Global Transportation Battery Recycling Market Report

RA08533

Global Transportation Battery Recycling Market by Type (Lithium-based Battery, Lead-acid Battery, Nickel-based Battery, and Others), Sources (Industrial Batteries, Automotive Batteries, Electronic Appliances Batteries, and Others), and Regional Analysis (Europe, North America, Asia-Pacific, and LAMEA): Global Opportunity Analysis and Industry Forecast, 2022-2030

Global Transportation Battery Recycling Market Analysis

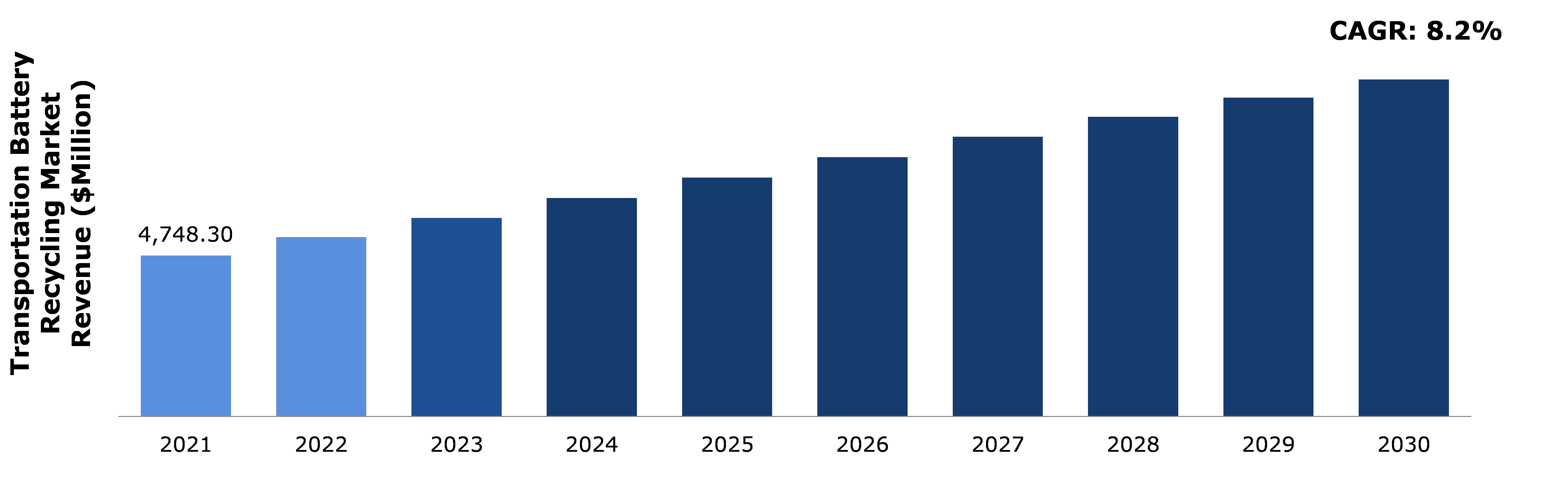

The global transportation battery recycling market size was $4,748.3 million in 2021 and is predicted to grow with a CAGR of 8.2%, by generating a revenue of $9,947.5 million by 2030.

Global Transportation Battery Recycling Market Synopsis

Transportation battery recycling market is gaining significant popularity as awareness regarding electric vehicles is increasing among people across the globe. Electric Vehicles (EVs) are cost effective compared to fuel based vehicles as the prices of fuels are increasing daily. The Government of India also started several initiatives and launched various schemes to promote EVs. The FAME-2 (Faster Adoption and Manufacturing of Hybrid and Electric Vehicle) is one of the scheme initiated by the Indian Government. In this scheme, the government allocated subsidies for manufacturers who are involved in development of EVs as well as developers of electric motors and lithium-ion batteries. The National Electric Mobility Mission Plan (NEMMP) is one of the initiatives started by the government for promotion of adoption of the electric vehicles to achieve national fuel security. Increasing adoption of electric vehicles is generating demand for the battery recycling services. These factors are estimated to boost revenue growth of the transportation battery recycling market in upcoming years.

However, some factors such as easy availability of raw materials for manufacturing new battery can decrease the demand for recycled batteries. Large supply and lower cost of raw materials used in battery manufacturing such as manganese, cobalt, nickel, and lithium, results in reduced manufacturing cost of batteries. However, recycling process of battery is costly which can affect the final cost of a recycled battery.

Battery recycling process is playing major role to protect the environment. Batteries contain harmful components such as nickel, cobalt, and manganese. These components tend to leak over the time of use. If these components can contaminate soil and water around it, if the batteries are not recycled properly. Nickel and cobalt are reusable and recyclable. In the mining process of nickel and cobalt, several toxic gases are released in atmosphere which can harm the environment. Owing to all these factors, battery recycling is an important process.

