Contingent Workforce Management Market Report

RA08622

Contingent Workforce Management Market by Type (Permanent Staffing and Flexible Staffing), End-user Industry (IT & Telecom, BFSI, Healthcare, Manufacturing-Automotive, Business/Professional Service, Retail Trade, Pharma/Biotech/Medical Equip, Manufacturing-Consumer Products, Government (Excluding Education), Transportation/Warehousing/Packaging, Manufacturing-Others, Real Estate and Rental Leasing, and Others), and Regional Analysis (North America, Europe, Asia-Pacific, and LAMEA): Global Opportunity Analysis and Industry Forecast, 2022-2031

Global Contingent Workforce Management Market Analysis

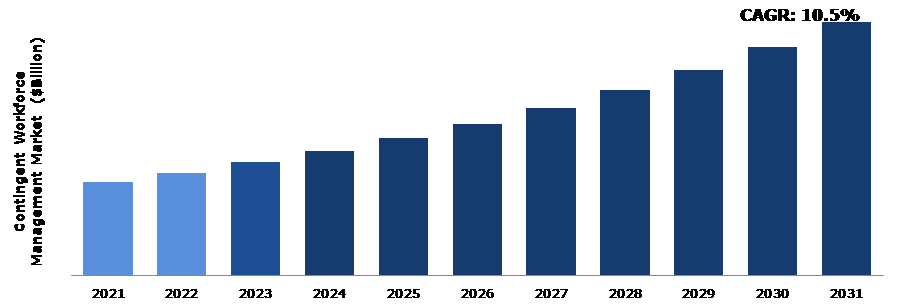

The Global Contingent Workforce Management Market Size was $171,531.1 billion in 2021 and is predicted to grow with a CAGR of 10.5%, by generating a revenue of $465,192.9 billion by 2031.

Global Contingent Workforce Management Market Synopsis

The process of managing the contingent workforce in a company is called contingent workforce management. It often includes procedures for worker assignment, supply of tools and system access, creating and implementing rules and regulations, and enrolling contingent employees in any compliance or development courses that their position might demand. Companies that must quickly ramp up or down their labor base due to economic conditions or the yearly pattern of the workforce may find great benefits in using an external workforce. Regular employees also benefit from this since they don't have to be paid off when business demands change because the flexible nature of the contingent workforce protects them from these kinds of changes. Furthermore, finding and recruiting individuals takes time, and there are instances when you need to find crucial talent on immediate basis. Employers can swiftly fill available positions by hiring contingent labor. These factors are anticipated to boost the contingent workforce management market growth in the upcoming years.

However, the hiring of contingent employees has many issues. Finding a contingent worker that can perform the job and adjust quickly to the working culture might be challenging. Organizations may also encounter legal and compliance concerns as a result of worker misclassification. Organizations are frequently wary of disclosing confidential information to these non-permanent employees. A corporation faces the danger of incurring significant fines if it classifies someone as a contingent worker when they should be considered an employee. Before planning a strategy to hire contingent employees, organizations must be aware of the rules that apply in their sector.

The increasing demand for flexible workforces is expected to offer lucrative opportunities in the upcoming years. The pandemic brought attention to flexible work arrangements, especially remote working. Flexible work arrangements aid organizations in cost-cutting, increased productivity, and rise in employee engagement.

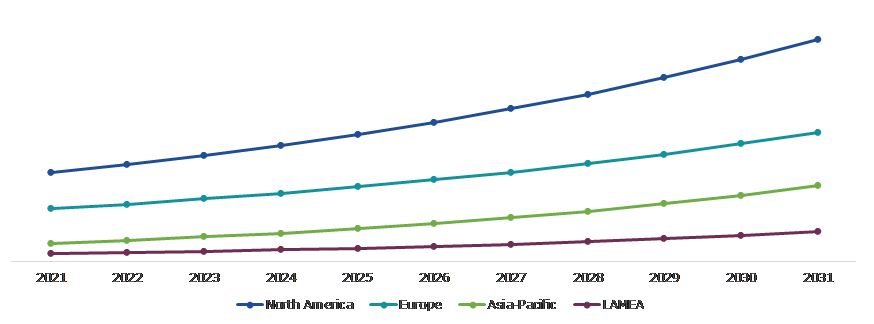

According to regional analysis, the North America accounted for the highest contingent workforce management market share in 2021. Due to the pandemic, there was a considerable demand in the region for workforce management. Organizations increasingly adopted digital management systems because of layoffs and remote working during the outbreak.

