Ambulance Services Market Report

RA08607

Ambulance Services Market by Mode of Transportation (Air Ambulance, Ground Ambulance, and Water Ambulance), Service Type (Emergency Medical Transport and Non-emergency Medical Transport), Emergency Ground Ambulance (Basic Life Support Ambulance and Advance Life Support Ambulance), Operating Type (Public Private Partnership, Government, Private, and Others), and Region (North America, Europe, Asia-Pacific, and LAMEA): Global Opportunity Analysis and Industry Forecast, 2022-2031

Global Ambulance Services Market Analysis

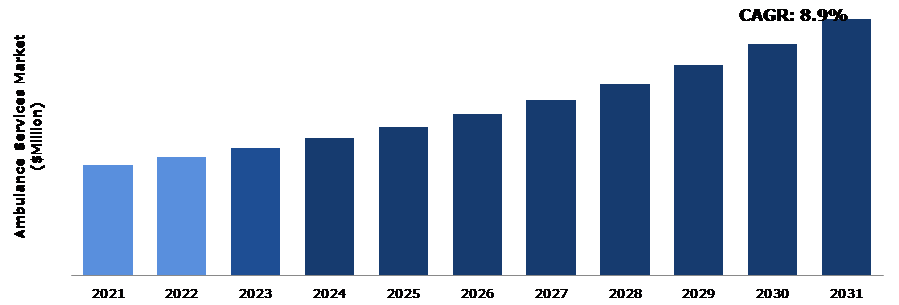

The Global Ambulance Services Market Size was $40,625 million in 2021 and is predicted to grow with a CAGR of 8.9%, generating a revenue of $94,204.9 million by 2031.

Global Ambulance Services Market Synopsis

Emergency medical services, also referred to as ambulance services, are emergency services that offer out-of-hospital emergency medical assistance and transportation to patients who have injuries or ailments. They give the person adequate medical care before they arrive at the hospital. The primary goal of ambulance services is to treat patients who need immediate medical attention or to transport patients to the nearest hospitals or healthcare facilities for additional, urgently needed care. The ideal situation is for this to set off a chain of events that prompts a prompt response of knowledge, resources, and service aimed at patient stabilization and secure emergency patient transportation to the closest suitable facility. Some studies have indicated a significant correlation between response time and death rate, making effective ambulance service delivery essential in lowering mortality and disability rates. Even though Emergency Medical Services (EMS) is actively present in these communities, it is currently the practice in many low- and middle-income nations to utilize a private vehicle or a taxi to take the injured or unwell individual to the hospital.

Finding a single ambulance that could cover a big geographic area has been difficult in underdeveloped nations due to the lack of adequate ambulances. This is impossible due to the weak infrastructure in these countries, which causes the ambulances to quickly wear out and operate poorly.

The air ambulance service, which operates as a modern example of urban air mobility, provides high-quality medical services and on-demand transportation to a tiny percentage of patients. Air ambulance services are used particularly for patients who are in a critical condition thereby increasing the patients’ chances of survival. Air ambulance services are a crucial component of the medical transport system that helps move patients, supplies, equipment, and medical professionals throughout the medical network for both long-distance scheduled transfers as well as time-critical emergency transportation. Despite the much greater cost per transfer compared to surface ambulance choices, air ambulance services continue to exist because of the value air transport provides to hospitals. The perception of higher levels of care for more rapid inter-facility and emergency scene response transfers over vast distances and unmatched access to locations with inadequate roads are all linked to helicopter and fixed-wing transports. Furthermore, Air EMS frequently transports the most seriously injured patients to hospital facilities for treatment.

Ambulance Services Overview

An ambulance is a vehicle that is used to transport sick or injured persons who need immediate medical attention and transport them to a hospital. Patients can be moved between hospitals using ambulances as well. The tools required to stabilize a sick or injured person and transport them to the hospital are available in ambulances. Stretchers, spine boards, defibrillators, oxygen and oxygen masks, splints, bandages, and a variety of medications and intravenous fluids are all included. Some ambulances are outfitted with equipment that allows doctors to administer anesthesia and do emergency surgery.

COVID-19 Impact on Global Ambulance Services Market

The COVID-19 epidemic had a positive effect on the ambulance services market growth. The COVID-19 outbreak is fueling an increase in the need for ambulance services to offer emergency care for COVID-19 patients. The number of COVID-19 cases around the globe has also sharply increased the demand for ambulances. For instance, Delhi-based healthcare firm Medulance claims that the ongoing pandemic has caused a three times increase in demand for its ambulance service. After the COVID-19 pandemic, the end-to-end emergency response service provider around the globe reported a spike in new subscribers on its platform. For example, on September 2020, the Bengaluru-based ICATT Kyathi's launched air ambulance services to provide emergency services in remote areas where inadequate medical services are available.

