Optical Detector Market Report

RA08510

Optical Detector Market by Type (Extrinsic and Intrinsic), Sensor Type (Fiber Optic Sensor, Image Sensor, Photoelectric Sensor, and Ambient Light & Proximity Sensor), End-use (Automotive, Medical, Consumer Electronics, Industrial, and Others), and Regional Analysis (North America, Europe, Asia-Pacific, and LAMEA): Global Opportunity Analysis and Industry Forecast, 2022–2030

Global Optical Detector Market Analysis

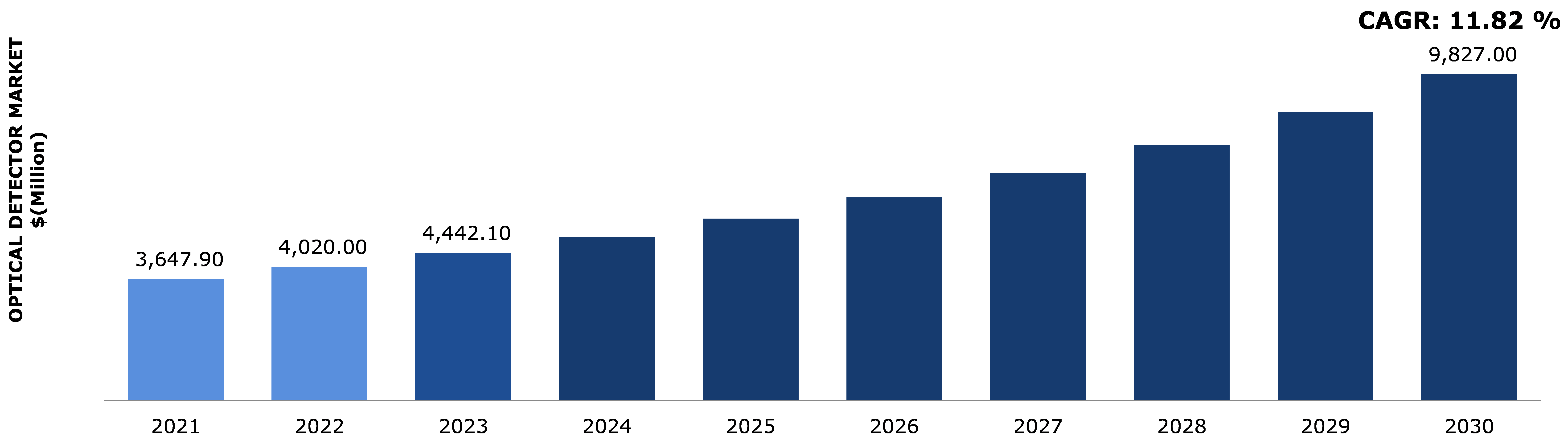

The global optical detector market is predicted to garner $9,827.00 million in the 2022-2030 timeframe, growing from $3,647.90 million in 2021, at a healthy CAGR of 11.82%.

Market Synopsis

Strategic alliances among market players, along with technical advancements, acquisitions, and collaborations in the market, are driving the global optical detector market. The rising popularity of smart wearable gadgets in mature economies is supposed to drive sales in the optical detector market. Fitbits, smartwatches, pulse oximeters, and other wearable health monitors are now being merged with sensing devices and provide real-time patient's medical monitoring services. These detectors have just a number of benefits, including high precision, easy handling, and no reaction to electromagnetic waves, makes them perfect to be used in medical-grade wearable technology. According to a Pew Research Center survey from January 2020, roughly 21% of U.S. adults wear wearable technology or wearable fitness trackers on a regular basis; as a result, market participants introduce technically advanced products with optical sensing devices to meet the increasing demands for wearable healthcare devices. All such factors will drive the global optical detector market.

However, high manufacturing cost of optical detector along with raw material cost might be a growth-restricting factor for the market. Moreover, optical detectors have a number of disadvantages, including the fact that ambient light can interfere with their operation, - long-term stability is limited to indicator leaching or light absorption, dynamic range may be limited, selectivity might be poor, and that an analytical signal requires a charge transfer of the electrolyte from the specimen into the identifier phase. All such factors will limit the growth of optical detector market.

According to the regional analysis, the Asia-Pacific optical detector market is anticipated to grow during the review period with revenue of $9827 million and a CAGR of 11.82% due to increasing popularity of advanced technologies in the region.

Optical Detector Overview

A transducer that converts an optical signal into an electrical signal is known as an optical detector (photo detectors, photo sensors,). Light impulses are converted into electrical signals by an optical detector, which can then be amplified and analyzed. Such detectors, which are one of the most important types of an optical fiber communication system, determine the performance of a fiber optic communication link. The increased demand for photo sensors in industries of both developing and developed nations such as manufacturing, pharmaceuticals, and others is creating the way of growth for the market.

A gadget that converts light waves into an electronic signal is known as an optical detector. The purpose of an optical sensor is to quantify a physical quantity of light, and depending on type of detector, translate this into a shape that a developing capacity device could really read. Optical detectors are used for contact-free component detection, counting, and positioning. Optical detector, both internal and external, can be used. Inner sensors are usually used to measure curves and other slight changes in direction, whereas outer sensors gather as well as transmit the requisite amount of light.

Impact Analysis of COVID-19 on the Global Optical Detector Market

The COVID-19 pandemic significantly harmed the growth prospects of photoelectric sensor market companies in the first half of 2020. Several manufacturing plants, including those in the automotive, packaging, and logistics industries, went out of business in 2020. Consumer demand dwindled, international trade restrictions were imposed, and supply chains got disrupted, limiting market potential even further. Automotive and transportation are important end-use industries for industrial sensors. Many countries, including the United States, China, Japan, and South Korea have halted automotive production as a result of the COVID-19 epidemic. This is expected to reduce optical sensor demand and have a significant impact on market growth over the forecast period.