Contingent Workforce Management Overview

The process of managing the human resources of a company is known as contingent workforce management. It includes all of the processes involved in hiring, selecting, and maintaining employees. Permanent recruits who have long-term employment agreements with the firm and temporary or contract employees who take on short-term tasks for employers are the two categories in contingent workforce management.

COVID-19 Impact on Global Contingent Workforce Management Market

The novel coronavirus outbreak had a huge impact on the way people work, with an upsurge in remote working for many employees; however, a trend that has significantly accelerated is the increase in the demand for contingent workforce and ultimately, the contingent workforce solutions. Due to the pandemic and global lockdowns, flexibility became the norm for organizations, and this led to an understanding of the value of outsourced workforces. The expenditure on solutions for managing contingent workforces has grown dramatically as a result of the growing need to streamline expenses. Workforce management was an efficient way to counteract the disruption driven by the pandemic. Businesses had to change how their staff collaborated in order to adjust to the new market conditions. The pandemic has compelled firms to create a future-proof talent strategy. Businesses are currently concentrating on workforce flexibility, good project management, and providing more remote work to employees as a result of the pandemic experience, and some of these changes are anticipated to be permanent in the upcoming years.

Increased Work Flexibility and Ability of Contingent Workforce Management in the Industrial Sector to Drive the Market Growth

The value of flexible work has grown significantly among employees across the world. The productivity and amount of time an employee spends working increases with flexible options. Flexible work arrangements not only benefit employees but also businesses. Flexibility in the workplace helps businesses attract top talent. Higher profit margins are produced during economic upturns and capital can be preserved during market crises with the contingent workforce. The business environment of today is changing. Small businesses must be adaptable and ready to react to changing conditions. Ideally, contingent work's temporary, short-term nature suits that criterion. By using contingent workers, a company is not locked into a strict, protracted contract. A firm can employ the contingent workforce as a resource as needed. A company can hire contingent labor to fill up the gaps if there is an unexpected increase in work. They can locate a skilled contractor if a particular project comes up. The obligations of the business to the freelancer also stop when a time of collaboration ends. These factors are anticipated to boost the contingent workforce management market size during the forecasted time period.

To know more about global contingent workforce management market drivers, get in touch with our analysts here.

Growing Co-employment Contingent Workforce Management to Restrain the Market Growth

The term "co-employment risk" is used to describe situations in which two or more businesses have some kind of control over a worker and are consequently seen as having employer duties to that worker. When businesses use staff that is supplied by outside parties, co-employment risk frequently exists. Risk is a significant but complex concern in programs for contingent workers. To manage contingent program risk effectively, client stakeholders—including procurement, legal, HR, and business managers—must work together. Such a risk is anticipated to hamper the contingent workforce management market growth.

Increasing Use of Contingent Workforce in IT and Telecommunications Industry to Offer Lucrative Opportunities

Contingent workers are becoming a huge part of the workforce in the IT and telecommunications sectors. The organizations in these sectors are increasingly employing contingent workforce on a project or short-term basis lasting anything from a few months up to two years in tenure. This fixed-term period is aiding management to evaluate skills and assess whether contingent workers fit the company’s requirements before hiring permanently. Tech companies often require the utilization of a wide range of specialists in various areas of operations. The use of a contingent workforce helps tech companies to hire professionals with the required expertise and helps them to hire the talent without creating a long-term financial commitment. These are the major factors anticipated to boost the contingent workforce management market size during the analysis timeframe.

To know more about global contingent workforce management market opportunities, get in touch with our analysts here.

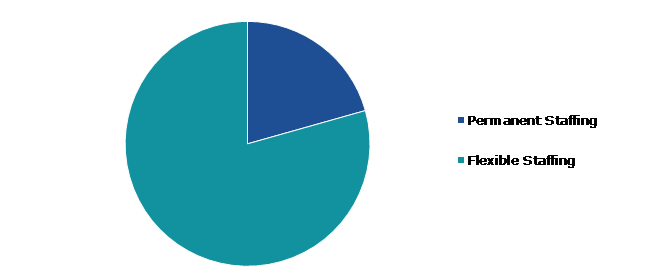

Global Contingent Workforce Management Market, by Type

Based on type, the market has been divided into permanent staffing and flexible staffing. Among these, the flexible staffing sub-segment accounted for the highest market share in 2021 whereas the permanent staffing sub-segment is estimated to show the fastest growth during the forecast period.

