Cell Counting Market Report

RA00370

Cell Counting Market, by Products [Spectrophotometers (Single-Mode Readers and Multi-Mode Readers), Flow Cytometers, Hematology Analyzers, Cell Counters (Automated Cell Counters, Hemocytometers, and Manual Cell Counters)], End User (Hospitals & Diagnostic Laboratories, Research Institutions, Pharmaceutical & Biotechnology Companies, and Others), and Regional Analysis (North America, Europe, Asia-Pacific, and LAMEA): Global Opportunity Analysis and Industry Forecast, 2020–2027

Cell Counting Market Analysis:

Cell counting refers to a practice of counting cells for multiple medical applications in pharmaceutical, biotechnology, and other clinical & medical research activities. Cell counts determine the cell concentration or cells per unit of volume in liquid media. Multiple treatments need to carry out the cell counting process necessary in order to decide further procedures. Cell counting procedure can be either done manually or automatically. While manual cell counting is prone to errors and is time-consuming, automatic cell counting is highly reliable and quick. Cell counting facilitates the maintenance of cell cultures and helps in the preparation of cells for downstream experiments and transfection during research and experiment works. Cell counting plays an important role in the determination of the concentration of white blood cells and red blood cells, toxicity effects of specific drugs on model cells, and the presence of pathogens. Also, cell counting helps in the determination of the amounts of chemicals and reagents to be added in a solution. These benefits offered by cell counting and increasing research activities across the globe have facilitated the growth of the market.

Growing prevalence of AIDS and cancer amongst the global population is the major factor driving the market growth

Growing cases of acquired immunodeficiency syndrome (AIDS) and cancer across the globe has increased demand for cell counting massively. Cell counting facilitates the determination of intra-tumor heterogeneity, which is a vital procedure in assessing cancer progression in the patient’s body. Cell counting helps in the determination and identification of metastatic tumors, primary tumors, and circulating tumors. Identification of these tumors is extremely critical and vital for the purpose of monitoring and therapeutic targeting, under which further treatment procedures are decided. As per a report by the World Health Organization (WHO) from September 2018, cancer was responsible for approximately 9.6 million deaths in 2018, making it the second leading cause of death globally. Another report from 2018 states that approximately 37.9 million people were infected with AIDS with 770,000 deaths across the globe. Significantly growing cases have made it extremely important to perform the process of cell counting and in turn, facilitated market growth. Further, cell counting has become an integral procedure of hospital and clinical setups. Cell counting helps in determining the concentration of platelets, plasma, red blood cells, and white blood cells, which facilitates in the evaluation of the immune system and identification of bacteria, pathogens, and viruses in the host’s body. All these factors are majorly promoting the usage of cell counting in multiple treatments, medical procedures, and research activities, which is increasing the demand for cell counting procedures and equipment.

High costs, scarcity of skilled professionals, and poor healthcare infrastructure to hamper the market growth

High costs of the apparatus, equipment, and procedures restrict people from spending on cell counting procedures for medical or research purposes. Further, underdeveloped healthcare infrastructure with obsolete technology restricts the growth of cell counting majorly in most regions across the globe. Also, the lack of skilled professionals is causing hindrance in the growth of the cell counting market.

Increased government and corporate funding, improved image analysis solutions, and development of enhanced informatics solution to create lucrative market opportunities

Increased investments by government organizations and corporate firms have facilitated the significant growth of healthcare sectors across the globe. High investments have enabled research centers, educational institutes, hospitals, and other medical setups to acquire the latest technology in the cell counting sector owing to the development of infrastructure. The growing inflow of investments for research purposes is expected to create huge growth opportunities for the market. Further, highly advanced and improved image analysis systems are now available across the globe at cost-effective prices. These image systems enhance the cell counting process by increasing accuracy and decreasing the time taken. Also, the development of enhanced informatics systems has improved the data analysis and visualization process. All these factors have contributed to the rise in demand for biologics in the treatment of chronic diseases and have created huge growth opportunities for the cell counting market.

