Electric Wheel Chair Market Report

RA08525

Electric Wheel Chair Market by Product Type (Center Wheel Drive, Rear Wheel Drive, Front Wheel Drive, Standing Electric Wheel Chairs, and Others), End-user (Homecare Settings and Hospital & Clinics), and Regional Analysis (North America, Europe, Asia Pacific, and LAMEA): Global Opportunity Analysis and Industry Forecast, 2021–2028

Global Electric Wheel Chair Market Analysis

According to the global electric wheel chair market forecast, the market size is expected to reach up to $4,817.6 million by 2028, surging from $2,598.3 million in 2020, at a noteworthy CAGR of 8.2%.

Market Synopsis

Increasing rate of occupational injuries to upsurge the global electric wheel chair market growth.

However, lower product penetration of electric wheel chair in the middle or low-income countries, may restrict the market growth.

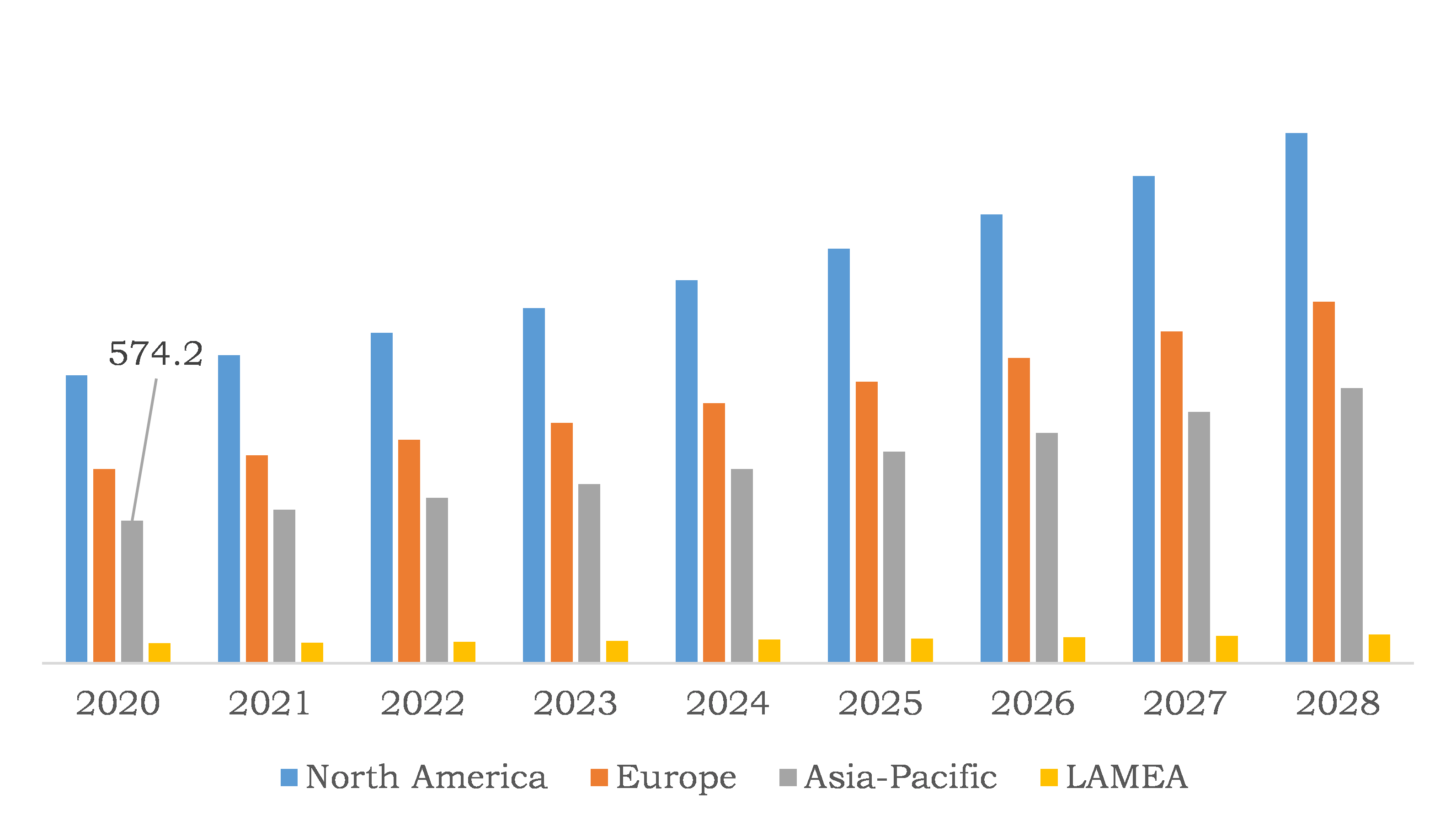

According to the regional analysis of the electric wheel chair market, the Asia- Pacific market is expected to surge at a CAGR of 8.7%, by registering a revenue of $1,108.1 million, throughout the analysis period.

Electric Wheel Chair Overview

An electric wheel chair or power wheel chair is a wheel chair that is built and works on electric motor rather than manual power. Electric wheel chair is useful and essential equipment for the elderly and impaired person. It makes their mobility easier and their life more comfortable. These wheel chairs come with advanced features including seatbelts and brakes in order to ensure the utmost safety. Also, electric wheel chairs provide joysticks for easy maneuvering.

COVID-19 Impact on Electric Wheel Chair Market

The corona virus pandemic has had significantly disrupted the growth of the industries worldwide creating a mass disturbance for sellers as well as buyers. Moreover, the global pandemic has also impacted the global electric wheel chair industry in a negative way. Furthermore, owing to multiple manufacturers namely Permobil and Ottobock SE & Co KGaA in electric wheel chair market facing challenges in supply of their products, global electric wheel chair market witnessed declined growth, during the analysis period.

However, in June 2020, team of researchers at Indian Institute of Technology, Madras ((IIT-M) announced the development of India’s 1st motorized wheel chair vehicle, called ‘NeoBolt’. These advanced wheel chairs can be used not only on plain road but even on uneven terrains. Also, this wheel chair is powered by a lithium-ion battery which has the highest speed of 25km/h. Such inventions are further projected to create enormous opportunities, in the global electric wheel chair market, post coronavirus outbreak.

Increasing Rate of Occupational Injuries to Upsurge the Market Growth

