Financial Protection Market Report

RA08573

Financial Protection Market by Type (Short Term Financial Protection and Long Term Financial Protection), Policy Coverage (Payment Protection and Mortgage Payment Protection), End-user (Men and Women), and Regional Analysis (North America, Europe, Asia-Pacific, and LAMEA): Global Opportunity Analysis and Industry Forecast, 2021–2028

Financial Protection Market Analysis

The global financial protection market is anticipated to garner $29,381.6 million in the 2021–2028 timeframe, growing from $22,100.0 million in 2020, at a healthy CAGR of 3.8%.

Market Synopsis

The rapid growth in the number of diseases across the globe is anticipated to boost the global financial protection market. Additionally, acquisitions and business expansion by key market players are anticipated to boost the market growth.

However, the lack of knowledge among the people regarding the benefits of financial protections is anticipated to hamper the market growth in the near future.

According to the regional analysis of the market, the Asia-Pacific financial protection market is anticipated to grow at a CAGR of 6.4%, by generating a revenue of $9,801.7 million during the review period.

Financial Protection Overview

Financial security is an integral aspect of universal health coverage (UHC), and it is one of the health systems' aims, along with service coverage. When there are no financial barriers to access, and direct payments required to get health services (out-of-pocket health spending) are not a source of financial hardship, financial protection is established. Monitoring impoverishing health expenses, including any amount spent on health out-of-pocket by the poor, as well as high out-of-pocket health spending, is required to provide a complete picture of financial hardship.

Impact Analysis of COVID-19 on the Global Financial Protection Market

In the recent years the world has experienced an unprecedented situation of COVID-19 outbreak, due to which the world has been impacted very badly. However, the financial protection market has experienced a boost in the growth during the COVID-19 timeframe. Many people have lost their jobs and many people have experienced serious health conditions due to which the financial protection has grabbed the attention of many people and the number of financial protection policy numbers has increased rapidly in the recent months.

Customizable Financial Protection Plans are Projected to Drive the Market Growth

In recent months the world has experienced a dangerous pandemic which has affected the people widely while some of the people lost their jobs and few others experienced the deadly COVID-19, due to which the number of people opting for insurance policies have increased. Additionally, upsurge of various disease such as malaria, dengue, and cancer among various other diseases which lead to longer hospitalization tenure is considered as major factor enhancing the global financial protection market growth. Due to above mentioned factors people around the globe are opting for customized financial protections plans.

To know more about global financial protection market drivers, get in touch with our analysts here.

Lack of Knowledge about Financial Protection is Anticipated to Restrain the Market Growth

The lack of knowledge about various financial protections and policies is anticipated to hamper the market growth in the near future. Additionally, increase in the policy cots is another factor affecting the growth of the financial protection market.

Rise in Unemployment is Anticipated to Create Growth Opportunities

The rising number of unemployed people across the world and various factors are anticipated to create better growth opportunities for the financial protection market in the near future. If the person losses his job or the income source, he can be dependent upon the insurers to cover up his debt payments. Additionally, adoption of latest technologies by key players in order to provide income protection to the consumers is projected to boost the market growth in the upcoming years.

To know more about global financial protection market opportunities, get in touch with our analysts here.

Based on type, the market has been divided into short term financial protection and Long Term Financial Protection. Long term financial protection sub-segment is anticipated to be the fastest growing sub-segment in the projected time frame. Download PDF Sample ReportFinancial Protection Market

By Type

Source: Research Dive Analysis

The long term financial protection sub-segment is anticipated to have the fastest growth rate of 4.6% and generate a revenue of $16,109.0 million by 2028, growing from $11,417.5 million in 2020.

In comparison to a short-term plan, a long-term health insurance policy provides more coverage. A long-term policy is good for two to three years and comes with a number of renewal perks. A long-term policy can take several forms. Individual health insurance, family floater insurance, critical illness insurance, senior citizen insurance, and so forth. Moreover, the long term protection has less chances of the policy getting rejected and more, these factors are anticipated to boost the long term financial protection sub-segment.

Financial Protection Market

By Policy CoverageBased on policy coverage, the market has been divided into Payment Protection and mortgage Payment Protection. Payment Protection sub-segment held the largest market share in the year 2020.

Source: Research Dive Analysis

The payment protection sub-segment held the largest market value in 2020 accounting for $14,552.5 million and is anticipated to grow at CAGR of 3.4% during the forecast period.

