Artificial Intelligence And Robotics In Aerospace And Defense Market Report

RA08635

Artificial Intelligence and Robotics in Aerospace and Defense Market by Type (Hardware, Software, and Services), Application (Military, Commercial, and Space), and Regional Analysis (North America, Europe, Asia-Pacific, and LAMEA): Global Opportunity Analysis and Industry Forecast, 2022-2031

Global Artificial Intelligence and Robotics in Aerospace and Defense Market Analysis

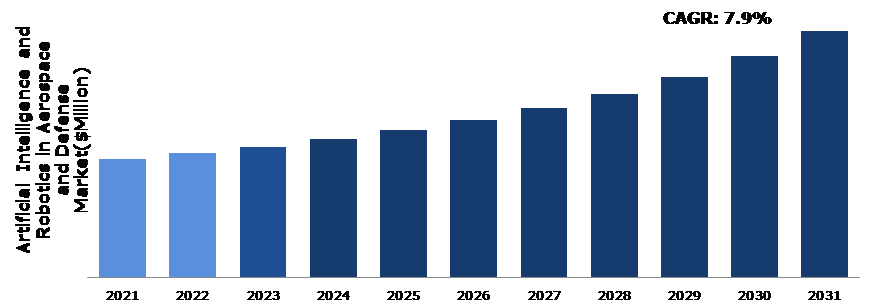

The Global Artificial Intelligence and Robotics in Aerospace and Defense Market Size was $17,200.0 million in 2021 and is predicted to grow with a CAGR of 7.9%, by generating a revenue of $35,848.1 million by 2031.

Global Artificial Intelligence and Robotics in Aerospace and Defense Market Synopsis

Artificial intelligence (AI) is one of the most generally recognized technologies across a wide range of sectors, including manufacturing. AI industrial robots are gaining popularity in the manufacturing industry. Industrial automation has already changed the manufacturing process, and AI-enabled robots are increasing that effect with more efficient and smooth procedures. AI industrial robots improves in the accuracy and consistency of product manufacture. Robots can operate for long periods of time without tiring and may function in hazardous environments. They save labor and inventory expenses while allowing for a quick response to design changes. As a result, AI-enabled industrial robots can significantly increase production value. These factors are anticipated to boost the artificial intelligence and robotics in aerospace and defense industry growth in the upcoming years.

One of the most significant threats to the artificial intelligence and robotics in aerospace and defense sector is the continuous transformation in the relationship between aircraft manufacturers and their suppliers. This will have a detrimental impact on the suppliers' sales and profitability. Additionally, the global military sector is facing a significant challenge to remain profitable in the face of a prospective market decline and to high costs in order to maintain consistent financial performance.

Due to technological advancements, it is now possible to perform complicated activities within a single click. AI-enabled robots provide a completely automated procedure that requires no human intervention. Artificially intelligent technologies are programmed to react automatically to unexpected events. Industrial robotics using artificial intelligence (AI) is based on algorithms that automate decision-making in manufacturing activities. These algorithms improve over time as the machine learns innovative methods to do the task. These factors are driving AI and robotics in aerospace and defense market growth.

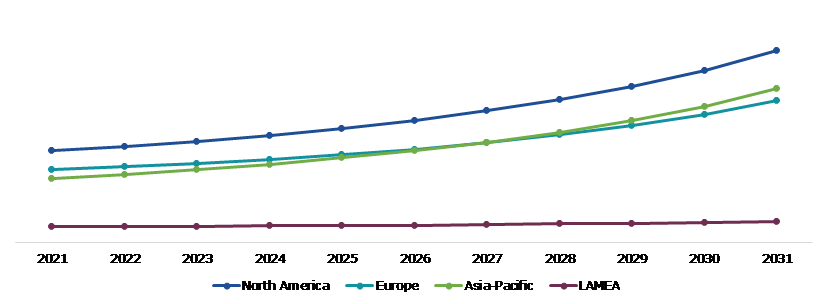

According to regional analysis, the Asia-Pacific artificial intelligence and robotics in aerospace and defense market in anticipated to show the fastest growth during the forecast period. This is because in China's New Generation Artificial Intelligence Development Plan highlights the country's strategy for developing AI for defense applications such as command and decision-making support, military deductions, defense equipment, and other uses. Such advancements are expected to have a significant beneficial impact on the market under consideration throughout the projected period.

