Mobile Tomography Market Report

RA08618

Mobile Tomography Market by Technology (High Slice Scanners, Mid Slice Scanners, Low Slice Scanners, and Others), Application (Oncology, Neurology, Cardiology, Vascular, and Others), End-Use (Hospitals, Clinics, Diagnostic Center, Research Academics, and Ambulatory Center), and Region (North America, Europe, Asia-Pacific, and LAMEA): Global Opportunity Analysis and Industry Forecast 2022–2031

Global Mobile Tomography Market Analysis

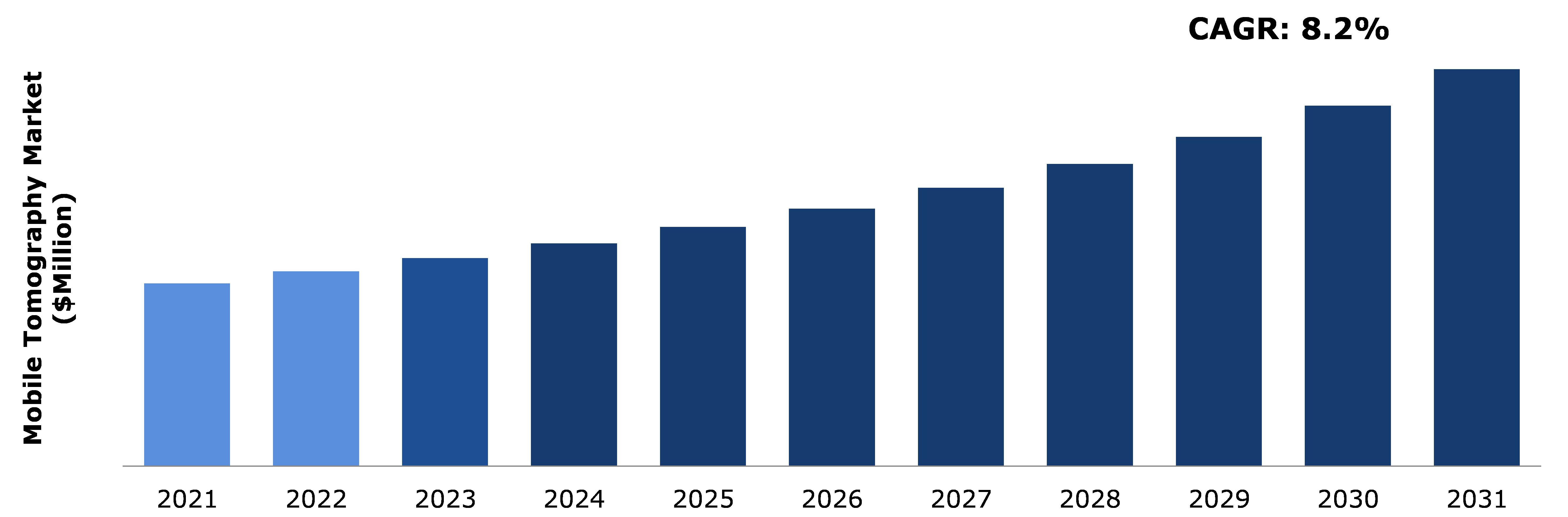

The Global Mobile Tomography Market Size was $631.4 million in 2021 and is predicted to grow with a CAGR of 8.2%, by generating a revenue of $1,371.1 million by 2031.

Global Mobile Tomography Market Synopsis

The introduction of advanced sophisticated technologies in mobile tomography is a key factor driving the market growth. In addition to this, increasing prevalence of chronic disorders such as oncology, massive healthcare infrastructure spending, rising patients rate with cancer and increase in utilization of mobile tomography for imaging the tumor are driving the market.

Increased research and development of major market players, as well as the introduction of new innovative technologies and increased investment by market players is boosting the global mobile tomography market. Greater government assistance for integrating mobile tomography with new technologies, as well as increased resources and improved infrastructure in the health care sector, are predicted to boost the mobile tomography market growth throughout the forecast period.

However, mobile tomography with increased awareness in industrialized regions and low understanding in undeveloped regions and the enhanced benefits of mobile tomography are driving the mobile tomography market. Increased costs for scanning images with CT scans may restrain the mobile tomography market size during the forecast period.

