Specialty Insurance Market Report

RA08508

Specialty Insurance Market by Type (Life Insurance and Non-life Insurance), Distribution Channel (Direct and Indirect Channel), End-users (Businesses and Individuals), and Regional Analysis (North America, Europe, Asia-Pacific, and LAMEA): Global Opportunity Analysis and Industry Forecast, 2021–2028

Global Specialty Insurance Market Analysis

The global specialty insurance market size is predicted to garner a revenue of $243.70 billion in the 2021–2028 timeframe, growing from $133.64 billion in 2020, at a healthy CAGR of 7.6%.

Market Synopsis

The specialty insurance market share is expected to rise due to an increase in demand for specialized expertise and technology advancements.

However, misconceptions and a lack of information about specialty insurance may hinder the specialty insurance market's expansion.

According to the regional analysis of the market, the Asia-Pacific specialty insurance market share is anticipated to grow at a CAGR of 8.0%, by generating a revenue of $69.11 billion during the review period.

Specialty Insurance Market Overview

Specialty insurance is meant to protect enterprises with unusual needs from liability claims. Furthermore, this insurance is sought for objects or situations that are considered one-of-a-kind and are not often covered by ordinary insurance policies. Specialty insurance is in great demand in the construction, environmental, healthcare, and energy industries. Errors and omissions (E&O) insurance, a sort of professional liability insurance, is also a common type of specialty insurance plan.

Covid-19 Impact on Specialty Insurance Market

In March 2020, the World Health Organization declared COVID-19 as a pandemic, which resulted in restrictions on travel and disturbances in financial markets, as well as negatively impacted supply chains and production levels. The COVID-19 pandemic has caused massive disruptions and changes in a variety of businesses. The COVID-19 pandemic is having a negative influence on specialty insurance. During the crisis, worldwide travel, trade, and new developments were halted, affecting industries like aviation, marine, and construction. As a result, the utilization of underlying assets has decreased fast, and losses in these sectors have resulted in a drop in specialty insurance coverages. As a result, during the global health crisis, demand for specialty insurance policies has plummeted.

Advancements in Technology are Anticipated to Drive the Specialty Insurance Market Growth

Insurance businesses are leveraging innovative digital solutions to extend their operations and establish product lines based on niche client demand as a result of shifting business models, which contributes considerably to market growth. For loss prediction and prevention, risk monitoring, and claims processing, the integration of technologies such as cloud computing, artificial intelligence, and blockchain is becoming a prominent element that is expected to provide profitable potential for specialty insurance market growth in the coming years.

To know more about global specialty insurance market trends, get in touch with our analysts here.

Lack of Knowledge Might Restrain the Market Growth

Misconceptions and a lack of information about specialty insurance stifle the specialty insurance market's expansion. Competitive pricing based on coverages, the need for a whole new policy to cover a company's assets, and agent commissions are just a few of the common myths about specialty insurance. Furthermore, market restrictions include awareness of the various specialty risk insurance covered, repayment mechanisms, and transparency in terms of prices for specialty insurance.

Developing Economies are Expected to Create the Opportunities for Specialty Insurance Market

Developing nations, particularly rising economies like Australia, India, China, Singapore, and South Korea provide considerable opportunity for specialty insurers to expand and develop their portfolios. Specialty insurance offers a wide range of coverage alternatives as well as a great deal of flexibility in terms of coverages, policy term, and policy duration, all of which contribute to the specialty insurance market's expansion. Furthermore, a surge in demand for specialized expertise is a major driver of market expansion.

To know more about global specialty insurance market opportunities, get in touch with our analysts here.

Based on type, the specialty insurance market has been sub-segmented into Life Insurance and non-Life Insurance of which the Life Insurance type sub-segment is projected to generate the maximum revenue and non-Life Insurance is expected to be the fastest growing during the forecast period. Download PDF Sample ReportSpecialty Insurance Market

By Type

Source: Research Dive Analysis

The life insurance sub-segment is predicted to have a dominating market share in the global market and register a revenue of $200.21 billion during the forecast period. For those who would have difficulty qualifying for standard coverage, specialty life insurance focuses on guaranteed and simplified life insurance policies. For someone with a pre-existing medical condition, these insurances may make sense. They are also wonderful options for individuals who do not have the time or desire to undertake a physical examination.

