K12 Education Market Report

RA08640

K12 Education Market by Type (Public and Private), Deployment Mode (Cloud and On-Premise), Application (High School, Middle School, and Pre-Primary School and Primary School), Spend Analysis (Hardware, Software, and Others), and Regional Analysis (North America, Europe, Asia-Pacific, and LAMEA): Global Opportunity Analysis and Industry Forecast, 2022-2031

Global K12 Education Market Analysis

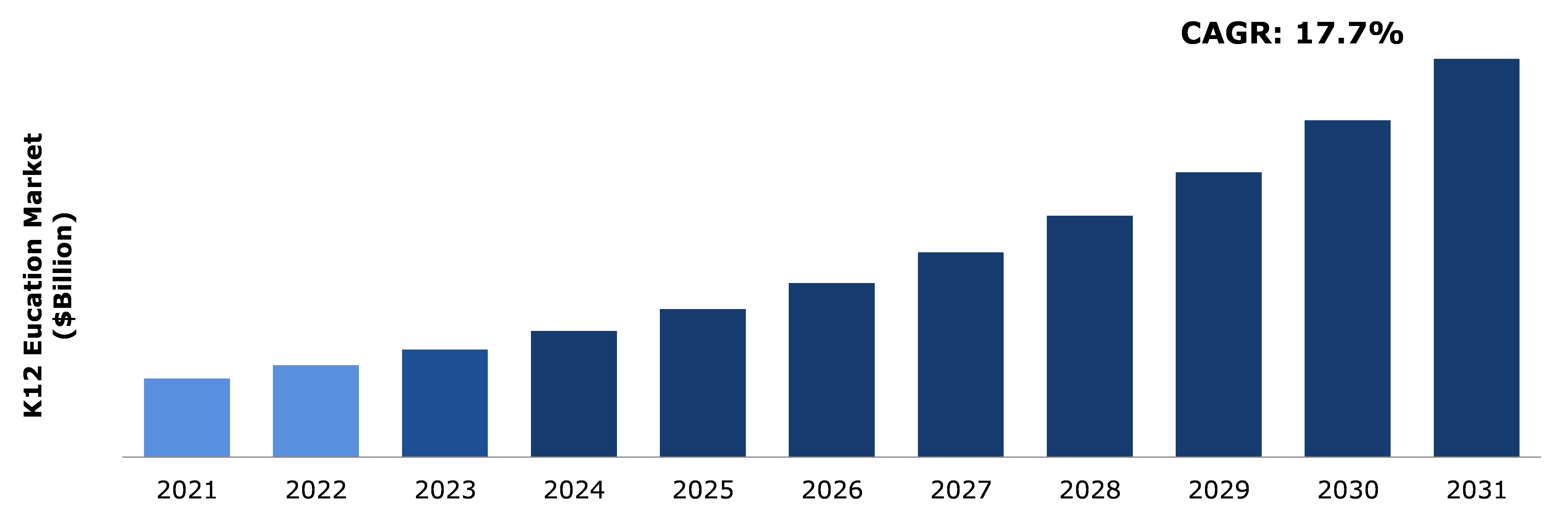

The Global K12 Education Market Size was $103.5 billion in 2021 and is predicted to grow with a CAGR of 17.7%, by generating a revenue of $525.7 billion by 2031.

Global K12 Education Market Synopsis

The global K-12 education market is expected to grow due to various features such as the personalized and dynamic school experience offered by this medium. The market is also likely to profit from developments such as personalized learning and lower infrastructure prices, which are expected to serve as advantages and help the sector grow as anticipated and experience strong demand during the forecast period. Schools switching from the conventional blackboard approach to incorporation with digital sensors are driving the need for K-12 private teaching. For example, the Huawei IdeaHub Board is approved by TUV Rheinland in March 2021, which reduces hazardous light and filters dangerous rays for a safe cinematic experience.

In comparison to instructor-led courses that take place in person, online and e-learning platforms place a considerably greater emphasis on motivation and willingness. Only 7% of students who enroll in Massive Open Online Courses (MOOCs) finish them, according to a survey. The K–12 education sector's growth is impacted by this aspect. Many K12 education sector firms are investigating how to encourage students to enroll in online courses by arranging live events with in-person interactions with instructors and limiting the timeline of courses so that students are encouraged to finish them properly and on time.

