Aerospace Coatings Market Report

RA00055

Aerospace Coatings Market, By Resin (Polyurethane Resin, Epoxy Resin, Others), By Technology (Solvent Based Coating, Water Based Coating, Powder Coating, Others), By Aircraft (Spacecraft, Military Aircraft, Helicopter, Commercial Aircraft, Others), By (Interior, Exterior), By End-use (MRO, OEM): Global Opportunity Analysis and Industry Forecast, 2019–2026

Update Available On-Demand

Global Market Study of Aerospace Coatings 2026:

Global Aerospace Coatings Market has accounted for $ 745.5 Million in 2018 and willing to $ 1,144.1 Million by 2026, growing at a CAGR of over 5.5% from 2019 to 2026. North American market dominated in 2018 with a size of over $ 223.7 Million. Asia-Pacific Aerospace coatings market expected to grow at 6.3% CAGR during the forecast period.

The aerospace coatings are majorly used for repair & maintenance and aircrafts manufacturing, in order to extend the life of the aircraft’s. the application of aerospace coatings is to withstand extreme weather conditions. These can be applied on both in interior as well as exteriors surfaces of the aircrafts.

Aerospace Coatings Market Synopsis

Product development and company acquisitions among market players, along with the growth in the production and sales of aircrafts, is projected to accelerate the growth of the aerospace coatings market.

On the other hand, the fluctuations in the raw material prices is a factor restricting the market growth.

According to the regional analysis of the market, the North America aerospace coatings market dominated in 2018 and is anticipated to surpass a revenue of $223.7 million during the review period, owing to the presence of key aircraft manufacturers in the region.

Aerospace coatings Market Trends

Rapid growth in the air travelers in the recent years have force the commercial airlines to expand the aircraft fleet, this is further anticipated to create lucrative growth to the aerospace coatings. Rising aircraft delivers by the key manufacturers such as Boeing and Airbus among others, which in turn is leading to the growth of aerospace coatings market. However, improved standard of living in the developing nations is have directed towards the growth of aircraft production and sales, thus the growing demand for the aircrafts manufacturing is further boosted the aerospace coatings market.

However, the stringent environmental regulations by various governments across the globe is further anticipated to hamper the market growth in the near future. Additionally, fluctuations in the prices of raw materials is another key factor that will hinder the aerospace coating market.

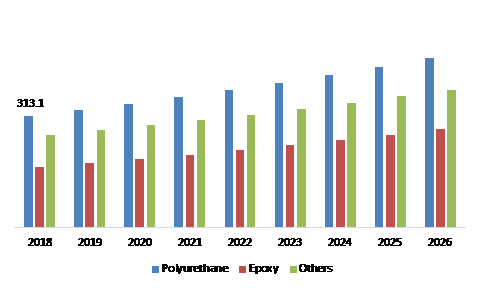

Aerospace coatings Market, By Resin

Epoxy will dominate the global market throughout the forecast period

Source: Research Dive Analysis

Epoxy aerospace coatings market forecast will surpass $ 478.4 Million by 2026, at a CAGR of 6.2%, from more than $ 171.5 Million in 2018. Epoxy resin exhibits various properties such as strength, chemical resistance and durability in the coatings, these features of this resin will significantly increase the preference over other types. These type of resins have the capability to dry fast and water resistance which make the more reliable and highly preferable.

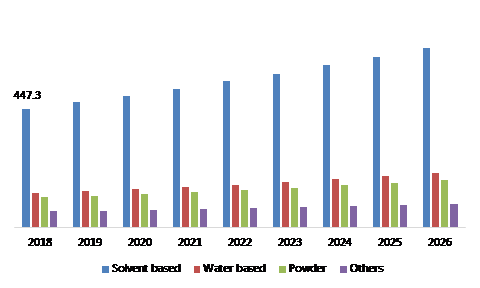

Aerospace coatings Market, By Technology

Silicone Implants will dominate the global market throughout the forecast period

Source: Research Dive Analysis

The solvent based coatings accounted for $ 447.3 Million in the year 2018 and is further anticipated to continue its dominance over the forecast period growing at a CAGR of 5.3%. Solvent based coatings are widely used due to the various properties such as greater performance in terms of enhanced coverage, even surface finish and highly carrion resistant. Water based coatings are further anticipated to grow at a CAGR 6.1% over the forecast period reaching $ 203.7 Million by 2026. Properties such as environmental friendly are anticipated further upsurge the water based coatings market.