The COVID-19 pandemic has had a major impact on the semiconductor industry, limiting demand for sensing devices. Global semiconductor sales fell by 3.6%in the first quarter of 2020, according to the Semiconducting Industry Group, due to significant disruptions in international supply-chain activities caused by the COVID-19 pandemic. Furthermore, as a result of various governments' lockdown scenarios, several major automotive and consumer electronics OEMs have ceased manufacturing operations, resulting in a drop in optical sensor sales. The aforementioned factors indicate that the pandemic may have had a minor impact on the optical detector market.

However, coronavirus (COVID-19) remains a significant public health issue that affects people all over the world. It has become a necessity to discover a method for rapidly quantitative measurements monoclonal antibody in order to evaluate the specific immune system required to fight against COVID-19 and evaluate the effects of vaccinations. Photo sensors are useful in video imaging, optics, biomedical imaging, safety, infrared night, gas sensors, and motion sensors because they can precisely convert light into electrical signals.

These factors are expected to positively impact the market growth.

Extensive use of Optical Detector Sensors in Different Industries is one of the Major Driving Factors of the Growth

During the projected period, the market is likely to be driven by the increasing use of photo detectors in various sectors. Currently, the demand for sensors that offer precise output is continuously increasing from different industries. These sensors should be able to detect objects of different sizes and sense all kinds of materials. They should possess a long-sensing range, must be cost-effective, and have a long life. As manufacturers focus on increasing their production efficiency without hampering the quality of products, the demand for these photoelectric sensors is continuously increasing. A defect in the production process may lead to huge losses. This leads manufacturers to adopt photoelectric sensors in their production or assembly lines. For instance, photoelectric sensors are used for detecting the size of products, spotting faults in them, counting small objects, and checking misaligned caps on bottles in the food & beverages industry. In the printing and packaging industry, photoelectric sensors can detect colors by independently scanning red, green, and blue lights. They are used to monitor large areas with light grids. In the transportation industry, photoelectric sensors are used to evaluate the position and measure the distance of objects. In the logistics and materials handling industry, robotic pickers or trucks rely on photoelectric sensors for efficient and safe operations. Automatic doors and elevators also use these sensors to detect the presence of individuals or count them. Volkswagen, BMW Group, Daimler, Audi AG, and other prominent OEMs in the region are putting a strong emphasis on ADAS (advanced driver-assistance systems) and self-driving cars. Several government regulations encouraging the installation of automobile safety systems in vehicles will also lead to auto industry embrace optical sensors. In the near future, the rapidly increasing demand for portable barcode scanners in the retail industry is expected to fuel the demand for highly efficient photodiode sensors. Barcode scanning systems assist businesses in tracking a large volume of data. The adoption of photoelectric sensors is increasing in the industrial sector owing to the growing focus of manufacturers on increasing their productivity and reducing their manual work to remain competitive in the global market.

To know more about global optical detector market drivers, get in touch with our analysts here.

The Price Competitiveness of the Market Will Restrain the Growth of the Market

For manufacturers or system vendors, many industrial sensors are custom-made. It is not yet a commodity. The specifications for a sensor change depending on the application, which raises the cost of a sensor, and sensor producers are unable to minimize the cost due to a lack of mass production. Sensor producers, on the other hand, are expected to supply the greatest technology at a cheaper cost by OEMs. As a result, sensor makers face increased pricing pressure, forcing them to reduce earnings.

Growing Application Area of the Optical Detector Will Create Growth Opportunities for the Market

The market is being driven by ongoing technological breakthroughs in optical detector, as well as the ease of access to great quality and affordable optical fibers and optoelectronic parts that aid in the evolution of optical detector for biological applications. The growing need for advanced smartphone security features such as fingerprint scans on-screen and a detector in optical sensor that detects and confirms fingerprints being added to the market is driving the market growth. Another factor driving the market's growth is the rising demand for sensors with applications in intelligent lighting, which assists in saving energy. Sensing devices that can survive extreme environments and give high precision are required in numerous industrial areas such as aerospace & defense, healthcare, and others. All of these properties are provided by optical sensors, resulting in the exponential rise of their market. They improve lighting and heating systems while also assisting in cost reduction through effective energy consumption reduction. Market expansion is aided by innovation and advances.

Furthermore, consumer electronic devices, such as smartphones, tablets, and laptops, are being outfitted with optical sensors for a variety of applications, including device security, gesture recognition, and facial recognition. Furthermore, rising demand for on-screen finger-print sensor technology in smartphones will provide additional growth opportunities for the market. In addition to this, optical detectors are used for a variety of applications, such as laptops and motion sensors. In order to sustain their responsiveness to the property being evaluated, detection systems will be of the right type for the application. Detections are found in a variety of everyday devices, such as computer systems, photocopier computers, and light fittings that turn forward instantly when it’s dark. A few of the more typical uses include burglar alarms, synchro for photographic flashes, and systems that detect the presence of objects. All such factors bring new opportunities in the market.

To know more about global optical detector market opportunities, get in touch with our analysts here.

