Ammunition Market Report

RA03619

Ammunition Market by Product Type (Centrefire and Rimfire), Caliber Size (Small, Medium, Large, and Others), Application (Defense and Civil & Commercial), and Regional Analysis (North America, Europe, Asia-Pacific, and LAMEA): Global Opportunity Analysis and Industry Forecast, 2022-2031

Global Ammunition Market Analysis

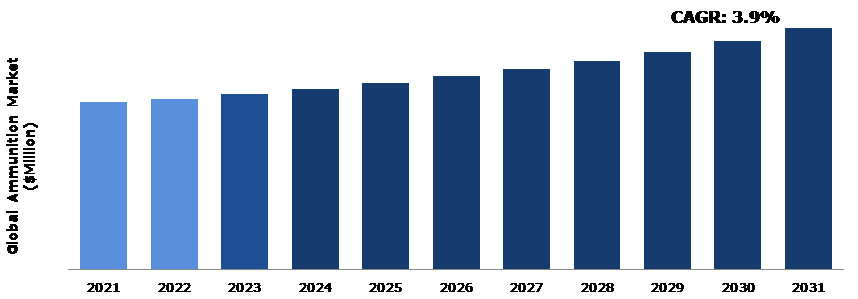

The Global Ammunition Market Size was $21,980.00 million in 2021 and is predicted to grow with a CAGR of 3.9%, by generating a revenue of $31,717.40 million by 2031.

Global Ammunition Market Synopsis

The modernization of military capabilities and the acquisition of new weapons are among the main drivers of the ammunition market. As countries upgrade their military equipment and weapons, they require specialized ammunition that meets the specifications of these new systems. Modern weapons systems require ammunition that is more advanced, accurate, and precise, with features such as longer ranges, improved penetration capabilities, and enhanced lethality. Moreover, as nations seek to enhance their defense capabilities, they increase their defense budgets, which also drives the demand for ammunition. There is increasing demand for advanced and high-quality ammunition by military and law enforcement agencies worldwide. As modern warfare becomes more complex and sophisticated, the need for advanced ammunition that can adapt to changing battlefield requirements is becoming more critical. These factors are anticipated to boost the ammunition industry growth in the upcoming years.

However, some of the disadvantages of ammunition include government regulations. Government regulations are one of the significant restraints in the ammunition market. The ammunition market is heavily regulated worldwide due to the potential dangers and risks associated with the use of ammunition. Moreover, restrictions on the sale of ammunition to certain countries can also limit market growth. Governments around the world impose trade restrictions and sanctions on countries based on various factors, such as human rights violations, terrorism, or nuclear proliferation concerns. Such restrictions can prevent manufacturers from selling ammunition to specific countries, thereby affecting the market's growth.

Ammunition manufacturers can diversify their product offerings by developing ammunition for niche markets, such as self-defense, competition shooting, and long-range shooting. With increasing concerns about personal safety, demand for ammunition for personal defense is growing. Ammunition manufacturers develop specialized ammunition such as hollow-point bullets that expand upon impact, reducing the risk of over-penetration and collateral damage. There is growing concern about the environmental impact of lead-based ammunition. Ammunition manufacturers have been exploring new markets and applications for ammunition beyond traditional uses, such as self-defense and hunting. For example, specialized ammunition has been developed for long-range shooting, competition shooting, and tactical training. This diversification has opened up new opportunities for manufacturers to expand their customer base and increase their revenue.

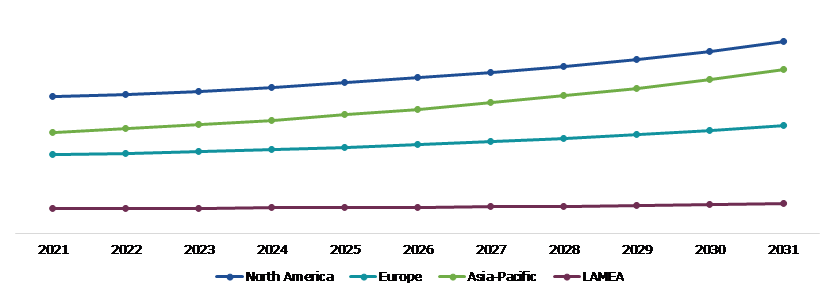

According to regional analysis, the Asia-Pacific ammunition market accounted for highest market share in 2021 and is anticipated to show fastest growth in the projected timeframe. The Asia-Pacific region is one of the fastest-growing markets for ammunition globally. Many countries in the Asia-Pacific region, including India, China, Japan, and South Korea, are increasing their defense spending, which is leading to the development and modernization of their armed forces. This, in turn, is driving the ammunition market in the region.

