RFID Market Report

RA06063

RFID Market by Product (Tag and Reader), Type (Active and Passive), Material (Plastic, Paper, Glass, Metal, and Others), Frequency (Low Frequency, High Frequency, and Ultra High Frequency), End-User (Retail, BFSI, Government, Industrial, Transport & Logistics, Healthcare, and Others), and Regional Analysis (North America, Europe, Asia-Pacific, and LAMEA): Global Opportunity Analysis and Industry Forecast, 2020–2027

Global RFID Market Analysis

The global radio frequency identification RFID market accounted for $9,966.4 million in 2019 and is predicted to grow at a CAGR of 9.9% by generating a revenue of $21,361.9 million by 2027.

Market Synopsis

Rise in the demand of RFID technologies in end-use industries for operational use is predicted to be the major driving factor for the global RFID market in the estimated period.

However, the cost involved in manufacturing and installing of RFID tags is predicted to hinder the market in the forecast period.

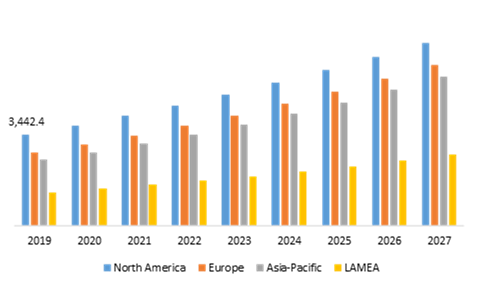

According to the regional analysis, the North American RFID market accounted for $3,442.4 million in 2019 and is predicted to grow with a CAGR of 9.0% in the estimated timeframe.

RFID Overview

The RFID stands for radio-frequency identification; the technology uses electromagnetic fields to track RFID tags and identify the product labelled with these tags automatically. RFIDs are similar to barcodes on electronic devices that stores data in the database. The RFID tags are used in various end-use industries to track the progress in the assembly line during production.

Impact Analysis of COVID-19 on the Global RFID Market

The coronavirus pandemic has created a chaos in various end-use industries and negatively impacted several markets drastically. However, the RFID market has witnessed a significant rise in the market growth rate during the time of the pandemic. The RFID technology automates the process of data collection and vastly reduces human effort and error in tracking information. During the pandemic, RFIDs were used in multiple ways in the healthcare sector for instance in tracking medical equipment and other valuable medical devices so that the staff could quickly locate the equipment in the hospital premises. These advantages of RFIDs are predicted to drive the global market at the time of pandemic.

Rise in the Use of RFID Technology For Operational Use In The End-Use Industry

The global RFID market is projected to grow significantly in the estimation period as several end use industries involved in manufacturing units utilize RFID technology. RFID tags are used via wireless non-contact radio frequency wave’s that help in transferring data to the RFID readers. This technology allows users to automatically identify and track products stored in inventories and also track a product’s production stage. For instance, RFID technology in manufacturing industries are used not only to track products but also help in understanding the lifecycle of the product.

RFIDs in retail sector are used to track the inventory products through where the product can be identified and tracked on all the way until their delivery to various departmental stores. For instance, in United States (US), all the departmental stores of Walmart use RFID technology to track merchandising and shipment right up to their delivery in the departmental stores.

To know more about global RFID market drivers, get in touch with our analysts here.

Cost Associated with RFID Technology to Act as a Restraint for the Growth of the Market

The cost associated while manufacturing the RFID tags and reader is expensive. The RFID technology are ten times more expensive as compared to barcode readers. The barcode readers are a major alternative product for the RFIDs. Although RFID is a more versatile and practical technology, barcoding will continue to be a dominant technology in various way, one being the affordable cost. The cost factor is a major restraint for the global RFID market and is predicted to hinder the market in the forecast period.

To know more about global RFID market opportunities, get in touch with our analysts here.

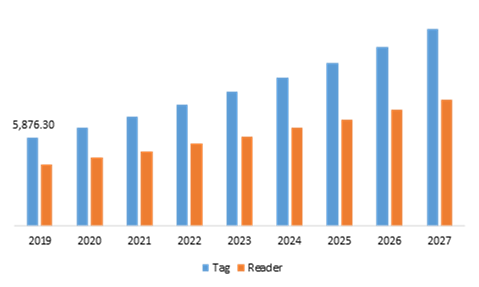

Global RFID Market, by Product

Based on product, the RFID market has been divided into tag and reader. The tag sub-s egment is projected to generate the maximum revenue and have the highest growth rate in the estimated period.

