Radiation Oncology Market Report

RA08347

Radiation Oncology Market by Type (External Beam Radiation Therapy and Internal Beam Radiation Therapy), Application (Prostate Cancer, Breast Cancer, Lung Cancer, Head & Neck Cancer, Colorectal Cancer, Cervical Cancer, Gynaecological Cancer, and Others), and Regional Analysis (North America, Europe, Asia-Pacific, and LAMEA): Global Opportunity Analysis and Industry Forecast, 2022–2030

Global Radiation Oncology Market Analysis

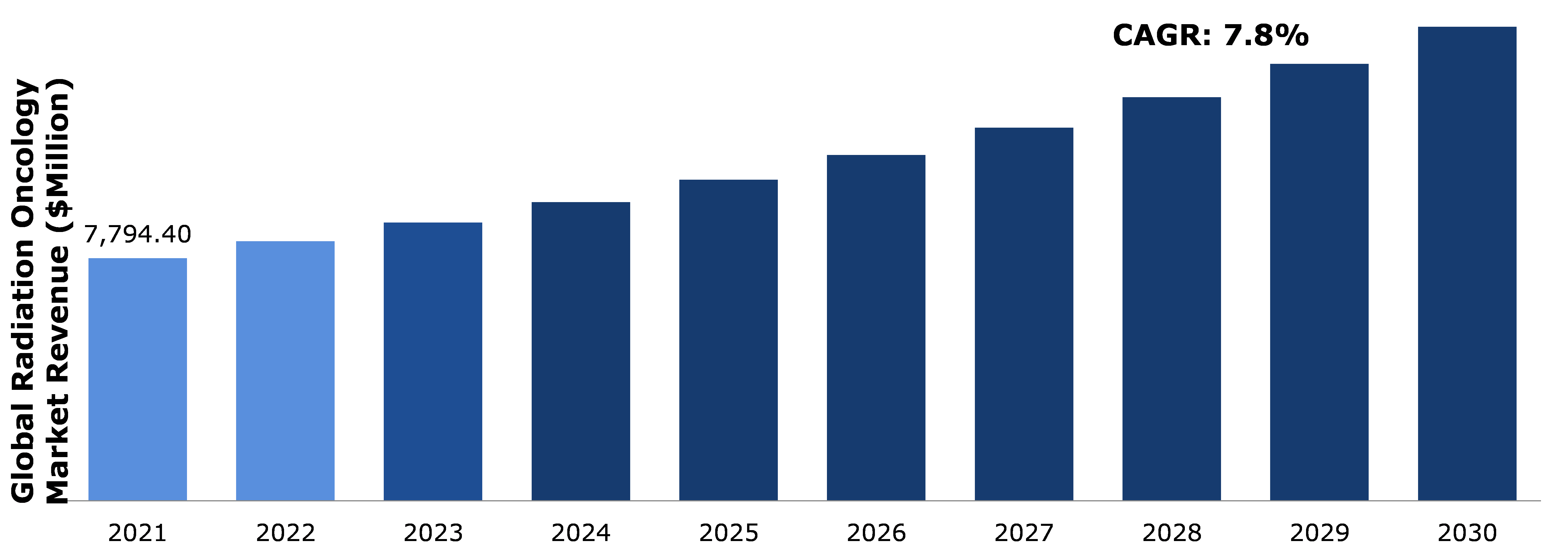

The global radiation oncology market size was $7,794.4 million in 2021 and is predicted to grow with a CAGR of 7.8%, by generating a revenue of $15,231.2million by 2030.

Global Radiation Oncology Market Synopsis

Radiation therapy, also known as radiotherapy, has emerged as a cost-effective cancer treatment modality that has gained considerable attention in mitigating cancer morbidity and mortality. The global radiation oncology market is being driven by an increase in demand for technologically superior treatment options. The introduction of cutting-edge techniques has aided in accurate tumour localization during treatment. The use of diagnostic imaging has improved the efficacy of radiation oncology. 3D conformal radiation, intensity-modulated radiation, volumetric-modulated arc therapy, stereotactic radiosurgery, and 3D high-dose-rate brachytherapy have all become more popular treatment options. Furthermore, improved imaging modalities are becoming more important in terms of diagnosis, staging, and therapy planning. Given the ongoing advancements in radiation oncology, tumour targeting advancements in radiation oncology have laid the foundations for personalised treatment approaches.

The study market will be challenged by a lack of competent radiotherapy experts, an insufficient medical infrastructure to support radiation equipment, and adverse effects noticed after radiation therapy. Side effects such nausea, vomiting, and diarrhoea are typical, but exposure to many radiation doses in a single cycle can result in radiation sickness and mortality as a serious complication. Furthermore, there is a global lack of radiation oncology-trained healthcare personnel, particularly in underdeveloped countries.

Some of the major factors that will create opportunities in the market are the rising prevalence of cancer, the increasing use of radiation therapy in treatment for cancer, and technological breakthroughs in radiotherapy equipment. The radiation oncology market is expected to be driven by technological advancements that improve treatment safety and efficacy. 4D radiotherapy is a combination of 4D imaging and radiotherapy that allows for real-time tumour tracking and precise information about tumour size, shape, area, and volume. This combination allows doctors to compensate for organ, tumour, or patient movement while still delivering a conformal dose.

Radiation oncology market outlook in North America accounted for the largest revenue share in 2021, owing to rising cancer prevalence, high use of novel oncology procedures, and high healthcare expenditure. Collaborations between academic institutions and medical device manufacturers to commercialise innovative radiation therapy techniques are also driving regional market growth.

