Global AAC Blocks And Panels Market Report

RA08588

Global AAC Blocks and Panels Market by Product Type (Blocks, Panels, Lintels, and Others), End User (Residential Construction, Commercial Construction, Industrial Construction, and Infrastructural Construction), and Regional Analysis (North America, Europe, Asia-Pacific, and LAMEA): Industry Forecast, 2022–2031

Global AAC Blocks and Panels Market Analysis

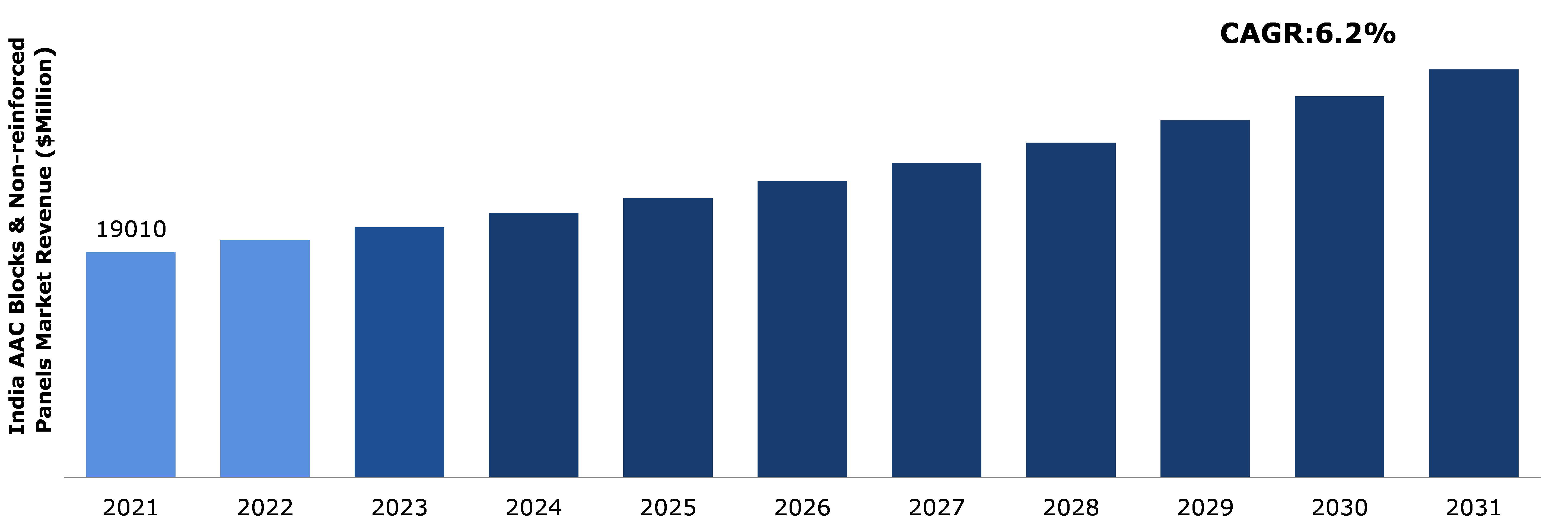

The AAC blocks and panels market size was $19,010 million in 2021 and is predicted to grow with a CAGR of 6.2% by generating a revenue of $34,361.6 million by 2031.

Global AAC Blocks and Panels Market Synopsis

Autoclaved Aerated Concrete (ACC) block is made up of a special mixture and has exceptional build qualities such as rigidity, low weight, thermal insulation, sound absorption, unmatched fire resistance, and affordability. This ecological and non-toxic building construction material has replaced red bricks as a popular option for construction material during the past ten years. It is expected to become the standard for building construction in the future due to its incomparable building ability. AAC is an organic, non-toxic building material that is both eco-friendly and energy-efficient. Additionally, the AAC blocks' thermal insulation qualities lower energy use and aid in the fight against global warming, saving money over the course of the building's life. They have been a popular choice in building materials as they assist in making homes more efficient, quick, and affordable. They are dimensionally stable and shows durability. AAC, which is made of cement, is resistant to water, rot, mold, mildew, and insects. All these features of the AAC blocks are likely to drive AAC blocks and Panels market growth in the forecast time period.

However, despite AAC block's rapid expansion in construction applications over the past 10 years, it still only accounts for 7-8% of the industry. Red bricks still account for 85-90% of the market, which indicates tremendous future potential. In addition, they are brittle in nature and break easily. So, these factors are expected to hamper the growth of the AAC blocks and panels market demand in the forecast period.

Manufacturing of AAC blocks is becoming more popular in India, and numerous plants are springing up all throughout the nation, particularly in Western India. The use of AAC blocks is expected to surge in the forecast year as builders and architects become more aware of the many benefits, they offer over red clay and fly ash bricks. Urban labor shortages and high interest rates have compelled builders and developers to search for quicker and more effective building materials. This factor boosts the AAC blocks and panels market demand during the forecast year.

