Gene Synthesis Market Report

RA08565

Gene Synthesis Market by Method (Solid Phase Synthesis, PCR Based Enzyme Synthesis, and CHIP Based DNA Synthesis), End User (Academic and Research Institutes, Biotech and Pharmaceutical Companies, Diagnostic Laboratories and Other), and Regional Analysis (North America, Europe, Asia-Pacific, and LAMEA): Global Opportunity Analysis and Industry Forecast, 2022-2031

Global Gene Synthesis Market Analysis

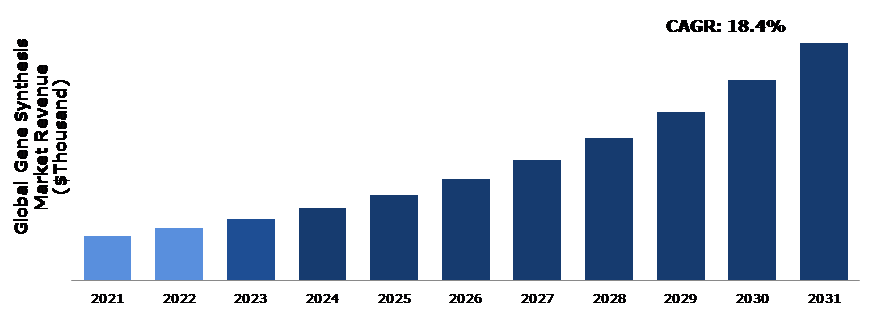

The Global Gene Synthesis Market Size was $1,110,000 thousand in 2021 and is predicted to grow with a CAGR of 18.4%, by generating a revenue of $5,984,016.7 thousand by 2031.

Global Gene Synthesis Market Synopsis

The demand for personalized medicine and therapeutics for various chronic diseases, as well as increased government funding for genomics, are the main drivers of the growth of the gene synthesis market. The gene synthesis market share is expected to be driven further owing to rising research and development in the fields of genomics and next-generation sequencing. The gene synthesis has gained popularity in recent years because customized medicine strives to give each patient a treatment plan that is specifically designed for them based on the molecular basis of their illness. Huge amounts of health-related data and insights are being produced by healthcare technology, genomics, connected devices, big data analytics, and artificial intelligence, allowing healthcare providers to provide better and more rapid diagnostic and treatment services by making more knowledgeable treatment decisions.

The possibility of an unintentional or intentional biological event has increased as a consequence of new techniques for DNA editing and synthesis that make it simpler to alter biological agents and systems. With the aid of gene synthesis, the researchers can easily manipulate any gene or DNA, thereby making a whole new genome. These technologies can enable the generation of pathogen or toxin DNA that may be intentionally or unintentionally misapplied. This factor is expected to hinder the market expansion of gene synthesis market in the forecast time period.

Increased government support through increased funding for gene development and expanded reimbursement policies to enable common people to benefit from newly developed therapies aids in accelerating the market for gene synthesis in response to rising demand.

