Data Center Power Market Report

RA00415

Data Center Power Market, by Product (PDU, UPS, Busway, Others), End-User (IT & Telecommunications, BFSI, Government, Energy, Healthcare, Retail, Others), Regional Analysis (North America, Europe, Asia Pacific, LAMEA): Global Opportunity Analysis and Industry Forecast, 2020–2027

The global data center power market forecast shall be $56,626.5 million by 2027, rising from $32,349.0 million in 2019 at a healthy rate of 7.2%. The Asia Pacific data center power market is estimated to increase at a CAGR of 8.0% by generating a revenue of $16,863.4 million, during the projected timeframe. The extensively growing data storage need from cloud-based applications along with the surge in the data center construction activities worldwide are some of the key factors that are expected to increase the growth of the market, in the forecast period.

Data Center Power Market Synopsis

Continuous development in advanced management solutions by the leading manufacturers operating in the data center power field to improve energy consumptions is projected to accelerate the growth of the data center power market.

On the other hand, the higher installation costs and the lack of awareness about data centers are factors restricting the market growth.

According to the regional analysis, the Asia-Pacific regional market is expected to witness prominent growth, by generating a revenue of $16,863.4 million with a CAGR of 8.0% during the review period.

Data Center Power Market Analysis:

Data centers mainly comprise of multiple elements such as communication & storage equipment, power supplies, heating ventilation & air conditioning (HVAC) equipment, and monitoring systems that offer secure and safe locations for data and equipment. Moreover, the power in the data center is a crucial component that allows these components to function properly and protects the data center from a local failure of the power supply.

Impact Analysis of COVID-19 on the Global Data Center Power Market:

The outbreak of the novel coronavirus disease (COVID-19) has created a considerable impact on the global data center power market, in the recent months. The consequent demand for software as a service (SaaS), along with a rapid shift to work from home culture during the pandemic are some of the elements responsible for the increasing demand for data centers. In addition to this, the emergence of a new business environment amid the COVID-19 outbreak is predicted to spur the demand for digitization and cloud services, which will ultimately create a significant impact on the global data center power market, in the COVID-19 outbreak.

The COVID-19 health emergency has massively affected businesses such as food & beverages, retail, automotive, and semiconductor industries across the globe. Hence, key players operating in the data center power market are coming forward to help other businesses. For instance, the COVID-19 pandemic has created a sudden huge demand for online services such as gaming and videos, live broadcasts, and others in Romania. Hence, in September 2020, INVITE Systems, an innovation leader in the technology platform, teamed up with Huawei to install a highly reliable data center in order to fulfill the requirements of the enterprise.

These above-mentioned factors and company initiatives are further expected to surge the growth of the market in the COVID-19 apocalypse.

The upsurge in IT infrastructure particularly in the developing economies may boost the data center power market

The extensive growth of data center power is significantly attributed to the growing emphasis on the development of IT infrastructure in countries such as China, India, and Brazil. For instance, according to the Indo- European Business Forum (IEBF), India's IT (information technology) & infrastructure sectors shall reach up to $10 trillion by the end of 2030. In addition to this, astonishingly increasing demand for cloud storage has led to an increase in the number of data centers in these regions which are consuming extensive energy. These factors may flourish the growth of the market in the forecast years.

Furthermore, to surge the efficiency and to minimize the power usage effectiveness (PUE) ratio, manufacturers operating in the data center power field are developing advanced management solutions that are improving the energy consumption in these systems. Owing to these factors, the industries across the developed as well as developing nations are going for the adoption of data centers, which will ultimately spur the market growth in the analysis period.

To know more about global data center power market drivers, get in touch with our analysts here.

The high initial investment may restrain the growth of the global data center power industry

The higher installation cost of data centers is expected to restrain the growth of the global market, in the forecast period. Moreover, complexities and lack of awareness regarding data centers' knowledge may also create a negative impact on the global data center power market, throughout the review period.