Artificial Intelligence and Robotics in Aerospace and Defense Overview

Artificial intelligence and robotics are two powerful technologies that, when combined, generate an even more powerful technology. Artificial intelligence and robotics can be utilized to efficiently do a range of activities, eliminating the need for human labor in many cases.

Robotics and artificial intelligence (AI) complement and expand human potential, boost productivity, and shift away from basic thinking and toward human-like cognitive skills. The era of augmented intelligence, which seamlessly links human and machine intellect is the next stage of AI.

COVID-19 Impact on Global Artificial Intelligence and Robotics in Aerospace and Defense Market

The global aerospace and defense manufacturing sector is undergoing an unprecedented disruption due to the COVID-19 pandemic. Also, the revenue of airport operators and airlines in the commercial airline industry declined in 2020 and 2021 due to restrictions on internal and international travel to slow the spread of COVID-19. Consequently, the market for artificial intelligence and robotics in aerospace and defense witnessed a slight decline as the revenues of end users declined. Furthermore, several major airlines and airport authorities have invested in the use of artificial intelligence in different passenger operations at airports to improve safety and efficiency during the COVID-19 epidemic.

The rising use of AI-based technologies in the aerospace and defense sector, as well as increased expenditures being allocated to develop and integrate AI and machine learning (ML) into end-user sectors, are expected to keep the market in focus throughout the forecast period. However, the associated technical and operational challenges that are frequently experienced throughout the early phases of development and acceptance of a nascent technology are impeding the adoption of AI-based technologies.

Growing Applications of Artificial Intelligence to Drive the Market Growth

An increasing focus is being placed on developing AI systems that will enable autonomous operations in the aviation sector. AI has been integrated at various levels in a variety of aerospace applications, including aircraft maintenance, aircraft health and performance monitoring, airport operations, and pilot training, among others. Now that a new roadmap for the safe and ethical operation of AI has been established, companies in the aerospace and military sectors are likely to expand their deployment of AI and machine learning technology.

The defense sector has been one of the most active users of AI technologies. AI is rapidly becoming more prevalent in intelligence operations, command and control, and the usage of various semiautonomous and autonomous vehicles. In the modern military, aircraft autonomy based on AI concepts is in use to varied degrees. AI-based technologies, targeting technology, and autonomous drones are all utilized in the intelligence, surveillance, and reconnaissance (ISR) system.

To know more about global artificial intelligence and robotics in aerospace and defense market drivers, get in touch with our analysts here.

Increasing Technical and Operational Challenges to Restrain the Market Growth

Although AI technology and autonomous operations improve military decision-making, and increase the speed and scope of military action, these technologies may also be unpredictable or susceptible to unusual forms of manipulation. As a result, there is skepticism over the dependability of AI-based systems and robots in future combat operations. Additionally, using robots in complex military scenarios has given rise to a number of moral considerations. Concerns regarding utilizing killer robots that can fire weapons autonomously without a human in the loop have prompted scientists and activities to push the United Nations and global government to consider a preemptive ban on killer robots. During the projected term, these concerns and the ensuing pressure on the government are anticipated to hinder market growth.

Multiple Research and Development Initiatives to Drive Excellent Opportunities

A significant number of research and development activities are presently happening around the world to investigate the possible uses of artificial intelligence (AI) in the aerospace sector, particularly in domains such as air traffic control. Aviation authorities are now focusing on resolving ethical and safety issues about the incorporation of AI in such operations. In 2020, EASA published Artificial Intelligence Roadmap 1.0, which provides the Agency's initial perspective on the safety and ethical components of AI development in the aviation domain. Euro control, Europe's primary agency for coordinating and planning all air traffic control, has announced an action plan to accelerate the development of AI in aviation and air traffic management. Such instances provide lucrative opportunities for the market studied.