The non-life insurance sub-segment is expected to be the fastest growing in the global market and register a revenue of $43.49 billion, with a CAGR of 8.3% during the forecast period. Non-life insurance covers commercial auto insurances, flood insurance, cyber liability insurance, special event insurance and others. One of the reasons for non-life insurance's consistent growth is a greater emphasis on innovation, which is driven by a greater emphasis on customer centricity. Behavioral developments and preferences of insurance purchasers have fueled increased innovation in the insurance sector throughout the years. Consumer behavior has shifted as a result of increased internet usage, more social networking, and behavioral shifts related to increased use of mobile and handheld technology.

Specialty Insurance Market

By Distribution ChannelBased on distribution channel, specialty insurance market is divided into Direct and inDirect channel. Among these, Direct channel sub-segment is anticipated to hold the maximum share of the global market revenue while inDirect channel is expected to be the fastest growing.

Source: Research Dive Analysis

The direct channel sub-segment is predicted to have a dominating market share in the global market and register a revenue of $149.41 billion during the forecast period. Advertising via traditional media, telemarketing, and the use of the internet to solicit business are all examples of direct response marketing. On the internet, consumers may readily compare policy benefits and pricing, particularly on various sites dedicated to comparing insurance prices. The direct response technique is the most cost effective for the consumer because marketing insurance goods is significantly cheaper than through an agency network, and the competition is much broader.

The indirect channel sub-segment is anticipated to experience the fastest market growth during the forecast period. It is predicted that the market shall generate a revenue of $94.29 billion by 2028, growing from $51.02 billion in 2020, with a CAGR of 7.8%. The indirect channel is comprised of agents and brokers. Insurance agents and brokers are investing in digital technologies such as cloud computing in order to better serve customers online while increasing sales and margins. These internet portals and other mobile platforms are intended to improve corporate processing efficiency while cutting costs. The growth of the sub-segment is predicted to be boosted by the integration of technology into existing services.

Specialty Insurance Market

By End-UsersBased on end-users, the market has been bifurcated into Businesses and individuals sub-segments of which the Businesses sub-segment is projected to generate highest revenue and is expected to grow at a faster rate during the forecast period.

Source: Research Dive Analysis

The businesses insurance sub-segment is anticipated to generate highest revenue during the forecast period. It is predicted that the market shall generate a revenue of $186.56 billion by 2028, growing from $100.89 billion in 2020, with a CAGR of 7.8%. Specialty insurance plans are becoming increasingly important for businesses to protect themselves against unforeseen losses. Specialty business insurance protects them from lawsuits, property damage, commercial obligations, and other risks that aren't covered by standard non-life insurance plans. The growth of the businesses sub-segment is expected to accelerate in the next years as a result of these causes.

Specialty Insurance Market

By RegionThe specialty insurance market was inspected across North America, Europe, Asia-Pacific, and LAMEA.

Source: Research Dive Analysis

The Market for Specialty Insurance in Asia-Pacific to be the Fastest Growing

Asia-Pacific is anticipated to be the fastest growing market during the forecast time period and reach $69.11 billion by 2028, with a CAGR of 8.0%. The Asia-Pacific region market is predicted to increase significantly throughout the forecast period due to the presence of various emerging economies and financial centers such as Singapore, India, and Hong Kong. Insurance firms in the region are aiming to give low-cost insurance premium options. As cloud technologies become more widely used and internet users become more frequent, the region's insurance companies are increasingly moving to digital insurance platforms.