Increase in Accidents Rates to Drive the Market Growth

Increased use of personal automobiles has resulted in an increase in accidents. Accidents frequently require urgent hospital admissions for medical treatment and care. As a result, accidental patients need ambulance services to reach the hospital as soon as possible to take proper medical treatment. The United States ranks among the nations with the highest number of traffic accidents worldwide. Every year, there are about 10 million traffic accidents in the United States. For instance, according to the WHO report published on June 2022, every year there are near about 1.3 million people who suffer from road accidents around the globe. Non-fatal injuries affect between 20 and 50 million more people, with many becoming disabled as a result of their injuries. All these factors are anticipated to boost the global ambulance services market share growth.

To know more about global ambulance services market drivers, get in touch with our analysts here.

Lack of Ambulance Services in Developing Countries to Restrain the Market Growth

Ambulance services are associated with saving lives and considerably enhancing the emergency response system's quality. The increased incidences of heart failure, obesity, cardiac arrest, and other conditions are rising as a result of unhealthy lifestyles. Due to the increased risk, it is essential that nations’ emergency medical services be equipped to manage such situations. Without a competent ambulance service, a huge number of medically and traumatically injured patients would die, as would patients who did not have access to speedy transportation to a hospital. These factors are likely to impede global ambulance services market revenue growth in the future.

Increase in the Demand for Air Ambulance Services to Drive Excellent Opportunities

Air EMS is an essential component of emergency medical care. It exists to connect a complex healthcare service to patients when speed and degree of treatment are crucial variables in the patient's successful outcome. Air ambulance services benefit patients by transporting them quickly and providing highly skilled medical assistance and equipment. A patient's medical outcome may depend on how quickly they can obtain the right care. Three types of missions can be classified as part of air ambulance transport: inter-facility transport, scene response, and organ transport. Air ambulance services offer society special and significant medical transport capabilities. Over large distances or crowded places, air ambulance services can transport patients or live organs more quickly than surface options. Additionally, in areas where surface transportation is problematic, such as the backcountry or during disaster scenarios, air ambulance services offer unmatched access to accident scenes. All such factors are expected to boost the global ambulance services size growth in the forecast time period.

To know more about global ambulance services market opportunities, get in touch with our analysts here.

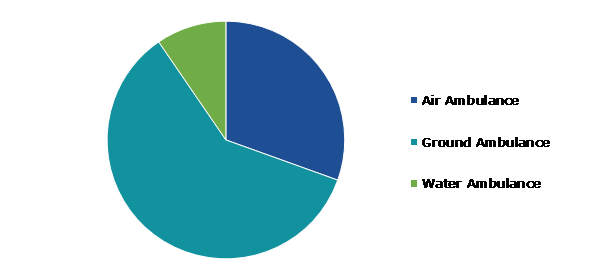

Global Ambulance Services Market, by Mode of Transportation

Based on mode of transportation, the market has been divided into air ambulance, ground ambulance, and water ambulance. Among these, the ground ambulance sub-segment accounted for the highest market share in 2021 whereas the air ambulance sub-segment is estimated to show the fastest growth during the forecast period.

Global Ambulance Services Market Size, by Mode of Transportation, 2021

Source: Research Dive Analysis

The ground ambulance sub-type accounted for a dominant market share in 2021. The most frequently employed medical transport services are ground ambulances, which are furnished with fundamental respiratory systems, stretchers, oxygen cylinders, and a saline administration setup. These ambulances are necessary for both patients who need ongoing monitoring but don't require urgent assistance and people who are disabled and need help moving around. Although not the greatest patient transport vehicle available, a non-emergency ground ambulance is the most widely used since it is significantly less expensive than other alternatives such as air ambulance.

The air ambulance sub-type is anticipated to show the fastest growth in 2031. Air ambulances are typically employed when there is a sizable distance to go and road transportation is neither reliable nor stable enough for the patient. Air ambulances are the most practical alternative since, in addition, the patient's location is frequently too remote for road transfer to be a practical option.

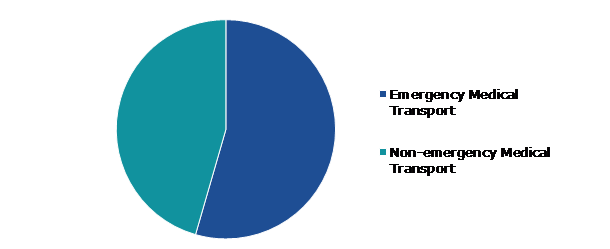

Global Ambulance Services Market, by Service Type

Based on service type, the market has been divided into emergency medical transport and non-emergency medical transport. Among these, the emergency medical transport sub-segment accounted for the highest revenue share in 2021.