To know more about global artificial intelligence and robotics in aerospace and defense market opportunities, get in touch with our analysts here.

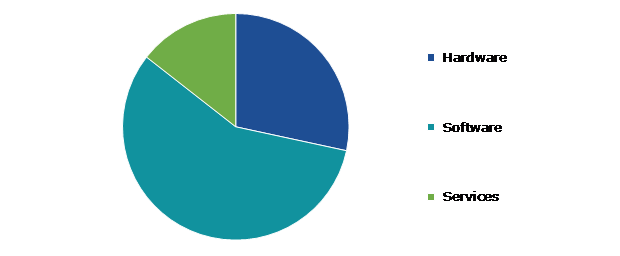

Global Artificial Intelligence and Robotics in Aerospace and Defense Market, by Type

Based on type, the market has been divided into hardware, software, and services. Among these, the software sub-segment accounted for the highest market share in 2021 and it is estimated to show the fastest growth during the forecast period.

Global Artificial Intelligence and Robotics in Aerospace and Defense Market Size, by Type, 2021

Source: Research Dive Analysis

The software sub-type accounted for a dominating market share in 2021. This segment includes a variety of software algorithms created by companies or made accessible through open-source platforms. The acceptability of AI-enabled technology is mostly determined by software, which is one of the key defining aspects. Strategic agility and readiness are getting more complex and demand for improved operating systems is increasing. Data is a crucial facilitator for information-driven operations in innovative realms like cyber and space, that demand its use. The development of cloud-based AI computer algorithms received significant investment from major corporations including IBM, Microsoft, and Google. TensorFlow and Google's open-source AI platform allow anyone to obtain hands-on expertise in AI computation and supply the company with unique datasets, helping them to identify future market opportunities.

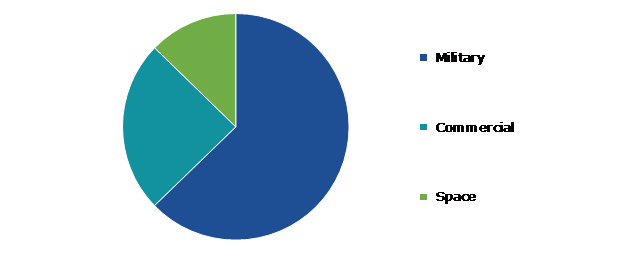

Global Artificial Intelligence and Robotics in Aerospace and Defense Market, by Application

Based on application, the market has been divided into military, commercial, and space. Among these, the military sub-segment accounted for highest revenue share in 2021.

Global Artificial Intelligence and Robotics in Aerospace and Defense Market Share, by Application, 2021

Source: Research Dive Analysis

The military sub-segment accounted for a dominating market share in 2021. It is expected that automated logistics, which combines unmanned ground vehicles (UGV) and unmanned aerial vehicles (UAV), bioinspired robots (swarm AI and deep neural networks), underwater mines location through neural networks, and object location, will support market growth. Increased military budget spending on R&D and the purchase of AI-based equipment, as well as increased investments in the development and integration of AI and robotics, are also expected to improve market prospects. These factors are anticipated to boost the growth of the military sub-segment during the analysis timeframe.

Global Artificial Intelligence and Robotics in Aerospace and Defense Market, Regional Insights

The artificial intelligence and robotics in aerospace and defense market was investigated across North America, Europe, Asia-Pacific, and LAMEA.

Global Artificial Intelligence and Robotics in Aerospace and Defense Market Size & Forecast, by Region, 2021-2031 (USD Million)

Source: Research Dive Analysis

The Market for Artificial Intelligence and Robotics in Aerospace and Defense in Asia-Pacific to be the Fastest Growing

The Asia-Pacific artificial intelligence and robotics in aerospace and defense market is anticipated to show the fastest growth during the forecast period. In the use of artificial intelligence and machine learning technologies, OEMs and operators equally are expected to increase their investment in AI integration procedures throughout the supply chain. The leading innovators in the field of AI development and integration have emerged to be countries including Japan, South Korea, and China. Advanced AI applications in the aviation sector are the focus of research projects being carried out through numerous institutes in the area. Numerous manufacturing facilities in Asia-Pacific that produce aircraft and related components have seen consistent gains as a consequence of the adoption of AI technologies. For instance, the Pratt & Whitney factory in Singapore has recently experienced continuous rise in output volumes as a result of the adoption of adaptive machining and cutting-edge automated inspection systems.

