Dextrin Market Report

RA04159

Dextrin Market by Type (Maltodextrin, Cyclodextrin, Amylodextrin, and Others), Application (Food, Pharmaceutical, Industrial, Cosmetics, and Others), and Regional Analysis (North America, Europe, Asia-Pacific, and LAMEA): Global Opportunity Analysis and Industry Forecast, 2021–2028

Global Dextrin Market Analysis

The global dextrin market size is predicted to garner $3,538.00 million in the 2021–2028 timeframe, growing from $2,656.90 million in 2020, at a healthy CAGR of 3.60%.

Market Synopsis

Strategic alliances among market players, along with growing demands for dextrin in number of health benefits, are expected to accelerate the growth of the dextrin market.

However, side effects of high consumption of dextrin such as weight gain might be growth-restricting factor for the market.

According to the regional analysis, the Asia-Pacific dextrin market size is anticipated to grow during the review period and generate a revenue of $1,238.30 million, with CAGR of 3.60% due to increasing consumption of dextrin in food industry.

Dextrin Overview

Dextrin is low molecular carbohydrate, a colorless, odorless, and tasteless substance. Dextrin is formed by hydrolyzing the glycogen or starch. It is mostly available in potatoes, non-wheat, rice, corn, and other sources. Moreover, dextrin is applicable in many industries such as food industry for food finishing and processing. Also, dextrin is used in pharm industries as a binding agent.

Covid-19 Impact on Dextrin Market Shares

The novel coronavirus pandemic had a devastating effect on several industries. The global dextrin market experienced a moderate growth during this period. Dextrin market growth was affected due to the outbreak of COVID-19 in three different ways such as demand, production, supply chain, and market disruption. Also, ongoing restrictions in manufacturing units are some of the factors that decrease the market for dextrin.

On the other hand, there are many companies that are working dedicatedly to support customers in pandemic times to deliver essential food items. For instance, in May 2020, Tate & Lyle, global supplier of food and beverage ingredients, revealed that they have experienced higher demand for shelf-stable foods and ingredients used in packaged in Europe and North America regions. The above-stated factors show that the pandemic may generate substantial investment opportunities in the market in the coming years.

Increasing Prevalence of Dextrin in Medicines to Surge the Market Growth

The global dextrin industry is witnessing a massive growth mainly due to increasing demand for dextrin in healthcare and pharmaceutical industry that carries health benefits such as dextrin with saline solution can dehydrate the body and dextrin can lower down the blood sugar level. Moreover, increasing demand for natural ingredients are some of the factors that may boost expansions to fuel the growth of the global dextrin market.

Furthermore, according to an article in Medical News Today, in July 2018, FDA (U.S. Food and Drug Administration) revealed that maltodextrin is safe to consume when taken in proper amount. Along this, maltodextrin is the best choice for people that needs quick energy and muscle gain and therefore many athletes use maltodextrins. These factors that are predicted to drive the growth of the market.

To know more about global dextrin market trends, drivers, get in touch with our analysts here.

Side Effects of Dextrin to Restrain the Market Growth

Dextrin is safe to consume but there are several side effects of using too much dextrin such as rapid breathing, low blood phosphate, swelling, loss of consciousness, and other side effects. These are some of the factors anticipated to hinder the market value of the dextrin in the next few years.

Growing Demand for Dextrin in Textile Industry to Create Massive Investment Opportunities

The global dextrin market is spreading at a very fast pace due to increasing demand for dextrin as textile coating and finishing agent to increase stiffness and weight of textile fabrics. Also, dextrin is chemical free and therefore it is used in textile industry. All such aspects thereby are positively affecting the market growth.

Furthermore, dextrin industry already has leading market players innovating strategies to attract customers. For example, Angel Starch And Food Private Limited, manufacturer and exporters of industrial starch, offers various dextrin starch such as Tapioca White Dextrin that is mostly used in textile as an efficient thickening agent and provides stiffness to clothes. All such aspects may further lead to lucrative market opportunities for key players in the upcoming years.

To know more about global dextrin market trends, opportunities, get in touch with our analysts here.