Learning analytics has grown in the educational business owing to the advances in technology. This enables academic institutions to provide customized learning. The adoption of online education systems is driven by artificial intelligence. It delivers customized content to students based on their characteristics, performance, and active behaviors. Therefore, institutions are investing significantly in virtual learning methods, which is anticipated to propel the K12 education market during the forecast period. Progress is measured via various processes such as tests, puzzles, and videos. eLearning is adaptable, increases student engagement, and can be accessed from anywhere at any time. It adjusts to individual learning styles and demands. All these factors are anticipated to create several growth opportunities for the key players operating in the market.

K12 Education Overview

The growing idea of K–12 education has altered the traditional approach to education and ensured that all kids from kindergarten through the 12th grade receive a solid foundational education. K–12 education, which includes primary and secondary education, emphasizes greater teacher–student interaction. The K-12 educational paradigm, which comprises kindergarten, primary, secondary, high school, and pre-university education, uses the letters K for kindergarten and 12 for the 12th grade.

COVID-19 Impact on Global K12 Education Market

Lockdowns around the world to stop the spread of the COVID-19 pandemic have caused enormous issues for the education sector around the world. Schools, colleges, and other learning facilities had to shut down during the COVID-19 pandemic to prevent the coronavirus from spreading. Schools and colleges had to adopt online learning for continuing education. Though, students from rural areas of developing and underdeveloped countries were unable to afford the gadgets required for online learning. Stable internet connection in these rural areas was also a concern for some of them. Therefore, the COVID-19 pandemic had a significant impact on the K12 education market.

Growing Popularity of Online Learning to Drive the Market Growth

Software solutions provide institutions with well-organized enterprise resource planning tools that assist faculty members in developing better courses and effectively managing classrooms and schools. Online education systems create virtual classrooms, allowing teachers to manage a big audience. In addition, online learning not only allows students to access knowledge from any place but also assures that resources are constantly available. For example, students can access books online from any location rather than physically visiting a library.

To know more about global K12 education market drivers, get in touch with our analysts here.

Lack of Government Budget to Restrain the K12 Education Market Growth

The development of K12 education systems may make the educational system more competitive if the K-12 education plan is implemented. However, the governments of various countries need to resolve a few difficulties before the proposal can be implemented. The K12 education system is good, but it only works if the government or another authority meets all of the standards. If the government could devote a higher budget to educational needs, the K-12 program would be one step closer to success. These issues are expected to hamper the growth of the K12 education industry.

Adoption of Artificial intelligence (AI) and Open Educational Resources (OER), and Increase in Investments by Educational Institutes to Drive Excellent Market Opportunities

Artificial intelligence is essential in the online education sector. AI algorithms may give personalized content depending on student profile, performance, and active behavior. It may also provide meaningful content in the form of quizzes, tests, and videos for measuring progress. Open educational resources (OER) have the potential to replace traditional textbooks. Faculty and students are progressively using OER. In addition, schools are investing in online learning programs because they are simple to set up, require no additional expenditures, are adaptable, and promote student involvement. Thus, all of these factors are projected to contribute to the growth of the online k12 education market during the forecast period.

To know more about global K12 education market opportunities, get in touch with our analysts here.

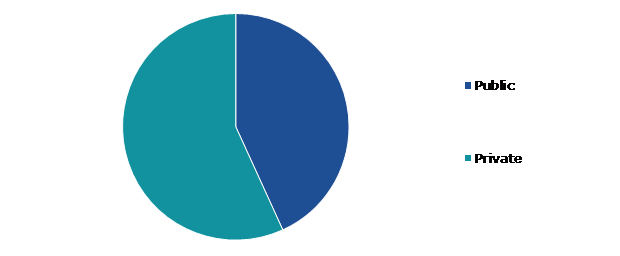

Global K12 Education Market, by Type

Based on type, the market has been divided into public and private. Among these, the private sub-segment accounted for the highest market share in 2021, whereas the public sub-segment is estimated to show the fastest growth during the forecast period.

Global K12 Education Market Size, by Type, 2021

Source: Research Dive Analysis

The public sub-segment is anticipated to show the fastest growth by 2031. K-12 online public schools are attempting to offer a personalized, high-quality education with instruction from state-certified teachers to help students reach their potential. These online schools adhere to the same state testing, school accountability, and attendance policies as traditional brick-and-mortar schools. However, the public school system has significant obstacles, such as a lack of proper infrastructure, insufficient budget, a staff deficit, and limited facilities. The U.S. Department of Education and other federal agencies work to guarantee that 50 billion kids in K-12 public schools have access to a safe and high-quality education.