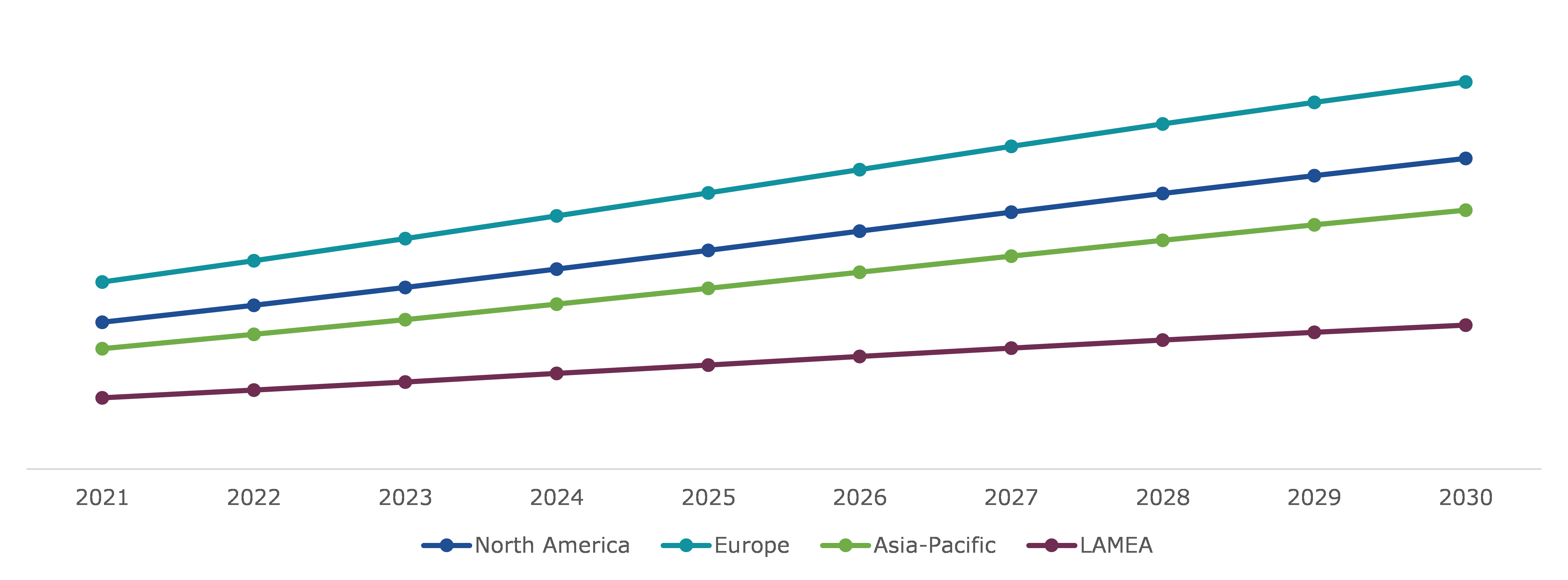

According to regional analysis, the Europe transportation battery recycling market accounted for $1,691.3 million in 2021 and is predicted to grow with a CAGR of 8.1% in the projected timeframe.

Transportation Battery Recycling Overview

In transportation vehicles, batteries such as lithium ion batteries, nickel metal hydride batteries, zinc air batteries, and lead batteries are used. Batteries used in the transportation vehicles are rechargeable. Demand for electric vehicles is increasing day by day as large number of population is adopting EVs. Batteries used in transportation vehicles contain magnesium and lithium along with cobalt and nickel. These metals have the potential to pollute water and soil, harming the ecosystem, if they are not recycled appropriately.

COVID-19 Impact on Transportation Battery Recycling Market

During the outbreak of COVID-19, many sectors were affected adversely and automobile sector was one of those which witnessed negative growth. Automobile sector is the major end-user of the batteries and their recycling process. In 2020, lockdowns were imposed around the world and restrictions on transportation as well as traveling caused decrease in demand for vehicles, which led to decrease in demand for battery recycling. Imports and exports were banned between countries which caused stoppage of manufacturing process as the raw material supply chain was disrupted.

However, in late 2021, many restrictions on traveling and transportation were withdrawn and people started to travel, which increased the demand of customers for electric vehicles as well as related services such as battery recharging and battery recycling. In 2019, under FAME-2 scheme, Indian Government allocated around $120 million (Rs.10,000 crores) for the second phase of this scheme. The National Electric Mobility Mission Plan was launched to increase awareness and promote electric vehicles and hybrid vehicles across the nation. As awareness regarding electric vehicles is rising, demand for the same is predicted to increase in near future and impact revenue growth of transportation battery recycling market in a positive manner.

Government and Initiatives to Increase Awareness Regarding Electric Vehicles and Increasing Fuel Prices are Predicted to Drive the Market Growth

Several new gigafactories for battery recycling have been built in the Europe by European businesses. For instance, Veolia, top resource management business in the U.K., announced intentions to build its first facility for recycling electric vehicle batteries in the country. In the U.K., 20% of the old EV batteries are anticipated to be processed by battery recycling businesses. By 2024, the project of building of facilities for battery recycling is expected to be completed. The global sales of the electric vehicles is predicted up to 245 million by 2030, according to the International Energy Agency (IEA). These increasing number of electric vehicles is projected to drive revenue of transportation battery recycling market growth.

Petrol and diesel are non-renewable fossil fuels which are widely used in automobiles. As these fuels available in nature they are limited. Demand for these fuels is high and supply is low, causing the rise in its prices. Electric vehicles are a better alternative as they run on batteries. People are considering electric as well as hybrid vehicles over fossil fuel based vehicles due to rise in the prices of petrol and diesel around the globe. Rising number of electric and hybrid vehicles may result in increasing demand for batteries recycling services.

