Cleaning Services Market Report

RA08571

Cleaning Services Market by Service Type (Window Cleaning, Vacuuming, Floor Care, Janitorial Services, Carpet & Upholstery, and Other Services), Application (Commercial and Residential), and Regional Analysis (North America, Europe, Asia-Pacific, and LAMEA): Global Opportunity Analysis and Industry Forecast, 2022-2031

Global Cleaning Services Market Analysis

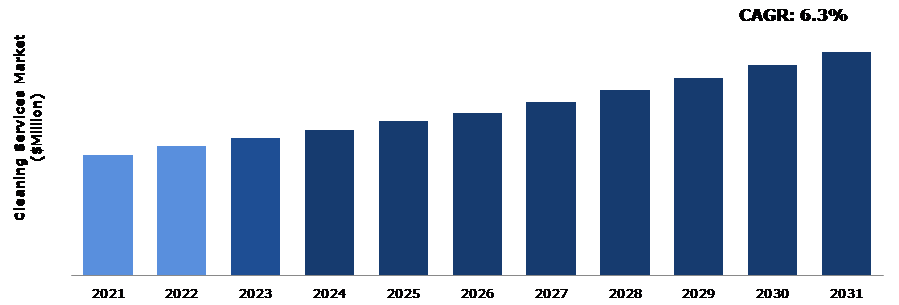

The Global Cleaning Services Market Size was $62,183.3 million in 2021 and is predicted to grow with a CAGR of 6.3%, by generating a revenue of $115,082.0 million by 2031.

Global Cleaning Services Market Synopsis

Global cleaning services market expansion is being driven by the healthcare sector's expansion. As the healthcare industry continues to grow, the demand for cleaning services in hospitals, clinics, and other medical facilities also increases. An additional driving force behind the expansion of the cleaning services industry is the inverse relationship between vacancy rates and the hiring of cleaners for business spaces. Cleaning services have expanded more rapidly as a result of new technologies, interoperability between different pieces of cleaning machinery, and increased competition in the market. Additionally, advance cleaning machinery benefits cleaning services in the store sector because it enables them to finish the job rapidly and on a budget.

The rising availability of automated cleaning technologies that could eventually replace some manual cleaning duties could result in a decline in the demand for human cleaners and initiate a trend towards automated cleaning solutions. This factor is anticipated to limit the market for cleaning services over the following few years.

There are many large, new business buildings and office spaces being built as a result of the recent rise in urbanization. As a result, there is a greater need for highly developed cleaning services like vacuuming, floor cleaning, and other cleaning electrical devices. The market players may have opportunities due to this factor to offer the best and affordable cleaning services. In the upcoming years, these elements are anticipated to boost the revenue of the cleaning services industry.

According to regional analysis, the Asia-Pacific cleaning services market accounted maximum market share in 2021. The growth is attributed to the presence of big cleaning service providers in nations like China and Japan. The demand for various cleaning services has grown as a result of the rapidly growing urbanization and the rising commercial infrastructure requiring cleaning services. Such elements are expected to increase market revenue over the anticipated time frame.

Cleaning Services Overview

Cleaning services refer to the professional cleaning and maintenance of various types of buildings and spaces, including commercial buildings, offices, residential properties, hospitals, schools, and public spaces. Cleaning services typically include a range of activities such as dusting, vacuuming, mopping, and disinfecting surfaces, as well as specialized services such as carpet cleaning, window washing, and deep cleaning. These services may be provided by in-house cleaning staff or outsourced to third-party cleaning companies. Cleaning services are essential for maintaining a clean, healthy, and safe environment, and are critical in preventing the spread of infectious diseases.

COVID-19 Impact on Global Cleaning Services Market

The COVID-19 pandemic has led to a modest growth in the market for cleaning services. The government imposed a strict lockdown as a result of the COVID-19 pandemic, which had a serious effect on people's health and wellbeing around the globe. Majority of office buildings and other commercial structures were closed as a result of the COVID-19 outbreak which had a benefical effect on the expansion of the cleaning services market share during the pandemic. The need for disinfection and sanitization services has grown as a result of the government's stringent regulations and sanitization standards. This factor is predicted to have a positive effect on the expansion of the cleaning services industry in the future.

