Aquafeed Market Report

RA00395

Aquafeed Market by Form (Dry and Wet), Product (Vitamins, Minerals, Antioxidants, Amino Acids, Antibiotics, and Others), Species (Fish, Shrimps, Mollusks, and Others), and Regional Analysis (North America, Europe, Asia-Pacific, and LAMEA): Global Opportunity Analysis and Industry Forecast, 2021-2028

Global Aquafeed Market Analysis

The global aquafeed market was valued at $57,031.0 million in 2020 and is projected to reach $120,719.70 million by 2028, registering a CAGR of 10.5%.

Market Synopsis

Increased consumption of seafood among millennial is expected to drive the aquafeed market size growth in the coming years.

However, high cost of aquafeed products is likely to restrain the aquafeed market share growth.

According to the regional analysis of the market, the Asia-Pacific aquafeed market is anticipated to grow at a CAGR of 11.20%, by generating a revenue of $48,046.50 million during the review period.

Aquafeed Overview

Aquafeed is the feed supplies required for aquaculture to develop properly. It generally comes either in dry or wet form. Aquafeed provides proper nutrition to aquatic animals. The feed for these animals is composed of various ingredients such as soyabean and corn. These ingredients provide the animals with adequate nutrition like vitamins, minerals, amino acids, and antibiotics, thus, enhancing the health of the aquatic animals.

COVID-19 Impact on the Global Aquafeed Market

The occurrence of COVID-19 pandemic has proved to have a negative impact on aquafeed market size growth. As the impact of COVID-19 pandemic has had a severe impact on the health and wellbeing of the people across the world, the fear of infection and its severe symptoms have settled in the people. Amid high rate of corona virus transmission and prevalence of serious symptoms, many people have started avoiding consuming seafood in due to the fear of catching infection through food. Also, the demand for aquafeed products were reduced due to less production of aquaculture. Such factors are anticipated to reduce the aquafeed market revenue in the coming years.

Increasing Demand for Seafood to Surge the Market Growth

Rapidly increasing consumption of seafood among people across the world is expected to drive the aquafeed market share growth in the coming years. Growing awareness about the health benefits of consuming seafood has inclined the people towards including seafood in their diet. Thus, due to rising demand for seafood, the aquaculture cultivation has increased tremendously which has boosted the aquafeed market revenue growth in the past few years. Also, many small-scale industries have now started their own aquaculture industry owing to rapid growth of the market. This factor is further anticipated to generate huge aquafeed market share growth in the forecast time period.

To know more about global aquafeed market drivers, get in touch with our analysts here.

High Cost of Aquafeed Products to Restrain the Market Growth

Aquafeed is feed required for proper development of the market. Since the ingredients used in the formulation of the feed like fish oil, soyabean, and corn are very costly, not everyone in the developing country can afford it. This factor is likely to hinder the aquafeed market share growth of the next few years.

Development of Product Portfolio by Major Companies to Fuel the Market Growth

Improvements in the existing aquafeed products and new product launches by the major market players are expected to drive the aquafeed market share growth in future. Major market players in the aquafeed market have started focusing on developing and launching new products to meet the rising demand for high quality aquaculture feed. For instance, according to a news published in The Fish Site, an online news portal, on July 10, 2020, BlueNalu, a company specializing in cell-based seafood, signed an agreement with Pulmuone, a food product organization in South Korea, to introduce cell based aquafeed for aquaculture in the country. Such factors are likely to stimulate the aquafeed market share growth in the next few years.

To know more about global aquafeed market opportunities, get in touch with our analysts here.

The global aquafeed market by form is segmented into Dry and wet aquafeed. Dry aquafeed sub segment is projected to generate both maximum revenue and register the fastest growth.Aquafeed Market

By Form

Download PDF Sample Report

Source: Research Dive Analysis

The dry aquafeed sub-segment is predicted to have the highest revenue in the global market and register a revenue of $71,878.30 million during the forecast period. The growth is attributed to rising demand of people for dry aquafeed as it can be easily stored in normal temperature and atmospheric conditions. Also, it can be easily manufactured in the company in different shapes and sizes. Furthermore, dry aquafeed is easily exported from one country to another, without any compromise in the texture and quality of the product. This factor is likely to surge the sub-segment market growth in the future.

Aquafeed Market

By ProductThe global aquafeed market by product is segmented into vitamins, minerals, antioxidants, Amino Acids, antibiotics, and others. Amino Acids aquafeed sub-segment is projected to generate both maximum revenue and fastest growth.

