Aerospace Foam Market Report

RA00058

Aerospace Foam Market, By Offerings (Hardware, Software, Services), By Aerospace foam markets Market, By Material (PU Foam, PE Foam, Metal Foam, Melamine Foam, PMI Foam, Others), By End-use (Spacecraft, Military Aircraft, Helicopter, Commercial Aircraft, Others): Global Opportunity Analysis and Industry Forecast, 2019–2026

Update Available On-Demand

Aerospace Foam Industry Insights 2026:

Global Aerospace Foam Market forecast will be $ 7,342.7 Million by 2026, rising from $ 3,967.0 Million in 2018, at a CAGR of 8.0%. Europe region will have enormous opportunities for the market investors to grow over the coming years. North American industry of Aeropsace Foam Market, anticipated to grow at a CAGR of 7.7% over the forecast period.

Aerospace foams are cellular structured and low-density materials that are used for insulation, vibration dampeners and cushioning. Moreover, various properties such as tensile strength, excellent rigidness, durable, heat resistant and lightweight have increased the for aerospace foams in multiple aircraft applications, such as rooftops, gaskets to seal, rotor blades and headrests.

Aerospace Foam Market Synopsis

Rapid development in aircraft manufacturing, along with huge investments by various governments across the globe over military aircraft, is expected to boost the growth of the aerospace foam market.

On the other hand, the governments of across the globe have stringent regulations towards the use of polyurethane (PU) foams, which is growth-restricting factor for the market.

According to the regional analysis of the market, the North America aerospace foam market valued for the majority of market share in 2018 and is anticipated to generate a revenue of $1,626.5 million at a CAGR of 7.7% during the review period.

Driving Factors of Aerospace Foam Industry:

An increase in the demand for low-cost carriers has upsurge the demand from commercial aircraft, due to its insulating and excellent lightweight properties. Additionally, rapid development has improved the demand for aerospace foam in aircraft manufacturing. Huge investments done by various governments globally over military aircraft are anticipated to boost the market by creating better growth potential. Moreover, the growing demand for PU foam products for aircraft interior cabins and flight decks has grown, this is due to the outstanding cushioning and absorption formulations.

In spite of the wide range of advantages, major factors affecting the market growth are the stringent government regulations towards the usage of PU foams that are anticipated to hamper the aerospace foam market growth.

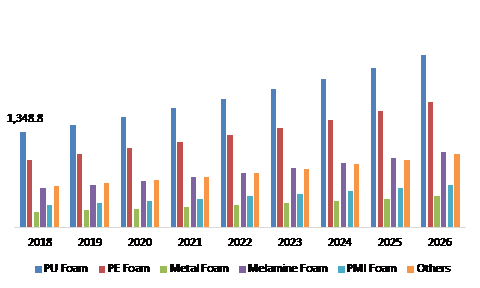

Aerospace Foam Market, by Material

The Metal Foam segment is predicted to be most lucrative till the end of 2026

Source: Research Dive Analysis

The PU foam segment in the aerospace foam market was accounted for $ 1,348.8 Million in the year 2018 and is expected to grow at a CAGR of 7.6% over the forecast period. However, metal foam sub-segment is expected to register the highest growth rate over the forecast period growing at a CAGR of 9.2%. The metal foam is anticipated to witness foremost traction due to its lightweight properties combined with a rise in demand in aircraft applications. Additionally, growth in the demand for metal foam armors majorly for space-based vehicle and military aircrafts likely to create significant market growth opportunities.

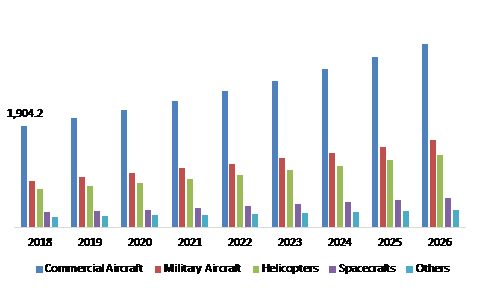

Aerospace foam market, by Mode of End-use

Spacecrafts segment is predicted to be most lucrative till the end of 2026

Source: Research Dive Analysis

The commercial aircraft end-use segment held the largest market value in the year 2018, by accounting for $ 1,904.2 million. The rise in the number of people traveling by air globally is enhancing the growth of the aerospace coatings market. Additionally, the growing demand for low-cost carriers or low-cost operators in regions such as the Middle East, Asia Pacific, and Latin America, is the major reason for the upsurge in for commercial aircraft segment. These key factors are lead to the growth of the aerospace foams market globally.