Growing Applications of Cleaning Services in the Construction Sector to Drive the Market Growth

The cleaning services market in the construction sector is predicted to rise significantly in the future years due to an increase in the number of applications for cleaning services in this industry. With the increased demand for environmentally friendly and sustainable building techniques, there is a demand for specialist cleaning services that can assure the safety and cleanliness of construction sites. Also, there is a growing need for efficient and effective cleaning solutions as the construction sector continues to grow and expand in order to maintain compliance with safety and health laws. These factors are driving the growth of the cleaning services market in the construction sector, creating opportunities for service providers to offer specialised and innovative cleaning solutions to meet the needs of the industry.

To know more about global cleaning services market drivers, get in touch with our analysts here.

The High Competitiveness in the Cleaning Services Industry to Restrain the Market Growth

The cleaning services market is highly competitive, with many providers vying for the same customers. This can make it challenging for new entrants to establish themselves and for existing providers to maintain their market share. Cleaning services are labor-intensive, which can lead to higher labor costs for service providers. Additionally, finding and retaining skilled labor can be a challenge in some areas.

Increasing Demand for Cleaning Services in Commercial Sector to Drive Excellent Market Opportunities

To increase productivity, some service providers use cutting-edge technology. These solutions, which are growing more affordable for commercial cleaning businesses to adopt, include IoT (Internet of things) technology, productivity software, and high-tech cleaning equipment. To meet the rising customer demands, commercial cleaning firms are now expanding their array of specialized services. The demand for sustainable cleaning options has been increasing, as environmental regulations have become more stringent all over the world. Future development is anticipated to be driven by green cleaning techniques and products as consumers become more environmentally aware. Businesses are increasingly turning to commercial cleaners to lessen their environmental effect. This shift towards eco-friendly cleaning procedures is owing to the fact that many commercial cleansers are made with biodegradable and non-toxic chemicals. These eco-friendly cleaners are more sustainable and have a smaller environmental imprint than typical cleaning products. As a result, firms that utilise commercial cleaners can lessen their environmental effect while also demonstrating their commitment to sustainability.

To know more about global cleaning services market opportunities, get in touch with our analysts here.

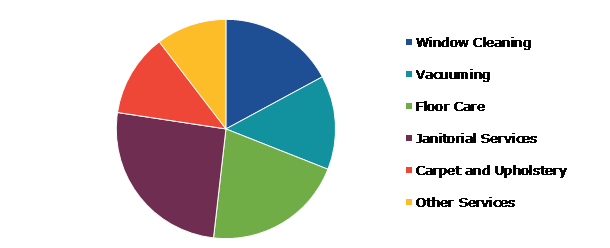

Global Cleaning Services Market, by Service Type

Based on servicetype, the market is divided into window cleaning, vacuuming, floor care, janitorial services, carpet & upholstery, and other services; among these, the janitorial services sub-segment accounted for the highest market share in 2021.

Global Cleaning Services Market Share, by Service Type, 2021

Source: Research Dive Analysis

The janitorial cleaning services sub-segment accounted for a dominant market share in 2021. Janitorial cleaning services are commercial cleaning services that are offered to a variety of locations including offices, hospitals, colleges, department shops, and other commercial establishments. These services include routine cleaning duties like dusting, cleaning, wiping, and garbage collection, as well as more specialist services like floor polishing, window cleaning, and carpet cleaning.Janitorial service providers are using technology to improve their service delivery and enhance customer experience. This includes using software for scheduling and dispatching, automated cleaning equipment, and sensors to monitor and manage cleaning activities.

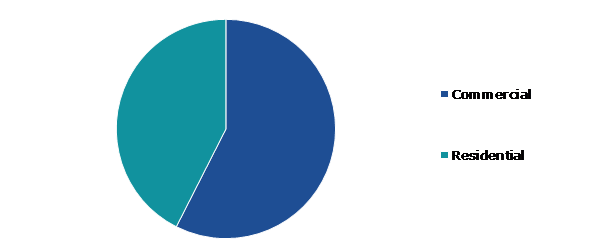

Global Cleaning Services Market, by Application

Based on application, the market has been divided into commerical and residential. Among these, the commerical sub-segment accounted for the highest revenue share in 2021.

Global Cleaning Services Market Size, by Application, 2021

Source: Research Dive Analysis

The commercial sub-segment accounted a dominant market share in 2021. Commercial clients are demanding specialized cleaning services to meet their unique needs, such as cleaning for healthcare facilities or industrial sites. Janitorial service providers are responding by offering specialized services that cater to these specific markets. Commercial clients are placing greater emphasis on sustainability and environmental responsibility. Janitorial service providers are offering eco-friendly and sustainable cleaning solutions, such as the use of green cleaning products and implementing recycling programs.