According to regional analysis, the Asia-Pacific AAC blocks and panels market growth accounted for $19,849.8 million in 2021 and is predicted to grow with a CAGR of 4.9% in the projected timeframe. This is because in China, the demand for high-quality building materials is constantly increasing and to it is necessary produce high-quality reinforced parts in addition to the normal blocks.

Global AAC Blocks and Panels Overview

AAC is a precast, lightweight foam concrete building material that can be used to create blocks-like concrete masonry units. AAC products, which are made of quartz sand, sintered gypsum, lime, cement, water, and aluminum powder, are cured in an autoclave under high heat and pressure. The thin-set mortar, as opposed to the conventional concrete mortar used in CMU construction, is used to stack AAC panels, commonly known as "units." A full structure may be constructed out of only one material owing to the design flexibility of AAC and its combined structural and insulating components.

COVID-19 Impact on Global AAC Blocks and Panels Market

The COVID-19 impact on AAC blocks and panel market has brought several uncertainties leading to severe economic losses as various businesses, industries and construction across the world were standstill. This has ultimately lowered the demand and supply of construction raw material due to disruptions in supply chain, closure of manufacturing plants, halt in transportation services, as well as economic slowdown across several countries. For instance, the construction sector faced the highest impact in terms of sales and acquisition of new projects. Also, several construction projects were postponed or cancelled due to shortage of raw materials, labors, fear of contracting the COVID-19 virus among workers, as well as travel restrictions. However, due to decreasing raw material production, increasing financial burden on builders, and disruption in supply chains for material and production equipment have adversely influenced the market developments, during the pandemic and manufacturing units have hampered the market share during the pandemic. However, in April 2020, the government's decision to resume construction in non-coronavirus hotspots is anticipated to benefit the real estate industry and keep migrant workers on the job sites.

Increase in Applications of AAC Blocks and Panels Trend in Constructional Area to Drive the Market Growth

AAC blocks are 8 to 9 times larger than traditional red bricks and offer better compressive strength than traditional red clay brick, also they are also 3 times lighter. In addition, the blocks are lightweight, more durable, and uniform in size and shape, as well as eco-friendly and certified green building material, which reduces construction costs. Furthermore, AAC blocks are having planar surface as well as the internal walls do not require require plastering, which helps to save the cost of plastering. They provide a big hand for the construction industry. Their market is increasing due to urbanization. So, it is anticipated that it will drive the growth of AAC blocks and panels market share growth in the future.

To know more about AAC Blocks and Panels market drivers, get in touch with our analysts here.

Growing Popularity of Red Bricks Over AAC Block to Restrain the Market Growth

Red bricks are the most common type and the oldest type of brick used. The red bricks can be attributed to their convenience, durability, low cost, easy availability, and feasibility, so they are preferred by most people for building construction. So, it shows adverse impact on the AAC block and panel market growth and its popularity. Sometimes plaster is not able to attach the AAC blocks correctly because the surface of these blocks is smooth in nature. AAC block effort necessitates caution during manufacturing to avoid the surface becoming too rough. All such factors are likely to impede market growth in the next few years.

Use of AAC Block Makes It Ideal for Construction of Internal and External Wall in The House

Rapidly growing industrialization in developing countries like India has increased the need for AAC blocks and panels. Autoclaved aerated concrete's superior features, such as low cost, capacity to withstand earthquake and fire, and variety in block sizes, are making it popular in the building sector. Furthermore, government in India has focused more on road connections, motorways, and residential buildings, which is fueling demand for autoclaved aerated concrete.

AAC blocks have been embraced by the construction industry, and their use is likely to increase in the future years as developers & designers have become more aware of the many advantages of using AAC blocks over clay and fly ash bricks. In a nation like India, when thermal power stations produce a lot of industrial wastes (fly ash), bricks are a gift since they employ coal ash like a raw material. This factor boosts the AAC blocks and panels market opportunity during the forecast period.

To know more about AAC Blocks and Panels market opportunities, get in touch with our analysts here.