Global Ambulance Services Market Share, by Service Type, 2021

Source: Research Dive Analysis

The emergency medical transport sub-segment accounted for a dominant market share in 2021. Emergency medical transportation is defined as transportation required for a patient with an emergency medical condition as described in the emergency medical service rule and requires a skilled medical professional such as an emergency medical technician and prompt transport to a facility, typically a hospital, where adequate emergency medical assistance is available.

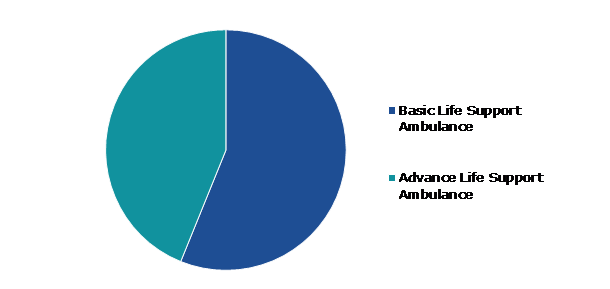

Global Ambulance Services Market, by Emergency Ground Ambulance

Based on the emergency ground ambulance, the market has been divided into basic life support ambulance and advance life support ambulance. Among these, the basic life support ambulance sub-segment accounted for the highest revenue share in 2021.

Global Ambulance Services Market Forecast, by Emergency Ground Ambulance, 2021

Source: Research Dive Analysis

The basic life support ambulance sub-segment accounted for a dominant market share in 2021. Basic life support ambulances are ideally suited to handle cases where the patient won't need extensive medical care or heart monitoring until they arrive at the hospital. They have basic life-saving tools like stretchers, oxygen tanks, blood pressure monitors, and other things that help stabilize the patient and keep him comfortable until more sophisticated medical care is available.

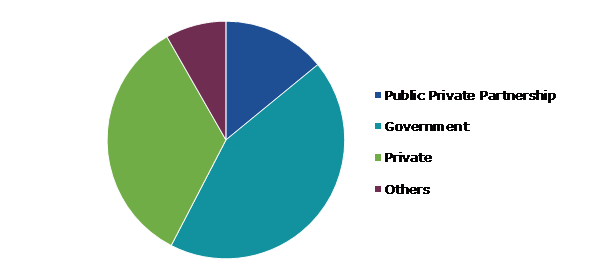

Global Ambulance Services Market, by Operating Type

Based on the operating type, the market has been divided into public private partnership, government, private, and others. Among these, the government sub-segment accounted for the highest revenue share in 2021.

Global Ambulance Services Market Analysis, by Operating Type, 2021

Source: Research Dive Analysis

The government sub-segment accounted for a dominant market share in 2021. These ambulances are supported by regional, provincial, or federal government and work independently of the local fire and police departments. These are typically only present in large cities in some nations, although practically all emergency ambulances in nations like the United Kingdom are a part of a national health system.

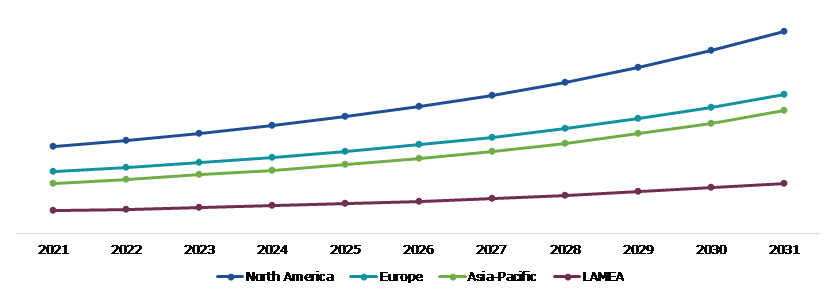

Global Ambulance Services Market, Regional Insights

The ambulance services market was investigated across North America, Europe, Asia-Pacific, and LAMEA.

Global Ambulance Services Market Size & Forecast, by region, 2021-2031 (USD Million)

Source: Research Dive Analysis

The Market for Ambulance Services in North America is the Most Dominant

The North America ambulance services market accounted for the highest market share in 2031. The presence of several major market players in this area, the rising demand for high-quality healthcare services, the region's well-established healthcare infrastructure, and favorable reimbursement policies and regulatory reforms in the healthcare industry are all contributing factors to the growth. The ambulance services market in the North America region is also growing as a result of technological developments like the ability to book ambulance services online. Rising emergency healthcare costs, an increase in hospitals providing appropriate air ambulance services, and better medical facilities across the nation are further factors influencing the ambulance services market opportunity in the region.

