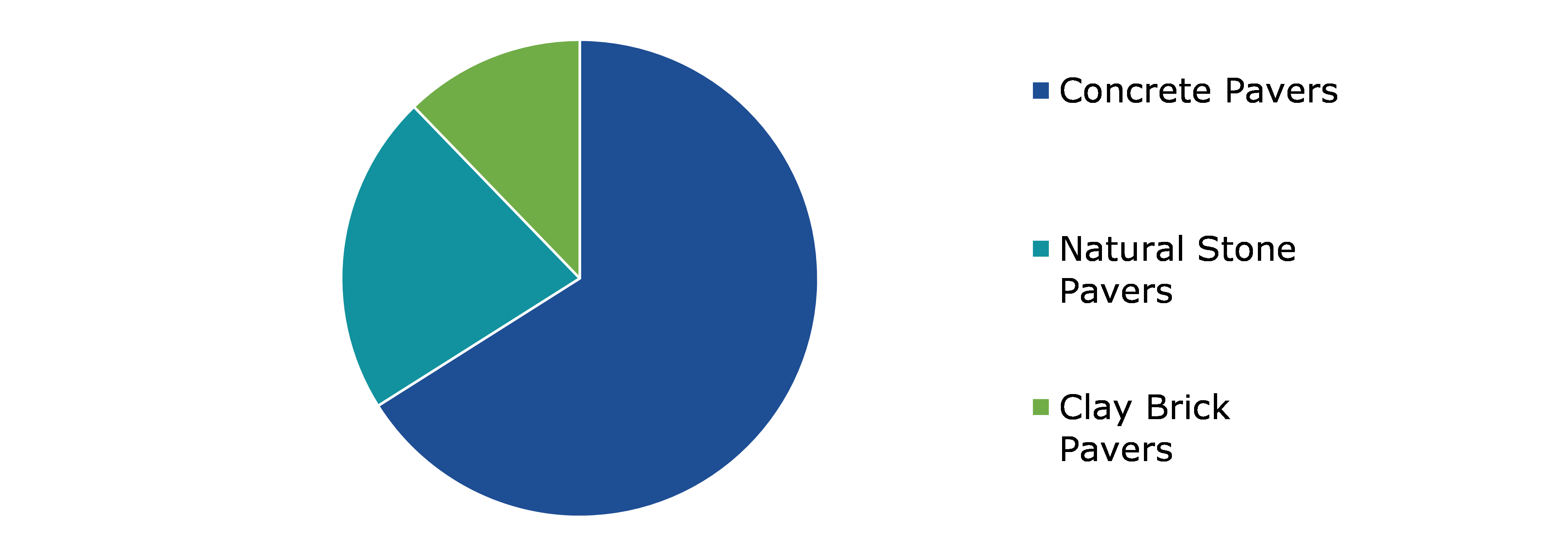

Global Paving Stone Market, by Paving Material

Based on paving material, the market has been divided into concrete pavers, natural stone pavers, and clay brick pavers. Among these, the concrete pavers sub-segment accounted for the highest market share in 2021 whereas the natural stone pavers sub-segment is estimated to show the fastest growth during the forecast period.

Global Paving Stone Market Size, by Paving Material, 2021

Source: Research Dive Analysis

The Concrete Pavers sub-type is anticipated to have a dominant share in 2021. In concrete paving applications, adaptability is more important than quality. Leading paver manufacturers, like Gomaco, Power Curbers, Terex, and Wirtgen, all provide high mobility equipment that may be configured to handle a variety of duties. The benefit of these smaller pavers for a contractor is that they can be swiftly constructed to do a variety of jobs such as gutter, barrier, and variable width surfaces. Because of their mobility, these units may be moved swiftly from one location to another. They can also handle tight radii, and certain models (such as Gomaco's latest GT-3600 or Power Curbers' 2700-C) can even be set up to perform left or right side pouring.

The Natural Stone Pavers sub-type is anticipated to show the fastest growth in 2021. Natural stone, in addition to being aesthetically beautiful, has significant benefits for the end user in terms of durability and lifetime. It preserves its appearance over time, improving with age, unlike items made from composite aggregate mixes, which may become revealed after a few years of trafficking. Natural stone paving is also resistant to frost. Another advantage of natural stone over other hardscape choices is its ease of maintenance.