In November 2022, Samsung Electronics introduced its new premium diagnostic imaging solutions integrated with AI technology to help healthcare professionals examine and diagnose patient efficiently.

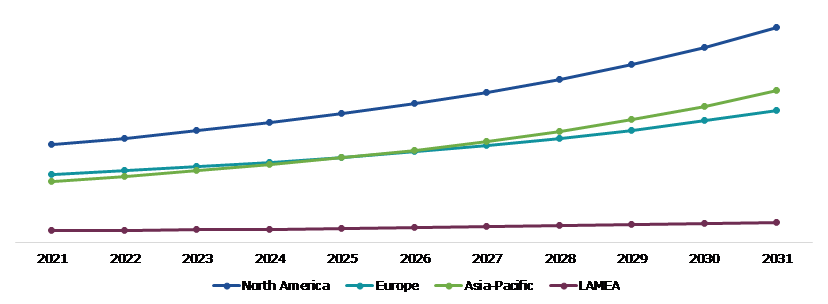

According to regional analysis, the North America dominated the mobile tomography market in 2021 owing to the rising healthcare spending by governmental authorities, rapid technological innovations, and rising spending by manufacturers in research & development activities to introduce new solutions.

Mobile Tomography Overview

Mobile tomography can be defined as CT scan equipment on wheels, which may be transferred easily from one room to another. Mobile tomography equipment is designed to offer patients improved safety and more precise findings. These innovations reduce the need for patients and healthcare professionals to visit certain CT scanning facilities. Global market demand is being driven by factors like increasing cardiovascular disease prevalence, a need for portable diagnostic equipment, and strategic market player activities.

COVID-19 Impact on Global Mobile Tomography Market

The covid-19 had a positive impact on the market since it resulted in increased number of patients requiring imaging of the organs, tissues, blood vessels, and other organs. Further, the advanced intuitive technologies, in mobile tomography, is a major factor responsible for the market growth. These advanced solutions allow doctors and diagnostic centers to provide quick results furthering allow them to assist covid-19 patients efficiently. However, during the short-term, unavailability of medical device components, lack of skilled professionals and high operational costs to the manufacturers, slowed down the market.

The global mobile tomography market is driven primarily by an increase in the prevalence of cardiovascular diseases such as coronary heart disease and chronic diseases such as diabetes; an increase in various types of cancer such as lung cancer, breast cancer, and head cancer; an increase in cases of communicable diseases such as COVID-19, an increase in demand for mobile tomography scans to detect infection; and an increase in the usage of mobile tomography scans to determine the efficacy development of new mobile tomography systems by a wide number of significant participants and developments in mobile tomography system technologies.

Increased Prevalence of Chronic Illnesses Globally to Drive the Market Growth

Increase in chronic disorders among the population backed by rising pollution, changing lifestyles and dietary intake, increase in geriatric population are some of the major factors driving market growth. Additionally, major manufacturers are proactively focusing on introducing mobile tomography solutions that are integrated with advanced technologies mainly AI to improve the clinical experience and enhance the diagnosis and examination process. This together is responsible for driving the mobile tomography market demand in the coming years.

To know more about global mobile tomography market drivers, get in touch with our analysts here.

Lack Of Skill Among the Individuals Over Mobile Tomography to Restrain the Market Growth

The latest advancements in technology, such as increased features and the integration of hardware and software systems, make mobile tomography more complex. Individuals, mainly healthcare professionals, find it difficult to operate the systems due to lack of expertise and on-floor training, which could be a growing challenge for the mobile tomography market.

Increasing Government Support for Mobile Tomography to Drive Excellent Opportunities

The mobile tomography market is experiencing growth at a faster rate due to new features integrated into the systems that allow quick access to disorder diagnosis. The government is also showing more interest in expanding the medical sector by investing in equipment that allows fast disorder detection, and it is giving more financing to the development of the healthcare industry by enhancing infrastructure. Additionally, the major market players are actively engaged in introducing new mobile tomography technologies and advances. Moreover, increasing investments in ongoing mobile tomography product line to upgrade the existing product line will help to boost the growth of the mobile tomography market over the forecast period.

To know more about global mobile tomography market opportunities, get in touch with our analysts here.