Source: Research Dive Analysis

The amino acids sub-segment is predicted to have a dominating market share in the global market and a revenue of $30,213.80 million during the forecast period. The sub-segment is projected to show an impressive growth in future owing to increasing demand for protein in the sea creatures’ diet. Amino acids are an essential component of protein and hence to provide proper nutrition to aquaculture, the demand for amino acid-based feed has increased tremendously. This factor is likely to boost the market growth in the next few years.

Aquafeed Market

By SpeciesThe global aquafeed market by species is segmented into Fish, shrimps, mollusks, and others. Fish sub-segment is projected to generate both maximum revenue and register fastest growth.

Source: Research Dive Analysis

The fish sub-segment is predicted to have a dominating market share in the global market and a revenue of $73,035.40 million during the forecast period. The sub-segment is projected to show an exponential growth in future owing to increasing consumption of fish among the millennial across the world. Consumption of different varieties to fish such as catfish and salmon has increased among people due to which the cultivation of these fish has grown rapidly. This factor is anticipated to raise the market shares in the next few years.

Aquafeed Market

By RegionThe aquafeed market was investigated across North America, Europe, Asia-Pacific, and LAMEA.

Source: Research Dive Analysis

The Market for Aquafeed in Asia-Pacific to Observe both Dominant and Fastest Growth

The Asia-Pacific aquafeed market is expected to observe both dominant and fastest growth and register a revenue of $48,046.50 million in the predicted time span. The growth of the region is subjected to rapidly increasing aquaculture production in the region and presence of countries like China and Indonesia which are the largest aquaculture producing companies in the world. As these countries produce maximum aquatic animals, the demand for aquafeed is also high in these countries. These factors are further anticipated to raise the market share in the future.

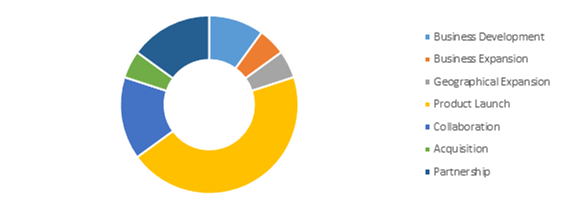

Competitive Scenario in the Global Aquafeed Market

Product launches and acquisitions are common strategies followed by major market players.

Source: Research Dive Analysis

The companies involved in the aquafeed market are Aller Aqua A/S, Alltech, Inc., Beneo Gmbh (Suedzucker Group), Schouw & Co. (Biomar A/S), Cargill Incorporated, Charoen Pokphand Foods Public Company Limited, NUTRECO N.V., Avanti Feeds Limited, Biomin GmbH, and Coppens International B.V..

Porter’s Five Forces Analysis for the Global Aquafeed Market

- Bargaining Power of Suppliers: The suppliers in the aquafeed market are high in number. Several companies are working on product innovation and development.

Thus, the bargaining power suppliers is low. - Bargaining Power of Buyers: Buyers are growing in number and have huge bargaining power; they demand best and advance product at low prices. This increases the pressure on the manufacturing companies to offer the best service in a cost-effective way. Thus, buyers can freely choose the product that best fits their preference.

Thus, the bargaining power of the buyers is high. - Threat of New Entrants: New companies entering the aquafeed market are adopting new aquafeed product launches in the market in minimum time frame.

Thus, the threat of the new entrants is high. - Threat of Substitutes: There is no suitable substitute is available in the market for aquafeed.

Thus, the threat of substitutes is low. - Competitive Rivalry in the Market: The competitive rivalry among industry leaders is rather intense, especially between the global players. These companies are launching their new products in the international market and strengthening the footprint worldwide.

Therefore, competitive rivalry in the market is high.

| Aspect | Particulars |

| Historical Market Estimations | 2019-2020 |

| Base Year for Market Estimation | 2020 |

| Forecast Timeline for Market Projection | 2021-2028 |

| Geographical Scope | North America, Europe, Asia-Pacific, LAMEA |

| Segmentation by Form |

|

| Segmentation by Product |

|

| Segmentation by Species |

|

| Key Companies Profiled |

|

Q1. What is the impact of COVID-19 on the aquafeed market?

A. Aquafeed market experienced a negative impact in COVID-19 pandemic owing to demand and supply chain disruption.

Q2. How is the rising seafood trade propelling the demand for aquafeed market?

A. Rising seafood trade has propelled the demand for aquafeed market as the demand for healthy aquatic creatures for consumption has increased and their health maintenance requires good quality feed.

Q3. What does aquafeed mean?

A. Aquafeed means feed for aquatic animals like fish and shrimps.

Q4. Which fish feed is the best?

