Formulation Development Outsourcing Market Report

RA08625

Formulation Development Outsourcing Market by Services Type (Pre-Formulation and Formulation Development), Route of Formulation (Oral, Injectable, and Others), End-user (Pharmaceutical Industries and Research and Academic Institutes), and Regional Analysis (North America, Europe, Asia-Pacific, and LAMEA) Global Opportunity Analysis and Industry Forecast, 2022-2031

Global Formulation Development Outsourcing Market Analysis

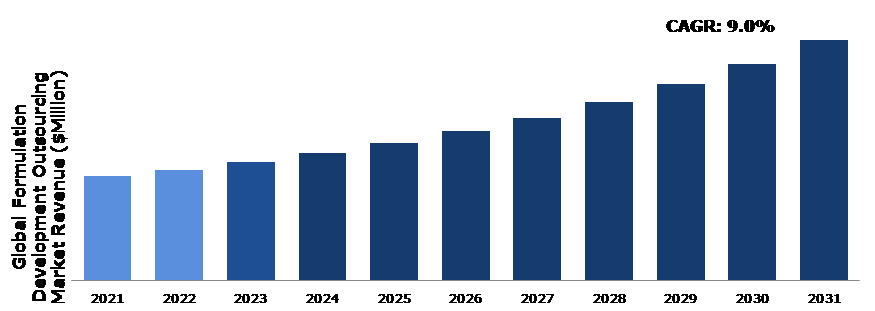

The Global Formulation Development Outsourcing Market Size was $22,452.5 million in 2021 and is predicted to grow with a CAGR of 9.0%, by generating a revenue of $51,901.3 million by 2031.

Global Formulation Development Outsourcing Market Synopsis

Significant factors driving market expansion include the increasing relevance of novel drug development as a result of the increasing patent expirations of important pharmaceuticals and the increased outsourcing of formulation development services by the majority of pharmaceutical and biotechnological companies. To reduce the risk involved and save both, time and money as the drug develops, majority of the biopharmaceutical companies work with outsourcing services in their early phases of the process. The rising need for novel medications as a result of the significant burden of infectious and chronic diseases is one of the main factors driving the demand for formulation development. These factors are anticipated to boost the formulation development outsourcing growth in the upcoming years.

However, high total R&D expenses are a result of protracted development times and dismal success rates. The pharmaceutical industry's structural changes and a lack of funds to complete the drug development process through formulation development are the main reasons preventing their market expansion.

Development services are still in high demand, and for over the past few years, formulation and bioavailability-related development services have seen significant increase. Pharmaceutical companies are playing an important role in the formulation development outsourcing market by innovating and focusing on cancer formulation development and other medication development. The major players are working together to produce effective medications and gene treatments that will benefit biotech. Furthermore, the adoption of new techniques and pharmaceutical services by key market players will accelerate market size throughout the forecast period. Some of the important players provide clinics, drug substance development, and medical items to patients. Furthermore, formulation development outsourcing market competitors are competing to increase their revenue by developing and creating many innovative products that drive customer demand.

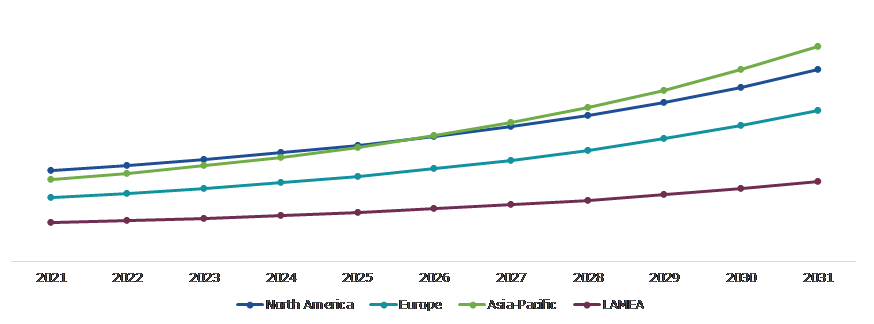

According to regional analysis, the North America formulation development outsourcing market accounted for highest market share in 2021. The expansion of the regional market can be ascribed to higher R&D spending and increased use of cutting-edge technology. Due to the high prevalence of chronic diseases, the demand for biotechnology and pharmaceutical services outsourcing services is rising quickly in the region.