Massively growing rates of occupational injury, along with road traffic injury contribute to the high and surging rate of disability worldwide. For example, as per, world health organization (WHO), a specialized association of the United Nations (UN) responsible for the public health, almost 1.3 million people die as a result of road accidents and around 20-50 million people suffer non-fatal injuries. These facts and figures showcase the demand of wheel chairs, which may drive the global electric wheel chair market, in the forecast period.

To know more about global electric wheel chair market drivers, get in touch with our analysts here.

Lower Product Penetration in the Low-income Regions to Restrain the Market Growth

However, lack of information regarding the electric wheel chair across the middle or low-income countries may restrain the market growth of global electric wheel chair market, throughout the projected period. Further, high-cost electric wheel chair products may also negatively impact the electric wheel chair market, in the coming years.

Significant Expansion of Healthcare Establishments across the Asia-Pacific Region to Create Investment Opportunities

Asian countries such as India, Japan, China, and Singapore have experienced notable expansion of hospitals & healthcare equipment manufacturers in the recent several years. Furthermore, the extensively increasing awareness among the Asian consumers regarding enhancing the quality of life has also increased. In addition to this, burden of various chronic conditions along with geriatric population are increasing in the APAC region. Thereby the adoption and constant growth of electric wheel chair in this region have increased, which can create the market opportunities for global electric wheel chair industry, in the forecast period.

To know more about global electric wheel chair market opportunities, get in touch with our analysts here.

Based on product type, the market has been divided into Center Wheel Drive, rear wheel drive, front wheel drive, standing electric wheel chairs, and others sub-segments of which the front wheel drive sub-segment is anticipated to experience the fastest growth, throughout the analysis period. Download PDF Sample ReportElectric Wheel Chair Market

By Product Type

Source: Research Dive Analysis

The front wheel drive sub-segment is expected to have the lucrative growth in the global market and register a revenue of $939.8 million by 2028.

The extensive growth in front wheel drive type is mainly attributed to its greater stability and unmatched performance. These wheel chairs can easily navigate tight corners in the home, such as 90° turns in a hallway. Also, front wheel powered chairs are significantly used indoors mainly because of their excellent maneuverability. Such key elements are increasing the adoption of front wheel drive electric wheel chairs, in the forecast period.