Global Optical Detector Market, by Type

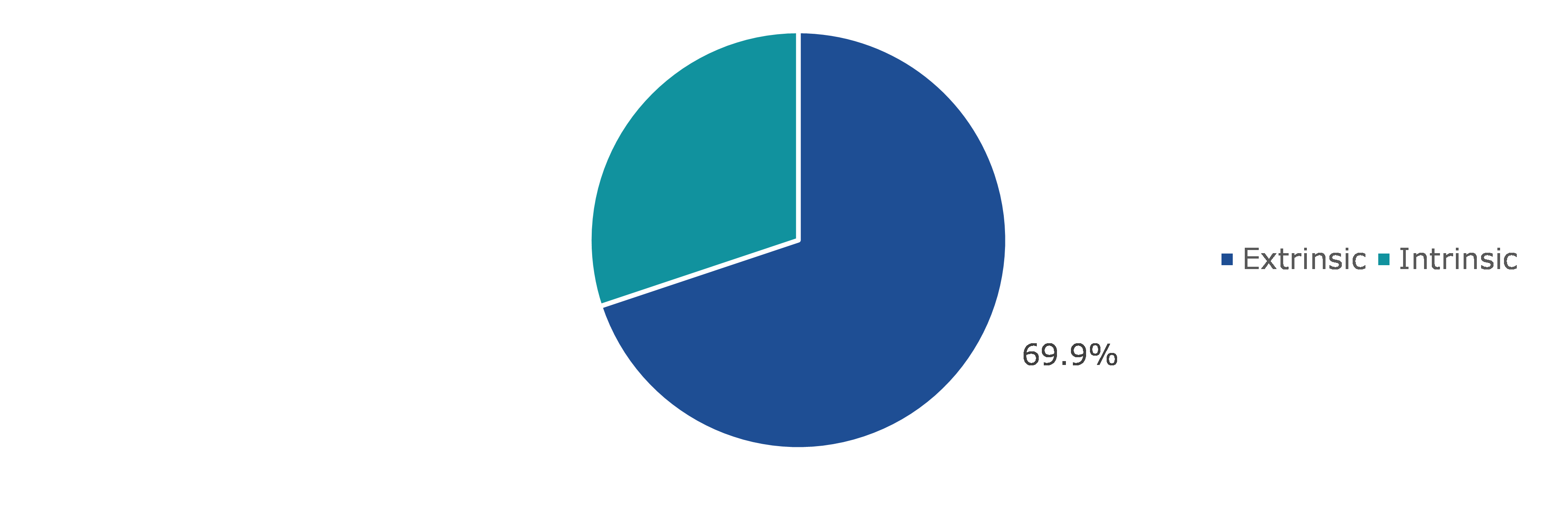

Based on type, the market has been divided into extrinsic and intrinsic. Extrinsic sub-segment accounted for the highest revenue share in 2021 and is predicted to show the fastest growth during the forecast period.

Global Optical Detector Market Share, By Type, 2021

Source: Research Dive Analysis

The extrinsic optical detector sub-segment is predicted to have a dominating market share in the global market and register a revenue of $7,103.10 million during the forecast period. Extrinsic detector transmits modulated light from a conventional sensor, such as a resistance thermometer, via a fiber-optic cable, which is typically multimode. Extrinsic detector’s ability to reach places that are otherwise inaccessible is a key feature that makes it useful in such a wide range of applications. One example is the installation of fiber-optic cables into aircraft jet engines to measure temperature by transmitting radiation to a radiation pyrometer located far away from the engine. In the same way, fiber-optic cable can be used to measure the internal temperature of electrical transformers, where extreme electromagnetic fields make other measurement techniques impossible. Extrinsic detectors have a significant advantage in that they provide excellent noise protection to measurement signals. Unfortunately, the output of many sensors is not in a form that can be transmitted via fiber-optic cable, so conversion must occur prior to transmission. These factors and strategic alliances may bolster the growth of the sub-segment during the forecast period.

Global Optical Detector Market, by Sensor Type

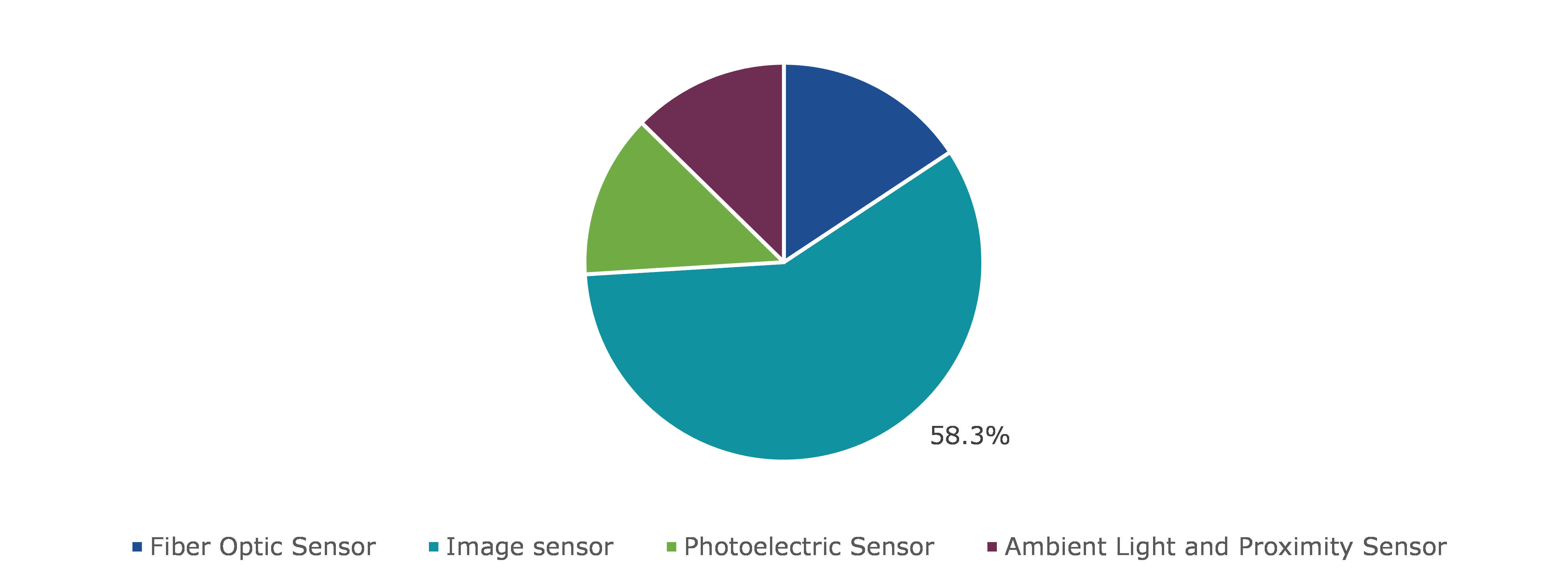

On the basis of sensor type, the analysis has been divided into fiber optic sensor, image sensor, photoelectric sensor, and ambient light & proximity sensor. Image sensor sub-segment is predicted to be the most dominant and fiber optic sensor anticipated to show the fastest growth during the forecast period.