Formulation Development Outsourcing Overview

The pharmaceutical and biotechnology sectors are seeing an increase in the technique of outsourcing drug development. The formulation development outsourcing market has grown due to an increase in the number of biopharmaceutical and pharmaceutical companies that outsource their work. Small and medium-sized pharmaceutical companies that have the necessary resources frequently use formulation development outsourcing services. The process of product development is sped up through outsourcing, which is also a more affordable option than hiring a specialist personnel.

COVID-19 Impact on Global Formulation Development Outsourcing Market

Since pharmaceuticals fell under the category of essential services and were spared from the limits imposed by the statewide lockdown, the impact of COVID-19 on the pharma sector has been less severe than that seen in the other sectors. However, the COVID-19 pandemic slowed down major pharmaceutical companies' production, their supply chain, and the export of some crucial APIs and medications. It also brought to light, the world's reliance on China for various pharmaceuticals' APIs. Due to lockdown measures implemented by the Chinese government during the outbreak, 44 Chinese firms were judged to be inactive. It had an effect on China's exports of important materials. It has caused several countries to launch plans for domestic API production, and countries around the EU have reviewed its healthcare systems to combat pandemics and guarantee a steady flow of API production. Leading pharmaceutical firms are adapting their business strategies and providing solutions based on key performance indicators as needed by each nation. Pharmaceutical companies had to adjust their business strategies to serve a sizable patient base as a result of rising healthcare expenditures and the current COVID-19 pandemic. For the API sector to be able to utilize operations in the event of exceptional conditions, the production process needs to be restructured. The COVID-19 virus provided pharmaceutical businesses with the ideal opportunity to evaluate their position, prepare for upcoming problems, and realign their reliance on various supply chains.

Growing Chronic Diseases and Increase in Clinical Trials Drives the Growth of the Market

The primary cause of disability and death worldwide are diseases like chronic respiratory diseases (CRD), diabetes, chronic kidney diseases (CKD), cancer, cardiac strokes, and neurological disorders. Researchers are now facing new obstacles and opportunities as a result of the emergence and spread of numerous infectious and chronic diseases. These diseases require early diagnosis, prevention, and treatment, which calls for the development of novel diagnostic tools, tests, medications, and vaccinations. The other two major infectious diseases are hepatitis and HIV. The World Health Organization (WHO) estimates that as of October 2017, 71 million people worldwide were believed to be infected with hepatitis C. The WHO also reported that 36.7 million people worldwide were HIV-positive. These elements support the expansion of the global clinical trials market.

To know more about global formulation development outsourcing market drivers, get in touch with our analysts here.

Limited Funds for Formulation Development Outsourcing to Restrain the Market Growth

Drug development is a lengthy, expensive, and difficult process with no guarantee that a drug will be successful. Funding is needed at every stage of the drug development process. High total R&D expenses are a result of protracted development times and dismal success rates. Treatment development is a time-consuming, costly, and complex process that is full of uncertainty about whether or not a drug will be successful. Every stage of the drug development process necessitates funding. Long development timeframes and low success rates result in high total R&D expenses. The key constraints restricting market growth are structural changes in the pharmaceutical sector and a lack of funds to complete the medication development process through formulation development.

Increasing Demand For Medications of Chronic Diseases to Drive Excellent Opportunity

Chronic diseases and conditions are becoming increasingly widespread all over the world. Europe's pharmaceutical and biotechnology businesses have boosted their R&D spending in recent years in response to the growing demand for novel drugs. This might be attributed to an aging population, chronic diseases, and infectious diseases. The creation of anti-cancer pharmaceutical formulations is crucial since formulation includes stability, solubility, and bioavailability throughout drug development.

To know more about global formulation development outsourcing market opportunities, get in touch with our analysts here.

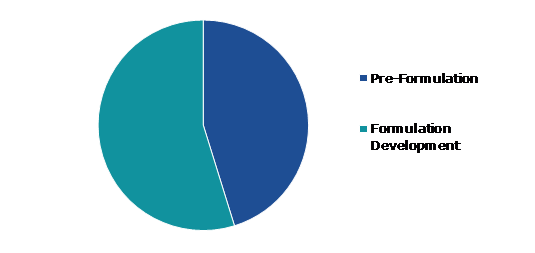

Global Formulation Development Outsourcing Market, by Services Type

Based on services type, the market has been divided into pre-formulation and formulation development. Among these, the formulation development segment accounted for the highest market share in 2021 whereas the pre-formulation sub-segment is estimated to show the fastest growth during the forecast period.