Ammunition Overview

Ammunition refers to a supply of bullets, shells, or other projectiles that are used in firearms or other weapons. It can also refer to the material or resources that are used to support a particular effort or cause, such as political ammunition or intellectual ammunition. In general, the term ammunition refers to any type of material that can be used to attack or defend against an opponent, whether in a physical or metaphorical sense.

COVID-19 Impact on Global Ammunition Market

The COVID-19 pandemic has had a significant impact on the global economy and various industries, including the ammunition market. In the early stages of the pandemic, there was a surge in demand for firearms and ammunition as people panic-bought them in anticipation of social unrest, uncertainty, and potential breakdowns in law and order. This demand for firearms and ammunition was particularly high in the United States, where there were concerns about the pandemic's impact on the economy, and protests against police brutality and racism were taking place. The pandemic also led to disruptions in the supply chain, which made it harder for manufacturers to keep up with the demand. However, as the pandemic progressed, the demand for firearms and ammunition started to level off, and the market returned to pre-pandemic levels. This was due in part to increased availability of vaccines, reduced fears of social unrest, and fewer concerns about economic collapse.

However, the ammunition market has also been affected by the pandemic's impact on manufacturing and distribution. The pandemic has caused disruptions in global supply chains, and ammunition manufacturers have faced challenges in acquiring raw materials and transporting finished products. This led to supply shortages and price increases for certain types of ammunition.

Growing Demand of Ammunition in Military and Law Enforcement Agencies to Drive the Market Growth

Ammunition has immense application across day-to-day products. For instance, military and law enforcement agencies are some of the biggest customers of the ammunition market, as they need large quantities of ammunition to train their personnel and carry out their operations effectively. These agencies require various types of ammunition, such as small arms ammunition, medium and heavy ammunition, and specialized ammunition for different applications. In addition to the demand for training and operational purposes, military and law enforcement agencies also need to keep a significant amount of ammunition in reserve for emergency situations. This demand for ammunition is driven by the need to be prepared for any potential conflict or threat that may arise. The demand from military and law enforcement agencies remains a significant driver of the ammunition market, and it is expected to continue to drive the growth of the industry in the coming years.

To know more about global ammunition market drivers, get in touch with our analysts here.

High Cost of Production of Ammunition to Restrain the Market Growth

The high cost of production is a significant restraint for the ammunition market, particularly in developing countries. The manufacturing process of ammunition involves several stages, including the production of metal casings, bullets, and gunpowder, which require expensive machinery and specialized skills. Additionally, the raw materials used in ammunition production, such as lead, copper, and brass, are subject to fluctuations in prices, further driving up the cost of production. These high costs of production can make it difficult for manufacturers to keep prices competitive, particularly in regions with lower purchasing power. As a result, many developing countries may rely on importing ammunition, which can be costlier due to taxes and other import-related fees, which is anticipated to hamper the ammunition market growth.

Innovation in Ammunition Technology to Drive Excellent Opportunities

The innovation in ammunition technology is the need for safety. Modern ammunition is designed with safety features that minimize the risk of accidental discharge or malfunction. Companies that can successfully innovate in this area may be well-positioned for growth. For example, new materials and manufacturing techniques can result in ammunition that is more accurate and consistent, while advances in propellants and bullet design can increase range and stopping power. Companies that can successfully develop and commercialize new types of ammunition that offer these kinds of performance improvements may be able to capture a larger share of the market and gain a competitive advantage. Additionally, there may be challenges associated with marketing and selling new types of ammunition, as consumers and law enforcement agencies may be hesitant to adopt unfamiliar products. The potential rewards of innovation in the ammunition market could be significant.

To know more about global ammunition market opportunities, get in touch with our analysts here.

