Heavy Construction Equipment Market Report

RA08509

Heavy Construction Equipment Market by Type (Earth Moving, Material Handling, and Heavy Construction Vehicles), End-use Industry (Construction, Mining, and Oil & Gas), and Regional Analysis (North America, Europe, Asia-Pacific, and LAMEA): Global Opportunity Analysis and Industry Forecast, 2021–2028

Global Heavy Construction Equipment Market Analysis

The global heavy construction equipment market size was $176.8 billion in 2020 and is predicted to grow with a CAGR of 4.8%, by generating a revenue of $257.2 billion by 2028.

Market Synopsis

Heavy construction equipment market is gaining huge popularity owing to increase in demand for housing due to rapid urbanization, industrialization, and population growth. In addition, construction projects such as development of smart cities, rail & road construction, bridges, and other mining activities are driving the heavy construction equipment market size. This is because in these construction projects, timely completion of work as well as quality of work matter. The heavy equipment such as backhoe excavator ensures optimum use of materials and manpower. Ageing infrastructure that requires repair, maintenance, or replacement is another factor driving the market growth.

However, these construction equipment have made the workers work monotonous and it requires only skilled labors to handle such big equipment. This factor is estimated to restrain the heavy construction equipment market share during the forecast period.

The role of heavy construction equipment in reducing the cost of construction projects by increasing the rate of output and timely project completion especially for large contracts is estimated to generate huge growth opportunities. In addition, renting heavy construction equipment has become quite popular as it is economical to buy such heavy construction equipment on rent. These equipment play an important role in maintaining the production rate where there is a shortage of skilled labors.

According to regional analysis, the Asia-Pacific heavy construction equipment market accounted for $64.7 billion in 2020 and is predicted to grow with a CAGR of 5.6% in the projected timeframe.

Heavy Construction Equipment Market Overview

Heavy construction equipment also include heavy duty vehicles, heavy machines, and construction equipment. Heavy vehicles are essential for construction projects of any size right from construction of residential & commercial buildings to large civil projects. Some of the popular examples of these equipment include excavators, dump trucks, bulldozers, motor graders, and others. These equipment are designed for performing various tasks such as earthworks, open-pit mining, material handling, construction, demolition, and others. The heavy construction equipment can be classified into earth moving equipment, hoisting equipment, earth-compacting equipment, hauling equipment, and conveying equipment.

Covid-19 Impact on Heavy Construction Equipment Market

The global crisis caused by COVID-19 pandemic had a devastating impact on several industries owing to nation-wide lockdown imposed across various countries and social distancing norms. Similarly, the construction equipment industry was negatively impacted by the pandemic as the heavy equipment manufacturers had to temporarily shut down their operations owing to drastic decline in demand, shortage of labors, and raw materials. Also, decline in government investments in construction & infrastructure projects due to onset of pandemic has affected the heavy construction equipment market growth. As construction is a volatile industry, reduced economic activity due to low demand for commercial, industrial facilities, refurbishment, or residential construction has affected the heavy construction equipment market share during the pandemic. In addition, the migrant and local workers working in the construction sites were unable to reach their work locations due to on-site COVID-19 protocols that have affected the productivity and building materials supply chain.

Many heavy construction equipment manufacturers have shifted their focus towards manufacturing of essential medical supplies to battle coronavirus. These manufacturers have shifted their focus towards development of ventilators, masks, face shields, and other essentials. For instance, on May 13, 2020, the Association of Equipment Manufacturers (AEM), the U.S.-based trade association company, partnered with The Marek Group, the U.S.-based large field sales network group, to supply the COVID-19 essentials such as personal protective equipment (PPE) and face shields. In addition, four excavators from Shandong Lingong Construction Machinery Co., Ltd., the well-known construction equipment manufacturer, were used to construct two hospitals in Wuhan, China which was the epicenter of COVID-19 virus.

Rapid Urbanization and Industrialization to Drive the Market Growth

Rapid urbanization and industrialization especially in the developing countries lead to economic growth, create employment opportunities, and help in the development of nation. It also creates socio-economic and environmental changes by constructing energy-efficient buildings for sustainable future. For instance, urbanization in India is led by 100 Smart Cities Mission, Atal Mission for Rejuvenation and Urban Transformation, Clean India Mission, National urban information system, Sardar Patel National Urban Housing Mission, National Heritage City Development and Augmentation Yojana. The use of heavy construction equipment plays a vital role in urbanization and industrialization as it uses advanced engineering technology for cooling the engine and fuel injection that drives the efficiency of that equipment. Other major factors for selecting heavy construction equipment are high digging strength, dump heights, dump depths, engine horse power, ground clearance, and other factors.

