Cryogenic Equipment Market Report

RA03757

Cryogenic Equipment Market by Product (Tanks, Valves, Vaporizers, Pumps, Vacuum Jacketed Piping, and Others), Gas Type (Nitrogen, Oxygen, Argon, LNG, and Others), Application (Distribution and Storage), and Region (North America, Europe, Asia-Pacific, and LAMEA): Opportunity Analysis and Industry Forecast, 2023-2032

Cryogenic Equipment Overview

Cryogenic equipment comprises of different products such as tanks, valves, pumps, vaporizers, vacuum jacketed piping, and others. Transporting liquefied industrial gases like oxygen, hydrogen, nitrogen, helium, and argon is done with the use of cryogenic equipment. In most cases, they are designed to store liquid gases at temperatures lower than -150°C. Horizontal, vertical, double-walled, and insulated configurations of cryogenic equipment are varieties available. They can be moving or transportable as well as fixed or static. The equipment is used for storing LNG in LNG liquefaction terminals and on ships in the form of tankers. They also have several applications in a variety of industries including medical technology, food, electronics, and metal processing.

Advancements in cryogenic equipment technology have expanded the range of applications for the equipment, from cold storage to core operations in numerous end-user sectors. Cryogenic equipment is frequently used for metal processing, biomedical & chemical storage, freezing & cooling, and boosting specific chemical reactions. In addition, several fluid cryogens are used as fuel in rocketry and aircraft. Holders, pressure containers, cold snares, purifiers, and funneling are all components of cryogenic equipment. The preservation of internal temperature of the fluid is ensured by cryogenic equipment and also facilitates the workers to be protected from hazardous contaminants. The development of improved fluid management techniques has increased owing to the improvement in metal structure.

Global Cryogenic Equipment Market Analysis

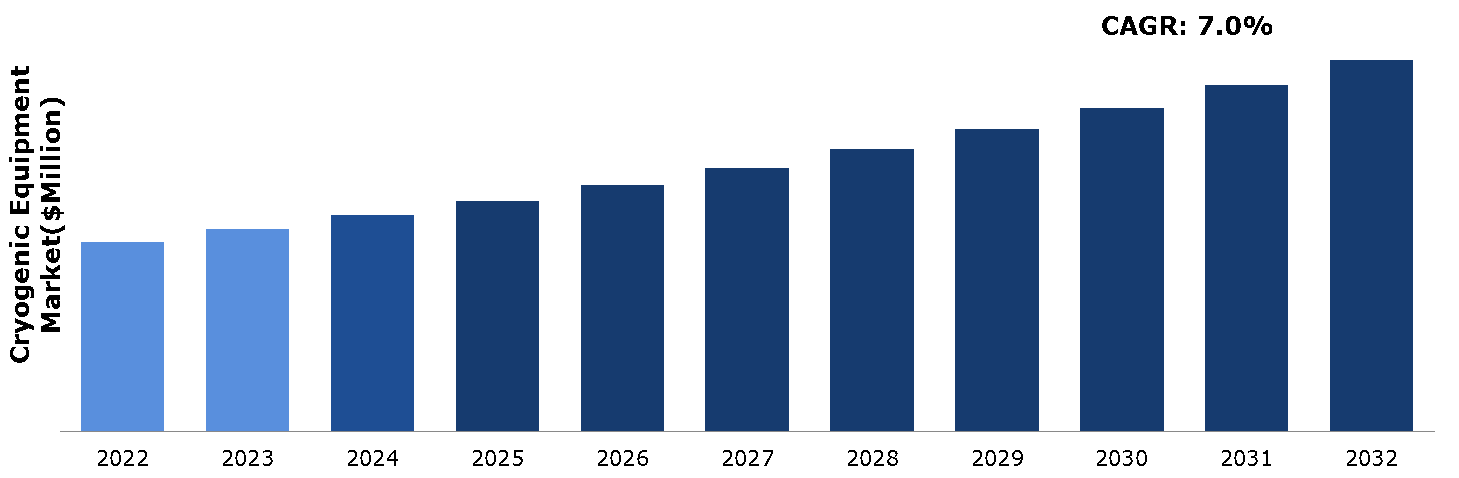

The global cryogenic equipment market size was $19,890.0 million in 2022 and is predicted to grow with a CAGR of 7.0%, by generating a revenue of $39,005.3 million by 2032.