Radiation Oncology Overview

Radiation therapy is a type of cancer treatment in which high doses of radiation are used to kill cancer cells and shrink tumours. The radiation oncology is widely applied in many types of cancer, for example, in prostate and breast cancer, the use of radiation therapy has been increased. Electron-emitting high-energy linear accelerators (linac), compact advanced radiotherapy systems, brachytherapy, systemic beam radiation therapy, and proton therapy are some of the key product types in the radiation oncology market.

COVID-19 Impact on Radiation Oncology Market

The coronavirus disease of 2019 wreaked havoc on the health-care industry. While much of the research has focused on the direct expenses of preventing and treating COVID-19, the pandemic has also had an impact on the economics of radiation therapy delivery. These factors have been impacted by the COVID-19 pandemic on multiple levels: the number of patients seen at cancer centres decreased, additional safety procedures were implemented, personnel availability of healthcare staff & training got impacted, patient behaviour got influenced, and clinical practise changed. The supply and manufacturing chain difficulties interrupted product releases. The pandemic has had a significant impact on the radiation oncology market opportunity. Furthermore, a shortage of trained professionals and insufficient funding for academic and research institutions impacted the cost of providing care throughout the cancer continuum, especially in radiation oncology. Variations in the direct & indirect costs of delivering treatment, reimbursement arrangements, changes in demand & use, and the projected value of treatment affected surgical delays and decreased hospital visits, which slowed market growth.

Despite the availability of emergency radiation therapy services, the number of cases of emergency patients visiting the centres for treatment decreased. Additionally, the relatively small proportion of oncology-focused clinical trials hampered market growth in 2020. The increase in healthcare budget by many countries such as the U.S., India etc., and huge investment in technological improvement of radiation oncology devices are expected to see radiation oncology market growth.

In 2021, uplifting of lockdown and slowdown of COVID-19 spread led to the demand for novel radiation therapy technology for cancer patients for better treatment and monitoring through remote location. As COVID 19 hampered the healthcare system, the investment by the government to improve the healthcare growth of healthcare sector and radiation oncology also increased.

The Rising Prevalence of Cancer due to Sedentary Lifestyle to Drive the Market Growth.

The soaring cancer prevalence is a major driver of the global oncology radiation therapy market. Cancer is the leading cause of mortality worldwide. According to WHO, the international public health agency, in 2020, the cancer accounted for 10 million deaths, which in every 6th death, 1 was suffering from cancer. The significant proportion of cancer cases are caused by sedentary lifestyle choices, improper diet, and lack of exercise, making people prone to cancer.

To know more about global radiation oncology market drivers, get in touch with our analysts here.

Scarcity of Trained Professional in the Radiation Oncology is a Major Reason to Hinder the Market Growth

One of the major factors impeding the growth of the radiation oncology market is the scarcity of skilled radiotherapy professionals. In developed countries, for example, there are approximately 2 radiation oncologists per 1,000 cancer patients, whereas in developing countries like India, there are less than 1 radiation oncologist per 1,000 cancer patients. And the lack of radiation oncology training & education among physicians in many countries may further hamper the market growth.

To know more about global radiation oncology market drivers, get in touch with our analysts here.

Rise in Trend of Radiation Use in the Therapy of the Cancer to Create Opportunities in Coming Years.

As many cancers can be managed by radiation therapy, the rising radiation oncology market trend for radiation therapy in cancer care for nearly half of the patient population is a major factor driving demand in the radiation oncology market. Radiotherapy has gained popularity in both alleviating and healing areas. The increased use of radiation therapy in breast and prostate cancer is boosting the radiation oncology market’s prospects. Radiation therapy has changed dramatically in the last decade thanks to innovations like image-guided and intensity-modulated radiation therapy, digital imaging, and computer-controlled linear accelerators. Many medical incidents and blunders have been decreased as a result of these developments. Adoption of multidisciplinary approaches to cancer is opening up new market opportunities.

To know more about global radiation oncology market drivers, get in touch with our analysts here.