To know more about global heavy construction equipment market drivers, get in touch with our analysts here.

Requirement of Skilled Labor and High Heavy Construction Equipment Cost to Restrain Market Growth

Skilled labors are required for successful operations of heavy construction equipment machines. Also, purchasing brand new equipment involves high cost. In addition, training the workers on new equipment adds to the cost that the company as the company has to invest on machines and workers. These factors are estimated to restrain the heavy construction equipment market size during the forecast period.

Equipment Rentals Option to Generate Excellent Opportunities

Equipment rental has become an attractive option for the individual businesses and the heavy construction equipment manufacturers to meet the growing demand for heavy equipment from the construction industry. Renting construction equipment offers various advantages as the equipment is well maintained & reliable, no capital investment is required, and there is zero service & maintenance cost. Also, the companies get an opportunity to try and experience new heavy construction equipment models before making a purchase decision. The power and precision of technologically advanced machinery can be experienced by the manufacturers along with cost saving. These equipment are maintenance free as they go through regular maintenance checks and rental companies include the maintenance in their contract. Various heavy construction equipment that can be rented include backhoe loaders, excavators, bulldozers, multi-terrain loaders, motor grader, track loaders, skid steer loaders, wheel loaders, wheel excavators, and others.

To know more about global heavy construction equipment market opportunities, get in touch with our analysts here.

Based on type, the market has been divided into Earth Moving, material handling, and heavy construction vehicles. Among these, the Earth Moving sub-segment accounted for highest market share in 2020 and it is estimated to show the fastest growth during the forecast period. Download Exclusive Free Sample ReportHeavy Construction Equipment Market

By Type

Source: Research Dive Analysis

The earth moving sub-type is anticipated to have a dominant market share and generate a revenue of $138.6 billion by 2028, growing from $92.5 billion in 2020. This growth is majorly owing to the use of heavy construction equipment of heavy-duty vehicles in mining and construction activities where they are used to move or relocate heavy rocks, materials, mud, and debris. Various earth moving equipment used in construction & mining activities include excavators, backhoe loader, trencher, motor grader, bulldozer, telehandler, dump truck, and others. For instance, excavator comprises of a hydraulic system that generates hydraulic force to control the mechanical arm of the machine for excavating or moving large objects.

Heavy Construction Equipment Market

By End-use IndustryBased on end-use industry, the market has been divided into Construction, mining, and oil & gas. Among these, the Construction sub-segment accounted for the highest revenue share in 2020 and it is estimated to show the fastest growth during the forecast period.

Source: Research Dive Analysis

The construction sub-segment is anticipated to have a dominant market share and generate a revenue of $128.6 billion by 2028, growing from $84.9 billion in 2020. This is majorly owing to large number of on-going construction projects across the world. For instance, as stated on January 10, 2021, in Latham Australia, the popular manufacturer & supplier of material handling & power transmission equipment, stated that construction industry across the world is evolving at a fast pace with the rapid infrastructure and construction projects. Istanbul New Airport is a $5.6 billion ongoing construction project which is an expanding hub for international transit. Already 80 million passengers move through city’s two airport terminals every year. Once the new airport is complete, it is estimated to accommodate 150 million passengers each year across three terminals.

Heavy Construction Equipment Market

By RegionThe heavy construction equipment market was investigated across North America, Europe, Asia-Pacific, and LAMEA.

Source: Research Dive Analysis

The Market for Heavy Construction Equipment in Asia-Pacific to be the Most Dominant and Fastest Growing

The Asia-Pacific heavy construction equipment market accounted $64.7 billion in 2020 and is projected to grow with a CAGR of 5.6%. Asia-Pacific heavy construction equipment market is driven by economic development of countries such as India, China, and Japan along with significant government investment in the construction sector. For instance, as stated on July 09, 2021, in the Construction Global, the leading construction news provider platform, some of the top, on-going construction projects in this region include Linear Chuo Shinkansen, the high-speed rail network of Japan. This project is estimated to be completed by 2027 and it will transport passengers from Tokyo to Nagoya, having a distance of 286 kilometers in just 40 minutes. Similarly, the Beijing International Airport, China is estimated to complete its further expansion by 2025 which will surpass Dubai’s Al Maktoum International Airport in terms of passenger capacity, airport space, plane capacity, and cost. Such large construction projects are estimated to drive the Asia-Pacific heavy construction equipment market size during the forecast period.