In the recent years, the demand for the payment protection sub-segment has upsurged. This growth is majorly due to the number of unemployment increasing across the globe and various other factors. As the unemployment is growing, people are unable to repay the loans and others thus, the payment protection sub-segment is anticipated dominate the financial protection market growth.

Financial Protection Market

By End-userBased on end-user, the analysis has been divided into Men and woMen. Out of these, Men sub-segMent held the largest market share in 2020.

Source: Research Dive Analysis

The men sub-segment of the global financial protection market is anticipated to grow at a CAGR of 2.8% and reach $15,295.3 million by 2028, growing from $12,391.9 million in 2020.

The men sub-segment held the largest market share in the global financial protection market and the number of policy holders is very high as compared to women. This growth is owing to the cheaper price of the policies for men when compared to women. Accidents occurred by men are much higher than the number of accidents occurred by women. The above mentioned factors are anticipated to be the key factors for the men sub-segment dominance in the global financial protection market.

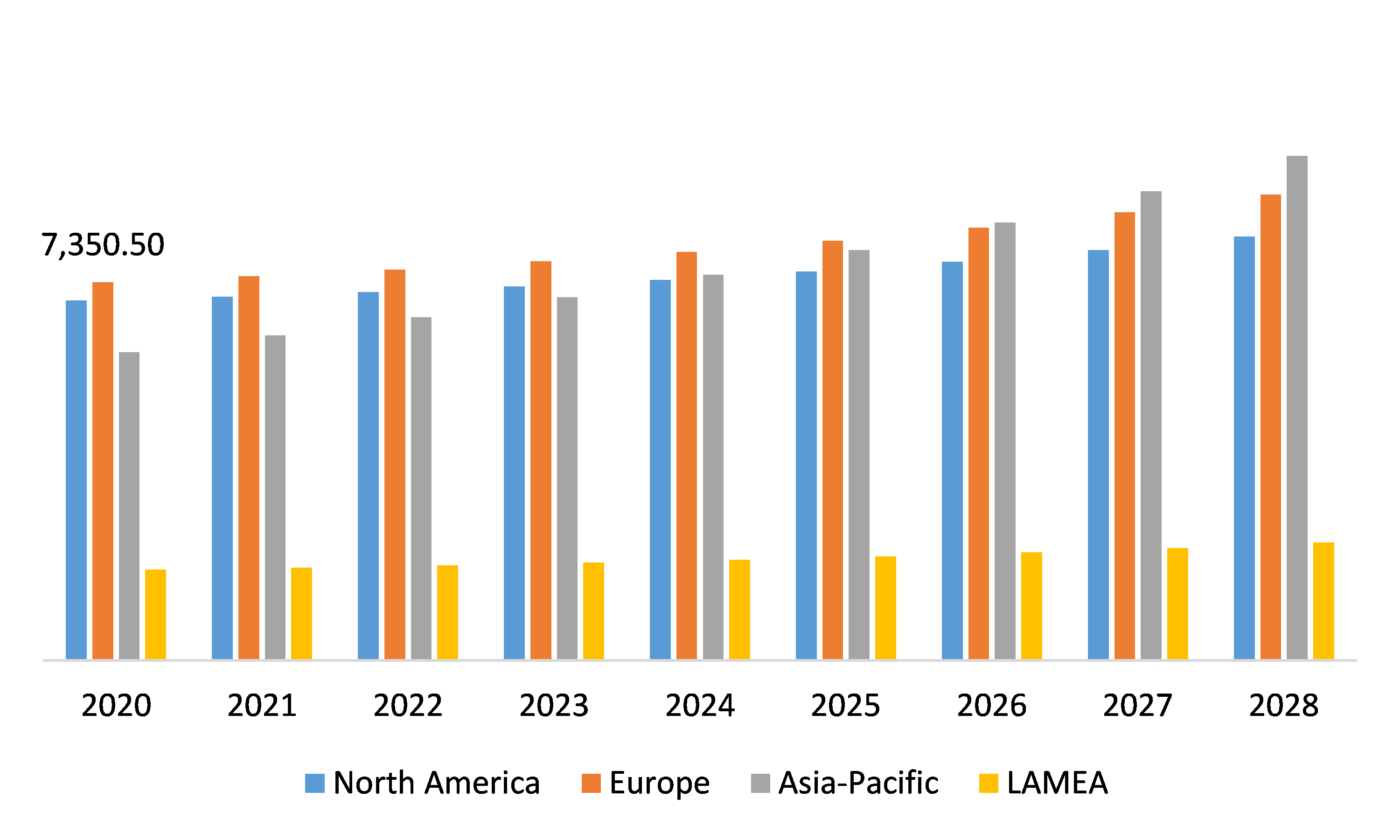

Global Financial Protection Market, Regional Insights:

The financial protection market was investigated across North America, Europe, Asia-Pacific, and LAMEA.

