Japan Meat Products Market Report

RA08603

Japan Meat Products Market by Processed Meat Type (Hamburger, Sausage, Kebabs, and Nuggets), Meat Type (Beef, Pork, Chicken & Mutton, and Others), and Packaging (Chilled, Frozen and Canned): Japan Opportunity Analysis and Industry Forecast, 2022-2031

Japan Meat Products Market Analysis

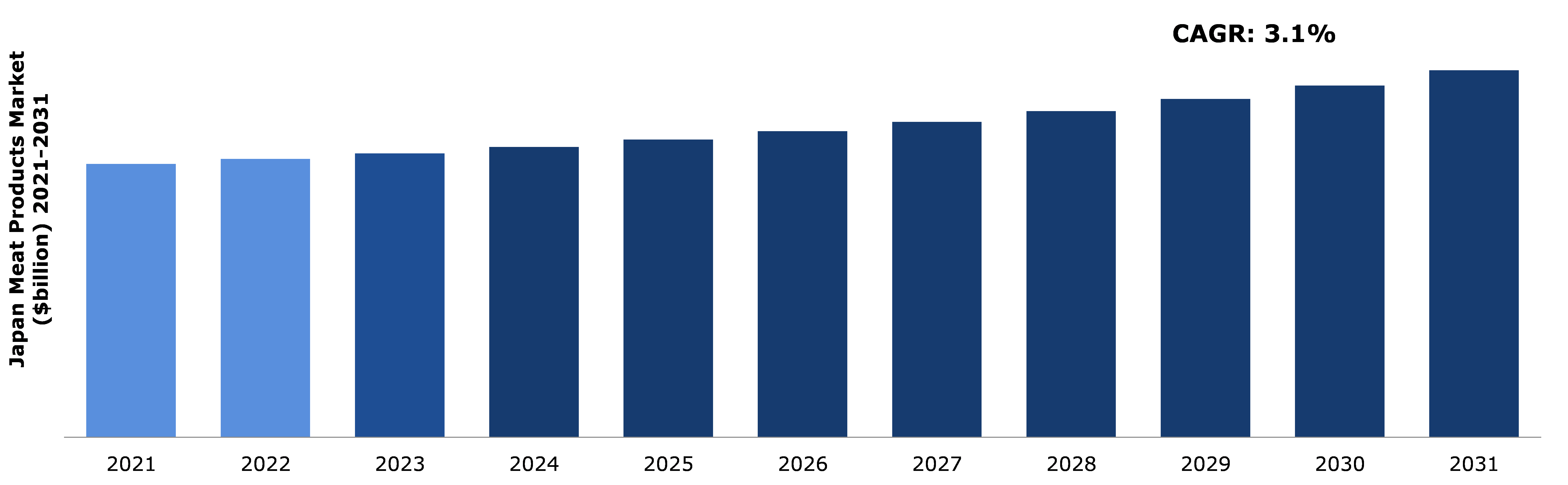

The Japan Meat Products Market Size was $18.9 billion in 2021 and is predicted to grow with a CAGR of 3.1%, by generating a revenue of $25.3 billion by 2031.

Japan Meat Products Market Synopsis

In today’s scenario, the Japanese geriatric population is facing high risk of health concerns prevalent in old age due to lack of consumption of animal protein. According to The Tokyo’s National Institute of Biomedical Innovation, general Japanese population is at higher risk of sarcopenia and frailty due to low quantity and quality of protein intake. To cater to the rising demand for meat products in the country and increase protein intake of the population, the Japanese government has increased the import of meat and meat products from other countries like US and Australia. As per the report by Foreign Agricultural Services, in 2021, Japan imported approximately 712,511 metric tons of meat products, accounting for nearly 125% growth in meat import in the last 10 years.

Apart from this, as the consumption of meat products has increased among consumers in Japan, meat products’ manufacturers have got tremendous opportunity to expand their business, strengthen their customer base, and introduce new products in the market.

Moreover, The Japan's Health, Labor and Welfare Ministry are in process to focusing on drafting regulatory frameworks and guidelines for the eventual commercialization and industrialization of cultivated meat in Japan. Deep-tech food companies namely MeaTech 3D are pushing its technological abilities and introducing 3D-bioprinting technology that can produce complex meat products for the Japan market. These strategic movements are creating emerging opportunities for new players further supplementing the Japan meat products industry.

