Liquid Smoke Market Report

RA08569

Liquid Smoke Market by Type (Hickory, Mesquite, Applewood, and Others), Application (Meat, Seafood, Sauces/Marinades, and Bakery & Confectionery), and Regional Analysis (North America, Europe, Asia-Pacific, and LAMEA): Global Opportunity Analysis and Industry Forecast, 2021–2028

Global Liquid Smoke Market Analysis

The global liquid smoke market is predicted to garner $1,14,266.2 thousand in the 2020–2028 timeframe, growing from $68,271.4 thousand in 2020 at a healthy CAGR of 6.7%.

Market Synopsis

Strategic alliances among market players, along with growth in processed meat industry, are expected to accelerate the growth of the liquid smoke market.

However, lack of awareness regarding the use liquid smoke in food preservation and flavoring might be a growth -restricting factor for the market.

According to the regional analysis, the North America liquid smoke market is anticipated to grow during the review period and generate revenue of $32,451.6 thousand by 2028 due to increasing consumption of grilled and smoked meat in the region.

Liquid Smoke Overview

Liquid smoke is a flavor of smoke that is made by burning woods and capturing the smoke. It is then compressed to liquid substance. Also, liquid smoke is mostly used in foods for giving them smoky flavor. Moreover, ingredients present in liquid smoke enhance the shelf life of food and affect the flavors, appearance, aroma, and texture of food.

Impact Analysis of COVID-19 on the Global Liquid Smoke Market

The novel coronavirus pandemic had a devastating effect on several industries, including the liquid smoke market, which experienced a negative growth during this period. Due to complete lockdown worldwide, manufacturing capacity of the liquid smoke got affected; along with this, most of the restaurants were completely closed and therefore they were unable to open their outlet facility. All such factors are expected to cause the revenue loss in global liquid industry. In addition to this, liquid smoke is not considered as the essential ingredient for cooking and therefore it was not the priority for people to use it, thereby decreasing the global market growth.

Increasing Prevalence of Barbeque and Smoked Food to Surge the Market Growth

The global liquid smoke industry is witnessing a massive growth mainly due to increase in trends of smoke flavor food and barbeque sauces among the people. Now-a-days, people are loving the taste of traditional grilled smoke in food items, such factors will drive the global liquid smoke market. Moreover, smoke flavors are mostly used in preparation of grilled meats such as ham, shrimps, bacon, steaks, and others which are few of the popular food items.

The trend of smoked food is already motivating leading market players to innovate strategies to attract customers. For example, in December 2019, Kerry Group, Ireland based food company, announced that they are going to adopt Rapid Thermal Pyrolysis (RTP) technology. This technology is used to convert the biomass into liquid smoke product. This acquisition will support the company's capacity expansion in the liquid smoke market. These types of initiatives from market leaders are also predicted to drive the growth of the market.

To know more about global liquid smoke market drivers, get in touch with our analysts here.

Side Effect Associated with Liquid Smoke to Restrain the Market Growth

There are many people worldwide that are allergic to liquid smoke. This factor is expected to restrain the growth of the global market during the forecast period. In addition to this, lack of awareness regarding the use of liquid smoke in food mostly in developing countries is one of the aspects that may create a negative impact on the growth of the market during the forecast period.

Growing Trends of Packaged Food in the Market to Create Massive Investment Opportunities

The global liquid smoke market is growing at a very fast pace due to changes in the food pattern of the people that are encouraging them to buy best quality food products and packaged food. The growth of the market is attributed to the innovation that is performed in packaged foods. Moreover, advancements in the retail infrastructure along with availability of different flavors such as smoke flavors in food and free delivery are some of the elements that have led to the growth of the global liquid smoke market. Therefore, increasing inclination towards the ready to eat foods is a major growth accelerating factor of the liquid smoke, thereby positively affecting the market growth.

Furthermore, certain key vendors operating in liquid smoke market are adopting certain strategies and innovations for staying upfront in the competitive environment. For instance, Nolan Ryan Beef, US based food company, announced in July 2019, that they have launched uncured beef franks in hot dog and frank food using liquid smoke. All such factors may further lead to lucrative market opportunities for key players in the upcoming years.

To know more about global liquid smoke market opportunities, get in touch with our analysts here.