The center wheel drive sub-segment held the highest share of the electric wheel chair market in 2020 and it is expected to register a revenue of $1,007.2 million by 2028.

Electric wheel chairs of center wheel drive sub-segment climb obstacles well, like small bumps and curbs. These wheel chairs have the 360 ̊ turning radius which can help in improving maneuverability for disabled patients in their home or smaller spaces. Furthermore, innovations of novel products are also expected to fuel the sub-segment’s growth, in the forecast period. For instance, in July 2020, Sunrise Medical, prominent manufacturer of mobility products namely power wheel chairs, lightweight wheel chairs, and pediatric wheel chairs, announced the official launch of the QUICKIE Q500 H, a hybrid drive power wheel chair (combination of mid and rear wheel technology). This wheel chair mainly delivers greater indoor maneuverability combined with impressive outdoor performance. Abovementioned crucial factors and advanced product development may further lead to bolster the sub-segment’s growth, in the projected period.

Electric Wheel Chair Market

By End-userBased on end-user, the market has been categorized into Homecare Settings and hospitals & clinics. Out of these, the Homecare Settings sub-segment is anticipated to garner the maximum revenue in the global market, throughout the analysis period.

Source: Research Dive Analysis

The homecare settings sub-segment of the global electric wheel chair market holds prominent share and is estimated to grow at the most notable CAGR and surpass $3,108.4 million by 2028, with a rise from $1,642.9 million in 2020.

Increasing adoption of E-commerce platform for medical equipment in the global electric wheel chair industry may create favorable conditions for homecare settings sub-segment. In addition to this, extensive growth in disabilities owing to the increase in the prevalence of chronic conditions and surge in elderly population is one of the factors accelerating the adoption of electrical wheel chairs in homecare settings to enhance the welfare of patients.

Global Electric Wheel Chair Market, Regional Insights:

The electric wheel chair market was investigated across North America, Europe, Asia-Pacific, and LAMEA.

Source: Research Dive Analysis

The Market for Electric Wheel Chair in Asia-Pacific to be the Most Lucrative

Asia-Pacific electric wheel chair market accounted $574.2 million in 2020 and is projected to generate a revenue of $1,108.1 million by 2028.

The massive support from the government authorities to fortify effective mobility aids & equipment in Asian countries, is one of the major reasons driving electric wheel chair market, in the APAC region. Also, Asia-Pacific region is backed by huge population base in countries, namely China and India, due to the enormous improvements in healthcare infrastructure. Moreover, the increasing awareness programs initiated by government as well as non-governmental bodies are contributing to the growth of the electric wheel chair market in Asia-pacific region.

The Market for Electric Wheel chair in North America to be the Most Dominant

Electric wheel chair market for North America region is highly competitive and leading companies in the market are adopting multiple strategies to garner maximum North America electric wheel chair market share. North America electric wheel chair market accounted $1,158.9 million in 2020 and is expected to register a revenue of $2,134.2 million by 2028.

This growth is due to the increased adoption of advanced wheel chairs and high target population particularly across the US and Canada. Also, the presence of prominent players and their partnership strategies will further accelerate the electric wheel chair market growth, in the projected period. In January 2021, Permobil, Inc., one of the prominent electric wheel chair manufacturers, and LUCI, the US based notable motorized wheel chair manufacturers announced partnership in order to provide LUCI’s cutting-edge smart wheel chair technology to Veterans Affairs’ (VA) rehabilitation clinics in the US.

