Intrathecal Drug Delivery System Market Report

RA00043

Intrathecal Drug Delivery System Market, By Product Type (Externalized and connected to a pump and Fully Implemented) By Application (Pain Management, Spasticity Management). Regional Analysis (North America, Europe, Asia Pacific, LAMEA) Global Opportunity Analysis and Industry Forecast, 2020–2027

Intrathecal Drug Delivery System Market Outlook 2027:

The Global Intrathecal Drug Delivery System Market was $ 975.1 Million in 2019 and forecast will be $ 1,662.0 Million in 2027, registering a CAGR of 7.2% from 2019 to 2027.

Intrathecal Drug Delivery plays the crucial role in the treatment of intractable pain in a small group of suitably selected patients, such as significant reduction in quality of life along with that have no other treatment. Intrathecal drug delivery, also called as the "pain pump," which uses the small pump for the delivery of pain medication directly to patient’s spinal cord.

Intrathecal Drug Delivery System Market Driving Factors:

Rising prevalence of cancer all over the globe is giving significant boost to the growth of Global Market for Intrathecal Drug Delivery Systems

Intrathecal drug delivery system market drivers such as increasing demand for (IDD) Intrathecal Drug Delivery system along with extensively improved analgesia are anticipated to upsurge the global market of intrathecal drug delivery system. Unavoidable cancer pain treated with dosages of opioids may cause systematic complications such as excessive sedation and pneumonia. On the other hand, intrathecal drug delivery system has less adverse effects as compare to traditional opioid-based (morphine & morphine - like) treatments. Therefore, it is expected that intrathecal drug delivery system may boost the market in upcoming years.

Market Restraints:

Inequality issues coupled with expensive cell therapy treatments will pose a severe threat to the Cancer Stem Cells Market growth

Complications of ITDD System such as pharmacological complications, mechanical system complications, surgical complications, patient-specific complications are projected to decline the Intrathecal Drug Delivery System market share. Such complications may occur during the pump refill related to either reprogramming error, or medication error leading to systemic toxicity or death.

Trends and Future Opportunities in Intrathecal Drug Delivery System Market:

Growing acceptance for IT Therapy worldwide will create the enormous opportunities to the Intrathecal Drug Delivery

Adoption of IT therapies for cancer cases coupled with numerous prospective trials over terminal illness and cancer are expected to create enormous opportunities for the growth of intrathecal drug delivery system market. For instance, IT therapy has become widely accepted alternative for the standard medical management for patients of cancer. These therapies can effectively decrease neuropathic pain of cancer patient, along with decreasing the requirement for supplementary opioids. For instance, as per Staats et al study, it is found that AIDS patient suffering from pain experienced statistically and clinically significant analgesia when treated with implantable device.

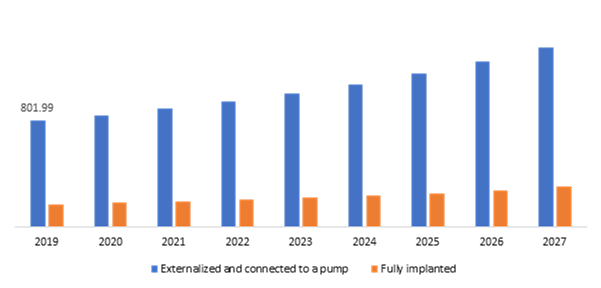

Intrathecal Drug Delivery System market, by Product Type:

Externalized and connected to a pump market is projected to hold a dominant share, owing to increasing demand for IDD System along with the Cost – Effectiveness

Source: Research Dive Analysis

Externalized and connected to a pump market generated a revenue of $801.9 million in 2019, and is further projected to reach up to $1,358.6 million by the year of 2027.

Depending on product type the market is divided into externalized and connected to a pump and Fully Implemented. Externalized and connected to a pump has the highest market share owing to Rising demand for Intrathecal Drug Delivery System for cancer pain and cost–effectiveness cancer pain treatment.