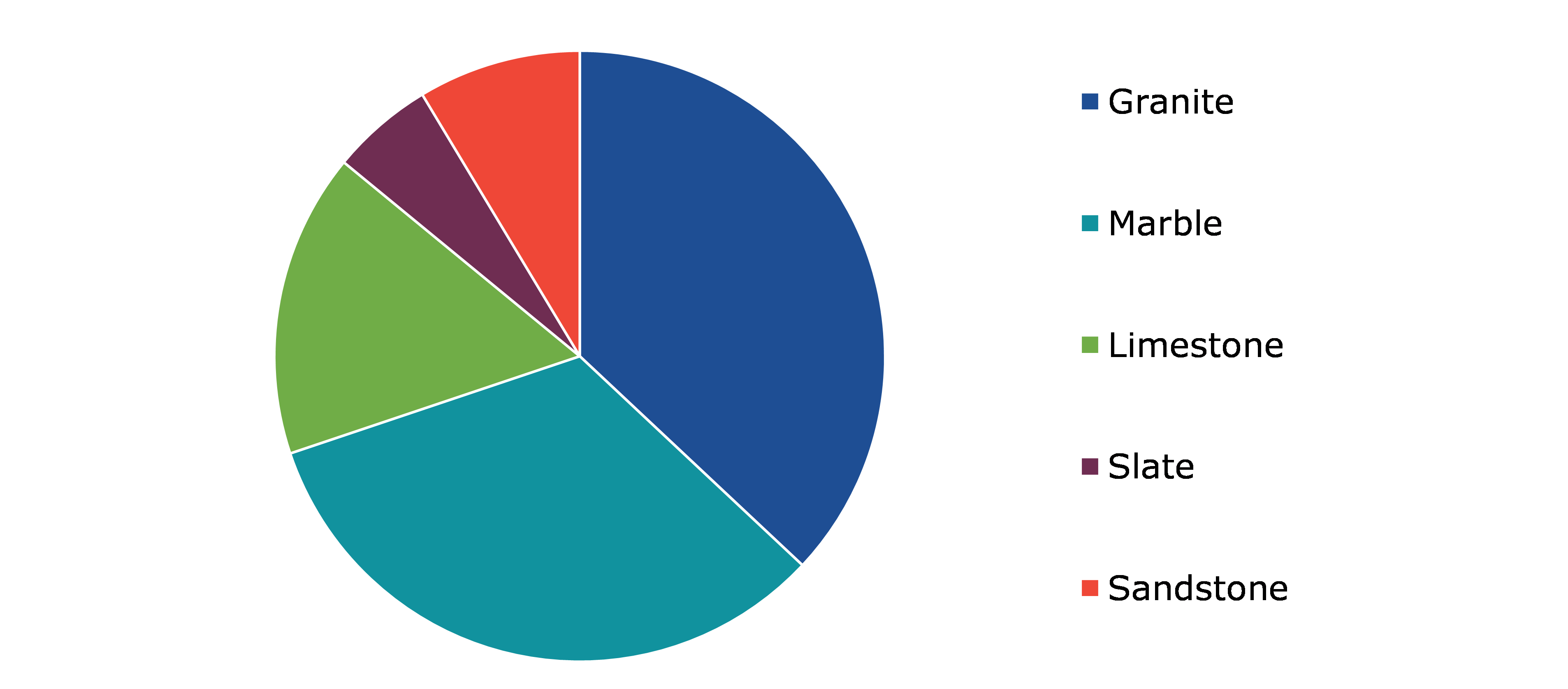

Global Paving Stone Market, by Natural Stone Pavers

Based on natural stone pavers, the market has been divided into granite, marble, limestone, slate, sandstone, and others. Among these, the Granite sub-segment accounted for highest revenue share in 2021.

Global Paving Stone Market Share, by Natural Stone Pavers 2021

Source: Research Dive Analysis

The Granite sub-segment is anticipated to have a dominant market in 2021. Granite is the most resistant stone on the market and can, hence, withstand extreme temperatures. These fire- and heat-resistant qualities are emphasized when granite is used as counter tops, as they can withstand direct heat from culinary equipment without warping. Granite is commonly used to construct long-lasting constructions such as temples, gravestones, and memorials. Granite carving was time-consuming prior to the availability of power tools/equipment. As a result, the stone was only employed for essential projects.

