Logistics Services (3PL & 4PL) Market Report

RA08612

Logistics Services (3PL & 4PL) Market by Service Type (Transportation, Warehousing, Value Added Services, and Others), Application (Consumer Electronics, Healthcare, Automotive, Industrial, Food and Beverages, Aerospace and Defense, and Others), and Regional Analysis (North America, Europe, Asia-Pacific, and LAMEA): Global Opportunity Analysis and Industry Forecast, 2022-2031

Global Logistics Services (3PL & 4PL) Market Analysis

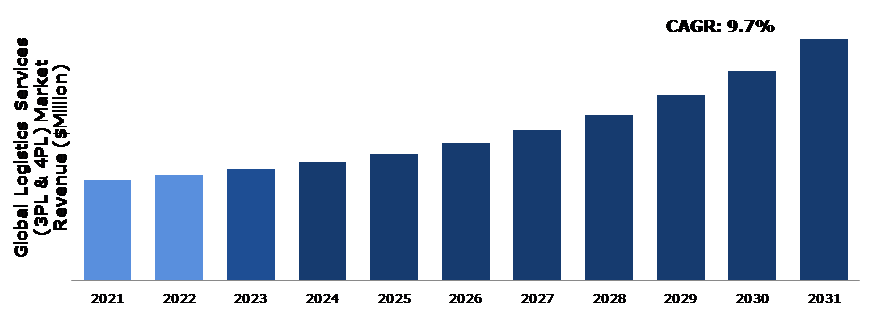

The Global Logistics Services (3PL & 4PL) Market Size was $1,257.3 million in 2021 and is predicted to grow with a CAGR of 9.7%, by generating a revenue of $3,040 million by 2031.

Global Logistics Services (3PL & 4PL) Market Synopsis

Logistics services (3PL & 4PL) market ecosystem is also known as a third-party logistics provider. These logistic providers provide firms with outsourced logistic services such as customs brokerage, freight forwarding, shipping & distribution, inventory storage & management, and cross-docking, among other things. One of the main advantages of 3PL and 4PL is that it offers firms cost-effective and outsourced logistic services. Logistics services usually include customs brokerage, inventory storage and management, shipping and distribution, cross-docking, and others. Third- and fourth-party logistics providers can supply individual e-commerce businesses with shipping costs that are both affordable and attractive due to their large clientele. Directly managing logistics is an expensive affair. On the other side, 3PL & 4PL businesses also benefit from their economic sector to offer useful shipping services at significantly cheaper costs. These factors are anticipated to boost the logistics services (3PL & 4PL) market growth in the upcoming years.

However, a lack of logistical control may hamper market growth. Manufacturing businesses must depend on third-party logistics service providers' competence, dependability, and honesty, restricting their influence over operational efficiency. Whenever organizations are unable to track warehouse activity, valid concerns about product quality arise. These logistical disturbances may have an influence on organizational planning, predictability, and consumer happiness, reducing industrial progress.

Businesses are searching for methods to simplify their supply chains as the global economy gets more complicated. This, in turn, is expected to offer ample growth opportunities to the market players during the forecast period. Logistics services (3PL & 4PL) providers are assisting businesses and retailers with cost-cutting, enhanced productivity, and supply-chain management. The service providers are offering a wide range of services, such as order management, transportation planning, warehousing, and inventory control.