Source: Research Dive Analysis

COVID-19 Impact on Global Cryogenic Equipment Market

The COVID-19 pandemic had both positive and negative impacts on various markets, including cryogenic equipment. For cryogenic equipment, industries like healthcare and pharmaceuticals witnessed an increase in need for cryogenic freezers and storage tanks for vaccine distribution and other medical purposes. On the contrary, industries like aerospace and certain research sectors witnessed a decrease in demand, which influenced production patterns. However, some cryogenic equipment manufacturers faced labor shortages due to infected workers or quarantine requirements.

During the COVID-19 pandemic, cryogenic equipment played a crucial role in various aspects while managing the situation. Cryogenic equipment, such as ultra-low temperature freezers, were essential for storing and preserving certain vaccines, like those using mRNA technology (e.g., Pfizer-BioNTech and Moderna vaccines), which required extremely cold temperatures for stability. The need for cryogenic equipment became apparent as countries around the world began mass vaccination campaigns to curb the spread of COVID-19. Vaccination centers, hospitals, and research facilities required specialized freezers and containers to store and distribute vaccines safely. This led to an increase in the product demand during the pandemic.

Rising Demand for Liquefied Natural Gas (LNG) to Drive the Market Growth

There is a rise in natural gas consumption, surge in need for clean energy production technologies, such as LNG, and an increase in demand for metallurgical processes. This is anticipated to drive the demand for cryogenic equipment, such as tanks, vaporizers, and other items. In the upcoming years, liquefied natural gas (LNG) is expected to experience an increase in demand owing to its optimistic environmental adaptability and effects as a cleaner alternative to conservative fossil fuels. The intensified demand for LNG is certainly expected to boost the sales of cryogenic equipment as LNG requires specialized equipment for storage, transporting, and regasification. Cryogenic equipment including liquefaction plants, LNG storage tanks, and shipping boats work together as an important component of the LNG supply chain. These equipment components must be built to endure extremely low temperatures as natural gas is kept in its liquefied state via cryogenic processes. More funds will be invested in LNG infrastructure and cryogenic equipment to meet the rising demand for LNG.

High Equipment Cost and Specialized Infrastructural Requirement to Restrain the Market Growth

Cryogenic equipment involves advanced technologies and materials to operate at extremely low temperatures. Therefore, the manufacturing and maintenance costs of such equipment can be considerably higher than conventional systems. This cost obligation can impact businesses and industries from investing in cryogenic applications, especially for smaller or financially constrained enterprises. Cryogenic equipment is required to uphold stable and precise temperatures to make sure the efficiency and safety of the processes involved. Achieving this level of precision requires advanced manufacturing and engineering techniques, which can be costly. Furthermore, upholding cryogenic temperatures demands a significant amount of energy. This is expected to increase the operational costs associated with cooling and insulation, which can impact the equipment's overall cost.

Cryogenic applications typically require specialized infrastructures to handle low-temperature environments safely and efficiently. This includes the need for well-insulated containers, specialized storage facilities, and safety measures to prevent accidents or gas leaks. These infrastructural requirements can be costly and complex, making it difficult for many companies to implement cryogenic technologies. Moreover, cryogenic materials, such as liquid helium and liquid nitrogen, can be harmful to human health owing to their potential to displace oxygen and low temperatures. Specialized safety protocols, equipment, and facilities are necessary to handle and store cryogenic substances safely. Therefore, for the operation of these equipment a team of trained professional is essential. All these factors are projected to restrain the market revenue growth during the forecast years.

Growing Demand of Cryogenic Equipment in Space Missions to Drive Excellent Opportunities

Cryogenic equipment plays a crucial role in space exploration, enabling the storage and transportation of materials and propellants at extremely low temperatures. These cryogenic systems are essential for various space missions and offer several opportunities for advancements and breakthroughs in space exploration. Cryogenic fuels, such as liquid hydrogen (LH2) and liquid oxygen (LOX), are used in modern rocket engines. These fuels provide high specific impulse, resulting in efficient propulsion systems. Cryogenic equipment is used to store, handle, and deliver these propellants to the rocket engines and can be used to liquefy gases present on the Moon or Mars, like water ice, to produce propellants locally. This would significantly reduce the costs and logistical challenges of sending propellants from Earth, making colonization and sustainable human presence on these celestial bodies more feasible. Furthermore, continued advancements in cryogenic technologies for space applications can lead to innovations in materials science, superconductivity, and low-temperature electronics. These advancements can have broader applications beyond space exploration, and thus would simultaneously boost the product demand.