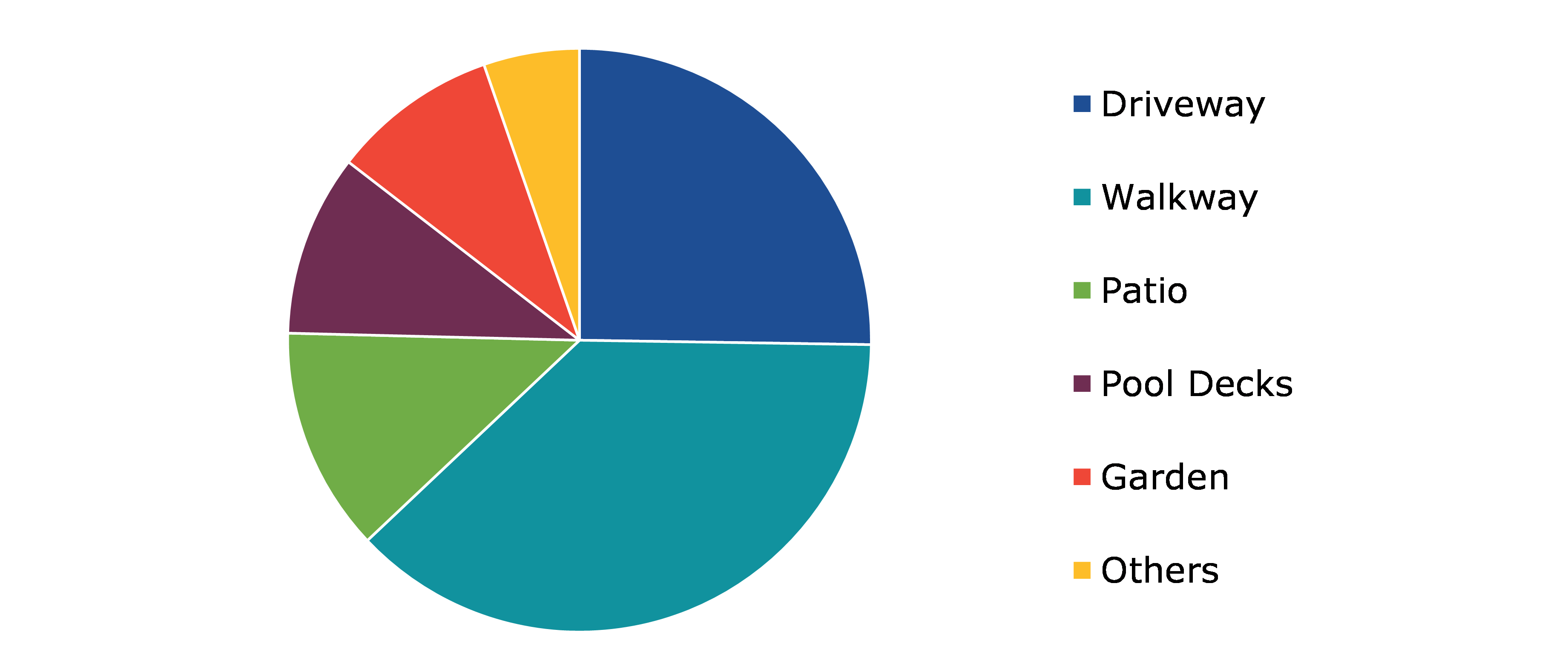

Global Paving Stone Market, by Application

Based on application, the market has been divided into driveway, walkway, patio, pool decks, garden, and others. Among these, the walkway sub-segment accounted for highest revenue share in 2021.

Global Paving Stone Market Forecast, by Application, 2021

Source: Research Dive Analysis

The Walkways sub-segment is anticipated to have a dominant market in 2021. The major objective of constructing a walkway is to provide a level and safe path for people to walk on. Walkways make it easy to stroll, especially while wearing high heels, or if there are elderly people around, or the weather is bad! If there are children or elderly people at home, there is even more reason to create a pave stone walkway for their safety.

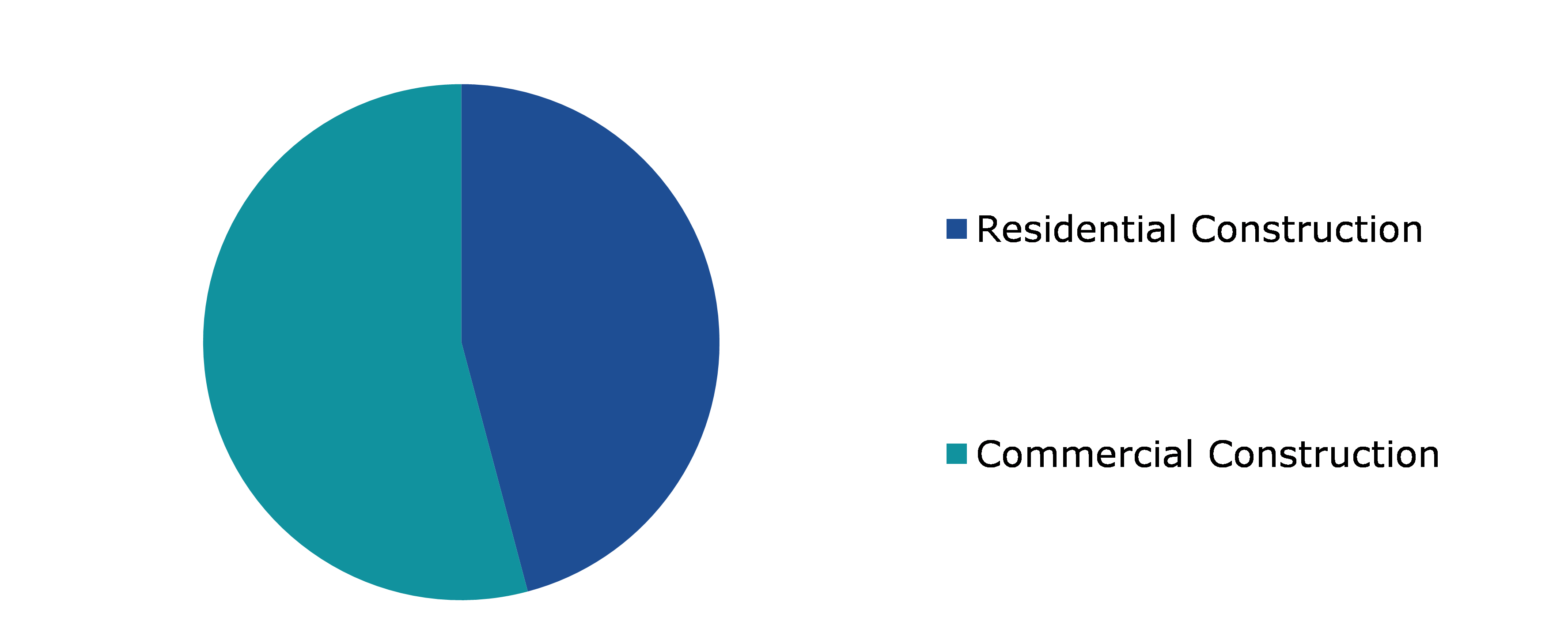

Global Paving Stone Market, by End-use

Based on end-use, the market has been divided into residential construction and commercial construction. Among these, the commercial construction sub-segment accounted for highest revenue share in 2021.