The increasing prominence of the solar-powered data center may create massive opportunities for the global data center power market in the future

Data centers become a more crucial component for businesses owing to the surging digitization among industries and IT operations. Moreover, most of the companies are going for the adoption data centers to maintain business continuity. Moreover, in recent years, governments across the developing countries such as India and China are working on a policy for establishing solar-powered data centers. Cost-effectiveness along with carbon footprint reduction are some of the key factors that are expected to increase the adoption of the solar-powered data center in the upcoming years. In addition to this, the companies involved in this field are deploying these innovative data centers, to stronghold their presence in the international market. For instance, in August 2020, CtrlS Datacenters Limited, Asia's significant Rated-4 Hyperscale Datacenter, and a managed services provider has made an announcement that they have deployed a solar PV system at its Mumbai datacenter infrastructure. It is predicted that the solar power system may help offer CO2 emissions reduction equivalent to around 7,000 trees per anum. These factors may lead to creating lucrative market opportunities, in the future.

To know more about global data center power market opportunities, get in touch with our analysts here.

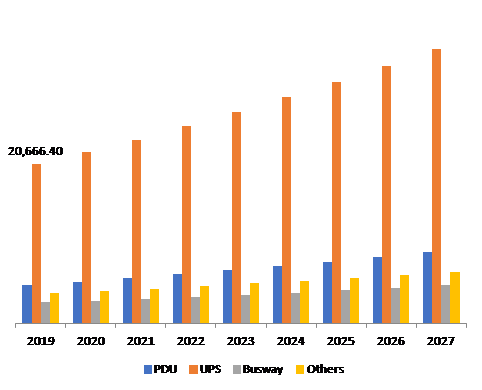

Global Data Center Power Market, by Product:

UPS sub-segment for the data center power market shall generate a revenue of $35,628.9 million by 2027 majorly because of the rising implementation of cloud computing worldwide

Source: Research Dive Analysis

The UPS sub-segment will have a significant market share and it is anticipated to register a revenue of $35,628.9 million by 2027, rising from $20,666.4 million in 2019. The increasing implementation of cloud computing along with the extensively rising demand for ubiquitous and sensitive data has created a positive impact on the sub-segment, in the analysis period. Furthermore, clean, consistent, and uninterrupted power flow, accessibility to the Software as a Service (SaaS), and high-performance are predicted to surge the market growth in the analysis timeframe. Hence, companies involved in this market are following business development strategies such as capacity expansion and product innovations to grow in the global industry. For instance, in march 2020, Huawei has officially made an announcement that they have launched its all-new UPS power module worldwide. This company’s innovative UPS power module will serve clients in the data center industry, helping them surge revenue while decreasing operational expenses. On the other hand, PDU product type shall have a rapid market growth in the global market and is anticipated to generate a revenue of $9,298.9 million, at a CAGR of 8.0%, during the analysis timeframe. The PDU manufacturers operating in the global market are delivering solutions that have energy monitoring capabilities along with control consumption for the usage of energy resources. In addition to this, PDU solutions are helping enterprises minimize energy usage & carbon footprint, which ultimately enhances the efficiency of the systems. These key factors are projected to increase market growth in the forecast period.

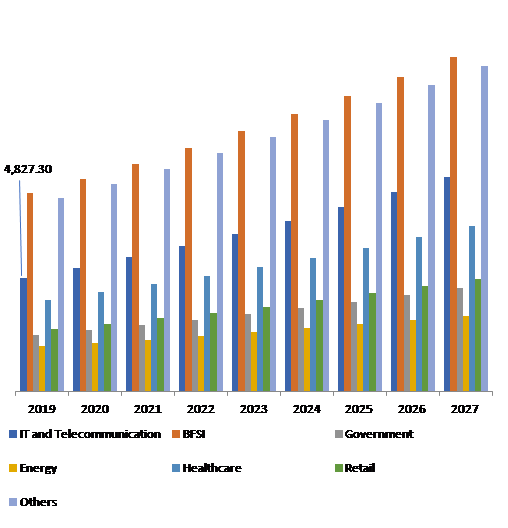

Global Data Center Power Market, by End-user:

The IT & telecommunications sub-segment for the data center power market shall have exponential market growth owing to the supportive government policies

Source: Research Dive Analysis

The IT & telecommunications sub-segment of the global data center power market shall have rapid growth and it is anticipated to cross $9,115.7 million by 2027, with an increase from $4,827.3 million in 2019 at a remarkable 8.2% CAGR; this is mainly because emerging IT & telecom service providers are deploying huge data center infrastructure to manage the extensively increasing amount of data. Furthermore, the government’s supportive policy implementations along with the strong presence of key players like CtrlS Datacenters and Schneider Electric in the emerging countries are expected to create a positive impact on the sub-segment, throughout the projected period.

For instance, in February 2020, CtrlS Datacenters, a pioneer in the Rated-4 Hyperscale Data Centers has proposed the plan to operationalize 6 million square feet of hyper-scale data center parks in India by the end of 2023 with setting up approximately 500+ edge data centers. However, BFSI end-user for the data center market will have a dominating market share in 2020, and it is expected to generate a revenue of $14,224.8 million by 2027, surging from $8,423.1 million in 2019, owing to the massive demand from BFSI sector, significantly driven by the rising focus on digitization. In addition to this, the industry rapidly shifted towards cloud networking and cloud computing to enhance banking capacities. These significant factors are expected to propel the sub-segment growth over the analysis timeframe.

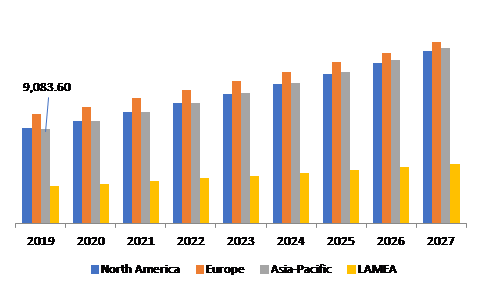

Regional Insights:

Asia Pacific data center power market has a significant market growth and it will reach up to $16,863.4 million by the end of 2027

Source: Research Dive Analysis

Asia-Pacific data center power market share is expected to rise at a CAGR of 8.0% by registering revenue of $16,863.4 million by 2027. Asia Pacific is anticipated to grow the highest mainly due to the predominantly growing adoption of advanced technologies, like AI and IoT. In addition to his, governments of this region are significantly supporting the data center power projects, in the recent serval years. For instance, in July 2020, Yotta Infrastructure, a leading hyper-scale Data Center solutions provider, has signed a memorandum of understanding (MOU) with the Tamil Nadu, India government in order to establish a data center park of around $450m-$600m in southern India. Moreover, in May 2020 The Cabinet of Thailand has granted $146.6 million for the state cloud and data center services. Such initiatives and key factors are further projected to flourish the data center power market, in the Asia Pacific region.

Europe market for data center power facilities accounted for $10,510.2 million in 2019 and it is estimated to generate a revenue of $17,435.3 million by the end of 2027. The increasing growth of this market is mainly attributed to the substantial expansion of mobile broadband, along with huge growth in big data analytics and cloud computing, particularly in the U.K Italy, and France. Moreover, in the recent several years, the demand for space and utilities has extensively increased to unprecedented levels with the massive businesses expansions. In addition to this, an extensively increased spending by data center service providers to develop novel products of the Europe region is one of the significant factors driving the market growth, during the forecast period.