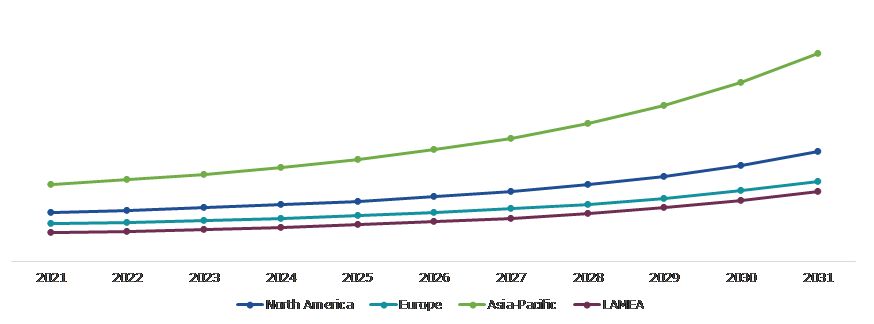

According to regional analysis, the Asia-Pacific logistics services (3PL & 4PL) market accounted for the highest market size in 2021. The logistics services (3PL & 4PL) in transportation in the Asia-Pacific region are under large-scale development as the number of logistics services (3PL & 4PL) providers in China are increasing rapidly. The increase in e-commerce sector and rising use of outsourced logistics services are expected to drive the regional market growth.

Logistics Services (3PL & 4PL) Overview

The planning and execution process is managed by the logistics services (3PL & 4PL) for the safe handling and movement of products from the location of production to the point of usage. The quality and profitability of shipping and logistics operations would both increase with digitalization. Logistics services 3PL and 4PL is a supply chain integrator and a growing market in supply and demand. It is not a logistical stakeholder, but rather a comprehensive supply chain solution with its information technology, integration skills, and other resources to generate a profit.

COVID-19 Impact on Global Logistics Services (3PL & 4PL) Market

The COVID-19 pandemic has brought several uncertainties leading to severe economic losses as various businesses across the world were on a standstill. This has ultimately lowered the demand for logistics services (3PL & 4PL) market as well as resulted in an economic slowdown across several countries. In addition, import-export restrictions were laid down on major logistics services (3PL &4PL)-providing countries such as the U.S. and China. In addition, the construction & automotive sector faced the highest impact in terms of sales and acquisition of new projects due to which the logistics services (3pl&4pl) demand reduced significantly. The COVID-19 pandemic had a direct impact on logistics companies involved in the flow, storage, and transfer of commodities. Logistics companies enable trade and commerce and assist companies in getting their products to clients as an essential component of value chains both domestically and beyond international borders. Therefore, supply chain interruptions brought on by the pandemic might affect the sector's competitiveness and economic expansion.

Growing E-commerce Sector and Business Policy Support to Drive the Market Growth

The e-commerce industry is expanding along with increase in customers' demands for fast deliveries. Same-day and one-day deliveries are more popular these days. Major shops have begun to provide logistical services as a result to meet client expectations of fast services. Additionally, as e-commerce continues to expand, there will be an increase in demand for logistics services in fields owing to quick delivery & inventory management. In tier three to five cities, where the demand for logistics services has expanded, there would be a major growth in the demand for 3PL service providers. These factors are anticipated to drive the logistics services (3pl&4pl) market expansion during the forecast period.

To know more about global logistics services (3PL & 4PL) market drivers, get in touch with our analysts here.

Infrastructure Shortage and Lack of Logistics Experts to Restrain the Market Growth

The lack of skilled logistics professionals is anticipated to restrict the market expansion. There are now few young and skilled employees working for various logistics organizations due to poor recruiting and hiring practices. Compared to the salary levels in other industries, the logistics industry pays relatively less. A company chooses a 3PL&4PL supplier by giving up some control over the delivery. When a company chooses to work with a third-party logistics provider, they are placing a great deal of trust in the 3PL&4PL to uphold the agreed-upon SLAs, and that is especially true for tasks that may directly affect customer satisfaction. Therefore, these factors are anticipated to limit the expansion of the global logistics market during the forecast period.

Rising Adoption of Artificial Intelligence in Logistic Industry to Drive Excellent Opportunities

The logistics industry is considered a crucial sector to boost international trade as a consequence of digitalization and globalization. Furthermore, significant technical advances in the sectors of cloud computing, big data, algorithmic development, connection, and processing power have made artificial intelligence's performance, accessibility, and pricing more beneficial than ever before. Artificial intelligence, machine learning, and blockchain technology have changed the fragmented logistics industry. Artificial intelligence is now an essential component of all future software systems.

To know more about global logistics services (3PL & 4PL) market opportunities, get in touch with our analysts here.