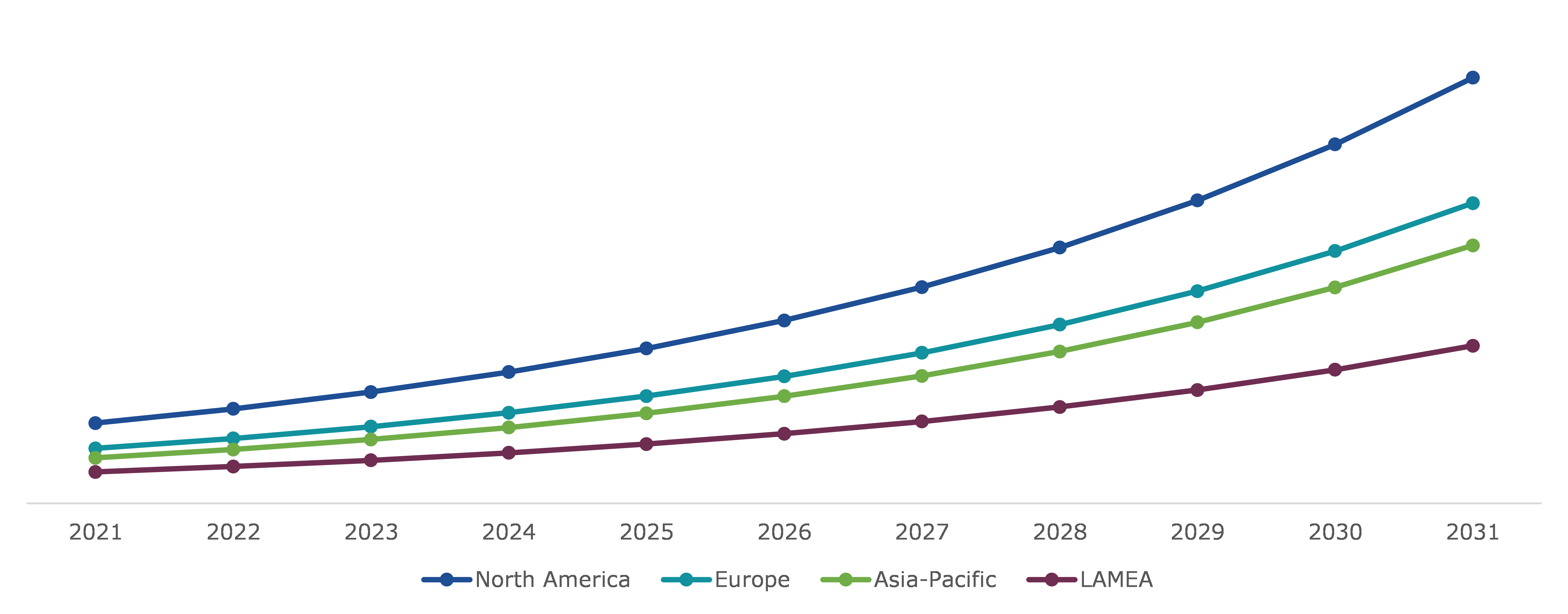

Region-wise, the North America gene synthesis market accounted for a dominating market share in 2021. The regional growth is majorly attributed to extensive research going on in the field of DNA and gene synthesis, synthetic biology and more by the researchers.

Gene Synthesis Overview

Gene synthesis is the chemical synthesis of a DNA strand. Unlike cell- or PCR-based DNA replication, gene synthesis does not require a template strand. Instead, as nucleotides are added to a single-stranded molecule over the course of gene synthesis, it acts as a template for the creation of a complimentary strand. Gene synthesis is the pillar technology on which the field of synthetic biology is based. Nucleic acids perform a wide range of biological tasks, from mediating cell-cell communication and encoding proteins to controlling gene expression in the nucleus and constructing biofilms from extracellular DNA. To examine these roles, synthetic genes are used by researchers and scientists.

COVID-19 Impact on Global Gene Synthesis Market

The COVID-19 pandemic has had both positive and negative impact on the gene synthesis industry. In the initial time of pandemic, the cell and gene therapy (CGT) sector experienced severe disruption as a result of the coronavirus 2019 (COVID-19), which has presented significant challenges in the supply of materials, production, and logistics operations. The majority of enterprises and research projects worldwide ended at the beginning of the COVID-19 pandemic as a result of the rising SARS-CoV-2 infection rate, which also decreased demand for gene synthesizers in the market and their usage in laboratories.

As the pandemic progressed and the demand for vaccines increased significantly, globally, the use of gene synthesis techniques had been adopted by researchers and scientists to study the physiology of viral genome on human DNA. Such factors have driven the gene synthesis market share growth in the pandemic era.

Growing Prevalence of Diseases Globally Projected to Drive Market Growth

Due to the increasing frequency of infectious diseases worldwide, the need for effective drugs and vaccine has increased and this has triggered the researchers and scientists to pace up their research activities and develop effective treatment options for diseases like cancer and tumors. Chemical medications and biological treatments, such as gene therapy, are effective treatments for certain disorders. The treatment of endemic and infectious diseases has improved thanks to the use of genomics. It also enables to comprehend new drug resistance and find potential targets for vaccinations and novel therapies. Since it can be treated with recombinant DNA technology, DNA & RNA ribozyme, and single chain antibodies, gene therapy has drawn the attention of many researchers for the treatment of infectious disorders. All such factors are likely to drive global gene synthesis market share growth in the forecast time period.

To know more about global gene synthesis market drivers, get in touch with our analysts here.