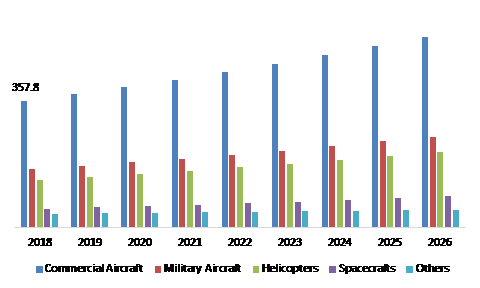

Aerospace coatings Market, By Aircraft type

Spacecraft segment is predicted to be most lucrative till the end of 2026

Source: Research Dive Analysis

The commercial aircrafts market size was $ 357.8 Million in 2018 and will grow at a CAGR of 5.3% during the coming years. Growing passengers spending capabilities for air travelling among middle and higher class population is anticipated to upsurge the demand for commercial aircrafts market. The growing government spending over military aircrafts in the recent years is further anticipated to upsurge the global aerospace coatings market. The military aircrafts segment accounted for $ 256.3 Million in the year 2026 growing at a CAGR of 5.7% from $ 164.0 million.

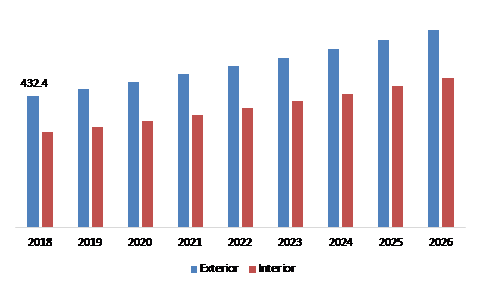

Aerospace coatings Market, By Application

Exterior is the most preferred application during the study period

Source: Research Dive Analysis

The exterior application segment dominated the global aerospace coatings market in 2018, with a share of more than 58%. The growing demand for exterior use in aerospace coatings is due to the need for handling extreme severe environmental conditions, thus exterior coatings in aerospace coatings market is anticipated to continue its dominance over the forecast period. However, interior application is further projected to grow at a faster pace over the forecast period due to the frequent renovations and maintenance cycles done by the airlines in order to meet the customers’ needs and to develop decorative appearance.

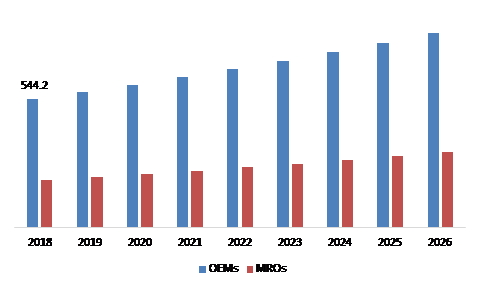

Aerospace coatings Market, By End-use

OEMs segment is predicted to be most lucrative till the end of 2026

Source: Research Dive Analysis

The OEM end-use segment was estimated to be more than $ 544.2 Million in 2018. Growing demand from the airlines to increase the commercial aircraft fleet is one of the key growth factor for aerospace coatings OEM market. Rising government spending for military aircrafts across the globe is another key factor that is projected to upsurge the growth of the market in the near future. MRO segment is anticipated to grow at a highest CAGR of 6.0% over the forecast period accounting for $ 492.0 Million by 2026.

Aerospace coatings Market, By Region

North America market will be the top investment pocket among other regions by the end of forecast period

North America Aerospace Coatings Market Outlook 2026:

North America market dominated the global market in 2018 with a size of over $ 223.7 million. The high share attained by this region can be majorly attributed to the presence of major aircraft manufacturing players in this region.

Asia-Pacific Aerospace coatings Market Overview 2026:

The Asia-Pacific market will witness growth at more than 6.3% CAGR, owing huge investments done by the governments in this region on military aircrafts. The growth in the cargo traffic, increasing air travelers and rising international trade in the emerging countries in this region such as India, China and South Korea are anticipated to drive the Asia-pacific market in the near future.