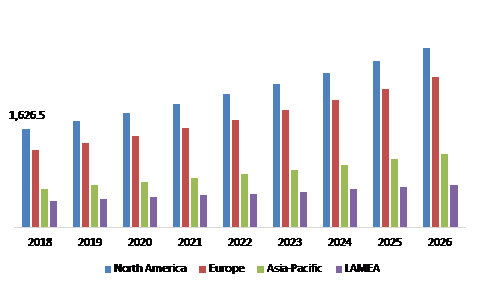

Aerospace Foams Market, by Region:

Europe region will have enormous opportunities for the market investors to grow over the coming years

Source: Research Dive Analysis

North America Aerospace Foam Industry Outlook 2026:

North America aerospace foam industry accounted for the largest market share in the year 2018 accounting for $ 1,626.5 Million and is further anticipated to grow at a CAGR of 7.7% over the forecast period. Whereas the European market is expected to experience a swift growth over the forecast period, majorly due to the presence of the major key players in this region.

Key participants in the Global Aerospace foam market:

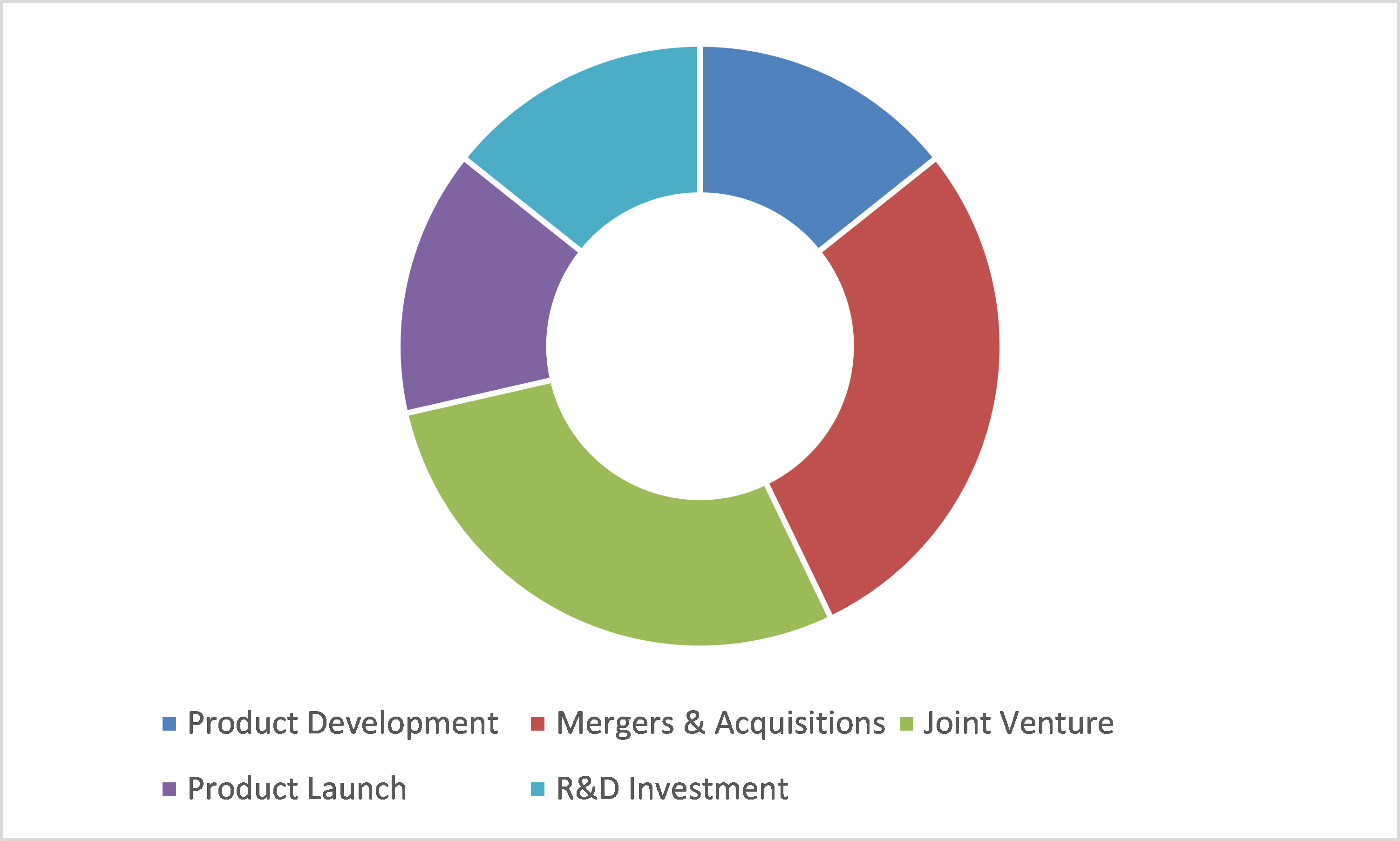

Product development and joint ventures are the most common strategies followed by the market players

Source: Research Dive Analysis

Aerospace foam market players include Erg Materials and Aerospace Corp, SABIC, Rogers Corporation, Evonik Industries AG, Foampartner, Boyd Corporation, Armacell International S.A., UFP Technologies, BASF SE, and Zotedfoams Plc among many others. Product development and acquisitions are some of the key strategies opted by the industry participants to retain their position in the global or regional markets. These key players are majorly concentrating on technology advancements in current technology, new product launches, mergers and acquisitions, and geographical expansion. These are some of the growth strategies adopted by these companies.

In March 2018, Evonik Industries has developed a new foam in the product line of ROHACRYL™. The product is thermally stable, lightweight, environmentally friendly and is easy to shape. It can be used in aerospace, sports equipment, automotive and many others.