Source: Research Dive Analysis

The tag sub-segment is predicted to have a dominating market share along with highest growth rate in the forecast period. The tag sub-segment accounted for $5,876.3 million in 2019 and is predicted to grow with a CAGR of 10.3% in the estimated period. Increasing demand of RFID tags for convenient tracking of products is predicted to drive the sub-segment market in the estimated period.

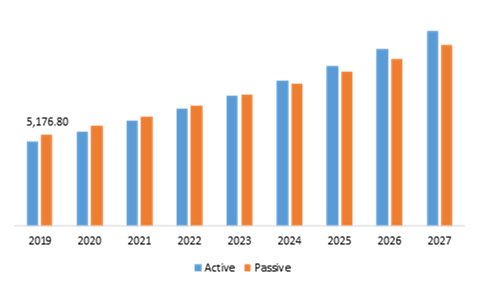

Global RFID Market, by Type

On the basis of type, the market has been sub-segmented into active and passive. The passive sub-segment is projected to generate the maximum revenue and active sub-segment is predicted to have the highest growth rate.

Source: Research Dive Analysis

The passive sub-segment is projected to have the highest market share in terms of revenue in the estimated period. Passive sub-segment accounted for $5,176.8 million in 2019 and is predicted to grow with a CAGR of 8.9% in the estimated period. The passive type of RFID technology is mostly used in tracking the goods in multiple end-use industries as passive tags are powered by energy that is generated from radio waves and does not include any battery or/and is comparatively cheaper. This factor is predicted to boost the sub-segment market in the estimated period.

The active sub-segment is anticipated to have the highest growth rate in the forecast period. Active sub-segment accounted for $4,789.4 million in 2019 and is predicted to grow with a CAGR of 10.9% in the estimated period. Active RFID technology is powered by battery and thus can be read at higher range of frequency with the help of RFID readers which is predicted to drive the sub-segment market in the estimated period.

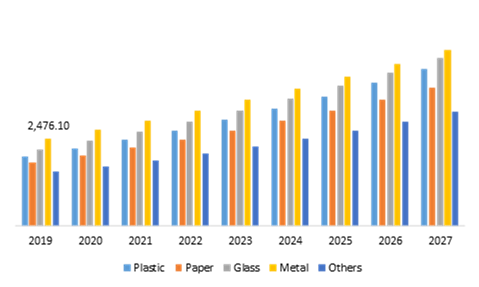

Global RFID Market, by Material

Based on material the market has been sub-segmented into plastic, paper, glass, metal and others. Metal sub-segment is predicted to have the fastest growth rate and the plastic sub-segment is predicted to hold the highest market share.

Source: Research Dive Analysis

The plastic material sub-segment of the global RFID market is predicted to have maximum growth rate. Plastic material sub-segment accounted for $ 1,968.2 million in 2019 and is predicted to grow with a CAGR of 10.6% in the estimated period. Plastic is used in most of the RFID technologies as they can be screened with any reader and large amounts of data can be stored which can then be used for operational purposes in manufacturing. These aspects are predicted to drive the sub-segment market in the estimated period.

The metal sub-segment is predicted to have a dominating market share in the global market. Metal sub-segment accounted for $2,476.1 million in 2019 and is predicted to grow with a CAGR of 9.0% in the estimated period. High durability of the metal RFIDs is a cost-effective way of stakeholders to track products, which is predicted to drive the sub-segment market in the estimated period.