The private sub-segment accounted for a dominating market share in 2021. The K-12 model is one of the innovations that the world education system has universally accepted and made mandatory for private schools. There is a lot of teacher-student interaction in K-12, in which the teacher encourages a lot of question-and-answer sessions, assignments, and other activities to build advanced learning habits in pupils. Individual attention is encouraged in this educational system. The private school includes traditional financing this strategy which focuses on increasing pupils' self-education capacities.

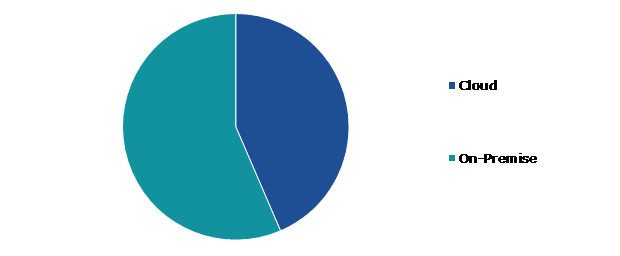

Global K12 Education Market, by Deployment Mode

Based on deployment mode, the market has been divided into cloud and on-premise. Among these, the on-premise sub-segment accounted for the highest revenue share in 2021.

Global K12 Education Market Share, by Deployment Mode 2021

Source: Research Dive Analysis

The cloud sub-segment is anticipated to be the fastest growing by 2031. The most significant issue for K-12 schools is a lack of funding, which prevents schools from using online education solutions. K-12 school districts can access the powerful and affordable features of cloud computing. These features bring many benefits to schools, including minimized data storage costs, eliminating the cost of expensive hardware, and providing ease of access and mobility. Cloud technology benefits both students and teachers since it empowers both the teacher and the learner. Integrating cloud computing systems and services into regular workflows enables administrators to do more by automating and simplifying access.

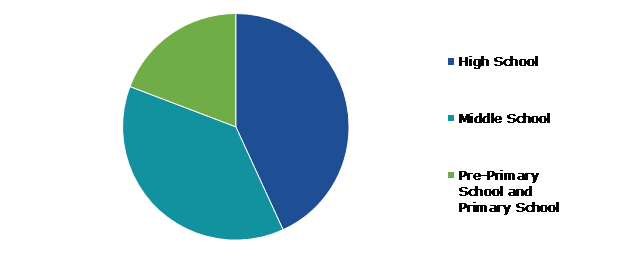

Global K12 Education Market, by Application

Based on application, the market has been divided into high school, middle school, and pre-primary school and primary school. Among these, the high school sub-segment accounted for the highest revenue share in 2021.

Global K12 Education Market Trends, by Application, 2021

Source: Research Dive Analysis

The high school sub-segment is anticipated to have a dominant market share by 2031. The inclusion of technology in higher education and the provision of high-quality education to students are expected to drive the high school segment. Higher education is known as post-secondary education. It is considered the final stage of formal learning that takes place after secondary education. Higher education is offered by several educational institutions such as colleges, universities, academics and institutes of technology, seminaries, trade schools, vocational schools, and several other career colleges. Higher secondary education consists of training & research guidance and post-secondary education.

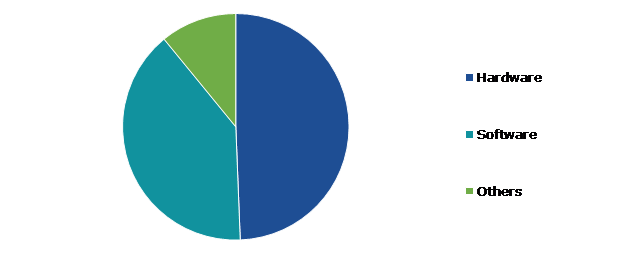

Global K12 Education Market, by Spend Analysis

Based on spend analysis, the market has been divided into hardware, software, and others. Among these, the hardware sub-segment accounted for the highest revenue share in 2021.

Global K12 Education Market Growth, by End-use, 2021

Source: Research Dive Analysis

The software sub-segment is anticipated to show the fastest growth by 2031. K-12 software is intended to help students in primary and secondary instruction and learning. This type of software can assist in managing student information, assisting instructors in teaching different courses, facilitating student collaboration, simplifying administrative operations, and enabling individualized learning. The software solution provides organizations with well-organized enterprise resource planning tools that support academic staff in creating better courses and effectively running classrooms and schools. In addition, institutions utilize software such as Blackboard, which allows them to manage courses and provides students with access to modular information and resources. Currently, there are countless platforms that can help emulate a teacher and student's interactions in a classroom.