Raw Materials Used in Batteries are Easily Available at a Lower Cost as Compared to Cost of Recycling of Batteries Expected to Restrain the Market Growth

Supply chain of the raw materials such as nickel, cobalt, and manganese, which are used in battery manufacturing process is very strong. As raw materials used in the manufacturing of batteries are easily available in market at a lower price in comparison to the price of battery recycling process which increases the cost of final recycled batteries. Hence, people tend to consider buying newly manufactured batteries instead of recycled batteries and this is expected to restrain growth of the transportation battery recycling market share.

Raising Awareness Regarding Environment Protection may Create Growth Opportunity for the Transportation Battery Recycling Market

Batteries used in transportation vehicles contain manganese and lithium along with cobalt and nickel. It is hazardous, if the batteries containing these components are left un-recycled. For instance, cobalt can contaminate water, and high concentration of cobalt in water can cause serious health issues such as it can even paralyze a person. Soil contamination can reduce fertility of the land and can make it barren. To avoid this, recycling of these metals as well as the batteries is considered important. This will also reduce requirement of mining nickel, cobalt, and manganese as nickel and cobalt are recyclable and reusable. In the process of mining and extraction of these metals, many toxic gases are released into nature. This can be controlled and reduced by recycling of the available batteries, which is expected to boost revenue growth of the transportation battery recycling market opportunity.

To know more about global transportation battery recycling market opportunities, get in touch with our analysts here.

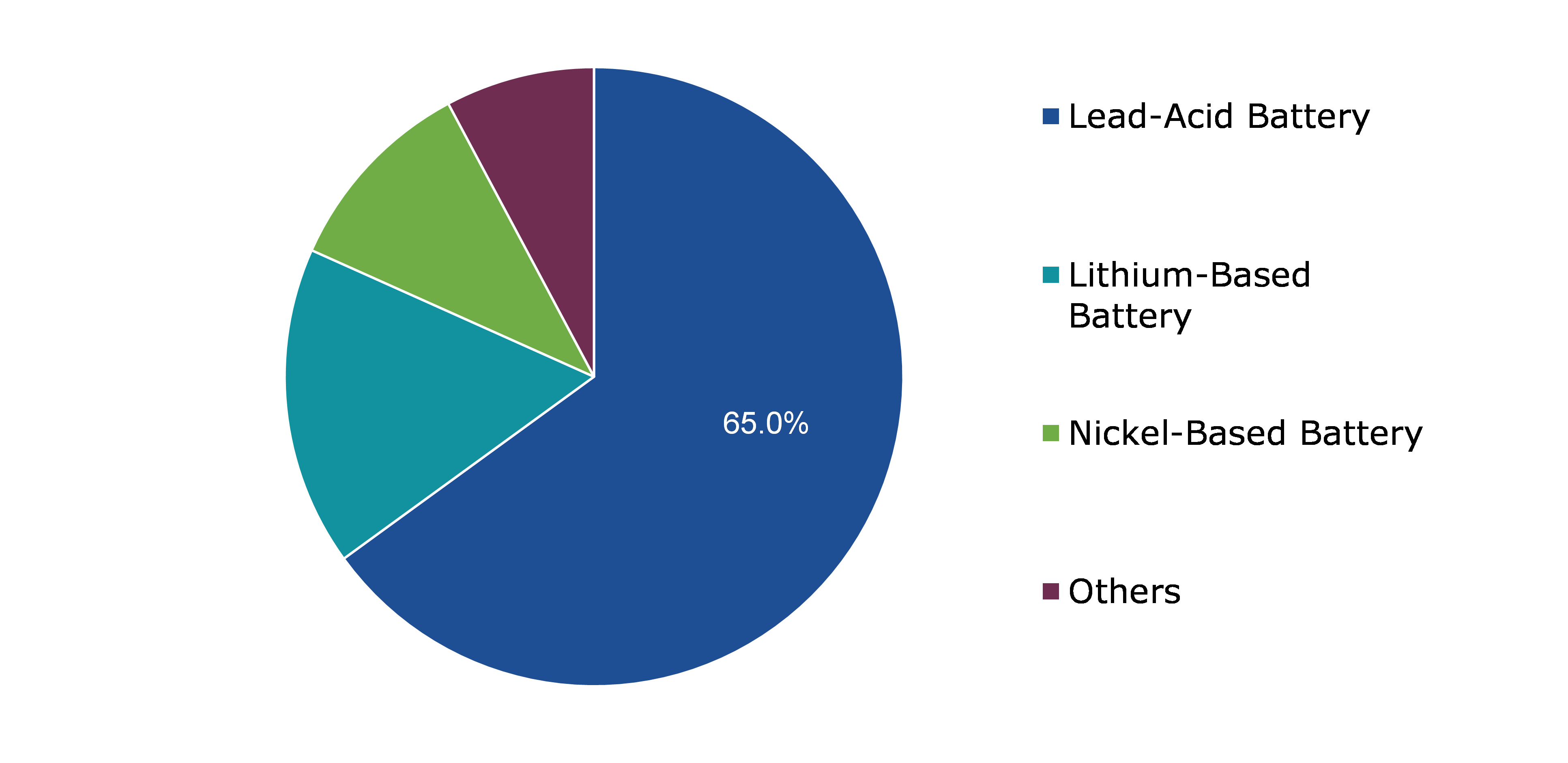

Global Transportation Battery Recycling Market, by Type

Based on type, the market is further divided into lithium-based battery, lead-acid battery, nickel-based battery, and others. Among these, lithium based battery sub-segment accounted for highest market share in 2021, whereas the lead-acid battery sub–segment is estimated to show the fastest growth during the forecast period.