Based on type, the market has been divided into Maltodextrin, cyclodextrin, amylodextrin, and others sub-segments of which the Maltodextrin sub-segment is projected to generate the maximum revenue as well as show the fastest growth. Download PDF Sample ReportDextrin Market

By Type

Source: Research Dive Analysis

The maltodextrin type sub-segment is predicted to have a dominating share as well as fastest market growth in the global market. The sub-segment is expected to register a revenue of $1,836.60 million during the forecast period. Maltodextrin is type of dextrin that comes in powdery form and is extracted from potato, corn, and rice. Moreover, according to an article by Healthline, information provider of healthcare products, in September 2018, maltodextrin is the best fast-digesting carbohydrate and therefore maltodextrin supplements can easily be helpful in maintaining anaerobic power during exercise. These factors and strategic alliances may bolster the growth of the sub-segment during the forecast period and surge the dextrin market demand.

Dextrin Market

By ApplicationOn the basis of application, the market has been sub-segmented into Food, pharmaceutical, industrial, cosmetics, and others sub-segments. Among the mentioned sub-segments, the Food sub-segment is predicted to show the fastest growth as well as dominant market share.

Source: Research Dive Analysis

The food sub-segment of the global dextrin market is projected to have the dominant share. It is also projected to surpass $1,242.50 million by 2028, with an increase from $890.1 million in 2020. This growth in the market can be attributed to growing demand for dextrin such as wheat dextrin, corn dextrin, potato dextrin, and others in food industry due to its high consumption in dairy, bakery, confectionary, and other types of dairy products as a thickening and gelling agent. Also, rising population of health-conscious people that consume health supplements for weight loss may increase the demand for sub-segment and dextrin market.

Dextrin Market

By RegionThe dextrin market share was investigated across North America, Europe, Asia-Pacific, and LAMEA.

Source: Research Dive Analysis

The Market for Dextrin in Asia-Pacific to be the Most Dominant

The Asia-Pacific dextrin market accounted $932.6 million in 2020 and is projected to register a revenue of $1,238.30 million by 2028. The extensive growth of the Asia-Pacific dextrin market is mainly driven by higher disposable incomes with existence of top leading companies augmenting the industry growth in the region. Moreover, growing demands for dextrin in textile and paper industries across China, India, Japan, and other countries is one of the factors that is fueling the market growth across the globe. These factors will ultimately drive the demand in the dextrin market across the region.

The Market for Dextrin in Europe to be the Fastest Growing

The share of Europe dextrin market is expected to rise at a CAGR of 4.50%, by registering a revenue of $1,022.50 million by 2028. The growth shall be a result of rising demand for wheat dextrin in food industry for food finishing and as a thickener. In addition to this, Netherland and Germany are the most leading countries in dextrin market. Such aspects may bolster the demand for dextrin market, in the upcoming years.

