Virtual Fitness Market Report

RA08338

Virtual Fitness Market, by Streaming Type (Live, On-demand), Session Type (Group, Solo), Device Type (Smart TV, Smartphones, Laptops, Desktops & Tablets, Others), Revenue Model (Subscription, Advertisement, Hybrid), End User (Professional Gyms, Sports Institutes, Defense Institutes, Educational Institutions, Corporate Institutions, Individuals, Others), and Regional Analysis (North America, Europe, Asia Pacific, LAMEA): Global Opportunity Analysis and Industry Forecast, 2020–2027

The global market for virtual fitness solutions forecast estimated $59,650.3 million by 2027 rising from $6,060.0 million in 2019 at a healthy CAGR of 33.5%. The Asia Pacific virtual fitness market is anticipated to spike at a growth rate of 34.9% by generating a revenue of $15,580.7 million in 2027. Massive expansion of mobile devices combined with pro-fitness government policies particularly in India, China, South Korea, and Australia are exponentially increasing the adoption of virtual fitness solutions in the APAC region.

Virtual Fitness Market Analysis:

Virtual fitness is a concept of a premier on-demand or live fitness programs that offer fitness classes, fitness assessments, and expert fitness tips to users at their home. The virtual fitness platform provides a broad variety of formats ranging from high energy sessions like body pump, spin, and aerobics, to gentle core strengthening exercises such as yoga and Pilates.

Impact Analysis of COVID-19 on the Global Virtual Fitness Market

The novel coronavirus pandemic has positively affected the virtual fitness market growth. During the COVID-19 pandemic, the fitness-freaks and health-conscious people rapidly shifted to innovative video exercise platforms. Also, startups such as Fittr, Fitternity, and HealthifyMe announced that they gained more customers, in services related to mental health like corporate wellness programs and others. For instance, Mindbody, a leading Software developer for gyms and spas & salons, data stated that it witnessed a spike of 73% in consumers that are using pre-recorded exercise video in 2020. In addition to this, several technology leaders are coming up with effective situational decision to help and support the community to strengthen their customer reach. For example, in September 2020, Fitbit, the U.S. based consumer electronics and fitness company, announced to offer a free trial of ‘Fitbit Premium’, its new home workout service, in order to help people, sleep-well, exercise, and stay healthy during the COVID crisis. Such company initiatives showcase that the demand for virtual fitness programs has increased during COVID-19 pandemic.

Rapid shift of people to the virtual fitness solutions from gyms and offline fitness institutions is expected to surge the demand for virtual fitness industry worldwide

People tend to experience lack in motivation after a certain time to go to the gym, and hence end up quitting the gym.. For example, according to a study conducted by glofox.com, more than 12% of new members join the gym in January. However, out of the new January members, approximately 80% quit within 5 months while 14% joining members quit the gym by the end of February. On the other hand, Daily Burn, Inc., a leading health and virtual fitness company, has witnessed around 268% year-over-year increase in membership signups, during the COVID-19 pandemic. Furthermore, according to the ACSM (American College of Sports Medicine), fitness apps held the 13th rank in fitness trends of year 2019. These facts and figures showcase that health-conscious people are shifting to indoor virtual workouts from offline fitness institutions, which is further expected to raise the demand for virtual fitness programs, in the forecast period.

In addition to this, increasing number of overweight kids and obesity among school students is expected to drive the demand for workout programs, which may ultimately boost the global market for virtual fitness solutions, during the forecast period. For example, according to a survey conducted by World Obesity Federation., as per an estimation of 2019, more than 150 million children across the globe were obese and further this number is predicted to rise to 206 million by the end of 2025. The above-stated elements showcase that the need for virtual workout programs is expected to massively surge in the coming years.

To know more about global virtual fitness market drivers, get in touch with our analysts here.

Lack of awareness regarding online fitness programs may restrain the growth of the global virtual fitness industry

Lack of awareness about various innovative virtual exercise classes among the developing economies is further anticipated to hamper the global market growth during the forecast period. In addition to this, high cost of content creation, coupled with lack of availability of strong network connectivity, is restraining the market growth.

Introduction of exergaming platforms among people may create attractive opportunities for the key players, which is further expected to create market opportunities

In recent years, exergaming has been one of the most recognized fitness trends; it is the combination of workout and gaming. The platforms help people in building self-confidence, fitness, and strength through the attractive gaming platform. Newly developed exergaming platforms are the perfect option for users to enjoy their favorite games while being physically active.

Hence, market leaders including Zwift Inc, are entering the international market to provide interactive video game exercise platforms. The company offers an advanced app for runners, cyclists, and triathletes that enhance indoor training activities. For instance, in December 2019, Zwift teamed up with Absa Cape Epic., the most televised mountain bike race, to strengthen indoor training portfolio for gravel riders and mountain bikers. Such strategic tie-ups and technological innovations are further expected to create enormous market opportunities in the future.

