Dry Type Transformer Market Report

RA00430

Dry Type Transformer Market, by Type (Converter Transformer, Rectifier Transformer), Technology (Cast Resin, Vacuum Pressure Impregnated ), Phase (Single-Phase, Three-Phase), Voltage Range (Low, Medium), End-Use ( Industrial, Commercial and others) , Region (North America, Europe, Asia Pacific, LAMEA): Global Opportunity Analysis and Industry Forecast, 2020–2027

The global dry type transformer market will reach $6556.7 million by 2027, increasing from $4822.4 million in 2019 at a healthy CAGR of 6.1%. The North America dry type transformer is estimated to increase at a CAGR of 6.6% by registering a revenue of $1,078.0 million, throughout the analysis period. Strategic collaborations among the market players along with the launching of advanced digital technology in the dry type transformer industry are expected to accelerate the North America dry type transformer growth.

Dry Type Transformer Analysis:

Dry type transformers are used to maintain the voltages or currents in an electrical circuit. Dry means they have auto cool ventilation system that use natural air to cool rather than oil, silicone or other liquids to cool the coils or core. They are also called “voltage changing” as they can balance higher level of voltage to normal level.

Impact Analysis of COVID-19 on the Dry Type Transformer Market

The global dry type transformer market is affected due to outbreak of the COVID-19 pandemic due to lockdown condition, which has led to disruption of supply chain, delaying in projects and their construction, postponing of renewable electricity projects, also biofuel investments and oher renewable heat projects. Recent studies show that the global solar industry is 40% dependent on China and other Asian countries. For instance according to the Asian Development Bank, the developing countries in Asia-Pacific are planning to start their own development in solar industry as the pandemic uncovered the dependency on China for energy transitions. Furthermore, Germany on Sep 30, 2020 announced that they are planning to boost the production of transformers by 4.5% of all sizes and voltages. These key factors may generate investment opportunities for the dry type transformer market, in the global marketplace.

However, several companies are coming forward with strategic steps to help socities during the pandemic. For instance, HPS (Hammond Power Solutions) on Mar 17, 2020 announced that they will supply their products online and the facilities will remain open even during the strict lockdown. Therefore, these enterprises have experienced sudden market growth in the COVID-19 pandemic. These key factors may generate investment opportunities for the dry type transformer industry, in the global marketplace.

Expansion of electricity distribution in developing countries will drive the global dry type transformer market

The dry type transformer market is witnessing massive growth mainly because of the expansion in electricity distribution and industrialization across the world. Almost every industry, large or small scale, relies on machineries that require specific voltage; for example, oil, gas, mining, marine and many more industries have specialized requirement of voltages for fire safety, and dry transformer is the best option to fulfill this demand. Moreover, the ventures involved in dry type transformer businesses are providing transformers according to the demand of customers with advanced safety and voltage features at a less expensive rate. Also, to maintain and fulfill all the requirements of transformers, companies such as ABB and HITACHI have integrated their services in all types of transformers to attract customers. For instance, ABB offers many types of dry transformer like “HiDry72” with 72.5 kV voltage for different megacities. This type of development may drive the global dry type transformer market during the forecast period.

To know more about dry type transformer market drivers, get in touch with our analysts here.

A surge in high cost of dry type transformers may restrain the growth of the global industry

Higher cost of dry type transformer is one restricting factor that affects the global dry transformer market. The complex construction of dry type transformer makes it costlier than wet type or oil immersed transformers. This will affect the growth of dry type transformer market during the forecast period.

Technological advancements in dry type transformer market may create huge opportunities in the future

The dry type transformer industry is growing at a very fast pace due to the technological advancements and higher applications of dry type transformers. Also, there is extended focus on replacing the former electric equipment with high class quality advance systems will accelerate the dry transformer market across the globe. For instance, Hitachi ABB Power Grids on 2 Oct 2020, has announced that they are planning to invest $6.2 million to modify equipment and increase manufacturing capacity at its of transformer plant in Virginia, USA. Moreover, modernization are taking place across the world, T&D (Transmission and Distribution) products are unable to serve the power demand especially in industrial sector. Most of the developing countries such as China or India are upgrading their T&D products to ensure uninterrupted power supply. Furthermore, HITACHI-ABB offers TXpert™ technology for digital dry type transformer, it is designed with smart hardware and software components which track, report and trend the performance of dry type transformer. It is world’s first digital transformer. This factor will increase productivity and profitability of dry transformer market

To know more about dry type transformer market opportunities, get in touch with our analysts here.