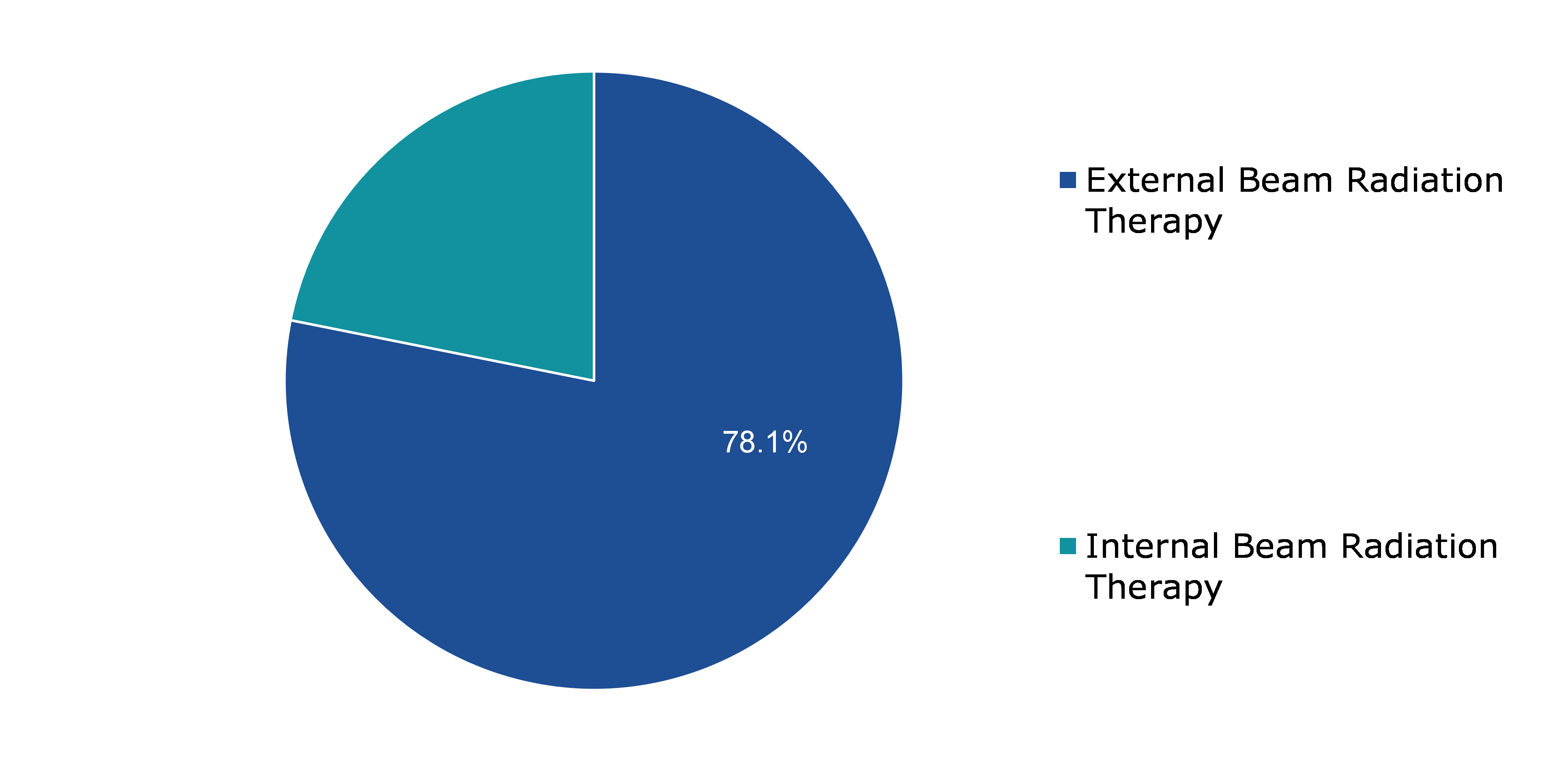

Global Radiation Oncology Market, by Type

Based on the type, the market has been divided into internal beam radiation therapy and external beam radiation therapy. The external beam radiation therapy sub-segment is expected to dominate the market share to generate the highest revenue in this timeframe.

Global Radiation Oncology Market Share, by Type, 2021

Source: Research Dive Analysis

External beam radiation therapy sub-type is expected to dominate the market share and generate a revenue of $11,638.2 million by 2030, growing from $6,090 million in 2021. The high energy radiation is used externally, and dose is deposited on tumour to destroy the carcinoma cells, with such care to avoid any normal tissues during treatment. The photons, protons, or electrons are used according to the patient treatment. The external beam radiation therapy has better accuracy to target the tumour to destroy the abnormal cells and alleviate pain, which makes it best choice of treatment among the patients. Thus, adoption of the external beam radiation therapy is increasing day by day by the oncologist.