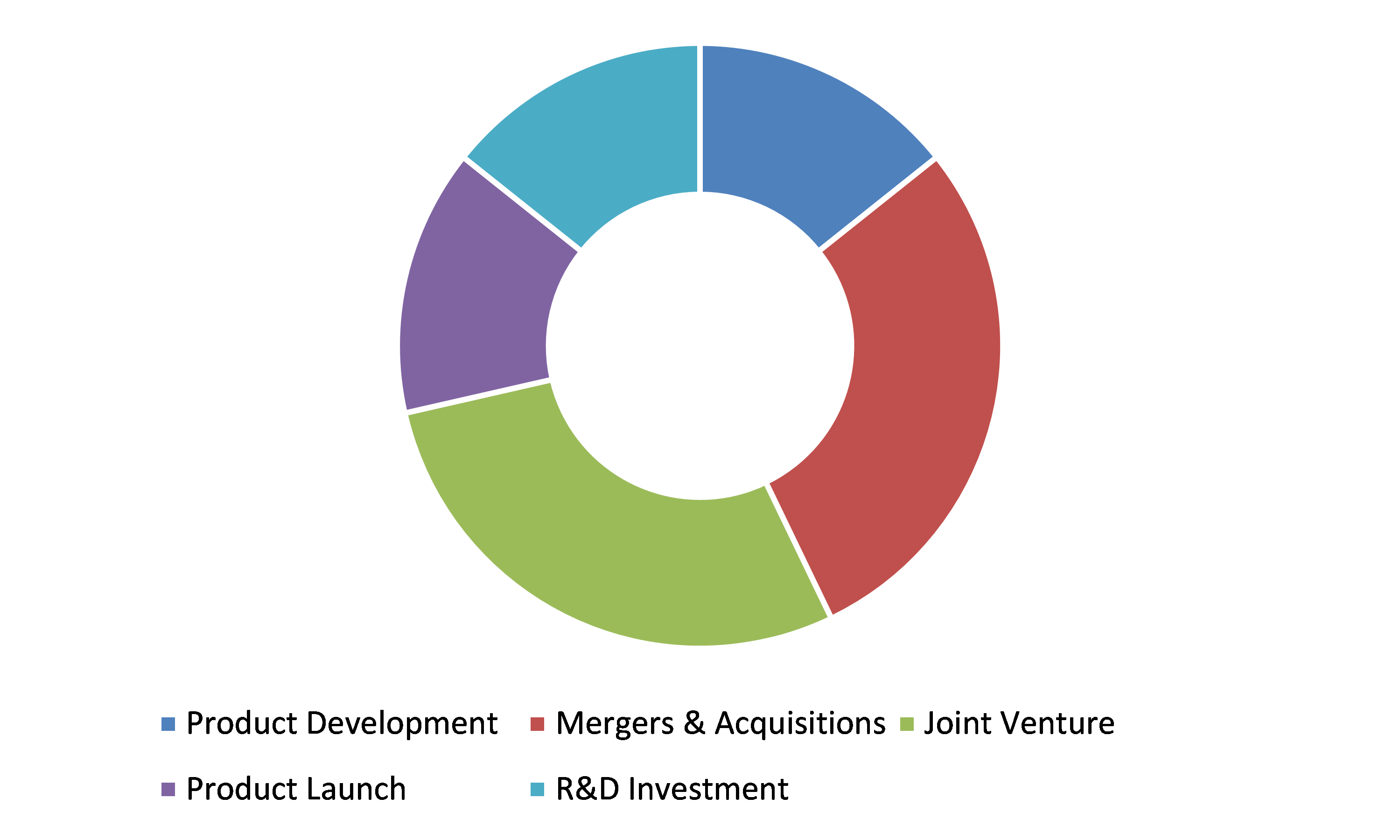

Competitive Scenario in the Global Electric Wheel Chair Market

Treatment type launches and mergers & acquisitions are common strategies followed by major market players.

Source: Research Dive Analysis

Some of the leading electric wheel chair market players are Invacare Corporation., Karma Medical Products Co., LTD. MATSUNAGA MANUFACTORY Co., Ltd., MEYRA GmbH, Miki Kogyosho Co., Ltd., NISSIN MEDICAL INDUSTRIES CO., LTD., OTTOBOCK, Permobil, Pride Mobility Products Corp., and Sunrise Medical.

Porter’s Five Forces Analysis for the Global Electric Wheel Chair Market:

- Bargaining Power of Suppliers: The suppliers operating in the global electric wheel chair market are high in number and are much larger and more globalized. So, there will be less threat from the supplier.

Thus, the bargaining power of the suppliers is low. - Bargaining Power of Buyers: Buyers demand effective electric wheel chair in lower cost. This has increased the pressure on the electric wheel chair manufacturers to offer the wheel chair in a cost-effective way. Thus, many suppliers have started offering best yet cost–effective electric wheel chair. This gives the buyers the option to freely choose electric wheel chair that best fits their preference. Thus, the bargaining power of the buyer is high.

- Threat of New Entrants: The companies entering the global electric wheel chair market are adopting technological innovations to attract customers. Also, these companies are implementing various effective strategies and there is government support in some countries.