Global Transportation Battery Recycling Market Share, by Type, 2021

Source: Research Dive Analysis

The lithium-based battery sub-type is anticipated to show the fastest growth and generate a revenue of $1,702.3 million by 2030, growing from $793 million in 2021. Lithium ion batteries are most commonly used in the transportation vehicles due to their ability to store large amount of energy. These batteries are light weight and compact. Lithium ion batteries are low maintenance and eco-friendly as they contain less toxic components in comparison to other battery types. Lithium batteries do not quickly self-discharge as compared to nickel based and lead-acid based batteries. Charging of lithium batteries is easy and less time consuming.

The lead-acid battery sub-type is forecasted to have dominant market share and generate a revenue of $6,517.1 million by 2030, growing from $3,086.3 million in 2021. Manufacturing cost of lead-acid batteries is low per watt in comparison to others. Manufacturing process of lead-acid batteries is less complicated as compared to lithium-ion batteries. These batteries are used in various transportation vehicles. Performance of lead-acid batteries is not affected due to temperature changes. Recycling process of lead-acid batteries is less time consuming and less complicated than lithium based batteries.

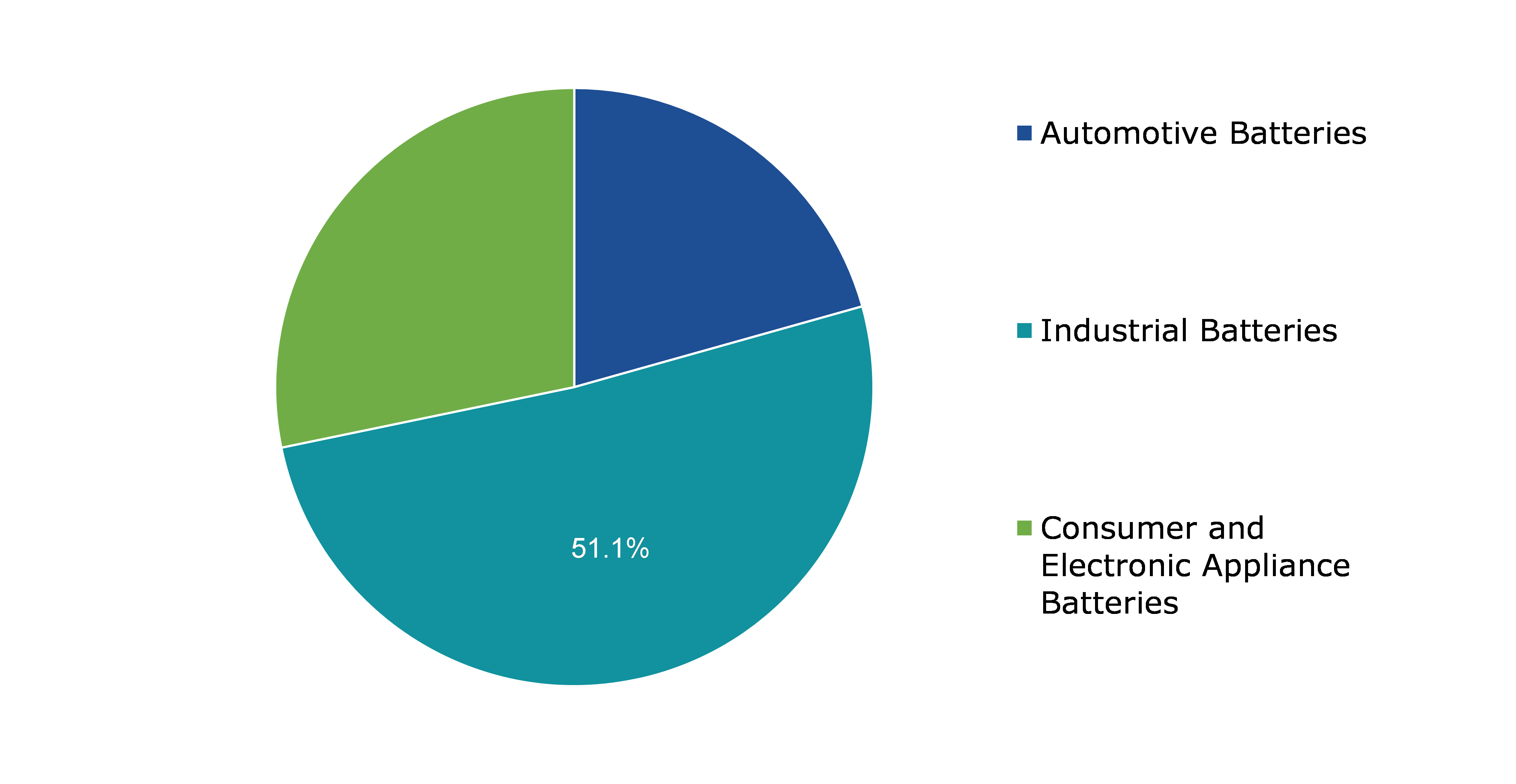

Global Transportation Battery Recycling Market, by Sources

Based on sources, the global transportation battery recycling market has been divided into industrial batteries, automotive batteries, electronic appliances batteries, and others. Among these, industrial batteries sub-segment accounted for highest revenue share in 2021, where automotive batteries sub-segment is anticipated to have the fastest growth during the forecast period.