Global Formulation Development Outsourcing Market Size, by Services Type, 2021

Source: Research Dive Analysis

The formulation development segment accounted for the largest market share in 2021. The process of formula development is crucial because it entails creating a stable and patient-acceptable drug preparation and form. On behalf of Informa Pharma Intelligence, Rentschler Biopharma SE, and Leukocare AG, Informa Engage conducted a survey in 2018 to assess the current state, significance, and future of formulation in the development of pharmaceutical products. Participants in the poll who were active in the biopharmaceutical business provided insightful responses. Pharmaceutical formulations are clinically relevant when they significantly affect patients' quality of life, illness outcomes, and adherence to treatment regimens.

The pre-formulation segment is anticipated to show the fastest growth by during the forecast period. Pre-formulation research can be divided into a number of categories. The phase of development during which the physicochemical qualities of the drug material are described and established is known as preformulation. The optimal formulation and delivery technique for pre-Clinical trials are determined by knowledge of the relevant physiochemical and biopharmaceutical characteristics.

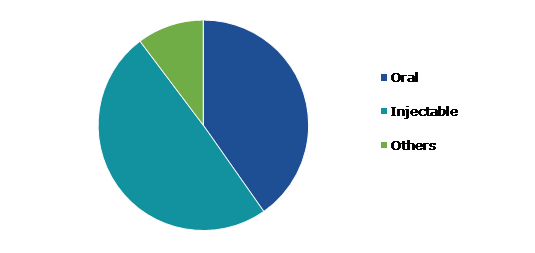

Global Formulation Development Outsourcing Market, by Route of Formulation

Based on route of formulation, the market has been divided into oral, injectable, and others. Among these, the oral segment is expected to show a fastest CAGR during the forecast period.

Global Formulation Development Outsourcing Market Share, by Route of Formulation, 2021

Source: Research Dive Analysis

The oral segment accounted for the largest market share in 2021. A licensed product that is administered orally and absorbed through the stomach, intestine, or gastrointestinal tract is referred to as an oral formulation. This includes, but is not limited to, the introduction of substances using tablets, capsules, controlled time-release preparations, liquid suspensions, and sublingual administration. Oral formulations are self-administering and do not require the assistance of a trained physician for medication administration, which is one of the primary reasons for their worldwide popularity. Furthermore, as compared to others, these formulations provide greater formulation design flexibility.

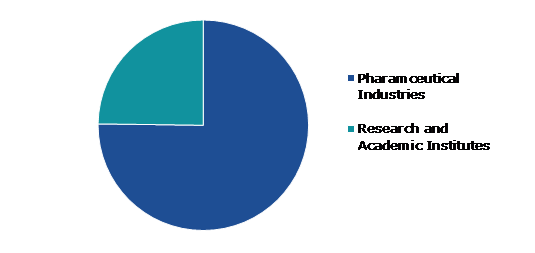

Global Formulation Development Outsourcing Market, by End-user

Based on end-user, the market has been divided into pharmaceutical industries and research and academic institutes. Among these, the pharmaceutical industries segment accounted for highest revenue share in 2021.

Global Formulation Development Outsourcing Market Forecast, by End-user, 2021

Source: Research Dive Analysis

The pharmaceutical industries segment accounted for the largest market share in 2021. The purpose of pharmaceutical industries is to cure, immunize, or treat patients' symptoms, and hence, it finds, develops, manufactures, and promotes medicines or pharmaceutical drugs for usage as medications. Pharmaceutical industries provide medicines for the individual treatment of various types of diseases. Personalized medicine, also known as precision medicine, aims to provide medical care depending on a patient's unique features and genetic composition. Precision treatments are becoming more popular as companies abandon the one-size-fits-all model for common medical conditions. GSK, Teva Pharmaceuticals, and AstraZeneca are among the major pharmaceutical firms investing in the development of personalized medicines.

Global Formulation Development Outsourcing Market, Regional Insights

The formulation development outsourcing market was investigated across North America, Europe, Asia-Pacific, and LAMEA.