Thus, threat of the new entrants is high. - Threat of Substitutes: There is no alternative equipment available.

Thus, the threat of substitutes is low. - Competitive Rivalry in the Market: The competitive rivalry among the industry leaders is rather intense, especially between the global players including Invacare Corporation, Pride Mobility Products Corp., and Sunrise Medical. These companies are launching their value-added services in the international market and strengthening the footprint worldwide.

Therefore, the competitive rivalry in the market is high.

| Aspect | Particulars |

| Historical Market Estimations | 2019-2020 |

| Base Year for Market Estimation | 2020 |

| Forecast timeline for Market Projection | 2021-2028 |

| Geographical Scope | North America, Europe, Asia-Pacific, LAMEA |

| Segmentation by Product type |

|

| Segmentation by End-user |

|

| Key Countries Covered | U.S., Canada, Mexico, Germany, France, UK, Italy, Spain, Russia, Rest of Europe, China, Japan, India, Australia, South Korea, Rest of Asia-Pacific, Brazil, Saudi Arabia, United Arab Emirates, Rest of LAMEA |

| Key Companies Profiled |

|

Q1. How big is the electric wheel chair market?

A. The global electric wheel chair market size was over $2,598.3 million in 2020 and is projected to reach $4,817.6 million by 2028.

Q2. Which are the major companies in the electric wheel chair market?

A. Invacare Corporation., Karma Medical Products Co., LTD., and MATSUNAGA MANUFACTORY Co., Ltd. are some of the key players in the global electric wheel chair Market.

Q3. Which region possesses greater investment opportunities in the coming future for the electric wheel chair market?

A. The Asia-Pacific region possesses great investment opportunities for the investors to witness the most promising growth in the future.

Q4. What is the growth rate of the Asia-Pacific electric wheel chair market?

A. Asia-Pacific electric wheel chair market is anticipated to grow at 8.7% CAGR during the forecast period.

Q5. What are the strategies opted by the leading players in the electric wheel chair market?

A. Capacity expansion, treatment type development, along with joint ventures are the key strategies opted by the operating companies in this market.

Q6. Which companies are investing more on R&D practices for the electric wheel chair market?

A. Pride Mobility Products Corp. and Sunrise Medical are investing more on R&D activities for developing new treatment types and technologies.

Q7. How many people use electric wheel chair?

A. According to the recent US Census data, almost 20% of the US population is suffering from some type of disability. Around 3 million US people use an electric wheel chair full-time.

Q8. What factors may limit the electric wheel chair market growth?

A. Lack of funding for wheel chairs, lack of staff capacity, and lack of skills, technology, & equipment for local manufacturing are some of the factors which may limit the market growth.

Q9. What are electric wheel chairs used for?

A. Electric wheel chair is useful and essential equipment for the elderly and impaired person. It makes their mobility easier and their life more comfortable.

Q10. What is an electric wheel chair called?

A. Electric wheel chair is a type of mobility aid that is propelled with the help of an electric motor rather than manual effort.

Q11. How does the electric wheel chair work?

A. Electric wheel chairs utilize electric motors to accelerate the wheels. They are usually powered by 4/5 amp deep-cycle rechargeable batteries.