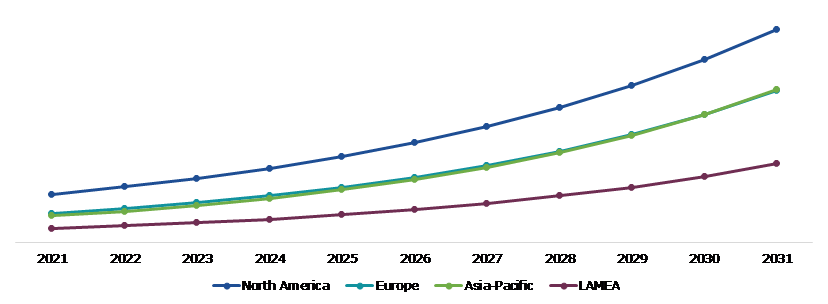

Global K12 Education Market, Regional Insights

The K12 education market was investigated across North America, Europe, Asia-Pacific, and LAMEA.

Global K12 Education Market Size & Forecast, by Region, 2021-2031 ($Billion)

Source: Research Dive Analysis

The Market for K12 Education in North America to be the Most Dominant

North America accounted for a dominating market share in 2021. due to the region's rapidly developing education system, a strong emphasis on reducing the administrative burden on teachers, massive spending on EdTech, an enhanced need for personalized learning in classrooms, and a rise in demand for intelligent solutions to improve students' school achievement. Furthermore, several significant firms are focusing more on academic information in the form of audio, video, and charts, which AI may use to improve students' knowledge. In the region, academic institutions are using learning frameworks such as classroom instruction and hybrid learning.