Global Paving Stone Market Trends, by End-use, 2021

Source: Research Dive Analysis

The Commercial Construction sub-segment is anticipated to have a dominant market in 2021. One of the most significant materials in the construction sector is paver stone. It is made from cement and crushed stone and is used to construct sidewalks, patios, and other outdoor buildings. Paver Stone is commonly utilized in commercial settings such as retail malls, restaurants, and other such establishments. Commercial pavers are typically less expensive than residential pavers. Many of the blocks in this category are constructed of concrete, a heavier material.

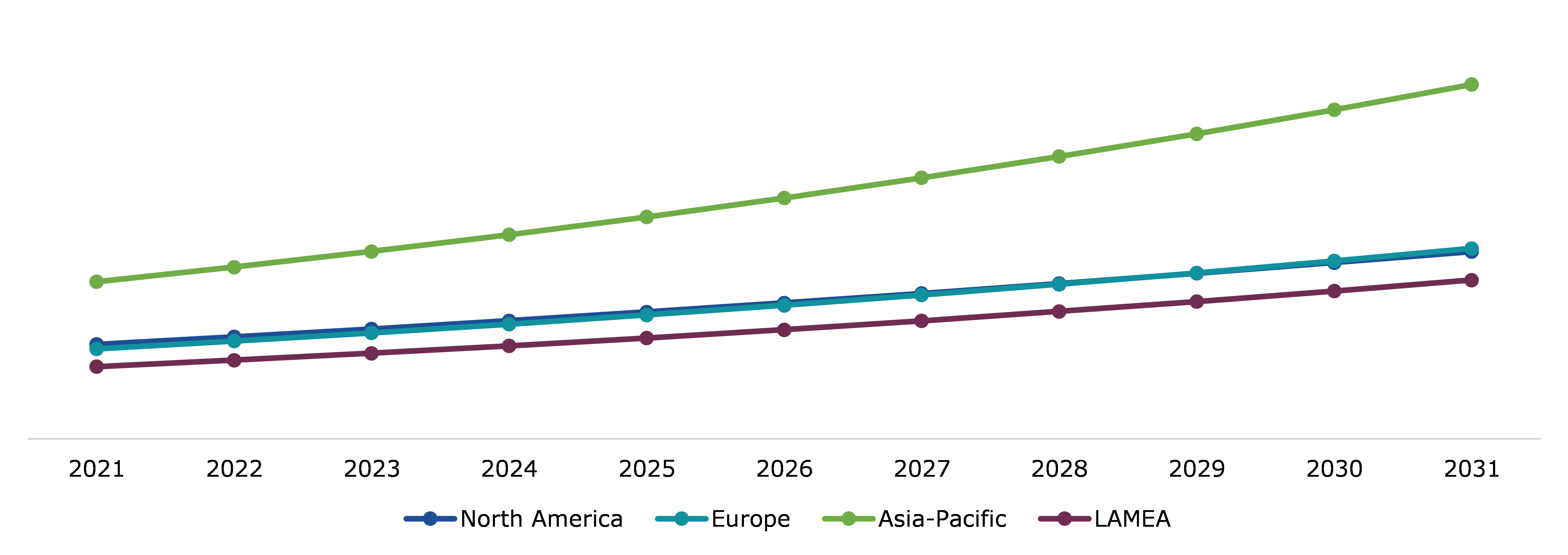

Global Paving Stone Market, Regional Insights

The paving stone market was investigated across North America, Europe, Asia-Pacific, and LAMEA.

Global Paving Stone Market Size & Forecast, by Region, 2021-2031 (USD Million)

Source: Research Dive Analysis

The Market for Paving Stone in Asia-Pacific to be the Most Dominant

The Asia-Pacific paving stone market accounted $15,301.90 million in 2021 and is projected to grow with a CAGR of 8.4%. The demand for paving stone in the Asia-Pacific region is driven by China, India, Japan, Australia, and Indonesia which dominate the pave stone market. The rise in the number of vehicles on the road, followed by the need for more environmentally friendly materials to pave roads, the expansion of the global economic system, the emergence in the need for more durable and longer lasting roads, and the increase in urbanization are some of the major factors driving the growth of the paving materials market. The region's emerging economies are projected to see significant demand for concrete block as the construction industry expands due to rapid economic development and government initiatives toward infrastructure building. These countries' expanding populations constitute a sizable customer base. Massive expansion in residential and non-residential building, as well as low-maintenance, time-efficient, and cost-effective solutions are driving the growth of the Asia-Pacific paving stone market.