Competitive Scenario in the Global Heavy Construction Equipment Market

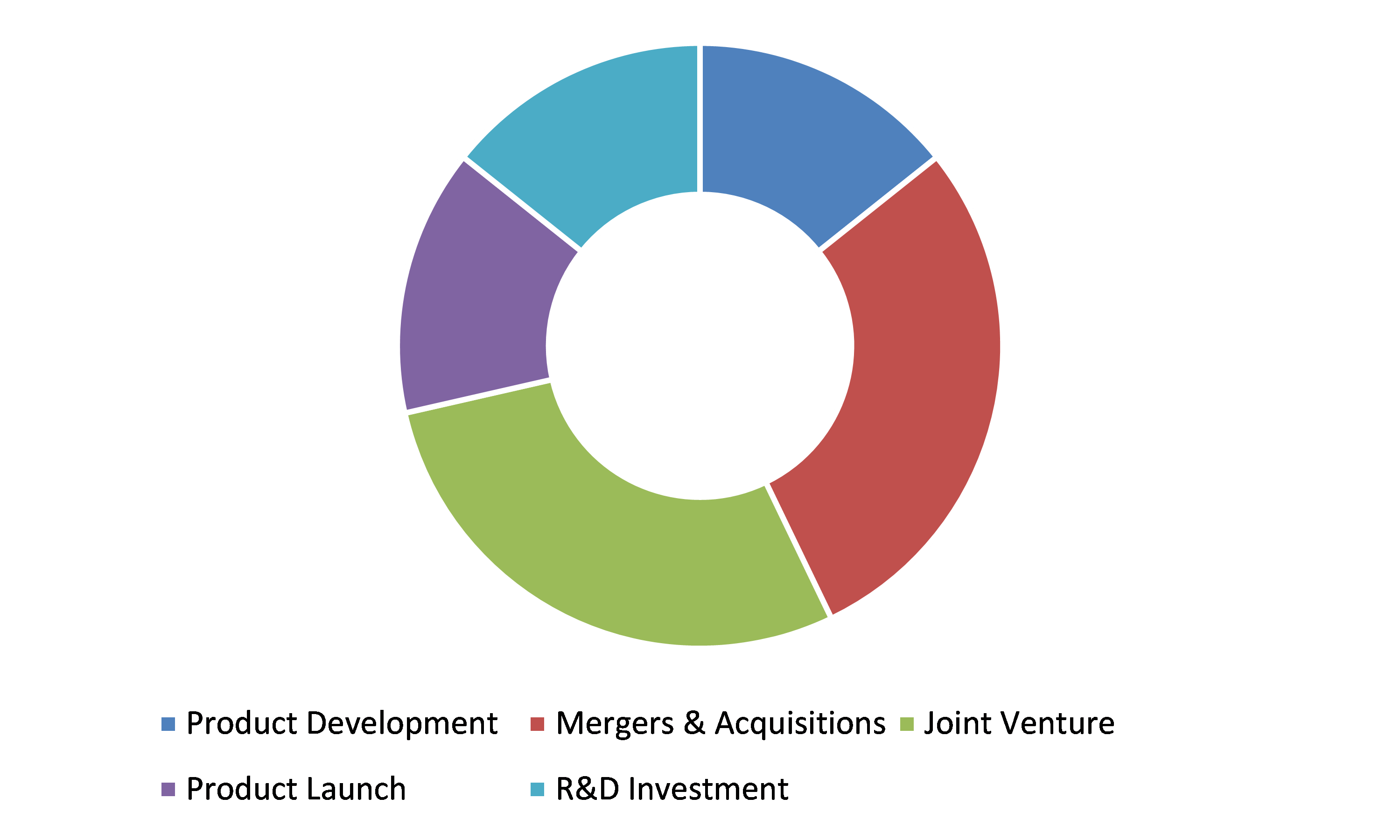

Acquisition and product advancement are common strategies followed by major market players.