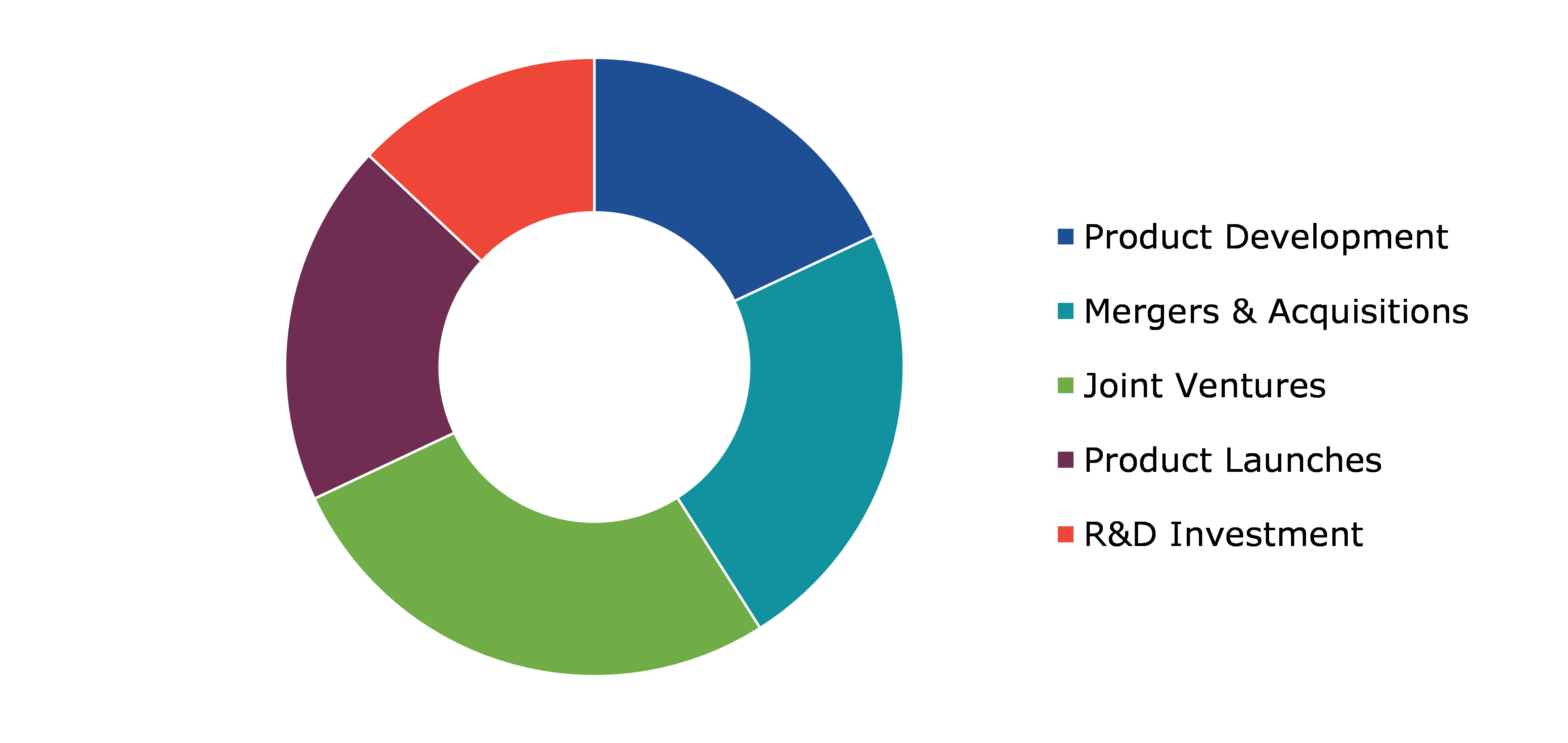

Competitive Scenario in the Global K12 Education Market

Product and merger acquisitions are common strategies followed by major market players. For instance, in April 2020, Tencent Classroom, a Chinese e-learning hub, reported that more than 80% of K12 students completed their classes through online school.

Source: Research Dive Analysis

Some of the leading K12 education market players are McGraw-Hill Education, Pearson Education Inc., Cengage Learning India Pvt. Ltd., K12 Inc., Blackboard Inc., Tata Class Edge, Educomp Solutions, Next Education India Pvt. Ltd., Adobe Systems, and TAL Education Group.

| Aspect | Particulars |

| Historical Market Estimations | 2020 |

| Base Year for Market Estimation | 2021 |

| Forecast Timeline for Market Projection | 2022-2031 |

| Geographical Scope | North America, Europe, Asia-Pacific, and LAMEA |

| Segmentation by Type |

|

| Segmentation by Deployment Mode |

|

| Segmentation by Application |

|

| Segmentation by Spend Analysis |

|

| Key Companies Profiled |

|

Q1. What is the size of the global K12 education market?

A. The size of the global K12 education market was over $ 103.5 billion in 2021 and is projected to reach $ 525.7 billion by 2031.

Q2. Which are the major companies in the K12 education market?

A. Marshalls, NewLine Hardscapes, and Belgard are some of the key players in the global K12 education market.

Q3. Which region, among others, possesses greater investment opportunities in the future?

A. Asia-Pacific possesses great investment opportunities for investors in the future.

Q4. What will be the growth rate of the Asia-Pacific K12 education market?

A. Asia-Pacific K12 education market is anticipated to grow at 8.4% CAGR during the forecast period.

Q5. What are the strategies opted by the leading players in this market?

A. Product launch and mergers & acquisitions are the two key strategies opted by the operating companies in this market.

Q6. Which companies are investing more on R&D practices?

A. Marshalls, NewLine Hardscapes, Belgard, Fendt Builder, Rosetta, and King'S Material are the companies investing more on R&D activities for developing new products and technologies.