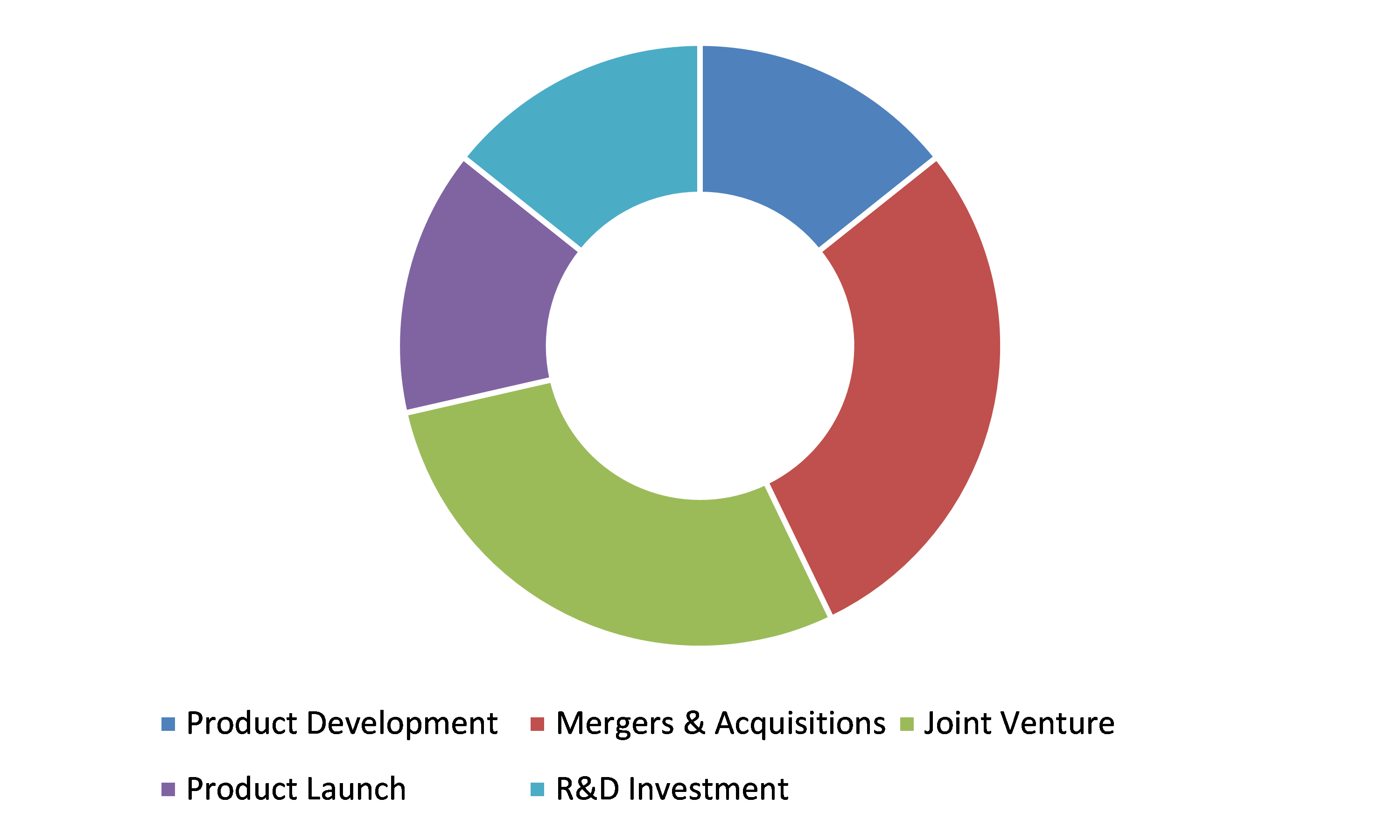

Competitive Scenario in the Global Dextrin Market

Product launches and mergers & acquisitions are common strategies followed by major market players.

Source: Research Dive Analysis

Some of the leading dextrin market players are Archer Daniels Midland Company, Cargill, Inc., Tate & Lyle, Roquette Frères S.A, Ingredion Incorporated, American Key Products, Inc., Meelunie B.V, Agridient Inc., Emsland Group, and Avebe.

Porter’s Five Forces Analysis for the Global Dextrin Market:

- Bargaining Power of Suppliers: The product suppliers of dextrin market are high in number and are larger and more globalized. So, there will be less threat from the suppliers.

Thus, the bargaining power of suppliers is low. - Bargaining Power of Buyers: Buyers demand different types of dextrin that give health benefits. This has increased the pressure on the dextrin providers to offer the best dextrin in different forms and colors. This gives the buyers the option to freely choose dextrin that best fits their preference.

Thus, the bargaining power of the buyers is high. - Threat of New Entrants: Companies entering the dextrin market are adopting various innovations such as developing dextrin that are available in textures and colors.

Thus, the threat of the new entrants is moderate. - Threat of Substitutes: There are different forms of starch available for various industries, but dextrin is the best choice because it is chemical free and healthier as suggested by many studies.

Thus, the threat of substitutes is low. - Competitive Rivalry in the Market: The competitive rivalry among industry leaders is rather intense, especially between the global players including Archer Daniels Midland Company and Cargill, Inc. These companies are launching their value-added services in the international market and strengthening the footprint worldwide.

Therefore, competitive rivalry in the market is high.

| Aspect | Particulars |

| Historical Market Estimations | 2019-2020 |

| Base Year for Market Estimation | 2020 |

| Forecast Timeline for Market Projection | 2021-2028 |

| Geographical Scope | North America, Europe, Asia-Pacific, LAMEA |

| Segmentation by Type |

|

| Segmentation by Application |

|

| Key Companies Profiled |

|

Q1. What is the size of the global dextrin market?

A. The size of the global dextrin market was over $2,656.90 million in 2020 and is projected to reach $3,538.00 million by 2028.

Q2. Which are the major companies in the dextrin market?

A. Archer Daniels Midland Company and Cargill, Inc. are some of the key players in the global dextrin market.

Q3. Which region, among others, possesses greater investment opportunities in the near future?

A. The Asia-Pacific region possesses great investment opportunities for investors to witness the most promising growth in the future.

Q4. What will be the growth rate of the Asia-Pacific Dextrin market?

A. Asia Pacific dextrin market is anticipated to grow at 3.60% CAGR during the forecast period.

Q5. What are the strategies opted by the leading players in this market?