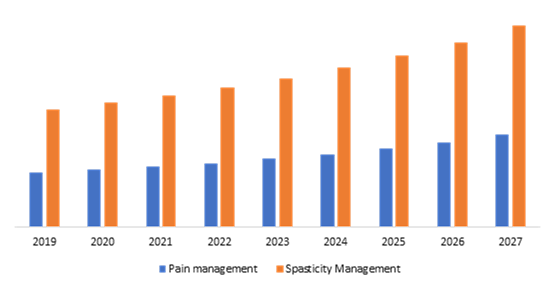

Intrathecal Drug Delivery System market, By Application:

Spasticity Management segment is will generate revenue of $1,140.2 Mn by the year 2027

Source: Research Dive Analysis

Spasticity Management segment generated a revenue of $668.0 million in 2019, and is further projected to reach upto $1,140.2 million by the year of 2027.

By Application, Intrathecal Drug Delivery System market is categorized into Pain Management and Spasticity Management. Spasticity Management contributes the most among the application segment. With the advent of fully programmable systems spasticity is managed by controlling the flow of drug delivery which is essential as spasticity patients require varying drug based on condition and body requirement.

Intrathecal Drug Delivery System market, by Region:

North America region will dominate the global market during the projected period, owing to the enduring nature of the Intrathecal devices

North America Intrathecal Drug Delivery System Market:

North America has the highest intrathecal drug delivery system market size globally and is expected generate revenue of $392.7 million in 2019, and is further projected to reach upto $695.9 million by the year of 2027.

In North America the growth of fully implanted Intrathecal drug device is on the rise due to ease of usage which signifies better control and long-lasting nature of the Intrathecal devices. Thus, this is one of the major driving factors for Intrathecal drug devices. Spasticity management is also one of the major reasons why an ITDD system is growing in North America.

U.S, hold the majority of the share of the North America market and it is one of the leading countries globally. Companies are spending heavily on research & Development activities, inorder to provide innovative and effective pain management solution thereby driving the growth of Intrathecal Drug delivery systems in the country. For instance, In U.S, the FDA approved the SynchroMed II myPTM Personal Therapy Manager of Medtronic Company. This has significant usage for patients suffering from chronic pain.