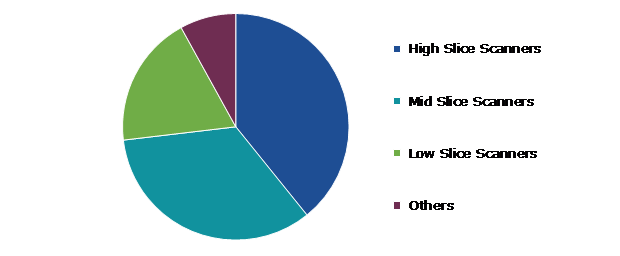

Global Mobile Tomography Market, by Technology

Based on technology, the market has been divided into high slice scanners, mid slice scanners, low slice scanners, and others. Among these, the high slice scanners sub-segment accounted for the highest market share in 2021 and is estimated to show the fastest growth during the forecast period.

Global Mobile Tomography Market Share, by Technology, 2021

Source: Research Dive Analysis

The high slice scanners sub-type accounted for a dominating market share in 2021. This is due to the increasing use of high-slice scanners in the healthcare industry, as these scanners have superior diagnostic capabilities, resulting in clearer images with lower doses of radiation. This aids in detecting the root cause of a disease, which enables a timely cure of the disease detected. Furthermore, high slice scanners are suggested for advanced imaging, such as in cardiovascular testing, because it is comparatively faster, does not need to develop film images, and provide a larger imaging area. As a result, it is more suitable for people who have arrhythmias, rapid heart rates, obesity, or pediatric patients. Radiologists can use computers to improve images and detect microcalcifications that low and medium-slice CTs might overlook. The benefits of these scanners promote the growth of the mobile tomography market.

The mid slice scanners sub-type is anticipated to show the fastest growth by 2031. The mid slice scanners have lower maintenance costs which reduce the operational costs of the healthcare facilities. Also, this type of scanners has less radiation and less contrast medium which improves overall patient safety and provides high efficiency while diagnosing.

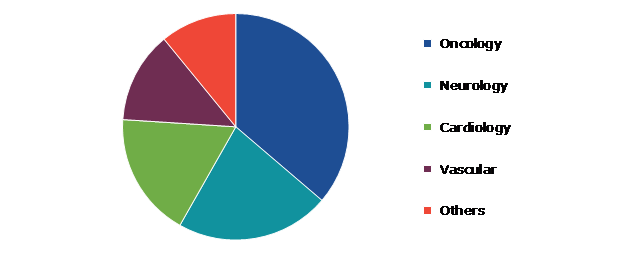

Global Mobile Tomography Market, by Application

Based on application, the market has been divided into oncology, neurology, cardiology, vascular, and others. Among these, the oncology sub-segment accounted for highest revenue share in 2021.

Global Mobile Tomography Market Size, by Application, 2021

Source: Research Dive Analysis

The oncology sub-segment accounted for a dominating market share in 2021. The rising prevalence of cancer, as well as the increased usage of mobile tomography scans in the diagnosis of various types of cancer, including lumps and tumors, are expected to drive the market. The development of innovative technologies such as computer-aided detection and identification of suspicious cancer nodules, as well as risk assessment, is expected to boost growth, particularly in lung cancer. Furthermore, mobile tomography can be used to calibrate the obtained image with biopsy data, facilitating in accurate diagnosis. These factors are anticipated to boost the growth of oncology sub-segment during the analysis timeframe.

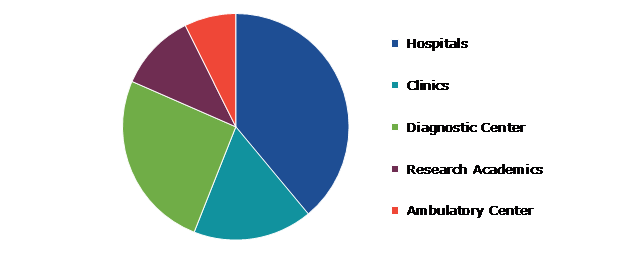

Global Mobile Tomography Market, by End-use

Based on end-use, the market has been divided into hospitals, clinics, diagnostic center, research academics, and ambulatory center. Among these, the hospitals sub-segment accounted for highest revenue share in 2021.