Global Formulation Development Outsourcing Market Size & Forecast, by Region, 2021-2031 (USD Million)

Source: Research Dive Analysis

The Market for Formulation Development Outsourcing in North America to be the Most Dominant

The market is anticipated to expand significantly in the North America region due to the spread of chronic diseases. Additionally, this region has a highly developed healthcare system and cutting-edge technical advancements. The region's demand for formulation development outsourcing is expanding due to an increase in the number of approved drugs and the development of a vaccine. Countries such as China and India are leading the industry and driving market growth. The rising trend of outsourcing medical services is a significant driver in the expansion of the North American pharmaceutical contract manufacturing market. Another important element that significantly contributes to the market expansion is the patent cliff. The increasing patent expirations of numerous medications, along with the shrinking profit margins on branded medications, are prompting a majority of healthcare organizations to outsource manufacturing in order to reduce costs.

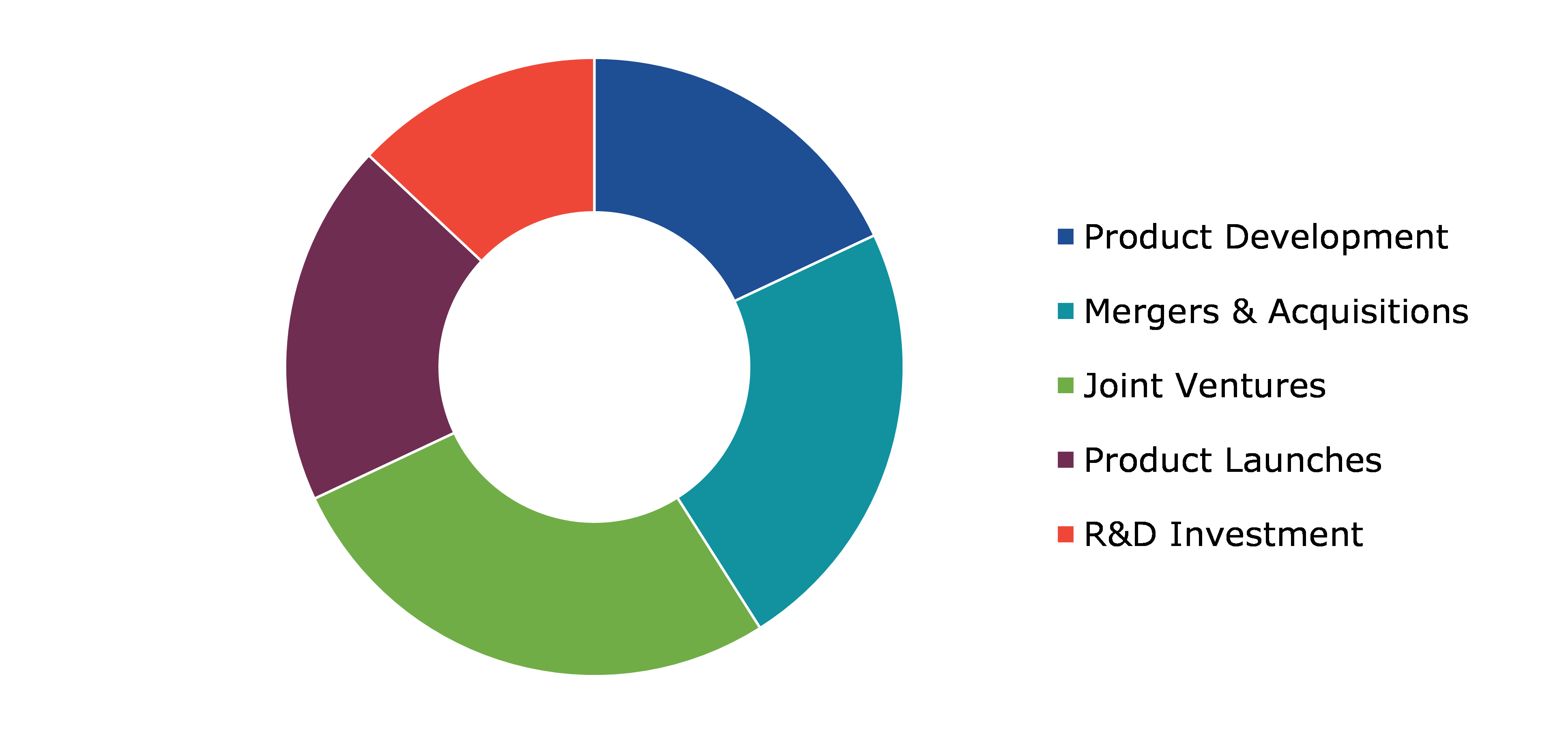

Competitive Scenario in the Global Formulation Development Outsourcing Market

Investment and agreement are common strategies followed by major market players. For instance, in January 2022, Coriolis Pharma launched new ATMP Formulation Development Facilities. The proximity of the new facilities to Coriolis' Martinized headquarters will greatly enhance the company's capacity for ATMP development.