Competitive Scenario in the Global Artificial Intelligence and Robotics in Aerospace and Defense Market

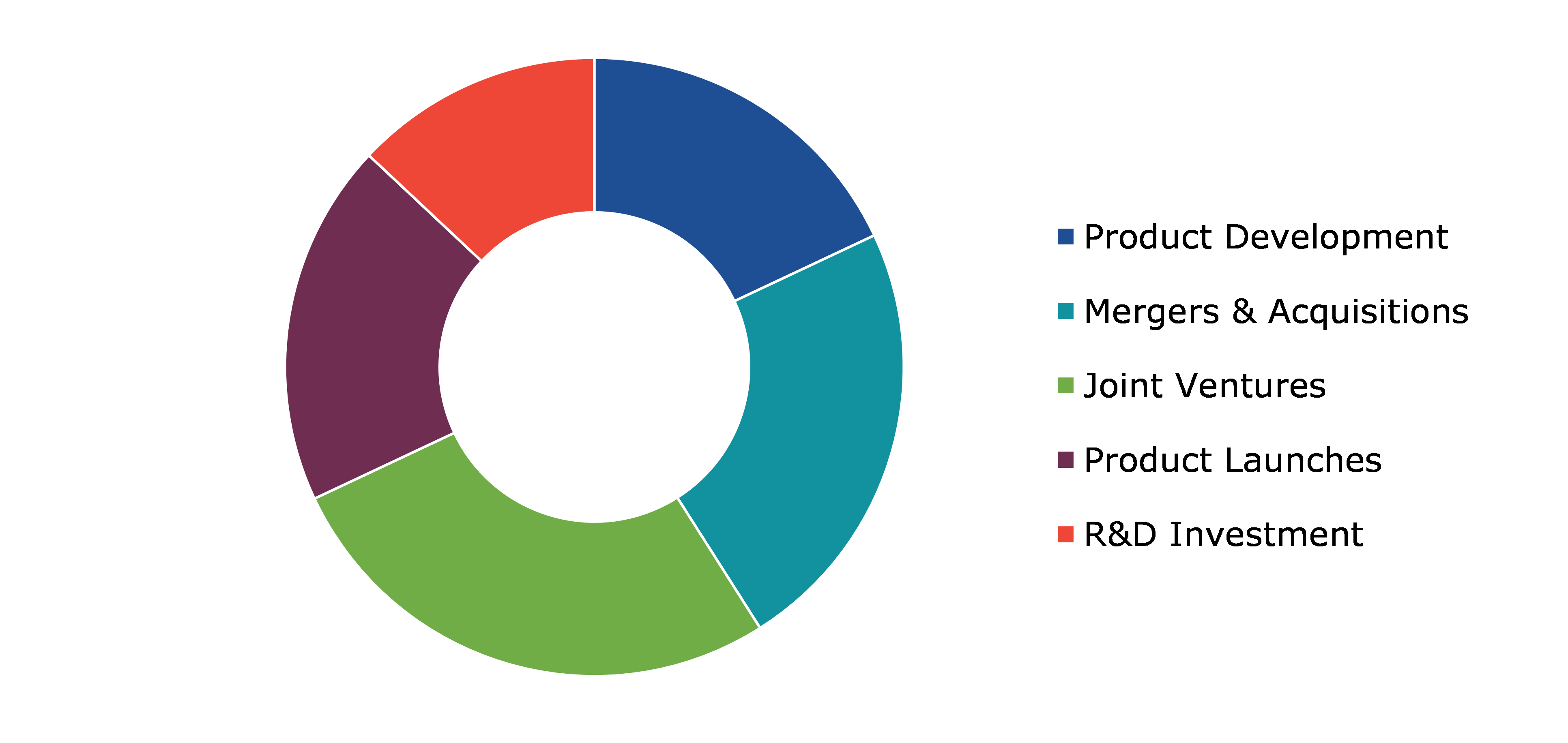

Investment and agreement are common strategies followed by major market players. For instance, in October 2021, IBM and Raytheon Technologies have entered into a collaboration agreement to create advanced artificial intelligence, cryptography, and quantum technologies for the aerospace, defense, and intelligence industries. For aerospace and government clients, the systems integrated with AI and quantum technologies are expected to have more secure communication networks and enhanced decision-making processes.

