Blood Stream Infection Testing Market Report

RA08350

Blood Stream Infection Testing Market by Product (Instruments, Consumables, and Software & Services), Technique (Conventional and Automated), and Technology (Culture-based, Molecular, and Proteomic), Application (Bacterial, Fungal, and Mycobacterial), End-user (Hospitals, Independent Diagnostics Centers, and Others), and Regional Analysis (North America, Europe, Asia-Pacific and LAMEA): Global Opportunity Analysis and Industry Forecast, 2022–2030

Global Blood Stream Infection Testing Market Analysis

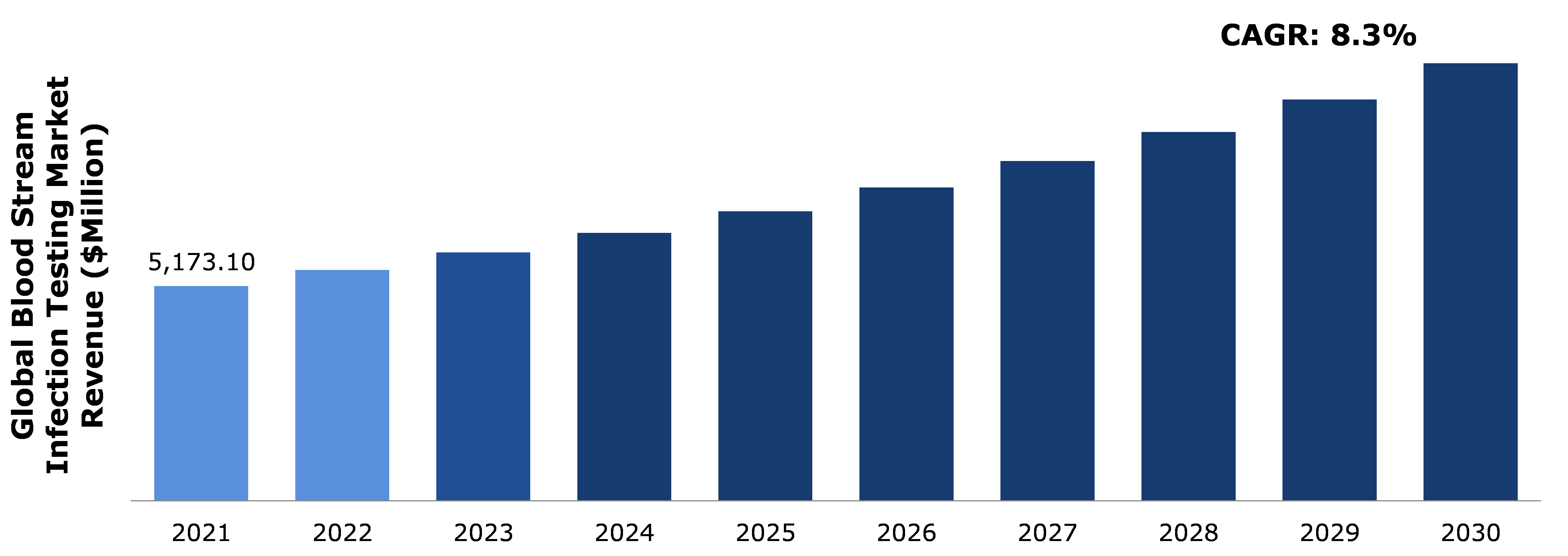

The global blood stream infection testing market size was $5,173.1 million in 2021 and grow with a CAGR of 8.3%, by generating a revenue of $10,540.8million by 2030.

Blood Stream Infection Testing Market Synopsis

The blood stream infection/sepsis is concern for human due to high morbidity and mortality rates. Globally, it is estimated to affect 30 million people, leading to 6 million deaths every year. For detection and diagnosis of the infection, the in-vitro diagnostic techniques (blood cultures) are widely used. In the microbiology laboratory, technological developments in molecular approaches including in situ hybridization, DNA-microassay-based hybridization method and nucleic acid amplification-based technique have transformed the diagnosis of microbial infections. As the blood stream infection analyzing devices have become faster, more automated, and easier to use, they have become essential part of routine testing and repertoire in most diagnostic laboratories. According to World Health Organization (WHO), there were about 48.9 million sepsis cases and 11 million sepsis-related deaths worldwide in 2017, accounting for nearly 20% of all global deaths. In 2017, children accounted for nearly half of all global sepsis cases, with an estimated 20 million cases and 2.9 million global deaths in children under the age of five.

Several technologically advanced products that provide enhanced solutions for the detection of microorganisms in the blood stream have been introduced in the market in recent years. These advanced products are expected to cannibalize the market for traditional products such as microscopes and polystainers, affecting revenue growth of traditional blood culture testing products. To remain competitive in the market, key players will need to diversify their product portfolio by incorporating new technologies. This will be a difficult task for market participants who have a well-established portfolio of conventional products.

One of the key factors that will create opportunities in market is rise in prevalence of chronic and infectious diseases around the world. Furthermore, increasing geriatric population, which is more susceptible to sepsis and other medical ailments, is fueling the market growth. Laboratories, diagnostic centers, and other healthcare facilities are increasingly using these tests to detect the presence of antibodies in the blood as well as identify and isolate infected individuals. Other factors, such as rising health consciousness among the general population, improvements in healthcare infrastructure, and extensive Research and Development (R&D) activities in the field of medical sciences, are expected to create investment opportunities for the major players in the market.

Blood Stream Infection Testing Overview

Blood stream infection is the infectious disease caused due to presence of bacteria, pathogen, or fungi microorganism in systemic circulation which evokes the inflammatory response by altering the physiochemical aspects of body. For identifying the infection, the blood sample is taken from blood stream and evaluated by laboratories, diagnostic centers, and other healthcare facilities.

COVID-19 Impact on the Global Blood Stream Infection Testing Market

In 2020, the COVID-19 outbreak caused global public health emergency and brought the world to a halt, affecting every other sector. COVID-19 impact on blood stream infection testing market is positive. A blood culture is considered as the global standard for diagnosis of the infection or pathogen which is expected to increase the demand for blood stream infection testing. The rise in cases of COVID-19 and sepsis in North America and Europe boosted the growth of blood stream testing. The incidence rate of blood stream infection in global COVID-19 patient was found to be 0.863% compared to patients without COVID having 0.437%, which increased the requirement for diagnosis of pathogens or microbes during the pandemic. As the coronavirus has been undergoing mutation, it is likely that the blood stream infection testing will rise in near future. Advancements in blood stream testing methods have greatly impacted the diagnosis of infection or pathogen. These advancements require less time for analysis of blood cultures compared to traditional methods of blood culture analysis. The increased investment in the blood stream testing R&D and production is expected to drive the blood stream testing market expansion.

Increase in the Number of Sepsis Cases and High Incidences of Infectious Diseases among People to drive the Market Growth

The increase in the number of sepsis and bacteremia cases globally is expected to drive the blood stream infection testing market. Bacteremia and sepsis are few of the top causes of mortality rate in U.S., causing over 600 fatalities each day. Thus the need for rapid and precise diagnosis has increased to identify the pathogen and recent advancement in blood stream infection testing are expected to boost the market growth. The increasing incidences of blood stream infection in elderly population who are susceptible to infection due to low immunity is anticipated to drive the demand for blood stream infection testing and boost the growth of the market.

