Local Anesthesia Drugs Market Report

RA08643

Local Anesthesia Drugs Market by Drugs Type (Bupivacaine, Ropivacaine, Lidocaine, Chloroprocaine, Prilocaine, Benzocaine, and Other Local Anesthetics), Application (Injectable and Surface Anesthetic), and Regional Analysis (North America, Europe, Asia-Pacific, and LAMEA): Global Opportunity Analysis and Industry Forecast, 2022-2031

Global Local Anesthesia Drugs Market Analysis

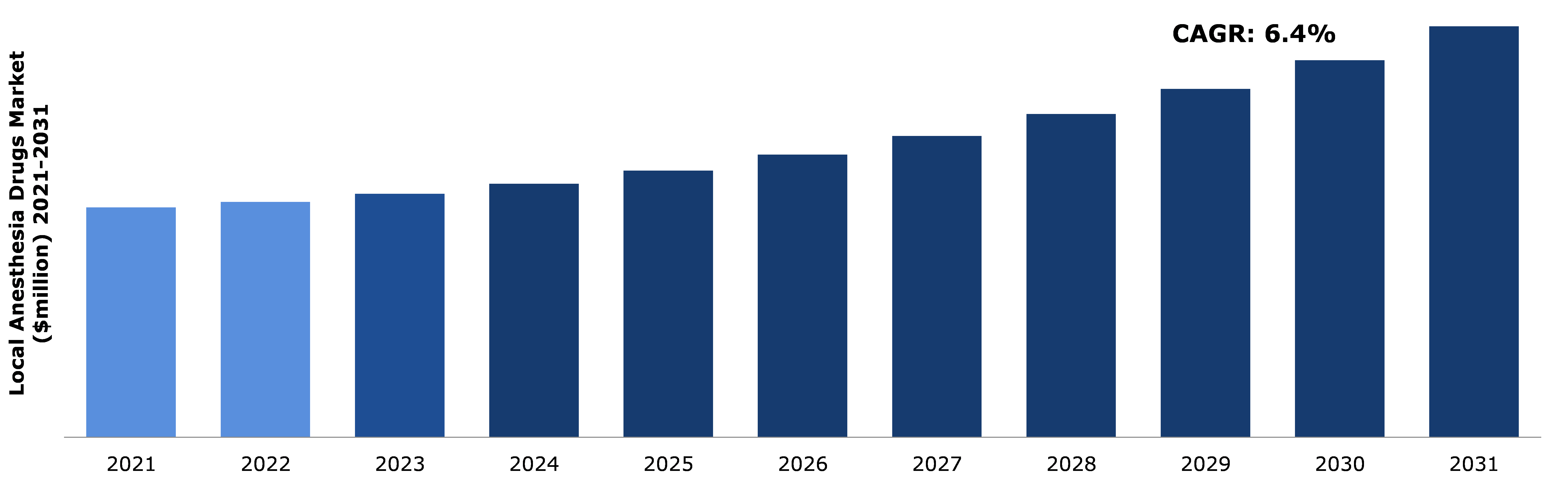

The Global Local Anesthesia Drugs Market Size was $2,643.50 million in 2021 and is predicted to grow with a CAGR of 6.4%, by generating a revenue of $4,724.80 million by 2031.

Global Local Anesthesia Drugs Market Synopsis

The growing incidences of chronic diseases among people and rising hospitalization rate globally has triggered the growth of local anesthesia drugs market share growth in the forecast time. Chronic diseases like cancer and tumors require intense treatment which can cause intense pain in the patients’ body, thereby making then traumatic during treatment or surgical procedures. Local anesthesia helps in making the affected area numb so that the surgical procedure can be conducted smoothly and the patient is able to bear the pain. This factor is likely to drive the local anesthesia market share growth in the forecast time period.

The market growth is expected to be restricted in the forecast period owing to side effects caused by the anesthesia. Also, strict regulations imposed on the use of anesthesia drugs by the regulatory bodies is likely to impede local anesthesia drugs market growth in the forecast time period.

The introduction of novel and effective medications such as articaine and ropivacaine is further fueling the expansion of the market for local anesthesia drugs. This expansion is augmented by rising healthcare spending in developing countries such as India, China, and Brazil, where the number of surgeries performed has been steadily increasing.

Region-wise, the North America local anesthesia drugs market accounted for a dominating market share in 2021.

Local Anesthesia Drugs Overview

Local anesthesia is a temporary loss of sensation in a specific place or parts of the body. Local anesthesia drugs are used to treat uncomfortable circumstances, eliminate pain when performing large or minor surgeries, and reduce pain after surgery. At greater doses, certain drugs are utilized as local anesthetics. A local anesthetic can be administered directly into the affected area or absorbed through the skin. When a vast area needs to be anaesthetized or medications may not penetrate sufficiently, the doctor may use a different anesthetic that lasts 4 to 6 hours.