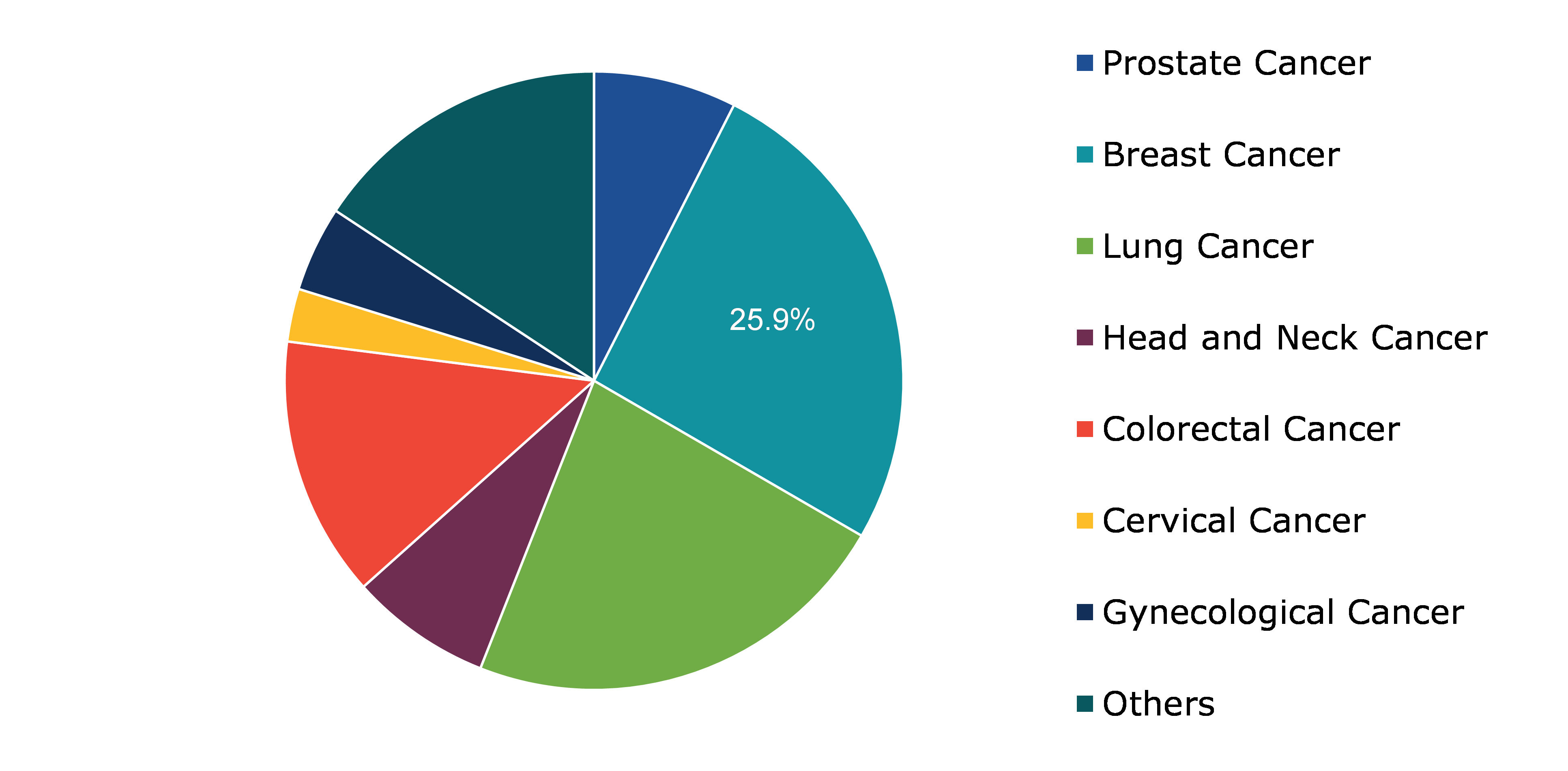

Global Radiation Oncology Market, by Application

Based on the application, the market has been categorised into prostate cancer, breast cancer, lung cancer, head & neck cancer, colorectal cancer, cervical cancer, gynaecological cancer, and other.

Global Radiation Oncology Market Share, by Application, 2021

Source: Research Dive Analysis

The breast cancer sub-segment is foreseen to have largest market share and generate a revenue of $3,552.4 million by 2030, increase from $2,017.5 in 2021. According to WHO, the international public health agency, in 2020, the breast cancer had the highest incidence rate of 47.8 per 1, 00,000 people worldwide. The breast cancer is increasing due to aging, obesity, and exposure to radiation. Increase in number of cases of breast cancer is increasing the demand for radiation therapy. These factors are expected to enhance the radiation oncology market demand over the time.

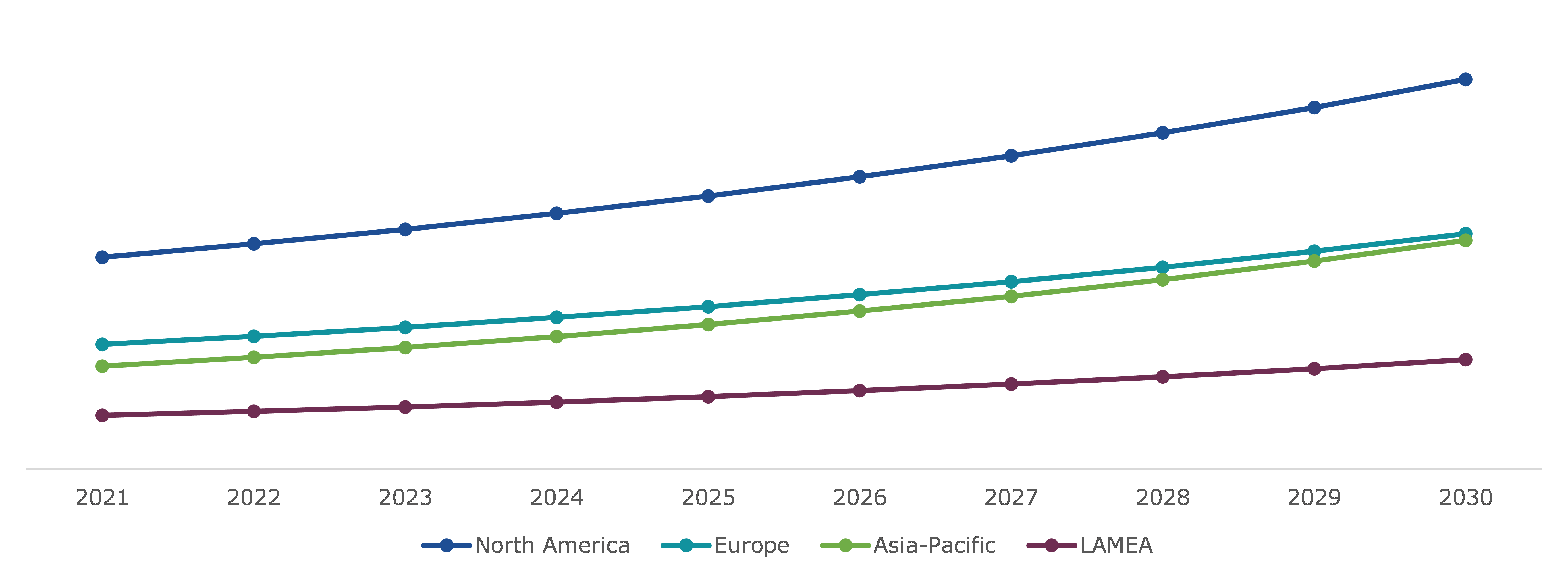

Global Radiation Oncology Market, by Regional Insights

The radiation oncology market was investigated across North America, Europe, Asia-Pacific, and LAMEA.