1.Research Methodology

1.1.Desk Research

1.2.Real time insights and validation

1.3.Forecast model

1.4.Assumptions and forecast parameters

1.4.1.Assumptions

1.4.2.Forecast parameters

1.5.Data sources

1.5.1.Primary

1.5.2.Secondary

2.Executive Summary

2.1.360° summary

2.2.By product type trends

2.3.By end user trends

3.Market overview

3.1.Market segmentation & definitions

3.2.Key takeaways

3.2.1.Top investment pockets

3.2.2.Top winning strategies

3.3.Porter’s five forces analysis

3.3.1.Bargaining power of consumers

3.3.2.Bargaining power of suppliers

3.3.3.Threat of new entrants

3.3.4.Threat of substitutes

3.3.5.Competitive rivalry in the market

3.4.Market dynamics

3.4.1.Drivers

3.4.2.Restraints

3.4.3.Opportunities

3.5.Technology landscape

3.6.Regulatory landscape

3.7.Patent landscape

3.8.Pricing overview

3.8.1.by product type

3.8.2.by end user

3.9.Market value chain analysis

3.9.1.Stress point analysis

3.9.2.Raw material analysis

3.9.3.Manufacturing process

3.9.4.Distribution channel analysis

3.9.5.Operating vendors

3.9.5.1.Raw material suppliers

3.9.5.2.Product manufacturers

3.9.5.3.Product distributors

3.10.Strategic overview

4.Electric Wheel Chair Market, by Product Type

4.1.Center Wheel Drive

4.1.1.Market size and forecast, by region, 2020-2028

4.1.2.Comparative market share analysis, 2020 & 2028

4.2.Rear Wheel Drive

4.2.1.Market size and forecast, by region, 2020-2028

4.2.2.Comparative market share analysis, 2020 & 2028

4.3.Front Wheel Drive

4.3.1.Market size and forecast, by region, 2020-2028

4.3.2.Comparative market share analysis, 2020 & 2028

4.4.Standing Electric Wheelchairs

4.4.1.Market size and forecast, by region, 2020-2028

4.4.2.Comparative market share analysis, 2020 & 2028

4.5.Others

4.5.1.Market size and forecast, by region, 2020-2028

4.5.2.Comparative market share analysis, 2020 & 2028

5.Electric Wheel Chair Market, by End User

5.1.Homecare Settings

5.1.1.Market size and forecast, by region, 2020-2028

5.1.2.Comparative market share analysis, 2020 & 2028

5.2.Hospital & Clinics

5.2.1.Market size and forecast, by region, 2020-2028

5.2.2.Comparative market share analysis, 2020 & 2028

6.Electric Wheel Chair Market, by Region

6.1.North America

6.1.1.Market size and forecast, by product type, 2020-2028

6.1.2.Market size and forecast, by end user, 2020-2028

6.1.3.Market size and forecast, by country, 2020-2028

6.1.4.Comparative market share analysis, 2020 & 2028

6.1.5.U.S.