Global Optical Detector Market Share, By Sensor Type, 2021

Source: Research Dive Analysis

The image sensor sub-segment of the global optical detector market is projected to have the dominating share and surpass $5,553.00 million by 2030, with an increase from $2,128.00 million in 2021. One of the primary factors driving the growth of the image sensor is the increasing number of cameras used in mobile devices such as smartphones and tablets. As camera features and image quality become more important in smartphones, increased adoption of cameras in artificial intelligence (AI), augmented reality (AR), and virtual reality (VR) applications, as well as in autonomous automobiles, is likely to open up new revenue streams for image sensor manufacturers. The increasing use of sensor technology in automobiles drives the image sensor sub-segment. They can be found in automated driving (ADAS), driver recording systems, driver monitoring systems, blind-spot detection systems, night vision systems, eMirrors, cabin monitoring systems, surrounding view systems, and parking assistance systems. The increasing use of ADAS in automobiles is one of the major factors driving the growth of the global optical detector market. Sensor technology is used in these systems to ensure safe driving, provide parking assistance, avoid collisions, and issue lane-departure warnings.

Global Optical Detector Market, by End-use

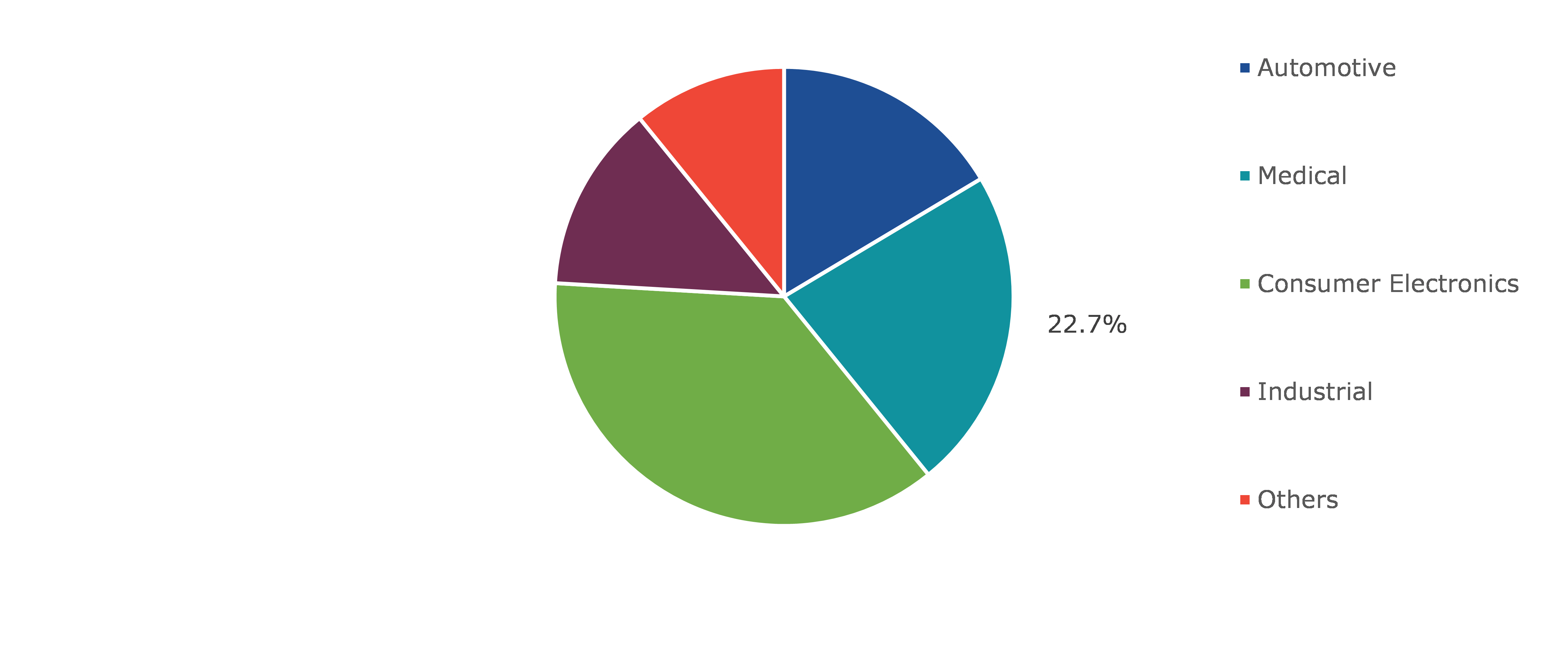

Based on end-use, the segment is further divided into automotive, medical, consumer electronics, industrial, and others. Among these consumer electronics sub-segment is predicted to be the most dominant sub-segment and medical sub-segment is anticipated to have the fastest growth during the forecast period.

Global Optical Detector Market Share, By End-Use, 2021

Source: Research Dive Analysis

The medical sub-segment of the global optical detector market is projected to have the fastest growth and surpass $2,475.3 million by 2030, with an increase from $829.2 million in 2021. Photo detectors serve as the foundation for ambient sensors and image sensors, in consumer devices, spectrometry, bio imaging, food & production performance monitoring, and a broad range of other devices and applications. The growing the using sensing devices in smart healthcare such as biosensors extrinsic for continuous heart-rate monitoring, heart variance, and oxygen levels will drive market growth. During the forecast period, factors such as high market for smart gadgets in the health sector and a surge in demand for IoT devices will start driving market growth.