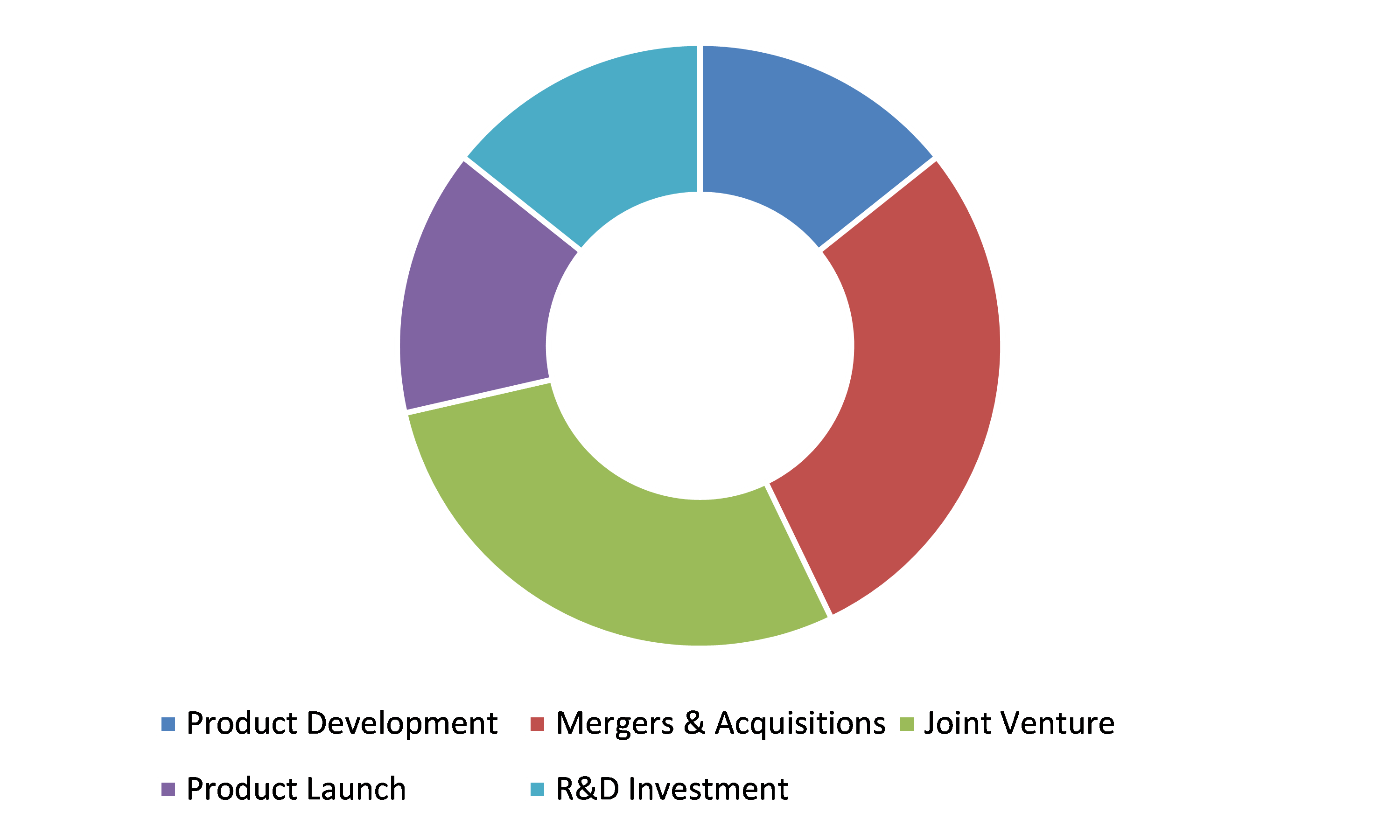

Key participants in Global Intrathecal Drug Delivery System Market:

Merger & Acquisition and Advanced Product development are the frequent strategies followed by the market players

Source: Research Dive Analysis

Some of the prominent manufacturers of Intrathecal drug delivery system include Medtronic Plc, Flownix Medical Inc, Teleflex Incorporated, DePay Synthes, Tricumed Medizintechnik GmbH, Smiths Group Plc, Summit Medical Group, B Braun Melsungen AG, Becton, Dickinson & Company and Fresenius Medical Care AG & Co. KGaA. To gain competitive advantage these companies investing heavily in R&D for devolving fully programmable ITDD which can be fully implanted within the body and is safe for use coupled with the ability to control the flow of the drug delivery.

Scope of the Market Report:

| Aspect | Particulars |

| Historical Market Estimations | 2018-2019 |

| Base Year for Market Estimation | 2018 |

| Forecast timeline for Market Projection | 2020-2027 |

| Geographical Scope | North America, Europe, Asia-Pacific, LAMEA |

| By Product Type |

|

| Segmentation by application |

|

| Key Countries covered | U.S., Canada, Germany, France, Spain, Russia, Japan, China, India, South Korea, Australia, Brazil, and Saudi Arabia |

| Key Companies Profiled |

|

Source: Research Dive Analysis

Q1. What is intrathecal drug delivery system?

A. The intrathecal drug delivery system market size was over $975.1 million in 2019, and is further anticipated to reach $1662.0 million by 2027.

Q2. Who are the leading companies in the intrathecal drug delivery system Market?

A. Summit Medical Group, B Braun Melsungen AG, Becton, Dickinson & Company are some of the key players in the global intrathecal drug delivery system market.

Q3. Which region possess greater investment opportunities in the coming future?

A. North-America region possess great investment opportunities for the investors to witness the most promising growth in the coming years.

Q4. What is the growth rate of North America market?

A. North America intrathecal drug delivery system market is projected to grow at 7.4% CAGR during the forecast period.

Q5. What are the strategies opted by the leading players in this market?

A. Product development, and joint ventures are the key strategies opted by the operating companies in this market.

Q6. Which companies are investing more on R&D practices?

A. Medtronic Plc and Flownix Medical Inc companies are investing more on R&D activities for developing new products and technologies.