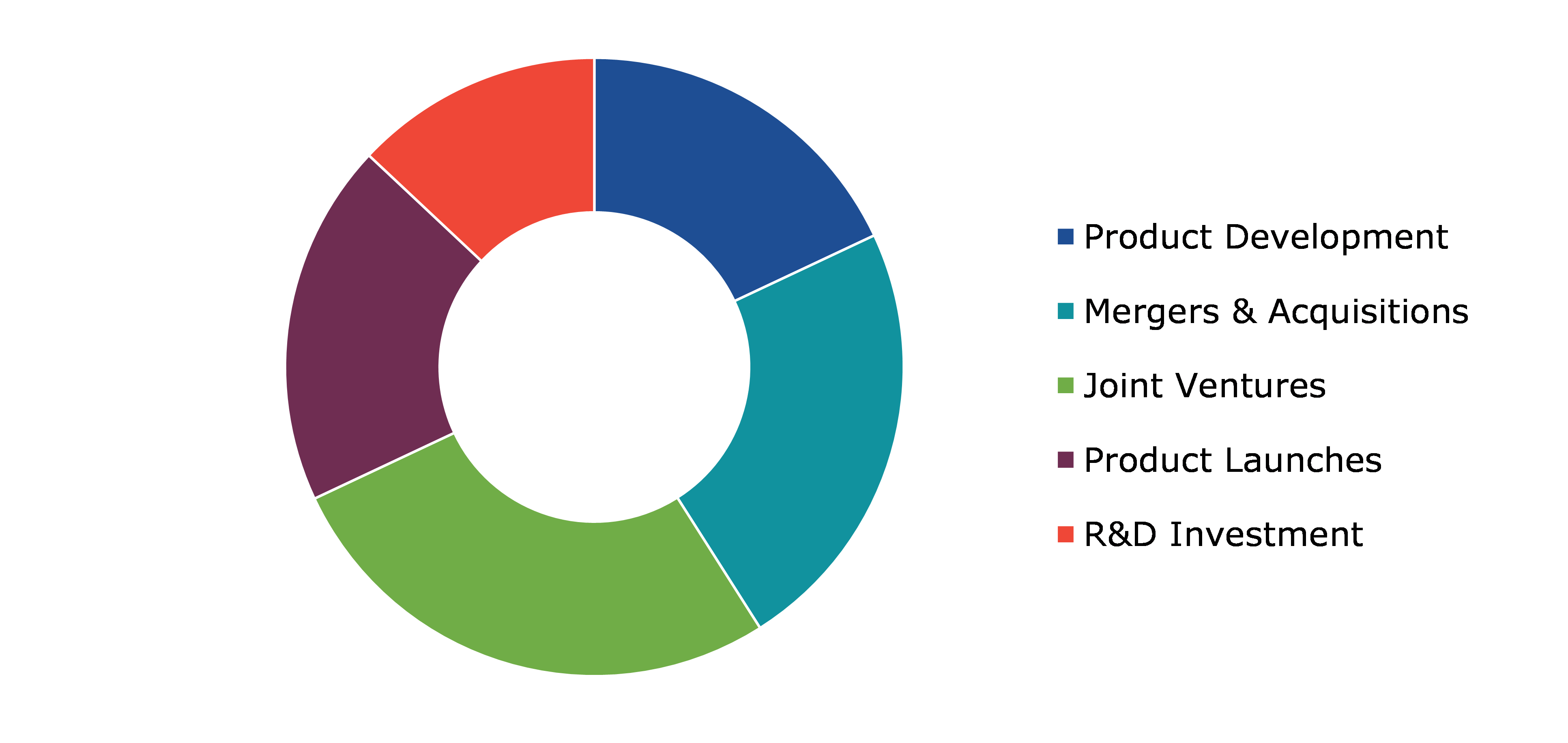

Competitive Scenario in the Global Paving Stone Market

Investment and agreement are common strategies followed by major market players. For instance, Mr. Obinna Okpara's K2O Entertainment and Mr. Emeka Okparaji's Hermès Paving Stones announced their new alliance on May 12, 2021, which resulted in the merger of the two conglomerate enterprises.

Source: Research Dive Analysis

Some of the leading paving stone market players are Marshalls, NewLine Hardscapes, Belgard, Fendt Builder, Rosetta, King's Material, Anchor Block Company, Brock International, Midwest Manufacturing, and Wienerberger.

| Aspect | Particulars |

| Historical Market Estimations | 2020 |

| Base Year for Market Estimation | 2021 |

| Forecast Timeline for Market Projection | 2022-2031 |

| Geographical Scope | North America, Europe, Asia-Pacific, and LAMEA |

| Segmentation by Paving Material |

|

| Segmentation by Natural Stone Pavers

|

|

| Segmentation by Application

|

|

| Segmentation by End-use

|

|

| Key Companies Profiled |

|

Q1. What is the size of the global paving stone market?

A. The size of the global paving stone market was over $40,289.30 million in 2021 and is projected to reach $86,730.90 million by 2031.

Q2. Which are the major companies in the paving stone market?

A. Marshalls, NewLine Hardscapes, and Belgard are some of the key players in the global paving stone market.

Q3. Which region, among others, possesses greater investment opportunities in the near future?

A. The Asia-Pacific region possesses great investment opportunities for investors to witness the most promising growth in the future.

Q4. What will be the growth rate of the Asia-Pacific paving stone market?

A. Asia-Pacific paving stone market is anticipated to grow at 7.9% CAGR during the forecast period.

Q5. What are the strategies opted by the leading players in this market?

A. Product development and mergers & acquisitions are the key strategies opted by the operating companies in this market.

Q6. Which companies are investing more on R&D practices?

A. Marshalls, NewLine Hardscapes, Belgard, Fendt Builder, Rosetta, and King's Material are the companies investing more on R&D activities for developing new products and technologies.

