Hydrogen Generation Market Report

RA03647

Hydrogen Generation Market by Source (Blue, Gray, and Green), Type (Merchant and Captive), Technology (Steam Methane Reforming, Coal Gasification, and Others), Application (Oil Refining, Chemical Processing, Iron & Steel Production, and Others), End-use Industry (Transportation, Power Generation, and Buildings), and Regional Analysis (North America, Europe, Asia-Pacific, and LAMEA): Global Opportunity Analysis and Industry Forecast, 2021–2028

Global Hydrogen Generation Market Analysis

The global hydrogen generation market size was $126,200.0 million in 2020 and is predicted to grow with a CAGR of 6.9%, by generating a revenue of $212,877.4 million by 2028.

Market Synopsis

Hydrogen generation market is gaining huge demand owing to the use of hydrogen as a carrier. This energy carrier facilitates transport of energy from one place to another. Also, hydrogen can be generated from various sources such as biomass, water, fossil fuel, and others. Hydrogen generation technology is becoming popular as hydrogen has highest energy content than any other fuel by weight. For instance, the energy content by weight in hydrogen is three times more than that of gasoline. Due to this factor, hydrogen is used as a rocket fuel and in fuel cells to generate electricity for spacecrafts.

However, hydrogen storage systems are more expensive compared to natural gas storage systems. This is majorly owing to weight and volume of hydrogen storage systems which are too high that leads to inadequate vehicle range compared to petroleum fueled vehicles. This factor is anticipated to restrain the hydrogen generation market size during the forecast period.

The development of advanced electrolysis technologies to enhance the scalability of hydrogen production units is estimated to generate huge growth opportunities. For instance, proton exchange membrane or polymer electrolyte membrane (PEM) electrolyzers can be used for residential as well as industrial purpose. Such advanced electrolysis technology is favored as it helps in reducing the operating expenses and capital expenditures required for hydrogen generation.

According to regional analysis, the Asia-Pacific hydrogen generation market accounted for $53,483.6 million in 2020 and is predicted to grow with a CAGR of 7.5% in the projected timeframe.

Hydrogen Generation Market Overview

Hydrogen generation refers to various methods of producing hydrogen via different processes such as steam methane reforming electrolysis and others. Hydrogen is used in synthesis of ammonia and for manufacturing of nitrogenous fertilizers. Also, it can be used for manufacturing of methanol and as a rocket fuel in various space research activities. Hydrogen is a clean fuel, its production does not emit harmful carbon dioxide due to which it helps in decarbonizing the economy and achieving climate neutrality goals.

COVID-19 Impact on Hydrogen Generation Market

The COVID-19 pandemic had a major impact on hydrogen generation market globally. This is majorly owing to reduced investment in new energy sector which has slowed down the expansion of clean energy technologies. For instance, as stated on June 11, 2020, the International Energy Agency, the Paris-based intergovernmental organization, only 6 out of 46 technologies working on clean energy transformation were on track to meet the sustainability goals in 2019. Owing to complete lockdown imposed across various countries, the global energy demand declined by sharp 25% and in the countries with partial lockdown restrictions, the energy demand was declined by almost 18%. Hence, lower capital spending, supply chain disruptions, and economic downturn brought by the COVID-19 pandemic have negatively impacted hydrogen generation market share.

Various hydrogen projects announced in 2020 is estimated to help the economy and clean energy initiatives back on track. For instance, in November 2020, China announced a 15-year strategy for new energy vehicles for developing fuel cell technology for hydrogen-powered buses and trucks. China is already a leading country in government-sponsored hydrogen research and development projects. In addition, the Singaporean and Australian governments have signed a memorandum of understanding in October 2020 regarding low emissions technology. Also, Singapore announced $49 million towards low-carbon research funding initiative in October 2020.

Adoption of Carbon Capture, Utilization, & Storage (CCUS) Technology for Hydrogen Generation to Drive the Market Growth

At present the global hydrogen generation is primarily dependent on fossil fuels and technologies such as steam methane reforming and coal gasification. However, these technologies lead to emission of harmful greenhouse gases. Hence, CCUS technology is being incorporated as it reduces environmental impact and increases the sustainability of the process. CCUS technology is incorporated for large scale hydrogen production to reduce the carbon emissions. For instance, the carbon generated during CCUS can be utilized for production of fertilizers and for enhanced oil recovery (EOR). For instance, Susteon, the U.S.-based startup company, is actively working towards production of blue hydrogen using CCUS technology. The company has developed compact distributed H2 generators to produce high-purity pressurized hydrogen while capturing carbon dioxide. The company uses catalytic nonthermal plasma that activates methane for the production of syngas. This syngas is purified and compressed to produce high-purity, high-pressure carbon-free hydrogen.

To know more about global hydrogen generation market drivers, get in touch with our analysts here.