Scope of the Market Report:

| Aspect | Particulars |

| Historical Market Estimations | 2016-2018 |

| Base Year for Market Estimation | 2018 |

| Forecast timeline for Market Projection | 2019-2026 |

| Geographical Scope | North America, Europe, Asia-Pacific, LAMEA |

| Segmentation by Material |

|

| Segmentation by End-use |

|

| Key Countries covered | U.S., Canada, Germany, France, Spain, Russia, Japan, China, India, South Korea, Australia, Brazil, and Saudi Arabia |

| Key Companies Profiled |

|

Source: Research Dive Analysis

Q1. What is the size of the Aerospace foam market?

A. The global Aerospace foam market size was over $ 3,967.0 Million in 2018, and is further anticipated to reach $ 7,342.7 Million by 2026.

Q2. Who are the leading companies in the Aerospace foam market?

A. Evonik Industries AG, Rogers Corporation, Foampartner, and BASF SE are some of the key players in the global aerospace foam market.

Q3. Which region possesses greater investment opportunities in the coming future?

A. Europe possesses great investment opportunities for the investors to witness the most promising growth in the coming years.

Q4. What is the growth rate of the Europe Market?

A. Europe Aerospace foam market is projected to grow at 8.7% CAGR during the forecast period.

Q5. What are the strategies opted by the leading players in this market?

A. Product development and joint ventures are the key strategies opted by the operating companies in this market.

Q6. Which companies are investing more in R&D practices?