1. Research Methodology

1.1. Desk Research

1.2. Real time insights and validation

1.3. Forecast model

1.4. Assumptions and forecast parameters

1.4.1. Assumptions

1.4.2. Forecast parameters

1.5. Data sources

1.5.1. Primary

1.5.2. Secondary

2. Executive Summary

2.1. 360° summary

2.2. Product Type

2.3. Application

3. Market overview

3.1. Market segmentation & definitions

3.2. Key takeaways

3.2.1. Top investment pockets

3.2.2. Top winning strategies

3.3. Porter’s five forces analysis

3.3.1. Bargaining power of consumers

3.3.2. Bargaining power of suppliers

3.3.3. Threat of new entrants

3.3.4. Threat of substitutes

3.3.5. Competitive rivalry in the market

3.4. Market dynamics

3.4.1. Drivers

3.4.2. Restraints

3.4.3. Opportunities

3.5. Technology landscape

3.6. Regulatory landscape

3.7. Patent landscape

3.8. Market value chain analysis

3.8.1. Stress point analysis

3.9. Strategic overview

4. Intrathecal Drug Delivery Systems Market, by Product

4.1. Externalized and connected to a pump

4.1.1. Market size and forecast, by region, 2016-2026

4.1.2. Comparative market share analysis, 2018 & 2026

4.2. Fully Implanted

4.2.1. Market size and forecast, by region, 2016-2026

4.2.2. Comparative market share analysis, 2018 & 2026

5. Intrathecal Drug Delivery Systems Market, by Application

5.1. Pain Management

5.1.1. Market size and forecast, by region, 2016-2026

5.1.2. Comparative market share analysis, 2018 & 2026

5.2. Spasticity Management

5.2.1. Market size and forecast, by region, 2016-2026

5.2.2. Comparative market share analysis, 2018 & 2026

6. Intrathecal Drug Delivery Systems Market, by Region

6.1. North America

6.1.1. Market size and forecast, by Product, 2016-2026

6.1.2. Market size and forecast, by application, 2016-2026

6.1.3. Market size and forecast, by country, 2016-2026

6.1.4. Comparative market share analysis, 2018 & 2026

6.1.5. U.S.

6.1.5.1. Market size and forecast, by Product, 2016-2026

6.1.5.2. Market size and forecast, by application, 2016-2026

6.1.5.3. Comparative market share analysis, 2018 & 2026

6.1.6. Canada

6.1.6.1. Market size and forecast, by Product, 2016-2026

6.1.6.2. Market size and forecast, by application, 2016-2026

6.1.6.3. Comparative market share analysis, 2018 & 2026

6.1.7. Mexico

6.1.7.1. Market size and forecast, by Product, 2016-2026

6.1.7.2. Market size and forecast, by application, 2016-2026

6.1.7.3. Comparative market share analysis, 2018 & 2026

6.2. Europe

6.2.1. Market size and forecast, by Product, 2016-2026

6.2.2. Market size and forecast, by application, 2016-2026

6.2.3. Market size and forecast, by country, 2016-2026

6.2.4. Comparative market share analysis, 2018 & 2026

6.2.5. Germany

6.2.5.1. Market size and forecast, by Product, 2016-2026

6.2.5.2. Market size and forecast, by application, 2016-2026

6.2.5.3. Comparative market share analysis, 2018 & 2026

6.2.6. Spain

6.2.6.1. Market size and forecast, by Product, 2016-2026

6.2.6.2. Market size and forecast, by application, 2016-2026

6.2.6.3. Comparative market share analysis, 2018 & 2026

6.2.7. France

6.2.7.1. Market size and forecast, by Product, 2016-2026

6.2.7.2. Market size and forecast, by application, 2016-2026

6.2.7.3. Comparative market share analysis, 2018 & 2026

6.2.8. Italy

6.2.8.1. Market size and forecast, by Product, 2016-2026

6.2.8.2. Market size and forecast, by application, 2016-2026

6.2.8.3. Comparative market share analysis, 2018 & 2026

6.2.9. Rest of the Europe

6.2.9.1. Market size and forecast, by Product, 2016-2026

6.2.9.2. Market size and forecast, by application, 2016-2026

6.2.9.3. Comparative market share analysis, 2018 & 2026

6.3. Asia-Pacific

6.3.1. Market size and forecast, by Product, 2016-2026

6.3.2. Market size and forecast, by application, 2016-2026

6.3.3. Market size and forecast, by country, 2016-2026

6.3.4. Comparative market share analysis, 2018 & 2026

6.3.5. China

6.3.5.1. Market size and forecast, by Product, 2016-2026

6.3.5.2. Market size and forecast, by application, 2016-2026

6.3.5.3. Comparative market share analysis, 2018 & 2026