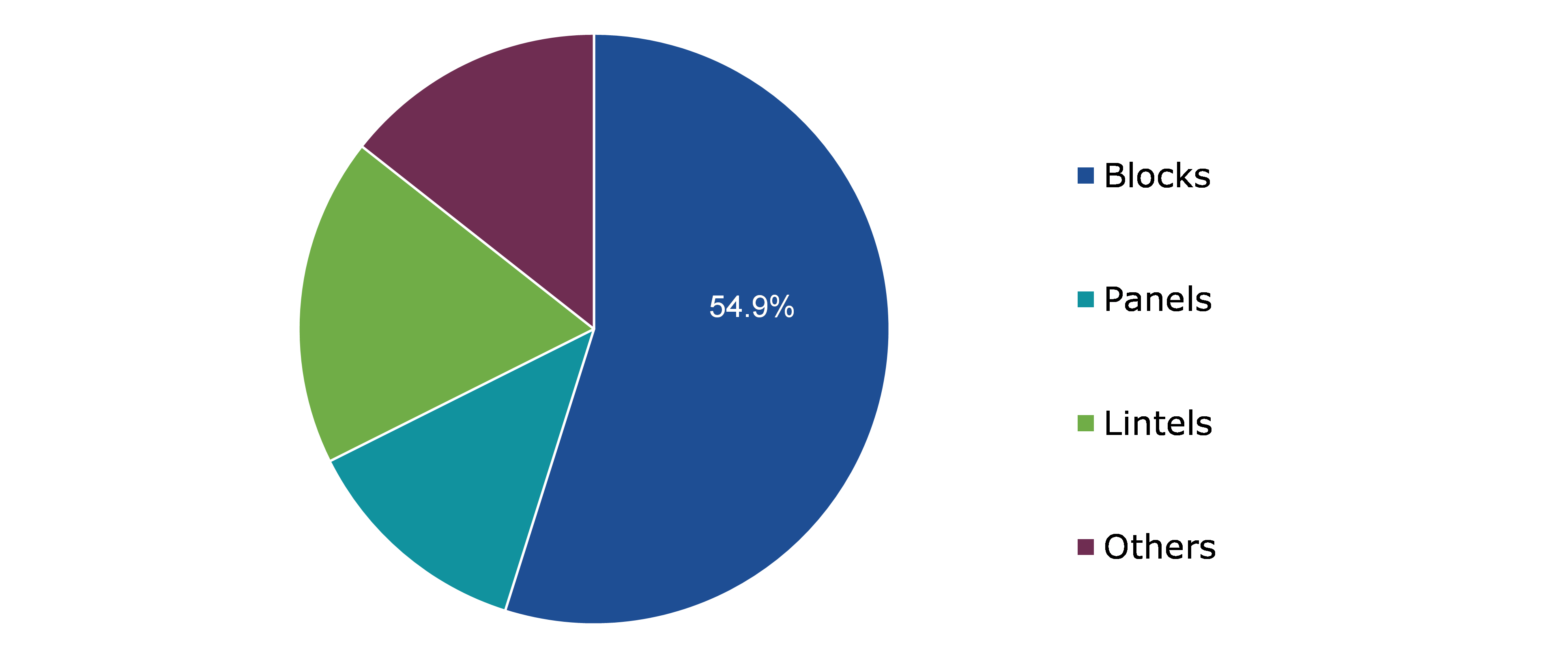

Global AAC Blocks and Panels Market, by Product Type

On the basis of product type, the market is divided into blocks, panels, lintels, and others. Among these, blocks sub-segment is predicted to account for the highest market share in 2021, whereas panel sub-segment is estimated to show the fastest growth during the forecast period.

Global AAC Blocks and Panels Market Share, by Product Type, 2021

Source: Research Dive Analysis

Blocks sub-type is anticipated to have a dominant AAC blocks and panels market share in 2021 and also have fastest growth by 2031. It is created by reacting aluminum powder with an appropriate amount of lime, cement, fly ash, or sand. For more than 80 years, lightweight cellular concrete, known as autoclaved aerated concrete (AAC) has been utilized in construction. AAC bricks are quite popular due to their superior strength, load-bearing, and thermal insulating characteristics. These bricks are quite inexpensive, costing only around one-third of what conventional red bricks do. Unlike other building materials, AAC block material is non-combustible and provides up to six hours of fire resistance and up to 1,200 degrees Celsius, depending on the block thickness. As a result, it is important for fire safety as well.

Panels sub-segment, panels are polymer-based composite materials that have features such as chemical resistance, strength & lightness, and high temperature tolerance. They are used to increase the mechanical strength of the panel. Due to these advantages, panels are being used more frequently in building construction applications, which is expected to accelerate the sub-segment market growth over the course of the projected period.