High Cost of Hydrogen Storage and Transportation to Restrain the Market Growth

Hydrogen can be stored either as a gas in high-pressure tanks or it can be stored as a liquid in cryogenic temperatures. However, this hydrogen must be in gaseous form to be used as a fuel cell. This method of hydrogen storage leads to inherent loss of energy as compressing hydrogen utilizes 13% of total energy content by itself and if it is liquified, then it loses about 40% of energy. Hence, setting up the necessary infrastructure required for hydrogen fuel cells requires large capital investment. These factors are anticipated to restrain the hydrogen generation market size during the analysis timeframe.

Use of Hydrogen for Clean Transportation, in Space Industry, and in Energy Sector to Generate Excellent Growth Opportunities

Hydrogen has wide range of applications across various sectors. For instance, hydrogen can be used for clean transportation in fuel cell that generates electricity directly onboard a vehicle with an electric engine. These vehicles are “zero-emission” vehicles as they release only water as a by-product. Also, in energy sector, hydrogen can be used to produce clean and silent energy. This energy can be used as back-up energy systems, for portable power generators, and as a captive fleet. Similarly, in space industry hydrogen can be used as a rocket fuel as it concentrated most of the energy. For instance, 1 kg of hydrogen has 3 times more energy than 1 kg of gasoline. This is an important factor as launcher in space industry must be as light as possible. Also, stationary hydrogen fuel cells can be used to provide uninterrupted power supply to data centers and hospitals. It can be used to power telecommunications in remote locations and as backup power for regional emergency shelters.

To know more about global hydrogen generation market opportunities, get in touch with our analysts here.

Based on source, the market has been divided into gray, Blue, and green. Among these, the Blue sub-segment had accounted for highest market share in 2020 and green sub-segment is estimated to show the fastest growth during the forecast period. Download PDF Sample ReportHydrogen Generation Market

By Source

Source: Research Dive Analysis

The blue sub-type is anticipated to have a dominant market share and generate a revenue of $108,146.9 million by 2028, growing from $64,661.2 million in 2020. Blue hydrogen is produced from natural gas via steam reforming process in which natural gas is mixed with hot stream and a catalyst. Blue hydrogen is a low-carbon fuel which can be used for power generation, heating buildings, powering cars & trucks, and others. In blue hydrogen, the CO2 which is produced does not escape into the environment. Instead, this CO2 is captured at the production site and stored separately. This technology is known as carbon capture and storage (CCS) which helps in reducing the carbon emission into the atmosphere. Hence, it is environmentally friendly compared to gray hydrogen, but blue hydrogen adds up the carbon storage cost.

The green sub-type is anticipated to show the fastest growth and generate a revenue of $46,381.6 million by 2028, growing from $25,949.0 million in 2020. Green hydrogen is gaining huge popularity as it is produced from renewable energy sources such as wind energy which is environmentally friendly. Green hydrogen stabilizes heat supply & electricity as green hydrogen can be converted into electricity and heat and can be used for electricity supply & domestic energy. Green hydrogen supports global transition in sustainable energy and net zero carbon emissions. It has unprecedented momentum to meet the global hydrogen demand as clean energy solution. Also, major investments in green hydrogen technology are anticipated to drive the green hydrogen demand. For instance, the European Union (EU) has planned to invest $430 million in green hydrogen projects by 2030.

Hydrogen Generation Market

By TypeBased on type, the market has been divided into Merchant and captive. Among these, the Merchant hydrogen generation accounted for the highest revenue share in 2020 and it is estimated to show the fastest growth during the forecast period.

Source: Research Dive Analysis

The merchant hydrogen generation sub-segment is anticipated to have a dominant market share and generate a revenue of $138,331.3 million by 2028, growing from $80,101.7 million in 2020. In merchant hydrogen type, the hydrogen is produced for delivery to other locations as an industrial gas. The merchant hydrogen production and distribution are beneficial for various end-use industries such as oil & gas. For instance, merchant hydrogen is used in the manufacturing of gasoline, plastics, metals, jet fuel, and agricultural fertilizers. In addition, merchant hydrogen is also used in food oil products and in pharmaceutical industry. Though the present market for merchant hydrogen is small, its emerging application in fuel for transportation is anticipated to gain huge popularity in the upcoming years.

Hydrogen Generation Market

By TechnologyBased on technology, the market has been divided into Steam Methane Reforming, coal gasification, and others. Among these, the Steam Methane Reforming sub-segment accounted for the highest market share in 2020 and is predicted to show the fastest growth during the forecast period.

Source: Research Dive Analysis

Steam methane reforming sub-segment is anticipated to have a dominant market share and generate a revenue of $116,915.4 million by 2028, growing from $66,741.6 million in 2020. Steam methane reforming is a process in which natural gas or methane stream such as landfill gas or biogas is reacted with steam in presence of catalyst to produce hydrogen. This process is widely used for hydrogen generation at present, however it leads to the emission of carbon dioxide. Steam methane reforming produces hydrogen rich gas with 70-75% hydrogen on dry mass basis. When natural gas is used in steam methane reforming process, the efficiency of hydrogen produced is 72% on a lower heating value basis. Based on feedstock, the cost of hydrogen and scale of production varies.