To know more about global blood stream infection testing market drivers, get in touch with our analysts here.

High Diagnostic Costs and Medical Costs to Hamper the Blood stream Infection Testing Market Growth

The recent advancement in technology of instruments for rapid and accurate testing has increased the cost of the testing. Also, introduction to automated machines such as MALDI-TOF, DOT, and others are novel technologies which can diagnosis blood infection with high accuracy and precision, but has significantly increased the cost of diagnostic instruments for blood stream infections. Thus high purchasing cost and maintenance cost of these instruments is expected restrain the market growth over the forecast period. Furthermore, lack of medical reimbursement for these advanced blood stream testing for diagnosis of infection is expected to hinder the blood stream infection testing market growth.

Technological Advancements and Ongoing Research & Development on Blood-Borne Infectious Diseases to Create Investment Opportunities in Blood stream Infection Testing Market

In 2019, the global population of people over 65 was near 1 billion, and according to WHO, an international public health agency, the population of people above 65 is expected to increase to 1.4 billion by 2030. The increase in global geriatric population which is prone to infection is expected to drive revenue growth of the market. The significance of quick and accurate medical examinations as a result of COVID-19 is expected to drive the market growth. To identify diseases and do proper diagnosis, scientists are developing low-cost and quick methods. Methods such as antibiotic susceptibility testing, high-throughput blood processing, and high sensitivity pathogen detection are anticipated to provide investment opportunities for key players in the market.

To know more about global blood stream infection testing market opportunities, get in touch with our analysts here.

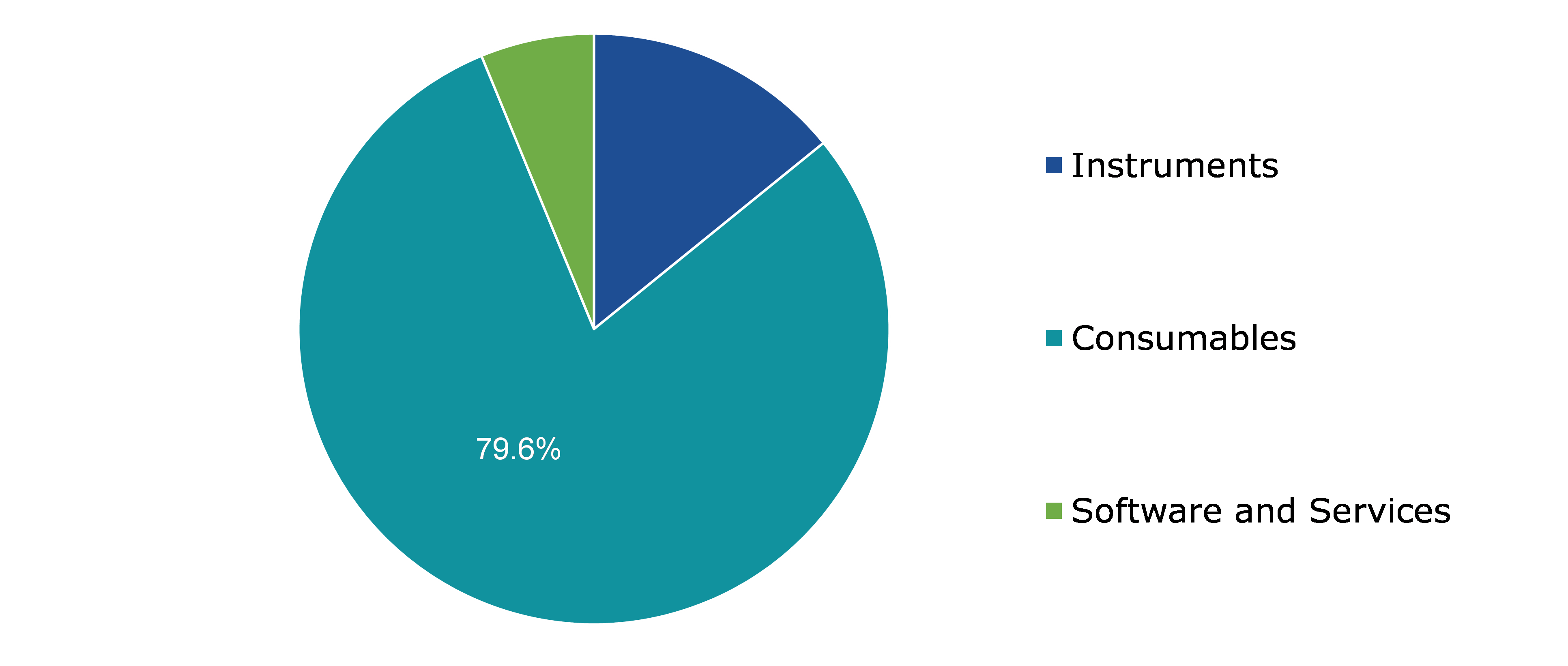

Global Blood Stream Infection Testing Market Growth, by Product

Based on product, the market has been divided into instruments, consumables, and software & services. Among these consumables sub-segment accounted for the highest market share in 2021 and expected to dominate market in near future.

Global Blood Stream Infection Testing Market Share Value, by Product, 2021

Source: Research Dive Analysis

The consumables sub-segment is anticipated to have dominant market share and generate a revenue of $8,505.3 million by 2030, increasing from $4,119.4 million in 2021. The consumables used in the blood stream testing include syringes, needle, bandage, test tubes, and reagents, and others such as tourniquets, alcohol-swabs, gauze pads, and bandages. The increase in blood stream testing by recommendation by doctor to analyze the pathogen, so particular antibiotics can be provided to eliminate the pathogen rather than depending on the broad spectrum antibiotics.

The instruments sub-segment is expected to show fastest growth in the market and generate a revenue of $1,535.7 million by 2030, growing from $732.2 million in 2021. The improvement in healthcare services in several hospitals, clinics, diagnostic centers are upgrading their instruments with more modern and technological advanced instruments. The many companies such as Axiomtek is focusing on improving existing technology in computing technology of instrument for better performance of instrumentation.