Global Logistics Services (3PL & 4PL) Market, by Service Type

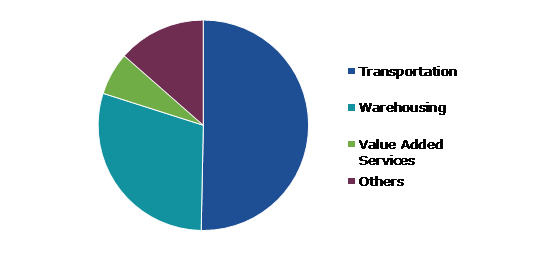

Based on service type, the market has been divided into transportation, warehousing, value added services, and others. Among these, the transportation sub-segment accounted for the highest market share in 2021, whereas the warehousing sub-segment is estimated to witness the fastest growth during the forecast period.

Global Logistics Services (3PL & 4PL) Market Size, by Service Type 2021

Source: Research Dive Analysis

The transportation sub-type is anticipated to have a dominant market share in 2021. Transportation in logistics can clearly identify which form of transportation will work best for the specific shipping requirements. Additionally, road, rail, air, and water routes are all included in transportation logistics. Supply chain management in the retail and healthcare industries, for example, is a subset of transportation logistics. Transportation logistics may be further divided into other industries such as retail supply chain management, healthcare supply chain management, and others. These factors are anticipated to boost the growth of transportation sub-segment during the analysis timeframe.

The warehousing sub-type is anticipated to show the fastest growth in 2031. Warehousing is important in supply chain management because commodities must be transferred from the manufacturer to the final recipient. According to the benefits of warehousing in logistics, if a warehouse operation is ineffective, the entire supply chain may be immobilized, such as a shortage of products, delays, or obstructions. All logistical measures conducted within the scope of a warehouse should avoid the warehouse becoming a supply chain bottleneck. The importance of logistics for an enterprise's competitive position is undeniable in the modern world. Warehousing in logistics is an important aspect of business operations, and it is a necessary component for the growth of an enterprise's customer service process.

Global Logistics Services (3PL & 4PL) Market, by Application

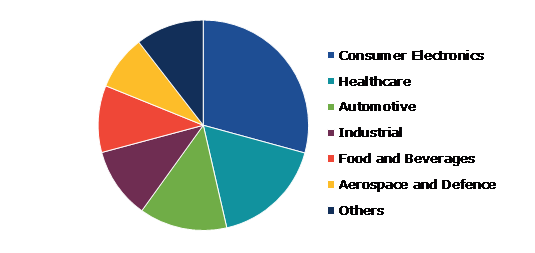

Based on application, the market has been divided into consumer electronics, healthcare, automotive, industrial, food and beverages, aerospace and defense, and others. Among these, the consumer electronics sub-segment accounted for the highest revenue share in 2021.

Global Logistics Services (3PL&4PL) Market Share, by Application, 2021

Source: Research Dive Analysis

The consumer electronics sub-segment accounted for the highest logistics services (3PL & 4PL) market share in 2021. Consumer electronics are electrical devices designed for regular, usually domestic, usage. Portable consumer devices have developed rapidly in the recent years, including phones and tablet PCs. Advanced technological solutions have had an impact on many businesses, particularly the logistics industry. Consumers nowadays are digitally aware, which drives up their expectations of firms. They desire fast shipment, real-time visibility, flexibility, and excellent customer service. These factors are anticipated to boost the growth of consumer sub-segment during the analysis timeframe.

Global Logistics Services (3PL & 4PL) Market, Regional Insights

The logistics services (3PL & 4PL) market was investigated across North America, Europe, Asia-Pacific, and LAMEA.