Cell Counting Market, by Products:

Spectrophotometers segment to be most lucrative till 2027

The spectrophotometers segment will have a dominating share in the global market and is expected to register a significant revenue during the forecast timeframe. Spectrophotometry procedure in cell counting has become the most adopted choice to detect cell concentration causing a rise in the demand for spectrophotometers. Further, spectrophotometers have wide applications in bioprocessing, therapeutics, and research. Spectrophotometers are being adopted majorly owing to their high accuracy and ability to measure and identify different intensities of light.

Cell Counting Market, by End User:

Hospitals & diagnostic laboratories segment to register maximum growth

Hospitals & diagnostic laboratories segment is anticipated to register maximum growth in the cell counting market during the forecast period. Increasing investment for pharmaceutical research and development activities, commercial expansion of multiple pharmaceutical firms, and growing regulatory approvals for cell culture-based vaccines are the major factors driving the market growth. Further, growing patients of AIDS and cancer highly rely on hospitals and diagnostic laboratories for proper treatment as well as assessment owing to the highly developed infrastructural facilities installed with advanced technologies.

Cell Counting Market, by Region:

North America region to hold the largest market share by 2027

The North America region is expected to hold the largest market share in the cell counting market during the forecast timeframe. Rising focus on cancer research, biomedical, and stem cells, growing prevalence of chronic diseases like AIDS and cancer, availability of advanced healthcare sector, and government-initiated R&D activities are driving the market growth. Further, the wide availability of key players and early adoption of cell counting technologies has facilitated the region’s growth in the cell counting market.

Asia-Pacific region to grow exponentially in the forecast period

The Asia-Pacific region is anticipated to grow exponentially in the cell counting market during the forecast period. Growing expenditure by public and private organizations for R&D, increasing the geriatric population, improving healthcare facilities, an increasing number of stem cell research, genomics, and proteomics are driving the regional market growth.

Key Participants in the Global Cell Counting Market:

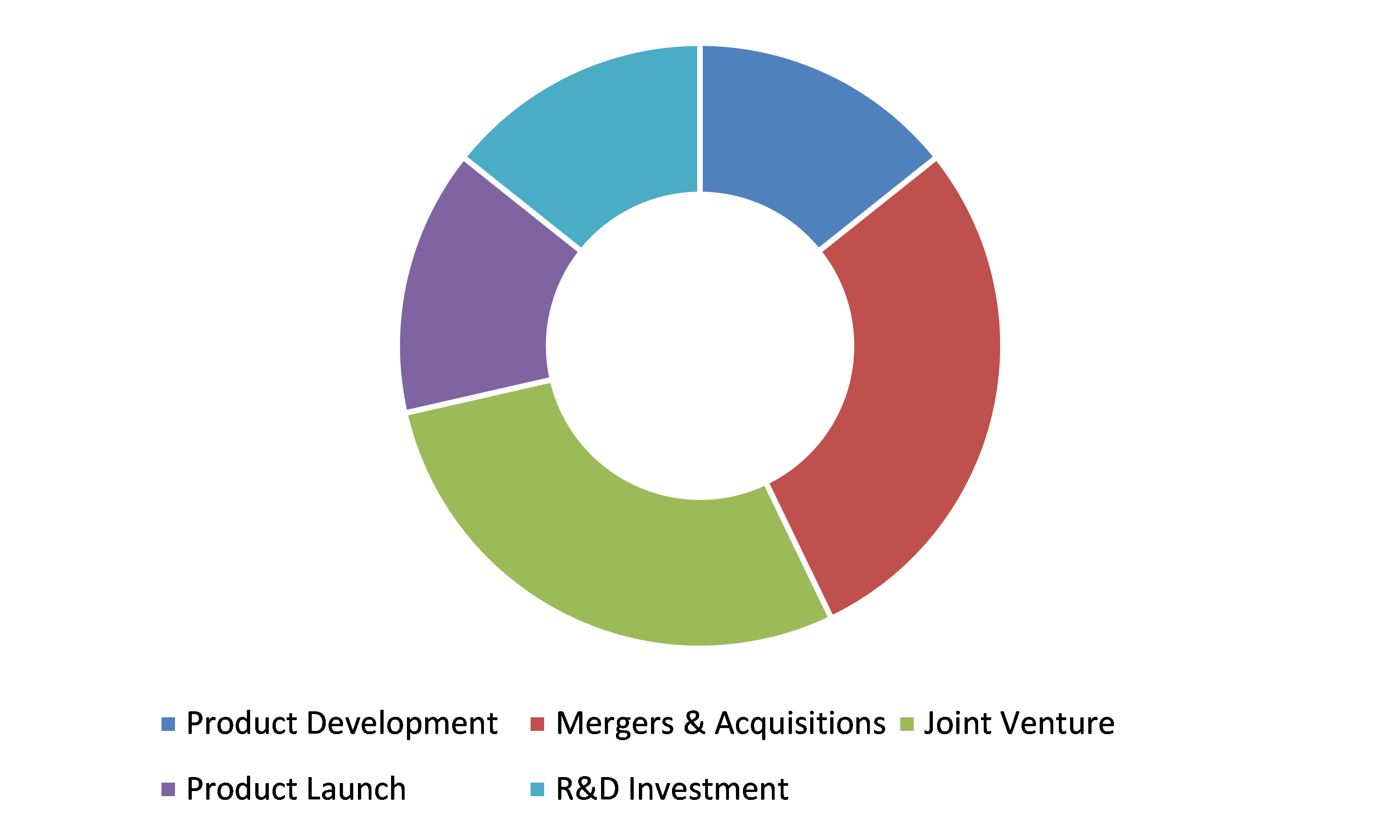

Merger & acquisition and advanced product development are the frequent strategies followed by the market players

Source: Research Dive Analysis

Some of the significant cell counting market players include GENERAL ELECTRIC COMPANY, BioTek Instruments, Inc., Danaher., Thermo Fisher Scientific Inc., BD., Agilent Technologies, Inc., Merck KGaA, Bio-Rad Laboratories, Inc., PerkinElmer Inc., and Tecan Trading AG.

Cell counting market players are emphasizing more on merger & acquisition and advanced product development. These are the multiple strategies implemented by established organizations. To emphasize more on the competitor analysis of market players, Porter’s five forces model is explained in the report.

| Aspect | Particulars |

| Historical Market Estimations | 2018-2019 |

| Base Year for Market Estimation | 2019 |

| Forecast timeline for Market Projection | 2020-2027 |

| Geographical Scope | North America, Europe, Asia-Pacific, LAMEA |

| Segmentation by Products |

|

| Segmentation by End User |

|

| Key Countries Covered | U.S., Canada, Germany, France, Spain, Russia, Japan, China, India, South Korea, Australia, Brazil, and Saudi Arabia |

| Key Companies Profiled |

|

Q1. Which are the leading companies in the cell counting market?

A. PerkinElmer Inc., Danaher., and Thermo Fisher Scientific Inc. are the leading companies in the cell counting market.

Q2. Which region possesses greater investment opportunities in the coming future?

A. The Asia-Pacific region possesses great investment opportunities for investors to witness the most promising growth in the future.

Q3. What are the strategies opted by the leading players in this market?

A. Technological advancements, product development, along with joint ventures are the key strategies opted by the operating companies in this market.

Q4. Which companies are investing more in R&D practices?