Hydrogen Generation Market

By ApplicationBased on application, the market has been divided into Oil Refining, chemical processing, iron & steel production, and others. Among these, the Oil Refining sub-segment accounted for the highest market share in 2020 and is anticipated for the fastest growth during the forecast period.

Source: Research Dive Analysis

The oil refining sub-segment is anticipated to have a dominant market share and generate a revenue of $87,682.7 million by 2028, growing from $49,313.4 million in 2020. Hydrogen is widely used for oil refining to lower the sulfur content of the diesel fuel. Growing demand for fuel from transportation and power generation sector, both domestically and internationally has increased the demand for hydrogen in the oil refining sector. Also, to meet the growing demand for hydrogen at oil refineries, hydrogen is purchased from merchant suppliers rather than producing hydrogen on-site at the refinery. Moreover, at present, most of the oil refineries meet their hydrogen demand via steam methane reforming process of hydrogen production.

Hydrogen Generation Market

By End-use IndustryBased on end-use industry, the market has been divided into Transportation, power generation, and buildings. Among these, the Transportation sub-segment accounted for the highest market share in 2020 and is anticipated for the fastest growth during the forecast period.

Source: Research Dive Analysis

The transportation sub-segment is anticipated to have a dominant market share and generate a revenue of $132,592.9 million by 2028, growing from $76,445.7 million in 2020. Hydrogen can be used as a fuel in transportation sector and it offers same long driving range as that of conventional fuels. The use of hydrogen in transportation helps in decarbonizing the transportation sector. This is because the use of hydrogen as a fuel has zero emissions, and it only produces water vapor as a byproduct. For instance, fuel cell uses hydrogen to generate electricity onboard the vehicle via chemical process without combustion. For instance, the leading automotive manufacturers namely Honda, Toyota, and Hyundai have already sold many fuel cell electric vehicles (FCEV) in the U.S., and other automotive companies are planning to produce their own FCEVs in coming years. Also, many fuel cell buses are operating in the U.S. that offers clean and reliable transportation along with reducing the maintenance costs.

Hydrogen Generation Market

By RegionThe hydrogen generation market was investigated across North America, Europe, Asia-Pacific, and LAMEA.

Source: Research Dive Analysis

The Market for Hydrogen Generation in Asia-Pacific to be the Most Dominant and Fastest Growing

The Asia-Pacific hydrogen generation market accounted $53,483.6 million in 2020 and is projected to grow with a CAGR of 7.5%. Asia-Pacific is a world leader in hydrogen market owing to announcements of new hydrogen projects and growing investments in clean energy sector. For instance, in August 2021, China approved renewable mega-project for green hydrogen in the Chinese region of Inner Mongolia. This project aims to utilize solar and wind power for producing green hydrogen and to achieve net zero emission goal. The Inner Mongolia’a Energy Administration has approved cluster of hydrogen plants in Ordos and Baotou. These plants will utilize 370 megawatts of wind and 1.85 gigawatts of solar for production of 66,900 tons of green hydrogen. Also, in Japan, hydrogen is an important sector that helps in decarbonizing the economy. In addition, hydrogen is among 14 sectors that comes under the Green Growth Strategy Through Achieving Carbon Neutrality in 2050 which was announced in December 2020. Also, India is all set to install its first green hydrogen-based energy storage project in Simhadri, Andhra Pradesh. These factors are anticipated to drive the Asia-Pacific hydrogen generation market share during the forecast period.