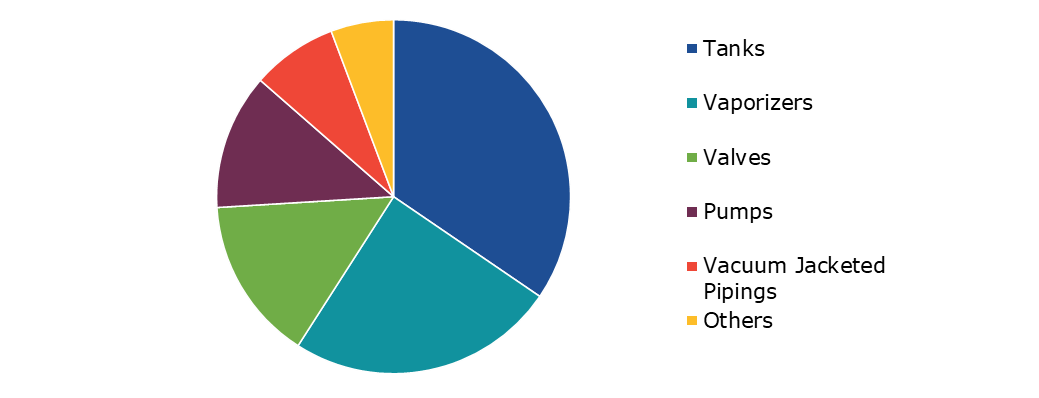

Global Cryogenic Equipment Market Share, by Product, 2022

Source: Research Dive Analysis

The tanks sub-segment accounted for the highest market share in 2022. The storage and transportation of liquid oxygen, liquefied natural gas (LNG), liquid nitrogen, and other cryogenic gases are all dependent on cryogenic tanks. Cryogenic tanks are anticipated to be more widespread at the same time in sectors including healthcare, energy, and aerospace. The arrangement for liquefied natural gas (LNG) has substantially extended as a result of the demand for natural gas and its competence to burn cleanly. The requirement for cryogenic tanks is anticipated to progress as more LNG facilities and terminals are constructed as they are an important part of LNG transportation and storage. For storing and transporting cryogenic materials such as nitrogen and liquid oxygen, in the industrial and healthcare sectors, cryogenic tanks are opted. There is expected to be an increase in demand for these gases as they are crucial for processes such as cryosurgery, cryopreservation, and numerous medical procedures. Cryogenic tanks are also important for a variety of scientific and research fields, such as low-temperature physics, superconductivity, and material science. The need for cryogenic tanks to support such experiments may grow as R&D initiatives proceed.

Global Cryogenic Equipment Market Share, by Gas Type, 2022

Source: Research Dive Analysis

The liquified natural gas (LNG) sub-segment accounted for the highest market share in 2022. Numerous industrialized and developing nations are advancing towards cleaner energy sources owing to the increasing awareness related to battling climate change and lowering carbon emissions. LNG is regarded as a substantially cleaner fossil fuel in comparison to oil and coal as it emits fewer greenhouse gas emissions when exhausted for electricity production and other industrial purposes. The development of petrochemicals, steel, and equipment manufacturing are among a few of the industrial processes where LNG is repeatedly utilized. It is expected that as industries expand, correspondingly the demand for LNG as a fuel source else feedstock will rise. Furthermore, LNG is more convenient to move around and store in comparison to the natural gas delivered by pipeline, compelling it an appropriate alternative in regions with inadequate pipeline networks.

