Polished Concrete Market Report

RA08390

Polished Concrete Market by Product (Densifiers, Sealers & Crack Fillers, and Conditioners), Method (Dry and Wet), Construction Type (New Construction and Renovation), End-Use (Residential and Non-residential), and Region (North America, Europe, Asia-Pacific, and LAMEA): Global Opportunity Analysis and Industry Forecast, 2022-2031

Global Polished Concrete Market Analysis

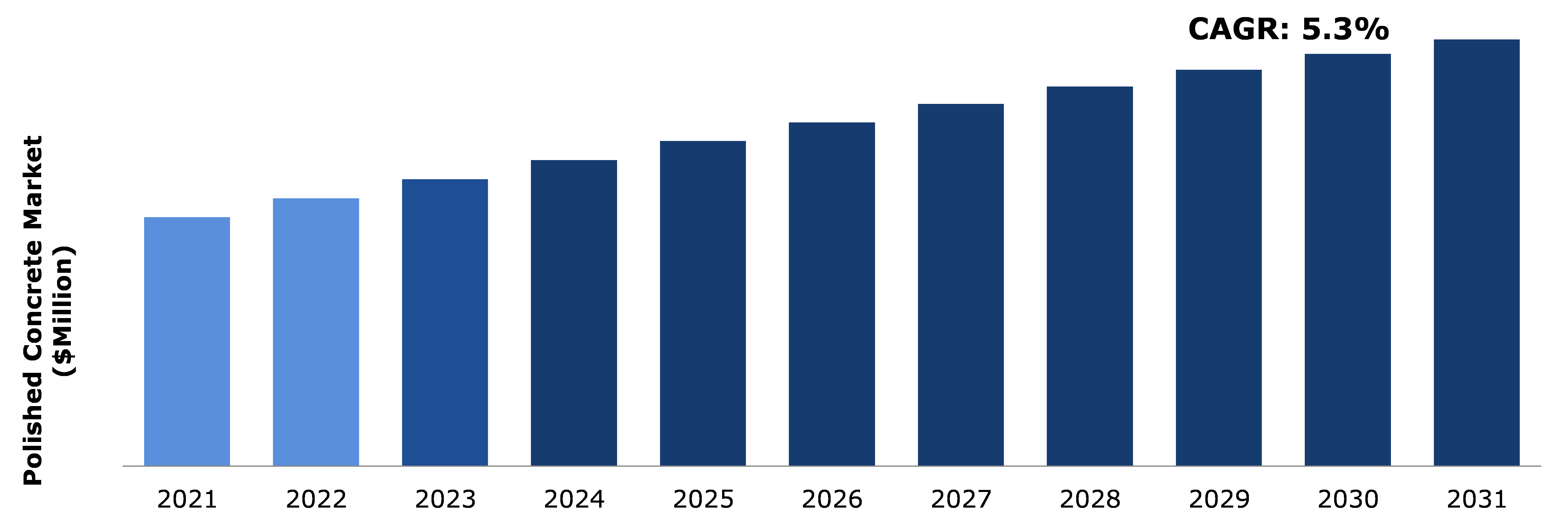

The Global Polished Concrete Market Size was $2,148.7 million in 2021 and is expected to grow with a CAGR of 5.3%, by generating a revenue of $3,683.4 million by 2031.

Global Polished Concrete Market Synopsis

Polished concrete is a concrete conditioner for hard and polished surfaces. Huge demand has been witnessed for aesthetic infrastructure all over the globe due to the image and value that is projected by the looks of the spaces, which can add and retain customer base in hotels or other commercial buildings. The polished concrete gives rich & glossy look and does not cause any wear & tear of the floor. Increase in population and demand for private homes across the globe is projected to drive the polished concrete market growth during the forecast period. Rise in investments in housing developments is anticipated to lead to revenue growth of the polished concrete market in Asia-Pacific and Middle East & Africa.

The presence of synthetic chemicals in polished concrete can pose health risk, which is expected to restrict polished concrete market growth during the forecast period. Some of the research studies hint that exposure to polished concrete can increase the risk of cancer. Moreover, polished concrete is flammable and toxic.

In addition, there are fluctuations in prices of raw materials, which directly influence prices of products such as cement that is used to make concrete and these price fluctuations lead to drop in profit margin. Moreover, cement impacts the environment as manufacturing of cement leads to emission of harmful greenhouse gases during production. This factor might restrain the polished concrete industry due to opposition from many environmental activists and pressure from governments of various countries.

Rapid growth in residential and commercial construction projects has led to an increase in demand for polished concrete. The polished concrete market size is expected to boost and project exponential growth in Asia-Pacific, as there has been an increase in residential, commercial, and industrial construction activities, which is expected to drive revenue growth of polished concrete market in Asia-Pacific. These factors are anticipated to boost the polished concrete market size during the forecast period.

Polished Concrete Market Overview

Polished concrete is a multi-step technique that requires mechanical grinding & sharpening the concrete and then polishing it using bonded adhesives. Polished concrete is a beautiful, robust, polished, and simple to clean flooring that offers long lasting finish, skid-resistance, and dent-resistant finish. This procedure endures glossy finish to the flooring, and it is extensively utilized in commercial and residential constructions.

COVID-19 Impact on Global Polished Concrete Market

The coronavirus outbreak had a catastrophic effect on various businesses. The polished concrete industry faced a detrimental impact as all the building projects across several nations were postponed till further notice. Moreover, there has been a negative impact due to the absence of supply chain infrastructure, lack of availability of manpower, shortage of raw materials, and the price of raw materials rose, owing to supply chain concerns across many nations. The governments of various nations set limitations throughout the globe where individuals were instructed to stay inside the house owing to which all the active building projects ended and new ones procrastinated. However, there has been an upsurge in demand for polished concrete due to easing of COVID-19 limitations. The polished concrete market is seeing expansion as infrastructural development is in a continual requirement for development.

Growing Construction Activities to Surge the Market Growth

Rapid growth in commercial construction sectors such as construction of commercial buildings, hotels, airports, and others is anticipated to boost the polished concrete market size during the forecast period. Polished concrete for flooring offers various advantages such as the aesthetic appeal of the floor, resistance to sliding on the floor due to suitable friction, and resistance to wear and tear caused due to excessive footfall. It is anticipated that the polished concrete demand in Middle East and Asia-Pacific country is expected grow rapidly owing to surge in construction activities and growth in demand for residential housing. Moreover, rise in investments in affordable housing sector and urbanization in the emerging countries are anticipated to drive polished concrete demand. The aesthetic aspect of polished concrete with enhanced ambience demonstrates the quality of the facility and these elements are anticipated to boost polished concrete market demand during the forecast period.