A. Matsya Bandhu Floating Fish feed is best for fish.

Q5. What does fish feed contain?

A. Fish feed contains ingredients such as wheat bran, corn, soyabean meal, and rice polish.

Q6. How would the fluctuations in ingredient prices impact the growth of the aquafeed market globally?

A. The fluctuations in ingredient prices will certainly have some unpredictable impact on the aquafeed market globally. If the ingredient price becomes high, then the product price will also increase and vice versa.

Q7. Which country captures the largest share of soybean aquafeed market?

A. Brazil holds the largest share of soybean aquafeed market.

CHAPTER 1:INTRODUCTION

1.1.Research methodology

1.1.1.Desk research

1.1.2.Real-time insights and validation

1.1.3.Forecast model

1.1.4.Assumptions & forecast parameters

1.1.4.1.Assumptions

1.1.4.2.Forecast parameters

CHAPTER 2:EXECUTIVE SUMMARY

2.1.360° summary

2.2.Form trends

2.3.Product trends

2.4.Species trends

CHAPTER 3:MARKET OVERVIEW

3.1.Market definition and scope

3.2.Key takeaways

3.2.1.Top investment pockets

3.2.2.Top winning strategies

3.2.2.1.Top winning strategies, by year

3.2.2.2.Top winning strategies, by development

3.2.2.3.Top winning strategies, by company

3.3.Porter's five forces analysis

3.4.Market dynamics

3.5.Drivers

3.5.1.Rising consumption of seafood among people to drive the market

3.5.2.Rising awareness about the health benefits of consuming seafood

3.6.Restraints

3.6.1.High prices of aquafeed products to restrain the market growth

3.7.Opportunities

3.7.1.New product launches by the manufacturing companies to surge the market growth

3.8.Regulatory landscape

3.9.Patent landscape

3.10.Market value chain analysis

3.11.Strategic overview

CHAPTER 4:IMPACT OF COVID19 ON GLOBAL AQUAFEED MARKET

4.1.Introduction

4.2.COVID-19 health assessment

4.3.Impact of COVID-19 on the global economy

4.4.Impact of COVID-19 on global aquafeed market

4.4.1.Technological impact

4.4.2.Investment scenario

4.5.Aquafeed market size and forecast, by region, 2021-2028

CHAPTER 5:GLOBAL AQUAFEED MARKET, BY FORM

5.1.Overview

5.1.1.Market size and forecast, by form

5.2.Dry

5.2.1.Key market trends, growth factors and opportunities

5.2.2.Market size and forecast, by region

5.2.3.Market share analysis, by country

5.3.Wet

5.3.1.Key market trends, growth factors and opportunities

5.3.2.Market size and forecast, by region

5.3.3.Market share analysis, by country

CHAPTER 6:GLOBAL AQUAFEED MARKET, BY PRODUCT

6.1.Overview

6.1.1.Market size and forecast, by product

6.2.Vitamins

6.2.1.Key market trends, growth factors and opportunities

6.2.2.Market size and forecast, by region

6.2.3.Market share analysis, by country

6.3.Minerals

6.3.1.Key market trends, growth factors and opportunities

6.3.2.Market size and forecast, by region

6.3.3.Market share analysis, by country

6.4.Antioxidants

6.4.1.Key market trends, growth factors and opportunities

6.4.2.Market size and forecast, by region

6.4.3.Market share analysis, by country

6.5.Amino Acids

6.5.1.Key market trends, growth factors and opportunities

6.5.2.Market size and forecast, by region

6.5.3.Market share analysis, by country

6.6.Antibiotics

6.6.1.Key market trends, growth factors and opportunities

6.6.2.Market size and forecast, by region

6.6.3.Market share analysis, by country

6.6.Others

6.6.1.Key market trends, growth factors and opportunities

6.6.2.Market size and forecast, by region

6.6.3.Market share analysis, by country

CHAPTER 7:GLOBAL AQUAFEED MARKET, BY SPECIES

7.1.Overview

7.1.1.Market size and forecast, by species

7.2.Fish

7.2.1.Key market trends, growth factors and opportunities

7.2.2.Market size and forecast, by region

7.2.3.Market share analysis, by country

7.3.Shrimps

7.3.1.Key market trends, growth factors and opportunities

7.3.2.Market size and forecast, by region

7.3.3.Market share analysis, by country

CHAPTER 8:GLOBAL AQUAFEED MARKET, BY REGION

8.1.Overview

8.1.1.Market size and forecast, by region

8.2.North America

8.2.1.Key market trends, growth factors, and opportunities

8.2.2.Market size and forecast, by form

8.2.3.Market size and forecast, by product

8.2.4.Market size and forecast, by species

8.2.5.Market size and forecast, by country

8.2.6.U.S.