Global Mobile Tomography Market Trends, by End-use, 2021

Source: Research Dive Analysis

The hospital sub-segment accounted a dominating market share in 2021. The market share has been impacted by both the rising number of yearly surgeries and emergency hospital admissions. Mobile tomography is a useful diagnostic tool for making an accurate diagnosis both before and after surgery to assess the efficacy of the procedure. Hospitals had to install their own mobile tomography scan equipment due to the challenges and risks of transferring seriously ill patients to a remote diagnostic facility for mobile tomography scans, which hastened the development of this market. Over the projected period, the diagnostic centers category is expected to grow more rapidly. These factors are anticipated to boost the growth of hospital sub-segment during the analysis timeframe.

Global Mobile Tomography Market, Regional Insights

The mobile tomography market was investigated across North America, Europe, Asia-Pacific, and LAMEA.

Global Mobile Tomography Market Size & Forecast, by Region, 2021-2031 (USD Million)

Source: Research Dive Analysis

The Market for Mobile Tomography in North America Was the Most Dominant

The North America mobile tomography market accounted a dominating market share in 2021. This is mainly due to wide developments in mobile tomography with new innovative technologies and various applications. An increase in chronic disorders in the region among the geriatric population and an increase in detection of the disorders efficiently due to mobile tomography is also projected to promote the market in the region.