To know more about global polished concrete market drivers, get in touch with our analysts here.

Negative Environmental Impact with the Use of Polished Concrete to Restrain the Market Growth

The negative environmental effect connected with the usage of polished concrete is likely to hinder the polished concrete market growth during the forecast period. The major component of polished concrete is cement, which leads to emission of harmful carbon dioxide and greenhouse gases. This feature may cause a negative influence on the growth of the market during the forecast period.

Growing Population and Rapid Urbanization to Create Massive Investment Opportunities

The rise in development and increase in demand for inexpensive residences are anticipated to fuel the polished concrete market expansion. For instance, the Affordable Rental Housing complexes (ARHC) under the Pradhan Mantri Awas Yojana, gives quality housing at an affordable price to the urban poor population of India. Remodeling and rebuilding of nonresidential areas is projected to raise demand for polished concrete as it offers attractive ambience, which is further expected to attract people who desire of achieving similar infrastructure in personal spaces. All these reasons propel the expansion of polished concrete market.

To know more about global polished concrete market opportunities, get in touch with our analysts here.

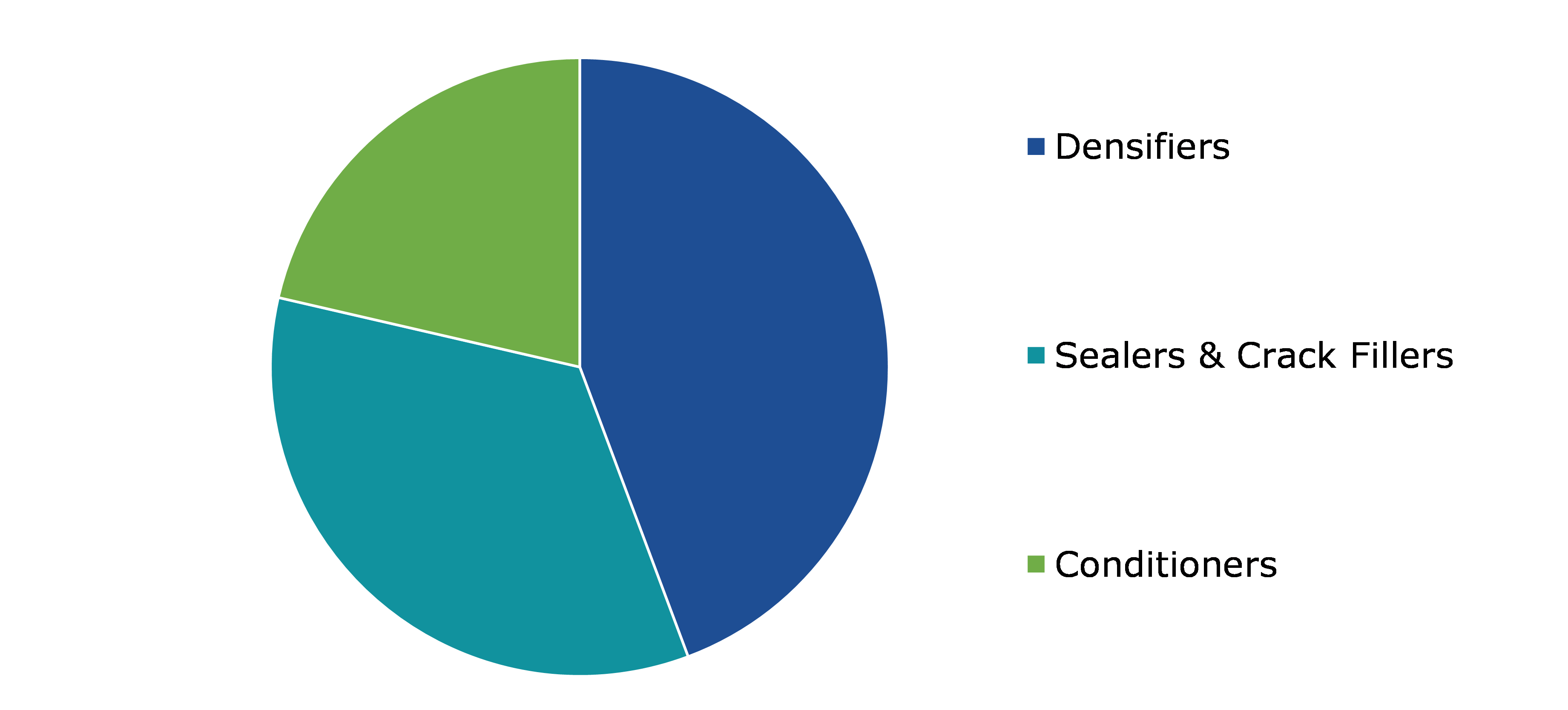

Global Polished Concrete Market, By Product

By product, the market has been divided into densifiers, sealers & crack fillers, and conditioners. Out of these, the densifiers segment accounted for the highest market size in 2021 and sealers & crack fillers is anticipated to show the fastest growth during the forecast period.

Global Polished Concrete Market Size, By Product, 2021

Source: Research Dive Analysis

The densifier segment accounted for the highest market size in 2021. Concrete densifiers find various applications in hospitals, stadiums, airports, and factories for polished floor surfaces. This is majorly owing to enhanced surface durability offered by densifiers compared to concrete surfaces that are not treated with densifiers. For instance, CFI (Coating for Industry) launched new product named WearCOAT 3020 that gives an excellent finish to polished concrete floors and enhances their durability. This product is lithium silicate and water-based concrete densifier. During the polishing of slab, concrete densifier is used as a chemical hardener that is put on top of the concrete slab. Densifier is employed for the refining process. These concrete densifiers work as a pore filler and raise the surface density of the slab. These factors are anticipated to boost the growth of densifier segment during the forecast period.

Sealers & Crack Fillers segment is expected to show fastest growth during the forecast period. The sealer & crack filler adds great value to the polished concrete by boosting the longevity of the flooring. Sealer & crack filler can be utilized in situations where the temperature fluctuates regularly. Sealer and crack filler are two different methods. In crack sealing process, hot sealant is applied to the cracks to prevent water intrusion whereas in crack filling, asphalt emulsion is placed into non-working cracks that is used to reinforce the adjacent pavement and prevent water infiltration.