Competitive Scenario in the Global Specialty Insurance Market

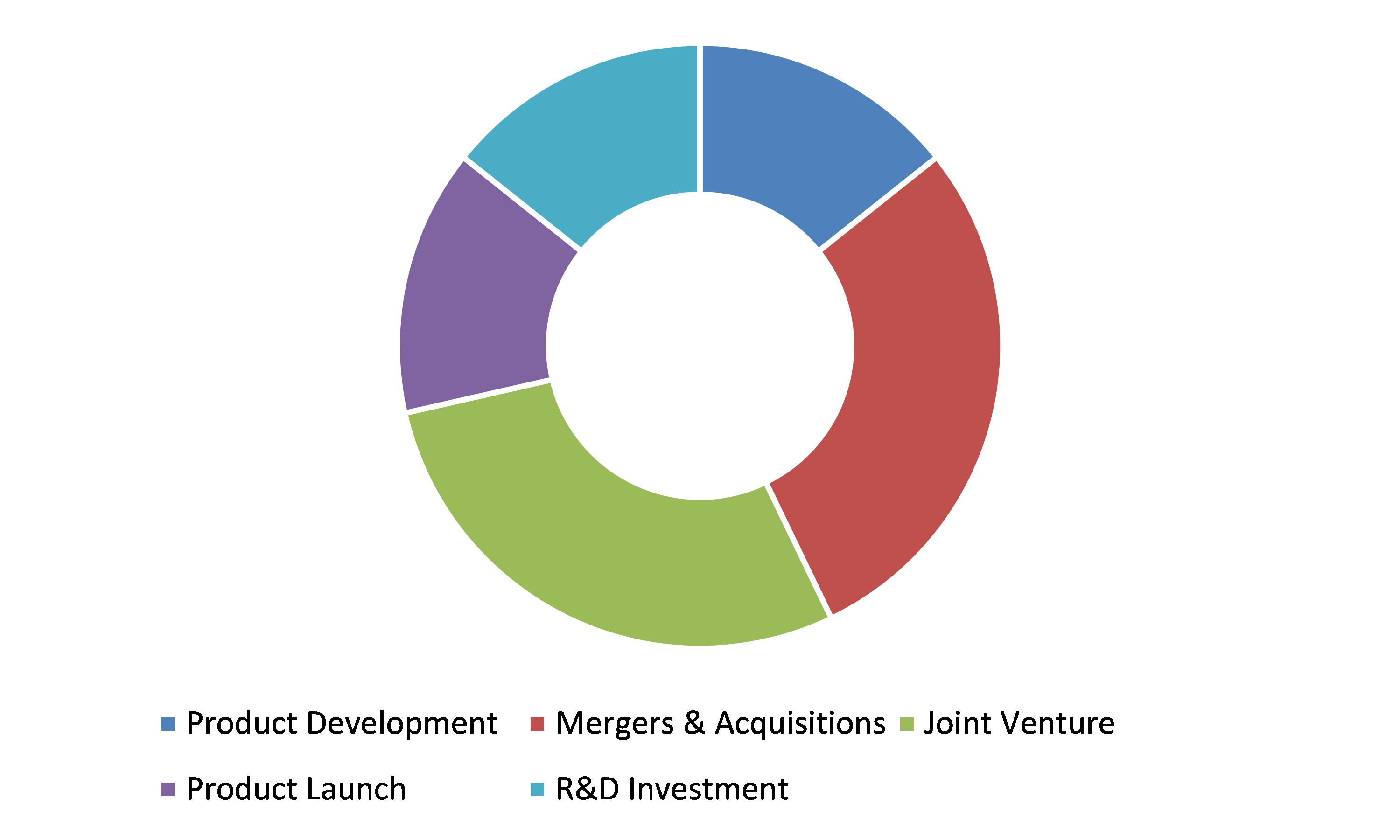

Product launches and mergers & acquisitions are common strategies followed by major market players.

Source: Research Dive Analysis

Some of the leading specialty insurance market players are AXA, American International Group Inc., Allianz, Assicurazioni Generali S.P.A., Berkshire Hathaway Inc., Chubb, Munich Re, PICC, Tokio Marine HCC, and Zurich.

Porter’s Five Forces Analysis for the Global Specialty Insurance Market:

- Bargaining Power of Suppliers: Specialty insurance market contains moderate concentration of distributors & suppliers and therefore, the distributors & suppliers’ control is predicted to be reasonable, resulting in moderate bargaining power of dealers.

Thus, the bargaining power of the suppliers is considered to be moderate. - Bargaining Power of Buyers: Buyers might have great bargaining power, significantly because of high players functioning in the specialty insurance market.

Therefore, the bargaining power of the buyer is high. - Threat of New Entrants: Specialty insurance companies entering the market are adopting technological innovations to attract clients. But due to the high government regulations,

the threat of the new entrants is moderate. - Threat of Substitutes: There are fewer product alternatives for specialty insurance.