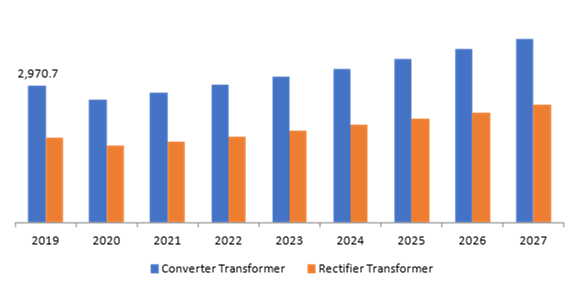

Dry Type Transformer Market, by Type:

Converter transformer will generate a revenue of $ 3,999.0 million by 2027, mainly because of its enhanced applications in power industry

Source: Research Dive Analysis

The converter type dry transformer shall have a dominating market share in the global market and is expected to register a revenue of $3,999.0 million, during the analysis timeframe. Owing to the increasing demand for HVDC (high voltage direct current) technology featured with high voltage electricity transmissions between generation and consumption centers over long distances. It is mostly used in HVDC converter station, energy generation from renewable sources like offshore wind farming, hydro power-plants and solar panels. Also, growing renewable energy sectors have driving the transmission technologies and eventually dry transformer market. For instance, Siemen on 17 August 2020 announced that they are planning to supply HVDC power transmission technology for the BorWin epsilon offshore platform. These initiatives may create massive opportunities for the sub-segment, throughout the forecast period.

The rectifier type sub-segment of dry transformers shall have the fastest market growth and it is anticipated to generate a revenue of $2,557.7 million by 2027, growing from $1,851.7 million in 2019. The growth of the rectifier transformer sub-segment for the global dry type transformer market is mainly attributed to increased applications in industrial processes which require direct current in their machineries. The rectifier transformer offers flawless operations, sturdy construction and long-life service of transformer and is used in industries such as oil, gas, chemical, automotive, metals and mining. Also, The major companies such as Siemens, ABB, GE, TES Transformer, Neeltran and Dovop Electric are innovating the transformers with different voltages to offer valuable services. These key factors are expected to boost the demand for rectifier transformers in the global market, during the projected period.

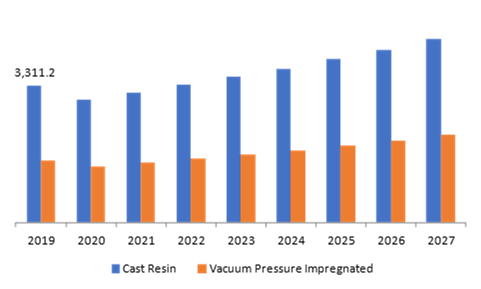

Dry Type Transformer Market, by Technology:

The cast resin sub-segment for dry type transformer will have the highest market share; this is mainly because of the growing safety features

Source: Research Dive Analysis

The Cast resin sub-segment for the dry type transformer will be a rapidly-growing segment and is estimated to generate a revenue of $4,438.2 million, throughout the analysis timeframe. In recent years, organizations operating in the transformer industry across the globe are adopting the cast resin option due to many applications, being fire-resistance, low maintenance and attractive. For instance, OTDS (power distribution and product company) in UK, offers Cast Resin Dry Transformers manufactured in accordance to IEC60076-11 and a quality system with conformity of ISO 9001. These factors are responsible for the flourishing of the sub-segment growth, over the analysis timeframe

The vacuum pressure impregnated sub-segment of the dry type transformer will have the fastest growth and it is projected to surpass $2,118.5 million by 2027, with an increase from $1,511.2 million in 2019; this is mainly owing to excellent mechanical and strength to short circuits due to varnish coating of polyester all over this type of transformer. Moreover, the extensive growth of the sub-segment is mainly attributed to enhanced safety, minimum maintenance, reduced cost of cabling, reliability, enhanced overloading capacity, resistant capacity, and being hazard free. These key factors may enhance the sub-segment growth.

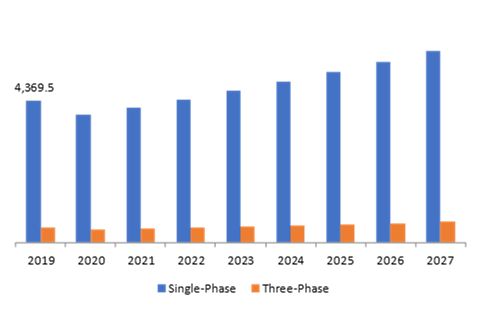

Dry Type Transformer Market, by Phase

The single- phase sub-segment will have significant growth in the global market; this is mainly because of advantages like low cost and enhanced efficiency

Source: Research Dive Analysis

The single phase dry type transformers shall have significant growth and this sub-segment is anticipated to generate a revenue of $5,913.5 million by 2027, during the forecast period. The single phase dry type transformer has applications in power supply for homes and businesses and power supply that is sufficient to run the motors. There are different key players in the market that offer single phase dry transformers, featured with many more advancements. For instance, Eaton, power management company offers several types of dry transformers such as general purpose ventilated dry transformers, encapsulated dry transformer, totally enclosed non-ventilated dry transformer with different ranges of voltage to provide better service to the customers .