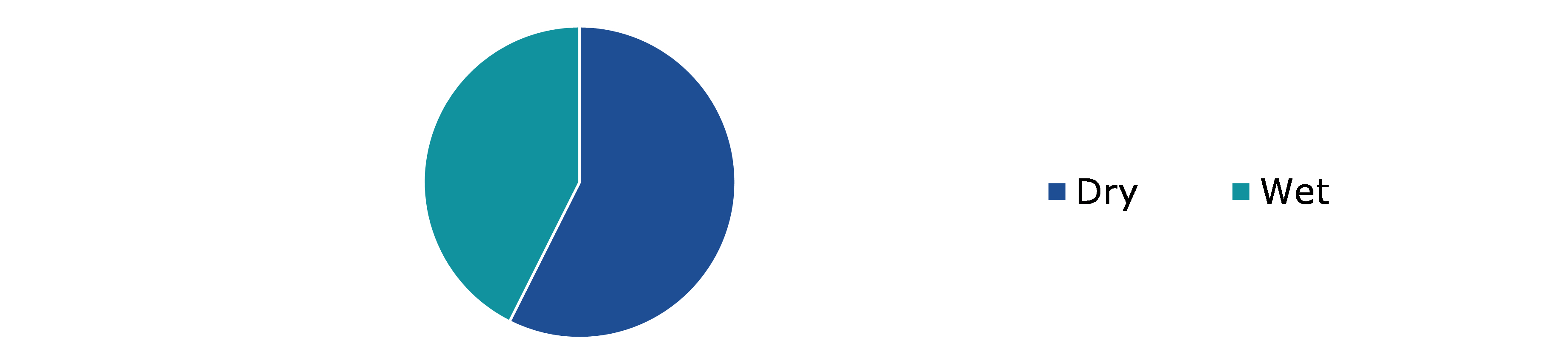

Global Polished Concrete Market, by Method

By method, the market is bifurcated into dry and wet. The dry segment accounted for the dominant market share and it is expected to show the fastest growth during the forecast period.

Global Polished Concrete Market Share, by Method

Source: Research Dive Analysis

The dry segment of the global polished concrete industry accounted for highest market size in 2021. The dry polished concrete uses dust extraction system, which is certified with HEPA (High Efficiency Particulate Air) filters. This protects the employees operating in dry polished concrete process from hazardous respirable silica dust, therefore, this method guarantees safe environment. Comparing the dry polished concrete methods with wet method, dry conditioner method endures more shine and finish. The dry method is suited in both small areas & large open spaces and also it more cost effective. These factors may propel the generation of revenue and increase the growth of dry segment during the forecast period.

The wet segment of the global polished concrete is expected to account for significant growth during the forecast period. This growth is primarily due to reduced downtime & employment of environment-friendly propane powered instruments and equipment, which carry out 100 % dust free process. In the wet concrete polishing method, water is added to provide lubrication and to reduce the friction of diamond tooling. The wet concrete polishing method is cost-effective and it keeps harmful substances out of the air. Moreover, in this method, the slurry that is produced can be recycled. In addition, the wet method allows the diamonds to cut faster on medium-hard to very-hard surfaces. This process has shorter downtime and it can use environment-friendly propane-fueled machine. The above-mentioned are anticipated to drive the wet segment during the forecast period.

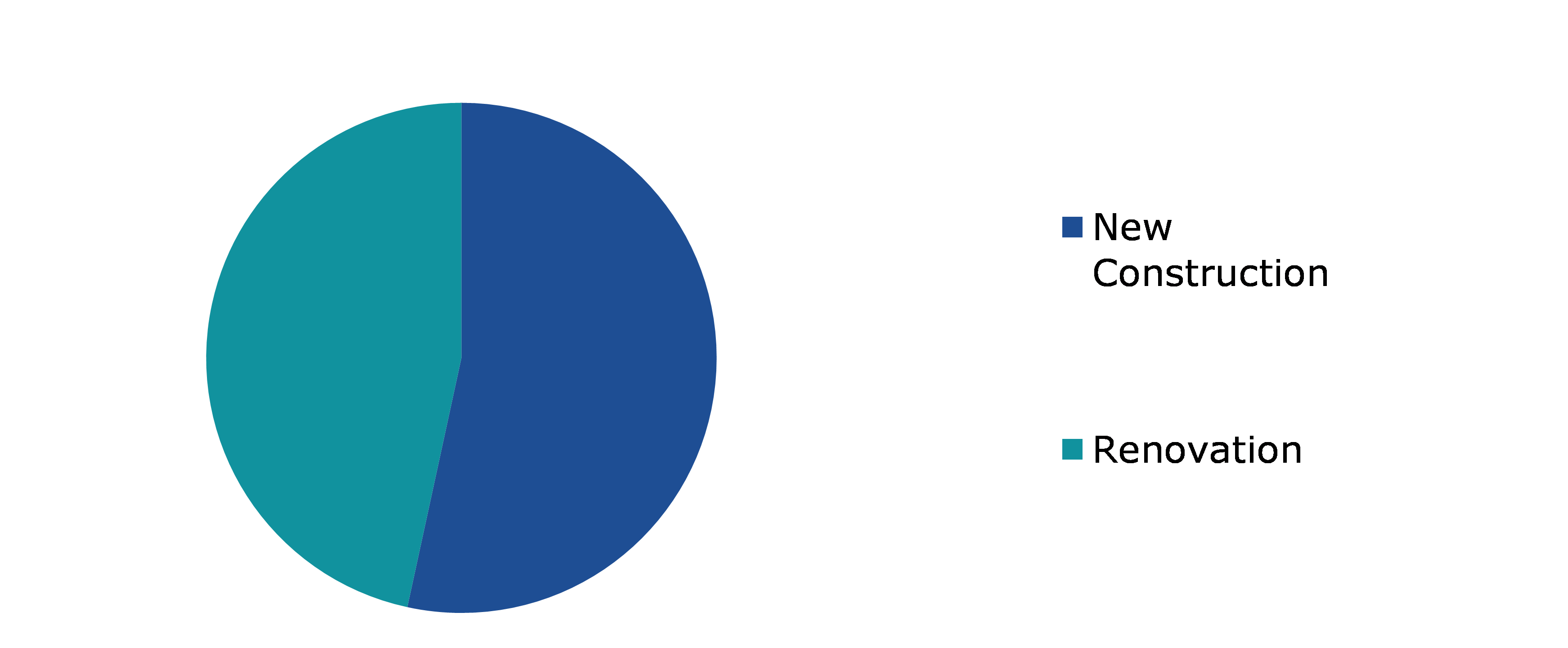

Global Polished Concrete Market, by Construction Type

By construction type, the market is classified into new construction and renovation. The new construction segment registered for the dominant market share in 2021 and renovation segment is estimated to the fastest growth during the forecast period.