1.Research Methodology

1.1.Desk Research

1.2.Real time insights and validation

1.3.Forecast model

1.4.Assumptions and forecast parameters

1.5.Market size estimation

1.5.1.Top-down approach

1.5.2.Bottom-up approach

2.Report Scope

2.1.Market definition

2.2.Key objectives of the study

2.3.Report overview

2.4.Market segmentation

2.5.Overview of the impact of COVID-19 on Global K12 Education market

3.Executive Summary

4.Market Overview

4.1.Introduction

4.2.Growth impact forces

4.2.1.Drivers

4.2.2.Restraints

4.2.3.Opportunities

4.3.Market value chain analysis

4.3.1.List of raw material suppliers

4.3.2.List of manufacturers

4.3.3.List of distributors

4.4.Innovation & sustainability matrices

4.4.1.Technology matrix

4.4.2.Regulatory matrix

4.5.Porter’s five forces analysis

4.5.1.Bargaining power of suppliers

4.5.2.Bargaining power of consumers

4.5.3.Threat of substitutes

4.5.4.Threat of new entrants

4.5.5.Competitive rivalry intensity

4.6.PESTLE analysis

4.6.1.Political

4.6.2.Economical

4.6.3.Social

4.6.4.Technological

4.6.5.Environmental

4.7.Impact of COVID-19 on K12 Education market

4.7.1.Pre-covid market scenario

4.7.2.Post-covid market scenario

5.K12 Education Market Analysis, by Type

5.1.Overview

5.2.Private

5.2.1.Definition, key trends, growth factors, and opportunities

5.2.2.Market size analysis, by region

5.2.3.Market share analysis, by country

5.3.Public

5.3.1.Definition, key trends, growth factors, and opportunities

5.3.2.Market size analysis, by region

5.3.3.Market share analysis, by country

5.4.Research Dive Exclusive Insights

5.4.1.Market attractiveness

5.4.2.Competition heatmap

6.K12 Education Market Analysis, by Deployment Mode

6.1.Cloud

6.1.1.Definition, key trends, growth factors, and opportunities

6.1.2.Market size analysis, by region

6.1.3.Market share analysis, by country

6.2.On-premise

6.2.1.Definition, key trends, growth factors, and opportunities

6.2.2.Market size analysis, by region

6.2.3.Market share analysis, by country

6.3.Research Dive Exclusive Insights

6.3.1.Market attractiveness

6.3.2.Competition heatmap

7.K12 Education Market Analysis, by Application

7.1.High School

7.1.1.Definition, key trends, growth factors, and opportunities

7.1.2.Market size analysis, by region

7.1.3.Market share analysis, by country

7.2.Middle School

7.2.1.Definition, key trends, growth factors, and opportunities

7.2.2.Market size analysis, by region

7.2.3.Market share analysis, by country

7.3.Pre-Primary School and Primary School

7.3.1.Definition, key trends, growth factors, and opportunities

7.3.2.Market size analysis, by region

7.3.3.Market share analysis, by country

7.4.Research Dive Exclusive Insights

7.4.1.Market attractiveness

7.4.2.Competition heatmap

8.K12 Education Market Analysis, by Spend Analysis

8.1.Hardware

8.1.1.Definition, key trends, growth factors, and opportunities

8.1.2.Market size analysis, by region

8.1.3.Market share analysis, by country

8.2.Software

8.2.1.Definition, key trends, growth factors, and opportunities

8.2.2.Market size analysis, by region

8.2.3.Market share analysis, by country

8.3.Others

8.3.1.Definition, key trends, growth factors, and opportunities

8.3.2.Market size analysis, by region

8.3.3.Market share analysis, by country

8.4.Research Dive Exclusive Insights

8.4.1.Market attractiveness

8.4.2.Competition heatmap

9.K12 Education Market, by Region

9.1.North America

9.1.1.U.S.