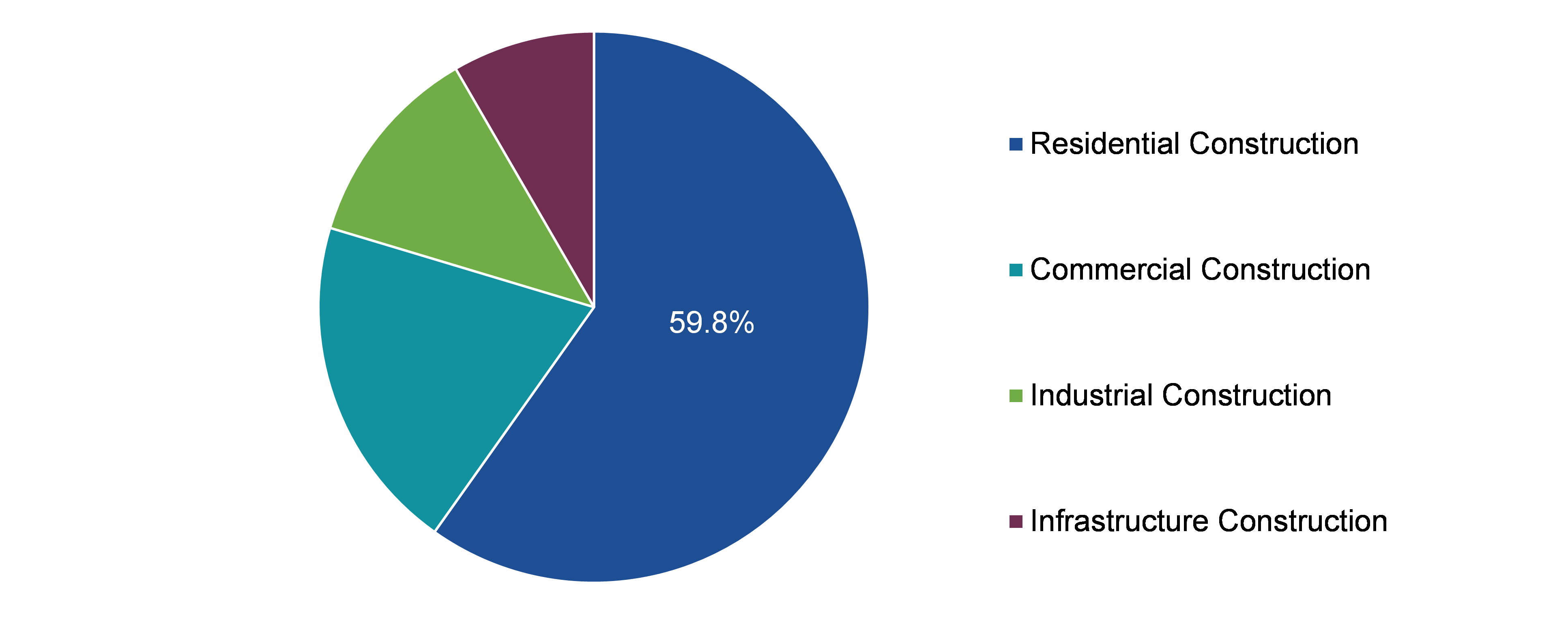

Global AAC Blocks and Panels Market, by End-use

Based on end-use industry, the market has been divided into residential construction, commercial construction, industrial construction, and infrastructural construction. Among these, the residential sub-segment accounted for the highest revenue share in 2021.

Global AAC Blocks and Panels Market Share, by End-use, 2021

Source: Research Dive Analysis

The Residential sub-segment is anticipated to have a dominant market share in 2021. In residential sector, AAC block is widely used for residential construction that boosts the protection. AAC provides protection in case of fire, and is ecologically better than the more customary basic building materials. The demand for AAC blocks has increased due to the increasing adoption of sustainability in India's real estate sector and the achievement of green building certification by over 23% of office buildings in six major cities, including Mumbai, Bangalore, Hyderabad, New Delhi, Chennai, and Kolkata.

Global AAC Blocks and Panels Market, Regional Insights

The AAC blocks and panels market analysis was investigated across North America, Europe, Asia-Pacific, and LAMEA.

Global AAC Blocks and Panels Market Size & Forecast, by Region, 2022-2031 (USD Million)

Source: Research Dive Analysis

The Market for India AAC Blocks and Panels in Asia-Pacific to be the Most Dominant

The Asia-Pacific AAC blocks and panels market size is projected to grow by 2031. The region's large market is a result of the expansion of the building and construction sector. The AAC block market is expanding rapidly in Asia-Pacific. This region will thus represent the largest market for AAC blocks. Additionally, increased market penetration will be brought on by rising awareness and the amazing qualities of the material. APAC countries are increasingly emphasizing on the construction of green structures to understand a sustainable future and are examining useful and efficient development methods. In fact, emerging nations use them and they are expected to grow and gain significant popularity.