Global Polished Concrete Market Forecast, by Construction Type

Source: Research Dive Analysis

The new construction segment accounted for the highest market size in 2021. Demand for polished concrete is expected to increase exponentially due to rapid urbanization, investment in development of smart cities, and migration of people to urban areas, which drives growth of new construction activities. The new construction activities include construction of residential and commercial spaces around the world. This growth is majorly due to increasing number of new construction projects involving residential projects, warehouses, office spaces, and others. The abovementioned factors augment the growth of the new construction segment, which eventually is expected to pump revenue growth of polished concrete market during the forecast period.

The renovation segment is expected to show the fastest growth during the forecast period. This growth is due to increased restoration initiatives that enhance the visual appeal of the floor in a cost-effective manner. For instance, as mentioned in Build Up, a European platform for energy efficiency in buildings, on October 4, 2019, 35 % of buildings in Europe are over 50 years old and over 75% of the buildings are energy inefficient. Hence, the rehabilitation of old buildings is required for energy saving and to minimize CO2 emissions. Such factors may generate substantial possibilities for the remodeling segment during the forecast period.

Global Polished Concrete Market, by End-Use

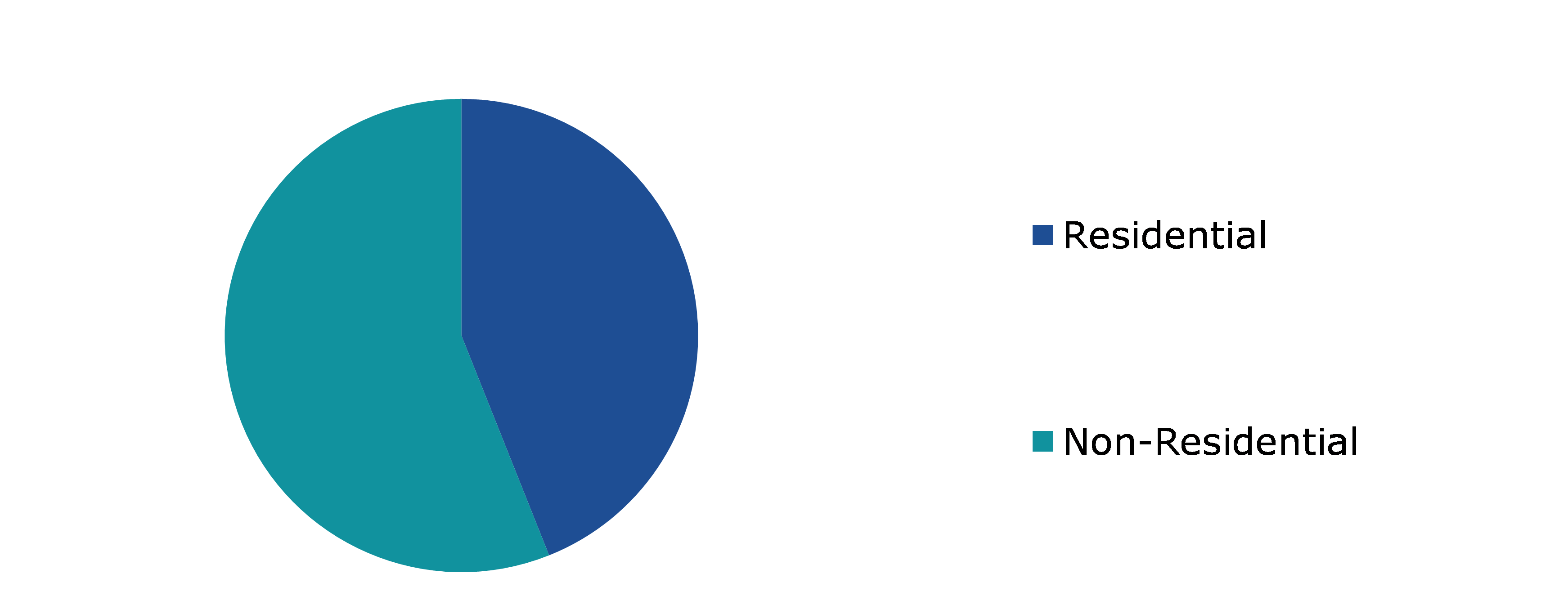

By end-use, the market is divided into residential and non-residential. The non-residential segment accounted for the dominant market size and it is projected to show fastest growth during the forecast period.

Global Polished Concrete Market Growth, by End-Use

Source: Research Dive Analysis

The non-residential segment of the global polished concrete market accounted for the dominant market share in 2021. An expeditious construction of hospitals, commercial complexes, hotels, and industrial buildings has been witnessed recently due to which the polished concrete market is encountering an exponential demand from non-residential segment. For instance, the data published in the U.S. Census Bureau on April 1, 2021, the total construction spending on non-residential construction in U.S. was $35,1200 million and it is expected to grow during the forecast period. Since polished concrete is eco-friendly as there is no hazardous impact on indoor air quality or the environment, use of polished concrete for building of non-residential spaces such as industrial or commercial construction aids the contractor to achieve the LEED (Leadership in Energy and Environmental Design) ratings, which is a program for efficient and environment friendly construction. The investment on construction industry is rapidly accelerating on non-residential construction and is estimated to further increase. All these factors are estimated to rapidly propel the growth of polished concrete market during the forecast period.