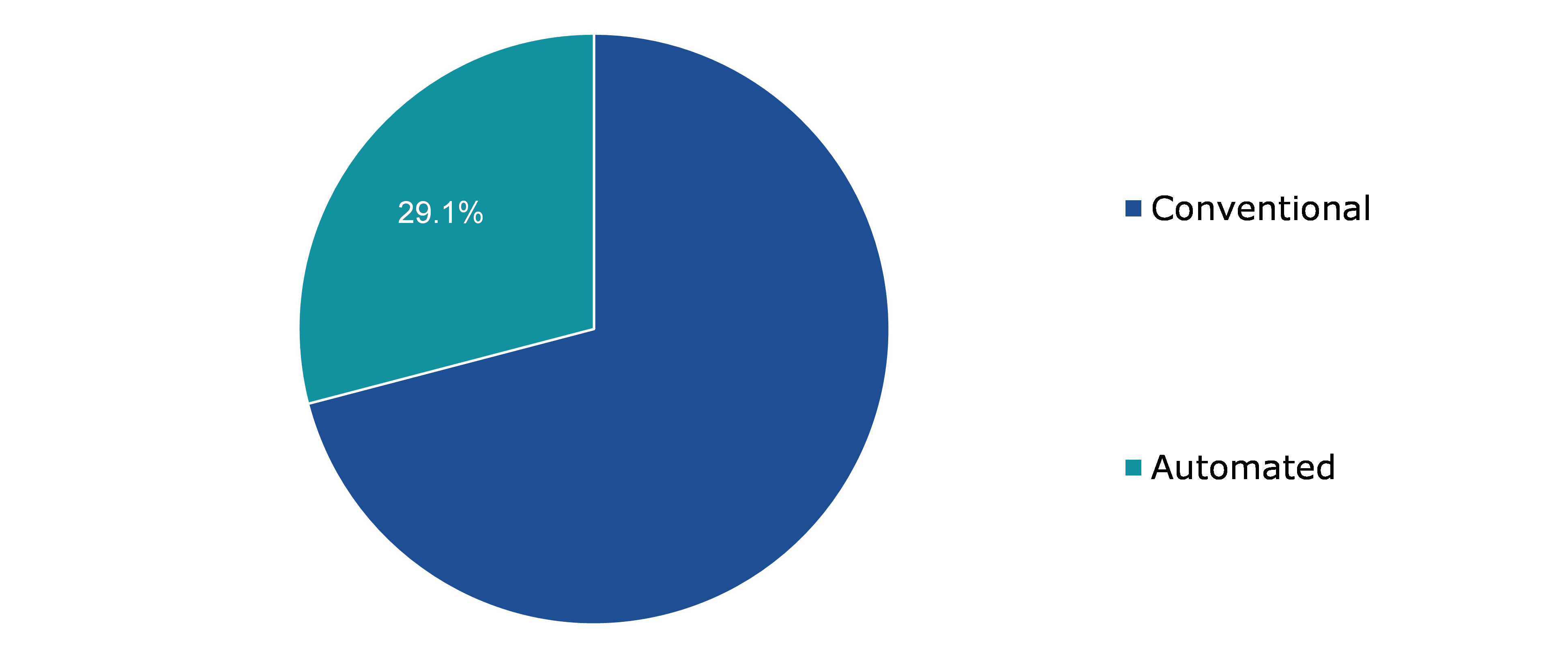

Global Blood Stream Infection Testing Market Trends, by Technique

Based on technique, the market has been divided into conventional and automated. Among these, the conventional sub-segment is expected to be dominant in market share and the automated sub-segment is expected to show fastest growth in the market.

Global Blood Stream Infection Testing Market Share, by Technique, 2021

Source: Research Dive Analysis

The automated sub-segment is expected to show fastest growth in blood stream infection testing market and generate a revenue of $3,280.1 million by 2030, increasing from $1,504 million in 2021. As automated medical instruments are much more efficient than traditional ones and produce more accurate and reliable results, and they are in high demand due to increase in development of the healthcare sector. These factors are expected to drive the growth of this sub-segment.

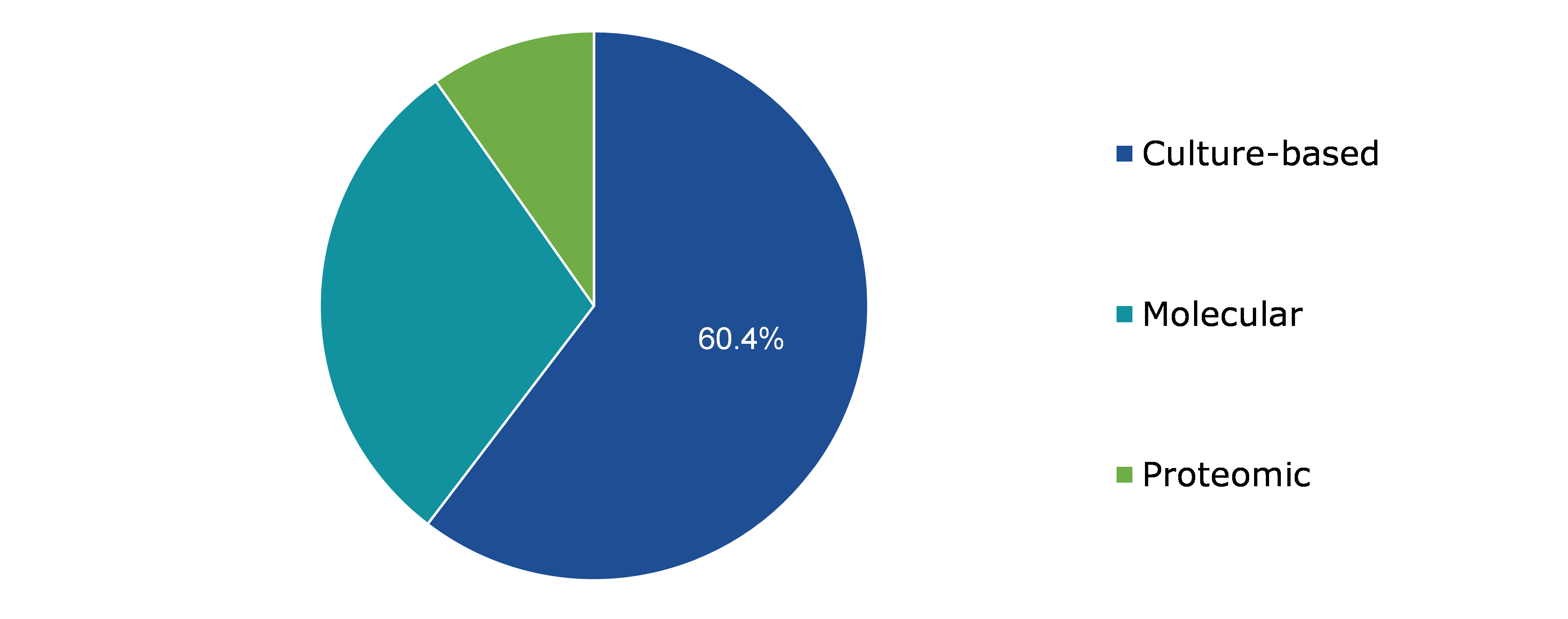

Global Blood Stream Infection Testing Market Forecast, by Technology

Based on technology, the market has been divided into culture-based, molecular, and proteomic. Among these, the culture-based sub-segment is expected to be dominant in the market share and the molecular sub-segment is expected to show fastest growth in the market.

Global Blood Stream Infection Testing Market Share, by Technology, 2021

Source: Research Dive Analysis

The culture-based sub-segment is expected to be dominant in blood stream infection testing market share and generate a revenue of $6,092.1 million by 2030, increasing from $3,123.1 million in 2021. The most widely used method is culture-based in blood testing and has remained best for blood stream infection detection as it can detect various bacteria present in blood as well as fungi.