Global Contingent Workforce Management Market Size, by Type, 2021

Source: Research Dive Analysis

The flexible staffing sub-type accounted for the largest market share in 2021. Employing contingent workers is one way that businesses use flexible staffing. As an alternative to recruiting permanent staff, HR teams and other departments use a contingent workforce to address changing business and operational difficulties. Contingent workers are independent contractors, freelancers, gig workers, and employees offered through agencies; they are employed by companies to fill a short-term skill gap, such as during a permanent employee's maternity leave, fulfilling a rapid increase in the demand for workers (e.g., seasonal work), using temporary workers to test candidates for permanent positions supporting a small business instead than making expensive full-time recruits, acquiring top talent from employees who value other flexibility in their work schedules, such as parents and students. Owing to the various benefits of flexible staffing, organizations increasingly used this strategy in 2021 and are expected to further hire a flexible workforce in the upcoming years.

The permanent staffing sub-type is anticipated to show the fastest growth in 2031. The process of supplying necessary applicants for long-term employment based on predetermined candidate criteria is known as permanent staffing. To ensure a full solution offering, a permanent staffing service provider gathers the most suitable people based on the standards of salary, experience, cultural resonance, and job description. Finding, selecting, interviewing, and integrating the necessary talent into the business are the responsibilities of a provider of permanent staffing solutions. While staffing employees permanently, the company offers various benefits to employees such as a provident fund for the retirement of the employee, medical insurance, regular holidays, etc. Owing to these benefits, the inclination towards permanent job roles is expected to increase among employees in the upcoming years.

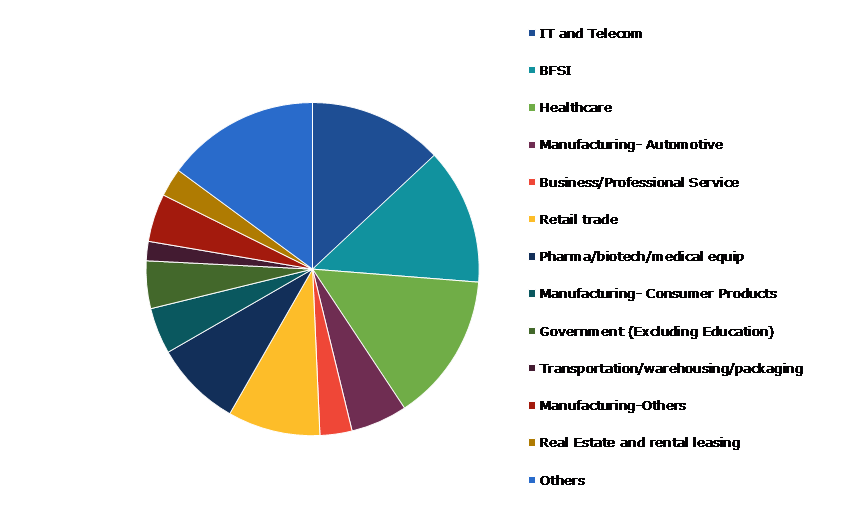

Global Contingent Workforce Management Market, by End-user Industry

Based on end-use industry, the market has been divided into IT & Telecom, BFSI, healthcare, manufacturing-automotive, business/professional service, retail trade, pharma/biotech/medical equip, manufacturing-consumer products, government (excluding education), transportation/warehousing/packaging, manufacturing-others, real estate & rental leasing, and others. Among these, the business/professional service sub-segment is estimated to show the fastest growth during the forecast period in 2031.