Global Polished Concrete Market, Regional Insights

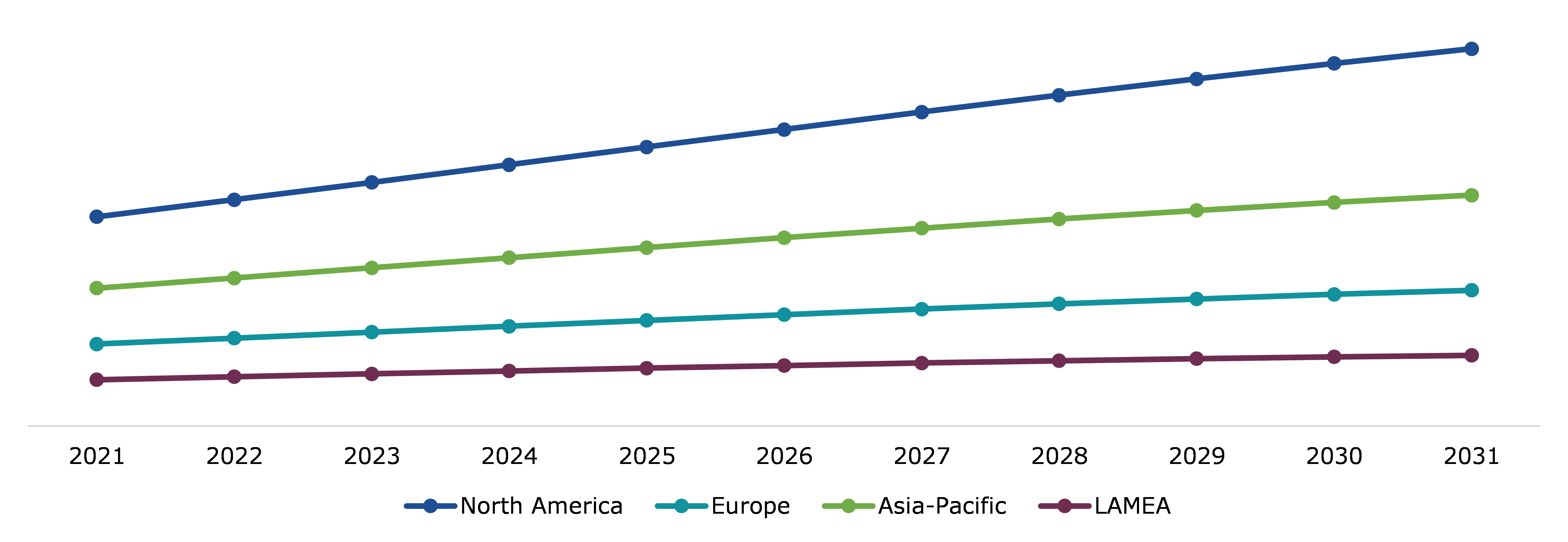

The polished concrete market analysis has been analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Global Polished Concrete Market Size & Forecast, by Region, 2021-2031 ($ Million)

Source: Research Dive Analysis

The Market for Polished Concrete in North America to be the Most Dominant

The tremendous improvements in e-commerce business have raised need for construction of new warehouses and logistics hubs in North America. The stringent government regulations on emission of harmful VOC’s and greenhouse gases are expected to drive the polished concrete demand as it is a cost-effective flooring solution. For instance, the total construction spending in U.S. was $1,516,927 million that includes both the private and public construction as published in Census.gov in February 2021. For instance, the Atlanta Business Chronicles developers in metro Atlanta region has created 18 million square feet of warehouse space to accommodate big e-commerce corporations such as Amazon and Home Depot. All these reasons are expected to eventually fuel the demand in the polished concrete market in North America.

The Market for Polished Concrete in Asia-Pacific to Show Considerable Growth

The growth is the result of increasing residential construction, industrialization, urbanization in Asia-Pacific. For instance, during the pandemic, the China State Construction Engineering Corporate (CSCEC) had constructed 2 hospitals in Wuhan within a span of 10-12 days. This is one of the largest construction companies in China. Such rapid construction activities and developments are expected to foster the market growth, which is anticipated to eventually boost Asia-Pacific polished concrete market in the upcoming years.

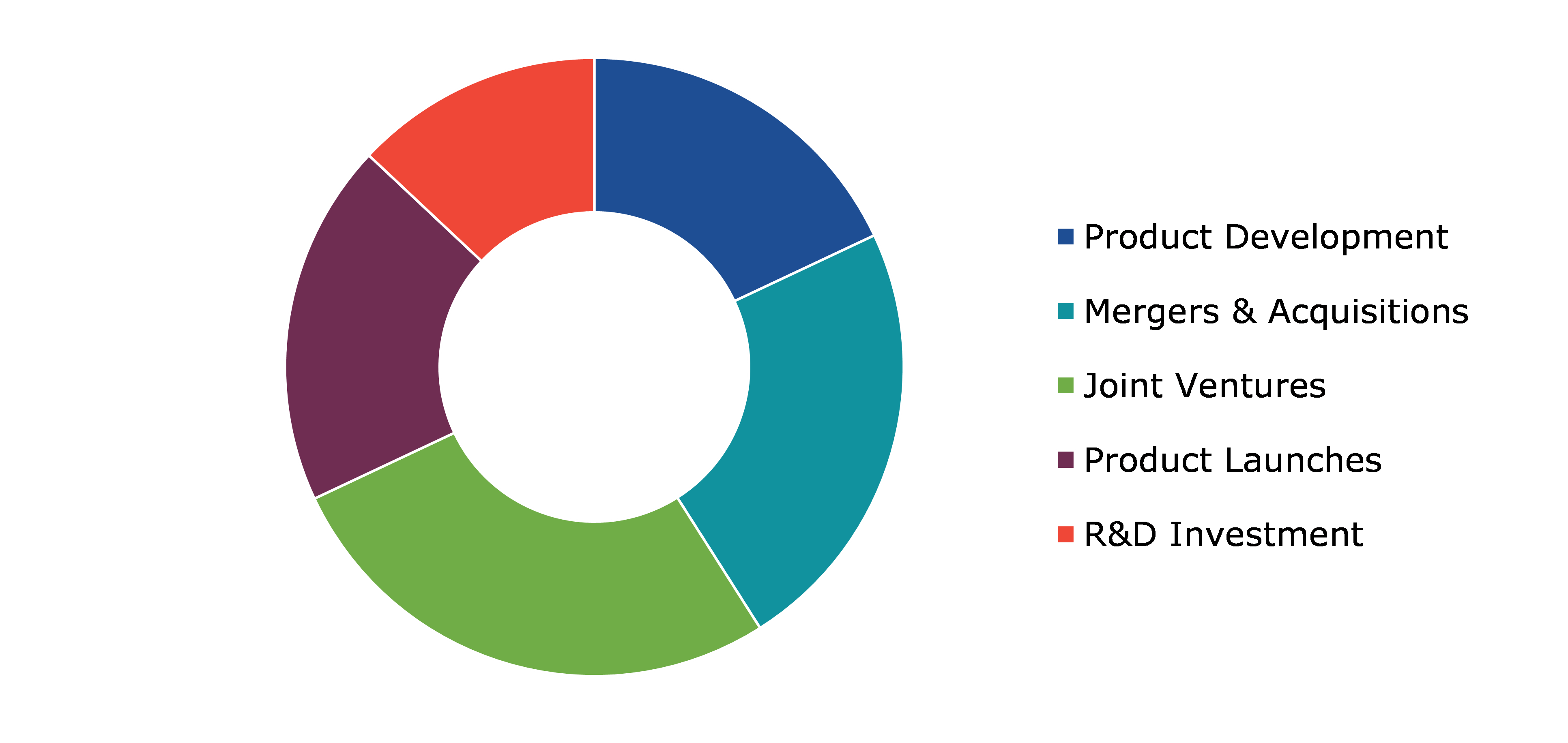

Competitive Scenario in the Global Polished Concrete Market

Acquisition, business expansions, and partnership are common strategies followed by major market players. For instance, in December 2020, PPG Industries acquired Tikkurila (Finland), a finish paint and coatings manufacturer. This acquisition is expected to provide PPG Industries with new cross-selling opportunities, growth opportunities for employees, and product solutions for new segments and customers.