A. Technological development and strategic partnerships are the key strategies opted by the operating companies in this market.

Q6. What are the segments of dextrin market?

A. Some of the segments of dextrin market are based upon type and end-user.

1.Research Methodology

1.1.Desk Research

1.2.Real time insights and validation

1.3.Forecast model

1.4.Assumptions and forecast parameters

1.4.1.Assumptions

1.4.2.Forecast parameters

1.5.Data sources

1.5.1.Primary

1.5.2.Secondary

2.Executive Summary

2.1.360° summary

2.2.By type trends

2.3.By application trends

3.Market overview

3.1.Market segmentation & definitions

3.2.Key takeaways

3.2.1.Top investment pockets

3.2.2.Top winning strategies

3.3.Porter’s five forces analysis

3.3.1.Bargaining power of consumers

3.3.2.Bargaining power of suppliers

3.3.3.Threat of new entrants

3.3.4.Threat of substitutes

3.3.5.Competitive rivalry in the market

3.4.Market dynamics

3.4.1.Drivers

3.4.2.Restraints

3.4.3.Opportunities

3.5.Technology landscape

3.6.Regulatory landscape

3.7.Patent landscape

3.8.Market value chain analysis

3.8.1.Stress point analysis

3.8.2.Raw material analysis

3.8.3.Manufacturing process

3.8.4.Application analysis

3.8.5.Operating vendors

3.8.5.1.Raw material suppliers

3.8.5.2.type manufacturers

3.8.5.3.type distributors

3.9.Strategic overview

4.Dextrin Market, by Type

4.1.Overview

4.1.1.Market size and forecast, by type

4.2.Maltodextrin

4.2.1.Key market trends, growth factors, and opportunities

4.2.2.Market size and forecast, by region, 2020-2028

4.2.3.Market share analysis, by country 2020 & 2028

4.3.Cyclodextrin

4.3.1.Key market trends, growth factors, and opportunities

4.3.2.Market size and forecast, by region, 2020-2028

4.3.3.Market share analysis, by country 2020 & 2028

4.4. Amylodextrin

4.4.1.Key market trends, growth factors, and opportunities

4.4.2.Market size and forecast, by region, 2020-2028

4.4.3.Market share analysis, by country 2020 & 2028

4.5.Others

4.5.1.Key market trends, growth factors, and opportunities

4.5.2.Market size and forecast, by region, 2020-2028

4.5.3.Market share analysis, by country 2020 & 2028

5.Dextrin Market, by Application

5.1.Overview

5.1.1.Market size and forecast, by Application

5.2.Food

5.2.1.Key market trends, growth factors, and opportunities

5.2.2.Market size and forecast, by region, 2020-2028

5.2.3.Market share analysis, by country 2020 & 2028

5.3.Pharmaceutical

5.3.1.Key market trends, growth factors, and opportunities

5.3.2.Market size and forecast, by region, 2020-2028

5.3.3.Market share analysis, by country 2020 & 2028

5.4.Industrial

5.4.1.Key market trends, growth factors, and opportunities

5.4.2.Market size and forecast, by region, 2020-2028

5.4.3.Market share analysis, by country 2020 & 2028

5.5.Cosmetics

5.5.1.Key market trends, growth factors, and opportunities

5.5.2.Market size and forecast, by region, 2020-2028

5.5.3.Market share analysis, by country 2020 & 2028

5.6.Others

5.6.1.Key market trends, growth factors, and opportunities

5.6.2.Market size and forecast, by region, 2020-2028

5.6.3.Market share analysis, by country 2020 & 2028

6.Dextrin Market, by Region

6.1.Overview

6.1.1.Market size and forecast, by region

6.2.North America

6.2.1.Key market trends, growth factors, and opportunities

6.2.2.Market size and forecast, by type, 2020-2028

6.2.3.Market size and forecast, by Application, 2020-2028

6.2.4.Market size and forecast, by country, 2020-2028

6.2.5.U.S.