6.1.5.1.Market size and forecast, by product type, 2020-2028

6.1.5.2.Market size and forecast, by end user, 2020-2028

6.1.5.3.Comparative market share analysis, 2020 & 2028

6.1.6.Canada

6.1.6.1.Market size and forecast, by product type, 2020-2028

6.1.6.2.Market size and forecast, by end user, 2020-2028

6.1.6.3.Comparative market share analysis, 2020 & 2028

6.1.7.Mexico

6.1.7.1.Market size and forecast, by product type, 2020-2028

6.1.7.2.Market size and forecast, by end user, 2020-2028

6.1.7.3.Comparative market share analysis, 2020 & 2028

6.2.Europe

6.2.1.Market size and forecast, by product type, 2020-2028

6.2.2.Market size and forecast, by end user, 2020-2028

6.2.3.Market size and forecast, by country, 2020-2028

6.2.4.Comparative market share analysis, 2020 & 2028

6.2.5.Germany

6.2.5.1.Market size and forecast, by product type, 2020-2028

6.2.5.2.Market size and forecast, by end user, 2020-2028

6.2.5.3.Comparative market share analysis, 2020 & 2028

6.2.6.UK

6.2.6.1.Market size and forecast, by product type, 2020-2028

6.2.6.2.Market size and forecast, by end user, 2020-2028

6.2.6.3.Comparative market share analysis, 2020 & 2028

6.2.7.France

6.2.7.1.Market size and forecast, by product type, 2020-2028

6.2.7.2.Market size and forecast, by end user, 2020-2028

6.2.7.3.Comparative market share analysis, 2020 & 2028

6.2.8.Spain

6.2.8.1.Market size and forecast, by product type, 2020-2028

6.2.8.2.Market size and forecast, by end user, 2020-2028

6.2.8.3.Comparative market share analysis, 2020 & 2028

6.2.9.Italy

6.2.9.1.Market size and forecast, by product type, 2020-2028

6.2.9.2.Market size and forecast, by end user, 2020-2028

6.2.9.3.Comparative market share analysis, 2020 & 2028

6.2.10.Rest of Europe

6.2.10.1.Market size and forecast, by product type, 2020-2028

6.2.10.2.Market size and forecast, by end user, 2020-2028

6.2.10.3.Comparative market share analysis, 2020 & 2028

6.3.Asia Pacific

6.3.1.Market size and forecast, by product type, 2020-2028

6.3.2.Market size and forecast, by end user, 2020-2028

6.3.3.Market size and forecast, by country, 2020-2028

6.3.4.Comparative market share analysis, 2020 & 2028

6.3.5.China

6.3.5.1.Market size and forecast, by product type, 2020-2028

6.3.5.2.Market size and forecast, by end user, 2020-2028

6.3.5.3.Comparative market share analysis, 2020 & 2028

6.3.6.India

6.3.6.1.Market size and forecast, by product type, 2020-2028

6.3.6.2.Market size and forecast, by end user, 2020-2028

6.3.6.3.Comparative market share analysis, 2020 & 2028

6.3.7.Japan

6.3.7.1.Market size and forecast, by product type, 2020-2028

6.3.7.2.Market size and forecast, by end user, 2020-2028

6.3.7.3.Comparative market share analysis, 2020 & 2028

6.3.8.South Korea

6.3.8.1.Market size and forecast, by product type, 2020-2028

6.3.8.2.Market size and forecast, by end user, 2020-2028

6.3.8.3.Comparative market share analysis, 2020 & 2028

6.3.9.Australia

6.3.9.1.Market size and forecast, by product type, 2020-2028

6.3.9.2.Market size and forecast, by end user, 2020-2028

6.3.9.3.Comparative market share analysis, 2020 & 2028

6.3.10.Rest of Asia Pacific

6.3.10.1.Market size and forecast, by product type, 2020-2028

6.3.10.2.Market size and forecast, by end user, 2020-2028

6.3.10.3.Comparative market share analysis, 2020 & 2028

6.4.LAMEA

6.4.1.Market size and forecast, by product type, 2020-2028

6.4.2.Market size and forecast, by end user, 2020-2028

6.4.3.Market size and forecast, by country, 2020-2028

6.4.4.Comparative market share analysis, 2020 & 2028

6.4.5.Latin America

6.4.5.1.Market size and forecast, by product type, 2020-2028

6.4.5.2.Market size and forecast, by end user, 2020-2028

6.4.5.3.Comparative market share analysis, 2020 & 2028

6.4.6.Middle East

6.4.6.1.Market size and forecast, by product type, 2020-2028

6.4.6.2.Market size and forecast, by end user, 2020-2028

6.4.6.3.Comparative market share analysis, 2020 & 2028

6.4.7.Africa

6.4.7.1.Market size and forecast, by product type, 2020-2028

6.4.7.2.Market size and forecast, by end user, 2020-2028

6.4.7.3.Comparative market share analysis, 2020 & 2028

7.Company profiles

7.1. Invacare Corporation.

7.1.1.Business overview

7.1.2.Financial performance

7.1.3.Product portfolio

7.1.4.Recent strategic moves & developments

7.1.5.SWOT analysis

7.2.Karma Medical Products Co., LTD.

7.2.1.Business overview

7.2.2.Financial performance

7.2.3.Product portfolio

7.2.4.Recent strategic moves & developments

7.2.5.SWOT analysis

7.3.MATSUNAGA MANUFACTORY Co., Ltd.

7.3.1.Business overview

7.3.2.Financial performance

7.3.3.Product portfolio

7.3.4.Recent strategic moves & developments

7.3.5.SWOT analysis

7.4.MEYRA GmbH

7.4.1.Business overview

7.4.2.Financial performance

7.4.3.Product portfolio

7.4.4.Recent strategic moves & developments

7.4.5.SWOT analysis

7.5.Miki Kogyosho Co., Ltd.

7.5.1.Business overview

7.5.2.Financial performance

7.5.3.Product portfolio

7.5.4.Recent strategic moves & developments

7.5.5.SWOT analysis

7.6.NISSIN MEDICAL INDUSTRIES CO., LTD.

7.6.1.Business overview

7.6.2.Financial performance

7.6.3.Product portfolio

7.6.4.Recent strategic moves & developments

7.6.5.SWOT analysis

7.7.OTTOBOCK

7.7.1.Business overview

7.7.2.Financial performance

7.7.3.Product portfolio

7.7.4.Recent strategic moves & developments

7.7.5.SWOT analysis

7.8.Permobil

7.8.1.Business overview

7.8.2.Financial performance

7.8.3.Product portfolio

7.8.4.Recent strategic moves & developments

7.8.5.SWOT analysis

7.9.Pride Mobility Products Corp.