Despite the advancements in technology, low importance of domestic agricultural production, rising concerns of Japanese food consumption habits, and ageing population are considered significant factors responsible for hampering the food & agriculture as well as the meat industry.

The most important growth driver for the Japan meat products market is the meat products’ manufacturers operating their businesses proactively focusing on filling the gap of lack of protein intake and other nutritional properties in Japanese population. In order to fill this gap, the meat and meat products’ market players are actively emphasizing on new product innovations. Adopting various expansion strategies mainly amalgamation, joint ventures with plant-based meat products startups is expected to provide growth opportunities for the market players prevailing in the Japan meat products market.

Japan Meat Products Overview

Meat products in Japan is gaining huge popularity owing to increase in consumption of beef, pork, and other meat products among people. This is majorly owing to the availability of flavored and nutritious meat products such as burgers, sausages, hot dogs, nuggets, and others. A rapid drift from seafood to meat consumption is another factor influencing the meat products popularity in Japan.

COVID-19 Impact on Japan Meat Products Market

The COVID-19 pandemic has brought several uncertainties leading to severe economic losses as various businesses across the world came to a standstill. This has ultimately lowered the demand for meat products due to lack of investment from major market players in exploring new meat and meat products’ business segments. Furthermore, nationwide lockdowns and strict intercity travel restrictions significantly slowed the market. Moreover, manufacturing and supply of meat products were hampered due to complexities in supply chain, unavailability of packaging materials, volatility in currency rates, and other factors. Moreover, changes in trade policies, disruption in import-export activities, unavailability of skilled professionals are other factors hampering the Japan Meat Products market size growth.

Increase in Livestock Production to Fuel Market Growth

Increase in livestock production in Japan is responsible for boosting the Japan meat products market. The livestock production in Japan is increasing rapidly owing to expansion and intensification of livestock species. According to the statistical data by Japan's Ministry of Agriculture, Forestry, and Fisheries, the consumption of chicken has increased rapidly in Japan, and it is estimated to overcome that of pork in the coming years. Additionally, there has been significant increase in the percentage of household consumption of meat products including chicken, pork, beef during the COVID-19 pandemic due to strong preference for home meals and increased retail purchases of meat products. These factors are anticipated to fuel the Japan meat products market share growth.

To know more about Japan meat products market drivers, get in touch with our analysts here.

Availability of Meat Substitutes to Restrain the Market Growth

The demand for plant-based meat products is rising in Japan due to the increasing popularity of vegan food. Japanese population is now incorporating plant-based meat products in their diet as a substitute for animal-based meat products. High influence of plant-based meat products on health of people is significantly impacting the growth of animal-based meat products market in the country. People are now preferring to consume greener and environment friendly meals for their daily diet. In 2019, the Japan Meat Information Service Center (JMISC) conducted a survey according to which at least 50% of the Japanese population was aware of availability of alternative products to animal meat in the market. Nearly 60% of the survey participants were ready to consume plant-based meat products, for their health and the welfare of the planet. Thus, the Japan's meat products market is likely to be hampered by rapidly growing demand for plant-based meat products.

New Product Launches by Major Companies to Drive Excellent Opportunities

Business growth strategies such as business expansion and product launch have become a prominent step for the companies to cater the rising demand for meat and meat products in the nation. For instance, according to an article published in The Spoon Tech, in 2022, Beyond Meat company has partnered with United Super Market Holdings (USMH), Japan’s one of the biggest grocery store chains. As per the agreement, USMH will have the sole right to distribute Beyond Meat-branded meat product in Japan and the option to use Beyond's meat in new products created for the Japanese market. Another article published in Food Matters live, in 2021, mentions that Japanese foodtech start-up Next Meats has recently launched three new meat products in 2021 namely, NEXT Pork, NEXT Tuna and NEXT Milk. With such initiatives, the meat products market is likely to be driven further in Japan.

To know more about Japan meat products market opportunities, get in touch with our analysts here.