Source: Research Dive Analysis

Some of the leading heavy construction equipment market players are Caterpillar Inc., Komatsu Ltd., John Deere, XCMG Group, SANY Group, Volvo Construction Equipment, Hitachi Construction Machinery Co., Ltd., Leibherr, Hyundai Doosan Infracore, and JCB.

Porter’s Five Forces Analysis for the Global Heavy Construction Equipment Market:

- Bargaining Power of Suppliers: All the companies operating in construction machinery market buy various raw material in the form of machine components from suppliers. Hence, the supplier is in the dominant position in the industrial goods sector and can use their negotiating power to extract higher prices from the manufacturers.

Thus, the bargaining power of suppliers is high. - Bargaining Power of Buyers: The buyers in the construction equipment industry want to buy the best and technologically advanced equipment at low price which puts pressure on the manufacturers and reduces their profitability.

Thus, buyer’s bargaining power will be high. - Threat of New Entrants: The new players entering in the heavy construction equipment market have to invest huge capital along with the launch of innovative and technologically advanced products. Hence, new players are less likely to enter into such dynamic industry where established players such as Caterpillar Inc. and Komatsu are already at the dominant position.

Thus, the threat of the new entrants is low. - Threat of Substitutes: At present there are no alternative products for heavy construction equipment.

Thus, the threat of substitutes is low. - Competitive Rivalry in the Market: The companies operating in this market are focusing on advanced product development to boost their consumer base and to increase their sales & profitability.

Therefore, competitive rivalry in the market is high.

| Aspect | Particulars |

| Historical Market Estimations | 2019-2020 |

| Base Year for Market Estimation | 2020 |

| Forecast Timeline for Market Projection | 2021-2028 |

| Geographical Scope | North America, Europe, Asia-Pacific, LAMEA |

| Segmentation by Type |

|

| Segmentation by End-use Industry |

|

| Key Companies Profiled |

|

Q1. What is the size of the global heavy construction equipment market?

A. The size of the global heavy construction equipment market was over $176.8 billion in 2020 and is projected to reach $257.2 billion by 2028.

Q2. Which are the major companies in the heavy construction equipment market?

A. Caterpillar Inc., Komatsu Ltd., and John Deere are some of the key players in the global heavy construction equipment market.

Q3. Which region, among others, possesses greater investment opportunities in the near future?

A. The Asia-Pacific region possesses great investment opportunities for investors to witness the most promising growth in the future.

Q4. What will be the growth rate of the Asia-Pacific heavy construction equipment market?

A. Asia-Pacific heavy construction equipment market is anticipated to grow at 5.6% CAGR during the forecast period.

Q5. What are the strategies opted by the leading players in this market?

A. Acquisition and product advancement are the two key strategies opted by the operating companies in this market.

Q6. Which companies are investing more on R&D practices?

A. Volvo Construction Equipment, Hitachi Construction Machinery Co., Ltd., and Leibherr are the companies investing more on R&D activities for developing new products and technologies.

Q7. Who is the largest heavy equipment manufacturer?

A. Caterpillar Inc. is the largest heavy equipment manufacturer in the world.

Q8. What is considered heavy equipment in construction?

A. The heavy equipment in the construction industry refers to the heavy-duty vehicles that are used for executing various construction tasks such as earthwork operations, new construction, material handling, and demolition. The excavators, motor graders, dump trucks, bulldozers are some of the examples of heavy equipment in construction.

Q9. What type of heavy equipment is there?

A. The different heavy equipment can be classified into earth moving, material handling, and heavy construction vehicles.

Q10. What is the biggest heavy equipment?

A. The biggest heavy equipment are the wheel loader and excavator which are classified as earth moving equipment.

Q11. What are examples of construction equipment?

A. The different construction equipment include excavators, backhoe, trenchers, graders, bulldozers, wheel tractor scraper, loaders, tower cranes, telehandlers, compactors, dump trucks, pavers, and others.

Q12. What is heavy equipment?

A. Heavy equipment also known as heavy machinery are designed for executing various construction tasks that involve large construction projects and earthwork operations.