Key Players Operating in the Global Aerospace Coatings Market

Aerospace Coatings key players include Akzonobel N.V, Asahi Kinzoku Kogyo Inc., AHC Oberflachentechnik GmbH, BASF SE, Argosy International, Brycoat. Inc., Henkel AG & Co. KGaA, Cheaerospacel, Hentzen Coatings, Inc. and Hohman Plating & manufacturing LLC. Key industry participants are adopting numerous strategies like new product development and acquisitions to strengthen their position in the current market, and also to expand their existing product line. For instance, on July 2019, AkzoNobel and Airbus partnered and developed and new chromate-free exterior, which is anticipated to enhance the aircraft coatings industry.

Scope of the Market Report:

| Aspect | Particulars |

| Historical Market Estimations | 2018-2019 |

| Base Year for Market Estimation | 2018 |

| Forecast timeline for Market Projection | 2019-2026 |

| Geographical Scope | North America, Europe, Asia-Pacific, LAMEA |

| Segmentation by Resin |

|

| Segmentation by Technology |

|

| Segmentation by Aircraft Type |

|

| Segmentation by End-user |

|

| Segmentation by End-user |

|

| Key Countries covered | U.S., Canada, Germany, France, Spain, Russia, Japan, China, India, South Korea, Australia, Brazil, and Saudi Arabia |

| Key Companies Profiled |

|

Source: Research Dive Analysis

Q1. What is the size of Aerospace Coatings Market?

A. The global Aerospace coatings market size was over $ 745.5 Million in 2018, and is further anticipated to reach $ 1,144.1 Million by 2026.

Q2. Who are the leading companies in the Aerospace coatings market?

A. Akzonobel N.V, Asahi Kinzoku Kogyo Inc., AHC Oberflachentechnik GmbH, BASF SE, Argosy International, Brycoat. Inc. are some of the key players in the global Aerospace coatings market.

Q3. Which region possesses greater investment opportunities in the coming future?

A. The Asia-Pacific region possess great investment opportunities for the investors to witness the most promising growth in the coming years.

Q4. What is the growth rate of the Asia-Pacific market?

A. The Asia-Pacific Aerospace coatings market is projected to grow at 6.3% CAGR during the forecast period.

Q5. What are the strategies opted by the leading players in this market?