Global Cleaning Services Market, Regional Insights

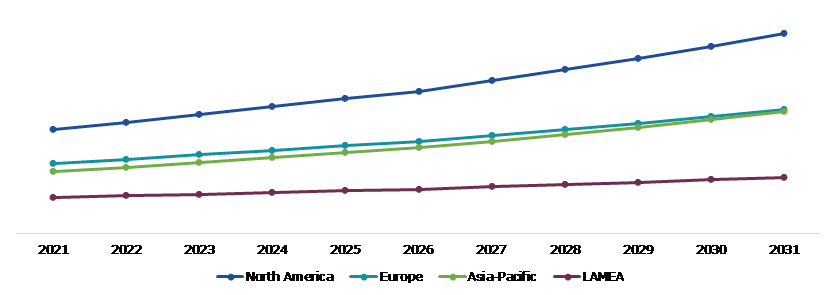

The cleaning services market was investigated across North America, Europe, Asia-Pacific, and LAMEA.

Global Cleaning Services Market Size & Forecast, by Region, 2021-2031 (USD Million)

Source: Research Dive Analysis

The Market for Cleaning Services in North America was the Most Dominant

The North America cleaning services market dominated the global market in 2021. The region is currently experiencing rapid urbanization and industrialization, leading to a significant increase in demand for cleaning services, particularly in the commercial and industrial sectors. The growing middle class in the region is driving demand for residential cleaning services, as people have less time to clean their homes and are willing to pay for professional cleaning services. Technological advancements are driving innovation in the cleaning services market in the North America region. This includes the development of new cleaning equipment and solutions that are more efficient and effective in cleaning, as well as the use of software for scheduling and dispatching cleaning services.