Source: Research Dive Analysis

The Asia-Pacific Financial Protection Market is Anticipated to Experience the Fastest Growth Rate

Financial protection market in the Asia-Pacific region is anticipated to grow at the highest CAGR of 6.5% and reach $9,801.7 million in 2028.

The Asia-Pacific financial protection market growth is majorly attributed to the growing number of policy holders as well as growing number of people opting for financial protections. Additionally, the increasing awareness among the people regarding the benefits of the financial protection is anticipated to boost the Asia-Pacific financial protection market growth.

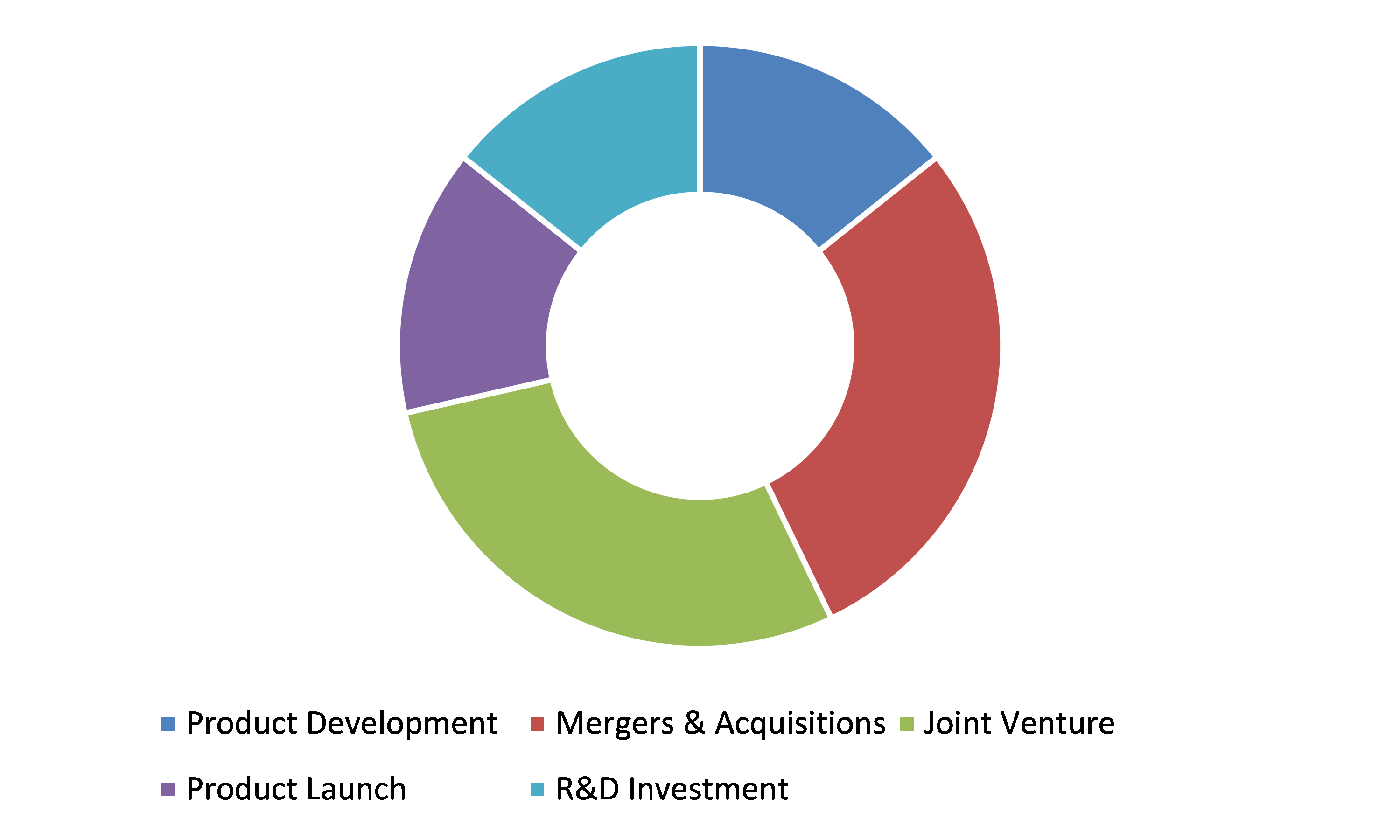

Competitive Scenario in the Global Financial Protection Market

Product advancements, innovations, and business expansion are common strategies followed by major market players.

Source: Research Dive Analysis

Some of the leading financial protection market players are AXA, American International Group, Inc., Aon, ABI, Aviva, Marsh Ltd., The Guardian Life Insurance Company of America, Citizens Advice, Zurich, and StanCorp Financial Group, Inc.

Porter’s Five Forces Analysis for the Global Financial Protection Market:

- Bargaining Power of Suppliers: The number of financial protection players is high.

Thus, the bargaining power suppliers is low. - Bargaining Power of Buyers: Buyers have little bargaining power because establishing financial protections requires a large capital investment.

Thus, the bargaining power of the buyers is low. - Threat of New Entrants: The companies entering financial protection market have to deal with high investment cost.

Thus, the threat of the new entrants is moderate. - Threat of Substitutes: The availability of the alternatives for the financial protection is very low.

Thus, the threat of substitutes is low. - Competitive Rivalry in the Market: The competitive rivalry among industry leaders is extensive mainly because the number of players operating in financial protection industry are concentrating on acquiring number of customer base.

Therefore, competitive rivalry in the market is high.

| Aspect | Particulars |

| Historical Market Estimations | 2019-2020 |

| Base Year for Market Estimation | 2020 |

| Forecast Timeline for Market Projection | 2021-2028 |

| Geographical Scope | North America, Europe, Asia-Pacific, LAMEA |

| Segmentation by Type |

|

| Segmentation by Policy Coverage |

|

| Segmentation by End-user |

|

| Key Companies Profiled |

|

Q1. What is the size of the global financial protection market?

A. The size of the global financial protection market was over $1,768.0 million in 2020 and is projected to reach $29,381.6 million by 2028.

Q2. Which are the major companies in the financial protection market?

A. AXA and American International Group, Inc. are some of the major companies operating in the global financial protection market.

Q3. Which region, among others, possesses greater investment opportunities in the near future?

A. The Asia-Pacific region possesses great investment opportunities for investors to witness the most promising growth in the future.

Q4. What will be the growth rate of the Asia-Pacific financial protection market?

A. The growth rate of the Asia-Pacific Financial protection market is 6.5%.

Q5. What are the strategies opted by the leading players in this market?

A. Product innovations, technological advancements, and business expansions are the key strategies opted by the operating companies in this market.

Q6. Which companies are investing more on R&D practices?