Global Logistics Services (3PL & 4PL) Market Size & Forecast, by region, 2021-2031 (USD Million)

Source: Research Dive Analysis

The Market for Logistics Services (3PL & 4PL) in Asia-Pacific was the Most Dominant in 2021

Asia-Pacific accounted for the highest logistics services (3PL & 4PL) market share in 2021. Growing demand for logistics services (3pl&4pl) in this region is driving market growth. A significant opportunity for 3PL providers is anticipated to develop from the expanding cross-trade routes and ports. This is anticipated to fuel the market expansion in countries such as Vietnam, South Korea, Japan, and India. The market expansion is anticipated to be driven by the continued development of logistics infrastructure and the growing importance of transportation practices in countries in the region.

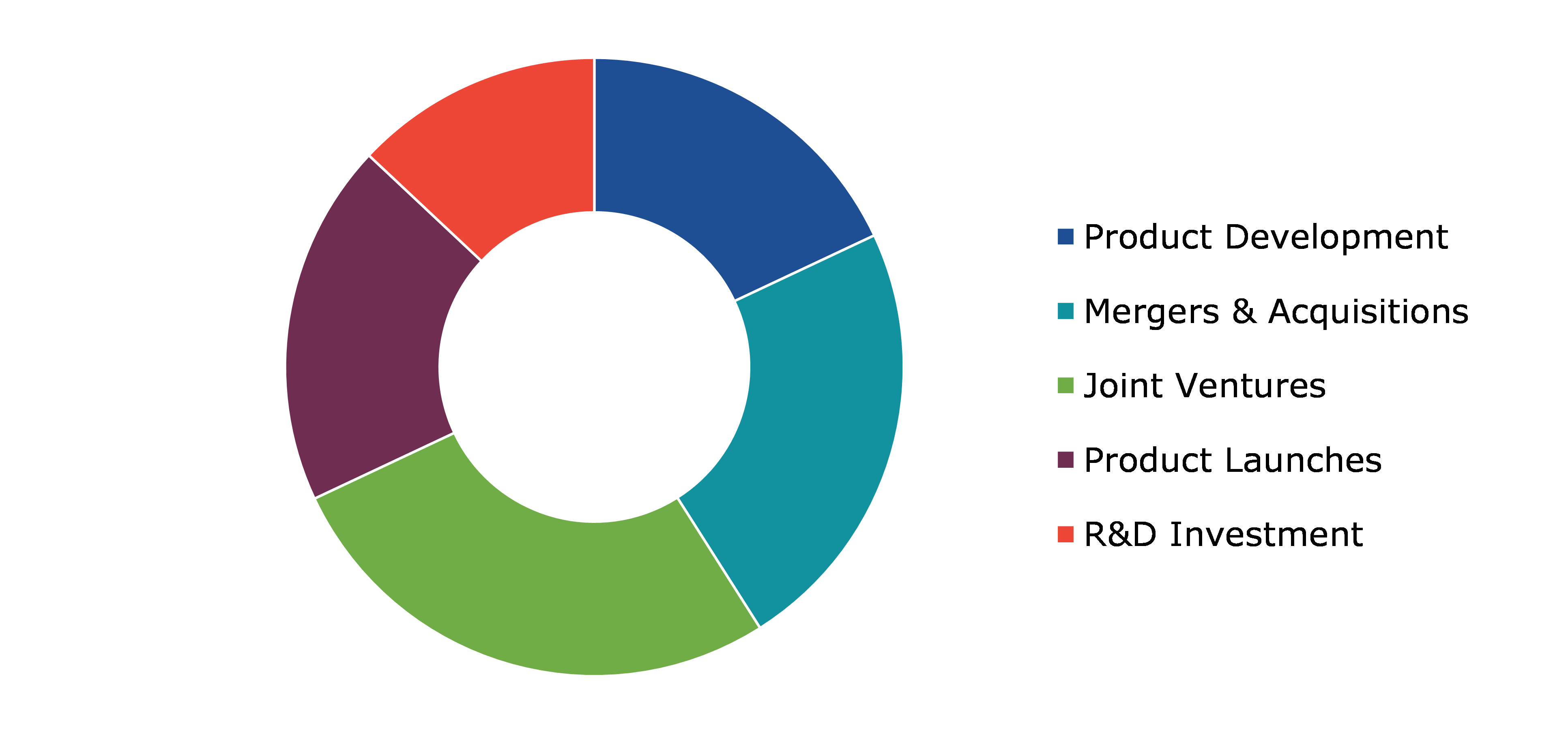

Competitive Scenario in the Global Logistics Services (3PL & 4PL) Market

Investment and agreement are common strategies followed by major market players. For instance, in June 2020, Liftit, a Colombian cargo transportation start-up, has created "Flota Logistica," an open cooperation and free ecosystem for logistics services. This allows enterprises to publish and register cargo offers.