COVID-19 Impact on Global Local Anesthesia Drugs Market

The COVID-19 pandemic has had a moderate impact on the local anesthesia drugs industry. Several swift alterations in reaction to COVID-19 had an immediate impact on local anesthetic medicines and their practices. Because of the lockdown, the supply chain for anesthesia drugs, globally, was slowed. The most difficult consequences resulted from the cancellation or postponing of non-essential surgical operations, which had a direct negative impact on the demand of anesthesia drugs. Anesthetics may reduce the effectiveness of a COVID-19 vaccination. This is due to the fact that a vaccine interacts with the immune system, as does anesthesia, both of which can interfere with how a vaccine teaches the body to fight infection. The American Society of Anesthesiologists recommends waiting at least two weeks following the last dose before undergoing anesthetic-assisted surgery.

However, the demand for local anesthesia was high owing to increased cases of viral infection and the high severity of symptoms observed in the patients. As the hospitalization rates increased in the pandemic era, the demand for anesthetic drugs also increased which has moderately impacted the market growth.

Growing Number of Surgical Procedures Globally Projected to Drive Market Growth

Rising cases of chronic diseases, like cancer and diabetes and high hospitalization rates due to these diseases, globally, is projected to drive the global local anesthesia market share growth in the forecast time period. Patients suffering from cancer, for instance, require hospitalizations, surgery, chemotherapy, anesthetic, and pain medication. Analgesia is routinely treated with opioids and local anesthetics. Also, rising incidences of surgeries, globally, owing to complications due to old age, accidents and dental treatments is expected to increase the demand for local anesthesia drugs. The growth in the number of surgeries performed can be attributed to the ageing population, which is more prone to chronic diseases such as cardiovascular disorders, respiratory ailments, cancer, neurological disorders, and various gastro, orthopedic, and spinal difficulties. For instance, according to a research paper ‘Trauma of major surgery: A global problem that is not going away’, published in September, 2022, worldwide, approximately 310 million major surgeries are performed every year out of which nearly 40 to 50 million surgeries take place in USA and 20 million in Europe. This factor is likely to drive the local anesthesia market in the forecast time period.

To know more about global local anesthesia drugs market drivers, get in touch with our analysts here.

Various Side Effects Associated with Using Local Anesthesia to Restrain Market Growth

Although, using local anesthesia is much better that using intravenous anesthesia, several side effects are also associated with it. Pain after injection, needle fracture, edema, anesthetic prolongation and numerous temporal abnormalities, trismus, inflammation, hematoma, skin injury, gingival lesions, and ocular complications are some common consequences that may limit market growth. Also, adoption of non-invasive surgeries that do not require the use of local anesthesia by patients and healthcare professionals is further likely to hinder local anesthesia drugs market revenue growth in the forecast time period.

New Anesthetic Drug Launches By the Manufacturers to Drive the Market Growth

The introduction of novel and effective medications such as articaine, and ropivacaine is further fueling the expansion of the market for local anesthesia drugs. For instance, according to a news published by American Hospital Association, on September 18, 2020, the Food and Drug Administration approved a new intravenous general anesthetic drug for propofol injectable emulsion. Also, increased reimbursement policies by the government and insurers for covering expensive surgeries has increased the number of patients opting for surgeries for various chronic diseases. This factor is further anticipated to drive market growth in the future. Also, the market expansion is augmented by rising healthcare spending in developing countries such as India, and Brazil, where the number of surgeries performed has been steadily increasing.

To know more about global local anesthesia drugs market opportunities, get in touch with our analysts here.