9.1.1.1.Market size analysis, by Type

9.1.1.2.Market size analysis, by Deployment Mode

9.1.1.3.Market size analysis, by Application

9.1.1.4.Market size analysis, by Spend Analysis

9.1.2.Canada

9.1.2.1.Market size analysis, by Type

9.1.2.2.Market size analysis, by Deployment Mode

9.1.2.3.Market size analysis, by Application

9.1.2.4.Market size analysis, by Spend Analysis

9.1.3.Mexico

9.1.3.1.Market size analysis, by Type

9.1.3.2.Market size analysis, by Deployment Mode

9.1.3.3.Market size analysis, by Application

9.1.3.4.Market size analysis, by Spend Analysis

9.1.4.Research Dive Exclusive Insights

9.1.4.1.Market attractiveness

9.1.4.2.Competition heatmap

9.2.Europe

9.2.1.Germany

9.2.1.1.Market size analysis, by Type

9.2.1.2.Market size analysis, by Deployment Mode

9.2.1.3.Market size analysis, by Application

9.2.1.4.Market size analysis, by Spend Analysis

9.2.2.UK

9.2.2.1.Market size analysis, by Type

9.2.2.2.Market size analysis, by Deployment Mode

9.2.2.3.Market size analysis, by Application

9.2.2.4.Market size analysis, by Spend Analysis

9.2.3.France

9.2.3.1.Market size analysis, by Type

9.2.3.2.Market size analysis, by Deployment Mode

9.2.3.3.Market size analysis, by Application

9.2.3.4.Market size analysis, by Spend Analysis

9.2.4.Spain

9.2.4.1.Market size analysis, by Type

9.2.4.2.Market size analysis, by Deployment Mode

9.2.4.3.Market size analysis, by Application

9.2.4.4.Market size analysis, by Spend Analysis

9.2.5.Italy

9.2.5.1.Market size analysis, by Type

9.2.5.2.Market size analysis, by Deployment Mode

9.2.5.3.Market size analysis, by Application

9.2.5.4.Market size analysis, by Spend Analysis

9.2.6.Rest of Europe

9.2.6.1.Market size analysis, by Type

9.2.6.2.Market size analysis, by Deployment Mode

9.2.6.3.Market size analysis, by Application

9.2.6.4.Market size analysis, by Spend Analysis

9.2.7.Research Dive Exclusive Insights

9.2.7.1.Market attractiveness

9.2.7.2.Competition heatmap

9.3.Asia-Pacific

9.3.1.China

9.3.1.1.Market size analysis, by Type

9.3.1.2.Market size analysis, by Deployment Mode

9.3.1.3.Market size analysis, by Application

9.3.1.4.Market size analysis, by Spend Analysis

9.3.2.Japan

9.3.2.1.Market size analysis, by Type

9.3.2.2.Market size analysis, by Deployment Mode

9.3.2.3.Market size analysis, by Application

9.3.2.4.Market size analysis, by Spend Analysis

9.3.3.India

9.3.3.1.Market size analysis, by Type

9.3.3.2.Market size analysis, by Deployment Mode

9.3.3.3.Market size analysis, by Application

9.3.3.4.Market size analysis, by Spend Analysis

9.3.4.Australia

9.3.4.1.Market size analysis, by Type

9.3.4.2.Market size analysis, by Deployment Mode

9.3.4.3.Market size analysis, by Application

9.3.4.4.Market size analysis, by Spend Analysis

9.3.5.South Korea

9.3.5.1.Market size analysis, by Type

9.3.5.2.Market size analysis, by Deployment Mode

9.3.5.3.Market size analysis, by Application

9.3.5.4.Market size analysis, by Spend Analysis

9.3.6.Rest of Asia-Pacific

9.3.6.1.Market size analysis, by Type

9.3.6.2.Market size analysis, by Deployment Mode

9.3.6.3.Market size analysis, by Application

9.3.6.4.Market size analysis, by Spend Analysis

9.3.7.Research Dive Exclusive Insights

9.3.7.1.Market attractiveness

9.3.7.2.Competition heatmap

9.4.LAMEA

9.4.1.Brazil

9.4.1.1.Market size analysis, by Type

9.4.1.2.Market size analysis, by Deployment Mode

9.4.1.3.Market size analysis, by Application

9.4.1.4.Market size analysis, by Spend Analysis

9.4.2.Saudi Arabia

9.4.2.1.Market size analysis, by Type

9.4.2.2.Market size analysis, by Deployment Mode

9.4.2.3.Market size analysis, by Application

9.4.2.4.Market size analysis, by Spend Analysis

9.4.3.UAE

9.4.3.1.Market size analysis, by Type

9.4.3.2.Market size analysis, by Deployment Mode

9.4.3.3.Market size analysis, by Application

9.4.3.4.Market size analysis, by Spend Analysis

9.4.4.South Africa

9.4.4.1.Market size analysis, by Type

9.4.4.2.Market size analysis, by Deployment Mode

9.4.4.3.Market size analysis, by Application

9.4.4.4.Market size analysis, by Spend Analysis

9.4.5.Rest of LAMEA

9.4.5.1.Market size analysis, by Type

9.4.5.2.Market size analysis, by Deployment Mode

9.4.5.3.Market size analysis, by Application

9.4.5.4.Market size analysis, by Spend Analysis

9.4.6.Research Dive Exclusive Insights

9.4.6.1.Market attractiveness

9.4.6.2.Competition heatmap

10.Competitive Landscape

10.1.Top winning strategies, 2021

10.1.1.By strategy

10.1.2.By year

10.2.Strategic overview

10.3.Market share analysis, 2021

11.Company Profiles

11.1.McGraw-Hill Education

11.1.1.Overview

11.1.2.Business segments

11.1.3.Product portfolio

11.1.4.Financial performance

11.1.5.Recent developments

11.1.6.SWOT analysis

11.2.Pearson Education Inc.

11.2.1.Overview

11.2.2.Business segments

11.2.3.Product portfolio

11.2.4.Financial performance

11.2.5.Recent developments

11.2.6.SWOT analysis

11.3.Cengage Learning India Pvt. Ltd

11.3.1.Overview

11.3.2.Business segments

11.3.3.Product portfolio

11.3.4.Financial performance

11.3.5.Recent developments

11.3.6.SWOT analysis

11.4.K12 Inc.