6.2.5.1.Market size and forecast, by type, 2020-2028

6.2.5.2.Market size and forecast, by Application, 2020-2028

6.2.6.Canada

6.2.6.1.Market size and forecast, by type, 2020-2028

6.2.6.2.Market size and forecast, by Application, 2020-2028

6.2.7.Mexico

6.2.7.1.Market size and forecast, by type, 2020-2028

6.2.7.2.Market size and forecast, by Application, 2020-2028

6.3.Europe

6.3.1.Key market trends, growth factors, and opportunities

6.3.2.Market size and forecast, by type, 2020-2028

6.3.3.Market size and forecast, by Application, 2020-2028

6.3.4.Market size and forecast, by country, 2020-2028

6.3.5.Germany

6.3.5.1.Market size and forecast, by type, 2020-2028

6.3.5.2.Market size and forecast, by Application, 2020-2028

6.3.6.UK

6.3.6.1.Market size and forecast, by type, 2020-2028

6.3.6.2.Market size and forecast, by Application, 2020-2028

6.3.7.France

6.3.7.1.Market size and forecast, by type, 2020-2028

6.3.7.2.Market size and forecast, by Application, 2020-2028

6.3.8.Spain

6.3.8.1.Market size and forecast, by type, 2020-2028

6.3.8.2.Market size and forecast, by Application, 2020-2028

6.3.9.Italy

6.3.9.1.Market size and forecast, by type, 2020-2028

6.3.9.2.Market size and forecast, by Application, 2020-2028

6.3.10.Rest of Europe

6.3.10.1.Market size and forecast, by type, 2020-2028

6.3.10.2.Market size and forecast, by Application, 2020-2028

6.4.Asia Pacific

6.4.1.Key market trends, growth factors, and opportunities

6.4.2.Market size and forecast, by type, 2020-2028

6.4.3.Market size and forecast, by Application, 2020-2028

6.4.4.Market size and forecast, by country, 2020-2028

6.4.5.China

6.4.5.1.Market size and forecast, by type, 2020-2028

6.4.5.2.Market size and forecast, by Application, 2020-2028

6.4.6.Japan

6.4.6.1.Market size and forecast, by type, 2020-2028

6.4.6.2.Market size and forecast, by Application, 2020-2028

6.4.7.India

6.4.7.1.Market size and forecast, by type, 2020-2028

6.4.7.2.Market size and forecast, by Application, 2020-2028

6.4.8.South Korea

6.4.8.1.Market size and forecast, by type, 2020-2028

6.4.8.2.Market size and forecast, by Application, 2020-2028

6.4.9.Australia

6.4.9.1.Market size and forecast, by type, 2020-2028

6.4.9.2.Market size and forecast, by Application, 2020-2028

6.4.9.3.Comparative market share analysis, 2020 & 2028

6.4.10.Rest of Asia Pacific

6.4.10.1.Market size and forecast, by type, 2020-2028

6.4.10.2.Market size and forecast, by Application, 2020-2028

6.5.LAMEA

6.5.1.Key market trends, growth factors, and opportunities

6.5.2.Market size and forecast, by type, 2020-2028

6.5.3.Market size and forecast, by Application, 2020-2028

6.5.4.Market size and forecast, by country, 2020-2028

6.5.5.Latin America

6.5.5.1.Market size and forecast, by type, 2020-2028

6.5.5.2.Market size and forecast, by Application, 2020-2028

6.5.6.Middle East

6.5.6.1.Market size and forecast, by type, 2020-2028

6.5.6.2.Market size and forecast, by Application, 2020-2028

6.5.7.Africa

6.5.7.1.Market size and forecast, by type, 2020-2028

6.5.7.2.Market size and forecast, by Application, 2020-2028

7.Company profiles

7.1.Archer Daniels Midland Company

7.1.1.Company overview

7.1.2.Operating business segments

7.1.3.Product portfolio

7.1.4.Financial Performance

7.1.5.Recent strategic moves & developments

7.2.Cargill, Inc.

7.2.1.Company overview

7.2.2.Operating business segments

7.2.3.Product portfolio

7.2.4.Financial Performance

7.2.5.Recent strategic moves & developments

7.3.Tate & Lyle

7.3.1.Company overview

7.3.2.Operating business segments

7.3.3.Product portfolio

7.3.4.Financial Performance

7.3.5.Recent strategic moves & developments

7.4.Roquette Frères S.A

7.4.1.Company overview

7.4.2.Operating business segments

7.4.3.Product portfolio

7.4.4.Financial Performance

7.4.5.Recent strategic moves & developments

7.5.Ingredion Incorporated

7.5.1.Company overview

7.5.2.Operating business segments

7.5.3.Product portfolio

7.5.4.Financial Performance

7.5.5.Recent strategic moves & developments

7.6.American Key Products, Inc.