A. Merck KGaA and GENERAL ELECTRIC COMPANY are investing more in R&D practices.

-

1. RESEARCH METHODOLOGY

1.1. Desk Research

1.2. Real time insights and validation

1.3. Forecast model

1.4. Assumptions and forecast parameters

1.5. Market size estimation

1.5.1. Top-down approach

1.5.2. Bottom-up approach

-

2. REPORT SCOPE

2.1. Market definition

2.2. Key objectives of the study

2.3. Report overview

2.4. Market segmentation

2.5. Overview of the impact of COVID-19 on Global Cell Counting Market

-

3. EXECUTIVE SUMMARY

-

4. MARKET OVERVIEW

4.1. Introduction

4.2. Growth impact forces

4.2.1. Drivers

4.2.2. Restraints

4.2.3. Opportunities

4.3. Market value chain analysis

4.3.1. List of raw material suppliers

4.3.2. List of manufacturers

4.3.3. List of distributors

4.4. Innovation & sustainability matrices

4.4.1. Technology matrix

4.4.2. Regulatory matrix

4.5. Porter’s five forces analysis

4.5.1. Bargaining power of suppliers

4.5.2. Bargaining power of consumers

4.5.3. Threat of substitutes

4.5.4. Threat of new entrants

4.5.5. Competitive rivalry intensity

4.6. PESTLE analysis

4.6.1. Political

4.6.2. Economical

4.6.3. Social

4.6.4. Technological

4.6.5. Environmental

4.7. Impact of COVID-19 on Cell Counting Market

4.7.1. Pre-covid market scenario

4.7.2. Post-covid market scenario

-

5. Cell Counting Market, By Product

5.1. Overview

5.2 Instruments

5.2.1 Definition, key trends, growth factors, and opportunities

5.2.2 Market size analysis, by region, 2020-2027

5.2.3 Market share analysis, by country, 2020-2027

5.3 Consumables

5.3.1 Definition, key trends, growth factors, and opportunities

5.3.2 Market size analysis, by region, 2020-2027

5.3.3 Market share analysis, by country, 2020-2027

5.4 Research Dive Exclusive Insights

5.4.1 Market attractiveness

5.4.2 Competition heatmap

-

6. Cell Counting Market, By Technology

6.1. Overview

6.2 Research Applications

6.2.1 Definition, key trends, growth factors, and opportunities

6.2.2 Market size analysis, by region, 2020-2027

6.2.3 Market share analysis, by country, 2020-2027

6.3 Clinical & Diagnostic Applications

6.3.1 Definition, key trends, growth factors, and opportunities

6.3.2 Market size analysis, by region, 2020-2027

6.3.3 Market share analysis, by country, 2020-2027

6.4 Industrial Applications

6.4.1 Definition, key trends, growth factors, and opportunities

6.4.2 Market size analysis, by region, 2020-2027

6.4.3 Market share analysis, by country, 2020-2027

6.5 Research Dive Exclusive Insights

6.5.1 Market attractiveness

6.5.2 Competition heatmap

-

7. Cell Counting Market, By Distribution Channel

7.1. Overview

7.2 Research Institutes

7.2.1 Definition, key trends, growth factors, and opportunities

7.2.2 Market size analysis, by region, 2020-2027

7.2.3 Market share analysis, by country, 2020-2027

7.3 Hospitals & Diagnostic Laboratories

7.3.1 Definition, key trends, growth factors, and opportunities

7.3.2 Market size analysis, by region, 2020-2027

7.3.3 Market share analysis, by country, 2020-2027

7.4 Pharmaceutical & Biotechnology Companies and Contract Research Organizations (CROs)

7.4.1 Definition, key trends, growth factors, and opportunities

7.4.2 Market size analysis, by region, 2020-2027