11.4.1.Overview

11.4.2.Business segments

11.4.3.Product portfolio

11.4.4.Financial performance

11.4.5.Recent developments

11.4.6.SWOT analysis

11.5.Blackboard Inc

11.5.1.Overview

11.5.2.Business segments

11.5.3.Product portfolio

11.5.4.Financial performance

11.5.5.Recent developments

11.5.6.SWOT analysis

11.6.Tata Class Edge.

11.6.1.Overview

11.6.2.Business segments

11.6.3.Product portfolio

11.6.4.Financial performance

11.6.5.Recent developments

11.6.6.SWOT analysis

11.7.Educomp Solutions

11.7.1.Overview

11.7.2.Business segments

11.7.3.Product portfolio

11.7.4.Financial performance

11.7.5.Recent developments

11.7.6.SWOT analysis

11.8.Next Education India Pvt. Ltd.

11.8.1.Overview

11.8.2.Business segments

11.8.3.Product portfolio

11.8.4.Financial performance

11.8.5.Recent developments

11.8.6.SWOT analysis

11.9.Adobe Systems.

11.9.1.Overview

11.9.2.Business segments

11.9.3.Product portfolio

11.9.4.Financial performance

11.9.5.Recent developments

11.9.6.SWOT analysis

11.10.TAL Education Group

11.10.1.Overview

11.10.2.Business segments

11.10.3.Product portfolio

11.10.4.Financial performance

11.10.5.Recent developments

11.10.6.SWOT analysis

12.Appendix

12.1.Parent & peer market analysis

12.2.Premium insights from industry experts

12.3.Related reports

K12 education is a system of education prevalent in the US and Canada wherein the primary and secondary education is supported through public schools, colleges, and similar educational institutions. In this system of education, the authority to implement and monitor the educational standards is decentralized and vested in local governments at district, municipality, or county level. This system evolved in the early 19th century and has been at the core of public education since then.

Forecast Analysis of the K12 Education Market

In recent years, there has been an increase in the adoption of Artificial intelligence (AI) and Open Educational Resources (OER) in the education sector which is expected to be the primary growth driver of the global K12 education market in the forecast years. Along with this, a surge in the popularity of online education is expected to push the market further. Also, growing investments by global educational institutions in the education sector is predicted to offer numerous investment and growth opportunities to the market in the analysis timeframe. However, lack of adequate budgetary allocation from the government side may restrain the growth of the K12 education market in the forecast period.

Regionally, the K12 education market in the North America region is expected to be the most dominant by 2031. The growing demand for personalized learning in schools and colleges is anticipated to become the main growth driver of the market in this region.

According to the report published by Research Dive, the global K12 education market is expected to gather a revenue of $525.7 billion by 2031 and grow at 17.7% CAGR in the 2022-2031 timeframe. Some prominent market players include McGraw-Hill Education, Blackboard Inc., Next Education India Pvt. Ltd., Pearson Education Inc., Tata Class Edge, Adobe Systems, Cengage Learning India Pvt. Ltd., Educomp Solution, TAL Education Group, K12 Inc., and many others.

Covid-19 Impact on the Market

The outbreak of the Covid-19 pandemic has had a massive negative effect on almost all industries and businesses across the world. The K12 education market faced a similar fate due to the pandemic. The primary reason behind the slowdown in the market was closure of educational institutions including schools, colleges, and universities across the world to curb the spread of the virus which reduced the scope of education during the pandemic.

Significant Market Developments

The significant companies operating in the industry are adopting numerous growth strategies & business tactics such as partnerships, collaborations, mergers & acquisitions, and launches to maintain a robust position in the overall market, thus helping the K12 education market to flourish. For instance:

- In January 2022, Instructure, an edtech company, announced the acquisition of LearnPlatform, a digital educational tools provider. This acquisition is predicted to help Instructure to increase its foothold in the K12 education market in the near future.

- In December 2022, SchoolStatus, a leading educational communication solutions provider, announced the acquisition of Smore, a global K12 email newsletter tool. This acquisition is expected to push the market share of SchoolStatus substantially in the coming period.

- In January 2023, LEAD, an edtech startup in India, announced the acquisition of Pearson, a British education publishing company. Under this acquisition agreement, LEAD is set to take over Pearson’s local K12 business, which is anticipated to push LEAD’s market revenue higher in the next few years.

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com