Global Transportation Battery Recycling Market Share, by Sources, 2021

Source: Research Dive Analysis

Industrial batteries sub-segment is expected to have highest market share and generate a revenue of $5,014.3 million by 2030, growing from $2,426.6 million in 2021. Lead- acid batteries are important part in industrial applications including UPS system, emergency power backup, and in industrial automation machinery. These batteries are cost effective and perform effortlessly even under extreme temperature change. The recycling process of this battery is also simple which makes the industrial batteries sub-segment largest contributor in transportation battery recycling market.

The automotive batteries sub-segment is expected to have the fastest growth and generate a revenue of $2,101.8 million by 2030, growing from $980.4 million in 2021. The rapidly increasing use of automobiles, as well as the increasing number of government policies governing transportation battery recycling, are driving revenue growth of the transportation battery recycling market.

Global Transportation Battery Recycling Market, Regional Insights

The transportation battery recycling market was investigated across Europe, North America, Asia-Pacific, and LAMEA.

Global Transportation Battery Recycling Market Size & Forecast, by Region, 2021-2030 (USD Million)

Source: Research Dive Analysis

The Transportation Battery Recycling Market in Europe to be the Most Dominant

The transportation battery recycling market in Europe accounted $1,691.3 million in 2021 and it is projected to grow with a CAGR of 8.1%. Adoption of electric vehicles is at peak in the European countries. In 2020, the European commission announced to implement sustainability standards for developing batteries market. Leading companies such as Volkswagen, Renault, and Tesla are located in this region and may penetrate demand of advanced batteries in near future, which is projected to boost the transportation battery recycling market revenue growth.

The Transportation Battery Recycling Market in Asia-Pacific is Expected to be the Fastest Growing

The transportation battery recycling market in Asia-Pacific region accounted $1,088.3 million in 2021 and it is projected to generate $2,339.7 million revenue by 2030. Over the forecast period, the Asia-Pacific transportation battery recycling market is expected to grow at a significant rate. The Asia-Pacific transportation battery recycling market is primarily driven by strict environmental regulations, developing automotive industry, and decreased labor costs related to recycling transportation batteries.