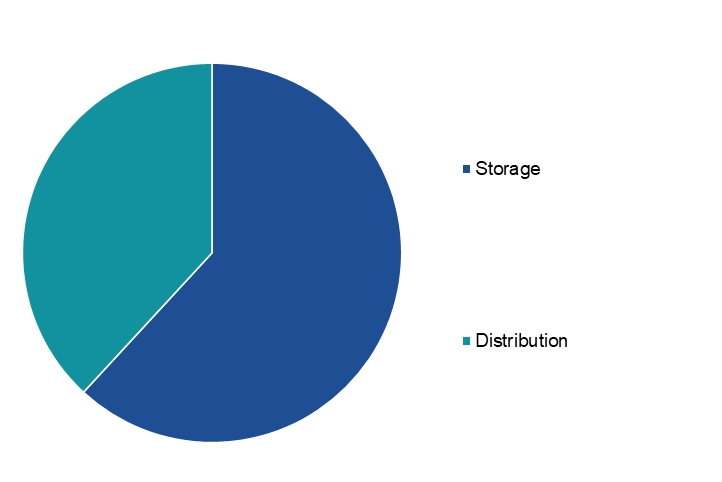

Global Cryogenic Equipment Market Share, by Application, 2022

Source: Research Dive Analysis

The storage sub-segment accounted for the highest market share in 2022. Cryogenic storage is widely used in storing biological samples, such as stem cells, tissues, blood components, vaccines, and other biomaterials. The low temperatures help slow down biological activity and chemical reactions, preserving the samples for future use in research, medical treatment, and diagnostics. Some medications, especially certain vaccines and biological drugs, require cryogenic storage to maintain their stability and potency for an extended period. Certain materials used in superconducting applications require cryogenic temperatures to maintain their superconducting properties, enabling highly efficient electrical transmission and other technological advancements. In addition, cryogenic storage is essential for storage of gases like LNG, nitrogen, oxygen, and others.

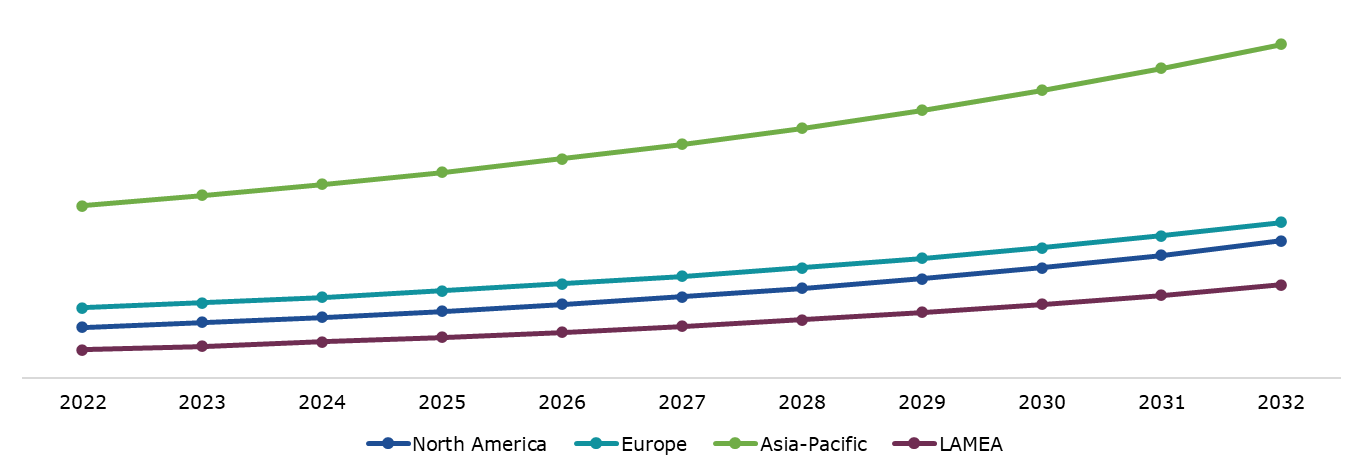

Global Cryogenic Equipment Market Size & Forecast, by Region, 2022-2032 ($Million)

Source: Research Dive Analysis

The Asia-Pacific cryogenic equipment market generated the highest revenue in 2022. The region has been witnessing rapid industrialization and technological advancements. Cryogenic equipment finds application in industries like chemicals, pharmaceuticals, and liquefied natural gas (LNG) that require low-temperature processes, storage, and transportation. As these industries expand, the demand for cryogenic equipment is likely to grow. Asia-Pacific is a major consumer of LNG due to its increasing energy demands and cryogenic equipment is essential for the liquefaction, transportation, and regasification of LNG. As the demand for cleaner energy sources rises, the LNG market is projected to grow, driving the demand for cryogenic equipment. In addition, space agencies and private space exploration companies in Asia-Pacific are actively involved in space research and satellite launches. The equipment is used in rocket propulsion systems, such as liquid hydrogen and oxygen storage & delivery systems. The growing space industry in the region is expected to contribute to the demand for cryogenic equipment in the upcoming years.