Source: Research Dive Analysis

Some of the leading polished concrete market players are Pittsburgh Plate Glass Industries, Inc., 3M, BASF SE, Sika AG, Ultra Tech Cement Limited, The Sherwin Williams Company, Boral Limited, Solomon Colors Inc., Vexcon Chemicals Inc., and The Euclid Chemical Company.

| Aspect | Particulars |

| Historical Market Estimations | 2020 |

| Base Year for Market Estimation | 2021 |

| Forecast Timeline for Market Projection | 2022-2031 |

| Regional Scope | North America, Europe, Asia-Pacific, and LAMEA |

| Segmentation by Product |

|

| Segmentation by Method |

|

| Segmentation by Construction Type |

|

| Segmentation by End-Use |

|

| Key Companies Profiled |

|

Q1. What is the size of the global polished concrete market?

A. The size of the global polished concrete market was over $2,148.7 million in 2021 and is projected to reach $3,683.4 million by 2031.

Q2. Which are the major companies in the polished concrete market?

A. Pittsburgh Plate Glass Industries, Inc., 3M, and BASF SE are some of the major players operating in the polished concrete market.

Q3. Which region possesses greater investment opportunities in the near future?

A. Asia-Pacific possesses great investment opportunities for investors to witness the most promising growth in the future.

Q4. What is expected to be the growth rate of the Asia-Pacific polished concrete market?

A. Asia-Pacific polished concrete market is anticipated to grow at 5.1% CAGR during the forecast period.

Q5. What are the strategies opted by the leading players in this market?

A. Acquisition, business expansion, and partnership are the key strategies opted by the operating companies in this market.

Q6. Which companies are investing more on R&D practices?

A. Sika AG, Ultra Tech Cement Limited, and The Sherwin Williams Company are investing more on R&D activities for developing new products and technologies.

1.Research Methodology

1.1.Desk Research

1.2.Real time insights and validation

1.3.Forecast model

1.4.Assumptions and forecast parameters

1.5.Market size estimation

1.5.1.Top-down approach

1.5.2.Bottom-up approach

2.Report Scope

2.1.Market definition

2.2.Key objectives of the study

2.3.Report overview

2.4.Market segmentation

2.5.Overview of the impact of COVID-19 on Global polished concrete market

3.Executive Summary

4.Market Overview

4.1.Introduction

4.2.Growth impact forces

4.2.1.Drivers

4.2.2.Restraints

4.2.3.Opportunities

4.3.Market value chain analysis

4.3.1.List of raw material suppliers

4.3.2.List of manufacturers

4.3.3.List of distributors

4.4.Innovation & sustainability matrices

4.4.1.Method matrix

4.4.2.Regulatory matrix

4.5.Porter’s five forces analysis

4.5.1.Bargaining power of suppliers

4.5.2.Bargaining power of consumers

4.5.3.Threat of substitutes

4.5.4.Threat of new entrants

4.5.5.Competitive rivalry intensity

4.6.PESTLE analysis

4.6.1.Political

4.6.2.Economical

4.6.3.Social

4.6.4.Technological

4.6.5.Environmental

4.7.Impact of COVID-19 on polished concrete market

4.7.1.Pre-covid market scenario

4.7.2.Post-covid market scenario

5.Polished Concrete Market Analysis, by Product

5.1.Overview

5.2.Densifiers

5.2.1.Definition, key trends, growth factors, and opportunities

5.2.2.Market size analysis, by region, 2022-2031

5.2.3.Market share analysis, by country, 2022-2031

5.3.Sealers & Crack Fillers

5.3.1.Definition, key trends, growth factors, and opportunities

5.3.2.Market size analysis, by region, 2022-2031

5.3.3.Market share analysis, by country, 2022-2031

5.4.Conditioners

5.4.1.Definition, key trends, growth factors, and opportunities

5.4.2.Market size analysis, by region, 2022-2031

5.4.3.Market share analysis, by country, 2022-2031

5.5.Research Dive Exclusive Insights

5.5.1.Market attractiveness

5.5.2.Competition heatmap

6.Polished Concrete Market Analysis, by Method

6.1.Overview

6.2.Dry

6.2.1.Definition, key trends, growth factors, and opportunities

6.2.2.Market size analysis, by region, 2022-2031

6.2.3.Market share analysis, by country, 2022-2031

6.3.Wet

6.3.1.Definition, key trends, growth factors, and opportunities

6.3.2.Market size analysis, by region, 2022-2031

6.3.3.Market share analysis, by country, 2022-2031

6.4.Research Dive Exclusive Insights

6.4.1.Market attractiveness

6.4.2.Competition heatmap

7.Polished Concrete Market Analysis, by Construction Type

7.1.Overview

7.2.New Construction

7.2.1.Definition, key trends, growth factors, and opportunities

7.2.2.Market size analysis, by region, 2022-2031

7.2.3.Market share analysis, by country, 2022-2031

7.3.Renovation

7.3.1.Definition, key trends, growth factors, and opportunities

7.3.2.Market size analysis, by region, 2022-2031

7.3.3.Market share analysis, by country, 2022-2031

7.4.Research Dive Exclusive Insights

7.4.1.Market attractiveness

7.4.2.Competition heatmap

8.Polished Concrete Market Analysis, by End-Use

8.1.Overview

8.2.Residential

8.2.1.Definition, key trends, growth factors, and opportunities

8.2.2.Market size analysis, by region, 2022-2031

8.2.3.Market share analysis, by country, 2022-2031

8.3.Non-Residential

8.3.1.Definition, key trends, growth factors, and opportunities

8.3.2.Market size analysis, by region, 2022-2031

8.3.3.Market share analysis, by country, 2022-2031

8.4.Food and Beverage

8.5.Research Dive Exclusive Insights

8.5.1.Market attractiveness

8.5.2.Competition heatmap

9.Polished Concrete Market, by Region

9.1.North America

9.1.1.U.S.