Source: Research Dive Analysis

Some of the leading logistics services (3PL & 4PL) market players are C.H. Robinson Worldwide, Inc., DB Schenker, DHL, FedEx Corporation, 4PL Group, Kuehne + Nagel International AG, Maersk, Global4PL, Orkestra SCS, and Phoenix Freight Systems.

| Aspect | Particulars |

| Historical Market Estimations | 2020 |

| Base Year for Market Estimation | 2021 |

| Forecast Timeline for Market Projection | 2022-2031 |

| Geographical Scope | North America, Europe, Asia-Pacific, LAMEA |

| Segmentation by Service Type |

|

| Segmentation by Application |

|

| Key Companies Profiled |

|

Q1. What is the size of the global logistics services (3PL & 4PL) market?

A. The size of the global logistics services (3PL & 4PL) market was over $1,257.3 million in 2021 and is projected to reach $3,040 million by 2031.

Q2. Which are the major companies in the logistics services (3pl&4pl) market?

A. C.H. Robinson Worldwide, Inc, DB Schenker, and DHL are some of the key players in the global logistics services (3PL & 4PL) market.

Q3. Which region, among others, possesses greater investment opportunities in the near future?

A. The Asia-Pacific region possesses great investment opportunities for investors to witness the most promising growth in the future.

Q4. What will be the growth rate of the Asia-Pacific logistics services (3PL & 4PL) market?

A. Asia-Pacific logistics services (3PL&4PL) market is anticipated to grow at 10.9% CAGR during the forecast period.

Q5. What are the strategies opted by the leading players in this market?

A. Agreement and investment are the two key strategies opted by the operating companies in this market.

Q6. Which companies are investing more on R&D practices?

A. 4PL Group, Kuehne + Nagel International AG, and Maersk are the companies investing more on R&D activities for developing new products and technologies.

1.Research Methodology

1.1.Desk Research

1.2.Real time insights and validation

1.3.Forecast model

1.4.Assumptions and forecast parameters

1.5.Market size estimation

1.5.1.Top-down approach

1.5.2.Bottom-up approach

2.Report Scope

2.1.Market definition

2.2.Key objectives of the study

2.3.Report overview

2.4.Market segmentation

2.5.Overview of the impact of COVID-19 on Global logistics services (3PL & 4PL) market