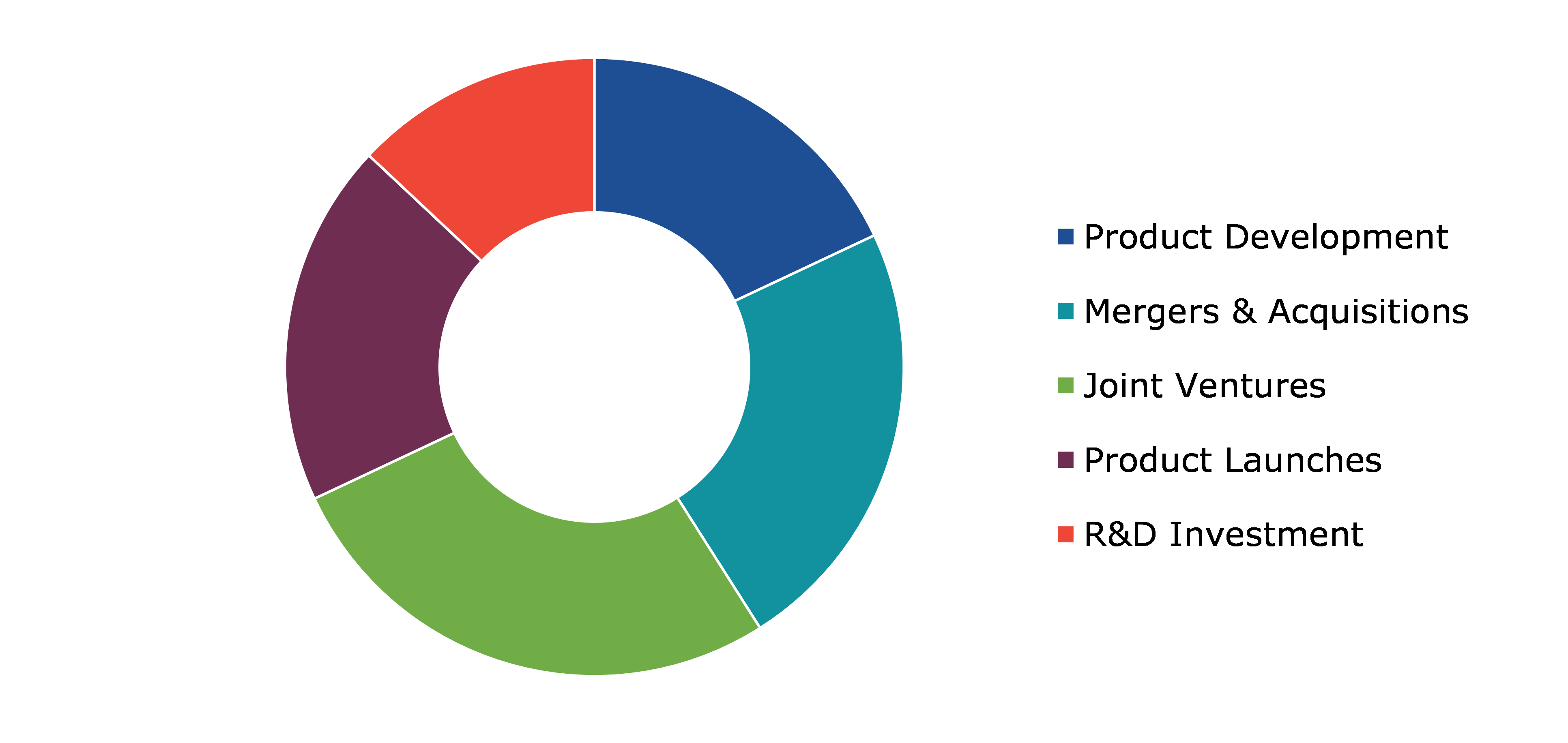

Competitive Scenario in the Global Cryogenic Equipment Market

Investment and acquisition are common strategies followed by major market players. For instance, in May 2022, Chart Industries, Inc. acquired CSC Cryogenic Service Center AB, a Swedish company. The acquisition is expected to expand the geographic presence, along with the expansion of company’s repair and service capabilities for mobile equipment, in particular trailers, as well as stationary and transportable tanks, ISO containers, flowmeters, pumps, and LNG fueling stations. Chart Industries has a huge customer base looking for exclusive full care maintenance and service agreements in the Nordic region as well as commissioning and installation capabilities for LNG stations. The acquisition of CSC would also bring firm relationships with major customers in the marine industry and utilizing the company’s global commercial team.

Source: Research Dive Analysis

Some of the leading cryogenic equipment market players are LAPESA GRUPO EMPRESARIAL, Linde plc, Cryolor, Auguste Cryogenics, Cryofab, Inc., Emerson Electric Co., Chart Industries, NIKKISO, INOX India Limited, and MAN Energy Solutions.

| Aspect | Particulars |

| Historical Market Estimations | 2021 |

| Base Year for Market Estimation | 2022 |

| Forecast Timeline for Market Projection | 2023-2032 |

| Geographical Scope | North America, Europe, Asia-Pacific, and LAMEA |

| Segmentation by Product |

|

|

Segmentation by Gas Type

|

|

| Segmentation by Application |

|

| Key Companies Profiled |

|

Q1. What is the size of the global cryogenic equipment market?