To know more about global virtual fitness market opportunities, get in touch with our analysts here.

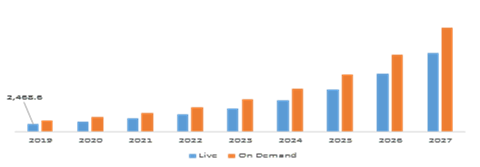

Global Virtual Fitness Market, by Streaming Type:

The live sub-segment for the virtual fitness market will have rapid market growth; this is mainly due to increasing health concerns among the people owing to growing prevalence of heart diseases

Source: Research Dive Analysis

The live sub-segment of the global virtual fitness market will have the fastest growth and is projected to surpass $25,725.7 million by 2027, with an increase from $2,468.6 million in 2019.

The market growth of live streaming fitness platform is mainly attributed to its key features including variety, comfort, and convenience. Live streaming platform is able to serve virtual classes for workouts including Pilates, yoga, toning & dancing classes celebrity trainer classes, and Barre. Thus, the demand for such classes has extensively increased in the recent years. For example, in March 2020, 24 Hour Fitness USA, Inc., a privately owned and operated fitness center, announced to launch a new 24/7 Live At-Home Streaming Channel’ which is free-of-cost. The channel offers innovative workout content & community interaction in order to help people stay fit and minimize stress. Such key developments are helping companies expanding its customer reach, which may further create great market opportunities for the players in the coming years.

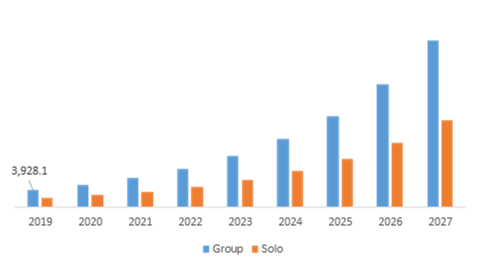

Global Virtual Fitness Market, by Session type:

Group session sub-segment for virtual fitness market shall have lucrative growth mainly because of availability of wide range of popular workouts including Barre ang Yoga

Source: Research Dive Analysis

The group sessions for the global virtual fitness market will have a lucrative growth, and it is projected to register a revenue of $39,264.5 million by 2027, at CAGR of 33.7%. The adoption of the group session for workout has enormously increased because the class emphasizes mainly on improving postural alignment, resulting in robust strength and balance, ease of movement, and enhanced functional fitness. Moreover, players working in virtual fitness industry, like Les Mills, are offering professional gym trainers for best customer experience. Such factors may boost the segment growth in the forecast years.

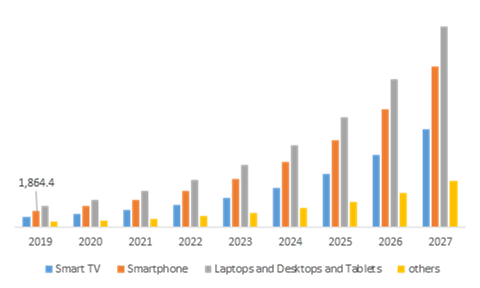

Global Virtual Fitness, by Device Type:

Smartphone device sub-segment for global virtual fitness market is expected grow at notable CAGR of 34.0% and generate a revenue of $18,996.9 million by 2027

Source: Research Dive Analysis

The smartphone sub-segment for the virtual fitness market will be a rapidly growing sub-segment and it is further expected to generate a revenue of $18,996.9 million by 2027; this is mainly due to increasing popularity of the pioneering fitness apps including Apple HealthKit, Samsung Health, Google Fit, and LG Health. In addition to this, increasing smartphone penetration in developing countries like India may also create a positive opportunity for the sub-segment growth. For instance, according to the Omidyar Network, a self-styled philanthropic investment firm, mobile phone penetration in India is set to increase up to 85% to 90% by 2020. The massive adoption of smartphones will increase the usage of mobile apps, which may also create lucrative market opportunities for the virtual fitness platform in the coming years.

However, laptop, desktops, & tablets device type shall have a dominating share in the global market and is anticipated to register a revenue of $23,670.2 million during the projected period. The sub-segment for virtual fitness industry has experienced notable growth mainly because of an increasing shift of people towards indoor workouts. Moreover, the sub-segment provides multiple key features including longer battery life, high-performance speed, ease of usability, and miniaturization to the fitness freak people.