A. AXA are American International Group, Inc. companies are investing more on R&D practices.

1.Research Methodology

1.1.Desk Research

1.2.Real time insights and validation

1.3.Forecast model

1.4.Assumptions and forecast parameters

1.4.1.Assumptions

1.4.2.Forecast parameters

1.5.Data sources

1.5.1.Primary

1.5.2.Secondary

2.Executive Summary

2.1.360° summary

2.2.Type trends

2.3.Policy trends

2.4.End-user trends

3.Market overview

3.1.Market segmentation & definitions

3.2.Key takeaways

3.2.1.Top investment pockets

3.2.2.Top winning strategies

3.3.Porter’s five forces analysis

3.3.1.Bargaining power of consumers

3.3.2.Bargaining power of suppliers

3.3.3.Threat of new entrants

3.3.4.Threat of substitutes

3.3.5.Competitive rivalry in the market

3.4.Market dynamics

3.4.1.Drivers

3.4.2.Restraints

3.4.3.Opportunities

3.5.Source landscape

3.6.Regulatory landscape

3.7.Patent landscape

3.8.Market value chain analysis

3.9.Strategic overview

4.Financial Protection Market, by Type

4.1.Short Term Financial Protection

4.1.1.Market size and forecast, by region, 2021-2028

4.1.2.Comparative market share analysis, 2021 & 2028

4.2.Long Term Financial Protection

4.2.1.Market size and forecast, by region, 2021-2028

4.2.2.Comparative market share analysis, 2021 & 2028

5.Financial Protection Market, by Policy

5.1.Payment Protection

5.1.1.Market size and forecast, by region, 2021-2028

5.1.2.Comparative market share analysis, 2021 & 2028

5.2.Mortgage Payment Protection

5.2.1.Market size and forecast, by region, 2021-2028

5.2.2.Comparative market share analysis, 2021 & 2028

6.Financial Protection Market, by End-users

6.1.Men

6.1.1.Market size and forecast, by region, 2021-2028

6.1.2.Comparative market share analysis, 2021 & 2028

6.2.Women

6.2.1.Market size and forecast, by region, 2021-2028

6.2.2.Comparative market share analysis, 2021 & 2028

7.Financial Protection Market, by Region

7.1.North America

7.1.1.Market size and forecast, by Type, 2021-2028

7.1.2.Market size and forecast, by Policy, 2021-2028

7.1.3.Market size and forecast, by End-user, 2021-2028

7.1.4.Market size and forecast, by country, 2021-2028

7.1.5.Comparative market share analysis, 2021 & 2028

7.1.6.U.S.