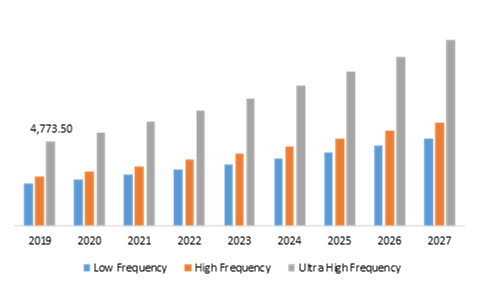

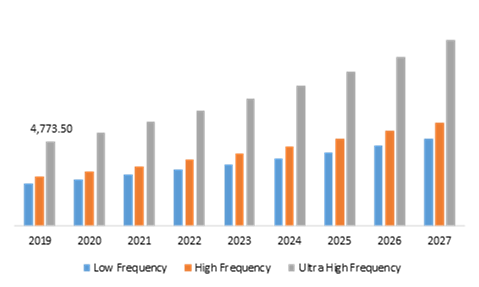

Global RFID Market, by Frequency

Based on frequency, the market has been sub-segmented into low frequency, high frequency, and ultra-high frequency. Ultra-high frequency sub-segment is predicted to have the fastest growth rate along with the highest market share.

Source: Research Dive Analysis

The ultra-high frequency sub-segment of the global RFID market is predicted to have the maximum growth rate along with highest market share in the estimated period. Ultra-high frequency sub-segment accounted for $4,773.5 million in 2019 and is predicted to grow with a CAGR of 10.3% in the estimated period. Ultra-high frequency RFID technology is also known as RAIN and have extremely high read range compared to both low frequency and high frequency RFID. This factor is predicted to boost the sub-segment market in the estimated period.

Global RFID Market, by End-User

Based on end-user the market has been sub-segmented into retail, BFSI, government, industrial, transport & logistics, healthcare, and others. BFSI sub-segment is predicted to have the fastest growth rate and retail sub-segment is predicted to hold the highest market share.

Source: Research Dive Analysis

The retail sub-segment of the global RFID market is predicted to have highest market share in the estimated period. Retail sub-segment was accounted for $2,145.2 million in 2019 and is predicted to grow with a CAGR of 8.9% in the estimated period. Increasing demand of the RFID technology in the retail sector for tracking of the product is predicted to boost the sub-segment market in the estimated period.

The BFSI sub-segment of the global RFID market is predicted to have maximum growth rate in the estimated period. BFSI sub-segment accounted for $1,395.3 million in 2019 and is predicted to grow with a CAGR of 11.0% in the estimated period. BFSI sub-segment involves in asset tracking, ID card solution, CCTV surveillance solution, and much more. Such high applications are predicted to drive the sub-segment market in the forecast period.

Global RFID Market, Regional Insights:

The RFID market was investigated across North America, Europe, Asia-Pacific, and LAMEA.

Source: Research Dive Analysis

The Market for RFID in North America to be the Most Dominant

The North America RFID market accounted $3,442.4 million in 2019 and is projected to grow with a CAGR of 9.0%. The growth of the North America market is mainly driven by increasing adoption of RFID technology for various operational uses in and tracking the manufacturing stage of the products. Moreover, presence of large number of companies in the region is predicted to create more investment opportunity for the regional market in the estimated period.

The Market for RFID in Asia-Pacific to be the Fastest Growing

The share of Asia-Pacific RFID market generated a revenue of $2,495.6 million in 2019 and is anticipated to grow at a CAGR of 10.6% in the estimated period. Increasing investment by majority of the companies for the expansion of business activity in the region is predicted to drive the sub-segment market in the estimated period. Moreover, various companies are investing more in the development of advanced products and this is predicted to create more investment opportunities for the region market in the estimated period.

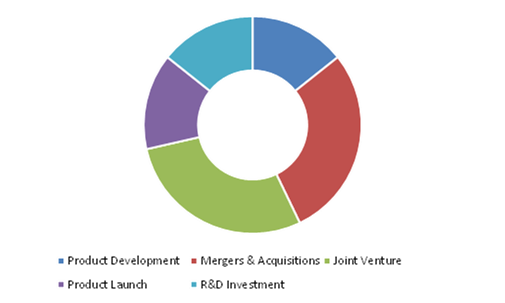

Competitive Scenario in the Global RFID Market

Product launches and acquisition are common strategies followed by major market players.

Source: Research Dive Analysis

Some of the leading RFID market players are Honeywell, NXP Semiconductors, Avery Dennison, Zebra Technologies, Impinj, HID Global, GAO RFID, Identiv, Invengo, and Nedap among others.