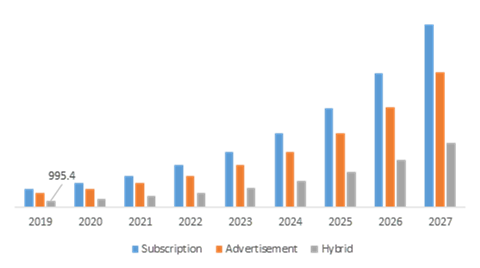

Global Virtual Fitness Market, by Revenue Model:

The hybrid revenue model for global virtual fitness platform is in extensive demand mainly because its capability to reach the fitness-freak clients worldwide

Source: Research Dive Analysis

The hybrid revenue model for virtual fitness platform is expected to register a noteworthy revenue of $10,007.9 million by 2027, increasing at a growth rate of 33.8%.

The hybrid revenue model has witnessed exponential growth mainly because of its ability to reach the clients including, those keen to access features of the free of cost virtual fitness programs combined with those willing to buy the subscription plan. Hence, the technology leaders are strategically aligned with other companies to provide hybrid models for customers to strengthen their customer reach. For example, in May 2020, Mindbody, business management software developers for gyms and spas & salons worldwide, made an announcement to release the integrated live streaming feature for fitness and beauty & wellness businesses. Also, the company has announced to serve inclusive hybrid memberships of both in-studio and virtual offerings. Such factors are expected to drive the global market during the analysis period.

The subscription revenue model for the virtual fitness market will have a massive share in the global market in 2020 and is projected to generate a revenue of $28,555.6 million by 2027, with a CAGR of 33.6% over the analysis period. The presence of popular fitness brands including Apple Fitness Plus, Daily Burn, Peloton App, Barre3, and Aptive and their innovative ideas to expand its customer reach are expected drive the sub-segment in the forecast period.

Global Virtual Fitness Market, by End-User:

The professional gyms sub-segment will have a dominating market share in 2020 and it is expected to generate $11,593.9 million by 2027

Source: Research Dive Analysis

Professional gyms will have a dominating share in the global market in 2020, and it is further projected to generate a revenue of $11,593.9 million by the end of 2027, with an increase from $1,377.9 million in 2019. Massively increasing obesity rates particularly in the urban world has resulted in surged health and wellness awareness in the consumers. For example, as per the survey conducted by the Center for Disease Control & Prevention (CDC), from 1999–2000 through 2017–2018, the obesity prevalence surged from 30.5% to 42.4% across the U.S. Hence, awareness regarding health and well-being has extensively increased among people, which may further lead to create great opportunities for the sub-segment in the market.

The individual end-user sub-segment for virtual fitness platforms is anticipated to grow at notable CAGR of 39.3% and is further expected to generate a revenue of $15,290.7 million by 2027. Increasing health concerns across the developed as well as developing countries contribute in the enormous revenue generation of global online fitness industry. Sedentary lifestyle is one of the major reasons of increasing health consciousness among the people. The sedentary lifestyle can increase the causes of mortality, diabetes, obesity, and double the risk of cardiovascular diseases. For instance, as per survey conducted by the CDC, approximately 29 million adults in the U.S. have total cholesterol levels higher than 240 mg/dL.3. Moreover, as per the estimation of the WHO, around 177 million patients suffer from diabetes, across the globe. Furthermore, this count is likely to be more than double by the end of 2030. Two-thirds of diabetic patients are the citizens of developing countries including India, Indonesia, China, UAE, Russia, Brazil Pakistan, and others.

Regional Insights:

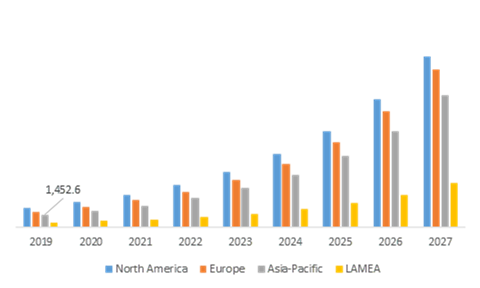

Asia-Pacific region will have a lucrative market in the coming years and it will reach up to $15,580.7 million by the end of 2027

Source: Research Dive Analysis

The Asia-Pacific virtual fitness market accounted $1,452.6 million in 2019 and is projected to register a revenue of $15,580.7 million by 2027’ this is mainly owing to the massive internet penetration among the Asian countries including China and India. As per data published by learnbonds.com, an economy website that provides readers with daily income investing news, Asian countries have 2.3 billion internet users, which is around 50.3% of the global internet user population. Moreover, emerging economies like India and China have massive populations that are accessing the internet significantly via smartphones. Such internet proliferation and significant adoption of smartphones is expected to create lucrative opportunities for the key players in the region.

North America virtual fitness market generated a revenue of $2,291.9 million in 2019, and it is further projected surpass $20,173.7 million by 2027.