7.1.6.1.Market size and forecast, by Type, 2021-2028

7.1.6.2.Market size and forecast, by Policy, 2021-2028

7.1.6.3.Market size and forecast, by End-user, 2021-2028

7.1.6.4.Comparative market share analysis, 2021 & 2028

7.1.7.Canada

7.1.7.1.Market size and forecast, by Type, 2021-2028

7.1.7.2.Market size and forecast, by Policy, 2021-2028

7.1.7.3.Market size and forecast, by End-user, 2021-2028

7.1.7.4.Comparative market share analysis, 2021 & 2028

7.1.8.Mexico

7.1.8.1.Market size and forecast, by Type, 2021-2028

7.1.8.2.Market size and forecast, by Policy, 2021-2028

7.1.8.3.Market size and forecast, by End-user, 2021-2028

7.1.8.4.Comparative market share analysis, 2021 & 2028

7.2.Europe

7.2.1.Market size and forecast, by Type, 2021-2028

7.2.2.Market size and forecast, by Policy, 2021-2028

7.2.3.Market size and forecast, by End-user, 2021-2028

7.2.4.Market size and forecast, by country, 2021-2028

7.2.5.Comparative market share analysis, 2021 & 2028

7.2.6.UK

7.2.6.1.Market size and forecast, by Type, 2021-2028

7.2.6.2.Market size and forecast, by Policy, 2021-2028

7.2.6.3.Market size and forecast, by End-user, 2021-2028

7.2.6.4.Comparative market share analysis, 2021 & 2028

7.2.7.Germany

7.2.7.1.Market size and forecast, by Type, 2021-2028

7.2.7.2.Market size and forecast, by Policy, 2021-2028

7.2.7.3.Market size and forecast, by End-user, 2021-2028

7.2.7.4.Comparative market share analysis, 2021 & 2028

7.2.8.France

7.2.8.1.Market size and forecast, by Type, 2021-2028

7.2.8.2.Market size and forecast, by Policy, 2021-2028

7.2.8.3.Market size and forecast, by End-user, 2021-2028

7.2.8.4.Comparative market share analysis, 2021 & 2028

7.2.9.Spain

7.2.9.1.Market size and forecast, by Type, 2021-2028

7.2.9.2.Market size and forecast, by Policy, 2021-2028

7.2.9.3.Market size and forecast, by End-user, 2021-2028

7.2.9.4.Comparative market share analysis, 2021 & 2028

7.2.10.Italy

7.2.10.1.Market size and forecast, by Type, 2021-2028

7.2.10.2.Market size and forecast, by Policy, 2021-2028

7.2.10.3.Market size and forecast, by End-user, 2021-2028

7.2.10.4.Comparative market share analysis, 2021 & 2028

7.2.11.Rest of Europe

7.2.11.1.Market size and forecast, by Type, 2021-2028

7.2.11.2.Market size and forecast, by Policy, 2021-2028

7.2.11.3.Market size and forecast, by End-user, 2021-2028

7.2.11.4.Comparative market share analysis, 2021 & 2028

7.3.Asia Pacific

7.3.1.Market size and forecast, by Type, 2021-2028

7.3.2.Market size and forecast, by Policy, 2021-2028

7.3.3.Market size and forecast, by End-user, 2021-2028

7.3.4.Market size and forecast, by country, 2021-2028

7.3.5.Comparative market share analysis, 2021 & 2028

7.3.6.India

7.3.6.1.Market size and forecast, by Type, 2021-2028

7.3.6.2.Market size and forecast, by Policy, 2021-2028

7.3.6.3.Market size and forecast, by End-user, 2021-2028

7.3.6.4.Comparative market share analysis, 2021 & 2028

7.3.7.China