Competitive Scenario in the Global Cleaning Services Market

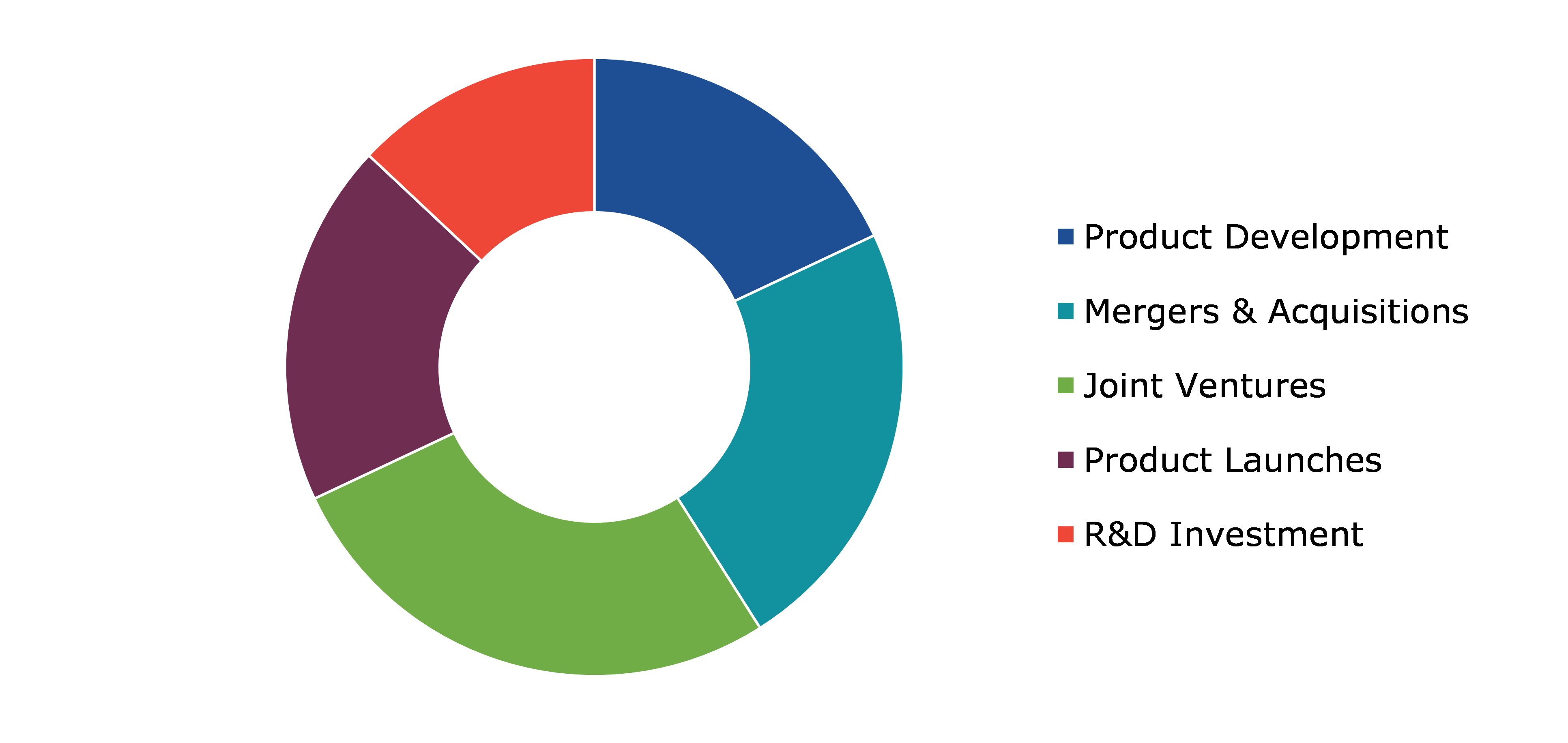

Investment and agreement are common strategies followed by major market players. For instance, in March 2023, ABM, a leading provider of facility services, infrastructure solutions, and parking management, has signed a multi-year agreement to deliver first-class housekeeping solutions and manage day-to-day and event staffing for Tropicana Field and Al Lang Stadium in St. Petersburg, Florida.

Source: Research Dive Analysis

Some of the leading cleaning services market players are ABM Industries Inc., Analog Cleaning Systems, Aramark Corporation, Chem-Dry, Cleannet, Jani-King International, Inc., Pritchard Industries Inc, Sodexo, ISS Facility Services, Inc., and The Servicemaster Company, Llc.

| Aspect | Particulars |

| Historical Market Estimations | 2020-2021 |

| Base Year for Market Estimation | 2021 |

| Forecast Timeline for Market Projection | 2022-2031 |

| Geographical Scope | North America, Europe, Asia-Pacific, LAMEA |

| Segmentation by Service type |

|

| Segmentation by Application |

|

| Key Companies Profiled |

|

Q1. What are some popular cleaning services?

A. Some popular cleaning services are window cleaning, floor cleaning, and vacuuming.

Q2. Which country has largest cleaning services market?

A. The U.S has the largest cleaning services market in the world.

Q3. What is the growth rate of cleaning services market?

A. The cleaning services market is expected to grow at a CAGR of 11.5%.

Q4. What is the size of the global cleaning services market?

A. The global cleaning services market was valued at $201,023.4 million in 2020, and is projected to reach $462,476.8 million by 2028, registering a CAGR of 11.5% from 2021 to 2028.

Q5. What are the strategies opted by the leading players in this market?

A. Agreement and investment are the two key strategies opted by the operating companies in this market.

Q6. Which companies are investing more on R&D practices?

A. ABM Industries Inc., Analog Cleaning Systems, Aramark Corporation, Chem-Dry, Cleannet, Jani-King International, Inc. are the companies investing more on R&D activities for developing new products and technologies.