A. Product development and acquisitions are the key strategies opted by the operating companies in this market.

1. Research Methodology

1.1. Desk Research

1.2. Real time insights and validation

1.3. Forecast model

1.4. Assumptions and forecast parameters

1.4.1. Assumptions

1.4.2. Forecast parameters

1.5. Data sources

1.5.1. Primary

1.5.2. Secondary

2. Executive Summary

2.1. 360° summary

2.2. Resin

2.3. Technology

2.4. End-user

2.5. Aircraft

2.6. Application

3. Market overview

3.1. Market segmentation & definitions

3.2. Key takeaways

3.2.1. Top investment pockets

3.2.2. Top winning strategies

3.3. Porter’s five forces analysis

3.3.1. Bargaining power of consumers

3.3.2. Bargaining power of suppliers

3.3.3. Threat of new entrants

3.3.4. Threat of substitutes

3.3.5. Competitive rivalry in the market

3.4. Market dynamics

3.4.1. Drivers

3.4.2. Restraints

3.4.3. Opportunities

3.5. Technology landscape

3.6. Regulatory landscape

3.7. Patent landscape

3.8. Market value chain analysis

3.8.1. Stress point analysis

3.9. Strategic overview

4. Aerospace Coatings Market, by Resin

4.1. Polyurethane Resins

4.1.1. Market size and forecast, by region, 2016-2026

4.1.2. Comparative market share analysis, 2018 & 2026

4.2. Epoxy Resins

4.2.1. Market size and forecast, by region, 2016-2026

4.2.2. Comparative market share analysis, 2018 & 2026

4.3. Others

4.3.1. Market size and forecast, by region, 2016-2026

4.3.2. Comparative market share analysis, 2018 & 2026

5. Aerospace Coatings Market, by Technology

5.1. Water Based Coatings

5.1.1. Market size and forecast, by region, 2016-2026

5.1.2. Comparative market share analysis, 2018 & 2026

5.2. Solvent Based Coatings

5.2.1. Market size and forecast, by region, 2016-2026

5.2.2. Comparative market share analysis, 2018 & 2026

5.3. Powder Coating

5.3.1. Market size and forecast, by region, 2016-2026

5.3.2. Comparative market share analysis, 2018 & 2026

5.4. Others

5.4.1. Market size and forecast, by region, 2016-2026

5.4.2. Comparative market share analysis, 2018 & 2026

6. Aerospace Coatings Market, by Aircraft

6.1. Military Aircraft

6.1.1. Market size and forecast, by region, 2016-2026

6.1.2. Comparative market share analysis, 2018 & 2026

6.2. Spacecraft

6.2.1. Market size and forecast, by region, 2016-2026

6.2.2. Comparative market share analysis, 2018 & 2026

6.3. Commercial Aircraft

6.3.1. Market size and forecast, by region, 2016-2026

6.3.2. Comparative market share analysis, 2018 & 2026

6.4. Helicopters

6.4.1. Market size and forecast, by region, 2016-2026

6.4.2. Comparative market share analysis, 2018 & 2026

6.5. Others

6.5.1. Market size and forecast, by region, 2016-2026

6.5.2. Comparative market share analysis, 2018 & 2026

6.5.3.