Competitive Scenario in the Global Hydrogen Generation Market

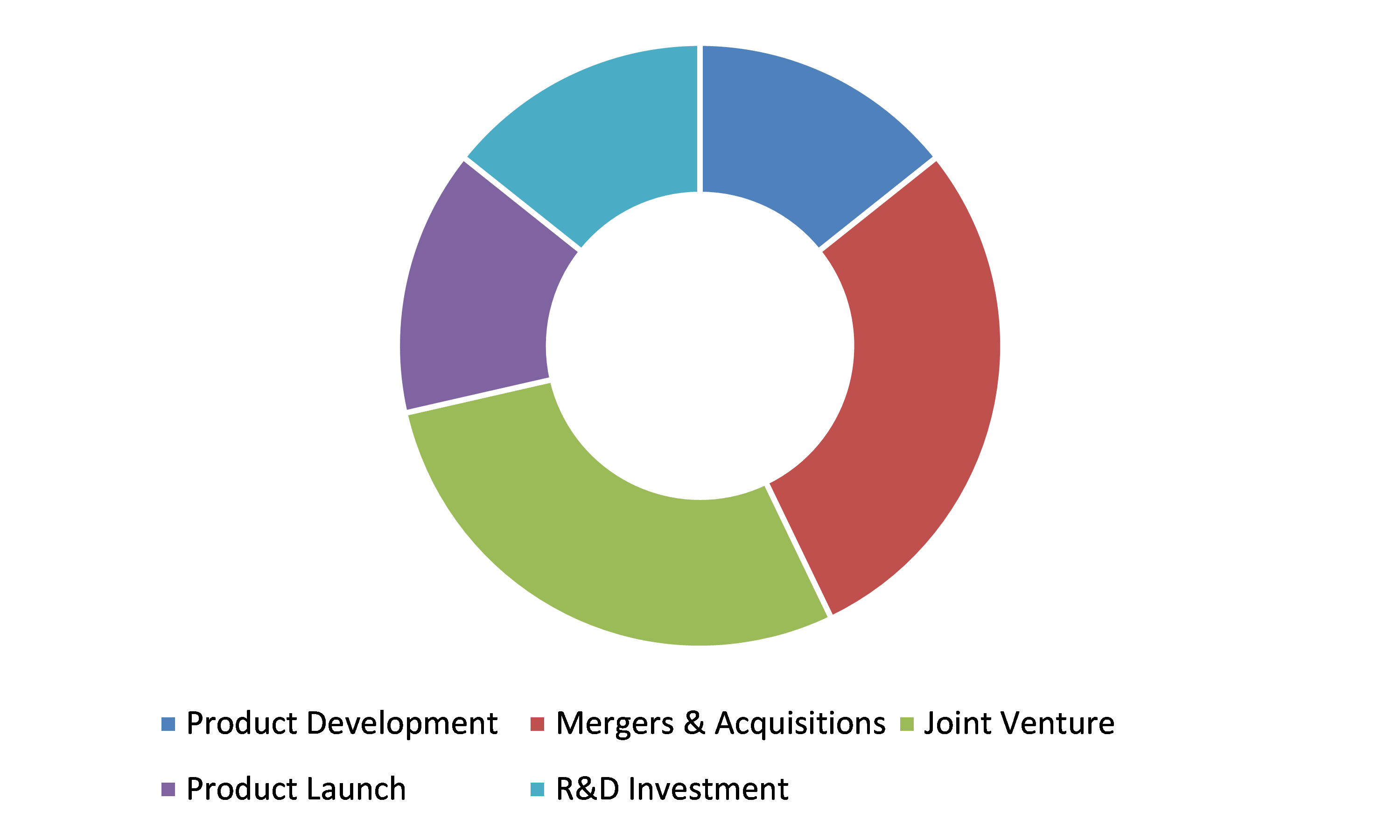

New Project and investment are common strategies followed by major market players.

Source: Research Dive Analysis

Some of the leading hydrogen generation market players are Air Liquide S.A., Cummins Inc., Linde plc, Air Products and Chemicals, Inc., Iwatani Corporation, Engie SA, ITM Power plc, Messer Group, Showa Denko, and Uniper SE.

Porter’s Five Forces Analysis for the Global Hydrogen Generation Market:

- Bargaining Power of Suppliers: The majority of the companies operating in the hydrogen generation market are dependent on suppliers for the purchase of various raw materials such as feedstock. But the raw material required for hydrogen production is less due to which the suppliers have less bargaining potential.

Thus, the bargaining power of suppliers is moderate. - Bargaining Power of Buyers: The number of buyers in hydrogen generation market is increasing gradually owing to wide range of application of hydrogen in power generation and transport sector. Also, since buyers are already eligible for various government incentives, tax credits, and subsidies required for setting up hydrogen generation plants, they are not eligible for bargaining.

Thus, buyer’s bargaining power will be low. - Threat of New Entrants: The new entrants entering hydrogen generation industry, bring innovation and business expansion by launching new hydrogen generation projects.

Thus, the threat of the new entrants is moderate. - Threat of Substitutes: The availability of alternatives energy sources such as gasoline fuel which is widely used at present, increases the threat of substitute. However, hydrogen is clean energy source that does not emit harmful greenhouse gases.

Thus, the threat of substitutes is moderate. - Competitive Rivalry in the Market: The companies operating in this market are focusing on acquiring new hydrogen generation projects, investments, and increasing their production capacity to achieve the carbo neutrality goals.

Therefore, competitive rivalry in the market is high.

| Aspect | Particulars |

| Historical Market Estimations | 2019-2020 |

| Base Year for Market Estimation | 2020 |

| Forecast Timeline for Market Projection | 2021-2028 |

| Geographical Scope | North America, Europe, Asia-Pacific, LAMEA |

| Segmentation by Source |

|

| Segmentation by Type |

|

| Segmentation by Technology |

|

| Segmentation by Application |

|

| Segmentation by End-use Industry |

|

| Key Companies Profiled |

|

Q1. What is the size of the global hydrogen generation market?

A. The size of the global hydrogen generation market was over $126,200.0 million in 2020 and is projected to reach $212,877.4 million by 2028.

Q2. Which are the major companies in the hydrogen generation market?

A. Air Liquide S.A., Cummins Inc., and Linde plc are some of the key players in the global hydrogen generation market.

Q3. Which region, among others, possesses greater investment opportunities in the near future?

A. The Asia-Pacific region possesses great investment opportunities for investors to witness the most promising growth in the future.

Q4. What will be the growth rate of the Asia-Pacific hydrogen generation market?