A. BASF SE and Boyd Corporation investing more in R&D activities for developing new products and technologies.

1. Research Methodology

1.1. Desk Research

1.2. Real time insights and validation

1.3. Forecast model

1.4. Assumptions and forecast parameters

1.4.1. Assumptions

1.4.2. Forecast parameters

1.5. Data sources

1.5.1. Primary

1.5.2. Secondary

2. Executive Summary

2.1. 360° summary

2.2. Material

2.3. End-use

2.4. Region

3. Market overview

3.1. Market segmentation & definitions

3.2. Key takeaways

3.2.1. Top investment pockets

3.2.2. Top winning strategies

3.3. Porter’s five forces analysis

3.3.1. Bargaining power of consumers

3.3.2. Bargaining power of suppliers

3.3.3. Threat of new entrants

3.3.4. Threat of substitutes

3.3.5. Competitive rivalry in the market

3.4. Market dynamics

3.4.1. Drivers

3.4.2. Restraints

3.4.3. Opportunities

3.5. End-use landscape

3.6. Regulatory landscape

3.7. Patent landscape

3.8. Market value chain analysis

3.8.1. Stress point analysis

3.9. Strategic overview

4. Aerospace Foams Market, by Material

4.1. PU Foam

4.1.1. Market size and forecast, by region, 2016-2026

4.1.2. Comparative market share analysis, 2018 & 2026

4.2. PE Foam

4.2.1. Market size and forecast, by region, 2016-2026

4.2.2. Comparative market share analysis, 2018 & 2026

4.3. Metal Foam

4.3.1. Market size and forecast, by region, 2016-2026

4.3.2. Comparative market share analysis, 2018 & 2026

4.4. Melamine Metal Foam

4.4.1. Market size and forecast, by region, 2016-2026

4.4.2. Comparative market share analysis, 2018 & 2026

4.5. PMI Foam

4.5.1. Market size and forecast, by region, 2016-2026

4.5.2. Comparative market share analysis, 2018 & 2026

4.6. Others

4.6.1. Market size and forecast, by region, 2016-2026

4.6.2. Comparative market share analysis, 2018 & 2026

5. Aerospace Foams Market, by End-use

5.1. Commercial Aircraft

5.1.1. Market size and forecast, by region, 2016-2026

5.1.2. Comparative market share analysis, 2018 & 2026

5.2. Military Aircraft

5.2.1. Market size and forecast, by region, 2016-2026

5.2.2. Comparative market share analysis, 2018 & 2026

5.3. Helicopters

5.3.1. Market size and forecast, by region, 2016-2026

5.3.2. Comparative market share analysis, 2018 & 2026

5.4. Spacecraft

5.4.1. Market size and forecast, by region, 2016-2026

5.4.2. Comparative market share analysis, 2018 & 2026

5.5. Others

5.5.1. Market size and forecast, by region, 2016-2026

5.5.2. Comparative market share analysis, 2018 & 2026

6. Aerospace Foams Market, by Region

6.1. North America

6.1.1. Market size and forecast, by Material, 2016-2026

6.1.2. Market size and forecast, by End-use, 2016-2026

6.1.3. Market size and forecast, by country, 2016-2026

6.1.4. Comparative market share analysis, 2018 & 2026

6.1.5. U.S.

6.1.5.1. Market size and forecast, by Material, 2016-2026

6.1.5.2. Market size and forecast, by End-use, 2016-2026

6.1.5.3. Comparative market share analysis, 2018 & 2026

6.1.6. Canada

6.1.6.1. Market size and forecast, by Material, 2016-2026

6.1.6.2. Market size and forecast, by End-use, 2016-2026

6.1.6.3. Comparative market share analysis, 2018 & 2026

6.1.7. Mexico

6.1.7.1. Market size and forecast, by Material, 2016-2026

6.1.7.2. Market size and forecast, by End-use, 2016-2026

6.1.7.3. Comparative market share analysis, 2018 & 2026

6.2. Europe

6.2.1. Market size and forecast, by Material, 2016-2026

6.2.2. Market size and forecast, by End-use, 2016-2026

6.2.3. Comparative market share analysis, 2018 & 2026

6.2.4. Germany

6.2.4.1. Market size and forecast, by Material, 2016-2026

6.2.4.2. Market size and forecast, by End-use, 2016-2026

6.2.4.3. Comparative market share analysis, 2018 & 2026

6.2.5. Spain

6.2.5.1. Market size and forecast, by Material, 2016-2026

6.2.5.2. Market size and forecast, by End-use, 2016-2026

6.2.5.3. Comparative market share analysis, 2018 & 2026

6.2.6. France

6.2.6.1. Market size and forecast, by Material, 2016-2026

6.2.6.2. Market size and forecast, by End-use, 2016-2026

6.2.6.3. Comparative market share analysis, 2018 & 2026

6.2.7. Italy

6.2.7.1. Market size and forecast, by Material, 2016-2026

6.2.7.2. Market size and forecast, by End-use, 2016-2026

6.2.7.3. Comparative market share analysis, 2018 & 2026