1.Research Methodology

1.1.Desk Research

1.2.Real time insights and validation

1.3.Forecast model

1.4.Assumptions and forecast parameters

1.4.1.Assumptions

1.4.2.Forecast parameters

1.5.Data sources

1.5.1.Primary

1.5.2.Secondary

2.Executive Summary

2.1.360° summary

2.2.Type trends

2.3.End-use Industry trends

3.Market overview

3.1.Market segmentation & definitions

3.2.Key takeaways

3.2.1.Top investment pockets

3.2.2.Top winning strategies

3.3.Porter’s five forces analysis

3.3.1.Bargaining power of consumers

3.3.2.Bargaining power of suppliers

3.3.3.Threat of new entrants

3.3.4.Threat of substitutes

3.3.5.Competitive rivalry in the market

3.4.Market dynamics

3.4.1.Drivers

3.4.2.Restraints

3.4.3.Opportunities

3.5.Technology landscape

3.6.Regulatory landscape

3.7.Patent landscape

3.8.Market value chain analysis

3.9.Strategic overview

4.Heavy Construction Equipment Market, by Type

4.1.Earth Moving

4.1.1.Market size and forecast, by region, 2020-2028

4.1.2.Comparative market share analysis, 2020 & 2028

4.2.Material Handling

4.2.1.Market size and forecast, by region, 2020-2028

4.2.2.Comparative market share analysis, 2020 & 2028

4.3.Heavy Construction Vehicles

4.3.1.Market size and forecast, by region, 2020-2028

4.3.2.Comparative market share analysis, 2020 & 2028

5.Heavy Construction Equipment Market, by End-use Industry

5.1.Construction

5.1.1.Market size and forecast, by region, 2020-2028

5.1.2.Comparative market share analysis, 2020 & 2028

5.2.Mining

5.2.1.Market size and forecast, by region, 2020-2028

5.2.2.Comparative market share analysis, 2020 & 2028

5.3.Oil & Gas

5.3.1.Market size and forecast, by region, 2020-2028

5.3.2.Comparative market share analysis, 2020 & 2028

6.Heavy Construction Equipment Market, by Region

6.1.North America

6.1.1.Market size and forecast, by Type, 2020-2028

6.1.2.Market size and forecast, by End-use Industry, 2020-2028

6.1.3.Market size and forecast, by country, 2020-2028

6.1.4.Comparative market share analysis, 2020 & 2028

6.1.5.U.S.