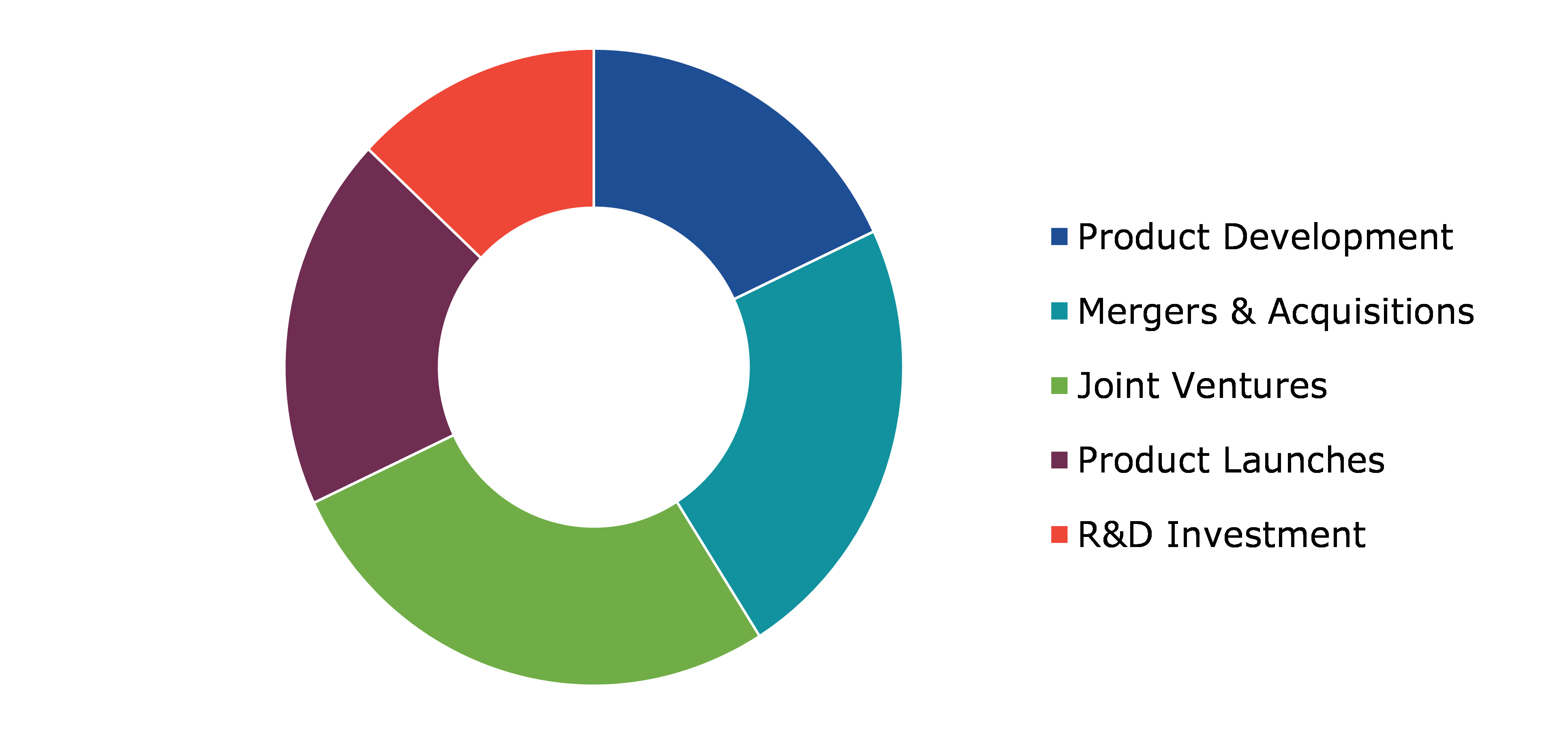

Competitive Scenario in the Global AAC Blocks and Panels Market

Product launches and mergers & acquisitions are common strategies followed by major market players.

For instance, the only publicly traded firm in India's AAC Block Space and the biggest in Western India is Big Bloc. According to recent report in July 2020, the company intends to introduce ACC panels, tile adhesives, and gypsum plaster in the near future. In the next two to three years, the company wants to overtake all other AAC block and panel producers in India.

Source: Research Dive Analysis

Some of the leading global AAC blocks and panels market players are MASA GmbH, Aercon AAC, AKG Gazbeton, JK Laxmi Cement, Biltech Building Elements, CSR Ltd., Forterra plc, H+H International A/S, CK Birla Group, and Xella.

| Aspect | Particulars |

| Historical Market Estimations | 2020-2021 |

| Base Year for Market Estimation | 2021 |

| Forecast Timeline for Market Projection | 2022-2031 |

| Geographical Scope | North America, Europe, Asia-Pacific, and LAMEA |

| Segmentation by Product Type |

|

| Segmentation by End-use |

|

| Key Companies Profiled |

|

Q1. What is the size of the AAC Blocks and Panels market?

A. The size of the AAC blocks and panels market was over $19,010 million in 2021 and is projected to reach $34,361.6 million by 2031.

Q2. Which are the major companies in the AAC Blocks and Panels market?

A. Maxlite AAC Blocks (India) Private Limited, GR Enterprises, and Fusion Block are some of the key players in the AAC Blocks and Panels market.