A. Asia-Pacific hydrogen generation market is anticipated to grow at 7.5% CAGR during the forecast period.

Q5. What are the strategies opted by the leading players in this market?

A. New project and investment are the two key strategies opted by the operating companies in this market.

Q6. Which companies are investing more on R&D practices?

A. Air Products and Chemicals, Inc., Iwatani Corporation, and Engie SA are the companies investing more on R&D activities for developing new products and technologies.

Q7. What was the value of the market in Asia-Pacific in 2020?

A. Asia-Pacific hydrogen generation market had accounted for $53,483.6 million in 2020.

Q8. What are the major drivers for hydrogen generation market?

A. Growing investments in green hydrogen projects across the world to achieve sustainability goals and to reduce the carbon emissions from various industrial processes such as transportation, oil refining, iron & steel production is a major driver for the hydrogen generation market.

Q9. How is hydrogen produced in the future?

A. In future hydrogen will be produced from renewable energy sources such as wind, power, and solar energy which is known as green hydrogen.

1.Research Methodology

1.1.Desk Research

1.2.Real time insights and validation

1.3.Forecast model

1.4.Assumptions and forecast parameters

1.4.1.Assumptions

1.4.2.Forecast parameters

1.5.Data sources

1.5.1.Primary

1.5.2.Secondary

2.Executive Summary

2.1.360° summary

2.2.Source trends

2.3.Type trends

2.4.Technology trends

2.5.Application trends

2.6.End-use Industry trends

3.Market overview

3.1.Market segmentation & definitions

3.2.Key takeaways

3.2.1.Top investment pockets

3.2.2.Top winning strategies

3.3.Porter’s five forces analysis

3.3.1.Bargaining power of consumers

3.3.2.Bargaining power of suppliers

3.3.3.Threat of new entrants

3.3.4.Threat of substitutes

3.3.5.Competitive rivalry in the market

3.4.Market dynamics

3.4.1.Drivers

3.4.2.Restraints

3.4.3.Opportunities

3.5.Technology landscape

3.6.Regulatory landscape

3.7.Patent landscape

3.8.Market value chain analysis

3.9.Strategic overview

4.Hydrogen Generation Market, by Source

4.1.Blue

4.1.1.Key market trends, growth factors, and opportunities

4.1.2.Market size and forecast, by region, 2020-2028

4.1.3.Market share analysis, by country, 2020 & 2028

4.2.Gray

4.2.1.Key market trends, growth factors, and opportunities

4.2.2.Market size and forecast, by region, 2020-2028

4.2.3.Market share analysis, by country, 2020 & 2028

4.3.Green

4.3.1.Key market trends, growth factors, and opportunities

4.3.2.Market size and forecast, by region, 2020-2028

4.3.3.Market share analysis, by country, 2020 & 2028

5.Hydrogen Generation Market, by Type

5.1.Merchant

5.1.1.Key market trends, growth factors, and opportunities

5.1.2.Market size and forecast, by region, 2020-2028

5.1.3.Market share analysis, by country, 2020 & 2028

5.2.Captive

5.2.1.Key market trends, growth factors, and opportunities

5.2.2.Market size and forecast, by region, 2020-2028

5.2.3.Market share analysis, by country, 2020 & 2028

6.Hydrogen Generation Market, by Technology

6.1.Steam Methane Reforming

6.1.1.Key market trends, growth factors, and opportunities

6.1.2.Market size and forecast, by region, 2020-2028

6.1.3.Market share analysis, by country, 2020 & 2028

6.2.Coal Gasification

6.2.1.Key market trends, growth factors, and opportunities

6.2.2.Market size and forecast, by region, 2020-2028

6.2.3.Market share analysis, by country, 2020 & 2028

6.3.Others

6.3.1.Key market trends, growth factors, and opportunities

6.3.2.Market size and forecast, by region, 2020-2028

6.3.3.Market share analysis, by country, 2020 & 2028

7.Hydrogen Generation Market, by Application

7.1.Oil Refining

7.1.1.Key market trends, growth factors, and opportunities

7.1.2.Market size and forecast, by region, 2020-2028

7.1.3.Market share analysis, by country, 2020 & 2028

7.2.Chemical Processing

7.2.1.Key market trends, growth factors, and opportunities

7.2.2.Market size and forecast, by region, 2020-2028

7.2.3.Market share analysis, by country, 2020 & 2028

7.3.Iron and Steel Production

7.3.1.Key market trends, growth factors, and opportunities

7.3.2.Market size and forecast, by region, 2020-2028

7.3.3.Market share analysis, by country, 2020 & 2028

7.4.Others

7.4.1.Key market trends, growth factors, and opportunities

7.4.2.Market size and forecast, by region, 2020-2028

7.4.3.Market share analysis, by country, 2020 & 2028

8.Hydrogen Generation Market, by End-use Industry

8.1.Transportation

8.1.1.Key market trends, growth factors, and opportunities

8.1.2.Market size and forecast, by region, 2020-2028

8.1.3.Market share analysis, by country, 2020 & 2028

8.2.Power Generation

8.2.1.Key market trends, growth factors, and opportunities

8.2.2.Market size and forecast, by region, 2020-2028

8.2.3.Market share analysis, by country, 2020 & 2028

8.3.Buildings

8.3.1.Key market trends, growth factors, and opportunities

8.3.2.Market size and forecast, by region, 2020-2028

8.3.3.Market share analysis, by country, 2020 & 2028

9.Hydrogen Generation Market, by Region

9.1.North America

9.1.1.Key market trends, growth factors, and opportunities

9.1.2.Market size and forecast, by Source, 2020-2028

9.1.3.Market size and forecast, by Type, 2020-2028

9.1.4.Market size and forecast, by Technology, 2020-2028

9.1.5.Market size and forecast, by Application, 2020-2028

9.1.6.Market size and forecast, by End-use Industry, 2020-2028

9.1.7.Market size and forecast, by country, 2020-2028

9.1.8.U.S.