6.3.6. Japan

6.3.6.1. Market size and forecast, by Product, 2016-2026

6.3.6.2. Market size and forecast, by application, 2016-2026

6.3.6.3. Comparative market share analysis, 2018 & 2026

6.3.7. India

6.3.7.1. Market size and forecast, by Product, 2016-2026

6.3.7.2. Market size and forecast, by application, 2016-2026

6.3.7.3. Comparative market share analysis, 2018 & 2026

6.3.8. Australia

6.3.8.1. Market size and forecast, by Product, 2016-2026

6.3.8.2. Market size and forecast, by application, 2016-2026

6.3.8.3. Comparative market share analysis, 2018 & 2026

6.3.9. South Korea

6.3.9.1. Market size and forecast, by Product, 2016-2026

6.3.9.2. Market size and forecast, by application, 2016-2026

6.3.9.3. Comparative market share analysis, 2018 & 2026

6.3.10. Rest of the Asia Pacific

6.3.10.1. Market size and forecast, by Product, 2016-2026

6.3.10.2. Market size and forecast, by application, 2016-2026

6.3.10.3. Comparative market share analysis, 2018 & 2026

6.4. LAMEA

6.4.1. Market size and forecast, by Product, 2016-2026

6.4.2. Market size and forecast, by application, 2016-2026

6.4.3. Market size and forecast, by country, 2016-2026

6.4.4. Comparative market share analysis, 2018 & 2026

6.4.5. Brazil

6.4.5.1. Market size and forecast, by Product, 2016-2026

6.4.5.2. Market size and forecast, by application, 2016-2026

6.4.5.3. Comparative market share analysis, 2018 & 2026

6.4.6. Saudi Arabia

6.4.6.1. Market size and forecast, by Product, 2016-2026

6.4.6.2. Market size and forecast, by application, 2016-2026

6.4.6.3. Comparative market share analysis, 2018 & 2026

6.4.7. South Africa

6.4.7.1. Market size and forecast, by Product, 2016-2026

6.4.7.2. Market size and forecast, by application, 2016-2026

6.4.7.3. Comparative market share analysis, 2018 & 2026

6.4.8. Rest of LAMEA

6.4.8.1. Market size and forecast, by Product, 2016-2026

6.4.8.2. Market size and forecast, by application, 2016-2026

6.4.8.3. Comparative market share analysis, 2018 & 2026

7. Company profiles

7.1. Flownix Medical Inc

7.1.1. Business overview

7.1.2. Financial performance

7.1.3. Product portfolio

7.1.4. Recent strategic moves & developments

7.1.5. SWOT analysis

7.2. Teleflex Incorporated

7.2.1. Business overview

7.2.2. Financial performance

7.2.3. Product portfolio

7.2.4. Recent strategic moves & developments

7.2.5. SWOT analysis

7.3. Medtronics Plc

7.3.1. Business overview

7.3.2. Financial performance

7.3.3. Product portfolio

7.3.4. Recent strategic moves & developments

7.3.5. SWOT analysis

7.4. DePay Synthes

7.4.1. Business overview

7.4.2. Financial performance

7.4.3. Product portfolio

7.4.4. Recent strategic moves & developments

7.4.5. SWOT analysis

7.5. Tricumed Medizintechnik GmbH

7.5.1. Business overview

7.5.2. Financial performance

7.5.3. Product portfolio

7.5.4. Recent strategic moves & developments

7.5.5. SWOT analysis

7.6. Smiths Group Plc

7.6.1. Business overview

7.6.2. Financial performance

7.6.3. Product portfolio

7.6.4. Recent strategic moves & developments

7.6.5. SWOT analysis

7.7. Summit Medical Group.

7.7.1. Business overview

7.7.2. Financial performance

7.7.3. Product portfolio

7.7.4. Recent strategic moves & developments

7.7.5. SWOT analysis

7.8. B Braun Melsungen AG,

7.8.1. Business overview

7.8.2. Financial performance

7.8.3. Product portfolio

7.8.4. Recent strategic moves & developments

7.8.5. SWOT analysis

Since ages, anaesthetists have been using the intrathecal (IT) space to provide optimum anaesthesia and analgesia. Especially, to help patients bear the pain during the operative period, and also for postoperative pain relief. Cancer pain can arise due to a tumor compressing or infiltrating tissue. In addition to this, pain occurs in 67% of the patients with metastatic cancer. Treatments such as chemotherapy, radiations, and surgery might give rise to painful conditions that continue for a longer duration, even after the treatment is completed. Hence, the method using intrathecal drug delivery system is been considered more beneficial and efficient as compared to the other methods.