Global Transportation Battery Recycling Market Competitive Scenario

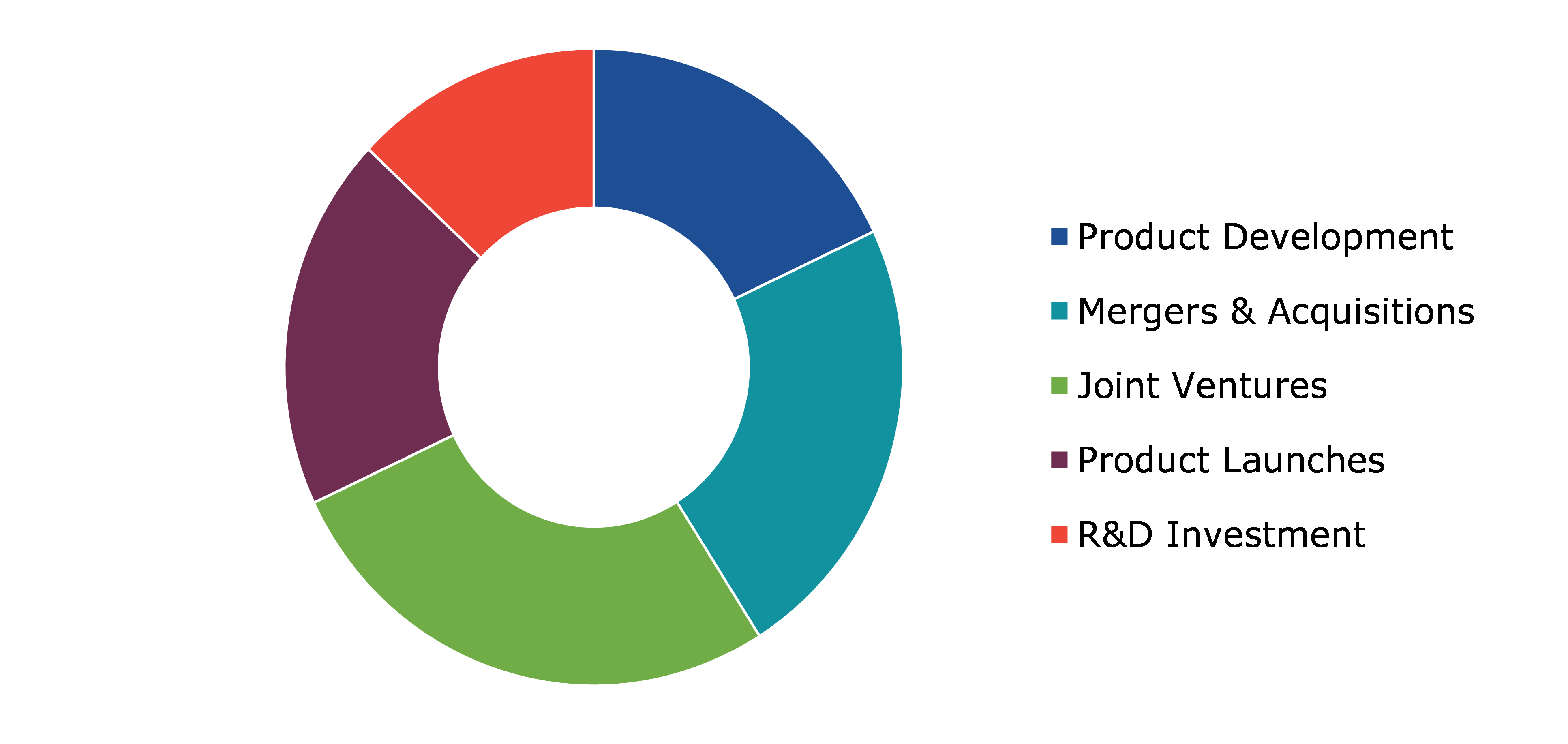

Product Innovation, product advancements, collaboration and partnerships are the common strategies followed by major market players. For instance, in November 2021 Aqua Metal, a leading innovator of metal recycling signed agreement of collaboration with LINICO Corporation to process lithium-ion battery black mass into high-quality metals.

Source: Research Dive Analysis

Some of the leading players in transportation battery recycling market are Cell2Recycle, Inc., Umicore, Aqua Metals, Inc., Exide Technologies, Battery Solutions, Contemporary Amperex Technology Co., Limited, Kochi Industries, Li-Cycle Corp, and GEM Co. Ltd.

| Aspect | Particulars |

| Historical Market Estimations | 2020-2021 |

| Base Year for Market Estimation | 2021 |

| Forecast timeline for Market Projection | 2022-2030 |

| Geographical Scope | Europe, North America, Asia-Pacific, and LAMEA |

| Segmentation by Type

|

|

| Segmentation by Source |

|

| Key Companies Profiled |

|

Q1. What is the size of the transportation battery recycling market?

A. The global transportation battery recycling market size was over $4,748.3 million in ¬¬¬2021 and is further anticipated to reach $9,947.5 million by 2030.

Q2. Which are the leading companies in the transportation battery recycling market?

A. Exide Technologies, Cell2Recycle, Inc., Umicore, and Aqua Metals are some of the key players in the global transportation battery recycling market.

Q3. Which region possesses greater investment opportunities in the coming future?

A. Europe possesses great investment opportunities for the investors to witness the most promising growth in the coming years.

Q4. What is the growth rate of the Asia-Pacific market?

A. The Asia-Pacific transportation battery recycling market is anticipated to grow at 8.5% CAGR during the forecast period.

Q5. What are the strategies opted by the leading players in this market?

A. Product innovation, product advancement, and partnership are the key strategies opted by the operating companies in this market.

Q6. Which companies are investing more on R&D practices?

A. Contemporary Amperex Technology Co., Limited and Umicore are investing more on R&D activities for developing new products and technologies.

1.Research Methodology

1.1.Desk Research

1.2.Real time insights and validation

1.3.Forecast model

1.4.Assumptions and forecast parameters

1.5.Market size estimation

1.5.1.Top-down approach

1.5.2.Bottom-up approach

2.Report Scope

2.1.Market definition

2.2.Key objectives of the study

2.3.Report overview

2.4.Market segmentation

2.5.Overview of the impact of COVID-19 on Global Transportation Battery Recycling market