Global Blood Stream Infection Testing Market Size, by Application

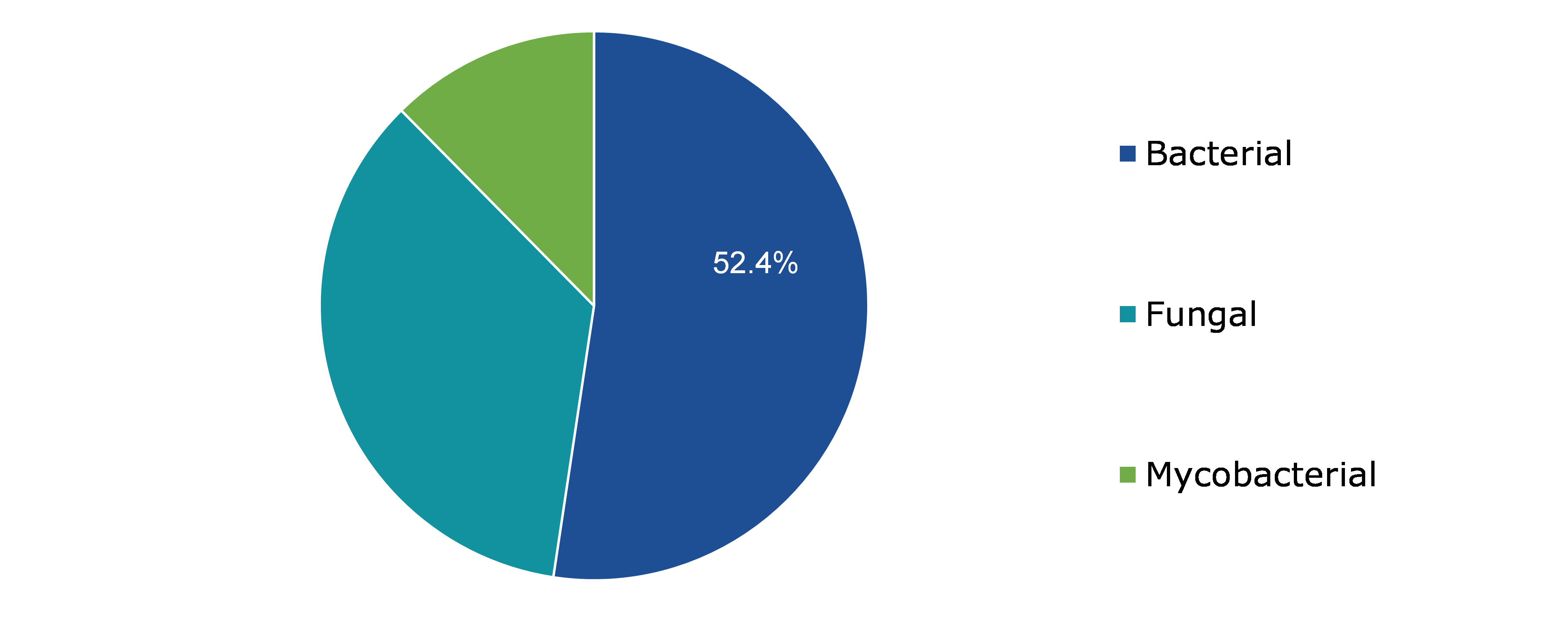

Based on application, the market has been divided into bacterial, fungal, and mycobacterial. Among these, the bacterial sub-segment is anticipated to be dominant in market share and the fungal sub-segment is expected to show fastest growth in the market.

Global Blood Stream Infection Testing Market Share, by Application, 2021

Source: Research Dive Analysis

The bacterial sub-segment is expected to be dominant in blood stream infection testing market share and generate a revenue of $5,776.6 million by 2030, increasing from $2,709.3 million in 2021. In 2019, around 1.27 million deaths occurred due to antimicrobial resistance bacterial infection, thus it is important to diagnose the bacterial infection precisely to treat the antimicrobial resistance bacteria. This factor is expected to drive the growth of this sub-segment.

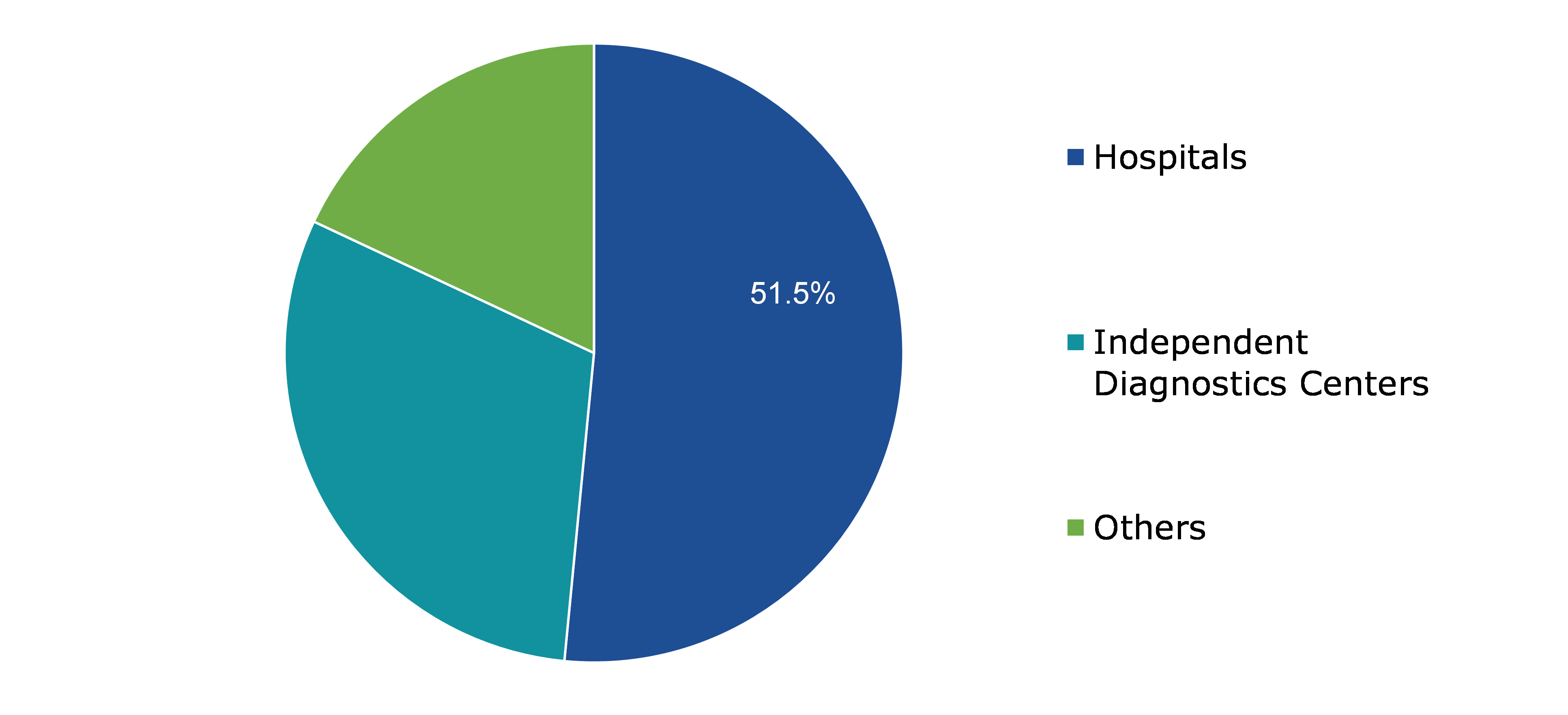

Global Blood Stream Infection Testing Market, by End-user

Based on end-user, the market has been divided into hospitals, independent diagnostics centers, others. Among these, the independent diagnostics center sub-segment is expected to show fastest growth in market and the hospital sub-segment is expected to be dominant in market share.