6.2.8. Rest of the Europe

6.2.8.1. Market size and forecast, by Material, 2016-2026

6.2.8.2. Market size and forecast, by End-use, 2016-2026

6.2.8.3. Comparative market share analysis, 2018 & 2026

6.3. Asia-Pacific

6.3.1. Market size and forecast, by Material, 2016-2026

6.3.2. Market size and forecast, by End-use, 2016-2026

6.3.3. Comparative market share analysis, 2018 & 2026

6.3.4. China

6.3.4.1. Market size and forecast, by Material, 2016-2026

6.3.4.2. Market size and forecast, by End-use, 2016-2026

6.3.4.3. Comparative market share analysis, 2018 & 2026

6.3.5. Japan

6.3.5.1. Market size and forecast, by Material, 2016-2026

6.3.5.2. Market size and forecast, by End-use, 2016-2026

6.3.5.3. Comparative market share analysis, 2018 & 2026

6.3.6. India

6.3.6.1. Market size and forecast, by Material, 2016-2026

6.3.6.2. Market size and forecast, by End-use, 2016-2026

6.3.6.3. Comparative market share analysis, 2018 & 2026

6.3.7. Australia

6.3.7.1. Market size and forecast, by Material, 2016-2026

6.3.7.2. Market size and forecast, by End-use, 2016-2026

6.3.7.3. Comparative market share analysis, 2018 & 2026

6.3.8. South Korea

6.3.8.1. Market size and forecast, by Material, 2016-2026

6.3.8.2. Market size and forecast, by End-use, 2016-2026

6.3.8.3. Comparative market share analysis, 2018 & 2026

6.3.9. Rest of the Asia Pacific

6.3.9.1. Market size and forecast, by Material, 2016-2026

6.3.9.2. Market size and forecast, by End-use, 2016-2026

6.3.9.3. Comparative market share analysis, 2018 & 2026

6.4. LAMEA

6.4.1. Market size and forecast, by Material, 2016-2026

6.4.2. Market size and forecast, by End-use, 2016-2026

6.4.3. Comparative market share analysis, 2018 & 2026

6.4.4. Brazil

6.4.4.1. Market size and forecast, by Material, 2016-2026

6.4.4.2. Market size and forecast, by End-use, 2016-2026

6.4.4.3. Comparative market share analysis, 2018 & 2026

6.4.5. Saudi Arabia

6.4.5.1. Market size and forecast, by Material, 2016-2026

6.4.5.2. Market size and forecast, by End-use, 2016-2026

6.4.5.3. Comparative market share analysis, 2018 & 2026

6.4.6. South Africa

6.4.6.1. Market size and forecast, by Material, 2016-2026

6.4.6.2. Market size and forecast, by End-use, 2016-2026

6.4.6.3. Comparative market share analysis, 2018 & 2026

6.4.7. Rest of LAMEA

6.4.7.1. Market size and forecast, by Material, 2016-2026

6.4.7.2. Market size and forecast, by End-use, 2016-2026

6.4.7.3. Comparative market share analysis, 2018 & 2026

7. Company profiles

7.1. Evonik Industries AG

7.1.1. Business overview

7.1.2. Financial performance

7.1.3. Material portfolio

7.1.4. Recent strategic moves & developments

7.1.5. SWOT analysis

7.2. Rogers Corporation

7.2.1. Business overview

7.2.2. Financial performance

7.2.3. Material portfolio

7.2.4. Recent strategic moves & developments

7.2.5. SWOT analysis

7.3. Foampartner

7.3.1. Business overview

7.3.2. Financial performance

7.3.3. Material portfolio

7.3.4. Recent strategic moves & developments

7.3.5. SWOT analysis

7.4. BASF SE

7.4.1. Business overview

7.4.2. Financial performance

7.4.3. Material portfolio

7.4.4. Recent strategic moves & developments

7.4.5. SWOT analysis

7.5. Boyd Corporation

7.5.1. Business overview

7.5.2. Financial performance

7.5.3. Material portfolio

7.5.4. Recent strategic moves & developments

7.5.5. SWOT analysis

7.6. Armacell International S.A.

7.6.1. Business overview

7.6.2. Financial performance

7.6.3. Material portfolio

7.6.4. Recent strategic moves & developments

7.6.5. SWOT analysis

7.7. SABIC

7.7.1. Business overview

7.7.2. Financial performance

7.7.3. Material portfolio

7.7.4. Recent strategic moves & developments

7.7.5. SWOT analysis

7.8. UFP Technologies

7.8.1. Business overview

7.8.2. Financial performance

7.8.3. Material portfolio

7.8.4. Recent strategic moves & developments

7.8.5. SWOT analysis

7.9. Erg Materials and Aerospace Corp

7.9.1. Business overview

7.9.2. Financial performance

7.9.3. Material portfolio

7.9.4. Recent strategic moves & developments

7.9.5. SWOT analysis

7.10. Zotedfoams Plc

7.10.1. Business overview

7.10.2. Financial performance

7.10.3. Material portfolio

7.10.4. Recent strategic moves & developments

7.10.5. SWOT analysis