Global Optical Detector Market, Regional Insights:

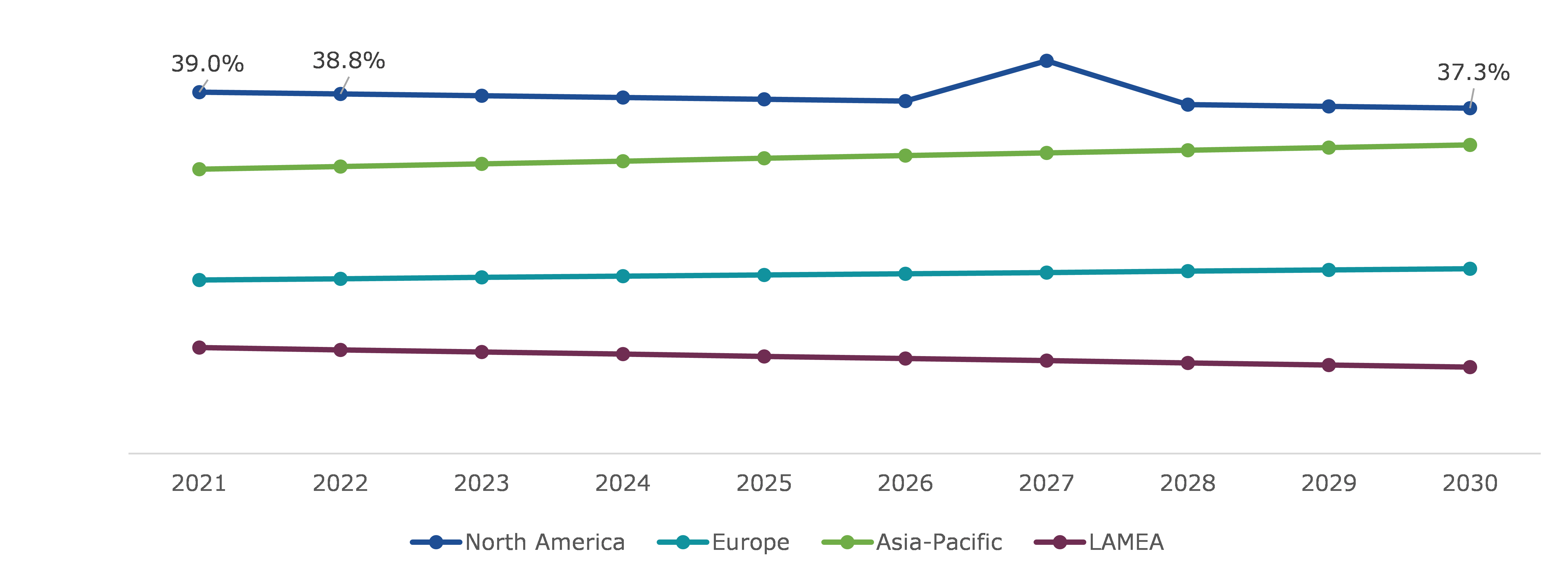

The optical detector market was investigated across North America, Europe, Asia-Pacific, and LAMEA.

Global Optical Detector Market Size & Forecast, By Region, 2021-2030 (USD Million)

Source: Research Dive Analysis

The Market for Optical Detector in Asia-Pacific to be the Fastest Growing

The Asia-Pacific optical detector market is fastest growing market by registering a revenue of $3,278.3 million by 2030, growing at a CAGR of 12.84%. Optical detectors are used in a variety of industries, including healthcare, metrology, imaging & remote sensing, robotics, and cars. Photo sensors analyze and report data using lasers, imaging systems, and optical fibers. The Asia-Pacific region produces a lot of consumer electronics, especially smartphones and tablets, which contain restore recognition and 3D mapping, which are two of the biggest drivers of optical detectors market growth in the region. To provide huge sensor arrays and a wide dynamic sensing range, sensors are being engineered to be extremely tiny, passive, and lightweight. Various measures are being implemented by governments around the region to develop and expand local manufacturing industries. In July 2020, the South Korean government invested $414 million to boost the number of smart factories in the country. In recent years, technologies such as AI and IoT in these factories have gained enormous traction, resulting in a surge in demand for optical detectors in the region.

Furthermore, In Japan and China, automobile manufacturers are incorporating more sensors in low-cost vehicles in response to rising consumer safety concerns in ASEAN countries. Light sensors are expected to be in high demand in the near future as a result of this. Additionally, in India, increasing emphasis on the adoption of technologies such as internet of Things (IoT) and face recognition, as well as regulatory changes in emerging markets to increase security across different industry verticals, are driving up deployment of light sensors, boosting the region's industry growth. According to the government, in December 2019, China implemented new regulations requiring Chinese telecom carriers to scan the faces of users registering for new mobile phone services. Light sensor market growth is being fueled by such regulations. Such factors display that the demand for optical detectors going to increase exponentially in the upcoming years.

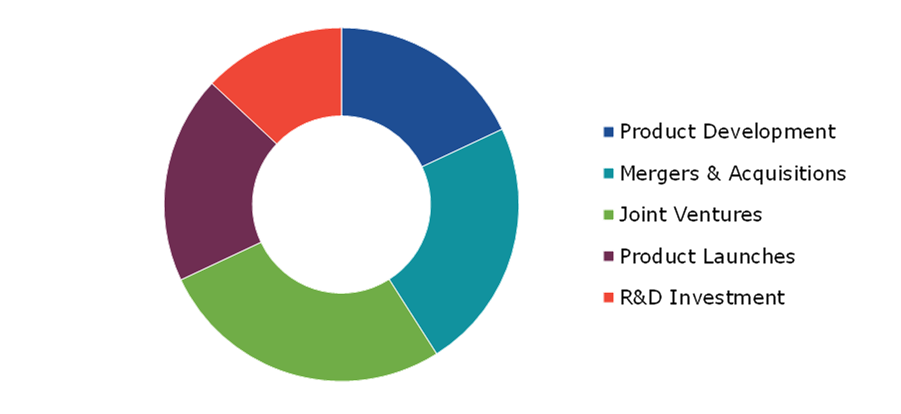

Competitive Scenario in the Global Optical Detector Market

Product launches and mergers & acquisitions are common strategies followed by major market players.