High Cost of Gene Synthesis to Restrain Market Growth

The difficulties in using gene synthesis techniques and the high cost of the process in some places may limit their development, which would restrain the gene synthesis market share growth. Also, high levels of competitiveness in the medical technology sector and lengthy lead times for ways to obtain desired genes can also pose difficulties for the market's expansion. Gene synthesis provides new methods for DNA editing and synthesis that make it easier to change biological agents and systems. These technologies make it possible to create disease or toxin DNA that might be accidentally or purposefully misapplied. All such factors are likely to hinder gene synthesis market revenue growth in the forecast time period.

Scientific Advancements in the Research and Development Field in Pharmaceutical and Biotechnology Field to Drive the Market Growth

Increased next-generation sequencing research and development, government support for genomics, and rising demand for customized/personalized medicine and therapies for various chronic diseases are all factors contributing to the growth of the gene synthesis market. Personalized medicine has gained popularity in recent years because it tries to give each patient a treatment plan that is specifically designed for them based on the molecular cause of their illness.

Biological research has been transformed by gene synthesis technology. The ability to build or reprogram entire genomes and cells has freed scientists from the limitations of the traditional methods of altering one gene at a time. To expedite vaccine development, scientists can easily manufacture newly discovered viral genomes. Additionally, they can create sustainable biofuels and new cancer-fighting enzymes, increase crop yields, and lessen crops' susceptibility to common pests and plant diseases that threaten the availability of food and make the world hungrier. Apart from this, growing prevalence of new diseases across the world has boosted the researchers and scientists to pace up their research activities and understand the biology behind the infections like Zika virus and Monkey pox using gene synthesis methods and thereby developing a strong vaccine portfolio against them. All these factors are likely to propel the gene synthesis market growth in the forecast time period.

To know more about global gene synthesis market opportunities, get in touch with our analysts here.