1.Research Methodology

1.1.Desk Research

1.2.Real time insights and validation

1.3.Forecast model

1.4.Assumptions and forecast parameters

1.5.Market size estimation

1.5.1.Top-down approach

1.5.2.Bottom-up approach

2.Report Scope

2.1.Market definition

2.2.Key objectives of the study

2.3.Report overview

2.4.Market segmentation

2.5.Overview of the impact of COVID-19 on Global Paving Stone market

3.Executive Summary

4.Market Overview

4.1.Introduction

4.2.Growth impact forces

4.2.1.Drivers

4.2.2.Restraints

4.2.3.Opportunities

4.3.Market value chain analysis

4.3.1.List of raw material suppliers

4.3.2.List of manufacturers

4.3.3.List of distributors

4.4.Innovation & sustainability matrices

4.4.1.Technology matrix

4.4.2.Regulatory matrix

4.5.Porter’s five forces analysis

4.5.1.Bargaining power of suppliers

4.5.2.Bargaining power of consumers

4.5.3.Threat of substitutes

4.5.4.Threat of new entrants

4.5.5.Competitive rivalry intensity

4.6.PESTLE analysis

4.6.1.Political

4.6.2.Economical

4.6.3.Social

4.6.4.Technological

4.6.5.Environmental

4.7.Impact of COVID-19 on Paving Stone market

4.7.1.Pre-covid market scenario

4.7.2.Post-covid market scenario

5.Paving Stone Market Analysis, by Paving Material

5.1.Overview

5.2.Concrete Pavers

5.2.1.Definition, key trends, growth factors, and opportunities

5.2.2.Market size analysis, by region

5.2.3.Market share analysis, by country

5.3.Natural Stone Pavers

5.3.1.Definition, key trends, growth factors, and opportunities

5.3.2.Market size analysis, by region

5.3.3.Market share analysis, by country

5.4.Clay Brick Pavers

5.4.1.Definition, key trends, growth factors, and opportunities

5.4.2.Market size analysis, by region

5.4.3.Market share analysis, by country

5.5.Research Dive Exclusive Insights

5.5.1.Market attractiveness

5.5.2.Competition heatmap

6.Paving Stone Market Analysis, by Natural Stone Pavers

6.1.Granite

6.1.1.Definition, key trends, growth factors, and opportunities

6.1.2.Market size analysis, by region

6.1.3.Market share analysis, by country

6.2.Marble

6.2.1.Definition, key trends, growth factors, and opportunities

6.2.2.Market size analysis, by region

6.2.3.Market share analysis, by country

6.3.Limestone

6.3.1.Definition, key trends, growth factors, and opportunities

6.3.2.Market size analysis, by region

6.3.3.Market share analysis, by country

6.4.Slate

6.4.1.Definition, key trends, growth factors, and opportunities

6.4.2.Market size analysis, by region

6.4.3.Market share analysis, by country

6.5.Sandstone

6.5.1.Definition, key trends, growth factors, and opportunities

6.5.2.Market size analysis, by region

6.5.3.Market share analysis, by country

6.6.Research Dive Exclusive Insights

6.6.1.Market attractiveness

6.6.2.Competition heatmap

7.Paving Stone Market Analysis, by Application

7.1.Driveway

7.1.1.Definition, key trends, growth factors, and opportunities

7.1.2.Market size analysis, by region

7.1.3.Market share analysis, by country

7.2.Walkway

7.2.1.Definition, key trends, growth factors, and opportunities

7.2.2.Market size analysis, by region

7.2.3.Market share analysis, by country

7.3.Patio

7.3.1.Definition, key trends, growth factors, and opportunities

7.3.2.Market size analysis, by region

7.3.3.Market share analysis, by country

7.4.Pool Decks

7.4.1.Definition, key trends, growth factors, and opportunities

7.4.2.Market size analysis, by region

7.4.3.Market share analysis, by country

7.5.Garden

7.5.1.Definition, key trends, growth factors, and opportunities

7.5.2.Market size analysis, by region

7.5.3.Market share analysis, by country

7.6.Others

7.6.1.Definition, key trends, growth factors, and opportunities

7.6.2.Market size analysis, by region

7.6.3.Market share analysis, by country

7.7.Research Dive Exclusive Insights

7.7.1.Market attractiveness

7.7.2.Competition heatmap

8.Paving Stone Market Analysis, by End-use

8.1.Residential Construction

8.1.1.Definition, key trends, growth factors, and opportunities

8.1.2.Market size analysis, by region

8.1.3.Market share analysis, by country

8.2.Commercial Construction.

8.2.1.Definition, key trends, growth factors, and opportunities

8.2.2.Market size analysis, by region

8.2.3.Market share analysis, by country

8.3.Research Dive Exclusive Insights

8.3.1.Market attractiveness

8.3.2.Competition heatmap

9.Paving Stone Market, by Region

9.1.North America

9.1.1.U.S.