7. Aerospace Coatings Market, by Application

7.1. Interior

7.1.1. Market size and forecast, by region, 2016-2026

7.1.2. Comparative market share analysis, 2018 & 2026

7.2. Exterior

7.2.1. Market size and forecast, by region, 2016-2026

7.2.2. Comparative market share analysis, 2018 & 2026

8. Aerospace Coatings Market, by End-Use

8.1. OEM

8.1.1. Market size and forecast, by region, 2016-2026

8.1.2. Comparative market share analysis, 2018 & 2026

8.2. MRO

8.2.1. Market size and forecast, by region, 2016-2026

8.2.2. Comparative market share analysis, 2018 & 2026

9. Aerospace Coatings Market, by Region

9.1. North America

9.1.1. Market size and forecast, by Resin, 2016-2026

9.1.2. Market size and forecast, by Technology, 2016-2026

9.1.3. Market size and forecast, by application, 2016-2026

9.1.4. Market size and forecast, by aircraft, 2016-2026

9.1.5. Market size and forecast, by end-use, 2016-2026

9.1.6. Market size and forecast, by country, 2016-2026

9.1.7. Comparative market share analysis, 2018 & 2026

9.1.8. U.S.

9.1.8.1. Market size and forecast, by Resin, 2016-2026

9.1.8.2. Market size and forecast, by Technology, 2016-2026

9.1.8.3. Market size and forecast, by aircraft, 2016-2026

9.1.8.4. Market size and forecast, by application, 2016-2026

9.1.8.5. Market size and forecast, by end-use, 2016-2026

9.1.8.6. Comparative market share analysis, 2018 & 2026

9.1.9. Canada

9.1.9.1. Market size and forecast, by Resin, 2016-2026

9.1.9.2. Market size and forecast, by Technology, 2016-2026

9.1.9.3. Market size and forecast, by aircraft, 2016-2026

9.1.9.4. Market size and forecast, by application, 2016-2026

9.1.9.5. Market size and forecast, by end-use, 2016-2026

9.1.9.6. Comparative market share analysis, 2018 & 2026

9.1.10. Mexico

9.1.10.1. Market size and forecast, by Resin, 2016-2026

9.1.10.2. Market size and forecast, by Technology, 2016-2026

9.1.10.3. Market size and forecast, by aircraft, 2016-2026

9.1.10.4. Market size and forecast, by application, 2016-2026

9.1.10.5. Market size and forecast, by end-use, 2016-2026

9.1.10.6. Comparative market share analysis, 2018 & 2026

9.2. Europe

9.2.1. Market size and forecast, by Resin, 2016-2026

9.2.2. Market size and forecast, by Technology, 2016-2026

9.2.3. Market size and forecast, by aircraft, 2016-2026

9.2.4. Market size and forecast, by application, 2016-2026

9.2.5. Market size and forecast, by end-use, 2016-2026

9.2.6. Comparative market share analysis, 2018 & 2026

9.2.7. Germany

9.2.7.1. Market size and forecast, by Resin, 2016-2026

9.2.7.2. Market size and forecast, by Technology, 2016-2026

9.2.7.3. Market size and forecast, by aircraft, 2016-2026

9.2.7.4. Market size and forecast, by application, 2016-2026

9.2.7.5. Market size and forecast, by end-use, 2016-2026

9.2.7.6. Comparative market share analysis, 2018 & 2026

9.2.8. Spain

9.2.8.1. Market size and forecast, by Resin, 2016-2026

9.2.8.2. Market size and forecast, by Technology, 2016-2026

9.2.8.3. Market size and forecast, by aircraft, 2016-2026

9.2.8.4. Market size and forecast, by application, 2016-2026

9.2.8.5. Market size and forecast, by end-use, 2016-2026

9.2.8.6. Comparative market share analysis, 2018 & 2026

9.2.9. France

9.2.9.1. Market size and forecast, by Resin, 2016-2026

9.2.9.2. Market size and forecast, by Technology, 2016-2026

9.2.9.3. Market size and forecast, by aircraft, 2016-2026

9.2.9.4. Market size and forecast, by application, 2016-2026

9.2.9.5. Market size and forecast, by end-use, 2016-2026

9.2.9.6. Comparative market share analysis, 2018 & 2026

9.2.10. Italy

9.2.10.1. Market size and forecast, by Resin, 2016-2026

9.2.10.2. Market size and forecast, by Technology, 2016-2026

9.2.10.3. Market size and forecast, by aircraft, 2016-2026

9.2.10.4. Market size and forecast, by application, 2016-2026

9.2.10.5. Market size and forecast, by end-use, 2016-2026

9.2.10.6. Comparative market share analysis, 2018 & 2026

9.2.11. Rest of the Europe

9.2.11.1. Market size and forecast, by Resin, 2016-2026

9.2.11.2. Market size and forecast, by Technology, 2016-2026

9.2.11.3. Market size and forecast, by aircraft, 2016-2026

9.2.11.4. Market size and forecast, by application, 2016-2026

9.2.11.5. Market size and forecast, by end-use, 2016-2026

9.2.11.6. Comparative market share analysis, 2018 & 2026

9.3. Asia-Pacific

9.3.1. Market size and forecast, by Resin, 2016-2026

9.3.2. Market size and forecast, by Technology, 2016-2026

9.3.3. Market size and forecast, by aircraft, 2016-2026

9.3.4. Market size and forecast, by application, 2016-2026

9.3.5. Market size and forecast, by end-use, 2016-2026

9.3.6. Comparative market share analysis, 2018 & 2026

9.3.7. China