1.Research Methodology

1.1.Desk Research

1.2.Real time insights and validation

1.3.Forecast model

1.4.Assumptions and forecast parameters

1.5.Market size estimation

1.5.1.Top-down approach

1.5.2.Bottom-up approach

2.Report Scope

2.1.Market definition

2.2.Key objectives of the study

2.3.Report overview

2.4.Market segmentation

2.5.Overview of the impact of COVID-19 on Global cleaning services market

3.Executive Summary

4.Market Overview

4.1.Introduction

4.2.Growth impact forces

4.2.1.Drivers

4.2.2.Restraints

4.2.3.Opportunities

4.3.Market value chain analysis

4.3.1.List of raw material suppliers

4.3.2.List of manufacturers

4.3.3.List of distributors

4.4.Innovation & sustainability matrices

4.4.1.Technology matrix

4.4.2.Regulatory matrix

4.5.Porter’s five forces analysis

4.5.1.Bargaining power of suppliers

4.5.2.Bargaining power of consumers

4.5.3.Threat of substitutes

4.5.4.Threat of new entrants

4.5.5.Competitive rivalry intensity

4.6.PESTLE analysis

4.6.1.Political

4.6.2.Economical

4.6.3.Social

4.6.4.Technological

4.6.5.Environmental

4.7.Impact of COVID-19 on cleaning services market

4.7.1.Pre-covid market scenario

4.7.2.Post-covid market scenario

5.Cleaning Services Market Analysis, by Service Type

5.1.Overview

5.2.Window Cleaning

5.2.1.Definition, key trends, growth factors, and opportunities

5.2.2.Market size analysis, by region, 2021-2031

5.2.3.Market share analysis, by country, 2021-2031

5.3.Vacuuming

5.3.1.Definition, key trends, growth factors, and opportunities

5.3.2.Market size analysis, by region, 2021-2031

5.3.3.Market share analysis, by country, 2021-2031

5.4.Floor Care

5.4.1.Definition, key trends, growth factors, and opportunities

5.4.2.Market size analysis, by region, 2021-2031

5.4.3.Market share analysis, by country, 2021-2031

5.5.Janitorial

5.5.1.Definition, key trends, growth factors, and opportunities

5.5.2.Market size analysis, by region, 2021-2031

5.5.3.Market share analysis, by country, 2021-2031

5.6.Carpet & Upholstery

5.6.1.Definition, key trends, growth factors, and opportunities

5.6.2.Market size analysis, by region, 2021-2031

5.6.3.Market share analysis, by country, 2021-2031

5.7.Other Services

5.7.1.Definition, key trends, growth factors, and opportunities

5.7.2.Market size analysis, by region, 2021-2031

5.7.3.Market share analysis, by country, 2021-2031

5.8.Research Dive Exclusive Insights

5.8.1.Market attractiveness

5.8.2.Competition heatmap

6.Cleaning Services Market Analysis, by Application

6.1.Commercial

6.1.1.Definition, key trends, growth factors, and opportunities

6.1.2.Market size analysis, by region, 2021-2031

6.1.3.Market share analysis, by country, 2021-2031

6.2.Residential

6.2.1.Definition, key trends, growth factors, and opportunities

6.2.2.Market size analysis, by region, 2021-2031

6.2.3.Market share analysis, by country, 2021-2031

6.3.Research Dive Exclusive Insights

6.3.1.Market attractiveness

6.3.2.Competition heatmap

7.Cleaning Services Market, by Region

7.1.North America

7.1.1.U.S.