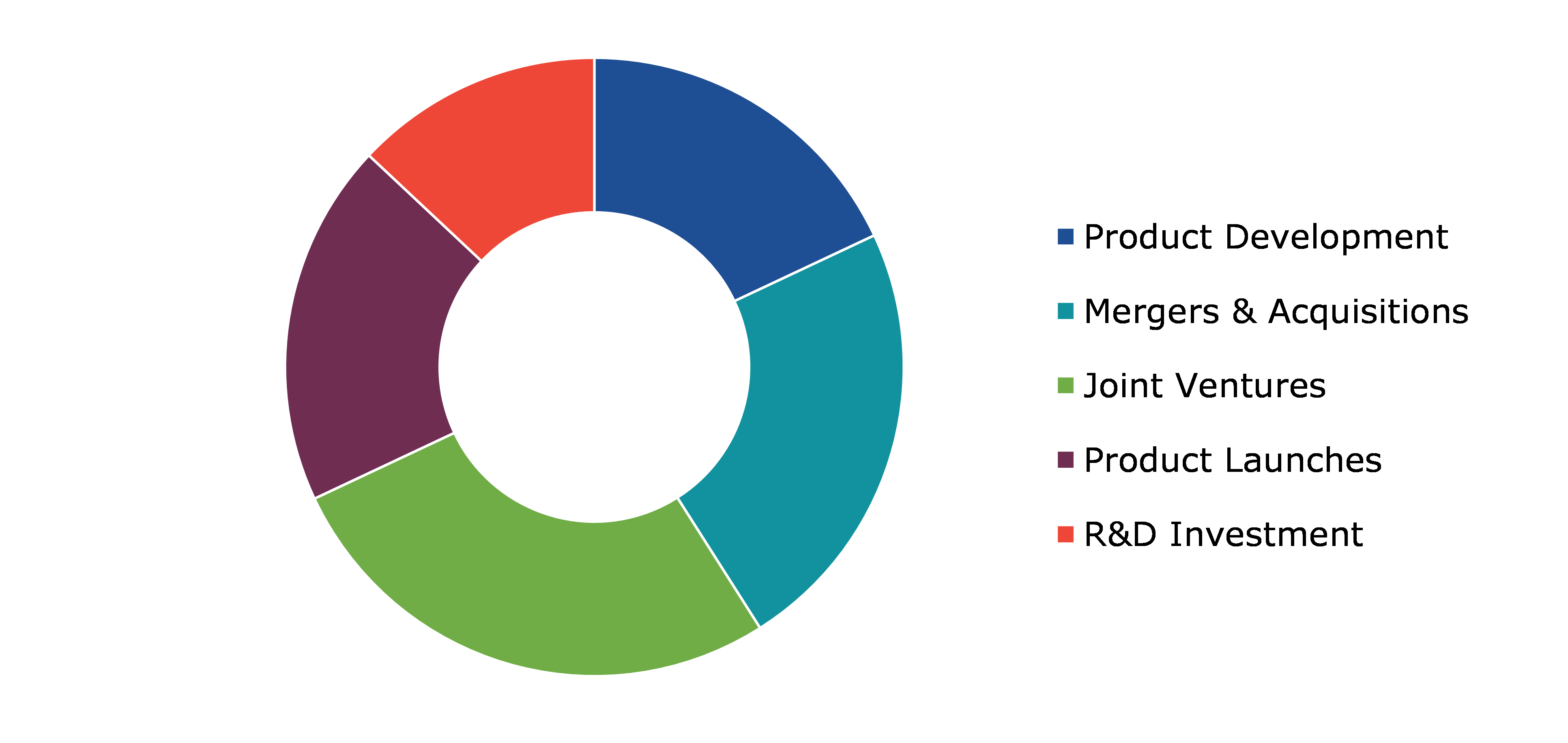

Competitive Scenario in the Global Mobile Tomography Market

Investment and agreement are common strategies followed by major market players. For instance, in May 2020, Fujfilm Corporation introduced new technology, such as AL-based technology, for detecting pulmonary nodules. This newly discovered technique is used to diagnose lung cancer. Screening and imaging of chest Ct scanners are used to detect pulmonary nodules.

Source: Research Dive Analysis

Some of the leading mobile tomography market players are Koninklijke Philips N.V., Medtronics, Canon Medical Systems Corporation, Fujifilm Corporation, NeuroLogica Corp, Neusoft Corporation, Koning Corporation, Olympus Corporation, Planmed Oy, United Imaging Healthcare.

| Aspect | Particulars |

| Historical Market Estimations | 2020 |

| Base Year for Market Estimation | 2021 |

| Forecast Timeline for Market Projection | 2022-2031 |

| Geographical Scope | North America, Europe, Asia-Pacific, LAMEA |

| Segmentation by Technology |

|

| Segmentation by Application |

|

| Segmentation by End-use |

|

| Key Companies Profiled |

|

Q1. What is the size of the global mobile tomography market?

A. The size of the global mobile tomography market was over $631.4 million in 2021 and is projected to reach $1,371.1 million by 2031.

Q2. Which are the major companies in the mobile tomography market?

A. Koninklijke Philips N.V., Medtronics, Canon Medical Systems Corporation, and Fujifilm Corporation are some of the key players in the global mobile tomography market.

Q3. Which region, among others, possesses greater investment opportunities in the near future?

A. The Asia-Pacific region possesses great investment opportunities for investors to witness the most promising growth in the future.

Q4. What will be the growth rate of the Asia-Pacific mobile tomography market?

A. Asia-Pacific mobile tomography market is anticipated to grow at 8.2% CAGR during the forecast period.

Q5. What are the strategies opted by the leading players in this market?

A. Agreement and investment are the two key strategies opted by the operating companies in this market.

Q6. Which companies are investing more on R&D practices?

A. Koning Corporation, Olympus Corporation, and Planmed Oy are the companies investing more on R&D activities for developing new products and technologies.