However, three phase dry type transformer is the fastest growing sub-segment and generate a revenue of $643.2 million by 2027 with a CAGR of 6.6% owing to less risk compared to single phase There are different benefits of dry type three phase transformer such as it has minimal risk for the person who operates this, it needs less copper, it has good conductance efficiency and it can hold the high range of power loads. For instance, Eaton offers general purpose ventilated dry transformers featured with three phase, general purpose encapsulated with three phases, totally enclosed non-ventilated three phase transformer

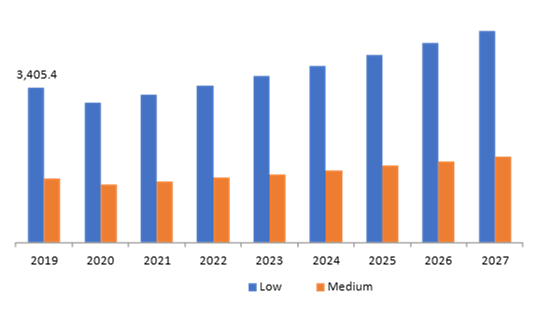

Dry Type Transformer Market, by Voltage

The low voltage sub-segment will have significant and fastest growth in the global market due to rising electrical infrastructure

Source: Research Dive Analysis

The low voltage sub-segment for the dry type transformer market shall have significant growth and it is anticipated to generate a revenue of $4,665.2 million by 2027, during the forecast period. The low voltage type dry type transformers are best alternative for all those who require environmental friendly type of dry transformer . standard voltage is 60 Hz. They are significantly used in commercial industry, institutional industry, and residential structure industry. For instance Eaton offers dry type low voltage transformers such as “Eaton's general-purpose low voltage dry-type distribution transformers” for industries that need low voltage dry transformers. These key factors may enhance the sub-segment growth.

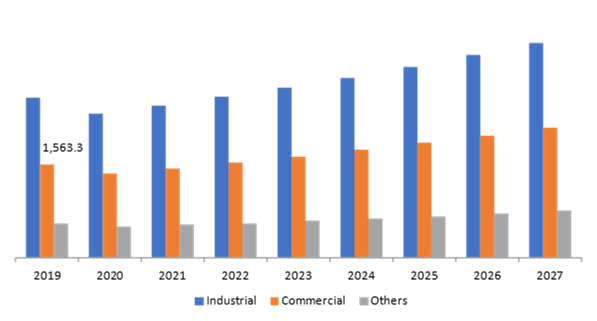

Dry Type Transformer Market, by End Use

The industrial sub-segment will have the significant growth in the global market due to rising demand for electrical infrastructure

Source: Research Dive Analysis

Industrial sub-segment may experience significant growth during the forecast period with a revenue of $3,590.1 million with CAGR of 5.9% due to higher applications in different industries according to the voltage range. Industries such as oil, gas, automobile, steel manufactures, electrochemical industry and many more. Also, technology inventions led the development of smart transformers that can be used for charging of multiple electric charging. Steel manufacturing industry uses dry transformers for manufacturing or delivering high currents over a different range of voltages for their functioning. Furthermore, they are also used in aerospaces, audio systems, current transformers, communications, data processing and different circuits.

However, the commercial sub-segment of dry type transformers will have the fastest growth and it is projected to surpass $2,181.2 million by 2027, with an increase from $1,563.3 million in 2019; this is mainly owing to rising demand of dry type transformers because commercial machineries need powers continuously with low maintenance, heat resistant and fire proof. All these key factors may enhance the market of dry type transformer globally and eventually sub-segment growth.

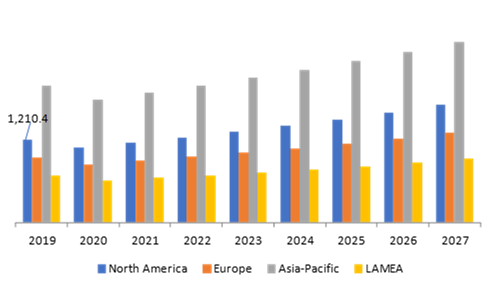

Regional Insights:

North America region has a lucrative market and it will reach up to $1,708.0 million by the end of 2027 mainly because of the presence of industry players and their heavy investments to enhance the safety & convenience of customers

Source: Research Dive Analysis

The North America market for dry type transformer accounted for $1,210.4 million in 2019 and is projected to register a revenue of $1,708.0 million by 2027. The extensive growth of the North America dry type transformers market is mainly driven by key factors such as heavy investments by market players along with the adoption of advanced systems such as innovative technologies in dry type transformers due to superior advantages. Also, massively increasing demand from the companies operating in the corporate sector is also likely to bolster the demand for dry type transformer services, which will ultimately accelerate the dry type transformer growth, during the analysis period.