A. The size of the global cryogenic equipment market was over $19,890.0 million in 2022 and is projected to reach $39,005.3 million by 2032.

Q2. Which are the major companies in the cryogenic equipment market?

A. LAPESA GRUPO EMPRESARIAL, Linde plc, Cryofab, Inc., Emerson Electric Co., and Chart Industries are some of the key players in the global cryogenic equipment market.

Q3. Which region, among others, possesses greater investment opportunities in the future?

A. Asia-Pacific possesses great investment opportunities for investors in the future.

Q4. What will be the growth rate of the Asia-Pacific cryogenic equipment market?

A. The Asia-Pacific cryogenic equipment market is anticipated to grow at 6.9% CAGR during the forecast period.

Q5. What are the strategies opted by the leading players in this market?

A. Acquisition and investment are the two key strategies opted by the operating companies in this market.

Q6. Which companies are investing more on R&D practices?

A. Chart Industries, Inc., Linde Plc, and Emerson Electric Co., are the companies investing more on R&D activities for developing new products and technologies.

1. Research Methodology

1.1. Desk Research

1.2. Real time insights and validation

1.3. Forecast model

1.4. Assumptions and forecast parameters

1.5. Market size estimation

1.5.1. Top-down approach

1.5.2. Bottom-up approach

2. Report Scope

2.1. Market definition

2.2. Key objectives of the study

2.3. Report overview

2.4. Market segmentation

2.5. Overview of the impact of COVID-19 on global cryogenic equipment market

3. Executive Summary

4. Market Overview

4.1. Introduction

4.2. Growth impact forces

4.2.1. Drivers

4.2.2. Restraints

4.2.3. Opportunities

4.3. Market value chain analysis

4.3.1. List of raw material suppliers

4.3.2. List of manufacturers

4.3.3. List of distributors

4.4. Innovation & sustainability matrices

4.4.1. Technology matrix

4.4.2. Regulatory matrix

4.5. Porter’s five forces analysis

4.5.1. Bargaining power of suppliers

4.5.2. Bargaining power of consumers

4.5.3. Threat of substitutes

4.5.4. Threat of new entrants

4.5.5. Competitive Rivalry Intensity

4.6. PESTLE analysis

4.6.1. Political

4.6.2. Economical

4.6.3. Social

4.6.4. Technological

4.6.5. Environmental

4.7. Impact of COVID-19 on cryogenic equipment market

4.7.1. Pre-covid market scenario

4.7.2. Post-covid market scenario

5. Cryogenic Equipment Market Analysis, by Product

5.1. Overview

5.2. Tanks

5.2.1. Definition, key trends, growth factors, and opportunities

5.2.2. Market size analysis, by region, 2022-2032

5.2.3. Market share analysis, by country, 2022-2032

5.3. Valves

5.3.1. Definition, key trends, growth factors, and opportunities

5.3.2. Market size analysis, by region, 2022-2032

5.3.3. Market share analysis, by country, 2022-2032

5.4. Vaporizers

5.4.1. Definition, key trends, growth factors, and opportunities

5.4.2. Market size analysis, by region, 2022-2032

5.4.3. Market share analysis, by country, 2022-2032

5.5. Pumps

5.5.1. Definition, key trends, growth factors, and opportunities

5.5.2. Market size analysis, by region, 2022-2032

5.5.3. Market share analysis, by country, 2022-2032

5.6. Vacuum Jacketed Piping

5.6.1. Definition, key trends, growth factors, and opportunities

5.6.2. Market size analysis, by region, 2022-2032

5.6.3. Market share analysis, by country, 2022-2032

5.7. Others

5.7.1. Definition, key trends, growth factors, and opportunities

5.7.2. Market size analysis, by region, 2022-2032

5.7.3. Market share analysis, by country, 2022-2032

5.8. Research Dive Exclusive Insights

5.8.1. Market attractiveness

5.8.2. Competition heatmap

6. Cryogenic Equipment Market Analysis, by Gas Type

6.1. Overview

6.2. Nitrogen

6.2.1. Definition, key trends, growth factors, and opportunities