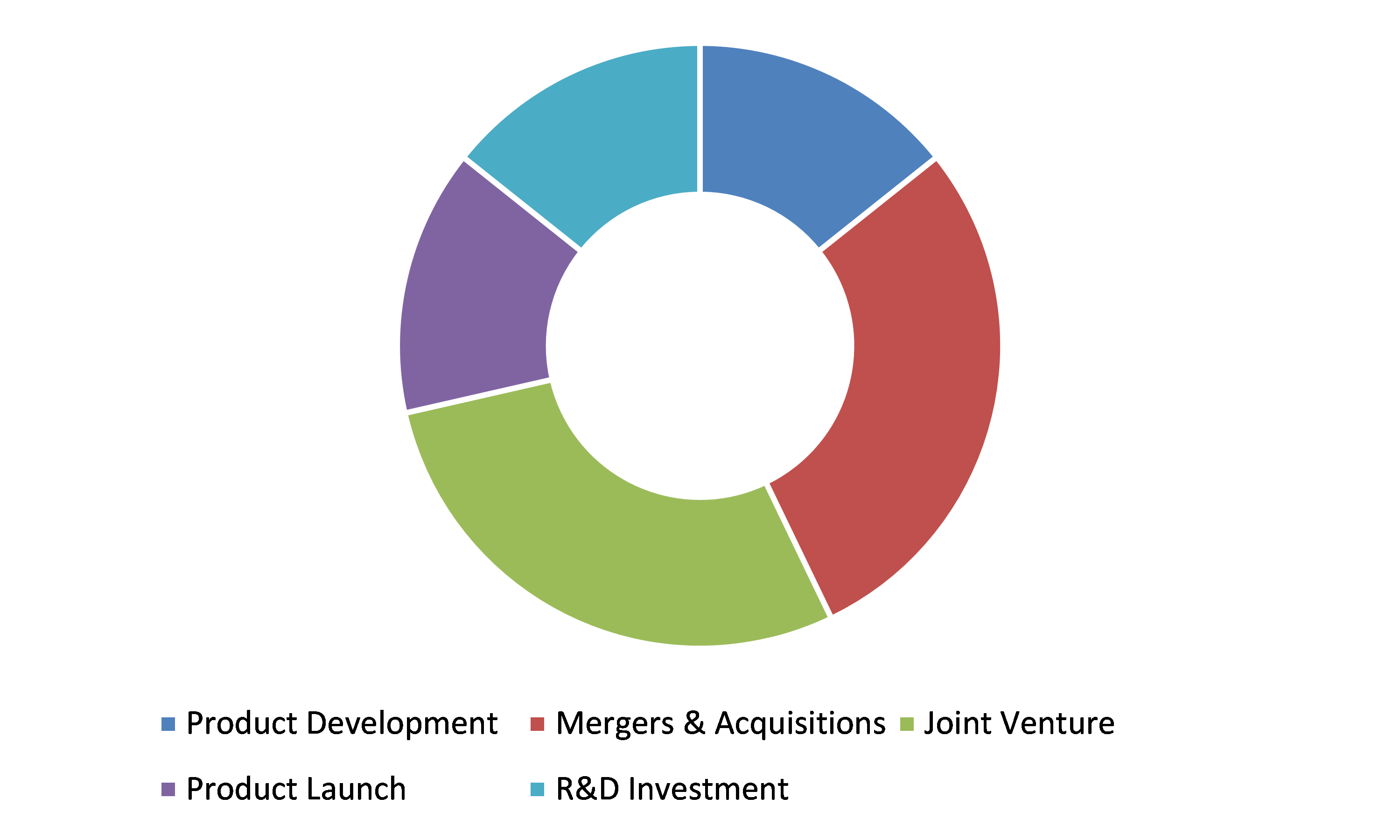

Competitive Scenario in the Global Data Center Power Market:

The advanced technology development coupled with mergers & acquisitions are the frequent strategies followed by the significant market players

Source: Research Dive Analysis

Some of the leading data center power market players include Vertiv Group Corp., ABB, General Electric, Schneider Electric, Anord Mardix, ZincFive, Inc., Siemens, Mitsubishi Electric Corporation, Cisco Systems, Inc., and Eaton. Data center power market players are focusing on Merger & acquisition and advanced technological developments in order to acquire prominent position in the international market.