9.1.8.1.Market size and forecast, by Source, 2020-2028

9.1.8.2.Market size and forecast, by Type, 2020-2028

9.1.8.3.Market size and forecast, by Technology, 2020-2028

9.1.8.4.Market size and forecast, by Application, 2020-2028

9.1.8.5.Market size and forecast, by End-use Industry, 2020-2028

9.1.9.Canada

9.1.9.1.Market size and forecast, by Source, 2020-2028

9.1.9.2.Market size and forecast, by Type, 2020-2028

9.1.9.3.Market size and forecast, by Technology, 2020-2028

9.1.9.4.Market size and forecast, by Application, 2020-2028

9.1.9.5.Market size and forecast, by End-use Industry, 2020-2028

9.1.10.Mexico

9.1.10.1.Market size and forecast, by Source, 2020-2028

9.1.10.2.Market size and forecast, by Type, 2020-2028

9.1.10.3.Market size and forecast, by Technology, 2020-2028

9.1.10.4.Market size and forecast, by Application, 2020-2028

9.1.10.5.Market size and forecast, by End-use Industry, 2020-2028

9.2.Europe

9.2.1.Key market trends, growth factors, and opportunities

9.2.2.Market size and forecast, by Source, 2020-2028

9.2.3.Market size and forecast, by Type, 2020-2028

9.2.4.Market size and forecast, by Technology, 2020-2028

9.2.5.Market size and forecast, by Application, 2020-2028

9.2.6.Market size and forecast, by End-use Industry, 2020-2028

9.2.7.Market size and forecast, by country, 2020-2028

9.2.8.Germany

9.2.8.1.Market size and forecast, by Source, 2020-2028

9.2.8.2.Market size and forecast, by Type, 2020-2028

9.2.8.3.Market size and forecast, by Technology, 2020-2028

9.2.8.4.Market size and forecast, by Application, 2020-2028

9.2.8.5.Market size and forecast, by End-use Industry, 2020-2028

9.2.9.UK

9.2.9.1.Market size and forecast, by Source, 2020-2028

9.2.9.2.Market size and forecast, by Type, 2020-2028

9.2.9.3.Market size and forecast, by Technology, 2020-2028

9.2.9.4.Market size and forecast, by Application, 2020-2028

9.2.9.5.Market size and forecast, by End-use Industry, 2020-2028

9.2.10.France

9.2.10.1.Market size and forecast, by Source, 2020-2028

9.2.10.2.Market size and forecast, by Type, 2020-2028

9.2.10.3.Market size and forecast, by Technology, 2020-2028

9.2.10.4.Market size and forecast, by Application, 2020-2028

9.2.10.5.Market size and forecast, by End-use Industry, 2020-2028

9.2.11.Italy

9.2.11.1.Market size and forecast, by Source, 2020-2028

9.2.11.2.Market size and forecast, by Type, 2020-2028

9.2.11.3.Market size and forecast, by Technology, 2020-2028

9.2.11.4.Market size and forecast, by Application, 2020-2028

9.2.11.5.Market size and forecast, by End-use Industry, 2020-2028

9.2.12.Spain

9.2.12.1.Market size and forecast, by Source, 2020-2028

9.2.12.2.Market size and forecast, by Type, 2020-2028

9.2.12.3.Market size and forecast, by Technology, 2020-2028

9.2.12.4.Market size and forecast, by Application, 2020-2028

9.2.12.5.Market size and forecast, by End-use Industry, 2020-2028

9.2.13.Rest of Europe9.2.13.1.Market size and forecast, by Source, 2020-2028

9.2.13.2.Market size and forecast, by Type, 2020-2028

9.2.13.3.Market size and forecast, by Technology, 2020-2028

9.2.13.4.Market size and forecast, by Application, 2020-2028

9.2.13.5.Market size and forecast, by End-use Industry, 2020-2028

9.3.Asia Pacific

9.3.1.Key market trends, growth factors, and opportunities

9.3.2.Market size and forecast, by Source, 2020-2028

9.3.3.Market size and forecast, by Type, 2020-2028

9.3.4.Market size and forecast, by Technology, 2020-2028

9.3.5.Market size and forecast, by Application, 2020-2028

9.3.6.Market size and forecast, by End-use Industry, 2020-2028

9.3.7.Market size and forecast, by country, 2020-2028

9.3.8.China

9.3.8.1.Market size and forecast, by Source, 2020-2028

9.3.8.2.Market size and forecast, by Type, 2020-2028