Q3. Which region, among others, possesses greater investment opportunities in the near future for AAC blocks and panels market?

A. Asia-Pacific possesses great investment opportunities for investors to witness the most promising growth in the future.

Q4. What will be the growth rate of the Asia-Pacific AAC Blocks and Panels market?

A. Asia-Pacific AAC Blocks and Panels market is anticipated to grow at 6.59% CAGR during the forecast period.

Q5. What are the strategies opted by the leading players in AAC blocks and panels market?

A. Agreement and investment are the two key strategies opted by the operating companies in this market.

Q6. Which companies are investing more on R&D practices for AAC blocks and panels market?

A. MASA GmbH, Aercon AAC, AKG Gazbeton, and JK Laxmi Cement are the companies investing more on R&D activities for developing new products and technologies.

1.Research Methodology

1.1.Desk research

1.2.Real time insights and validation

1.3.Forecast model

1.4.Assumptions and forecast parameters

1.5.Market size estimation

1.5.1.Top-down approach

1.5.2.Bottom-up approach

2.Report Scope

2.1.Market definition

2.2.Key objectives of the study

2.3.Report overview

2.4.Market segmentation

2.5.Overview of the impact of COVID-19 on Global AAC blocks and panels market

3.Executive Summary

4.Market Overview

4.1.Introduction

4.2.Growth impact forces

4.2.1.Drivers

4.2.2.Restraints

4.2.3.Opportunities

4.3.Market value chain analysis

4.3.1.List of raw material suppliers

4.3.2.List of manufacturers

4.3.3.List of distributors

4.4.Innovation & sustainability matrices

4.4.1.Technology matrix

4.4.2.Regulatory matrix

4.5.Porter’s five forces analysis

4.5.1.Bargaining power of suppliers

4.5.2.Bargaining power of consumers

4.5.3.Threat of substitutes

4.5.4.Threat of new entrants

4.5.5.Competitive rivalry intensity

4.6.PESTLE analysis

4.6.1.Political

4.6.2.Economical

4.6.3.Social

4.6.4.Technological

4.6.5.Environmental

4.7.Impact of COVID-19 on AAC blocks and panels market

4.7.1.Pre-covid market scenario

4.7.2.Post-covid market scenario

5.AAC Blocks and Panels Market Analysis, by Product Type

5.1.Overview

5.2.Blocks

5.2.1.Definition, key trends, growth factors, and opportunities

5.2.2.Market size analysis, by region, 2022-2031

5.2.3.Market share analysis, by country, 2022-2031

5.3.Panels

5.3.1.Definition, key trends, growth factors, and opportunities

5.3.2.Market size analysis, by region, 2022-2031

5.3.3.Market share analysis, by country, 2022-2031

5.4.Lintels

5.4.1.Definition, key trends, growth factors, and opportunities

5.4.2.Market size analysis, by region, 2022-2031

5.4.3.Market share analysis, by country, 2022-2031

5.5.Others

5.5.1.Definition, key trends, growth factors, and opportunities

5.5.2.Market size analysis, by region, 2022-2031

5.5.3.Market share analysis, by country, 2022-2031

5.6.Research Dive Exclusive Insights

5.6.1.Market attractiveness

5.6.2.Competition heatmap

6.AAC Blocks and Panels Market Analysis, by End-use

6.1.Residential Construction

6.1.1.Definition, key trends, growth factors, and opportunities

6.1.2.Market size analysis, by region, 2022-2031

6.1.3.Market share analysis, by country, 2022-2031

6.2.Commercial Construction

6.2.1.Definition, key trends, growth factors, and opportunities

6.2.2.Market size analysis, by region, 2022-2031

6.2.3.Market share analysis, by country, 2022-2031

6.3.Industrial Construction

6.3.1.Definition, key trends, growth factors, and opportunities

6.3.2.Market size analysis, by region, 2022-2031

6.3.3.Market share analysis, by country, 2022-2031

6.4.Infrastructure Construction

6.4.1.Definition, key trends, growth factors, and opportunities

6.4.2.Market size analysis, by region, 2022-2031

6.4.3.Market share analysis, by country, 2022-2031

6.5.Research Dive Exclusive Insights

6.5.1.Market attractiveness

6.5.2.Competition heatmap

7.AAC Blocks and Panels Market, by Region

7.1.North America

7.1.1.U.S.