Global Contingent Workforce Management Market Share, by End-use Industry, 2021

Source: Research Dive Analysis

The business/professional service sub-segment is estimated to show the fastest growth during the forecast period. The term "business/professional service” is wide and includes a variety of businesses. Professional services can be any tasks that a business owner would need to contract out to free up more time for their top objectives. Professional services firms specialize in a particular skill or area, and their work enables business owners to concentrate on their primary operations. Instead of a real, physical product, they provide knowledge and concepts to aid businesses in becoming successful. Professional services can be provided as an addition to a company's core offerings or as the customer's main source of income. Consultants and professional service providers are different in that consultants may just provide advice or direction on a certain function, but professional service providers are frequently accountable for the outcome of their work. These factors are anticipated to boost the contingent workforce management market growth of business/professional service sub-segment during the analysis timeframe.

Global Contingent Workforce Management Market, Regional Insights

The contingent workforce management market was investigated across North America, Europe, Asia-Pacific, and LAMEA.

Global Contingent Workforce Management Market Size & Forecast, by Region, 2021-2031 (USD Billion)

Source: Research Dive Analysis

The Market for Contingent Workforce Management in North America to be the Most Dominant

The North America is anticipated to dominate the global contingent workforce management market during the forecast period. The demand for contingent workforce management in the North America region is driven by rising labor force participation rate and rapid industrialization, which has increased demand for flexible workforces from businesses in a variety of industries, including the manufacturing, ITES/BPO, and retail sectors, North America has a significant opportunity to expand its contingent workforce management market. Due to the quick industrialization, rising labor force participation and increased need for flexible workers from businesses in many industries, the contingent workforce management market share has grown significantly.