7.4.3 Market share analysis, by country, 2020-2027

7.5 Other End Users

7.5.1 Definition, key trends, growth factors, and opportunities

7.5.2 Market size analysis, by region, 2020-2027

7.5.3 Market share analysis, by country, 2020-2027

7.6 Research Dive Exclusive Insights

7.6.1 Market attractiveness

7.6.2 Competition heatmap

8. Cell Counting Market, By Region

8.1 North America

8.1.1 U.S

8.1.1.1 Market size analysis, By Product, 2020-2027

8.1.1.2 Market size analysis, By Technology, 2020-2027

8.1.1.3 Market size analysis, By Distribution Channel, 2020-2027

8.1.2 Canada

8.1.2.1 Market size analysis, By Product, 2020-2027

8.1.2.2 Market size analysis, By Technology, 2020-2027

8.1.2.3 Market size analysis, By Distribution Channel, 2020-2027

8.1.3 Mexico

8.1.3.1 Market size analysis, By Product, 2020-2027

8.1.3.2 Market size analysis, By Technology, 2020-2027

8.1.3.3 Market size analysis, By Distribution Channel, 2020-2027

8.1.4 Research Dive Exclusive Insights

8.1.4.1 Market attractiveness

8.1.4.2 Competition heatmap

8.2 Europe

8.2.1 Germany

8.2.1.1 Market size analysis, By Product, 2020-2027

8.2.1.2 Market size analysis, By Technology, 2020-2027

8.2.1.3 Market size analysis, By Distribution Channel, 2020-2027

8.2.2 UK

8.2.2.1 Market size analysis, By Product, 2020-2027

8.2.2.2 Market size analysis, By Technology, 2020-2027

8.2.2.3 Market size analysis, By Distribution Channel, 2020-2027

8.2.3 France

8.2.3.1 Market size analysis, By Product, 2020-2027

8.2.3.2 Market size analysis, By Technology, 2020-2027

8.2.3.3 Market size analysis, By Distribution Channel, 2020-2027

8.2.4 Spain

8.2.4.1 Market size analysis, By Product, 2020-2027

8.2.4.2 Market size analysis, By Technology, 2020-2027

8.2.4.3 Market size analysis, By Distribution Channel, 2020-2027

8.2.5 Italy

8.2.5.1 Market size analysis, By Product, 2020-2027

8.2.5.2 Market size analysis, By Technology, 2020-2027

8.2.5.3 Market size analysis, By Distribution Channel, 2020-2027

8.2.6 Rest of Europe

8.2.6.1 Market size analysis, By Product, 2020-2027

8.2.6.2 Market size analysis, By Technology, 2020-2027

8.2.6.3 Market size analysis, By Distribution Channel, 2020-2027

8.2.7 Research Dive Exclusive Insights

8.2.7.1 Market attractiveness

8.2.7.2 Competition heatmap

8.3 Asia-Pacific

8.3.1 China

8.3.1.1 Market size analysis, By Product, 2020-2027

8.3.1.2 Market size analysis, By Technology, 2020-2027

8.3.1.3 Market size analysis, By Distribution Channel, 2020-2027

8.3.2 Japan

8.3.2.1 Market size analysis, By Product, 2020-2027

8.3.2.2 Market size analysis, By Technology, 2020-2027

8.3.2.3 Market size analysis, By Distribution Channel, 2020-2027

8.3.3 India

8.3.3.1 Market size analysis, By Product, 2020-2027

8.3.3.2 Market size analysis, By Technology, 2020-2027

8.3.3.3 Market size analysis, By Distribution Channel, 2020-2027

8.3.4 Australia

8.3.4.1 Market size analysis, By Product, 2020-2027

8.3.4.2 Market size analysis, By Technology, 2020-2027

8.3.4.3 Market size analysis, By Distribution Channel, 2020-2027

8.3.5 South Korea

8.3.5.1 Market size analysis, By Product, 2020-2027

8.3.5.2 Market size analysis, By Technology, 2020-2027

8.3.5.3 Market size analysis, By Distribution Channel, 2020-2027

8.3.6 Rest of Asia-Pacific