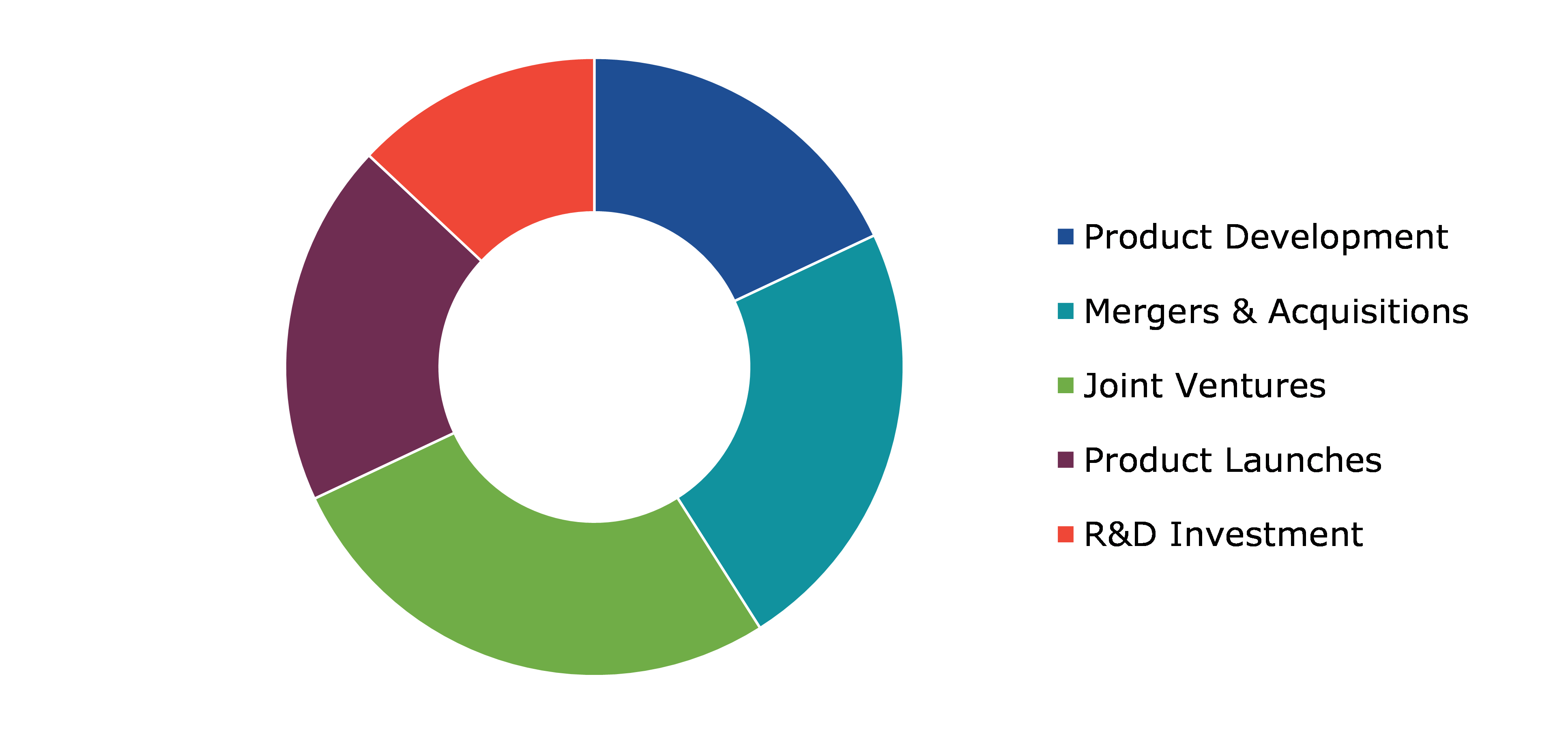

Competitive Scenario in the Global Ambulance Services Market

Investment and agreement are common strategies followed by major market players. For instance, in March 2022, Airbus inked an agreement with Airlift Global, a business financed by UK-based AUM Capital, to develop helicopter emergency medical services and allied air medical services in India.

Source: Research Dive Analysis

Some of the leading ambulance services market players are Babcock International Group PLC, Acadian Ambulance Service, BVG India, Falck A/S, Ziqitza HealthCare, Air Methods, Harmonie Ambulance, Envision Healthcare, Medivic Aviation, and Aeromedevac Air Ambulance.

| Aspect | Particulars |

| Historical Market Estimations | 2020-2021 |

| Base Year for Market Estimation | 2021 |

| Forecast Timeline for Market Projection | 2022-2031 |

| Geographical Scope | North America, Europe, Asia-Pacific, and LAMEA |

| Segmentation by Mode of Transportation |

|

| Segmentation by Service Type |

|

| Segmentation by Emergency Ground Ambulance |

|

| Segmentation by Operating Type |

|

| Key Companies Profiled |

|

Q1. What is the size of the global ambulance services market?