Thus, the threat of substitutes is moderate. - Competitive Rivalry in the Market: The competitive rivalry among industry leaders is rather intense, especially between the global players including US Specialty Insurance Company, Anchor Specialty Insurance, and Berkshire Hathaway Inc.

Therefore, competitive rivalry in the market is high.

| Aspect | Particulars |

| Historical Market Estimations | 2019-2020 |

| Base Year for Market Estimation | 2020 |

| Forecast Timeline for Market Projection | 2021-2028 |

| Geographical Scope | North America, Europe, Asia-Pacific, LAMEA |

| Segmentation by Type |

|

| Segmentation by Distribution channel |

|

| Segmentation by End-Users |

|

| Key Companies Profiled |

|

Q1. What is the size of the global specialty insurance market?

A. The size of the global specialty insurance market 2020 was over $133.64 billion and is projected to reach $243.70 billion by 2028.

Q2. Which are the major companies in the specialty insurance market?

A. AXA, American International Group Inc., and Berkshire Hathaway Inc. are some of the key players in the global specialty insurance market.

Q3. Which region, among others, possesses greater investment opportunities in the near future?

A. The Asia-Pacific region possesses great investment opportunities for investors to witness the most promising growth in the future.

Q4. What will be the growth rate of the Asia-Pacific Specialty Insurance market?

A. Asia-Pacific commercial insurance market is anticipated to grow at 8.0% CAGR during the forecast period.

Q5. What are the strategies opted by the leading players in this market?

A. Technological development and strategic partnerships are the key strategies opted by the operating companies in this market.

Q6. What is specialty insurance?

A. Specialty insurance is meant to protect enterprises with unusual needs from liability claims.

Q7. What will be the market value of Specialty Insurance Market by the end of 2030?

A. The market value of Specialty Insurance Market by the end of 2030 is estimated to reach $265 billion.

Q8. What are insurance markets?