Based on type, the market has been divided into Hickory, mesquite, applewood, and others sub-segments of which the Hickory focal sub-segment is projected to generate the maximum revenue as well as show the fastest growth. Download PDF Sample ReportLiquid Smoke Market

By Type

Source: Research Dive Analysis

The hickory type sub-segment is predicted to be the dominating as well as the fastest growing market share in the global market and register a revenue of $48,607.1 thousand during the forecast period. Hickory type of liquid smoke is one of the most popular liquid smokes that is majorly used in barbequed or grilled meats. Also, hickory type liquid smoke is mostly preferred due to its strong taste and aroma. Moreover, key players operating in the market are adopting strategic collaborations to offer best type of liquid smoking to customers. For instance, B&G Foods Inc., America based food company, offers various brands of hickory liquid smoke named Wright’s Liquid Smoke. These factors may bolster the growth of the sub-segment during the forecast period.

Liquid Smoke Market

By ApplicationOn the basis of application, the market has been sub-segmented into Meat, seafood, sauces/marinades, and bakery & confectionery. Among the mentioned sub-segments, the Meat sub-segment is predicted to show the fastest growth as well as garner a dominant market share.

Source: Research Dive Analysis

The meat sub-segment of the global liquid smoke market is projected to have the fastest growth as well as the dominant share and surpass $49,910.1 thousand by 2028, with an increase from $29,068.3 thousand in 2020. This growth in the market can be attributed to the rising number of people preferring meat in their daily diet. The rapid growth of fast food chains such as Subway, Burger King, McDonalds, Taco Bell, and KFC has the high influenced people to buy affordable meal packages which is predicted to be one of the factors to influence the customers to buy smoky meat products. All such elements may increase the demand for meat and further surge the market growth.

Liquid Smoke Market

By RegionThe liquid smoke market was investigated across North America, Europe, Asia-Pacific, and LAMEA.

Source: Research Dive Analysis

The Market for Liquid Smoke in Europe to be the Most Dominant

The Europe liquid smoke market accounted $26,079.7 thousand in 2020 and is projected to register a revenue of $43,764.0 thousand by 2028. The extensive growth of the Europe liquid smoke market is mainly driven by high disposable incomes with existence of top leading brands. Moreover, liquid smoke is majorly used in fast food and therefore it is produced on commercial basis and is also regulated by the governments support, fueling the market growth across the globe. These factors will ultimately drive the demand for the liquid smoke market across the region.

The Market for Liquid Smoke in North America to be the Fastest Growing

The share of North America liquid smoke market is anticipated to grow at a CAGR of 7.1% by registering a revenue of $32,451.6 thousand by 2028. The growth shall be a result of increasing trends of smoke food products that include barbeque and confectionery. Also, growing trends of seafood will increase the demand for liquid smoke which will eventually foster the North America liquid smoke market, in the upcoming years.