A. The size of the global ambulance services market was over $40,625 million in 2021 and is projected to reach $94,204.9 million by 2031.

Q2. Which are the major companies in the ambulance services market?

A. Babcock International Group PLC, Acadian Ambulance Service, and BVG India are some of the key players in the global ambulance services market.

Q3. Which region, among others, possesses greater investment opportunities in the near future?

A. The Asia-Pacific region possesses great investment opportunities for investors to witness the most promising growth in the future.

Q4. What will be the growth rate of the Asia-Pacific ambulance services market?

A. Asia-Pacific ambulance services market is anticipated to grow at 9.5% CAGR during the forecast period.

Q5. What are the strategies opted by the leading players in this market?

A. Agreement and investment are the two key strategies opted by the operating companies in this market.

Q6. Which companies are investing more on R&D practices?

A. Falck A/S, Ziqitza HealthCare, and Air Methods are the companies investing more on R&D activities for developing new products and technologies.

1.Research Methodology

1.1.Desk Research

1.2.Real time insights and validation

1.3.Forecast model

1.4.Assumptions and forecast parameters

1.5.Market size estimation

1.5.1.Top-down approach

1.5.2.Bottom-up approach

2.Report Scope

2.1.Market definition

2.2.Key objectives of the study

2.3.Report overview

2.4.Market segmentation

2.5.Overview of the impact of COVID-19 on the global ambulance services market

3.Executive Summary

4.Market Overview

4.1.Introduction

4.2.Growth impact forces

4.2.1.Drivers

4.2.2.Restraints

4.2.3.Opportunities

4.3.Market value chain analysis

4.3.1.List of raw material suppliers

4.3.2.List of manufacturers

4.3.3.List of distributors

4.4.Innovation & sustainability matrices

4.4.1.Technology matrix

4.4.2.Regulatory matrix

4.5.Porter’s five forces analysis

4.5.1.Bargaining power of suppliers

4.5.2.Bargaining power of consumers

4.5.3.Threat of substitutes

4.5.4.Threat of new entrants

4.5.5.Competitive rivalry intensity

4.6.PESTLE analysis

4.6.1.Political

4.6.2.Economical

4.6.3.Social

4.6.4.Technological

4.6.5.Environmental

4.7.Impact of COVID-19 on ambulance services market

4.7.1.Pre-covid market scenario

4.7.2.Post-covid market scenario

5.Ambulance Services Market Analysis, by Mode of Transportation

5.1.Overview

5.2.Air Ambulance

5.2.1.Definition, key trends, growth factors, and opportunities

5.2.2.Market size analysis, by region, 2021-2031

5.2.3.Market share analysis, by country, 2021-2031

5.3.Ground Ambulance

5.3.1.Definition, key trends, growth factors, and opportunities

5.3.2.Market size analysis, by region, 2021-2031

5.4.Market share analysis, by country, 2021-2031

5.5.Water Ambulance

5.5.1.Definition, key trends, growth factors, and opportunities

5.5.2.Market size analysis, by region, 2021-2031

5.5.3.Market share analysis, by country, 2021-2031

5.6.Research Dive Exclusive Insights

5.6.1.Market attractiveness

5.6.2.Competition heatmap

6.Ambulance Services Market Analysis, by Service Type

6.1.Emergency Medical Transport

6.1.1.Definition, key trends, growth factors, and opportunities

6.1.2.Market size analysis, by region, 2021-2031

6.1.3.Market share analysis, by country, 2021-2031

6.2.Non-emergency Medical Transport

6.2.1.Definition, key trends, growth factors, and opportunities

6.2.2.Market size analysis, by region, 2021-2031

6.2.3.Market share analysis, by country, 2021-2031

6.3.Research Dive Exclusive Insights

6.3.1.Market attractiveness

6.3.2.Competition heatmap

7.Ambulance Services Market Analysis, by Emergency Ground Ambulance

7.1.Basic Life Support Ambulance

7.1.1.Definition, key trends, growth factors, and opportunities

7.1.2.Market size analysis, by region, 2021-2031

7.1.3.Market share analysis, by country, 2021-2031

7.2.Advance Life Support Ambulance

7.2.1.Definition, key trends, growth factors, and opportunities

7.2.2.Market size analysis, by region, 2021-2031

7.2.3.Market share analysis, by country, 2021-2031

7.3.Research Dive Exclusive Insights

7.3.1.Market attractiveness

7.3.2.Competition heatmap

8.Ambulance Services Market Analysis, by Operating Type

8.1.Public Private Partnership

8.1.1.Definition, key trends, growth factors, and opportunities

8.1.2.Market size analysis, by region, 2021-2031

8.1.3.Market share analysis, by country, 2021-2031

8.2.Government

8.2.1.Definition, key trends, growth factors, and opportunities

8.2.2.Market size analysis, by region, 2021-2031

8.2.3.Market share analysis, by country, 2021-2031

8.3.Private

8.3.1.Definition, key trends, growth factors, and opportunities

8.3.2.Market size analysis, by region, 2021-2031

8.3.3.Market share analysis, by country, 2021-2031

8.4.Others

8.4.1.Definition, key trends, growth factors, and opportunities

8.4.2.Market size analysis, by region, 2021-2031

8.4.3.Market share analysis, by country, 2021-2031

8.5.Research Dive Exclusive Insights

8.5.1.Market attractiveness

8.5.2.Competition heatmap

9.Ambulance Services Market, by Region

9.1.North America

9.1.1.U.S.