1.Research Methodology

1.1.Desk Research

1.2.Real time insights and validation

1.3.Forecast model

1.4.Assumptions and forecast parameters

1.5.Market size estimation

1.5.1.Top-down approach

1.5.2.Bottom-up approach

2.Report Scope

2.1.Market definition

2.2.Key objectives of the study

2.3.Report overview

2.4.Market segmentation

2.5.Overview of the impact of COVID-19 on Global mobile tomography market

3.Executive Summary

4.Market Overview

4.1.Introduction

4.2.Growth impact forces

4.2.1.Drivers

4.2.2.Restraints

4.2.3.Opportunities

4.3.Market value chain analysis

4.3.1.List of component providers

4.3.2.List of manufacturers

4.3.3.List of distributors

4.4.Innovation & sustainability matrices

4.4.1.Technology matrix

4.4.2.Regulatory matrix

4.5.Porter’s five forces analysis

4.5.1.Bargaining power of suppliers

4.5.2.Bargaining power of consumers

4.5.3.Threat of substitutes

4.5.4.Threat of new entrants

4.5.5.Competitive rivalry intensity

4.6.PESTLE analysis

4.6.1.Political

4.6.2.Economical

4.6.3.Social

4.6.4.Technological

4.6.5.Environmental

4.7.Impact of COVID-19 on Global Tomography Market

4.7.1.Pre-covid market scenario

4.7.2.Post-covid market scenario

5. Global Mobile Tomography Market Analysis, by Technology

5.1.Overview

5.2.High Slice Scanners

5.2.1.Definition, key trends, growth factors, and opportunities

5.2.2.Market size analysis, by region

5.2.3.Market share analysis, by country

5.3.Mid Slice Scanners

5.3.1.Definition, key trends, growth factors, and opportunities

5.3.2.Market size analysis, by region

5.3.3.Market share analysis, by country

5.4.Low Slice Scanners

5.4.1.Definition, key trends, growth factors, and opportunities

5.4.2.Market size analysis, by region

5.4.3.Market share analysis, by country

5.5.Others

5.5.1.Definition, key trends, growth factors, and opportunities

5.5.2.Market size analysis, by region

5.5.3.Market share analysis, by country

5.6.Research Dive Exclusive Insights

5.6.1.Market attractiveness

5.6.2.Competition heatmap

6.Global Mobile Tomography Market Analysis, by Application

6.1.Oncology

6.1.1.Definition, key trends, growth factors, and opportunities

6.1.2.Market size analysis, by region

6.1.3.Market share analysis, by country

6.2.Neurology

6.2.1.Definition, key trends, growth factors, and opportunities

6.2.2.Market size analysis, by region

6.2.3.Market share analysis, by country

6.3.Cardiology

6.3.1.Definition, key trends, growth factors, and opportunities

6.3.2.Market size analysis, by region

6.3.3.Market share analysis, by country

6.4.Vascular

6.4.1.Definition, key trends, growth factors, and opportunities

6.4.2.Market size analysis, by region

6.4.3.Market share analysis, by country

6.5.Others

6.5.1.Definition, key trends, growth factors, and opportunities

6.5.2.Market size analysis, by region

6.5.3.Market share analysis, by country

6.6.Research Dive Exclusive Insights

6.6.1.Market attractiveness

6.6.2.Competition heatmap

7.Global Mobile Tomography Market Analysis, by End-use

7.1.Hospitals

7.1.1.Definition, key trends, growth factors, and opportunities

7.1.2.Market size analysis, by region

7.1.3.Market share analysis, by country

7.2.Clinics

7.2.1.Definition, key trends, growth factors, and opportunities

7.2.2.Market size analysis, by region

7.2.3.Market share analysis, by country

7.3.Diagnostic Center

7.3.1.Definition, key trends, growth factors, and opportunities

7.3.2.Market size analysis, by region

7.3.3.Market share analysis, by country

7.4.Research Academics

7.4.1.Definition, key trends, growth factors, and opportunities

7.4.2.Market size analysis, by region

7.4.3.Market share analysis, by country

7.5.Ambulatory Center

7.5.1.Definition, key trends, growth factors, and opportunities

7.5.2.Market size analysis, by region

7.5.3.Market share analysis, by country

7.6.Research Dive Exclusive Insights

7.6.1.Market attractiveness

7.6.2.Competition heatmap

8.Global Mobile Tomography Market, by Region

8.1.North America

8.1.1.U.S.