Asia-Pacific dry type transformer shall have significant growth at a CAGR of 5.7% by registering a revenue of $2,622.7 million by 2027. Extensive increase in adoption of dry type transformer in Asia-Pacific region is due to technological advancements in electrical industries, renewable power consumption and increasing initiatives by governments towards energy-efficient solutions in developing countries such as India, China, and South Korea. Moreover, leading players operating in the dry type transformer services are opting for various effective strategies such as strategic alliances, launching of value-added products/services, and business expansion to strengthen their market position in the global industry. Moreover, government of Australia has taken some initiatives and subsidies for using wind, installation of solar power energy and renewable energy which will stimulate the dry type transformer market. According to guidelines of IS 11171 and IEC 60076 , Bureau of Indian standards on 23 Jan 2018, they have mentioned some standards that should be followed when designing any dry type transformer. There are many manufacturers in Asia-Pacific following these guidelines and this is predicted to boost the regional growth. Key players such as ABB, Schneider Electric, Kirloskar Electric, Voltamp Transformers, GE, Siemens, Raychem, Hyundai Heavy Industries, Fuji Electric, Bharat Heavy Electricals Limited and many more are expected to propel the growth of the market, over the forecast period.

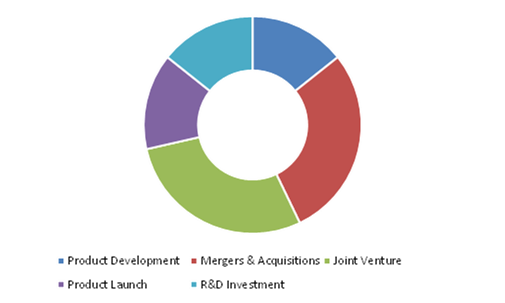

Competitive Scenario in the Global Dry Type Transformer Market:

The advanced product development coupled with mergers & acquisitions are the frequent strategies followed by the significant market players

Source: Research Dive Analysis

Some of the leading dry type transformer players include ABB Limited, General Electric, Eaton Corporation, Schneider Electric, Siemens AG,CG Power and Industrial Solutions Ltd, Toshiba Corporation, Bharat Heavy Electricals Limited and Raychem RPG. Dry type transformer players are focusing on Merger & acquisition and advanced product developments. These are the effective strategies followed by the startup as well as established organizations.

Porter’s Five Forces Analysis for Dry Type Transformer Market:

- Bargaining Power of Suppliers: The dry type transformer service suppliers are high in number, and established service providers of the dry type transformer are much larger and globalized. So, there will be less threat from suppliers. Thus, the bargaining power of the suppliers is HIGH

- Bargaining Power of Buyers: Buyers will have huge bargaining power, significantly because of multiple players operating in the dry type transformer services. The dry transformer providers offer safety and security with popular brands at an affordable rate. The buyers can freely choose the convenient service that best fits their preferences. Thus, the bargaining power of the buyer is HIGH

- Threat of New Entrants: The companies that are emerging into the dry type transformer are adopting technological innovations such as developing digital dry transformers with sensors to detect or analyze data. Also, these companies are implementing various effective strategies such as offering discounts and free-services. Thus, the threat of new entrants is Moderate

- Threat of Substitutes: Customers have their own preference when it comes to dry type transformer, also several substitutes are available in this market such as different types of transformers with different types of services. However, such alternatives can’t offer the kind of safety and applications that a dry type transformer service does. Thus, the threat of substitutes is Low

- Competitive Rivalry in the Market: The competitive rivalry among the industry leaders is rather intense, especially between the global players including ABB Limited, General Electric, Eaton Corporation, Schneider Electric, Siemens. These companies are launching their value-added services in the international markets and strengthening the footprint worldwide. Competitive rivalry in the market is High

| Aspect | Particulars |

| Historical Market Estimations | 2018-2019 |

| Base Year for Market Estimation | 2019 |

| Forecast timeline for Market Projection | 2020-2027 |

| Geographical Scope | North America, Europe, Asia-Pacific, LAMEA |

| Segmentation by Type |

|

| Segmentation by Technology |

|

| Segmentation by Phase |

|

| Key Countries Covered | U.S., Canada, Mexico, Germany, France, UK, Italy, Spain, Russia, Rest of Europe, China, Japan, India, Australia, South Korea, Rest of Asia-Pacific, Brazil, Saudi Arabia, United Arab Emirates, Rest of LAMEA |

| Key Companies Profiled |

|

Q1. What is the size of the dry type transformer market?