9.1.1.1.Market size analysis, by Mode of Transportation, 2021-2031

9.1.1.2.Market size analysis, by Service Type, 2021-2031

9.1.1.3.Market size analysis, by Emergency Ground Ambulance, 2021-2031

9.1.1.4.Market size analysis, by Operating Type, 2021-2031

9.1.2.Canada

9.1.2.1.Market size analysis, by Mode of Transportation, 2021-2031

9.1.2.2.Market size analysis, by Service Type, 2021-2031

9.1.2.3.Market size analysis, by Emergency Ground Ambulance, 2021-2031

9.1.2.4.Market size analysis, by Operating Type, 2021-2031

9.1.3.Mexico

9.1.3.1.Market size analysis, by Mode of Transportation, 2021-2031

9.1.3.2.Market size analysis, by Service Type, 2021-2031

9.1.3.3.Market size analysis, by Emergency Ground Ambulance, 2021-2031

9.1.3.4.Market size analysis, by Operating Type, 2021-2031

9.1.4.Research Dive Exclusive Insights

9.1.4.1.Market attractiveness

9.1.4.2.Competition heatmap

9.2.Europe

9.2.1.Germany

9.2.1.1.Market size analysis, by Mode of Transportation, 2021-2031

9.2.1.2.Market size analysis, by Service Type, 2021-2031

9.2.1.3.Market size analysis, by Emergency Ground Ambulance, 2021-2031

9.2.1.4.Market size analysis, by Operating Type, 2021-2031

9.2.2.UK

9.2.2.1.Market size analysis, by Mode of Transportation, 2021-2031

9.2.2.2.Market size analysis, by Service Type, 2021-2031

9.2.2.3.Market size analysis, by Emergency Ground Ambulance, 2021-2031

9.2.2.4.Market size analysis, by Operating Type, 2021-2031

9.2.3.France

9.2.3.1.Market size analysis, by Mode of Transportation, 2021-2031

9.2.3.2.Market size analysis, by Service Type, 2021-2031

9.2.3.3.Market size analysis, by Emergency Ground Ambulance, 2021-2031

9.2.3.4.Market size analysis, by Operating Type, 2021-2031

9.2.4.Spain

9.2.4.1.Market size analysis, by Mode of Transportation, 2021-2031

9.2.4.2.Market size analysis, by Service Type, 2021-2031

9.2.4.3.Market size analysis, by Emergency Ground Ambulance, 2021-2031

9.2.4.4.Market size analysis, by Operating Type, 2021-2031

9.2.5.Italy

9.2.5.1.Market size analysis, by Mode of Transportation, 2021-2031

9.2.5.2.Market size analysis, by Service Type, 2021-2031

9.2.5.3.Market size analysis, by Emergency Ground Ambulance, 2021-2031

9.2.5.4.Market size analysis, by Operating Type, 2021-2031

9.2.6.Rest of Europe

9.2.6.1.Market size analysis, by Mode of Transportation, 2021-2031

9.2.6.2.Market size analysis, by Service Type, 2021-2031

9.2.6.3.Market size analysis, by Emergency Ground Ambulance, 2021-2031

9.2.6.4.Market size analysis, by Operating Type, 2021-2031

9.2.7.Research Dive Exclusive Insights

9.2.7.1.Market attractiveness

9.2.7.2.Competition heatmap

9.3.Asia-Pacific

9.3.1.China

9.3.1.1.Market size analysis, by Mode of Transportation, 2021-2031

9.3.1.2.Market size analysis, by Service Type, 2021-2031

9.3.1.3.Market size analysis, by Emergency Ground Ambulance, 2021-2031

9.3.1.4.Market size analysis, by Operating Type, 2021-2031

9.3.2.Japan

9.3.2.1.Market size analysis, by Mode of Transportation, 2021-2031

9.3.2.2.Market size analysis, by Service Type, 2021-2031

9.3.2.3.Market size analysis, by Emergency Ground Ambulance, 2021-2031

9.3.2.4.Market size analysis, by Operating Type, 2021-2031

9.3.3.India

9.3.3.1.Market size analysis, by Mode of Transportation, 2021-2031

9.3.3.2.Market size analysis, by Service Type, 2021-2031

9.3.3.3.Market size analysis, by Emergency Ground Ambulance, 2021-2031

9.3.3.4.Market size analysis, by Operating Type, 2021-2031

9.3.4.Australia

9.3.4.1.Market size analysis, by Mode of Transportation, 2021-2031

9.3.4.2.Market size analysis, by Service Type, 2021-2031

9.3.4.3.Market size analysis, by Emergency Ground Ambulance, 2021-2031

9.3.4.4.Market size analysis, by Operating Type, 2021-2031

9.3.5.South Korea

9.3.5.1.Market size analysis, by Mode of Transportation, 2021-2031

9.3.5.2.Market size analysis, by Service Type, 2021-2031

9.3.5.3.Market size analysis, by Emergency Ground Ambulance, 2021-2031