The growth in the region is mainly attributed to the growing need of innovative fitness platforms due to increasing prevalence of chronic diseases like diabetes, obesity, CVDs and others. For instance, according to the estimation of CDC, in the U.S., Type 2 diabetes is the most common disease which is caused by sedentary lifestyle and obesity in around 90% of the cases. Moreover, as per a survey conducted by CDC in 2020, 23.6%. In addition to this, as per estimation of Youth Risk Behavior Surveillance System (YRBSS) in 2019, 15.5% of high school students were obese and an additional 16.1% were overweight, in the U.S. Above-stated figures showcase that the need for innovative fitness platforms and health awareness program especially in the educational institutions is expected to increase dramatically, which may further create favorable conditions for the virtual fitness industry, in the region.

Competitive Scenario in the Global Virtual Fitness Market:

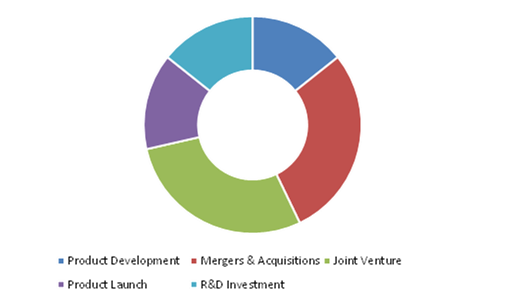

Technological development and mergers & acquisitions are the frequent strategies followed by the significant market players

Source: Research Dive Analysis

Some of the leading virtual fitness market players are Fitbit, Inc., ClassPass Inc., FitnessOnDemand, Peloton, Wellbeats, Inc., Zwift Inc, REH-FIT, Les Mills International Ltd., Sworkit, and Navigate Wellbeing Solutions. Established as well as start-up organizations operating in the virtual fitness industry are focusing majorly on advanced technological developments, mergers & acquisitions, business expansion, and others. For instance, in August 2020, ClassPass, teamed up with Fyt, one of the largest personal training services, in order to emphasize on live streamed virtual personal training sessions.

Porter’s Five Forces Analysis for Virtual Fitness Market:

- Bargaining Power of Suppliers: The suppliers of the global virtual fitness industry are less in number. Hence, the bargaining power of the supplier is High.

- Bargaining Power of Buyer: The virtual fitness market is fragmented. Hence, there is a vast product differentiation found in the virtual fitness solution. Thus, the bargaining power of the buyer is Low.

- Threat of New Entrants: Emerging companies are following various strategies such as product innovation, combined with strategic collaboration to strengthen their footprint in the international market. Hence, the threat of the new entrant is High.

- Threat of Substitutes: There is no alternative product for virtual fitness solutions. Thus, the threat of substitutes is Low.

- Competitive Rivalry in the Market: Strong presence of innovation leaders including Fitbit, ClassPass are creating huge rivalry in the global industry. Heavy investment in R&D coupled with major business expansion are some of the factors increasing competitive rivalry among the key players. Competitive rivalry in the market is High

| Aspect | Particulars |

| Historical Market Estimations | 2018-2019 |

| Base Year for Market Estimation | 2019 |

| Forecast timeline for Market Projection | 2020-2027 |

| Geographical Scope | North America, Europe, Asia-Pacific, LAMEA |

| Segmentation by Streaming Type |

|

| Segmentation by Session Type |

|

| Segmentation by Device Type |

|

| Segmentation by Revenue Model |

|

| Segmentation by End-User |

|

| Key Countries Covered | The U.S., Canada, Mexico, Germany, France, UK, Italy, Spain, Rest of Europe, China, Australia, Japan, India, South Korea, Rest of Asia-Pacific, Latin America, Middle East, and Africa

|

| Key Companies Profiled |

|

Q1. What is the size of the global virtual fitness market?

A. The global virtual fitness market size was over $6,060.0 million in 2019 and is projected to reach $59,650.3 million by 2027.

Q2. Which are the major companies in the virtual fitness market?

A. Fitbit, Inc., ClassPass Inc., and FitnessOnDemand are some of the key players in the global virtual fitness market.

Q3. Which region possesses greater investment opportunities in the coming future?

A. The Asia-Pacific region possesses great investment opportunities for investors to witness the most promising growth in the future.

Q4. What is the growth rate of the Asia-Pacific virtual fitness market?

A. Asia-Pacific virtual fitness market is anticipated to grow at 34.9% CAGR during the forecast period.

Q5. What are the strategies opted by the leading players in this market?

A. Technological development and strategic partnerships are the key strategies opted by the operating companies in this market.

Q6. Which companies are investing more on R&D practices?

A. Peloton, Wellbeats, Inc., and Zwift Inc. companies are investing more on R&D activities for developing new products and technologies.