Global Gene Synthesis Market, By Method

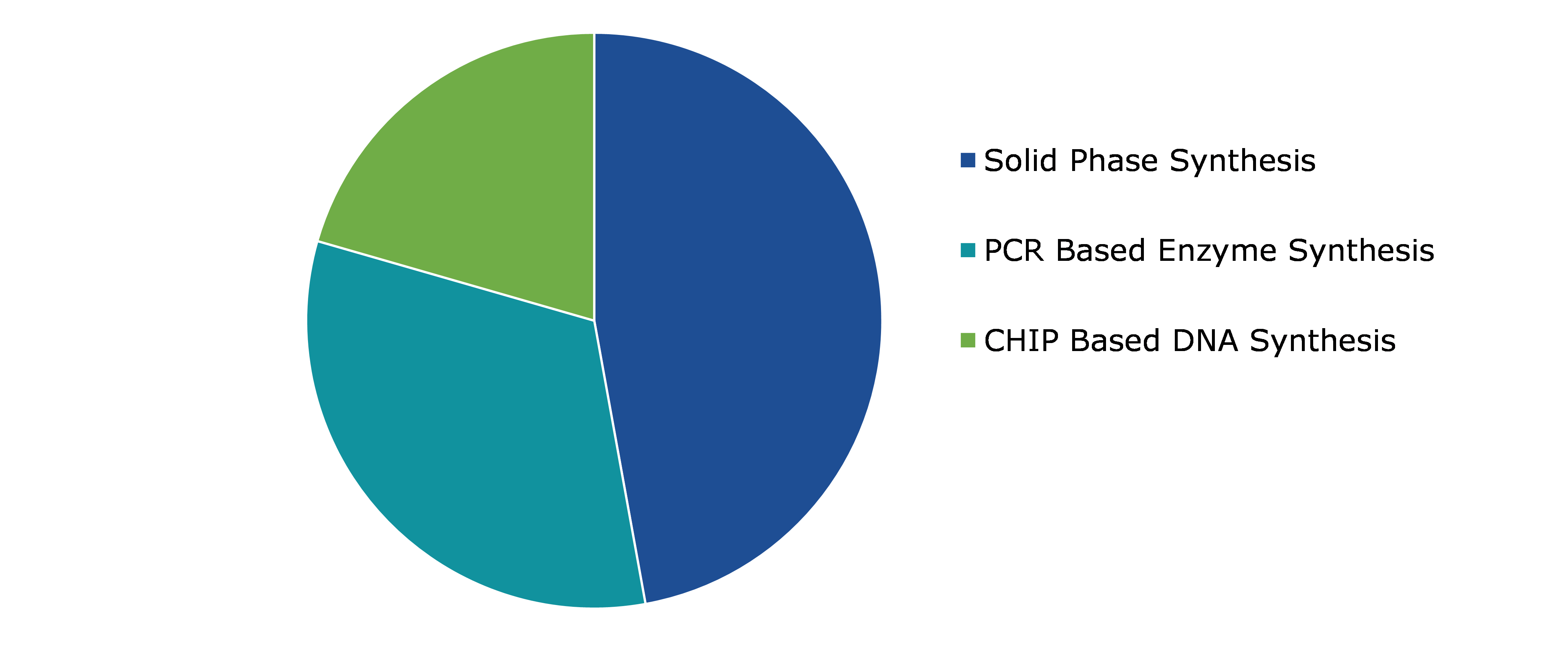

By method, the market has been divided into solid phase synthesis, PCR based enzyme synthesis, and CHIP based DNA synthesis. Among these, the solid phase synthesis segment had a dominant market share in 2021 and PCR based enzyme is anticipated to have the fastest growth in the forecast time period.

Global Gene Synthesis Market Size, by Method, 2021

Source: Research Dive Analysis

The solid phase synthesis segment accounted for a dominant market share in 2021. The term "solid phase" refers to a conventional method of producing artificial genes that has a greater accuracy rate. In the solid-phase gene synthesis process, the molecules are separately synthesized and bound in an ionic bond to a solid surface known as controlled porosity glass beads. Such factors are responsible for the growth of gene synthesis market share in the forecast time frame.

Global Gene Synthesis Market, By End User

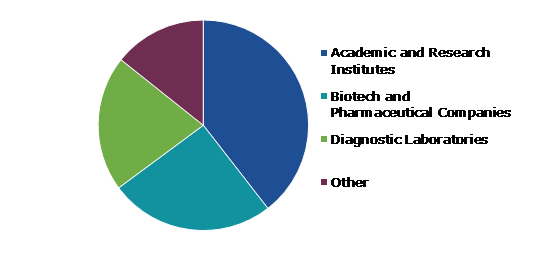

By end user, the market has been divided into academic and research institutes, biotech and pharmaceutical companies, diagnostic laboratories and other. Among these, the academic & research institutes segment had a dominant market share in 2021 and is anticipated to have the fastest growth in the forecast time period.

Global Gene Synthesis Market Growth, by End User, 2021

Source: Research Dive Analysis

The academic and research institutes segment accounted for a dominant market share in 2021. Government and academic institutions are working to develop novel therapeutics using gene synthesis techniques. This has resulted in more government support for chronic disease development sector, better gene treatment, and new technologies, as well as more research and development and enhanced usage.

Global Gene Synthesis Market, Regional Insights

The gene synthesis market was analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Global Gene Synthesis Market Size & Forecast, by Region, 2021-2031 ($Thousand)

Source: Research Dive Analysis

The Gene Synthesis Market in North America to be the Most Dominant

The North America gene synthesis market size accounted for a dominating market share in 2021. The region offers tremendous opportunity for the growth of the gene synthesis market. The market for gene synthesis is expected to grow in North America owing to the region's growing chronic disease rates, higher gene therapy, and expanded research and development on new gene-based technologies. Also, established technologically advanced research and development centers and availability of experienced researchers in the region are further anticipated to drive the market growth.