9.3.5.4.Market size analysis, by Operating Type, 2021-2031

9.3.6.Rest of Asia-Pacific

9.3.6.1.Market size analysis, by Mode of Transportation, 2021-2031

9.3.6.2.Market size analysis, by Service Type, 2021-2031

9.3.6.3.Market size analysis, by Emergency Ground Ambulance, 2021-2031

9.3.6.4.Market size analysis, by Operating Type, 2021-2031

9.3.7.Research Dive Exclusive Insights

9.3.7.1.Market attractiveness

9.3.7.2.Competition heatmap

9.4.LAMEA

9.4.1.Brazil

9.4.1.1.Market size analysis, by Mode of Transportation, 2021-2031

9.4.1.2.Market size analysis, by Service Type, 2021-2031

9.4.1.3.Market size analysis, by Emergency Ground Ambulance, 2021-2031

9.4.1.4.Market size analysis, by Operating Type, 2021-2031

9.4.2.Saudi Arabia

9.4.2.1.Market size analysis, by Mode of Transportation, 2021-2031

9.4.2.2.Market size analysis, by Service Type, 2021-2031

9.4.2.3.Market size analysis, by Emergency Ground Ambulance, 2021-2031

9.4.2.4.Market size analysis, by Operating Type, 2021-2031

9.4.3.UAE

9.4.3.1.Market size analysis, by Mode of Transportation, 2021-2031

9.4.3.2.Market size analysis, by Service Type, 2021-2031

9.4.3.3.Market size analysis, by Emergency Ground Ambulance, 2021-2031

9.4.3.4.Market size analysis, by Operating Type, 2021-2031

9.4.4.South Africa

9.4.4.1.Market size analysis, by Mode of Transportation, 2021-2031

9.4.4.2.Market size analysis, by Service Type, 2021-2031

9.4.4.3.Market size analysis, by Emergency Ground Ambulance, 2021-2031

9.4.4.4.Market size analysis, by Operating Type, 2021-2031

9.4.5.Rest of LAMEA

9.4.5.1.Market size analysis, by Mode of Transportation, 2021-2031

9.4.5.2.Market size analysis, by Service Type, 2021-2031

9.4.5.3.Market size analysis, by Emergency Ground Ambulance, 2021-2031

9.4.5.4.Market size analysis, by Operating Type, 2021-2031

9.4.6.Research Dive Exclusive Insights

9.4.6.1.Market attractiveness

9.4.6.2.Competition heatmap

10.Competitive Landscape

10.1.Top winning strategies, 2021

10.1.1.By strategy

10.1.2.By year

10.2.Strategic overview

10.3.Market share analysis, 2021

11.Company Profiles

11.1.Babcock International Group PLC

11.1.1.Overview

11.1.2.Business segments

11.1.3.Product portfolio

11.1.4.Financial performance

11.1.5.Recent developments

11.1.6.SWOT analysis

11.2.Acadian Ambulance Service

11.2.1.Overview

11.2.2.Business segments

11.2.3.Product portfolio

11.2.4.Financial performance

11.2.5.Recent developments

11.2.6.SWOT analysis

11.3.BVG India

11.3.1.Overview

11.3.2.Business segments

11.3.3.Product portfolio

11.3.4.Financial performance

11.3.5.Recent developments

11.3.6.SWOT analysis

11.4.Falck A/S

11.4.1.Overview

11.4.2.Business segments

11.4.3.Product portfolio

11.4.4.Financial performance

11.4.5.Recent developments

11.4.6.SWOT analysis

11.5.Ziqitza HealthCare

11.5.1.Overview

11.5.2.Business segments

11.5.3.Product portfolio

11.5.4.Financial performance

11.5.5.Recent developments

11.5.6.SWOT analysis

11.6.Air Methods

11.6.1.Overview

11.6.2.Business segments

11.6.3.Product portfolio

11.6.4.Financial performance

11.6.5.Recent developments

11.6.6.SWOT analysis

11.7.Harmonie Ambulance

11.7.1.Overview

11.7.2.Business segments

11.7.3.Product portfolio

11.7.4.Financial performance

11.7.5.Recent developments

11.7.6.SWOT analysis

11.8.Envision Healthcare

11.8.1.Overview

11.8.2.Business segments

11.8.3.Product portfolio

11.8.4.Financial performance

11.8.5.Recent developments

11.8.6.SWOT analysis

11.9.MEDIVIC Aviation

11.9.1.Overview

11.9.2.Business segments

11.9.3.Product portfolio

11.9.4.Financial performance

11.9.5.Recent developments

11.9.6.SWOT analysis

11.10.Aeromedevac Air Ambulance

11.10.1.Overview

11.10.2.Business segments

11.10.3.Product portfolio

11.10.4.Financial performance

11.10.5.Recent developments

11.10.6.SWOT analysis