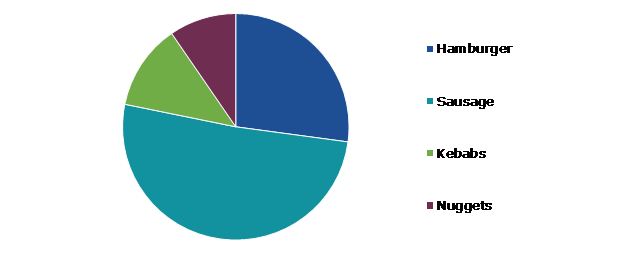

Japan Meat Products Market, by Processed Meat Type

Based on processed meat type, the market has been divided into hamburger, sausage, kebabs and nuggets. Among these, the sausage sub-segment accounted for the highest market share in 2021 and is estimated to show the fastest growth during the forecast period.

Japan Meat Products Market Share, by Processed Meat Type, 2021

Source: Research Dive Analysis

The sausage sub-type had a dominant market share in 2021 and it is expected to showcase significant growth in the coming years. A sausage is a sort of meat product that is often manufactured with ground meat, mainly pork, beef, or chicken, along with salt, spices, and additional seasonings. As extenders or fillers, additional components like grains or breadcrumbs may be used. Uncooked meat sausages are widely used in the preparation of patties. The most distinctive characteristics of Japanese sausages, which are a little different from those we may be accustomed to in the west, are their crispy skins and Arabiki sausages.

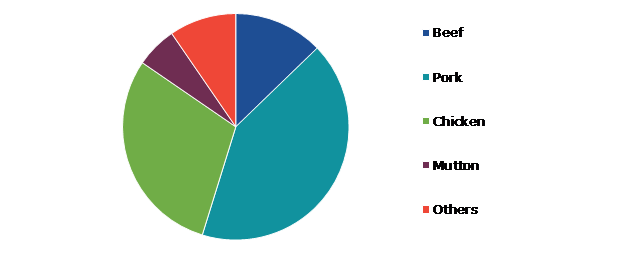

Japan Meat Products Market, by Meat Type

Based on meat type, the market has been divided into beef, pork, chicken, mutton, and others. Among these, the pork sub-segment accounted for highest revenue share in 2021 and is likely to showcase robust growth in the coming years.

Global Camping and Caravanning Market Size, by Meat Type, 2021

Source: Research Dive Analysis

The pork sub-segment had a dominant market share in 2021. Japanese pork producers place a strong emphasis on the meat's texture, which is primarily influenced by taste, succulence, and tenderness. Enhancing the flavor and melting sensation of fat, which are essential components in creating a tasty dish, has been a major focus in Japan. Pork is unparalleled in its ability to be both flavorful and springy, tender, and succulent in texture owing to a moderate quantity of fatty meat. Pork fat contains oleic acid, a monounsaturated fatty acid that does not elevate cholesterol levels. Also, Japanese pork is rich in protein and vitamin B1. Hence, it has gained huge popularity in Japanese cuisine being both nutritious and delicious.

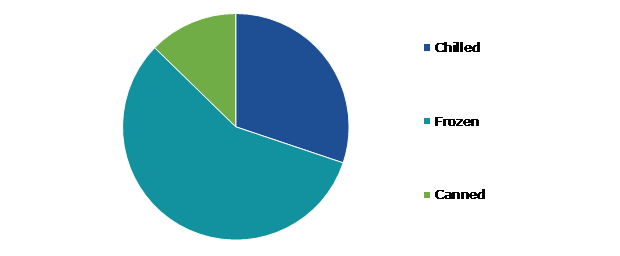

Japan Meat Products Market, by Packaging

Based on packaging, the market has been divided into chilled, frozen, and canned. Among these, the frozen segment accounted for highest market share and is also expected to have the fastest growth in the forecast time period.

Japan Meat Products Market Analysis, by Packaging, 2021

Source: Research Dive Analysis

The frozen sub-segment had a dominant market share in 2021 and it is expected to flourish at a high rate in the forecast period. The demand for organic frozen foods among consumers is predicted to boost the market for meat products. This is linked to rising health concerns and better knowledge regarding the advantages of organic meat products.