6.2.2. Market size analysis, by region, 2022-2032

6.2.3. Market share analysis, by country, 2022-2032

6.3. Oxygen

6.3.1. Definition, key trends, growth factors, and opportunities

6.3.2. Market size analysis, by region, 2022-2032

6.3.3. Market share analysis, by country, 2022-2032

6.4. Argon

6.4.1. Definition, key trends, growth factors, and opportunities

6.4.2. Market size analysis, by region, 2022-2032

6.4.3. Market share analysis, by country, 2022-2032

6.5. LNG

6.5.1. Definition, key trends, growth factors, and opportunities

6.5.2. Market size analysis, by region, 2022-2032

6.5.3. Market share analysis, by country, 2022-2032

6.6. Others

6.6.1. Definition, key trends, growth factors, and opportunities

6.6.2. Market size analysis, by region, 2022-2032

6.6.3. Market share analysis, by country, 2022-2032

6.7. Research Dive Exclusive Insights

6.7.1. Market attractiveness

6.7.2. Competition heatmap

7. Cryogenic Equipment Market Analysis, by Application

7.1. Overview

7.2. Storage

7.2.1. Definition, key trends, growth factors, and opportunities

7.2.2. Market size analysis, by region, 2022-2032

7.2.3. Market share analysis, by country, 2022-2032

7.3. Distribution

7.3.1. Definition, key trends, growth factors, and opportunities

7.3.2. Market size analysis, by region, 2022-2032

7.3.3. Market share analysis, by country, 2022-2032

7.4. Research Dive Exclusive Insights

7.4.1. Market attractiveness

7.4.2. Competition heatmap

8. Cryogenic Equipment Market, by Region

8.1. North America

8.1.1. U.S.

8.1.1.1. Market size analysis, by Product, 2022-2032

8.1.1.2. Market size analysis, by Gas Type, 2022-2032

8.1.1.3. Market size analysis, by Application, 2022-2032

8.1.2. Canada

8.1.2.1. Market size analysis, by Product, 2022-2032

8.1.2.2. Market size analysis, by Gas Type, 2022-2032

8.1.2.3. Market size analysis, by Application, 2022-2032

8.1.3. Mexico

8.1.3.1. Market size analysis, by Product, 2022-2032

8.1.3.2. Market size analysis, by Gas Type, 2022-2032

8.1.3.3. Market size analysis, by Application, 2022-2032

8.1.4. Research Dive Exclusive Insights

8.1.4.1. Market attractiveness

8.1.4.2. Competition heatmap

8.2. Europe

8.2.1. Germany

8.2.1.1. Market size analysis, by Product, 2022-2032

8.2.1.2. Market size analysis, by Gas Type, 2022-2032

8.2.1.3. Market size analysis, by Application, 2022-2032

8.2.2. UK

8.2.2.1. Market size analysis, by Product, 2022-2032

8.2.2.2. Market size analysis, by Gas Type, 2022-2032

8.2.2.3. Market size analysis, by Application, 2022-2032

8.2.3. France

8.2.3.1. Market size analysis, by Product, 2022-2032

8.2.3.2. Market size analysis, by Gas Type, 2022-2032

8.2.3.3. Market size analysis, by Application, 2022-2032

8.2.4. Spain

8.2.4.1. Market size analysis, by Product, 2022-2032

8.2.4.2. Market size analysis, by Gas Type, 2022-2032

8.2.4.3. Market size analysis, by Application, 2022-2032

8.2.5. Italy

8.2.5.1. Market size analysis, by Product, 2022-2032

8.2.5.2. Market size analysis, by Gas Type, 2022-2032

8.2.5.3. Market size analysis, by Application, 2022-2032

8.2.6. Rest of Europe

8.2.6.1. Market size analysis, by Product, 2022-2032

8.2.6.2. Market size analysis, by Gas Type, 2022-2032

8.2.6.3. Market size analysis, by Application, 2022-2032

8.2.7. Research Dive Exclusive Insights

8.2.7.1. Market attractiveness

8.2.7.2. Competition heatmap

8.3. Asia-Pacific

8.3.1. China

8.3.1.1. Market size analysis, by Product, 2022-2032

8.3.1.2. Market size analysis, by Gas Type, 2022-2032

8.3.1.3. Market size analysis, by Application, 2022-2032

8.3.2. Japan

8.3.2.1. Market size analysis, by Product, 2022-2032

8.3.2.2. Market size analysis, by Gas Type, 2022-2032

8.3.2.3. Market size analysis, by Application, 2022-2032

8.3.3. India

8.3.3.1. Market size analysis, by Product, 2022-2032