A. The global dry type transformer size was over $4,822.4 million in 2019 and is projected to reach $6,556.7 million by 2027.

Q2. Which are the major companies in the dry type transformer market?

A. ABB Limited, General Electric and Eaton Corporation, are some of the key players in the global dry type transformer Market.

Q3. Which region possesses greater investment opportunities in the coming future?

A. The North America region possesses great investment opportunities for the investors to witness the most promising growth in the future.

Q4. What is the growth rate of the North America market?

A. North America dry type transformer is anticipated to grow at 6.6% CAGR during the forecast period.

Q5. What are the strategies opted by the leading players in this market?

A. Capacity expansion, product development, along with joint ventures are the key strategies opted by the operating companies in this market.

Q6. Which companies are investing more on R&D practices?

A. ABB Limited and General Electric companies are investing more on R&D activities for developing new products and technologies.

1. Research Methodology

1.1. Desk Research

1.2. Real time insights and validation

1.3. Forecast model

1.4. Assumptions and forecast parameters

1.4.1. Assumptions

1.4.2. Forecast parameters

1.5. Data sources

1.5.1. Primary

1.5.2. Secondary

2. Executive Summary

2.1. 360° summary

2.2. By Type trends

2.3. By Technology trends

2.4. By Phase trends

2.5. By Voltage range trends

2.6. By End-use trends

3. Market Overview

3.1. Market segmentation & definitions

3.2. Key takeaways

3.2.1. Top investment pockets

3.2.2. Top winning strategies

3.3. Porter’s five forces analysis

3.3.1. Bargaining power of consumers

3.3.2. Bargaining power of suppliers

3.3.3. Threat of new entrants

3.3.4. Threat of substitutes

3.3.5. Competitive rivalry in the market

3.4. Market dynamics

3.4.1. Drivers

3.4.2. Restraints

3.4.3. Opportunities

3.5. Technology landscape

3.6. Regulatory landscape

3.7. Patent landscape

3.8. Pricing overview

3.8.1. By Vehicle Type

3.8.2. By Application

3.8.3. By Sales Channel

3.9. Market value chain analysis

3.9.1. Stress point analysis

3.9.2. Raw material analysis

3.9.3. Manufacturing process

3.9.4. Distribution channel analysis

3.9.5. Operating vendors

3.9.5.1. Raw material suppliers

3.9.5.2. Product manufacturers

3.9.5.3. Product distributors

3.10. Strategic overview

4. Dry Type Transformer Market, by Type

4.1. Converter Transformer

4.1.1. Key market trends, growth factors and opportunities

4.1.2. Market size and forecast, by region

4.1.3. Market share analysis, by country

4.2. Rectifier Transformer

4.2.1. Key market trends, growth factors and opportunities

4.2.2. Market size and forecast, by region

4.2.3. Market share analysis, by country

5. Dry Type Transformer Market, by Technology

5.1. Cast Resin

5.1.1. Key market trends, growth factors and opportunities

5.1.2. Market size and forecast, by region

5.1.3. Market share analysis, by country

5.2. Vacuum Pressure Impregnated

5.2.1. Key market trends, growth factors and opportunities

5.2.2. Market size and forecast, by region

5.2.3. Market share analysis, by country

6. Dry Type Transformer Market, by Phase

6.1. Single-Phase

6.1.1. Key market trends, growth factors and opportunities

6.1.2. Market size and forecast, by region

6.1.3. Market share analysis, by country

6.2. Three-Phase

6.2.1. Key market trends, growth factors and opportunities

6.2.2. Market size and forecast, by region

6.2.3. Market share analysis, by country

7. Dry Type Transformer Market, by Voltage Range

7.1. Low

7.1.1. Key market trends, growth factors and opportunities

7.1.2. Market size and forecast, by region

7.1.3. Market share analysis, by country

7.2. Medium

7.2.1. Key market trends, growth factors and opportunities

7.2.2. Market size and forecast, by region

7.2.3. Market share analysis, by country

8. Dry Type Transformer Market, by End-use

8.1. Industrial

8.1.1. Key market trends, growth factors and opportunities

8.1.2. Market size and forecast, by region

8.1.3. Market share analysis, by country

8.2. Commercial

8.2.1. Key market trends, growth factors and opportunities

8.2.2. Market size and forecast, by region

8.2.3. Market share analysis, by country

8.3. Others

8.3.1. Key market trends, growth factors and opportunities