Ambulance is basically a medical equipped vehicle whose primary role is to provide medical treatment to patients while transporting them to the nearest medical facility like a hospital. Ambulance services, also known as medical emergency services, typically provide basic medical amenities like stretchers, oxygen masks, defibrillators, bandages, etc. Advanced ambulance services are specifically used when the medical condition of the patient is critical and the patient may need life support while transporting him/her to the hospital.

Forecast Analysis of the Ambulance Services Market

Over the years, there has been a steep increase in the number of automobile accidents across the globe which is expected to be the primary growth driver of the ambulance services market in the 2022-2031 timeframe. Along with this, there has been an increase in demand for air ambulance services for quick and skilled medical assistance, especially in crowded and large areas. This growth in demand for air ambulance services is predicted to boost the ambulance services market in the analysis timeframe. Moreover, growing awareness regarding the importance of emergency medical services to lower mortality and disability rates is expected to offer numerous growth opportunities to the market in the forecast years. However, according to the market analysts, lack of ambulance services in developing countries is expected to a barrier in the full-fledged growth of the ambulance services market in the forecast period.

Regionally, the ambulance services market in the North America region is expected to be the most dominant in the forecast period. The well-established healthcare industry and rising demand for advanced medical care are predicted to be the main contributing factors to the growth of the market in this region.

As per a report by Research Dive, the global ambulance services market is expected to reach a revenue of $94,204.9 million in the 2022–2031 timeframe, thereby growing at CAGR of 8.9% by 2031. Some prominent market players include Babcock International Group PLC, Ziqitza HealthCare, Envision Healthcare, Acadian Ambulance Service, Y Air Methods, Medivic Aviation, BVG India, Harmonie Ambulance, Aeromedevac Air Ambulance, Falck A/S, and many others.

Covid-19 Impact on the Market

The Covid-19 pandemic and the subsequent lockdowns have had a catastrophic impact on various businesses and markets worldwide. The ambulance services market, however, faced a positive impact of the pandemic. The growth in the demand for emergency medical services on account of rising Covid-19 cases across the world during the pandemic resulted in a massive surge in the growth rate of the market.

Significant Market Developments

The key players of the market are adopting various business strategies such as partnerships, mergers & acquisitions, and launches to gain a leading position in the market, thus helping the ambulance services market to flourish. For instance:

- In June 2021, Empress Ambulance Service, a New-York based emergency medical services provider, announced the acquisition of Empire State Ambulance Corp. This acquisition is predicted to boost the market share of the acquiring company substantially in the coming period.

- In August 2022, StanPlus, one of the largest emergency response networks in India, announced a partnership with Narayana Hrudayalaya, a multispecialty hospital in India. This partnership is aimed at developing basic and advanced life support systems for patients and provide critical care through ambulance services within 15 minutes. The partnership is expected to cater to the demands of the medical sector in a holistic manner.

- In January 2023, Swiggy, an online food ordering and delivery company based in India, announced that it was launching an ambulance service for its delivery executives and their dependents to address their medical emergencies. The delivery agents can dial a toll-free number or tap an SOS button to avail the ambulance service prior, during, or after a delivery.

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com