9.3.7.1. Market size and forecast, by Resin, 2016-2026

9.3.7.2. Market size and forecast, by Technology, 2016-2026

9.3.7.3. Market size and forecast, by aircraft, 2016-2026

9.3.7.4. Market size and forecast, by application, 2016-2026

9.3.7.5. Market size and forecast, by end-use, 2016-2026

9.3.7.6. Comparative market share analysis, 2018 & 2026

9.3.8. Japan

9.3.8.1. Market size and forecast, by Resin, 2016-2026

9.3.8.2. Market size and forecast, by Technology, 2016-2026

9.3.8.3. Market size and forecast, by aircraft, 2016-2026

9.3.8.4. Market size and forecast, by application, 2016-2026

9.3.8.5. Market size and forecast, by end-use, 2016-2026

9.3.8.6. Comparative market share analysis, 2018 & 2026

9.3.9. India

9.3.9.1. Market size and forecast, by Resin, 2016-2026

9.3.9.2. Market size and forecast, by Technology, 2016-2026

9.3.9.3. Market size and forecast, by aircraft, 2016-2026

9.3.9.4. Market size and forecast, by application, 2016-2026

9.3.9.5. Market size and forecast, by end-use, 2016-2026

9.3.9.6. Comparative market share analysis, 2018 & 2026

9.3.10. Australia

9.3.10.1. Market size and forecast, by Resin, 2016-2026

9.3.10.2. Market size and forecast, by Technology, 2016-2026

9.3.10.3. Market size and forecast, by aircraft, 2016-2026

9.3.10.4. Market size and forecast, by application, 2016-2026

9.3.10.5. Market size and forecast, by end-use, 2016-2026

9.3.10.6. Comparative market share analysis, 2018 & 2026

9.3.11. South Korea

9.3.11.1. Market size and forecast, by Resin, 2016-2026

9.3.11.2. Market size and forecast, by Technology, 2016-2026

9.3.11.3. Market size and forecast, by aircraft, 2016-2026

9.3.11.4. Market size and forecast, by application, 2016-2026

9.3.11.5. Market size and forecast, by end-use, 2016-2026

9.3.11.6. Comparative market share analysis, 2018 & 2026

9.3.12. Rest of the Asia Pacific

9.3.12.1. Market size and forecast, by Resin, 2016-2026

9.3.12.2. Market size and forecast, by Technology, 2016-2026

9.3.12.3. Market size and forecast, by aircraft, 2016-2026

9.3.12.4. Market size and forecast, by application, 2016-2026

9.3.12.5. Market size and forecast, by end-use, 2016-2026

9.3.12.6. Comparative market share analysis, 2018 & 2026

9.4. LAMEA

9.4.1. Market size and forecast, by Resin, 2016-2026

9.4.2. Market size and forecast, by Technology, 2016-2026

9.4.3. Market size and forecast, by aircraft, 2016-2026

9.4.4. Market size and forecast, by application, 2016-2026

9.4.5. Market size and forecast, by end-use, 2016-2026

9.4.6. Comparative market share analysis, 2018 & 2026

9.4.7. Brazil

9.4.7.1. Market size and forecast, by Resin, 2016-2026

9.4.7.2. Market size and forecast, by Technology, 2016-2026

9.4.7.3. Market size and forecast, by aircraft, 2016-2026

9.4.7.4. Market size and forecast, by application, 2016-2026

9.4.7.5. Market size and forecast, by end-use, 2016-2026

9.4.7.6. Comparative market share analysis, 2018 & 2026

9.4.8. Saudi Arabia

9.4.8.1. Market size and forecast, by Resin, 2016-2026

9.4.8.2. Market size and forecast, by Technology, 2016-2026

9.4.8.3. Market size and forecast, by aircraft, 2016-2026

9.4.8.4. Market size and forecast, by application, 2016-2026

9.4.8.5. Market size and forecast, by end-use, 2016-2026

9.4.8.6. Comparative market share analysis, 2018 & 2026

9.4.9. South Africa

9.4.9.1. Market size and forecast, by Resin, 2016-2026

9.4.9.2. Market size and forecast, by Technology, 2016-2026

9.4.9.3. Market size and forecast, by aircraft, 2016-2026

9.4.9.4. Market size and forecast, by application, 2016-2026

9.4.9.5. Market size and forecast, by end-use, 2016-2026

9.4.9.6. Comparative market share analysis, 2018 & 2026

9.4.10. Rest of LAMEA

9.4.10.1. Market size and forecast, by Resin, 2016-2026

9.4.10.2. Market size and forecast, by Technology, 2016-2026

9.4.10.3. Market size and forecast, by aircraft, 2016-2026

9.4.10.4. Market size and forecast, by application, 2016-2026

9.4.10.5. Market size and forecast, by end-use, 2016-2026

9.4.10.6. Comparative market share analysis, 2018 & 2026

10. Company profiles

10.1. Akzonobel N.V

10.1.1. Business overview

10.1.2. Financial performance

10.1.3. Resin portfolio

10.1.4. Recent strategic moves & developments

10.1.5. SWOT analysis

10.2. Asahi Kinzoku Kogyo Inc.

10.2.1. Business overview

10.2.2. Financial performance

10.2.3. Resin portfolio

10.2.4. Recent strategic moves & developments

10.2.5. SWOT analysis

10.3. AHC Oberflachentechnik GmbH

10.3.1. Business overview

10.3.2. Financial performance

10.3.3. Resin portfolio

10.3.4. Recent strategic moves & developments

10.3.5. SWOT analysis

10.4. BASF SE

10.4.1. Business overview

10.4.2. Financial performance

10.4.3. Resin portfolio

10.4.4. Recent strategic moves & developments