Porter’s Five Forces Analysis for Data Center Power Market:

- Bargaining Power of Suppliers: The suppliers of data center power market are high in number. Hence, the negotiation power of suppliers will be minimal. Thus, there will be less threat from the suppliers. Therefore, the bargaining power of the supplier is Moderate

- Bargaining Power of Buyer: A majority of the key companies operating in the global data center power market have initiated to deliver the best service at an affordable price. Thus, buyers may have multiple options to choose the convenient option that best fits their preferences. Therefore, the bargaining power of the buyer will be HIGH

- Threat of New Entrants: The companies entering into the data center power market are preferring technological innovations like developing an advanced software application to attract the clients. Also, these companies are opting for the multiple business development strategies like value propositions, technological a well as technical innovations, and successful product launching. Thus, the threat of the new entrant will be High

- Threat of Substitutes: There is no alternative product for this data center power solutions. Thus, the threat of substitutes is Low

- Competitive Rivalry in the Market: The competitive rivalry in the market players is rather intense, particularly between the tech-giants such as Eaton., ABB, Schneider Electric. Such players are releasing their value-added product portfolio in the global industry and strengthening the footprint.Competitive rivalry in the market is High

| Aspect | Particulars |

| Historical Market Estimations | 2018-2019 |

| Base Year for Market Estimation | 2019 |

| Forecast timeline for Market Projection | 2020-2027 |

| Geographical Scope | North America, Europe, Asia-Pacific, LAMEA |

| Segmentation by Product |

|

| Segmentation by End-user |

|

| Key Countries Covered | The U.S., Canada, Mexico, Germany, France, UK, Italy, Spain, Rest of Europe, China, Australia, Japan, India, South Korea, Rest of Asia-Pacific, Latin America, Middle East, and Africa

|

| Key Companies Profiled |

|

Q1. What is the size of the global data center power market?

A. The global data center power market size was over $32,349.0 million in 2019 and is projected to reach $56,626.5 million by 2027.

Q2. Which are the major companies in the data center power market ?

A. Cisco Systems, General Electric, and Eaton. are some of the key players in the global data center power market.

Q3. Which region possesses greater investment opportunities in the coming future?

A. The Asia-Pacific region possesses great investment opportunities for investors to witness the most promising growth in the future.

Q4. What is the growth rate of the Asia-Pacific Data center power Market?

A. Asia-Pacific data center power market is anticipated to grow at 8.0% CAGR during the forecast period.

Q5. What are the strategies opted by the leading players in this market?

A. Technological development and strategic partnerships are the key strategies opted by the operating companies in this market.

Q6. Which companies are investing more on R&D practices?