Porter’s Five Forces Analysis for the Global RFID Market:

- Bargaining Power of Suppliers: There are large number of manufacturers present in the market as compared to buyers as the market is very niche.

Thus, the bargaining power suppliers is moderate. - Bargaining Power of Buyers: Buyers have lower bargaining power as there are lesser number of buyers present in the market whereas supplier are more.

Thus, the bargaining power of the buyers is low. - Threat of New Entrants: For developing new product a huge investment is required.

Thus, the threat of the new entrants is low. - Threat of Substitutes: There are numerous alternative products for RFIDs such as barcode tags and barcode readers.

Thus, the threat of substitutes is high. - Competitive Rivalry in the Market: Due to the presence of large number of manufacturers there is a huge competitive rivalry among the suppliers and manufacturer.

Therefore, competitive rivalry in the market is high.

| Aspect | Particulars |

| Historical Market Estimations | 2018-2019 |

| Base Year for Market Estimation | 2019 |

| Forecast Timeline for Market Projection | 2020-2027 |

| Geographical Scope | North America, Europe, Asia-Pacific, LAMEA |

| Segmentation by Product |

|

| Segmentation by Type |

|

| Segmentation by Material |

|

| Segmentation by Frequency |

|

| Segmentation by End-User |

|

| Key Companies Profiled |

|

Q1. What is the size of the global RFID market?

A. The size of the global RFID market was over $9,966.4 million in 2019 and is projected to reach $ 21,361.9 million by 2027.

Q2. Which are the major companies in the RFID market?

A. Avery Dennison and Zebra Technologies are some of the key players in the global RFID market.

Q3. Which region, among others, possesses greater investment opportunities in the near future?

A. The Asia-Pacific region possesses great investment opportunities for investors to witness the most promising growth in the future.

Q4. What will be the growth rate of the Asia-Pacific RFID market?

A. Asia Pacific RFID market is anticipated to grow at 10.6% CAGR during the forecast period.

Q5. What are the strategies opted by the leading players in this market?

A. Product development and acquisitions are the key strategies opted by the operating companies in this market.

Q6. Which companies are investing more on R&D practices?

A. Zebra Technologies is the company which is investing more on R&D activities for developing new products and technologies.