Global Blood Stream Infection Testing Market Share, by End-user, 2021

Source: Research Dive Analysis

The hospitals sub-segment is expected to be dominant in blood stream infection testing market share and generate a revenue of $5,247.1 million by 2030, increasing from $2,665.6 million in 2021. The improvement in healthcare facilities is major driving factor for this sub-segment. Due to pandemic the healthcare system was overwhelmed and to improve facilities, several hospitals are expected to improve their laboratories for blood testing which will be major driving factor for blood stream infection testing market.

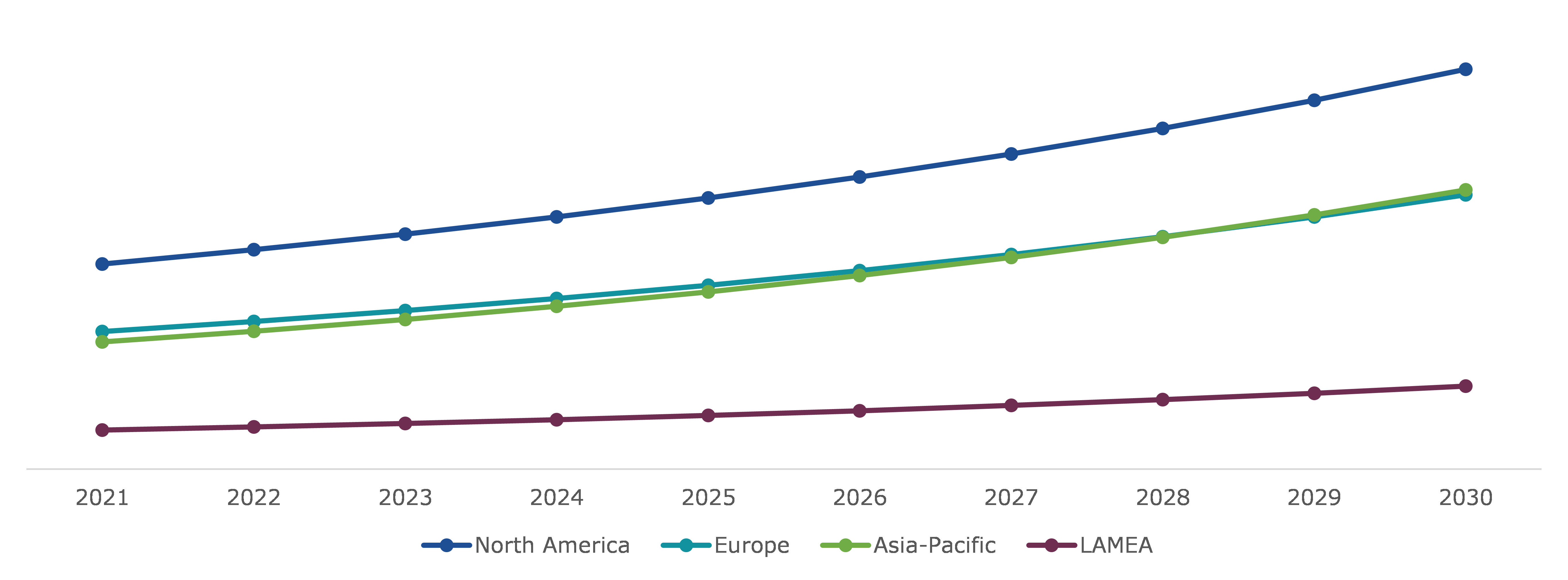

Global Blood Stream Infection Testing Market Value, Regional Insights

The blood stream infection testing market outlook was investigated across North America, Europe, Asia-Pacific, and LAMEA.

Global Blood Stream Infection Testing Market Size & Forecast, by Region, 2022-2030 (USD Million)

Source: Research Dive Analysis

The Market for Blood Stream Infection Testing in North America to be Most Dominant

The North America blood stream infection testing market trend generated a revenue of $2,084.8 million in 2021 and is predicted to grow at significant CAGR of 7.8%. Increasing geriatric population in the U.S. and Canada will give rise to blood stream infection testing as the geriatric population are more prone to communicable disease due to their poor immunity. Presence of a large number of healthcare facilities in the U.S. is worth more than $800 billion and easy access to the healthcare facilities is expected to generate maximum revenue drive the growth of the blood stream infection testing market opportunity. Furthermore, the bacteremia is found out to be one of major cause of mortality in the U.S., thus need for of companies investing more in research and development of blood stream infection testing devices for better and faster diagnostic are expected to create market opportunities during the forecast period.

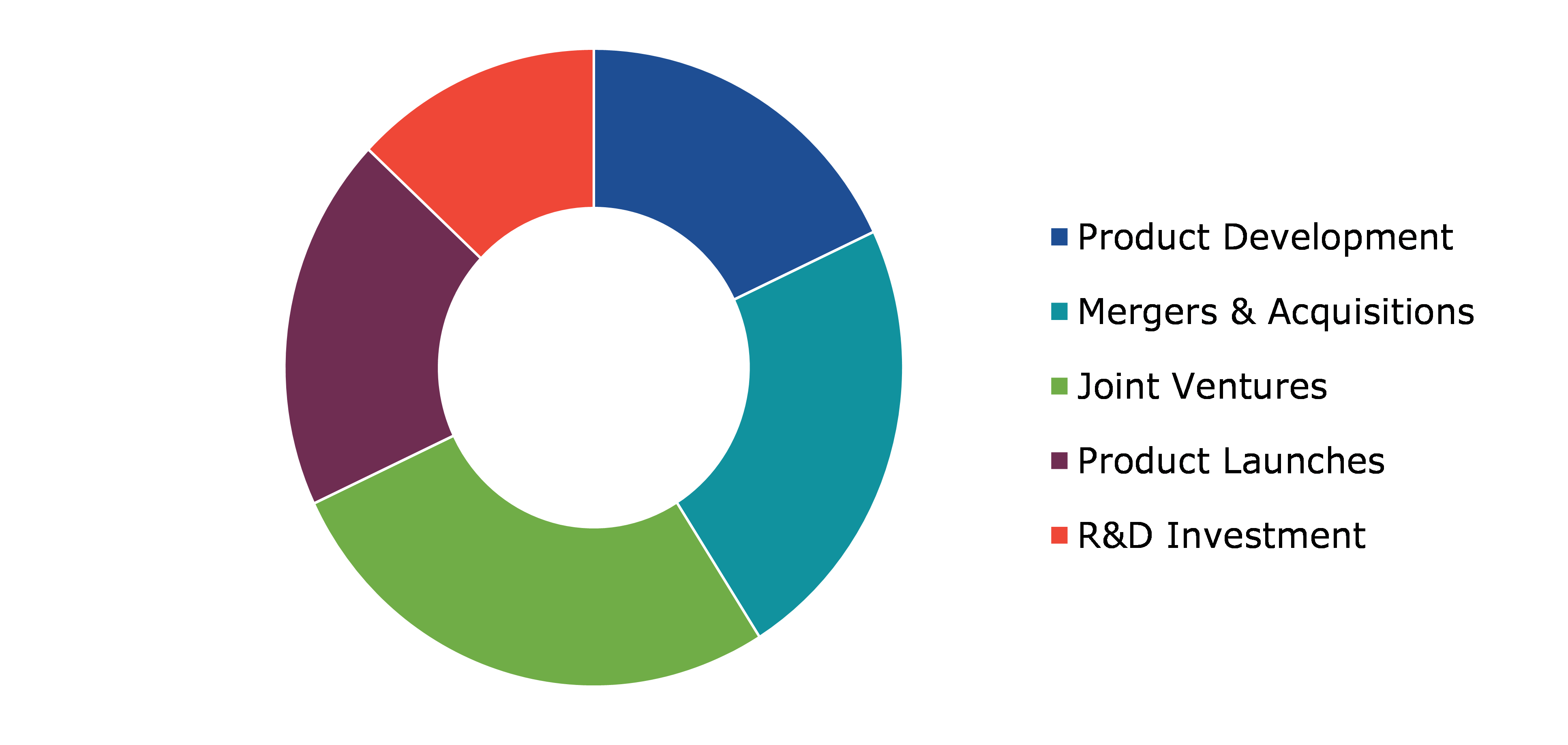

Competitive Scenario in the Global Blood Stream Infection Testing Market

Collaborations and product developments are key strategies in the global blood stream infection testing market. For instance, the product ‘accelerate pheno system’ developed by Accelerate Diagnostics Inc., leading in-vitro diagnostics company, which performs identification and antimicrobial susceptibility testing within 7 hrs.