Source: Research Dive Analysis

Some of the leading artificial intelligence and robotics in aerospace and defense market players are Airbus SE, IBM Corporation, Boeing Company, GE Aviation, Thales Group, Lockheed Martin Corporation, Intel Corporation, Raytheon Technologies Corporation, General Dynamics Corporation, and Microsoft Corporation.

| Aspect | Particulars |

| Historical Market Estimations | 2021 |

| Base Year for Market Estimation | 2021 |

| Forecast Timeline for Market Projection | 2022-2031 |

| Geographical Scope | North America, Europe, Asia-Pacific, and LAMEA |

| Segmentation by Type |

|

| Segmentation by Application |

|

| Key Companies Profiled |

|

Q1. What is the size of the global artificial intelligence and robotics in aerospace and defense market?

A. The size of the global artificial intelligence and robotics in aerospace and defense market was over $17,200.0 million in 2021 and is projected to reach $35,848.1 million by 2031.

Q2. Which are the major companies in the artificial intelligence and robotics in aerospace and defense market?

A. Airbus SE, IBM Corporation, and Boeing Company are some of the key players in the global artificial intelligence and robotics in aerospace and defense market.

Q3. Which region, among others, possesses greater investment opportunities in the near future?

A. The Asia-Pacific region possesses great investment opportunities for investors to witness the most promising growth in the future.

Q4. What will be the growth rate of the Asia-Pacific artificial intelligence and robotics in aerospace and defense market?

A. Asia-Pacific artificial intelligence and robotics in aerospace and defense market is anticipated to grow at 9.4% CAGR during the forecast period.

Q5. What are the strategies opted by the leading players in this market?

A. Agreement and investment are the two key strategies opted by the operating companies in this market.

Q6. Which companies are investing more on R&D practices?

A. Airbus SE, IBM Corporation, and Boeing Company are the companies investing more on R&D activities for developing new products and technologies.

1.Research Methodology

1.1.Desk Research

1.2.Real time insights and validation

1.3.Forecast model

1.4.Assumptions and forecast parameters

1.5.Market size estimation

1.5.1.Top-down approach

1.5.2.Bottom-up approach

2.Report Scope

2.1.Market definition

2.2.Key objectives of the study

2.3.Report overview

2.4.Market segmentation

2.5.Overview of the impact of COVID-19 on the global artificial intelligence and robotics in aerospace and defense market

3.Executive Summary

4.Market Overview

4.1.Introduction

4.2.Growth impact forces

4.2.1.Drivers

4.2.2.Restraints

4.2.3.Opportunities

4.3.Market value chain analysis

4.3.1.List of raw material suppliers

4.3.2.List of manufacturers

4.3.3.List of distributors

4.4.Innovation & sustainability matrices

4.4.1.Technology matrix

4.4.2.Regulatory matrix

4.5.Porter’s five forces analysis

4.5.1.Bargaining power of suppliers

4.5.2.Bargaining power of consumers

4.5.3.Threat of substitutes

4.5.4.Threat of new entrants

4.5.5.Competitive rivalry intensity

4.6.PESTLE analysis

4.6.1.Political

4.6.2.Economical

4.6.3.Social

4.6.4.Technological

4.6.5.Environmental

4.7.Impact of COVID-19 on the artificial intelligence and robotics in aerospace and defense market

4.7.1.Pre-covid market scenario

4.7.2.Post-covid market scenario

5.Artificial Intelligence and Robotics in Aerospace and Defense Market Analysis, by Type