A. The markets that buy and sell insurances are defined as insurance markets.

1.Research Methodology

1.1.Desk Research

1.2.Real time insights and validation

1.3.Forecast model

1.4.Assumptions and forecast parameters

1.4.1.Assumptions

1.4.2.Forecast parameters

1.5.Data sources

1.5.1.Primary

1.5.2.Secondary

2.Executive Summary

2.1.360° summary

2.2.By Type trends

2.3.By End-Users trends

2.4.By Distribution Channel trends

3.Market overview

3.1.Market segmentation & definitions

3.2.Key takeaways

3.2.1.Top investment pockets

3.2.2.Top winning strategies

3.3.Porter’s five forces analysis

3.3.1.Bargaining power of consumers

3.3.2.Bargaining power of suppliers

3.3.3.Threat of new entrants

3.3.4.Threat of substitutes

3.3.5.Competitive rivalry in the market

3.4.Market dynamics

3.4.1.Drivers

3.4.2.Restraints

3.4.3.Opportunities

3.5.Distribution Channel landscape

3.6.Regulatory landscape

3.7.Patent landscape

3.8.Pricing overview

3.8.1.by Type

3.8.2.by End-Users

3.8.3.By Distribution Channel type

3.9.Market value chain analysis

3.9.1.Stress point analysis

3.9.2.Raw material analysis

3.9.3.Manufacturing process

3.9.4.Distribution Channel analysis

3.9.5.Operating vendors

3.9.5.1.Raw material suppliers

3.9.5.2.Product manufacturers

3.9.5.3.Product distributors

3.10.Strategic overview

4.Specialty Insurance Market, by Type

4.1.Life insurance

4.1.1.Market size and forecast, by region, 2020-2028

4.1.2.Comparative market share analysis, 2020 & 2028

4.2.Non-Life insurance

4.2.1.Market size and forecast, by region, 2020-2028

4.2.2.Comparative market share analysis, 2020 & 2028

5.Specialty Insurance Market, by End-Users

5.1.Businesses

5.1.1.Market size and forecast, by region, 2020-2028

5.1.2.Comparative market share analysis, 2020 & 2028

5.2.Individuals

5.2.1.Market size and forecast, by region, 2020-2028

5.2.2.Comparative market share analysis, 2020 & 2028

6.Specialty Insurance Market, by Distribution Channel

6.1.Direct Channel

6.1.1.Market size and forecast, by region, 2020-2028

6.1.2.Comparative market share analysis, 2020 & 2028

6.2.Indirect Channel

6.2.1.Market size and forecast, by region, 2020-2028

6.2.2.Comparative market share analysis, 2020 & 2028

7.Specialty Insurance Market, by Region

7.1.North America

7.1.1.Market size and forecast, by Type, 2020-2028

7.1.2.Market size and forecast, by End-Users, 2020-2028

7.1.3.Market size and forecast, by Distribution Channel, 2020-2028

7.1.4.Market size and forecast, by country, 2020-2028

7.1.5.Comparative market share analysis, 2020 & 2028

7.1.6.U.S.