7.9.1.Business overview

7.9.2.Financial performance

7.9.3.Product portfolio

7.9.4.Recent strategic moves & developments

7.9.5.SWOT analysis

7.10.Sunrise Medical

7.10.1.Business overview

7.10.2.Financial performance

7.10.3.Product portfolio

7.10.4.Recent strategic moves & developments

7.10.5.SWOT analysis

Electric wheel chair, also known as electric-powered wheelchair (EPW) or power wheel chair is a wheelchair powered by an electric motor. This wheel chair consists of one or more rechargeable batteries. Electric wheel chair reduces manual activity as it does not require any human assistance for moving the wheelchair. It is useful and essential equipment for the impaired and elderly people as the wheel chair makes their mobility easier. Electric wheel chairs come with advanced features, such as brakes and seatbelts to ensure the utmost safety. Besides, these wheel chairs provide joysticks for easy maneuvering.

COVID-19 Impact on Electric Wheel Chair Market

The outbreak of COVID-19 across the globe has drastically impacted the global electric wheel chair market growth. The negative growth of the market is majorly owing to the multiple manufacturers namely Ottobock SE & KGaA and Permobil in the electric wheel chair market facing challenges in the supply of their products. In addition, the reduction in manufacturing of power wheel chair and the focus of healthcare staff to support COVID-19 departments has hugely impacted the market growth during the period of coronavirus crisis.

However, various key companies of the electric wheel chair market are coming up with novel strategies to sustain in the global industry. For instance, in March 2020, Invacare Corporation launched ‘Invacare AVIVA FX Power Wheel Chair,’ which is built with LiNX Technology. Such strategic steps are expected to help the market witness prominent growth post-coronavirus pandemic crisis.

Electric Wheel Chair Market Trends and Developments

The companies operating in the global industry are adopting several growth strategies and business tactics such as partnerships, collaboration, business expansion, and product launches to obtain a leading position in the global industry, which is predicted to drive the global electric wheel chair market growth in the upcoming years.

For instance, in January 2021, Permobil, Inc., the wholesaler of surgical and medical equipment, and LUCI Mobility, an accessory for power wheelchairs, entered into a partnership to provide the groundbreaking smart wheelchair technology of LUCI through Permobil’s industry-leading clinical education & commercial organization to rehabilitation clinics of Veterans Affairs (VA) in the United States.

In February 2021, Sunrise Medical, the leading designer and manufacturer of mobility products, announced the launch of the new ‘QUICKIE Q300 M Mini,’ which is the narrowest power wheelchair to complement the company’s QUICKIE power portfolio. The Q300 will easily maneuver as its ultra-narrow base can go through a narrow doorway, or crowded restaurant.

In August 2021, Invacare Corporation, the leading manufacturer & distributor of non-acute medical equipment, announced the launch of the ‘Invacare AVIVA STORM RX’ electric wheelchair and set a new standard for the rear-wheel drive power mobility. According to the company, the AVIVA STORM RX is the next generation of Invacare power mobility products and an innovative development the in rear-wheel drive power wheelchairs.

Forecast Analysis of Global Market

The global electric wheel chair market is projected to witness an exponential growth over the forecast period, owing to the notable expansion of hospitals & healthcare infrastructure in the recent several years. Conversely, the lack of public charging infrastructure is expected to hamper the market growth in the projected timeframe.

The increasing rates of occupational injury along with road traffic and the increasing burden of chronic conditions among people around the world are the significant factors and electric wheel chair market trends estimated to bolster the growth of the global market in the coming future. According to a latest report published by Research Dive, the global electric wheel chair market is expected to garner $4817.6 million during the forecast period (2021-2028). Regionally, the North America market is estimated to observe dominant growth by 2028, owing to the growing adoption of advanced wheel chairs and the presence of prominent market players in the region.

The key players functioning in the global market include

- Invacare Corporation,

- MATSUNAGA MANUFACTORY Co., Ltd.,

- Karma Medical Products Co., LTD.,

- MEYRA GmbH,

- NISSIN MEDICAL INDUSTRIES CO., LTD.,

- Miki Kogyosho Co., Ltd.,

- OTTOBOCK,

- Pride Mobility Products Corp.,

- Permobil,

- Sunrise Medical.

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com