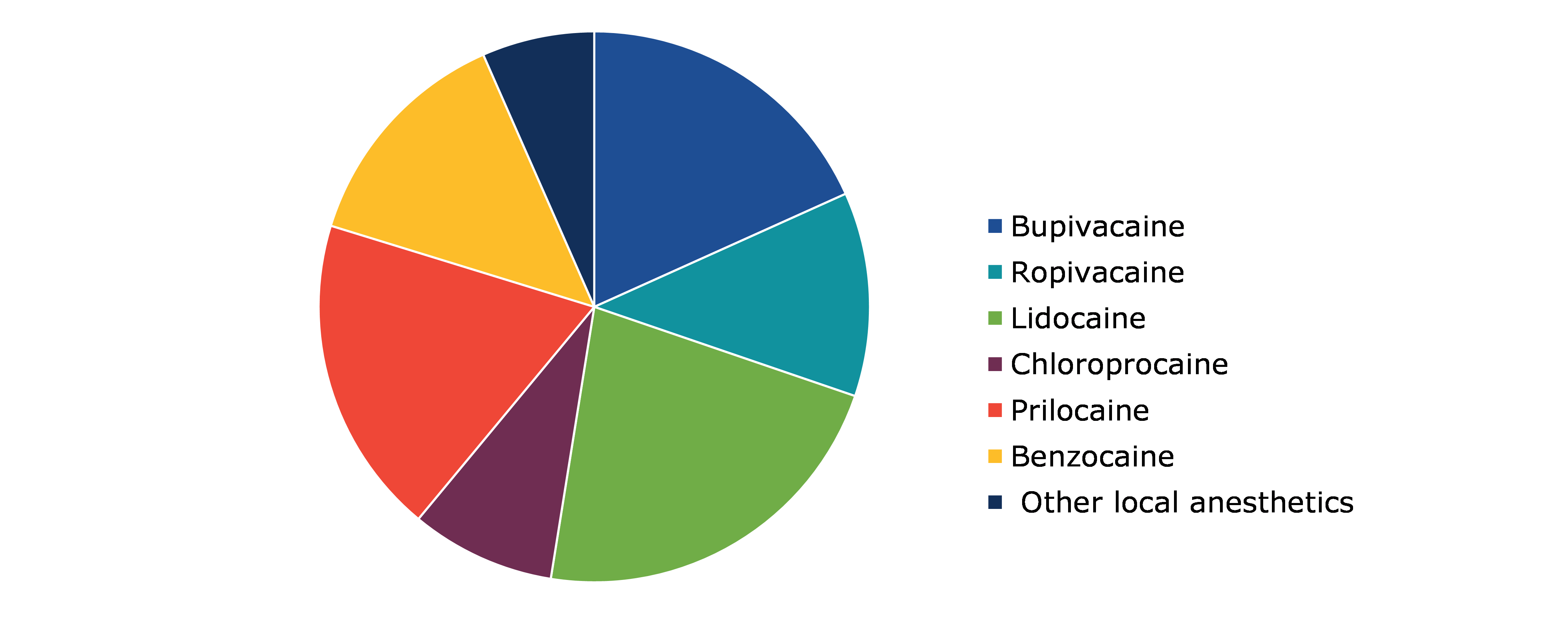

Global Local Anesthesia Drugs Market, By Drug Type

By drugs type, the market has been divided into bupivacaine, ropivacaine, lidocaine, chloroprocaine, prilocaine, benzocaine and other local anesthetics. Among these, the Lidocaine segment had a dominant market share in 2021 and Bupivacaine is anticipated to have the fastest growth in the forecast time period.

Global Local Anesthesia Drugs Market Size, by Drugs Type, 2021

Source: Research Dive Analysis

The Lidocaine segment accounted for a dominant market share in 2021. Lidocaine is a type of local anesthetic. It is used to anaesthetize or numb the surgical area during small surgical operations such as dental, oral, diagnostic, or other therapeutic treatments. It is also used to provide brief relief from other skin, eye, or ear irritations. The market is expanding due to its widespread use as a topical and injectable anesthetic.