7.1.6.1.Market size and forecast, by Type, 2020-2028

7.1.6.2.Market size and forecast, by End-Users, 2020-2028

7.1.6.3.Market size and forecast, by Distribution Channel, 2020-2028

7.1.6.4.Comparative market share analysis, 2020 & 2028

7.1.7.Canada

7.1.7.1.Market size and forecast, by Type, 2020-2028

7.1.7.2.Market size and forecast, by End-Users, 2020-2028

7.1.7.3.Market size and forecast, by Distribution Channel, 2020-2028

7.1.7.4.Comparative market share analysis, 2020 & 2028

7.1.8.Mexico

7.1.8.1.Market size and forecast, by Type, 2020-2028

7.1.8.2.Market size and forecast, by End-Users, 2020-2028

7.1.8.3.Market size and forecast, by Distribution Channel, 2020-2028

7.1.8.4.Comparative market share analysis, 2020 & 2028

7.2.Europe

7.2.1.Market size and forecast, by Type, 2020-2028

7.2.2.Market size and forecast, by End-Users, 2020-2028

7.2.3.Market size and forecast, by Distribution Channel, 2020-2028

7.2.4.Market size and forecast, by country, 2020-2028

7.2.5.Comparative market share analysis, 2020 & 2028

7.2.6.Germany

7.2.6.1.Market size and forecast, by Type, 2020-2028

7.2.6.2.Market size and forecast, by End-Users, 2020-2028

7.2.6.3.Market size and forecast, by Distribution Channel, 2020-2028

7.2.6.4.Comparative market share analysis, 2020 & 2028

7.2.7.UK

7.2.7.1.Market size and forecast, by Type, 2020-2028

7.2.7.2.Market size and forecast, by End-Users, 2020-2028

7.2.7.3.Market size and forecast, by Distribution Channel, 2020-2028

7.2.7.4.Comparative market share analysis, 2020 & 2028

7.2.8.France

7.2.8.1.Market size and forecast, by Type, 2020-2028

7.2.8.2.Market size and forecast, by End-Users, 2020-2028

7.2.8.3.Market size and forecast, by Distribution Channel, 2020-2028

7.2.8.4.Comparative market share analysis, 2020 & 2028

7.2.9.Italy

7.2.9.1.Market size and forecast, by Type, 2020-2028

7.2.9.2.Market size and forecast, by End-Users, 2020-2028

7.2.9.3.Market size and forecast, by Distribution Channel, 2020-2028

7.2.9.4.Comparative market share analysis, 2020 & 2028

7.2.10.Spain

7.2.10.1.Market size and forecast, by Type, 2020-2028

7.2.10.2.Market size and forecast, by End-Users, 2020-2028

7.2.10.3.Market size and forecast, by Distribution Channel, 2020-2028

7.2.10.4.Comparative market share analysis, 2020 & 2028

7.2.11.Rest of Europe

7.2.11.1.Market size and forecast, by Type, 2020-2028

7.2.11.2.Market size and forecast, by End-Users, 2020-2028

7.2.11.3.Market size and forecast, by Distribution Channel, 2020-2028

7.2.11.4.Comparative market share analysis, 2020 & 2028

7.3.Asia-Pacific

7.3.1.Market size and forecast, by Type, 2020-2028

7.3.2.Market size and forecast, by End-Users, 2020-2028

7.3.3.Market size and forecast, by Distribution Channel, 2020-2028

7.3.4.Market size and forecast, by country, 2020-2028

7.3.5.Comparative market share analysis, 2020 & 2028

7.3.6.China

7.3.6.1.Market size and forecast, by Type, 2020-2028

7.3.6.2.Market size and forecast, by End-Users, 2020-2028

7.3.6.3.Market size and forecast, by Distribution Channel, 2020-2028

7.3.6.4.Comparative market share analysis, 2020 & 2028

7.3.7.Japan

7.3.7.1.Market size and forecast, by Type, 2020-2028

7.3.7.2.Market size and forecast, by End-Users, 2020-2028

7.3.7.3.Market size and forecast, by Distribution Channel, 2020-2028

7.3.7.4.Comparative market share analysis, 2020 & 2028

7.3.8.India

7.3.8.1.Market size and forecast, by Type, 2020-2028

7.3.8.2.Market size and forecast, by End-Users, 2020-2028

7.3.8.3.Market size and forecast, by Distribution Channel, 2020-2028

7.3.8.4.Comparative market share analysis, 2020 & 2028

7.3.9.South Korea

7.3.9.1.Market size and forecast, by Type, 2020-2028

7.3.9.2.Market size and forecast, by End-Users, 2020-2028

7.3.9.3.Market size and forecast, by Distribution Channel, 2020-2028

7.3.9.4.Comparative market share analysis, 2020 & 2028

7.3.10.Australia

7.3.10.1.Market size and forecast, by Type, 2020-2028

7.3.10.2.Market size and forecast, by End-Users, 2020-2028

7.3.10.3.Market size and forecast, by Distribution Channel, 2020-2028

7.3.10.4.Comparative market share analysis, 2020 & 2028

7.3.11.Rest of Asia Pacific

7.3.11.1.Market size and forecast, by Type, 2020-2028

7.3.11.2.Market size and forecast, by End-Users, 2020-2028

7.3.11.3.Market size and forecast, by Distribution Channel, 2020-2028

7.3.11.4.Comparative market share analysis, 2020 & 2028

7.4.LAMEA

7.4.1.Market size and forecast, by Type, 2020-2028

7.4.2.Market size and forecast, by End-Users, 2020-2028

7.4.3.Market size and forecast, by Distribution Channel, 2020-2028

7.4.4.Market size and forecast, by country, 2020-2028

7.4.5.Comparative market share analysis, 2020 & 2028

7.4.6.Latin America

7.4.6.1.Market size and forecast, by Type, 2020-2028

7.4.6.2.Market size and forecast, by End-Users, 2020-2028

7.4.6.3.Market size and forecast, by Distribution Channel, 2020-2028

7.4.6.4.Comparative market share analysis, 2020 & 2028

7.4.7.Middle East

7.4.7.1.Market size and forecast, by Type, 2020-2028

7.4.7.2.Market size and forecast, by End-Users, 2020-2028

7.4.7.3.Market size and forecast, by Distribution Channel, 2020-2028

7.4.7.4.Comparative market share analysis, 2020 & 2028

7.4.8.Africa

7.4.8.1.Market size and forecast, by Type, 2020-2028

7.4.8.2.Market size and forecast, by End-Users, 2020-2028

7.4.8.3.Market size and forecast, by Distribution Channel, 2020-2028

7.4.8.4.Comparative market share analysis, 2020 & 2028

8.Company profiles

8.1.AXA

8.1.1.Business overview

8.1.2.Financial performance

8.1.3.Product portfolio

8.1.4.Recent strategic moves & developments

8.1.5.SWOT analysis

8.2.American International Group Inc.

8.2.1.Business overview

8.2.2.Financial performance

8.2.3.Product portfolio

8.2.4.Recent strategic moves & developments

8.2.5.SWOT analysis

8.3.Allianz

8.3.1.Business overview

8.3.2.Financial performance

8.3.3.Product portfolio

8.3.4.Recent strategic moves & developments

8.3.5.SWOT analysis

8.4.ASSICURAZIONI GENERALI S.P.A.

8.4.1.Business overview

8.4.2.Financial performance

8.4.3.Product portfolio

8.4.4.Recent strategic moves & developments

8.4.5.SWOT analysis

8.5.Berkshire Hathaway Inc.