Source: Research Dive Analysis

Some of the leading optical detector market players are ams AG., ROHM Semiconductor, Hamamatsu Photonics K.K., Analog Devices Inc., STMicroelectronics, Vishay Intertechnology, Inc., Excelitas Technologies Corp., Leuze electronic GmbH + Co. KG, Semiconductor Types Industries, LLC., and Fotech Extrinsics Limited.

| Aspect | Particulars |

| Historical Market Estimations | 2019-2020 |

| Base Year for Market Estimation | 2021 |

| Forecast Timeline for Market Projection | 2022-2030 |

| Geographical Scope | North America, Europe, Asia-Pacific, LAMEA |

| Segmentation by Type |

|

| Segmentation by Sensor type |

|

| Segmentation by End-use |

|

| Key Companies Profiled |

|

Q1. What is the size of the global optical detector market?

A. The size of the global optical detector market was over $3,647.90 million in 2021 and is projected to reach $9,827.00 million by 2030.

Q2. Which are the major companies in the optical detector market?

A. ams AG. and ROHM Semiconductor, are some of the key players in the global optical detector market.

Q3. Which region, among others, possesses greater investment opportunities in the near future?

A. The Asia-Pacific region possesses great investment opportunities for investors to witness the most promising growth in the future.

Q4. What will be the growth rate of the Asia-Pacific optical detector market?

A. Asia-Pacific optical detector market is anticipated to grow at 12.84% CAGR during the forecast period.

Q5. What are the strategies opted by the leading players in this market?

A. Technological development and strategic partnerships are the key strategies opted by the operating companies in this market.

Q6. Which companies are investing more on R&D practices?

A. ams AG. and ROHM Semiconductor are investing more on R&D activities for developing new products and technologies.

1.Research Methodology

1.1.Desk Research

1.2.Real time insights and validation

1.3.Forecast model

1.4.Assumptions and forecast parameters

1.5.Market size estimation

1.5.1.Top-down approach

1.5.2.Bottom-up approach

2.Report Scope

2.1.Market definition

2.2.Key objectives of the study

2.3.Report overview

2.4.Market segmentation

2.5.Overview of the impact of COVID-19 on Global Optical detector market

3.Executive Summary

4.Market Overview

4.1.Introduction

4.2.Growth impact forces

4.2.1.Drivers

4.2.2.Restraints

4.2.3.Opportunities

4.3.Market value chain analysis

4.3.1.List of raw material suppliers

4.3.2.List of manufacturers

4.3.3.List of distributors

4.4.Innovation & sustainability matrices

4.4.1.Technology matrix

4.4.2.Regulatory matrix

4.5.Porter’s five forces analysis

4.5.1.Bargaining power of suppliers

4.5.2.Bargaining power of consumers

4.5.3.Threat of substitutes

4.5.4.Threat of new entrants

4.5.5.Competitive rivalry intensity

4.6.PESTLE analysis

4.6.1.Political

4.6.2.Economical

4.6.3.Social

4.6.4.Technological

4.6.5.Environmental

4.7.Impact of COVID-19 on Optical detector market

4.7.1.Pre-covid market scenario

4.7.2.Post-covid market scenario

5.Optical detector Market Analysis, by Type

5.1.Overview

5.1.1.Market size and forecast, by Type

5.2.Extrinsic

5.2.1.Market size and forecast, by region, 2022-2030

5.2.2.Comparative market share analysis, 2022 & 2030

5.3.Intrinsic

5.3.1.Market size and forecast, by region, 2022-2030

5.3.2.Comparative market share analysis, 2022 & 2030

5.4.Research Dive Exclusive Insights

5.4.1.Market attractiveness

5.4.2.Competition heatmap

6.5.Optical detector Market, by Sensor type

6.1.Overview

6.1.1.Market size and forecast, by Sensor type

6.2.Fiber Optic Sensor

6.2.1.Market size and forecast, by region, 2022-2030

6.2.2.Comparative market share analysis, 2022 & 2030

6.3.Image sensor

6.3.1.Market size and forecast, by region, 2022-2030

6.3.2.Comparative market share analysis, 2022 & 2030

6.4.Photoelectric Sensor

6.4.1.Market size and forecast, by region, 2022-2030

6.4.2.Comparative market share analysis, 2022 & 2030

6.5.Ambient Light and Proximity Sensor

6.5.1.Market size and forecast, by region, 2022-2030

6.5.2.Comparative market share analysis, 2022 & 2030

6.6.Research Dive Exclusive Insights

6.6.1.Market attractiveness

6.6.2.Competition heatmap

7.5.Optical detector Market, by End-Use

7.1.Overview

7.1.1.Market size and forecast, by End-Use

7.2.Automotive

7.2.1.Market size and forecast, by region, 2022-2030

7.2.2.Comparative market share analysis, 2022 & 2030

7.3.Medical

7.3.1.Market size and forecast, by region, 2022-2030

7.3.2.Comparative market share analysis, 2022 & 2030

7.4.Consumer Electronics

7.4.1.Market size and forecast, by region, 2022-2030

7.4.2.Comparative market share analysis, 2022 & 2030

7.5.Industrial

7.5.1.Market size and forecast, by region, 2022-2030

7.5.2.Comparative market share analysis, 2022 & 2030

7.6.Others

7.6.1.Market size and forecast, by region, 2022-2030

7.6.2.Comparative market share analysis, 2022 & 2030

7.7.Research Dive Exclusive Insights

7.7.1.Market attractiveness

7.7.2.Competition heatmap

8.5.Optical detector Market, by Region

8.1.North America

8.1.1.U.S.