8.3.2. Market size and forecast, by region

8.3.3. Market share analysis, by country

9. Dry Type Transformer Market, by Region

9.1. North America

9.1.1. Market size and forecast, by type, 2020-2027

9.1.2. Market size and forecast, by technology, 2020-2027

9.1.3. Market size and forecast, by phase, 2020-2027

9.1.4. Market size and forecast, by voltage range, 2020-2027

9.1.5. Market size and forecast, by end-use, 2020-2027

9.1.6. Market size and forecast, by country, 2020-2027

9.1.7. Comparative market share analysis, 2020 & 2027

9.1.8. U.S.

9.1.8.1. Comparative market share analysis, 2020& 2027

9.1.9. Canada

9.1.9.1. Market size and forecast, by type, 2020-2027

9.1.9.2. Market size and forecast, by technology, 2020-2027

9.1.9.3. Market size and forecast, by phase, 2020-2027

9.1.9.4. Market size and forecast, by voltage range, 2020-2027

9.1.9.5. Market size and forecast, by end-use, 2020-2027

9.1.9.6. Comparative market share analysis, 2020 & 2027

9.1.10. Mexico

9.1.10.1. Market size and forecast, by type, 2020-2027

9.1.10.2. Market size and forecast, by technology, 2020-2027

9.1.10.3. Market size and forecast, by phase, 2020-2027

9.1.10.4. Market size and forecast, by voltage range, 2020-2027

9.1.10.5. Market size and forecast, by end-use, 2020-2027

9.1.10.6. Comparative market share analysis, 2020 & 2027

9.2. Europe

9.2.1. Market size and forecast, by type, 2020-2027

9.2.2. Market size and forecast, by technology, 2020-2027

9.2.3. Market size and forecast, by phase, 2020-2027

9.2.4. Market size and forecast, by voltage range, 2020-2027

9.2.5. Market size and forecast, by end-use, 2020-2027

9.2.6. Market size and forecast, by country, 2020-2027

9.2.7. Comparative market share analysis, 2020 & 2027

9.2.8. UK

9.2.8.1. Market size and forecast, by type, 2020-2027

9.2.8.2. Market size and forecast, by technology, 2020-2027

9.2.8.3. Market size and forecast, by phase, 2020-2027

9.2.8.4. Market size and forecast, by voltage range, 2020-2027

9.2.8.5. Market size and forecast, by end-use, 2020-2027

9.2.8.6. Comparative market share analysis, 2020 & 2027

9.2.9. France

9.2.9.1. Market size and forecast, by type, 2020-2027

9.2.9.2. Market size and forecast, by technology, 2020-2027

9.2.9.3. Market size and forecast, by phase, 2020-2027

9.2.9.4. Market size and forecast, by voltage range, 2020-2027

9.2.9.5. Market size and forecast, by end-use, 2020-2027

9.2.9.6. Comparative market share analysis, 2020 & 2027

9.2.10. Spain

9.2.10.1. Market size and forecast, by type, 2020-2027

9.2.10.2. Market size and forecast, by technology, 2020-2027

9.2.10.3. Market size and forecast, by phase, 2020-2027

9.2.10.4. Market size and forecast, by voltage range, 2020-2027

9.2.10.5. Market size and forecast, by end-use, 2020-2027

9.2.10.6. Comparative market share analysis, 2020 & 2027

9.2.11. Italy

9.2.11.1. Market size and forecast, by type, 2020-2027

9.2.11.2. Market size and forecast, by technology, 2020-2027

9.2.11.3. Market size and forecast, by phase, 2020-2027

9.2.11.4. Market size and forecast, by voltage range, 2020-2027

9.2.11.5. Market size and forecast, by end-use, 2020-2027

9.2.11.6. Comparative market share analysis, 2020 & 2027

9.2.12. Rest of Europe

9.2.12.1. Market size and forecast, by type, 2020-2027

9.2.12.2. Market size and forecast, by technology, 2020-2027

9.2.12.3. Market size and forecast, by phase, 2020-2027

9.2.12.4. Market size and forecast, by voltage range, 2020-2027

9.2.12.5. Market size and forecast, by end-use, 2020-2027

9.2.12.6. Comparative market share analysis, 2020 & 2027

9.3. Asia Pacific

9.3.1. Market size and forecast, by type, 2020-2027

9.3.2. Market size and forecast, by technology, 2020-2027

9.3.3. Market size and forecast, by phase, 2020-2027

9.3.4. Market size and forecast, by voltage range, 2020-2027

9.3.5. Market size and forecast, by end-use, 2020-2027

9.3.6. Market size and forecast, by country, 2020-2027

9.3.7. Comparative market share analysis, 2020 & 2027

9.3.8. China

9.3.8.1. Market size and forecast, by type, 2020-2027

9.3.8.2. Market size and forecast, by technology, 2020-2027

9.3.8.3. Market size and forecast, by phase, 2020-2027

9.3.8.4. Market size and forecast, by voltage range, 2020-2027

9.3.8.5. Market size and forecast, by end-use, 2020-2027

9.3.8.6. Comparative market share analysis, 2020 & 2027