5.1.Overview

5.2.Hardware

5.2.1.Definition, key trends, growth factors, and opportunities

5.2.2.Market size analysis, by region, 2021-2031

5.2.3.Market share analysis, by country, 2021-2031

5.3.Software

5.3.1.Definition, key trends, growth factors, and opportunities

5.3.2.Market size analysis, by region, 2021-2031

5.3.3.Market share analysis, by country, 2021-2031

5.4.Services

5.4.1.Definition, key trends, growth factors, and opportunities

5.4.2.Market size analysis, by region, 2021-2031

5.4.3.Market share analysis, by country, 2021-2031

5.5.Research Dive Exclusive Insights

5.5.1.Market attractiveness

5.5.2.Competition heatmap

6.Artificial Intelligence and Robotics in Aerospace and Defense Market Analysis, by Application

6.1.Overview

6.2.Military

6.2.1.Definition, key trends, growth factors, and opportunities

6.2.2.Market size analysis, by region, 2021-2031

6.2.3.Market share analysis, by country, 2021-2031

6.3.Commercial

6.3.1.Definition, key trends, growth factors, and opportunities

6.3.2.Market size analysis, by region, 2021-2031

6.3.3.Market share analysis, by country, 2021-2031

6.4.Space

6.4.1.Definition, key trends, growth factors, and opportunities

6.4.2.Market size analysis, by region, 2021-2031

6.4.3.Market share analysis, by country, 2021-2031

6.5.Research Dive Exclusive Insights

6.5.1.Market attractiveness

6.5.2.Competition heatmap

7.Artificial Intelligence and Robotics in Aerospace and Defense Market, by Region

7.1.North America

7.1.1.U.S.