3.Executive Summary

4.Market Overview

4.1.Introduction

4.2.Growth impact forces

4.2.1.Drivers

4.2.2.Restraints

4.2.3.Opportunities

4.3.Market value chain analysis

4.3.1.List of raw material suppliers

4.3.2.List of manufacturers

4.3.3.List of distributors

4.4.Innovation & sustainability matrices

4.4.1.Technology matrix

4.4.2.Regulatory matrix

4.5.Porter’s five forces analysis

4.5.1.Bargaining power of suppliers

4.5.2.Bargaining power of consumers

4.5.3.Threat of substitutes

4.5.4.Threat of new entrants

4.5.5.Competitive rivalry intensity

4.6.PESTLE analysis

4.6.1.Political

4.6.2.Economical

4.6.3.Social

4.6.4.Technological

4.6.5.Environmental

4.7.Impact of COVID-19 on logistics services (3PL & 4PL) market

4.7.1.Pre-covid market scenario

4.7.2.Post-covid market scenario

5.Logistics Services (3PL & 4PL) Market Analysis, by Service Type

5.1.Overview

5.2.Transportation

5.2.1.Definition, key trends, growth factors, and opportunities

5.2.2.Market size analysis, by region

5.2.3.Market share analysis, by country

5.3.Warehousing

5.3.1.Definition, key trends, growth factors, and opportunities

5.3.2.Market size analysis, by region

5.3.3.Market share analysis, by country

5.4.Value Added Services

5.4.1.Definition, key trends, growth factors, and opportunities

5.4.2.Market size analysis, by region

5.4.3.Market share analysis, by country

5.5.Others

5.5.1.Definition, key trends, growth factors, and opportunities

5.5.2.Market size analysis, by region

5.5.3.Market share analysis, by country

5.6.Research Dive Exclusive Insights

5.6.1.Market attractiveness

5.6.2.Competition heatmap

6.Logistics Services (3PL & 4PL) Market Analysis, by Application

6.1.Consumer Electronics

6.1.1.Definition, key trends, growth factors, and opportunities

6.1.2.Market size analysis, by region, 2021-2031

6.1.3.Market share analysis, by country, 2021-2031

6.2.Healthcare

6.2.1.Definition, key trends, growth factors, and opportunities

6.2.2.Market size analysis, by region, 2021-2031

6.2.3.Market share analysis, by country, 2021-2031

6.3.Automotive

6.3.1.Definition, key trends, growth factors, and opportunities

6.3.2.Market size analysis, by region, 2021-2031

6.3.3.Market share analysis, by country, 2021-2031

6.4.Industrial

6.4.1.Definition, key trends, growth factors, and opportunities

6.4.2.Market size analysis, by region, 2021-2031

6.4.3.Market share analysis, by country, 2021-2031

6.5.Food and Beverages

6.5.1.Definition, key trends, growth factors, and opportunities

6.5.2.Market size analysis, by region, 2021-2031

6.5.3.Market share analysis, by country, 2021-2031

6.6.Aerospace and Defense

6.6.1.Definition, key trends, growth factors, and opportunities

6.6.2.Market size analysis, by region, 2021-2031

6.6.3.Market share analysis, by country, 2021-2031

6.7.Others

6.7.1.Definition, key trends, growth factors, and opportunities

6.7.2.Market size analysis, by region, 2021-2031

6.7.3.Market share analysis, by country, 2021-2031

6.8.Research Dive Exclusive Insights

6.8.1.Market attractiveness

6.8.2.Competition heatmap

7.Logistics Services (3PL & 4PL) Market, by Region

7.1.North America

7.1.1.U.S.