A. Anord Mardix and Eaton. companies are investing more on R&D activities for developing new products and technologies.

1. Research Methodology

1.1. Desk Research

1.2. Real time insights and validation

1.3. Forecast model

1.4. Assumptions and forecast parameters

1.4.1. Assumptions

1.4.2. Forecast parameters

1.5. Data sources

1.5.1. Primary

1.5.2. Secondary

2. Executive Summary

2.1. 360° summary

2.2. By product trends

2.3. By end-user trends

3. Market Overview

3.1. Market segmentation & definitions

3.2. Key takeaways

3.2.1. Top investment pockets

3.2.2. Top winning strategies

3.3. Porter’s five forces analysis

3.3.1. Bargaining power of consumers

3.3.2. Bargaining power of suppliers

3.3.3. Threat of new entrants

3.3.4. Threat of substitutes

3.3.5. Competitive rivalry in the market

3.4. Market dynamics

3.4.1. Drivers

3.4.2. Restraints

3.4.3. Opportunities

3.5. Technology landscape

3.6. Regulatory landscape

3.7. Patent landscape

3.8. Pricing overview

3.8.1. by Product Type

3.8.2. by End-User type

3.9. Market value chain analysis

3.9.1. Stress point analysis

3.9.2. Raw material analysis

3.9.3. Manufacturing process

3.9.4. Distribution channel analysis

3.9.5. Operating vendors

3.9.5.1. Raw material suppliers

3.9.5.2. Product manufacturers

3.9.5.3. Product distributors

3.10. Strategic overview

4. Data Center Power Market, by Product

4.1. PDU

4.1.1. Market size and forecast, by region, 2019-2027

4.1.2. Comparative market share analysis, 2019 & 2027

4.2. UPS

4.2.1. Market size and forecast, by region, 2019-2027

4.2.2. Comparative market share analysis, 2019 & 2027

4.3. Busway

4.3.1. Market size and forecast, by region, 2019-2027

4.3.2. Comparative market share analysis, 2019 & 2027

4.4. Others

4.4.1. Market size and forecast, by region, 2019-2027

4.4.2. Comparative market share analysis, 2019 & 2027

5. Data Center Power Market, by End-User

5.1. IT & Telecommunications

5.1.1. Market size and forecast, by region, 2019-2027

5.1.2. Comparative market share analysis, 2019 & 2027

5.2. BFSI

5.2.1. Market size and forecast, by region, 2019-2027

5.2.2. Comparative market share analysis, 2019 & 2027

5.3. Government

5.3.1. Market size and forecast, by region, 2019-2027

5.3.2. Comparative market share analysis, 2019 & 2027

5.4. Energy

5.4.1. Market size and forecast, by region, 2019-2027

5.4.2. Comparative market share analysis, 2019 & 2027

5.5. Retail

5.5.1. Market size and forecast, by region, 2019-2027

5.5.2. Comparative market share analysis, 2019 & 2027

5.6. Healthcare

5.6.1. Market size and forecast, by region, 2019-2027

5.6.2. Comparative market share analysis, 2019 & 2027

5.7. Others

5.7.1. Market size and forecast, by region, 2019-2027

5.7.2. Comparative market share analysis, 2019 & 2027

6. Data Center Power Market, by Region

6.1. North America

6.1.1. Market size and forecast, by product, 2019-2027

6.1.2. Market size and forecast, by end-user, 2019-2027

6.1.3. Comparative market share analysis, 2019 & 2027

6.1.4. U.S.

6.1.4.1. Market size and forecast, by product, 2019-2027

6.1.4.2. Market size and forecast, by end-user, 2019-2027

6.1.4.3. Comparative market share analysis, 2019 & 2027

6.1.5. Canada

6.1.5.1. Market size and forecast, by product, 2019-2027

6.1.5.2. Market size and forecast, by end-user, 2019-2027

6.1.5.3. Comparative market share analysis, 2019 & 2027

6.1.6. Mexico

6.1.6.1. Market size and forecast, by product, 2019-2027

6.1.6.2. Market size and forecast, by end-user, 2019-2027

6.1.6.3. Comparative market share analysis, 2019 & 2027

6.2. Europe

6.2.1. Market size and forecast, by product, 2019-2027

6.2.2. Market size and forecast, by end-user, 2019-2027

6.2.3. Market size and forecast, by country, 2019-2027

6.2.4. Comparative market share analysis, 2019 & 2027

6.2.5. Germany

6.2.5.1. Market size and forecast, by product, 2019-2027

6.2.5.2. Market size and forecast, by end-user, 2019-2027

6.2.5.3. Comparative market share analysis, 2019 & 2027

6.2.6. UK

6.2.6.1. Market size and forecast, by product, 2019-2027

6.2.6.2. Market size and forecast, by end-user, 2019-2027

6.2.6.3. Comparative market share analysis, 2019 & 2027

6.2.7. France

6.2.7.1. Market size and forecast, by product, 2019-2027

6.2.7.2. Market size and forecast, by end-user, 2019-2027