9.1.1.1.Market size analysis, by Paving Material

9.1.1.2.Market size analysis, by Natural Stone Pavers

9.1.1.3.Market size analysis, by Application

9.1.1.4.Market size analysis, by End-use

9.1.2.Canada

9.1.2.1.Market size analysis, by Paving Material

9.1.2.2.Market size analysis, by Natural Stone Pavers

9.1.2.3.Market size analysis, by Application

9.1.2.4.Market size analysis, by End-use

9.1.3.Mexico

9.1.3.1.Market size analysis, by Paving Material

9.1.3.2.Market size analysis, by Natural Stone Pavers

9.1.3.3.Market size analysis, by Application

9.1.3.4.Market size analysis, by End-use

9.1.4.Research Dive Exclusive Insights

9.1.4.1.Market attractiveness

9.1.4.2.Competition heatmap

9.2.Europe

9.2.1.Germany

9.2.1.1.Market size analysis, by Paving Material

9.2.1.2.Market size analysis, by Natural Stone Pavers

9.2.1.3.Market size analysis, by Application

9.2.1.4.Market size analysis, by End-use

9.2.2.UK

9.2.2.1.Market size analysis, by Paving Material

9.2.2.2.Market size analysis, by Natural Stone Pavers

9.2.2.3.Market size analysis, by Application

9.2.2.4.Market size analysis, by End-use

9.2.3.France

9.2.3.1.Market size analysis, by Paving Material

9.2.3.2.Market size analysis, by Natural Stone Pavers

9.2.3.3.Market size analysis, by Application

9.2.3.4.Market size analysis, by End-use

9.2.4.Spain

9.2.4.1.Market size analysis, by Paving Material

9.2.4.2.Market size analysis, by Natural Stone Pavers

9.2.4.3.Market size analysis, by Application

9.2.4.4.Market size analysis, by End-use

9.2.5.Italy

9.2.5.1.Market size analysis, by Paving Material

9.2.5.2.Market size analysis, by Natural Stone Pavers

9.2.5.3.Market size analysis, by Application

9.2.5.4.Market size analysis, by End-use

9.2.6.Rest of Europe

9.2.6.1.Market size analysis, by Paving Material

9.2.6.2.Market size analysis, by Natural Stone Pavers

9.2.6.3.Market size analysis, by Application

9.2.6.4.Market size analysis, by End-use

9.2.7.Research Dive Exclusive Insights

9.2.7.1.Market attractiveness

9.2.7.2.Competition heatmap

9.3.Asia Pacific

9.3.1.China

9.3.1.1.Market size analysis, by Paving Material

9.3.1.2.Market size analysis, by Natural Stone Pavers

9.3.1.3.Market size analysis, by Application

9.3.1.4.Market size analysis, by End-use

9.3.2.Japan

9.3.2.1.Market size analysis, by Paving Material

9.3.2.2.Market size analysis, by Natural Stone Pavers

9.3.2.3.Market size analysis, by Application

9.3.2.4.Market size analysis, by End-use

9.3.3.India

9.3.3.1.Market size analysis, by Paving Material

9.3.3.2.Market size analysis, by Natural Stone Pavers

9.3.3.3.Market size analysis, by Application

9.3.3.4.Market size analysis, by End-use

9.3.4.Australia

9.3.4.1.Market size analysis, by Paving Material

9.3.4.2.Market size analysis, by Natural Stone Pavers

9.3.4.3.Market size analysis, by Application

9.3.4.4.Market size analysis, by End-use

9.3.5.South Korea

9.3.5.1.Market size analysis, by Paving Material

9.3.5.2.Market size analysis, by Natural Stone Pavers

9.3.5.3.Market size analysis, by Application

9.3.5.4.Market size analysis, by End-use

9.3.6.Rest of Asia Pacific

9.3.6.1.Market size analysis, by Paving Material

9.3.6.2.Market size analysis, by Natural Stone Pavers

9.3.6.3.Market size analysis, by Application

9.3.6.4.Market size analysis, by End-use

9.3.7.Research Dive Exclusive Insights

9.3.7.1.Market attractiveness

9.3.7.2.Competition heatmap

9.4.LAMEA

9.4.1.Brazil

9.4.1.1.Market size analysis, by Paving Material

9.4.1.2.Market size analysis, by Natural Stone Pavers

9.4.1.3.Market size analysis, by Application

9.4.1.4.Market size analysis, by End-use

9.4.2.Saudi Arabia

9.4.2.1.Market size analysis, by Paving Material

9.4.2.2.Market size analysis, by Natural Stone Pavers

9.4.2.3.Market size analysis, by Application

9.4.2.4.Market size analysis, by End-use

9.4.3.UAE

9.4.3.1.Market size analysis, by Paving Material

9.4.3.2.Market size analysis, by Natural Stone Pavers

9.4.3.3.Market size analysis, by Application

9.4.3.4.Market size analysis, by End-use

9.4.4.South Africa

9.4.4.1.Market size analysis, by Paving Material

9.4.4.2.Market size analysis, by Natural Stone Pavers

9.4.4.3.Market size analysis, by Application

9.4.4.4.Market size analysis, by End-use

9.4.5.Rest of LAMEA

9.4.5.1.Market size analysis, by Paving Material

9.4.5.2.Market size analysis, by Natural Stone Pavers

9.4.5.3.Market size analysis, by Application

9.4.5.4.Market size analysis, by End-use

9.4.6.Research Dive Exclusive Insights

9.4.6.1.Market attractiveness

9.4.6.2.Competition heatmap

10.Competitive Landscape

10.1.Top winning strategies, 2021

10.1.1.By strategy

10.1.2.By year

10.2.Strategic overview

10.3.Market share analysis, 2021

11.Company Profiles

11.1.Marshalls

11.1.1.Overview

11.1.2.Business segments

11.1.3.Product portfolio

11.1.4.Financial performance

11.1.5.Recent developments

11.1.6.SWOT analysis

11.2.NewLine Hardscapes

11.2.1.Overview

11.2.2.Business segments

11.2.3.Product portfolio

11.2.4.Financial performance

11.2.5.Recent developments

11.2.6.SWOT analysis

11.3.Belgard

11.3.1.Overview

11.3.2.Business segments

11.3.3.Product portfolio

11.3.4.Financial performance

11.3.5.Recent developments

11.3.6.SWOT analysis