Competitive Scenario in the Global Contingent Workforce Management Market

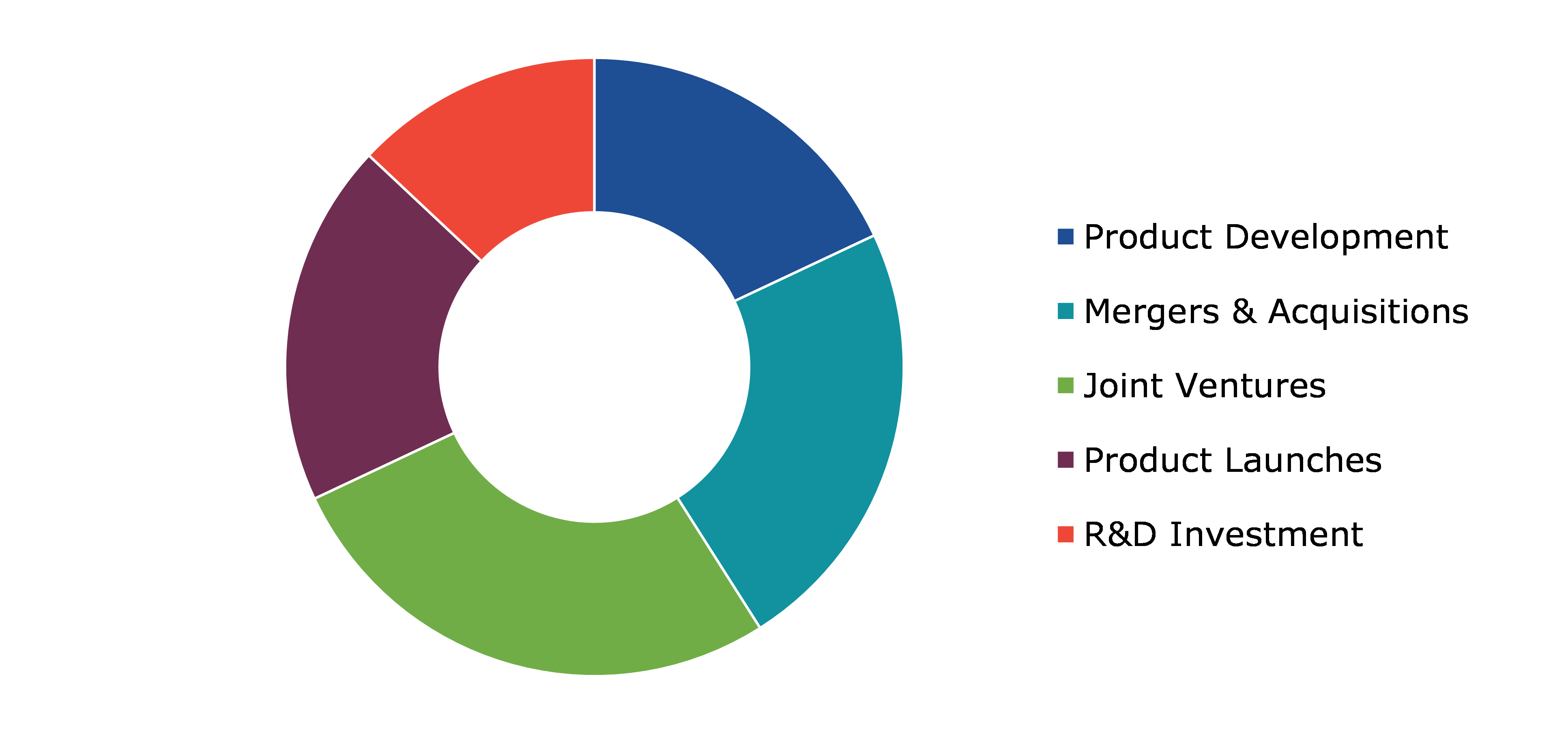

Partnership and agreement are common strategies followed by major market players. For instance, in 2021, Workday acquired VNDLY, a contingent workforce management company for $510M. VNDLY develops specialized ERP software to accommodate contingent employees.

Source: Research Dive Analysis

Some of the leading contingent workforce management market players are Avature, Beeline, BOWEN Group, Impartx, Coupa Software Inc, SAP SE, CXC Global, Magnit, Ramco Systems, Zeel Solutions Ltd.

| Aspect | Particulars |

| Historical Market Estimations | 2020 |

| Base Year for Market Estimation | 2021 |

| Forecast Timeline for Market Projection | 2022-2031 |

| Geographical Scope | North America, Europe, Asia-Pacific, LAMEA |

| Segmentation by Type |

|

| Segmentation by End-user Industry |

|

| Key Companies Profiled |

|

Q1. What is the size of the global contingent workforce management market?

A. The size of the global Contingent Workforce Management market was over $ 171,531.1 billion in 2021 and is projected to reach $ 465,192.9 billion by 2031.

Q2. Which are the major companies in the contingent workforce management market?

A. Avature, Beeline, and BOWEN Group are some of the key players in the global contingent workforce management market.

Q3. Which region, among others, possesses greater investment opportunities in the near future?

A. The Asia-Pacific region possesses great investment opportunities for investors to witness the most promising growth in the future.

Q4. What will be the growth rate of the Asia-Pacific contingent workforce management market?

A. Asia-Pacific contingent workforce market is anticipated to grow at 15.1% CAGR during the forecast period.

Q5. What are the strategies opted by the leading players in this market?

A. Partnership and investment are the two key strategies opted by the operating companies in this market.

Q6. Which companies are investing more on R&D practices?

A. Coupa Software Inc, SAP SE, and CXC Global, Inc. are the companies investing more on R&D activities for developing new products and technologies.

1.Research Methodology

1.1.Desk Research

1.2.Real time insights and validation

1.3.Forecast model

1.4.Assumptions and forecast parameters

1.5.Market size estimation

1.5.1.Top-down approach

1.5.2.Bottom-up approach

2.Report Scope

2.1.Market definition

2.2.Key objectives of the study

2.3.Report overview

2.4.Market segmentation

2.5.Overview of the impact of COVID-19 on Global contingent workforce management market