10.4.5. SWOT analysis

10.5. Argosy International

10.5.1. Business overview

10.5.2. Financial performance

10.5.3. Resin portfolio

10.5.4. Recent strategic moves & developments

10.5.5. SWOT analysis

10.6. Brycoat. Inc.

10.6.1. Business overview

10.6.2. Financial performance

10.6.3. Resin portfolio

10.6.4. Recent strategic moves & developments

10.6.5. SWOT analysis

10.7. Henkel AG & Co. KGaA

10.7.1. Business overview

10.7.2. Financial performance

10.7.3. Resin portfolio

10.7.4. Recent strategic moves & developments

10.7.5. SWOT analysis

10.8. Cheaerospacel

10.8.1. Business overview

10.8.2. Financial performance

10.8.3. Resin portfolio

10.8.4. Recent strategic moves & developments

10.8.5. SWOT analysis

10.9. Hentzen Coatings, Inc.

10.9.1. Business overview

10.9.2. Financial performance

10.9.3. Resin portfolio

10.9.4. Recent strategic moves & developments

10.9.5. SWOT analysis

10.10. Hohman Plating & manufacturing LLC

10.10.1. Business overview

10.10.2. Financial performance

10.10.3. Resin portfolio

10.10.4. Recent strategic moves & developments

10.10.5. SWOT analysis

The aerospace coatings are primarily used for repair, maintenance, and especially in the aircrafts manufacturing industry. Aerospace coatings are used to extend the life of the aircraft. The aircraft manufacturing companies apply aerospace coatings so that the vessel can withstand the extreme weather conditions up in the air. These coatings are applied on both interior and exterior surfaces of the aircrafts.

Rapid growth in the air travelers in the recent years have increased the demand for the commercial airlines. This is one of the main factors anticipated to boost the growth of the aerospace coatings market.

Rising aircraft deliveries by the key manufacturers such as Boeing and Airbus, is leading to the growth of aerospace coatings market. Improved living standard of the urban population in the developing countries have enhanced the growth of the global aerospace coatings market.

Trending Developments of the Market

According to a recent report by Research Dive, the leading players of the global aerospace coatings market include Asahi Kinzoku Kogyo Inc., Brycoat. Inc., Akzonobel N.V, AHC Oberflachentechnik GmbH, Argosy International, BASF SE, Henkel AG & Co. KGaA, Hohman Plating & manufacturing LLC, Cheaerospacel, Hentzen Coatings, Inc. and many more.

These industry players are concentrating on the research and development of smart strategies including product launches, mergers and acquisitions, collaborations and partnerships, and existing technology upgradation to sustain the competition in the market.

Some of the recent developments of the market are as follows:

- As per a latest press release, Akzo Nobel N.V. has completed the acquisition of 100% of the shares of Fabryo Corporation S.R.L. (Fabryo). This acquisition has made the company a front-runner in the Romanian decorative paints market.

The contract includes six supply centers for ornamental paints, two production amenities, mortars, and adhesives. The agreement also promises one of the largest decorative paints workshops in the area, which includes the volume for further extension.

- In another report, AkzoNobel has announced another upcoming acquisition of a French aerospace coatings manufacturer Mapaero. The proposed acquisition is promised to reinforce AkzoNobel’s global position in aerospace coatings, especially in the structural and cabin coating sub-segments, which will contribute directly towards delivering the company’s 2020 guidance.

- Mercer Global Advisors, Inc., a national Registered Investment Adviser (RIA), has made a recent announcement regarding the acquisition of Argosy Wealth Management, Inc. which is a famous wealth management firm based out of California, USA. Argosy serves approximately 300 households with assets under management (AUM) of approximately $330MM.

- Intermolecular, Inc has recently signed a definitive agreement pursuant. According to this agreement, a fully owned subsidiary of Merck KGaA, Darmstadt, Germany, will buy Intermolecular for $1.20 per share in an all cash transaction. The acquisition has been solidly permitted by Intermolecular's Board of Directors and the Executive Board of Merck KGaA, Darmstadt, Germany.

Conclusion

The aerospace coatings market has experienced a massive decline during the coronavirus emergencies. This is because of the government regulations and restrictions imposed throughout nations to combat the spread of the novel virus. However, with all the R&D, mergers, acquisitions, and other strategies, the aerospace coatings market will be back on its track in no time.

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com