Competitive Scenario in the Global Liquid Smoke Market

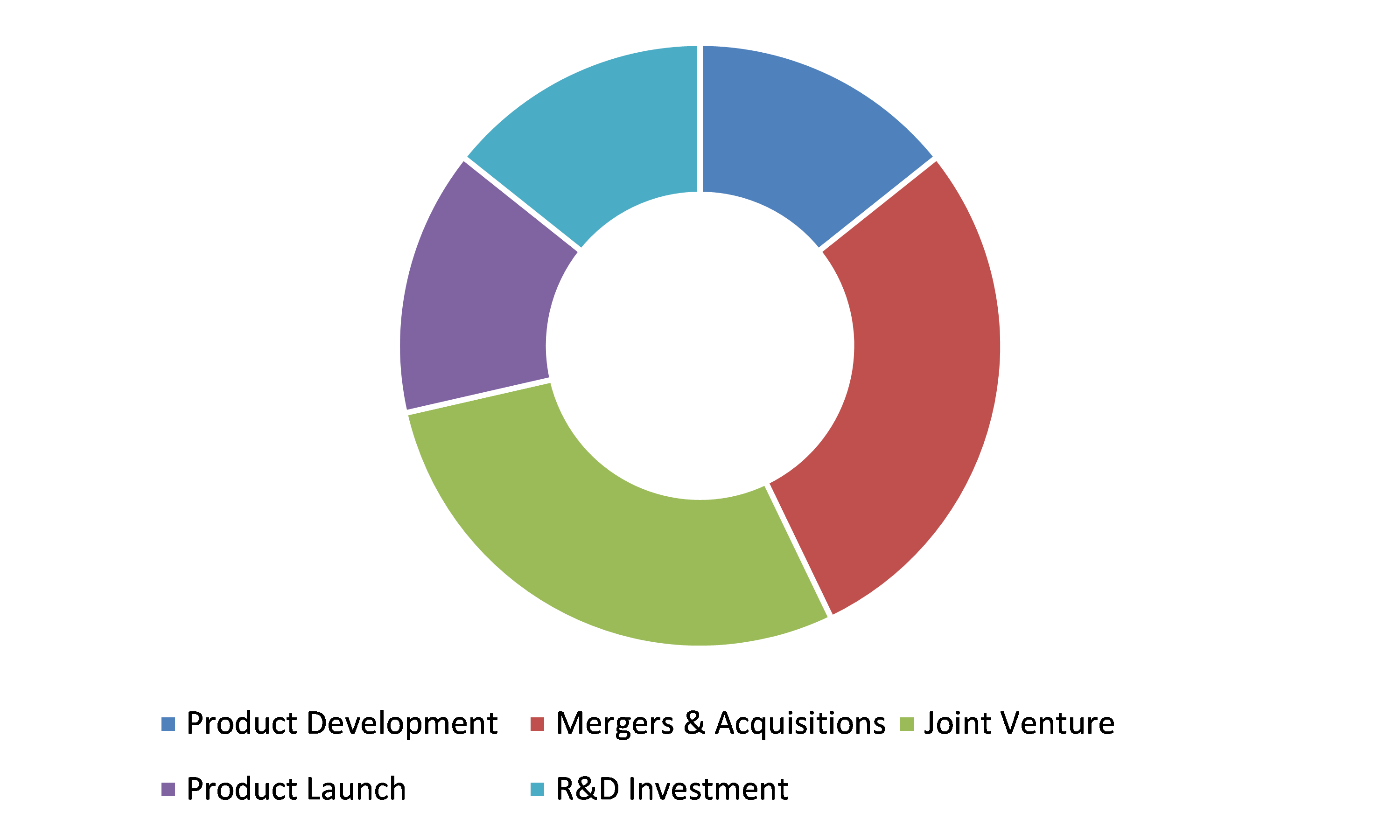

Product launches and mergers & acquisitions are common strategies followed by major market players.

Source: Research Dive Analysis

Some of the leading liquid smoke market players are Kerry Group, Red Arrow International, Colgin, MSK Ingredients Ltd., Azelis SA., Besmoke Ltd., Ruitenberg Ingredients, Baumer Foods, Redbrook Ingredient Services Ltd., and B&G Foods.

Porter’s Five Forces Analysis for the Global Liquid Smoke Market:

- Bargaining Power of Suppliers: The service suppliers of liquid smoke market are high in number and are larger and more globalized. So, there will be less threat from the suppliers.

Thus, the bargaining power of suppliers is low. - Bargaining Power of Buyers: Buyers demand flavorful liquid smoke that can give strong smoky taste. This has increased the pressure on the liquid smoke providers to offer the best product in a cost-effective way. Thus, many suppliers are offering best yet cost–effective liquid smoke products. This gives the buyers the option to freely choose liquid smoke flavor that best fits their preference.

Thus, the bargaining power of buyers is high. - Threat of New Entrants: Companies entering the liquid smoke market are adopting various innovations such as developing liquid smoke that is organic.

Thus, the threat of the new entrants is moderate. - Threat of Substitutes: There are different types of ways that can give the smoky flavor to the food such as powder smoke and conventional cooking, but they do not offer the convenience as that of liquid smoke.

Thus, the threat of substitutes is low. - Competitive Rivalry in the Market: The competitive rivalry among industry leaders is rather intense, especially between the global players including Kerry Group and Red Arrow International. These companies are launching their value-added services in the international market and strengthening the footprint worldwide.

Therefore, competitive rivalry in the market is high.

| Aspect | Particulars |

| Historical Market Estimations | 2019-2020 |

| Base Year for Market Estimation | 2020 |

| Forecast Timeline for Market Projection | 2021-2028 |

| Geographical Scope | North America, Europe, Asia-Pacific, LAMEA |

| Segmentation by Type |

|

| Segmentation by Distribution Channel |

|

| Key Companies Profiled |

|

Q1. What is the size of the global liquid smoke market?

A. The size of the global liquid smoke market was over $68,271.4 thousand in 2020 and is projected to reach $1,14,266.2 thousand by 2028.

Q2. Which are the major companies in the liquid smoke market?

A. Kerry Group and Red Arrow International are some of the key players in the global liquid smoke market.

Q3. Which region, among others, possesses greater investment opportunities in the near future?