8.3.6.1 Market size analysis, By Product, 2020-2027

8.3.6.2 Market size analysis, By Technology, 2020-2027

8.3.6.3 Market size analysis, By Distribution Channel, 2020-2027

8.3.7 Research Dive Exclusive Insights

8.3.7.1 Market attractiveness

8.3.7.2 Competition heatmap

8.4 LAMEA

8.4.1 Brazil

8.4.1.1 Market size analysis, By Product, 2020-2027

8.4.1.2 Market size analysis, By Technology, 2020-2027

8.4.1.3 Market size analysis, By Distribution Channel, 2020-2027

8.4.2 Saudi Arabia

8.4.2.1 Market size analysis, By Product, 2020-2027

8.4.2.2 Market size analysis, By Technology, 2020-2027

8.4.2.3 Market size analysis, By Distribution Channel, 2020-2027

8.4.3 UAE

8.4.3.1 Market size analysis, By Product, 2020-2027

8.4.3.2 Market size analysis, By Technology, 2020-2027

8.4.3.3 Market size analysis, By Distribution Channel, 2020-2027

8.4.4 South Africa

8.4.4.1 Market size analysis, By Product, 2020-2027

8.4.4.2 Market size analysis, By Technology, 2020-2027

8.4.4.3 Market size analysis, By Distribution Channel, 2020-2027

8.4.5 Rest of LAMEA

8.4.5.1 Market size analysis, By Product, 2020-2027

8.4.5.2 Market size analysis, By Technology, 2020-2027

8.4.5.3 Market size analysis, By Distribution Channel, 2020-2027

8.4.6 Research Dive Exclusive Insights

8.4.6.1 Market attractiveness

8.4.6.2 Competition heatmap

9. Competitive Landscape

9.1 Top winning strategies, 2020-2027

9.1.1 By strategy

9.1.2 By year

9.2 Strategic overview

9.3 Market share analysis, 2020-2027

10. Company Profiles

10.1 Thermo Fisher Scientific Inc

10.1.1 Overview

10.1.2 Business segments

10.1.3 Product portfolio

10.1.4 Financial performance

10.1.5 Recent developments

10.1.6 SWOT analysis

10.2 Merck KGaA

10.2.1 Overview

10.2.2 Business segments

10.2.3 Product portfolio

10.2.4 Financial performance

10.2.5 Recent developments

10.2.6 SWOT analysis

10.3 PerkinElmer Inc

10.3.1 Overview

10.3.2 Business segments

10.3.3 Product portfolio

10.3.4 Financial performance

10.3.5 Recent developments

10.3.6 SWOT analysis

10.4 Olympus Corporation

10.4.1 Overview

10.4.2 Business segments

10.4.3 Product portfolio

10.4.4 Financial performance

10.4.5 Recent developments

10.4.6 SWOT analysis

10.5 HORIBA Ltd

10.5.1 Overview

10.5.2 Business segments

10.5.3 Product portfolio

10.5.4 Financial performance

10.5.5 Recent developments

10.5.6 SWOT analysis

10.6 Logos Biosystems Inc

10.6.1 Overview

10.6.2 Business segments

10.6.3 Product portfolio

10.6.4 Financial performance

10.6.5 Recent developments

10.6.6 SWOT analysis

10.7 Corning Incorporated

10.7.1 Overview

10.7.2 Business segments

10.7.3 Product portfolio

10.7.4 Financial performance

10.7.5 Recent developments

10.7.6 SWOT analysis

10.8 Tecan Trading AG

10.8.1 Overview

10.8.2 Business segments

10.8.3 Product portfolio

10.8.4 Financial performance

10.8.5 Recent developments

10.8.6 SWOT analysis

10.9 Abbott

10.9.1 Overview

10.9.2 Business segments

10.9.3 Product portfolio

10.9.4 Financial performance

10.9.5 Recent developments

10.9.6 SWOT analysis

10.10 General Electric Company

10.10.1 Overview

10.10.2 Business segments

10.10.3 Product portfolio

10.10.4 Financial performance

10.10.5 Recent developments

10.10.6 SWOT analysis

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com