1.Research Methodology

1.1.Desk Research

1.2.Real time insights and validation

1.3.Forecast model

1.4.Assumptions and forecast parameters

1.4.1.Assumptions

1.4.2.Forecast parameters

1.5.Data sources

1.5.1.Primary

1.5.2.Secondary

2.Executive Summary

2.1.360° summary

2.2.By streaming type trends

2.3.By session trends

2.4.By device trends

2.5.By revenue model trends

2.6.By end-user trends

3.Market overview

3.1.Market segmentation & definitions

3.2.Key takeaways

3.2.1.Top investment pockets

3.2.2.Top winning strategies

3.3.Porter’s five forces analysis

3.3.1.Bargaining power of consumers

3.3.2.Bargaining power of suppliers

3.3.3.Threat of new entrants

3.3.4.Threat of substitutes

3.3.5.Competitive rivalry in the market

3.4.Market dynamics

3.4.1.Drivers

3.4.2.Restraints

3.4.3.Opportunities

3.5.Technology landscape

3.6.Regulatory landscape

3.7.Patent landscape

3.8.Pricing overview

3.8.1.by streaming type

3.8.2.by session type

3.8.3.by device type

3.8.4.by revenue model type

3.8.5.by end-user

3.9.Market value chain analysis

3.9.1.Stress point analysis

3.9.2.Raw material analysis

3.9.3.Manufacturing process

3.9.4.Distribution channel analysis

3.9.5.Operating vendors

3.9.5.1.Raw material suppliers

3.9.5.2.Product manufacturers

3.9.5.3.Product distributors

3.10.Strategic overview

4.Virtual fitness Market, by Streaming Type

4.1.Live

4.1.1.Market size and forecast, by region, 2019-2027

4.1.2.Comparative market share analysis, 2019 & 2027

4.2.On Demand

4.2.1.Market size and forecast, by region, 2019-2027

4.2.2.Comparative market share analysis, 2019 & 2027

5.Virtual fitness Market, by session type

5.1.Group

5.1.1.Market size and forecast, by region, 2019-2027

5.1.2.Comparative market share analysis, 2019 & 2027

5.2.Solo

5.2.1.Market size and forecast, by region, 2019-2027

5.2.2.Comparative market share analysis, 2019 & 2027

6.Virtual fitness Market, by Device Type

6.1.Smart TV

6.1.1.Market size and forecast, by region, 2019-2027

6.1.2.Comparative market share analysis, 2019 & 2027

6.2.Smartphone

6.2.1.Market size and forecast, by region, 2019-2027

6.2.2.Comparative market share analysis, 2019 & 2027

6.3.Laptops, Desktops & Tablets,

6.3.1.Market size and forecast, by region, 2019-2027

6.3.2.Comparative market share analysis, 2019 & 2027

6.4.Others

6.4.1.Market size and forecast, by region, 2019-2027

6.4.2.Comparative market share analysis, 2019 & 2027

7.Virtual fitness Market, by Revenue Model

7.1.Subscription

7.1.1.Market size and forecast, by region, 2019-2027

7.1.2.Comparative market share analysis, 2019 & 202

7.2.Advertisement

7.2.1.Market size and forecast, by region, 2019-2027

7.2.2.Comparative market share analysis, 2019 & 2027

7.3.Hybrid

7.3.1.Market size and forecast, by region, 2019-2027

7.3.2.Comparative market share analysis, 2019 & 2027

8.Virtual fitness Market, by End-User

8.1.Professional Gyms

8.1.1.Market size and forecast, by region, 2019-2027

8.1.2.Comparative market share analysis, 2019 & 2027

8.2.Sports Institutes

8.2.1.Market size and forecast, by region, 2019-2027

8.2.2.Comparative market share analysis, 2019 & 2027

8.3.Defense Institutes

8.3.1.Market size and forecast, by region, 2019-2027

8.3.2.Comparative market share analysis, 2019 & 2027

8.4.Educational Institutions

8.4.1.Market size and forecast, by region, 2019-2027

8.4.2.Comparative market share analysis, 2019 & 2027

8.5.Corporate Institutions

8.5.1.Market size and forecast, by region, 2019-2027

8.5.2.Comparative market share analysis, 2019 & 2027

8.6.Individuals

8.6.1.Market size and forecast, by region, 2019-2027

8.6.2.Comparative market share analysis, 2019 & 2027

8.7.Others

8.7.1.Market size and forecast, by region, 2019-2027

8.7.2.Comparative market share analysis, 2019 & 2027

9.Virtual fitness Market, by Region

9.1.North America

9.1.1.Market size and forecast, by streaming type, 2019-2027

9.1.2.Market size and forecast, by session type, 2019-2027

9.1.3.Market size and forecast, by device type, 2019-2027

9.1.4.Market size and forecast, by revenue model, 2019-2027

9.1.5.Market size and forecast, by end-user, 2019-2027

9.1.6.Market size and forecast, by country, 2019-2027

9.1.7.Comparative market share analysis, 2019 & 2027

9.1.8.U.S.