A. The North America region possesses great investment opportunities for investors to witness the most promising growth in the future.

Q4. What will be the growth rate of the North America liquid smoke market?

A. North America liquid smoke market is anticipated to grow at 7.1% CAGR during the forecast period.

Q5. What are the strategies opted by the leading players in this market?

A. Technological development and strategic partnerships are the key strategies opted by the operating companies in this market.

Q6. Which companies are investing more on R&D practices?

A. Kerry Group and Red Arrow International are investing more on R&D activities for developing new products and technologies.

1.Research Methodology

1.1.Desk Research

1.2.Real time insights and validation

1.3.Forecast model

1.4.Assumptions and forecast parameters

1.4.1.Assumptions

1.4.2.Forecast parameters

1.5.Data sources

1.5.1.Primary

1.5.2.Secondary

2.Executive Summary

2.1.360° summary

2.2.By Type trends

2.3.By Application trends

3.Market overview

3.1.Market segmentation & definitions

3.2.Key takeaways

3.2.1.Top investment pockets

3.2.2.Top winning strategies

3.3.Porter’s five forces analysis

3.3.1.Bargaining power of consumers

3.3.2.Bargaining power of suppliers

3.3.3.Threat of new entrants

3.3.4.Threat of substitutes

3.3.5.Competitive rivalry in the market

3.4.Market dynamics

3.4.1.Drivers

3.4.2.Restraints

3.4.3.Opportunities

3.5.Technology landscape

3.6.Regulatory landscape

3.7.Patent landscape

3.8.Market value chain analysis

3.9.Strategic overview

4.Liquid Smoke Market, by Type

4.1.Overview

4.1.1.Market size and forecast, by type

4.2.Hickory

4.2.1.Key market trends, growth factors, and opportunities

4.2.2.Market size and forecast, by region, 2020-2028

4.2.3.Market share analysis, by country 2020 & 2028

4.3.Mesquite

4.3.1.Key market trends, growth factors, and opportunities

4.3.2.Market size and forecast, by region, 2020-2028

4.3.3.Market share analysis, by country 2020 & 2028

4.4.Applewood

4.4.1.Key market trends, growth factors, and opportunities

4.4.2.Market size and forecast, by region, 2020-2028

4.4.3.Market share analysis, by country 2020 & 2028

4.5.Others

4.5.1.Key market trends, growth factors, and opportunities

4.5.2.Market size and forecast, by region, 2020-2028

4.5.3.Market share analysis, by country 2020 & 2028

5.Liquid Smoke Market, by Application

5.1.Overview

5.1.1.Market size and forecast, by Application

5.2.Meat

5.2.1.Key market trends, growth factors, and opportunities

5.2.2.Market size and forecast, by region, 2020-2028

5.2.3.Market share analysis, by country 2020 & 2028

5.3.Seafood

5.3.1.Key market trends, growth factors, and opportunities

5.3.2.Market size and forecast, by region, 2020-2028

5.3.3.Market share analysis, by country 2020 & 2028

5.4.Sauce/Marinades

5.4.1.Key market trends, growth factors, and opportunities

5.4.2.Market size and forecast, by region, 2020-2028

5.4.3.Market share analysis, by country 2020 & 2028

5.5.Bakery & Confectionery

5.5.1.Key market trends, growth factors, and opportunities

5.5.2.Market size and forecast, by region, 2020-2028

5.5.3.Market share analysis, by country 2020 & 2028

6.Liquid Smoke Market, by Region

6.1.Overview

6.1.1.Market size and forecast, by region

6.2.North America

6.2.1.Key market trends, growth factors, and opportunities

6.2.2.Market size and forecast, by Type, 2020-2028

6.2.3.Market size and forecast, by Application , 2020-2028

6.2.4.Market size and forecast, by country, 2020-2028

6.2.5.U.S.