7.1.1.1.Market size analysis, by Service Type, 2021-2031

7.1.1.2.Market size analysis, by Application, 2021-2031

7.1.2.Canada

7.1.2.1.Market size analysis, by Service Type, 2021-2031

7.1.2.2.Market size analysis, by Application, 2021-2031

7.1.3.Mexico

7.1.3.1.Market size analysis, by Service Type, 2021-2031

7.1.3.2.Market size analysis, by Application, 2021-2031

7.1.4.Research Dive Exclusive Insights

7.1.4.1.Market attractiveness

7.1.4.2.Competition heatmap

7.2.Europe

7.2.1.Germany

7.2.1.1.Market size analysis, by Service Type, 2021-2031

7.2.1.2.Market size analysis, by Application, 2021-2031

7.2.2.UK

7.2.2.1.Market size analysis, by Service Type, 2021-2031

7.2.2.2.Market size analysis, by Application, 2021-2031

7.2.3.France

7.2.3.1.Market size analysis, by Service Type, 2021-2031

7.2.3.2.Market size analysis, by Application, 2021-2031

7.2.4.Spain

7.2.4.1.Market size analysis, by Service Type, 2021-2031

7.2.4.2.Market size analysis, by Application, 2021-2031

7.2.5.Italy

7.2.5.1.Market size analysis, by Service Type, 2021-2031

7.2.5.2.Market size analysis, by Application, 2021-2031

7.2.6.Rest of Europe

7.2.6.1.Market size analysis, by Service Type, 2021-2031

7.2.6.2.Market size analysis, by Application, 2021-2031

7.2.7.Research Dive Exclusive Insights

7.2.7.1.Market attractiveness

7.2.7.2.Competition heatmap

7.3.Asia-Pacific

7.3.1.China

7.3.1.1.Market size analysis, by Service Type, 2021-2031

7.3.1.2.Market size analysis, by Application, 2021-2031

7.3.2.Japan

7.3.2.1.Market size analysis, by Service Type, 2021-2031

7.3.2.2.Market size analysis, by Application, 2021-2031

7.3.3.India

7.3.3.1.Market size analysis, by Service Type, 2021-2031

7.3.3.2.Market size analysis, by Application, 2021-2031

7.3.4.Australia

7.3.4.1.Market size analysis, by Service Type, 2021-2031

7.3.4.2.Market size analysis, by Application, 2021-2031

7.3.5.South Korea

7.3.5.1.Market size analysis, by Service Type, 2021-2031

7.3.5.2.Market size analysis, by Application, 2021-2031

7.3.6.Rest of Asia-Pacific

7.3.6.1.Market size analysis, by Service Type, 2021-2031

7.3.6.2.Market size analysis, by Application, 2021-2031

7.3.7.Research Dive Exclusive Insights

7.3.7.1.Market attractiveness

7.3.7.2.Competition heatmap

7.4.LAMEA

7.4.1.Brazil

7.4.1.1.Market size analysis, by Service Type, 2021-2031

7.4.1.2.Market size analysis, by Application, 2021-2031

7.4.2.Saudi Arabia

7.4.2.1.Market size analysis, by Service Type, 2021-2031

7.4.2.2.Market size analysis, by Application, 2021-2031

7.4.3.UAE

7.4.3.1.Market size analysis, by Service Type, 2021-2031

7.4.3.2.Market size analysis, by Application, 2021-2031

7.4.4.South Africa

7.4.4.1.Market size analysis, by Service Type, 2021-2031

7.4.4.2.Market size analysis, by Application, 2021-2031

7.4.5.Rest of LAMEA

7.4.5.1.Market size analysis, by Service Type, 2021-2031

7.4.5.2.Market size analysis, by Application, 2021-2031

7.4.6.Research Dive Exclusive Insights

7.4.6.1.Market attractiveness

7.4.6.2.Competition heatmap

8.Competitive Landscape

8.1.Top winning strategies, 2021

8.1.1.By strategy

8.1.2.By year

8.2.Strategic overview

8.3.Market share analysis, 2021

9.Company Profiles

9.1.C.H. Robinson Worldwide, Inc.