8.1.1.1.Market size analysis, by Technology

8.1.1.2.Market size analysis, by Application

8.1.1.3.Market size analysis, by End-use

8.1.2.Canada

8.1.2.1.Market size analysis, by Technology

8.1.2.2.Market size analysis, by Application

8.1.2.3.Market size analysis, by End-use

8.1.3.Mexico

8.1.3.1.Market size analysis, by Technology

8.1.3.2.Market size analysis, by Application

8.1.3.3.Market size analysis, by End-use

8.1.4.Research Dive Exclusive Insights

8.1.4.1.Market attractiveness

8.1.4.2.Competition heatmap

8.2.Europe

8.2.1.Germany

8.2.1.1.Market size analysis, by Technology

8.2.1.2.Market size analysis, by Application

8.2.1.3.Market size analysis, by End-use

8.2.2.UK

8.2.2.1.Market size analysis, by Technology

8.2.2.2.Market size analysis, by Application

8.2.2.3.Market size analysis, by End-use

8.2.3.France

8.2.3.1.Market size analysis, by Technology

8.2.3.2.Market size analysis, by Application

8.2.3.3.Market size analysis, by End-use

8.2.4.Spain

8.2.4.1.Market size analysis, by Technology

8.2.4.2.Market size analysis, by Application

8.2.4.3.Market size analysis, by End-use

8.2.5.Italy

8.2.5.1.Market size analysis, by Technology

8.2.5.2.Market size analysis, by Application

8.2.5.3.Market size analysis, by End-use

8.2.6.Rest of Europe

8.2.6.1.Market size analysis, by Technology

8.2.6.2.Market size analysis, by Application

8.2.6.3.Market size analysis, by End-use

8.2.7.Research Dive Exclusive Insights

8.2.7.1.Market attractiveness

8.2.7.2.Competition heatmap

8.3.Asia-Pacific

8.3.1.China

8.3.1.1.Market size analysis, by Technology

8.3.1.2.Market size analysis, by Application

8.3.1.3.Market size analysis, by End-use

8.3.2.Japan

8.3.2.1.Market size analysis, by Technology

8.3.2.2.Market size analysis, by Application

8.3.2.3.Market size analysis, by End-use

8.3.3.India

8.3.3.1.Market size analysis, by Technology

8.3.3.2.Market size analysis, by Application

8.3.3.3.Market size analysis, by End-use

8.3.4.Australia

8.3.4.1.Market size analysis, by Technology

8.3.4.2.Market size analysis, by Application

8.3.4.3.Market size analysis, by End-use

8.3.5.South Korea

8.3.5.1.Market size analysis, by Technology

8.3.5.2.Market size analysis, by Application

8.3.5.3.Market size analysis, by End-use

8.3.6.Rest of Asia-Pacific

8.3.6.1.Market size analysis, by Technology

8.3.6.2.Market size analysis, by Application

8.3.6.3.Market size analysis, by End-use

8.3.7.Research Dive Exclusive Insights

8.3.7.1.Market attractiveness

8.3.7.2.Competition heatmap

8.4.LAMEA

8.4.1.Brazil

8.4.1.1.Market size analysis, by Technology

8.4.1.2.Market size analysis, by Application

8.4.1.3.Market size analysis, by End-use

8.4.2.Saudi Arabia

8.4.2.1.Market size analysis, by Technology

8.4.2.2.Market size analysis, by Application

8.4.2.3.Market size analysis, by End-use

8.4.3.UAE

8.4.3.1.Market size analysis, by Technology

8.4.3.2.Market size analysis, by Application

8.4.3.3.Market size analysis, by End-use

8.4.4.South Africa

8.4.4.1.Market size analysis, by Technology

8.4.4.2.Market size analysis, by Application

8.4.4.3.Market size analysis, by End-use

8.4.5.Rest of LAMEA

8.4.5.1.Market size analysis, by Technology

8.4.5.2.Market size analysis, by Application

8.4.5.3.Market size analysis, by End-use

8.4.6.Research Dive Exclusive Insights

8.4.6.1.Market attractiveness

8.4.6.2.Competition heatmap

9.Competitive Landscape

9.1.Top winning strategies, 2021

9.1.1.By strategy

9.1.2.By year

9.2.Strategic overview

9.3.Market share analysis, 2021

10.Company Profiles

10.1.Koninklijke Philips N.V.