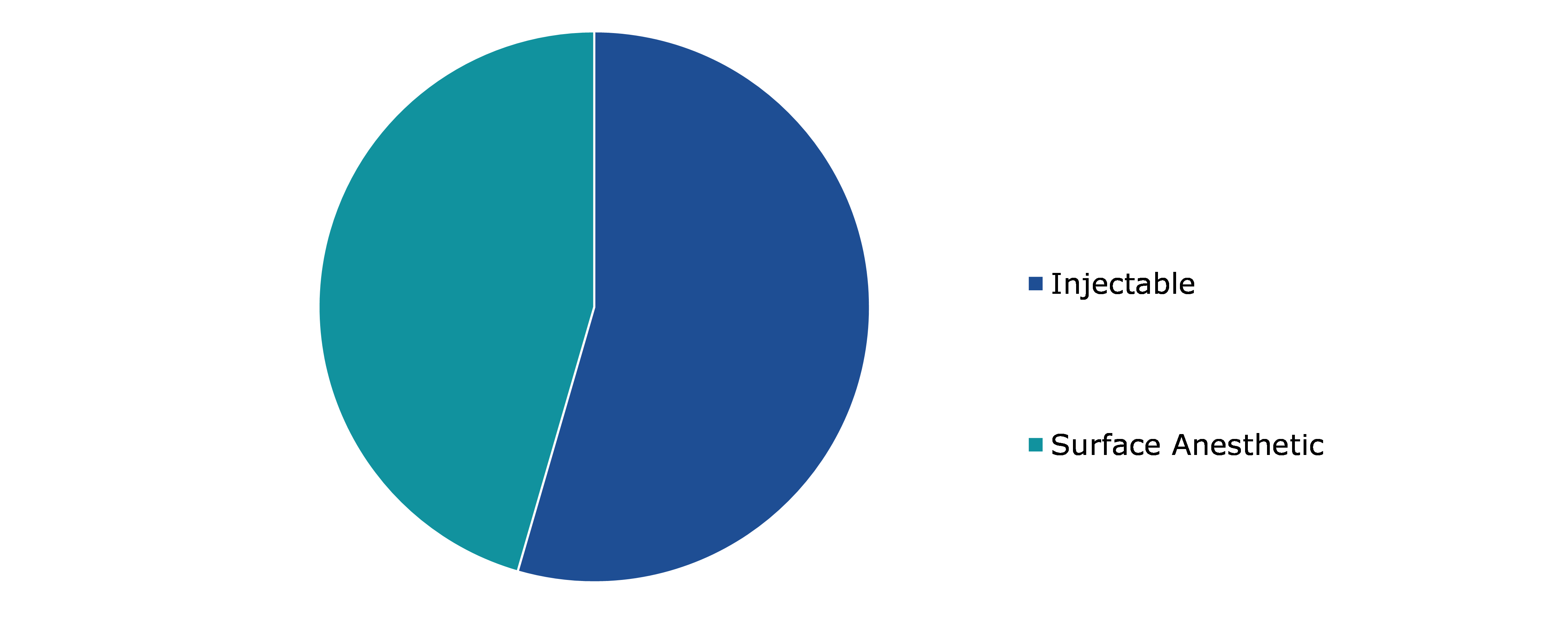

Global Local Anesthesia Drugs Market, By Application

By application, the market has been divided into injectable and surface anesthetic. Among these, injectable segment had a dominant market share in 2021 and surface anesthetics is anticipated to have the fastest growth in the forecast time period.

Global Local Anesthesia Drugs Market Share, by Application, 2021

Source: Research Dive Analysis

The injectable segment accounted for a dominant market share in 2021. This is primarily because injectable anesthetics are widely used in a variety of surgical procedures. Injectable anesthetics are typically utilized for numbing rather than pain management during procedures. A local anesthetic injection may be required for dental work such as a root canal, skin biopsy, removal of a growth under the skin, and removal of a mole.

Global Local Anesthesia Drugs Market, Regional Insights

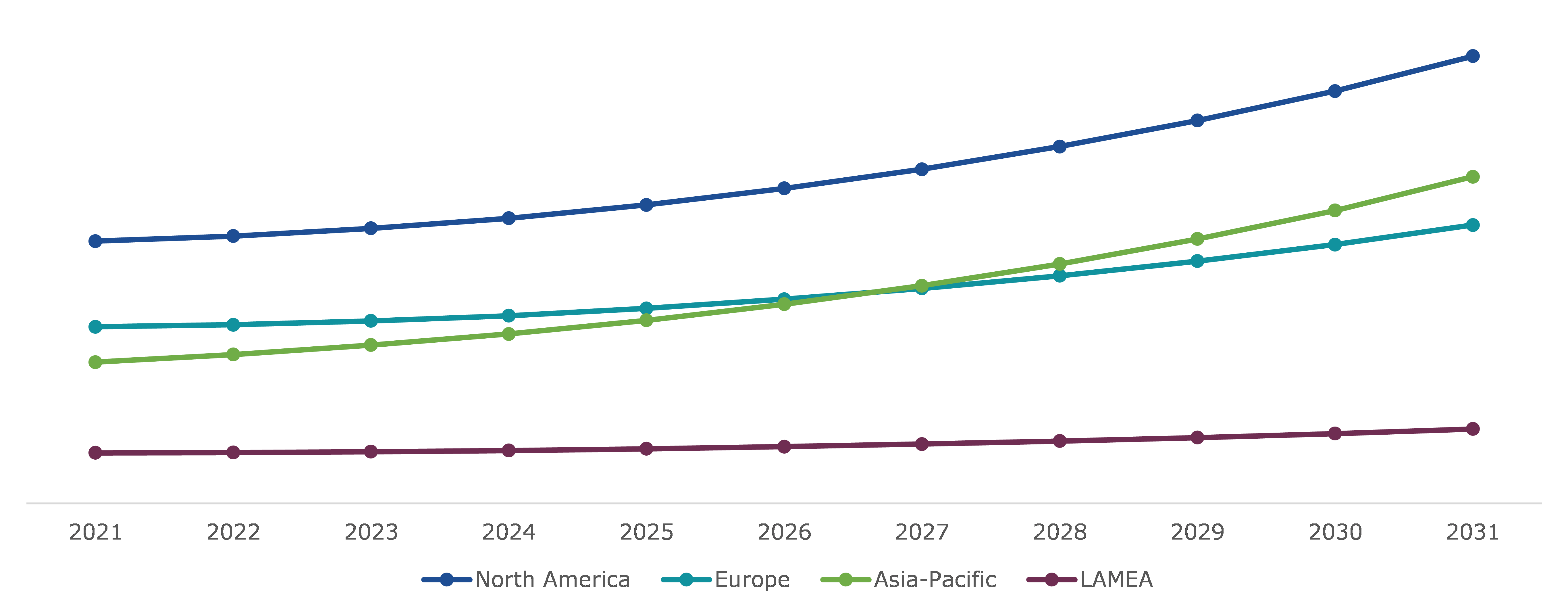

The local anesthesia drugs market was analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Global Local Anesthesia Drugs Market Size & Forecast, by Region, 2021-2031 ($ Million)

Source: Research Dive Analysis

The Local Anesthesia Drugs Market in North America to be the Most Dominant

The North America local anesthesia drugs market size accounted for a dominating market share in 2021. The region offers tremendous growth opportunity for growth of local anesthesia drugs market. The market for local anesthesia drugs is expected to grow in North America because of a rise in the number of surgical procedures performed. The development of new anesthetic technologies for administration, as well as the rise in chronic diseases among the elderly, has fueled market expansion. The U.S. has the world's largest market share for anesthesia. Major players in the region with adequate investment in R&D for the manufacturing of revolutionary novel medications are a key component in the region's market growth. Also, established technologically advanced research and development centers and availability of experienced researchers to develop new drugs in the region is further anticipated to drive the market growth.