8.1.2.Market size and forecast, by Type, 2022-2030

8.1.3.Market size and forecast, by Sensor type, 2022-2030

8.1.4.Market size and forecast, by Distribution Channel, 2022-2030

8.1.5.Canada

8.1.6.Market size and forecast, by Type , 2022-2030

8.1.7.Market size and forecast, by Sensor type , 2022-2030

8.1.8.Market size and forecast, by End-use, 2022-2030

8.1.9.Mexico

8.1.10.Market size and forecast, by Type , 2022-2030

8.1.11.Market size and forecast, by Sensor type , 2022-2030

8.1.12.Market size and forecast, by End-use, 2022-2030

8.1.13.Research Dive Exclusive Insights

8.1.13.1.Market attractiveness

8.1.13.2.Competition heatmap

8.2.Europe

8.2.1.Germany

8.2.2.Market size and forecast, by Type , 2022-2030

8.2.3.Market size and forecast, by Sensor type , 2022-2030

8.2.4.Market size and forecast, by End-use, 2022-2030

8.2.5.UK

8.2.6.Market size and forecast, by Type , 2022-2030

8.2.7.Market size and forecast, by Sensor type , 2022-2030

8.2.8.Market size and forecast, by End-use, 2022-2030

8.2.9.France

8.2.10.Market size and forecast, by Type , 2022-2030

8.2.11.Market size and forecast, by Sensor type , 2022-2030

8.2.12.Market size and forecast, by End-use, 2022-2030

8.2.13.Spain

8.2.14.Market size and forecast, by Type , 2022-2030

8.2.15.Market size and forecast, by Sensor type , 2022-2030

8.2.16.Market size and forecast, by End-use, 2022-2030

8.2.17.Italy

8.2.18.Market size and forecast, by Type , 2022-2030

8.2.19.Market size and forecast, by Sensor type , 2022-2030

8.2.20.Market size and forecast, by End-use, 2022-2030

8.2.21.Rest of Europe

8.2.22.Market size and forecast, by Type , 2022-2030

8.2.23.Market size and forecast, by Sensor type , 2022-2030

8.2.24.Market size and forecast, by End-use, 2022-2030

8.2.25.Research Dive Exclusive Insights

8.2.25.1.Market attractiveness

8.2.25.2.Competition heatmap

8.3.Asia Pacific

8.3.1.China

8.3.2.Market size and forecast, by Type , 2022-2030

8.3.3.Market size and forecast, by Sensor type , 2022-2030

8.3.4.Market size and forecast, by End-use, 2022-2030

8.3.5.Japan

8.3.6.Market size and forecast, by Type , 2022-2030

8.3.7.Market size and forecast, by Sensor type , 2022-2030

8.3.8.Market size and forecast, by End-use, 2022-2030

8.3.9.India

8.3.10.Market size and forecast, by Type , 2022-2030

8.3.11.Market size and forecast, by Sensor type , 2022-2030

8.3.12.Market size and forecast, by End-use, 2022-2030

8.3.13.Australia

8.3.14.Market size and forecast, by Type , 2022-2030

8.3.15.Market size and forecast, by Sensor type , 2022-2030

8.3.16.Market size and forecast, by End-use, 2022-2030

8.3.17.South Korea

8.3.18.Market size and forecast, by Type , 2022-2030

8.3.19.Market size and forecast, by Sensor type , 2022-2030

8.3.20.Market size and forecast, by End-use, 2022-2030

8.3.21.Rest of Asia Pacific

8.3.22.Market size and forecast, by Type , 2022-2030

8.3.23.Market size and forecast, by Sensor type , 2022-2030

8.3.24.Market size and forecast, by End-use, 2022-2030

8.3.25.Research Dive Exclusive Insights

8.3.25.1.Market attractiveness

8.3.25.2.Competition heatmap

8.4.LAMEA

8.4.1.Brazil

8.4.2.Market size and forecast, by Type , 2022-2030

8.4.3.Market size and forecast, by Sensor type , 2022-2030

8.4.4.Market size and forecast, by End-use, 2022-2030

8.4.5.Saudi Arabia

8.4.6.Market size and forecast, by Type , 2022-2030

8.4.7.Market size and forecast, by Sensor type , 2022-2030

8.4.8.Market size and forecast, by End-use, 2022-2030

8.4.9.UAE

8.4.10.Market size and forecast, by Type , 2022-2030

8.4.11.Market size and forecast, by Sensor type , 2022-2030

8.4.12.Market size and forecast, by End-use, 2022-2030

8.4.13.South Africa

8.4.14.Market size and forecast, by Type , 2022-2030

8.4.15.Market size and forecast, by Sensor type , 2022-2030

8.4.16.Market size and forecast, by End-use, 2022-2030

8.4.17.Rest of LAMEA

8.4.18.Market size and forecast, by Type , 2022-2030

8.4.19.Market size and forecast, by Sensor type , 2022-2030

8.4.20.Market size and forecast, by End-use, 2022-2030

8.4.21.Research Dive Exclusive Insights

8.4.21.1.Market attractiveness

8.4.21.2.Competition heatmap

9.Competitive Landscape

9.1.Top winning strategies, 2021

9.1.1.By strategy

9.1.2.By year

9.2.Strategic overview

9.3.Market share analysis, 2021

10.Company Profiles

10.1.ams AG.

10.1.1.Business overview

10.1.2.Financial persensor typeance

10.1.3.Product portfolio

10.1.4.Recent strategic moves & developments

10.1.5.SWOT analysis

10.2.ROHM Semiconductor

10.2.1.Business overview

10.2.2.Financial persensor typeance

10.2.3.Product portfolio

10.2.4.Recent strategic moves & developments

10.2.5.SWOT analysis

10.3.Hamamatsu Photonics K.K.