7.3.7.1.Market size and forecast, by Type, 2021-2028

7.3.7.2.Market size and forecast, by Policy, 2021-2028

7.3.7.3.Market size and forecast, by End-user, 2021-2028

7.3.7.4.Comparative market share analysis, 2021 & 2028

7.3.8.Japan

7.3.8.1.Market size and forecast, by Type, 2021-2028

7.3.8.2.Market size and forecast, by Policy, 2021-2028

7.3.8.3.Market size and forecast, by End-user, 2021-2028

7.3.8.4.Comparative market share analysis, 2021 & 2028

7.3.9.South Korea

7.3.9.1.Market size and forecast, by Type, 2021-2028

7.3.9.2.Market size and forecast, by Policy, 2021-2028

7.3.9.3.Market size and forecast, by End-user, 2021-2028

7.3.9.4.Comparative market share analysis, 2021 & 2028

7.3.10.Australia

7.3.10.1.Market size and forecast, by Type, 2021-2028

7.3.10.2.Market size and forecast, by Policy, 2021-2028

7.3.10.3.Market size and forecast, by End-user, 2021-2028

7.3.10.4.Comparative market share analysis, 2021 & 2028

7.3.11.Rest of Asia-Pacific

7.3.11.1.Market size and forecast, by Type, 2021-2028

7.3.11.2.Market size and forecast, by Policy, 2021-2028

7.3.11.3.Market size and forecast, by End-user, 2021-2028

7.3.11.4.Comparative market share analysis, 2021 & 2028

7.4.LAMEA

7.4.1.Market size and forecast, by Type, 2021-2028

7.4.2.Market size and forecast, by Policy, 2021-2028

7.4.3.Market size and forecast, by End-user, 2021-2028

7.4.4.Market size and forecast, by country, 2021-2028

7.4.5.Comparative market share analysis, 2021 & 2028

7.4.6.Brazil

7.4.6.1.Market size and forecast, by Type, 2021-2028

7.4.6.2.Market size and forecast, by Policy, 2021-2028

7.4.6.3.Market size and forecast, by End-user, 2021-2028

7.4.6.4.Comparative market share analysis, 2021 & 2028

7.4.7.Saudi Arabia

7.4.7.1.Market size and forecast, by Type, 2021-2028

7.4.7.2.Market size and forecast, by Policy, 2021-2028

7.4.7.3.Market size and forecast, by End-user, 2021-2028

7.4.7.4.Comparative market share analysis, 2021 & 2028

7.4.8.South Africa

7.4.8.1.Market size and forecast, by Type, 2021-2028

7.4.8.2.Market size and forecast, by Policy, 2021-2028

7.4.8.3.Market size and forecast, by End-user, 2021-2028

7.4.8.4.Comparative market share analysis, 2021 & 2028

7.4.9.Rest of LAMEA

7.4.9.1.Market size and forecast, by Type, 2021-2028

7.4.9.2.Market size and forecast, by Policy, 2021-2028

7.4.9.3.Market size and forecast, by End-user, 2021-2028

7.4.9.4.Comparative market share analysis, 2021 & 2028

8.Company profiles

8.1.ABI

8.1.1.Business overview

8.1.2.Financial performance

8.1.3.Product portfolio

8.1.4.Recent strategic moves & developments

8.1.5.SWOT analysis

8.2.Aviva

8.2.1.Business overview

8.2.2.Financial performance

8.2.3.Product portfolio

8.2.4.Recent strategic moves & developments

8.2.5.SWOT analysis

8.3.AXA

8.3.1.Business overview

8.3.2.Financial performance

8.3.3.Product portfolio

8.3.4.Recent strategic moves & developments

8.3.5.SWOT analysis

8.4.American International Group, Inc.