3.Executive Summary

4.Market Overview

4.1.Introduction

4.2.Growth impact forces

4.2.1.Drivers

4.2.2.Restraints

4.2.3.Opportunities

4.3.Market value chain analysis

4.3.1.List of raw material suppliers

4.3.2.List of manufacturers

4.3.3.List of distributors

4.4.Innovation & sustainability matrices

4.4.1.Technology matrix

4.4.2.Regulatory matrix

4.5.Porter’s five forces analysis

4.5.1.Bargaining power of suppliers

4.5.2.Bargaining power of consumers

4.5.3.Threat of substitutes

4.5.4.Threat of new entrants

4.5.5.Competitive rivalry intensity

4.6.PESTLE analysis

4.6.1.Political

4.6.2.Economical

4.6.3.Social

4.6.4.Technological

4.6.5.Environmental

4.7.Impact of COVID-19 on Transportation Battery Recycling market

4.7.1.Pre-covid market scenario

4.7.2.Post-covid market scenario

5.Transportation Battery Recycling Market Analysis, by Type

5.1.Overview

5.2.Lithium-based Battery

5.2.1.Definition, key trends, growth factors, and opportunities, 2021-2030

5.2.2.Market size analysis, by region, 2021-2030

5.2.3.Market share analysis, by country, 2021-2030

5.3.Lead-acid Battery

5.3.1.Definition, key trends, growth factors, and opportunities, 2021-2030

5.3.2.Market size analysis, by region, 2021-2030

5.3.3.Market share analysis, by country, 2021-2030

5.4.Nickel-based Battery

5.4.1.Definition, key trends, growth factors, and opportunities, 2021-2030

5.4.2.Market size analysis, by region, 2021-2030

5.4.3.Market share analysis, by country, 2021-2030

5.5.Research Dive Exclusive Insights

5.5.1.Market attractiveness, 2021-2030

5.5.2.Competition heatmap, 2021-2030

6.Transportation Battery Recycling Market Analysis, by Sources

6.1.Industrial Batteries

6.1.1.Definition, key trends, growth factors, and opportunities, 2021-2030

6.1.2.Market size analysis, by region, 2021-2030

6.1.3.Market share analysis, by country, 2021-2030

6.2.Automotive Batteries

6.2.1.Definition, key trends, growth factors, and opportunities, 2021-2030

6.2.2.Market size analysis, by region, 2021-2030

6.2.3.Market share analysis, by country, 2021-2030

6.3.Electronic Appliances Batteries

6.3.1.Definition, key trends, growth factors, and opportunities, 2021-2030

6.3.2.Market size analysis, by region, 2021-2030

6.3.3.Market share analysis, by country, 2021-2030

6.4.Research Dive Exclusive Insights

6.4.1.Market attractiveness, 2021-2030

6.4.2.Competition heatmap, 2021-2030

7.Transportation Battery Recycling Market, by Region

7.1.North America

7.1.1.U.S.