Source: Research Dive Analysis

Some of the leading formulation development outsourcing market players are Charles River Laboratories. Syngene International Limited, Catalent, Inc, Piramal Pharma Ltd., Intertek Group plc, Thermo Fisher Scientific, Eurofins Scientific, Laboratory Corporation of America Holdings.,Dr. Reddy’s Laboratories Ltd.,and EMERGENT.

| Aspect | Particulars |

| Historical Market Estimations | 2020 |

| Base Year for Market Estimation | 2021 |

| Forecast Timeline for Market Projection | 2022-2031 |

| Geographical Scope | North America, Europe, Asia-Pacific, LAMEA |

| Segmentation by Services Type |

|

| Segmentation by Route of Formulation |

|

| Segmentation by End-user |

|

| Key Companies Profiled |

|

Q1. What is the size of the global formulation development outsourcing market?

A. The size of the global formulation development outsourcing market was over $22,452.5 million in 2021 and is projected to reach $51,901.3 million by 2031.

Q2. Which are the major companies in the formulation development outsourcing market?

A. Charles River Laboratories., Syntene International Limited, Catalent, Inc, Piramal Pharma Ltd. are some of the key players in the global formulation development outsourcing market.

Q3. Which region, among others, possesses greater investment opportunities in the near future?

A. The Asia-Pacific region possesses great investment opportunities for investors to witness the most promising growth in the future.

Q4. What will be the growth rate of the Asia-Pacific formulation development outsourcing market?

A. Asia-Pacific formulation development outsourcing market is anticipated to grow at 10.4% CAGR during the forecast period.

Q5. What are the strategies opted by the leading players in this market?

A. Agreement and investment are the two key strategies opted by the operating companies in this market.

Q6. Which companies are investing more on R&D practices?

A. Intertek Group plc, Thermo Fisher Scientific, Eurofins Scientific. are the companies investing more on R&D activities for developing new products and technologies.

1.Research Methodology

1.1.Desk Research

1.2.Real time insights and validation

1.3.Forecast model

1.4.Assumptions and forecast parameters

1.5.Market size estimation

1.5.1.Top-down approach

1.5.2.Bottom-up approach

2.Report Scope

2.1.Market definition

2.2.Key objectives of the study

2.3.Report overview

2.4.Market segmentation

2.5.Overview of the impact of COVID-19 on Global formulation development outsourcing market