6.2.7.3. Comparative market share analysis, 2019 & 2027

6.2.8. Spain

6.2.8.1. Market size and forecast, by product, 2019-2027

6.2.8.2. Market size and forecast, by end-user, 2019-2027

6.2.8.3. Comparative market share analysis, 2019 & 2027

6.2.9. Italy

6.2.9.1. Market size and forecast, by product, 2019-2027

6.2.9.2. Market size and forecast, by end-user, 2019-2027

6.2.9.3. Comparative market share analysis, 2019 & 2027

6.2.10. Rest of Europe

6.2.10.1. Market size and forecast, by product, 2019-2027

6.2.10.2. Market size and forecast, by end-user, 2019-2027

6.2.10.3. Comparative market share analysis, 2019 & 2027

6.3. Asia Pacific

6.3.1. Market size and forecast, by product, 2019-2027

6.3.2. Market size and forecast, by end-user, 2019-2027

6.3.3. Comparative market share analysis, 2019 & 2027

6.3.4. China

6.3.4.1. Market size and forecast, by product, 2019-2027

6.3.4.2. Market size and forecast, by end-user, 2019-2027

6.3.4.3. Comparative market share analysis, 2019 & 2027

6.3.5. India

6.3.5.1. Market size and forecast, by product, 2019-2027

6.3.5.2. Market size and forecast, by end-user, 2019-2027

6.3.5.3. Comparative market share analysis, 2019 & 2027

6.3.6. Australia

6.3.6.1. Market size and forecast, by product, 2019-2027

6.3.6.2. Market size and forecast, by end-user, 2019-2027

6.3.6.3. Market size and forecast, by organization size, 2019-2027

6.3.6.4. Market size and forecast, by vertical, 2019-2027

6.3.6.5. Comparative market share analysis, 2019 & 2027

6.3.7. Rest of Asia Pacific

6.3.7.1. Market size and forecast, by product, 2019-2027

6.3.7.2. Market size and forecast, by end-user, 2019-2027

6.3.7.3. Comparative market share analysis, 2019 & 2027

6.4. LAMEA

6.4.1. Market size and forecast, by product, 2019-2027

6.4.2. Market size and forecast, by end-user, 2019-2027

6.4.3. Market size and forecast, by country, 2019-2027

6.4.4. Comparative market share analysis, 2019 & 2027

6.4.5. Latin America

6.4.5.1. Market size and forecast, by product, 2019-2027

6.4.5.2. Market size and forecast, by end-user, 2019-2027

6.4.5.3. Comparative market share analysis, 2019 & 2027

6.4.6. Middle East

6.4.6.1. Market size and forecast, by product, 2019-2027

6.4.6.2. Market size and forecast, by end-user, 2019-2027

6.4.6.3. Comparative market share analysis, 2019 & 2027

6.4.7. Africa

6.4.7.1. Market size and forecast, by product, 2019-2027

6.4.7.2. Market size and forecast, by end-user, 2019-2027

6.4.7.3. Comparative market share analysis, 2019 & 2027

7. Company Profiles

7.1. Vertiv Group Corp.

7.1.1. Business overview

7.1.2. Financial performance

7.1.3. Product portfolio

7.1.4. Recent strategic moves & developments

7.1.5. SWOT analysis

7.2. Cisco Systems

7.2.1. Business overview

7.2.2. Financial performance

7.2.3. Product portfolio

7.2.4. Recent strategic moves & developments

7.2.5. SWOT analysis

7.3. ABB

7.3.1. Business overview

7.3.2. Financial performance

7.3.3. Product portfolio

7.3.4. Recent strategic moves & developments

7.3.5. SWOT analysis

7.4. General Electric

7.4.1. Business overview

7.4.2. Financial performance

7.4.3. Product portfolio

7.4.4. Recent strategic moves & developments

7.4.5. SWOT analysis

7.5. Schneider Electric

7.5.1. Business overview

7.5.2. Financial performance

7.5.3. Product portfolio

7.5.4. Recent strategic moves & developments

7.5.5. SWOT analysis

7.6. Eaton.

7.6.1. Business overview

7.6.2. Financial performance

7.6.3. Product portfolio

7.6.4. Recent strategic moves & developments

7.6.5. SWOT analysis

7.7. ZincFive, Inc.

7.7.1. Business overview

7.7.2. Financial performance

7.7.3. Product portfolio

7.7.4. Recent strategic moves & developments

7.7.5. SWOT analysis

7.8. Mitsubishi Electric Corporation

7.8.1. Business overview

7.8.2. Financial performance

7.8.3. Product portfolio

7.8.4. Recent strategic moves & developments

7.8.5. SWOT analysis

7.9. Anord Mardix

7.9.1. Business overview

7.9.2. Financial performance

7.9.3. Product portfolio

7.9.4. Recent strategic moves & developments

7.9.5. SWOT analysis

7.10. Siemens

7.10.1. Business overview

7.10.2. Financial performance

7.10.3. Product portfolio

7.10.4. Recent strategic moves & developments

7.10.5. SWOT analysis