Competitive Scenario in Global Local Anesthesia Drugs Market

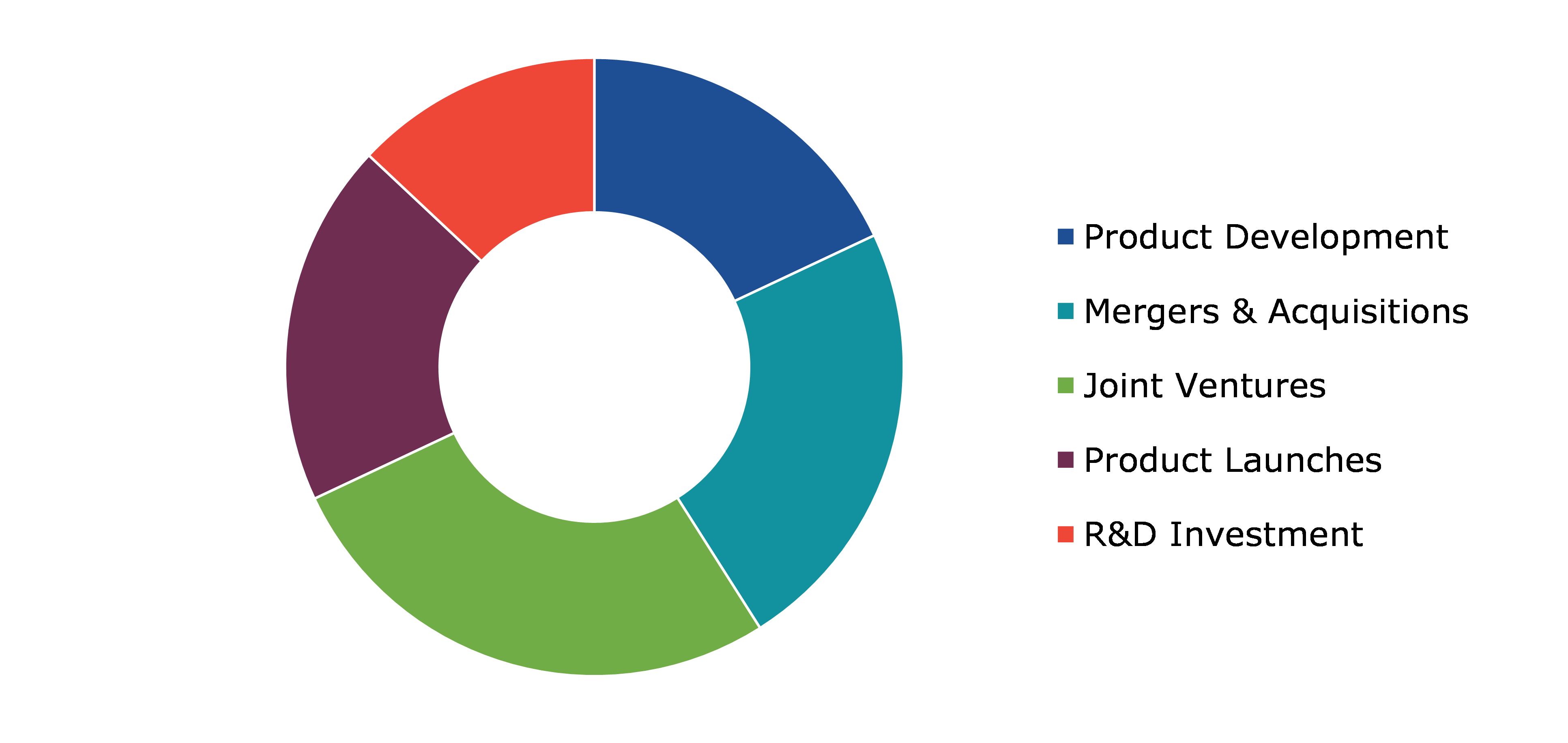

Investment and agreement are common strategies followed by major market players.

Source: Research Dive Analysis

The key players profiled in this report include Novartis AG, Aspen Pharmacare, Sagent Pharmaceuticals, Pacira Pharmaceuticals, Inc., Teva Pharmaceutical Industries Ltd., Fresenius Kabi, Mylan N.V., GSK plc., AstraZeneca plc, and Hikma Pharmaceuticals plc.

| Aspect | Particulars |

| Historical Market Estimations | 2020 |

| Base Year for Market Estimation | 2020-2021 |

| Forecast Timeline for Market Projection | 2022-2031 |

| Geographical Scope | North America, Europe, Asia-Pacific, and LAMEA |

| Segmentation by Drug Type |

|

| Segmentation by Application |

|

| Key Companies Profiled |

|

Q1. What is the size of the global local anesthesia drugs market?