9.1.8.1.Market size and forecast, by streaming type, 2019-2027

9.1.8.2.Market size and forecast, by session type, 2019-2027

9.1.8.3.Market size and forecast, by device type, 2019-2027

9.1.8.4.Market size and forecast, by revenue model, 2019-2027

9.1.8.5.Market size and forecast, by end-user, 2019-2027

9.1.8.6.Comparative market share analysis, 2019 & 2027

9.1.9.Canada

9.1.9.1.Market size and forecast, by streaming type, 2019-2027

9.1.9.2.Market size and forecast, by session type, 2019-2027

9.1.9.3.Market size and forecast, by device type, 2019-2027

9.1.9.4.Market size and forecast, by revenue model, 2019-2027

9.1.9.5.Market size and forecast, by end-user, 2019-2027

9.1.9.6.Comparative market share analysis, 2019 & 2027

9.1.10.Mexico

9.1.10.1.Market size and forecast, by streaming type, 2019-2027

9.1.10.2.Market size and forecast, by session type, 2019-2027

9.1.10.3.Market size and forecast, by device type, 2019-2027

9.1.10.4.Market size and forecast, by revenue model, 2019-2027

9.1.10.5.Market size and forecast, by end-user, 2019-2027

9.1.10.6.Comparative market share analysis, 2019 & 2027

9.2.Europe

9.2.1.Market size and forecast, by streaming type, 2019-2027

9.2.2.Market size and forecast, by session type, 2019-2027

9.2.3.Market size and forecast, by device type, 2019-2027

9.2.4.Market size and forecast, by revenue model, 2019-2027

9.2.5.Market size and forecast, by end-user, 2019-2027

9.2.6.Market size and forecast, by country, 2019-2027

9.2.7.Comparative market share analysis, 2019 & 2027

9.2.8.Germany

9.2.8.1.Market size and forecast, by streaming type, 2019-2027

9.2.8.2.Market size and forecast, by session type, 2019-2027

9.2.8.3.Market size and forecast, by device type, 2019-2027

9.2.8.4.Market size and forecast, by revenue model, 2019-2027

9.2.8.5.Market size and forecast, by end-user, 2019-2027

9.2.8.6.Comparative market share analysis, 2019 & 2027

9.2.9.UK

9.2.9.1.Market size and forecast, by streaming type, 2019-2027

9.2.9.2.Market size and forecast, by session type, 2019-2027

9.2.9.3.Market size and forecast, by device type, 2019-2027

9.2.9.4.Market size and forecast, by revenue model, 2019-2027

9.2.9.5.Market size and forecast, by end-user, 2019-2027

9.2.9.6.Comparative market share analysis, 2019 & 2027

9.2.10.France

9.2.10.1.Market size and forecast, by streaming type, 2019-2027

9.2.10.2.Market size and forecast, by session type, 2019-2027

9.2.10.3.Market size and forecast, by device type, 2019-2027

9.2.10.4.Market size and forecast, by revenue model, 2019-2027

9.2.10.5.Market size and forecast, by end-user, 2019-2027

9.2.10.6.Comparative market share analysis, 2019 & 2027

9.2.11.Spain

9.2.11.1.Market size and forecast, by streaming type, 2019-2027

9.2.11.2.Market size and forecast, by session type, 2019-2027

9.2.11.3.Market size and forecast, by device type, 2019-2027

9.2.11.4.Market size and forecast, by revenue model, 2019-2027

9.2.11.5.Market size and forecast, by end-user, 2019-2027

9.2.11.6.Comparative market share analysis, 2019 & 2027

9.2.12.Italy

9.2.12.1.Market size and forecast, by streaming type, 2019-2027

9.2.12.2.Market size and forecast, by session type, 2019-2027

9.2.12.3.Market size and forecast, by device type, 2019-2027

9.2.12.4.Market size and forecast, by revenue model, 2019-2027

9.2.12.5.Market size and forecast, by end-user, 2019-2027

9.2.12.6.Comparative market share analysis, 2019 & 2027

9.2.13.Rest of Europe

9.2.13.1.Market size and forecast, by streaming type, 2019-2027

9.2.13.2.Market size and forecast, by session type, 2019-2027

9.2.13.3.Market size and forecast, by device type, 2019-2027

9.2.13.4.Market size and forecast, by revenue model, 2019-2027

9.2.13.5.Market size and forecast, by end-user, 2019-2027

9.2.13.6.Comparative market share analysis, 2019 & 2027

9.3.Asia Pacific

9.3.1.Market size and forecast, by streaming type, 2019-2027

9.3.2.Market size and forecast, by session type, 2019-2027

9.3.3.Market size and forecast, by device type, 2019-2027