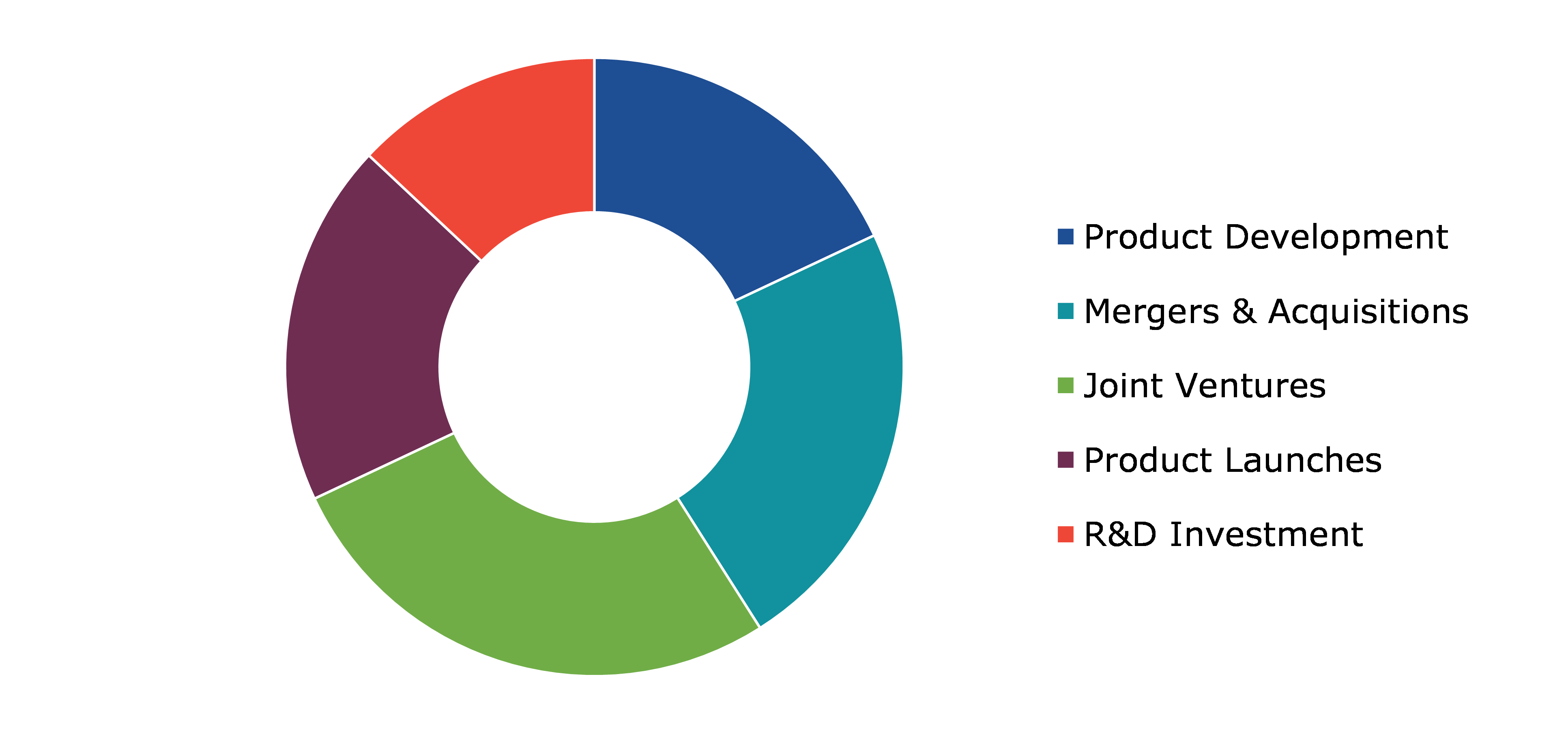

Competitive Scenario in the Japan Meat Products Market

Investment, agreement, and product launch are common strategies followed by major market players. For instance, in September 2021, Tyson Foods and Dickey's Barbecue Pit partnered to develop a cook-in-bag rib product by 2022 to address the ever-increasing consumer demand for functionality and convenience. The new product line comprises Dickey's three most popular flavor profiles and are now available at different stores in Japan.