9.3.9. India

9.3.9.1. Market size and forecast, by type, 2020-2027

9.3.9.2. Market size and forecast, by technology, 2020-2027

9.3.9.3. Market size and forecast, by phase, 2020-2027

9.3.9.4. Market size and forecast, by voltage range, 2020-2027

9.3.9.5. Market size and forecast, by end-use, 2020-2027

9.3.9.6. Comparative market share analysis, 2020 & 2027

9.3.10. Australia

9.3.10.1. Market size and forecast, by type, 2020-2027

9.3.10.2. Market size and forecast, by technology, 2020-2027

9.3.10.3. Market size and forecast, by phase, 2020-2027

9.3.10.4. Market size and forecast, by voltage range, 2020-2027

9.3.10.5. Market size and forecast, by end-use, 2020-2027

9.3.10.6. Comparative market share analysis, 2020 & 2027

9.3.11. Rest of Asia Pacific

9.3.11.1. Market size and forecast, by type, 2020-2027

9.3.11.2. Market size and forecast, by technology, 2020-2027

9.3.11.3. Market size and forecast, by phase, 2020-2027

9.3.11.4. Market size and forecast, by voltage range, 2020-2027

9.3.11.5. Market size and forecast, by end-use, 2020-2027

9.3.11.6. Comparative market share analysis, 2020 & 2027

9.4. LAMEA

9.4.1. Market size and forecast, by type, 2020-2027

9.4.2. Market size and forecast, by technology, 2020-2027

9.4.3. Market size and forecast, by phase, 2020-2027

9.4.4. Market size and forecast, by voltage range, 2020-2027

9.4.5. Market size and forecast, by end-use, 2020-2027

9.4.6. Market size and forecast, by country, 2020-2027

9.4.7. Comparative market share analysis, 2020 & 2027

9.4.8. Latin America

9.4.8.1. Market size and forecast, by type, 2020-2027

9.4.8.2. Market size and forecast, by technology, 2020-2027

9.4.8.3. Market size and forecast, by phase, 2020-2027

9.4.8.4. Market size and forecast, by voltage range, 2020-2027

9.4.8.5. Market size and forecast, by end-use, 2020-2027

9.4.8.6. Comparative market share analysis, 2020 & 2027

9.4.9. Middle East

9.4.9.1. Market size and forecast, by type, 2020-2027

9.4.9.2. Market size and forecast, by technology, 2020-2027

9.4.9.3. Market size and forecast, by phase, 2020-2027

9.4.9.4. Market size and forecast, by voltage range, 2020-2027

9.4.9.5. Market size and forecast, by end-use, 2020-2027

9.4.9.6. Comparative market share analysis, 2020 & 2027

9.4.10. Africa

9.4.10.1. Market size and forecast, by type, 2020-2027

9.4.10.2. Market size and forecast, by technology, 2020-2027

9.4.10.3. Market size and forecast, by phase, 2020-2027

9.4.10.4. Market size and forecast, by voltage range, 2020-2027

9.4.10.5. Market size and forecast, by end-use, 2020-2027

9.4.10.6. Comparative market share analysis, 2020 & 2027

10. Company Profiles

10.1. ABB LIMITED

10.1.1. Business overview

10.1.2. Financial performance

10.1.3. Product portfolio

10.1.4. Recent strategic moves & developments

10.1.5. SWOT analysis

10.2. GENERAL ELECTRIC

10.2.1. Business overview

10.2.2. Financial performance

10.2.3. Product portfolio

10.2.4. Recent strategic moves & developments

10.2.5. SWOT analysis

10.3. EATON

10.3.1. Business overview

10.3.2. Financial performance

10.3.3. Product portfolio

10.3.4. Recent strategic moves & developments

10.3.5. SWOT analysis

10.4. SCHENEIDER ELECTRIC

10.4.1. Business overview

10.4.2. Financial performance

10.4.3. Product portfolio

10.4.4. Recent strategic moves & developments

10.4.5. SWOT analysis

10.5. SIEMENS

10.5.1. Business overview

10.5.2. Financial performance

10.5.3. Product portfolio

10.5.4. Recent strategic moves & developments

10.5.5. SWOT analysis

10.6. CG POWER AND INDUSTRIAL SOLUTIONS LIMITED

10.6.1. Business overview

10.6.2. Financial performance

10.6.3. Product portfolio

10.6.4. Recent strategic moves & developments

10.6.5. SWOT analysis

10.7. TOSHIBA CORPORATION

10.7.1. Business overview

10.7.2. Financial performance

10.7.3. Product portfolio

10.7.4. Recent strategic moves & developments

10.7.5. SWOT analysis

10.8. BHARAT HEAVY ELECTRICALS LIMITED

10.8.1. Business overview

10.8.2. Financial performance

10.8.3. Product portfolio

10.8.4. Recent strategic moves & developments

10.8.5. SWOT analysis

10.9. RAYCHEM RPG PRIVATE LIMITED

10.9.1. Business overview

10.9.2. Financial performance

10.9.3. Product portfolio

10.9.4. Recent strategic moves & developments

10.9.5. SWOT analysis

10.10. INSTRUMENT TRANSFORMER EQUIPMENT CORPORATION

10.10.1. Business overview