7.1.1.1.Market size analysis, by Type, 2021-2030

7.1.1.2.Market size analysis, by Sources, 2021-2030

7.1.2.Canada

7.1.2.1.Market size analysis, by Type, 2021-2030

7.1.2.2.Market size analysis, by Sources, 2021-2030

7.1.3.Mexico

7.1.3.1.Market size analysis, by Type, 2021-2030

7.1.3.2.Market size analysis, by Sources, 2021-2030

7.1.4.Research Dive Exclusive Insights

7.1.4.1.Market attractiveness

7.1.4.2.Competition heatmap

7.2.Europe

7.2.1.Germany

7.2.1.1.Market size analysis, by Type, 2021-2030

7.2.1.2.Market size analysis, by Sources, 2021-2030

7.2.2.UK

7.2.2.1.Market size analysis, by Type, 2021-2030

7.2.2.2.Market size analysis, by Sources, 2021-2030

7.2.3.France

7.2.3.1.Market size analysis, by Type, 2021-2030

7.2.3.2.Market size analysis, by Sources, 2021-2030

7.2.4.Spain

7.2.4.1.Market size analysis, by Type, 2021-2030

7.2.4.2.Market size analysis, by Sources, 2021-2030

7.2.5.Italy

7.2.5.1.Market size analysis, by Type, 2021-2030

7.2.5.2.Market size analysis, by Sources, 2021-2030

7.2.6.Rest of Europe

7.2.6.1.Market size analysis, by Type, 2021-2030

7.2.6.2.Market size analysis, by Sources, 2021-2030

7.2.7.Research Dive Exclusive Insights

7.2.7.1.Market attractiveness

7.2.7.2.Competition heatmap

7.3.Asia Pacific

7.3.1.China

7.3.1.1.Market size analysis, by Type, 2021-2030

7.3.1.2.Market size analysis, by Sources, 2021-2030

7.3.2.Japan

7.3.2.1.Market size analysis, by Type, 2021-2030

7.3.2.2.Market size analysis, by Sources, 2021-2030

7.3.3.India

7.3.3.1.Market size analysis, by Type, 2021-2030

7.3.3.2.Market size analysis, by Sources, 2021-2030

7.3.4.Australia

7.3.4.1.Market size analysis, by Type, 2021-2030

7.3.4.2.Market size analysis, by Sources, 2021-2030

7.3.5.South Korea

7.3.5.1.Market size analysis, by Type, 2021-2030

7.3.5.2.Market size analysis, by Sources, 2021-2030

7.3.6.Rest of Asia Pacific

7.3.6.1.Market size analysis, by Type, 2021-2030

7.3.6.2.Market size analysis, by Sources, 2021-2030

7.3.7.Research Dive Exclusive Insights

7.3.7.1.Market attractiveness

7.3.7.2.Competition heatmap

7.4.LAMEA

7.4.1.Brazil

7.4.1.1.Market size analysis, by Type, 2021-2030

7.4.1.2.Market size analysis, by Sources, 2021-2030

7.4.2.Saudi Arabia

7.4.2.1.Market size analysis, by Type, 2021-2030

7.4.2.2.Market size analysis, by Sources, 2021-2030

7.4.3.UAE

7.4.3.1.Market size analysis, by Type, 2021-2030

7.4.3.2.Market size analysis, by Sources, 2021-2030

7.4.4.South Africa

7.4.4.1.Market size analysis, by Type, 2021-2030

7.4.4.2.Market size analysis, by Sources, 2021-2030

7.4.5.Rest of LAMEA

7.4.5.1.Market size analysis, by Type, 2021-2030

7.4.5.2.Market size analysis, by Sources, 2021-2030

7.4.6.Research Dive Exclusive Insights

7.4.6.1.Market attractiveness

7.4.6.2.Competition heatmap

8.Competitive Landscape

8.1.Top winning strategies, 2021

8.1.1.By strategy

8.1.2.By year

8.2.Strategic overview

8.3.Market share analysis, 2021

9.Company Profiles

9.1.Exide Technologies

9.1.1.Overview

9.1.2.Business segments

9.1.3.Type portfolio

9.1.4.Financial performance

9.1.5.Recent developments

9.1.6.SWOT analysis

9.2. Battery Solutions Inc.

9.2.1.Overview

9.2.2.Business segments

9.2.3.Type portfolio

9.2.4.Financial performance

9.2.5.Recent developments

9.2.6.SWOT analysis

9.3. Call2Recycle, Inc.

9.3.1.Overview

9.3.2.Business segments

9.3.3.Type portfolio

9.3.4.Financial performance

9.3.5.Recent developments

9.3.6.SWOT analysis

9.4. Umicore

9.4.1.Overview

9.4.2.Business segments

9.4.3.Type portfolio

9.4.4.Financial performance

9.4.5.Recent developments

9.4.6.SWOT analysis

9.5. Aqua Metals, Inc.

9.5.1.Overview

9.5.2.Business segments

9.5.3.Type portfolio

9.5.4.Financial performance

9.5.5.Recent developments

9.5.6.SWOT analysis

9.6. Contemporary Amperex Technology Co., Limited

9.6.1.Overview

9.6.2.Business segments

9.6.3.Type portfolio

9.6.4.Financial performance

9.6.5.Recent developments

9.6.6.SWOT analysis

9.7.Li-Cycle Corp.

9.7.1.Overview

9.7.2.Business segments

9.7.3.Type portfolio

9.7.4.Financial performance

9.7.5.Recent developments

9.7.6.SWOT analysis

9.8.GEM CO., Ltd.

9.8.1.Overview

9.8.2.Business segments

9.8.3.Type portfolio

9.8.4.Financial performance

9.8.5.Recent developments

9.8.6.SWOT analysis

9.9.ENERSYS.

9.9.1.Overview

9.9.2.Business segments

9.9.3.Type portfolio

9.9.4.Financial performance

9.9.5.Recent developments

9.9.6.SWOT analysis

9.10.Johnson Controls.

9.10.1.Overview

9.10.2.Business segments

9.10.3.Type portfolio

9.10.4.Financial performance

9.10.5.Recent developments

9.10.6.SWOT analysis

10.Appendix

10.1.Parent & peer market analysis

10.2.Premium insights from industry experts

10.3.Related reports

Batteries consist of toxic chemicals and heavy metals like lithium, cadmium, mercury, lead, and others than can deteriorate the environment by contaminating ground water and surface waters. Thus, an immaculate practice of reprocessing and reutilizing of batteries is carried out so as to considerably reduce the number of discarded batteries as a waste. This practice is called transportation battery recycling.

Forecast Analysis of the Global Transportation Battery Recycling Market

Extensive application of battery technology in portable electronics, grid scale energy storage, transportation, and many more is expected to drive the growth of the market during the forecast period. In addition, increasing prevalence of electric vehicle across the globe is further expected to accelerate the growth of the transportation battery recycling market during the forecast period. Moreover, growing demand for consumer electronics is expected to create tremendous opportunities for the growth of the global market during the forecast period. However, unavailability of proper collection infrastructure is expected to hinder the growth of the market during the forecast period.

According to the report published by Research Dive, the global transportation battery recycling market is expected to generate a revenue of $9,947.5 million by 2030, growing exponentially at a CAGR of 8.2% during the forecast period 2022-2030. The major players of the market include Cell2Recycle, Inc., Aqua Metals, Inc., Umicore, Exide Technologies, Contemporary Amperex Technology Co. Limited, Battery Solutions, Kochi Industries, GEM Co. Ltd., and Li-Cycle Corp.

Key Trends and Developments of the Transportation Battery Recycling Market

The key companies operating in the industry are adopting various growth strategies & business tactics such as partnerships, collaborations, mergers & acquisitions, and launches to maintain a robust position in the overall market, which is subsequently helping the global transportation battery recycling market to grow exponentially. For instance,

- In July 2021, Ecobat, a global leader in the collection, recycling, production, and distribution of batteries, acquired Promesa, a leading EV lithium-ion battery recycling operator based in Hettstedt, Germany, in order to expand Ecobat's position in Europe as a dominant player of recycling batteries of all chemistries.

- In July 2021, Li-Cycle Holdings Corp, a Canada-based battery recycling company collaborated with Helbiz, an Italian-American intra-urban micro-mobility leader, in order to create a safe and sustainable recycling solution for end-of-life lithium-ion batteries used by e-scooters and e-bikes.

- In October 2021, Heritage Battery Recycling, an innovative battery recycling company addressing sustainable solutions for lithium-ion batteries, announced the combination of their battery management and recycling business, with Retriev Technologies, the largest and most diverse lithium-ion battery processor in North America, in order to further develop a comprehensive recycling and reuse battery management platform.

Most Profitable Region of the Market

The Europe region is expected to be most dominant and grow at a CAGR of 8.1% during the forecast period. Immense presence of prominent electric vehicle manufacturers in this region is expected to drive the growth of the market. In addition, rapid adoption of sustainable activities in this region is further expected to accelerate the growth of the regional transportation battery recycling market during the forecast period.

Impact of COVID-19 on the Market

The outbreak of coronavirus has had a devastating impact on the growth of the global transportation battery recycling market, owing to the occurrence of lockdowns in numerous countries across the globe. Lockdowns adversely disrupted the supply chain and workforce due to the stringent restrictions imposed by the government on social distancing during the pandemic, in order to curb the spread of the virus. In addition, manufacturing plants of numerous automotive companies were also shut down, which decreased the sales of electric vehicles. Thus, COVID-19 has had a negative impact on the market.

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com