7.1.1.1.Market size analysis, by Type, 2021-2031

7.1.1.2.Market size analysis, by Application, 2021-2031

7.1.2.Canada

7.1.2.1.Market size analysis, by Type, 2021-2031

7.1.2.2.Market size analysis, by Application, 2021-2031

7.1.3.Mexico

7.1.3.1.Market size analysis, by Type, 2021-2031

7.1.3.2.Market size analysis, by Application, 2021-2031

7.1.4.Research Dive Exclusive Insights

7.1.4.1.Market attractiveness

7.1.4.2.Competition heatmap

7.2.Europe

7.2.1.Germany

7.2.1.1.Market size analysis, by Type, 2021-2031

7.2.1.2.Market size analysis, by Application, 2021-2031

7.2.2.UK

7.2.2.1.Market size analysis, by Type, 2021-2031

7.2.2.2.Market size analysis, by Application, 2021-2031

7.2.3.France

7.2.3.1.Market size analysis, by Type, 2021-2031

7.2.3.2.Market size analysis, by Application, 2021-2031

7.2.4.Spain

7.2.4.1.Market size analysis, by Type, 2021-2031

7.2.4.2.Market size analysis, by Application, 2021-2031

7.2.5.Italy

7.2.5.1.Market size analysis, by Type, 2021-2031

7.2.5.2.Market size analysis, by Application, 2021-2031

7.2.6.Rest of Europe

7.2.6.1.Market size analysis, by Type, 2021-2031

7.2.6.2.Market size analysis, by Application, 2021-2031

7.2.7.Research Dive Exclusive Insights

7.2.7.1.Market attractiveness

7.2.7.2.Competition heatmap

7.3.Asia-Pacific

7.3.1.China

7.3.1.1.Market size analysis, by Type, 2021-2031

7.3.1.2.Market size analysis, by Application, 2021-2031

7.3.2.Japan

7.3.2.1.Market size analysis, by Type, 2021-2031

7.3.2.2.Market size analysis, by Application, 2021-2031

7.3.3.India

7.3.3.1.Market size analysis, by Type, 2021-2031

7.3.3.2.Market size analysis, by Application, 2021-2031

7.3.4.Australia

7.3.4.1.Market size analysis, by Type, 2021-2031

7.3.4.2.Market size analysis, by Application, 2021-2031

7.3.5.South Korea

7.3.5.1.Market size analysis, by Type, 2021-2031

7.3.5.2.Market size analysis, by Application, 2021-2031

7.3.6.Rest of Asia-Pacific

7.3.6.1.Market size analysis, by Type, 2021-2031

7.3.6.2.Market size analysis, by Application, 2021-2031

7.3.7.Research Dive Exclusive Insights

7.3.7.1.Market attractiveness

7.3.7.2.Competition heatmap

7.4.LAMEA

7.4.1.Brazil

7.4.1.1.Market size analysis, by Type, 2021-2031

7.4.1.2.Market size analysis, by Application, 2021-2031

7.4.2.Saudi Arabia

7.4.2.1.Market size analysis, by Type, 2021-2031

7.4.2.2.Market size analysis, by Application, 2021-2031

7.4.3.UAE

7.4.3.1.Market size analysis, by Type, 2021-2031

7.4.3.2.Market size analysis, by Application, 2021-2031

7.4.4.South Africa

7.4.4.1.Market size analysis, by Type, 2021-2031

7.4.4.2.Market size analysis, by Application, 2021-2031

7.4.5.Rest of LAMEA

7.4.5.1.Market size analysis, by Type, 2021-2031

7.4.5.2.Market size analysis, by Application, 2021-2031

7.4.6.Research Dive Exclusive Insights

7.4.6.1.Market attractiveness

7.4.6.2.Competition heatmap

8.Competitive Landscape

8.1.Top winning strategies, 2021

8.1.1.By strategy

8.1.2.By year

8.2.Strategic overview

8.3.Market share analysis, 2021

9.Company Profiles

9.1.Airbus SE

9.1.1.Overview

9.1.2.Business segments

9.1.3.Product portfolio

9.1.4.Financial performance

9.1.5.Recent developments

9.1.6.SWOT analysis

9.2.IBM Corporation

9.2.1.Overview

9.2.2.Business segments

9.2.3.Product portfolio

9.2.4.Financial performance

9.2.5.Recent developments

9.2.6.SWOT analysis

9.3.Boeing Company

9.3.1.Overview

9.3.2.Business segments

9.3.3.Product portfolio

9.3.4.Financial performance

9.3.5.Recent developments

9.3.6.SWOT analysis

9.4.GE Aviation

9.4.1.Overview

9.4.2.Business segments

9.4.3.Product portfolio

9.4.4.Financial performance

9.4.5.Recent developments

9.4.6.SWOT analysis

9.5.Thales Group

9.5.1.Overview

9.5.2.Business segments

9.5.3.Product portfolio

9.5.4.Financial performance

9.5.5.Recent developments

9.5.6.SWOT analysis

9.6.Lockheed Martin Corporation

9.6.1.Overview

9.6.2.Business segments

9.6.3.Product portfolio

9.6.4.Financial performance

9.6.5.Recent developments

9.6.6.SWOT analysis

9.7.Intel Corporation

9.7.1.Overview

9.7.2.Business segments

9.7.3.Product portfolio

9.7.4.Financial performance

9.7.5.Recent developments

9.7.6.SWOT analysis

9.8.Raytheon Technologies Corporation

9.8.1.Overview

9.8.2.Business segments

9.8.3.Product portfolio

9.8.4.Financial performance

9.8.5.Recent developments

9.8.6.SWOT analysis

9.9.General Dynamics Corporation

9.9.1.Overview

9.9.2.Business segments

9.9.3.Product portfolio

9.9.4.Financial performance

9.9.5.Recent developments

9.9.6.SWOT analysis

9.10.Microsoft Corporation

9.10.1.Overview

9.10.2.Business segments

9.10.3.Product portfolio

9.10.4.Financial performance

9.10.5.Recent developments

9.10.6.SWOT analysis

The aerospace and defense sector is constantly changing and searching for new solutions to improve productivity, lower costs, and improve performance. To keep up with the company's fast pace, the aerospace and defense industries need to constantly grow and enhance their products and services. This is where the artificial intelligence and robotics solution comes in.

Artificial intelligence and robotics in aerospace and defense market have become increasingly prominent in recent years. Artificial intelligence and robotics are two potent technologies that, when used together, produce an even more potent technology. Artificial intelligence and robotics can be used to efficiently perform a variety of tasks, reducing the need for human labor in many cases. Robotics and artificial intelligence (AI) expand and improve human potential, increase production, and shift away from basic thinking towards cognitive abilities more like those of humans.