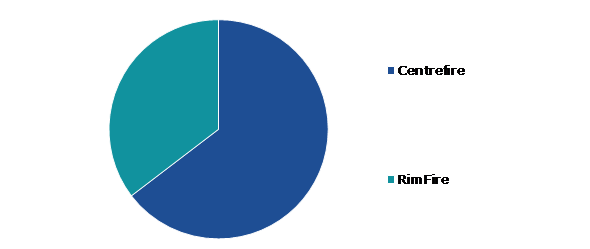

Global Ammunition Market, by Product Type

Based on product type, the market has been divided into centrefire and rim fire. Among these, the centrefire sub-segment accounted for the highest market share in 2021, whereas the rim fire sub-segment is estimated to show the fastest growth during the forecast period.

Global Ammunition Market Size, by Product Type, 2021

Source: Research Dive Analysis

The centrefire sub-type accounted for the largest market share in 2021. Centrefire cartridges are available in a wide variety of calibers, making them suitable for a broad range of firearms, including rifles, handguns, and shotguns. This versatility makes them popular with hunters, sport shooters, and law enforcement agencies. Centrefire cartridges are generally more powerful than rimfire cartridges, allowing for greater accuracy and range. They also offer better consistency and reliability, making them ideal for use in high-pressure situations. Centrefire cartridges are widely available and can be purchased from a variety of retailers, including sporting goods stores, gun shops, and online retailers. This availability makes them a popular choice for gun owners who want to ensure that they always have access to ammunition.

The rimfire sub-type is anticipated to show the fastest growth in 2031. Rimfire ammunition has the primer contained in the rim of the ammunition casing. Rimfire ammunition is limited to low-pressure loads and rimfire cartridges are not reloadable. Rimfire ammunition is commonly used for small game hunting, target shooting, and plinking. It is often preferred over centerfire ammunition for these activities because it is less expensive and produces less recoil, making it easier to shoot accurately and comfortably. Rimfire ammunition is generally less expensive than centerfire ammunition, making it more accessible to casual shooters and hunters. Additionally, the popularity of rimfire firearms among younger shooters and those new to the sport has contributed to the growth of the rimfire ammunition segment. Rimfire firearms are typically easier to handle and have less recoil than larger-caliber firearms, making them a good choice for beginners. The rimfire segment is expected to continue growing in the ammunition market due to rimfire ammunition’s affordability, popularity for recreational shooting and hunting, and ease of use for beginners.

Global Ammunition Market, by Caliber Size

Based on caliber size, the market has been divided into small, medium, large, and others. Among these, the small sub-segment accounted for highest revenue share in 2021.

Global Ammunition Market Share, by Caliber Size, 2021

Source: Research Dive Analysis

The small sub-segment accounted for the largest market share in 2021. Small caliber ammunition, such as .22 LR, 9mm, and .223 Remington, are widely used for a variety of applications, including recreational shooting, hunting, and self-defense. With rising concerns about personal safety and security, there has been an increased demand for personal defense weapons such as handguns, which typically use small size calibers. This has driven the growth of the small caliber segment. Small caliber ammunition is also popular among hunters and sport shooters, who use it for a variety of purposes such as target shooting, plinking, and small game hunting. These factors are anticipated to boost the growth of small sub-segment during the analysis timeframe.

Global Ammunition Market, by Application

Based on application, the market has been divided into defense, and civil & commercial. Among these, the defense sub-segment accounted for highest revenue share in 2021.

Global Ammunition Market Growth, by Application, 2021

Source: Research Dive Analysis

The defense sub-segment accounted for the largest market share in 2021. The defense is a major end-user of ammunition, and many companies focus on producing ammunition specifically for the military market. As military technology advances, there is a need for ammunition that can support new weapon systems and combat tactics. This has led to increased demand for advanced ammunition that can be used in a range of environments and situations. Geopolitical tensions also play a significant role in driving the demand for ammunition in the defense sector. Countries around the world are investing heavily in their military capabilities in response to perceived threats from their neighbors or other countries. This has led to increased demand for ammunition to ensure that armed forces are properly equipped and prepared to defend against potential threats. These factors are anticipated to boost the growth of defense sub-segment during the analysis timeframe.

Global Ammunition Market, Regional Insights

The ammunition market was investigated across North America, Europe, Asia-Pacific, and LAMEA.