3.Executive Summary

4.Market Overview

4.1.Introduction

4.2.Growth impact forces

4.2.1.Drivers

4.2.2.Restraints

4.2.3.Opportunities

4.3.Market value chain analysis

4.3.1.List of raw material suppliers

4.3.2.List of manufacturers

4.3.3.List of distributors

4.4.Innovation & sustainability matrices

4.4.1.Technology matrix

4.4.2.Regulatory matrix

4.5.Porter’s five forces analysis

4.5.1.Bargaining power of suppliers

4.5.2.Bargaining power of consumers

4.5.3.Threat of substitutes

4.5.4.Threat of new entrants

4.5.5.Competitive rivalry intensity

4.6.PESTLE analysis

4.6.1.Political

4.6.2.Economical

4.6.3.Social

4.6.4.Technological

4.6.5.Environmental

4.7.Impact of COVID-19 on contingent workforce management market

4.7.1.Pre-covid market scenario

4.7.2.Post-covid market scenario

5.Contingent Workforce Management Market Analysis, by Type

5.1.Overview

5.2.Permanent Staffing

5.2.1.Definition, key trends, growth factors, and opportunities

5.2.2.Market size analysis, by region, 2021-2031

5.2.3.Market share analysis, by country, 2021-2031

5.3.Flexible Staffing

5.3.1.Definition, key trends, growth factors, and opportunities

5.3.2.Market size analysis, by region, 2021-2031

5.3.3.Market share analysis, by country, 2021-2031

5.4.Research Dive Exclusive Insights

5.4.1.Market attractiveness

5.4.2.Competition heatmap

6.Contingent Workforce Management Market Analysis, by End-user Industry

6.1.IT and Telecom

6.1.1.Definition, key trends, growth factors, and opportunities

6.1.2.Market size analysis, by region, 2021-2031

6.1.3.Market share analysis, by country, 2021-2031

6.2.BFSI

6.2.1.Definition, key trends, growth factors, and opportunities

6.2.2.Market size analysis, by region, 2021-2031

6.2.3.Market share analysis, by country, 2021-2031

6.3.Healthcare

6.3.1.Definition, key trends, growth factors, and opportunities

6.3.2.Market size analysis, by region, 2021-2031

6.3.3.Market share analysis, by country, 2021-2031

6.4.Manufacturing-Automotive

6.4.1.Definition, key trends, growth factors, and opportunities

6.4.2.Market size analysis, by region, 2021-2031

6.4.3.Market share analysis, by country, 2021-2031

6.5.Business/Professional Services

6.5.1.Definition, key trends, growth factors, and opportunities

6.5.2.Market size analysis, by region, 2021-2031

6.5.3.Market share analysis, by country, 2021-2031

6.6.Retail Trade

6.6.1.Definition, key trends, growth factors, and opportunities

6.6.2.Market size analysis, by region, 2021-2031

6.6.3.Market share analysis, by country, 2021-2031

6.7.Pharma/Biotech/Medical equip

6.7.1.Definition, key trends, growth factors, and opportunities

6.7.2.Market size analysis, by region, 2021-2031

6.7.3.Market share analysis, by country, 2021-2031

6.8.Manufacturing- Consumer Products

6.8.1.Definition, key trends, growth factors, and opportunities

6.8.2.Market size analysis, by region, 2021-2031

6.8.3.Market share analysis, by country, 2021-2031

6.9.Government (Excluding Education)

6.9.1.Definition, key trends, growth factors, and opportunities

6.9.2.Market size analysis, by region, 2021-2031

6.9.3.Market share analysis, by country, 2021-2031

6.10.Transportation/warehousing/packaging

6.10.1.Definition, key trends, growth factors, and opportunities

6.10.2.Market size analysis, by region, 2021-2031

6.10.3.Market share analysis, by country, 2021-2031

6.11.Manufacturing-Others

6.11.1.Definition, key trends, growth factors, and opportunities

6.11.2.Market size analysis, by region, 2021-2031

6.11.3.Market share analysis, by country, 2021-2031

6.12.Real Estate and rental leasing

6.12.1.Definition, key trends, growth factors, and opportunities

6.12.2.Market size analysis, by region, 2021-2031

6.12.3.Market share analysis, by country, 2021-2031

6.13.Others

6.13.1.Definition, key trends, growth factors, and opportunities

6.13.2.Market size analysis, by region, 2021-2031

6.13.3.Market share analysis, by country, 2021-2031

6.14.Research Dive Exclusive Insights

6.14.1.Market attractiveness

6.14.2.Competition heatmap

7.Contingent Workforce Management Market, by Region

7.1.North America

7.1.1.U.S.