9.1.1.Overview

9.1.2.Business segments

9.1.3.Product portfolio

9.1.4.Financial performance

9.1.5.Recent developments

9.1.6.SWOT analysis

9.2.DB Schenker

9.2.1.Overview

9.2.2.Business segments

9.2.3.Product portfolio

9.2.4.Financial performance

9.2.5.Recent developments

9.2.6.SWOT analysis

9.3.DHL

9.3.1.Overview

9.3.2.Business segments

9.3.3.Product portfolio

9.3.4.Financial performance

9.3.5.Recent developments

9.3.6.SWOT analysis

9.4.FedEx Corporation

9.4.1.Overview

9.4.2.Business segments

9.4.3.Product portfolio

9.4.4.Financial performance

9.4.5.Recent developments

9.4.6.SWOT analysis

9.5.4PL Group

9.5.1.Overview

9.5.2.Business segments

9.5.3.Product portfolio

9.5.4.Financial performance

9.5.5.Recent developments

9.5.6.SWOT analysis

9.6.Kuehne + Nagel International AG

9.6.1.Overview

9.6.2.Business segments

9.6.3.Product portfolio

9.6.4.Financial performance

9.6.5.Recent developments

9.6.6.SWOT analysis

9.7.Maersk

9.7.1.Overview

9.7.2.Business segments

9.7.3.Product portfolio

9.7.4.Financial performance

9.7.5.Recent developments

9.7.6.SWOT analysis

9.8.Global4PL

9.8.1.Overview

9.8.2.Business segments

9.8.3.Product portfolio

9.8.4.Financial performance

9.8.5.Recent developments

9.8.6.SWOT analysis

9.9.Orkestra SCS

9.9.1.Overview

9.9.2.Business segments

9.9.3.Product portfolio

9.9.4.Financial performance

9.9.5.Recent developments

9.9.6.SWOT analysis

9.10.Phoenix Freight Systems

9.10.1.Overview

9.10.2.Business segments

9.10.3.Product portfolio

9.10.4.Financial performance

9.10.5.Recent developments

9.10.6.SWOT analysis

A third-party logistics service company, or 3PL company as it is known, helps in providing transport, storage, and delivery of a company’s goods and services to its customers. Thus, a company can outsource its logistics module to a 3PL company which can pick, pack, store, and deliver the goods to the intended destination. A fourth-party logistics (4PL) service company, on the other hand, has a much wider scope as it takes care of the entire supply chain management of a company. Thus, a company who wishes to outsource its supply management functions can do so with the support of a 4PL company.

Forecast Analysis:

According to the report published by Research Dive, the global logistics services (3PL & 4PL) market is expected to gather a revenue of $3,040 million by 2031 and grow at 9.7% CAGR in the 2022–2031 timeframe. An increase in the adoption artificial intelligence (AI) in the logistics sector which is predicted to be the primary growth driver of the logistics services (3PL & 4PL) market in the forecast period. Additionally, growing expanse of e-commerce sector across the globe is anticipated to push the market forward. Along with this, advantages such as cost-effectiveness of outsourced logistic services is projected to offer numerous growth and investment opportunities to the market in the analysis timeframe. However, lack of skilled logistics professionals is estimated to create hurdles in the full-fledged growth of the logistics services (3PL & 4PL) market in the coming period.

Regionally, the logistics services (3PL & 4PL) market in the Asia-Pacific region is expected to be highly dominant by 2031. Continued development of logistics infrastructure and transportation services in this region is expected to be the leading factor behind the growth of the market.

Some prominent market players include C.H. Robinson Worldwide, Inc., 4PL Group, Global4PL, DB Schenker, Kuehne + Nagel International AG, Orkestra SCS, DHL, Maersk, Phoenix Freight Systems, FedEx Corporation, and many others.

Covid-19 Impact on the Market

The outbreak of the Covid-19 pandemic has had a massive negative effect on almost all industries and businesses across the world. The logistics services (3PL & 4PL) market, too, faced a negative impact of the pandemic. The pandemic witnessed shutdown of major industries and companies which slumped the supply of finished goods. Also, the demand for various goods reduced during the pandemic. Hence, overall trade was affected which brought down the demand for logistics sector and reduced the growth rate of the logistics services (3PL & 4PL) market.

Significant Market Developments

The significant companies operating in the industry are adopting numerous growth strategies & business tactics such as partnerships, collaborations, mergers & acquisitions, and launches to maintain a robust position in the overall market, thus helping the logistics services (3PL & 4PL) market to flourish. For instance:

- In December 2021, MSC Group, a leading shipping company, announced the acquisition of Bolloré Africa Logistics, a leading transport company operating in the whole of Africa. This acquisition is predicted to help MSC Group to expand its operations in the African continent and gain a lead over its competitors.

- In February 2023, Maersk, a global leader in shipping services, announced that it had signed a partnership agreement with Ashdod Port Company, a port management company handling the Ashdod Port in Israel. This partnership is predicted to boost the market share of both the companies substantially in the next few years.

- In March 2023, Dubai South, one of the largest logistics market players, announced that it was collaborating with dnata, a global air services provider. This collaboration is aimed at enhancing the logistical services and cargo handling in the Dubai South area and thus, further economic investments. The collaboration will help both the partners to pool their resources and integrate their operations efficiently.

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com