Global Ammunition Market Size & Forecast, by Region, 2021-2031 (USD Million)

Source: Research Dive Analysis

The Market for Ammunition in Asia-Pacific was the Most Dominant

The Asia-Pacific ammunition market accounted for the largest market share in 2021. The Asia-Pacific region is a significant driver of the ammunition market due to several factors, including the growing geopolitical tensions, increasing military modernization programs, and the rising demand for small arms for civilian applications such as hunting and personal defense. Countries such as China, India, Japan, and South Korea have been investing heavily in the development of their military capabilities, which has led to a surge in demand for ammunition. Additionally, the region has witnessed several conflicts and security threats, such as the ongoing tensions in the Korean peninsula, the territorial disputes in the South China Sea, and the ongoing war in Afghanistan, which have further boosted the demand for ammunition. Moreover, the growing popularity of shooting sports and hunting activities in the region has also contributed to the growth of the ammunition market. Countries such as Australia, New Zealand, and Japan have seen a significant rise in demand for hunting and sporting ammunition, which has led to the development of a robust ammunition industry in the region.

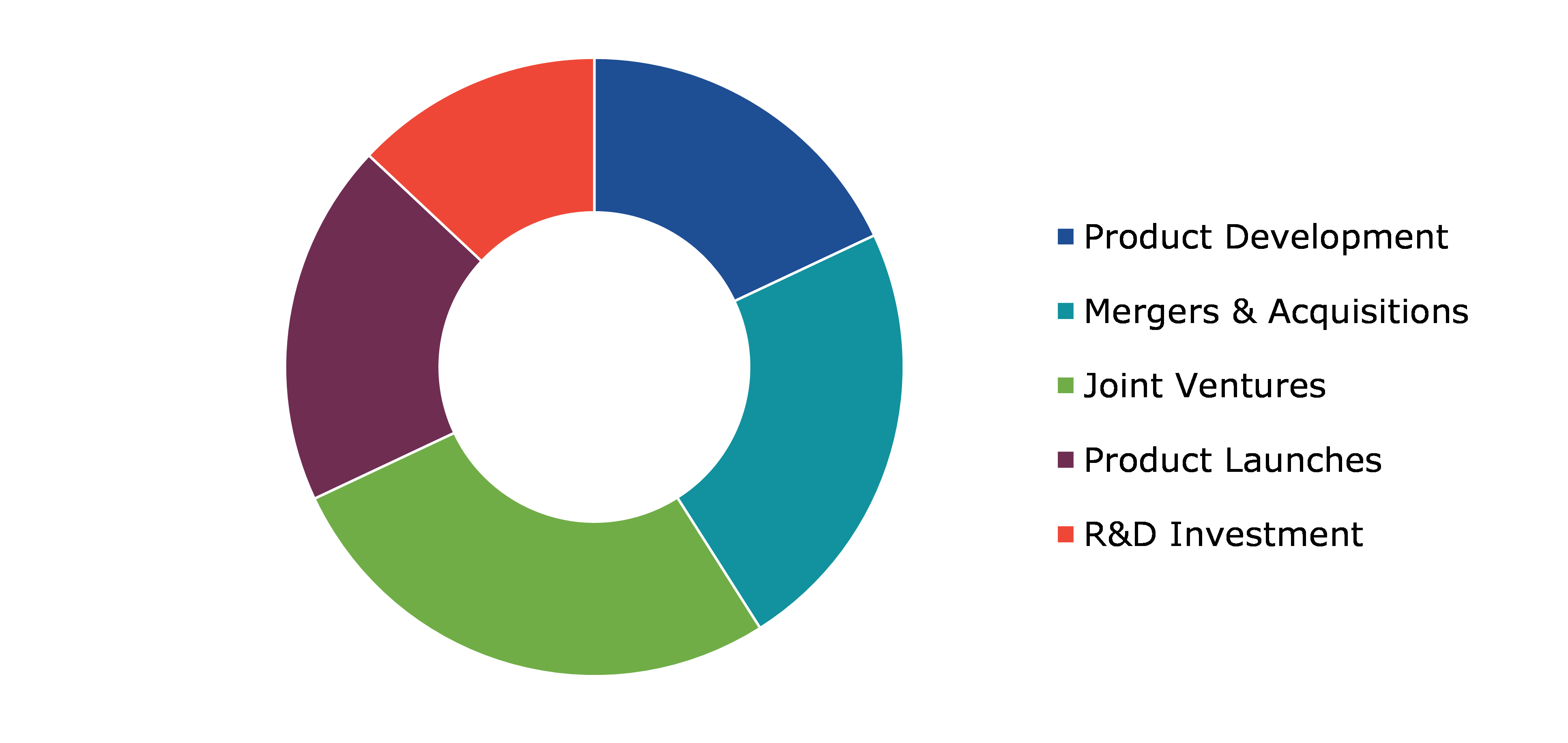

Competitive Scenario in the Global Ammunition Market

Investment and agreement are common strategies followed by major market players. For instance, in December 2021, for the Indian Army's artillery weapons, the Indian government announced an Expression of Interest to buy 1,966 rounds of 155 mm Terminally Guided Munitions to upgrade their capabilities.