Competitive Scenario in Global Gene Synthesis Market

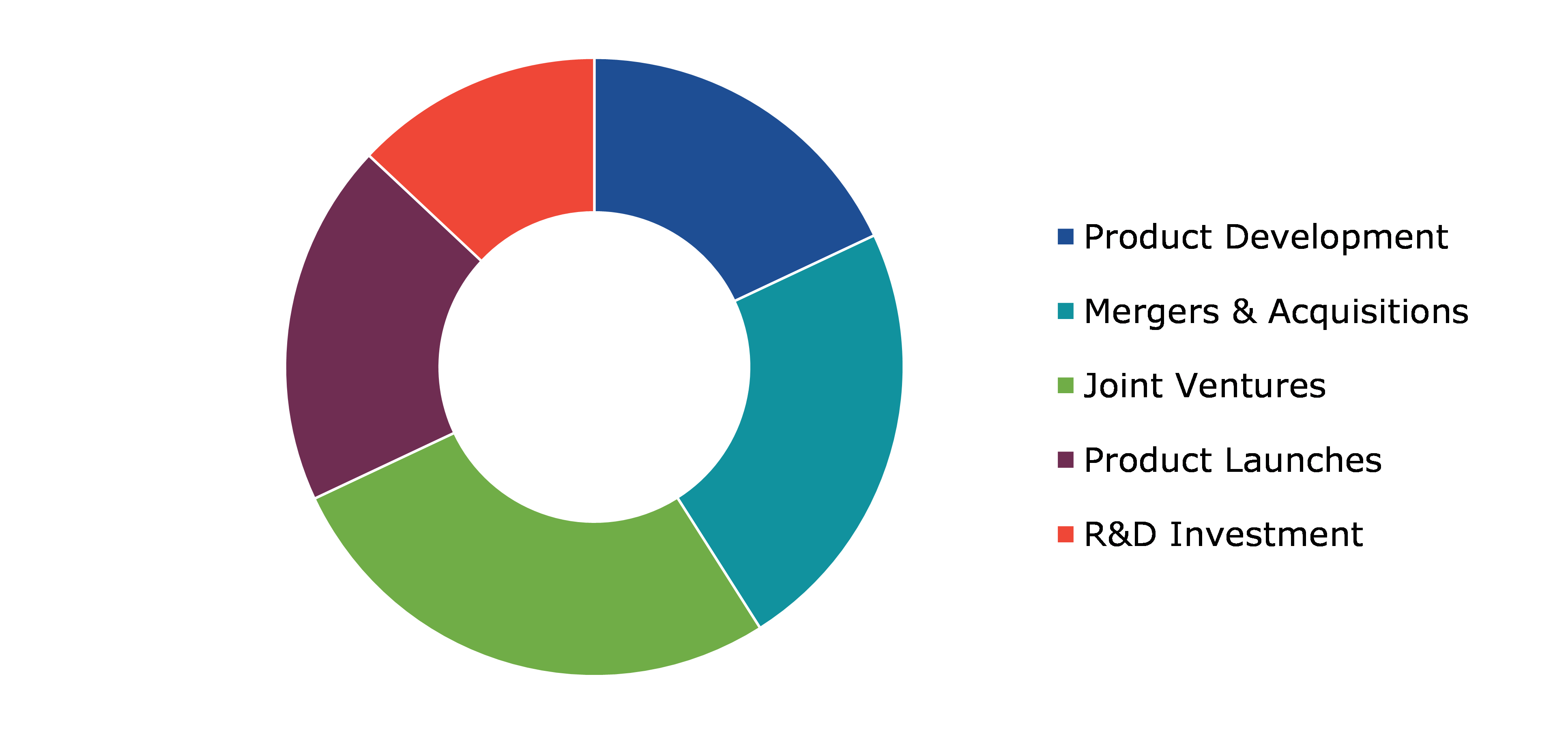

Investment and agreement are common strategies followed by major market players.

Source: Research Dive Analysis

The key players profiled in this report include Genscript Biotech Corporation, Thermo Fisher Scientific, Inc., Brooks Automation, Inc., Boster Biological Technology, Twist Bioscience Corporation, Danaher Corporation, Biomatik Corporation, ProteoGenix, ProMab Biotechnologies, Inc., and OriGene Technologies, Inc.

| Aspect | Particulars |

| Historical Market Estimations | 2020 |

| Base Year for Market Estimation | 2021 |

| Forecast Timeline for Market Projection | 2022-2031 |

| Geographical Scope | North America, Europe, Asia-Pacific, and LAMEA |

| Segmentation by Method |

|

| Segmentation by End User |

|

| Key Companies Profiled |

|

Q1. What is the size of the global gene synthesis market?

A. The global gene synthesis market size was $1,110,000 thousand in 2021 and is predicted to grow with a CAGR of 18.4%, by generating a revenue of $5,984,016.7 thousand by 2031.

Q2. Which are the major companies in the gene synthesis market?

A. Genscript Biotech Corporation, Biomatik Corporation, and ProteoGenix is the key player in the global Gene Synthesis market.

Q3. Which region, among others, possesses greater investment opportunities in the near future?

A. The Asia-Pacific region possesses great investment opportunities for investors to witness the most promising growth in the future.

Q4. What will be the growth rate of the North America gene synthesis market?

A. North America gene synthesis market is anticipated to grow at a CAGR of 18.2% during the forecast period.

Q5. What are the strategies opted by the leading players in the market?