10.3.1.Business overview

10.3.2.Financial persensor typeance

10.3.3.Product portfolio

10.3.4.Recent strategic moves & developments

10.3.5.SWOT analysis

10.4.Analog Devices Inc.

10.4.1.Business overview

10.4.2.Financial persensor typeance

10.4.3.Product portfolio

10.4.4.Recent strategic moves & developments

10.4.5.SWOT analysis

10.5.STMicroelectronics

10.5.1.Business overview

10.5.2.Financial persensor typeance

10.5.3.Product portfolio

10.5.4.Recent strategic moves & developments

10.5.5.SWOT analysis

10.6.Vishay Intertechnology, Inc.

10.6.1.Business overview

10.6.2.Financial persensor typeance

10.6.3.Product portfolio

10.6.4.Recent strategic moves & developments

10.6.5.SWOT analysis

10.7.Excelitas Technologies Corp.

10.7.1.Business overview

10.7.2.Financial persensor typeance

10.7.3.Product portfolio

10.7.4.Recent strategic moves & developments

10.7.5.SWOT analysis

10.8.Leuze electronic GmbH + Co. KG

10.8.1.Business overview

10.8.2.Financial persensor typeance

10.8.3.Product portfolio

10.8.4.Recent strategic moves & developments

10.8.5.SWOT analysis

10.9.Semiconductor Types Industries, LLC

10.9.1.Business overview

10.9.2.Financial persensor typeance

10.9.3.Product portfolio

10.9.4.Recent strategic moves & developments

10.9.5.SWOT analysis

10.10.Fotech Extrinsics Limited

10.10.1.Business overview

10.10.2.Financial persensor typeance

10.10.3.Product portfolio

10.10.4.Recent strategic moves & developments

10.10.5.SWOT analysis

11.Appendix

11.1.Parent & peer market analysis

11.2.Premium insights from industry experts

11.3.Related reports

Optical detector is a device that is used to detect radiation or optical signal and convert ii into an electrical signal. Its change in state or its response under the influence of a flux of optical radiation can effectively determine the amount of light received. Optical detectors are one of the most significant types of an optical fiber communication system, and hence they deduce the implementation of a fiber optic communication link.

COVID-19 Impact on the Optical Detector Market

The outbreak of COVID-19 has had an adverse impact on the growth of the global optical detector market, owing to the prevalence of lockdowns in various countries across the globe. Lockdowns led to the large-scale disruption in the supply chains due to the closure of manufacturing plants of various industries including packaging, automotive, logistics, and many more. Consumer demand declined and the international trade restrictions were imposed, limiting market potential even further. Thus, the COVID-19 pandemic has had a negative impact on the growth of the optical detector market.

Optical Detector Market Trends and Developments

The key companies operating in the industry are adopting various growth strategies & business tactics such as partnerships, collaborations, mergers & acquisitions, and launches to maintain a robust position in the overall market, which is subsequently helping the global optical detector market to grow exponentially. For instance:

- In October 2020, Omron Corporation, the leading manufacturer of control equipment, electronic components, factory automation systems, ticket vending machines, automotive electronics, and medical equipment, announced the launch of E3AS-HL CMOS Laser Sensor for optical sensing applications. The new optical sensor helps industrial automation equipment to detect the opacity, pattern, or color changes bu using image array technology.

- In November 2020, Synopsys, an American electronic design automation company that focuses on silicon design and verification, silicon intellectual property and software security and quality, acquired Light Tec, a global provider of optical scattering measurements and measurement equipment, in order to extend customer access to precision light scattering data for materials and media used in optical systems.

- In October 2021, Precision Optics, a developer of advanced optical instruments for the medical and defense industries, acquired Lighthouse Imaging Corporation, a medical device manufacturer that specializes in medical optics design and assembly, in $2.9M cash and share deal so as to increase Precision Optics’ ability to assist their customers in developing next generation applications which are helping to change the future of healthcare.

- In March 2022, STMicroelectronics, a French-Italian electronics and semiconductors manufacturer, announced the launch of a new high-resolution Time-of-Flight (ToF) sensors that brings advanced three-dimensional depth imaging to smartphones and other devices. The VD55H1 is a sensor that maps 3D surfaces by measuring the distance to over half a million points.

Forecast Analysis of the Optical Detector Market

Rising use of photodetectors and photosensors in numerous industrial sectors across the globe is expected to drive the growth of the optical detector market during the forecast period. In addition, the long sensing range, extended life, and cost-effective features of optical detectors are further expected to bolster the growth of the market during the forecast period. Furthermore, persistent technological breakthroughs in the optical detectors are expected to create ample opportunities for the growth of the optical detector market in the near future. However, extortionate cost of optical detectors is expected to impede the growth of the market during the forecast period.

According to the report published by Research Dive, the global optical detector market is expected to generate a revenue of $9,827.00 million by 2030, growing rapidly at a CAGR of 11.82% during the forecast period 2022-2030.The major players of the market include ams AG, Hamamatsu Photonics K.K., ROHM Semiconductor, Analog Devices Inc., Vishay Intertechnology, Inc., STMicroelectronics, Excelitas Technologies C`orp., Semiconductor Types Industries, LLC, Leuze electronic GmbH + Co. KG, and Fotech Extrinsics Limited.

Most Profitable Region

The Asia-Pacific region is predicted to grow at the fastest rate, and generate a revenue of $3,278.3 million during the forecast period. Optical detectors are majorly used in a variety of industries in the region, including metrology, healthcare, imaging & remote sensing, cars, and robotics. In addition, the Asia-Pacific region is a leading producer of consumer electronics, especially tablets and smartphones, which contain 3D mapping and restore recognition. All these factors are expected to bolster the growth of the Asia-Pacific region in the optical detector market.

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com