Recent Trends in the Artificial Intelligence and Robotics in Aerospace and Defense Market

Artificial intelligence and robotics in aerospace and defense market is continuously evolving with new technologies and practices. The aerospace and defense industries have now begun utilizing AI to improve cyber security measures, such as finding vulnerabilities in systems and networks as well as detecting and responding to cyber threats. In addition, robotics is being utilized to improve manufacturing processes in the aerospace and defense industries. This involves everything, from 3D printing technology to robots used on assembly lines.

Newest Insights in the Artificial Intelligence and Robotics in Aerospace and Defense Market

As per a report by Research Dive, the global artificial intelligence and robotics in aerospace and defense market is expected to grow at a CAGR of 7.9% and generate revenue of $35,848.1 million by 2031. The primary factors driving the growth of the market are the increasing use of AI in intelligence operations, command and control, and the use of different semiautonomous and autonomous vehicles. However, rising operational and technological difficulties are expected to hinder the market growth.

Artificial intelligence and robotics in aerospace and defense market in the Asia-Pacific region are expected to remain dominant in the coming years. The region's high revenue in 2021 was driven by the widespread adoption of AI technologies, and the numerous companies in the region that manufacture aircraft and related components have consistently experienced improvements.

How are Market Players Responding to the Rising Demand for Artificial Intelligence and Robotics in Aerospace and Defense?

Market players are responding to the rising demand for artificial intelligence and robotics in aerospace and defense by investing in research and development to investigate at potential applications of AI in the aircraft industry, especially in areas like air traffic control. Aviation authorities are currently concentrating on overcoming ethical and security concerns around the use of AI in such missions.

In addition, market players are increasingly focusing on strategic partnerships and collaborations with other players in the industry to leverage their strengths and expand their reach. Some of the foremost players in the artificial intelligence and robotics in aerospace and defense market are IBM Corporation, Microsoft Corporation, Boeing Company, Airbus SE, GE Aviation, Thales Group, Intel Corporation, Raytheon Technologies Corporation, Lockheed Martin Corporation, General Dynamics Corporation, and others. These players are focused on implementing strategies such as mergers and acquisitions, novel developments, collaborations, and partnerships to reach a leading position in the global market.

For instance,

- In March 2021, Sea Machines Robotics, a top provider of cutting-edge technologies for the marine and maritime industries, and HamiltonJet, a global market frontrunner for waterjet propulsion systems for high speed marine vessels, signed a contract to create a new pilot-assist product that makes use of autonomous command and control and computer vision to drive waterjet watercraft to the forefront of navigation and use in the 21st century.

- In October 2021, IBM, an international technology company, announced a collaboration contract to develop advanced cryptographic, AI, and quantum solutions for the defense, aerospace, and intelligence industries. These systems can incorporate AI and quantum technologies and are projected to provide more secure communication networks and superior decision-making processes for aerospace and government customers.

- In March 2022, Paras Aerospace, a firm that develops technology for UAV solutions, launched PARAS, an AI drone IT product that meets the data processing needs of the solar, powerline, mining, wind, and pipeline inspection industries.

COVID-19 Impact on the Global Artificial Intelligence and Robotics in Aerospace and Defense Market

The COVID-19 pandemic made an adverse impact on the global artificial intelligence and robotics in aerospace and defense market. The global aerospace and defense manufacturing industry is going through tremendous changes. Also, because of limits on domestic and international travel to stop the spread of COVID-19, the revenue of airport operators and airlines in the commercial aircraft business fell in 2020 and 2021. As a result, the market for artificial intelligence and robotics in aerospace and defense experienced a modest decline as end-user revenues fell. However, the increasing usage of AI-based technologies in the aerospace and defense sectors, as well as increased spending on developing and integrating AI and machine learning (ML) into end-user sectors, are projected to fuel the artificial intelligence and robotics in aerospace and defense market growth in the coming years.

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com