Global Radiation Oncology Market Size and Forecast, by Region Insights, 2021-2030 (USD Million)

Source: Research Dive Analysis

The North America Region Market is Expected to have Dominant Market Share

The North America radiation oncology market size estimated $3,349.2 million in 2021, and expected to grow at 7.1%. The rising prevalence of breast cancer, particularly in developed countries, as a result of aging, obesity, and radiation exposure, is expected to drive sub-segment market growth during the study period. According to available data, approximately 330,840 new cases of breast cancer were expected to be diagnosed in the United States in 2021. This factor is expected to increase demand for radiation therapy, which is expected to drive radiation oncology market growth during the forecasted period.

The Asia-Pacific Region Market is Expected to have a Significant Market Share

The Asia-Pacific radiation oncology market size was estimated $1,626.7 million in 2021, and expected to grow with CAGR of 9.4%. According to the data provided by WHO, the international public health agency, in 2020, the Asia region contribute to 49.3% of total cases of cancer worldwide. In Asia, 3.6 million men population suffers from the lung cancer followed by stomach, liver, colorectal, and oesophageal cancers. And 4 million females suffer from breast cancer followed by lung, cervical, colorectal, and stomach cancers. The implementation of radiation oncology by the Asian countries has reduced the death rate drastically. The incidence rate of cancer in Asia is low as compared to other regions, but as most of world population is in Asian countries, thus number of cases compared to another region is more. The increase in cases of cancer is expected to show development in radiation oncology market share in major countries.