8.4.1.Business overview

8.4.2.Financial performance

8.4.3.Product portfolio

8.4.4.Recent strategic moves & developments

8.4.5.SWOT analysis

8.5.Citizens Advice

8.5.1.Business overview

8.5.2.Financial performance

8.5.3.Product portfolio

8.5.4.Recent strategic moves & developments

8.5.5.SWOT analysis

8.6.Aon

8.6.1.Business overview

8.6.2.Financial performance

8.6.3.Product portfolio

8.6.4.Recent strategic moves & developments

8.6.5.SWOT analysis

8.7.Marsh Ltd.

8.7.1.Business overview

8.7.2.Financial performance

8.7.3.Product portfolio

8.7.4.Recent strategic moves & developments

8.7.5.SWOT analysis

8.8.The Guardian Life Insurance Company of America

8.8.1.Business overview

8.8.2.Financial performance

8.8.3.Product portfolio

8.8.4.Recent strategic moves & developments

8.8.5.SWOT analysis

8.9.Zurich

8.9.1.Business overview

8.9.2.Financial performance

8.9.3.Product portfolio

8.9.4.Recent strategic moves & developments

8.9.5.SWOT analysis

8.10.StanCorp Financial Group, Inc.

8.10.1.Business overview

8.10.2.Financial performance

8.10.3.Product portfolio

8.10.4.Recent strategic moves & developments

8.10.5.SWOT analysis

Financial protection is a key component of universal health coverage (UHC) with an access to all needed quality health services without any financial hardship. With financial protection insurance, regular payments that replace part of income can be done if the insured person is not able to work due to an accident or illness. It pays out until the insured person retire, can start working again, die, or reach the end of the policy term. Financial protection insurance typically pays out between 50-65 percent of the insured person income if that person is unable to work.

COVID-19 Impact on Financial Protection Market

The outbreak of COVID-19 across the globe has positively impacted the global financial protection market growth. Many people experienced serious health condition and many people lost their jobs across the globe, which increased the demand for financial protection policy during the pandemic period. Besides, the COVID-19 pandemic is also responsible for several cuts in salary and workforce as various business sectors faced huge losses due to the slowing economy. Thus, most people are taking income protection plans to pay off bills and other utilities in order to sustain during the financial crisis.

Financial Protection Market: Trends and Developments

The companies operating in the global industry are adopting several growth strategies and business tactics such as partnerships, collaboration, business expansion, and product launches to obtain a leading position in the global industry, which is predicted to drive the global financial protection market growth in the upcoming years.

For instance, in September 2021, Bharti AXA Life Insurance, a joint venture between AXA and Bharti Enterprises, announced the launch of a single premium group protection plan, ‘Bharti AXA Life Group Credit Protection Pro.’ The plan is specifically designed by the company to provide customers with a complete solution to secure their future by providing financial protection to their families against unsettled liabilities.

In January 2022, Max Life Insurance, a leading life insurance company in India, entered into a collaboration with Policybazaar, one of India’s largest online marketplace for insurance, to empower homemakers’ financial protection with an option to get an independent term insurance policy. The ‘Max Life Smart Secure Plus Plan’ help in securing independent lives of female homemakers. The aim of the companies behind this collaboration is to address critical challenges of their customer base and enhance penetration in the largely untapped segment.

Forecast Analysis of the Global Market

The global financial protection market is projected to witness an exponential growth over the forecast period, owing to the rising adoption of latest technologies by key market players to provide income protection. Conversely, the lack of knowledge among people and the increasing costs of financial protection policies are expected to hamper the market growth in the projected timeframe.

The increasing number of unemployed people and the rapid growth in the number of several diseases such as cancer, malaria, and dengue among people worldwide are the significant factors and financial protection market trends estimated to bolster the growth of the global market in the coming future. According to a latest report published by Research Dive, the global financial protection market is expected to garner $29,381.6 million during the forecast period (2021-2028). Regionally, the Asia-Pacific market is estimated to grow at the fastest rate by 2028, owing to the increasing number of policy holders and rising number of people opting for financial protections in the region.

The key players functioning in the global market include AXA, Aon, American International Group, Inc., ABI, Marsh Ltd., Aviva, The Guardian Life Insurance Company of America, Zurich, Citizens Advice, and StanCorp Financial Group, Inc.

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com