Source: Research Dive Analysis

The major key players in the global blood stream infection testing market are Thermo Fisher Scientific, F. Hoffmann-La Roche Ltd., Abbott Laboratories, Becton Dickinson, bioMérieux SA, Cepheid, Luminex Corporation, Accelerate Diagnostics Inc., AdvanDX, and Bruker Corp.

| Aspect | Particulars |

| Historical Market Estimations | 2020-2021 |

| Base Year for Market Estimation | 2021 |

| Forecast timeline for Market Projection | 2022-2030 |

| Geographical Scope | North America, Europe, Asia-Pacific, and LAMEA |

| Segmentation by Product |

|

| Segmentation by Technique |

|

| Segmentation by Technology |

|

| Segmentation by Application |

|

| Segmentation by End-user |

|

| Key Companies Profiled |

|

Q1. What is the size of the global blood stream infection testing market?

A. The size of the global blood stream infection testing market was over $5,173.1 million in 2021 and is projected to reach $10,540.8 million by 2030.

Q2. Which are the major companies in the blood stream infection testing market?

A. Becton Dickinson, Thermo Fisher Scientific, and Abbott Laboratories are some of the key players in the global blood stream infection testing market.

Q3. Which region, among others, possesses greater investment opportunities in the near future?

A. The North America region possesses great investment opportunities for investors to witness the most promising growth in the future.

Q4. What will be the growth rate of the North America blood stream infection testing market?

A. North America blood stream infection testing market is anticipated to grow at 9.2% CAGR during the forecast period.

Q5. What are the strategies opted by the leading players in this market?

A. Research & development is the key strategies opted by the operating companies in this market.

Q6. Which companies are investing more on R&D practices?

A. Thermo Fisher Scientific, Accelerate Diagnostics Inc., and Becton Dickinson are the companies investing more on R&D activities for developing new products and technologies.

1.Research Methodology

1.1.Desk Research

1.2.Real time insights and validation

1.3.Forecast model

1.4.Assumptions and forecast parameters

1.5.Market size estimation

1.5.1.Top-down approach

1.5.2.Bottom-up approach

2.Report Scope

2.1.Market definition

2.2.Key objectives of the study

2.3.Report overview

2.4.Market segmentation

2.5.Overview of the impact of COVID-19 on Global blood stream infection testing market