10.1.1.Overview

10.1.2.Business segments

10.1.3.Product portfolio

10.1.4.Financial performance

10.1.5.Recent developments

10.1.6.SWOT analysis

10.2.Medtronics

10.2.1.Overview

10.2.2.Business segments

10.2.3.Product portfolio

10.2.4.Financial performance

10.2.5.Recent developments

10.2.6.SWOT analysis

10.3.Canon Medical Systems Corporation

10.3.1.Overview

10.3.2.Business segments

10.3.3.Product portfolio

10.3.4.Financial performance

10.3.5.Recent developments

10.3.6.SWOT analysis

10.4.Fujifilm Corporation

10.4.1.Overview

10.4.2.Business segments

10.4.3.Product portfolio

10.4.4.Financial performance

10.4.5.Recent developments

10.4.6.SWOT analysis

10.5.NeuroLogica Corp

10.5.1.Overview

10.5.2.Business segments

10.5.3.Product portfolio

10.5.4.Financial performance

10.5.5.Recent developments

10.5.6.SWOT analysis

10.6.Neusoft corporation

10.6.1.Overview

10.6.2.Business segments

10.6.3.Product portfolio

10.6.4.Financial performance

10.6.5.Recent developments

10.6.6.SWOT analysis

10.7.Koning Corporation

10.7.1.Overview

10.7.2.Business segments

10.7.3.Product portfolio

10.7.4.Financial performance

10.7.5.Recent developments

10.7.6.SWOT analysis

10.8.Olympus Corporation

10.8.1.Overview

10.8.2.Business segments

10.8.3.Product portfolio

10.8.4.Financial performance

10.8.5.Recent developments

10.8.6.SWOT analysis

10.9.Planmed oy

10.9.1.Overview

10.9.2.Business segments

10.9.3.Product portfolio

10.9.4.Financial performance

10.9.5.Recent developments

10.9.6.SWOT analysis

10.10.United Imaging Healthcare

10.10.1.Overview

10.10.2.Business segments

10.10.3.Product portfolio

10.10.4.Financial performance

10.10.5.Recent developments

10.10.6.SWOT analysis

The increasing prevalence of chronic diseases, such as cancer and heart disease, is driving demand for diagnostic imaging technologies, including mobile tomography. Mobile tomography can be used to diagnose a variety of medical conditions, including head injuries, lung infections, and spinal cord injuries. The images generated by the mobile tomography device can provide doctors with valuable information about the size, shape, and location of internal organs, as well as any abnormalities or injuries present. This technology allows medical professionals to bring imaging equipment to patients who are unable to travel to a hospital or imaging center.

The demand for mobile tomography is being boosted by the convenience and portability of the technology, which allows imaging to be performed in remote or emergency settings. Additionally, the increasing prevalence of chronic diseases and technological advancements in mobile tomography is driving demand from healthcare providers who require reliable and accurate imaging solutions. The mobile tomography market is being driven by the growing need for portable and easy-to-use imaging equipment, particularly in developing countries where access to traditional imaging methods may be limited.

Newest Insights in the Mobile Tomography Market

The introduction of AI and machine learning technologies in mobile tomography devices to enhance the accuracy and speed of image analysis is boosting the mobile tomography market. As per a report by Research Dive, the global mobile tomography market is anticipated to surpass a revenue of $1,371.1 million in the 2022–2031 timeframe. The North America market is predicted to experience dominant growth in the years to come. This is because the region has a huge demand for mobile tomography due to rising chronic diseases among the elderly population in this region.

How are Mobile Tomography Market Players Responding to the Rising Demand for Mobile Tomography?

Market players are expanding their product offerings, improving product quality, increasing production capacity, and collaborating with other market players to cater to the rising demand for mobile tomography solutions. Some of the foremost players in the mobile tomography market are Canon Medical Systems Corporation, Koninklijke Philips N.V., Medtronics, Fujifilm Corporation, Koning Corporation, NeuroLogica Corp, Neusoft Corporation, Olympus Corporation, United Imaging Healthcare., Planmed Oy, and others. These players are focused on implementing strategies such as mergers and acquisitions, novel developments, collaborations, and partnerships to reach a leading position in the global market. For instance:

- In August 2020, Siemens Healthineers, a German medical device company, received clearance from the US Food and Drug Administration (FDA) for a mobile head computed tomography (CT) scanner. The scanner, known as the SOMATOM On.site, is designed to enable critically ill patients to receive CT head imaging without being moved from the intensive care unit (ICU).

- In September 2020, the Simon Hegele Group, a German logistics and supply chain management company, launched a new service that provides mobile CT scanners to hospitals and healthcare facilities. The service is designed to provide fast and flexible access to medical imaging equipment, in response to the increased demand for convenient and portable imaging solutions.

- In November 2022, NeuroLogica, a global leader in the field of point-of-care computed tomography (CT) imaging, received the US FDA clearance for the BodyTom 64 Point-of-Care Mobile Computed Tomography (CT) Scanner, a head-to-toe trauma imaging device.

COVID-19 Impact on the Global Mobile Tomography Market

The unpredicted rise of the coronavirus pandemic in 2020 significantly impacted the global mobile tomography market. One of the main factors driving demand for mobile tomography scanners during the pandemic has been the need to provide imaging services to COVID-19 patients in isolation wards and intensive care units. Mobile CT scanners have proven to be a valuable tool in the diagnosis and treatment of COVID-19 patients, allowing for faster and more accurate diagnosis of respiratory complications associated with the disease. On the other hand, the pandemic also led to the postponement of non-urgent medical procedures and reduced access to healthcare services in some regions, which has resulted in a decline in demand for mobile tomography scanners. Additionally, supply chain disruptions and restrictions on international trade have led to delays in the delivery of imaging equipment and increased costs for some customers. However, the COVID-19 pandemic has highlighted the importance of mobile imaging solutions in healthcare, and this is expected to drive demand for mobile tomography technologies in the future.

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com