8.2.6.1.Market size and forecast, by form

8.2.6.2.Market size and forecast, by product

8.2.6.3.Market size and forecast, by species

8.2.7.Canada

8.2.7.1.Market size and forecast, by form

8.2.7.2.Market size and forecast, by product

8.2.7.3.Market size and forecast, by species

8.2.8.Mexico

8.2.8.1.Market size and forecast, by form

8.2.8.2.Market size and forecast, by product

8.2.8.3.Market size and forecast, by species

8.3.Europe

8.3.1.Key market trends, growth factors, and opportunities

8.3.2.Market size and forecast, by form

8.3.3.Market size and forecast, by product

8.3.4.Market size and forecast, by species

8.3.5.Market size and forecast, by country

8.3.6.Germany

8.3.6.1.Market size and forecast, by form

8.3.6.2.Market size and forecast, by product

8.3.6.3.Market size and forecast, by species

8.3.7.UK

8.3.7.1.Market size and forecast, by form

8.3.7.2.Market size and forecast, by product

8.3.7.3.Market size and forecast, by species

8.3.8.France

8.3.8.1.Market size and forecast, by form

8.3.8.2.Market size and forecast, by product

8.3.8.3.Market size and forecast, by species

8.3.9.Italy

8.3.9.1.Market size and forecast, by form

8.3.9.2.Market size and forecast, by product

8.3.9.3.Market size and forecast, by species

8.3.10.Russia

8.3.10.1.Market size and forecast, by form

8.3.10.2.Market size and forecast, by product

8.3.10.3.Market size and forecast, by species

8.3.11.Rest of Europe

8.3.11.1.Market size and forecast, by form

8.3.11.2.Market size and forecast, by product

8.3.11.3.Market size and forecast, by species

8.4.Asia-Pacific

8.4.1.Key market trends, growth factors, and opportunities

8.4.2.Market size and forecast, by form

8.4.3.Market size and forecast, by product

8.4.4.Market size and forecast, by species

8.4.5.Market size and forecast, by country

8.4.6.China

8.4.6.1.Market size and forecast, by form

8.4.6.2.Market size and forecast, by product

8.4.6.3.Market size and forecast, by species

8.4.7.Japan

8.4.7.1.Market size and forecast, by form

8.4.7.2.Market size and forecast, by product

8.4.7.3.Market size and forecast, by species

8.4.8.Singapore

8.4.8.1.Market size and forecast, by form

8.4.8.2.Market size and forecast, by product

8.4.8.3.Market size and forecast, by species

8.4.9.South Korea

8.4.9.1.Market size and forecast, by form

8.4.9.2.Market size and forecast, by product

8.4.9.3.Market size and forecast, by species

8.4.10.India

8.4.10.1.Market size and forecast, by form

8.4.10.2.Market size and forecast, by product

8.4.10.3.Market size and forecast, by species

8.4.11.Rest of Asia-Pacific

8.4.11.1.Market size and forecast, by form

8.4.11.2.Market size and forecast, by product

8.4.11.3.Market size and forecast, by species

8.5.LAMEA

8.5.1.Key market trends, growth factors, and opportunities

8.5.2.Market size and forecast, by form

8.5.3.Market size and forecast, by product

8.5.4.Market size and forecast, by species

8.5.5.Market size and forecast, by country

8.5.6.Latin America

8.5.6.1.Market size and forecast, by form

8.5.6.2.Market size and forecast, by product

8.5.6.3.Market size and forecast, by species

8.5.7.Middle East

8.5.7.1.Market size and forecast, by form

8.5.7.2.Market size and forecast, by product

8.5.7.3.Market size and forecast, by species

8.5.8.Africa

8.5.8.1.Market size and forecast, by form

8.5.8.2.Market size and forecast, by product

8.5.8.3.Market size and forecast, by species

CHAPTER 9:COMPANY PROFILES

9.1.Ridley Corporation Ltd.

9.1.1.Company overview

9.1.2.Company snapshot

9.1.3.Operating business Segments

9.1.4.Product portfolio

9.2.Altech, Inc.

9.2.1.Company overview

9.2.2.Company snapshot

9.2.3.Product portfolio

9.2.4.Key strategic moves and developments

9.3.Biomar A/S

9.3.1.Company overview

9.3.2.Company snapshot

9.3.3.Product portfolio

9.3.4.Key strategic moves and developments

9.4.Growel Feed Pvt Ltd.