A. Agreement and investment are the two key strategies opted by the operating companies in this market.

1.Research Methodology

1.1.Desk Research

1.2.Real time insights and validation

1.3.Forecast model

1.4.Assumptions and forecast parameters

1.5.Market size estimation

1.5.1.Top-down approach

1.5.2.Bottom-up approach

2.Report Scope

2.1.Market definition

2.2.Key objectives of the study

2.3.Report overview

2.4.Market segmentation

2.5.Overview of the impact of COVID-19 on the global gene synthesis market

3.Executive Summary

4.Market Overview

4.1.Introduction

4.2.Growth impact forces

4.2.1.Drivers

4.2.2.Restraints

4.2.3.Opportunities

4.3.Market value chain analysis

4.3.1.List of raw material suppliers

4.3.2.List of manufacturers

4.3.3.List of distributors

4.4.Innovation & sustainability matrices

4.4.1.Technology matrix

4.4.2.Regulatory matrix

4.5.Porter’s five forces analysis

4.5.1.Bargaining power of suppliers

4.5.2.Bargaining power of consumers

4.5.3.Threat of substitutes

4.5.4.Threat of new entrants

4.5.5.Competitive rivalry intensity

4.6.PESTLE analysis

4.6.1.Political

4.6.2.Economical

4.6.3.Social

4.6.4.Technological

4.6.5.Environmental

4.7.Impact of COVID-19 on the gene synthesis market

4.7.1.Pre-covid market scenario

4.7.2.Post-covid market scenario

5.Gene Synthesis Market Analysis, by Method

5.1.Overview

5.2.Solid Phase Synthesis

5.2.1.Definition, key trends, growth factors, and opportunities

5.2.2.Market size analysis, by region, 2021-2031

5.2.3.Market share analysis, by country, 2021-2031

5.3.PCR-based Enzyme Synthesis

5.3.1.Definition, key trends, growth factors, and opportunities

5.3.2.Market size analysis, by region, 2021-2031

5.3.3.Market share analysis, by country, 2021-2031

5.4.CHIP-based DNA Synthesis

5.4.1.Definition, key trends, growth factors, and opportunities

5.4.2.Market size analysis, by region, 2021-2031

5.4.3.Market share analysis, by country, 2021-2031

5.5.Research Dive Exclusive Insights

5.5.1.Market attractiveness

5.5.2.Competition heatmap

6.Gene Synthesis Market Analysis, by End User

6.1.Overview

6.2.Academic and Research Institutes

6.2.1.Definition, key trends, growth factors, and opportunities

6.2.2.Market size analysis, by region, 2021-2031

6.2.3.Market share analysis, by country, 2021-2031

6.3.Biotech and Pharmaceutical Companies

6.3.1.Definition, key trends, growth factors, and opportunities

6.3.2.Market size analysis, by region, 2021-2031

6.3.3.Market share analysis, by country, 2021-2031

6.4.Diagnostic Laboratories

6.4.1.Definition, key trends, growth factors, and opportunities

6.4.2.Market size analysis, by region, 2021-2031

6.4.3.Market share analysis, by country, 2021-2031

6.5.Others

6.5.1.Definition, key trends, growth factors, and opportunities

6.5.2.Market size analysis, by region, 2021-2031

6.5.3.Market share analysis, by country, 2021-2031

6.6.Research Dive Exclusive Insights

6.6.1.Market attractiveness

6.6.2.Competition heatmap

7.Gene Synthesis Market, by Region

7.1.North America

7.1.1.U.S.