6.1.5.1.Market size and forecast, by Type, 2020-2028

6.1.5.2.Market size and forecast, by End-use Industry, 2020-2028

6.1.5.3.Comparative market share analysis, 2020 & 2028

6.1.6.Canada

6.1.6.1.Market size and forecast, by Type, 2020-2028

6.1.6.2.Market size and forecast, by End-use Industry, 2020-2028

6.1.6.3.Comparative market share analysis, 2020 & 2028

6.1.7.Mexico

6.1.7.1.Market size and forecast, by Type, 2020-2028

6.1.7.2.Market size and forecast, by End-use Industry, 2020-2028

6.1.7.3.Comparative market share analysis, 2020 & 2028

6.2.Europe

6.2.1.Market size and forecast, by Type, 2020-2028

6.2.2.Market size and forecast, by End-use Industry, 2020-2028

6.2.3.Market size and forecast, by country, 2020-2028

6.2.4.Comparative market share analysis, 2020 & 2028

6.2.5.Germany

6.2.5.1.Market size and forecast, by Type, 2020-2028

6.2.5.2.Market size and forecast, by End-use Industry, 2020-2028

6.2.5.3.Comparative market share analysis, 2020 & 2028

6.2.6.UK

6.2.6.1.Market size and forecast, by Type, 2020-2028

6.2.6.2.Market size and forecast, by End-use Industry, 2020-2028

6.2.6.3.Comparative market share analysis, 2020 & 2028

6.2.7.France

6.2.7.1.Market size and forecast, by Type, 2020-2028

6.2.7.2.Market size and forecast, by End-use Industry, 2020-2028

6.2.7.3.Comparative market share analysis, 2020 & 2028

6.2.8.Spain

6.2.8.1.Market size and forecast, by Type, 2020-2028

6.2.8.2.Market size and forecast, by End-use Industry, 2020-2028

6.2.8.3.Comparative market share analysis, 2020 & 2028

6.2.9.Italy

6.2.9.1.Market size and forecast, by Type, 2020-2028

6.2.9.2.Market size and forecast, by End-use Industry, 2020-2028

6.2.9.3.Comparative market share analysis, 2020 & 2028

6.2.10.Rest of Europe

6.2.10.1.Market size and forecast, by Type, 2020-2028

6.2.10.2.Market size and forecast, by End-use Industry, 2020-2028

6.2.10.3.Comparative market share analysis, 2020 & 2028

6.3.Asia Pacific

6.3.1.Market size and forecast, by Type, 2020-2028

6.3.2.Market size and forecast, by End-use Industry, 2020-2028

6.3.3.Market size and forecast, by country, 2020-2028

6.3.4.Comparative market share analysis, 2020 & 2028

6.3.5.China

6.3.5.1.Market size and forecast, by Type, 2020-2028

6.3.5.2.Market size and forecast, by End-use Industry, 2020-2028

6.3.5.3.Comparative market share analysis, 2020 & 2028

6.3.6.Japan

6.3.6.1.Market size and forecast, by Type, 2020-2028

6.3.6.2.Market size and forecast, by End-use Industry, 2020-2028

6.3.6.3.Comparative market share analysis, 2020 & 2028

6.3.7.India

6.3.7.1.Market size and forecast, by Type, 2020-2028

6.3.7.2.Market size and forecast, by End-use Industry, 2020-2028

6.3.7.3.Comparative market share analysis, 2020 & 2028

6.3.8.South Korea

6.3.8.1.Market size and forecast, by Type, 2020-2028

6.3.8.2.Market size and forecast, by End-use Industry, 2020-2028

6.3.8.3.Comparative market share analysis, 2020 & 2028

6.3.9.Australia

6.3.9.1.Market size and forecast, by Type, 2020-2028

6.3.9.2.Market size and forecast, by End-use Industry, 2020-2028

6.3.9.3.Comparative market share analysis, 2020 & 2028

6.3.10.Rest of Asia Pacific

6.3.10.1.Market size and forecast, by Type, 2020-2028

6.3.10.2.Market size and forecast, by End-use Industry, 2020-2028

6.3.10.3.Comparative market share analysis, 2020 & 2028

6.4.LAMEA

6.4.1.Market size and forecast, by Type, 2020-2028

6.4.2.Market size and forecast, by End-use Industry, 2020-2028

6.4.3.Market size and forecast, by country, 2020-2028

6.4.4.Comparative market share analysis, 2020 & 2028

6.4.5.Latin America

6.4.5.1.Market size and forecast, by Type, 2020-2028

6.4.5.2.Market size and forecast, by End-use Industry, 2020-2028

6.4.5.3.Comparative market share analysis, 2020 & 2028

6.4.6.Middle East

6.4.6.1.Market size and forecast, by Type, 2020-2028

6.4.6.2.Market size and forecast, by End-use Industry, 2020-2028

6.4.6.3.Comparative market share analysis, 2020 & 2028

6.4.7.Africa

6.4.7.1.Market size and forecast, by Type, 2020-2028

6.4.7.2.Market size and forecast, by End-use Industry, 2020-2028

6.4.7.3.Comparative market share analysis, 2020 & 2028

7.Company profiles

7.1.Caterpillar Inc.

7.1.1.Business overview

7.1.2.Financial performance

7.1.3.Product portfolio

7.1.4.Recent strategic moves & developments

7.1.5.SWOT analysis

7.2.Komatsu Ltd.

7.2.1.Business overview

7.2.2.Financial performance

7.2.3.Product portfolio

7.2.4.Recent strategic moves & developments

7.2.5.SWOT analysis

7.3.John Deere

7.3.1.Business overview

7.3.2.Financial performance

7.3.3.Product portfolio

7.3.4.Recent strategic moves & developments

7.3.5.SWOT analysis

7.4.XCMG Group

7.4.1.Business overview

7.4.2.Financial performance

7.4.3.Product portfolio

7.4.4.Recent strategic moves & developments

7.4.5.SWOT analysis

7.5.SANY Group

7.5.1.Business overview

7.5.2.Financial performance

7.5.3.Product portfolio

7.5.4.Recent strategic moves & developments

7.5.5.SWOT analysis

7.6.Volvo Construction Equipment

7.6.1.Business overview

7.6.2.Financial performance

7.6.3.Product portfolio

7.6.4.Recent strategic moves & developments

7.6.5.SWOT analysis

7.7.Hitachi Construction Machinery Co., Ltd.