Source: Research Dive Analysis

Some of the leading ammunition market players are Northrop Grumman Corporation, FN Herstal, Olin Corporation, General Dynamics Corporation, BAE Systems, Inc., Rheinmetall Defense, Nexter KNDS Group, Hanwha Corporation, ST Engineering, and Remington Arms Company LLC.

| Aspect | Particulars |

| Historical Market Estimations | 2020 |

| Base Year for Market Estimation | 2021 |

| Forecast Timeline for Market Projection | 2022-2031 |

| Geographical Scope | North America, Europe, Asia-Pacific, LAMEA |

| Segmentation by Product Type |

|

| Segmentation by Caliber Size

|

|

| Segmentation by Application |

|

| Key Companies Profiled |

|

Q1. What is the size of the global ammunition market?

A. The size of the global ammunition market was over $21,980.00 million in 2021 and is projected to reach $31,717.40 million by 2031.

Q2. Which are the major companies in the ammunition market?

A. Northrop Grumman Corporation, FN Herstal, and Olin Corporation are some of the key players in the global ammunition market.

Q3. Which region, among others, possesses greater investment opportunities in the near future?

A. The Asia-Pacific region possesses great investment opportunities for investors to witness the most promising growth in the future.

Q4. What will be the growth rate of the Asia-Pacific ammunition market?

A. Asia-Pacific ammunition market is anticipated to grow at 5.1% CAGR during the forecast period.

Q5. What are the strategies opted by the leading players in this market?

A. Agreement and investment are the two key strategies opted by the operating companies in this market.

Q6. Which companies are investing more on R&D practices?

A. General Dynamics Corporation, BAE Systems, Inc., and Rheinmetall Defense are the companies investing more on R&D activities for developing new products and technologies.