1.Research Methodology

1.1.Desk Research

1.2.Real time insights and validation

1.3.Forecast model

1.4.Assumptions and forecast parameters

1.4.1.Assumptions

1.4.2.Forecast parameters

1.5.Data sources

1.5.1.Primary

1.5.2.Secondary

2.Executive Summary

2.1.360° summary

2.2.Product trends

2.3.Type trends

2.4.Material trend

2.5.Frequency trends

2.6.End-User trends

3.Market overview

3.1.Market segmentation & definitions

3.2.Key takeaways

3.2.1.Top investment pockets

3.2.2.Top winning strategies

3.3.Porter’s five forces analysis

3.3.1.Bargaining power of consumers

3.3.2.Bargaining power of suppliers

3.3.3.Threat of new entrants

3.3.4.Threat of substitutes

3.3.5.Competitive rivalry in the market

3.4.Market dynamics

3.4.1.Drivers

3.4.2.Restraints

3.4.3.Opportunities

3.5.Technology landscape

3.6.Regulatory landscape

3.7.Patent landscape

3.8.Pricing overview

3.8.1.By product

3.8.2.By Type

3.8.3.By Material

3.8.4.By Frequency

3.8.5.By end user

3.8.6.By region

3.9.Market value chain analysis

3.9.1.Stress point analysis

3.9.2.Raw material analysis

3.9.3.Manufacturing process

3.9.4.Distribution channel analysis

3.9.5.Operating vendors

3.9.5.1.Raw material suppliers

3.9.5.2.Product manufacturers

3.9.5.3.Product distributors

3.10.Strategic overview

4.RFID Market , by Product

4.1.Tag

4.1.1.Market size and forecast, by region, 2019-2027

4.1.2.Comparative market share analysis, 2019-2027

4.2.Reader

4.2.1.Market size and forecast, by region, 2019-2027

4.2.2.Comparative market share analysis, 2019-2027

5.RFID Market , by Type

5.1.Active

5.1.1.Market size and forecast, by region, 2019-2027

5.1.2.Comparative market share analysis, 2019-2027

5.2.Passive

5.2.1.Market size and forecast, by region, 2019-2027

5.2.2.Comparative market share analysis, 2019-2027

6.RFID Market , by Material

6.1.Plastic

6.1.1.Market size and forecast, by region, 2019-2027

6.1.2.Comparative market share analysis, 2019-2027

6.2.Paper

6.2.1.Market size and forecast, by region, 2019-2027

6.2.2.Comparative market share analysis, 2019-2027

6.3.Glass

6.3.1.Market size and forecast, by region, 2019-2027

6.3.2.Comparative market share analysis, 2019-2027

6.4.Metal

6.4.1.Market size and forecast, by region, 2019-2027

6.4.2.Comparative market share analysis, 2019-2027

6.5.Others

6.5.1.Market size and forecast, by region, 2019-2027

6.5.2.Comparative market share analysis, 2019-2027

7.RFID Market , by Frequency

7.1.Low Frequency

7.1.1.Market size and forecast, by region, 2019-2027

7.1.2.Comparative market share analysis, 2019-2027

7.2.High Frequency

7.2.1.Market size and forecast, by region, 2019-2027

7.2.2.Comparative market share analysis, 2019-2027

7.3.Ultra High Frequency

7.3.1.Market size and forecast, by region, 2019-2027

Comparative market share analysis, 2019-2027

8.RFID Market , by End user

8.1.Retail

8.1.1.Market size and forecast, by region, 2019-2027

8.1.2.Comparative market share analysis, 2019-2027

8.2.BFSI

8.2.1.Market size and forecast, by region, 2019-2027

8.2.2.Comparative market share analysis, 2019-2027

8.3.Government

8.3.1.Market size and forecast, by region, 2019-2027

8.3.2.Comparative market share analysis, 2019-2027

8.4.Healthcare

8.4.1.Market size and forecast, by region, 2019-2027

8.4.2.Comparative market share analysis, 2019-2027

8.5.Industrial

8.5.1.Market size and forecast, by region, 2019-2027

8.5.2.Comparative market share analysis, 2019-2027

8.6.Transport and Logistic

8.6.1.Market size and forecast, by region, 2019-2027

8.6.2.Comparative market share analysis, 2019-2027

8.7.Other

8.7.1.Market size and forecast, by region, 2019-2027

8.7.2.Comparative market share analysis, 2019-2027