8.5.1.Business overview

8.5.2.Financial performance

8.5.3.Product portfolio

8.5.4.Recent strategic moves & developments

8.5.5.SWOT analysis

8.6.Chubb Limited

8.6.1.Business overview

8.6.2.Financial performance

8.6.3.Product portfolio

8.6.4.Recent strategic moves & developments

8.6.5.SWOT analysis

8.7.Munich RE

8.7.1.Business overview

8.7.2.Financial performance

8.7.3.Product portfolio

8.7.4.Recent strategic moves & developments

8.7.5.SWOT analysis

8.8.PICC

8.8.1.Business overview

8.8.2.Financial performance

8.8.3.Product portfolio

8.8.4.Recent strategic moves & developments

8.8.5.SWOT analysis

8.9.Tokio Marine HCC

8.9.1.Business overview

8.9.2.Financial performance

8.9.3.Product portfolio

8.9.4.Recent strategic moves & developments

8.9.5.SWOT analysis

8.10.Zurich

8.10.1.Business overview

8.10.2.Financial performance

8.10.3.Product portfolio

8.10.4.Recent strategic moves & developments

8.10.5.SWOT analysis

Specialty insurance is meant to cover & protect businesses with non-traditional needs and negligence claims. This insurance can be obtained for events or items that are considered unique and are hardly covered by the standard insurance policies. Healthcare, environmental, construction, energy, and environmental industries highly demand for specialty insurance. Moreover, a type of professional liability, errors & omissions (E&O) insurance is considered as a standard type of specialty insurance plan.

COVID-19 Impact on Specialty insurance Market

The outbreak of COVID-19 across the globe has unfavorably impacted the global specialty insurance market growth. The negative specialty insurance market growth is majorly due to the closing down of various insurance brokerage firms in the developing countries like Japan and India due to a drop-in the client demand for insurance. Although the business of insurance market has increased dramatically in the recent years, but it has been estimated that it might face an uncertain fall in 2021 due to the COVID-19 pandemic. This is majorly owing to the increase in insurance prices and the implementation of lockdown by government agencies in most countries around the world.

Specialty insurance Market Trends and Developments

The companies operating in the global industry are adopting several growth strategies and business tactics such as partnerships, collaboration, business expansion, and product launches to obtain a leading position in the global industry, which is predicted to drive the global specialty insurance market growth in the upcoming years.

For instance, in July 2020, Munich Re Specialty Insurance, the leading provider of extensive, casualty, and specialty property insurance solutions to customers, announced the launch of a new Miscellaneous Professional Liability (MPL) solution for commercial, non-specialist businesses. The MPL covers both defense and liability costs from claims that allege omissions or errors in the rendering of professional services.

In October 2020, ReAlign Insurance, an insurance holding company, organized to build a vertically aligned, specialty program insurance platform, announced the launch of Summit Specialty Insurance in Nebraska. The Summit Specialty has received the needed regulatory approvals to operate as a surplus lines insure. The new carrier is now working to achieve authorization to begin underwriting activity in markets across the country.

In October 2021, Mosaic Insurance, the Bermuda-based specialty insurance startup, and DXC Technology, the American multinational corporation, entered into a strategic partnership to launch a Specialty Insurance technology platform, combining of Mosiac’s IP & expertise, and powered by DXC’s technology services. This platform can increase the speed at which specialty insurance is underwritten and sold.

Forecast Analysis of Global Market

The global specialty insurance market is projected to witness an exponential growth over the forecast period, owing to the presence of developing nations, particularly increasing economies like India, Australia, China, South Korea, and Singapore are projected to open up new growth opportunities for the market by 2028. Conversely, the lack of information and misconceptions related to specialty insurance are expected to hamper the market growth in the projected timeframe.

The growing demand for specialized expertise and constant technological advancements are the significant factors and specialty insurance market trends estimated to bolster the growth of the global market in the coming future. According to a latest report published by Research Dive, the global specialty insurance market is expected to garner $243.70 billion during the forecast period (2021-2028). Regionally, the Asia-Pacific specialty insurance market is estimated to observe the rapid growth by 2028, owing to the due to the presence of the presence of various developing economies and financial centers such as Singapore, Hong Kong, and India.

The key players functioning in the global market include Zurich, AXA, Tokio Marine HCC, American International Group Inc., Assicurazioni Generali S.P.A., Allianz, PICC, Chubb, Berkshire Hathaway Inc., and Munich Re.

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com