9.3.8.3.Market size and forecast, by Technology, 2020-2028

9.3.8.4.Market size and forecast, by Application, 2020-2028

9.3.8.5.Market size and forecast, by End-use Industry, 2020-2028

9.3.9.Japan

9.3.9.1.Market size and forecast, by Source, 2020-2028

9.3.9.2.Market size and forecast, by Type, 2020-2028

9.3.9.3.Market size and forecast, by Technology, 2020-2028

9.3.9.4.Market size and forecast, by Application, 2020-2028

9.3.9.5.Market size and forecast, by End-use Industry, 2020-2028

9.3.10.India

9.3.10.1.Market size and forecast, by Source, 2020-2028

9.3.10.2.Market size and forecast, by Type, 2020-2028

9.3.10.3.Market size and forecast, by Technology, 2020-2028

9.3.10.4.Market size and forecast, by Application, 2020-2028

9.3.10.5.Market size and forecast, by End-use Industry, 2020-2028

9.3.11.South Korea

9.3.11.1.Market size and forecast, by Source, 2020-2028

9.3.11.2.Market size and forecast, by Type, 2020-2028

9.3.11.3.Market size and forecast, by Technology, 2020-2028

9.3.11.4.Market size and forecast, by Application, 2020-2028

9.3.11.5.Market size and forecast, by End-use Industry, 2020-2028

9.3.12.Australia

9.3.12.1.Market size and forecast, by Source, 2020-2028

9.3.12.2.Market size and forecast, by Type, 2020-2028

9.3.12.3.Market size and forecast, by Technology, 2020-2028

9.3.12.4.Market size and forecast, by Application, 2020-2028

9.3.12.5.Market size and forecast, by End-use Industry, 2020-2028

9.3.13.Rest of Asia Pacific

9.3.13.1.Market size and forecast, by Source, 2020-2028

9.3.13.2.Market size and forecast, by Type, 2020-2028

9.3.13.3.Market size and forecast, by Technology, 2020-2028

9.3.13.4.Market size and forecast, by Application, 2020-2028

9.3.13.5.Market size and forecast, by End-use Industry, 2020-2028

9.4.LAMEA

9.4.1.Key market trends, growth factors, and opportunities

9.4.2.Market size and forecast, by Source, 2020-2028

9.4.3.Market size and forecast, by Type, 2020-2028

9.4.4.Market size and forecast, by Technology, 2020-2028

9.4.5.Market size and forecast, by Application, 2020-2028

9.4.6.Market size and forecast, by End-use Industry, 2020-2028

9.4.7.Market size and forecast, by country, 2020-2028

9.4.8.Latin America

9.4.8.1.Market size and forecast, by Source, 2020-2028

9.4.8.2.Market size and forecast, by Type, 2020-2028

9.4.8.3.Market size and forecast, by Technology, 2020-2028

9.4.8.4.Market size and forecast, by Application, 2020-2028

9.4.8.5.Market size and forecast, by End-use Industry, 2020-2028

9.4.9.Middle East

9.4.9.1.Market size and forecast, by Source, 2020-2028

9.4.9.2.Market size and forecast, by Type, 2020-2028

9.4.9.3.Market size and forecast, by Technology, 2020-2028

9.4.9.4.Market size and forecast, by Application, 2020-2028

9.4.9.5.Market size and forecast, by End-use Industry, 2020-2028

9.4.10.Africa

9.4.10.1.Market size and forecast, by Source, 2020-2028

9.4.10.2.Market size and forecast, by Type, 2020-2028

9.4.10.3.Market size and forecast, by Technology, 2020-2028

9.4.10.4.Market size and forecast, by Application, 2020-2028

9.4.10.5.Market size and forecast, by End-use Industry, 2020-2028

10.Company profiles

10.1.Air Liquide S.A.

10.1.1.Company overview

10.1.2.Operating business segments

10.1.3.Product portfolio

10.1.4.Financial performance

10.1.5.Key strategy moves and development

10.2.Cummins Inc.

10.2.1.Company overview

10.2.2.Operating business segments

10.2.3.Product portfolio

10.2.4.Financial performance

10.2.5.Key strategy moves and development

10.3.Linde plc

10.3.1.Company overview

10.3.2.Operating business segments

10.3.3.Product portfolio

10.3.4.Financial performance

10.3.5.Key strategy moves and development

10.4.Air Products and Chemicals, Inc.