Competitive Scenario in the Global Radiation Oncology Market

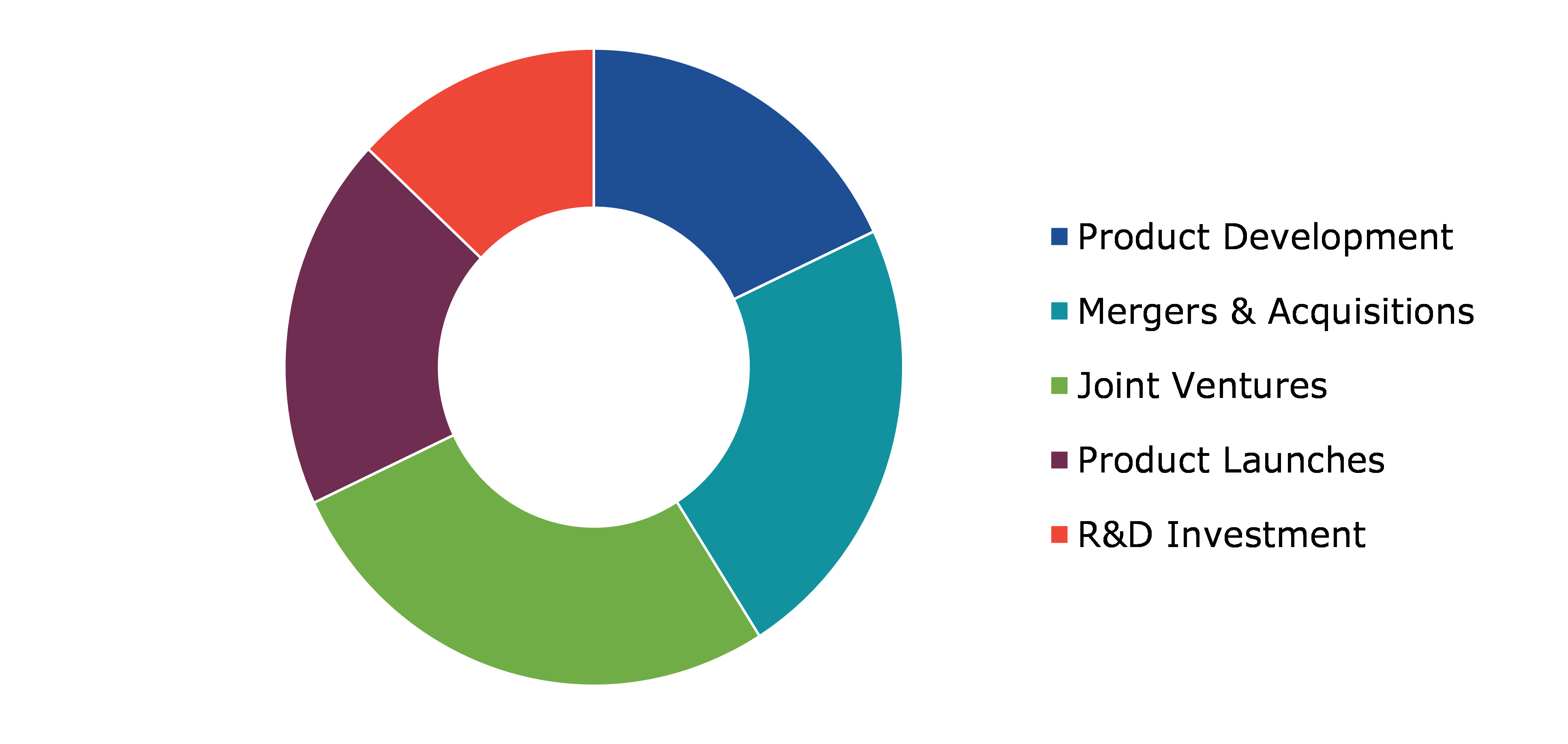

The key strategy used by major market players are product development and enhancement in the radiation oncology such as 3-D conformal radiation therapy, intensity-modulated radiation therapy (IMRT), image-guided radiation therapy (IGRT), tomotherapy®, stereotactic radiosurgery, and stereotactic body radiation therapy. Varian, American based leading radiation oncology device manufacturer, has received Investigational Device Exemption (IDE) for FAST-02 Clinical Trial of Flash Technology, which will deliver high dose of radiation than conventional radiation therapy.

Source: Research Dive Analysis

The leading players in radiation oncology market are Varian Medical Systems, Inc., Elekta AB, Accuray Incorporated, Mevion Medical Systems, IBA Worldwide, Nordion (Canada) Inc., BD, Isoray Inc., Provision Healthcare, Panacea Medical Technologies Pvt. Ltd, and Novartis.

| Aspect | Particulars |

| Historical Market Estimations | 2020-2021 |

| Base Year for Market Estimation | 2021 |

| Forecast timeline for Market Projection | 2022-2030 |

| Geographical Scope | North America, Europe, Asia-Pacific, LAMEA |

|

Segmentation by Type

|

|

| Segmentation by Application |

|

| Key Companies Profiled |

|

Q1. What is the size of the global radiation oncology market?

A. The size of the global radiation oncology market was $7,794.4 million in 2021 and is predicted to reach $15,231.2 by 2030.

Q2. Which are the major companies in the radiation oncology market?

A. Varian Medical Systems, Inc., Elekta AB, Accuray Incorporated, and C.R Bard Inc. are the major players in the global radiation oncology market.

Q3. Which region, among others, possesses greater investment opportunities in the near future?

A. The Asia-Pacific region offers investors numerous opportunities to witness the exceptional growth in the future.

Q4. What will be the growth rate of the Asia-Pacific radiation oncology market?

A. Asia-Pacific radiation oncology market is expected to grow at 9.4% CAGR in the forecasted period.

Q5. What are the strategies opted by the leading players in this market?

A. The strategies like product development are opted by the leading players in the market.

Q6. Which companies are investing more on R&D practices?