Source: Research Dive Analysis

Some of the leading meat products market players are NH FOODS LTD, ITOHAM FOODS INC., NICHIREI CORPORATION, JOHNSONVILLE JAPAN LLC, STARZEN CO., LTD., MARUBENI CORPORATION, SOJITZ CORPORATION, SANKYOMEAT INC., LACTO JAPAN CO., LTD., TYSON FOODS, INC.

| Aspect | Particulars |

| Historical Market Estimations | 2021 |

| Base Year for Market Estimation | 2021 |

| Forecast Timeline for Market Projection | 2022-2031 |

| Segmentation by Processed Meat Type |

|

| Segmentation by Meat Type |

|

| Segmentation by Packaging |

|

| Key Companies Profiled |

|

Q1. What is the size of the Japan meat products market?

A. The size of the Japan meat products market was over $18.9 billion in 2021 and is projected to reach $25.3 billion by 2031.

Q2. Which are the major companies in the Japan meat products market?

A. NH FOODS LTD, ITOHAM FOODS INC., NICHIREI CORPORATION, JOHNSONVILLE JAPAN LLC are some of the key players in the Japan meat products market.

Q3. Which sub-segment held the maximum share in processed meat type segment in 2021?

A. The sausage sub-segment held major share in the processed meat type segment in 2021.

Q4. What are the strategies opted by the leading players in this market?

A. Agreement and investment are the two key strategies opted by the operating companies in this market.

Q5. Which companies are investing more on R&D practices?

A. STARZEN CO., LTD., MARUBENI CORPORATION, SOJITZ CORPORATION are the companies investing more on R&D activities for developing new products and technologies.