7.1.1.1.Market size analysis, by Service Type, 2021-2031

7.1.1.2.Market size analysis, by Application, 2021-2031

7.1.2.Canada

7.1.2.1.Market size analysis, by Service Type, 2021-2031

7.1.2.2.Market size analysis, by Application, 2021-2031

7.1.3.Mexico

7.1.3.1.Market size analysis, by Service Type, 2021-2031

7.1.3.2.Market size analysis, by Application, 2021-2031

7.1.4.Research Dive Exclusive Insights

7.1.4.1.Market attractiveness

7.1.4.2.Competition heatmap

7.2.Europe

7.2.1.Germany

7.2.1.1.Market size analysis, by Service Type, 2021-2031

7.2.1.2.Market size analysis, by Application, 2021-2031

7.2.2.UK

7.2.2.1.Market size analysis, by Service Type, 2021-2031

7.2.2.2.Market size analysis, by Application, 2021-2031

7.2.3.France

7.2.3.1.Market size analysis, by Service Type, 2021-2031

7.2.3.2.Market size analysis, by Application, 2021-2031

7.2.4.Spain

7.2.4.1.Market size analysis, by Service Type, 2021-2031

7.2.4.2.Market size analysis, by Application, 2021-2031

7.2.5.Italy

7.2.5.1.Market size analysis, by Service Type, 2021-2031

7.2.5.2.Market size analysis, by Application, 2021-2031

7.2.6.Rest of Europe

7.2.6.1.Market size analysis, by Service Type, 2021-2031

7.2.6.2.Market size analysis, by Application, 2021-2031

7.2.7.Research Dive Exclusive Insights

7.2.7.1.Market attractiveness

7.2.7.2.Competition heatmap

7.3.Asia Pacific

7.3.1.China

7.3.1.1.Market size analysis, by Service Type, 2021-2031

7.3.1.2.Market size analysis, by Application, 2021-2031

7.3.2.Japan

7.3.2.1.Market size analysis, by Service Type, 2021-2031

7.3.2.2.Market size analysis, by Application, 2021-2031

7.3.3.India

7.3.3.1.Market size analysis, by Service Type, 2021-2031

7.3.3.2.Market size analysis, by Application, 2021-2031

7.3.4.Australia

7.3.4.1.Market size analysis, by Service Type, 2021-2031

7.3.4.2.Market size analysis, by Application, 2021-2031

7.3.5.South Korea

7.3.5.1.Market size analysis, by Service Type, 2021-2031

7.3.5.2.Market size analysis, by Application, 2021-2031

7.3.6.Rest of Asia Pacific

7.3.6.1.Market size analysis, by Service Type, 2021-2031

7.3.6.2.Market size analysis, by Application, 2021-2031

7.3.7.Research Dive Exclusive Insights

7.3.7.1.Market attractiveness

7.3.7.2.Competition heatmap

7.4.LAMEA

7.4.1.Brazil

7.4.1.1.Market size analysis, by Service Type, 2021-2031

7.4.1.2.Market size analysis, by Application, 2021-2031

7.4.2.Saudi Arabia

7.4.2.1.Market size analysis, by Service Type, 2021-2031

7.4.2.2.Market size analysis, by Application, 2021-2031

7.4.3.UAE

7.4.3.1.Market size analysis, by Service Type, 2021-2031

7.4.3.2.Market size analysis, by Application, 2021-2031

7.4.4.South Africa

7.4.4.1.Market size analysis, by Service Type, 2021-2031

7.4.4.2.Market size analysis, by Application, 2021-2031

7.4.5.Rest of LAMEA

7.4.5.1.Market size analysis, by Service Type, 2021-2031

7.4.5.2.Market size analysis, by Application, 2021-2031

7.4.6.Research Dive Exclusive Insights

7.4.6.1.Market attractiveness

7.4.6.2.Competition heatmap

8.Competitive Landscape

8.1.Top winning strategies, 2021

8.1.1.By strategy

8.1.2.By year

8.2.Strategic overview

8.3.Market share analysis, 2021

9.Company Profiles

9.1.ABM Industries Inc

9.1.1.Overview

9.1.2.Business segments

9.1.3.Product portfolio

9.1.4.Financial performance

9.1.5.Recent developments

9.1.6.SWOT analysis

9.2.Analog Cleaning Systems

9.2.1.Overview

9.2.2.Business segments

9.2.3.Product portfolio

9.2.4.Financial performance

9.2.5.Recent developments

9.2.6.SWOT analysis

9.3.Aramark Corporation

9.3.1.Overview

9.3.2.Business segments

9.3.3.Product portfolio

9.3.4.Financial performance

9.3.5.Recent developments

9.3.6.SWOT analysis

9.4.Chem-Dry

9.4.1.Overview

9.4.2.Business segments

9.4.3.Product portfolio

9.4.4.Financial performance

9.4.5.Recent developments

9.4.6.SWOT analysis

9.5.Cleannet

9.5.1.Overview

9.5.2.Business segments

9.5.3.Product portfolio

9.5.4.Financial performance

9.5.5.Recent developments

9.5.6.SWOT analysis

9.6.Jani-King International, Inc.

9.6.1.Overview

9.6.2.Business segments

9.6.3.Product portfolio

9.6.4.Financial performance

9.6.5.Recent developments

9.6.6.SWOT analysis

9.7.Pritchard Industries Inc.

9.7.1.Overview

9.7.2.Business segments

9.7.3.Product portfolio

9.7.4.Financial performance

9.7.5.Recent developments

9.7.6.SWOT analysis

9.8.Sodexo

9.8.1.Overview

9.8.2.Business segments

9.8.3.Product portfolio

9.8.4.Financial performance

9.8.5.Recent developments

9.8.6.SWOT analysis

9.9.ISS Facility Services, Inc.