3.Executive Summary

4.Market Overview

4.1.Introduction

4.2.Growth impact forces

4.2.1.Drivers

4.2.2.Restraints

4.2.3.Opportunities

4.3.Market value chain analysis

4.3.1.List of raw material suppliers

4.3.2.List of manufacturers

4.3.3.List of distributors

4.4.Innovation & sustainability matrices

4.4.1.Technology matrix

4.4.2.Regulatory matrix

4.5.Porter’s five forces analysis

4.5.1.Bargaining power of suppliers

4.5.2.Bargaining power of consumers

4.5.3.Threat of substitutes

4.5.4.Threat of new entrants

4.5.5.Competitive rivalry intensity

4.6.PESTLE analysis

4.6.1.Political

4.6.2.Economical

4.6.3.Social

4.6.4.Technological

4.6.5.Environmental

4.7.Impact of COVID-19 on blood stream infection testing market

4.7.1.Pre-covid market scenario

4.7.2.Post-covid market scenario

5.Blood Stream Infection Testing Market Analysis, by Product

5.1.Overview

5.2.Consumables

5.2.1.Definition, key trends, growth factors, and opportunities, 2021-2030

5.2.2.Market size analysis, by region, 2021-2030

5.2.3.Market share analysis, by country, 2021-2030

5.3.Instruments

5.3.1.Definition, key trends, growth factors, and opportunities, 2021-2030

5.3.2.Market size analysis, by region, 2021-2030

5.3.3.Market share analysis, by country, 2021-2030

5.4.Software & Services

5.4.1.Definition, key trends, growth factors, and opportunities, 2021-2030

5.4.2.Market size analysis, by region, 2021-2030

5.4.3.Market share analysis, by country, 2021-2030

5.5.Research Dive Exclusive Insights

5.5.1.Market attractiveness, 2021-2030

5.5.2.Competition heatmap, 2021-2030

6.Blood Stream Infection Testing Market Analysis, by Technique

6.1.Conventional

6.1.1.Definition, key trends, growth factors, and opportunities, 2021-2030

6.1.2.Market size analysis, by region, 2021-2030

6.1.3.Market share analysis, by country, 2021-2030

6.2.Automated

6.2.1.Definition, key trends, growth factors, and opportunities, 2021-2030

6.2.2.Market size analysis, by region, 2021-2030

6.2.3.Market share analysis, by country, 2021-2030

6.3.Research Dive Exclusive Insights

6.3.1.Market attractiveness, 2021-2030

6.3.2.Competition heatmap, 2021-2030

7.Blood Stream Infection Testing Market Analysis, by Technology

7.1.Culture-based

7.1.1.Definition, key trends, growth factors, and opportunities, 2021-2030

7.1.2.Market size analysis, by region, 2021-2030

7.1.3.Market share analysis, by country, 2021-2030

7.2.Molecular

7.2.1.Definition, key trends, growth factors, and opportunities, 2021-2030

7.2.2.Market size analysis, by region, 2021-2030

7.2.3.Market share analysis, by country, 2021-2030

7.3.Proteomic

7.3.1.Definition, key trends, growth factors, and opportunities, 2021-2030

7.3.2.Market size analysis, by region, 2021-2030

7.3.3.Market share analysis, by country, 2021-2030

7.4.Research Dive Exclusive Insights

7.4.1.Market attractiveness, 2021-2030

7.4.2.Competition heatmap, 2021-2030

8.Blood Stream Infection Testing Market Analysis, by Application

8.1.Bacterial

8.1.1.Definition, key trends, growth factors, and opportunities, 2021-2030

8.1.2.Market size analysis, by region, 2021-2030

8.1.3.Market share analysis, by country, 2021-2030

8.2.Fungal

8.2.1.Definition, key trends, growth factors, and opportunities, 2021-2030

8.2.2.Market size analysis, by region, 2021-2030

8.2.3.Market share analysis, by country, 2021-2030

8.3.Mycobacterial

8.3.1.Definition, key trends, growth factors, and opportunities, 2021-2030

8.3.2.Market size analysis, by region, 2021-2030

8.3.3.Market share analysis, by country, 2021-2030

8.4.Research Dive Exclusive Insights

8.4.1.Market attractiveness, 2021-2030

8.4.2.Competition heatmap, 2021-2030

9.Blood Stream Infection Testing Market Analysis, by End-user

9.1.Hospitals

9.1.1.Definition, key trends, growth factors, and opportunities, 2021-2030

9.1.2.Market size analysis, by region, 2021-2030

9.1.3.Market share analysis, by country, 2021-2030

9.2.Independent Diagnostics Centers

9.2.1.Definition, key trends, growth factors, and opportunities, 2021-2030

9.2.2.Market size analysis, by region, 2021-2030

9.2.3.Market share analysis, by country, 2021-2030

9.3.Others

9.3.1.Definition, key trends, growth factors, and opportunities, 2021-2030

9.3.2.Market size analysis, by region, 2021-2030

9.3.3.Market share analysis, by country, 2021-2030

9.4.Research Dive Exclusive Insights

9.4.1.Market attractiveness, 2021-2030

9.4.2.Competition heatmap, 2021-2030

10.Blood Stream Infection Testing Market, by Region

10.1.North America

10.1.1.U.S.

10.1.1.1.Market size analysis, by Product, 2021-2030

10.1.1.2.Market size analysis, by Technique, 2021-2030

10.1.1.3.Market size analysis, by Technology, 2021-2030

10.1.1.4.Market size analysis, by Application, 2021-2030

10.1.1.5.Market size analysis, by End-user, 2021-2030

10.1.2.Canada

10.1.2.1.Market size analysis, by Product, 2021-2030

10.1.2.2.Market size analysis, by Technique, 2021-2030

10.1.2.3.Market size analysis, by Technology, 2021-2030

10.1.2.4.Market size analysis, by Application, 2021-2030

10.1.2.5.Market size analysis, by End-user, 2021-2030

10.1.3.Mexico

10.1.3.1.Market size analysis, by Product, 2021-2030

10.1.3.2.Market size analysis, by Technique, 2021-2030

10.1.3.3.Market size analysis, by Technology, 2021-2030

10.1.3.4.Market size analysis, by Application, 2021-2030

10.1.3.5.Market size analysis, by End-user, 2021-2030

10.1.4.Research Dive Exclusive Insights

10.1.4.1.Market attractiveness, 2021-2030

10.1.4.2.Competition heatmap, 2021-2030

10.2.Europe

10.2.1.Germany

10.2.1.1.Market size analysis, by Product, 2021-2030

10.2.1.2.Market size analysis, by Technique, 2021-2030

10.2.1.3.Market size analysis, by Technology, 2021-2030

10.2.1.4.Market size analysis, by Application, 2021-2030

10.2.1.5.Market size analysis, by End-user, 2021-2030

10.2.2.U.K.