A. The global local anesthesia drugs market size was $2,643.50 million in 2021 and is predicted to grow with a CAGR of 6.4%, by generating a revenue of $4,724.80 million by 2031.

Q2. Which are the major companies in the local anesthesia drugs market?

A. Novartis AG is the key player in the global local anesthesia drugs market.

Q3. Which region, among others, possesses greater investment opportunities in the near future?

A. The Asia-Pacific region possesses great investment opportunities for investors to witness the most promising growth in the future.

Q4. What will be the growth rate of the North America local anesthesia drugs market?

A. North America local anesthesia drugs market is anticipated to grow at a CAGR of 5.9% during the forecast period.

Q5. What are the strategies opted by the leading players in the market?

A. Agreement and investment are the two key strategies opted by the operating companies in this market.

1.Research Methodology

1.1.Desk Research

1.2.Real time insights and validation

1.3.Forecast model

1.4.Assumptions and forecast parameters

1.5.Market size estimation

1.5.1.Top-down approach

1.5.2.Bottom-up approach

2.Report Scope

2.1.Market definition

2.2.Key objectives of the study

2.3.Report overview

2.4.Market segmentation

2.5.Overview of the impact of COVID-19 on the global local anesthesia drugs market

3.Executive Summary

4.Market Overview

4.1.Introduction

4.2.Growth impact forces

4.2.1.Drivers

4.2.2.Restraints

4.2.3.Opportunities

4.3.Market value chain analysis

4.3.1.List of suppliers

4.3.2.List of manufacturers

4.3.3.List of distributors

4.4.Innovation & sustainability matrices

4.4.1.Technology matrix

4.4.2.Regulatory matrix

4.5.Porter’s five forces analysis

4.5.1.Bargaining power of suppliers

4.5.2.Bargaining power of consumers

4.5.3.Threat of substitutes

4.5.4.Threat of new entrants

4.5.5.Competitive rivalry intensity

4.6.PESTLE analysis

4.6.1.Political

4.6.2.Economical

4.6.3.Social

4.6.4.Technological

4.6.5.Environmental

4.7.Impact of COVID-19 on the local anesthesia drugs market

4.7.1.Pre-covid market scenario

4.7.2.Post-covid market scenario

5.Local Anesthesia Drugs Market Analysis, by Drug Type

5.1.Overview

5.2.Bupivacaine

5.2.1.Definition, key trends, growth factors, and opportunities

5.2.2.Market size analysis, by region, 2021-2031

5.2.3.Market share analysis, by country, 2021-2031

5.3.Ropivacaine

5.3.1.Definition, key trends, growth factors, and opportunities

5.3.2.Market size analysis, by region, 2021-2031

5.3.3.Market share analysis, by country, 2021-2031

5.4.Lidocaine

5.4.1.Definition, key trends, growth factors, and opportunities

5.4.2.Market size analysis, by region, 2021-2031

5.4.3.Market share analysis, by country, 2021-2031

5.5.Chloroprocaine

5.5.1.Definition, key trends, growth factors, and opportunities

5.5.2.Market size analysis, by region, 2021-2031

5.5.3.Market share analysis, by country, 2021-2031

5.6.Prilocaine

5.6.1.Definition, key trends, growth factors, and opportunities

5.6.2.Market size analysis, by region, 2021-2031

5.6.3.Market share analysis, by country, 2021-2031

5.7.Benzocaine

5.7.1.Definition, key trends, growth factors, and opportunities

5.7.2.Market size analysis, by region, 2021-2031

5.7.3.Market share analysis, by country, 2021-2031

5.8.Other Local Anesthetics

5.8.1.Definition, key trends, growth factors, and opportunities

5.8.2.Market size analysis, by region, 2021-2031

5.8.3.Market share analysis, by country, 2021-2031

5.9.Research Dive Exclusive Insights

5.9.1.Market attractiveness

5.9.2.Competition heatmap

6.Local Anesthesia Drugs Market Analysis, by Application

6.1.Overview

6.2.Injectable

6.2.1.Definition, key trends, growth factors, and opportunities

6.2.2.Market size analysis, by region, 2021-2031

6.2.3.Market share analysis, by country, 2021-2031

6.3.Surface Anesthetic

6.3.1.Definition, key trends, growth factors, and opportunities

6.3.2.Market size analysis, by region, 2021-2031

6.3.3.Market share analysis, by country, 2021-2031

6.4.Research Dive Exclusive Insights

6.4.1.Market attractiveness

6.4.2.Competition heatmap

7.Local Anesthesia Drugs Market, by Region

7.1.North America

7.1.1.U.S.