9.1.1.1.Market size analysis, by Product, 2022-2031

9.1.1.2.Market size analysis, by Method, 2022-2031

9.1.1.3.Market size analysis, by Construction Type, 2022-2031

9.1.1.4.Market size analysis, by End-Use, 2022-2031

9.1.2.Canada

9.1.2.1.Market size analysis, by Product, 2022-2031

9.1.2.2.Market size analysis, by Method, 2022-2031

9.1.2.3.Market size analysis, by Construction Type, 2022-2031

9.1.2.4.Market size analysis, by End-Use, 2022-2031

9.1.3.Mexico

9.1.3.1.Market size analysis, by Product, 2022-2031

9.1.3.2.Market size analysis, by Method, 2022-2031

9.1.3.3.Market size analysis, by Construction Type, 2022-2031

9.1.3.4.Market size analysis, by End-Use, 2022-2031

9.1.4.Research Dive Exclusive Insights

9.1.4.1.Market attractiveness

9.1.4.2.Competition heatmap

9.2.Europe

9.2.1.Germany

9.2.1.1.Market size analysis, by Product, 2022-2031

9.2.1.2.Market size analysis, by Method, 2022-2031

9.2.1.3.Market size analysis, by Construction Type, 2022-2031

9.2.1.4.Market size analysis, by End-Use, 2022-2031

9.2.2.UK

9.2.2.1.Market size analysis, by Product, 2022-2031

9.2.2.2.Market size analysis, by Method, 2022-2031

9.2.2.3.Market size analysis, by Construction Type, 2022-2031

9.2.2.4.Market size analysis, by End-Use, 2022-2031

9.2.3.France

9.2.3.1.Market size analysis, by Product, 2022-2031

9.2.3.2.Market size analysis, by Method, 2022-2031

9.2.3.3.Market size analysis, by Construction Type, 2022-2031

9.2.3.4.Market size analysis, by End-Use, 2022-2031

9.2.4.Spain

9.2.4.1.Market size analysis, by Product, 2022-2031

9.2.4.2.Market size analysis, by Method, 2022-2031

9.2.4.3.Market size analysis, by Construction Type, 2022-2031

9.2.4.4.Market size analysis, by End-Use, 2022-2031

9.2.5.Italy

9.2.5.1.Market size analysis, by Product, 2022-2031

9.2.5.2.Market size analysis, by Method, 2022-2031

9.2.5.3.Market size analysis, by Construction Type, 2022-2031

9.2.5.4.Market size analysis, by End-Use, 2022-2031

9.2.6.Rest of Europe

9.2.6.1.Market size analysis, by Product, 2022-2031

9.2.6.2.Market size analysis, by Method, 2022-2031

9.2.6.3.Market size analysis, by Construction Type, 2022-2031

9.2.6.4.Market size analysis, by End-Use, 2022-2031

9.2.7.Research Dive Exclusive Insights

9.2.7.1.Market attractiveness

9.2.7.2.Competition heatmap

9.3.Asia-Pacific

9.3.1.China

9.3.1.1.Market size analysis, by Product, 2022-2031

9.3.1.2.Market size analysis, by Method, 2022-2031

9.3.1.3.Market size analysis, by Construction Type, 2022-2031

9.3.1.4.Market size analysis, by End-Use, 2022-2031

9.3.2.Japan

9.3.2.1.Market size analysis, by Product, 2022-2031

9.3.2.2.Market size analysis, by Method, 2022-2031

9.3.2.3.Market size analysis, by Construction Type, 2022-2031

9.3.2.4.Market size analysis, by End-Use, 2022-2031

9.3.3.India

9.3.3.1.Market size analysis, by Product, 2022-2031

9.3.3.2.Market size analysis, by Method, 2022-2031

9.3.3.3.Market size analysis, by Construction Type, 2022-2031

9.3.3.4.Market size analysis, by End-Use, 2022-2031

9.3.4.Australia

9.3.4.1.Market size analysis, by Product, 2022-2031

9.3.4.2.Market size analysis, by Method, 2022-2031

9.3.4.3.Market size analysis, by Construction Type, 2022-2031

9.3.4.4.Market size analysis, by End-Use, 2022-2031

9.3.5.South Korea

9.3.5.1.Market size analysis, by Product, 2022-2031

9.3.5.2.Market size analysis, by Method, 2022-2031

9.3.5.3.Market size analysis, by Construction Type, 2022-2031

9.3.5.4.Market size analysis, by End-Use, 2022-2031

9.3.6.Rest of Asia-Pacific

9.3.6.1.Market size analysis, by Product, 2022-2031

9.3.6.2.Market size analysis, by Method, 2022-2031

9.3.6.3.Market size analysis, by Construction Type, 2022-2031

9.3.6.4.Market size analysis, by End-Use, 2022-2031

9.3.7.Research Dive Exclusive Insights

9.3.7.1.Market attractiveness

9.3.7.2.Competition heatmap

9.4.LAMEA

9.4.1.Brazil

9.4.1.1.Market size analysis, by Product, 2022-2031

9.4.1.2.Market size analysis, by Method, 2022-2031

9.4.1.3.Market size analysis, by Construction Type, 2022-2031

9.4.1.4.Market size analysis, by End-Use, 2022-2031

9.4.2.Saudi Arabia

9.4.2.1.Market size analysis, by Product, 2022-2031

9.4.2.2.Market size analysis, by Method, 2022-2031

9.4.2.3.Market size analysis, by Construction Type, 2022-2031

9.4.2.4.Market size analysis, by End-Use, 2022-2031

9.4.3.UAE

9.4.3.1.Market size analysis, by Product, 2022-2031

9.4.3.2.Market size analysis, by Method, 2022-2031

9.4.3.3.Market size analysis, by Construction Type, 2022-2031

9.4.3.4.Market size analysis, by End-Use, 2022-2031

9.4.4.South Africa

9.4.4.1.Market size analysis, by Product, 2022-2031

9.4.4.2.Market size analysis, by Method, 2022-2031

9.4.4.3.Market size analysis, by Construction Type, 2022-2031

9.4.4.4.Market size analysis, by End-Use, 2022-2031

9.4.5.Rest of LAMEA

9.4.5.1.Market size analysis, by Product, 2022-2031

9.4.5.2.Market size analysis, by Method, 2022-2031

9.4.5.3.Market size analysis, by Construction Type, 2022-2031

9.4.5.4.Market size analysis, by End-Use, 2022-2031

9.4.6.Research Dive Exclusive Insights

9.4.6.1.Market attractiveness

9.4.6.2.Competition heatmap

10.Competitive Landscape

10.1.Top winning strategies, 2021

10.1.1.By strategy

10.1.2.By year

10.2.Strategic overview

10.3.Market share analysis

11.Company Profiles

11.1.Pittsburgh Plate Glass Industries, Inc.