1.Research Methodology

1.1.Desk Research

1.2.Real time insights and validation

1.3.Forecast model

1.4.Assumptions and forecast parameters

1.5.Market size estimation

1.5.1.Top-down approach

1.5.2.Bottom-up approach

2.Report Scope

2.1.Market definition

2.2.Key objectives of the study

2.3.Report overview

2.4.Market segmentation

2.5.Overview of the impact of COVID-19 on Global ammunition market

3.Executive Summary

4.Market Overview

4.1.Introduction

4.2.Growth impact forces

4.2.1.Drivers

4.2.2.Restraints

4.2.3.Opportunities

4.3.Market value chain analysis

4.3.1.List of raw material suppliers

4.3.2.List of manufacturers

4.3.3.List of distributors

4.4.Innovation & sustainability matrices

4.4.1.Technology matrix

4.4.2.Regulatory matrix

4.5.Porter’s five forces analysis

4.5.1.Bargaining power of suppliers

4.5.2.Bargaining power of consumers

4.5.3.Threat of substitutes

4.5.4.Threat of new entrants

4.5.5.Competitive rivalry intensity

4.6.PESTLE analysis

4.6.1.Political

4.6.2.Economical

4.6.3.Social

4.6.4.Technological

4.6.5.Environmental

4.7.Impact of COVID-19 on ammunition market

4.7.1.Pre-covid market scenario

4.7.2.Post-covid market scenario

5.Ammunition Market Analysis, by Product Type

5.1.Overview

5.2.Centrefire

5.2.1.Definition, key trends, growth factors, and opportunities

5.2.2.Market size analysis, by region,2021-2031

5.2.3.Market share analysis, by country,2021-2031

5.3.Rim fire

5.3.1.Definition, key trends, growth factors, and opportunities

5.3.2.Market size analysis, by region,2021-2031

5.3.3.Market share analysis, by country,2021-2031

5.4.Research Dive Exclusive Insights

5.4.1.Market attractiveness

5.4.2.Competition heatmap

6.Ammunition Market Analysis, by Caliber Size

6.1.Overview

6.2.Small

6.2.1.Definition, key trends, growth factors, and opportunities

6.2.2.Market size analysis, by region,2021-2031

6.2.3.Market share analysis, by country,2021-2031

6.3.Medium

6.3.1.Definition, key trends, growth factors, and opportunities

6.3.2.Market size analysis, by region,2021-2031

6.3.3.Market share analysis, by country,2021-2031

6.4.Large

6.4.1.Definition, key trends, growth factors, and opportunities

6.4.2.Market size analysis, by region,2021-2031

6.4.3.Market share analysis, by country,2021-2031

6.5.Research Dive Exclusive Insights

6.5.1.Market attractiveness

6.5.2.Competition heatmap

7.Ammunition Market Analysis, by Application

7.1.Overview

7.2.Defense

7.2.1.Definition, key trends, growth factors, and opportunities

7.2.2.Market size analysis, by region,2021-2031

7.2.3.Market share analysis, by country,2021-2031

7.3.Civil and Commercial

7.3.1.Definition, key trends, growth factors, and opportunities

7.3.2.Market size analysis, by region,2021-2031

7.3.3.Market share analysis, by country,2021-2031

7.4.Research Dive Exclusive Insights

7.4.1.Market attractiveness

7.4.2.Competition heatmap

8.Ammunition Market, by Region

8.1.North America

8.1.1.U.S.