Data center power is a power solution used to increase the efficiency of data centers and manage the power usage effectiveness (PUE). The data center manufacturers are evolving advanced power management solutions, such as battery monitoring equipment, smart UPS, and intelligent rack power distribution unit (PDU) to minimize the overall power consumption rate. Mainly, data centers are comprised of numerous elements, such as power supplies, communication & storage equipment, monitoring systems, and heating ventilation & air conditioning (HVAC) equipment that offer safe and secure locations for the data & equipment.

COVID-19 Impact on the Global Industry

The global data center power market is anticipated to witness an upsurge in the growth rate during the COVID-19 pandemic. The rapid shift to work from home culture and the consequent demand for SaaS (software as a service) in the pandemic crisis are some of the factors expected to increase the demand for the data centers. Moreover, the emergence of a new business environment amidst the COVID-19 chaos is predicted to escalate the demand for cloud services and digitization, which will subsequently boost the growth of the global data center power market during COVID-19 pandemic.

Furthermore, the key players operating in the global data center power market are helping other businesses such as food & beverages, automotive, retail, semi-conductor, and others to sustain in the COVID-19 crisis. For instance, in September 2020, an innovation leader in technology platform, INVITE Systems teamed up with Huawei in Romania to install a highly reliable data center for fulfilling the requirements of the enterprise.

Key Developments in the Global Market

The key industry players are implementing various business tactics & growth strategies such as technological advancements, partnerships, and introducing innovative solutions in the market to maintain a robust position in the overall market, which is subsequently helping the data center power market to grow at a robust pace.

For instance, in March 2018, Cyber Power Systems, Inc. launched a new software namely ‘Power Panel’ for its UPS system that enable users in remotely monitoring UPS with serial port number. This software also allow users control the unwatched computer shutdowns.

In June 2019, Schneider Electric and Green Mountain AS announced 3MW data center capacity at the DC2-Telemark site. The aim of the companies was to meet the requirement of the customers and achieve rapid deployment at the brown field development.

In February 2020, ABB Group introduced an innovative switchgear namely ‘NeoGear.’ With NeoGear, the company introduced a laminated bus plate technology for low-voltage switchgears. With the digital capabilities and the combined connectivity of the ABB Ability™ platform, the novel switchgear offers maximum safety, more flexibility, highest reliability, and better efficiency.

Forecast Analysis of Data Center Power Market

Global data center power market is anticipated to observe a strong growth over the forecast period due to the growing adoption of data centers by various companies across the globe to maintain its business continuity. In addition, the governments across the developing countries such as China, & India are working on a policy to establish solar-powered data centers, which is expected to create opportunities for the global market growth by 2027. However, the higher installation costs associated with data centers is likely to hinder the market growth in the near future.

The increasing growth in IT infrastructure and the growing demand for cloud storage across the globe are the major factors estimated to propel the growth of the global data center power market by 2027. Research Dive in its latest published report predicts that the data center power market will generate $56,626.5 million during the forecast period by 2027. The Europe region is anticipated to subjugate the global market throughout the forecast, owing to the huge growth in cloud computing & big data analytics and the substantial expansion of mobile broadband in the region. The key players functioning in the global industry include ABB, Vertiv Group Corp., Eaton, General Electric, Anord Mardix, Schneider Electric, ZincFive, Inc., Mitsubishi Electric Corporation, Siemens, and Cisco Systems, Inc.

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com