7.1.1.1.Market size analysis, by Drug Type

7.1.1.2.Market size analysis, by Application

7.1.2.Canada

7.1.2.1.Market size analysis, by Drug Type

7.1.2.2.Market size analysis, by Application

7.1.3.Mexico

7.1.3.1.Market size analysis, by Drug Type

7.1.3.2.Market size analysis, by Application

7.1.4.Research Dive Exclusive Insights

7.1.4.1.Market attractiveness

7.1.4.2.Competition heatmap

7.2.Europe

7.2.1.Germany

7.2.1.1.Market size analysis, by Drug Type

7.2.1.2.Market size analysis, by Application

7.2.2.UK

7.2.2.1.Market size analysis, by Drug Type

7.2.2.2.Market size analysis, by Application

7.2.3.France

7.2.3.1.Market size analysis, by Drug Type

7.2.3.2.Market size analysis, by Application

7.2.4.Spain

7.2.4.1.Market size analysis, by Drug Type

7.2.4.2.Market size analysis, by Application

7.2.5.Italy

7.2.5.1.Market size analysis, by Drug Type

7.2.5.2.Market size analysis, by Application

7.2.6.Rest of Europe

7.2.6.1.Market size analysis, by Drug Type

7.2.6.2.Market size analysis, by Application

7.2.7.Research Dive Exclusive Insights

7.2.7.1.Market attractiveness

7.2.7.2.Competition heatmap

7.3.Asia-Pacific

7.3.1.China

7.3.1.1.Market size analysis, by Drug Type

7.3.1.2.Market size analysis, by Application

7.3.2.Japan

7.3.2.1.Market size analysis, by Drug Type

7.3.2.2.Market size analysis, by Application

7.3.3.India

7.3.3.1.Market size analysis, by Drug Type

7.3.3.2.Market size analysis, by Application

7.3.4.Australia

7.3.4.1.Market size analysis, by Drug Type

7.3.4.2.Market size analysis, by Application

7.3.5.South Korea

7.3.5.1.Market size analysis, by Drug Type

7.3.5.2.Market size analysis, by Application

7.3.6.Rest of Asia-Pacific

7.3.6.1.Market size analysis, by Drug Type

7.3.6.2.Market size analysis, by Application

7.3.7.Research Dive Exclusive Insights

7.3.7.1.Market attractiveness

7.3.7.2.Competition heatmap

7.4.LAMEA

7.4.1.Brazil

7.4.1.1.Market size analysis, by Drug Type

7.4.1.2.Market size analysis, by Application

7.4.2.Saudi Arabia

7.4.2.1.Market size analysis, by Drug Type

7.4.2.2.Market size analysis, by Application

7.4.3.UAE

7.4.3.1.Market size analysis, by Drug Type

7.4.3.2.Market size analysis, by Application

7.4.4.South Africa

7.4.4.1.Market size analysis, by Drug Type

7.4.4.2.Market size analysis, by Application

7.4.5.Rest of LAMEA

7.4.5.1.Market size analysis, by Drug Type

7.4.5.2.Market size analysis, by Application

7.4.6.Research Dive Exclusive Insights

7.4.6.1.Market attractiveness

7.4.6.2.Competition heatmap

8.Competitive Landscape

8.1.Top winning strategies, 2021

8.1.1.By strategy

8.1.2.By year

8.2.Strategic overview

8.3.Market share analysis, 2021

9.Company Profiles

9.1.Novartis AG

9.1.1.Overview

9.1.2.Business segments

9.1.3.Product portfolio

9.1.4.Financial performance

9.1.5.Recent developments

9.1.6.SWOT analysis

9.2.Aspen Pharmacare

9.2.1.Overview

9.2.2.Business segments

9.2.3.Product portfolio

9.2.4.Financial performance

9.2.5.Recent developments

9.2.6.SWOT analysis

9.3.Sagent Pharmaceuticals, Inc.

9.3.1.Overview

9.3.2.Business segments

9.3.3.Product portfolio

9.3.4.Financial performance

9.3.5.Recent developments

9.3.6.SWOT analysis

9.4.Teva Pharmaceutical Industries Ltd.

9.4.1.Overview

9.4.2.Business segments

9.4.3.Product portfolio

9.4.4.Financial performance

9.4.5.Recent developments

9.4.6.SWOT analysis

9.5.Pacira Pharmaceuticals, Inc.

9.5.1.Overview

9.5.2.Business segments

9.5.3.Product portfolio

9.5.4.Financial performance

9.5.5.Recent developments

9.5.6.SWOT analysis

9.6.Fresenius Kabi

9.6.1.Overview

9.6.2.Business segments

9.6.3.Product portfolio

9.6.4.Financial performance

9.6.5.Recent developments

9.6.6.SWOT analysis

9.7.Mylan N.V.

9.7.1.Overview

9.7.2.Business segments

9.7.3.Product portfolio

9.7.4.Financial performance

9.7.5.Recent developments

9.7.6.SWOT analysis

9.8.GSK plc.