10.2.2.1.Market size analysis, by Product, 2021-2030

10.2.2.2.Market size analysis, by Technique, 2021-2030

10.2.2.3.Market size analysis, by Technology, 2021-2030

10.2.2.4.Market size analysis, by Application, 2021-2030

10.2.2.5.Market size analysis, by End-user, 2021-2030

10.2.3.France

10.2.3.1.Market size analysis, by Product, 2021-2030

10.2.3.2.Market size analysis, by Technique, 2021-2030

10.2.3.3.Market size analysis, by Technology, 2021-2030

10.2.3.4.Market size analysis, by Application, 2021-2030

10.2.3.5.Market size analysis, by End-user, 2021-2030

10.2.4.Spain

10.2.4.1.Market size analysis, by Product, 2021-2030

10.2.4.2.Market size analysis, by Technique, 2021-2030

10.2.4.3.Market size analysis, by Technology, 2021-2030

10.2.4.4.Market size analysis, by Application, 2021-2030

10.2.4.5.Market size analysis, by End-user, 2021-2030

10.2.5.Italy

10.2.5.1.Market size analysis, by Product, 2021-2030

10.2.5.2.Market size analysis, by Technique, 2021-2030

10.2.5.3.Market size analysis, by Technology, 2021-2030

10.2.5.4.Market size analysis, by Application, 2021-2030

10.2.5.5.Market size analysis, by End-user, 2021-2030

10.2.6.Rest of Europe

10.2.6.1.Market size analysis, by Product, 2021-2030

10.2.6.2.Market size analysis, by Technique, 2021-2030

10.2.6.3.Market size analysis, by Technology, 2021-2030

10.2.6.4.Market size analysis, by Application, 2021-2030

10.2.6.5.Market size analysis, by End-user, 2021-2030

10.2.7.Research Dive Exclusive Insights

10.2.7.1.Market attractiveness, 2021-2030

10.2.7.2.Competition heatmap, 2021-2030

10.3.Asia-Pacific

10.3.1.China

10.3.1.1.Market size analysis, by Product, 2021-2030

10.3.1.2.Market size analysis, by Technique, 2021-2030

10.3.1.3.Market size analysis, by Technology, 2021-2030

10.3.1.4.Market size analysis, by Application, 2021-2030

10.3.1.5.Market size analysis, by End-user, 2021-2030

10.3.2.Japan

10.3.2.1.Market size analysis, by Product, 2021-2030

10.3.2.2.Market size analysis, by Technique, 2021-2030

10.3.2.3.Market size analysis, by Technology, 2021-2030

10.3.2.4.Market size analysis, by Application, 2021-2030

10.3.2.5.Market size analysis, by End-user, 2021-2030

10.3.3.India

10.3.3.1.Market size analysis, by Product, 2021-2030

10.3.3.2.Market size analysis, by Technique, 2021-2030

10.3.3.3.Market size analysis, by Technology, 2021-2030

10.3.3.4.Market size analysis, by Application, 2021-2030

10.3.3.5.Market size analysis, by End-user, 2021-2030

10.3.4.Australia

10.3.4.1.Market size analysis, by Product, 2021-2030

10.3.4.2.Market size analysis, by Technique, 2021-2030

10.3.4.3.Market size analysis, by Technology, 2021-2030

10.3.4.4.Market size analysis, by Application, 2021-2030

10.3.4.5.Market size analysis, by End-user, 2021-2030

10.3.5.South Korea

10.3.5.1.Market size analysis, by Product, 2021-2030

10.3.5.2.Market size analysis, by Technique, 2021-2030

10.3.5.3.Market size analysis, by Technology, 2021-2030

10.3.5.4.Market size analysis, by Application, 2021-2030

10.3.5.5.Market size analysis, by End-user, 2021-2030

10.3.6.Rest of Asia-Pacific

10.3.6.1.Market size analysis, by Product, 2021-2030

10.3.6.2.Market size analysis, by Technique, 2021-2030

10.3.6.3.Market size analysis, by Technology, 2021-2030

10.3.6.4.Market size analysis, by Application, 2021-2030

10.3.6.5.Market size analysis, by End-user, 2021-2030

10.3.7.Research Dive Exclusive Insights

10.3.7.1.Market attractiveness, 2021-2030

10.3.7.2.Competition heatmap, 2021-2030

10.4.LAMEA

10.4.1.Brazil

10.4.1.1.Market size analysis, by Product, 2021-2030

10.4.1.2.Market size analysis, by Technique, 2021-2030

10.4.1.3.Market size analysis, by Technology, 2021-2030

10.4.1.4.Market size analysis, by Application, 2021-2030

10.4.1.5.Market size analysis, by End-user, 2021-2030

10.4.2.Saudi Arabia

10.4.2.1.Market size analysis, by Product, 2021-2030

10.4.2.2.Market size analysis, by Technique, 2021-2030

10.4.2.3.Market size analysis, by Technology, 2021-2030

10.4.2.4.Market size analysis, by Application, 2021-2030

10.4.2.5.Market size analysis, by End-user, 2021-2030

10.4.3.UAE

10.4.3.1.Market size analysis, by Product, 2021-2030

10.4.3.2.Market size analysis, by Technique, 2021-2030

10.4.3.3.Market size analysis, by Technology, 2021-2030

10.4.3.4.Market size analysis, by Application, 2021-2030

10.4.3.5.Market size analysis, by End-user, 2021-2030

10.4.4.South Africa

10.4.4.1.Market size analysis, by Product, 2021-2030

10.4.4.2.Market size analysis, by Technique, 2021-2030

10.4.4.3.Market size analysis, by Technology, 2021-2030

10.4.4.4.Market size analysis, by Application, 2021-2030

10.4.4.5.Market size analysis, by End-user, 2021-2030

10.4.5.Rest of LAMEA

10.4.5.1.Market size analysis, by Product, 2021-2030

10.4.5.2.Market size analysis, by Technique, 2021-2030

10.4.5.3.Market size analysis, by Technology, 2021-2030

10.4.5.4.Market size analysis, by Application, 2021-2030

10.4.5.5.Market size analysis, by End-user, 2021-2030

10.4.6.Research Dive Exclusive Insights

10.4.6.1.Market attractiveness, 2021-2030

10.4.6.2.Competition heatmap, 2021-2030

11.Competitive Landscape

11.1.Top winning strategies, 2021

11.1.1.By strategy

11.1.2.By year

11.2.Strategic overview

11.3.Market share analysis, 2021

12.Company Profiles

12.1. Thermo Fisher Scientific

12.1.1.Overview

12.1.2.Business segments

12.1.3.Product portfolio

12.1.4.Financial performance

12.1.5.Recent developments

12.1.6.SWOT analysis

12.2.F. Hoffmann-La Roche Ltd

12.2.1.Overview

12.2.2.Business segments

12.2.3.Product portfolio

12.2.4.Financial performance

12.2.5.Recent developments

12.2.6.SWOT analysis

12.3.Abbott

12.3.1.Overview

12.3.2.Business segments

12.3.3.Product portfolio

12.3.4.Financial performance

12.3.5.Recent developments

12.3.6.SWOT analysis

12.4. BD

12.4.1.Overview

12.4.2.Business segments

12.4.3.Product portfolio

12.4.4.Financial performance

12.4.5.Recent developments

12.4.6.SWOT analysis

12.5.BIOMÉRIEUX

12.5.1.Overview

12.5.2.Business segments

12.5.3.Product portfolio

12.5.4.Financial performance

12.5.5.Recent developments

12.5.6.SWOT analysis

12.6.Cepheid.

12.6.1.Overview

12.6.2.Business segments

12.6.3.Product portfolio

12.6.4.Financial performance

12.6.5.Recent developments

12.6.6.SWOT analysis

12.7.Luminex Corporation

12.7.1.Overview

12.7.2.Business segments

12.7.3.Product portfolio

12.7.4.Financial performance

12.7.5.Recent developments

12.7.6.SWOT analysis

12.8.Accelerate Diagnostics

12.8.1.Overview

12.8.2.Business segments

12.8.3.Product portfolio

12.8.4.Financial performance

12.8.5.Recent developments

12.8.6.SWOT analysis

12.9.AdvanDX

12.9.1.Overview

12.9.2.Business segments

12.9.3.Product portfolio

12.9.4.Financial performance

12.9.5.Recent developments

12.9.6.SWOT analysis

12.10.Bruker

12.10.1.Overview

12.10.2.Business segments

12.10.3.Product portfolio

12.10.4.Financial performance

12.10.5.Recent developments

12.10.6.SWOT analysis

13.Appendix

13.1.Parent & peer market analysis

13.2.Premium insights from industry experts

13.3.Related reports

The human body is complex and contains various important systems among which one of the most significant one is the circulatory system. The circulatory system uses blood to supply nutrients throughout the body. In certain instances, the blood may get infected with microorganisms such as viruses that may result in severe effects in the body if not detected in the earlier stages. Blood stream infection testing is one such method that directly detects any abnormality present in a human’s blood, allowing for quicker treatment.

COVID-19 Impact on the Industry

The rapid spread of COVID-19 all over the world led to major losses to various industries and organizations. The healthcare sector saw immense surge due to the urgent requirement to detect and find a solution to the virus. The pandemic resulted in a requirement for blood testing at a faster rate and the blood stream infection testing method turned to be one of the sought after for detection of the virus. This led to a massive growth of the blood stream infection testing market during the pandemic and is expected to see a continued rise.

Key Trends & Developments in Blood stream infection testing market

Several healthcare organizations and laboratories along with corporates are trying to come up with further enhancements in medical care; such advancements are predicted to aid the growth of the blood stream infection testing market. For instance,

- In March 2020, Becton, Dickinson, and Company, a pioneer in medical technology, partnered with BioMedonomics, a highly renowned clinical diagnostic organization, to launch a point-of-care test. The point-of-care test is capable of detecting an individual’s exposure to COVID-19 real time or in the past. The point-of-care test can take up to a minimal 15 minutes for the results, which helps in early detection and doesn’t require any complex equipment.

- In September 2020, Biomedical Advanced Research and Development Authority (BARDA), a U.S government organization that assists in funding and research, with the combined efforts of Luminex Corporation, a biotech company and manufacturer of testing equipment, was able to come up with an extremely competent high throughput test. This test is highly accurate and productive as it is capable of scanning thousands of samples for any sign of viruses and antibodies.

- In January 2021, Bruker Corporation a manufacturer of scientific material, received clearance from the US FDA to launch the MBTSepsityper Kit US IVD. The kit is effective in scanning the blood samples for over 425 types of disease-causing elements. It gives rapid results which allow quick analysis and even quicker diagnosis. The test kit is cost effective and can allow physicians to take decisions that can potentially save a patient’s life.

Forecast Analysis of Blood stream infection testing market

The global blood stream infection testing market has been seeing an exponential rise due to the COVID-19 pandemic and is predicted to see further growth during the forecast period. The world today is in dire need of effective and fast virus detection techniques due to the highly fatal nature of the coronavirus. Blood stream infection analysis has pushed the healthcare and medical industry along with scientific researchers to look for further advancements that in the future can help in preventing occurrences such as a pandemic. This need to explore the field of blood stream infection is also one of the major reasons for the growth of the blood stream infection testing market.

A recently published report by Research Dive has stated that the global blood stream infection testing market is set to garner revenue of $10,540.8 million by 2030. Moreover, North America region is expected to be the leading contributor to the market growth. A large number of key players, such as Thermo Fisher Scientific, Abbott Laboratories, F. Hoffmann-La Roche Ltd., Becton Dickinson, Cepheid, bioMérieux SA, Luminex Corporation, AdvanDX, Accelerate Diagnostics Inc., and Bruker Corp have given their contribution for further advancements and research in the market.

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com