A. Novartis, and Varian Medical Systems are the companies investing in the R&D practices

1.Research Methodology

1.1.Desk Research

1.2.Real time insights and validation

1.3.Forecast model

1.4.Assumptions and forecast parameters

1.5.Market size estimation

1.5.1.Top-down approach

1.5.2.Bottom-up approach

2.Report Scope

2.1.Market definition

2.2.Key objectives of the study

2.3.Report overview

2.4.Market segmentation

2.5.Overview of the impact of COVID-19 on Global radiation oncology market

3.Executive Summary

4.Market Overview

4.1.Introduction

4.2.Growth impact forces

4.2.1.Drivers

4.2.2.Restraints

4.2.3.Opportunities

4.3.Market value chain analysis

4.3.1.List of raw material suppliers

4.3.2.List of manufacturers

4.3.3.List of distributors

4.4.Innovation & sustainability matrices

4.4.1.Technology matrix

4.4.2.Regulatory matrix

4.5.Porter’s five forces analysis

4.5.1.Bargaining power of suppliers

4.5.2.Bargaining power of consumers

4.5.3.Threat of substitutes

4.5.4.Threat of new entrants

4.5.5.Competitive rivalry intensity

4.6.PESTLE analysis

4.6.1.Political

4.6.2.Economical

4.6.3.Social

4.6.4.Technological

4.6.5.Environmental

4.7.Impact of COVID-19 on radiation oncology market

4.7.1.Pre-covid market scenario

4.7.2.Post-covid market scenario

5.Radiation Oncology Market Analysis, by Type

5.1.Overview

5.2.External beam radiation therapy

5.2.1.Definition, key trends, growth factors, and opportunities, 2021-2030

5.2.2.Market size analysis, by region, 2021-2030

5.2.3.Market share analysis, by country, 2021-2030

5.3.Internal beam radiation therapy

5.3.1.Definition, key trends, growth factors, and opportunities, 2021-2030

5.3.2.Market size analysis, by region, 2021-2030

5.3.3.Market share analysis, by country, 2021-2030

5.4.Research Dive Exclusive Insights

5.4.1.Market attractiveness, 2021-2030

5.4.2.Competition heatmap, 2021-2030

6.Radiation Oncology Market Analysis, by Application

6.1.Prostate cancer

6.1.1.Definition, key trends, growth factors, and opportunities, 2021-2030

6.1.2.Market size analysis, by region, 2021-2030

6.1.3.Market share analysis, by country, 2021-2030

6.2.Breast cancer

6.2.1.Definition, key trends, growth factors, and opportunities, 2021-2030

6.2.2.Market size analysis, by region, 2021-2030

6.2.3.Market share analysis, by country, 2021-2030

6.3.Lung cancer

6.3.1.Definition, key trends, growth factors, and opportunities, 2021-2030

6.3.2.Market size analysis, by region, 2021-2030

6.3.3.Market share analysis, by country, 2021-2030

6.4.Head &neck cancer

6.4.1.Definition, key trends, growth factors, and opportunities, 2021-2030

6.4.2.Market size analysis, by region, 2021-2030

6.4.3.Market share analysis, by country, 2021-2030

6.5.Colorectal cancer

6.5.1.Definition, key trends, growth factors, and opportunities, 2021-2030

6.5.2.Market size analysis, by region, 2021-2030

6.5.3.Market share analysis, by country, 2021-2030

6.6.Cervical cancer

6.6.1.Definition, key trends, growth factors, and opportunities, 2021-2030

6.6.2.Market size analysis, by region, 2021-2030

6.6.3.Market share analysis, by country, 2021-2030

6.7.Gynaecological cancer

6.7.1.Definition, key trends, growth factors, and opportunities, 2021-2030

6.7.2.Market size analysis, by region, 2021-2030

6.7.3.Market share analysis, by country, 2021-2030

6.8.Research Dive Exclusive Insights

6.8.1.Market attractiveness, 2021-2030

6.8.2.Competition heatmap, 2021-2030

7.Radiation Oncology Market, by Region

7.1.North America

7.1.1.U.S.

7.1.1.1.Market size analysis, by Type, 2021-2030

7.1.1.2.Market size analysis, by Application, 2021-2030

7.1.2.Canada

7.1.2.1.Market size analysis, by Type, 2021-2030

7.1.2.2.Market size analysis, by Application, 2021-2030

7.1.3.Mexico

7.1.3.1.Market size analysis, by Type, 2021-2030

7.1.3.2.Market size analysis, by Application, 2021-2030

7.1.4.Research Dive Exclusive Insights

7.1.4.1.Market attractiveness, 2021-2030

7.1.4.2.Competition heatmap, 2021-2030

7.2.Europe

7.2.1.Germany

7.2.1.1.Market size analysis, by Type, 2021-2030

7.2.1.2.Market size analysis, by Application, 2021-2030

7.2.2.UK

7.2.2.1.Market size analysis, by Type, 2021-2030

7.2.2.2.Market size analysis, by Application, 2021-2030

7.2.3.France

7.2.3.1.Market size analysis, by Type, 2021-2030

7.2.3.2.Market size analysis, by Application, 2021-2030

7.2.4.Spain

7.2.4.1.Market size analysis, by Type, 2021-2030

7.2.4.2.Market size analysis, by Application, 2021-2030

7.2.5.Italy

7.2.5.1.Market size analysis, by Type, 2021-2030

7.2.5.2.Market size analysis, by Application, 2021-2030

7.2.6.Rest of Europe

7.2.6.1.Market size analysis, by Type, 2021-2030

7.2.6.2.Market size analysis, by Application, 2021-2030

7.2.7.Research Dive Exclusive Insights

7.2.7.1.Market attractiveness, 2021-2030

7.2.7.2.Competition heatmap, 2021-2030

7.3.Asia Pacific

7.3.1.China

7.3.1.1.Market size analysis, by Type, 2021-2030

7.3.1.2.Market size analysis, by Application, 2021-2030

7.3.2.Japan

7.3.2.1.Market size analysis, by Type, 2021-2030

7.3.2.2.Market size analysis, by Application, 2021-2030

7.3.3.India

7.3.3.1.Market size analysis, by Type, 2021-2030

7.3.3.2.Market size analysis, by Application, 2021-2030

7.3.4.Australia

7.3.4.1.Market size analysis, by Type, 2021-2030

7.3.4.2.Market size analysis, by Application, 2021-2030

7.3.5.South Korea

7.3.5.1.Market size analysis, by Type, 2021-2030

7.3.5.2.Market size analysis, by Application, 2021-2030

7.3.6.Rest of Asia Pacific

7.3.6.1.Market size analysis, by Type, 2021-2030

7.3.6.2.Market size analysis, by Application, 2021-2030

7.3.7.Research Dive Exclusive Insights

7.3.7.1.Market attractiveness, 2021-2030

7.3.7.2.Competition heatmap, 2021-2030

7.4.LAMEA

7.4.1.Brazil

7.4.1.1.Market size analysis, by Type, 2021-2030

7.4.1.2.Market size analysis, by Application, 2021-2030

7.4.2.Saudi Arabia

7.4.2.1.Market size analysis, by Type, 2021-2030

7.4.2.2.Market size analysis, by Application, 2021-2030

7.4.3.UAE

7.4.3.1.Market size analysis, by Type, 2021-2030

7.4.3.2.Market size analysis, by Application, 2021-2030

7.4.4.South Africa

7.4.4.1.Market size analysis, by Type, 2021-2030

7.4.4.2.Market size analysis, by Application, 2021-2030

7.4.5.Rest of LAMEA

7.4.5.1.Market size analysis, by Type, 2021-2030

7.4.5.2.Market size analysis, by Application, 2021-2030

7.4.6.Research Dive Exclusive Insights

7.4.6.1.Market attractiveness, 2021-2030

7.4.6.2.Competition heatmap, 2021-2030

8.Competitive Landscape

8.1.Top winning strategies, 2021

8.1.1.By strategy

8.1.2.By year

8.2.Strategic overview

8.3.Market share analysis, 2021

9.Company Profiles

9.1.Varian Medical Systems, Inc.