7.1.1.1.Market size analysis, by Method, 2021-2031

7.1.1.2.Market size analysis, by End User, 2021-2031

7.1.2.Canada

7.1.2.1.Market size analysis, by Method, 2021-2031

7.1.2.2.Market size analysis, by End User, 2021-2031

7.1.3.Mexico

7.1.3.1.Market size analysis, by Method, 2021-2031

7.1.3.2.Market size analysis, by End User, 2021-2031

7.1.4.Research Dive Exclusive Insights

7.1.4.1.Market attractiveness

7.1.4.2.Competition heatmap

7.2.Europe

7.2.1.Germany

7.2.1.1.Market size analysis, by Method, 2021-2031

7.2.1.2.Market size analysis, by End User, 2021-2031

7.2.2.UK

7.2.2.1.Market size analysis, by Method, 2021-2031

7.2.2.2.Market size analysis, by End User, 2021-2031

7.2.3.France

7.2.3.1.Market size analysis, by Method, 2021-2031

7.2.3.2.Market size analysis, by End User, 2021-2031

7.2.4.Spain

7.2.4.1.Market size analysis, by Method, 2021-2031

7.2.4.2.Market size analysis, by End User, 2021-2031

7.2.5.Italy

7.2.5.1.Market size analysis, by Method, 2021-2031

7.2.5.2.Market size analysis, by End User, 2021-2031

7.2.6.Rest of Europe

7.2.6.1.Market size analysis, by Method, 2021-2031

7.2.6.2.Market size analysis, by End User, 2021-2031

7.2.7.Research Dive Exclusive Insights

7.2.7.1.Market attractiveness

7.2.7.2.Competition heatmap

7.3.Asia-Pacific

7.3.1.China

7.3.1.1.Market size analysis, by Method, 2021-2031

7.3.1.2.Market size analysis, by End User, 2021-2031

7.3.2.Japan

7.3.2.1.Market size analysis, by Method, 2021-2031

7.3.2.2.Market size analysis, by End User, 2021-2031

7.3.3.India

7.3.3.1.Market size analysis, by Method, 2021-2031

7.3.3.2.Market size analysis, by End User, 2021-2031

7.3.4.Australia

7.3.4.1.Market size analysis, by Method, 2021-2031

7.3.4.2.Market size analysis, by End User, 2021-2031

7.3.5.South Korea

7.3.5.1.Market size analysis, by Method, 2021-2031

7.3.5.2.Market size analysis, by End User, 2021-2031

7.3.6.Rest of Asia-Pacific

7.3.6.1.Market size analysis, by Method, 2021-2031

7.3.6.2.Market size analysis, by End User, 2021-2031

7.3.7.Research Dive Exclusive Insights

7.3.7.1.Market attractiveness

7.3.7.2.Competition heatmap

7.4.LAMEA

7.4.1.Brazil

7.4.1.1.Market size analysis, by Method, 2021-2031

7.4.1.2.Market size analysis, by End User, 2021-2031

7.4.2.Saudi Arabia

7.4.2.1.Market size analysis, by Method, 2021-2031

7.4.2.2.Market size analysis, by End User, 2021-2031

7.4.3.UAE

7.4.3.1.Market size analysis, by Method, 2021-2031

7.4.3.2.Market size analysis, by End User, 2021-2031

7.4.4.South Africa

7.4.4.1.Market size analysis, by Method, 2021-2031

7.4.4.2.Market size analysis, by End User, 2021-2031

7.4.5.Rest of LAMEA

7.4.5.1.Market size analysis, by Method, 2021-2031

7.4.5.2.Market size analysis, by End User, 2021-2031

7.4.6.Research Dive Exclusive Insights

7.4.6.1.Market attractiveness

7.4.6.2.Competition heatmap

8.Competitive Landscape

8.1.Top winning strategies, 2021

8.1.1.By strategy

8.1.2.By year

8.2.Strategic overview

8.3.Market share analysis, 2021

9.Company Profiles

9.1.Genscript Biotech Corporation

9.1.1.Overview

9.1.2.Business segments

9.1.3.Product portfolio

9.1.4.Financial performance

9.1.5.Recent developments

9.1.6.SWOT analysis

9.2.Thermo Fisher Scientific, Inc.

9.2.1.Overview

9.2.2.Business segments

9.2.3.Product portfolio

9.2.4.Financial performance

9.2.5.Recent developments

9.2.6.SWOT analysis

9.3.Brooks Automation, Inc.

9.3.1.Overview

9.3.2.Business segments

9.3.3.Product portfolio

9.3.4.Financial performance

9.3.5.Recent developments

9.3.6.SWOT analysis

9.4.Boster Biological Technology

9.4.1.Overview

9.4.2.Business segments

9.4.3.Product portfolio

9.4.4.Financial performance

9.4.5.Recent developments

9.4.6.SWOT analysis

9.5.Twist Bioscience Corporation

9.5.1.Overview

9.5.2.Business segments

9.5.3.Product portfolio

9.5.4.Financial performance

9.5.5.Recent developments

9.5.6.SWOT analysis

9.6.Danaher Corporation

9.6.1.Overview

9.6.2.Business segments

9.6.3.Product portfolio

9.6.4.Financial performance

9.6.5.Recent developments

9.6.6.SWOT analysis

9.7.Biomatik Corporation

9.7.1.Overview

9.7.2.Business segments

9.7.3.Product portfolio

9.7.4.Financial performance

9.7.5.Recent developments

9.7.6.SWOT analysis

9.8.ProteoGenix

9.8.1.Overview

9.8.2.Business segments

9.8.3.Product portfolio

9.8.4.Financial performance

9.8.5.Recent developments

9.8.6.SWOT analysis

9.9.ProMab Biotechnologies, Inc.