9.RFID Market , by Region

9.1.North Region

9.1.1.Market size and forecast, by Product , 2019-2027

9.1.2.Market size and forecast, by Type, 2019-2027

9.1.3.Market size and forecast, by Material, 2019-2027

9.1.4.Market size and forecast, by Frequency , 2019-2027

9.1.5.Market size and forecast, by End user, 2019-2027

9.1.6.Market size and forecast, by country, 2019-2027

9.1.7.Comparative market share analysis, 2019-2027

9.1.8.U.S

9.1.8.1.Market size and forecast, by Product , 2019-2027

9.1.8.2.Market size and forecast, by Type, 2019-2027

9.1.8.3.Market size and forecast, by Material, 2019-2027

9.1.8.4.Market size and forecast, by Frequency , 2019-2027

9.1.8.5.Market size and forecast, by End user, 2019-2027

9.1.9.Canada

9.1.9.1.Market size and forecast, by Product , 2019-2027

9.1.9.2.Market size and forecast, by Type, 2019-2027

9.1.9.3.Market size and forecast, by Material, 2019-2027

9.1.9.4.Market size and forecast, by Frequency , 2019-2027

9.1.9.5.Market size and forecast, by End user, 2019-2027

9.1.10.Europe

9.1.10.1.Market size and forecast, by Product , 2019-2027

9.1.10.2.Market size and forecast, by Type, 2019-2027

9.1.10.3.Market size and forecast, by Material, 2019-2027

9.1.10.4.Market size and forecast, by Frequency , 2019-2027

9.1.10.5.Market size and forecast, by End user, 2019-2027

9.1.11.UK

9.1.11.1.Market size and forecast, by Product , 2019-2027

9.1.11.2.Market size and forecast, by Type, 2019-2027

9.1.11.3.Market size and forecast, by Material, 2019-2027

9.1.11.4.Market size and forecast, by Frequency , 2019-2027

9.1.11.5.Market size and forecast, by End user, 2019-2027

9.1.12.Germany

9.1.12.1.Market size and forecast, by Product , 2019-2027

9.1.12.2.Market size and forecast, by Type, 2019-2027

9.1.12.3.Market size and forecast, by Material, 2019-2027

9.1.12.4.Market size and forecast, by Frequency , 2019-2027

9.1.12.5.Market size and forecast, by End user, 2019-2027

9.1.12.6.Comparative market share analysis, 2019-2027

9.1.13.France

9.1.13.1.Market size and forecast, by Product , 2019-2027

9.1.13.2.Market size and forecast, by Type, 2019-2027

9.1.13.3.Market size and forecast, by Material, 2019-2027

9.1.13.4.Market size and forecast, by Frequency , 2019-2027

9.1.13.5.Market size and forecast, by End user, 2019-2027

9.1.13.6.Comparative market share analysis, 2019-2027

9.1.14.Italy

9.1.14.1.Market size and forecast, by Product , 2019-2027

9.1.14.2.Market size and forecast, by Type, 2019-2027

9.1.14.3.Market size and forecast, by Material, 2019-2027

9.1.14.4.Market size and forecast, by Frequency , 2019-2027

9.1.14.5.Market size and forecast, by End user, 2019-2027

9.1.14.6.Comparative market share analysis, 2019-2027

9.1.15.Rest of Europe

9.1.15.1.Market size and forecast, by Product , 2019-2027

9.1.15.2.Market size and forecast, by Type, 2019-2027

9.1.15.3.Market size and forecast, by Material, 2019-2027

9.1.15.4.Market size and forecast, by Frequency , 2019-2027

9.1.15.5.Market size and forecast, by End user, 2019-2027

9.1.15.6.Comparative market share analysis, 2019-2027

9.2.Asia-Pacific

9.2.1.Market size and forecast, by Product , 2019-2027

9.2.2.Market size and forecast, by Type, 2019-2027

9.2.3.Market size and forecast, by Material, 2019-2027

9.2.4.Market size and forecast, by Frequency , 2019-2027

9.2.5.Market size and forecast, by End user, 2019-2027

9.2.6.Market size and forecast, by country, 2019-2027

9.2.7.Comparative market share analysis, 2019-2027

9.2.8.China

9.2.8.1.Market size and forecast, by Product , 2019-2027

9.2.8.2.Market size and forecast, by Type, 2019-2027

9.2.8.3.Market size and forecast, by Material, 2019-2027