9.1.1.Overview

9.1.2.Business segments

9.1.3.Product portfolio

9.1.4.Financial performance

9.1.5.Recent developments

9.1.6.SWOT analysis

9.2.Elekta AB

9.2.1.Overview

9.2.2.Business segments

9.2.3.Product portfolio

9.2.4.Financial performance

9.2.5.Recent developments

9.2.6.SWOT analysis

9.3.Accuray Incorporated

9.3.1.Overview

9.3.2.Business segments

9.3.3.Product portfolio

9.3.4.Financial performance

9.3.5.Recent developments

9.3.6.SWOT analysis

9.4. Mevion Medical Systems

9.4.1.Overview

9.4.2.Business segments

9.4.3.Product portfolio

9.4.4.Financial performance

9.4.5.Recent developments

9.4.6.SWOT analysis

9.5.IBA Worldwide

9.5.1.Overview

9.5.2.Business segments

9.5.3.Product portfolio

9.5.4.Financial performance

9.5.5.Recent developments

9.5.6.SWOT analysis

9.6.Nordion (Canada) Inc.

9.6.1.Overview

9.6.2.Business segments

9.6.3.Product portfolio

9.6.4.Financial performance

9.6.5.Recent developments

9.6.6.SWOT analysis

9.7.BD

9.7.1.Overview

9.7.2.Business segments

9.7.3.Product portfolio

9.7.4.Financial performance

9.7.5.Recent developments

9.7.6.SWOT analysis

9.8.Isoray Inc.

9.8.1.Overview

9.8.2.Business segments

9.8.3.Product portfolio

9.8.4.Financial performance

9.8.5.Recent developments

9.8.6.SWOT analysis

9.9.Provision Healthcare

9.9.1.Overview

9.9.2.Business segments

9.9.3.Product portfolio

9.9.4.Financial performance

9.9.5.Recent developments

9.9.6.SWOT analysis

9.10.Panacea Medical Technologies Pvt. Ltd

9.10.1.Overview

9.10.2.Business segments

9.10.3.Product portfolio

9.10.4.Financial performance

9.10.5.Recent developments

9.10.6.SWOT analysis

10.Appendix

10.1.Parent & peer market analysis

10.2.Premium insights from industry experts

10.3.Related reports

The world is witnessing a bulging rise in the number of cancer patients worldwide. The treatment of cancer is associated with a huge set of novel challenges. The medical industry is curing cancer patients by using radiation therapies. Radiation therapy is the usage of high-energy radiation to destroy the DNA of cancer cells and abolish their capability to divide and proliferate. These therapies can be used to treat cancer, get rid of cancer related pain or ease other symptoms.

These days, the technology as well as treatments used in radiation oncology are continuously evolving. Latest improvements in the field of radiation oncology have helped numerous cancer patients, thus resulting in greater cure rates, reduced side effects, quicker treatment periods, and decreased number of treatments. Constant research and development activities and investments in radiation therapy techniques, rise in clinical and laboratory researches, and increased availability of well-trained radiation oncology experts are boosting the growth of the global radiation oncology market.

Newest Insights in the Radiation Oncology Market

As per a report by Research Dive, the global radiation oncology market is expected to grow with a striking CAGR in the 2022–2030 timeframe. The Asia-Pacific radiation oncology market is expected to perceive foremost and rapid growth in the years to come. This is because, the region has a gigantic demand for radiation oncology owing to the growing cases of cancer in the region. As Asia holds 49.3% of overall cases of cancer across the globe, the region is expected to perceive massive growth in the years to come.

How are Market Players Responding to the Rising Demand for Radiation oncology?

Market players are greatly capitalizing in pioneering researches and inventions to cater the rising demand for radiation oncology services. Some of the foremost players of the radiation oncology market are Elekta AB, Accuray Incorporated, IBA Worldwide, Novartis, Nordion (Canada) Inc., BD, Isoray Inc., Provision Healthcare, Varian Medical Systems, Inc., Panacea Medical Technologies Pvt. Ltd, Mevion Medical Systems, and others. These players are focused on planning and devising tactics such as mergers and acquisitions, collaborations, novel advances, and partnerships to reach a notable position in the global market.

For instance,

- In August 2019, Royal Philips, a worldwide frontrunner in health technology, launched IntelliSpace Radiation Oncology [1], an smart patient management solution to deal with complications, increase efficiency, and empower operational superiority in radiotherapy sectors.

- In October 2020, Mayo Clinic, a nonprofit American academic medical center focused on integrated health care, education, and research, and Google Health, a branch of Google focused on helping the world to be healthier through products and services that connect and add meaning to health information, collaborated and took an initiative to perform research for implementing artificial intelligence (AI) to radiation therapy planning, a vital part of cancer treatment.

- In June 2022, St. Luke’s Radiation Oncology Network (SLRON), one of the leading radiation oncology service provider, announced its novel 5 year plan that aims on offering the best cancer team and a pledge to research and carry out technological innovations to deliver the finest possible care for cancer patients.

COVID-19 Impact on the Global Radiation oncology Market

The unexpected rise of the coronavirus pandemic in 2020 has adversely impacted the global radiation oncology market. During the pandemic period, dearth of skilled professionals and inadequate capital for academic & research institutions affected the cost of offering care during the course of the cancer continuum, particularly in radiation oncology. Cancer patients as well as hospitals delayed or cancelled surgeries or hospital visits to avoid the spread of the virus, which resulted in a drastic downfall in the global market growth in the pandemic period. However, with the relaxation of the pandemic since the end of 2021, many healthcare centres offering radiation oncology treatments got back on track and began offering enhanced services, which is projected to thrust the growth of the radiation oncology market in the forthcoming years.

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com