7.1.1.1.Market size analysis, by Product Type, 2022-2031

7.1.1.2.Market size analysis, by End-use, 2022-2031

7.1.2.Canada

7.1.2.1.Market size analysis, by Product Type, 2022-2031

7.1.2.2.Market size analysis, by End-use, 2022-2031

7.1.3.Mexico

7.1.3.1.Market size analysis, by Product Type, 2022-2031

7.1.3.2.Market size analysis, by End-use, 2022-2031

7.1.4.Research Dive Exclusive Insights

7.1.4.1.Market attractiveness

7.1.4.2.Competition heatmap

7.2.Europe

7.2.1.Germany

7.2.1.1.Market size analysis, by Product Type, 2022-2031

7.2.1.2.Market size analysis, by End-use, 2022-2031

7.2.2.UK

7.2.2.1.Market size analysis, by Product Type, 2022-2031

7.2.2.2.Market size analysis, by End-use, 2022-2031

7.2.3.France

7.2.3.1.Market size analysis, by Product Type, 2022-2031

7.2.3.2.Market size analysis, by End-use, 2022-2031

7.2.4.Spain

7.2.4.1.Market size analysis, by Product Type, 2022-2031

7.2.4.2.Market size analysis, by End-use, 2022-2031

7.2.5.Italy

7.2.5.1.Market size analysis, by Product Type, 2022-2031

7.2.5.2.Market size analysis, by End-use, 2022-2031

7.2.6.Rest of Europe

7.2.6.1.Market size analysis, by Product Type, 2022-2031

7.2.6.2.Market size analysis, by End-use, 2022-2031

7.2.7.Research Dive Exclusive Insights

7.2.7.1.Market attractiveness

7.2.7.2.Competition heatmap

7.3.1.China

7.3.1.1.Market size analysis, by Product Type, 2022-2031

7.3.1.2.Market size analysis, by End-use, 2022-2031

7.3.2.Japan

7.3.2.1.Market size analysis, by Product Type, 2022-2031

7.3.2.2.Market size analysis, by End-use, 2022-2031

7.3.3.India

7.3.3.1.Market size analysis, by Product Type, 2022-2031

7.3.3.2.Market size analysis, by End-use, 2022-2031

7.3.4.Australia

7.3.4.1.Market size analysis, by Product Type, 2022-2031

7.3.4.2.Market size analysis, by End-use, 2022-2031

7.3.5.South Korea

7.3.5.1.Market size analysis, by Product Type, 2022-2031

7.3.5.2.Market size analysis, by End-use, 2022-2031

7.3.6.Rest of Asia Pacific

7.3.6.1.Market size analysis, by Product Type, 2022-2031

7.3.6.2.Market size analysis, by End-use, 2022-2031

7.3.7.Research Dive Exclusive Insights

7.3.7.1.Market attractiveness

7.3.7.2.Competition heatmap

7.4.LAMEA

7.4.1.Brazil

7.4.1.1.Market size analysis, by Product Type, 2022-2031

7.4.1.2.Market size analysis, by End-use, 2022-2031

7.4.2.Saudi Arabia

7.4.2.1.Market size analysis, by Product Type, 2022-2031

7.4.2.2.Market size analysis, by End-use, 2022-2031

7.4.3.UAE

7.4.3.1.Market size analysis, by Product Type, 2022-2031

7.4.3.2.Market size analysis, by End-use, 2022-2031

7.4.4.South Africa

7.4.4.1.Market size analysis, by Product Type, 2022-2031

7.4.4.2.Market size analysis, by End-use, 2022-2031

7.4.5.Rest of LAMEA

7.4.5.1.Market size analysis, by Product Type, 2022-2031

7.4.5.2.Market size analysis, by End-use, 2022-2031

7.4.6.Research Dive Exclusive Insights

7.4.6.1.Market attractiveness

7.4.6.2.Competition heatmap

8.Competitive Landscape

8.1.Top winning strategies, 2022

8.1.1.By strategy

8.1.2.By year

8.2.Strategic overview

8.3.Market share analysis, 2022

9.Company Profiles

9.1.MASA GmbH Aercon AAC

9.1.1.Overview

9.1.2.Business segments

9.1.3.Product portfolio

9.1.4.Financial performance

9.1.5.Recent developments

9.1.6.SWOT analysis

9.1.7.Research Dive Analyst View

9.2.AKG Gazbeton

9.2.1.Overview

9.2.2.Business segments

9.2.3.Product portfolio

9.2.4.Financial performance

9.2.5.Recent developments

9.2.6.SWOT analysis

9.2.7.Research Dive Analyst View

9.3.JK Laxmi Cement

9.3.1.Overview

9.3.2.Business segments

9.3.3.Product portfolio

9.3.4.Financial performance

9.3.5.Recent developments

9.3.6.SWOT analysis

9.3.7.Research Dive Analyst View

9.4. Biltech Building Elements

9.4.1.Overview

9.4.2.Business segments

9.4.3.Product portfolio

9.4.4.Financial performance

9.4.5.Recent developments

9.4.6.SWOT analysis

9.4.7.Research Dive Analyst View

9.5.CSR Ltd

9.5.1.Overview

9.5.2.Business segments

9.5.3.Product portfolio

9.5.4.Financial performance

9.5.5.Recent developments

9.5.6.SWOT analysis

9.5.7.Research Dive Analyst View

9.6.Forterra plc

9.6.1.Overview

9.6.2.Business segments

9.6.3.Product portfolio

9.6.4.Financial performance

9.6.5.Recent developments

9.6.6.SWOT analysis

9.6.7.Research Dive Analyst View

9.7.H+H International A/S

9.7.1.Overview

9.7.2.Business segments

9.7.3.Product portfolio

9.7.4.Financial performance

9.7.5.Recent developments

9.7.6.SWOT analysis

9.7.7.Research Dive Analyst View

9.8.CK Birla Group

9.8.1.Overview

9.8.2.Business segments

9.8.3.Product portfolio