10.10.2. Financial performance

10.10.3. Product portfolio

10.10.4. Recent strategic moves & developments

10.10.5. SWOT analysis

Dry type transformer is a type of power and magnetic core transformer that is designed on a relatively modern technology which uses forced or natural air cooling instead of oil. Dry type transformer uses environmentally safe high temperature insulation systems to cool. As this transformer consists of no moving parts, it requires least maintenance, while offering long-run cycle and reliability. Dry type transformers are completely hazard-free, and thus can be easily installed in schools, hospitals, factories, buildings, and chemical plants where fire safety is a major concern.

COVID-19 Impact on the Global Industry

The global dry type transformer market is anticipated to witness a decline in the growth rate in the COVID-19 pandemic. This is mainly due to the lockdown enforced across the globe, which has led to delay in projects & construction, disruption of supply chain, adverse impact on biofuel investments, lack of commission of renewable electricity projects, and other renewable heat projects. According to International Renewable Energy Agency (IRENA), China is the largest renewable energy producer across the globe with 40% of the global solar industry dependent on the country. These factors have adversely affected the growth of the global dry transformer market during the pandemic crisis.

However, many countries and industry players are taking strategic steps to sustain in the COVID-19 pandemic. For instance, in March 2020, Hammond Power Solutions (HPS) announced to continue supply their products online and that all the facilities will remain open even during the lockdown period. Furthermore, in September 2020, Germany announced to boost the production of transformers of all sizes & voltages by about 4.5%. These factors are generating investment opportunities for the global dry type transformer industry.

Key Developments in the Global Market

The key industry players are taking initiatives and adopting various business tactics & growth strategies such as mergers & acquisitions, partnerships, and product launches to maintain a strong position in the overall market, which is subsequently helping the dry type transformer market to grow exponentially.

In November 2018, ABB introduced the world’s first oil free dry-type digital transformer, ‘ABB Ability TXpert Dry’ and another transformer ‘TXpand’ at an event in in Xiamen, China. The aim of the company behind this new range product launches is to facilitate digitalization of grids and offer enhanced reliability, safety, and efficacy.

In January 2019, a leading manufacturer of dry type transformers & magnetics, Hammond Power Solutions launched an improved & upgraded line of three-phase encapsulated transformers for harsh and industrial environments. The HPS Titan N transformer is fully encapsulated in silica and epoxy, prevents the ingress of moisture, and provides protection from airborne contaminants.

Forecast Analysis of Dry Type Transformer Market

Global dry type transformer market is anticipated to witness a noteworthy growth over the forecast period due to the growing focus on replacing the existing electric equipment with advanced and high-quality systems. In addition, technological advancements in dry type transformers is expected to create massive opportunities for the global market growth by 2027. Conversely, higher costs associated with dry type transformers is likely to hamper the market growth in the near future.

The growing industrialization and the expansion in electricity distribution across the globe are the major factors estimated to boost the growth of the global dry type transformer market in the forecast period. Research Dive in its latest published report anticipates that the dry type transformer market will grow at a CAGR of 6.1% from 2020 to 2027. The Asia Pacific region is anticipated to witness a considerable growth throughout the forecast, owing to rising demand for electricity distribution in developing countries. The key players functioning in the global industry include General Electric, ABB Limited, Eaton Corporation, Siemens AG, Schneider Electric, CG Power and Industrial Solutions Ltd, Bharat Heavy Electricals Limited, Toshiba Corporation, and Raychem RPG.

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com