9.8.1.Overview

9.8.2.Business segments

9.8.3.Product portfolio

9.8.4.Financial performance

9.8.5.Recent developments

9.8.6.SWOT analysis

9.9.AstraZeneca plc

9.9.1.Overview

9.9.2.Business segments

9.9.3.Product portfolio

9.9.4.Financial performance

9.9.5.Recent developments

9.9.6.SWOT analysis

9.10.Hikma Pharmaceuticals plc

9.10.1.Overview

9.10.2.Business segments

9.10.3.Product portfolio

9.10.4.Financial performance

9.10.5.Recent developments

9.10.6.SWOT analysis

Local anesthesia drugs are essential in modern medicine, as they facilitate pain relief during surgical procedures and other medical interventions without the use of general anesthesia. These drugs have undergone significant development over the past few decades, leading to the creation of a range of options for clinicians to choose from.

The evolution of local anesthesia drugs has revolutionized modern medicine, allowing for surgical procedures and medical interventions without the need for general anesthesia. Today, they are an essential tool for pain management and play a crucial role in improving patient outcomes and reducing healthcare costs. The local anesthesia drugs market is continually growing, driven by the increasing demand for dental and cosmetic surgeries and the rise in chronic diseases. The development of new and innovative local anesthetics is revolutionizing pain management in surgical and chronic pain patients, making these drugs a valuable tool in modern medicine.

Newest Insights in the Local Anesthesia Drugs Market

As per a report by Research Dive, the global local anesthesia drugs market is expected to grow at a CAGR of 6.4% and generate revenue of $4,724.80 million by 2031. The rising prevalence of chronic diseases worldwide, coupled with an increase in hospitalization rates, has fueled the growth of the local anesthesia drugs market. Chronic illnesses such as cancer and tumors often require intensive treatment, which can be painful for patients and traumatic during surgical procedures. Local anesthesia drugs are used to numb the affected area, allowing for smooth and painless surgical procedures. This crucial function is expected to be a key driver of market growth in the forecast period.

In 2021, the local anesthesia drugs market size in North America held a dominant market share, indicating tremendous growth potential for the region. This North America market is expected to remain dominant due to an increase in the number of surgical procedures being performed in this region. The market expansion is also being driven by the development of new technologies for administering anesthesia and the growing prevalence of chronic diseases among the elderly population. Notably, the United States holds the largest market share for anesthesia drugs globally.

How are Market Players Responding to the Rising Demand for Local Anesthesia Drugs?

Market players are responding to the rising demand for local anesthesia drugs by investing in research and development to create more advanced and efficient pain management solutions. Some of the foremost players in the local anesthesia drugs market are AstraZeneca plc, Aspen Pharmacare, Pacira Pharmaceuticals, Inc., Sagent Pharmaceuticals, Teva Pharmaceutical Industries Ltd., Novartis AG, Fresenius Kabi, Mylan N.V., GSK plc., and Hikma Pharmaceuticals plc., and others. These players are focused on implementing strategies such as mergers and acquisitions, novel developments, collaborations, and partnerships to reach a leading position in the global market.

For instance:

- In October 2020, Innocoll Holdings Limited, a specialty pharmaceutical firm, announced the commercial launch of XARACOLL® (bupivacaine HCI) implant. The implant is designed to provide acute postsurgical pain relief for up to 24 hours in adults following open inguinal hernia repair, which is a commonly performed and painful surgery.

- In December 2020, Hikma Pharmaceuticals PLC, a multinational pharmaceutical company, announced the launch of Bupivacaine HCl Injection, USP through its US-based affiliate, Hikma Pharmaceuticals USA Inc. Bupivacaine HCl Injection is indicated for use in adults who require local or regional anesthesia or analgesia for dental, surgical, and oral procedures, as well as diagnostic and therapeutic procedures. It is also used for obstetrical procedures.

- In May 2021, Heron Therapeutics, Inc., a biotechnology company focused on developing best-in-class treatments for unmet patient needs, announced that ZYNRELEF (bupivacaine and meloxicam) has been approved by the U.S. Food and Drug Administration (FDA). ZYNRELEF is the first and only dual-acting local anesthetic that has been clinically proven to ease pain and eradicate the need for opioids for up to 72 hours following surgery, surpassing the current standard-of-care bupivacaine solution.

COVID-19 Impact on the Global Local Anesthesia Drugs Market

The COVID-19 pandemic has moderately affected the global local anesthesia drugs market. The pandemic caused disruptions in the supply chain of anesthesia drugs due to the lockdowns imposed worldwide. Additionally, the cancellation or postponement of non-essential surgeries led to a direct negative impact on the demand for anesthesia drugs. Anesthetics can also affect the effectiveness of a COVID-19 vaccine, which has led to recommendations from the American Society of Anesthesiologists to wait at least two weeks after the last vaccine dose before undergoing surgery. However, the demand for local anesthesia drugs increased due to the severity of COVID-19 symptoms observed in patients and the high hospitalization rates. This has moderately impacted the market growth.

In the post-pandemic period, the global local anesthesia drugs market is expected to continue its growth trajectory in the coming years due to an increase in surgical procedures, advancements in drug delivery technologies, and the rising prevalence of chronic diseases.

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com