7.6.1.Company overview

7.6.2.Operating business segments

7.6.3.Product portfolio

7.6.4.Financial Performance

7.6.5.Recent strategic moves & developments

7.7.Meelunie B.V

7.7.1.Company overview

7.7.2.Operating business segments

7.7.3.Product portfolio

7.7.4.Financial Performance

7.7.5.Recent strategic moves & developments

7.8.Agridient Inc.

7.8.1.Company overview

7.8.2.Operating business segments

7.8.3.Product portfolio

7.8.4.Financial Performance

7.8.5.Recent strategic moves & developments

7.9.Emsland Group

7.9.1.Company overview

7.9.2.Operating business segments

7.9.3.Product portfolio

7.9.4.Financial Performance

7.9.5.Recent strategic moves & developments

7.10.Avebe

7.10.1.Company overview

7.10.2.Operating business segments

7.10.3.Product portfolio

7.10.4.Financial Performance

7.10.5.Recent strategic moves & developments

A majority of today’s consumers are extremely health conscious and aim to boost their immunity power through foods they eat. Many consumers want to replace white sugar in their diet with a healthy substance. In the food and beverage industry, the usual sugar, which is high in calories, is greatly being substituted by a diversity of sugar replacements, and one among them is dextrin.

But, what exactly is dextrin? Dextrin is a fibre that offers satisfaction without contributing any flavour or viscosity to the original food item. It is an ideal ingredient for replacing sugar in food items. Also, dextrin is a carbohydrate that is a water-soluble polysaccharide developed by the hydrolysis of starch, which is itself a carbohydrate.

Several food items contain dextrin. Wheat dextrin is used for adding thickness to numerous food items, such as stews or soups, or even baby foods. It is also a well-known item to substitute fats in low-calorie food products.

There are numerous health benefits of dextrin. As dextrin offers a rich source of soluble fibre, including this substance in daily diet can offer several health benefits such as improved skin health, weight loss, greater bone density, and reduced cholesterol levels.

Besides being a wonderful source of fibre, dextrin is also believed to be prebiotic. Hence, by including dextrin in the diet, one can boost the health and efficiency of probiotics, which help in digestive problems and aid in maintaining homeostasis in the stomach. Also, dextrin has been considered to reduce triglyceride levels, which if high can upsurge the risk of strokes and heart disorders in a person. The consumption of dextrin can aid in reducing the glycemic index - which aids in maintaining healthy blood sugar levels - of the food a person consumes. In fact, the consumption of dextrin can aid almost every single system in a person’s body to process more efficiently, and thus stay away from a negative and toxic inner environment. As a result, the demand for dextrin is rising profoundly in the global food manufacturing sector.

Recent Trends in the Dextrin Industry

As per a repost by Research Dive, the global dextrin market is foreseen to grow with a CAGR of 3.60% by garnering $3,538.00 million by 2028. Some of the leading players active in the market are Meelunie B.V, Archer Daniels Midland Company, Cargill, Inc., Tate & Lyle, Avebe., Roquette Frères S.A, American Key Products, Inc., Agridient Inc., Emsland Group, Ingredion Incorporated, and others. Market players are concentrating on developing strategies such as novel product developments, partnerships, mergers and acquisitions, and collaborations to attain a leading position in the global market. For instance,

- In January 2018, Haribo, a foremost manufacturer and seller of candy products, made use of dextrin in its novel fruit gummy to decrease sugar by 30%.

- An American multinational company and one of the largest chocolate manufacturers in the world, Hershey, has formed a strategy to enlarge its reduced-sugar product range by means of acquisitions, in-house R&D, and licensing or partnerships. In May 2021, the company signed a deal to procure Lily's Sweets, the fast-growing ‘no sugar added’ chocolate brand. Lily's Sweets brand substitutes sugar with dextrin, inulin, erythritol, and stevia extract.

COVID-19 Impact on the Dextrin Industry

The unexpected outburst of the coronavirus pandemic has moderately impacted the global dextrin market. The pandemic has impacted the growth of the dextrin market in several ways. For instance, the demand of food products raised, however the production, supply chains, and logistics department of the food industries that use dextrin were severely impacted. Moreover, constantly altering restrictions on manufacturing industries and implementation of lockdown have reduced the growth of the dextrin market to a certain extent amidst the pandemic situation. However, to survive amidst the pandemic situation, many market players are taking initiatives to support consumers in the crisis by providing essential food products. Nevertheless, as and when the pandemic situation eases, the demand for dextrin is expected boost remarkably owing to its growing applications in the food industry.

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com