8.3.3.2. Market size analysis, by Gas Type, 2022-2032

8.3.3.3. Market size analysis, by Application, 2022-2032

8.3.4. Australia

8.3.4.1. Market size analysis, by Product, 2022-2032

8.3.4.2. Market size analysis, by Gas Type, 2022-2032

8.3.4.3. Market size analysis, by Application, 2022-2032

8.3.5. South Korea

8.3.5.1. Market size analysis, by Product, 2022-2032

8.3.5.2. Market size analysis, by Gas Type, 2022-2032

8.3.5.3. Market size analysis, by Application, 2022-2032

8.3.6. Rest of Asia-Pacific

8.3.6.1. Market size analysis, by Product, 2022-2032

8.3.6.2. Market size analysis, by Gas Type, 2022-2032

8.3.6.3. Market size analysis, by Application, 2022-2032

8.3.7. Research Dive Exclusive Insights

8.3.7.1. Market attractiveness

8.3.7.2. Competition heatmap

8.4. LAMEA

8.4.1. Brazil

8.4.1.1. Market size analysis, by Product, 2022-2032

8.4.1.2. Market size analysis, by Gas Type, 2022-2032

8.4.1.3. Market size analysis, by Application, 2022-2032

8.4.2. UAE

8.4.2.1. Market size analysis, by Product, 2022-2032

8.4.2.2. Market size analysis, by Gas Type, 2022-2032

8.4.2.3. Market size analysis, by Application, 2022-2032

8.4.3. South Africa

8.4.3.1. Market size analysis, by Product, 2022-2032

8.4.3.2. Market size analysis, by Gas Type, 2022-2032

8.4.3.3. Market size analysis, by Application, 2022-2032

8.4.4. Argentina

8.4.4.1. Market size analysis, by Product, 2022-2032

8.4.4.2. Market size analysis, by Gas Type, 2022-2032

8.4.4.3. Market size analysis, by Application, 2022-2032

8.4.5. Rest of LAMEA

8.4.5.1. Market size analysis, by Product, 2022-2032

8.4.5.2. Market size analysis, by Gas Type, 2022-2032

8.4.5.3. Market size analysis, by Application, 2022-2032

8.4.6. Research Dive Exclusive Insights

8.4.6.1. Market attractiveness

8.4.6.2. Competition heatmap

9. Competitive Landscape

9.1. Top winning strategies, 2022

9.1.1. By strategy

9.1.2. By year

9.2. Strategic overview

9.3. Market share analysis, 2022

10. Company Profiles

10.1. LAPESA GRUPO EMPRESARIAL

10.1.1. Overview

10.1.2. Business segments

10.1.3. Product portfolio

10.1.4. Financial performance

10.1.5. Recent developments

10.1.6. SWOT analysis

10.2. Linde plc

10.2.1. Overview

10.2.2. Business segments

10.2.3. Product portfolio

10.2.4. Financial performance

10.2.5. Recent developments

10.2.6. SWOT analysis

10.3. Cryolor

10.3.1. Overview

10.3.2. Business segments

10.3.3. Product portfolio

10.3.4. Financial performance

10.3.5. Recent developments

10.3.6. SWOT analysis

10.4. Auguste Cryogenics

10.4.1. Overview

10.4.2. Business segments

10.4.3. Product portfolio

10.4.4. Financial performance

10.4.5. Recent developments

10.4.6. SWOT analysis

10.5. Cryofab, Inc.

10.5.1. Overview

10.5.2. Business segments

10.5.3. Product portfolio

10.5.4. Financial performance

10.5.5. Recent developments

10.5.6. SWOT analysis

10.6. Emerson Electric Co.

10.6.1. Overview

10.6.2. Business segments

10.6.3. Product portfolio

10.6.4. Financial performance

10.6.5. Recent developments

10.6.6. SWOT analysis

10.7. Chart Industries

10.7.1. Overview

10.7.2. Business segments

10.7.3. Product portfolio

10.7.4. Financial performance

10.7.5. Recent developments

10.7.6. SWOT analysis

10.8. NIKKISO

10.8.1. Overview

10.8.2. Business segments

10.8.3. Product portfolio

10.8.4. Financial performance

10.8.5. Recent developments

10.8.6. SWOT analysis

10.9. INOX India Limited

10.9.1. Overview

10.9.2. Business segments

10.9.3. Product portfolio

10.9.4. Financial performance

10.9.5. Recent developments

10.9.6. SWOT analysis

10.10. MAN Energy Solutions

10.10.1. Overview

10.10.2. Business segments

10.10.3. Product portfolio

10.10.4. Financial performance

10.10.5. Recent developments

10.10.6. SWOT analysis

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com