9.4.1.Company overview

9.4.2.Company snapshot

9.4.3.Product portfolio

9.5.Nexus Feed Limited

9.5.1.Company overview

9.5.2.Company snapshot

9.5.3.Product portfolio

9.6.Purina Animal Nutrition LLC

9.6.1.Company overview

9.6.2.Company snapshot

9.6.3.Product portfolio

9.6.4.Key strategic moves and developments

9.7.Skretting

9.7.1.Company overview

9.7.2.Company snapshot

9.7.3.Product portfolio

9.7.4.Key strategic moves and development

9.8.Cargill

9.8.1.Company overview

9.8.2.Company snapshot

9.8.3.Operating business segments

9.8.4.Product portfolio

9.8.5.Key strategic moves and developments

9.9.Hanpel Co. Ltd

9.9.1.Company overview

9.9.2.Company snapshot

9.9.3.Operating business segments

9.9.4.Product portfolio

9.9.5.Key strategic moves and developments

9.10.Aller Aqua

9.9.1.Company overview

9.9.2.Company snapshot

9.9.3.Operating business segments

9.9.4.Product portfolio

9.9.5.Key strategic moves and developments

Aquafeed refers to any feed supplies for aquatic organisms as a part of aquaculture so as to provide them with proper nutrition. The feed for aquatic animals is either in wet or dry form, and they are composed of various ingredients like corn, soyabean, and many others. These ingredients significantly enhance the health of the aquatic animals by providing them with necessary minerals, vitamins, and antibiotics.

Forecast Analysis of the Global Aquafeed Market

Expeditiously increasing consumption of seafood across the globe is expected to drive the growth of the market during the forecast period. In addition, the rising awareness about the health benefits of consumption of seafood by aquatic animals is further expected to bolster the growth of the global aquafeed market during the forecast period. Moreover, new product launches from prominent players of the market worldwide is expected to create immense opportunities for the growth of the market during the forecast period. However, extortionate cost of aquafeed products in expected to impede the growth of the aquafeed market during the forecast period.

According to the report published by research Dive, the global aquafeed market is expected to garner a revenue of $120,719.70 million by 2028, growing exponentially at a CAGR of 10.5% during the forecast period 2021-2028. The major players of the market include Aller Aqua A/S, Alltech, Inc., Beneo Gmbh (Suedzucker Group), Avanti Feeds Limited, Biomin GmbH, and Coppens International B.V., Schouw & Co. (Biomar A/S), Cargill Incorporated, NUTRECO N.V. Charoen Pokphand Foods Public Company Limited, Schouw & Co. (Biomar A/S), and many more.

Key Developments

The key companies operating in the industry are adopting various growth strategies & business tactics such as partnerships, collaborations, mergers & acquisitions, and launches to maintain a robust position in the overall market, which is subsequently helping the global aquafeed market to grow exponentially.

For instance, in March 2021, BioMar, a world leader in high performance diets for more than 45 different fish and shrimp species in more than 80 countries, acquired majority shares of Viet-UC, an innovative provider of shrimp farming and pisciculture services, in order to establish aquafeed business in one of the world’s leading shrimp producing countries, Vietnam.

In August 2021, NovoNutrients, a U.S.-based producer of microbial meals for aquafeeds using industrial waste streams, secured a $9 million funding to finish its pilot project which involves capturing carbon emissions to develop high-quality animal-free proteins using naturally occurring microbes and industrial biotech.

In May 2021, Skretting, the global leader in providing innovative and sustainable nutritional solutions for the aquaculture industry, acquired the extrusion facility of Ridley, Australia’s leading provider of high-performance animal nutrition solutions, in order to increase Skretting’s aquafeed production capacity.

Most Profitable Region

The Asia-Pacific region is expected to be most lucrative and dominate the global market during the forecast period. The region is expected to generate a revenue of $48,046.50 during the forecast period. Rapidly surging aquaculture production in this region is expected to stimulate the growth of the market. In addition, the presence of prominent players of the market in this region is further expected to accelerate the growth of the aquafeed market in the Asia-Pacific region during the forecast period.

COVID-19 Impact on the Market

The outbreak of COVID-19 has had a devastating impact on the growth of the global aquafeed market, owing to the prevalence of lockdowns in various countries across the globe. Lockdowns adversely led to the fewer production of aquaculture due to the stringent restrictions imposed by the government on shut down of numerous manufacturing units in order to the curb the spread of the virus during the pandemic. Thus, coronavirus has had a negative impact on the growth of the global aquafeed market during the pandemic period.

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com