3.Executive Summary

4.Market Overview

4.1.Introduction

4.2.Growth impact forces

4.2.1.Drivers

4.2.2.Restraints

4.2.3.Opportunities

4.3.Market value chain analysis

4.3.1.List of raw material suppliers

4.3.2.List of manufacturers

4.3.3.List of distributors

4.4.Innovation & sustainability matrices

4.4.1.Technology matrix

4.4.2.Regulatory matrix

4.5.Porter’s five forces analysis

4.5.1.Bargaining power of suppliers

4.5.2.Bargaining power of consumers

4.5.3.Threat of substitutes

4.5.4.Threat of new entrants

4.5.5.Competitive rivalry intensity

4.6.PESTLE analysis

4.6.1.Political

4.6.2.Economical

4.6.3.Social

4.6.4.Technological

4.6.5.Environmental

4.7.Impact of COVID-19 on formulation development outsourcing market

4.7.1.Pre-covid market scenario

4.7.2.Post-covid market scenario

5.Formulation Development Outsourcing Market Analysis, by Services Type

5.1.Overview

5.2.Pre-Formulation

5.2.1.Definition, key trends, growth factors, and opportunities

5.2.2.Market size analysis, by region, 2021-2031

5.2.3.Market share analysis, by country, 2021-2031

5.3.Formulation Development

5.3.1.Definition, key trends, growth factors, and opportunities

5.3.2.Market size analysis, by region, 2021-2031

5.3.3.Market share analysis, by country, 2021-2031

5.4.Research Dive Exclusive Insights

5.4.1.Market attractiveness

5.4.2.Competition heatmap

6.Formulation Development Outsourcing Market Analysis, by Route of Formulation

6.1.Oral

6.1.1.Definition, key trends, growth factors, and opportunities

6.1.2.Market size analysis, by region, 2021-2031

6.1.3.Market share analysis, by country, 2021-2031

6.2.Injectable

6.2.1.Definition, key trends, growth factors, and opportunities

6.2.2.Market size analysis, by region, 2021-2031

6.2.3.Market share analysis, by country, 2021-2031

6.3.Others

6.3.1.Definition, key trends, growth factors, and opportunities

6.3.2.Market size analysis, by region, 2021-2031

6.3.3.Market share analysis, by country, 2021-2031

6.4.Research Dive Exclusive Insights

6.4.1.Market attractiveness

6.4.2.Competition heatmap

7.Formulation Development Outsourcing Market Analysis, by End-user

7.1.Pharmaceutical Industries

7.1.1.Definition, key trends, growth factors, and opportunities

7.1.2.Market size analysis, by region, 2021-2031

7.1.3.Market share analysis, by country, 2021-2031

7.2.Research and Academic Institutes

7.2.1.Definition, key trends, growth factors, and opportunities

7.2.2.Market size analysis, by region, 2021-2031

7.2.3.Market share analysis, by country, 2021-2031

7.3.Research Dive Exclusive Insights

7.3.1.Market attractiveness

7.3.2.Competition heatmap

8.Formulation Development Outsourcing Market, by Region

8.1.North America

8.1.1.U.S.