8.1.1.1.Market size analysis, by Product Type,2021-2031

8.1.1.2.Market size analysis, by Caliber Size,2021-2031

8.1.1.3.Market size analysis, by Application,2021-2031

8.1.2.Canada

8.1.2.1.Market size analysis, by Product Type,2021-2031

8.1.2.2.Market size analysis, by Caliber Size,2021-2031

8.1.2.3.Market size analysis, by Application,2021-2031

8.1.3.Mexico

8.1.3.1.Market size analysis, by Product Type,2021-2031

8.1.3.2.Market size analysis, by Caliber Size,2021-2031

8.1.3.3.Market size analysis, by Application,2021-2031

8.1.4.Research Dive Exclusive Insights

8.1.4.1.Market attractiveness

8.1.4.2.Competition heatmap

8.2.Europe

8.2.1.Germany

8.2.1.1.Market size analysis, by Product Type,2021-2031

8.2.1.2.Market size analysis, by Caliber Size,2021-2031

8.2.1.3.Market size analysis, by Application,2021-2031

8.2.2.UK

8.2.2.1.Market size analysis, by Product Type,2021-2031

8.2.2.2.Market size analysis, by Caliber Size,2021-2031

8.2.2.3.Market size analysis, by Application,2021-2031

8.2.3.France

8.2.3.1.Market size analysis, by Product Type,2021-2031

8.2.3.2.Market size analysis, by Caliber Size,2021-2031

8.2.3.3.Market size analysis, by Application,2021-2031

8.2.4.Spain

8.2.4.1.Market size analysis, by Product Type,2021-2031

8.2.4.2.Market size analysis, by Caliber Size,2021-2031

8.2.4.3.Market size analysis, by Application,2021-2031

8.2.5.Italy

8.2.5.1.Market size analysis, by Product Type,2021-2031

8.2.5.2.Market size analysis, by Caliber Size,2021-2031

8.2.5.3.Market size analysis, by Application,2021-2031

8.2.6.Rest of Europe

8.2.6.1.Market size analysis, by Product Type,2021-2031

8.2.6.2.Market size analysis, by Caliber Size,2021-2031

8.2.6.3.Market size analysis, by Application,2021-2031

8.2.7.Research Dive Exclusive Insights

8.2.7.1.Market attractiveness

8.2.7.2.Competition heatmap

8.3.Asia Pacific

8.3.1.China

8.3.1.1.Market size analysis, by Product Type,2021-2031

8.3.1.2.Market size analysis, by Caliber Size,2021-2031

8.3.1.3.Market size analysis, by Application,2021-2031

8.3.2.Japan

8.3.2.1.Market size analysis, by Product Type,2021-2031

8.3.2.2.Market size analysis, by Caliber Size,2021-2031

8.3.2.3.Market size analysis, by Application,2021-2031

8.3.3.India

8.3.3.1.Market size analysis, by Product Type,2021-2031

8.3.3.2.Market size analysis, by Caliber Size,2021-2031

8.3.3.3.Market size analysis, by Application,2021-2031

8.3.4.Australia

8.3.4.1.Market size analysis, by Product Type,2021-2031

8.3.4.2.Market size analysis, by Caliber Size,2021-2031

8.3.4.3.Market size analysis, by Application,2021-2031

8.3.5.South Korea

8.3.5.1.Market size analysis, by Product Type,2021-2031

8.3.5.2.Market size analysis, by Caliber Size,2021-2031

8.3.5.3.Market size analysis, by Application,2021-2031

8.3.6.Rest of Asia Pacific

8.3.6.1.Market size analysis, by Product Type,2021-2031

8.3.6.2.Market size analysis, by Caliber Size,2021-2031

8.3.6.3.Market size analysis, by Application,2021-2031

8.3.7.Research Dive Exclusive Insights

8.3.7.1.Market attractiveness

8.3.7.2.Competition heatmap

8.4.LAMEA

8.4.1.Brazil

8.4.1.1.Market size analysis, by Product Type,2021-2031

8.4.1.2.Market size analysis, by Caliber Size,2021-2031

8.4.1.3.Market size analysis, by Application,2021-2031

8.4.2.Saudi Arabia

8.4.2.1.Market size analysis, by Product Type,2021-2031

8.4.2.2.Market size analysis, by Caliber Size,2021-2031

8.4.2.3.Market size analysis, by Application,2021-2031

8.4.3.UAE

8.4.3.1.Market size analysis, by Product Type,2021-2031

8.4.3.2.Market size analysis, by Caliber Size,2021-2031

8.4.3.3.Market size analysis, by Application,2021-2031

8.4.4.South Africa

8.4.4.1.Market size analysis, by Product Type,2021-2031

8.4.4.2.Market size analysis, by Caliber Size,2021-2031

8.4.4.3.Market size analysis, by Application,2021-2031

8.4.5.Rest of LAMEA

8.4.5.1.Market size analysis, by Product Type,2021-2031

8.4.5.2.Market size analysis, by Caliber Size,2021-2031

8.4.5.3.Market size analysis, by Application,2021-2031

8.4.6.Research Dive Exclusive Insights

8.4.6.1.Market attractiveness

8.4.6.2.Competition heatmap

9.Competitive Landscape

9.1.Top winning strategies, 2021

9.1.1.By strategy

9.1.2.By year

9.2.Strategic overview

9.3.Market share analysis, 2021

10.Company Profiles

10.1.Northrop Grumman Corporation

10.1.1.Overview

10.1.2.Business segments

10.1.3.Product portfolio

10.1.4.Financial performance

10.1.5.Recent developments

10.1.6.SWOT analysis

10.2.FN Herstal

10.2.1.Overview

10.2.2.Business segments

10.2.3.Product portfolio

10.2.4.Financial performance

10.2.5.Recent developments

10.2.6.SWOT analysis

10.3.Olin Corporation

10.3.1.Overview

10.3.2.Business segments

10.3.3.Product portfolio

10.3.4.Financial performance

10.3.5.Recent developments

10.3.6.SWOT analysis

10.4.General Dynamics Corporation

10.4.1.Overview

10.4.2.Business segments

10.4.3.Product portfolio

10.4.4.Financial performance

10.4.5.Recent developments

10.4.6.SWOT analysis

10.5.BAE Systems, Inc.