9.8.4.Financial performance

9.8.5.Recent developments

9.8.6.SWOT analysis

9.8.7.Research Dive Analyst View

9.9.Xella

9.9.1.Overview

9.9.2.Business segments

9.9.3.Product portfolio

9.9.4.Financial performance

9.9.5.Recent developments

9.9.6.SWOT analysis

9.9.7.Research Dive Analyst View

10.Appendix

10.1.Parent & peer market analysis

10.2.Premium insights from industry experts

10.3.Related reports

The construction industry is coming up with innovative advances to create sturdy as well as visually appealing structures. Several traditional materials have been replaced with modern building materials and tools in recent years. Autoclaved aerated concrete (ACC) is an advanced building material with unique properties that makes it better than traditional bricks. ACC blocks and panels help in upholding the protection of a building infrastructure in numerous ways. Additionally, they are eco-friendly, lightweight, durable, uniform in size & shape, and save the overall cost of construction. Therefore, they are considered as the best substitute for regular building materials such as red bricks.

Why is the Demand for AAC Blocks and Panels Skyrocketing?

The demand for AAC blocks and panels is rising with the growing construction activities in urban areas. The huge global population holds an enormous demand for private and attractive homes. Besides, industries and manufacturing plants extensively use advanced building materials like AAC blocks and panels in their infrastructure. The application of AAC blocks and panels is expected to upsurge in the upcoming years as building developers & engineers have become more aware of the numerous benefits of using AAC blocks over clay and fly ash bricks.

Recent Trends in the AAC Blocks and Panels Market

As per a report by Research Dive, the global AAC blocks and panels market is expected to garner $34,361.6 million by 2031, with the Asia-Pacific region market experiencing rapid growth. This region is expected to be the largest market for AAC blocks and panels, mainly because of the evolving construction sector and rising focus on the construction of green structures in this region.

How are the Market Players Responding to the Rising Demand for AAC Blocks and Panels?

The rising awareness about the benefits of advanced building materials is driving the demand for AAC blocks and panels. Leading players in the AAC blocks and panels market are significantly investing in innovative product launches to fulfil the mounting demand for AAC blocks and panels. Some of the leading players in the AAC blocks and panels market are Biltech Building Elements, MASA GmbH, Aercon AAC, CK Birla Group, AKG Gazbeton, JK Laxmi Cement, CSR Ltd., Forterra plc, H+H International A/S, Xella., and others. These players are focused on developing strategies such as partnerships, mergers and acquisitions, novel developments, and collaborations to achieve a prominent position in the worldwide market. For instance,

- In January 2020, Topcem Cement, the producer of the AAC Blocks in North East India, under a joint venture introduced the Recognition of Prior Learning (RPL) programme in the construction industry under Pradhan Mantri Kausal Vikas Yojana (PMKVY) at Topcem India. PMKVY is the flagship scheme of the Ministry of Skill Development & Entrepreneurship (MSDE), Government of India.

- In June 2021, Magicrete, a leading producer of AAC products, dry mix mortars & precast construction solutions, introduced Autoclaved Lightweight Concrete (ALC Wall Panels), a substantial shift in wall building technology in India.

- In February 2022, BIGBLOC Construction Ltd, a company involved in the manufacture, sale, and marketing of AAC blocks, announced to expand its footprint in Maharashtra state by setting up a novel Greenfield Project of AAC Blocks with a capacity of nearly 5,00,000 cubic meters per year in the Palghar District.

COVID-19 Impact on the AAC Blocks and Panels Market

The abrupt rise of the coronavirus pandemic has negatively impacted the global AAC blocks and panels market. This is primarily owing to the implementation of strict lockdown and restrictions on the import or export of the raw materials required in the production of AAC blocks and panels. Also, the stoppage of construction projects has greatly declined the demand for AAC blocks and panels, thus reducing its sales. However, as the global construction sector is recovering with the relaxation of the pandemic situation, the AAC blocks and panels market is anticipated to flourish in the upcoming years.

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com