6.2.5.1.Market size and forecast, by Type, 2020-2028

6.2.6.Market size and forecast, by Application , 2020-2028

6.2.7.Canada

6.2.7.1.Market size and forecast, by Type, 2020-2028

6.2.8.Market size and forecast, by Application , 2020-2028

6.2.9.Mexico

6.2.10.Market size and forecast, by Application , 2020-2028

6.3.Europe

6.3.1.Key market trends, growth factors, and opportunities

6.3.2.Market size and forecast, by Type, 2020-2028

6.3.3.Market size and forecast, by Application , 2020-2028

6.3.4.Market size and forecast, by country, 2020-2028

6.3.5.Germany

6.3.5.1.Market size and forecast, by Type, 2020-2028

6.3.6.Market size and forecast, by Application , 2020-2028

6.3.7.UK

6.3.7.1.Market size and forecast, by Type, 2020-2028

6.3.7.2.Market size and forecast, by Application , 2020-2028

6.3.8.France

6.3.8.1.Market size and forecast, by Type, 2020-2028

6.3.8.2.Market size and forecast, by Application , 2020-2028

6.3.9.Spain

6.3.9.1.Market size and forecast, by Type, 2020-2028

6.3.9.2.Market size and forecast, by Application , 2020-2028

6.3.10.Italy

6.3.10.1.Market size and forecast, by Type, 2020-2028

6.3.10.2.Market size and forecast, by Application , 2020-2028

6.3.11.Rest of Europe

6.3.11.1.Market size and forecast, by Type, 2020-2028

6.3.11.2.Market size and forecast, by Application , 2020-2028

6.4.Asia Pacific

6.4.1.Key market trends, growth factors, and opportunities

6.4.2.Market size and forecast, by Type, 2020-2028

6.4.3.Market size and forecast, by Application , 2020-2028

6.4.4.Market size and forecast, by country, 2020-2028

6.4.5.China

6.4.5.1.Market size and forecast, by Type, 2020-2028

6.4.5.2.Market size and forecast, by Application , 2020-2028

6.4.6.Japan

6.4.6.1.Market size and forecast, by Type, 2020-2028

6.4.6.2.Market size and forecast, by Application , 2020-2028

6.4.7.India

6.4.7.1.Market size and forecast, by Type, 2020-2028

6.4.7.2.Market size and forecast, by Application , 2020-2028

6.4.8.South Korea

6.4.8.1.Market size and forecast, by Type, 2020-2028

6.4.8.2.Market size and forecast, by Application , 2020-2028

6.4.9.Australia

6.4.9.1.Market size and forecast, by Type, 2020 2028

6.4.9.2.Market size and forecast, by Application , 2020-2028

6.4.9.3.Comparative market share analysis, 2020 & 2028

6.4.10.Rest of Asia Pacific

6.4.10.1.Market size and forecast, by Type, 2020-2028

6.4.10.2.Market size and forecast, by Application , 2020-2028

6.5.LAMEA

6.5.1.Key market trends, growth factors, and opportunities

6.5.2.Market size and forecast, by Type, 2020-2028

6.5.2.1.Market size and forecast, by Application , 2020-2028

6.5.3.Market size and forecast, by country, 2020-2028

6.5.4.Latin America

6.5.4.1.Market size and forecast, by Type, 2020-2028

6.5.4.2.Market size and forecast, by Application , 2020-2028

6.5.5.Middle East

6.5.5.1.Market size and forecast, by Type, 2020-2028

6.5.5.2.Market size and forecast, by Application , 2020-2028

6.5.6.Africa

6.5.6.1.Market size and forecast, by Type, 2020-2028

6.5.6.2.Market size and forecast, by Application , 2020-2028

7.Company profiles

7.1.Kerry Group

7.1.1.Company overview

7.1.2.Operating business segments

7.1.3.Product portfolio

7.1.4.Financial Performance

7.1.5.Recent strategic moves & developments

7.2.Red Arrow International

7.2.1.Company overview

7.2.2.Operating business segments

7.2.3.Product portfolio

7.2.4.Financial Performance

7.2.5.Recent strategic moves & developments

7.3. Colgin

7.3.1.Company overview

7.3.2.Operating business segments

7.3.3.Product portfolio

7.3.4.Financial Performance

7.3.5.Recent strategic moves & developments

7.4.MSK Ingredients Ltd

7.4.1.Company overview

7.4.2.Operating business segments

7.4.3.Product portfolio

7.4.4.Financial Performance

7.4.5.Recent strategic moves & developments

7.5.Azelis SA

7.5.1.Company overview

7.5.2.Operating business segments

7.5.3.Product portfolio

7.5.4.Financial Performance

7.5.5.Recent strategic moves & developments

7.6.Besmoke Ltd.