8.1.1.1.Market size analysis, by Services Type, 2021-2031

8.1.1.2.Market size analysis, by Route of Formulation, 2021-2031

8.1.1.3.Market size analysis, by End-user, 2021-2031

8.1.2.Canada

8.1.2.1.Market size analysis, by Services Type, 2021-2031

8.1.2.2.Market size analysis, by Route of Formulation, 2021-2031

8.1.2.3.Market size analysis, by End-user, 2021-2031

8.1.3.Mexico

8.1.3.1.Market size analysis, by Services Type, 2021-2031

8.1.3.2.Market size analysis, by Route of Formulation, 2021-2031

8.1.3.3.Market size analysis, by End-user, 2021-2031

8.1.4.Research Dive Exclusive Insights

8.1.4.1.Market attractiveness

8.1.4.2.Competition heatmap

8.2.Europe

8.2.1.Germany

8.2.1.1.Market size analysis, by Services Type, 2021-2031

8.2.1.2.Market size analysis, by Route of Formulation, 2021-2031

8.2.1.3.Market size analysis, by End-user, 2021-2031

8.2.2.UK

8.2.2.1.Market size analysis, by Services Type, 2021-2031

8.2.2.2.Market size analysis, by Route of Formulation, 2021-2031

8.2.2.3.Market size analysis, by End-user, 2021-2031

8.2.3.France

8.2.3.1.Market size analysis, by Services Type, 2021-2031

8.2.3.2.Market size analysis, by Route of Formulation, 2021-2031

8.2.3.3.Market size analysis, by End-user, 2021-2031

8.2.4.Spain

8.2.4.1.Market size analysis, by Services Type, 2021-2031

8.2.4.2.Market size analysis, by Route of Formulation, 2021-2031

8.2.4.3.Market size analysis, by End-user, 2021-2031

8.2.5.Italy

8.2.5.1.Market size analysis, by Services Type, 2021-2031

8.2.5.2.Market size analysis, by Route of Formulation, 2021-2031

8.2.5.3.Market size analysis, by End-user, 2021-2031

8.2.6.Rest of Europe

8.2.6.1.Market size analysis, by Services Type, 2021-2031

8.2.6.2.Market size analysis, by Route of Formulation, 2021-2031

8.2.6.3.Market size analysis, by End-user, 2021-2031

8.2.7.Research Dive Exclusive Insights

8.2.7.1.Market attractiveness

8.2.7.2.Competition heatmap

8.3.Asia Pacific

8.3.1.China

8.3.1.1.Market size analysis, by Services Type, 2021-2031

8.3.1.2.Market size analysis, by Route of Formulation, 2021-2031

8.3.1.3.Market size analysis, by End-user, 2021-2031

8.3.2.Japan

8.3.2.1.Market size analysis, by Services Type, 2021-2031

8.3.2.2.Market size analysis, by Route of Formulation, 2021-2031

8.3.2.3.Market size analysis, by End-user, 2021-2031

8.3.3.India

8.3.3.1.Market size analysis, by Services Type, 2021-2031

8.3.3.2.Market size analysis, by Route of Formulation, 2021-2031

8.3.3.3.Market size analysis, by End-user, 2021-2031

8.3.4.Australia

8.3.4.1.Market size analysis, by Services Type, 2021-2031

8.3.4.2.Market size analysis, by Route of Formulation, 2021-2031

8.3.4.3.Market size analysis, by End-user, 2021-2031

8.3.5.South Korea

8.3.5.1.Market size analysis, by Services Type, 2021-2031

8.3.5.2.Market size analysis, by Route of Formulation, 2021-2031

8.3.5.3.Market size analysis, by End-user, 2021-2031

8.3.6.Rest of Asia Pacific

8.3.6.1.Market size analysis, by Services Type, 2021-2031

8.3.6.2.Market size analysis, by Route of Formulation, 2021-2031

8.3.6.3.Market size analysis, by End-user, 2021-2031

8.3.7.Research Dive Exclusive Insights

8.3.7.1.Market attractiveness

8.3.7.2.Competition heatmap

8.4.LAMEA

8.4.1.Brazil

8.4.1.1.Market size analysis, by Services Type, 2021-2031

8.4.1.2.Market size analysis, by Route of Formulation, 2021-2031

8.4.1.3.Market size analysis, by End-user, 2021-2031

8.4.2.Saudi Arabia

8.4.2.1.Market size analysis, by Services Type, 2021-2031

8.4.2.2.Market size analysis, by Route of Formulation, 2021-2031

8.4.2.3.Market size analysis, by End-user, 2021-2031

8.4.3.UAE

8.4.3.1.Market size analysis, by Services Type, 2021-2031

8.4.3.2.Market size analysis, by Route of Formulation, 2021-2031

8.4.3.3.Market size analysis, by End-user, 2021-2031

8.4.4.South Africa

8.4.4.1.Market size analysis, by Services Type, 2021-2031

8.4.4.2.Market size analysis, by Route of Formulation, 2021-2031

8.4.4.3.Market size analysis, by End-user, 2021-2031

8.4.5.Rest of LAMEA

8.4.5.1.Market size analysis, by Services Type, 2021-2031

8.4.5.2.Market size analysis, by Route of Formulation, 2021-2031

8.4.5.3.Market size analysis, by End-user, 2021-2031

8.4.6.Research Dive Exclusive Insights

8.4.6.1.Market attractiveness

8.4.6.2.Competition heatmap

9.Competitive Landscape

9.1.Top winning strategies, 2021

9.1.1.By strategy

9.1.2.By year

9.2.Strategic overview

9.3.Market share analysis, 2021

10.Company Profiles

10.1.Charles River Laboratories.

10.1.1.Overview

10.1.2.Business segments

10.1.3.Product portfolio

10.1.4.Financial performance

10.1.5.Recent developments

10.1.6.SWOT analysis

10.2.Syngene International Limited

10.2.1.Overview

10.2.2.Business segments

10.2.3.Product portfolio

10.2.4.Financial performance

10.2.5.Recent developments

10.2.6.SWOT analysis

10.3.Catalent, Inc

10.3.1.Overview

10.3.2.Business segments

10.3.3.Product portfolio

10.3.4.Financial performance

10.3.5.Recent developments

10.3.6.SWOT analysis

10.4.Piramal Pharma Ltd.

10.4.1.Overview

10.4.2.Business segments

10.4.3.Product portfolio

10.4.4.Financial performance

10.4.5.Recent developments

10.4.6.SWOT analysis

10.5.Intertek Group plc

10.5.1.Overview

10.5.2.Business segments

10.5.3.Product portfolio

10.5.4.Financial performance

10.5.5.Recent developments

10.5.6.SWOT analysis

10.6.Thermo Fisher Scientific

10.6.1.Overview

10.6.2.Business segments

10.6.3.Product portfolio

10.6.4.Financial performance

10.6.5.Recent developments

10.6.6.SWOT analysis

10.7.Eurofins Scientific

10.7.1.Overview

10.7.2.Business segments

10.7.3.Product portfolio

10.7.4.Financial performance

10.7.5.Recent developments

10.7.6.SWOT analysis

10.8.Laboratory Corporation of America Holdings.