7.7.1.Business overview

7.7.2.Financial performance

7.7.3.Product portfolio

7.7.4.Recent strategic moves & developments

7.7.5.SWOT analysis

7.8.Leibherr

7.8.1.Business overview

7.8.2.Financial performance

7.8.3.Product portfolio

7.8.4.Recent strategic moves & developments

7.8.5.SWOT analysis

7.9.Hyundai Doosan Infracore

7.9.1.Business overview

7.9.2.Financial performance

7.9.3.Product portfolio

7.9.4.Recent strategic moves & developments

7.9.5.SWOT analysis

7.10.JCB

7.10.1.Business overview

7.10.2.Financial performance

7.10.3.Product portfolio

7.10.4.Recent strategic moves & developments

7.10.5.SWOT analysis

The construction industry is undergoing a dynamic period of speedy innovations. In countless ways, construction equipment makers are beginning to advance in autonomous machinery, telematics, electromobility, and many others. In particular, strategic alliances amongst equipment manufacturers and users are driving this revolution.

This is a positive move for the industry which, long ago, might have lagged behind agriculture, transport, and other sectors. As novel, inventive technologies came to existence, equipment makers began enhancing their products and services to offer improved device uptime, higher lifecycle values of the machineries, and exclusive consumer solutions.

The construction equipment technology have made marvellous and vital developments in the recent years. Alike drones, equipment operators are now able to control the equipment from digital fields to advanced mining projects. Advances in 5G technology have facilitated remote handling of heavy equipment into a considerably deep mine by staying above the ground in a safe manner. This has eradicated the risks involved in sending human workers miles down in a mine and helped in attracting new personnel as the job has become less risky and filthy.

The invention of telematics and the Internet of Things is advancing as well as easing the jobs of people involved in building skyscrapers, mines, power plants, and many others. This is because machines can now communicate with each other and home base. Owing to such developments, the heavy construction equipment have advanced significantly. Also, the global heavy construction equipment market is experiencing widespread popularity due to upsurge in the demand for commercial as well as construction projects owing to speedy industrialization, urbanization, and increase in population worldwide. Furthermore, construction projects, for example: development of rail & road construction, building of massive bridges, creation of smart cities, and other mining activities are propelling the heavy construction equipment market growth.

Recent Trends in the Heavy Construction Equipment Industry

As per a repost by Research Dive, the global heavy construction equipment market is foreseen to grow with a CAGR of 4.8%, by garnering $257.2 billion by 2028. Some of the leading players active in the market are SANY Group, Komatsu Ltd., JCB, John Deere, XCMG Group, Volvo Construction Equipment, Hitachi Construction Machinery Co., Ltd., Caterpillar Inc., Leibherr, Hyundai Doosan Infracore, and others. Market players are concentrating on developing strategies such as novel product developments, partnerships, mergers and acquisitions, and collaborations to attain a leading position in the global market. For instance,

- In January 2021, Hyundai Construction Equipment, a leading construction and earthmoving equipment manufacturer in India, introduced an advanced series of excavators under the series name - SMART PLUS and novel global colour to fortify the brand position in the Indian as well as export market.

- In June 2021, Mahindra Construction Equipment (MCE), an Indian Construction Equipment OEM and part of the Mahindra Group, introduced the novel BS IV-compliant Motor Grader - Backhoe Loader and Mahindra RoadMaster G9075 & G9595– and Mahindra EarthMaster SX as well as VX. These novel products are equipped with MAXX telematics solution and offer users prognostic, diagnostic, and predictive fleet management solutions and many other features.

- September 2021, Volvo Construction Equipment, a major international company that develops, manufactures, and markets equipment for construction and related industries, introduced a novel series of pneumatic rollers, pavers, compactors, and wheel loaders for the Indian market.

COVID-19 Impact on the Heavy Construction Equipment Industry

The unexpected outburst of the coronavirus pandemic has negatively impacted the global heavy construction equipment market. This is mainly because heavy equipment manufacturers were forced to temporarily halt their processes due to the implementation of lockdown restrictions, sudden fall in demand, lack of labours, and issues in availability of raw materials. Also, decrease in investments by government bodies in construction and infrastructure projects owing to the pandemic crisis has significantly hampered the heavy construction equipment market growth.

However, during the pandemic, several heavy construction equipment makers have shifted their focus on the production of vital medical supplies to combat the COVID-19 virus. These equipment makers are currently concentrating on the production of masks, face shields, ventilators, and other essentials. Nevertheless, as and when the pandemic situation eases and the construction sector resumes, the heavy construction equipment market is expected to observe marvellous growth in coming future.

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com