10.4.1.Company overview

10.4.2.Operating business segments

10.4.3.Product portfolio

10.4.4.Financial performance

10.4.5.Key strategy moves and development

10.5.Iwatani Corporation

10.5.1.Company overview

10.5.2.Operating business segments

10.5.3.Product portfolio

10.5.4.Financial performance

10.5.5.Key strategy moves and development

10.6.Engie SA

10.6.1.Company overview

10.6.2.Operating business segments

10.6.3.Product portfolio

10.6.4.Financial performance

10.6.5.Key strategy moves and development

10.7.ITM Power plc

10.7.1.Company overview

10.7.2.Operating business segments

10.7.3.Product portfolio

10.7.4.Financial performance

10.7.5.Key strategy moves and development

10.8.Messer Group

10.8.1.Company overview

10.8.2.Operating business segments

10.8.3.Product portfolio

10.8.4.Financial performance

10.8.5.Key strategy moves and development

10.9.Showa Denko

10.9.1.Company overview

10.9.2.Operating business segments

10.9.3.Product portfolio

10.9.4.Financial performance

10.9.5.Key strategy moves and development

10.10.Uniper SE

10.10.1.Company overview

10.10.2.Operating business segments

10.10.3.Product portfolio

10.10.4.Financial performance

10.10.5.Key strategy moves and development

Since eras, hydrogen and energy have been paired in various applications from – powering the first internal combustion engines before 200 years to becoming a vital part of the existing refining industry. Hydrogen is a light, energy-dense, storable gas that gives out no direct discharges of contaminants or greenhouse gases. Nonetheless, for hydrogen to make a substantial contribution to the switch toward clean energy, it must be implemented in sectors such as transportation, constructions, and power generation. As per Research Dive analysts, the transportation sub-segment of the hydrogen generation market is projected to have a dominant market share and garner $132,592.9 million by 2028.

Hydrogen can be obtained from fossil fuels, biomass, water, or from a combination of both. Presently, natural gas is the prime source of hydrogen generation, accounting for about 3 quarters of the yearly global dedicated hydrogen production of about 70 million tonnes. Canada is one of the leading producers of hydrogen across the globe. Canadian organisations have invented several technologies to generate hydrogen cleanly and cost-effectively using biomass, methanol, fossil fuels, and renewable energy sources including wind, solar, hydroelectric or from by-product waste hydrogen captured from industries.

The Demand for Hydrogen Surges

Providing hydrogen to industries is now a foremost business worldwide as the demand for hydrogen has surged in the last few decades. Also, it is expected that its demand will endure to increase – almost wholly generated from fossil fuels, with 6% of worldwide natural gas and 2% of worldwide coal going in the hydrogen making.

Currently, there are several nations having polices that unswervingly support investments in hydrogen technologies, which is fueling the growth of the hydrogen generation market. There are nearly 50 targets, obligations, and policy incentives in position, currently, that directly support hydrogen, with the majority dedicated on transportation.

Recent Trends in the Hydrogen Generation Market

Since the last few years, worldwide spending on hydrogen energy development, research, and demonstration by government bodies has intensified across the globe.

As per a report by Research Dive, the global hydrogen generation market is expected to garner $212,877.4 million by 2028. Market players are significantly investing in innovative project launches and research for enhancing the production of hydrogen.

Some of the leading players of the hydrogen generation market are Air Liquide S.A., Cummins Inc., Linde plc, Air Products and Chemicals, Inc., Iwatani Corporation, Engie SA, ITM Power plc, Messer Group, Showa Denko, and Uniper SE, and others. These players are focused on developing strategies such as partnerships, novel developments, mergers and acquisitions, and collaborations to achieve a leading position in the global market. For instance,

- In August 2021, Indian researchers have come up with a novel technique of generating hydrogen from water by making use of magnets to increase its production 3 times and lower the energy required, thus paving the way toward environment-friendly hydrogen fuel at an affordable price.

- In November 2021, Indian Oil Corporation Limited (IOCL), a state-owned oil and gas company in India, introduced a tender to install green hydrogen generation units at its refineries in Uttar Pradesh, Mathura, Panipat, and Haryana.

- In March 2020, a Japanese consortium introduced largest-class hydrogen production unit of the world named, Fukushima Hydrogen Energy Research Field (FH2R). This new unit is a renewable energy-powered 10-MW class hydrogen production unit.

COVID-19 Impact on the Hydrogen Generation Market

The sudden onset of the coronavirus pandemic has adversely impacted the global hydrogen generation market. This is chiefly due to a decrease in investments in new energy generation industries, which has eventually slackened the growth of clean energy technologies. Moreover, lower capital expenditure, disruptions in supply chain, and economic recession due to pandemic have undesirably affected the hydrogen generation market’s growth.

However, numerous announcements regarding new hydrogen generation projects in the coming years is estimated to recuperate the market from the losses post-pandemic, and also help the world to resume the clean energy initiatives.

The Way Ahead for Hydrogen Generation Market

The future of hydrogen generation market is extremely bright as hydrogen holds the potential to be used in numerous application areas; which can help attain a future of secure, clean, and reasonably priced energy. To sum-up, the industrial world should emphasize on making hydrogen as a vital part of the clean and secure energy future.

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com