7.6.1.Company overview

7.6.2.Operating business segments

7.6.3.Product portfolio

7.6.4.Financial Performance

7.6.5.Recent strategic moves & developments

7.7.Ruitenberg Ingredients

7.7.1.Company overview

7.7.2.Operating business segments

7.7.3.Product portfolio

7.7.4.Financial Performance

7.7.5.Recent strategic moves & developments

7.8. Baumer Foods

7.8.1.Company overview

7.8.2.Operating business segments

7.8.3.Product portfolio

7.8.4.Financial Performance

7.8.5.Recent strategic moves & developments

7.9.Redbrook Ingredient Services Ltd

7.9.1.Company overview

7.9.2.Operating business segments

7.9.3.Product portfolio

7.9.4.Financial Performance

7.9.5.Recent strategic moves & developments

7.10.B&G Foods

7.10.1.Company overview

7.10.2.Operating business segments

7.10.3.Product portfolio

7.10.4.Financial Performance

7.10.5.Recent strategic moves & developments

In the world of barbeques, liquid smoke is usually spurned and ridiculed as a cheap method to impart smoke flavour in a food recipe. However, the popularity of liquid smoke is rising as it offers a delicious smoky flavour to various food dishes.

Liquid smoke is a flavouring agent obtained by condensing the smoke generated by burning wood. Advanced procedures of producing liquid smoke consist of filtration procedures to eliminate contaminants, such as dirt and ash from the ultimate product.

These days, liquid smoke is available in most conventional stores as a separate item. Also, it is a vital flavouring agent in numerous prepared food items found in supermarkets and restaurants such as beef jerky, hot dogs, applewood-smoked bacon, barbecue sauces, and baked beans. The point of liquid smoke is to add a smoky flavour without actually smouldering anything, so it is a suitable method to get a smoky flavour into a recipe if you do not have the time or required items to smoke something in the traditional way. Liquid smoke is a suitable, economical way to add a deep, smoky flavour to foods without the burning of wood chips.

Growing Popularity of Liquid Smoke

The liquid smoke industry across the globe is observing an enormous growth mostly owing to the surging popularity of smoke flavoured foods and barbeque sauces amongst public. These days, people are admiring the flavour of traditional grilled smoke in foods which is propelling the demand for liquid smoke worldwide. Furthermore, smoke flavours are mostly used in the recipes of grilled meats like steaks, shrimps, ham, bacon, and others which are greatly in demand nowadays. The trend of smoked food is greatly encouraging leading liquid smoke market players to modernize their business strategies to entice customers.

Latest Trends in the Liquid Smoke Market

As per a report by Research Dive, the global liquid smoke market is expected to grow from $68,271.4 thousand in 2020 to $1,14,266.2 thousand by 2028. The liquid smoke market in the North America region is observing accelerated growth and anticipated to surpass a revenue of $32,451.6 thousand by 2028. This is mainly owing to the rising popularity of smoked food products that include barbeque and confectionery in this region. Market players are significantly investing in research and development to cater the mounting demand for liquid smoke. Some of the foremost players of the liquid smoke market are MSK Kerry Group, Red Arrow International, Ingredients Ltd., Redbrook Ingredient Services Ltd., B&G Foods., Azelis SA., Besmoke Ltd., Ruitenberg Ingredients, Baumer Foods, Colgin, and others. These players are focused on forming strategies, for example, mergers and acquisitions, partnerships, novel developments, and collaborations to achieve a prominent position in the global market.

For instance,

- In February 2021, Azelis, a foremost provider of specialty chemicals and food ingredients, announced the launch of a novel extraction and distillation plant to develop smoke flavours. The company vends its smoke flavours under the well-established Scansmoke® brand.

- In August 2021, TMI Foods, a foremost provider of fully cooked crispy and back bacon in the UK and a Dawn Farms firm, signed an elite licensing agreement with Besmoke, the producer of draft-smoked ingredients, smoke and grill flavours, and taste-enhancement products. The novel Puresmoke technology assures to offer genuine as well as clean wood smoke flavours and will be exclusively built into the curing or cooking processes at the advanced facility of TMI Foods in Northampton.

COVID-19 Impact on the Liquid Smoke Market

The abrupt rise of the coronavirus pandemic in 2020 has negatively impacted the global liquid smoke market. This is mainly due to the cessation of liquid smoke manufacturing factories due to the implementation of lockdown in several regions during the pandemic period. Also, a significant drop in the demand for restaurant foods during the pandemic has hampered the market growth. However, as the pandemic is relaxing, the liquid smoke market is expected to gain traction with a remarkable surge in the popularity of smoked food dishes worldwide. This is likely to boom the liquid smoke market growth in the coming years.

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com