11.1.1.Overview

11.1.2.Business segments

11.1.3.Product portfolio

11.1.4.Financial performance

11.1.5.Recent developments

11.1.6.SWOT analysis

11.1.7.Research Dive Analyst View

11.2.3M

11.2.1.Overview

11.2.2.Business segments

11.2.3.Product portfolio

11.2.4.Financial performance

11.2.5.Recent developments

11.2.6.SWOT analysis

11.2.7.Research Dive Analyst View

11.3.BASF SE

11.3.1.Overview

11.3.2.Business segments

11.3.3.Product portfolio

11.3.4.Financial performance

11.3.5.Recent developments

11.3.6.SWOT analysis

11.3.7.Research Dive Analyst View

11.4. Sika AG

11.4.1.Overview

11.4.2.Business segments

11.4.3.Product portfolio

11.4.4.Financial performance

11.4.5.Recent developments

11.4.6.SWOT analysis

11.4.7.Research Dive Analyst View

11.5.Ultra Tech Cement Limited

11.5.1.Overview

11.5.2.Business segments

11.5.3.Product portfolio

11.5.4.Financial performance

11.5.5.Recent developments

11.5.6.SWOT analysis

11.5.7.Research Dive Analyst View

11.6.The Sherwin Williams Company

11.6.1.Overview

11.6.2.Business segments

11.6.3.Product portfolio

11.6.4.Financial performance

11.6.5.Recent developments

11.6.6.SWOT analysis

11.6.7.Research Dive Analyst View

11.7.Boral Limited

11.7.1.Overview

11.7.2.Business segments

11.7.3.Product portfolio

11.7.4.Financial performance

11.7.5.Recent developments

11.7.6.SWOT analysis

11.7.7.Research Dive Analyst View

11.8.Solomon Colors Inc.

11.8.1.Overview

11.8.2.Business segments

11.8.3.Product portfolio

11.8.4.Financial performance

11.8.5.Recent developments

11.8.6.SWOT analysis

11.8.7.Research Dive Analyst View

11.9.Vexcon Chemicals Inc.

11.9.1.Overview

11.9.2.Business segments

11.9.3.Product portfolio

11.9.4.Financial performance

11.9.5.Recent developments

11.9.6.SWOT analysis

11.9.7.Research Dive Analyst View

11.10.The Euclid Chemical Company

11.10.1.Overview

11.10.2.Business segments

11.10.3.Product portfolio

11.10.4.Financial performance

11.10.5.Recent developments

11.10.6.SWOT analysis

11.10.7.Research Dive Analyst View

Polished concrete has become an increasingly popular flooring option for both residential, industrial, and commercial spaces. It is a type of flooring that is created by grinding down the surface of a concrete floor using progressively finer diamond grinding tools. The process involves removing the top layer of the concrete to reveal a smooth, shiny surface that is sealed with a protective coating. Polished concrete can be customized to create a range of finishes, from a matte to a high-gloss shine. Its numerous benefits, including low maintenance, cost-effectiveness, and eco-friendliness, make it a popular choice among homeowners and business owners as well.

Forecast Analysis of the Global Polished Concrete Market

According to a report published by Research Dive, the global polished concrete market is envisioned to generate a revenue of $3,683.4 million and grow at a CAGR of 5.3% throughout the forecast timeframe from 2022 to 2031.

With the rapid increase in construction activities across commercial sectors and the growing demand for residential housing, the polished concrete market is predicted to witness significant growth over the analysis period. Besides, the rising investments in affordable housing and the rapid urbanization across emerging nations are further expected to foster the growth of the market throughout the estimated period. Moreover, the growing population across the globe, increasing remodeling activities, and the growing demand for polished concrete due to its eye-catching ambiance are expected to create huge growth opportunities for the market during the analysis timeframe. However, the negative environmental impact of using polished concrete may restrict the growth of the market throughout the forecast period.

The major players of the polished concrete market include The Sherwin Williams Company, Ultra Tech Cement Limited, Boral Limited, Sika AG, Solomon Colors Inc., BASF SE, Vexcon Chemicals Inc., 3M, The Euclid Chemical Company, Pittsburgh Plate Glass Industries, Inc., and many more.

Key Market Developments

The key companies operating in the industry are adopting various growth strategies & business tactics such as partnerships, collaborations, mergers & acquisitions, and launches to maintain a robust position in the overall market, which is subsequently helping the global polished concrete market to grow exponentially. For instance:

- In April 2021, Sika AG, a specialty chemicals company, announced that it is working on the development of concrete admixtures by using LC3 technology that lowers CO2 emissions, together with the Swiss Federal Institute of Technology Lausanne. With this development, Sika aimed to gain a leading position as an enabler of sustainable construction.

- In January 2022, Seal for Life Industries, a company with deep history of innovation in market-leading technologies, announced its acquisition of Mascoat Ltd., and Verdia, Inc., two privately owned renowned industrial coatings companies. With this acquisition, the companies aimed to expand their coating portfolios by providing high-performance flooring solutions to protect their critical infrastructure assets.

- In January 2023, Sustain Labs Paris’ an enterprise based in India, in partnership with BW Businessworld, India's largest business news magazine ranked UltraTech, India's No. 1 cement company, at the top for providing sustainability in the infrastructure and engineering sector. With this recognition, Ultra Tech has adopted a holistic approach to the development of innovative products and services and the use of alternative fuels and raw materials (AFR) in construction activities.

Most Profitable Region

The North America region of the polished concrete market is predicted to hold the maximum share of the market over the forecast period. The strict government regulations in this region on the emission of harmful VOCs and greenhouse gases are expected to boost the regional growth of the market over the estimated period. Additionally, the rising spending on public and private constructions across the region is further expected to bolster market growth in the coming period.

Covid-19 Impact on the Polished Concrete Market

The outbreak of the Covid-19 pandemic has had a disastrous impact on the polished concrete market, likewise various other industries. This is mainly due to the lack of manpower, disruption in supply chains, and shortage of raw materials over the pandemic period. Moreover, the postponement of various construction projects due to the imposed lockdowns by governments has further declined the growth of the market throughout the crisis.

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com