Benefits of Intrathecal drug delivery system

Intrathecal drug delivery treatment is mainly used to give more comfort and relief from chronic pain so that the patient bears the pain and gets cured easily. Some of these drugs have been able to lessen or even eradicate oral or systemic pain medications. An intrathecal drug delivery system consists of a catheter connected to a pump. The pump can be an external system or a completely implanted device with a container that can be refilled percutaneously. The fully implantable pumps come in two different types: one is the fixed-rate and the other is programmable. Also, various infusion options are available in these pumps such as simple continuous or more complex variable rates.

Intrathecal drug delivery systems are not a complete cure and may not help the patient get rid of all the pain or spasm—patients will still have to continue with their other medicines. However, it is an ideal treatment for controlling the symptoms of the current medicines and can help patients be more active, return to their everyday activities, and sleep better.

A potential research has stated that considerable improvements have been observed in the mood, pain, and function of the patients implanted with an Intrathecal drug delivery system. However, patients who were not treated through an IT device exhibited a significant deterioration of the physical functions, depression, and anxiety scores.

Growing demand for Intrathecal drug delivery devices

The major factors accountable for the growth in development of these systems are the growing demand for intrathecal drug delivery system for treating cancer pain. Furthermore, rise in the use of cost-effective cancer pain treatment using such systems is anticipated to fuel the growth of intrathecal drug delivery system sector in the upcoming years. However, some mechanical complications in the ITDD systems are limiting the growth of the intrathecal drug delivery systems market. Some of these mechanical complications include a variety of errors that can lead to a sudden drop in medication administration resulting in potential withdrawal, or a considerable overdose resulting in respiratory depression, hemodynamic instability, and possibly death.

Rising investments of market players in Intrathecal drug delivery system market

Several major companies in Intrathecal drug Delivery Systems are profoundly investing in IT enabled technological up-gradation of Intrathecal drug delivery systems that are programmable as well as able to control the flow of drug into the patient’s body. Additionally, some of these companies are making efforts for getting FDA approval for their products and are participating in activities such as partnerships and collaborations. For instance, Flowonix Medical, Inc., a medical device company and Cerebral Therapeutics, Inc., a clinical-stage pharmaceutical company declared the successful implant of the fifth patient in the ADDRESS (Australian Direct Drug Administration for Refractory Epilepsy) trial. Together, they have established a treatment consisting of a micro-infusion device that manages the drug delivery to a part of the brain for patients having medically refractory epilepsy.

The growing investments by these companies in research & development activities, to develop an effective and advance pain management solution is boosting the growth of Intrathecal Drug delivery systems market all across the world. For instance, in the U.S, Medtronic plc declared the approval of the U.S. Food and Drug Administration (FDA) for its new SynchroMed II myPTM Personal Therapy Manager for patients with chronic pain. This device helps patients ease their unpredictable pain by offering boluses as per requirement, or drug doses within therapeutic limits prescribed by their doctor.

Medtronic plc is one of the well-known manufacturers of fully programmable intrathecal drug delivery systems. The other major players in the industry include Teleflex Incorporated, Smiths Group Plc, Flownix Medical Inc, DePay Synthes, Tricumed Medizintechnik GmbH, Summit Medical Group, B Braun Melsungen AG, Becton, Dickinson & Company, and Fresenius Medical Care AG & Co. KGaA.

Apart from these companies, Alcyone Lifesciences is one of the companies that has recently received FDA's breakthrough designation for its delivery system for intrathecal bolus administration of medicines to cure severe central nervous system disorders. The ThecaFlex DRx system has a port that is implanted below the patient’s skin and an intrathecal catheter for cerebrospinal fluid aspiration as well as infusion of treatments.

Future of Intrathecal drug delivery system market

Since the last two decades, IT therapy has been gaining acceptance as an alternative standard medical treatment for cancer patients with medium to severe intractable pain. In North America, the development of fully implanted Intrathecal drug system is increasing day by day owing to its easy and comfortable usage with better control and long-lasting nature of these Intrathecal devices. Moreover, according to a research report by Research Dive, the Intrathecal drug delivery system market is expected to generate a revenue of $1,662.0 million by the end of 2017 and will grow at a CAGR of 6.9% from 2020 to 2027. Hence, it is clear that the growing acceptance of Intrathecal drug delivery system, rising investments in the development of Intrathecal drug delivery devices, and advanced benefits of this device are sure to boost the growth of the market significantly, in the upcoming years.

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com