11.4.Fendt Builder

11.4.1.Overview

11.4.2.Business segments

11.4.3.Product portfolio

11.4.4.Financial performance

11.4.5.Recent developments

11.4.6.SWOT analysis

11.5.Rosetta

11.5.1.Overview

11.5.2.Business segments

11.5.3.Product portfolio

11.5.4.Financial performance

11.5.5.Recent developments

11.5.6.SWOT analysis

11.6.Anchor Block Company.

11.6.1.Overview

11.6.2.Business segments

11.6.3.Product portfolio

11.6.4.Financial performance

11.6.5.Recent developments

11.6.6.SWOT analysis

11.7.Brock International

11.7.1.Overview

11.7.2.Business segments

11.7.3.Product portfolio

11.7.4.Financial performance

11.7.5.Recent developments

11.7.6.SWOT analysis

11.8.King's Material

11.8.1.Overview

11.8.2.Business segments

11.8.3.Product portfolio

11.8.4.Financial performance

11.8.5.Recent developments

11.8.6.SWOT analysis

11.9.Midwest Manufacturing

11.9.1.Overview

11.9.2.Business segments

11.9.3.Product portfolio

11.9.4.Financial performance

11.9.5.Recent developments

11.9.6.SWOT analysis

11.10.Wienerberger

11.10.1.Overview

11.10.2.Business segments

11.10.3.Product portfolio

11.10.4.Financial performance

11.10.5.Recent developments

11.10.6.SWOT analysis

12.Appendix

12.1.Parent & peer market analysis

12.2.Premium insights from industry experts

12.3.Related reports

Paving stones, pavement slabs, or pavers are brick-like pieces, generally made from concrete, which are used for outdoor surface flooring and covering. In modern urban landscapes, paving stones are used for making roads, walkways, pool decks, patios, driveways, etc. Though primarily made from concrete, paving stones are now manufactured from marble, porcelain, rubber, and plastic also. Some of the most popular paving stone styles include Indian sandstone paving, porcelain pavers, slate paving style, and granite paving style.

Forecast Analysis of the Paving Stone Market

Growth in the demand for paving stones from commercial and industrial sectors is expected to be the primary growth driver of the global paving stone market in the forecast years. Along with this, governments’ growing emphasis on public-private partnerships (PPPs) for infrastructure development is expected to push the market further. Also, growing adoption of paving stones in various construction projects is predicted to offer numerous investment and growth opportunities to the market in the analysis timeframe. However, certain disadvantages associated with paving stones may restrain the growth of the paving stone market in the forecast period.

Regionally, the paving stone market in the Asia-Pacific region is expected to be the most dominant by 2031 and grow at a CAGR of 7.9% in the forecast period. The rapid pace of urbanization in countries such as China, India, Japan, Australia, and Indonesia is anticipated to become the main growth driver of the market in this region.

According to the report published by Research Dive, the global paving stone market is expected to gather a revenue of $ 86,730.90 million by 2031 and grow at 7.9% CAGR in the 2022-2031 timeframe. Some prominent market players include Marshalls, Rosetta, Brock International, NewLine Hardscapes, King's Material, Midwest Manufacturing, Belgard, Anchor Block Company, Wienerberger, Fendt Builder, and many others.

Covid-19 Impact on the Paving Stone Market

The outbreak of the Covid-19 pandemic has had a massive negative effect on almost all industries and businesses across the world. The paving stone market faced a similar fate due to the pandemic. The lockdowns imposed by several countries halted the various kinds of infrastructural projects in these regions and reduced the demand for paving stones. Also, the import-export restrictions disrupted the steady supply of these stones across the globe. All these factors brought down the growth rate of the market during the pandemic.

Significant Market Developments

The significant companies operating in the industry are adopting numerous growth strategies & business tactics such as partnerships, collaborations, mergers & acquisitions, and launches to maintain a robust position in the overall market, thus helping the paving stone market to flourish. For instance:

- In March 2022, Oldcastle APG, an architectural buildings products provider, announced that it was acquiring Calstone, a manufacturer of concrete masonry and pavers. This acquisition is anticipated to increase the market share of the acquiring company i.e., Oldcastle APG in the next few years.

- In April 2022, Outdoor Living Supply, an outdoor living products developer, announced the acquisition of Back Yard Living, a decorative hardscape, paving stones, fireplaces, and outdoor appliances provider. This acquisition is predicted to help Outdoor Living Supply to expand their business globally.

- In September 2022, System Pavers, an outdoor living design company, announced that it was partnering with The Cranemere Group, a capital market company. The collaboration is aimed at diversifying the product portfolio of System Pavers and helping the company to access newer markets. This partnership is, thus, anticipated to immensely help System Pavers to increase their footprint in the market in the coming period.

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com