7.1.1.1.Market size analysis, by Type, 2021-2031

7.1.1.2.Market size analysis, by End-user Industry, 2021-2031

7.1.2.Canada

7.1.2.1.Market size analysis, by Type, 2021-2031

7.1.2.2.Market size analysis, by End-user Industry, 2021-2031

7.1.3.Mexico

7.1.3.1.Market size analysis, by Type, 2021-2031

7.1.3.2.Market size analysis, by End-user Industry, 2021-2031

7.1.4.Research Dive Exclusive Insights

7.1.4.1.Market attractiveness

7.1.4.2.Competition heatmap

7.2.Europe

7.2.1.Germany

7.2.1.1.Market size analysis, by Type, 2021-2031

7.2.1.2.Market size analysis, by End-user Industry, 2021-2031

7.2.2.UK

7.2.2.1.Market size analysis, by Type, 2021-2031

7.2.2.2.Market size analysis, by End-user Industry, 2021-2031

7.2.3.France

7.2.3.1.Market size analysis, by Type, 2021-2031

7.2.3.2.Market size analysis, by End-user Industry, 2021-2031

7.2.4.Spain

7.2.4.1.Market size analysis, by Type, 2021-2031

7.2.4.2.Market size analysis, by End-user Industry, 2021-2031

7.2.5.Italy

7.2.5.1.Market size analysis, by Type, 2021-2031

7.2.5.2.Market size analysis, by End-user Industry, 2021-2031

7.2.6.Rest of Europe

7.2.6.1.Market size analysis, by Type, 2021-2031

7.2.6.2.Market size analysis, by End-user Industry, 2021-2031

7.2.7.Research Dive Exclusive Insights

7.2.7.1.Market attractiveness

7.2.7.2.Competition heatmap

7.3.Asia Pacific

7.3.1.China

7.3.1.1.Market size analysis, by Type, 2021-2031

7.3.1.2.Market size analysis, by End-user Industry, 2021-2031

7.3.2.Japan

7.3.2.1.Market size analysis, by Type, 2021-2031

7.3.2.2.Market size analysis, by End-user Industry, 2021-2031

7.3.3.India

7.3.3.1.Market size analysis, by Type, 2021-2031

7.3.3.2.Market size analysis, by End-user Industry, 2021-2031

7.3.4.Australia

7.3.4.1.Market size analysis, by Type, 2021-2031

7.3.4.2.Market size analysis, by End-user Industry, 2021-2031

7.3.5.South Korea

7.3.5.1.Market size analysis, by Type, 2021-2031

7.3.5.2.Market size analysis, by End-user Industry, 2021-2031

7.3.6.Rest of Asia Pacific

7.3.6.1.Market size analysis, by Type, 2021-2031

7.3.6.2.Market size analysis, by End-user Industry, 2021-2031

7.3.7.Research Dive Exclusive Insights

7.3.7.1.Market attractiveness

7.3.7.2.Competition heatmap

7.4.LAMEA

7.4.1.Brazil

7.4.1.1.Market size analysis, by Type, 2021-2031

7.4.1.2.Market size analysis, by End-user Industry, 2021-2031

7.4.2.Saudi Arabia

7.4.2.1.Market size analysis, by Type, 2021-2031

7.4.2.2.Market size analysis, by End-user Industry, 2021-2031

7.4.3.UAE

7.4.3.1.Market size analysis, by Type, 2021-2031

7.4.3.2.Market size analysis, by End-user Industry, 2021-2031

7.4.4.South Africa

7.4.4.1.Market size analysis, by Type, 2021-2031

7.4.4.2.Market size analysis, by End-user Industry, 2021-2031

7.4.5.Rest of LAMEA

7.4.5.1.Market size analysis, by Type, 2021-2031

7.4.5.2.Market size analysis, by End-user Industry, 2021-2031

7.4.6.Research Dive Exclusive Insights

7.4.6.1.Market attractiveness

7.4.6.2.Competition heatmap

8.Competitive Landscape

8.1.Top winning strategies, 2021

8.1.1.By strategy

8.1.2.By year

8.2.Strategic overview

8.3.Market share analysis, 2021

9.Company Profiles

9.1.Avature

9.1.1.Overview

9.1.2.Business segments

9.1.3.Product portfolio

9.1.4.Financial performance

9.1.5.Recent developments

9.1.6.SWOT analysis

9.2.Beeline

9.2.1.Overview

9.2.2.Business segments

9.2.3.Product portfolio

9.2.4.Financial performance

9.2.5.Recent developments

9.2.6.SWOT analysis

9.3.BOWEN Group

9.3.1.Overview

9.3.2.Business segments

9.3.3.Product portfolio

9.3.4.Financial performance

9.3.5.Recent developments

9.3.6.SWOT analysis

9.4.Impartx

9.4.1.Overview

9.4.2.Business segments

9.4.3.Product portfolio

9.4.4.Financial performance

9.4.5.Recent developments

9.4.6.SWOT analysis

9.5.Coupa Software Inc

9.5.1.Overview

9.5.2.Business segments

9.5.3.Product portfolio

9.5.4.Financial performance

9.5.5.Recent developments

9.5.6.SWOT analysis

9.6.SAP SE

9.6.1.Overview

9.6.2.Business segments

9.6.3.Product portfolio

9.6.4.Financial performance

9.6.5.Recent developments

9.6.6.SWOT analysis

9.7.CXC Global

9.7.1.Overview

9.7.2.Business segments

9.7.3.Product portfolio

9.7.4.Financial performance

9.7.5.Recent developments

9.7.6.SWOT analysis

9.8.Magnit

9.8.1.Overview

9.8.2.Business segments

9.8.3.Product portfolio

9.8.4.Financial performance

9.8.5.Recent developments