10.8.1.Overview

10.8.2.Business segments

10.8.3.Product portfolio

10.8.4.Financial performance

10.8.5.Recent developments

10.8.6.SWOT analysis

10.9.Dr. Reddy’s Laboratories Ltd.

10.9.1.Overview

10.9.2.Business segments

10.9.3.Product portfolio

10.9.4.Financial performance

10.9.5.Recent developments

10.9.6.SWOT analysis

10.10.EMERGENT

10.10.1.Overview

10.10.2.Business segments

10.10.3.Product portfolio

10.10.4.Financial performance

10.10.5.Recent developments

10.10.6.SWOT analysis

Formulation development refers to development of a drug product and to determine the lifecycle, efficiency, success, and patentability of that pharmaceutical product. Almost all pharmaceutical companies outsource this process to a company who specializes in this business cycle so as to relieve itself (the pharmaceutical company) from investing capital and time in medical trials of the drug.

Forecast Analysis of the Formulation Development Outsourcing Market

According to the report published by Research Dive, the global formulation development outsourcing market is expected to gather a revenue of $51,901.3 million by 2031 and grow at 9.0% CAGR in the 2022-2031 timeframe.

In recent years, there has been an increasing relevance of novel drug development due to growing patent expirations of important pharmaceuticals. This increased relevance is predicted to be the primary growth driver of the formulation development outsourcing market in the forecast period. Additionally, increased outsourcing of formulation development services by the majority of pharmaceutical and biotechnological companies is anticipated to push the market forward. Along with this, growing incidence of chronic diseases across the globe and increase in clinical trials is projected to offer numerous growth and investment opportunities in the market in the analysis timeframe. However, limited funds for formulation development outsourcing is estimated to create hurdles in the full-fledged growth of the formulation development outsourcing market in the coming period.

Regionally, the formulation development outsourcing market in the North America region is expected to be the most dominant by 2031. Highly developed healthcare system and cutting-edge technical advancements are anticipated to be the two main factors contributing to the growth of the market in the forecast period.

Some prominent market players include Charles River Laboratories, Intertek Group plc, Laboratory Corporation of America Holdings., Syngene International Limited, Thermo Fisher Scientific, Dr. Reddy’s Laboratories Ltd., Catalent, Inc, Eurofins Scientific, EMERGENT, Piramal Pharma Ltd., and many others.

Covid-19 Impact on the Market

The outbreak of the Covid-19 pandemic has had a massive negative effect on almost all industries and businesses across the world. The formulation development outsourcing market faced a similar fate due to the pandemic. Though the impact of the pandemic on the pharmaceutical sector was not as severe as other sectors, nonetheless, formulation development processes were stalled due to shortage of active pharmaceutical ingredients across the globe. This limited the scope of production of new drugs which led to a decline in the growth rate of the market.

Significant Market Developments

The significant companies operating in the industry are adopting numerous growth strategies & business tactics such as partnerships, collaborations, mergers & acquisitions, and launches to maintain a robust position in the overall market, thus helping the formulation development outsourcing market to flourish. For instance:

- In April 2022, DFE Pharma, an excipient providing pharmaceutical company, Harro Höfliger, a medical equipment manufacturer, and Sterling, an active pharmaceutical ingredient manufacturer, announced signing of a partnership. This partnership is aimed at developing dry-powder inhalation solutions for respiratory treatments and is expected to help all the three companies to pool their resources and achieve the intended target in a seamless manner.

- In October 2022, Catalent Inc., a global leader in pharmaceutical industry, announced the acquisition of Metrics Contract Services, a leading contract development and manufacturing organization (CDMO). This acquisition is expected to expand the footprint of Catalent substantially in the next few years.

- In October 2022, Symeres, a leading drug discovery company, announced the acquisition of Exemplify BioPharma, a US-based Contract Research Organization (CRO). The acquisition is predicted to boost the market share of Symeres in the North America region significantly in the coming period.

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com