1.Research Methodology

1.1.Desk Research

1.2.Real time insights and validation

1.3.Forecast model

1.4.Assumptions and forecast parameters

1.5.Market size estimation

1.5.1.Top-down approach

1.5.2.Bottom-up approach

2.Report Scope

2.1.Market definition

2.2.Key objectives of the study

2.3.Report overview

2.4.Market segmentation

2.5.Overview of the impact of COVID-19 on Japan meat products market

3.Executive Summary

4.Market Overview

4.1.Introduction

4.2.Growth impact forces

4.2.1.Drivers

4.2.2.Restraints

4.2.3.Opportunities

4.3.Market value chain analysis

4.3.1.List of raw material suppliers

4.3.2.List of manufacturers

4.3.3.List of distributors

4.4.Innovation & sustainability matrices

4.4.1.Technology matrix

4.4.2.Regulatory matrix

4.5.Porter’s five forces analysis

4.5.1.Bargaining power of suppliers

4.5.2.Bargaining power of consumers

4.5.3.Threat of substitutes

4.5.4.Threat of new entrants

4.5.5.Competitive rivalry intensity

4.6.PESTLE analysis

4.6.1.Political

4.6.2.Economical

4.6.3.Social

4.6.4.LEGAL

4.6.5.Technological

4.6.6.Environmental

4.7.Impact of COVID-19 on Japan meat products market

4.7.1.Pre-covid market scenario

4.7.2.Post-covid market scenario

5.Japan Meat Products Market Analysis, by Processed Meat Type

5.1.Overview

5.2.Hamburger

5.2.1.Definition, key trends, growth factors, and opportunities

5.2.2.Market size analysis, by region, 2021- 2031me

5.2.3.Market share analysis, by country, 2021- 2031

5.3.Sausage

5.3.1.Definition, key trends, growth factors, and opportunities

5.3.2.Market size analysis, by region, 2021- 2031

5.3.3.Market share analysis, by country, 2021- 2031

5.4.Kebabs

5.4.1.Definition, key trends, growth factors, and opportunities

5.4.2.Market size analysis, by region, 2021- 2031

5.4.3.Market share analysis, by country, 2021- 2031

5.5.Nuggets

5.5.1.Definition, key trends, growth factors, and opportunities

5.5.2.Market size analysis, by region, 2021- 2031

5.5.3.Market share analysis, by country, 2021- 2031

5.6.Research Dive Exclusive Insights

5.6.1.Market attractiveness

5.6.2.Competition heatmap

6.Japan Meat Products Market Analysis, by Meat Type

6.1.Overview

6.2.Beef

6.2.1.Definition, key trends, growth factors, and opportunities

6.2.2.Market size analysis, by region, 2021- 2031

6.2.3.Market share analysis, by country, 2021- 2031

6.3.Pork

6.3.1.Definition, key trends, growth factors, and opportunities

6.3.2.Market size analysis, by region, 2021- 2031

6.3.3.Market share analysis, by country, 2021- 2031

6.4.Chicken

6.4.1.Definition, key trends, growth factors, and opportunities

6.4.2.Market size analysis, by region, 2021- 2031

6.4.3.Market share analysis, by country, 2021- 2031

6.5.Mutton

6.5.1.Definition, key trends, growth factors, and opportunities

6.5.2.Market size analysis, by region, 2021- 2031

6.5.3.Market share analysis, by country, 2021- 2031

6.6.Others

6.6.1.Definition, key trends, growth factors, and opportunities

6.6.2.Market size analysis, by region, 2021- 2031

6.6.3.Market share analysis, by country, 2021- 2031

6.7.Research Dive Exclusive Insights

6.7.1.Market attractiveness

6.7.2.Competition heatmap

7.Japan Meat Products Market Analysis, by Packaging

7.1.Chilled

7.1.1.Definition, key trends, growth factors, and opportunities

7.1.2.Market size analysis, by region, 2021- 2031

7.1.3.Market share analysis, by country, 2021- 2031

7.2.Frozen

7.2.1.Definition, key trends, growth factors, and opportunities

7.2.2.Market size analysis, by region, 2021- 2031

7.2.3.Market share analysis, by country, 2021- 2031

7.3.Canned

7.3.1.Definition, key trends, growth factors, and opportunities

7.3.2.Market size analysis, by region, 2021- 2031

7.3.3.Market share analysis, by country, 2021- 2031

7.4.Research Dive Exclusive Insights

7.4.1.Market attractiveness

7.4.2.Competition heatmap

8.Competitive Landscape

8.1.Top winning strategies, 2021

8.1.1.By strategy

8.1.2.By year

8.2.Strategic overview

8.3.Market share analysis, 2021

9.Company Profiles

9.1.NH FOODS LTD

9.1.1.Overview

9.1.2.Business segments

9.1.3.Product portfolio

9.1.4.Financial performance

9.1.5.Recent developments

9.1.6.SWOT analysis

9.2.ITOHAM FOODS INC.

9.2.1.Overview

9.2.2.Business segments

9.2.3.Product portfolio

9.2.4.Financial performance

9.2.5.Recent developments

9.2.6.SWOT analysis

9.3.NICHIREI CORPORATION

9.3.1.Overview

9.3.2.Business segments

9.3.3.Product portfolio

9.3.4.Financial performance

9.3.5.Recent developments

9.3.6.SWOT analysis

9.4.JOHNSONVILLE JAPAN LLC

9.4.1.Overview

9.4.2.Business segments

9.4.3.Product portfolio

9.4.4.Financial performance

9.4.5.Recent developments

9.4.6.SWOT analysis

9.5.STARZEN CO., LTD.

9.5.1.Overview

9.5.2.Business segments

9.5.3.Product portfolio

9.5.4.Financial performance

9.5.5.Recent developments

9.5.6.SWOT analysis

9.6.MARUBENI CORPORATION

9.6.1.Overview

9.6.2.Business segments

9.6.3.Product portfolio

9.6.4.Financial performance

9.6.5.Recent developments

9.6.6.SWOT analysis

9.7.SOJITZ CORPORATION

9.7.1.Overview

9.7.2.Business segments

9.7.3.Product portfolio

9.7.4.Financial performance

9.7.5.Recent developments

9.7.6.SWOT analysis

9.8.SANKYOMEAT INC.

9.8.1.Overview

9.8.2.Business segments

9.8.3.Product portfolio

9.8.4.Financial performance

9.8.5.Recent developments

9.8.6.SWOT analysis

9.9.LACTO JAPAN CO., LTD.