9.8.6.SWOT analysis

9.9.Ramco Systems

9.9.1.Overview

9.9.2.Business segments

9.9.3.Product portfolio

9.9.4.Financial performance

9.9.5.Recent developments

9.9.6.SWOT analysis

9.10.Zeel Solutions Ltd

9.10.1.Overview

9.10.2.Business segments

9.10.3.Product portfolio

9.10.4.Financial performance

9.10.5.Recent developments

9.10.6.SWOT analysis

Contingent workforce entails to those workers which have been enrolled by a company or an organization to perform certain specific tasks for a specific period of time. Contingent workforce is an umbrella term which includes contractors, temporary workers, freelancers, consultants, etc., who offer their skills and services for a limited amount of time on a provisional basis. Management of this workforce and all things related to them is contingent workforce management.

Forecast Analysis of the Contingent Workforce Management Market

Over the years, there has been a steep increase in the demand for contingent workforce in IT and telecommunication industry which is expected to be the primary growth driver of the contingent workforce management market in the forecast period from 2022 to 2031. Along with this, increased work flexibility and ability of contingent workforce in industrial sector is predicted to boost the market growth in the analysis timeframe. Moreover, contingent workforce is highly in demand as they can be swiftly recruited in an organization to fill in vacancies. This growth in demand is expected to offer numerous growth opportunities for the market in the forecast years. However, according to the market analysts, growing co-employment contingent workforce management may become a restraint in the full-fledged growth of the global market in the coming years.

Regionally, the contingent workforce management market in the North America region is expected to be the most dominant in the forecast period. Rising labor force participation and increasing industrialization are predicted to be the main contributing factors to the growth of the market in this region.

As per a report by Research Dive, the global contingent workforce management market is expected to reach a revenue of $465,192.9 billion in the 2022–2031 timeframe, thereby growing at CAGR of 10.5% by 2031. Some prominent market players include Avature, Coupa Software Inc, Magnit, Beeline, SAP SE, Ramco Systems, BOWEN Group, CXC Global, Zeel Solutions Ltd, Impartx, and many others.

Covid-19 Impact on the Market

The Covid-19 pandemic and the subsequent lockdowns have had a catastrophic impact on various businesses and markets worldwide. The contingent workforce management market, however, faced a positive impact of the pandemic. During the pandemic, various organizations understood the importance of having a flexible workforce for streamlining expenses and operations. Moreover, outsourcing of certain tasks relieved the pressure of the organizations which increased the demand for contingent workforce further. These factors helped the market to grow during the pandemic period.

Significant Market Developments

The key players of the market are adopting various business strategies such as partnerships, mergers & acquisitions, and launches to gain a leading position in the market, thus helping the contingent workforce management market to flourish. For instance:

- In January 2021, PRO Unlimited, a leading company in contingent workforce management market, announced that it was acquiring PeopleTicker, a human resource company based in Florida. This acquisition is predicted to help PRO Unlimited to expand its footprint in the market substantially in the coming period.

- In December 2021, Workday, a human capital management and financial software provider, announced the acquisition of VNDLY, a contingent workforce management startup. This acquisition is predicted to boost the market share of the acquiring company i.e., Workday in the near future.

- In April 2022, Brightfield, a global leader in contingent workforce management, announced a partnership with Sapience Analytics, a leading workforce analytics company. This partnership is aimed at developing strategies to increase the effectiveness of contingent workforce using innovative analytics techniques. This partnership is expected to help both the companies to grow in their respective sectors significantly in the coming period.

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com