9.9.1.Overview

9.9.2.Business segments

9.9.3.Product portfolio

9.9.4.Financial performance

9.9.5.Recent developments

9.9.6.SWOT analysis

9.10.The Servicemaster Company, Llc

9.10.1.Overview

9.10.2.Business segments

9.10.3.Product portfolio

9.10.4.Financial performance

9.10.5.Recent developments

9.10.6.SWOT analysis

Keeping a clean and organized space is important not only for aesthetics but also for human health and well-being. However, in today’s busy world, it can be challenging to find the time and energy to clean our homes and offices. This is where professional cleaning services come into the role. These services can include regular cleaning, deep cleaning, move-in or move-out cleaning, and specialized cleaning services. Regular cleaning services typically include tasks such as vacuuming, dusting, mopping floors, cleaning bathrooms and kitchens, and emptying trash. On the other hand, deep cleaning services are more comprehensive and involve cleaning areas that are not typically cleaned during regular cleaning.

While move-in or move-out cleaning services are designed for clients who are moving into or out of space. These services typically involve a more thorough cleaning to ensure the space is clean and ready for the next occupant. Specialized cleaning services are designed for specific needs or industries. For example, a medical facility may require specialized cleaning services to meet industry-specific regulations and standards. Cleaning services can be provided by individual cleaners, small cleaning companies, or large commercial cleaning companies. In addition to providing a clean and organized space, hiring a professional cleaning service can also provide other benefits such as improved health and productivity.

Forecast Analysis of the Global Cleaning Services Market

According to the report published by Research Dive, the global cleaning services market is projected to generate a revenue of $115,082.0 million and grow at a CAGR of 6.3% over the estimated period from 2022 to 2031.

With the increasing applications of cleaning services in the construction sector owing to the increased demand for environmentally friendly and sustainable building techniques to assure the cleanliness and safety of construction sites, the global cleaning services market is expected to observe prominent growth over the analysis period. Besides, the rising need for efficient and effective cleaning solutions to maintain compliance with health laws is predicted to bolster the growth of the market during the estimated period. Moreover, the increasing demand for cleaning services in the commercial sector to increase productivity by adopting modern technology such as IoT, high-tech cleaning equipment, and many more, is predicted to create massive growth opportunities for the market over the forecast period. However, the high competitiveness in the cleaning services market may hamper the growth of the market in the coming period.

The major players of the cleaning services market include Jani-King International, Inc., Cleanness, Pritchard Industries Inc., Chem-Dry, Sodexo, Aramark Corporation, ISS Facility Services, Inc., Analog Cleaning Systems, The Servicemaster Company, Llc, ABM Industries Inc., and many more.

Key Developments of the Cleaning Services Market

The key companies operating in the industry are adopting various growth strategies & business tactics such as partnerships, collaborations, mergers & acquisitions, and launches to maintain a robust position in the overall market, subsequently helping the global cleaning services market to grow exponentially. For instance:

- In November 2021, CCS Facility Services, one of the largest building services contractors in the United States, announced its acquisition of Total Cleaning Systems, a renowned provider of commercial cleaning needs. With this acquisition, the companies aimed to provide green cleaning and industrial facilities across various industries including education, commercial real estate, healthcare, and many more.

- In February 2023, Aramark Healthcare+, the leading provider of food, facilities, and uniform services to millions of people across various nations announced its partnership with Healthcare Plus Solutions Group, a renowned healthcare provider founded by Quint Studer and Dan Collard. With this partnership, the companies aimed to drive innovative, evidence-based improvement for hospitals.

- In September 2022, ABM Industries Inc., a leading provider of facility solutions with offices throughout the United States announced the launch of its ABMNext innovation program which would advance corporate sustainability, inclusion, diversity, and equity, also enhance philanthropy and community engagement. This program would further aim to cultivate (Environmental, Social, and Governance) ESG culture across industries.

Most Profitable Region

The North America region of the cleaning services market generated the highest revenue in 2021. This is mainly due to rapid urbanization & industrialization, and the increasing demand for cleaning services across commercial and industrial sectors. Moreover, the rising demand for residential cleaning services among individuals and the growing technological advancements in the cleaning services sectors are expected to boost the regional growth of the market over the estimated period.

Covid-19 Impact on the Cleaning Services Market

The outbreak of the Covid-19 pandemic has brought several uncertainties across various industries, including the cleaning services market. This is mainly due to the government-imposed lockdowns across many nations due to the deadly virus’s tremendous spread. Moreover, the closure of commercial structures and office buildings owing to the serious impact on people’s health and well-being has further declined the market growth over the crisis. However, the growing need for disinfection and sanitization services due to the government's stringent regulations and sanitization standards has brought massive growth opportunities for the market over the pandemic period.

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com