9.2.8.4.Market size and forecast, by Frequency , 2019-2027

9.2.8.5.Market size and forecast, by End user, 2019-2027

9.2.8.6.Comparative market share analysis, 2019-2027

9.2.9.India

9.2.9.1.Market size and forecast, by Product , 2019-2027

9.2.9.2.Market size and forecast, by Type, 2019-2027

9.2.9.3.Market size and forecast, by Material, 2019-2027

9.2.9.4.Market size and forecast, by Frequency , 2019-2027

9.2.9.5.Market size and forecast, by End user, 2019-2027

9.2.9.6.Comparative market share analysis, 2019-2027

9.2.10.Japan

9.2.10.1.Market size and forecast, by Product , 2019-2027

9.2.10.2.Market size and forecast, by Type, 2019-2027

9.2.10.3.Market size and forecast, by Material, 2019-2027

9.2.10.4.Market size and forecast, by Frequency , 2019-2027

9.2.10.5.Market size and forecast, by End user, 2019-2027

9.2.10.6.Comparative market share analysis, 2019-2027

9.2.11.South Korea

9.2.11.1.Market size and forecast, by Product , 2019-2027

9.2.11.2.Market size and forecast, by Type, 2019-2027

9.2.11.3.Market size and forecast, by Material, 2019-2027

9.2.11.4.Market size and forecast, by Frequency , 2019-2027

9.2.11.5.Market size and forecast, by End user, 2019-2027

9.2.11.6.Comparative market share analysis, 2019-2027

9.2.12.Australia

9.2.12.1.Market size and forecast, by Product , 2019-2027

9.2.12.2.Market size and forecast, by Type, 2019-2027

9.2.12.3.Market size and forecast, by Material, 2019-2027

9.2.12.4.Market size and forecast, by Frequency , 2019-2027

9.2.12.5.Market size and forecast, by End user, 2019-2027

9.2.12.6.Comparative market share analysis, 2019-2027

9.2.13.Rest of Asia Pacific

9.2.13.1.Market size and forecast, by Product , 2019-2027

9.2.13.2.Market size and forecast, by Type, 2019-2027

9.2.13.3.Market size and forecast, by Material, 2019-2027

9.2.13.4.Market size and forecast, by Frequency , 2019-2027

9.2.13.5.Market size and forecast, by End user, 2019-2027

9.2.13.6.Comparative market share analysis, 2019-2027

9.3.LAMEA

9.3.1.1.Market size and forecast, by Product , 2019-2027

9.3.1.2.Market size and forecast, by Type, 2019-2027

9.3.1.3.Market size and forecast, by Material, 2019-2027

9.3.1.4.Market size and forecast, by Frequency , 2019-2027

9.3.2.Market size and forecast, by End user, 2019-2027

9.3.3.Latin America

9.3.3.1.Market size and forecast, by Product , 2019-2027

9.3.3.2.Market size and forecast, by Type, 2019-2027

9.3.3.3.Market size and forecast, by Material, 2019-2027

9.3.3.4.Market size and forecast, by Frequency , 2019-2027

9.3.3.5.Market size and forecast, by End user, 2019-2027

9.3.3.6.Comparative market share analysis, 2019-2027

9.3.4.Middle East

9.3.4.1.Market size and forecast, by Product , 2019-2027

9.3.4.2.Market size and forecast, by Type, 2019-2027

9.3.4.3.Market size and forecast, by Material, 2019-2027

9.3.4.4.Market size and forecast, by Frequency , 2019-2027

9.3.4.5.Market size and forecast, by End user, 2019-2027

9.3.5.Africa

9.3.5.1.Market size and forecast, by Product , 2019-2027

9.3.5.2.Market size and forecast, by Type, 2019-2027

9.3.5.3.Market size and forecast, by Material, 2019-2027

9.3.5.4.Market size and forecast, by Frequency , 2019-2027

9.3.5.5.Market size and forecast, by End user, 2019-2027

9.3.5.6.Comparative market share analysis, 2019-2027

10.Company profiles

10.1.Honeywell

10.1.1.Business overview

10.1.2.Financial performance

10.1.3.Product portfolio

10.1.4.Recent strategic moves & developments

10.1.5.SWOT analysis

10.2.NXP Semiconductor

10.2.1.Business overview

10.2.2.Financial performance

10.2.3.Product portfolio

10.2.4.Recent strategic moves & developments

10.2.5.SWOT analysis

10.3.Avery Deriminsion.