9.9.1.Overview

9.9.2.Business segments

9.9.3.Product portfolio

9.9.4.Financial performance

9.9.5.Recent developments

9.9.6.SWOT analysis

9.10.OriGene Technologies, Inc.

9.10.1.Overview

9.10.2.Business segments

9.10.3.Product portfolio

9.10.4.Financial performance

9.10.5.Recent developments

9.10.6.SWOT analysis

Gene synthesis is swiftly revolutionizing biomedical research. Gene synthesis services are significantly turning out to be a key part of current biological research processes. Gene synthesis, which is also called DNA synthesis, is the formation of gene-length double-stranded DNA fragments.

This technique is not new. The first gene was synthesized in 1970 as a part of an effort to decrypt a genetic code. Nevertheless, this technology has been accessible as a service from the year 2000. Today, gene synthesis is used to produce plasmids designed in computers, enhance gene expression, and in several other application areas.

Forecast Analysis of the Market

As per a report by Research Dive, the global gene synthesis market is expected to grow from $1,110,000 thousand in 2021 to $5,984,016.7 thousand by 2031. The market’s enormous growth is mostly owing to the mounting applications of gene synthesis in the healthcare sector. Additionally, in recombinant DNA technology, gene synthesis is extensively accepted tool that comprises recombinant protein production.

Moreover, the rising demand for gene synthesis amongst the population with genetic and chronic disorders across the globe and rising investments in the synthetic biology by government organizations and private & public companies are the factors predicted to hasten the global gene synthesis market growth. This is going to pave way for lucrative opportunities for the leading companies functioning in the market in the forthcoming years.

Gene Synthesis Market Trends and Developments

Market players are considerably investing in research and development to cater the mounting demand for gene synthesis in research activities. Some of the leading players of the gene synthesis market are Brooks Automation, Inc. (GENEWIZ), Twist Bioscience, Codex DNA, Biomatik, ProMab Biotechnologies, Inc., Boster Biological Technology, Integrated DNA Technologies, Inc., GenScript, OriGene Technologies, Inc., Thermo Fisher Scientific, Inc., and others. These players are concentrated on developing strategies, such as mergers and acquisitions, partnerships, novel developments, and collaborations to achieve a prominent position in the global market. For instance:

- In June 2019, GenScript, the global leader in offering gene synthesis services, introduced a substantial upgrade to its GenBrick™ Gene Synthesis platform, bringing scientists access to DNA sequences up to 200kb long with 100% precision.

- In November 2021, Codex DNA, Inc. (now Telesis Bio), a synthetic biology company focused on the development of automation solutions for DNA, RNA, and protein synthesis, announced the commercial availability of automated mRNA synthesis kit with integrated capping technology for BioXp™ system.

- In January 2023, Moderna, Inc., a biotechnology company pioneering mRNA therapeutics and vaccines, entered into a definitive agreement with OriCiro Genomics, a forerunner in cell-free DNA synthesis and amplification technologies, to acquire OriCiro for $85 million. With this acquisition, Moderna will obtain best-in-class tools for cell-free synthesis and amplification of plasmid DNA.

COVID-19 Impact on the Gene Synthesis Market

The abrupt rise of the coronavirus pandemic has both positively and negatively impacted the global gene synthesis market. This is mainly due to the rising usage of gene synthesis in scientific research activities. For instance, in 2020, the National Institute of Standards and Technology (NIST), unveiled that they have formed artificial gene fragments from the COVID-19 virus. The use of gene synthesis in such developments is greatly contributing to the market growth. Moreover, as the worldwide economy is recovering with the relaxation of pandemic, the use of gene synthesis in medical research projects is gaining traction. This is likely to boom the gene synthesis market in the imminent years.

Most Profitable Region

The gene synthesis market in the North America region is expected to be most dominant during the forecast period. This is mainly owing to the increasing rate of chronic diseases and higher gene therapy in the region. Besides, the expansion of research and development on new gene-based technologies and the availability of experienced researchers in the countries like the US and Canada, are the factors further anticipated to drive the regional market growth.

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com