10.5.1.Overview

10.5.2.Business segments

10.5.3.Product portfolio

10.5.4.Financial performance

10.5.5.Recent developments

10.5.6.SWOT analysis

10.6.Rheinmetall Defense

10.6.1.Overview

10.6.2.Business segments

10.6.3.Product portfolio

10.6.4.Financial performance

10.6.5.Recent developments

10.6.6.SWOT analysis

10.7.Nexter KNDS Group

10.7.1.Overview

10.7.2.Business segments

10.7.3.Product portfolio

10.7.4.Financial performance

10.7.5.Recent developments

10.7.6.SWOT analysis

10.8.Hanwha Corporation

10.8.1.Overview

10.8.2.Business segments

10.8.3.Product portfolio

10.8.4.Financial performance

10.8.5.Recent developments

10.8.6.SWOT analysis

10.9.ST Engineering

10.9.1.Overview

10.9.2.Business segments

10.9.3.Product portfolio

10.9.4.Financial performance

10.9.5.Recent developments

10.9.6.SWOT analysis

10.10.Remington Arms Company LLC

10.10.1.Overview

10.10.2.Business segments

10.10.3.Product portfolio

10.10.4.Financial performance

10.10.5.Recent developments

10.10.6.SWOT analysis

The term ammunition can include various components that are necessary to feed, fire, or function the firearm. The types of ammunition available in the market today are diverse, ranging from standard lead bullets to advanced armor-piercing rounds. The specific type of ammunition used in a firearm is determined by the type of firearm and the intended use of the firearm. Ammunition can be used for a variety of purposes, including target shooting, hunting, self-defense, and military or law enforcement operations. Some types of ammunition, such as sniper rounds, are specifically designed for long-range shooting. With the right ammunition, shooters can engage targets at greater distances, which can be particularly useful for hunting or tactical situations. Certain types of ammunition, such as hollow-point rounds, are designed to expand the impact and create a larger wound cavity. This can be particularly useful in self-defense situations, as it can increase the likelihood of stopping an attacker quickly. It is important to use ammunition responsibly and follow proper safety protocols while handling them.

Forecast Analysis of the Global Ammunition Market

According to the report published by Research Dive, the global ammunition market is anticipated to generate a revenue of $31,717.40 million and grow at a CAGR of 3.9% over the 2022-2031 timeframe.

The increasing demand for ammunition among military and law enforcement agencies for training and operational purposes and to reserve for emergencies and potential conflicts is predicted to bolster the growth of the ammunition market over the analysis timeframe. Moreover, the rising innovation in ammunition technology to develop and commercialize new types of ammunition with better accuracy and consistency, increased range, and stopping power is expected to create massive growth opportunities for the market over the estimated period. However, the high cost of production of ammunition, particularly in developing countries, may hinder the growth of the market over the forecast period.

The major players of the ammunition market include Remington Arms Company LLC, Northrop Grumman Corporation, ST Engineering, FN Herstal, Hanwha Corporation, General Dynamics Corporation, Nexter KNDS Group, BAE Systems, Inc., Rheinmetall Defense, and many more.

Key Developments of the Ammunition Market

The key companies operating in the industry are adopting various growth strategies & business tactics such as partnerships, collaborations, mergers & acquisitions, and launches to maintain a robust position in the overall market, which is subsequently helping the global ammunition market to grow exponentially. For instance:

- In April 2021, Elbit Systems, an Israel-based international defense electronics company announced its acquisition of BAE Systems Rokar International Ltd., a leading provider of the most advanced, technology-led defense, aerospace, and security solutions. With this acquisition, the companies aimed to enhance their capabilities in networked precision fire solutions.

- In June 2022, FN Herstal, S.A., the renowned designer and manufacturer of small-calibre firearms announced its collaboration with Fiocchi Munizioni SPA, a leading weapon and ammunition company providing ammunition for outdoor shooting sports. With this collaboration, the companies aimed to manufacture and supply 5.7x28mm ammunition to the US commercial market to meet the growing consumer demand.

- In July 2022, AMMO, Inc., a leader in design, performance, quality, and manufacturing of high-performance ammunition and components announced the successful development and launch of its new product, namely, “Green Streak®”, a one-way luminescent ammunition. It is a modern type of visual ammunition that does not use any form of pyrotechnic to illuminate the trajectory of the projectile.

Most Profitable Region

The Asia-Pacific region of the ammunition market held the largest market share in 2021. This is mainly due to the increasing military modernization programs, and several conflicts and security threats across the region. Moreover, the rising popularity of shooting sports, and hunting activities in the region is expected to boost the regional growth of the market over the estimated period.

Covid-19 Impact on the Global Ammunition Market

The outbreak of the Covid-19 pandemic has brought several uncertainties across various organizations and slowed down the global economy. It has also had a significant impact on the growth of the ammunition market. At first, there was a rise in the demand for firearms and ammunition because people across developed economies bought them in bulk due to the fear of social unrest, uncertainty, protest police brutality, or any other vital circumstances during the lockdown. However, with the progression of the pandemic, the demand for firearms and ammunition started declining, due to the availability of vaccines, reduced concerns about economic collapse, and decreased fear of social unrest. All these factors have declined the market growth over the crisis.

Personalize this research

- Triangulate with your own data

- Request your format and definition

- Get a deeper dive on a specific application, geography, customer or competitor

- + 1-888-961-4454 Toll - Free

- support@researchdive.com