10.3.1.Business overview

10.3.2.Financial performance

10.3.3.Product portfolio

10.3.4.Recent strategic moves & developments

10.3.5.SWOT analysis

10.4.Zebra Technologies

10.4.1.Business overview

10.4.2.Financial performance

10.4.3.Product portfolio

10.4.4.Recent strategic moves & developments

10.4.5.SWOT analysis

10.5.Impinj

10.5.1.Business overview

10.5.2.Financial performance

10.5.3.Product portfolio

10.5.4.Recent strategic moves & developments

10.5.5.SWOT analysis

10.6.HID Global

10.6.1.Business overview

10.6.2.Financial performance

10.6.3.Product portfolio

10.6.4.Recent strategic moves & developments

10.6.5.SWOT analysis

10.7.GAO RFID

10.7.1.Business overview

10.7.2.Financial performance

10.7.3.Product portfolio

10.7.4.Recent strategic moves & developments

10.7.5.SWOT analysis

10.8.Identiv

10.8.1.Business overview

10.8.2.Financial performance

10.8.3.Product portfolio

10.8.4.Recent strategic moves & developments

10.8.5.SWOT analysis

10.9.Invengo

10.9.1.Business overview

10.9.2.Financial performance

10.9.3.Product portfolio

10.9.4.Recent strategic moves & developments

10.9.5.SWOT analysis

10.10.Nedap

10.10.1.Business overview

10.10.2.Financial performance

10.10.3.Product portfolio

10.10.4.Recent strategic moves & developments

10.10.5.SWOT analysis

RFID is a data collection system that uses low-power radio waves to automatically classify artifacts. A device comprised of RFID tags, an antenna, an RFID scanner, and a transceiver that sends and receives data. RFID is similar to barcoding in the sense that data from a tag or label is collected by a computer and stored in a database. RFID, on the other hand, has a number of advantages over systems that use barcode asset monitoring tools. The most notable difference is that RFID tag data can be read even when the tag is not in direct view, while barcodes must be matched with an optical scanner.

Impact of COVID-19 on the Industry

The coronavirus pandemic has created a chaos in several end-use industries and negatively impacted various markets. However, the RFID market has witnessed a remarkable rise in the market growth rate during the COVID-19 pandemic. RFID technology automates data processing and significantly decreases human effort and error in monitoring information. During the pandemic, RFIDs were used in the healthcare sector in a variety of ways, including monitoring surgical equipment and other valuable medical instruments so that workers could easily identify the equipment inside the hospital grounds. These advantages of RFIDs are predicted to boost the growth of global RFID market at the time of pandemic.

Key Developments in the Industry

The key companies operating in the RFID market are adopting several growth strategies & business tactics such as mergers & acquisitions, collaborations, partnerships, and launches to maintain a strong position in the overall market, which is subsequently assisting the market to grow across the world.

For instance, in August 2019, Murata Manufacturing Co., Ltd., a global leader in manufacture and sale of passive ceramic-based electronic components & solutions, power supply modules, and communication modules, announced that they have developed LXTBKZMCMG-010, a small RFID IC tag that can be used on metal surfaces for surgical instruments Since surgical instruments are used after being cleaned and sterilized several times, attached IC tags must be sturdy and precautions taken to prevent them from falling off.

Moreover, in January 2020, FEIG ELECTRONIC, a leading global supplier of radio frequency identification (RFID) readers and antennas with fifty years of industry experience, announced the UCODE DNA RFID protection and parking contactless identification solution has been deployed in the Moscow International Business Center, also known as Moscow-City, one of the world's largest business district projects..

Furthermore, in February 2021, Murata Manufacturing Co., Ltd. announced that they received the award “Logistics of the year 2020” along with Bayer S.p.A. for the “RFID and Blockchain project”. The Italian logistics Association “Assologistica” presented them this award for the innovative approach to Technology and Logistics 4.0.

Analysis of RFID Market

The global RFID market is estimated to witness significant growth in the analysis period as several end use industries involved in manufacturing units make use of RFID technology. RFID tags are used to transfer data to RFID readers via wireless non-contact radio frequency waves. This technology enables users to automatically recognize and monitor goods held in inventories, as well as track the stage of development of a product.

The costs associated with producing RFID tags and readers are high. RFID technology is ten times more expensive than barcode readers. Barcode readers are a significant alternative product to RFIDs. While RFID is a more flexible and practical technology, barcoding will remain a dominant technology in a variety of ways, one of which is its low cost. RFIDs are used in the retail sector to manage inventory items, where the product can be marked and monitored all the way before it is delivered to different department stores. For example, in the United States (US), all of Walmart's department stores use RFID technology to monitor merchandising and distribution all the way through to delivery in the department stores.

These factors are estimated to surge the growth of the RFID market, throughout the analysis period. As per a newly published report by Research Dive, the global RFID market is predicted to garner $21,361.9 million by 2027. Geographically, North America market for RFID is estimated to dominate the global industry, owing to the increasing adoption of RFID technology for various operational use in several end use industries.

Key Players

- Honeywell

- NXP Semiconductors

- Avery Dennison

- Zebra Technologies

- Impinj

- HID Global

- GAO RFID

- Identiv

- Invengo

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com