9.3.4.Market size and forecast, by revenue model, 2019-2027

9.3.5.Market size and forecast, by end-user, 2019-2027

9.3.6.Market size and forecast, by country, 2019-2027

9.3.7.Comparative market share analysis, 2019 & 2027

9.3.8.China

9.3.8.1.Market size and forecast, by streaming type, 2019-2027

9.3.8.2.Market size and forecast, by session type, 2019-2027

9.3.8.3.Market size and forecast, by device type, 2019-2027

9.3.8.4.Market size and forecast, by revenue model, 2019-2027

9.3.8.5.Market size and forecast, by end-user, 2019-2027

9.3.8.6.Comparative market share analysis, 2019 & 2027

9.3.9.India

9.3.9.1.Market size and forecast, by streaming type, 2019-2027

9.3.9.2.Market size and forecast, by session type, 2019-2027

9.3.9.3.Market size and forecast, by device type, 2019-2027

9.3.9.4.Market size and forecast, by revenue model, 2019-2027

9.3.9.5.Market size and forecast, by end-user, 2019-2027

9.3.9.6.Comparative market share analysis, 2019 & 2027

9.3.10.Australia

9.3.10.1.Market size and forecast, by streaming type, 2019-2027

9.3.10.2.Market size and forecast, by session type, 2019-2027

9.3.10.3.Market size and forecast, by device type, 2019-2027

9.3.10.4.Market size and forecast, by revenue model, 2019-2027

9.3.10.5.Market size and forecast, by end-user, 2019-2027

9.3.10.6.Comparative market share analysis, 2019 & 2027

9.3.11.Rest of Asia Pacific

9.3.11.1.Market size and forecast, by streaming type, 2019-2027

9.3.11.2.Market size and forecast, by session type, 2019-2027

9.3.11.3.Market size and forecast, by device type, 2019-2027

9.3.11.4.Market size and forecast, by revenue model, 2019-2027

9.3.11.5.Market size and forecast, by end-user, 2019-2027

9.3.11.6.Comparative market share analysis, 2019 & 2027

9.4.LAMEA

9.4.1.Market size and forecast, by streaming type, 2019-2027

9.4.2.Market size and forecast, by session type, 2019-2027

9.4.3.Market size and forecast, by device type, 2019-2027

9.4.4.Market size and forecast, by revenue model, 2019-2027

9.4.5.Market size and forecast, by end-user, 2019-2027

9.4.6.Market size and forecast, by country, 2019-2027

9.4.7.Comparative market share analysis, 2019 & 2027

9.4.8.Latin America

9.4.8.1.Market size and forecast, by streaming type, 2019-2027

9.4.8.2.Market size and forecast, by session type, 2019-2027

9.4.8.3.Market size and forecast, by device type, 2019-2027

9.4.8.4.Market size and forecast, by revenue model, 2019-2027

9.4.8.5.Market size and forecast, by end-user, 2019-2027

9.4.8.6.Comparative market share analysis, 2019 & 2027

9.4.9.Middle East

9.4.9.1.Market size and forecast, by streaming type, 2019-2027

9.4.9.2.Market size and forecast, by session type, 2019-2027

9.4.9.3.Market size and forecast, by device type, 2019-2027

9.4.9.4.Market size and forecast, by revenue model, 2019-2027

9.4.9.5.Market size and forecast, by end-user, 2019-2027

9.4.9.6.Comparative market share analysis, 2019 & 2027

9.4.10.Africa

9.4.10.1.Market size and forecast, by streaming type, 2019-2027

9.4.10.2.Market size and forecast, by session type, 2019-2027

9.4.10.3.Market size and forecast, by device type, 2019-2027

9.4.10.4.Market size and forecast, by revenue model, 2019-2027

9.4.10.5.Market size and forecast, by end-user, 2019-2027

9.4.10.6.Comparative market share analysis, 2019 & 2027

10.Company profiles

10.1.Fitbit, Inc.

10.1.1.Business overview

10.1.2.Financial performance

10.1.3.Product portfolio

10.1.4.Recent strategic moves & developments

10.1.5.SWOT analysis

10.2.ClassPass Inc.

10.2.1.Business overview

10.2.2.Financial performance

10.2.3.Product portfolio

10.2.4.Recent strategic moves & developments

10.2.5.SWOT analysis

10.3.FitnessOnDemand

10.3.1.Business overview

10.3.2.Financial performance

10.3.3.Product portfolio

10.3.4.Recent strategic moves & developments

10.3.5.SWOT analysis

10.4.Peloton

10.4.1.Business overview

10.4.2.Financial performance

10.4.3.Product portfolio

10.4.4.Recent strategic moves & developments

10.4.5.SWOT analysis

10.5.Wellbeats, Inc.