9.9.1.Overview

9.9.2.Business segments

9.9.3.Product portfolio

9.9.4.Financial performance

9.9.5.Recent developments

9.9.6.SWOT analysis

9.10.TYSON FOODS, INC.

9.10.1.Overview

9.10.2.Business segments

9.10.3.Product portfolio

9.10.4.Financial performance

9.10.5.Recent developments

9.10.6.SWOT analysis

10.Appendix

10.1.Parent & peer market analysis

10.2.Premium insights from industry experts

10.3.Related reports

The consumption of meat has expanded significantly since it is an essential component of the human diet. It is one of the most important sources of fat, dietary protein, vitamins, and minerals for humans. Meat is considered to be the highest quality source of protein, not only for its nutritional advantages but also for its highly desired flavor. In Japan, meat consumption in all forms is increasing as a result of changing lifestyles. In comparison to 20 years ago, Japanese consumers now consume approximately 18% more meat per person. The demand for meat is higher than what the domestic sector can provide, and the shortfall is filled by imports.

Generally, the term “meat” refers to animal flesh that is intended for human consumption as food. Meat contains different nutrients including proteins, iron, zinc, phosphorus, selenium, vitamin A, and B-complex vitamins. In Japan, there are numerous types of meat, such as goat, beef, chicken and turkey, lamb, bear, snake, Java mouse, monkey, braised goat testicles, fried fox meat, grilled wild boar, grilled porcupine, and bat. Among these varieties, pork is the most widely consumed meat in the country. Japan meat products market is rapidly expanding as a result of increased meat import and export activities to meet rising demand and high health consciousness among Japanese consumers.

Newest Insights in the Japan Meat Products Market

The busy lifestyle of Japanese customers, especially in urban regions like Tokyo and Osaka, has increased the demand for easy-to-cook meat products in Japan. As per a report by Research Dive, the Japan meat products market is expected to surpass a revenue of $25.3 billion in the 2022–2031 timeframe. The Japanese meat products market is expected to grow at a rapid and dominant rate in the coming years. This is because the region has a gigantic demand for meat products owing to the growth in livestock production.

How are Market Players Responding to the Rising Demand for Japan Meat Products?

Market players are significantly investing in innovative research and inventions to cater for the rising demand for meat and meat products. Some of the foremost players in the Japan meat products market are Itoham Foods Inc., NH Foods Ltd., Johnsonville Japan LLC, Nichirei Corporation, Marubeni Corporation, Starzen Co., Ltd., Sankyomeat Inc., Sojitz Corporation, Tyson Foods, Inc., Lacto Japan Co., Ltd., and others. These players are focused on planning and devising tactics such as mergers and acquisitions, collaborations, novel advances, and partnerships to reach a notable position in the market. For instance:

- In June 2020, Meadow Vale Foods, a foremost supplier of poultry products to the foodservice and retail market, launched two novel Japanese style Chicken products: Karaage Chicken Bites and Katsu Chicken Fillet to meet increased demand.

- In February 2021, Mitake Food Manufacturing Co., Ltd., an expert in milling technology and distributor of rice flour in Japan, launched a new product Karaage Fried Chicken Flour, made from Rice to the U.S. With this launch, the company is likely to grab a prominent place in the Japan meat products market.

- In January 2023, the Kujira (Whale) Store, an store in the port town of Yokohama with no human workers, implemented 3 Whale Meat Vending Machines for whale bacon, whale sashimi, whale skin, whale steak, and canned whale meat.

COVID-19 Impact on the Japan Meat Products Market

The unpredicted rise of the coronavirus pandemic in 2020 has adversely impacted the Japan meat products market. During the pandemic period, several uncertainties resulted in significant economic losses as different firms all around the world came to a halt. This has ultimately reduced the need for meat products owing to a lack of investment by major industry players in exploring new meat and meat product business categories. Furthermore, difficulties in the supply chain, a lack of packaging supplies, fluctuations in currency rates, and other problems made it difficult to manufacture and supply meat products. In addition, the development of the Japan meat products market got hampered by changes in trade rules, disruptions in import-export operations, and a lack of experienced specialists during the pandemic. However, the market is expected to recuperate from the incurred losses and rise significantly in the post-pandemic period.

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com