Aerospace foams are cellular designed and low-density materials that are used for vibration dampeners, cushioning, and insulation in the aerospace industry. Aerospace foams have many features such as exceptional rigidness, tensile strength, hard-wearing, lightweight, and heat resistant. These properties have made aerospace foam necessary for various aircraft applications. These foams are used the flight rooftops, rotor blades, gaskets to seal, and headrests.

The demand for commercial aircraft has been increased with the popularity of budget-friendly carriers. This is because of the insulating and lightweight properties of these aircrafts. Rapid technological development has surged the need for aerospace foam in aircraft engineering. In addition, the demand for PU foam products for flight decks and aircraft interior cabins has grown because of the absorption formulations and excellent cushioning.

Apart from these, the huge government investments on military aircrafts are expected to boost the market by creating better growth potential. Although, with the havoc caused by the recent pandemic, the aerospace foam industry has experienced a major decline along with many other industries. Research has predicted that the industry will recover from the loss in next one year or two.

Recent Developments of the Market

According to a recent report published by Research Dive, the leading players of the global aerospace foam market include Rogers Corporation, Erg Materials and Aerospace Corp, Evonik Industries AG, SABIC, Foampartner, Armacell International S.A., Boyd Corporation, UFP Technologies, Zotedfoams Plc, BASF SE, and many more.

These industry players are concentrating on developing unique and outstanding strategies including product launches, mergers and acquisitions, partnerships, collaborations, and existing technology upgradation to withstand the market competition.

Some of the recent advancements of the market are as follows:

- Evonik Industries launched a new foam in the product line of ROHACRYL™. Released in March 2018, the new product is thermally steady, lightweight, environment- friendly and effortless to size or shape. The product is used in automotive, sports equipment, and many others apart from the aerospace industry.

- Rogers Corporation is a world leader in engineered material solutions. In a recent press release, it has announced the attainment of Griswold LLC which is a foremost producer of high-performance polyurethane and custom-engineered cellular elastomer. Griswold’s products and solutions offer a variation of applications in the general electronics, industrial, consumer, and automotive markets.

Griswold’s custom-engineered cellular elastomer multiplies the product portfolio of Rogers’ Elastomeric Material Solutions (“EMS”) segment. In addition, the high-performance polyurethane products of the company has increased the existing EMS capabilities of the Rogers Corporation.

- The Woodbridge Group, an international leader in the development and production of innovative urethane and particle foam technologies. In August 2017, it has completed its acquisition and 100% ownership of Woodbridge FoamPartner Company. Woodbridge Technical Products Company (WTP) is the new name of the venture.

- Boyd Corporation has recently been acquired by the affiliates of Goldman Sachs. Boyd is a significant provider of highly-engineered thermal management and environmental sealing solutions. The announcement comes after over three years of partnership of Boyd with a San Francisco based private equity firm, Genstar Capital.

- German-based, Evonik has successfully closed the acquisition of the US-based PeroxyChem for US$640 million after the responsible court in Washington D.C. dismissed the lawsuit filed by the Federal Trade Commission (FTC) to block the acquisition, as per a latest news.

Conclusion

Aerospace foam market has undergone a drastic and predictable decline during the coronavirus outbreak. Because of the trade restriction and supply chain disruption imposed by the governments throughout nations, the production, supply, and demand of aerospace foam has been decreased. However, with the strategic approaches of the key players, the industry will regain its growth in near future.

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com