10.5.1.Business overview

10.5.2.Financial performance

10.5.3.Product portfolio

10.5.4.Recent strategic moves & developments

10.5.5.SWOT analysis

10.6.Zwift Inc

10.6.1.Business overview

10.6.2.Financial performance

10.6.3.Product portfolio

10.6.4.Recent strategic moves & developments

10.6.5.SWOT analysis

10.7.REH-FIT

10.7.1.Business overview

10.7.2.Financial performance

10.7.3.Product portfolio

10.7.4.Recent strategic moves & developments

10.7.5.SWOT analysis

10.8.Les Mills International Ltd.

10.8.1.Business overview

10.8.2.Financial performance

10.8.3.Product portfolio

10.8.4.Recent strategic moves & developments

10.8.5.SWOT analysis

10.9.Sworkit

10.9.1.Business overview

10.9.2.Financial performance

10.9.3.Product portfolio

10.9.4.Recent strategic moves & developments

10.9.5.SWOT analysis

10.10.Navigate Wellbeing Solutions

10.10.1.Business overview

10.10.2.Financial performance

10.10.3.Product portfolio

10.10.4.Recent strategic moves & developments

10.10.5.SWOT analysis

Virtual fitness market is growing on popularity since the recent years. Fitness-conscious people worldwide are succumbing to online fitness programs as they are accommodative to the busy lifestyle of the urban population. However, after the coronavirus locked people’s lives indoors for a relatively long amount of time, the demand for virtual fitness programs witnessed a revolutionary boom. As per a report by Research Dive, the global virtual fitness market is expected to generate a revenue of $59,650.3 million by 2027.

Impact Analysis of Covid-19 on the Market

With the emergence of Covid-19 early in 2020, the nations had to go through strict regulations and heavy losses across industries. However, virtual fitness market has experienced a significantly higher turnout in revenue during the lockdown period.

Fitness startups Fittr, Fitternity, and HealthifyMe gained more customers during the time. The customers were seeking services related to health, mental wellbeing, corporate wellness programs, and many more. Mindbody, a leading software developer for gyms, spas and salons, has witnessed around 73% of rise in consumers who are using pre-recorded exercise videos, and fitness apps more than anything in the critical period of nationwide shutdown.

Many virtual fitness companies have taken initiative to help the people in crisis by providing necessary services which resulted in high-level of customer reach. In September 2020, for example, Fitbit, the U.S. based consumer electronics and fitness company, announced that they will offer a free trial of ‘Fitbit Premium’-its new home workout service-with an aim of helping people sleep-well, exercise, and stay healthy during the pandemic.

Recent Developments and Trends

According to a recent report by Research Dive, the leading players of the global virtual fitness market include Fitbit, Inc., ClassPass Inc., FitnessOnDemand, Peloton, Wellbeats, Inc., Zwift Inc, REH-FIT, Les Mills International Ltd., Sworkit, and Navigate Wellbeing Solutions.

These industry players are utilizing a lot of efforts on the research and development of smart and unique strategies to sustain the growth of the market. These strategies include product launches, mergers and acquisitions, collaborations, partnerships, and refurbishing of existing technology.

Some of the recent developments of the market are as follows:

- In January 2021, Google completed its $2.1 billion acquisition of Fitbit, as stated by a latest report. As per the news, after Google made a series of commitments about its planned process of Fitbit and usage of the health data it collects, the EU had approved the deal. However, Google got approval after agreeing to certain conditions, which includes that it won’t be able to use the consumer’s data from Fitbit in the European Economic Area (EEA) for ad targeting.

- As per a latest report, in March 2020, FitnessOnDemand has introduced its new product FLEX, which is designed as a new turnkey solution for clubs. The product has been designed to it easy for any club operator and offer their members custom fitness content without integrating into the current club systems or installing any new hardware.

- In September, 2020 Peloton announced its launch of the Peloton Bike+ and the innovative Peloton Tread. This product is considered to be an add-on to its portfolio of attached, immersive fitness products and great user experiences. As per the report, the Bike+ has become available for purchase in the U.S., Canada, U.K., and Germany from September 9, 2020. This latest arrival of Peloton product suite include two Bike models and two Tread models which offers the users new ways to syndicate cardio and strength training, adding more reasonable entry points to experience Peloton.

- In August 2020, ClassPass partnered with Fyt, one of the largest personal training services, in order to emphasize on live streamed virtual personal training sessions, as per a recent report.

Conclusion

The virtual fitness programs are designed for busy individuals who barely have time to go for an offline workout in a gym or any other fitness centers. These programs offer flexibility of time or place, which impress individuals with tight work schedules. These benefits of virtual fitness programs will never cease to appeal to people, keeping the profit level of the market remarkably high.

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com